Telegram Group

Case/Source Based MCQs of Money and Banking chapter class 12

- October 31, 2021

- MCQS , Money & Banking

Looking for Case study or Source-Based MCQs (Multiple Choice Questions) of Money and Banking chapter of Macroeconomics Class 12 CBSE, ISC and other state Board.

I have made a collection of important MCQs

Lets Practice.

Case/Source Based Multiple Choice Questions of Money and Banking Chapter Class 12

Following are the MCQs

1. Based on the passage below, answer the following questions.

The Reserve Bank of India (RBI) is India’s Central Bank, also known as the banker’s bank. The RBI controls the monetary and other banking policies of the Indian government. The Reserve Bank of India (RBI) was established on April 1, 1935, in accordance with the Reserve Bank of India Act, 1934. The role of RBI has undergone a significant change after the introduction of the new Economic Policy in 1991.

The Reserve Bank of India (RBI) is India’s central bank and regulatory body under the jurisdiction of the Ministry of Finance, the RBI is responsible for the issue and supply of the Indian rupee and the regulation of the Indian Banking system. It also manages the country’s main payment systems and works to promote its economic development.

On 8 November 2016, the government of India announced the demonetization of all ₹ 500 and ₹ 1000 banknotes of the Mahatma Gandhi Series on the recommendation of the Reserve Bank of India (RBI).

Answer the following Questions.

1. Why RBI is said to be a banker of the bank. Choose the correct option

a) Lender’s of last resort b) controller of credit c) Decide LRR d) None of the above.

Ans – a)

2. ‘RBI is responsible for issue and supply of Indian Rupee in the economy’. Identify the function of RBI and explain.

a) Central bank has the authority to issue currency in the economy. b) This develops the public faith in the system of note circulation. c) It allows the central bank to supervise and control the money supply. d) All of the above.

Ans – d)

3. Define Demonetisation.

a) it refers to selling the public sector to the private. b) It refers to the release of new coins. c) It refers to the process where currency notes of certain denominations are declared no longer as legal tender. d) None of the Above.

Ans – c)

4. How the role of RBI has changed after the 1991 New Economic Policy.

a) Its role changes from the regulator to facilitator b) Interest rates decision are left with financial institutions c) It only formulates the guidelines and decision-making rights are left with financial institutions d) All of the above.

The Monetary Policy Committee of the Reserve Bank of India kept interest rates on hold Thursday even as it vowed to keep policy sufficiently loose to help revive the coronavirus battered economy. Accepting a key demand of lenders and the corporate sector, the central bank cleared a one-time restructuring of loan accounts to bail out stressed borrowers, including personal, small, and medium loans.

The details of the loan restructuring scheme – expected to kick in after the moratorium on loan repayments ends. August 31 – will be worked out by a committee headed by former ICICI Bank Chairman KV Kamath. The RBI also continued to provide support on the liquidity front and opened a new targeted window for small lenders.

The central bank kept the repo rate unchanged at 4 percent and reduced the reverse repo rate to 3:35 percent.

Answer the following questions on the basis of the above Case.

Q.1 Suppose you are a member of the Monetary Policy Committee of the RBI. You have suggested the ___________ of the money supply be ensured to help revive the coronavirus battered economy.

a) restriction b) release c) doubling d) no change

Ans – b)

Q.2 “The Monetary Policy Committee of the RBI kept interest rates on hold—-“. Which of the following is highlighted above by the term ‘interest rates’?

a) Bank Rate and Repo Rate b) Bank Rate and Lending Rate c) Repo Rate and Reverse Repo Rate d) Bank Rate and Reverse Repo Rate

Q.3 What does the ‘Repo Rate’ mean?

a) Rate at which banks borrow from the RBI for short term b) Rate at which banks borrow from the RBI for long term c) Rate at which banks deposit excess funds with the RBI d) Rate at which banks lend funds to the public

Q.4 ‘Reduction in Repo Rate by RBI’ is likely to _ the demand for goods and services in the economy.

a) increase b) decrease c) double d) not effect

The key indicators of RBI Monetary Policy along with their current rates in the table given below:

On 9th October 2020, RBI has kept the Repo Rate unchanged at 4.00% and reduced reverse repo rate to 3.35%. In addition to that, the bank rate stands at 4.65%. This has been done to limit the damage to the economy caused by the Covid-19 and subsequent lockdowns.

Q.1 What does RBI Monetary Policy 2020 mean?

a) It is the policy formulated by the RBI in 2020 related to expenditure and taxation of the government. b) It is the policy formulated by the RBI in 2020 realted to money matters of the country. c) It is the policy formulated by the RBI in 2020 related to the government budget. d) It is the policy formulated by the RBI in 2020 realted to the distribution of credit among users as well as the rate of interest on borrowing and lending.

Ans – b), d)

Q.2 What does the ‘Bank Rate’ mean?

a) Rate at which banks borrow from the RBI for short term b) Rate at which banks borrow from the RBI for long term c) Rate at which banks deposit excess funds with the RBI d) Rate at which banks lend funds to the public.

Q.3 Which of the following is a quantitative credit control technique of RBI?

a) CRR b) SLR c) Repo Rate d) All of these

Q.4 Cut in Reverse Repo Rate is likely to _ the demand for goods and services in the economy during Covid – 19 lockdowns.

Case Study – 3

Keeping in view the continuing hardships faced by banks in terms of social distancing of staff and consequent strains on reporting requirements, the Reserve Bank of India has extended the relaxation of the minimum daily maintenance of the CRR of 80% for up to September 25, 2020. Currently, CRR is 3% and SLR is 18.50%.

“As announced in the Statement of Development and Regulatory Policies of March 27, 2020, the minimum daily maintenance of CRR was reduced from 90% of the prescribed CRR to 80% effective the fortnight beginning March 28, 2020 till June 26, 2020, that has now been extended up to September 25, 2020,” said the RBI.

Q.1 The full forms of CRR and SLR are:

a) Current Reserve Ratio and Statutory Legal Reserves b) Cash Reserve Ratio and Statutory Legal Reserves c) Current Required Ratio and Statutory Legal Reserves d) Cash Reserve Ratio and Statutory Liquidity Ratio

Q.2 What will be the value of money multiplier?

a) 33.33 b) 5.4 c) 4.65 d) None of these

Q.3 SLR implies:

a) Certain percentage of the total banks’s deposits has to be kept in the current account with RBI b) Certain percentage of net total demand and time deposits has to be kept by the bank with themselves. c) Certain percentage of net demand deposits has to be kept by the banks with RBI d) None of the above

Decrease in CRR will lead to __ .

a) fall in aggregate demand in the economy. b) rise in aggregate demand in the economy c) no change in aggregate demand in the economy d) fall in general price level in the economy

Case Study – 4

Due to Covid – 19, the Reserve Bank of India (RBI), cut Repo Rate to 4.4% the lowest in at least 15 years. Also, it reduced the CRR by 100 basis points. Previously, it was 4%. RBI governor Dr. Shaktikanta Das predicted a big global recession and said India will not be immune. It all depends on how India responds to the situation. Aggregate demand may weaken and ease core inflation.

Q.1 CRR stands for:

a) Cash Reserve Ratio b) Current Reserve Ratio c) Cash Required Rate d) Current Required Rate

Q.2 Cut in Repo Rate by RBI is likely to __ the aggregate demand in the Indian Economy.

“ reduced the CRR by 100 basis points. Previously, it was 4%.” Thus, CRR is reduced to ___ .

a) 5% b) 3% c) 96% d) 104%

Besides reduction in CRR and Repo Rate, What other measures can be taken by the Government of India through its budgetary policy to combat recession?

a) Decrease the bank rate b) Sell government securities in the open market c) Increase margin requirements on secured loans d) Decrease taxes and increase government expenditure

Anurag Pathak

Anurag Pathak is an academic teacher. He has been teaching Accountancy and Economics for CBSE students for the last 18 years. In his guidance, thousands of students have secured good marks in their board exams and legacy is still going on. You can subscribe his youtube channel and can download the Android & ios app for free lectures.

Related Posts

[cuet] mcqs commerce domain for b.com topicwise with answers.

- October 14, 2023

Matching Type MCQs of Financial Management Chapter with answers

- March 21, 2023

Assertion Reason MCQs of Financial Management Chapter with answers

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment *

Save my name, email, and website in this browser for the next time I comment.

Post Comment

Ad Blocker Detected!

- Andhra Pradesh

- Chhattisgarh

- West Bengal

- Madhya Pradesh

- Maharashtra

- Jammu & Kashmir

- NCERT Books 2022-23

- NCERT Solutions

- NCERT Notes

- NCERT Exemplar Books

- NCERT Exemplar Solution

- States UT Book

- School Kits & Lab Manual

- NCERT Books 2021-22

- NCERT Books 2020-21

- NCERT Book 2019-2020

- NCERT Book 2015-2016

- RD Sharma Solution

- TS Grewal Solution

- TR Jain Solution

- Selina Solution

- Frank Solution

- ML Aggarwal Solution

- Lakhmir Singh and Manjit Kaur Solution

- I.E.Irodov solutions

- ICSE - Goyal Brothers Park

- ICSE - Dorothy M. Noronhe

- Sandeep Garg Textbook Solution

- Micheal Vaz Solution

- S.S. Krotov Solution

- Evergreen Science

- KC Sinha Solution

- ICSE - ISC Jayanti Sengupta, Oxford

- ICSE Focus on History

- ICSE GeoGraphy Voyage

- ICSE Hindi Solution

- ICSE Treasure Trove Solution

- Thomas & Finney Solution

- SL Loney Solution

- SB Mathur Solution

- P Bahadur Solution

- Narendra Awasthi Solution

- MS Chauhan Solution

- LA Sena Solution

- Integral Calculus Amit Agarwal Solution

- IA Maron Solution

- Hall & Knight Solution

- Errorless Solution

- Pradeep's KL Gogia Solution

- OP Tandon Solutions

- Sample Papers

- Previous Year Question Paper

- Value Based Questions

- CBSE Syllabus

- CBSE MCQs PDF

- Assertion & Reason

- New Revision Notes

- Revision Notes

- HOTS Question

- Marks Wise Question

- Toppers Answer Sheets

- Exam Paper Aalysis

- Concept Map

- CBSE Text Book

- Additional Practice Questions

- Vocational Book

- CBSE - Concept

- KVS NCERT CBSE Worksheets

- Formula Class Wise

- Formula Chapter Wise

- JEE Crash Course

- JEE Previous Year Paper

- Important Info

- JEE Mock Test

- JEE Sample Papers

- SRM-JEEE Mock Test

- VITEEE Mock Test

- BITSAT Mock Test

- Manipal Engineering Mock Test

- AP EAMCET Previous Year Paper

- COMEDK Previous Year Paper

- GUJCET Previous Year Paper

- KCET Previous Year Paper

- KEAM Previous Year Paper

- Manipal Previous Year Paper

- MHT CET Previous Year Paper

- WBJEE Previous Year Paper

- AMU Previous Year Paper

- TS EAMCET Previous Year Paper

- SRM-JEEE Previous Year Paper

- VITEEE Previous Year Paper

- BITSAT Previous Year Paper

- UPSEE Previous Year Paper

- CGPET Previous Year Paper

- CUSAT Previous Year Paper

- AEEE Previous Year Paper

- Crash Course

- Previous Year Paper

- NCERT Based Short Notes

- NCERT Based Tests

- NEET Sample Paper

- Previous Year Papers

- Quantitative Aptitude

- Numerical Aptitude Data Interpretation

- General Knowledge

- Mathematics

- Agriculture

- Accountancy

- Business Studies

- Political science

- Enviromental Studies

- Mass Media Communication

- Teaching Aptitude

- NAVODAYA VIDYALAYA

- SAINIK SCHOOL (AISSEE)

- Mechanical Engineering

- Electrical Engineering

- Electronics & Communication Engineering

- Civil Engineering

- Computer Science Engineering

- CBSE Board News

- Scholarship Olympiad

- School Admissions

- Entrance Exams

- All Board Updates

- Miscellaneous

- State Wise Books

- Engineering Exam

Money and Banking Class 12 Notes PDF (Handwritten & Short Notes)

For some students, Money and Banking can be complex and difficult. To understand each and every topic in an easier way, students can look through the Money and Banking class 12 notes. After understanding the chapter Money and Banking, it is important for students to practise many questions from class 12 Economics notes so that level of understanding can be evaluated.

After practising questions from the Money and Banking class 12 notes, students can also go through the solutions. These answers and solutions for given questions are explained in an elaborate manner. Through this explanation, students can easily decrease the errors done while attempting questions. Accordingly, students can increase their efficiency level for the chapter Money and Banking.

Money and Banking Class 12 Notes PDF

The Money and Banking class 12 notes are created by our subject matter experts in a creative way. This short and compressed content is easily and freely accessible through the Selfstudys website. Easy and free access to the Class 12 Economics Notes PDF can be useful for all students who are in need.

How to Download the Money and Banking Class 12 Notes?

To have a brief knowledge about the chapter and to practise regularly, students can go through the given steps.

- Open the Selfstudys website on your device.

- Click the navigation button which can be seen on the top of the page.

- Select NCERT Books & Solutions.

- A pop-up menu will appear, select NCERT Notes from the given list.

- A new page will appear, select class 12th from the list of classes.

- Now click Economics from the list of subjects.

- Again a new page will appear, select the chapter Money and Banking class 12 notes.

Features of Money and Banking Class 12 Notes

These Money and Banking class 12 notes are considered to be an important study material by students. As it is great to keep a track on performance while preparing for the chapter Money and Banking. Here are some important features of the class 12 Economics notes:

- Brief Summary is Given: When a student starts preparing for the chapter Money and Banking, a brief summary is very important. These brief summaries are given in the Money and Banking class 12 notes. According to the given summary, students can get a brief idea about the chapter.

- All Sorts of Questions Are Provided: After finishing the chapter, students need to practise all sorts of questions which are provided in the class 12 Money and Banking notes. Practising questions in a uniform way can help students to improve their level of understanding.

- Answers to the Questions are Given: Answers are given to each and every question included in the Money and Banking class 12 notes. With the help of the answers given, students can easily solve all their doubts regarding the chapter.

- Frequently Asked Questions by the CBSE Board are Given: Inside the class 12 Economics notes, frequently asked questions of the chapter Money and Banking by the CBSE board are also given. Through this, students can get an idea about the level of difficulty in the class 12 CBSE board.

- Numerals and Solutions are Given: For the chapter Money and Banking, some numerical questions are also given with solutions. With the help of numericals, students can easily improve their level of accuracy while attempting questions.

- Chapter Name is Included: Inside the class 12 Economics notes, chapter name of Money and Banking is given. By looking through the chapter name, students can get a brief idea about what all need to be covered.

Advantages of Money and Banking Class 12 Notes

The Money and Banking class 12 notes can be beneficial throughout the preparation as it is a good source of information. This is one of the important advantages while preparing for the chapter Money and Banking. Some other advantages are:

- Explained in a Concise Manner: In the class 12 Business Studies notes, topics and definitions of the chapter Money and Banking are explained in a concise manner. So that students can have proper and accurate information in a few words.

- Improves Accuracy Level: Being accurate means to write or mark the answers correctly without any kind of errors. Practising questions on a uniform basis, students can easily improve their accuracy level.

- Improves Inner Confidence: Getting to know and practise the frequently asked Money and Banking questions, students can maintain and improve their inner confidence. Self-confidence is a must for class 12 students so that they can remove stress and anxiety.

- Provided in Simple Language: Questions and concepts are explained in an easy and simple language in the class 12 Money and Banking notes. Simple language of the class 12 notes can also help weak students to understand the chapter in a better way.

- Important Recalling Tool: The Money and Banking class 12 notes are considered to be an important recalling tool. For all students, it is a must to recall the given topics. Students can use the Money and Banking class 12 notes as it is considered ideal for the revision purpose.

- Eye-Catching Format: These class 12 Economics notes of chapter Money and Banking are presented in an eye-catching format where diagrams are given, short and precise definitions along with the colourful images are given. This format can attract many students to look through the class 12 Economics and study accordingly.

What are Money and Banking Class 12 Notes and Why Is It Popular?

The Money and Banking class 12 notes are considered to be necessary study resources as it includes all the important topics and concepts. With the help of notes, students can build a strong foundation for the chapter Money and Banking. A strong grip for the chapter Money and Banking is important for all students to perform and score better in the chapter.

It is popular among students because the revision notes of Class 12 Money and Banking saves student’s time and helps them clear their doubts in less time. Also, the notes are easier to grasp which allow students to cover more topics in a short span of time.

Super Easy Ways To Learn Through Money and Banking Class 12 Notes

Before starting to learn through the Money and Banking class 12 notes, students need to first cover the chapter from the NCERT Class 12 Economics book. In the chapter, all the topics and concepts are explained in a broad way. After completing the chapter Money and Banking, students can solve questions in a proper way. These questions and answers of the chapter are also given clearly in the class 12 Economics notes. Taking help of class 12 Economic notes students can ease their preparation process and can perform well in the chapter Money and Banking questions.

Tips to Cover the Chapter Money and Banking Class 12 Notes

Students are requested to follow basic tips to cover the chapter Money and Banking so that they can perform better in those questions. Some of the important and basic tips are:

- Complete the Chapter: Major step in preparing well is to complete the chapter Money and Banking given in the class 12 NCERT Economics book. Students need to read and understand each topic in the chapter Money and Banking.

- Fix a Proper Routine: While preparing for the Economics chapter Money and Banking, students need to fix and maintain a proper schedule. Students need to include short breaks at frequent intervals in the schedule. With the help of systematic routine, students can easily cover the class 12 Economics chapter.

- Take Own Notes: While understanding and studying the chapter Money and Banking, students can make their notes. Inside the notes, all the topics and concepts need to be elaborated in a proper manner.

- Practise Questions: After completing the chapter Money and Banking, students can easily practise questions in a better way. Students can exercise questions from the NCERT class 12 Economics book or the Money and Banking class 12 notes.

- Maintain a Proper Diet: While completing the chapter Money and Banking, students need to maintain a proper and healthy diet. Unhealthy diet of a student can decrease their level of concentration. As concentrating towards the Money and Banking is important to complete the chapter in a proper way because it can help students score better marks.

- Take Note of Mistakes: Students are suggested to take a note of all the earlier mistakes made. This can help them to analyse the mistakes and rectify them accordingly.

- Pay Attention to Topics and Concepts: It is important for students to recall all topics and concepts of Money and Banking to be able to perform well in the board examination. Therefore, the best method to use the Money and Banking Class 12 Notes is to recall the studied topics and concepts using revision notes.

- Prefer Day Study: While completing the chapter Money and Banking, students should prefer day study. Daylight is better than artificial light, accordingly students can improve their concentration skill in the daytime.

Is Money and Banking Class 12 Notes Relevant?

The Money and Banking class 12 notes contains the most relevant content. Relevant content means how well the information is presented so that students can use it. Accordingly, students don’t need to search for something relevant here and there. With the help of relevant content students can understand the chapter Money and Banking in a better way.

- NCERT Solutions for Class 12 Maths

- NCERT Solutions for Class 10 Maths

- CBSE Syllabus 2023-24

- Social Media Channels

- Login Customize Your Notification Preferences

One Last Step...

- Second click on the toggle icon

Provide prime members with unlimited access to all study materials in PDF format.

Allow prime members to attempt MCQ tests multiple times to enhance their learning and understanding.

Provide prime users with access to exclusive PDF study materials that are not available to regular users.

NCERT Solutions for Class 12 Macroeconomics Chapter 3 Case Study

NCERT Solutions for Class 12 Macroeconomics Chapter 3 Case Study Questions in English Medium prepared for academic session 2024-25. Students of class 12 economics can get here chapter 3 Money and Banking Case Study MCQ with Case based questions for practice in Case Studies during the exams.

Class 12 Macroeconomics Chapter 3 Case Studies Question Answers

- Class 12 Macroeconomics Chapter 3 Case Study

- Class 12 Macroeconomics Chapter 3 NCERT Solutions

- Class 12 Macroeconomics Chapter 3 MCQ Answers

- Class 12 Indian Eco & Macro Economics Solutions

- Class 12 NCERT Solutions in Hindi & English Medium

- Class 12 NCERT Books in Hindi & English Medium

The call for cash tells us what makes humans preference a positive quantity of cash. Since cash is needed to behaviour transactions, the cost of transactions will decide the cash humans will need to maintain: the bigger is the quantum of transactions to be made, the bigger is the amount of cash demanded. Since the quantum of transactions to be made relies upon on earnings, it must be clean that an upward push in earnings will result in upward push in call for cash.

Also, whilst humans maintain their financial savings with inside the shape of cash in place of placing it in a financial institution which offers them hobby, how an awful lot cash humans maintain additionally relies upon on price of hobby. Specifically, whilst hobby prices pass up, humans end up much less inquisitive about preserving cash because preserving cash quantities to preserving much less of hobby-incomes deposits, and as a consequence much less hobby acquired. Therefore, at better hobby prices, cash demanded comes down.

- Question 1: Why can we want cash?

- Question 2: What takes place whilst hobby prices pass up?

- Question 3: Whether True or False. (a) The call for cash tells us what makes humans preference a positive quantity of cash. (b) Since cash is needed to behaviour transactions, the cost of transactions will decide the cash humans will need to maintain. (c) When hobby prices pass up, humans preserve their cash in coins. (d) At better hobby prices, call for of cash comes down. (e) Rise in earnings will result in lower in call for cash.

- Question 4: Fill with inside the blanks. (a) The large is the quantum of transactions to be made, the bigger is the ____________ demanded. (b) When humans maintain their financial savings with inside the shape of cash in place of placing it in a financial institution which offers them hobby, how an awful lot cash humans maintain additionally relies upon on ____________. (c) When hobby prices pass up, humans end up _____________ in preserving cash.

- Answer 1: We want cash to make or behaviour transactions.

- Answer 2: When hobby prices pass up, humans end up much less inquisitive about preserving cash because preserving cash quantities to preserving much less of hobby-incomes deposits, and as a consequence much less hobby acquired.

- Answer 3: (a) True, (b) True, (c)False, (d)True, (e) False

- Answer 4: (a) amount of cash, (b) hobby price, (c) much less fascinated.

In a present-day financial system, cash incorporates coins and financial institution deposits. Depending on what styles of financial institution deposits are being included, there are numerous measures of cash. These are created with the aid of using a machine comprising styles of establishments: important financial institution of the financial system and the economic banking machine. Central financial institution: Central Bank is a totally critical organization in a present-day financial system. Almost each country has one important financial institution. India was given its important financial institution in 1935. Its call is the ‘Reserve Bank of India’. Central financial institution has numerous critical functions. It troubles the Forex of the country. It controls cash deliver of the country via diverse methods, like financial institution price, open marketplace operations and versions in reserve ratios. It acts as a banker to the authorities. It is the custodian of the Forex reserves of the financial system. It additionally acts as a financial institution to the banking machine, that is mentioned in element later.

From the factor of view of cash deliver, we want to cognizance on its feature of issuing Forex. This issued with the aid of using the important financial institution may be held with the aid of using the general public or with the aid of using the economic banks, and is referred to as the ‘high-powered cash’ or ‘reserve cash’ or ‘financial base’ because it acts as a foundation for credit score creation. Commercial Banks: Commercial banks are the alternative sort of establishments which might be part of the cash-growing machine of the financial system. They take delivery of deposits from the general public and lend out a part of those budget to people who need to borrow. The hobby price paid with the aid of using the banks to depositors is decrease than the price charged from the borrowers. This distinction among those styles of hobby prices, referred to as the ‘spread’ is the earnings appropriated with the aid of using the financial institution.

- Question 1: Fill with inside the blanks: (a) In a present-day financial system, cash incorporates coins and _________. (b) India was given its important financial institution in 1935. Its call is the ________. (c) Reserve Bank troubles the _________ of the country. (d) The hobby price paid with the aid of using the banks to depositors is ____________ than the price charged from the borrowers. (e) This distinction among those styles of ________, referred to as the ‘spread’ is the earnings appropriated with the aid of using the financial institution.

- Question 2: State whether or not True of False. (a) Central Bank controls cash deliver of the country via diverse methods. (b) Central Bank acts as a banker to the authorities. (c) Commercial Banks take delivery of deposits from the general public and lend out a part of those budget to people who need to borrow. (d) The hobby price paid with the aid of using the banks to depositors is better than the price charged from the borrowers.

- Answer 1: (a) financial institution deposits, (b) Reserve Bank of India, (c) Forex, (d) decrease, (e) hobby prices.

- Answer 2: (a) True, (b) True, (c) True, (d) False.

Banks can lend truly due to the fact they do now no longer count on all of the depositors to withdraw what they have got deposited on the equal time. When the banks lend to any man or woman, a brand-new deposit is opened in that man or woman’s call. Thus, cash deliver will increase to vintage deposits plus new deposit (plus Forex.) Let us take an example. Assume that there may be most effective one financial institution with inside the country. Let us assemble a fictional stability sheet for this financial institution. Balance sheet is a file of belongings and liabilities of any organization. Conventionally, the belongings of the organization are recorded at the left-hand aspect and liabilities at the right-hand aspect. Accounting regulations say that each facet of the stability sheet have to be identical or general belongings have to be identical to the full liabilities. Assets are mattering an organization owns or what an organization can declare from others. In case of a financial institution, aside from buildings, furniture, etc., its belongings are loans given to public.

When the financial institution offers out mortgage of Rs one hundred to a man or woman, that is the financial institutions declare on that man or woman for Rs one hundred. Another asset that a financial institution has is reserves. Reserves are deposits which industrial banks maintain with the Central financial institution, Reserve Bank of India (RBI) and its coins. These reserves are saved in part as coins and in part with inside the shape of monetary instruments (bonds and treasury bills) issued with the aid of using the RBI. Reserves are much like deposits we maintain with banks. We maintain deposits and those deposits are our belongings, they may be withdrawn with the aid of using us. Similarly, industrial banks like State Bank of India (SBI) maintain their deposits with RBI and those are referred to as Reserves.

- Question 1: Fill with inside the blanks: (a) Balance sheet is a file of ___________ any organization. (b) In case of a financial institution, aside from buildings, furniture, etc., its belongings are ___________. (c) Another asset that a financial institution has is ______________ which industrial banks maintain with the Central financial institution, Reserve Bank of India (RBI) and its coins. (d) When the financial institution offers out mortgage of Rs one hundred to a man or woman, that is the financial institution’s ____________ on that man or woman for Rs one hundred.

- Question 2: What are reserves?

- Question 3: State whether or not True or False. (a) Assets are mattering an organization owns or what an organization can declare from others. (b) Accounting regulations say that each facet of the stability sheet has to be identical or general belongings have to be identical to the full liabilities. (c) Reserves aren’t much like deposits we maintain with banks. (d) Reserves are deposits which industrial banks maintain with the Central financial institution.

- Answer 1: (a) belongings and liabilities, (b) loans given to public, (c) reserves, (d)declare

- Answer 2: Reserves are much like deposits we maintain with banks. We maintain deposits and those deposits are our belongings, they may be withdrawn with the aid of using us. Similarly, industrial banks like State Bank of India (SBI) maintain their deposits with RBI and those are referred to as Reserves.

- Answer 3: (a) True, (b)True, (c)False, (d) True.

There are styles of open marketplace operations: outright and repo. Outright open marketplace operations are everlasting in nature: whilst the important financial institution buys those securities (as a consequence injecting cash into the machine), it’s miles with none promise to promote them later. Similarly, whilst the important financial institution sells those securities (as a consequence taking flight cash from the machine), it’s miles with none promise to shop for them later. As a result, the injection/absorption of the cash is of everlasting nature. However, there may be any other sort of operation wherein whilst the important financial institution buys the security, this settlement of buy additionally has specification approximately date and rate of resale of this security. This sort of settlement is referred to as a repurchase settlement or repo. The hobby price at which the cash is lent on this manner is referred to as the reporate. Similarly, in preference to outright sale of securities the important financial institution might also additionally promote the securities via a settlement which has a specification approximately the date and rate at which it’ll be repurchased. This sort of settlement is referred to as an opposite repurchase settlement or opposite repo.

The price at which the cash is withdrawn on this way is referred to as the opposite reporate. The Reserve Bank of India conducts repo and opposite repo operations at diverse maturities: overnight, 7-day, 14- day, etc. This sort of operations has now end up the primary device of financial coverage of the Reserve Bank of India. The RBI can impact cash deliver with the aid of using converting the price at which it offers loans to the economic banks. This price is referred to as the Bank Rate in India. By growing the financial institution price, loans taken with the aid of using industrial banks end up greater expensive; this reduces the reserves held with the aid of using the economic financial institution and subsequently decreases cash deliver. A fall with inside the financial institution price can boom the cash deliver.

- Question 1: What is repo?

- Question 2: Fill with inside the blanks: (a) A fall with inside the financial institution price can _______ the cash deliver. (b) The Reserve Bank of India conducts repo and _______ at diverse maturities: overnight, 7-day, 14- day, etc. (c) There are styles of open marketplace operations: ________ and _________. (d) Outright open marketplace operations are __________ in nature. (e) The hobby price at which the cash is lent on this manner is referred to as the _______. (f) The price at which the cash is withdrawn on this way is referred to as the ________. (g) The RBI can impact _________ with the aid of using converting the price at which it offers loans to the economic banks. (h) By growing the financial institution price, ________ taken with the aid of using industrial banks end up greater expensive; this reduces the reserves held with the aid of using the economic financial institution and subsequently ________ cash deliver.

- Answer 1: When the important financial institution buys the security, this settlement of buy additionally has specification approximately date and rate of resale of this security. This sort of settlement is referred to as a repurchase settlement or repo.

- Answer 2: (a) boom, (b) opposite repo, (c) outright, repo, (d) everlasting, (e) reporate, (f) opposite reporate; (g) cash deliver, (h) loans, decreases

Demonetisation turned into a brand-new initiative taken with the aid of using the Government of India in November 2016 to address the trouble of corruption, black cash, terrorism and move of faux forex with inside the financial system. Old notes of Rs 500, and Rs one thousand have been not felony gentle. New notes with inside the denomination of Rs 500 and Rs 2000 have been launched. The public have been suggested to deposit vintage notes of their financial institution account until 31 December 2016 with none assertion and as much as 31March 2017 with the RBI with assertion. Further to keep away from a whole breakdown and coins crunch, authorities had allowed change of Rs 4000 vintage forex the with the aid of using new forex in step with man or woman and in step with day. Further until 12 December 2016, vintage notes have been proper as felony gentle at petrol pumps, authority’s hospitals and for fee of presidency dues, like taxes, electricity bills, etc. This circulate acquired each appreciation and criticism. There have been lengthy queues out of doors banks and ATM booths. The scarcity of forex in move had a negative effect at the financial sports.

However, matters advanced with time and normalcy returned. This circulate has had tremendous effect additionally. It advanced tax compliance as a big wide variety of humans have been offered with inside the tax ambit. The financial savings of a character have been channelised into the formal monetary machine. As a result, banks have greater sources at their disposal which may be used to offer greater loans at decrease hobby prices. It is an illustration of State’s choice to place a slash on black cash, displaying that tax evasion will not be tolerated. Tax evasion will bring about monetary penalty and social condemnation. Tax compliance will enhance and corruption will lower. Demonetisation may also assist tax management in any other manner, with the aid of using moving transactions out of the coin’s financial system into the formal fee machine. Households and corporations have started to shift from coins to digital fee technologies.

- Question 1: Fill with inside the blanks: (a) Demonetisation acquired each appreciation and _______. (b) The scarcity of forex in move had an _________ effect at the financial sports. (c) Due to demonetisation, tax __________ will enhance and ________ will lower. (d) New forex notes with inside the denomination of ₹ ___________ and ₹ _________ have been launched.

- Question 2: Why did the authorities take the initiative of demonetisation?

- Question 3: What precautions have been taken to keep away from whole breakdown?

- Question 4: What have been the results and blessings of the demonetisation?

- Question 5: State whether or not True or False: (a) Demonetisation acquired each appreciation and criticism. (b) Government had allowed change of ₹4000 vintage forex the with the aid of using new forex in step with man or woman and in step with day. (c) There have been no queues out of doors banks and ATM booths. (d) New forex notes with inside the denomination of ₹500 and ₹1000 have been launched. (e) Till 12 December 2016, vintage forex notes have been proper as felony gentle at petrol pumps, authority’s hospitals and for fee of presidency dues, like taxes, electricity bills, etc. (f) It advanced tax compliance as a big wide variety of humans have been offered with inside the tax ambit.

- Answer 1: (a) criticism, (b) negative, (c) compliance, corruption, (d) 500, 2000.

- Answer 2: Demonetisation turned into a brand-new initiative taken with the aid of using the Government of India in November 2016 to address the trouble of corruption, black cash, terrorism and move of faux forex with inside the financial system.

- Answer 3: The public have been suggested to deposit vintage notes of their financial institution account until 31 December 2016 with none assertion and as much as 31March 2017 with the RBI with assertion. Further to keep away from a whole breakdown and coins crunch, notes authorities had allowed change of ₹4000 vintage forex the with the aid of using new forex in step with man or woman and in step with day. Further until 12 December 2016, vintage forex notes have been proper as felony gentle at petrol pumps, authority’s hospitals and for fee of presidency dues, like taxes, electricity bills, etc.

- Answer 4: This circulate acquired each appreciation and criticism. There have been lengthy queues out of doors banks and ATM booths. The scarcity of forex in move had a negative effect at the financial sports. However, matters advanced with time and normalcy returned. This circulate has had tremendous effect additionally. It advanced tax compliance as a big wide variety of humans have been offered with inside the tax ambit. The financial savings of a character have been channelised into the formal monetary machine. As a result, banks have greater sources at their disposal which may be used to offer greater loans at decrease hobby prices. It is an illustration of State’s choice to place a slash on black cash, displaying that tax evasion will not be tolerated.

- Answer 5: (a) True, (b)True, (c) False, (d) False, (e) True, (f) True.

Copyright 2024 by Tiwari Academy | A step towards Free Education

Money And Banking Chapter 2 Notes, QnA 2023

Money and banking, money .

Money is a liquid asset used in the settlement of transactions. It is an economic unit that functions as a generally recognized medium of exchange for transactional purposes in an economy.

Function of money is based on the general acceptance of its value within a governmental economy and internationally through foreign exchange.

Money is commonly referred to as currency. Each government has its own money system.

It is a normally recognized medium of exchange that people and global economies intend to hold, and are willing to accept as payment for current or future transactions.

Supply of Money

The overall stock of money circulating in an economy or among the public is the money supply. This circulating money involves the currency, printed notes, money in the deposit accounts and in the form of other liquid assets.

Valuation and analysis of the money supply help the policy makers to frame the policy or to change the current policy of increasing or reducing the supply of money. The valuation of money is important as it ultimately affects the business cycle and thereby affects the economy.

The Reserve Bank of India publishes figures for four alternative measures of money supply, viz. M1, M2, M3 and M4.

- M1 = CU + DD M2 = M1 + Savings deposits with Post Office savings banks

- M3 = M1 + Net time deposits of commercial banks

- M4 = M3 + Total deposits with Post Office savings organisations (excluding National Savings Certificates)

- CU is currency (notes plus coins) held by the public and DD is net demand deposits held by commercial banks

Money deposits of the public held by the banks are to be included in the money supply.

The interbank deposits, in which a commercial bank holds in other commercial banks, are not to be regarded as part of the money supply.

- M1 and M2 are known as narrow money. M3 and M4 are known as broad money.

- These gradations are in decreasing order of liquidity.

- M1 is most liquid and easiest for transactions whereas M4 is least liquid of all.

- M3 is the most commonly used measure of money supply. It is also known as aggregate monetary resources.

Money Creation By The Commercial Banking System .

Commercial banks create money through credit against deposits through the bank multiplier. Here credit means granting loans and advances made by banks to the public.

Credit creation by commercial banks refers to the multiplication of original bank deposits,

As every loan creates a deposit.

Commercial Banks create deposits via lending. Banks don’t give loans in cash, instead they issue cheques against the name of the borrowers.

Now the borrower is free to draw money by drawing cheques upon the banks. Borrowers deposit the cheque in another bank. However, the bank knows that the amount of money that the depositors withdraw soon returns to the bank.

Banks keep a certain minimum fraction of the deposits made by customers as reserves. Rest of the deposits they lend. This fraction is called the Legal Reserve Ratio (LRR) and is fixed by the central bank.

Banks keep this fraction of deposits as Cash Reserves because all the depositors do not withdraw the entire amount in one go.

So, to meet the daily demand for withdrawal of cash, it is sufficient for banks to keep only a fraction of deposits as cash reserves. It means, if experience of the banks show that withdrawals are generally around 20% of the deposits, then it needs to keep only 20% of deposits as cash reserves (LRR).

Let’s take an example:

Suppose, initial deposits in banks is Rs 10000, now banks are required to keep only Rs 2000 (20%) as cash reserve and are free to lend Rs 8000.

Banks do not lend this money in cash. Rather, they open the accounts in the names of borrowers, who are free to withdraw the amount whenever they like.

Suppose borrowers withdraw the entire amount of 8000, it will come back into the banks in the form of deposit accounts of those who have received this payment.

With these new deposits of 8000, banks keep 20% as cash reserves and lend the balance Rs 6400. Borrowers use this amount and deposits back.

In this manner the deposits keep on increasing in each round by 80% of the last round deposits. Simultaneously, cash reserves also go on increasing, each time by 80% of the last cash reserve.

This deposit creation comes to end when total cash reserves become equal to the initial deposit.

Click Below For Class 12 All Subject Sample Papers 2024

1. 15+ Political Science Sample Paper 2024 2. 15+ Economics Sample Paper 2024 3. 15+ Business Studies Sample Paper 2024 4. 12+ Physical Education Sample Paper 2024 With Solution 5. 15+ Physics Sample Paper 2024 With Solution 6. 15+ Chemistry Sample Paper 2024 With Solution 7. 15+ Biology Sample Paper 2024 With Solution 8. 15+ English Sample Paper 2024 9. 15+ History Sample Paper 2024 10. 15+ Geography Sample Paper 2024 11. 15+ Maths Sample Paper 2024

Click Below To Learn Other Chapter Notes

- Unit 1: National Income and Related Aggregates

- Unit 3: Determination of Income and Employment

- Unit 4: Government Budget and the Economy

- Unit 5: Balance of Payments

- Unit 6: Development Experience (1947-90) and Economic Reforms since 1991

- Unit 7: Current challenges facing Indian Economy

- Unit 8: Development Experience of India

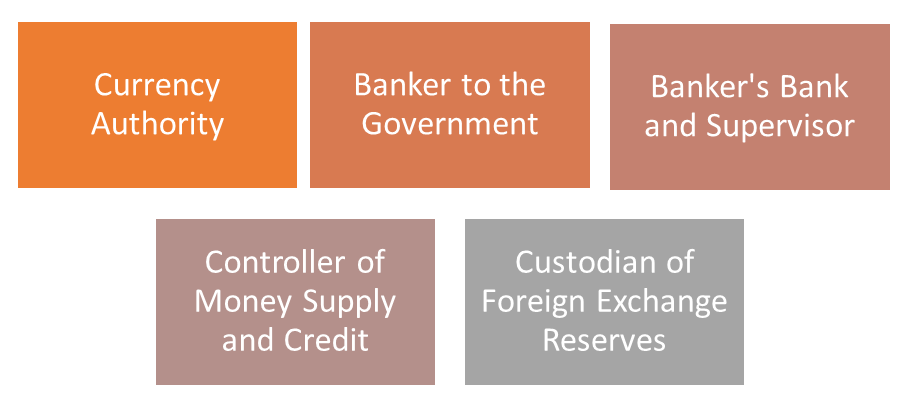

Central Bank And Its Functions

A central bank of any country ( e.g. Reserve Bank of India) is an independent national authority that conducts monetary policy, regulates banks, and provides financial services including economic research.

Central bank’s goals are to stabilize the nation’s currency, keep unemployment low, and prevent inflation.

Most central banks are governed by a board consisting of its member banks. The central bank aligned with the nation’s long-term policy goals. At the same time, it is free from political influence in its day-to-day operations.

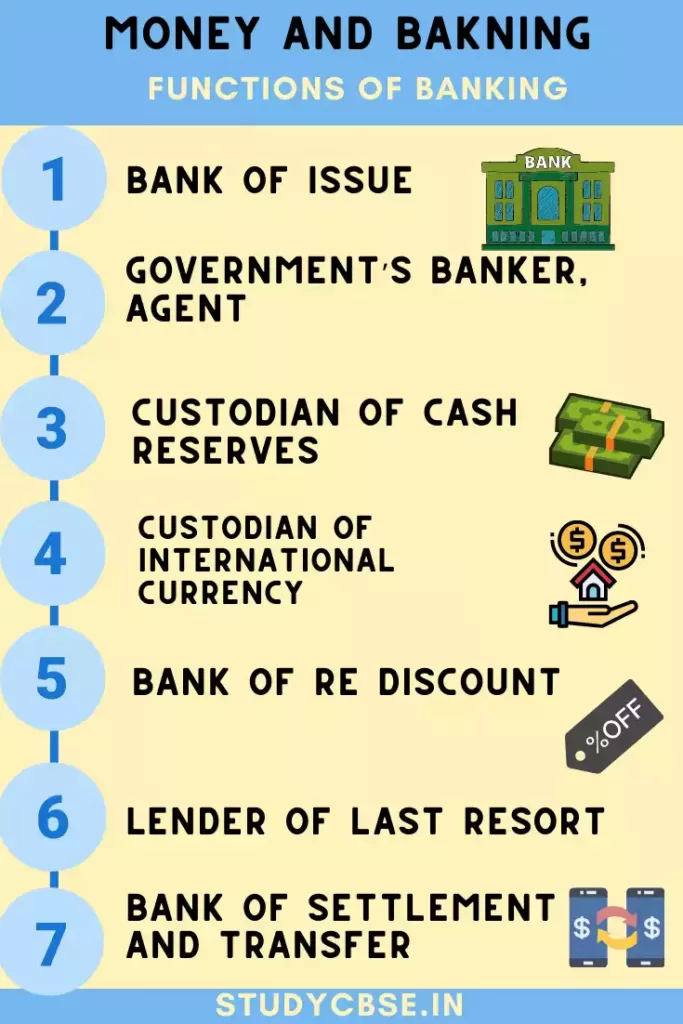

Functions of Central Bank

There are two kinds of functions of the Central bank.

Traditional Functions

Developmental Functions

The traditional functions of the central bank include the following:

- Bank of issue :

Possesses an exclusive right to issue notes in every country of the world. The issue of notes by one bank has led to uniformity in note circulation and balance in money supply.

- Government’s banker, agent :

Central bank performs banking functions for the government as commercial banks performs for the public by accepting the government deposits and granting loans to the government. As an agent, the central bank manages the public debt.

- Custodian of cash reserves :

Central bank takes care of the cash reserves of commercial banks.

- Custodian of international currency :

Central bank maintains a minimum reserve of international currency to meet emergency requirements of foreign exchange and overcome adverse requirements of deficit in balance of payments.

- Bank of re discount :

Serve the cash requirements of individuals and businesses by Re discounting the bills of exchange through commercial banks.

- Lender of last resort :

The central bank provides loans against treasury bills, government securities, and bills of exchange.

- Bank of settlement and transfer:

The central bank helps in settling mutual indebtedness between commercial banks.

- Controller of Credit :

The central bank regulate the credit creation by commercial banks directly or indirectly.

Functions that are related to the promotion of banking system and economic development of the country.

- Developing specialized financial institutions:

The central bank establishes institutions that serve credit requirements of the agriculture sector and other rural businesses.

- Influencing money market and capital market:

Central bank deals in short term credit and capital market deals in long term credit. The central bank maintains the country’s economic growth by controlling the activities of these markets.

- Collecting statistical data:

Gathers and analyzes data related to banking, currency, and foreign exchange position of a country.

Bank of issue

The central bank is the bank of issue. It issues notes and coins to commercial banks.

In addition to issuing currency to the banks, the central bank also issues currency to the central Government of the country.

Currency which are manufactured by the Government, they are put into circulation through the central bank.

However, the central bank has its monetary liability, it is obliged to back the currency issued by its asset of equal value such as gold and bullions.

Government Bank

Government banks are also called Public Sector Banks (PSBs), where a majority stake is held by the Ministry of Finance of the Government of India or Ministry of Finance of various State governments of India.

Currently there are 12 Public Sector Banks in India are existing.

Banker’s Bank

A bankers’ bank is a specific type of bank that exist for the purpose of servicing the charter banks that founded them.

Their banking services are not open to the public. These institutions are designed to support community banks.

Bankers’ banks can help community banks to effectively compete with larger banking entities.

Control of Credit Through Bank Rate

There are two methods of Credit Control through Bank Rate.

- Quantitative or general methods, and

- Qualitative or selective methods.

Quantitative or General Methods

This methods is used by the central bank to influence the total volume of credit in the banking system.

It regulates the lending ability of the financial sector of the whole economy and do not discriminate among the various sectors of the economy.

The quantitative methods of credit control are-

- Open market operations

- Cash-reserve ratio.

Qualitative or Selective Methods

These methods are used by the central bank to regulate the flows of credit into particular directions of the economy.

The qualitative methods affect the types of credit extended by the commercial banks. They affect the composition rather than the size of credit in the economy.

The qualitative methods of credit control are;

- Marginal requirements

- Regulation of consumer credit

- Control through directives

- Credit rationing

- Moral suasion and publicity

- Direct action

Bank Rate Policy

The bank rate or the discount rate is the rate at which a central bank is prepared to discount the first class bills of exchange.

The bank rate is different from the market interest rate. The bank rate is the rate discount of the central bank, while the market interest rate is the lending rate charged in the money market by the ordinary financial institutions.

An increase in the bank rate makes the credit costlier, reduces the volume of credit, discourages economic activity and brings down the price level in the economy.

A declining in the bank rate makes the credit cheaper, increases the volume of credit, encourages the businessmen to borrow and invest, and increases the levels of economic activity.

Bank rate policy aims at influencing:

- The cost and availability of credit to the commercial banks

- Interest rates and money supply in the economy

- The level of economic activity of the economy.

Cash Reserve Ratio (CRR)

Cash reserve ratio is a certain percentage or share that all banks have to keep with the RBI as a deposit as reserves in the form of liquid cash.

This percentage is fixed by the RBI, which changes from time to time. Currently, the CRR is fixed at 3%. That means for every Rs 100 worth of deposits, the bank has to keep Rs 3 with the RBI.

CRR keep inflation under control. During high inflation in the economy, RBI raises the CRR to sanction loans. It squeezes the money flow in the economy, reducing investments and bringing down inflation.

Statutory Liquidity Ratio (SLR)

SLR is the minimum percentage of the aggregate deposits that commercial banks has to maintains in the form of liquid cash, gold or other securities.

Basically it is the reserve requirement that banks are expected to keep before offering credit to customers.

SLR is not reserved with the Reserve Bank of India (RBI), but with banks themselves. But the ratio is fixed by RBI. The SLR was prescribed by Section 24 (2A) of Banking Regulation Act, 1949.

CRR and SLR are the tools of the central bank’s monetary policy to control credit growth, flow of liquidity and inflation in the economy.

Repo Rate and Reverse

Repo rate refers to the rate at which commercial banks borrow money from Central bank (Reserve Bank of India) by selling their securities to maintain liquidity, in case of shortage of funds or due to some statutory measures.

As you borrow money from the bank as a loan on interest, similarly, banks also borrow money from RBI during a cash crunch on which they are required to pay interest to the Central Bank. This interest rate is called the repo rate.

Repo stands for ‘Repurchasing Option’. It is an agreement in which banks provide eligible securities such as Treasury Bills to the RBI while availing overnight loans.

Components of a Repo Transaction

Control inflation – The Central bank increases or decreases the Repo rate depending on the inflation, to control the economy by keeping inflation in the limit.

Hedging & Leveraging – RBI aims to hedge and leverage by buying securities from the banks and provide cash to them

Short-Term Borrowing – RBI lends money for a short period of time, maximum being an overnight post which the banks buy back their securities deposited at a predetermined price.

Collaterals – RBI accepts collateral in the form of gold, bonds etc.

Cash Reserve (or) Liquidity – Banks borrow money from RBI to maintain liquidity as a precautionary measure.

Affect Of Repo Rate

Repo rate is a strong system of the Indian monetary policy that can regulate the country’s money supply, inflation levels, and liquidity.

The levels of repo have a direct impact on the cost of borrowing for banks. If repo rate is higher then borrowing will be a costly affair for businesses and industries, which in turn slows down investment and money supply in the market.

On the other hand lowers the repo rate, industries find it cheaper to borrow money. It also boost the overall supply of money in the economy.

Reverse Repo Rate

RBI borrows money from banks when there is excess liquidity in the market is called Reverse Repo Rate. In return the banks benefit out of it by receiving interest for their holdings with the central bank.

When levels of inflation is high in the economy, the RBI increases the reverse repo. It encourages the banks to keep more funds with the RBI to earn higher returns on excess funds. Banks are left with lesser funds to extend loans.

Open Market Operations

Open Market operations are purchases and sales of government securities and sometimes commercial paper by the central bank for the purpose of regulating the money supply and credit conditions on a continuous basis.

Under this system, when the central bank wants to reduce the money supply in the market, it sells securities in the market.

Similarly, when the central bank wants to increase the money supply, it purchase securities from the market. This step is taken to reduce the rate of interest and also to help in the economic growth of the country.

Margin Requirement

Margin Requirement means the amount of money that you are required to deposit for entering into a Trade and maintaining an Open Position.

It is the amount of equity, that an investor has in their brokerage account. A margin account is a account in which the broker lends the investor money to buy more securities than what they could otherwise buy with the balance in their account.

Frequently Asked Questions

Q1. What is Repo Rate?

Answer : Repo rate refers to the rate at which commercial banks borrow money from Central bank (Reserve Bank of India) by selling their securities to maintain liquidity, in case of shortage of funds or due to some statutory measures.

Q2. How the Repo Rate affects economy?

Answer : The levels of repo have a direct impact on the cost of borrowing for banks. If repo rate is higher then borrowing will be a costly affair for businesses and industries, which in turn slows down investment and money supply in the market.

Q3: What is money?

Answer: Money is a liquid asset used in the settlement of transactions. It is an economic unit that functions as a generally recognized medium of exchange for transactional purposes in an economy.

Money and Banking Unit 2 CBSE, class 12 Economics notes. This cbse Economics class 12 notes has a brief explanation of every topic that NCERT syllabus has. You will also get ncert solutions, cbse class 12 Economics sample paper, cbse Economics class 12 previous year paper.

Final Words

From the above article you must have learnt about ncert cbse class 12 Economics notes of unit 2 Money and Banking. We hope that this crisp and latest Economics class 12 notes will definitely help you in your exam.

- CBSE Class 12 Macro Economics Chapter 3 – Money and Banking Class 12 Notes

Money and Banking Class 12 Revision Notes

In the money and banking class 12 notes, we will be discussing the meaning and various roles that Money plays. Thus, we will discuss the functions of Money. Then, we will discuss the various motives of holding money under the heading “Demand for Money”. Demand For Money is also known as liquidity preference. Hence, we will seek knowledge about The Transaction and Speculative Motives for holding money. Then, we will learn the legal definitions of Narrow and Broad Money. Also, we will study about the creation of money by the Banking System under the head “Supply For Money.” Moreover, we will be studying the working of Commercial Banks. We will study the type of deposits. Also, we will come to know about the different types of lending by Commercial Banks.

Moreover, we will seek knowledge about the Instruments of Monetary Policy and the Reserve Bank of India (also called a lender of last resort). Here, we will learn about RBI (monetary authority of India). Also, about the instruments which RBI uses for conducting monetary policy. These include regulating money through Open Market Operations, Bank rate policy, Varying Reserve Requirements and others.

Download Toppr app for Android and iOS or signup for free.

Sub-topics under Money and Banking:

- Functions of Money and its Demand : In this Sub-topic, we will study the Functions of Money and Demand for Money also known as liquidity preference.

- Supply of Money : Here, we will learn the legal definitions of Narrow and Broad Money. Also, we will study money Creation by the Banking System Instruments of Monetary Policy and the RBI (lender of last resort).

- Instruments of Monetary Policy and the Reserve Bank of India : In this Sub-topic, we will learn about RBI (monetary authority of India). Also, about the instruments which RBI uses for conducting monetary policy.

Customize your course in 30 seconds

Which class are you in.

CBSE Class 12 Macro Economics Revision Notes

- CBSE Class 12 Macro Economics Chapter 4 – Income Determination Class 12 Notes

- CBSE Class 12 Macro Economics Chapter 6 – Open Economy Macroeconomics Class 12 Notes

- CBSE Class 12 Macro Economics Chapter 5 – Government Budget and the Economy Class 12 Notes

- CBSE Class 12 Macro Economics Chapter 2 – National Income Accounting Class 12 Notes

- CBSE Class 12 Macro Economics Chapter 1 – Introduction to Macro Economics Class 12 Notes

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

Commerce Aspirant » Economics Class 12 » Money and Banking Class 12 Notes Economics

Money and Banking Class 12 Notes Economics

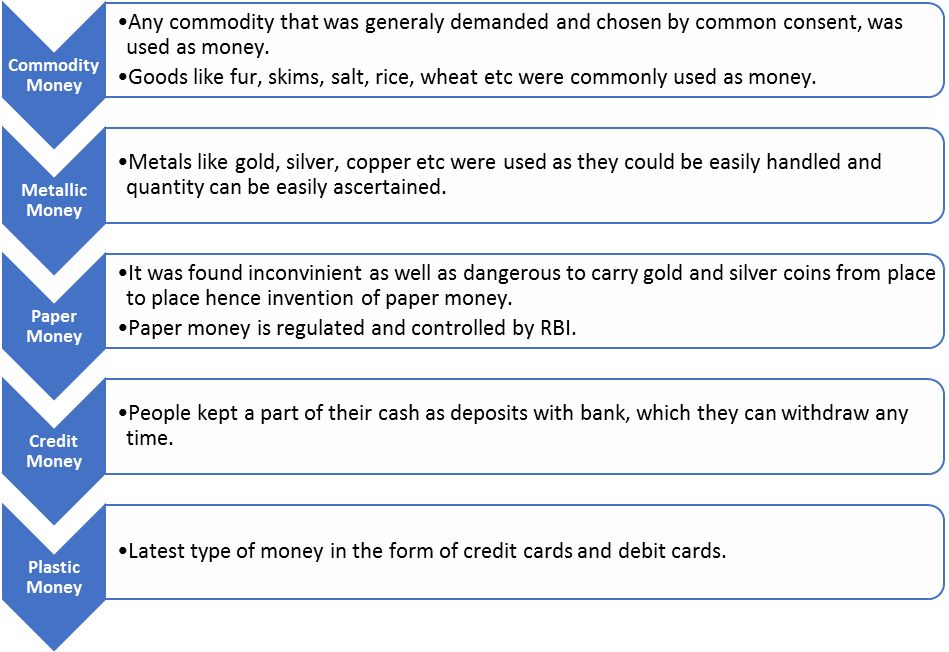

Money and Banking class 12 Notes studies the various concepts about the money used in the Indian economy and the role of commercial and central banks in supply of money and credit creation.

Money is an important discovery of modern times. It is the basic requirement of all economies in today’s time.

Before money was invented, the world used to trade as per the barter system of exchange in which the commodity was exchanged for another commodity.

Money and Banking is an important concept as one cannot imagine his life without money. Banks also plays an important role as they are considered a better place to store money or take advances and loans.

Money and Banking Class 12 Notes Economics: Overview

What is money.

Money is anything which is generally used as a medium of exchange, measure of value, store of value and means of standard deferred payment.

It covers all types of money: coins, paper notes, cheques, digital money, plastic money etc…. It can be used to buy anything as it is legally accepted by everyone. It removes the problem of double coincidence of wants as anyone can buy anything he needs.

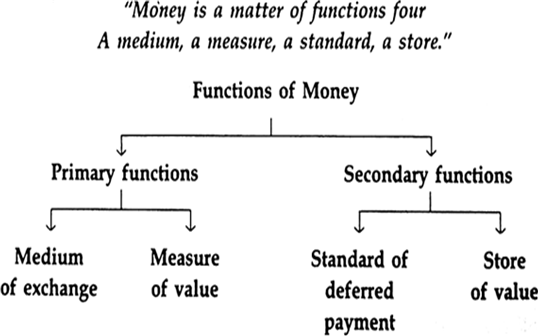

FUNCTIONS OF MONEY

The functions of money are broadly classified as:

- Primary Functions

- Secondary Functions

TYPES OF MONEY

- Legal Tender Money: Money which can be legally used to make payments for some obliged debt is known as legal tender money . It is of two types-

- Limited legal tender money : It is that form of legal money which is used to make payments for the debts up to a certain amount. For example; coins.

- Unlimited legal tender money : It is that form of legal money which can be used to make payment of debts up to any amount. There is no limit fixed. For example; paper/ currency notes.

- Full Bodied Money : It is that form of money in which face value is equal to intrinsic value of money. It means commodity value= money value. For example: gold and silver coins.

- Representative Full Bodied Money : It is that form of full bodied money in which intrinsic value is less than face value of money. It means commodity value< money value. For example: paper notes.

- Credit Money: It is that form of money whose intrinsic value is lower than its face value. It means that money value> commodity value. For example: credit cards, bank deposits etc….

MONETARY SYSTEM IN INDIA

- In India, monetary authority is ‘Reserve Bank of India’.

- Paper currency standard is followed in India.

- Coins are regarded as limited legal tender money.

- RBI has sole monopoly to issue currency in India.

- Ministry of Finance issues 1 rupee coins and notes in India.

- India follows Minimum Reserve System for issuing notes. It means that RBI has to keep a minimum of Rs. 200 crores as gold and foreign exchange with the World Bank for issuing coins and notes.

MONEY SUPPLY

Money supply refers to the total money held by public at a particular point of time in an economy.

It includes money only held by the “public” not the government or banking system. Money supply is a “Stock” concept.

There are 4 measures of money supply. As per money and banking class 12 we need to cover only M 1 measure of money supply.

MEASURES OF MONEY SUPPLY

(i) M 1 : It is the first and basic measure of money supply. It includes currency held by the public, demand deposits of commercial banks and other deposits with the RBI. M 1 = Currency and coins with public+ Demand deposits with commercial banks+ Other deposits with RBI

(ii) M 2 : It is a broader concept of money supply as compared to M 1 . It also includes savings deposits with the post office saving bank. M 2 = M 1 + Savings deposit with Post office saving bank

(iii) M 3 : It also includes net time deposits in addition to M 1 measure of money supply. M 3 = M 1 + Net time deposits with banks

(iv) M 4 : It includes total deposits with post office savings bank in addition to M 3 measure of money supply. M 4 = M 3 + Total deposits with post office saving bank

- M 1 is the most liquid form of money supply while M 4 is the least liquid.

- M 1 and M 2 are considered the narrow concept of money supply while M 3 and M 4 are the broader concept of money supply.

HIGH POWERED MONEY

- High powered money is the money produced by RBI and the government.

- It includes currency held by the public and the cash reserves held by the banks.

- It is denoted by symbol (H).

- It is different from money because money consists of demand deposits while it includes cash reserves which act as a base for generating demand deposits.

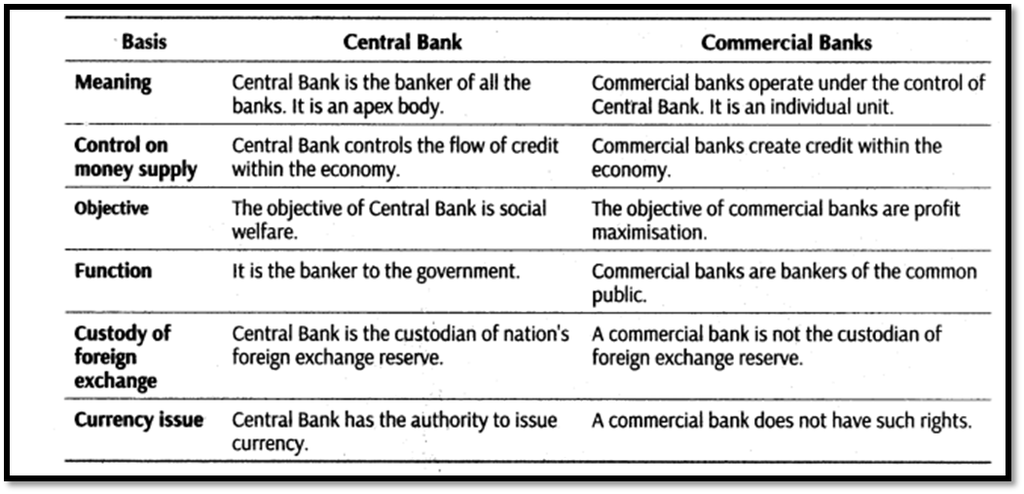

There are mainly 2 types of banks, Commercial Banks and Central Banks. In money and banking class 12 we will study about the functions of both banks and the credit creation process of commercial banks.

COMMERCIAL BANKS

A commercial bank is a bank which accepts deposits and advance loans for the purpose of earning profits. For example: SBI, PNB, Canara Bank, Kotak Mahindra Bank etc….

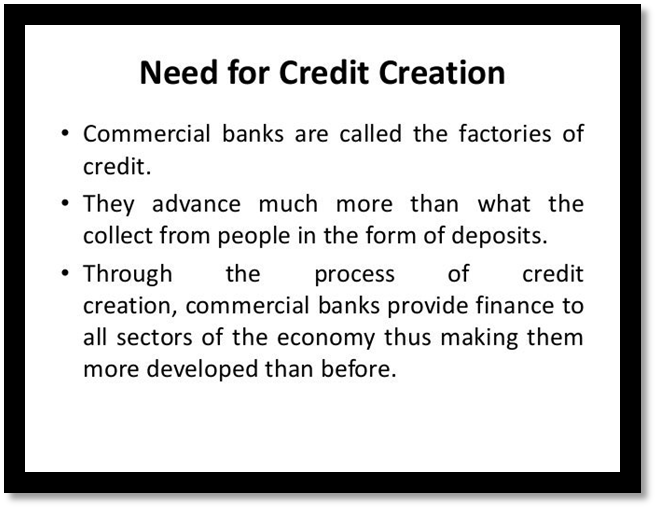

CREDIT CREATION PROCESS

This is an important activity of commercial bank. Through this process, commercial banks create credit, which is created through excess reserves of the initial deposits.

There are two main assumptions

1. The entire banking system is one unit known as “BANK”. 2. All the receipts and payments in the economy is done through the Banks.

For the credit creation, commercial banks are legally required to keep a certain fraction of deposits with RBI and themselves. This fraction is called Legal Reserve Ratio (LRR).

The bank knows that all the customers will not come in one go to withdraw their money and that there is a constant flow of money with the bank. That’s why only a fraction of deposits are kept as reserve.

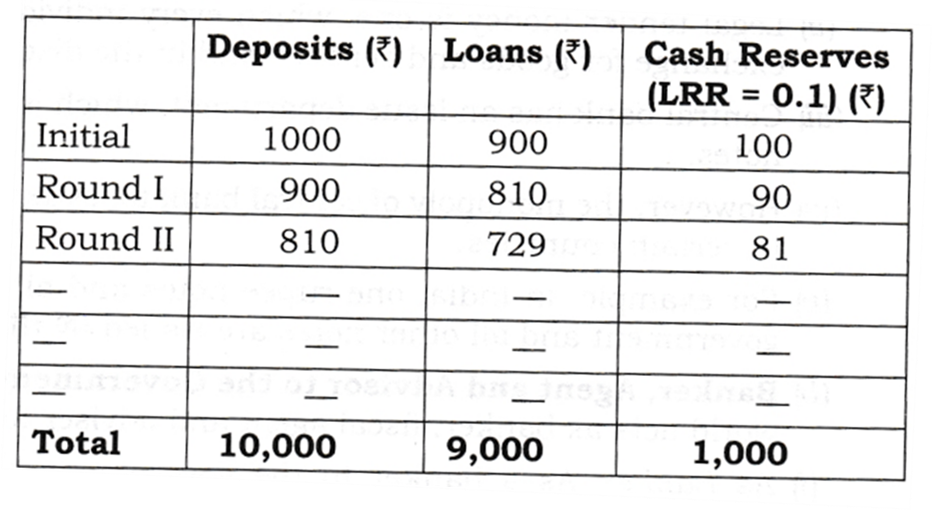

- Money creation is an important aspect of money and banking class 12. Let us take a hypothetical example to understand this concept.

- Let us assume that LRR= 10% and Initial deposits= Rs. 100.

- Now, the banks will keep 10% of Rs. 100 as reserve and give the rest Rs.90 as loan to the public in round 1.

- In round 2, banks will keep 10% of Rs. 90 as reserve and give Rs. 81 as loan to public.

- This process goes on and on till the reserves are exhausted. In this way, commercial banks create multiple credits with just the initial deposit.

- This gives rise to the concept of “Money Multiplier”.

- “Money Multiplier” or deposit multiplier measures the amount of deposits the commercial banks are able to create through the deposits of public kept with them as reserves. Money Multiplier = 1/LRR

- In this case, money multiplier is 1/10% = 10.

Total Deposits= = 100*10= Rs. 1000

CENTRAL BANKS

Central bank is the ‘apex’ body that controls, regulates and operates the entire banking system in the country. In India, the central bank is RBI.

FUNCTIONS OF CENTRAL BANK

- Bank of issue: Central bank has the sole authority to issue currency notes and coins (except one rupee notes and coins). The central bank is obliged to keep the reserves in terms of gold equal to the amount of currency issued with the World Bank. It leads to uniformity in note circulation. It gives the power to Central Bank to enhance the money supply. It also helps in maintaining stability in value of money.

- Bankers to Government: The RBI acts as a banker, agent and a financial advisor to the central and state government. As a banker, it carries out all the banking business of the government. As an agent, it manages the public debt. As a financial advisor, it advices the government from time to time in financial and monetary matters.

- Banker’s Bank: Being the apex bank, central bank acts as a banker to all other banks. Other banks in the economy keep their reserves with the RBI. It has same relationship with other banks as the commercial banks have with the public. It obliges the commercial banks to keep CRR with them during the credit creation process.

- Custodian of Foreign Exchange: Central banks keep the reserves of foreign currency with themselves so that there is no excess increase or decrease in price of foreign currency. Central bank does this so that foreign reserves are available to the public.

- Lender of Last Resort: When commercial banks fail to meet the needs of the public, then RBI helps the commercial banks and the public by advancing loans to them and acts as a lender of last resort.

- Clearing House: Central bank has the reserves of commercial banks with themselves. All commercial banks have their accounts with the RBI. Therefore, RBI can make settlement of claims of various banks against each other by editing the entries in their accounts.

- Supervisor: Central bank regulates and controls the commercial banks. It exercises regular inspection and of banks and entries passed by them.

CONTROL OF CREDIT AND MONEY SUPPLY

There are TWO ways of controlling the credit creation in the market: Quantitative measure and Qualitative measures.

QUANTITATIVE MEASURES

- Repo Rate: It is the rate at which central bank gives money to commercial banks for short- term purpose without any collateral. An increase in repo rate reduces the capability of commercial banks to lend money and thus decreases money supply in the economy. A decrease in repo rate increases the money supply in the economy.

- Bank Rate: It is the rate at which central bank lends money to commercial banks for long- term purpose by keeping something as collateral. An increase in bank rate will decrease the lending capacity of commercial banks and thus reduces money supply in the economy. A decrease in bank rate increases the money supply in the economy.

- Reverse Repo Rate: It is the rate at which commercial banks keep their reserves with central bank in order to earn interest willfully. An increase in reverse repo rate induces commercial banks to keep reserves with central bank rather than giving to public. So, money supply decreases in the economy. A decrease in reverse repo rate increases the money supply in the economy.

- Legal Reserve Ratio (LRR): It is the amount of deposits which the commercial banks are obliged to keep with themselves and the central bank for credit creation process. There are two parts of LRR: CRR and SLR.

- Cash Reserve Ratio (CRR): It is the amount of deposits which the commercial banks are obliged to keep with the central bank for creating credit in the economy. An increase in CRR decreases money supply in economy and decrease in CRR increases money supply in the economy.

- Statutory Liquidity Ratio (SLR): It is the amount of deposits which the commercial banks are obliged to keep with themselves for the credit creation process. An increase in SLR decreases money supply in economy and decrease in SLR increases money supply in the economy.

QUALITATIVE MEASURES

- Open Market Operations: It refers to the sale and purchase of securities in the open market by the central bank to/from commercial banks or public. Purchase of securities by central bank increases the bank capacity to give credit as it receives money and thus it increases the money supply in the economy. Sale of securities by commercial banks soaks the excess money from the economy and thus reduces the money supply in the market.

- Margin Requirement: It refers to the difference between the amount of loan and the market value of the securities offered against the loan. An increase in margin reduces the borrowing capacity and reduces the money supply in the economy. A decrease in margin increases the borrowing capacity and increases the money supply in the economy.

DIFFERENCE BETWEEN COMMERCIAL BANK AND CENTRAL BANK

CBSE Economics Class 12 Notes Term I Syllabus

Part A: Introductory Macroeconomics

- Money and Banking Class 12 Notes

- Government Budget and the Economy Notes

- Balance of Payments Class 12 Notes

- Foreign Exchange Rate Notes

Part B: Indian Economic Development

Development Experience (1947-90) and Economic Reforms since 1991:- 12 Marks

- Indian Economy on the eve of Independence Notes

- Indian Economy (1950-90) Notes

- Economic Reforms since 1991 Notes

Current challenges facing Indian Economy – 10 Marks

- Poverty Class 12 Notes

- Human Capital Formation Class 12

- Rural Development Class 12 Notes

- Economics Class 12 Notes

- Business Studies Class 12 Notes

- Accountancy Class 12 Notes

- Economics Class 12 MCQs

- Business Studies Class 12 MCQs

- Accountancy Class 12 MCQs

Sandeep garg Class 12 Solutions

Unit Number 319, Vipul Trade Centre, Sohna Road, Gurgaon, Sector 49, Gurugram, Haryana-122028, India

- +91-9667714335

- [email protected]

Class 11 Notes

- Economics Class 11 Notes

- Accountancy Class 11 Notes

Class 11 MCQs

- Economics Class 11 MCQs

- Business Studies Class 11 MCQs

Class 12 Notes

Class 12 MCQs

CBSE Class 12 Case Studies In Business Studies – Financial Management

FINANCIAL MANAGEMENT Financial Management: Definition Financial Management is concerned with optimal procurement as well as usage of finance.

Objective The prime objective of financial management is to maximise shareholder’s wealth by maximising the market price of a company’s shares.

Financial Decisions Involved in Financial Management

- Investment Decision

- Financing Decision

- Dividend Decision

Role of Financial Management

- To determine the capital requirements of business, both long-term and short-term.

- To determine the capital structure of the company and determine the sources from where required capital will be raised keeping in view the risk and return matrix.

- To decide about the allocation of funds into profitable avenues, keeping in view their safety as well.

- To decide about the appropriation of profits.

- To ensure efficient management of cash in order to ensure both liquidity and profitability.

- To exercise overall financial controls in order to promote safety, profitability and conservation of funds.

INVESTMENT DECISION

- It seeks to determine as to how the firm’s funds are invested in different assets

- It helps to evaluate new investment proposals and select the best option on the basis of associated risk and return.

- Investment decision can be long-term or short-term.

- A long-term investment decision is also called a Capital Budgeting decision.

Types of Investment Decision

- It refers to the amount of capital required to meet day- to-day running of business.

- It relates to decisions about cash, inventory and receivables.

- It affects both liquidity and profitability of business.

- It refers to the amount of capital required for investment in fixed assets or long term projects which will yield return and influence the earning capacity of business over a period of time.

- It affects the amount of assets, competitiveness and profitability of business.

- The expected cash flows from the proposed project should be carefully analysed.

- The expected rate of return should be carefully studied in terms of risk associated from the proposed project.

- Different types of ratio analysis should be done to evaluate the feasibility of the proposed project as compared to similar projects in the same industry.

FINANCING DECISION Financing Decision: Definition Financing decision relates to determining the amount of finance to be raised from different sources of finance.This decision determines the overall cost of capital and the financial risk of the enterprise. Types of Sources of Raising Finance

- Equity shares

- Preference shares

- Retained earnings

- Loan from bank or financial institutions

- Public deposit

Considerations Involved in the Issue of Debt

- Interest on borrowed funds has to be paid regardless of whether or not a business has made a profit. Likewise, borrowed funds have to be repaid ata fixed time.

- There is some amount of financial risk in debt financing.

- The cost of debt is less than equity as the degree of risk assumed by the investors is less and the amount of interest paid by the company is tax deductible.

Factors Affecting Financing Decision

- The source of finance which involves the least cost should be chosen.