How to Transfer Property Using Assignment of Property

These are step-by-step instructions to help you distribute property from a decedent’s estate using a Petition and Order for Assignment. It is best to read them all the way through before starting. Keep a copy of everything you file for your records.

Step 1: Prepare your forms and find out how you will file

Complete the forms using our Do-It-Yourself Settling a Small Estate tool. These instructions explain how many copies you need of each form and when you will need them.

Date and sign the Petition for Assignment. When you do this you are saying the information in the petition is true.

Some of the steps later in these instructions may have slightly different information for you depending on how you will file with the court. Each court decides how it will accept documents for filing. Contact your court to find out which methods are available. Depending on your court, you may be able to file by:

- In-person filing

- E-filing using MiFILE

- Mailing or dropping off documents

You can find contact information for your court on the Courts & Agencies page of Michigan Legal Help.

MiFILE is only available for some courts. Even in courts where it is available you can only use it for some case types. The State Court Administrative Office has a chart of courts that use e-Filing . To learn more, read What Is E-Filing? .

Step 2: If your court requires the form, sign the Testimony to Identify Heirs in front of a notary or deputy register

Not all courts require the Testimony to Identify Heirs form. If the court where you are filing your petition does not require this form, you do not need to sign it.

If your court requires this form, sign it in front of a notary or a deputy register at the probate court. There are notaries at many banks or credit unions. If you need more expanded hours many copy and print shops also have notaries available. Whatever option you choose, call first to make sure someone will be there when you go. Most notaries charge a small fee. You will need to show the notary or deputy register a photo ID, such as a driver’s license or state ID card.

Step 3: Make copies

After you sign your documents, make copies as follows:

- Petition for Assignment– 2 copies

- Protected Personal Identifying Information form– 2 copies

- Order for Assignment (Part 1)– 2 copies

- Order for Assignment (Part 2)– 2 copies

- Testimony to Identify Heirs, if the court where you’re filing requires it– 2 copies

- The death certificate–1 copy

- Proof of payment for funeral or burial expenses, or a bill showing the amount owed– 1 copy

If you are filing either by e-mail or using MiFILE, you will not need to make copies.

Step 4: File your forms and pay the filing fees

Contact your court to find out which filing methods are available. Depending on your court, you may be able to file electronically. To learn more about filing methods that may be available, read Step 1. If you are e-filing using MiFILE, you will need to know the case-type code. The case type code for a Petition for Assignment is PE.

File the following documents with the probate court in the county where the decedent lived or owned property when they died, and keep one copy for your records:

- Two copies of the Petition for Assignment, Protected Personal Identifying Information form, Order for Assignment (Part 1), and Order for Assignment (Part 2)

- Two copies of the Testimony to Identify Heirs if the probate court where you’re filing requires it

- A copy of the death certificate

- Proof that the funeral and burial expenses have been paid or a bill showing the amount owed

You must pay a $25 filing fee when you file your petition. You must also pay an inventory fee and a fee to get a certified copy of the Order Assigning Assets. The inventory fee is based on the value of property in the estate. If the property in the estate has no value, the inventory fee is $5. Use the Inventory Fee Calculator to find out how much the inventory fee will be.

Contact your court to find out which filing methods are available. Depending on your court, you may be able to file electronically. To learn more about filing methods that may be available, read Step 1.

After your petition is filed, a judge will review it and sign it (if it is approved). This could happen the same day you file it, or you may have to return to the court to pick it up another day. You will need a certified copy of the order to transfer the property in the estate. The fee to get a certified copy varies, but it is usually $15 to $20. You may want to get more than one certified copy, depending on how much property needs to be distributed.

Step 5: Decide how the property will be divided

The Do-It-Yourself Settling a Small Estate tool will tell you the shares each person is entitled to, but some things (like cars) cannot easily be divided. Decide how to divide the existing property so everyone gets the share they deserve.

Step 6: Transfer personal property

You need the certified copy of the Order Assigning Assets to transfer the property in the estate. You might need it to show to people who have personal property the decedent owned, like a bank or the decedent’s landlord .

If a decedent had a bank account, take a certified copy of order along with a copy of the death certificate to the decedent’s bank. The bank should give you the money in the account. If the order says more than one person is entitled to part of the account, it might be distributed as checks to each person entitled to a share.

If the decedent had property in an apartment or rented home, show the landlord a certified copy of the order to collect the decedent’s personal property.

Step 7: Transfer real estate (if needed)

Record a certified copy of the Order Assigning Assets with the register of deeds for the county where the property is located. Check the county’s website or call the local register of deeds office to find out the recording fee.

If the person getting the property will be living there, they must fill out a Principal Residence Exemption Affidavit and file it with the city or township where the property is located within 90 days after the decedent’s death.

If the decedent lived in the property and the person getting the property is not going to live there but plans to continue owning it, they need to fill out a Request to Rescind a Principal Residence Exemption and file it with the city or township where the property is located within 90 days after the decedent’s death.

The Principal Residence Exemption forms do not have to be filed for three years if the property is for sale.

Step 8: Transfer any vehicles (if needed)

The person inheriting the vehicle must sign the Certification from the Heir to a Vehicle, which was prepared by the Do-It-Yourself Settling a Small Estate tool. Take it to the Secretary of State’s (SOS) office with a copy of the death certificate. If you have a copy of the vehicle title, take that, too.

If there is no surviving spouse, more than one heir may each have an equal right to the car. Those who will not be getting the title in their names may complete and sign a Certification statement of their own to state they give up that right.

If the car is transferred to someone who is not the spouse or an heir, the person who gets it will have to pay use tax. The use tax is paid at the SOS office when the title is transferred.

Step 9: Collect any money due from the decedent’s employer

If the decedent’s employer hasn’t paid all wages and benefits due to the decedent, show the employer a certified copy of the order to collect that money.

Give the gift

For families

For advisors

Order For Assignment

Everything you need to know about Michigan Form PC 556o, including helpful tips, fast facts & deadlines, how to fill it out, where to submit it and other related MI probate forms.

About Order For Assignment

There are all sorts of forms executors, beneficiaries, and probate court clerks have to fill out and correspond with during probate and estate settlement, including affidavits, letters, petitions, summons, orders, and notices.

Order For Assignment is a commonly used form within Michigan. Here’s an overview of what the form is and means, including a breakdown of the situations when (or why) you may need to use it:

Atticus Fast Facts About Order For Assignment

Sometimes it’s tough to find a quick summary— here’s the important details you should know about Order For Assignment:

This form pertains to the State of Michigan

The relevant probate statute or Michigan laws related to this form include: MCL 700.1210, MCL 700.1302, MCL 700.3982

Government forms are not typically updated often, though when they are, it often happens rather quietly. While Atticus works hard to keep this information about Michigan’s Form PC 556o - Order For Assignment up to date, certain details can change from time-to-time with little or no communication.

How to file Form PC 556o

Step 1 - download the correct michigan form based on the name and id if applicable.

Double check that you have both the correct form name and the correct form ID. Some Michigan probate forms can look remarkably similar, so it’s best to double, even triple-check that you’re using the right one! Keep in mind that not all States have a standardized Form ID system for their probate forms.

Step 2 - Complete the Document

Fill out all relevant fields in Form PC 556o, take a break, and then review. Probate and estate settlement processes in MI are long enough to begin with, and making a silly error can push your timeline even farther back. No thank you!

Note: If you don’t currently know all of the answers and are accessing Form PC 556o online, be sure to avoid closing the browser tab and potentially losing all your progress (or use a platform like Atticus to help avoid making mistakes).

Step 3 - Have Form PC 556o witnessed or notarized (if required)

Some States and situations require particular forms to be notarized. If you have been instructed to get the document notarized or see it in writing on the document, then make sure to hire a local notary. There are max notary fees in the United States that are defined and set by local law. Take a look at our full guide to notary fees to make sure you aren’t overpaying or getting ripped off.

Step 4 - Submit Order For Assignment to the relevant office

This is most often the local probate court where the decedent (person who passed away) is domiciled (permanently resides) or the institution involved with this particular form (e.g. a bank). Some offices allow you to submit forms online, other’s don’t, and we while we generally recommend going in-person to expedite the process, sometimes that simply isn’t an option. It’s also a generally good idea to establish a positive working relationship with any probate clerk (unfortunately there’s enough people & process out there making things more difficult and unnecessarily confusing for them), so a best practice is to simply ask the probate clerk proactively exactly how and where they’d prefer you to submit all forms. Need help getting in touch with a local probate court or identifying a domicile probate jurisdiction? 👉 Find and Contact your Local Probate Court 👉 What is a Domicile Jurisdiction?

Sponsored by Atticus App

Need help with Michigan Probate?

Join all the other families who have trusted Atticus through probate, and experience the peace that comes from knowing you're taking the right steps, spending the least amount of money, and not wasting a single second.

When Order For Assignment is due

Different probate forms or processes can require different deadlines or response times for completing the appropriate form.

While some steps in the process are bound to specific deadlines (like petitioning for probate, having to submit an inventory of assets , or filing applicable notices to creditors and beneficiaries), many probate forms or processes are not tied to a specific deadline since the scope of work can vary based on situational factors or requirements involved.

Either way, there are a bunch of practical reasons why personal representatives should work to complete each step as thoroughly and quickly as possible when completing probate in Michigan.

5 reasons you should submit PC 556o as quickly as possible:

The sooner you begin, the faster Michigan can allow heirs and beneficiaries to get their share of assets subject to probate. Acting promptly can also decrease the costs & overall mental fatigue through an otherwise burdensome process. Helpful Context: What’s the Difference Between Probate and Non-Probate Assets?

In general, creditors of an estate usually have around 3-6 months from the time you file notice to creditors to file any claims for debt against the deceased’s assets. If they don’t, then that debt is forfeited (and more importantly, the executor won’t be held personally responsible). So doing this sooner means you have a better idea of who is owed what and ensures you won’t get a surprise collector months later.

Not filing a will within 30 days (on average) could mean that the probate process proceeds according to intestate laws (laws that govern what happens to someone's stuff without a will) or is subject to unnecessary supervision by the probate court. And if you aren't directly related to the deceased (a.k.a. next of kin ), this could also mean you lose your inheritance.

It’s important to file any necessary state tax returns on behalf of the deceased or estate by the following tax season in Michigan. If you don’t, you could owe penalties and interest. This also includes any necessary federal tax returns such as Forms 1040, 1041, or even a Form 706 estate tax return.

If a house in the State of Michigan is left empty (or abandoned) for a while, insurance can get dicey. For example, if the house burns down and no one has been there for a year, an insurance company may get out of paying your claim.

If you’re not using Atticus to get specific forms, deadlines, and timelines for Michigan probate, then try and stay as organized as possible, pay close attention to the dates mentioned in any correspondence you have with the State’s government officials, call the local Michigan probate clerk or court for exact answers regarding Form PC 556o, and when in doubt— consult a qualified trust & estates lawyer for that area.

How to Download, Open, and Edit Form PC 556o Online

Order For Assignment is one of the many probate court forms available for download through Atticus.

It may also be available through some Michigan probate court sites, such as . In order to access the latest version, be updated with any revisions, and get full instructions on how to complete each form, check out the Atticus Probate & Estate Settlement software or consider hiring a qualified legal expert locally within Michigan.

While Atticus automatically provides the latest forms, be sure to choose the correct version of Form PC 556o - Order For Assignment f using any other site or resource in order to avoid having to re-complete the form process and/or make another trip to the Michigan probate court office.

Order For Assignment is a .pdf, so opening it should be as simple as clicking “View Form” from within the Atticus app or by clicking the appropriate link found on any Michigan-provided government platform. Once you’ve opened the form, you should be able to directly edit the form before saving or printing.

Did you know?

Form PC 556o - Order For Assignment is a probate form in Michigan.

Michigan has multiple types of probate and the necessary forms depend on the unique aspects of each estate, such as type and value of assets, whether there was a valid will, who is serving as the personal representative or executor, and even whether or not they also live in Michigan.

During probate, all personal representatives and executives in are required to submit a detailed inventory of assets that must separate non-probate assets from probate assets.

Probate in Michigan, especially without guidance, can take years to finish and cost upwards of $14,000.

Frequently Asked Questions about Order For Assignment

What is probate, exactly?

Probate is the government’s way of making sure that when a person dies, the right stuff goes to the right people (including the taxes the government wants). All of that stuff is collectively known as someone’s “estate”, and it’s the job of the executor or personal representative to fill out all the forms and complete all the required steps to formally dissolve the estate. To get instant clarity on the entire probate process and get an idea of the steps, timeline, and best practices, read the Atticus Beginner’s Guide to Probate .

Where can I get help with Probate?

The best place? Create an account in Atticus to start getting estate-specific advice. You may need a lawyer, you may not, and paying for one when you didn’t need it really hurts. Atticus makes sure you make the best decisions (plus you can write it off as an executor expense). We’ve also created a list of other probate services . Be sure to check it out!

What does a MI executor or personal representative have to do?

An executor is named in someone’s will, and if the deceased didn’t have a will, then the spouse or other close family relative usually steps up to fulfill the role. If no one wants to do it, then a judge will appoint someone. The executor is responsible for the complete management of the probate process, including major responsibilities such as:

Creating an inventory of all probate assets .

Filling out all necessary forms

Paying off all estate debts and taxes

Submitting reports to the court and beneficiaries as requested

And much more. This process often stretches longer than a year. For an idea of what separates executors who succeed from those who make this way harder than it should be, visit our article, Executors of an Estate: What they do & secrets to succeeding .

The Exact Text on Form PC 556o

Here’s the text, verbatim, that is found on Michigan Form PC 556o - Order For Assignment. You can use this to get an idea of the context of the form and what type of information is needed. STATE OF MICHIGAN PROBATE COURT COUNTY ORDER FOR ASSIGNMENT (Part 1) CASE NO. and JUDGE Court address Court telephone no. In the matter of First, middle, and last name of decedent Last four digits of SSN Petitioner’s name, address, and telephone no.Petitioner’s attorney, bar no., address, and telephone no. PCS Code: OAA TCS Code: OFA Approved, SCAO Form PC 556o, Rev. 8/21 MCL 700.1210, MCL 700.1302, MCL 700.3982 Page 1 of 1 Distribute form to: Court, Part 2 Petitioner, Part 1 XXX-XX- A petition for assignment was filed on Date . IT IS ORDERED: 1. The property described in the above-referenced petition for assignment is assigned as follows: a. for funeral and burial expenses, $ to Name , $ to Name , and $ to Name . b. to the surviving spouse, . c. to the following heirs in the stated proportions, . For 63 days from the date of this order, the share of each heir other than a surviving spouse or minor child shall be subject to any unsatisfied debt of the decedent up to the value of property received through this order. 2. The petition is denied. dismissed/withdrawn. Judge signature and date I certify that I have compared this copy with the original on file and that it is a correct copy of the original. Date Deputy register STATE OF MICHIGAN PROBATE COURT COUNTY ORDER FOR ASSIGNMENT (Part 2) CASE NO. and JUDGE Court address Court telephone no. In the matter of First, middle, and last name of decedent Last four digits of SSN Petitioner’s name, address, and telephone no.Petitioner’s attorney, bar no., address, and telephone no. PCS Code: OAA TCS Code: OFA Approved, SCAO Form PC 556o, Rev. 8/21 MCL 700.1210, MCL 700.1302, MCL 700.3982 Page 1 of 1 Distribute form to: Court, Part 2 Petitioner, Part 1 XXX-XX- A petition for assignment was filed on Date . IT IS ORDERED: 1. The property described in the above-referenced petition for assignment is assigned as follows: a. for funeral and burial expenses, $ to Name , $ to Name , and $ to Name . b. to the surviving spouse, . c. to the following heirs in the stated proportions, . For 63 days from the date of this order, the share of each heir other than a surviving spouse or minor child shall be subject to any unsatisfied debt of the decedent up to the value of property received through this order. 2. The petition is denied. dismissed/withdrawn. Judge signature and date I certify that I have compared this copy with the original on file and that it is a correct copy of the original. Date Deputy register

Need help finding the rest of your Michigan Probate forms?

Atticus has probate and estate settlement forms for your State.

How to Probate a Will Without a Lawyer: 7 Short Steps

3 Valuable Tips for Settling a Family Member’s Estate

Letters Testamentary vs. Letters of Administration: Key Differences

Losing a loved one isn't just hard emotionally, it also means filling out a ton of forms & paperwork. Here's what to do next.

Click to get help with Probate & settling an estate

Because of national system maintenance by the American Association of Motor Vehicle Administrators (AAMVA), driver’s license/ID transactions won’t be able to be completed online or at self-service stations from 5 a.m. through noon Sunday, April 28. Vehicle transactions will still be available.

- All Services

- Elections Elections collapsed link

- License & ID License & ID collapsed link

- Vehicle Vehicle collapsed link

- Industry Services Industry Services collapsed link

- Resources Resources collapsed link

- Notary Notary collapsed link

- Languages Languages collapsed link

- Elections resources

- Your voter information (Michigan.gov/Vote)

- How to vote in Michigan

- Election results and data

- Election security in Michigan

- Ballot access

- Election administrator information

- Be a poll worker

- Board of State Canvassers

- Michigan Independent Citizens Redistricting Commission

- Voter education resources

- Register to vote

- Early in-person voting

- Absentee voting

- Vote on Election Day

- First-time voters

- Military and overseas voters

- Voters with disabilities

- Voter language accessibility

Filing for office, including petition signature requirements and political party status.

- Dates and deadlines

- MERTS/Campaign finance

- Personal financial disclosure

- Campaign finance disclosure

- Casino disclosure

- Lobby disclosure

- Legal Defense Funds

Elections administration, including the Election Inspector's Guide; absentee voting; and the Michigan Qualified Voter File.

Find information about the Board of State Canvassers and its meeting notices.

- License and ID information

- New drivers

- Basic Driver Improvement Course (BDIC) eligibility

- License restoration

- Driver assessment

- Road to Restoration

- Motorcycle riders

- New Michigan residents

- Out-of-state residents

- Buying, selling, or leasing

- License plates and tabs

- Disability parking

- Recreational vehicles and watercraft

How do I...

- Schedule an office visit

- Renew my tabs

- Change my address

- Purchase a copy of my driving record

- Correct my name

- Renew my license or ID

- Apply for or renew a disability parking placard

- Apply for or renew a CDL

- Order a license plate

- Order a duplicate title

The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

- Google Chrome

- Microsoft Edge

Mobile homes are titled in Michigan. Up until 1978, mobile homes were titled as a "trailer coach." Since 1978, they are titled as mobile homes. The title is identified as a "Certificate of Manufactured Home Ownership" or "Certificate of Mobile Home Title." These documents look like a vehicle title and serve the same purpose.

When a person buys a mobile home from a dealer, the dealer applies for the purchaser's new mobile home title using the Dealer Application for Certificate of Mobile Home Ownership . When an owner sells their mobile home, they assign the title to the new owner. The new owner brings the assigned title to a Secretary of State office to have it transferred into their name. An S-110L Application for Certificate of Manufactured Home Ownership is processed at the branch office. The fee for an original or transferred mobile home title is $90. If your mobile home title is lost, you may replace it by processing a duplicate title application at a Secretary of State office. When there is joint ownership on a title, only one of the owners must appear and sign the duplicate title application. An Appointment of Agent form from the co-owner is not required. Duplicate titles may also be ordered through our Online Services . They can only be issued to the owner listed on the title document. Whether you apply for a duplicate title at a branch office or online, the cost is $15. It will be mailed within 14 days. Same-day title service is not available for mobile home titles.

Abandoned mobile homes and missing titles

Mobile home park owners and operators often ask how they can obtain a title for a mobile home that has been abandoned in their park by the mobile home owner. The mobile home owner can assign their mobile home title to the mobile home park. This is the easiest method for mobile homes abandoned in a mobile home park, although usually the owner who abandoned the mobile home cannot be contacted for an assigned title. When the assigned title is not available, a court order may be necessary. For more information, please refer to the section, "Obtaining a court order."

Mobile home owners who need a title for a mobile home that was not properly recorded with the Michigan Department of State, or is titled in another owner's name, should have the previous mobile home owner assign their mobile home title to the current mobile home owner. This is the easiest method for a mobile home with a missing title. Previous owners who sold the mobile home may be required to obtain a duplicate title to properly assign the title to the current owner. When a duplicate title is not available, please refer to the section, "Obtaining a court order," for more information.

If the options for obtaining a title under "Abandoned mobile homes" and "Mobile homes with missing title" are not available, a park owner or current mobile home owner may obtain a court order awarding ownership that will serve in the place of an assigned title. The court order must identify the mobile home by year, make, vehicle identification/manufacturer's serial number and assign ownership under the proper name or names. In addition, the order must terminate any previous lien or liens, if applicable, and indicate any new lienholder information if applicable.

The Department of State has been advised that some circuit courts across the state are not familiar with accepting petitions for the awarding of mobile home ownership. Due to the lack of familiarity amongst some courts, the Michigan Department of State is providing this information when filing a petition with the court.

While there is no specified procedure or form, some courts will accept a filing petition to award ownership of a vehicle. Alternatively, some individuals have had success (when the mobile home is being conveyed along with the underlying real property) by filing a quiet title type action.

PLEASE NOTE : Any individual or entity with an interest in the property/mobile home should be named as a defendant. The Department of State should not be named as a defendant in any case filing, as this may delay the title issuance process. Courts should not order the Michigan Department of State to issue a mobile home title, they should indicate the proper owner of the mobile home in addition to the information already mentioned. Upon receipt of the court order, the Michigan Department of State will be able to issue a mobile home title when accompanied by the application for title, and title fee.

This web page is provided for informational purposes only and should not be interpreted as legal advice. You may wish to consult with an attorney.

Title application process

- Submit the assigned title or court order to a Secretary of State branch office to apply for a mobile home title in the name of the park.

- The park will need to provide a termination (discharge) of lien if the assigned title or the Department of State's title record shows there is a first secured party (bank loan).

- The title fee is $90. A 6% use tax is due on the value of the mobile home. The park owner declares the mobile home's value when applying for the title.

- Once the new mobile home title is issued in the name of the mobile home park, the mobile home park is the legal owner. You can rent the mobile home or use the title to sell it or, if you wish to scrap the mobile home, take it to a recycler for shredding. You will need to assign the title to the recycling center.

- Affidavit of Affixture of a Mobile Home

- Affidavit of Detachment of a Mobile Home

- Affidavit of Missing Mobile Home Title

- MHA Process Flow

Online Service

- Check on your application status

An official website of the United States government

Here's how you know

The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

What the New Overtime Rule Means for Workers

One of the basic principles of the American workplace is that a hard day’s work deserves a fair day’s pay. Simply put, every worker’s time has value. A cornerstone of that promise is the Fair Labor Standards Act ’s (FLSA) requirement that when most workers work more than 40 hours in a week, they get paid more. The Department of Labor ’s new overtime regulation is restoring and extending this promise for millions more lower-paid salaried workers in the U.S.

Overtime protections have been a critical part of the FLSA since 1938 and were established to protect workers from exploitation and to benefit workers, their families and our communities. Strong overtime protections help build America’s middle class and ensure that workers are not overworked and underpaid.

Some workers are specifically exempt from the FLSA’s minimum wage and overtime protections, including bona fide executive, administrative or professional employees. This exemption, typically referred to as the “EAP” exemption, applies when:

1. An employee is paid a salary,

2. The salary is not less than a minimum salary threshold amount, and

3. The employee primarily performs executive, administrative or professional duties.

While the department increased the minimum salary required for the EAP exemption from overtime pay every 5 to 9 years between 1938 and 1975, long periods between increases to the salary requirement after 1975 have caused an erosion of the real value of the salary threshold, lessening its effectiveness in helping to identify exempt EAP employees.

The department’s new overtime rule was developed based on almost 30 listening sessions across the country and the final rule was issued after reviewing over 33,000 written comments. We heard from a wide variety of members of the public who shared valuable insights to help us develop this Administration’s overtime rule, including from workers who told us: “I would love the opportunity to...be compensated for time worked beyond 40 hours, or alternately be given a raise,” and “I make around $40,000 a year and most week[s] work well over 40 hours (likely in the 45-50 range). This rule change would benefit me greatly and ensure that my time is paid for!” and “Please, I would love to be paid for the extra hours I work!”

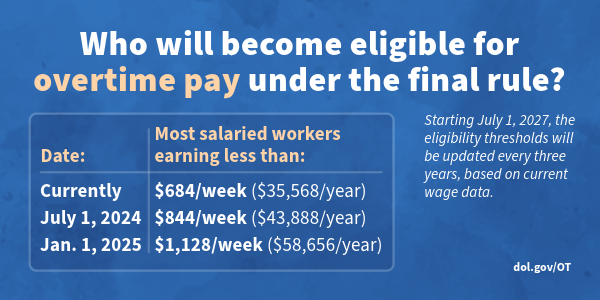

The department’s final rule, which will go into effect on July 1, 2024, will increase the standard salary level that helps define and delimit which salaried workers are entitled to overtime pay protections under the FLSA.

Starting July 1, most salaried workers who earn less than $844 per week will become eligible for overtime pay under the final rule. And on Jan. 1, 2025, most salaried workers who make less than $1,128 per week will become eligible for overtime pay. As these changes occur, job duties will continue to determine overtime exemption status for most salaried employees.

The rule will also increase the total annual compensation requirement for highly compensated employees (who are not entitled to overtime pay under the FLSA if certain requirements are met) from $107,432 per year to $132,964 per year on July 1, 2024, and then set it equal to $151,164 per year on Jan. 1, 2025.

Starting July 1, 2027, these earnings thresholds will be updated every three years so they keep pace with changes in worker salaries, ensuring that employers can adapt more easily because they’ll know when salary updates will happen and how they’ll be calculated.

The final rule will restore and extend the right to overtime pay to many salaried workers, including workers who historically were entitled to overtime pay under the FLSA because of their lower pay or the type of work they performed.

We urge workers and employers to visit our website to learn more about the final rule.

Jessica Looman is the administrator for the U.S. Department of Labor’s Wage and Hour Division. Follow the Wage and Hour Division on Twitter at @WHD_DOL and LinkedIn . Editor's note: This blog was edited to correct a typo (changing "administrator" to "administrative.")

- Wage and Hour Division (WHD)

- Fair Labor Standards Act

- overtime rule

SHARE THIS:

IMAGES

COMMENTS

PETITION AND ORDER FOR ASSIGNMENT CASE NUMBER and JUDGE ... PER, OAA Approved, SCAO Form PC 6, Rev. MCL 6., MCL ., MCL .3, MCL .3 Page of 3 Put last digits of SSN in bo on MC . I, Name and relationship ... Petition and Order for Assignment Author: Michigan State Court Administrative Office Keywords: PC 556, Petition and Order for Assignment ...

STATE OF MICHIGAN PROBATE COURT COUNTY PETITION FOR ASSIGNMENT CASE NO. and JUDGE Court address Court telephone no. In the matter of First, middle, and last name of decedent Last four digits of SSN Petitioner's name, address, and telephone no. Petitioner's attorney, bar no., address, and telephone no. JIS Code PER Approed SCAO Form PC m Re ...

P 6 (12/17) PETITION AND ORDER FOR ASSIGNMENT MCL 700.1210, MCL 700.1302, MCL 700.382 Approved, SCA JIS CDE: PE, AA STATE OF MIHIGAN PROATE OURT ... PC 556, Petition and Order for Assignment Author: Michigan State Court Administrative Office Created Date: 9/28/2017 10:25:39 AM ...

Michigan law (MCL 700.3982) allows small estates to be probated using an expedited process that does not require a personal representative to be appointed. ... Petition and Order for Assignment (PC 556) Protected Personal Identifying Information (MC 97) Testimony to Identify Heirs (PC 565) ... Value of state : 2000: $15,000 : 2001: $16,000 : ...

as indicated in Paragraph 3 of the Petition and Order for Assignment. Please refer to the attached table for the maximum lien amount that may be deducted for real property. After January 1, 2024, the $250,000 limit will be adjusted annually for cost of living. Prior to March 28, 2013, the inventory fee is calculated using the total . gross value

Small Estates. In order to use the assignment process, a decedent's estate must be small. Whether an estate is small depends on the value of the property in it. The dollar limit can change each year. If a person dies on or after February 21, 2024, an estate must be valued at $28,000 or less to be small.

Step 1: Prepare your forms and find out how you will file. Complete the forms using our Do-It-Yourself Settling a Small Estate tool. These instructions explain how many copies you need of each form and when you will need them. Date and sign the Petition for Assignment. When you do this you are saying the information in the petition is true.

4. If a Petition for Assignment was previously filed, an order assigned by the judge, and is now closed, a filing fee of $25.00 will be charged to reopen the estate for any changes made. The certification and inventory fees also will apply. 5. Michigan Compiled Laws (700.3982 Court order distributing small estates) a.

PC 586 (9/11) PETITION AND ORDER In the matter of Do not write below this line - For court use only FILE NO. Approved, SCAO JIS CODE: PAO Date Judge Bar no. PETITION AND ORDER MCR 5.113 STATE OF MICHIGAN PROBATE COURT COUNTY OF USE NOTE: If this form is being filed in the circuit court family division, please enter the court name and county in ...

PETITION & ORDER FOR ASSIGNMENT. Court Address Court Telephone No. 212 E. Paw Paw Street, Suite 220, Paw Paw, MI 49079 (269) 657-8225 ... STATE OF MICHIGAN JUDICIAL DISTRICT JUDICIAL CIRCUIT COUNTY CONTACT INFORMATION ... Approved, SCAO Form MC 505, Rev. 4/20 Page 1 of 1: JIS Code: CIF: This form is confidential and not to be served on other ...

Absent Voter Ballot Application. Absent Voter Ballot Application - Fillable Version. Absent Voter Ballot Application - Large Print Version. Abstract Reporting Certification. Acceptance of Office and Oath of Office - School Board. Additional / Replacement Dealer Plates Application. Adult BTW Contract.

Service Credit Applications. Act 88 Application (R3571G) Use this form to apply for Act 88, Reciprocal Retirement Act of 1961 service credit. Military Service Credit Application (R0081G) Use this form to apply for service credit for time you spent in active-duty military service. Parental Leave Service Credit Application (R0126G)

Hours. Monday - Thursday 8:30am-5:00pm. Friday 9:00am-3:00pm. Contact. (734) 743-1646. Michigan has specific legal provision under MCL 700.3982 that allows for a more straightforward process to distribute assets from a small estate. In this blog post, we will explore the concept of the Petition for Assignment, including its relevance under MCL ...

STATE OF MICHIGAN PROBATE COURT COUNTY OF PC 556 (9/13) PETITION AND ORDER FOR ASSIGNMENT Do not write below this line - For court use only FILE NO. Approved, SCAO JIS CODE: PER, OAA Last four digits of SSN Date PETITION AND ORDER FOR ASSIGNMENT City/Township MCL 700.1210, MCL 700.1302, MCL 700.3982

Atticus Fast Facts About Petition For Assignment. Sometimes it's tough to find a quick summary— here's the important details you should know about Petition For Assignment: This form pertains to the State of Michigan . The relevant probate statute or Michigan laws related to this form include: MCL 700.1210, MCL 700.1302, MCL 700.3982

9. The Court cannot assign real property if it is located out of state. Complete in full the Petition and Order for Assignment form (PC556) and Testimony to Identify Heirs form (PC 565) don't forget to sign and date the form. Please reference any financial institution's using name, address and account number in the description of property box ...

Distributing Small Estates via Petition for Assignment. The Estates and Protected Individuals Code (MCL 700.3982) provides a simplified procedure for distributing estates if the balance of the gross estate, after the payment of the decedent's funeral and burial expense, consists of property that is less than the small estate threshold.A Petition for Assignment may be filed with the Court to ...

STATE OF MICHIGAN PETITION AND ORDER FOR DISCOVERY FILE NO. PROBATE COURT ... PC 556A MCL (9/07) PETITION AND ORDER FOR DISCOVERY 700.1210, MCL 700.1302, MCL 700.3982. Title: Petition and Order for Assignment Author: Delridge Corporation 1-800-530-2255 Created Date:

Form PC 556o - Order For Assignment is a probate form in Michigan. Michigan has multiple types of probate and the necessary forms depend on the unique aspects of each estate, such as type and value of assets, whether there was a valid will, who is serving as the personal representative or executor, and even whether or not they also live in Michigan.

miOttawa - Ottawa County, Michigan

Petition and Order for Assignment: A description and gross value must be given of all property solely held by the decedent as of the date of death. For real property, determine the value by doubling the State Equalized Value (SEV) located on the tax bill. List the lien/mortgage amount, if there is one.

Please note -- these forms may only be used in Oakland County Probate Court. Acceptance of Appointment and Report of Guardian Ad Litem (PEMH 1141) Affidavit and Order Excusing Respondent's Presence (PEMH 1100) Bond Information Form (PEMH 1001) Certificate of Legal Counsel/Stipulation/Waiver of Attendance (PEMH 1136)

An S-110L Application for Certificate of Manufactured Home Ownership is processed at the branch office. The fee for an original or transferred mobile home title is $90. If your mobile home title is lost, you may replace it by processing a duplicate title application at a Secretary of State office. When there is joint ownership on a title, only ...

Starting July 1, most salaried workers who earn less than $844 per week will become eligible for overtime pay under the final rule. And on Jan. 1, 2025, most salaried workers who make less than $1,128 per week will become eligible for overtime pay. As these changes occur, job duties will continue to determine overtime exemption status for most ...