You are using an outdated browser. Please upgrade your browser to improve your experience.

Market Research Food & Beverage Market Research Food Service & Hospitality Market Research Restaurants Market Research

Restaurants Market Research Reports & Industry Analysis

Restaurants industry research & market reports, refine your search, seafood restaurants (uk) - industry report.

Apr 01, 2024 | Published by: Plimsoll Publishing Ltd. | USD 400

... CERUTTI'S LTD, FISHERS RESTAURANT (CLIFTON) LTD and M A AND I G CORNER LTD. This report covers activities such as accountants, fresh fish, hennessy cognac, suffolk, accountants in sudbury and includes a wealth of information ... Read More

Indian Restaurants (UK) - Industry Report

... BROOKLADY LTD, GOLDBUSTER LTD and INDIAN ZING LTD. This report covers activities such as indian restaurant pangbourne, indian takeaway reading, indian restaurant, indian restaurant reading, indian take away berkshire and includes a wealth of information ... Read More

Pizza Restaurants & Shops (UK) - Industry Report

... on the top 180 companies, including BABBO RESTAURANTS LTD, BOOKCASH TRADING LTD and DELMON PIZZA LTD. This report covers activities such as pizza, book a table, pasta, pizza take away, italian and includes a wealth ... Read More

Cafes & Coffee Shops (UK) - Industry Report

... on the top 310 companies, including AMT COFFEE LTD, BEACH HOUSE CAFE LTD and BOOST JUICE BARS (UK) LTD. This report covers activities such as cafe, restaurant, coffee, food, lunch and includes a wealth of ... Read More

Restaurants; Cafés & Casual Dining (GLOBAL) - Industry Report

Apr 01, 2024 | Published by: Plimsoll Publishing Ltd. | USD 1,500

... comprehensive individual analysis on the top 510 companies, including AGO, AMIYAKI TEI CO LTD and ARCLAND SERVICE HOLDINGS CO LTD. This report covers activities such as restaurant, restaurants, food, fast-food, pub and includes a wealth ... Read More

Restaurants and Cafés (NORDIC) - Industry Report

Apr 01, 2024 | Published by: Plimsoll Publishing Ltd. | USD 1,000

... 700 companies, including AG 925 RESTAURANT AB, ALIEN MAT AKTIEBOLAG and ARIGATO AB. This report covers activities such as full service, limited service, restaurants, fast food restaurants, mobile food services and includes a wealth of ... Read More

Restaurants (UK) - Industry Report

... AND BAR LTD, AKBAR BALTI RESTAURANT LTD and AMERIGO VESPUCCI LTD. This report covers activities such as restaurant, catering, hospitality, hotel, caterers and includes a wealth of information on the financial trends over the past ... Read More

Catering & Foodservice Equipment (GLOBAL) - Industry Report

... on the top 1460 companies, including ABM S.R.L., ADVANCE TABCO and AGMA SRL. This report includes a wealth of information on the financial trends over the past four years. Plimsoll Publishing’s latest Catering & Foodservice ... Read More

Chinese Restaurants (UK) - Industry Report

... CHINA PALACE (WORTHING) LTD, KALALA LTD and SOUTH CHINA LTD. This report covers activities such as restaurants, london, agila, beaconsfield, bucks and includes a wealth of information on the financial trends over the past four ... Read More

Restaurant & Catering Services (GLOBAL) - Industry Report

... on the top 420 companies, including AGO, AMREST, S.R.O. and ATFC LIMITED. This report covers activities such as Restaurants, restaurant, catering, diner, fast and includes a wealth of information on the financial trends over the ... Read More

Restaurants; Cafés & Casual Dining (EUROPEAN) - Industry Report

... comprehensive individual analysis on the top 260 companies, including ALPE-PANON, GOSTINSKE STORITVE D.O.O., AUTOGRILL DEUTSCHLAND GMBH and BIG BITE AS. This report covers activities such as restaurant, restaurants, food, fast-food, pub and includes a wealth ... Read More

Restaurants and Cafés (SWEDEN) - Industry Report

Apr 01, 2024 | Published by: Plimsoll Publishing Ltd. | USD 700

... 460 companies, including AKTIEBOLAGET OPERAKALLAREN, ARCTIC THAI & GRILL AB and BANTORGET SERVICE PARTNER AKTIEBOLAG. This report covers activities such as restaurants, bars , cafes, pubs , pub and includes a wealth of information on ... Read More

Restaurants and Cafés (FINLAND) - Industry Report

... 220 companies, including ALKAN OY, BURGERFLAMINGO OY and CPR FINLAND OY. This report covers activities such as restaurants, bars , cafes, pubs , pub and includes a wealth of information on the financial trends over ... Read More

Food Carryout and Delivery: US Market Trends and Opportunities, 3rd Edition

Mar 28, 2024 | Published by: Packaged Facts | USD 3,995

... Delivery will be growing faster than carryout due to starting from a lower base of sales and continuing expansion in foodservice delivery options. Delivery and carryout can also benefit restaurants that are facing labor issues. ... Read More

Consumer Foodservice in Switzerland

Mar 18, 2024 | Published by: Euromonitor International | USD 2,100

... and consumers sought out quick and easy food options on-the-go. Limited-service restaurants, and operators offering takeaway and home delivery benefited the most from this trend. The strong recovery of Switzerland’s travel and tourism industry has ... Read More

Cafés/Bars in Switzerland

Mar 18, 2024 | Published by: Euromonitor International | USD 990

... their own coffee while working remotely, the opportunity to spend time with others outside of the home continued to lift sales in 2023. There was an increased demand for quick and convenient meals and drinks ... Read More

Full-Service Restaurants in Switzerland

... increase prices in their efforts to maintain profitability. Full-service restaurant chains performed better than independent alternatives in current value terms, as chains are well-established in this category with strong brand identities that customers recognise and ... Read More

Self-Service Cafeterias in Switzerland

... as travel and tourism flows steadily move back to normality. In addition, more people are back in the office and seeking lunch-time meals, which has improved footfall at self-service cafeterias during lunch time. The overall ... Read More

Consumer Foodservice By Location in Switzerland

... Swiss market with an overwhelming majority of outlets. This dominance is partly attributed to the surge in demand for takeaway and delivery services, which are primarily offered by standalone locations. The rising popularity of casual ... Read More

Limited-Service Restaurants in Switzerland

... focusing on takeaway, delivery and online ordering systems. Many introduced innovative systems to enhance the customer experience, such as contactless pick-up, QR code menus, and streamlined delivery services. Consequently, limited-service restaurants was the only consumer ... Read More

China Restaurant Market: Analysis By Transaction Volume, By Type (Full-service Restaurants, Limited-service Restaurants, Cafes/Bars, and Others), By Ownership (Independent Foodservice and Chained Foodservice), By Food Type (Chinese Cuisine, Hotpot, Western And Casual Dining, Group Meal, Japanese Cuisine, Fast Food, and Others), Size and Trends with Impact of COVID-19 and Forecast up to 2029

Mar 15, 2024 | Published by: Daedal Research | USD 2,250

... Meal, Japanese Cuisine, Fast Food, and Others), Size and Trends with Impact of COVID-19 and Forecast up to 2029 Restaurants are establishments that prepares and serves meals and beverages to customers for payment, offering the ... Read More

Canada HoReCa Coffee Market Research Report Forecast to 2028

Mar 15, 2024 | Published by: Market Research Future | USD 2,950

... Cafe) coffee market is a dynamic and rapidly evolving sector that plays a crucial role in the coffee industry. This segment encompasses a wide range of establishments, including hotels, restaurants, cafes, and other hospitality businesses, ... Read More

2024 Global: Cloud Kitchen Foodservice Market - Innovative Markets Forecast (2030) report

Mar 15, 2024 | Published by: PerryHope Partners | USD 895

... for the period 2019 through 2030. Perry/Hope Partners' reports provide the most accurate industry forecasts based on our proprietary economic models. Our forecasts project the product market size nationally and by regions for 2019 to ... Read More

Consumer Foodservice By Location in Singapore

Mar 14, 2024 | Published by: Euromonitor International | USD 990

... and beverage concepts reflects a notable trend within the hospitality industry, signalling a strategic shift in how hotels approach guest experiences and revenue generation. Hotel-led foodservice concepts serve as powerful marketing tools, enabling hotels to ... Read More

Self-Service Cafeterias in Hong Kong, China

... the main players, Marugame Seimen. However, the channel did receive a marginal boost from inbound tourism flows. Most tourists, as part of their travel itinerary, seek out quality dining experiences. However, amongst value-seeking tourists, self-service ... Read More

< prev 1 2 3 4 5 6 7 8 9 10 next >

Filter your search

- Africa (67)

- Central America (1)

- Europe (386)

- Global (578)

- Middle East (83)

- North America (311)

- Oceania (61)

- South America (88)

Research Assistance

Join Alert Me Now!

Start new browse.

- Consumer Goods

- Food & Beverage

- Heavy Industry

- Life Sciences

- Marketing & Market Research

- Public Sector

- Service Industries

- Technology & Media

- Company Reports

- Reports by Country

- View all Market Areas

- View all Publishers

Connecting Franchisees, Franchisors & Financiers

Data and insight for a stronger industry.

RR leverages its extensive network of industry players to generate unit-level benchmarking data & concept analysis for $1B+ chains.

Industry Data Report Outlines

Concept benchmark reports.

Restaurant Research provides Concept Benchmark Reports on the largest and most important industry players.

Concept Report – Table of Contents

Download Sample Concept Benchmark Report

Concept Benchmark Coverage

Additional Concepts in Industry Data Reports

Information Request

A research department.

for the cost of a subscription

Nobull consumer research weekly

Get Corporate & Market Insights in your inbox

NBE Media LLC, 7810 Pineville Matthews Rd, Ste 1 Charlotte, NC 28266 Privacy Policy Copyright © NBE Media LLC

To read this content please select one of the options below:

Please note you do not have access to teaching notes, restaurant and foodservice research: a critical reflection behind and an optimistic look ahead.

International Journal of Contemporary Hospitality Management

ISSN : 0959-6119

Article publication date: 10 April 2017

The purpose of this paper is to present a review of the foodservice and restaurant literature that has been published over the past 10 years in the top hospitality and tourism journals. This information will be used to identify the key trends and topics studied over the past decade, and help to identify the gaps that appear in the research to identify opportunities for advancing future research in the area of foodservice and restaurant management.

Design/methodology/approach

This paper takes the form of a critical review of the extant literature that has been done in the foodservice and restaurant industries. Literature from the past 10 years will be qualitatively assessed to determine trends and gaps in the research to help guide the direction for future research.

The findings show that the past 10 years have seen an increase in the number of and the quality of foodservice and restaurant management research articles. The topics have been diverse and the findings have explored the changing and evolving segments of the foodservice industry, restaurant operations, service quality in foodservice, restaurant finance, foodservice marketing, food safety and healthfulness and the increased role of technology in the industry.

Research limitations/implications

Given the number of research papers done over the past 10 years in the area of foodservice, it is possible that some research has been missed and that some specific topics within the breadth and depth of the foodservice industry could have lacked sufficient coverage in this one paper. The implications from this paper are that it can be used to inform academics and practitioners where there is room for more research, it could provide ideas for more in-depth discussion of a specific topic and it is a detailed start into assessing the research done of late.

Originality/value

This paper helps foodservice researchers in determining where past research has gone and gives future direction for meaningful research to be done in the foodservice area moving forward to inform academicians and practitioners in the industry.

- Hospitality management

- Restaurants

- Food and beverage

- Foodservice research

DiPietro, R. (2017), "Restaurant and foodservice research: A critical reflection behind and an optimistic look ahead", International Journal of Contemporary Hospitality Management , Vol. 29 No. 4, pp. 1203-1234. https://doi.org/10.1108/IJCHM-01-2016-0046

Emerald Publishing Limited

Copyright © 2017, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Get the latest restaurant industry statistics and trends

The National Restaurant Association conducts research that identifies current and future restaurant industry trends.

The latest trends in key restaurant industry indicators.

Restaurant industry statistics on the national and state levels.

Our economic reports keep you ahead of trends in the restaurant industry

Report website accessibility issues

All Articles Food Restaurant and Foodservice Navigating today's restaurant technology landscape

Navigating today’s restaurant technology landscape

The National Restaurant Association’s Restaurant Technology Landscape Report 2024 gives insight into how customers and operators are approaching technology in the foodservice industry.

By Audrey Altmann 03/29/24

Food Restaurant and Foodservice Technology

LumiNola/Getty Images

The pandemic caused wide-scale change in the restaurant industry – especially in terms of adoption and innovations in technology.

“The pandemic accelerated operator technology utilization and consumer comfort with using technology in the restaurant experience,” said Hudson Riehle, senior vice president of research for the National Restaurant Association . “Looking ahead, that rapidity of change will continue to be a constant.”

A majority – 76% – of foodservice operators believe that using technology allows them to be competitive while also acknowledging that their business could be more up-to-date on tech innovations, according to the National Restaurant Association’s recently released Restaurant Technology Landscape Report 2024 .

While the industry is rightly focusing its attention and efforts on tech, businesses and customers are also expressing that not every part of dining out absolutely necessitates tech-enabled experiences. The report outlines how restaurant technology is separated into three types: must-have, want-to-have and nice-to-have technology, which then fit into three restaurant occasions: delivery, limited-service and full-service.

“It’s clear from the research in this report that an operator’s tech integration must closely align with their segment, type of operation and both current and future customer demographics,” Riehle shared.

Full-service eateries don’t need high-tech tools

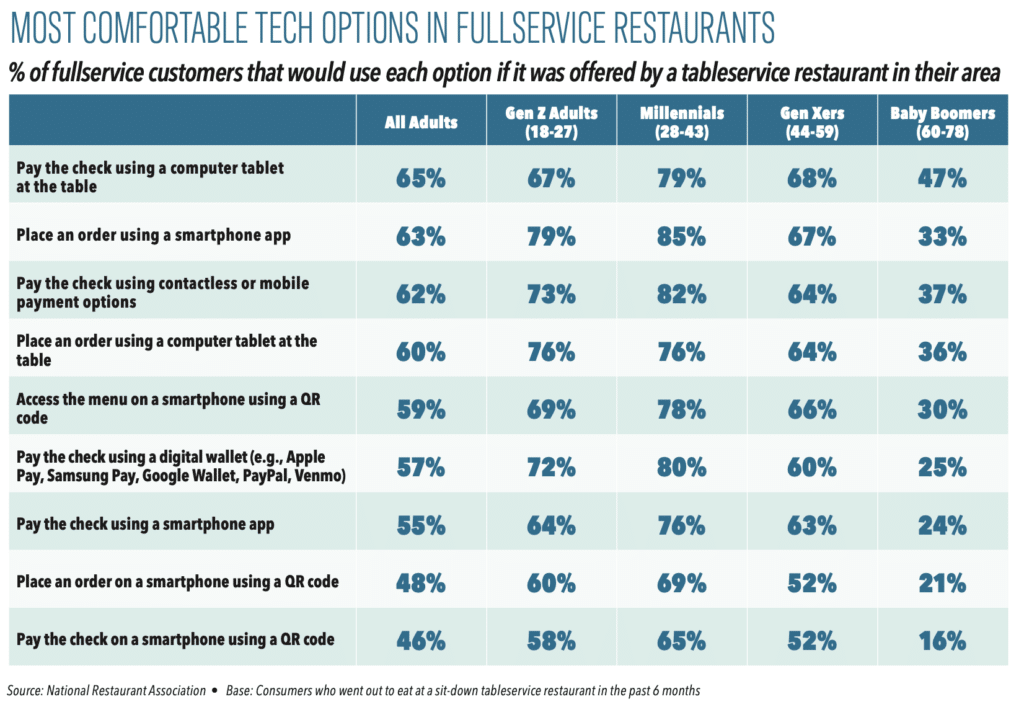

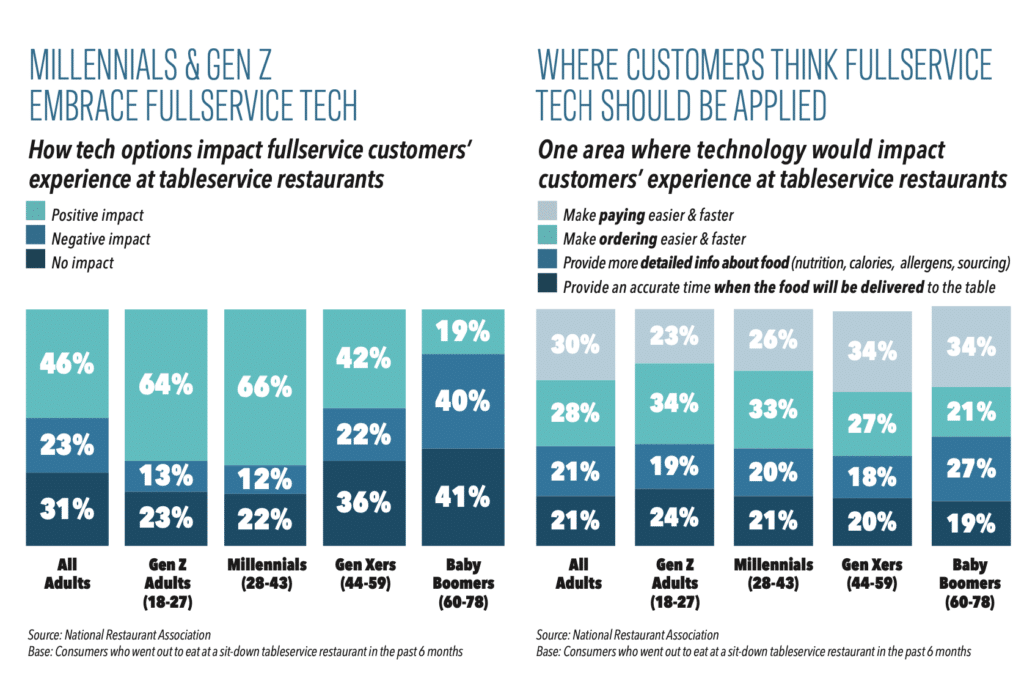

Technology advancements are coming into full-service businesses – 65% of customers would like tablets to be available on tables for digital payments, and 60% would use the devices for ordering. However, customers are not anticipating technology to take over other roles during a restaurant experience. Only 29% of adults are interested in food created by automation or robots and 37% would order food to be delivered to them by robotics.

Sixty-four percent of customers would choose traditional employee service in a full-service restaurant over a business that incorporates technology into the dining experience. So while ordering and payment technology would be used by restaurant patrons at a full-service establishment, the tools aren’t necessary for operators to adopt. Only 27% of these operators plan to invest in developing a smartphone app this year, showing that these features are nice to have, but they are not a necessity.

Limited-service restaurants want options

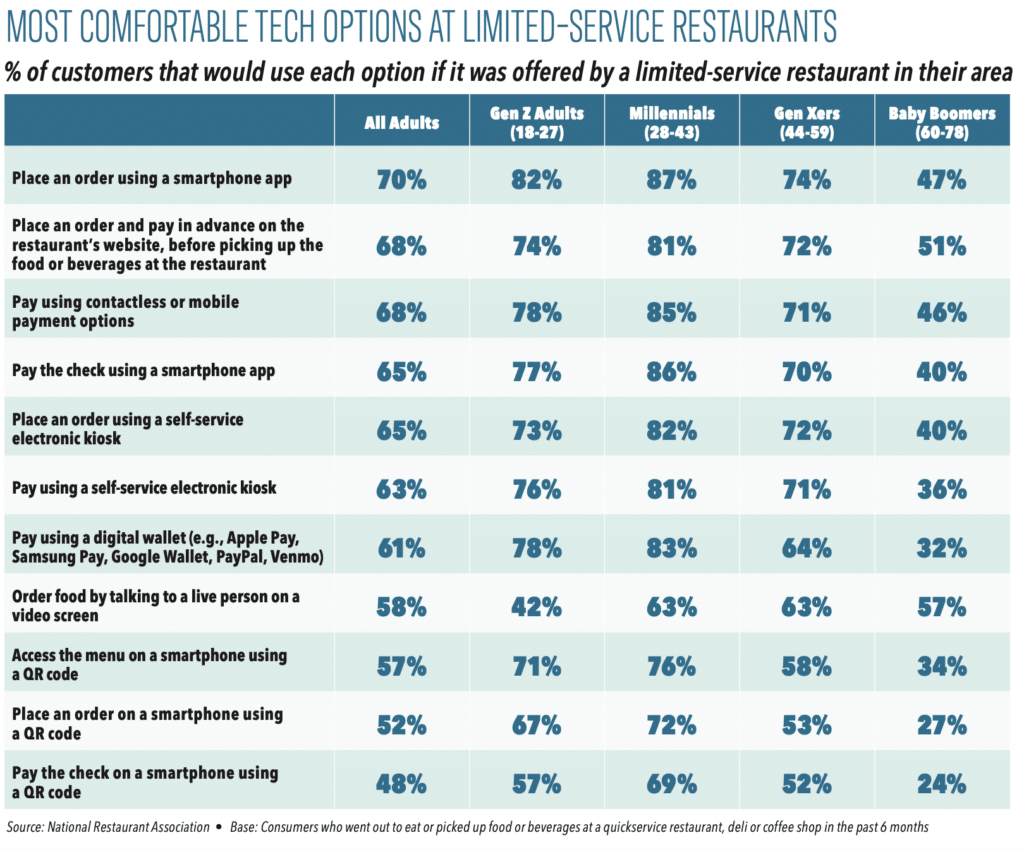

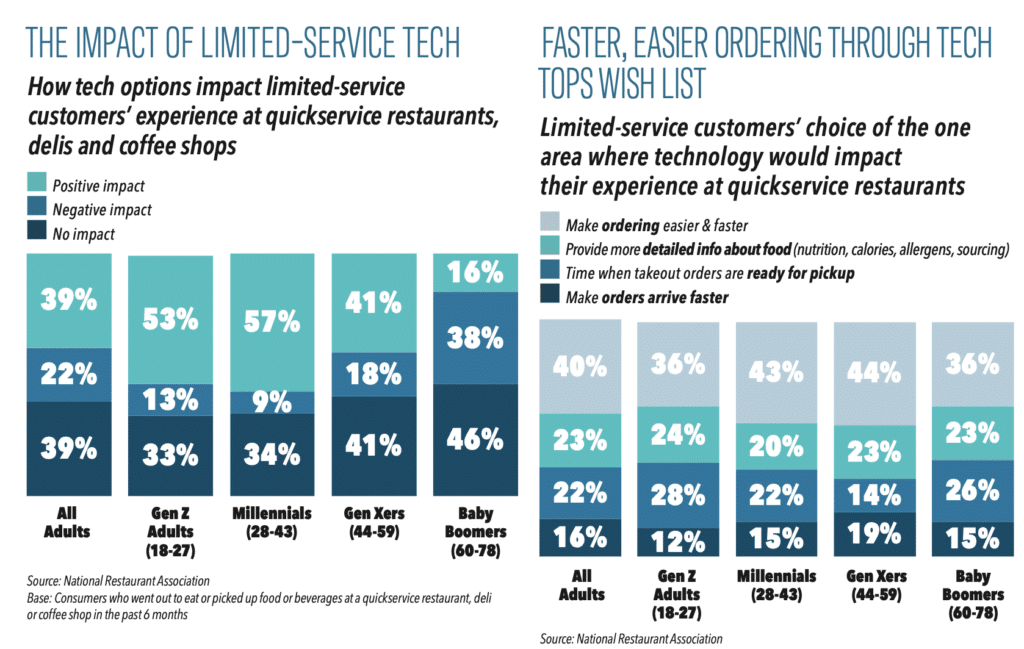

Quickservice brands are finding operational efficiencies when adopting technologies such as QR code-enabled menus and payment options or self-service kiosks for ordering and paying. Consumers reported a high desire to use these tools because of the ease of ordering, quickness of food arrival, ability to have more detailed information about menu items and speed of pickup orders. Forty percent of limited-service operators say they are spending resources on the development of smartphone apps in 2024 in order to capitalize on these opportunities.

Customers are expecting these tech–assisted experiences while at limited-service restaurants, but they are still looking to interact with humans for many tasks. Only 30% of adults reported that they would want their food to be made by automated systems, and about a third said they would order from an AI-generated person via video. And while technology is creating efficiencies, when choosing between a tech-enabled limited-service restaurant and a quickservice eatery without tech, 62% of customers said they would prefer the restaurant with traditional employee service.

Food delivery tech is essential

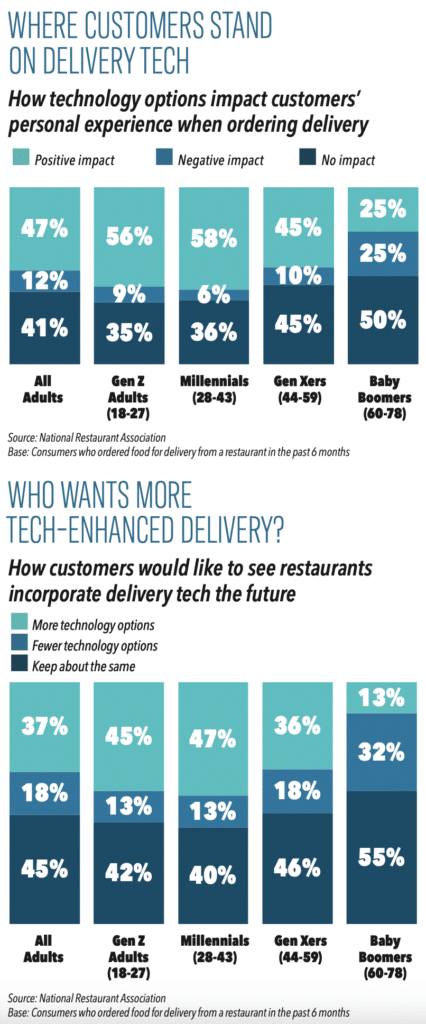

Restaurants offering food delivery overwhelmingly have embraced technology-based solutions because adult customers have come to expect using these tools during the delivery process.

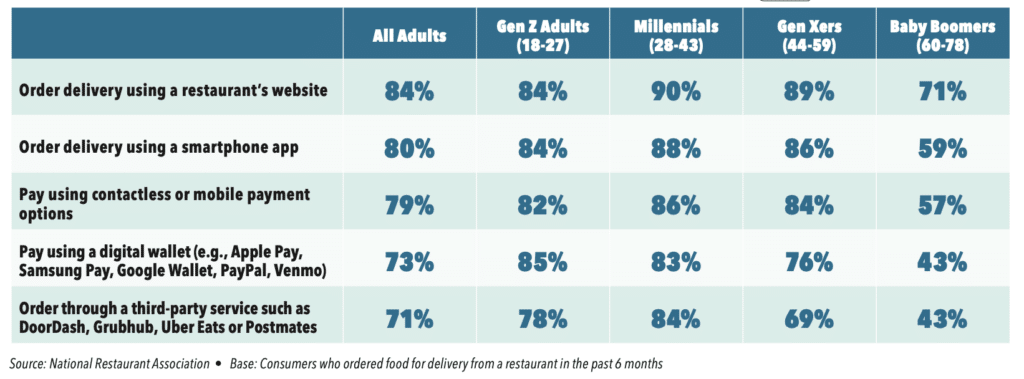

More than 80% of customers report that they would make a delivery order from a restaurant’s own website or from a mobile app while 71% said they would use third-party platforms to order food for delivery. Also, 79% and 73% said they would use a mobile payment or digital wallet, respectively, to pay for their order. These figures demonstrate the need for operators to keep pace with these restaurant technologies; consumers are anticipating that they will encounter these features in order to ease restaurant deliveries.

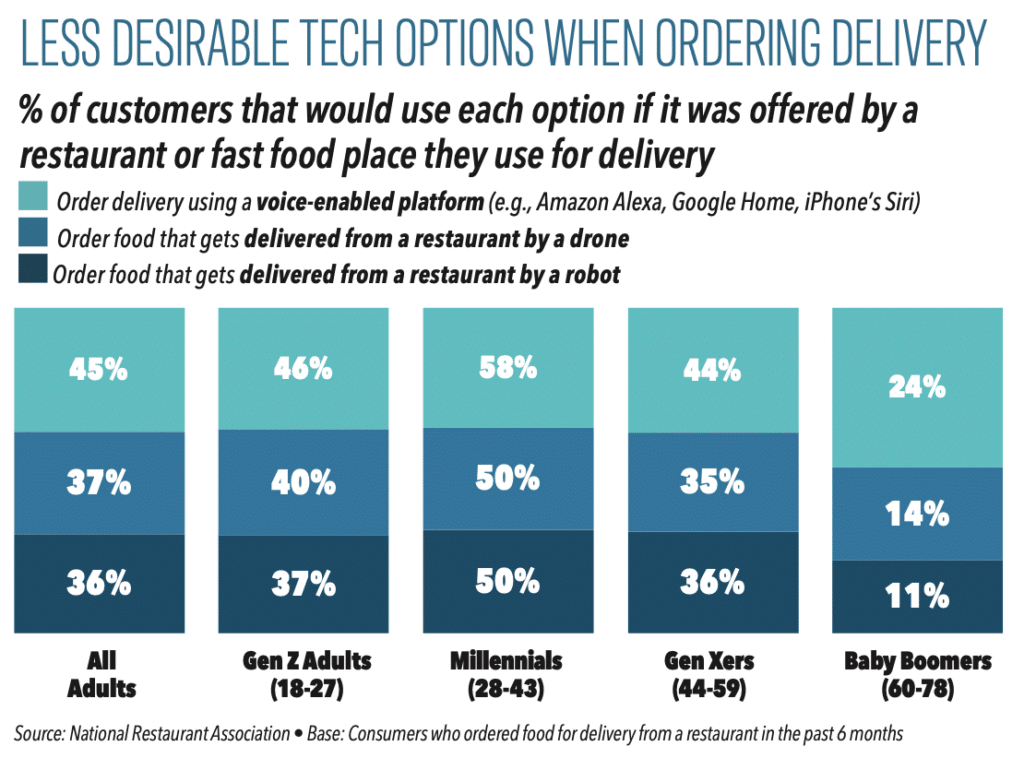

But, far fewer adults report that they are likely to make delivery orders via voice-enabled AI or would want food delivered via drones or robots – 45%, 37% and 36%, respectively. And 45% of customers also reported that they wish delivery tech would stay about the same in the future instead of growing or lessening. So, only 16% of operators reported they intend to devote resources to AI solutions this year.

Behind the scenes

In all categories of foodservice, operators should be focused on updating and implementing effective digital ordering and payment systems that meet consumers’ expectations “as the data is quite clear that this is currently [customers’] highest priority,’ said Riehle.

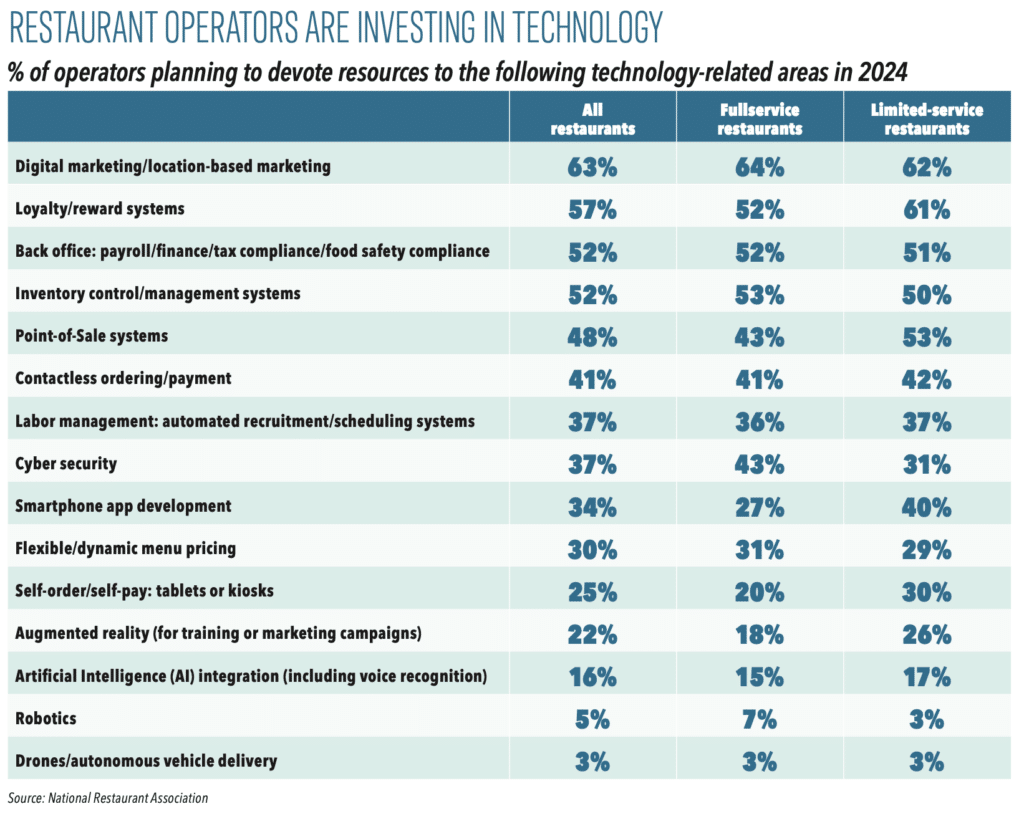

However, many restaurant technology efforts are related to other operational functions. According to the report, foodservice businesses’ top tech investments include digital marketing, loyalty and reward programs, administrative systems, inventory management, point-of-sale systems, labor management tools and cybersecurity.

“These systems are equally as important to finding operation efficiencies, even though not always visible to the customer base,” added Riehle.

Forty-seven percent of operators shared that they believe restaurant technology integration and automation are going to become more common. These innovations will continue to help aid employees in their job functions and support operators during labor shortages.

“Restaurant operators have tremendous entrepreneurial spirit, and they are constantly innovating – sometimes through new dishes or flavors, and sometimes through new business practices,” said Michelle Korsmo, the National Restaurant Association’s president and CEO in a statement . “[O]ur research on the technology landscape in restaurants provides insights on consumer expectations that operators need to confidently evaluate their tech investment.”

Recent related stories:

- Who is really using grocery technology?

- Restaurant ordering in the age of voice AI

- How eatertainment restaurants are transforming dining

_____________________________________

If you liked this article, sign up to receive one of SmartBrief’s Food & Beverage newsletters . They are among SmartBrief’s more than 250 industry-focused newsletters.

The State of Restaurant Tech in 2024: Beyond the Table Stakes

What do customers think operators need? What are restaurants actually investing in? Let’s unpack reality.

While the point of there being “more tech” in the restaurant industry post pandemic can’t be disputed, there’s no blanket over the topic. How it’s viewed, deployed, defined, and accepted changes by sector, consumer group, and need-state. In the National Restaurant Association’s Restaurant Technology Landscape Report for 2024 , the concept was split into three categories: nice-to-have, want-to-have, and must-have.

The first applied to full-service tech. “For most customers, engagement with employees is an integral part of the experience of going out to eat at a full-service restaurants, and the data suggests this isn’t changing anytime soon,” the Association said.

Customers don’t appear ready to trade a high-touch experience for a transactional one. Yet still, there is proof some would embrace convenience-enhancing systems intended to improve their overall visit. They simply don’t want tech to substitute human connection. The most popular example was the ability to pay checks easier and faster. Again, per the report, guests suggested these were nice-to-have concepts, but not essential to why they decide to dine.

The quick-service arena fell into the “want-to-have” bucket. By nature, it’s a field designed to operate with more limited guest-employee interaction. But the Association’s data showed many younger guests actually desire fewer human-provided services in these restaurant experiences than what’s out there today. They welcome tech that fills the gaps to make an experience faster and more efficient, and it was true across all ages. It’s not necessarily a deal breaker for quick-serves who don’t have these tech options. However, a solid majority of customers want them.

The last—“must-have”—applied to delivery tech. Compared to on-premises occasions, tech is already baked into the journey. So options like web- or app-based ordering are must-haves, rather than a nice add-on, and deal breakers to the point where users will head to another restaurant if they can’t use tech to order. “It’s much more important for operators to incorporate the baseline tech options that delivery customers expect, while keeping an eye on new developments that will set them apart from the competition,” the Association said.

“Restaurant operators have tremendous entrepreneurial spirit, and they are constantly innovating—sometimes through new dishes or flavors, and sometimes through new business practices,” said Michelle Korsmo, president and CEO of the Association, in a statement. “More than 3 in 4 operators say technology gives them a competitive edge, and this research will also help operators find the right technology fit for their restaurant and their customers. In addition to valuable research on restaurant operator outlook, our research on the technology landscape in restaurants provides insights on consumer expectations that operators need to confidently evaluate their tech investments.”

Let’s unpack some of the findings.

To the point Korsmo made, tech isn’t sneaking up on operators at this point. Seventy-six percent said using tech gives them a competitive edge, but many believe their restaurants could do more to keep pace. Just 13 percent felt their restaurant was on the leading edge in terms of how they’re using innovation compared to peers. Twenty-three percent said their operation was lagging.

Sixty-four percent added they consider their use of tech to be mainstream, “which means the restaurant industry is still far from becoming a tech-centric sector,” the Association said.

What it adds up to—restaurants aren’t close to tapping out their investments.

More on full service

Table-service consumers were given 11 tech-related options and asked how likely they’d be to use each one.

Access to computer tablets at the table topped the list. Sixty-five percent of sit-down guests said they’d likely use it to pay the check; 60 percent would to place an order.

A majority of Gen Z adults, millennials, and Gen Xers noted they’d deploy these options if available, while fewer than half of Baby Boomers felt the same. A majority of diners also said they were comfortable using a smartphone app to either place an order (63 percent) or pay (55 percent).

Other tech-driven payment options proved popular, too. Sixty-two percent of full-service consumers would pay the check using contactless or mobile payment options and 57 percent would activate a digital wallet (like Apple Pay or PayPay). Affinity for these options pulsed among younger people.

QR codes in the dining experience showed up further down. Although 59 percent of full-service diners said they’d pull up a menu on their smartphone using one, fewer than half were comfortable using QR codes to place an order (48 percent) or pay (46 percent). Boomers were the least likely to say they’d tap one at a full-service venue.

Twenty-seven percent of full-service operators said they plan to devote resources to smartphone app development in 2024 versus 40 percent of quick-service operators.

And when it came down to where category guests were least comfortable with tech, 37 percent shared they’d order food that gets delivered by automated systems or robots, and 29 percent said they’d like their food to be prepared by automated systems or robots.

So, robots aren’t quite here yet in the full-service arena.

Percentage of customers who would use each option if it was offered by a sit-down restaurant in their area

- Order food that gets prepared by automated systems or robots: 29 percent

- Order food that gets delivered to customers by automated systems or robots: 37 percent

Gen Z adults

- Order food that gets prepared by automated systems or robots: 41 percent

- Order food that gets delivered to customers by automated systems or robots: 43 percent

Millennials

- Order food that gets prepared by automated systems or robots: 45 percent

- Order food that gets delivered to customers by automated systems or robots: 58 percent

- Order food that gets prepared by automated systems or robots: 7 percent

- Order food that gets delivered to customers by automated systems or robots: 14 percent

Into the quick-service space

In this realm, consumers were handed a list of 14 tech-related options at quick-service spots, delis, and coffee shops, and asked how likely they’d be to use each one.

No. 1 on the list: Smartphone apps. Seventy percent of respondents said they’d use an app to order and 65 percent to pay. Most Gen Z adults, millennials, and Gen Zers would tap a smartphone app in their limited-service restaurant experience.

While fewer than half of Boomers reported the same, they were far more likely to accept use of smartphone apps here than in full service. The ability to pay when the order was placed on the restaurant’s website was another popular opinion.

Forty-two percent of limited-service operators noted they plan to invest in contactless or mobile pay tech in 2024.

The ability to order (65 percent) or pay (63 percent) with a kiosk was widespread among most category customers. In particular, younger ones. A way to increase ordering efficiency, the Association said, is to give guests the option of ordering by talking to a live person on a video screen—nearly six in 10 limited-service customers (58 percent) said they’d use this option.

QR codes were, understandably, more preferred in this setting than sit-down venues. Fifty-seven percent of quick-service diners said they’d access the menu on a smartphone using one, while roughly half would use it to place an order (52 percent) or pay the check (48 percent).

Like full service, there remains trepidation with automated systems and robots. Thirty-six percent of respondents would order food that gets delivered by automated systems or robots and 30 percent would like their food to be prepared by them. Limited-service customers, though, have no problem ordering through a live person via video screen, but they were less enamored by AI-generated interactions. About a third of these customers said they’d like this ordering option.

Percentage of customers that would use each option if it was offered by a limited-service restaurant in their area

- Order food that gets delivered to customers by automated systems or robots: 36 percent

- Order food by talking to an Artificial Intelligence (AI) generated person on a video screen: 33 percent

- Order food that gets prepared by automated systems or robots: 30 percent

- Order food that gets delivered to customers by automated systems or robots: 48 percent

- Order food that gets prepared by automated systems or robots: 43 percent

- Order food that gets delivered to customers by automated systems or robots: 53 percent

- Order food by talking to an Artificial Intelligence (AI) generated person on a video screen: 49 percent

- Order food that gets prepared by automated systems or robots: 46 percent

- Order food that gets delivered to customers by automated systems or robots: 39 percent

- Order food by talking to an Artificial Intelligence (AI) generated person on a video screen: 37 percent

- Order food that gets prepared by automated systems or robots: 31 percent

- Order food that gets delivered to customers by automated systems or robots: 12 percent

- Order food by talking to an Artificial Intelligence (AI) generated person on a video screen: 16 percent

- Order food that gets prepared by automated systems or robots: 9 percent

The delivery must-haves

As noted, delivery is one world where tech is table-stakes. If consumers expect digital and instant fulfillment in their retail lives (Amazon), the same is widely true of how they procure food through the channel. Delivery customers in the report saw eight tech-related options at restaurants that deliver F&B orders and were asked how likely they’d be to use each one.

Eighty-four percent reported they’d order delivery using a restaurant’s website. Eight in 10 delivery customers, including 50 percent of Boomers, added they’d tap delivery through a smartphone app.

These customers were much more likely to embrace electronic payment options (as you’d expect), with 70 percent of delivery customers saying they’d go for contactless or mobile payment outlets; 73 percent green-lighted digital wallet options as well.

Seventy-one percent of people said they’d be likely to order delivery through a third-party service, like DoorDash, etc.

Here’s a look at the percentage of guests who would use each option if it was offered by a restaurant they use for delivery, category agnostic.

On the “less comfortable with tech” side, fewer than half (45 percent) said they were eager to order via voice-enabled platforms like Alexa. Fewer than four in 10 said they’d order food that gets delivered by a drone or robot.

As for operators, 16 percent said they plan to invest in AI integration (including voice recognition) in 2024.

The integration game

There were four categories consumers showed particular interest in: ordering in advance at full-service restaurants; variable pricing; reserving specific tables online; and loyalty programs.

Sifting through, 70 percent of respondents—88 percent of Gen Z adults and 84 percent of millennials—said they’d take advantage of the ability to order in advance online, schedule a time to arrive, and get their food shortly after they’re seated in a full-service environment.

Thirty percent added they’d pay a fee to reserve a specific table from a seating chart on a website.

Percentage of consumers who would pay more to reserve their preferred table

- All adults: 30 percent

- Gen Z adults: 54 percent

- Millennials: 44 percent

- Gen Zers: 26 percent

- Boomers: 10 percent

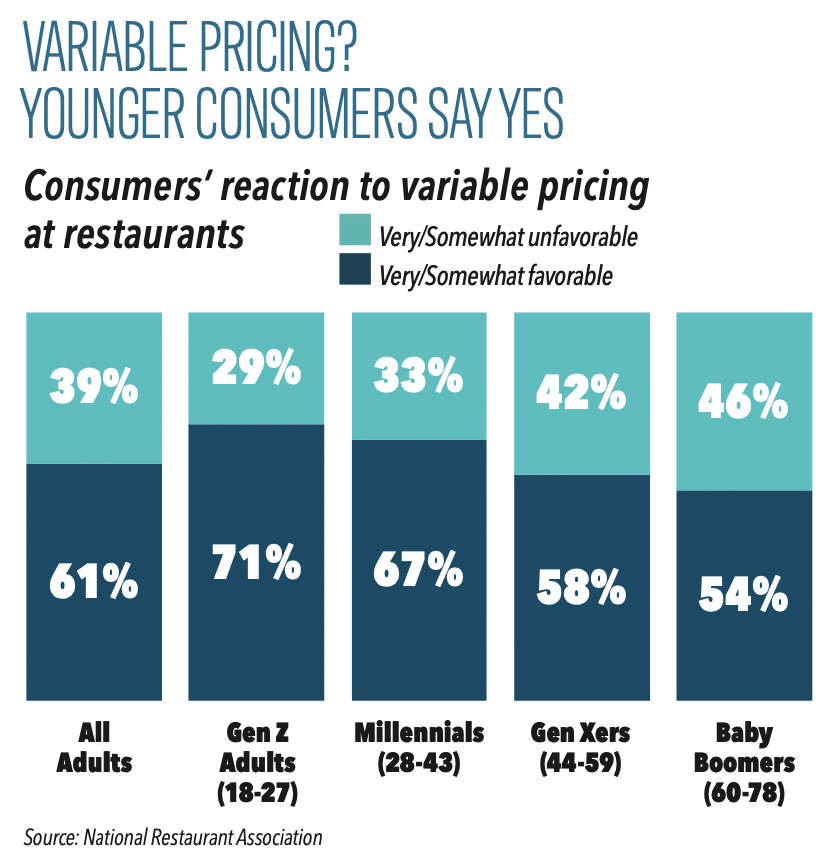

Sixty-one percent of adults noted they were game for variable pricing in general. Operators, the Association said, could communicate price changes to guests using a smartphone app and social media. Say fluctuations depending on how busy the restaurant is. Naturally, this concept created a firestorm with Wendy’s recently, but it’s broadly a more flexible idea than what that controversy made it out to be .

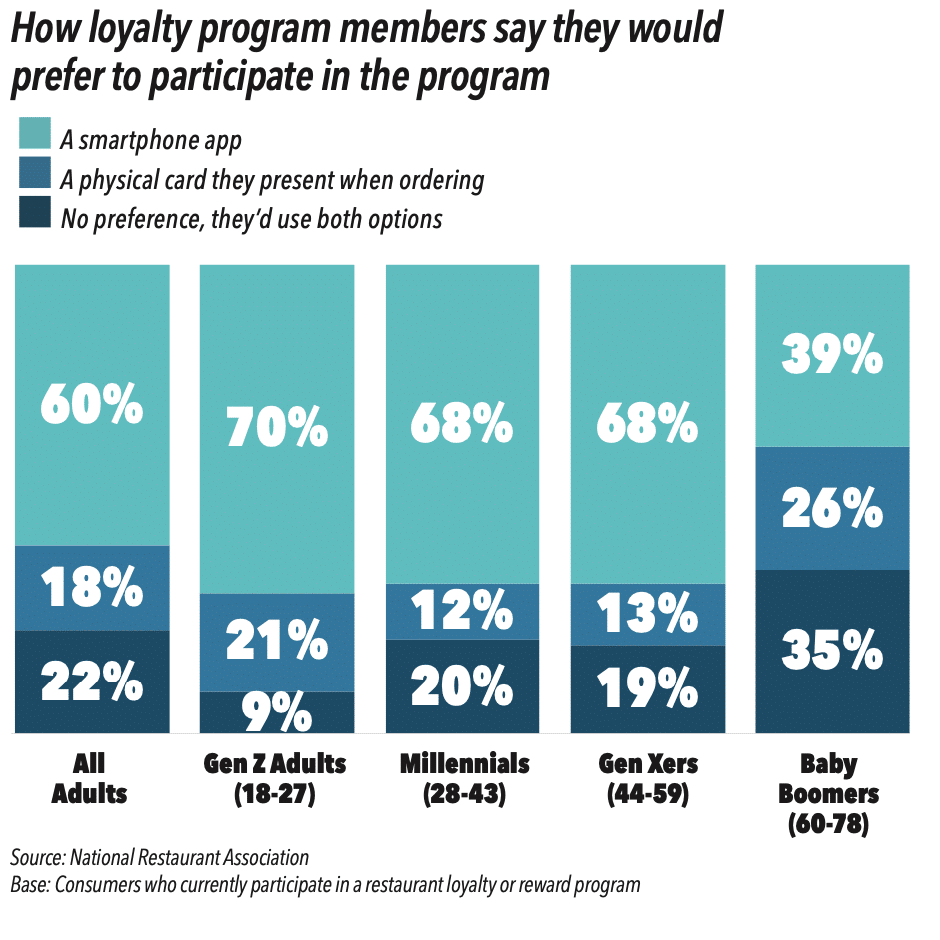

Shifting to loyalty, 52 percent of adults said they currently participate in a loyalty or rewards program at a restaurant, coffee shop, snack spot, or deli. Ninety-six percent of these participants reported being a member was a good way to get more value. Sixty percent of current users prefer to access programs through smartphone apps versus physical cards; 18 percent would rather use a card; 22 percent don’t have a preference. Boomers were the most likely to suggest they’d use both.

Sixty-one percent of quick-service operators expect to invest in loyalty/rewards technology in 2024.

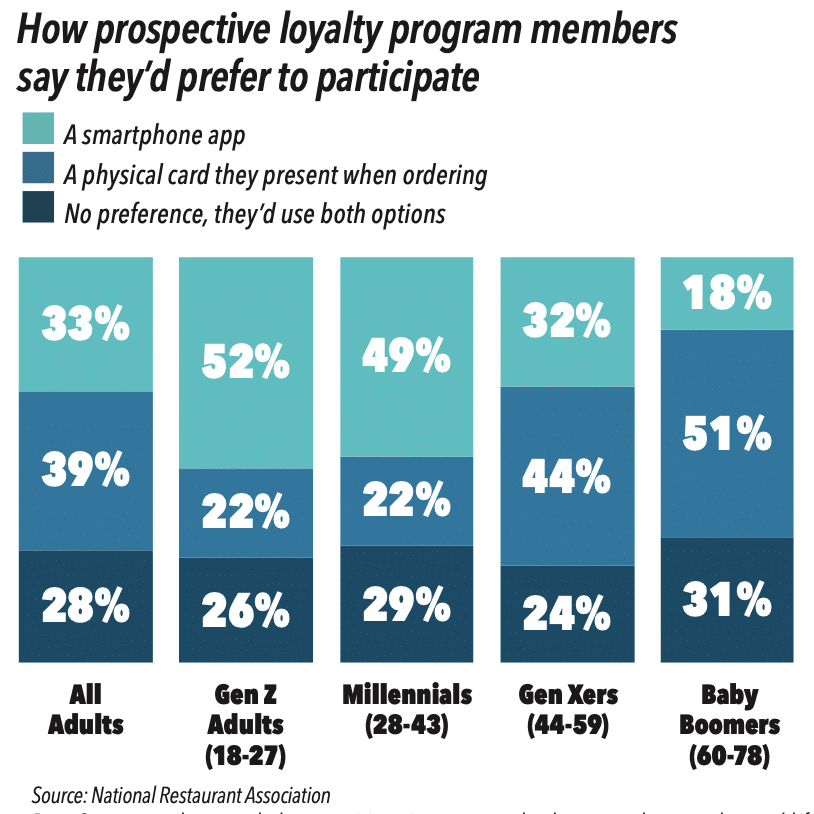

The Association added, for prospective loyalty customers, technology might be an issue, at least compared with current members. If given the choice, 39 percent said they’d prefer to have a physical card to present when ordering. Only a third preferred to participate using a smartphone app (this is the prospective pool of loyalty guests, not those who have already enrolled somewhere). Among Boomers, 51 percent said they’d rather use a card.

The operator response

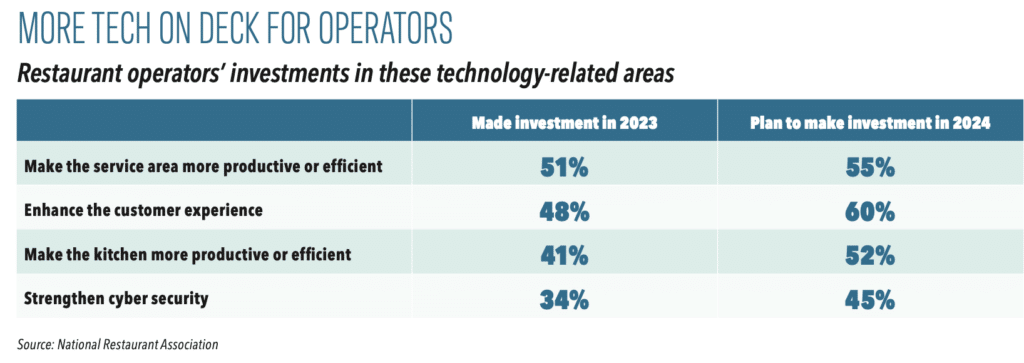

Half of operators in the Association’s survey said they devoted more resources to make their service more productive last year; 48 percent invested in the customer experience.

Four in 10 deployed tech to enhance productivity in the kitchen. Even more expect to spend on tech-related fixes in these areas in 2024. Seventy-three percent reported their restaurant is more efficient and productive today than pre-COVID.

The Association also asked operators to unpack where they plan to invest in 2024.

As always, labor challenges spiked. Forty-seven percent of operators said, in 2024, the use of tech and automation to help with labor will become more common (44 percent in full and 49 percent in quick service). Sixty-nine percent added tech integration in restaurants would augment rather than replace human labor (68 percent in full and 69 percent in quick). Twenty-five percent noted using temporary workers to increase staffing levels would become more prevalent and 37 percent expect to spend on automated labor management recruitment/scheduling systems.

“The data clearly show that restaurant operators and owners are rapidly embracing technology and integrating it into their daily operations,” said Hudson Riehle, SVP of research and knowledge for the Association, in a statement. “Understanding which technologies customers in each segment would like to have, really want, and consider essential, provides operators with substantial opportunities to enhance the customer experience, amplify marketing and operate more efficiently.”

You might also like...

Can Costa Coffee Capture U.S. Market Share?

Fast Casual, Then and Now: Does the Category Need to Evolve Again?

Savory Fund’s Journey from ‘Moonshots’ to Mega Growth

The Power of Personalized SMS for Quick-Service Restaurant Marketers

How Crispy Cones Rose from Roadside Tent to Shark Tank Stardom

How Meaningful Artwork Can Impact Restaurant Culture and Customers

La Madeleine Releases New App with Thanx

Wild Thyme Restaurant Group Wows Guests with Diverse Portfolio

Women now constitute 51 percent of kfc’s collective team.

During the celebration of Women’s History Month, KFC announced that it has successfully achieved parity between women and men globally across its corporate offices, referred to as restaurant support centers (RSCs). Women now constitute 51 percent of the collective team. KFC recognizes the importance of ensuring its team reflects its global customer base. By embracing […]

How Quick-Service Restaurants Can Captivate Gen Z Guests

Revenue management solutions launches ai-powered price studio dashboard.

Revenue Management Solutions, a global leader in restaurant data analytics, unveiled Price Studio, a groundbreaking AI-powered dashboard that will evolve strategic restaurant pricing and deliver new levels of profitability for restaurant brands. Price Studio sets a new standard in restaurant pricing strategy by marrying RMS’ unparalleled expertise with the latest AI technology. The easy-to-use solution […]

Wendy’s Picks ParTech to Enhance Loyalty Platform

ParTech, a global restaurant technology leader and provider of unified commerce for enterprise restaurants, announced Wendy’s has selected PAR’s industry-leading loyalty and offer solution, PAR Punchh, to advance its already successful loyalty program into the next generation of customer engagement. Wendy’s will leverage PAR Punchh’s AI-driven platform and Punchh Enterprise Support to enhance its loyalty […]

Subscribe to A.M. Jolt

Get daily updates on quick-serve industry news, tips, and events.

" * " indicates required fields

- CalMatters annual reader survey

- Help us better serve our readers for a chance to win a $100 Amazon gift card.

- Be an informed Californian

- Get news and commentary on the California issues you care about the most in one weekly email.

- Get news and commentary on the California issues you care about in one email.

By signing up, you agree to the terms .

- Newsletters

- Environment

- 2024 Voter Guide

- Legislator Tracker

- Daily Newsletter

- Data & Trackers

- CalMatters for Learning

- Youth Journalism

- College Journalism Network

- California Divide

- Manage donation

- News and Awards

- Sponsorship

- Inside the Newsroom

- CalMatters en Español

No, California’s wage bump for fast food workers isn’t doomsday for restaurants. Here’s why

Share this:.

- Click to share on X (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

As the minimum wage for fast food workers increases in California, many headlines are predicting mass layoffs and price increases. These headlines are based on an outdated theory that doesn’t apply to fast food restaurants, argue two economists.

Guest Commentary written by

Michael Reich

Michael Reich is an economics professor and chair of UC Berkeley’s Center on Wage and Employment Dynamics at the Institute for Research on Labor and Employment.

Justin Wiltshire

Justin Wiltshire is an assistant professor of economics at the University of Victoria in British Columbia, Canada, and an affiliate of UC Berkeley’s Center on Wage and Employment Dynamics at the Institute for Research on Labor and Employment.

Today, the minimum wage for California fast food workers will increase to $20 an hour, or 25% above the state’s $16 level. And a first-of-its-kind fast food council will give workers, employers and state government the opportunity to come together and set standards for the industry.

But rather than celebrating, many headlines are predicting mass layoffs , major burger price increases and even the end of fast food as we know it in California.

These headlines reflect an unsophisticated understanding of an outmoded and simplistic theory: In Econ 101, if you increase the price of labor, employers will use less of it or pass along the higher costs to consumers.

This explanation ignores that fast food restaurants have and use their power to set wages and employment levels well below the Econ 101 level. The modern theory of labor markets actually recognizes employers’ wage-setting power and that a higher minimum wage can help overcome this power, ultimately raising both pay and employment.

Outside the theoretical world, economists have conducted hundreds of studies on the actual effects of minimum wage. They repeatedly find that increasing the minimum wage raises the pay of low-wage workers, without leading to even minor job losses . Prices increase by minimal amounts that are too small to deter anyone from buying a burger or taco.

Our latest contribution to this research looked at what happened in fast food restaurants after California and New York nearly doubled their minimum wage to $15 over seven and a half years, from the end of 2013 to the beginning of 2022. We compared federal data on fast food jobs in the 36 most populous counties in California and New York – where the minimum wage jumped dramatically – to similar combinations of counties in states that kept the minimum wage at the federal level of $7.25 an hour.

We found that fast food employment in California and New York did not fall, compared to employment trends in the lower-wage areas. In fact, in the low-unemployment years after the pandemic, fast food employers in the $15 counties added workers.

Pizza Hut operators in California recently announced they were laying off delivery drivers and would rely on Uber Eats, DoorDash and other gig delivery services. Analysts blamed the layoffs on the new $20 pay floor . But Pizza Hut began working with those services in 2022 – not to save money but because they couldn’t hire enough drivers. Other national pizza chains have already partnered with delivery companies.

Recognizing all of this, a different question emerges: How do we square the absence of negative employment effects with the theory that higher wages means fewer jobs?

The answer is power.

When employers have too much power in the labor market, they can (and do) pay workers considerably less. Workers take the low-paid jobs, often because they seem to be the best option available at the time. But those artificially low wages lead workers to quit when they find better-paying options – or when they’re just tired of working for such low wages.

As a result, hiring and maintaining staffing levels becomes more difficult for employers, leaving them with unfilled vacancies.

In recent years, fast food and other low-wage workers have reset the power equation. They have taken to the streets, city halls and state houses to demand better pay, and they have convinced politicians around the country to raise the minimum wage.

By raising pay to meet the higher minimums, fast food restaurants were better able to attract workers to fill the vacant jobs. And those workers stayed longer.

Lower employee turnover and fewer vacancies demonstrate how higher minimum wages can result in more jobs. Lower turnover also helps restaurant owners because more experienced workers will be more productive, while the owners save on recruitment and retention costs.

What about prices? Won’t fast-food customers pay a lot more because of the higher wages?

Pundits claim that a 25% increase in the minimum wage means a 25% increase in prices. Again, the real world provides a different answer.

We examined how minimum wage increases in California and New York changed McDonald’s prices. Every dollar increase in the minimum wage led McDonald’s to raise the price of a $5 Big Mac by just 12 cents.

Fast food companies are reporting higher sales and bigger profits than before the pandemic. They have absorbed higher wage costs and remained profitable without reducing fast food jobs.

Time and time again, research – and reality – show that raising fast-food workers’ pay in California will only lead to higher living standards for workers and a more equitable economy.

Which fast food workers will get paid more in California?

California’s fast food workers are getting a raise. But the labor-industry truce is fraying

We want to hear from you

Help us better serve our readers by taking the 2024 Annual Reader Survey. Take the survey

We've recently sent you an authentication link. Please, check your inbox!

Sign in with a password below, or sign in using your email .

Get a code sent to your email to sign in, or sign in using a password .

Enter the code you received via email to sign in, or sign in using a password .

Subscribe to our newsletters:

- WeeklyMatters Catch up on the top stories in California with a summary of our reporting and commentary from the past week.

- Weekly Walters Get a digest of new insights from veteran journalist Dan Walters, who holds powerful people in California accountable.

- WhatMatters Start your day with a comprehensive rundown of the most important stories in California politics and policy.

- Inequality Insights Your weekly must-read to stay on top of inequality, one of California’s most pressing issues.

Sign in with your email

Lost your password?

Try a different email

Send another code

Sign in with a password

- Vacation Rentals

- Restaurants

- Things to do

- Elektrostal Tourism

- Elektrostal Hotels

- Elektrostal Bed and Breakfast

- Flights to Elektrostal

- Elektrostal Restaurants

- Things to Do in Elektrostal

- Elektrostal Travel Forum

- Elektrostal Photos

- Elektrostal Map

- All Elektrostal Hotels

- Elektrostal Hotel Deals

- Elektrostal Hostels

- Elektrostal Business Hotels

- Elektrostal Family Hotels

- Elektrostal Spa Resorts

- 3-stars Hotels in Elektrostal

- Elektrostal Hotels with Banquet hall

- Elektrostal Hotels with Game room

- Hotels near Electrostal History and Art Museum

- Hotels near Park of Culture and Leisure

- Hotels near Statue of Lenin

- Hotels near Museum and Exhibition Center

- Hotels near Museum of Labor Glory

- Hotels near (ZIA) Zhukovsky International Airport

- Hotels near (VKO) Vnukovo Airport

- Hotels near (DME) Domodedovo Airport

- Disney's Caribbean Beach Resort

- Hotel Riu Republica

- Excalibur Hotel & Casino

- Hyatt Ziva Cap Cana

- The Mirage Hotel & Casino

- Wyndham Alltra Cancun

- Dreams Macao Beach Punta Cana

- The Westin Reserva Conchal, an All-Inclusive Golf Resort & Spa

- Barcelo Bavaro Palace All Inclusive Resort

- Hilton Cancun, an All-Inclusive Resort

- Dreams Jade Resort & Spa

- Disney's Coronado Springs Resort

- Luxor Hotel & Casino

- Grand Hyatt Baha Mar

- Westgate Las Vegas Resort & Casino

- Popular All-Inclusive Resorts

- Popular Beach Resorts

- Popular Family Resorts

- Popular All-Inclusive Hotels

- Popular Hotels With Waterparks

- Popular Honeymoon Resorts

- Popular Luxury Resorts

- Popular All-Inclusive Family Resorts

- Popular Golf Resorts

- Popular Spa Resorts

- Popular Cheap Resorts

- All Elektrostal Restaurants

- Restaurants near Restaurant Globus

- Cafés in Elektrostal

- Chinese Restaurants in Elektrostal

- European Restaurants for Families in Elektrostal

- European Restaurants for Large Groups in Elektrostal

- European Restaurants for Lunch in Elektrostal

- Fast Food Restaurants in Elektrostal

- French Restaurants in Elektrostal

- Italian Restaurants in Elektrostal

- Japanese Restaurants in Elektrostal

- Pizza in Elektrostal

- Russian Restaurants in Elektrostal

- Seafood Restaurants in Elektrostal

- Vegetarian Restaurants in Elektrostal

- GreenLeaders

- Elektrostal

- Things to Do

- Travel Stories

- Rental Cars

- Add a Place

- Travel Forum

- Travelers' Choice

- Help Center

- Europe

- Russia

- Central Russia

- Moscow Oblast

- Elektrostal

- Elektrostal Restaurants

Restaurant Globus

Ratings and reviews, location and contact, restaurant globus, elektrostal - restaurant reviews & photos - tripadvisor.

IMAGES

COMMENTS

2024 What's Hot Culinary Forecast. More than 1,500 culinary professionals ranked the hottest trends out of 120 items in 7 categories—dishes, ingredients, flavors, condiments, beverages, alcohol beverages, macro trends—to forecast menu stars for the coming year. Learn More.

Consumer attitudes toward restaurant technology varies greatly by demographic and service segment—fullservice, limited-service and delivery—according to new research. In the Association's first look at restaurant technology integration since 2016—and post pandemic—data shows a good approach for operators is to match their tech investments to the customer base they serve.

The appetite for restaurants hasn't gone away. When we last surveyed restaurant customers for our 2021 restaurant trends report, the COVID-19 pandemic was creating massive uncertainty in the industry, and many worried that restaurant patronage might never recover. But in our most recent restaurant study, conducted in March 2023, 55% of ...

Washington, D.C. - Today, the National Restaurant Association released its 2021 State of the Restaurant Industry Report, which measures the impact of the coronavirus pandemic on the restaurant industry and examines the current state of key pillars including technology and off-premises, labor, and menu trends across segments based on a survey of 6,000 restaurant operators and consumer ...

Data & Research Research Reports. BROUGHT TO YOU BY. Recent. Recent. Menu Tracker: New items from Popeyes, Taco Bell, and Applebee's ... Serving up health care solutions designed for the ...

Washington, D.C. - Today, the National Restaurant Association released its 2020 State of the Restaurant Industry Report which examines key factors impacting the restaurant industry including the current state of the economy, operations, workforce, and food and menu trends across segments from quickservice to fine dining. The report is an authoritative look at the industry and its challenges ...

About Deloitte. Deloitte's restaurant industry trends and food service industry insights explore pathways for helping clients fuse purpose with profit to drive growth and create positive change. All while still meeting the evolving demands of consumers who aren't just buying food—they're buy into better.

Restaurants Market Research Reports & Industry Analysis. Restaurants are an essential part of any culture. Wherever you go, all across the globe, you can find places of business selling food, drinks and desserts. There are many types of restaurants, spanning from casual pizza parlors and food trucks, to hotel restaurants and formal establishments.

An analysis of the top restaurant trends for 2024 based on the latest restaurant research. Actionable takeaways for smoother, more profitable operations. Download Now. Like many other industries, the restaurant sector has been facing considerable challenges lately, including lower profit margins, higher food costs, and shifting diner preferences.

3.1.1 The restaurant location decision in research and practice. Restaurant location is a highly significant determinant of restaurant performance and survival (Parsa et al., 2005, 2011). For example, Park and Khan conclude that location is the primary factor predicting the success or failure of franchise restaurants. Further, personalizing ...

Additional Concepts in Industry Data Reports. Information Request. Name * First. Last. Email * Company. Comment or Message. Submit. A Research Department. for the cost of a subscription ... Restaurant Research provides Concept Benchmark Reports on the largest and most important industry players. Concept Report - Table of Contents ...

This information will be used to identify the key trends and topics studied over the past decade, and help to identify the gaps that appear in the research to identify opportunities for advancing future research in the area of foodservice and restaurant management.,This paper takes the form of a critical review of the extant literature that has ...

Given the recent surge in restaurant research, there is a need for timely reviews employing quantitative methods to portray the intellectual structure of the field. This paper aims to address this gap by conducting a comprehensive bibliometric analysis of restaurant research on the Web of Science database. The research investigates the dynamic ...

Automation is powering restaurant resilience. Various automation and technology use-cases are helping every restaurant fill critical gaps when they're not fully staffed. 100% of restaurant owners reported that automation and technology have improved their businesses, and they're using them in new, innovative ways to drive success. Another ...

The National Restaurant Association conducts research that identifies current and future restaurant industry trends. Economist's Notebook. ... Learn More. Industry Statistics. Restaurant industry statistics on the national and state levels. Learn More. Research Reports. Our economic reports keep you ahead of trends in the restaurant industry ...

The eating and drinking place sector finished 2020 nearly 2.5 million jobs below its pre-coronavirus level. By December, 110,000 eating and drinking places were closed long term or for good. The majority of permanently closed restaurants were well-established businesses in operation for 16 years; 16% had been open for at least 30 years.

The National Restaurant Association's Restaurant Technology Landscape Report 2024 gives insight into how customers and operators are approaching technology in the foodservice industry. 5 min ...

ABSTRACT. This study aimed to explore the impact of restaurant quality on customer satisfaction. Restaurant quality was measured using 11 dimensions related to. halal, food, hygiene, menu and ...

While the point of there being "more tech" in the restaurant industry post pandemic can't be disputed, there's no blanket over the topic. How it's viewed, deployed, defined, and accepted changes by sector, consumer group, and need-state. In the National Restaurant Association's Restaurant Technology Landscape Report for 2024, the concept was split into three categories: […]

The Restaurant Technology Landscape Report 2024 is based on surveys of restaurant operators and consumers. About the National Restaurant Association Founded in 1919, the National Restaurant Association is the leading business association for the restaurant industry, which comprises more than 1 million restaurant and foodservice outlets and a ...

This paper delves into the realm of green restaurants, which seamlessly combine environmentally conscious practices with culinary excellence. It scrutinized 106 reputable hospitality and tourism ...

Today, the minimum wage for California fast food workers will increase to $20 an hour, or 25% above the state's $16 level. And a first-of-its-kind fast food council will give workers, employers and state government the opportunity to come together and set standards for the industry.. But rather than celebrating, many headlines are predicting mass layoffs, major burger price increases and ...

Name Symbol Report exp Comp Rtg Exp next qtr EPS % chg Industry Options strike price Premium as % to stock price Days to exp; PVH: PVH: 4/1/24: 78: 48: Apparel-Clth Mfg

Valuable research and technology reports. Get a D&B Hoovers Free Trial. Financial Statements. Dun & Bradstreet collects private company financials for more than 23 million companies worldwide. Find out more. Get a D&B credit report on this company . Get a D&B credit report on this company .

Best Dining in Elektrostal, Moscow Oblast: See 603 Tripadvisor traveler reviews of 37 Elektrostal restaurants and search by cuisine, price, location, and more.

Valuable research and technology reports. Get a D&B Hoovers Free Trial. Financial Data. Dun & Bradstreet collects private company financials for more than 23 million companies worldwide. Find out more. Get a D&B credit report on this company . Get a D&B credit report on this company .

Restaurant Globus. Unclaimed. Review. Save. Share. 67 reviews #2 of 28 Restaurants in Elektrostal $$ - $$$ European Contemporary Vegetarian Friendly. Fryazevskoye Hwy., 14, Elektrostal Russia + Add phone number + Add website + Add hours Improve this listing. See all (2)