Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Insurance Agent Cover Letter Samples & Examples That Worked in 2024

Your insurance agent cover letter plays a pivotal role in persuading the hiring manager that you're the right person for the job. But how can one document do so much heavy lifting?

Our comprehensive guide is here to answer all your questions. Inside, you'll find professional looking templates, cover letter samples submitted by actual people, detailed examples, and valuable tips. In short, everything you need to know to make your cover letter stand out from the rest .

Keep reading to learn all about how to:

- Craft your insurance agent cover letter header & headline

- Personalize the greeting on your insurance agent cover letter

- Write an eye-catching insurance agent cover letter introduction

- Showcase your professional value as an insurance agent

- Conclude your cover letter with a strong closing statement

- Access top resources for job-seeking insurance agents

Still looking for a job? These 100+ resources will tell you everything you need to get hired fast.

1. Properly craft your insurance agent cover letter header & headline

The first step to writing an effective cover letter is to craft a well-formatted header and headline.

Your cover letter header is where you'll list all the necessary identifying information about yourself and the company you're applying to. As for your cover letter headline , this is a brief title statement used to hook an employer’s attention and serve as a preview for the information to come.

Below are more in-depth explanations and examples of each of these cover letter elements:

Formatting the header

A cover letter header isn't bound by a strict set of formatting rules and can vary in appearance depending on your personal stylistic preferences. However, a header should always contain between 3 to 4 lines of text that include:

- The name of the company & department you are applying to

- Your name and professional title

- Your professional contact information (phone number, email address, LinkedIn, etc.)

Here is an example of a well-formatted header on an insurance agent cover letter

To: Cigna Health, Hiring Department From: Jane Doe , Insurance Agent (123) 456-7890 | [email protected] | linkedin.com/in/jane-doe

Writing the headline

To write the headline of your cover letter, you should always use a keyword related to the position, an eye-catching number or trigger word, a powerful adjective or verb, and a promise.

Here is an example of a well-written headline from an Insurance Agent cover letter:

My 3-Step Approach to Matching Customers with Insurance Plans & How It Can Benefit Your Clients

Trigger Word/Number : 3-Step Approach Keyword: Insurance Plans Adjective/Verb: Matching, Benefit Promise: Your Clients – this addition at the end of the headline shows the employer that you will relate your skills and approach directly to the needs of their company and clients.

Let your cover letter write itself — with AI!

2. personalize the greeting on your insurance agent cover letter.

The greeting of your cover letter follows the headline. While generalized greetings – such as “To Whom It May Concern” – are the simplest options, personalized greetings help to make your cover letter more memorable to employers.

A personalized greeting will address a specific person or department within the company by name. In doing so, this helps to show the employer you have excellent attention to detail and have taken the time to research their company beforehand.

In some cases, you may be unable to pinpoint an exact person or department that will review your application. If this is true for you, try out one of the following alternatives:

To the [Company Name] Team

To the [Company Name] Hiring Manager

3. Write an eye-catching insurance agent cover letter introduction

With your header, headline, and greeting now in place, your next step is to write a compelling and eye-catching cover letter introduction .

A strong introductory paragraph will typically include:

- A brief overview of your professional history and goals

- A statement on why you are enthusiastic about applying to this company

- A mutual acquaintance (when possible)

Here is an example to help demonstrate how to write an insurance agent cover letter introduction

To the [Company Name] Hiring Manager,

I am an Insurance Agent with 5+ years of experience matching clients with the ideal home and property insurance plans. While working as an independent broker, I had the pleasure of meeting your company’s Head of Communications – Jack Smith – who encouraged me to apply for this position after learning of my growing client pool.

Find out your resume score!

4. Showcase your professional value as an insurance agent

Following the introduction of your cover letter are the body paragraphs. We generally recommended aiming for between 2 to 4 body paragraphs that offer more in-depth answers to the following questions:

- What excites you about working at this company?

- What do you hope to learn from working at this company?

- What accomplishments or qualifications make you stand out as an applicant?

- What key skills do you possess that are relevant to the position?

Focusing on your accomplishments is especially important, as they help to show employers the real-life value you can bring to the company.

Here is an example of how to describe an accomplishment in an insurance agent cover letter

As an Insurance Agent at [Former Employer], I achieved a 35% success rate in selling customers extra coverage with their base plans. Additionally, I regularly surpassed the monthly sales quota of $25K at an average of 10% higher sales.

5. Conclude your cover letter with a strong closing statement

To finalize your cover letter, you'll need an effective closing statement that includes:

- An enthusiastic sentence saying you are looking forward to hearing from them

- An additional sentence stating you will follow up, including how you will contact them or how they can contact you

- A formal sign-off

Here is an example of a strong closing statement from an insurance agent cover letter

As your new Insurance Agent, I will bring a large pool of loyal clients to your company and a high level of excellence in sales and consulting. I am eager to hear from you and would love to plan a formal meeting to further discuss this opportunity. I am available all weekdays from 9 a.m. to 4 p.m., and the best way to reach me is at (123) 456-7890.

If I do not hear back within a week, I will reach back out to check on the status of my application.

Best Regards,

[Applicant Name]

Follow this cover letter outline for maximum success.

6. Job-search resources for insurance agents

Armed with the perfect cover letter and your insurance agent resume , it's time to get to the grand finale — the actual job hunt! But this is easier said than done. Don't worry, we thought about this too. So, we've prepared a list of helpful resources for you to use:

- Industry-specific job boards: The most straightforward option is to look at websites that cater specifically to your profession. For example: InsuranceJobs.co.uk , iHireInsurance , or InsuranceJobs.com .

- Online job search engine: By filtering your search through location and keywords, you can find plenty of suitable opportunities with platforms like Indeed , Glassdoor , ZipRecruiter , and SimplyHired .

- Insurance associations: Organizations such as the Chartered Insurance Institute (CII), the National Association of Insurance and Financial Advisors (NAIFA), or the Independent Insurance Agents & Brokers of America (IIABA) offer unique opportunities for networking, further training, as well as job listings and so much more.

- Networking: Networking is king! And with a powerhouse of a platform like LinkedIn , you'll be able to connect with industry experts and potential employers from the comfort of your home.

- Specialized publications: Apart from occasional job postings, media like “ Insurance Journal ,” “ PropertyCasualty360 ,” or “Insurance Networking News (INN),” can help you stay up-to-date with latest industry trends, news, and strategies.

- Courses & certificates: Online learning platforms like Coursera , Udemy , edX , or even LinkedIn Learning offer a wide selection of courses and certificates that can help you stay sharp and keep developing.

It doesn't matter how many job postings you end up responding to, remember to always custom tailor every single cover letter to align as closely as possible to whatever the job description calls for.

Insurance Agent Cover Letter FAQ

What's the most effective way to showcase my skills in an insurance agent cover letter.

Write about your skills in a real-life context. Don't just say you're great at customer service; give specific examples of how your outstanding service led to increased client satisfaction or retention. Start by describing the situation, which skills you utilized to solve it, and mention what results you achieved.Ideally you'll also support your words with quantifiable results.

Should I use a specific structure for my cover letter?

When it comes to cover letter writing, nothing is set in stone. But we recommend following the structure outlined in our article. It's simple, professional, and it stood the test of time for a reason. Just make sure to always include: a greeting, introduction, main body, conclusion, and sign off.

Should I include my salary requirements in the cover letter?

Unless specifically requested in the job posting, it's usually best to avoid the salary discussion at this stage. You want the focus to be on your skills, experiences and fit for the role. Any further discussions about salary expectations should be left to later stages of job interviews.

How long should my cover letter be?

In this case, less is definitely more. Your cover letter should not exceed one page. Anything longer than that, and your job application goes straight in the bin. Aim for three to four well-crafted paragraphs. The idea behind a cover letter is to pique the hiring manager's interest, not give them your life story. Stay succinct, engaging, and relevant!

Do cover letter formats even matter?

Of course they do! Every single detail of your job application speaks volumes about your professionalism. For example, consistent formatting shows attention to detail. So, stick to a simple, clean font, keep margins even, and use a logical order - your contact details, the date, the recipient's details, then your letter content. But our cover letter templates will take care of any such details.

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

All accounting / finance cover letter examples

- Finance Analyst

- Investment Advisor

- Tax Services

All insurance agent cover letter examples

Related insurance agent resume examples.

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

Insurance Cover Letter: Sample & Guide [Entry Level + Senior Jobs]

Create a standout insurance cover letter with our online platform. browse professional templates for all levels and specialties. land your dream role today.

Writing a cover letter for an insurance job can be intimidating. With this guide, you'll understand how to write a competitive and professional cover letter that will give you the best chance of landing the job. We'll walk you through crafting your cover letter, from understanding the basics of insurance cover letters to actionable tips for creating an impressive and unique document.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Community Health Nurse Cover Letter Sample

- Clinical Nurse Educator Cover Letter Sample

- Clinical Research Associate Cover Letter Sample

- Infusion Nurse Cover Letter Sample

- Hospital Pharmacist Cover Letter Sample

- Dental Lab Technician Cover Letter Sample

- General Practitioner Cover Letter Sample

- Athletic Trainer Cover Letter Sample

- Nursing Attendant Cover Letter Sample

- Assistant Director Of Nursing Cover Letter Sample

- Staff Pharmacist Cover Letter Sample

- ER Nurse Cover Letter Sample

- Orthodontist Cover Letter Sample

- Staff Nurse Cover Letter Sample

- Pediatric Nurse Cover Letter Sample

- Pharmacy Assistant Cover Letter Sample

- Care Manager Cover Letter Sample

- Experienced Psychiatrist Cover Letter Sample

- Director Of Nursing Cover Letter Sample

- Nursing Assistant Cover Letter Sample

Insurance Cover Letter Sample

Dear Hiring Manager,

I am submitting my application for the position of Insurance with your organization. With over 10 years of experience in the insurance industry, I have the knowledge and expertise to be an effective member of your team.

I am currently working as an Insurance Agent with ABC Insurance Company, where I am responsible for providing customers with a variety of insurance products and services. I specialize in life and health insurance, and have been successful in helping customers develop comprehensive insurance plans tailored to their needs. My experience also includes providing customers with quotes, explaining policy coverage options, and negotiating premium rates.

In addition to my technical knowledge of the insurance industry, I possess strong customer service skills. I have had success in building relationships with customers and helping them to understand their policy coverage. I am also skilled in resolving customer complaints and handling difficult conversations with professionalism and empathy.

I am confident that my experience and qualifications make me an ideal candidate for the position. I am excited at the prospect of joining your team and contributing to the growth of your organization.

Thank you for your time and consideration. I look forward to hearing from you.

Sincerely, John Doe

Why Do you Need a Insurance Cover Letter?

- A insurance cover letter is a great way to make sure that you are adequately covered for any eventuality.

- It can help to protect you from financial losses and provide peace of mind in the event of an accident or other unexpected event.

- Insurance cover letters provide an assurance that any losses you suffer will be covered by the insurance company.

- Having an insurance cover letter also helps to ensure that you are not left with a large financial burden if something unexpected happens.

- Having a insurance cover letter is also important if you have any assets such as a house or a car that you would like to be protected.

- In the event of an accident, the insurance cover letter will provide you with the financial assistance that you need in order to recover any losses.

- Having an insurance cover letter also helps to ensure that your medical costs are covered in the event of an illness or injury.

A Few Important Rules To Keep In Mind

- Start with a professional greeting. Address your letter to the hiring manager by name if you know it.

- Outline your most relevant qualifications and experience in your opening paragraph.

- Include specific details that relate to the position and demonstrate why you are the ideal candidate.

- Explain why you are interested in the position and why you are the best candidate for the job.

- Keep your letter brief and to the point. Avoid using flowery language and excessive detail.

- Provide examples that demonstrate your experience and qualifications.

- Close with a thank you and a call to action.

- Proofread your letter carefully to ensure that there are no spelling or grammar errors.

What's The Best Structure For Insurance Cover Letters?

After creating an impressive Insurance resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Insurance cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Insurance Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

A Insurance Cover Letter Body Should Typically Include:

- A brief introduction that states the position you are applying for and why you are a good fit for the role.

- A description of your relevant experience and skills, including any industry-specific knowledge.

- Examples of how you have demonstrated the required skills in past positions (if applicable).

- A statement of your enthusiasm for the job and the company.

- A closing paragraph that summarizes your qualifications and expresses your interest in the position.

When writing a cover letter for an insurance job, it is important to focus on the specific skills that you possess that make you a qualified candidate. It is important to demonstrate your knowledge of the insurance industry and your interest in the position. Your cover letter should also focus on the benefits that you can bring to the organization.

When highlighting my relevant experience, I focus on the skills and knowledge I have acquired through my past positions. For example, I have years of experience in the insurance industry, so I am well versed in the industry's regulations and procedures. I am also knowledgeable about the various types of insurance policies available and the various coverage levels. Additionally, I possess excellent customer service and communication skills, which I have utilized in my past roles.

In my previous positions, I have demonstrated my ability to handle customer inquiries and complaints in a timely and professional manner. I am also highly organized and have experience in processing and filing paperwork. My strong attention to detail ensures that all documents are accurate and up to date. I have the ability to work independently and as part of a team, and I am comfortable taking on additional tasks when needed.

I am excited about the opportunity to join your organization and am confident that I can make a positive contribution. I am eager to use my knowledge and experience to help your organization succeed. Please do not hesitate to contact me if you have any questions. I look forward to hearing from you.

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing an Insurance Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Failing to customize the cover letter for the specific position and company.

- Including irrelevant personal information.

- Using a generic greeting such as "To whom it may concern" or "Dear Sir or Madam".

- Using too much technical jargon.

- Making spelling and grammar mistakes.

- Using overly flowery or fancy language.

- Including information that has already been included in the resume.

- Not mentioning any of the skills or qualifications the employer is looking for.

- Failing to provide contact information.

Key Takeaways For an Insurance Cover Letter

- Highlight relevant skills and qualifications that are relevant to the insurance industry.

- Express a clear understanding of the job role and how your skills will help the company.

- Explain the value you can bring to the company in terms of experience and qualifications.

- Outline the unique benefits of the insurance product and explain how it can help the customer.

- Communicate your enthusiasm and commitment to the insurance company and the customer.

- Provide examples of how you have successfully solved customer problems in the past.

- Convey a deep understanding of the customer’s needs and explain how the insurance product can meet them.

- Be professional and courteous in your correspondence.

- Ensure that all relevant information is included in the letter.

15 Insurance Agent Cover Letter Examples for 2024 (Free Templates)

Craft an exceptional Insurance Agent Cover Letter with our online builder. Explore professional example cover letter templates tailored for various levels and specialties. Leave a lasting impression on employers with a refined, professional Cover Letter. Secure your dream job today!

Table of Contents

Most popular insurance agent cover letter examples.

Explore additional Insurance Agent cover letter samples and guides and see what works for your level of experience or role.

Insurance Sales Manager Cover Letter Example

Insurance Broker Cover Letter Example

Insurance Sales Cover Letter Example

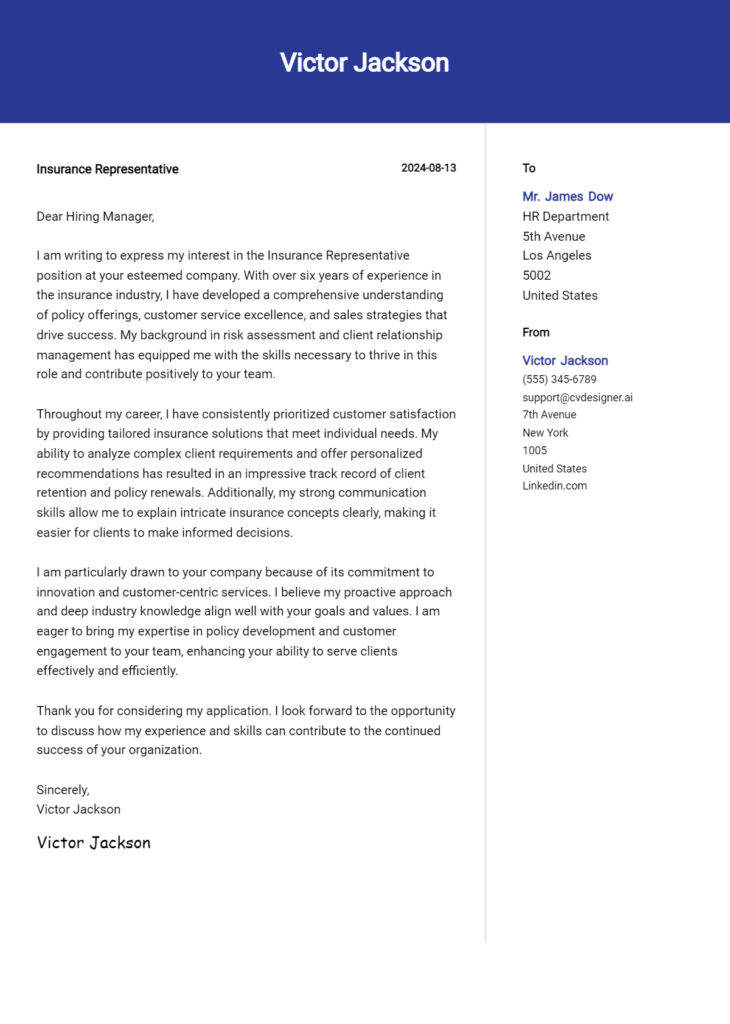

Insurance Representative Cover Letter Example

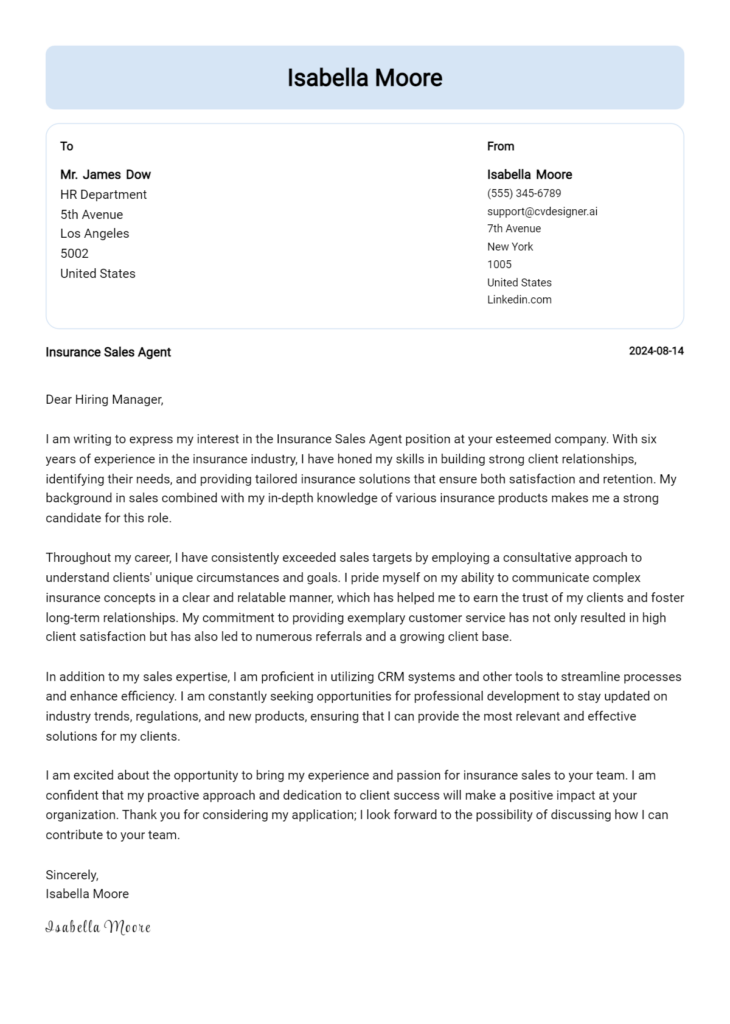

Insurance Sales Agent Cover Letter Example

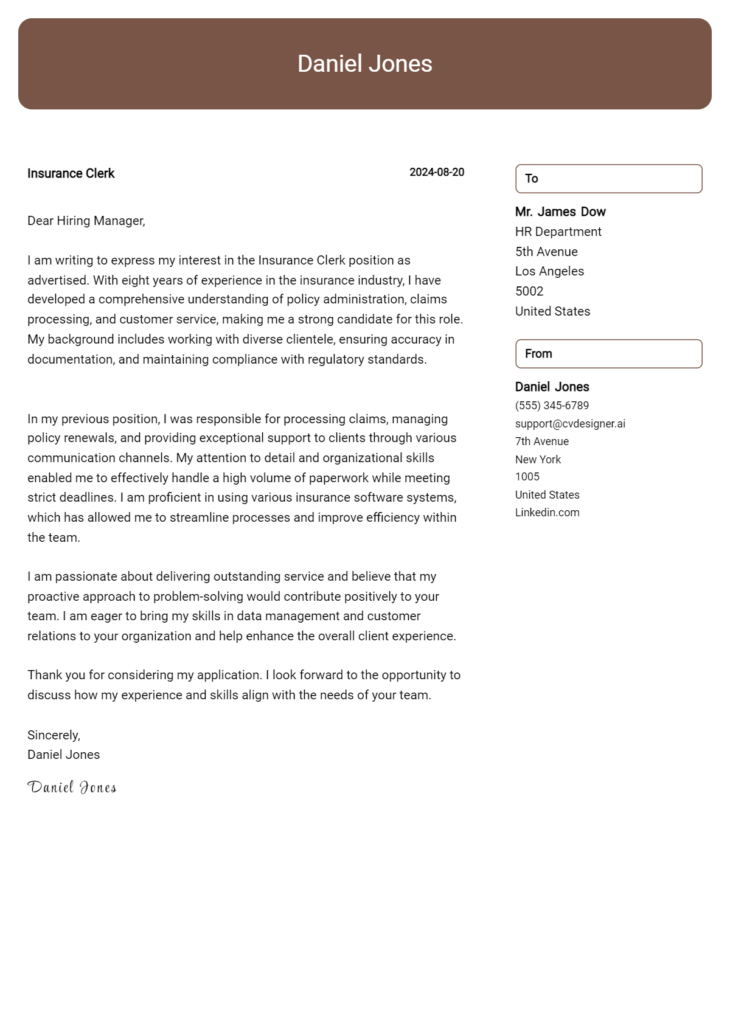

Insurance Clerk Cover Letter Example

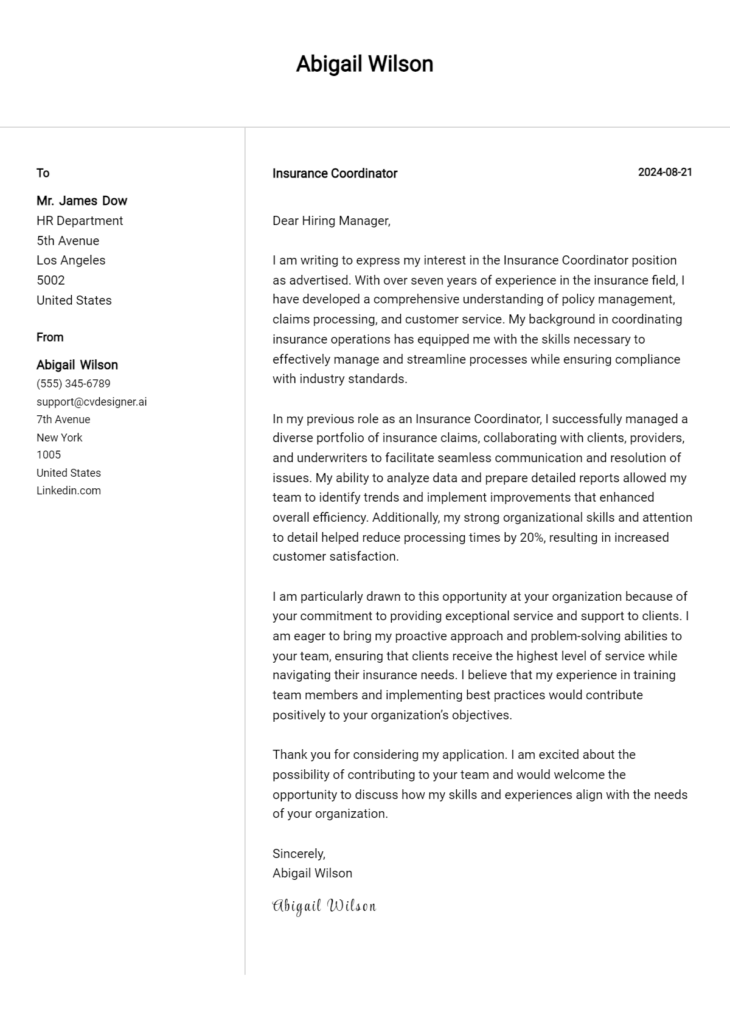

Insurance Coordinator Cover Letter Example

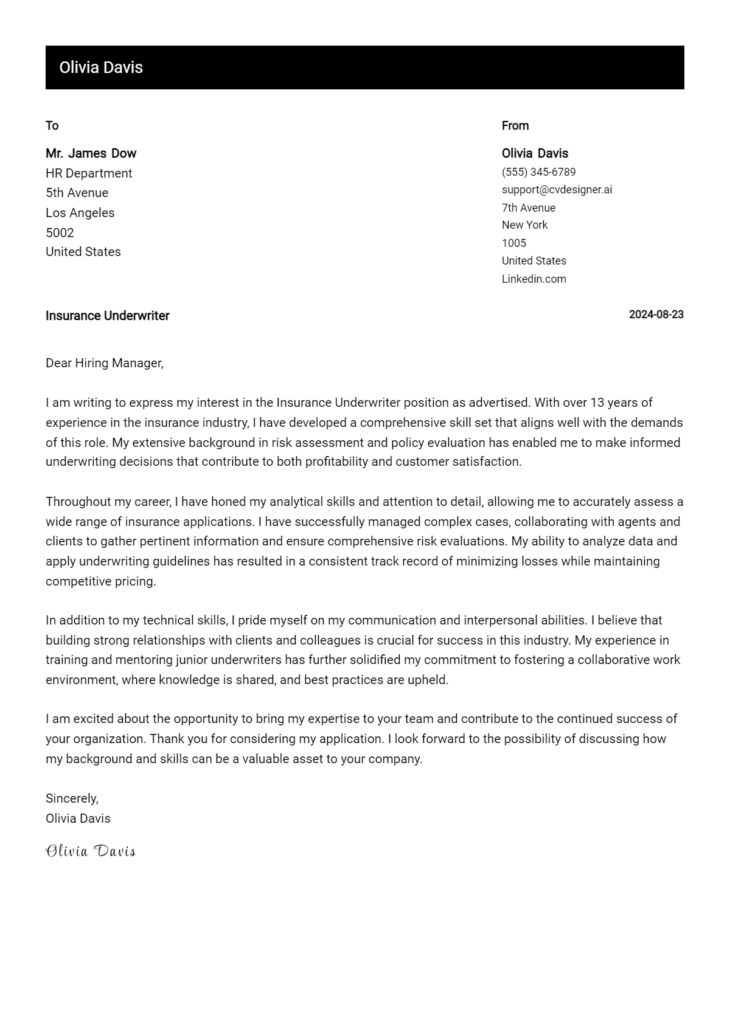

Insurance Underwriter Cover Letter Example

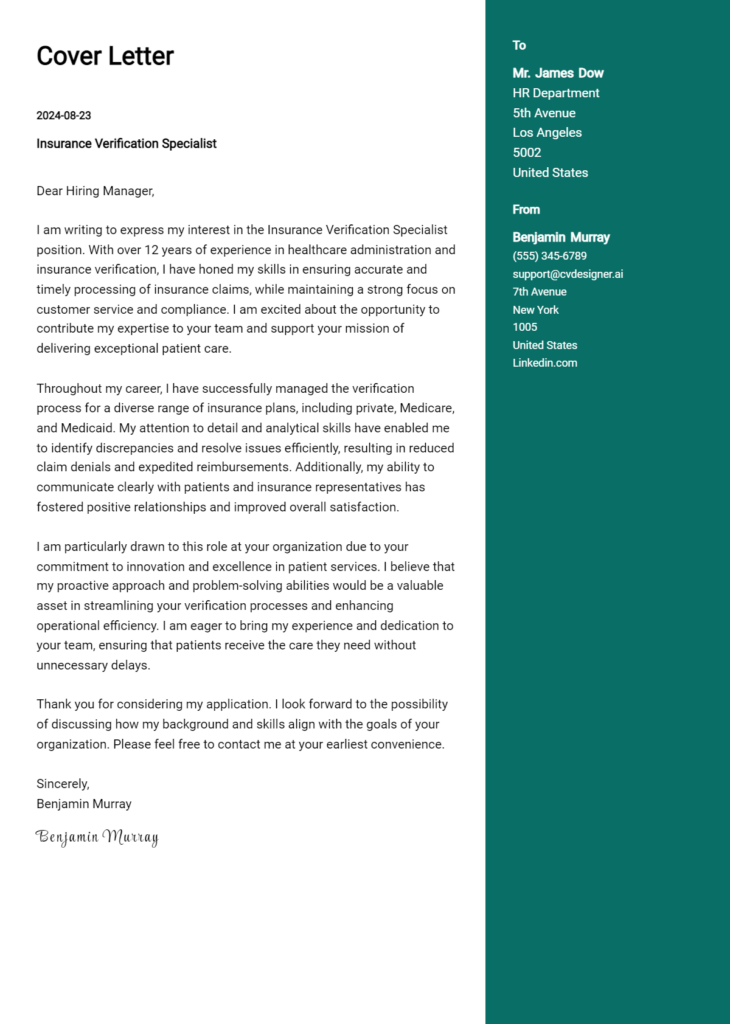

Insurance Verification Specialist Cover Letter Example

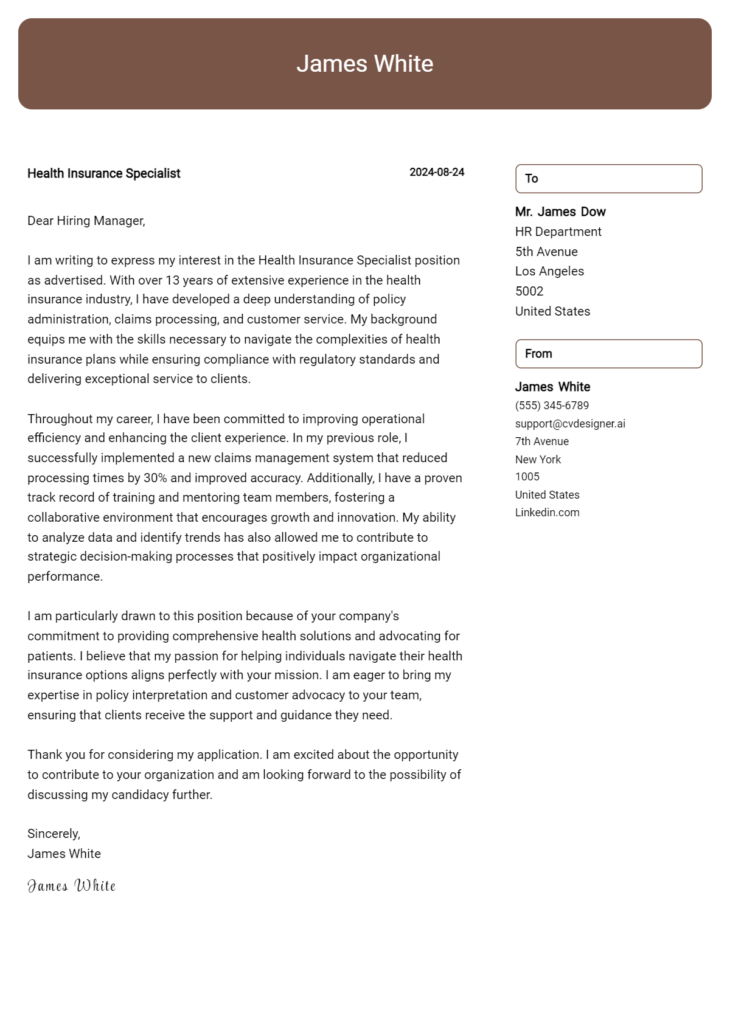

Health Insurance Specialist Cover Letter Example

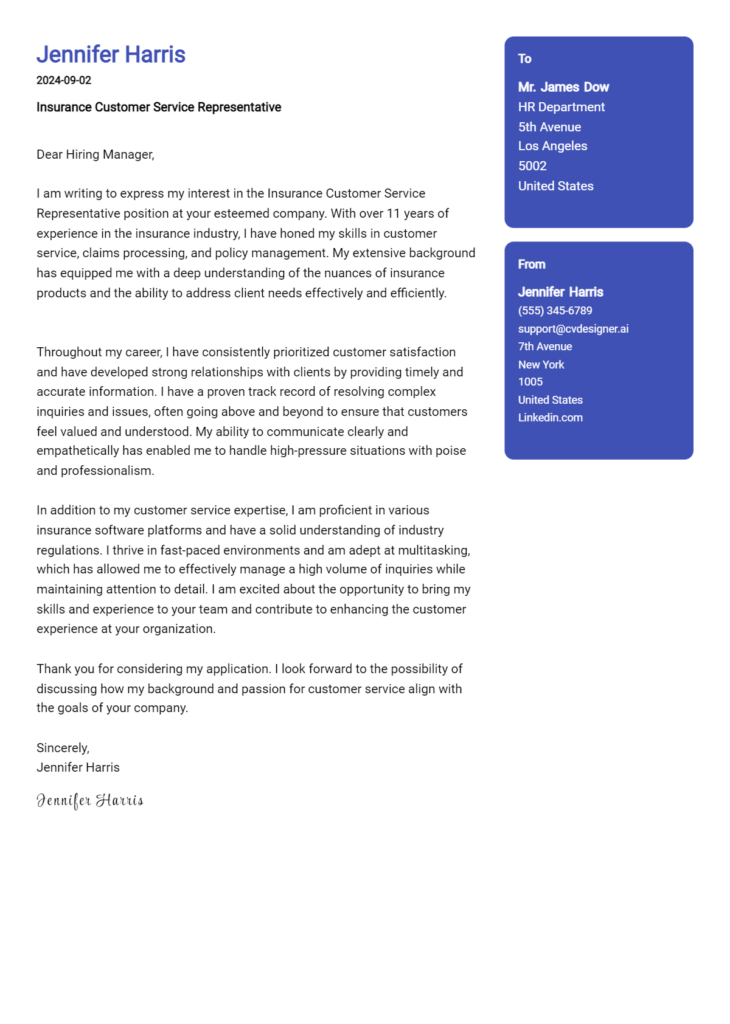

Insurance Customer Service Representative Cover Letter Example

Insurance Billing Specialist Cover Letter Example

Insurance Processor Cover Letter Example

Insurance Manager Cover Letter Example

Are you ready to take the next step in your career as an Insurance Agent? Crafting a standout cover letter is crucial in making a strong first impression on potential employers. In this comprehensive guide, we will explore everything you need to know to create a compelling cover letter that highlights your skills and experiences. By the end, you'll have the tools necessary to effectively communicate your qualifications and enthusiasm for the role. Here’s what we’ll cover:

- What does an Insurance Agent Cover Letter accomplish? Understand the purpose and impact of a well-written cover letter in your job application process.

- Key Components of an Insurance Agent Cover Letter: Discover the essential elements that should be included to make your letter effective and persuasive.

- Format an Insurance Agent Cover Letter: Learn about the proper structure and format to ensure your cover letter is professional and easy to read.

- Three different level cover letter examples: Review examples tailored for entry-level, mid-level, and senior Insurance Agent positions to inspire your own writing.

- Common Mistakes to Avoid in an Insurance Agent Cover Letter: Identify pitfalls that could weaken your application and how to steer clear of them.

- Key Takeaways: Summarize the crucial points to remember as you craft your cover letter.

Let’s dive in and equip you with the knowledge to create an outstanding cover letter that sets you apart from the competition!

What does a Insurance Agent Cover Letter accomplish?

A cover letter for an Insurance Agent serves as a crucial tool in the job application process, allowing candidates to highlight their skills, experience, and personal attributes that align with the insurance industry's demands. It acts as an introduction to the hiring manager, conveying enthusiasm for the position and demonstrating an understanding of the company's values and mission. By effectively articulating how one's background in sales, customer service, and risk assessment can contribute to the agency’s success, a well-crafted cover letter can set a candidate apart from others. For tips on creating an effective cover letter, you can refer to our cover letter guide , and if you need assistance in drafting one, our cover letter builder can simplify the process.

Key Components of a Insurance Agent Cover Letter

- Personalization: Begin your cover letter by addressing the hiring manager by name, if possible. This shows that you have done your research and are genuinely interested in the position. Tailor the content to reflect the specific job role of an Insurance Agent and mention the company’s name to enhance the personal touch.

- Professional Experience: Highlight your relevant work experience in the insurance industry. Discuss your previous roles, responsibilities, and achievements that demonstrate your ability to succeed as an Insurance Agent. Use metrics or specific examples wherever possible to illustrate your contributions.

- Skills and Qualifications: Clearly outline the skills that make you a strong candidate for the role, such as communication, negotiation, and customer service skills. Mention any relevant certifications or licenses that pertain to insurance, and how they enhance your capability in the position.

- Call to Action: Conclude your cover letter with a compelling call to action, encouraging the hiring manager to reach out for an interview. Express your enthusiasm for the opportunity and your eagerness to discuss how your experience aligns with the company’s needs. For more insights on structuring your cover letter effectively, you can refer to this cover letter format or explore various cover letter examples to guide you.

How to Format a Insurance Agent Cover Letter

As an aspiring insurance agent, crafting a compelling cover letter is crucial to making a positive first impression. Your cover letter should highlight your qualifications, skills, and enthusiasm for the role, while also demonstrating your understanding of the insurance industry.

- Start with a professional greeting, addressing the hiring manager by name if possible.

- Open with a strong introductory sentence that captures your interest in the position and the company.

- Mention your relevant experience in insurance or sales, emphasizing any specific achievements or recognitions.

- Highlight your understanding of different types of insurance products and how they meet client needs.

- Discuss your skills in building and maintaining client relationships, showcasing your customer service abilities.

- Include any relevant certifications or licenses you hold, such as a state insurance license or designations like CLU or CPCU.

- Illustrate your ability to analyze client needs and provide tailored insurance solutions.

- Emphasize your strong communication skills, both written and verbal, and your ability to explain complex concepts clearly.

- Mention your proficiency with technology and software used in the insurance industry, such as CRM systems or policy management tools.

- Conclude with a call to action, expressing your eagerness to discuss your application further and thanking the reader for their consideration.

Insurance Agent Entry-Level Cover Letter Example #1

Dear [Hiring Manager's Name],

I am writing to express my interest in the entry-level Insurance Agent position at [Company Name] as advertised on [where you found the job listing]. With a strong commitment to providing exceptional customer service and a keen interest in the insurance industry, I am excited about the opportunity to contribute to your team and help clients navigate their insurance needs.

During my time at [University/College Name], where I earned my degree in [Your Major], I developed a solid foundation in business principles and customer relations. My coursework in risk management and financial planning has equipped me with the knowledge necessary to understand various insurance products and their importance to individuals and businesses. Additionally, my involvement in [relevant extracurricular activities or internships] has honed my communication skills and ability to work effectively in a team-oriented environment.

I recently completed an internship at [Previous Company Name], where I assisted with client outreach and policy renewals. This experience allowed me to engage directly with clients, addressing their questions and concerns while providing them with tailored insurance solutions. I learned the importance of building trust and maintaining relationships, which I believe are essential qualities for a successful Insurance Agent. My ability to analyze clients' needs and present them with suitable options was recognized by my supervisor, who praised my proactive approach and attention to detail.

I am particularly drawn to [Company Name] because of its commitment to customer satisfaction and community involvement. I admire how your team is dedicated to educating clients about their insurance options and helping them make informed decisions. I am eager to bring my enthusiasm and strong work ethic to your organization, and I am confident that my background and passion for the insurance field will enable me to contribute positively to your clients and team.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the goals of [Company Name]. I am excited about the possibility of becoming a part of your team and contributing to the success of your clients. Please feel free to contact me at [Your Phone Number] or [Your Email Address] to schedule a conversation.

[Your Name]

Insurance Agent Mid-Level Cover Letter Example #2

I am writing to express my interest in the Insurance Agent position at [Company Name], as advertised on [where you found the job posting]. With over five years of experience in the insurance industry and a proven track record of achieving sales targets while delivering exceptional customer service, I am excited about the opportunity to contribute to your team.

In my previous role at [Previous Company Name], I successfully managed a diverse portfolio of clients, providing tailored insurance solutions that met their unique needs. By leveraging my strong relationship-building skills, I was able to increase client retention by 25% over a two-year period. My proactive approach to client management involved regular follow-ups and personalized consultations, ensuring that my clients felt valued and informed about their coverage options. This dedication not only fostered loyalty but also resulted in numerous referrals, significantly contributing to my team's overall success.

Additionally, I hold a comprehensive understanding of various insurance products, including life, health, and property insurance. This knowledge, combined with my analytical skills, allows me to assess clients' needs effectively and recommend the most suitable policies. At [Previous Company Name], I played a key role in developing and implementing a new client onboarding process that streamlined our operations and enhanced the customer experience. This initiative led to a 15% reduction in onboarding time and increased satisfaction ratings among new clients.

I am particularly drawn to the culture of innovation and customer-centric approach at [Company Name]. I believe my values align closely with your organization's mission to provide comprehensive insurance solutions while fostering lasting relationships with clients. I am eager to bring my expertise in sales strategy and client management to your team, helping to drive growth and ensure that your clients receive the highest standard of service.

Thank you for considering my application. I look forward to the opportunity to discuss how my experience and skills can contribute to the continued success of [Company Name]. Please feel free to contact me at [Your Phone Number] or [Your Email Address] to schedule a conversation.

Insurance Agent Experienced Cover Letter Example #3

I am writing to express my interest in the Insurance Agent position at [Company Name], as advertised on [where you found the job listing]. With over [number] years of experience in the insurance industry, I have honed my skills in sales, customer relationship management, and risk assessment, making me a valuable asset to your team. My extensive background in both personal and commercial lines of insurance has equipped me with the knowledge and expertise to meet diverse client needs effectively.

Throughout my career, I have consistently achieved and surpassed sales targets, demonstrating my strong ability to connect with clients and understand their unique insurance requirements. At [Previous Company Name], I successfully increased my client base by [percentage or number], leveraging my proactive approach to networking and relationship building. My commitment to providing exceptional customer service has earned me numerous referrals and high client retention rates, which I consider the hallmark of my professional success.

In addition to my sales accomplishments, I possess a comprehensive understanding of underwriting processes and regulatory compliance. I have effectively collaborated with underwriters and claims adjusters to ensure that all policies are accurately assessed and managed, ultimately delivering peace of mind to my clients. My ability to interpret complex insurance products and educate clients has empowered them to make informed decisions, thus enhancing their overall satisfaction and trust in the services I provide.

I am particularly drawn to [Company Name] because of its reputation for innovation and commitment to customer-centric solutions. I am eager to bring my experience and passion for the insurance industry to your esteemed organization, where I can contribute to further enhancing client relationships and driving business growth. I am confident that my proactive approach and dedication to excellence will align seamlessly with your team's goals.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms can be a perfect match for the Insurance Agent role at [Company Name]. I am excited about the prospect of contributing to your team and am available for an interview at your convenience.

Cover Letter Tips for Insurance Agent

When crafting a cover letter for an insurance agent position, it's essential to convey your understanding of the insurance industry, your interpersonal skills, and your commitment to client satisfaction. Start with a compelling introduction that highlights your enthusiasm for the role and briefly mentions your relevant experience. Use the body of the letter to detail your qualifications, showcasing specific achievements and how they relate to the job description. Remember to convey your passion for helping clients find the right coverage and your ability to build lasting relationships. Conclude with a strong closing statement that encourages further discussion and reiterates your interest in the position.

Cover Letter Tips for Insurance Agent:

- Tailor Your Letter: Customize your cover letter for each application by referencing the specific company and position. Highlight skills and experiences that align with the job description.

- Highlight Relevant Experience: Clearly outline your previous experience in sales, customer service, or the insurance industry. Use quantifiable achievements to demonstrate your impact.

- Showcase Soft Skills: Emphasize interpersonal skills like empathy, communication, and negotiation, as these are crucial for building trust with clients.

- Discuss Industry Knowledge: Mention your understanding of different types of insurance products (like life, health, or property insurance) and any certifications that enhance your credibility.

- Use a Professional Tone: Maintain a professional yet approachable tone throughout your cover letter. Avoid overly casual language while still being personable.

- Include a Call to Action: Encourage the hiring manager to contact you for an interview, expressing your eagerness to discuss how you can contribute to their team.

- Proofread: Carefully review your cover letter for any grammatical or spelling errors. A polished letter reflects attention to detail.

- Keep It Concise: Aim for a one-page cover letter. Be clear and concise, ensuring that every sentence adds value to your application.

How to Start a Insurance Agent Cover Letter

As you embark on your journey to secure a position as an insurance agent, your cover letter's introduction plays a crucial role in making a memorable first impression. Here are several examples of effective openings that can set the tone for your application:

I am excited to apply for the Insurance Agent position at [Company Name], as my extensive background in customer service and my passion for helping clients protect their assets align perfectly with your team's mission. With over five years of experience in the insurance industry and a proven track record of exceeding sales goals, I am eager to bring my expertise to [Company Name] and contribute to your ongoing success. After researching [Company Name] and its commitment to providing exceptional service, I am thrilled to submit my application for the Insurance Agent role, where I can leverage my skills in relationship building and policy management. As a dedicated professional with a strong background in risk assessment and client consultation, I am drawn to [Company Name]'s reputation for integrity and innovation, and I am excited about the opportunity to join your team as an Insurance Agent. Having successfully guided numerous clients through their insurance needs, I am passionate about helping individuals find the right coverage. I am excited to pursue the Insurance Agent position at [Company Name], where my skills can make a meaningful impact.

How to Close a Insurance Agent Cover Letter

As you conclude your cover letter for an Insurance Agent position, it's crucial to leave a lasting impression that reiterates your enthusiasm and qualifications. Here are some effective closing statements you can consider:

“I am eager to bring my extensive knowledge of insurance products and exceptional customer service skills to your team, and I look forward to the opportunity to discuss how I can contribute to your agency’s success.”

“Thank you for considering my application. I am excited about the prospect of leveraging my skills in risk assessment and client relationship management to help your clients find the best coverage options.”

“I appreciate your time and consideration, and I am looking forward to the possibility of discussing my candidacy further. I am confident that my proactive approach will make a positive impact on your agency.”

“I would love the chance to discuss how my background in sales and insurance aligns with the goals of your team. Thank you for the opportunity, and I hope to hear from you soon.”

Common Mistakes to Avoid in a Insurance Agent Cover Letter

When applying for a position as an insurance agent, a well-crafted cover letter can make all the difference in standing out from the competition. This document serves as your first impression and provides an opportunity to showcase your skills, experience, and enthusiasm for the role. However, common pitfalls can undermine your efforts and diminish your chances of landing an interview. To help you create an impactful cover letter, here are some mistakes to avoid:

- Failing to customize the letter for the specific job and company.

- Using a generic salutation instead of addressing the hiring manager by name.

- Overloading the cover letter with jargon or technical terms without explanation.

- Neglecting to highlight relevant achievements and experiences.

- Writing in a casual or overly informal tone that doesn’t match the industry.

- Making spelling and grammatical errors that reflect a lack of attention to detail.

- Focusing too much on salary expectations rather than your qualifications.

- Not including a strong closing statement that encourages further communication.

- Ignoring the importance of formatting, leading to a cluttered or difficult-to-read layout.

- Making it too lengthy; cover letters should be concise and to the point, ideally one page.

Key Takeaways for a Insurance Agent Cover Letter

In crafting a compelling cover letter for an insurance agent position, it's essential to highlight your relevant experience, interpersonal skills, and understanding of the insurance industry. Emphasize your ability to build strong relationships with clients, as trust and communication are vital in this role. Tailor your letter to reflect your knowledge of the specific insurance products offered by the company, showcasing how your expertise aligns with their needs. This personalized approach not only demonstrates your enthusiasm for the position but also sets you apart from other candidates.

To enhance the effectiveness of your cover letter, consider utilizing cover letter templates that can provide a professional layout and structure. Additionally, leveraging a cover letter builder can streamline the writing process, allowing you to focus on articulating your strengths and achievements clearly. By following these guidelines and utilizing available resources, you can create a persuasive cover letter that captures the attention of hiring managers and leads to successful job opportunities in the insurance sector.

Build your Cover Letter in minutes

Use an AI-powered cover letter builder and have your letter done in 5 minutes. Just select your template and our software will guide you through the process.

Make a cover letter in minutes

Pick your template, fill in a few details, and our builder will do the rest.