68 market research questions to ask (and how to ask them)

Example market research questions, market research questions to ask customers, market research questions for product development, market research questions for brand tracking, pricing survey questions for market research, how to write your own market research questions.

No two market research projects are alike, but happily there are some tried-and-tested questions you can use for inspiration to get the consumer insights you’re looking for.

It’s all about asking questions that are most relevant to the goals of your research. Every so often the best questions are actually quite straightforward, like asking consumers where they do their grocery shopping.

If you’re creating a customer profile, you’ll ask different questions than when you’re running creative testing with your target audience, or getting insights on key consumer trends in your market.

The right market research questions are the ones that will lead you to actionable insights, and give you a competitive advantage in your target market.

Let’s kick this off and get straight into some questions, shall we?

Where do we even begin with this?! There are so many types of research and we’ll get into which questions work for each below, but here are some classic example market research questions to get you started.

These particular questions are good for surveys that you might run when you’re running some essential consumer profiling research.

- Which of these products have you purchased in the last 3 months?

- Which of the following types of >INSERT YOUR PRODUCT/SERVICE CATEGORY< do you buy at least once a month?

- Approximately, how much would you say you spend on >INSERT YOUR PRODUCT/SERVICE CATEGORY< per month?

- What is stopping you from buying more of >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- When was the last time you tried a new >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

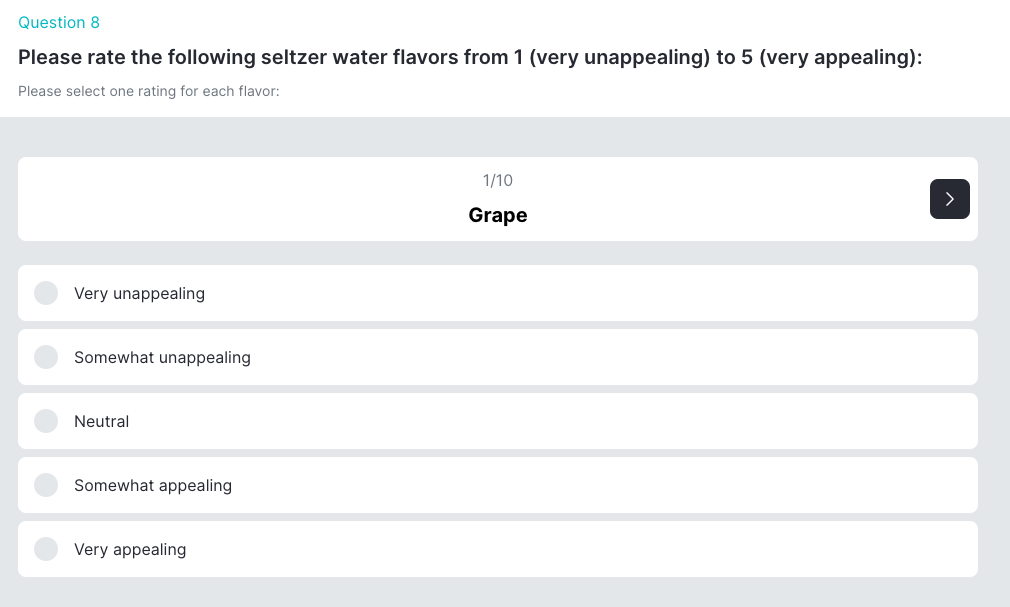

- Please rank the following on how important or unimportant they are when deciding which >INSERT PRODUCT CATEGORY< to buy?

- Which of these brands are you aware of?

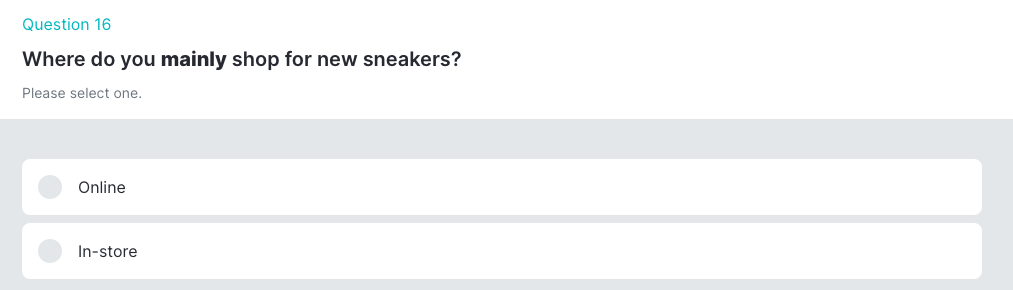

- Which of these brands have you purchased from in the last 3 months?

- How do you prefer to shop for >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Why do you prefer to shop online?

- Why do you prefer to shop in-store?

- Thinking about the following, how often do you use/listen/watch each of these media?

- Where do you go to keep up to date with the news?

- Which social media platforms do you use daily?

- What mobile phone do you currently own?

Surely you want to talk to your current customers to understand why they buy from you and what they think about your products?

Correct! But your consumer research should definitely not end with current customers!

Here’s why you should think about broadening your research to include other groups and different market research methods :

- Current customers: This is a must! Running research to your current customers will help you understand how you can make your product or service better. These are the people who’ve spent their hard-earned cash on your products so they have a unique perspective on what kind of value you offer. In addition, understanding why your existing customer base chose your brand over others can help you create messaging that resonates with people who are still on the fence.

- Previous customers: People who used to buy your products but don’t anymore can give you valuable insight into areas you might need to improve. Perhaps your brand perception has shifted making some customers buy elsewhere, or maybe your competitors offer customers better value for money than you currently do. These are the kinds of areas you can learn about by running research to previous customers.

- Non-customers: You should also ask people who haven’t bought your products why they haven’t. That way you’ll learn what you need to improve to bring new customers in. You should ideally ask the same kinds of questions, so that you can learn about what product features you need to work on but also things like the messaging you should be putting out there to win people over.

Here are some questions that are perfect for competitive market analysis research. Some of these questions might sound similar to some from our previous section on consumer profiling—that’s because there’s often some crossover between these types of research. Consumer profiling often refers to a more general type of research that covers similar ground to market analysis. If you’re wondering how to calculate market size , questions like these would be a great starting point.

- How often do you usually purchase >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

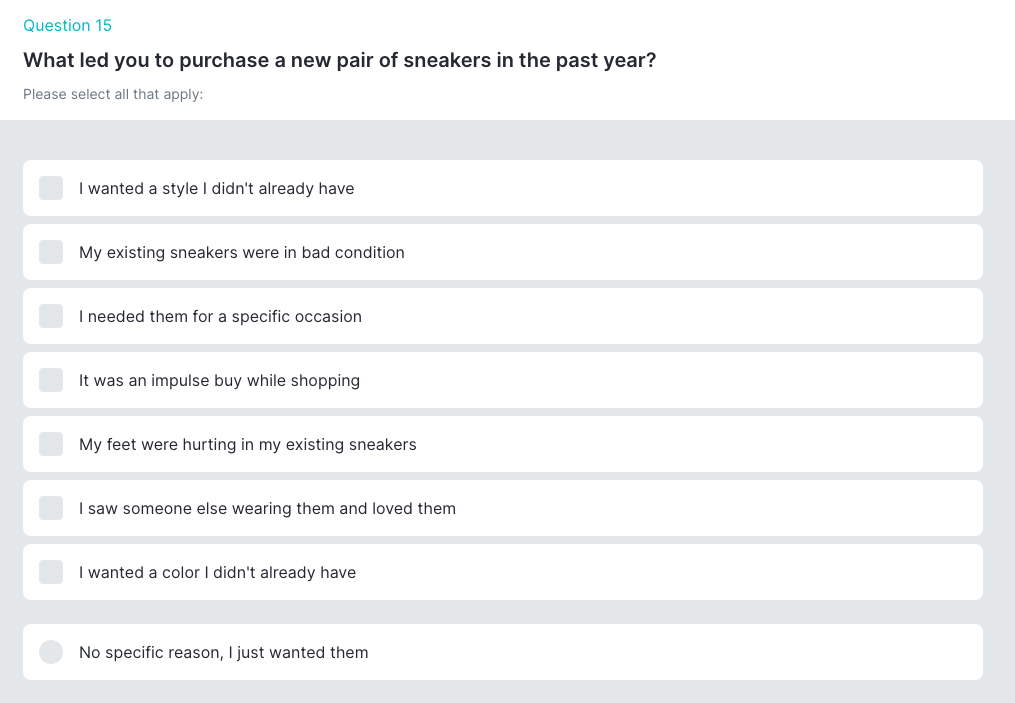

- Why do you buy >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- What types of >INSERT YOUR PRODUCT/SERVICE CATEGORY< do you buy?

- How often do you buy the following types of >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Where do you buy your >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Where do you find out about >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Which of these brands have your purchased in the last 12 months?

- How would you feel if you could no longer buy >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- How important or unimportant do you find the following topics? (e.g. sustainability, diversity and inclusion, ethical supply chain)

- What could be improved about the products you currently use?

By involving consumers in the product development process, you can make sure that your products are designed to meet—and ideally exceed—their needs.

Product market research can be done at several points in the product development process, by asking potential customers in your target market questions about existing products (yours or competitors’), prototypes, or just your own early-stage product ideas.

You can dive into the customer experience, specific product features or simply find out if the product quality matches the value proposition you’re putting out there.

Sometimes you even get a surprising answer to the question: how does our product or service help people?

You might learn from the survey responses that customers are using your product in a different way than you intended, opening you up to new target markets and different product types in the future.

Asking these questions also allows you to get feedback on your designs, so that you can make necessary changes before the product is released. Here’s some inspiration for when you’re conducting product market research.

There are different types of new product development research. A key type is Jobs to be done research. This research digs into the practical reasons people buy products—the jobs they need to get done with a specific product. You use these insights to help you create products that will genuinely help consumers, and that they’ll ultimately want to buy.

- How many times have you carried out [INSERT ACTIVITY] in the last 12 months?

- How much time would you typically spend on this [INSERT ACTIVITY]?

- How important or unimportant is carrying out this [INSERT ACTIVITY]?

- How satisfied or unsatisfied do you feel when carrying out this [INSERT ACTIVITY]?

- What is the best thing about carrying out [INSERT ACTIVITY]?

- How does carrying out [INSERT ACTIVITY] make you feel? Please select all that apply

- What particular problems or challenges do you run into while carrying out [INSERT ACTIVITY]?

When you’re cooking up your brand’s next product, you’ll want to go through a concept testing phase. This is where you ask consumers what they think about your idea and find out whether it’s likely to be a success. Here are some of the questions you could ask in your concept testing research.

- To what extent do you like or dislike this idea/product? [ATTACH IMAGE]

- What do you like about this idea/product?

- What do you dislike about this idea/product?

- Is easy to use

- Sounds tasty

- Is good quality

- Is Innovative

- Is different from others

- Purchase this product

- Replace the product I currently own with this

- What other products this idea/product reminds you of? Please provide as much detail as possible including the product name.

- What feature(s), if any, do you feel are missing from this product?

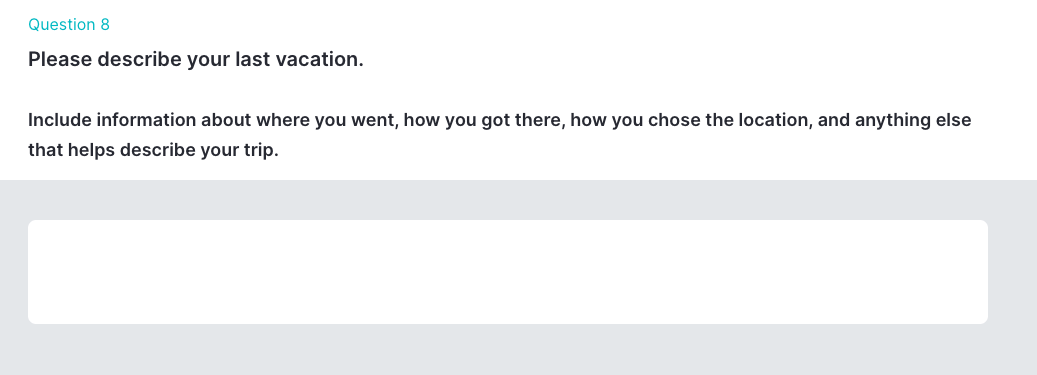

- How would you improve this idea/product? Be as descriptive as possible!

- What issues do you solve through the use of this product?

- When can you see yourself using this product? Please select all that apply.

- The price for this product is $25.00 per item. How likely or unlikely would you be to buy this product at this price?

Get inspired with NPD survey templates

Our in-house research experts have created New Product Development (NPD) survey templates to give you the perfect starting point for your product research!

Does the perspective of new customers change over time? How do you compare to other brands, and how do you become the preferred brand in your market and increase that market share?

Brand perception and brand awareness are super important metrics to track. These insights can be used to improve customer experience and satisfaction on a higher level than just product: the relationship you have with your customers.

This research can also help you understand how to reach the holy grail of branding: turning loyal customers into brand ambassadors.

You should also remember to ask marketing research questions about your brand to existing and potential customers.

Existing customers might have a different view after having interacted with your team and products, and you can use that to manage the expectations of your target customers down the line. And potential customers can help you understand what’s holding them back from joining your customer base.

Top tip: it’s completely fine (and super beneficial!) to run brand tracking into your competitors’ brands as well as your own. Replicating research for different brands will give you a tailored benchmark for your category and position.

Here are some key questions to ask in your brand tracking research.

- Which of the following, if any, have you purchased in the past 12 months?

- Thinking about >INSERT YOUR CATEGORY<, what brands, if any, are you aware of? Please type in all that you can think of.

- Which of these brands of facial wipes, if any, are you aware of?

- Which of these facial wipe brands, if any, have you ever purchased?

- Which of these facial wipe brands, if any, would you consider purchasing in the next 6 months?

- e.g. Innovative

- Easy to use

- Traditional

- We’d now like to ask you some specific questions about >INSERT YOUR BRAND<.

- When did you last use >INSERT YOUR BRAND<?

- What do you like most about >INSERT YOUR BRAND<?

- What do you like least about >INSERT YOUR BRAND<?

- How likely would you be to recommend >INSERT YOUR BRAND< to a friend, family or colleague?

- Why did you give that score? Include as much detail as possible

- In newspapers/magazines

- On Instagram

- On Facebook

- On the radio

- Through friends/family/colleagues

- When did you last use >INSERT MAIN COMPETITOR BRAND<?

- How likely would you be to recommend >INSERT MAIN COMPETITOR BRAND< to a friend, family or colleague?

Kick off your brand tracking with templates

Track your brand to spot—and act on!—how your brand’s perception and awareness affects how people buy. Our survey templates give you the ideal starting point!

When it comes to pricing your product, there’s no need to wing it—a pricing survey can give you the insights you need to arrive at the perfect price point.

By asking customers questions about their willingness to pay for your product, you can get a realistic sense of what price point will be most attractive to them and, not unimportant, why.

Top tip: good pricing research can be tough to get right. Asking how much people would theoretically be willing to pay for a product is very different from them actually choosing it in a shop, on a shelf next to competitors’ products, and with a whole load of other economic context that you can’t possibly test for. Price testing is useful, but should sometimes be taken with a pinch of salt.

Here are some questions you could use in your pricing research.

- Which of the following product categories have you bought in the last 12 months?

- How often do you currently purchase >INSERT YOUR CATEGORY<?

- At what price would you consider this >INSERT PRODUCT CATEGORY< to be so expensive that you would not consider buying it? (Too expensive)

- At what price would you consider this >INSERT PRODUCT CATEGORY< to be starting to get expensive, so that it is not out of the question, but you have to give some thought to buying it? (e.g. Expensive)

- At what price would you consider this >INSERT PRODUCT CATEGORY< to be a bargain—a great buy for the money? (e.g. cheap)

- At what price would you consider this >INSERT PRODUCT CATEGORY< to be priced so low that you would feel the quality couldn’t be very good? (Too cheap)

- How much do you currently pay for >INSERT PRODUCT CATEGORY<? Please type in below

- Thinking about this product, please rank the following aspects based on how much value they add, where 1 = adds the most value 10 = adds the least value.

- Thinking about the product category as a whole, please rank the following brands in order of value, where 1 is the most expensive and 10 is the least.

Formulating market research questions can be tricky. On the one hand, you want to be specific enough that you can get tangible, useful answers. But on the other hand, you don’t want to ask questions that are so difficult or unclear that respondents will get frustrated and give up halfway through.

Think about what answers you need and what actions you are hoping to take based on those answers.

We’ll help you get started with a list of steps to take when formulating your own market research questions, and putting them together in a survey that makes sense.

1. Define your research goals and link them to actions you can take

Before you can write great market research questions, you need to know what you want to learn from your research.

What are your goals? What do you want to find out? Once you have a clear understanding of your goals, you can start brainstorming questions that will help you achieve them.

2. Know your target market and the language they use

Who are you conducting market research for? It’s important to know your audience before you start writing questions, as this will help you determine the best way to phrase them.

For example, if you’re conducting market research for a new product aimed at teenagers, you’ll want to use different language than if you were conducting research for a new financial planning service aimed at retirees.

3. Keep it simple, and break things into smaller pieces

Don’t make your questions too complicated. Stick to simple, straightforward questions that can be easily understood by your target audience.

The more complex your questions are, the more likely it is that respondents will get confused and provide inaccurate answers.

If you feel a question is too difficult, see if you can break it up into smaller pieces and add follow-up questions on top.

And don’t ever load two questions into one! This falls into Consumer Research 101, but it’s amazing how often it happens. Instead of ‘What’s your favorite chocolate bar, and why?’ ask two questions: ‘What’s your favorite chocolate bar?’ and ‘Why is this your favorite chocolate bar?’

4. Be super specific

Make sure your questions are specific enough to get the information you need. Vague questions will only lead to vague answers.

For example, instead of asking ‘What do you think of this product?’, ask ‘What did you think of the taste of this product?’ or ‘What did you think of the packaging of this product?’.

5. Avoid leading questions

Leading questions are those that suggest a particular answer or course of action. For example, instead of asking ‘Do you like our new product?’, which suggests that the respondent should like the product, try asking ‘What are your thoughts on this product?

This question is neutral and allows the respondent to answer freely without feeling pressured in any particular direction. It’s also brand-neutral: people answering this question will have no idea who’s asking, and their opinion won’t be biased as a result.

6. Make sure your question is clear

It’s important that your question is clear and concise so that respondents understand exactly what they’re being asked. If there is any ambiguity in your question, respondents may interpret it in different ways and provide inaccurate answers.

Always test your questions on a few people before sending them to a larger group to make sure they understand what they’re being asked.

7. Avoid loaded words

Loaded words are those with positive or negative connotations that could influence the way respondents answer the question. For example, instead of asking ‘Do you love this product?’, which has a positive connotation, try asking ‘What are your thoughts on this product?’

This question is neutral and allows the respondent to answer freely without feeling pressured in any particular direction

8. Make sure the question is answerable

Before you include a question in your market research survey, make sure it’s actually answerable. There’s no point in asking a question if there’s no way for respondents to answer it properly. If a question isn’t answerable, either revise the question or remove it from your survey altogether.

9. Use an appropriate question type

When designing your market research survey, be sure to use an appropriate question type for each question you include. Using the wrong question type can lead to inaccurate or unusable results, so it’s important to choose wisely. Some common question types used in market research surveys include multiple choice, rating scale, and open-ended questions.

10. Pay attention to question order

The order of the questions in your survey can also impact the results you get from your research. In general, it’s best to start with more general questions and then move on to more specific ones later on in the survey. This will help ensure that respondents are properly warmed up and able to provide detailed answers by the time they reach the end of the survey.

Make smart decisions with the reliable insights

To make sure you make smart decisions that have real impact on your business, get consumer insights you can rely on. Here’s our rundown of the top market research tools.

Survey questions for market research are designed to collect information about a target market or audience. They can be used to gather data about consumer preferences, opinions, and behavior. Some common types of market research survey questions include demographic questions, behavioral questions and attitudinal questions.

There are many different types of market research questions that companies can use to gather information about consumer preferences and buying habits. They can be divided into different categories, like a competitive analysis, customer satisfaction or market trends, after which you can make them more specific and turn them into survey questions. These are some of the things your research questions can help you answer: – What is the target market for our product? – Who is our competition? – What do consumers think of our product? – How often do consumers purchase our product? – What is the typical customer profile for our product? – What motivates consumers to purchase our product?

When conducting market research, surveys are an invaluable tool for gathering insights about your target audience. But how do you write a market research questionnaire that will get you the information you need? First, determine the purpose of your survey and who your target respondents are. This will help you to write questions that are relevant and targeted. Next, craft clear and concise questions that can be easily understood. Be sure to avoid ambiguity, leading questions and loaded language. Finally, pilot your survey with a small group of people to make sure that it is effective. With these tips in mind, you can write a market research survey that will help you to gather the crucial insights you need.

Elliot Barnard

Customer Research Lead

Elliot joined Attest in 2019 and has dedicated his career to working with brands carrying out market research. At Attest Elliot takes a leading role in the Customer Research Team, to support customers as they uncover insights and new areas for growth.

Related articles

5 beverage branding ideas (with examples you can learn from), survey vs questionnaire: what’s the difference and which should you use, what does inflation mean for brands, consumer profiling, subscribe to our newsletter.

Fill in your email and we’ll drop fresh insights and events info into your inbox each week.

* I agree to receive communications from Attest. Privacy Policy .

You're now subscribed to our mailing list to receive exciting news, reports, and other updates!

- 33 Best Market Research Question Examples

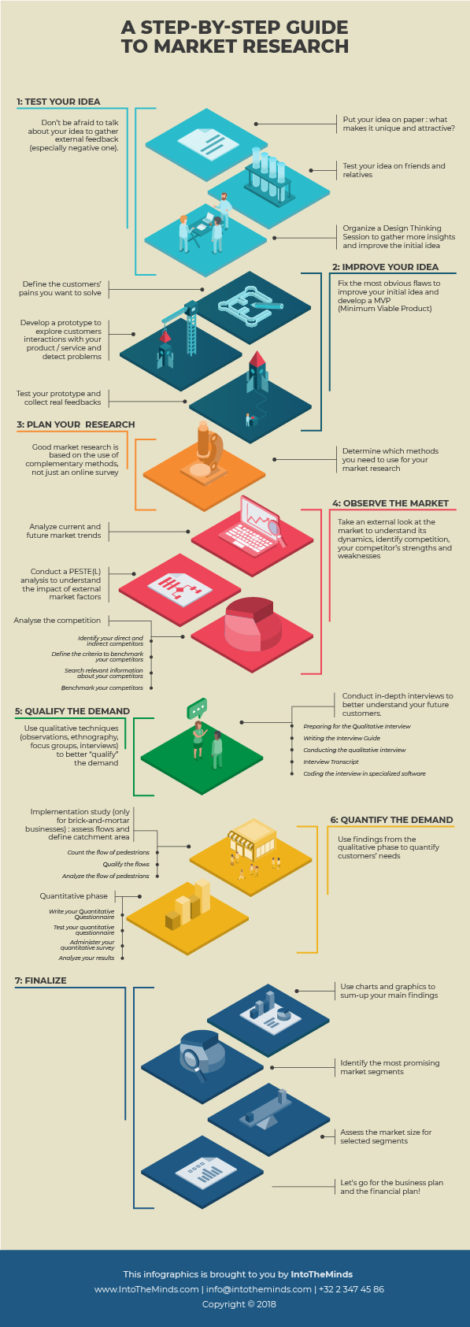

To build a successful business, it is important to gather useful insights through market research. More than anything else, carrying out market research helps you to collect necessary information and make the right business decisions with regard to market segmentation and product differentiation.

In this article, we will share sample questionnaires for different types of market research; specifically product, client, and customer market research. We will also show you how to use Formplus to create a simple online research questionnaire in no time.

What is Market Research?

Market research is the process of gathering valuable information about the needs of your target market, consumer behaviors, and market challenges. Conducting market research helps you to determine the feasibility of a product or service before its introduction to the market.

During market research , an organization can collect primary and/or secondary data. Primary data refers to information that is collected directly from the research participants and target markets while secondary data refers to already-processed information about the research context and subject(s).

Importance of Market Research

- Improves Sales

Market research provides unique insights into the expectations of your customers and clients, which helps you tailor your product to meet their specific needs. This would ultimately help to increase your sales.

- Identifying New Business Opportunities

With market research, you’d be able to spot untapped business opportunities in your industry and work on building a product in line with this. You can discover new geographical concentrations for your target market, for instance.

- Reduces Business Risks

As a business owner, your priority should be taking calculated risks and this can be achieved when you have forehand knowledge of the dynamics of your industry. Conducting market research arms you with useful insights that will help you make the right business decisions.

- Advertising

Market research also improves your advertising by helping you to identify the best channels to reach your customers. You’d better understand market demographics and also know the channels that can yield the best returns in terms of lead generation and sales.

- Competitive Advantage

With better knowledge of market needs and consumers’ preferences, you’d stay ahead of your competition. For instance, you can identify neglected market segments and focus on penetrating them.

Market Research Questionnaire Examples for Product

Product market research questions trigger responses that reveal how well-suited your product is for the target market. The right product-market research questions provide useful insight into the feasibility of the product before it is launched. Here are 11 question samples for your product market research questionnaire.

- What is your deciding factor for product patronage?

This question would help you focus your product’s unique selling point on what the target market considers valuable. For instance, if the deciding factor for your target market is affordability, you would want to work on a fair pricing rate for your product.

- How likely are you to purchase groceries online?

Since you want to create a product that satisfies a specific need, you need to be sure your target market would be willing to buy into your idea. If the market has no need for an online grocery store, there’s little or no reason for you to launch one.

- Which product features are most valuable to you?

You can tweak this question in line with your specific product. Data gathered via responses would help you identify the product features you need to invest in.

- Would you be willing to subscribe to a weekly business newsletter?

Questions like this would help you decide whether you need to go ahead with a specific development plan for your business. If you want to launch a newsletter, it helps to know if you have a willing audience for it.

- Would you like to process orders and payments in a single form?

This type of question would help you identify the need(s) of the market and you can work on creating a product or developing a feature to meet this need.

- Who is your trusted internet service provider?

If you’re looking to penetrate a new market, it is important for you to identify the existing competition; that is, organizations that provide similar services in your industry. Asking prospective customers to identify the brands they trust is an essential part of your competitive analysis.

- What challenges do you face with 3rd party logistics companies?

This question would help you to identify the specific needs of your target market. You can focus your product on providing solutions to the challenges highlighted.

- Would you find this product useful?

This is a straightforward question to determine whether your product fills a specific need in the market.

- Would you be willing to pay in installments for this service?

Questions like this would help you identify product features that your target market considers to be valuable.

- How much are you willing to pay for this product?

This question would help you fix a reasonable price for your product. While your product may be excellent, ensuring its affordability is key to penetrating the market effectively.

- How much do you spend on groceries every month?

This question would provide insights into the purchasing power of your target market.

Read: Research Questions: Definition, Types, +[Examples]

Market Research Questionnaire Examples for Customer

To better under your customers’ perceptions of your product, you can create and administer a market research questionnaire. A market research questionnaire for your customers should include questions that focus on the usefulness of different aspects of your product delivered to your customers.

You’d also want to centralize questions that bother on customer demographics, challenges, specific needs of your customers, and how your product meets these needs. Here are 11 specific questions you can include in your market research questionnaire for customers:

Demographic Questions

These questions will help you better understand who your customers are and also help you create an accurate buyer persona. Knowing who your customers are and what appeals to them means that you would be able to focus your product on what appeals to them.

- What is your monthly income range?

Knowing how much your customers earn gives you a hint of their purchasing power and how much they can typically spend on your product. This will inform the pricing of your product so that you do not price yourself out of business.

- How much do you spend on shopping every month?

Just like you, customers work with a budget and are more likely to purchase products whose costs fit into this. Responses to this question will help you fix an appropriate fee on your product.

- Where do you prefer to shop?

Catering to customer preferences is one way of securing repeated patronage. Responses to this question will inform your business expansion plan. For example, if your customers prefer shopping online, you can set up a Formplus online order form to allow them to place orders for items and make payments conveniently.

- How old are you?

This question will help you identify the age group that your product appeals to the most. Knowing this would help you craft marketing and advertising campaigns that appeal to the members of this group.

Feedback Questions

These questions help you to collect insightful information about customer experience; that is, how customers perceive your product and overall delivery. Responses to these questions would let you know why your customers buy from you and how well your product meets their needs.

- What specific needs does our product meet for you?

This question helps you to identify the unique selling point of your product. You would know why customers patronize your brand and you can leverage this information for better marketing and advertising.

- How would you rate our product delivery?

Responses to this question are a direct reflection of your customer’s perceptions of your product delivery. For better insight, you can ask them to provide reasons for their ratings.

- What challenges did you encounter while using our product?

These questions help you to identify business weaknesses from the point of view of the end user. If left unattended to, competitors can capitalize on these weaknesses to increase their customer base.

- How likely are you to recommend our product?

Happy customers are one of the most effective marketing tools as customers will only recommend a product they are satisfied with. If more people are eager to recommend your product, it means that your business and brand is on the right track.

Other market research question samples are:

- How would you rate our customer experience?

Feedback on customer experience is important because it helps you improve your brand’s relations with its customers across different business touchpoints.

- What do you think about product pricing?

This question would help you adjust your product pricing appropriately. If customers think your product is too expensive, they may stop buying from you.

- How often do you use our product?

This question would help you track repeated patronage and to know how your product fits into your customers’ everyday lives.

Market Research Questionnaire Examples for Client

Clients are individuals and organizations that you provide specific services for. Just like with customer market research questions, market research questions for clients help you assess your service delivery, identify clients’ unique needs, and gather useful insights via feedback. Here are 11 sample questions for you:

- How would you rate our service delivery?

This is a feedback question that will help you understand how well your service meets your client’s needs.

- What challenges are you experiencing with our services?

Responses to this question would highlight areas needing improvement in your overall service delivery.

- Would you be willing to recommend us to your network?

If the answers to this question are in the affirmative, then you can be sure that your clients are quite impressed with the service you provide.

- What specific needs do our services meet for you?

To clearly map out the value of your product from the clients’ perspectives, ask them to identify the specific needs your services meet for them.

- How can our service delivery be better?

This is another feedback question that would help you improve your services to better cater to the needs of your clients.

- For how long have you been a client?

This question helps you to gather meaningful data to improve your client retention strategies.

- What do you like the most about our services?

This question would help you identify the unique selling point of your services.

- How would you rate your last experience with us?

With this question, you’d be able to gather valuable information about a client’s experience with your services.

- What do you dislike about our service delivery?

This question allows clients to highlight areas needing improvement in your service delivery. The data gathered would help you improve your services for the benefit of your clients.

- Are our services helpful?

This is a simple question that requires clients to highlight the value of your services.

- Why did you choose us?

How to Create an Online Research Questionnaire

With Formplus, it is easier for you to create and administer an online questionnaire for market research. In the drag-and-drop form builder, you can add preferred form fields and edit them to suit specific research needs. Here’s a step-by-step guide on how to go about it:

- Sign in to your Formplus account. In your dashboard, click on “create new form” to get started on your online research questionnaire.

- Drag and drop preferred fields into your online questionnaire. You can edit form fields to include market research questions. You can also make some fields hidden or read-only depending on your research needs.

- Use the form customization options to tweak the appearance of the online research questionnaire. You can add preferred background images, add your organization’s logo or tweak the form font.

- Finally, copy the form link and share it with form respondents. You can use one or more of the multiple sharing options including the social media direct sharing buttons and the email invitation option.

Conclusion

While creating your market research questionnaire, it is important for you to tailor its questions to specific contexts. For instance, if you are conducting product market research, you should ask questions that would provide useful information on product feasibility among other things.

Conducting market research yields multiple benefits for your business. To make the process seamless and easy to coordinate, you can set up an online research questionnaire with Formplus and share this with your customers, clients, and target market(s).

Connect to Formplus, Get Started Now - It's Free!

- market research

- market research questionnaire

- busayo.longe

You may also like:

Margin of error – Definition, Formula + Application

In this article, we’ll discuss what a margin of error means, its related concepts, the formula for calculating it and some real-life applications

Taste Testing Market Research & How it Works

Introduction The purpose of taste testing is to determine the preferences of consumers. It is an important part of marketing research...

Projective Techniques In Surveys: Definition, Types & Pros & Cons

Introduction When you’re conducting a survey, you need to find out what people think about things. But how do you get an accurate and...

Target Market: Definitions, Examples + [Audience Identification]

Without knowledge of your target market, your entire product conception and marketing process is flawed. This article covers practical...

Formplus - For Seamless Data Collection

Collect data the right way with a versatile data collection tool. try formplus and transform your work productivity today..

Small Business Trends

132 market research questions to ask.

Market research sounds so formal. Yet it doesn’t have to be. It can be part of your daily marketing activity if you adopt one of the best and easiest techniques: simply ask questions.

Asking market research questions can yield new insights to boost your marketing to the next level. One example of market research involves gathering competitive information to inform your new product and service development.

Another market research example involves creating clear pictures of your ideal customers — called customer personas –for precise targeting. Other market research examples involve gathering feedback from existing customers to measure customer satisfaction.

The key to success, however, is knowing which questions to ask. Below is a list of 132 market research questions to use as templates for your own questions. Use them to ask questions internally to your team, or ask prospects and clients directly.

Types of Market Research Questions

Market research questions.

A good way to start your market research is to size up and describe your target audience. Gather primary and secondary research to assess the following marketing parameters:

- What is the size of our target market? How many potential customers are there?

- Do we have a good set of customer personas developed, to understand ideal target customers?

- Demographic questions: gender, age, ethnicity. Include annual income, education and marital status.

- Firmographic questions: size, industry. Include annual revenues and other relevant factors.

- Psychographic questions: habits, preferences, interests.

- What key consumer trends do we see?

- How do we identify new target segments? How do these new segments differ from those we already have?

- Which neighborhoods and zip codes do we get most of our customers from today?

- Which geographic locations are growing? Are the demographics of growth markets similar to those in which we already operate? If not, what should we change?

- Is online commerce or online service delivery a growth opportunity? Are our competitors doing business online?

- Can we find marketing partners to expand our reach?

Related: How to Conduct Market Research

Questions to Ask Customers

Use the following as survey questions, either post sale or as post-support surveys. Or use these market research questions to conduct a focus group, interview individual customers, or engage potential customers during the sales process.

Make it a point to include respondents who are less than thrilled with your customer service. You learn more than if you only talk with happy customers. Ask:

- How did you hear about us?

- What made you choose us?

- What features do you like most about our product or service?

- Is our product or service easy, fast, convenient to use?

- What do you wish our product or service did that it does not today?

- Are you aware that we offer _________?

- Were our personnel courteous in all dealings?

- Did we answer all your questions or solve your support problem?

- Can we help you get started using our product or service?

- Were you satisfied with our promptness and speed?

- Would you be willing to tell friends, family or colleagues about us?

- How do you rate your experience with us?

- Would you buy from us again?

- Why have you decided to leave us / not renew?

- How likely are you to recommend our product/service to others on a scale of 1-10?

- What is the primary reason for your score?

- Can you describe a situation where our product/service exceeded your expectations?

- What changes would most improve our product/service?

- If you could change one thing about our product/service, what would it be?

- How do our products/services fit into your daily life or routine?

- What other products/services do you wish we offered?

Related: Tailoring Survey Questions for Your Industry and Best Practices for Surveys

Pricing and Value

The following are pricing research questions to ask. Small business owners and marketers may want to assign someone to do a competitive analysis, such as gathering data from competitor websites and putting it into a spreadsheet.

Doing research may also require you to gather information internally. For example, meet with Sales to discuss feedback they receive from possible customers.

You could also ask Customer Support to start tracking when customers give price as a reason to not renew. Here are sample market research questions about pricing:

- Does our team have a compelling sales pitch based on value, not just price?

- How do we create more value to justify our prices?

- How can we position our product as “premium”?

- What are our competitors charging? Are our prices higher, lower or about the same?

- Are our prices allowing sufficient profit to stay in business?

- How often do sales and support staff hear pricing objections? And how often do they overcome them?

- Are we identifying enough people who can afford our products and services, or who want to pay what we ask for?

- Can we more precisely target prospects by income, neighborhoods and other factors to isolate a target audience receptive to our price point?

- In the case of B2B, are we targeting the right industries with needs and pain points we can solve?

- Are we targeting the right job title? Does the target executive have sufficient budget authority?

- How does our business model compare in our industry? Are we missing opportunities?

- What kind of promotions are our competitors advertising? Bulk buys / annual subscriptions? Free gift with purchase? Discounts? Sales events?

- How do our prices compare with the value you perceive from our products/services?

- What pricing model do you find most appealing – subscription, one-time purchase, pay-per-use?

- How sensitive are you to price changes in our products/services?

- What discounts or promotions would encourage you to make a purchase?

Product or Service Questions

Ask yourself or your team these market research questions about your products and services:

- Are our new products or services sufficiently unique compared with what already exists?

- What exactly is our value proposition — the reason customers should choose us? How can we best convey our benefits?

- How are customers currently solving the problem that our product addresses?

- What products do competitors offer? How does our target market view these competitive offerings?

- How do competitors deliver service? Does their process differ from our methods? Are there obvious advantages such as cost or time savings to gain if we adjust?

- Customers have been asking for a certain service — do others in the market offer it? What do they charge?

- What changes will customers likely want in the future that technology can provide?

- How do we get feedback about our product, so we know what to improve, and what to highlight in sales and marketing messages?

- What technology is available in the market to improve operational productivity or cut costs? What solutions are competitors or big corporations using?

- When considering new product development, do we interview customers to test their interest level?

- Are there any untapped market segments or niches where our products or services could be a perfect fit?

- What are the potential challenges or barriers that customers face when using our products or services?

- Have we conducted customer satisfaction surveys to gauge overall customer experience and identify areas for improvement?

- Are there any complementary products or services that we could offer to enhance our customers’ experience?

- How do customers perceive the quality and reliability of our products or services compared to competitors?

- What are the specific pain points or needs that our products or services address, and how well are we communicating this to customers?

- Have we explored partnerships or collaborations with other businesses to expand our product/service offerings?

- Are there any emerging trends or technologies in the market that could disrupt our current products or services?

- Have we analyzed customer feedback and complaints to identify recurring issues that require immediate attention?

- What are the future trends and demands in our industry, and how can we proactively align our offerings with these trends?

- What additional features would you like to see in our future products?

- How can we improve the user experience of our product/service?

- What would make you choose our product/service over a competitor’s?

- Are there any aspects of our product/service that you find unnecessary or rarely use?

Related: How to Minimize Survey Fatigue

Online Visibility Questions

Online traffic is essential to most small businesses, even local businesses, to drive in-store traffic. Market research questions can assess your company’s online visibility. Get answers from your digital team:

- How much website traffic do we receive compared with competitors? Check free tools like Alexa and SimilarWeb – while not exact they can compare relative levels of traffic.

- How prominently do we appear in search engines like Google and Bing?

- Do we appear in search engines for the queries our audience is searching for, using their words? Or do we need to invest in search engine optimization?

- Which search queries actually send us website traffic? Check Google Search Console or another SEO tool.

- How does our search visibility compare with competitors? A tool like SEMRush or Ahrefs can give this kind of advanced look.

- Have we done a gap analysis and identified which keywords our competitors rank for? Do we have a content marketing plan to attract more visitors?

- Have we claimed business listings like Google My Business and Bing Places, and completed them with engaging content such as photos?

- How prominently do we show up in Google Maps, Apple Maps and Bing Maps?

- Do we give visitors something to do on our website to engage them, such as fill out a lead gen form, read the blog, or schedule an appointment?

- Are our website’s loading speed and performance optimized for a better user experience?

- Do we have a mobile-friendly website that caters to the growing number of mobile users?

- Are we utilizing social media platforms effectively to engage with our target audience?

- Have we analyzed user behavior on our website through tools like Google Analytics to identify areas for improvement?

- Are we actively monitoring and responding to online reviews and comments about our business?

- Have we implemented effective link building strategies to improve our website’s authority and search rankings?

- How do our online advertising efforts compare with competitors in terms of reach and conversion rates?

- Are we using email marketing campaigns to nurture leads and maintain communication with our customers?

- Have we explored influencer marketing as a way to expand our online reach and brand visibility?

- Are we leveraging online customer feedback surveys to gather insights and improve our online presence?

- What type of content would you like to see more of on our website?

- How easy is it to navigate our website and find what you’re looking for?

- Are there any online channels (social media, forums, etc.) where you feel we should have a presence?

- How do you prefer to interact with us online – through email, live chat, social media, or other channels?

Related: How to Interpret Survey Results

Reputation Management

Customers today have extraordinary power to talk about a brand, and its products and services. Customers can choose dozens of social media sites or review sites like Yelp to share opinions.

A big part of market research today is to find out what customers think and say about your business (and also about your competitors). You want answers to the following market research questions:

- Do we have negative reviews online?

- Do we have any other type of reputation issue, such as poor word of mouth in our local community?

- Are competitors spamming with fake reviews?

- What can we learn from bad reviews?

- Do we thank those who give positive reviews and referrals, or do we ignore them?

- Do we address negative reviews or complaints by trying to make good or by correcting wrong facts?

- Can we use an app such as GatherUp.com to make it easy for customers to leave reviews?

- Does our website have compelling testimonials?

- What is the first thing that comes to mind when you hear our brand name?

- How would you describe our company to a friend or colleague?

- Are there any misconceptions about our brand that you think we should address?

- How do you perceive our efforts in responding to and resolving customer complaints or issues?

Messaging and Advertising

Assess your current marketing messages. Brands will want to know that their messaging supports their marketing goals. Make sure to also assess advertising to make sure it is in sync with goals and performing well:

- Have we identified the milestones in the customer journey, and what customers looking for at each milestone? Are we addressing the milestones?

- What emotions drive our customers’ buying decisions? Fear? Aspirational desire? Does our messaging align with these emotional needs?

- What information sources do prospects rely on? TV, online digital, social media, radio, newspapers?

- Which marketing and advertising channels have been our top performers?

- Have we developed quality content to educate and persuade prospects?

- What are the best advertising methods and media outlets to reach our prospects?

- Are we using our advertising spend to precisely target our desired buyer, or is it spray and pray?

- Where and how frequently do competitors advertise, and what messages do they use?

- Do we have good assets such as display ads and landing pages to drive prospects to? How do they compare with competitors’ assets?

- What social media channels does our target market use? Should we boost our presence on those channels?

- What issues do our target buyers talk about on social media?

- Do we use heat maps, A/B testing or other measurements to test content and calls to action?

- Do our marketing messages align with the values and brand identity we want to convey to our target audience?

- How do our marketing messages address common pain points or challenges faced by our customers?

- Have we conducted focus groups or surveys to gather direct feedback on the effectiveness of our marketing messages?

- Are there any cultural or regional considerations that could impact the resonance of our messaging with different segments of our target audience?

- What unique selling points (USPs) do we emphasize in our advertising, and how well do they differentiate us from competitors?

- Have we tested various advertising messages to identify which ones resonate best with our target audience?

- Are we effectively utilizing storytelling techniques in our marketing messages to create emotional connections with our customers?

- How do we track the success of our advertising campaigns in terms of reach, engagement, and conversions?

- Have we analyzed customer journey data to identify potential gaps in our messaging at various touchpoints?

- Are there any specific keywords or phrases that our target audience commonly uses, and how can we incorporate them into our messaging?

- What messages in our advertising resonate with you the most?

- Are there certain advertising channels where you feel our presence is lacking?

- How do you usually respond to our advertising – visit our website, follow us on social media, make a purchase?

- In your opinion, what could improve the effectiveness of our advertising campaigns?

Related: 9 Strategies to Get More Customer Feedback and When to Use Online Surveys .

These 132 questions and examples of market research should give you plenty to explore. Always come back to the most important question of all: what can we do better? Answering this one question can put your brand well on the way toward long term growth.

Image: Depositphotos.com

Thanks for the questions. I guess this is good because you know what type of data that you like to get from your target market.

Awwweeeesome. This questions well designed, covers key areas of business and are important for a startup, growing business as well as businesses that would like to maintain their level of success.

Thank you Joy Levin, this just made our business better.

Thanks for this awesome post. This definitely provides key research questions for my entrepreneurial journey. I’m looking forward to reading more of your articles, Joy Levin.

I love Messaging and Advertising in the content. This is really smart idea

Thanks for this awesome post. This definitely provides key research questions for my entrepreneurial journey. I’m looking forward to reading more of your articles

This questions well-designed covers key areas of business and are important for a startup, growing business as well as businesses that would like to maintain their level of success.

Thanks for this awesome post. I’m looking forward to reading more of your articles

Our pricing is Pocket Friendly and less than other group buy service providers in market.

I visited many sites however the suggestion air of presented topics at this web site is actually completely high.

Very nice article. I certainly appreciate this website. Keep it up!

This is my first mature visit at here and i am happy to admittance all this info.

Thank you for providing valuable information. We also provide affordable and result-oriented SEO services, please give a chance to serve you.

its useful, hope you share many good post the same.

Each and every point valuable. Now it’s all depend on everybody need.

Looking for more content on marketing topic.

Very nice! thank you for the valuable information that you Shared. it is the key to help my dream someday as business woman.

Great, as i know many people face these types of questions. You shared a lot of knowledge with us. All of us will get a lot of benefit from this blog. Thank you!!!

You explained everything well. In fact we all get a lot of knowledge from this. I really appreciate your effort. Thank you!!

Our TshirtHutt vision is simple: To deliver the best, most affordable T shirt printing in Dubai. And online base Tshirt Printing shop in Dubai and Delivery service all over UAE, Not Only this we are a Gifts Printing shop in Dubai.

Your email address will not be published. Required fields are marked *

© Copyright 2003 - 2024, Small Business Trends LLC. All rights reserved. "Small Business Trends" is a registered trademark.

Product Management

80 Market Research Questions for More Valuable Insights (+tips)

Content Writer

Created on:

April 15, 2024

Updated on:

Transform Insights into Impact

Build Products That Drive Revenue and Delight Customers!

There are different types of market research, with 85% of researchers regularly using online surveys as their go-to tool , allowing them to reach broad target audiences in a cost-effective way.

Online surveys can break down geographical barriers and uncover profound customer insights, but only if you come up with the right market research questions.

Your questions shape the data you get, influencing your understanding of customer behavior and key consumer trends.

In this article, you'll find many examples of market research questions organized by categories, followed by tips for creating and analyzing your own market research survey.

80 market research questions to ask for more valuable insights

Demographic questions.

Learning more about your existing customer base can help you identify your ideal customers and adjust your marketing strategy accordingly. During the process, you may also discover that you have different customer personas, and you can later segment your audience.

Also, having detailed demographic data allows you to create targeted marketing campaigns that will convert better.

Here are some questions to explore your target audience:

- What is your age and gender?

- Where do you live?

- Do you have a partner or children?

- What is your highest level of education?

- In what industry do you work?

- What is your current job title?

- What is your annual income?

- What's the category you spend the most money on (e.g., groceries, technology, clothes)?

- What's the average amount you spend on _____ (mention a particular category relevant to your industry)?

- What websites, newspapers or magazines do you use to stay informed?

Product opportunities

Almost half of the startups fail because they're building products for which there's no real market need . That's why it's essential to do a product opportunity assessment before you invest time and money into building a product that may not have a big enough target market.

The following market research interview questions will help you discover burning issues and problems that your new product or service can solve.

- What challenges and problems do you currently face in _____ (name specific area) that you can't find an adequate solution for?

- Are there any existing products that you find close to meeting your needs but still fall short in some aspects, and which?

- How do you currently cope with the absence of a dedicated solution for that problem?

- Hypothetically speaking, what would an ideal solution for that problem look like?

- What features would you like this product to include?

- Would you purchase this product if it was available today? If not, why?

- What is the one feature that would make our product a must-have for you?

- Are there any untapped market segments or niches where our product could solve the existing problems?

- If you were to brainstorm about a product that anticipates future needs in your industry, what would be its main features?

- How would you prioritize the importance of the following features? (you can provide them with a list of features they need to rank from the most important to the least important)

If you've already started developing your product, read this article on how to get feedback for early-stage products and validate your product.

Customer feedback

If you've already launched a product or service, you should ask your existing customers for feedback and suggestions for improvement. This is an essential component of continuous product discovery , which is the best way to increase customer satisfaction by anticipating their needs.

Here are some questions you can use:

- How long have you been using our product?

- How often do you use our product?

- What made you decide to purchase our product?

- Describe how you use our product and what problems it solves for you.

- Which features of our product do you use the most?

- Which features of our product do you use the least or not at all?

- What is the best feature of our product in your opinion?

- What might be the weakest feature or the biggest area for improvement in our product?

- Have you had any issues or problems with our product?

- What would you miss the most if our product was no longer available?

Click here to discover 13 proven ways to collect customer feedback . Also, here are some additional questions for your product feedback survey .

Brand awareness

Market research surveys can help you see how existing and potential customers perceive your brand and whether you need to raise brand awareness or adjust your brand image.

- Have you heard about our brand before?

- How did you hear about us?

- What is the first thing that comes to mind when someone mentions our brand?

- What emotions or feelings do you associate with our brand?

- How would you describe our brand in one sentence?

- Are you currently using our products, and how often?

- How likely are you to purchase our products again?

- Are you aware that we also offer _____? (this can be an excellent opportunity for up-selling)

- How often do you see our posts or ads on social media?

- You can also calculate the Net Promoter Score by asking your current customers: On a scale of 0 to 10, how likely are you to recommend our product to a friend or colleague?

Pricing analysis

The following market research survey questions will help you explore the balance between product quality, features, and cost and assess the perceived value of your product.

- What is more important to you: product quality or price?

- In your opinion, what's a fair and reasonable price for a product like this?

- What is the price range within which you'd feel comfortable purchasing this product?

- What is the maximum amount you'd be willing to spend on this product?

- If you think the price is too high, what additional features or improvements would justify the current price of our product?

- Are there specific payment options or financing plans that would make you consider purchasing our product?

- Do you find our pricing information clear and easy to understand?

Customer preferences

This set of questions will help you learn more about consumer preferences and their purchasing habits so that you can adjust your strategy accordingly.

- What factors are influencing your purchasing decisions the most?

- Where do you look for products you want to buy?

- Do you prefer offline or online shopping, and why?

- Do you read customer reviews, and on which websites?

- Are you looking for recommendations from your friends and family?

- Do you use social media to follow brand accounts, and which platforms do you use the most?

- What is your preferred way to receive information and updates about a brand (e.g., social media, email newsletter, SMS)?

- How do you prefer to consume information: through video, audio or reading?

Customer concerns

Understanding why people are not buying from you is essential for adjusting your offer and marketing. This set of questions will help you uncover potential objections you can address on your website.

- Is there anything that's preventing you from buying our product?

- What would need to happen for you to purchase our product today?

- If now is not the right time to buy it, why is that?

- Do you have any doubts or questions about our product?

- What was your biggest concern before purchasing our product?

- What is the main reason for canceling your subscription / not ordering again?

- Did you encounter any problems or challenges when using our product?

- If there was one thing about our product that would have made your decision-making process faster, what would it be?

Competitive analysis

It's important to research your competitors and learn both about their unique selling points and their weaknesses from users’ perspectives, which can help you discover your own competitive advantage and do a thorough market opportunity analysis.

- How are you currently dealing with the problem that our product solves?

- Are you already using a product with similar features?

- Which products or brands would you consider as an alternative to ours?

- Why did you choose our product over other options?

- Did you consider any other options?

- Does our product miss some features that our competitors' products have?

- Are our prices higher, lower or similar to those of other companies?

- Which of these products have you tried? (provide a list of your competitors' products)

- What is your preferred brand?

- If our product was no longer available, what other product would you choose instead?

The following market research questions can be applied to your website, landing page, social media platforms or any other channel you use to share information about your product or service or communicate with your customers.

- Was it easy to find information on our website?

- Is our website easy to navigate and user-friendly?

- Is some information missing on our website?

- Is product information clear and transparent?

- Do you think we should add any features to our website, and which ones?

- What kind of content would you like to see on our blog?

- Did you have any difficulties using our website?

Market research questions: Best practices

Here are a few tips to consider when creating your own market research questions:

- Define clear objectives: Before starting, you have to be clear on what you want to get out of the market research. Learning more about your potential customers? Identifying your competition? Evaluating a new product idea? Identifying different customer segments?

- Use neutral language: If you want to get unbiased results to drive customer-led product growth , use neutral language to avoid leading participants toward a particular response.

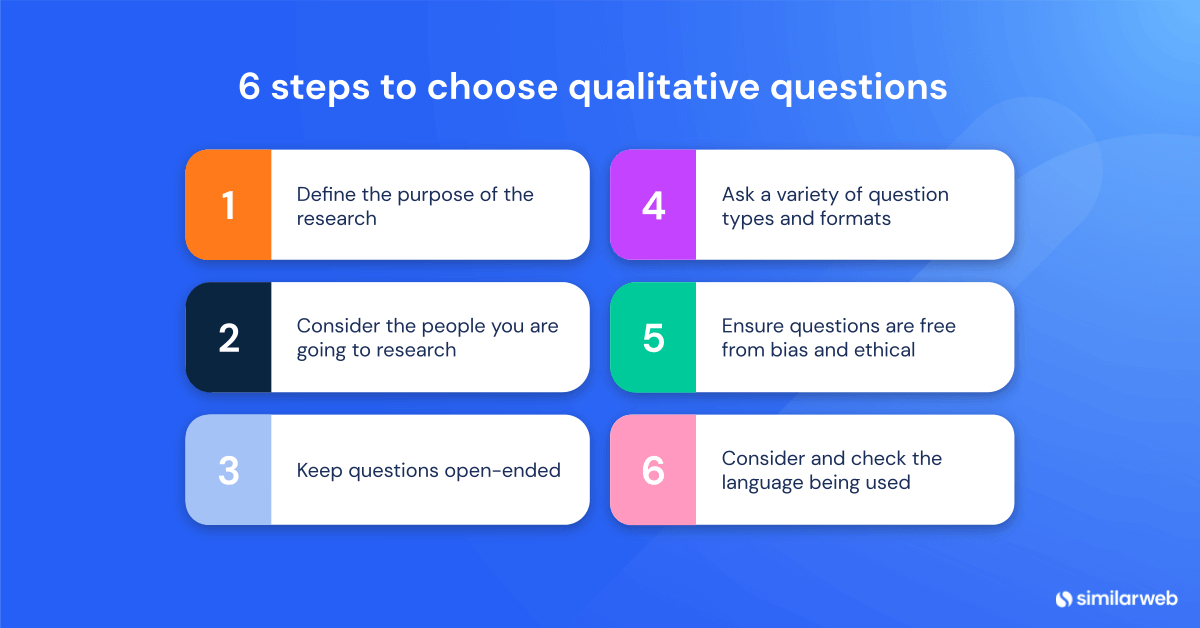

- Use different types of questions: You should combine multiple-choice questions, Likert scales and open-ended questions, as each of them helps you gather different types of data. While close-ended questions are great for collecting and analyzing large amounts of quantitative data, the open-ended format can be better when creating interview questions for market research as it provides you with deeper customer insights .

Writing questions and conducting market research is just the first step. The second and even more important step is to analyze the data you've gathered so you can uncover insights and patterns.

The best way to do so is through a customer feedback platform like Zeda.io, which provides you with a centralized workspace to collect and manage feedback and analyze data from all customer interaction points in one place.

Our platform helps you transform customer feedback into actionable insights that can help you decide which product to build or how to prioritize product features .

Thanks to advanced AI algorithms, we can help you spot product opportunities by uncovering the features users desire the most.

It can also help you analyze customer feedback to detect issues and frustrations reported by users so that you can enhance customer experience by promptly fixing them.

We can also spot trends in user feedback and calculate a potential revenue impact from adding new features.

We hope you were able to pick some ideas for creating your next customer survey or interview questions for market research.

After conducting research, it's crucial to thoroughly analyze your market research questionnaire using the right user feedback tools .

Zeda.io is an AI-powered tool that transforms raw customer data into actionable insights, helping you better understand your customers and spot emerging trends before competitors.

It helps you take the guesswork out of product discovery and confidently create products your target market will love.

Sign up today, and let's uncover burning issues and market gaps together.

Join Product Café Newsletter!

Sip on the freshest insights in Product Management, UX, and AI — straight to your inbox.

By subscribing, I agree to receive communications by Zeda.

How do you write a good market research question?

Good market research questions are the ones that are clear, concise, specific and aligned with your goals. To get unbiased data, avoid leading questions and suggesting particular answers to your target audience.

What questions should I ask for market research for a new product?

You should ask target customers about their pain points, struggles, challenges and desires. See how they're currently solving those problems, whether they're using any other similar product and whether some features of that product could be added or improved.

What are the 7 basic questions in market research?

Here are the key market research questions: What problem is our product solving? Who is our target audience? What product features are the most important for them? What influences their purchasing decisions? How much are they willing to pay? What's preventing potential customers from buying our product? Who are our main competitors?

What are the elements of market research?

The main elements of market research are researching your target audience, their needs and problems, doing a competitor analysis and spotting market trends.

IN THIS ARTICLE:

Latest articles

A product manager’s guide to navigating the pandemic.

Things have drastically changed since the pandemic, and it’s high time you update your roadmap keeping the current market dynamics in mind.

AI Product Management 101: Everything You Need to Know

Explore what is AI product management, AI product manager and more. Learn how you can step into the AI product management domain.

What is a Product Feedback Loop and How Can You Leverage it?

Product Feedback loops help brands nurture their relationships with users by helping them to stay updated about their users' needs, preferences, and complaints.

Decide what to build next with AI-powered Insights

- What are product discovery techniques?

- 8 key product discovery techniques link

Using Voice of the Customer to Enhance Customer Experience

Explore how Voice of the Customer (VoC) methods transform feedback into actionable insights to enhance products and customer experiences. Learn about one of the best VoC software and more!

The Most Underrated Feedback Channel You're Ignoring: In-App Feedback

Explore the benefits of in-app feedback for enhancing user experience and engagement, and learn how Zeda.io can optimize your feedback strategy.

Key Takeaways from Continuous Discovery Habits

Here are the key takeaways from Teresa Torres' Continuous Discovery Habits: Discover Products That Create Customer Value and Business Value

Download a resourse

Non tincidunt amet justo ante imperdiet massa adipiscing.

App Sign Up

Subscribe to newsletter, book a demo, ai-powered product discovery for customer-focused teams.

- A/B Monadic Test

- A/B Pre-Roll Test

- Key Driver Analysis

- Multiple Implicit

- Penalty Reward

- Price Sensitivity

- Segmentation

- Single Implicit

- Category Exploration

- Competitive Landscape

- Consumer Segmentation

- Innovation & Renovation

- Product Portfolio

- Marketing Creatives

- Advertising

- Shelf Optimization

- Performance Monitoring

- Better Brand Health Tracking

- Ad Tracking

- Trend Tracking

- Satisfaction Tracking

- AI Insights

- Case Studies

quantilope is the Consumer Intelligence Platform for all end-to-end research needs

Market Research Questions: What to Ask for Better Insights

You see the value in market research and have support from your stakeholders to get started on some projects, but when you sit down to draft your questionnaire, you don’t quite know where to start. Sound relatable? If so, read on to learn some key market research questions to ask for actionable customer feedback.

Table of Contents:

- Why ask market research questions?

Types of market research questions to ask

Market research questions for various research goals, question formatting options.

- Tips for getting the most out of your market research questions

Why ask market research questions?

Market research questions help us get to the core of consumer behavior - such as why consumers act the way they do and how they go about their buyers’ journey. Market research surveys are a means of answering these questions, so brands can optimize their offerings (be it products or services) according to customer needs. Without asking your customer base what they want or need, you’re left making assumptions that may or may not hit the mark - which can lead to a waste of valuable time and budget.

Back to Table of Contents

Some of the most basic examples of market research questions are those related to demographics (who consumers are), yet these are some of the most foundational questions a survey can ask to make other insights more powerful. Beyond demographic traits, psychographics (what consumers are like - attitudes, aspirations, etc.) and behavioral questions (how consumers act) also paint a detailed picture of a target market.

Examples of market research question types:

Demographic questions : e.g. Where do you live? How old are you? What is your gender? Annual income?

Psychographic questions : e.g. What interests you? How do you like to spend your free time?

What are your goals for the year?

Behavioral questions: How often do you grocery shop? Do you prefer to shop in-store or online?

On which days of the week are you most likely to watch television (and subsequently see advertising)? How much money do you usually spend on X products? Which retail brands do you buy from?

The type of questions you’ll want to ask in your market research survey will depend on your research goals. Are you trying to get to know your existing customers? Are you looking to engage with potential customers? Are you hoping to conduct a competitive analysis for your brand? A survey could be crafted around any or all of these objectives to fully explore each topic.

Once you determine the goal of your research, you can begin drafting your questionnaire using some of the question types above. Beyond capturing basic demographic questions among every survey respondent, below are a few examples of psychographic and behavioral question types:

Market research questions for existing customers

For brands who already have a solid customer base and want to get to know them better to improve customer retention, ask things like:

Why did you start using our [product or service]?

Would you buy from us again?

Would you recommend us to your family and friends?

Are there similar products that you use for different reasons?

What, if anything, would you improve about or product or service?

Market research questions for potential customers

If you’re looking to gather information about new customers you don’t already reach, get to know them through in-depth market research survey questions:

What factors influence your purchasing decision when shopping for a new [product or service type]?

Which of the following products [or services] are most appealing to you?

Where do you typically shop for [product or service]?

When will you be in the market for a new [product or service]?

How much do you typically spend on a new [product or service]?

Market research questions for products

Surveys are a great tool to test reactions and perceptions of your product before you finalize it for launch. Below are some examples of what to ask as you develop your final product so it fits what customers want:

What are the most/least important elements of a [product type]?

Which scents/flavors do you find most pleasant in our existing product line? Which ones do you hope to see in the future?

What pain points are you looking for a product/service to solve?

How does this product compare to others on the market?

Market research questions for pricing

Once you have settled on a product, you’ll need to determine the pricing for it. You can’t just set any price you want and expect consumers to pay it. The best way to go about pricing decisions is to actually survey your target customers to see what they’d be willing to spend:

Do you think the product is priced fairly?

What do you think is the ideal price for our [product or service]?

Are there any conditions in which you’d pay a higher price for our [product or service]?

What price is so high that you’d not even consider buying our [product or service]? (i.e. price sensitivity ).

Market research questions for branding

Lastly, a brand might have its target audience figured out, with a solid product that’s appropriately priced, but it needs to be marketed and branded . Ask questions like:

Are you familiar with our brand? (i.e. brand awareness)

Describe your customer experience so far with our brand.

How would you rate your customer satisfaction with our brand?

How likely are you to recommend our brand to family and friends?

For more on branding, consider a brand health tracker that can capture category entry points and the mental availability of brands:

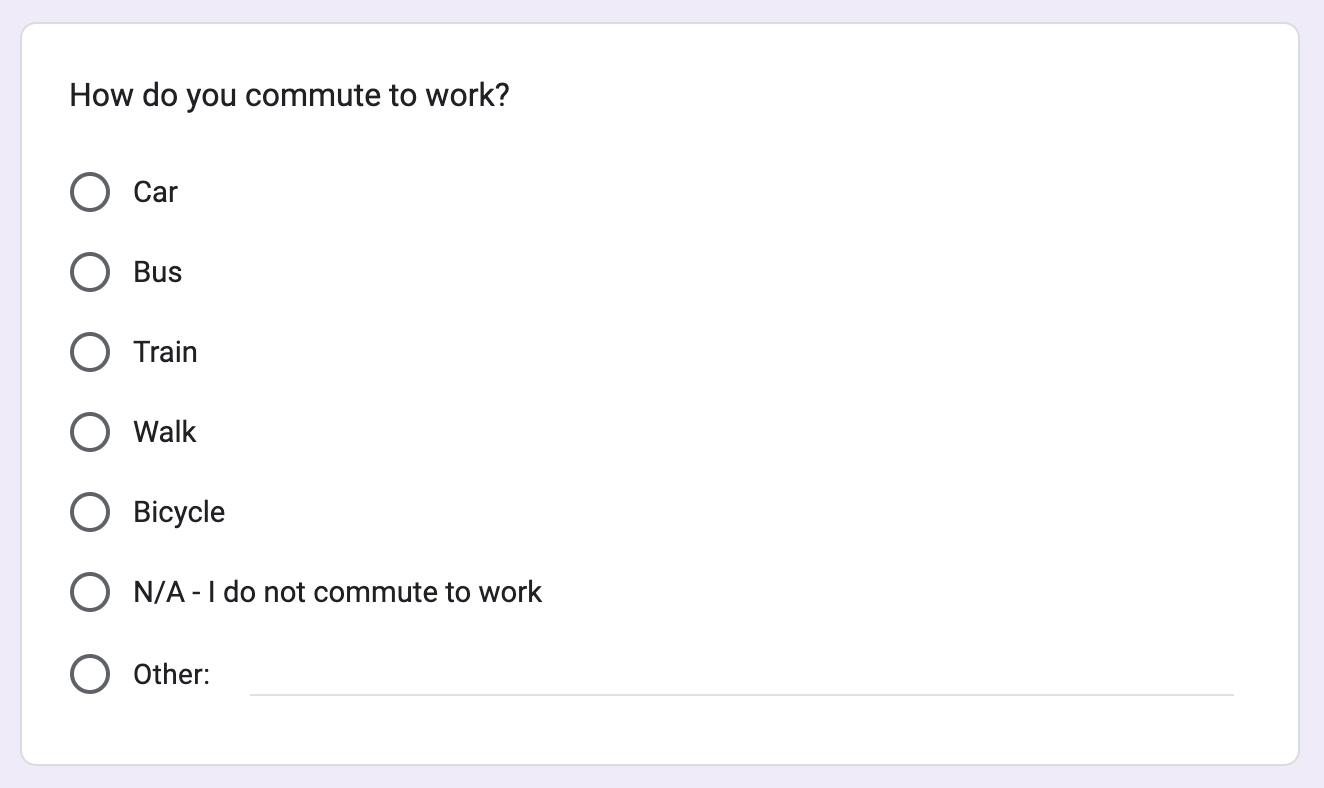

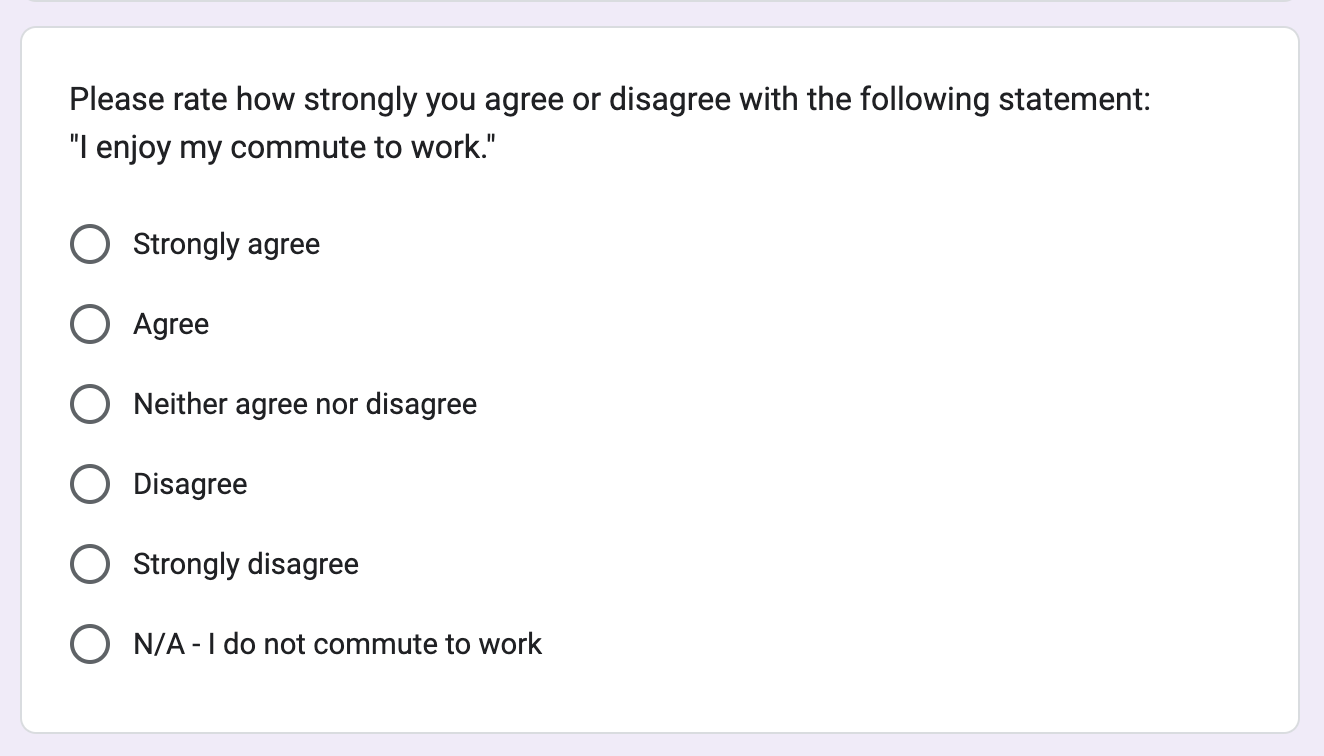

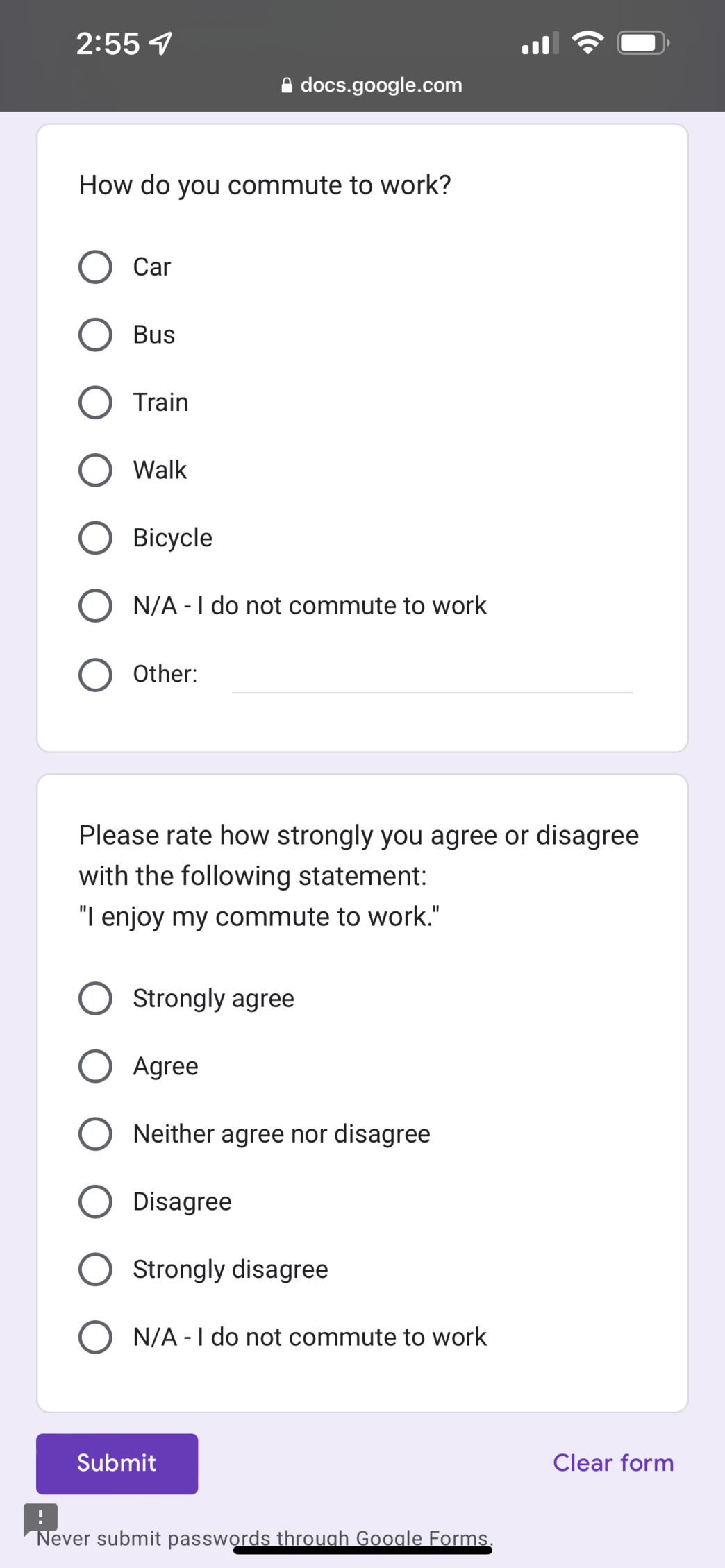

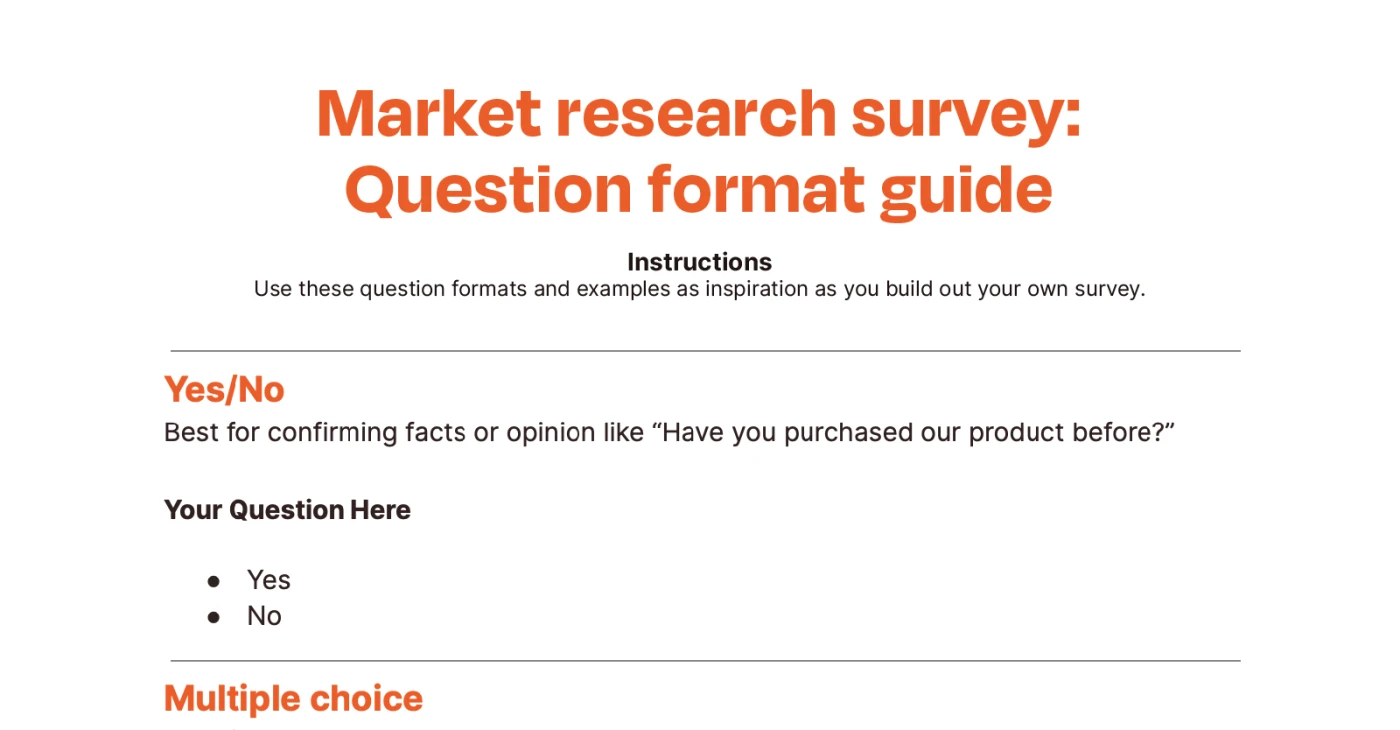

Once you’ve determined the question content you’d like to ask in your survey, there are multiple ways you can go about actually programming each one. Below are some common question formats, and when to use each one:

Multi-select: Use when you want a respondent to select as many items as apply to them from a list.

Rating scale/matrix: Use when you want respondents to provide a numeric rating on a single item (scale) or a list of items (matrix); (i.e. 1-5 likeness toward each, 1-5 level of satisfaction with each, etc.)

Open-ended questions : Use when you want respondents to provide written feedback to a question (i.e. ‘tell me about your latest shopping experience in-store’, or ‘what do you love about this product/service?;)

Tips for getting the most out of your market research questions

Asking the right questions in an online survey only goes so far if you don’t base your research on a marketing strategy that strengthens your competitive advantage.

1. Start with a goal