- Our Customers

- Switch to VL

- White Papers

- Lease Accounting Guide

- Become a Partner

Access our quick product overview videos

Balance Sheet Changes for ASC 842 [2021]

- No Comments

ASC 842 Lease Accounting Balance Sheet Examples

The Federal Accounting and Standards Board (FASB) created the new lease accounting standard (ASC 842) , which has raised questions about how balance sheets are affected. We’ve answered your top 10 questions about how ASC 842 will impact your balance sheet.

What is the purpose of the FASB lease accounting changes?

FASB ASC 842 increases disclosure and visibility into the leasing obligations of both public and private organizations.

Prior to ASC 842, most leases were not included on the balance sheet. The new standard requires companies to report right-of-use (ROU) assets and liabilities for almost all leases. The changes make it easier for users of financial statements to see a company’s exposure to risk and the true financial position of the organization, and to make comparisons between organizations.

Another important purpose of ASC 842 is to more closely align with the new international lease accounting standard (IFRS 16) , especially around the definition of a lease.

Are operating leases on the balance sheet?

Under the ASC 840 standard, only accounting for capital leases were recorded on the balance sheet. Operating leases were off the balance sheet, and the impact was generally limited to deferred rent or prepaid rent. The only insight you had for future obligations was limited to the maturity analysis in the disclosure report.

Under ASC 842, every lease (with the exception of short-term leases as defined below) must be represented on the balance with a liability and a ROU asset.

Additionally, disclosure reports must include more qualitative and quantitative disclosures under 842, such as weighted average discount rate, weighted average remaining lease term, cash paid for amounts included in lease liabilities, and a more descriptive maturity analysis (which must be tied back to the balance sheet).

How are ASC 842 short term leases and low value leases defined?

Under ASC 842, a short-term lease is defined as a lease that has a term of 12 months or less at commencement, and the lease does not have a renewal option that the lessee is reasonably certain to exercise.

Short-term leases do not need to be included on your balance sheet under ASC 842. However, you may recognize short-term lease payments on a straight-line basis over the lease term (similar to the way operating leases are recognized under ASC 840).

This practical expedient for short-term leases must be elected at the asset class level. That means you can’t pick and choose leases to define as short term; you’ll need to define the entire asset class as part of your practical expedient.

It’s also important to note that FASB has not defined a materiality threshold (where low value leases under a certain threshold may be excluded). IFRS (the international standard) has defined a low value lease threshold under which leases don’t have to be capitalized on the balance sheet, but FASB has not included this practical expedient to date. We recommend discussing the issue with your auditors to determine if they will allow you to use a materiality threshold.

How are capital leases reported on the balance sheet under ASC 842?

A finance lease (previously called a capital lease in ASC 840) is a lease that’s effectively a purchase arrangement.

ASC 840 capital leases and ASC 842 finance leases are substantially the same. Both are capitalized on the balance sheet, and the method for doing so is similar under both standards.

ASC 842 Lease Accounting Example

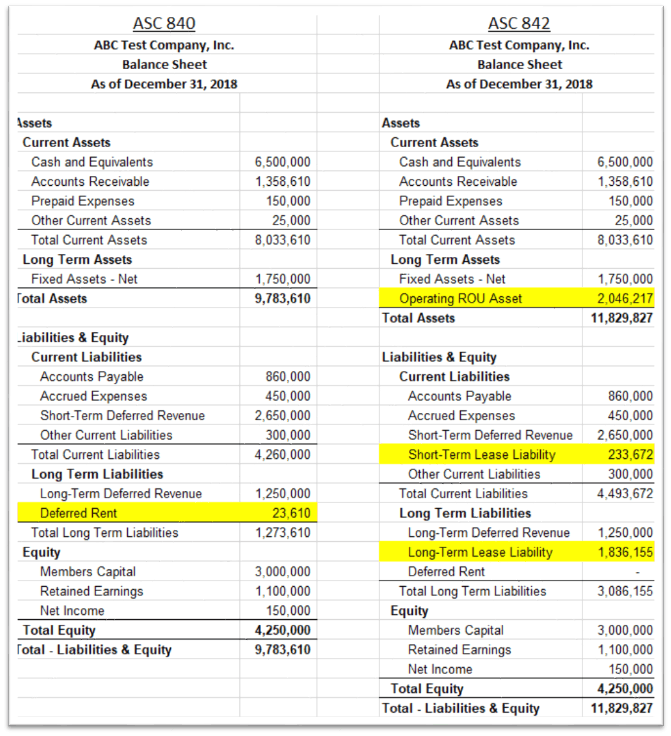

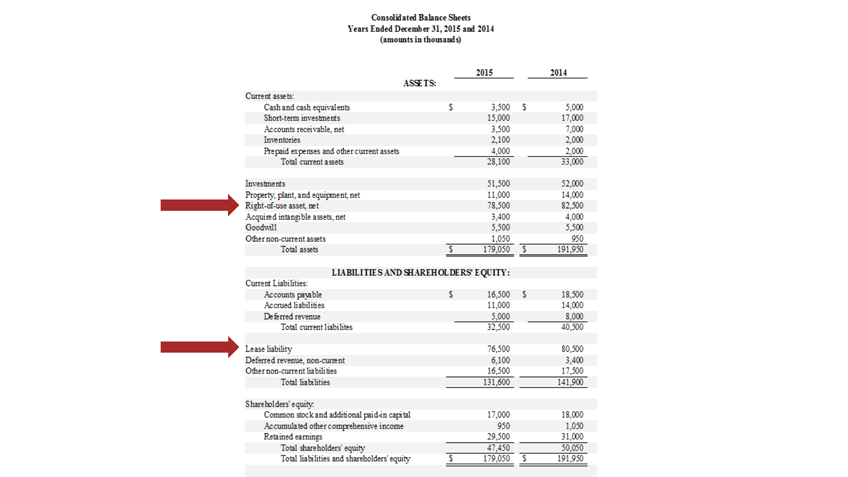

Here’s an example of a balance sheet for 840 and a balance sheet for 842. Both represent the same capital/finance lease data.

As you can see, only the terminology has changed. Total assets and liabilities remained the same for the reporting period. If we were to look at the income statement, the amortization and interest expense are calculated the same way in ASC 842 as they were in ASC 840. So there would be no impact to the P&L in this example.

When transitioning your existing leases to the new standard, you will need to reclassify Capital Lease Asset and Capital Lease Liability (840) to ROU Asset and Lease Liability (842). Any prepaid rents, lease incentives, and initial direct costs are rolled up into the ROU asset. (Refer to question 8 for more details about calculating the ROU asset).

How are operating leases reported on the balance sheet under ASC 842

In an operating lease , the lessee obtains control over the use of the underlying asset without ownership. (Refer to question 9 for information about how to classify a lease as either an operating lease or a finance lease for ASC 842 reporting.)

Under ASC 840, operating leases were unrecorded liabilities. Balance sheet impact for operating leases was limited to prepaid or deferred rent.

Accounting for operating leases represents the biggest change in ASC 842, and it will materially impact your balance sheet going forward.

All operating leases (except for short-term leases) are now capitalized on the balance sheet for FASB 842 the same way we previously would record capital leases under ASC 840, and now finance leases under ASC 842. They are recorded on the balance sheet as a ROU asset and lease liability.

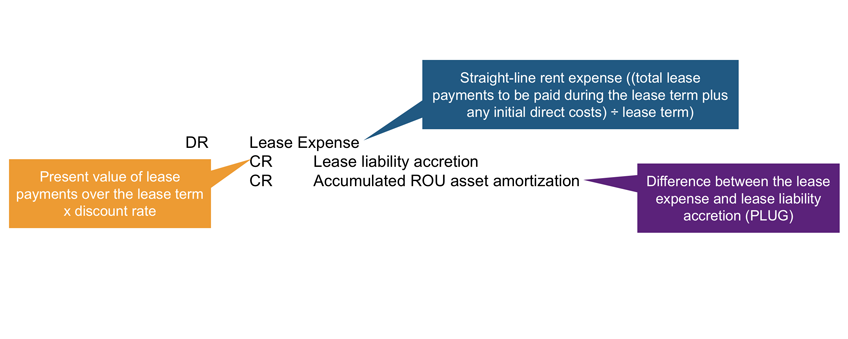

Operating lease expense is still straight-lined over the lease term:

- Operating lease liability is accounted for the same way as a finance lease, using an amortized cost basis.

- Amortization of the ROU asset is calculated as the difference between straight line rent and interest expense for the period.

These two expenses added together give you the total lease expense to book on your P&L.

Operating Leases on the Balance Sheet Example

Here’s an example of a balance sheet for 840 and a balance sheet for 842. Both represent the same operating lease data.

In this example, we have included only a single operating lease. It’s a real estate lease with an initial lease term of January 1, 2018 to December 31, 2025. The rent starts out at $27,000 per month, and increases 2% each year until it gets to the final amount of $31,014.51. For the sake of simplicity, we do not have any prepaid rents, initial direct costs, or lease incentives on this lease.

As you can see, under ASC 840, we have a very small deferred rent balance of $23,610 as of 12/31/18. Our Total Assets are only about $9.8 million and our Total Liabilities are only $5.5 million. Realistically, we have a future cash obligation on this lease of almost $2.5 million dollars, but the only way we would see that under 840 is if we dug into the disclosure report and looked at the maturity analysis. And remember, even the maturity analysis is not a fair representation of our actual liability, because of the time value of money.

Looking at the same example under ASC 842 (using a 5% discount rate), you can see a very different impact on the balance sheet.

To provide an apples-to-apples comparison with 840, we are capitalizing this lease on 1/1/18 and not transitioning. Our net present value of payments, which is the starting point for your lease liability, is almost $2.3 million.

As of 12/31/18, you can see that we have a total right of use asset of $2,046,000, and a total lease liability of $2,069,000 (including both short term and long term lease liability). Our Total Assets for the year went from about $9.8 million to $11.8 million. Our Total Liabilities went from $5.5 million to about $7.6 million.

For this example, there’s no change to the P&L. Our straight line rent expense under ASC 840 is $347,610 for 2018. Under ASC 842, the total lease expense is the same, but $239,000 is related to amortization, and $108,000 is related to interest expense. For 2018, we’ve made $324,000 in payments, but only reduced the liability balance by $216,000.

Keep in mind that the impact on this balance sheet represents only a single 5-year real estate lease. When you extrapolate this out to an entire property portfolio, and also capitalize any equipment leases you may have, the balance sheet impact will be much, much larger.

How has lease classification changed under ASC 842?

Upon adoption of ASC 842, almost all leases will be capitalized on the balance sheet. However, you will still need to classify them as either finance leases (previously called capital leases) or as operating leases using the lease classification test so that you can apply the correct accounting treatment.

Lease Classification Test

The lease classification test questions determine whether the leased asset is essentially owned as well as controlled by the lessee. If so, the lease must be classified as a finance lease. If the lessor retains ownership, the lease must be classified as an operating lease. So if the lease is non-cancelable and you answer YES to one or more of the lease classification test questions, then the lease is classified as a finance lease.

These four lease classification test questions remain the same as ASC 840:

Transfer of title test: By the end of the lease term, will ownership of the asset transfer from the lessor to the lessee?

Bargain purchase option test: Is there a purchase option in the lease that the lessee is reasonably certain to exercise?

Lease term test: Does the lease term encompass the major part of the remaining economic life of the underlying asset?

Present value test: Is the present value of lease payments plus RVG (residual value guaranteed by the lessor) greater than or equal to substantially all of the fair market value of the asset?

A fifth test question has been added in ASC 842:

Alternative use test: Is the asset so specialized that it is only useful to the lessee? This new test question means that after the asset is returned to the lessor, will it have no value to anyone else without a major overhaul by the lessor?

You may have noticed that the “bright lines” for lease classification tests have been removed in ASC 842. Previously they indicated what percentage constitutes a “major part” of economic life (75%) or “substantially all” of the fair market value (90%). These are now considered guidelines under the new standard and you can elect what percentage you choose to use.

In the past, it was easy to manipulate this number and classify more leases as operating leases (which did not need to be capitalized). Under ASC 842, all operating leases are recorded on the balance sheet anyway, so there’s no reason to do this.

How is lease liability calculated?

Lease liability is calculated as the Present Value of minimum future lease payments. You will need to make assumptions about the probable amounts owed under residual value guarantee, and also whether you are reasonably certain to exercise renewal options, termination options, and purchase options, because exercising these options impacts your minimum future lease payments.

The discount rate to use for the calculation is either the rate implicit in the lease (if known), or your organization’s incremental borrowing rate.

It’s important to remember that the assumptions you make at the inception of the lease (about whether or not you will exercise options) can and often do change over time. When those changes happen during the term of a lease, you will need to remeasure both your lease liability and your ROU asset. Remeasurements may also be needed due to abandonments, asset impairments and other causes.

How to calculate ROU?

The ROU asset is calculated as the lease liability plus or minus certain adjustments , which include:

+ Initial Direct Costs

+ Prepaid Lease Payments

– Lessor Incentives

– Accrued Rent

– ASC 420 Liability at Transition Date

All of these assets and liabilities that adjust the ROU asset are now reclassed from the balance sheet and included as one number to show the total leased asset.

What is an embedded lease?

Accounting for embedded leases represents one of the trickier aspects of implementing the new ASC 842 standard. Simply put, embedded leases are components within contracts that entail the use of a particular asset, where the user has control over that asset. A lease may exist within a contract even though the contract may not contain the word “lease.”

For example, embedded leases are commonly found in IT service contracts, where a vendor may provide specific equipment (such as on site servers). They are also frequently found in supply contracts, dedicated manufacturing capacity contracts, and advertising agreements (such as use of billboards).

You may have done some embedded leases accounting in the past, and the process has not changed much in ASC 842. However, this is now a significant issue because embedded leases have a much bigger impact on your income statement under the new rules.

Under ASC 840, operating leases were off balance sheet, so any embedded leases had an immaterial impact to the income statement since the expense was probably being straight lined anyway.

ASC 842 requires ALL leases to be capitalized on the balance sheet, including all embedded leases. That means you will need to examine your contracts to find any embedded leases within them, and you will need to separate the lease components (for use of assets within a contract) from non-lease components (payments for the service) within these contracts.

This is a complex and time-consuming task, so be sure to allocate the necessary time and resources to get it done. It also involves making judgments, so it’s imperative that people doing this work are experienced with leases and understand the standard. Also, you must document your policies and procedures to support your decisions and to provide justification for future audits.

How to identify an embedded lease

As you review the content of your existing contracts, ask these questions to decide (ideally with the guidance of your advisory partners) if they contain embedded leases :

- Does the agreement entail the use of one or more specific assets?

If no assets are specified, then no lease can exist within the contract. However, if an asset is explicitly or implicitly identified within an agreement, then a lease may exist.

- “Explicit” means the asset is identified on the contract, such as by a serial number or VIN number.

- “Implicit” means use of a specific asset is implied even if not explicit, such as when the supplier can’t fulfill the contract with any other asset for legal or economic reasons.

For example, power purchase agreements may include the use of a specified plant. Oil and gas drilling contracts may specify the use of equipment and pipelines.

- Is the asset physically distinct?

For a lease to exist, a specified asset must be a physically distinct object. Something intangible, such as exploration rights, cannot be considered an asset. A biological entity also cannot be considered an asset under 842.

- Does the supplier have substantive substitute rights for the asset?

If your agreement does specify the use of an asset, can the supplier easily substitute a different asset, and would the supplier benefit from doing so?

- If the supplier can substitute the asset and benefit economically by exercising that right, a lease may not exist in the contract.

Here’s an example : If a supplier uses trucks to ship materials and has the ability to substitute different trucks (with a smaller or larger capacity as needed), then there is no lease.

- If the supplier can’t substitute the asset and would not benefit from doing so, then the use of that asset may be considered a lease.

For example: A managed services contract might include office copiers. It’s not likely that the supplier can easily swap out one machine for another. And it’s also not likely that the supplier would benefit financially from doing that even if they could. In that case, the use of the office copier would constitute a lease.

- Does the customer obtain the economic benefit from using the asset?

If you as the customer get substantially all of the economic benefit from the use of the asset, then your use of that asset may be considered a lease.

Common practice is to interpret “substantially all” to mean greater than or equal to 90% of the economic benefits of the asset.

- Can the customer direct use of the asset? If you have physical control and decision making authority over when and how the asset is used throughout the period of the lease, then a lease may be present.

Read More Content About ASC 842

ASC 842 Compliance Software

- ASC 842 Summary

Leasehold Improvements for ASC 842

Author Visual Lease

Visual Lease Blogs - read about the best lease administration software, lease management solutions, commercial lease accounting software & IFRS 16 introduction.

- Lease Accounting

Lease Administration

- Lease Management

(888) 876-6500

Schedule a Demo

- By Industry

- Alliance Partners

- SB 253 and SB 261

- ESG Steward

- Integrations

- Finance and Accounting

- Real Estate, Fleet and Equipment Operations

- Sustainability

- Information Technology

- Business Services

- Construction

- Municipality & Higher Education

- Manufacturing

- Retail & Hospitality

- Transportation

- Implementation

- Connect with our Alliance Partners

- ASC 842 Lease Accounting

- ASC 842 Balance Sheet Changes: A Quick Reference

- Visual Lease Reporting Features: ASC 842 Journal Entries

- What is IFRS 16 & What Do I Need to Know?

- 2021 Guide to IFRS Compliant Lease Accounting Software

- IFRS & FASB Changes: A Lease Accounting Quick Reference Guide

- What is GASB 87 & What Do I Need to Know

- What You Need to Get Compliant With GASB 87

- GASB 87 Roundtable Discussion Recap: Anticipating Common Lease Accounting Challenges

- GASB 96: What You Need to Know

Want to subscribe to our podcast?

ASC 842: Lessee’s Financial Statement Presentation of Leases

FREE ACCOUNT

FASB Accounting Standards Codification (FASB ASC) 842, Leases, is effective for all entities other than a public business entity, a not-for-profit entity that has issued or is a conduit bond obligor for securities that are traded, listed, or quoted on an exchange or an over-the-counter market, or an employee benefit plan that files or furnishes financial statements with or to the U.S. Securities and Exchange Commission for annual reporting periods beginning after December 15, 2021 (i.e., calendar year 2022 for

Download the CPEA report: FASB ASC 842: Lessee’s Financial Statement Presentation of Leases

File name: cpea-report-fasb-asc-842-lessees-financial-statement-presentation-of-leases.pdf

Already a member?

Log in with your account, not a member, mentioned in this article, related content.

This site is brought to you by the Association of International Certified Professional Accountants, the global voice of the accounting and finance profession, founded by the American Institute of CPAs and The Chartered Institute of Management Accountants.

CA Do Not Sell or Share My Personal Information

Home » Resources » FASB Topic 842: Presentation and Disclosure

FASB Topic 842: Presentation and Disclosure

June 13, 2019

Introduction

In February 2016, the Financial Accounting Standards Board (“FASB” or “the Board”) issued its highly-anticipated leasing standard in ASU 2016-02 (“ASC 842” or “the new standard”) for both lessees and lessors. Under its core principle, a lessee will recognize right-of-use (“ROU”) assets and related lease liabilities on the balance sheet for all arrangements with terms longer than 12 months. The pattern of expense recognition in the income statement will depend on a lease’s classification.

During deliberations for the standard, many users indicated that the existing disclosure requirements did not provide sufficient information to understand an entity’s leasing activities. As a result, the new standard also introduces an overall disclosure objective together with significantly enhanced presentation and disclosure requirements for leases.

Disclosure Objective

FASB Accounting Standards Codification (ASC) 842-20-50-1 and 842-30-50-1 provide that “the objective of the disclosure requirements is to enable users of financial statements to assess the amount, timing, and uncertainty of cash flows arising from leases.” The standard further indicates that “a lessee [lessor] shall consider the level of detail necessary to satisfy the disclosure objective and how much emphasis to place on each of the various requirements. A lessee [lessor] shall aggregate or disaggregate disclosures so that useful information is not obscured by either the inclusion of a large amount of insignificant detail or by aggregating items that have different characteristics.”[1]

With that objective in mind, significant judgment will be required to determine the level of disclosures necessary for an entity. However, as a guiding principle, the basis for conclusions indicates “if leasing is a significant part of an entity’s business activities, the disclosures would be more comprehensive than for an entity whose leasing activities are less significant….”[2] For example, although the new standard does not provide specific quantitative or qualitative disaggregation requirements such as those required under ASC 606, for entities for which leasing is a significant portion of their business, such disaggregation might be appropriate.

Entities must make appropriate disclosures for each annual reporting period for which a statement of comprehensive income (statement of activities) is presented and in each year-end statement of financial position. Entities are not required to repeat disclosures if the information is already presented in the financial statements as required by other accounting standards.

Although the majority of the disclosures required by ASC 842 only affect an entity’s annual financial statements, the new standard requires that lessors provide a table disclosing lease income for each interim and annual reporting period[3]. Additionally, in the year of adoption, the Securities and Exchange Commission (SEC) requires public companies to include all required annual disclosures in any interim financial statements that are prepared until the next annual financial statements are filed – even if the disclosure requirements are only applicable for annual periods.

Presentation

Lessee A lessee is required to present ROU assets resulting from finance leases separately from ROU assets resulting from operating leases and separately from other assets, either on the face of the balance sheet or in the footnotes. Similarly, lease liabilities for finance leases are required to be presented separately from lease liabilities from operating leases and from other liabilities. In addition, ROU assets are presented as noncurrent in the lessee’s balance sheet, consistent with how other amortizing assets such as PP&E are presented. However, the related lease liabilities are subject to current and long-term presentation requirements in a classified balance sheet, consistent with the way other financial liabilities are presented.

If the lessee chooses to report ROU assets and liabilities within other line items on the balance sheet rather than in separate captions, the lessee is prohibited from reporting finance lease ROU assets or finance lease liabilities in the same caption as operating lease ROU assets and operating lease liabilities. Additionally, disclosure of which line items in the statement of financial position include the ROU assets and lease liabilities would be required.

For finance leases, a lessee should present the interest expense on the lease liability and amortization of the ROU asset in a manner consistent with how the lessee reports other interest expense and depreciation or amortization expense in the income statement. For operating leases, the lessee must present both components together as lease expense within income from continuing operations, consistent with the presentation of other operating expenses. Lease expense should be classified within cost of sales; selling, general, and administrative expense; or another expense line item depending on the nature of the lease.

The new standard does not provide specific guidance on the presentation of variable lease payments (for either finance or operating leases). Paragraph BC271 in the basis of conclusions for ASU 2016-02 indicates that amount recognized in the income statement should be presented within income from continuing operations. We believe that presentation as either lease expense or interest expense may be appropriate, depending on the nature of the lease. In making this determination, lessees should assess whether the payments are more akin to lease payments or interest.

The cash flow classification of payments related to finance leases should be consistent with the classification of payments associated with other financial liabilities. Payments of principal should be presented as financing activities, while payments of interest would typically result in operating cash flow presentation. Payments related to operating leases, leases to which the lessee has applied the practical expedient for short term leases, and any variable lease payments for either operating or finance leases should all be classified as operating cash outflows (unless the payment represents a cost of bringing another asset to the condition and location necessary for its intended use, in which case it should be classified within investing activities). Additionally, the establishment of ROU assets and lease liabilities at inception of a lease (or that change as a result of lease modifications or reassessment events) should be disclosed as noncash investing and financing activities.

Lessor A lessor is required to present lease assets (i.e., net investment in leases) resulting from sales-type and direct financing leases separately from other assets in the balance sheet. Lease assets are financial assets that are subject to current and long-term presentation requirements in a classified balance sheet.

For operating leases, the assets underlying the leases and related depreciation are presented in accordance with other accounting guidance (e.g., ASC 360). Assets subject to lease under operating leases should be presented separately from owned assets that are held and used by the lessor as they are subject to different risks. Any rent receivable, deferred rent revenue (i.e., that results from requirement to recognize rents on a straight-line basis), or prepaid initial direct costs would be subject to current and long-term presentation requirements.

Income arising from leases should be presented separately in the income statement or in the footnotes. If presented in the footnotes, a lessor must also disclose which line items include lease income. Revenue and cost of goods sold related to profit or loss on leases recognized at the commencement date should be presented on a gross basis if the lessor uses leases as an alternative means of realizing value from goods that it would otherwise sell. If the lessor uses leasing as a means of providing finance, profit or loss should be presented on a net basis (i.e., as a single line item).

The new standard does not provide specific guidance on the presentation of variable lease payments received for direct financing or sales type leases. We believe that presentation as either lease income or interest income may be appropriate, depending on the nature of the lease. In making this determination, Lessors should assess whether the payments are more akin to lease payments or interest.

Lessors must classify all cash receipts from leases as operating activities in the statement of cash flows.

As noted previously, the objective of the disclosure requirements in the new leasing standard is to enable users of financial statements to assess the amount, timing, and uncertainty of cash flows arising from leases. To help entities achieve this objective, the leasing standard prescribes quantitative and qualitative disclosures that are required for all entities.[4]

The following table summarizes the disclosure requirements of the leasing standard:

Sale and Leaseback

If a seller-lessee enters into a sale and leaseback transaction, it must provide the disclosures required for lessees. Similarly, a buyer-lessor must provide the disclosures for lessors. Additionally, a seller-lessee must disclose the main terms and conditions of the sale and leaseback transaction and must disclose any gains or losses arising from the transaction separately from gains or losses on disposal of other assets.

Leveraged Leases

Although ASC 842 removed leveraged lease accounting, leases that met the definition of a leveraged lease under ASC 840 that commenced before the effective date of ASC 842 are grandfathered in. As such, entities that continue to have leveraged leases must continue to provide disclosures as required by ASC 842-50, which carries forward existing guidance from ASC 840.

Other Disclosure Considerations

Transition The leasing standard requires an entity to provide the general disclosures required by ASC 250 Accounting Changes and Error Corrections. Entities are also required to provide an explanation to users of financial statements about which practical expedients were used in transition.

SAB 74 Disclosures In periods prior to adoption of the leasing standard, entities are required to make disclosures under the SEC’s Staff Accounting Bulletin No. 74 (codified in SAB Topic 11.M), Disclosure Of The Impact That Recently Issued Accounting Standards Will Have On The Financial Statements Of The Registrant When Adopted In A Future Period (“SAB 74”). SAB 74 requires that when a recently issued accounting standard has not yet been adopted, a registrant disclose the potential effects of the future adoption in its interim and annual SEC filings. SAB 74 disclosures should be both qualitative and quantitative. According to Center for Audit Quality Alert 2017-03, SAB Topic 11.M – A Focus on Disclosures for New Accounting Standards, the SEC staff expects that SAB 74 disclosures will become more robust and quantitative as the new accounting standard’s effective date approaches. As such, the following types of SAB 74 disclosures are expected in a registrant’s financial statements in the periods before new accounting standards are effective:

- A comparison of accounting policie s . Registrants should compare their current accounting policies to the expected accounting policies under the new accounting standard(s).

- Status of implementation. The status of the process should be disclosed, including significant implementation matters not yet addressed or if the process is lagging.

- Consideration of the effect of new footnote disclosure requirements in addition to the effect on the balance sheet and income statement. A new accounting standard may not be expected to materially affect the primary financial statements; however, it may require new significant disclosures that require significant judgments.

- Disclosure of the quantitative impact of the new accounting standard if it can be reasonably estimated.

- Disclosure that the expected financial statement impact of the new accounting standard cannot be reasonably estimated.

- Qualitative disclosures. When the expected financial statement impact is not yet known by a registrant, a qualitative description of the effect of the new accounting standard on the registrant’s accounting policies should be disclosed.

Selected Financial Data – 5 Year Table

Some SEC registrants have questioned whether they must recast all periods reflected in the 5 year Summary of Selected Financial Data in accordance with the new leasing standard? In short, the answer is “no”. Registrants are only required to adjust the periods in the financial data table that correspond to the periods adjusted in the registrant’s financial statements. For example, an entity that elects to adopt the new standard as of the effective date (i.e., without restating prior comparative periods), the four prior years in the selected financial data table would not be adjusted. Companies will be required to provide the disclosures required by Instruction 2 to S-K Item 301 regarding comparability of the data presented.

Appendix A – Disclosure Example – LESSEE

Background For purposes of this example, we have assumed that Susie’s Stitch-n-Sew (“Susie’s”) is a national retailer of fabrics and other craft materials which primarily leases its retail locations. We have not presented a statement of financial position, but have assumed that Susie’s has presented the following captions:

- Operating lease ROU assets

- Fixed assets, net

- Current portion of operating lease liabilities

- Long-term operating lease liabilities

- Current portion of long-term debt

- Long-term debt

We have also not presented a statement of comprehensive income, but have assumed that Susie’s has presented Cost of sales, SG&A expense, Depreciation and amortization expense, and Interest expense. This example assumes that the guidance in ASC 842 has been in effect for all periods presented, and that all amounts are in millions.

Note X. Leases Susie’s has historically entered into a number of lease arrangements under which we are the lessee. Specifically, of our 250 retail locations, 240 are subject to operating leases and 5 are subject to finance leases. In addition, we lease our corporate headquarters facility, as well as various warehouses and regional offices. We are also a party to an additional 12 leases in which we previously operated a retail location, but which are now subleased to third parties. In addition, we have elected the short-term lease practical expedient related to leases of various equipment used in our retail locations.

As of December 31, 20X9, we have entered into eight leases for additional retail locations and one lease for an additional warehouse which have not yet commenced. Although certain of the retail locations are currently under construction, we do not control the building during construction, and are thus not deemed to be the owner during construction.

All of our retail leases include multiple optional renewal periods. Upon opening a new retail location, we typically installs brand-specific leasehold improvements with a useful life of eight years. To the extent that the initial lease term of the related lease is less than the useful life of the leasehold improvements, we conclude that it is reasonably certain that a renewal option will be exercised, and thus that renewal period is included in the lease term, and the related payments are reflected in the ROU asset and lease liability. Generally, we do not consider any additional renewal periods to be reasonably certain of being exercised, as comparable locations could generally be identified within the same trade areas for comparable lease rates.

All of our leases include fixed rental payments, but many of our leases also include variable rental payments. Specifically, a number of our leases in certain markets require rent payments that are calculated as a percentage of sales in that location. In addition, we also commonly enter into leases under which the lease payments increase at pre-determined dates based on the change in the consumer price index. While the majority of our leases are gross leases, we also have a number of leases in which we make separate payments to the lessor based on the lessor’s property and casualty insurance costs and the property taxes assessed on the property, as well as a portion of the common area maintenance associated with the property. We have elected the practical expedient not to separate lease and nonlease components for all of our building leases.

During 20X9, 20×8 and 20×7, we recognized rent expense associated with our leases as follows:

Amounts recognized as right-of-use assets related to finance leases are included in Fixed assets, net in the accompanying statement of financial position, while related lease liabilities are included in Current portion of long-term debt and Long-term debt. As of December 31, 20×9 and 20×8, right-of-use assets and lease liabilities related to finance leases were as follows:

During the years ended December 31, 20×9, 20×8 and 20×7, we had the following cash and non-cash activities associated with our leases:

The future payments due under operating and finance leases as of December 31, 20×9 is as follows:

As of December 31, 20×9 and 20×8, the weighted-average remaining lease term for all operating leases is 3.4 years and 3.5 years, respectively, while the weighted-average remaining lease term for all finance leases is 4.9 years and 5.6 years, respectively.

Because we generally do not have access to the rate implicit in the lease, we utilize our incremental borrowing rate as the discount rate. The weighted average discount rate associated with operating leases as of December 31, 20×9 and 20×8 is 4.2% and 4.0%, respectively, while the weighted-average discount rate associated with finance leases is 3.9% and 3.8%, respectively.

For questions regarding FASB Topic 842 please contact Sean Spitzer or another member of Smith and Howard’s Assurance Services Group by completing the contact form below at calling 404-874-6244.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

Want to get insights right to your inbox?

Subscribe to our newsletters to get inside access to timely news, trends and insights from Smith + Howard.

- Online Courses

New Lease Accounting Standard (ASC 842): Blowing Up the Balance Sheet

Posted on Nov 15, 2016 by Amber Albert, CPA | Tags: Accounting

In a previous post, we outlined the top five biggest changes companies face in implementing the new lease accounting standard. Why are we even talking about ASC 842? Because it’s going to be HUGE! And that’s the subject of this week’s post as we discuss the impact the new lease accounting standard (ASC 842) will have on companies’ balance sheets.

According to the IASB’s press release announcing the publication of IFRS 16 Leases , “listed companies using IFRS Standards or U.S. GAAP are estimated to have around US$3.3 trillion of lease commitments; over 85 percent of which do not appear on their balance sheets.” Why? Because to date leases were either categorized as either ‘finance leases’ (which appeared on the balance sheet) or ‘operating leases’ (which were only disclosed in the notes to the financial statements).

Well no more! With the adoption of the new lease accounting standard, not only will companies be required to bring lease commitments onto their balance sheets, but the overall accounting for leases is changing!

As discussed above, ASC 842 requires all leases, including operating leases, be recorded on the balance sheet. This new requirement affects both assets and liabilities and will absolutely “blow up” the balance sheet!

The accounting for finance leases is similar to the accounting for capital leases under current U.S. GAAP where the lease is required to be recognized on the balance sheet. However, the accounting for operating leases is changing substantially.

So, how do operating leases get recorded on the balance? ASC 842 requires a lessee to recognize a right-of-use (ROU) asset and a lease liability. The lease liability is calculated based on the present value of lease payments to be made over the lease term discounted at the rate implicit in the lease, if known, or the lessee’s incremental borrowing rate, which is more likely. The ROU asset is the same amount as calculated for the lease liability, adjusted for any initial direct costs, prepaid lease payments or lease incentives received.

In subsequent reporting periods, lessees would recognize periodic lease expense, amortize the ROU asset, and accrete the lease liability using the effective interest method as follows:

As you can see, the new accounting for operating leases under ASC 842 will substantially impact the balance sheet. This is especially true for companies with numerous operating leases such as airlines, retailers, grocery stores, and drugstores. Take for example, Walgreens, who, according to a report by LeaseAccelerator, has approximately US$34 billion worth of operating leases they will have to bring onto their balance sheet!

Now that we know how operating leases are going to be recorded in the financial statements, let’s discuss why the guidance changing using an example.

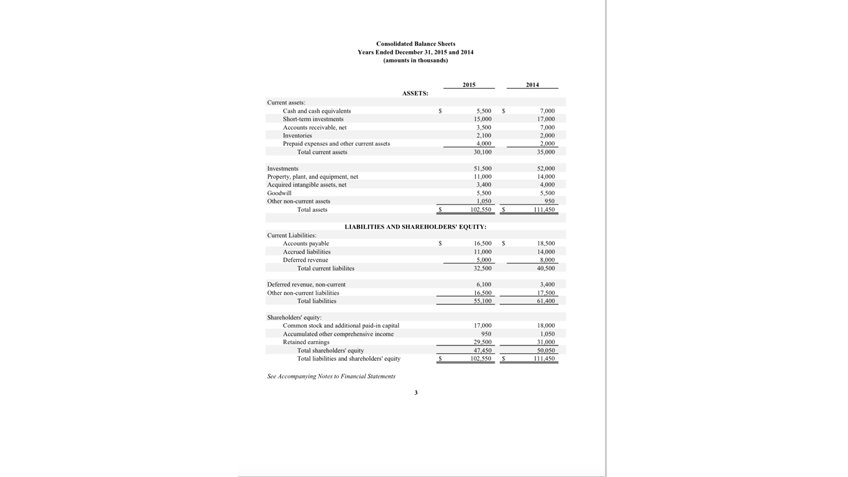

Imagine you are an investor and are considering investing in a company. You decide to analyze the balance sheet of the company (see below) because it reflects what the company owns and owes, and is a good indicator of the financial strength of the company.

Based on your review of the balance sheet, the company has cash-on-hand, a pool of investments, and no short- or long-term debt. In fact, their debt-to-equity ratio is only 1.2, which indicates that they use minimal debt to run their business. This company seems to be the ideal company to invest in, right?

Now, let’s take a look at the same example balance sheet, but after the company has adopted ASC 842.

What are your thoughts about this company now? They still have cash-on-hand and a pool of investments, but, because of the adoption of ASC 842, both their assets and liabilities increased. Now their debt to equity ratio is 2.8, a 133% increase, and indicates the company relies on substantial debt to run their business. Would you invest in this company now?

This example helps to paint the picture of why the lease accounting guidance is changing. The balance sheet is a “selfie” in time – it shows what a company owns and owes. But under the current guidance operating leases are considered “off-balance sheet” and, therefore, the balance sheet isn’t accurately depicting what companies owe. For this reason and others, current U.S. GAAP has been criticized for not providing users of the financial statements with the information necessary to understand a company’s leasing activities, hence the reason for the new standard.

Although “blowing up” the balance sheet is getting the most attention with respect to the new lease accounting standard, there are other changes too . Also, even though ASC 842 isn’t effect for public business entities until 2019, companies will need to make changes to their systems, process, and internal controls when implementing the new standard. Need help implementing the new standard? Check out this list of “go-to” resources or give us a call!

Disclaimer

This post is published to spread the love of GAAP and provided for informational purposes only. Although we are CPAs and have made every effort to ensure the factual accuracy of the post as of the date it was published, we are not responsible for your ultimate compliance with accounting or auditing standards and you agree not to hold us responsible for such. In addition, we take no responsibility for updating old posts, but may do so from time to time.

Comments (9)

Rick Kazmier: Apr 20, 2018 at 10:13 AM

I have read many articles on this subject and many articles classify the debt from operating leases as a "Non-Debt Liability." This non-debt liability is said to be excluded from covenant calculations. 1) Is the classification as a "Non-Debt Liability" defined in the ASU or anywhere in GAAP 2) Is exclusion of "Non-Debt Liability" discussed in the ASU or anywhere else in GAAP All loan documents require GAAP accounting. This change can dramatically impact covenant calculations, as you point out in the example. My question stems from understanding the legal basis banks, their customers and regulators will have regarding these changes. Thank you

Mike Walworth, CPA: Apr 20, 2018 at 11:23 AM

Thanks for your question, Rick. I believe the classification is addressed within the Basic of Conclusions, stating that the lease liability is an operating liability rather than debt. Check out this paragraph in ASU 2016-02 (BC 14) which states: The Board further considered the concern that the additional lease liabilities recognized as a result of adopting Topic 842 will cause some entities to violate debt covenants or may affect some entities’ access to credit because of the potential effect on the entity’s GAAP-reported assets and liabilities. Regarding access to credit, outreach has demonstrated that the vast majority of users, including private company users, presently adjust an entity’s financial statements for operating lease obligations that are not recognized in the statement of financial position under previous GAAP and, in doing so, often estimate amounts significantly in excess of what will be recognized under Topic 842. The Board also considered potential issues related to debt covenants and noted that the following factors significantly mitigate those potential issues: a. A significant portion of loan agreements contain “frozen GAAP” or “semifrozen GAAP” clauses such that a change in a lessee’s financial ratios resulting solely from a GAAP accounting change either: 1. Will not constitute a default 2. Will require both parties to negotiate in good faith when a technical default (breach of loan covenant) occurs as a result of new GAAP. b. Banks with whom outreach has been conducted state that they are unlikely to dissolve a good customer relationship by “calling a loan” because of a technical default arising solely from a GAAP accounting change, even if the loan agreement did not have a frozen or semifrozen GAAP provision. c. Topic 842 characterizes operating lease liabilities as operating liabilities, rather than debt. Consequently, those amounts may not affect certain financial ratios that often are used in debt covenants. d. Topic 842 provides for an extended effective date that should permit many entities’ existing loan agreements to expire before reporting under Topic 842. For those loan agreements that will not expire, do not have frozen or semifrozen GAAP provisions, and have covenants that are affected by additional operating liabilities, the extended effective date provides significant time for entities to modify those agreements. Also, check out Question 6.1.10 within KPMG's Lease Handbook available for download at this link: https://frv.kpmg.us/reference-library/2017/06/handbook-leases.html

LKS: Jul 16, 2018 at 02:41 PM

Can you confirm that the total lease liability is classified on the balance sheet long-term as opposed to presenting short and long-term pieces?

Mike Walworth, CPA: Jul 18, 2018 at 01:18 AM

Thanks for your question LKS. Here's what ASC 842 says about presentation: 842-20-45-1 states a lessee shall present in the statement of financial position or disclose in the notes all of the following: a) Finance lease ROU assets and operating lease ROU assets separately from each other and other assets b) Finance lease liabilities and operating lease liabilities separately from each other and from other liabilities. ROU assets and leases liabilities shall be subject to the same considerations as other nonfinancial assets and financial liabilities in classifying them as current and noncurrent in classified statements of financial position. ASC 842-20-45-2 through 45-3 talk about further presentation issues. Hope it helps!

michael duffy: Jan 28, 2019 at 04:49 PM

does this standard apply to a small division that rolls its financial statements up to a larger parent division that public reports numbers?

Mike Walworth, CPA: Jan 30, 2019 at 12:20 PM

Thanks for your question, Michael. The answer is "Yes", although I'd check with the parent to make sure it hasn't already been done on a top-side basis (otherwise they leases would be double-counted). I'd also check on their materiality threshold.

Marie Constant: Feb 10, 2019 at 12:26 PM

The FASB recently issued ASC 842 on lease accounting. ASC stands for Accounting Standards Codification. Try to research how this new pronouncement on leases reduced the problem of "off balance sheet financing." Many lessees were able to keep a liability for the lease obligation off of their balance sheets under the old rules. How did the new rules under ASC 842 make it more difficult for lessees to keep this liability off of their balance sheets?

Mike Walworth, CPA: Feb 11, 2019 at 10:07 AM

Thanks for reading, Marie. Yes, the new rules under both U.S. GAAP (ASC 842) and IFRS (IFRS 15) make it more difficult for leases to keep lease liabilities off their balance sheets because the new standards REQUIRE all leases to be recorded on the balance sheet. There are some exceptions such as "low value" assets (IFRS only) and short-term leases (both IFRS and US GAAP), but, for the most part, all LEASES will be reported. I capitalize "LEASES" because that becomes the de facto off-balance sheet test. In other words, the way to get out of recording a lease on the balance sheet is to ensure that the contract does not meet the definition of a lease. See this post for further discussion: https://www.gaapdynamics.com/insights/blog/2019/01/29/why-is-everybody-freaking-out-about-embedded-leases-asc-842/ Hope it helps!

Add a Comment

Allowed tags: <b><i><br> Add a new comment:

Ready To Make a Change?

Cookies on the GAAP Dynamics website

LeaseQuery is now FinQuery | Learn More

Operating Lease Accounting under ASC 842 Explained with a Full Example

by Kiley Arnold, CPA, Sr. Product Marketing Manager | Mar 12, 2023

1. Operating lease treatment under ASC 842 vs. ASC 840: What changed?

2. Operating lease vs. finance lease identification under ASC 842

- Transference of title/ownership to the lessee

- Purchase option

- Lease term for major part of the remaining economic life of the asset

- Present value represents “substantially all” of the fair value of the asset

- Asset specialization

3. Is lease capitalization required for all operating leases under 842?

4. Operating lease accounting example and journal entries

- Details on the example lease agreement

Step 1: Determine the lease term under ASC 840

Step 2: determine the total lease payments under gaap, step 3: prepare the straight-line amortization schedule under asc 840, step 4: on the asc 842 effective date, determine the total payments remaining, step 5: calculate the operating lease liability, step 6: calculate the right-of-use asset (with journal entry), operating lease treatment under asc 842 vs. asc 840: what changed.

Under ASC 840 , operating leases were considered off-balance sheet transactions . The rent expense associated with the arrangements was recognized in the income statement, but nothing was recorded on the balance sheet. This made it difficult to understand the total amount of commitments a company had. It could also make comparisons between companies difficult, depending on their different approaches to leased vs. capital assets.

To increase transparency, the FASB issued ASC 842, Leases . One of the main provisions of this new standard is that all leases must be recognized on a company’s balance sheet. For operating leases, ASC 842 requires recognition of a right-of-use asset and a corresponding lease liability upon lease commencement .

With the changes introduced under ASC 842, all leases are now presented on both the balance sheet and income statement whether they are operating or finance (capital) leases . The updated financial statement presentation requires issuers to show the operating ROU asset and operating lease liability separately from the finance (capital) ROU asset and lease liability both on the face of the financials and in the notes disclosures.

However, the effect of operating leases on the income statement is not changing. Companies will continue to recognize a straight-line expense for the lease payments made over the lease term as an operating expense on the statement of profit and loss.

Operating lease vs. finance lease identification under ASC 842

Operating vs. finance lease classification under ASC 842 is relatively similar to the operating lease vs. capital lease criteria under ASC 840, but certain “bright lines” for classification have been removed, consistent with the more “principles-based” approach of ASC 842. For a lease to be classified as a finance lease , it must meet one of the five criteria listed below. If the lease does not fall under any of these criteria, it is classified as an operating lease:

1. Transference of title/ownership to the lessee

Ownership of the underlying asset is transferred to the lessee by the end of the lease term.

2. Purchase option

The lease arrangement grants the lessee an option to purchase the asset , which is reasonably certain to be exercised. It is important to note, the purchase option must be reasonably certain to be exercised for this criteria to met.

3. Lease term for major part of the remaining economic life of the asset

The lease term spans a major part of the remaining economic life of the underlying asset.

Note: The FASB provided additional clarification that “major part” can be consistent with the 75% threshold used under ASC 840. Companies are allowed to determine how they will define the “major part” threshold . In practice, though, a large portion of organizations tend to lean towards using the 75% threshold previously seen in ASC 840.

4. Present value represents “substantially all” of the fair value of the asset

The present value of the sum of the remaining lease payments equals or exceeds substantially all of the underlying asset’s fair value. If applicable, any residual value guarantee by the lessee not already included in lease payments is also included in the present value calculation.

5. Asset specialization

The underlying asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term.

Is lease capitalization required for all operating leases under 842?

An entity can establish an accounting policy to exclude operating leases with a lease term of 12 months or less at lease commencement (provided they also do not have a purchase option that is reasonably certain of exercise) from capitalization on the balance sheet . Further, while ASC 842 does not have an exclusion for low-value assets, some companies have established a capitalization threshold. Similar to a capitalization threshold for fixed assets , the company has determined that leases below this value are not material to the company and therefore, are not recognized on the balance sheet.

Operating lease accounting example and journal entries

The following is a full example of how to transition an operating lease initially recorded under ASC 840 to ASC 842 accounting treatment.

Details on the example lease agreement:

First, assume a tenant signs a lease document with the following terms:

The lease begins on April 1, 2016 (commencement date) and continues for 120 full calendar months. The tenant is granted access to the premises 60 days prior to the commencement date to install equipment and furnishings (the “early access period”). Such access is subject to all the terms and conditions of this lease, except that the commencement date and the payment of rent shall not be triggered thereby.

Tenant improvement allowance

The tenant received a tenant improvement allowance , or TIA , of $1.2 million from the landlord as an incentive to sign the lease . The landlord paid the contractor directly for the construction of the improvements, which were constructed prior to the early access period.

Moving expenses

The tenant also received a reimbursement of $30,000 for moving expenses from the landlord.

Per the lease document, the first rent payment is due three full calendar months after the tenant begins operating at the leased location. Base rent is $205,000/month paid in arrears; with annual 3% increases on the anniversary of rent commencement.

Assumptions

Assume the lease is classified as an operating lease and the fair value of the building is $300 million. Assume the tenant opened for business at the location on June 1, 2016. Assume the tenant is a private company with a calendar year-end and transitioned to ASC 842 on January 1, 2022. Assume the discount rate implicit in the lease is unknown and the tenant’s incremental borrowing rate is 6% on September 1, 2016, and 9% on January 1, 2022.

The lease term stated in the contract is 120 months. The document also grants the tenant an early access period, subject to all the terms and conditions in the lease. Assuming the early access period started on February 1, 2016 – 60 days before the April 1 commencement date – then under ASC 840 the lease is accounted for beginning on that date, and the lease term is 122 months: from February 1, 2016, through March 31, 2026.

Note: To understand the difference between the commencement date, execution date, possession dates, etc, read this article on when a lease starts .

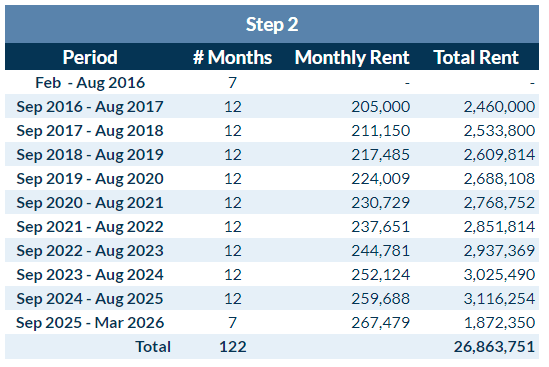

The tenant will begin paying rent on September 1, 2016 (3 months from the date the tenant opened for business). The total lease payments are $26,863,751, as illustrated in the payment schedule below.

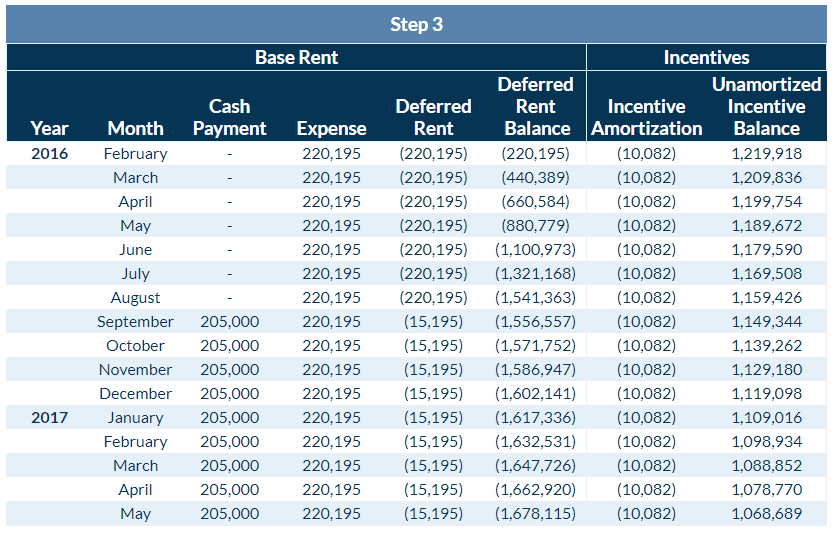

Under ASC 840, the lease term is 122 months (from step 1) and total rent is $26,863,751 (from step 2). Straight-line monthly rent expense calculated from base rent is therefore $220,195 ($26,863,751 divided by 122 months).

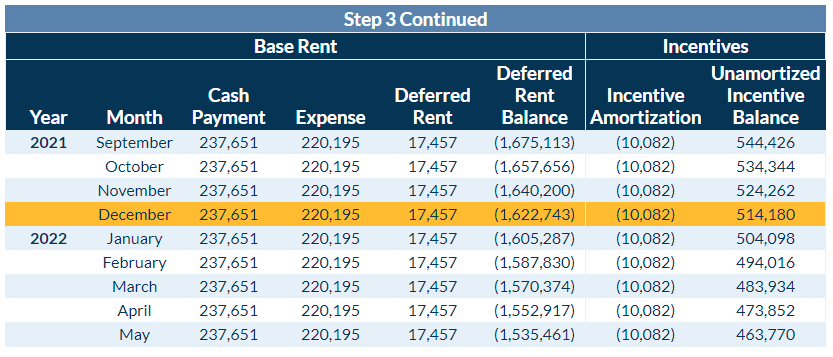

The tenant must also account for the total incentive of $1,230,000 ($1.2 million of tenant improvement allowances + $30,000 of moving expenses). Under ASC 840, the incentives are amortized over the lease term on a straight-line basis as well, resulting in a monthly credit to rent expense of $10,082 ($1,230,000 / 122 months). As a result of the incentive adjustment, periodic rent expense on the income statement is $210,113 ($220,195 – $10,082).

Below is the first 16 months’ straight-line amortization schedule under ASC 840, showing amortization of both rent and the incentives.

How is the rent-free period shown on the amortization schedule

The rent-free period is shown on the amortization table as seven months of no payment with the periodic straight-line expense accruing as deferred rent . Below is a summary of the columns in the amortization table impacted by the free rent:

- Cash Payment: This is the exact amount paid out each month.

- Expense: This is the periodic rent expense calculated from the total payment amount divided evenly over the number of months in the lease term, also known as straight-line rent expense.

- Deferred Rent: This is the difference between the expense incurred and the cash paid. In the first seven months, the company has free rent so the deferred rent amount is the total of the expense for the month.

- Deferred Rent Balance: This is the cumulative difference between the expense incurred and the cash paid. When the expense is greater than the payment the balance increases and when the expense is less than the payment the balance decreases until it is $0 at the end of the lease term.

For calendar-year private companies, the effective date of ASC 842 was January 1, 2022. The transition entry is recorded from either the start of the earliest comparative period presented or if companies utilize the practical expedient and do not present comparative financial statements, the transition date.

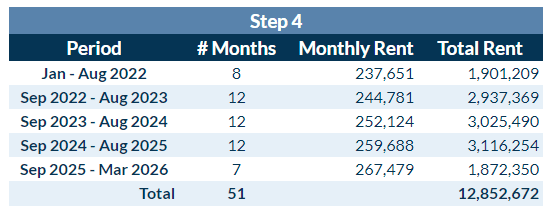

Most private companies will elect to use the practical expedient to not present comparative financial statements, so our example will as well. Therefore, the transition date for this company is January 1, 2022. The total remaining payments from January 1, 2022, through March 31, 2026, are $12,852,672, shown in the updated payment schedule below.

Since the company elected to not present comparative financials, they must calculate the present value of the remaining lease payments as of their transition date. ASC 842 requires private entities to use the rate inherent in the lease, unless that rate is not readily determinable. If the implicit rate is not determinable, the tenant has the option to use their incremental borrowing rate or a risk-free rate .

In this example, the tenant uses their January 2022 incremental borrowing rate of 9%, and payments are made at the end of the month. Using these facts and LeaseQuery’s present value calculator tool , the present value of the remaining lease payments is $10,604,260 . This is the lease liability as of January 1, 2022.

Note: The present value amount above ($10,604,260) is a simplified calculation based on Excel. The number you get should be lower than this, if you were using more accurate interest calculations, like those available in some lease accounting software solutions. Keep this in mind as you’re viewing demonstrations of lease accounting software from your choice of vendors.

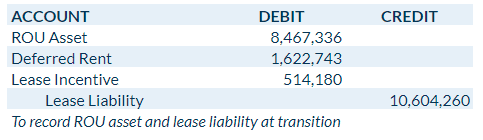

Per ASC 842, the ROU asset is the liability calculated in step 5 above, adjusted by deferred or prepaid rent and lease incentives . In this example, it is the liability of $10,604,260 plus the deferred rent balance as of December 2021, plus the unamortized incentive balance as of December 2021.

Below is a portion of the table from step 3 for the September 2021 through March 2022 periods to show how we arrive at the deferred rent balance and unamortized incentive balance as of December 31, 2021:

The formula for the ROU asset is the lease liability of $10,604,260 less $1,622,743 (accumulated deferred rent balance as of December 2021) less $514,180 (unamortized incentives as of December 2021). This gives us a total ROU asset of $8,467,336 . The journal entry to record the lease liability and ROU asset at transition clears the outstanding deferred rent and lease incentive amounts to the ROU asset and would look like this:

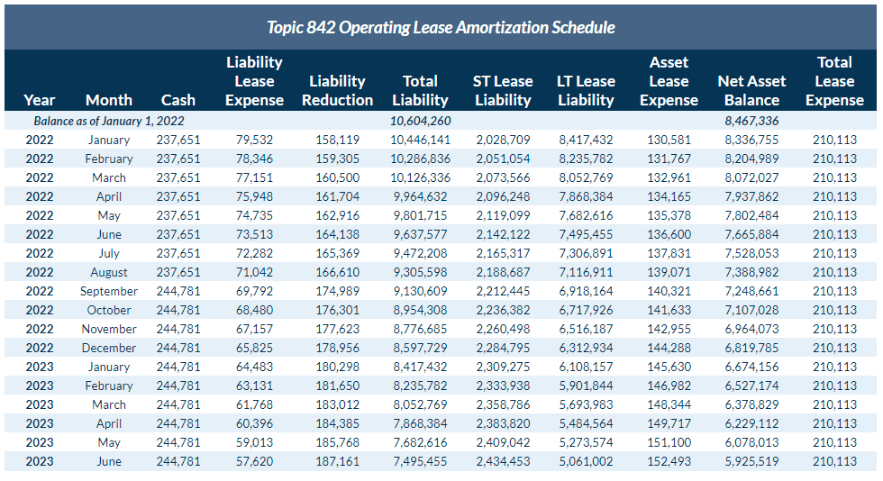

After recording the ROU asset and lease liability as of transition, the tenant would prepare an amortization table under ASC 842 to assist with the calculation of the periodic entries moving forward. Below is the amortization schedule for the lease in the example as of the transition date for a private company.

This concludes the example of how to transition an operating lease from ASC 840 to ASC 842.

Ultimate Lease Accounting Guide

For more examples of operating leases, finance leases, and more under ASC 842, download LeaseQuery’s Ultimate Lease Accounting Guide today.

© 2024 - Privacy - Terms

IMAGES

VIDEO

COMMENTS

Under ASC 842, the total lease expense is the same, but $239,000 is related to amortization, and $108,000 is related to interest expense. For 2018, we've made $324,000 in payments, but only reduced the liability balance by $216,000. Keep in mind that the impact on this balance sheet represents only a single 5-year real estate lease.

FASB Topic 842 Accounting For Leases - Presentation & Disclosure Introduction. In February 2016, the Financial Accounting Standards Board ("FASB" or "the Board") issued its highly-anticipated leasing standard in ASU 2016-02 ("ASC 842" or "the new standard") for both lessees and lessors. Under its core principle, a lessee will recognize right-of-use ("ROU") assets and ...

A fter a nearly 10-year collaboration to develop a converged standard on leasing, on Jan. 13, 2016, the IASB issued IFRS 16, Leases, and on Feb. 25, 2016, FASB issued Accounting Standards Update (ASU) 2016-02, Leases—Topic 842.The two standards differ on some points, but each accomplishes the joint objective of recognizing that leases give rise to assets and liabilities that should appear on ...

The FASB's new standard on leases, ASC 842, is effective for all entities. This guide discusses lessee and lessor accounting under ASC 842. The first four chapters provide an introduction and guidance on determining whether an arrangement is (or contains) a lease and how to classify and account for lease and nonlease components. This guide also

Resourcedownloadavailable. FASB Accounting Standards Codification (FASB ASC) 842, Leases, is effective for all entities other than a public business entity, a not-for-profit entity that has issued or is a conduit bond obligor for securities that are traded, listed, or quoted on an exchange or an over-the-counter market, or an employee benefit ...

some of the new presentation and disclosure requirements in ASC 842. Pre sentation of lease expense for operating leases, and amortization and interest expense for finance leases in the . statement of comprehensive income. is generally consistent with prior GAAP; and the presentation of cash flows arising from leases in the statement of cash ...

The entity's presentation of leases on its balance sheet, income statement and cash flows statement and the disclosures required of lessees and lessors under ASC 842; The effective date of ASC 842 and the transition guidance that should be applied in the initial implementation of ASC 842; We also shine spotlights throughout our guide on a ...

9.4.1 Current and noncurrent classification. A reporting entity that presents a classified balance sheet (see FSP 2.3.4) should report individual debt securities classified as trading, available-for-sale (AFS), or held-to-maturity (HTM) as either current or noncurrent on an individual basis under the provisions of ASC 210, Balance Sheet.

A GUIDE TO LESSEE ACCOUNTING UNDER ASC 842 Prepared by: Richard Stuart, Partner, National Professional Standards Group, RSM US LLP [email protected], +1 203 905 5027 July 2022 The FASB material is copyrighted by the Financial Accounting Foundation, 401 Merritt 7, Norwalk, CT 06856, and is used with permission.

Under ASC 840, lessees recognized capital leases on the balance sheet but only disclosed operating leases as off -balance sheet arrangements. There were no major differences in the accounting treatment for an operating lease versus a service contract. ASC 842 now changes that and, as such, the key determination will be whether a contract is or ...

On February 25, 2016, the FASB issued Accounting Standards Update No. 2016-02, Leases (Topic 842), to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing transactions. BC3.

Although ASC 842-20-45-1 permits disclosure in the notes in lieu of separate presentation on the balance sheet, ASC 842-20-45-3 prohibits combining finance lease and operating lease liabilities on the balance sheet. ... For example, if within one year of the balance sheet date, there is a lease incentive of $1,000,000 that will be received and ...

Accounting Standard Codification (ASC) 842, Leases, requires most leases to be recognized on the balance sheet and requires enhanced disclosures. The Financial Accounting Standards Board (FASB or Board) believes this results in a faithful representation of lessees' assets and liabilities and provides

Lease assets are financial assets that are subject to current and long-term presentation requirements in a classified balance sheet. For operating leases, the assets underlying the leases and related depreciation are presented in accordance with other accounting guidance (e.g., ASC 360).

When a sale-leaseback transaction results in a sale, ASC 842 provides guidance related to: (a) the buyer-lessor's accounting for the purchase of the asset, (b) the seller-lessee's accounting for the sale of the asset and (c) the buyer-lessor's and seller-lessee's accounting for the leaseback.

What is ASC 842? ASC 842, or Topic 842, is the new lease accounting standard issued by the FASB and governs how entities record the financial impact of their lease agreements. Among other changes, it requires all public and private entities reporting under US GAAP to record the vast majority of their leases to the balance sheet. This new standard was established to enhance transparency into ...

By requiring companies to recognize most leases on their balance sheets, ASC 842 ensures stakeholders have a clearer picture of a company's financial obligations and assets. ASC 842 significantly impacts financial statements and ratios. It brings most leases onto the balance sheet, affecting total assets, liabilities, and equity.

As you can see, the new accounting for operating leases under ASC 842 will substantially impact the balance sheet. This is especially true for companies with numerous operating leases such as airlines, retailers, grocery stores, and drugstores. Take for example, Walgreens, who, according to a report by LeaseAccelerator, has approximately US$34 ...

The guidance in ASC 842 should generally be applied as follows: • Determine whether a contract is or contains a lease: A lease conveys the right to control the use of identified property, plant, or equipment for a period of time in exchange for consideration. • Identify, and then allocate consideration to, the lease and nonlease components ...

balance sheet impact introduced by FASB ASC 842. The new lease standard is a fundamental change to how leases are recorded and results in significant balance sheet adjustments for almost all entities. Being mindful of the need to maintain independence (if required) when having conversations with clients regarding FASB ASC 842 may help

To increase transparency, the FASB issued ASC 842, Leases. One of the main provisions of this new standard is that all leases must be recognized on a company's balance sheet. For operating leases, ASC 842 requires recognition of a right-of-use asset and a corresponding lease liability upon lease commencement.

In February 2016, the Financial Accounting Standards Board issued new guidance over leases, Accounting Standards Update 2016-02: Leases (Topic 842), ("ASC 842"). ASC 842 requires that all leasing activity with initial terms in excess of twelve months be recognized on the balance sheet with a right of use asset and a lease liability.