PWC cover letter examples

Do you want to work for one of the largest professional service networks in the world?

A career at PWC can be interesting and very rewarding. The trouble is, you’ve got to get your foot in the door first, and that requires an impressive cover letter.

To help you create a standout application that highlights why you’d be a great fit for the company, check out our expert advice and PWC cover letter examples below.

CV templates

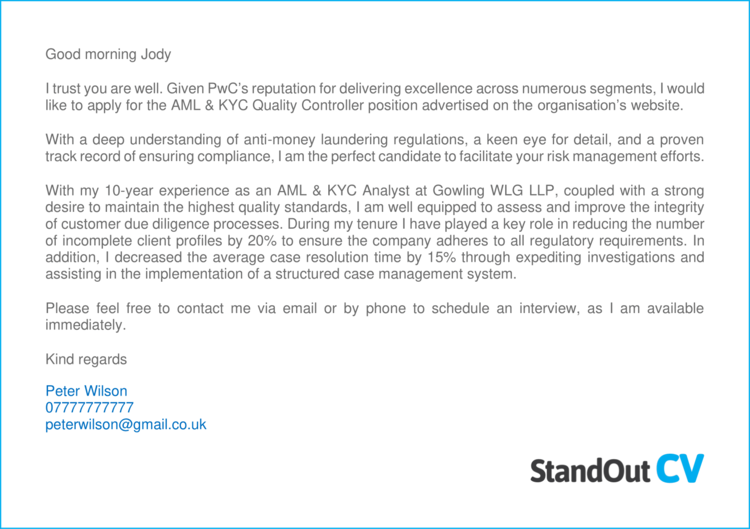

PWC cover letter example 1

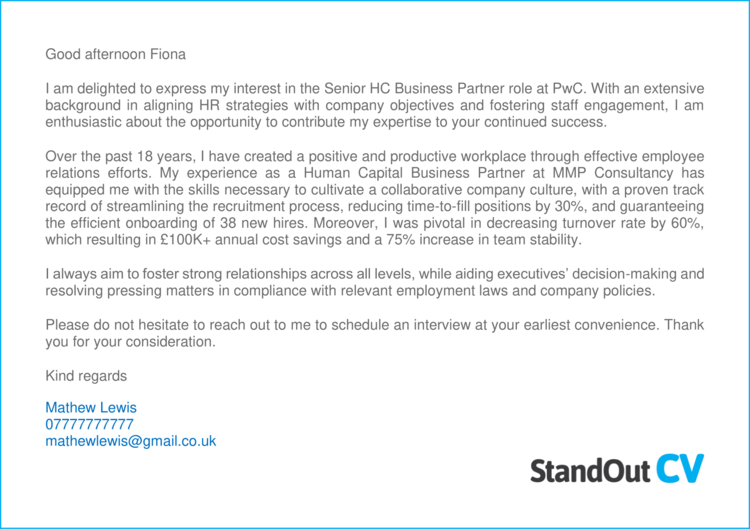

PWC cover letter example 2

PWC cover letter example 3

The PWC cover letter examples above should give you a good idea of the type of content you need to include in your own cover letter, and how it should be structured.

But if you’re really looking to wow recruiters and get your CV in front of the very best employers, then check out our guidance on how to write your own effective cover letter below.

How to write a PWC cover letter

A simple step-by-step guide to writing your very own winning cover letter.

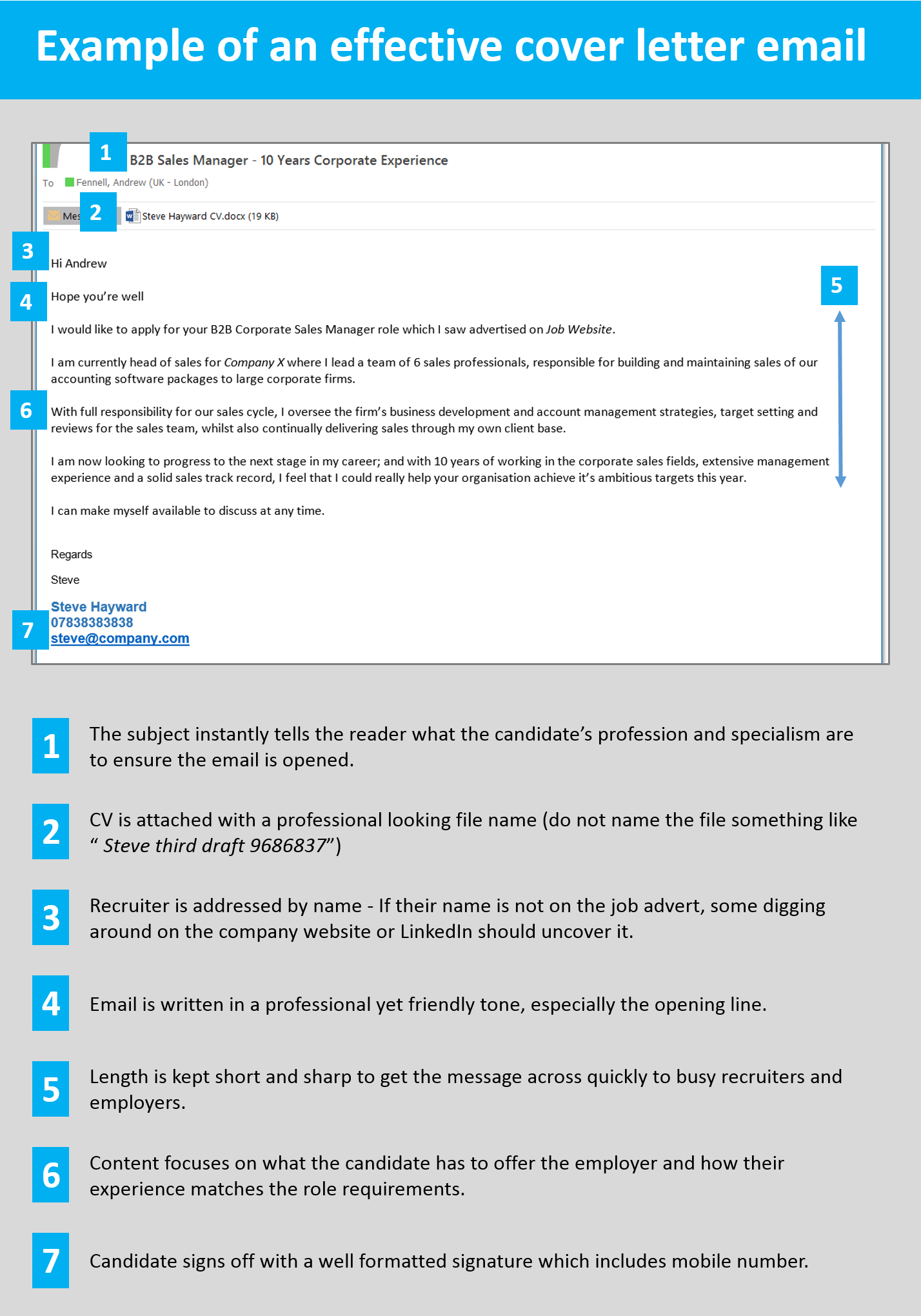

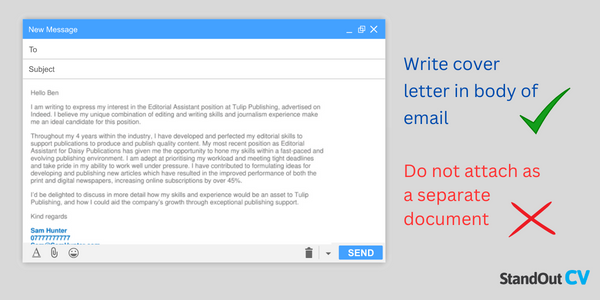

Write your cover letter in the body of an email/message

When writing your PWC cover letter, it’s best to type the content into the body of your email (or the job site messaging system) and not to attach the cover letter as a separate document.

This ensures that your cover letter gets seen as soon as a recruiter or employer opens your message.

If you attach the cover letter as a document, you’re making the reader go through an unnecessary step of opening the document before reading it.

If it’s in the body of the message itself, it will be seen instantly, which hugely increases the chances of it being read.

Start with a friendly greeting

To start building rapport with the recruiter or hiring manager right away, lead with a friendly greeting.

Try to strike a balance between professional and personable.

Go with something like…

- Hi [insert recruiter name]

- Hi [insert department/team name]

Stay away from old-fashioned greetings like “Dear sir/madam ” unless applying to very formal companies – they can come across as cold and robotic.

How to find the contact’s name?

Addressing the recruitment contact by name is an excellent way to start building a strong relationship. If it is not listed in the job advert, try to uncover it via these methods.

- Check out the company website and look at their About page. If you see a hiring manager, HR person or internal recruiter, use their name. You could also try to figure out who would be your manager in the role and use their name.

- Head to LinkedIn , search for the company and scan through the list of employees. Most professionals are on LinkedIn these days, so this is a good bet.

Identify the role you are applying for

Once you have opened the cover letter with a warm greeting, you need to explain which role you are interested in.

Sometimes a recruitment consultant could be managing over 10 vacancies, so it’s crucial to pinpoint exactly which one you are interested in.

Highlight the department/area if possible and look for any reference numbers you can quote.

These are some examples you can add..

- I am interested in applying for the role of *position at PWC* with your company.

- I would like to apply for the role of Sales assistant (Ref: 40f57393)

- I would like to express my interest in the customer service vacancy within your retail department

- I saw your advert for an IT project manager on Reed and would like to apply for the role.

See also: CV examples – how to write a CV – CV profiles

Highlight your suitability

The bulk of your cover letter should be focused around highlighting your suitability for the job you are applying to.

Doing this will show the recruiter that you are suitable candidate and encourage them to open your CV.

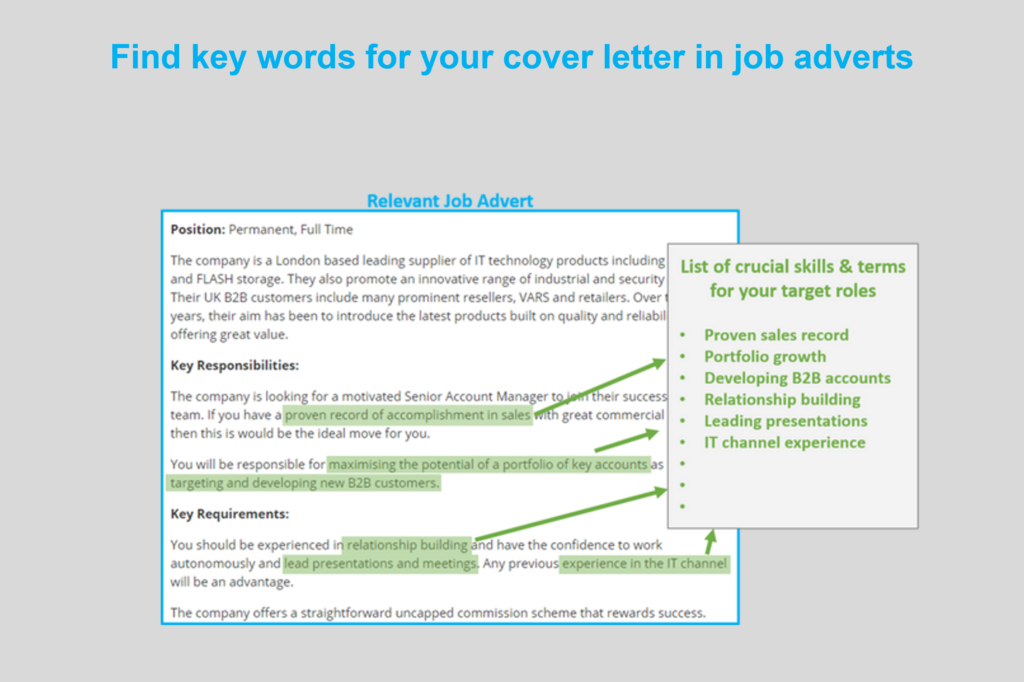

The best way to do this, is by studying the job advert you are applying to, and find out what the most important skills and knowledge are.

Once you know the most important requirements, you then need to highlight your matching skills to the recruiter. In a few sentences, tell them exactly why you are a good fit for the job and what you can offer the company.

Keep it short and sharp

It is best to keep your cover letter brief if you want to ensure you hold the attention of busy recruiters and hiring managers. A lengthy cover letter will probably not get read in full, so keep yours to around 3-6 sentences and save the real detail for your CV.

Remember the purpose of your cover letter is to quickly get recruiters to notice you and encourage them to open your CV, so it only needs to include the highlights of your experience.

Sign off professionally

To finish off your cover note, add a professional signature to the bottom, stating your important contact details and information.

This not only provides recruiters with multiple means of contacting you, but it also adds a nice professional appearance to the cover letter, which shows that you know how to conduct yourself in the workplace.

Include the following points;

- A friendly sign off – e.g. “Warm regards”

- Your full name

- Phone number (one you can answer quickly)

- Email address

- Profession title

- Professional social network – e.g. LinkedIn

Here is an example signature;

Warm regards,

Aaron Smith Customer service professional 075557437373 [email protected] LinkedIn

Quick tip : To save yourself from having to write your signature every time you send a job application, you can save it within your email drafts, or on a separate document that you could copy in.

What to include in your PWC cover letter

Your PWC cover letter will be unique to your situation, but there are certain content guidelines you should stick to for best results.

To attract and entice recruiters, stick with the following key subjects in your cover letter – adapting them to fit your profession and target jobs.

- Your professional experience – Employers will be keen to know if your experience is suitable for the job you are applying to, so provide a good summary of it in your cover letter.

- Your qualifications and education – Highlight your most relevant and high-level of qualification, especially if they are essential to the job.

- The positive impact you have made – Employers love to hear about the benefits you can bring to them, so shout about anything impressive you have done, such as saving money or improving processes.

- Your reasons for leaving – Use a few words of your cover letter to explain why you are leaving your current job and ensure you avoid any negative reasons.

- Your availability – Let recruiters know when you can start a new job . Are you immediately available, or do you have a month notice period?

PWC cover letter templates

Copy and paste these PWC cover letter templates to get a head start on your own.

Good morning, Jody

I trust you are well. Given PwC’s reputation for delivering excellence across numerous segments, I would like to apply for the AML & KYC Quality Controller position advertised on the organisation’s website.

With a deep understanding of anti-money laundering regulations, a keen eye for detail, and a proven track record of ensuring compliance, I am the perfect candidate to facilitate your risk management efforts.

With my 10-year experience as an AML & KYC Analyst at Gowling WLG LLP, coupled with a strong desire to maintain the highest quality standards, I am well equipped to assess and improve the integrity of customer due diligence processes. During my tenure I have played a key role in reducing the number of incomplete client profiles by 20% to ensure the company adheres to all regulatory requirements. In addition, I decreased the average case resolution time by 15% through expediting investigations and assisting in the implementation of a structured case management system.

Please feel free to contact me via email or by phone to schedule an interview, as I am available immediately.

Kind regards

Peter Wilson

Good afternoon, Fiona

I am delighted to express my interest in the Senior HC Business Partner role at PwC. With an extensive background in aligning HR strategies with company objectives and fostering staff engagement, I am enthusiastic about the opportunity to contribute my expertise to your continued success.

Over the past 18 years, I have created a positive and productive workplace through effective employee relations efforts. My experience as a Human Capital Business Partner at MMP Consultancy has equipped me with the skills necessary to cultivate a collaborative company culture, with a proven track record of streamlining the recruitment process, reducing time-to-fill positions by 30%, and guaranteeing the efficient onboarding of 38 new hires. Moreover, I was pivotal in decreasing turnover rate by 60%, which resulting in £100K+ annual cost savings and a 75% increase in team stability.

I always aim to foster strong relationships across all levels, while aiding executives’ decision-making and resolving pressing matters in compliance with relevant employment laws and company policies.

Please do not hesitate to reach out to me to schedule an interview at your earliest convenience. Thank you for your consideration.

Mathew Lewis

I hope you are well. I am writing in response to the Audit Manager vacancy at PwC. With a robust background in audit and assurance, experience in managing high-performing teams, and a commitment to delivering exceptional client service, I am eager to contribute my skills to your esteemed firm.

Over the course of 18 years working in various accounting-related roles for Goldhawk Ltd, I have consistently demonstrated an ability to lead and execute complex audit engagements, while upholding the highest standards of quality and integrity. My experience as an Associate Audit Manager, combined with a dedication to continuous improvement and strong client relationships positions me to thrive in collaborative and dynamic settings.

All my colleagues recognise my capabilities to thrive in a fast-paced environment, as I have been pivotal in ensuring 100% compliance with regulatory requirements and industry policies across 200+ audit engagements, I also implemented controls that lowered risks by 15%, as well as increased junior team members’ overall performance and technical proficiency by 40% through targeted training initiatives.

Please do not hesitate to reach out to me to schedule an interview at your earliest convenience.

Chris Murphy

Writing an impressive cover letter is a crucial step in landing a job at PWC, so taking the time to perfect it is well worth while.

By following the tips and examples above you will be able to create an eye-catching cover letter that will wow recruiters and ensure your CV gets read – leading to more job interviews for you.

Good luck with your job search!

Clinical psychology

- Anxiety disorders

- Feeding and eating disorders

- Mood disorders

- Neuro-developmental disorders

- Personality disorders

- Affirmations

- Cover Letters

- Relationships

- Resignation & Leave letters

Psychotherapy

Personality.

Table of Contents

Cover letter for PWC(4 samples)

As a BetterHelp affiliate, we may receive compensation from BetterHelp if you purchase products or services through the links provided.

The Optimistminds editorial team is made up of psychologists, psychiatrists and mental health professionals. Each article is written by a team member with exposure to and experience in the subject matter. The article then gets reviewed by a more senior editorial member. This is someone with extensive knowledge of the subject matter and highly cited published material.

This article will list samples of “cover letters for PWC.”

Samples of PWC cover letters

When applying for a position at PWC, your cover letter is an opportunity for you to tell your story, without being stuck in the formatting constraints of the resume. The best format for writing a cover letter is as follows:

- Address the employer with a formal salutation. For example, “Dear/Hello (name of the recipient).” If you do not know the recipient’s name, you can refer to them as the hiring manager.

- The next step is to state the position you are applying for and how you found the opening.

- Make a brief statement about why you’re interested in the position. Write a paragraph about why you are the perfect candidate for the job.

- State your skills and work experience. Ensure your skills and experiences are similar to the job position. When highlighting skills, provide the accomplishment you have achieved.

- Conclude your letter with a forward-looking statement. For example, “I look forward to discussing the position further.”

“Dear Hiring profession:

I attended your recruitment talk at Polytechnic University on 13 Sep and I was impressed by the prospect of an audit and international atmosphere at work in PwC. Since I have a compound background in both Engineering and Finance and I am currently pursuing a master degree in accounting expected to graduate in 2017, I welcome the opportunity to become a part of the PwC Assurance team and utilize my knowledge and skills to assist your clients to achieve their goals.

One of the primary competencies for a professional service provider is to communicate with clients effectively and efficiently. This skill is extremely essential to an auditor and I have some work experience to interact with customers as a rep. in a mutual funds company. This is the first job I conducted after graduation when I need to handle a large amount of inquiries and complaints from our clients. And I have to say it was an amazing opportunity to enhance my communication skills with customers from different background and I need to put myself on their shoes to understand the point what they want to deliver. This entry level position gave me a better understanding of the needs of various clients and how to offer them the most suitable service.

Except for proficient social abilities, another ability that plays a vital role in a career of an analyst is data analyze skills which include how to sort out mass of data and evaluate these evidence critically. I still remember the first time I got involved in some data analysis work was when I was appointed to be responsible for our official social media account and content marketing job. In order to plan a solid online marketing strategy I have to dig and collect tons of data to figure out the trend on the Internet and finance market as well as the habits and interests of web users. Even now I am still learning the database and Python techniques to improve my data processing skills as I believe these experience and tools will give me an apparent advantage in my career.

I define myself as a lifelong learner and what I value is personal growth both in work experience and mindset. I believe that to joining in PwC is the ideal beginning to launch my career in public accounting and help me grow fast and enrich my life. I sincerely appreciate your time and consideration.

Fan Bintai”

“Graduate Job in Consulting – Strategy

Having two degrees in business and management, I have strong enthusiasm and determination to enter the career path. I take my intentions seriously as building a brilliant career is a priority to me in order to realise my potential. Now I am intensively looking for a place to apply my knowledge I have acquired at university. My aspiration is to become a part of an organisation that makes significant changes in the world economy. To achieve this, I want to work within a graduate programme that would not only give me a chance to specialise in an area like consulting but also have opportunities to continue my development with training courses and professional accreditations. I believe the scheme at PwC offers just that.

I would relish the opportunity to work for a global professional services company that is highly respected by its clients and society in general. Moreover, your leading positions in such famous rankings as The Times Top 100 Graduate Employers and The Times Top 50 Employers for Women definitely strengthened my motivation to apply to you. For me, it shows your emphasis on investing in young female people. Therefore, I believe that I have the right combination of relevant skills to succeed in this role. I can define my strongest skills as follows: excellent interpersonal and communication skills, great analytical and research skills, leadership skills, and global acumen.

In terms of this graduate position, I think there are few attributes that would give me an advantage over other PwC candidates. Firstly, I speak fluently three languages and have basic knowledge in other three languages. Secondly, I effortlessly moved to the UK to do my master’s degree which signifies my ability to transcend any cultural or geographic barriers. Finally, I already have experience in working with a consultancy company. In particular, I successfully led a group of 6 students in a consulting project and delivered an individual report about the ways to improve interorganisational collaboration between professional service firms.

I appreciate your time taken to consider my application. I look forward to hearing from you.”

“The Human Resource Manager

P.O Box 8965-00100

Dear Mahinda,

RE: APPLICATION FOR THE GRADUATE TRAINEE PROGRAMME

I wish to express my interest in the above mentioned position as advertised in the newspaper. I graduated in October last year with a second class upper Bachelor’s degree in Communications from Kenyatta University.

I believe my excellent communication and interpersonal skills that I developed during my course work and attachment at ABC Company make me the best candidate for this position.

I am confident that your organisation’s graduate programme will help me to gain valuable experience in the industry.

Please find attached my CV for your consideration. I look forward to discussing the value I will be bringing to your company.

Yours Sincerely,

Michelle Wanjiku”

“MONTH DAY, YEAR

RECRUITER’S NAME

RECRUITER’S TITLE

OFFICE ADDRESS

Dear [RECRUITER] and members of the McKinsey recruiting team,

Thank you for considering my application for Business Analyst at PWC. I am attracted to PWC because of the firm’s commitment to create an unrivaled environment for exceptional people by developing one another through apprenticeship, mentoring, and sustaining a caring meritocracy.

Given the opportunity to join PWC, I would bring to the firm my entrepreneurial drive, problem solving skills, and a collaborative approach.

- Entrepreneurial drive: I was a scholarship athlete on the [UNIVERSITY] football team and was expected to arrive on campus a month before classes started. This reduced summer availability left me at a disadvantage for traditional summer internships, so I founded my own landscaping business. It was grassroots, and I conducted business relationships built on trust and relied on word of mouth. To ensure superb deliverables, I taught myself Google Sketchup to model my projects before building them. I learned about drainage and construction techniques using YouTube videos and manufacturer websites so that I could build retaining walls and outdoor structures. Using self-taught skills, I netted $30,000 in profit over the course of 3 summers which was a major source of funding for my education.

- Problem solving: To increase the competitiveness of our off-season testing, the [UNIVERSITY] strength staff started an event called the “Tricolour Draft.” As a captain in this draft, I was responsible for drafting a team of my peers. Rather than relying on my perception of players, I took a more empirical approach. After seeking out the previous year’s testing numbers, I entered them into Excel and added projections for players who were new to the team. I was then able to rank all my teammates based on their average performance across all the tests. I drafted my team strictly according to the unbiased rankings on this list and let the opposing teams draft based on their subjective feelings. My team ended up winning the competition and, using the exact same approach, I won the following years Tricolour Draft as well.

- Collaborative: When I was 4, my parents took roles as expats and moved our family to Khartoum, Sudan. I went to an international school but lived among the locals. This resulted in a unique environment to grow up in and one where I developed some great relationships. One such relationship was with a company employed driver, for whom I was the best man at his wedding at the age of 7! I quickly realized that everyone, from my peers to the locals, brought something to the table. I learned that people from all walks of life possessed valuable perspective and input worth considering. This recognition of diversity and drive to collaborate has given me the skills to produce results on teams and to form meaningful relationships with people of varied backgrounds.

I hope to bring these same attributes to PWC. Thank you for your consideration.

E-SIGNATURE

Frequently Asked Questions:

What are the common mistakes to avoid when writing a cover letter.

Here are a few common mistakes to avoid:

- Don’t focus on yourself too much.

- Don’t write salary expectations.

- Avoid wrong paragraphs.

What should my purchasing manager cover letter contain?

The main purpose of a cover letter is to introduce yourself, mention the job you’re applying for and show that your skills and experience match the needed skills and experience for the job.

If you like this blog post, please leave your comments and questions below.

Sample PWC Kenya Graduate Recruitment Cover Letter

Was this helpful?

Related posts, cover letter for hse position (5 samples), cover letter for lunch monitor (5 samples), cover letter for dnata equipment operator(5 samples).

Community of solvers

Publications and interviews

Loading Results

No Match Found

Application tips

Eight tips for successful applications.

Applying for a job or internship can be nerve-wracking. After all, nobody applies for positions they don't want! The following practical tips will help you maximise your chances of a career at PwC. The chances are that at least one will be useful.

Use your CV to clearly distinguish yourself from other students

Naturally, as a student, your CV will predominantly consist of information about your education rather than an extensive list of employers. We therefore especially want to hear what you do outside your studies, what part-time jobs and volunteer work you have done and whether you are active in any associations. And don't forget to mention your hobbies! This information helps to paint a more complete picture of who you are and what you can do before we meet you in the flesh.

Carefully check the spelling and grammar of your e-mail and CV

First impressions are extremely important. We're sure you'd never do something like this, but we sometimes receive applications that are full of spelling mistakes and bad grammar. If you've been known to misspell things now and again, then be sure to pay extra attention to this aspect or ask someone else to read through your application first.

The recruiters are here to help!

PwC's recruiters are always available if you have any questions about the procedure, what the job entails or general tips. Call or e-mail them if you are unclear about anything.

Do your homework on PwC

Make sure you have a definitive answer to the question Why do you want to work for PwC? , as this question plays a major role in the interviews. These interviews are a way for both sides to make acquaintance, so mutual interest in each other ensures a good start. If you'd like to know more about us, then you can attend one of the recruitment activities or contact us for other possibilities.

Contact a PwC professional in your network

Explore your own network to see if you know anybody who works for PwC: the chances are greater than you might think. Ask your family, friends, neighbours and acquaintances if they know anybody. If they do, then it's a great way to learn more about a particular position and what it's like to work for PwC.

Make a clear choice

Apply for a position that you are truly interested in. That's a much better strategy than simultaneously applying to five different jobs. And be sure to clarify in your cover letter why you think this vacancy/internship is right for you.

Dress smartly

Wear something that would give you confidence in a professional environment. We do not expect you to buy a new suit for your interview: you'll have plenty of time to expand your wardrobe once the application process is complete!

Ask questions

Consider in advance what you would like to know about us. After all, we'll be asking a lot about you! Make sure you ask for all the information you wish to know, e.g. by writing down all of the questions and learning them in advance.

Do you have questions about our application process? Just contact the recruiter who is mentioned in the specific vacancy.

Contact recruiters

Check our job opportunities

© 2017 - 2024 PwC. PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Legal disclaimer

- Terms and conditions

- About site provider

- E-mail webmaster

- Reporting & Whistleblowing Procedure

Pwc Cover Letter

Check out these pwc cover letter templates and examples previously used by job seekers to land on job interviews at pwc. use our ai cover letter generator to create a personalized cover letter for pwc..

4.5 Star Rated / 523 Users

Automatically apply on 1000's jobs in a single click.

Job Application Automation

Interview Answer

Resignation Letter

Job application bot

Cover Letter Examples

© 2024 Copyright LazyApply.com

Sample cover letter for Internship position at PwC

Management consultant, got the job yes.

1. Assurance has long been the business generating the largest part of PwC’s global revenues, accounting for 46%, 43% and 42% in 2013, 2014 and 2015 respectively. While consulting has been experiencing rapid growth in recent years (8% in 2013, 10% in 2014, and 18% in 2015), and with such a rapid growth, the combined revenues of consulting and assurance have represented around three quarters of PwC’s global revenues in the past three fiscal years. Joining the Assurance/Consulting programme would allow me to gain experience and acquire knowledge from both the biggest business and the fastest growing business in PwC. The cross-business experience and knowledge can equip me with a diverse skill set and be a solid fundamental of my future career.

2. Working in both assurance and consulting areas provides me the opportunity to apply my different skill sets and abilities into different types of business in the financial service industry.

Studying accounting and finance in both my undergraduate and graduate education, I believe the knowledge of accounting can be an advantage for me to start my work in assurance and make me adapt to day-to-day tasks in this area within a relatively short time.

Compared to assurance, consulting business requires more creativity and innovation in order to provide innovative solutions focused on different aspects of company operations, such as strategy, management, technology and risk. Working at Citibank as a personal banker trainee, I developed and showed such abilities via producing original business plans to promote newly-issued financial products.

As I used to work in different areas in financial services, such as private banking, the tax department in an accounting firm and the credit department in a commercial bank, I have gained quick-learning skills and adaptability in different service areas. These skills can help me to be fully prepared and confident when transferring from assurance to consulting or dealing with problems from different industries.

3. The training and development in both assurance and consulting areas are another reason for me to choose this programme. Over the first four years, PwC offers training towards the Chartered Accountant (CA) qualification, which is the first step to becoming a chartered accountant. After transferring to the consulting area, on-the-job learning opportunities and a robust learning curriculum are helpful for me to quickly integrate with the consulting team.

- CV Templates

- Cover Letter Examples

Senior Associate PwC cover letter example

Contact name Position Company name Address 1 Address 2

18 th January 2024

Dear …………, Whilst browsing the job adverts on the Dayjob.com website, I came across your vacancy for a Senior Associate. I am confident in my abilities and would like to put myself forward for this position.

I possess the powerful intellect along with the strong analytical skills needed to get results, implement constructive change, and improve inefficiencies.

I come to you as a highly motivated and resilient Senior Associate who leads by example and who has very strong operational experience in your areas of operations. As per your requirements I can maximise financial performance by utilizing technology to drive process improvements in your finance and accounting processes. In essence I have the financial skills and knowledge needed to provide the best possible service to your company and its clients.

What I feel really makes me unique is my experience of working with high profile cases which may have a greater level of economic impact or risk for your firm. I have a well-honed eye for detail and am comfortable putting data and customer metrics under the spotlight to find valuable statistics. It is this skill coupled my good client management competencies that allows me to have a pragmatic and solution-focused approach to my work.

With my current employer I have had an influence on the future success of my business. At work I provide information and advice about financial decisions and investment moves to colleagues and clients. Furthermore, I prepare and present research findings to both internal and external stakeholders. I have a reputation with senior managers for being someone who takes on those complex fee-earning matters that others avoid. One of the secrets of my success is getting everyone pushing in the same direction by making sure all teams communicate effectively through regular documented meetings and calls.

Through my career I have gained exposure to various industries and become fully certified in leading financial software solutions and tools. Aside from my technical competencies, I have also learnt how to remain calm when under pressure and break problems down into smaller manageable parts.

On a personal level I am passionate about building strong relationships with my clients, colleagues, and the communities I work in. This is something I can do due to my strong oral and written communication skills which allow me to talk with a variety of people in different environments.

At this stage of my career, I want to join a reputable company like yours that is passionate about finding eager, knowledgeable individuals and supporting them to become leaders in their field. After reviewing my attached resume, please feel free to contact me to arrange an interview or if you require any further information from me. Should you find interest in my application, then I will be available for an interview at your convenience. In closing I would like to thank you for taking the time to review my application.

Yours sincerely,

Name Address 1 Address 2 Tel: 0044 123 456 7890 Email: [email protected]

More Senior Associate cover letters

Senior Associate cover letter example Senior Associate cover letter example 1

Senior Associate resume examples

Senior Associate resume Senior Associate resume 1 Senior Associate PwC resume

More cover letters Cover letter examples

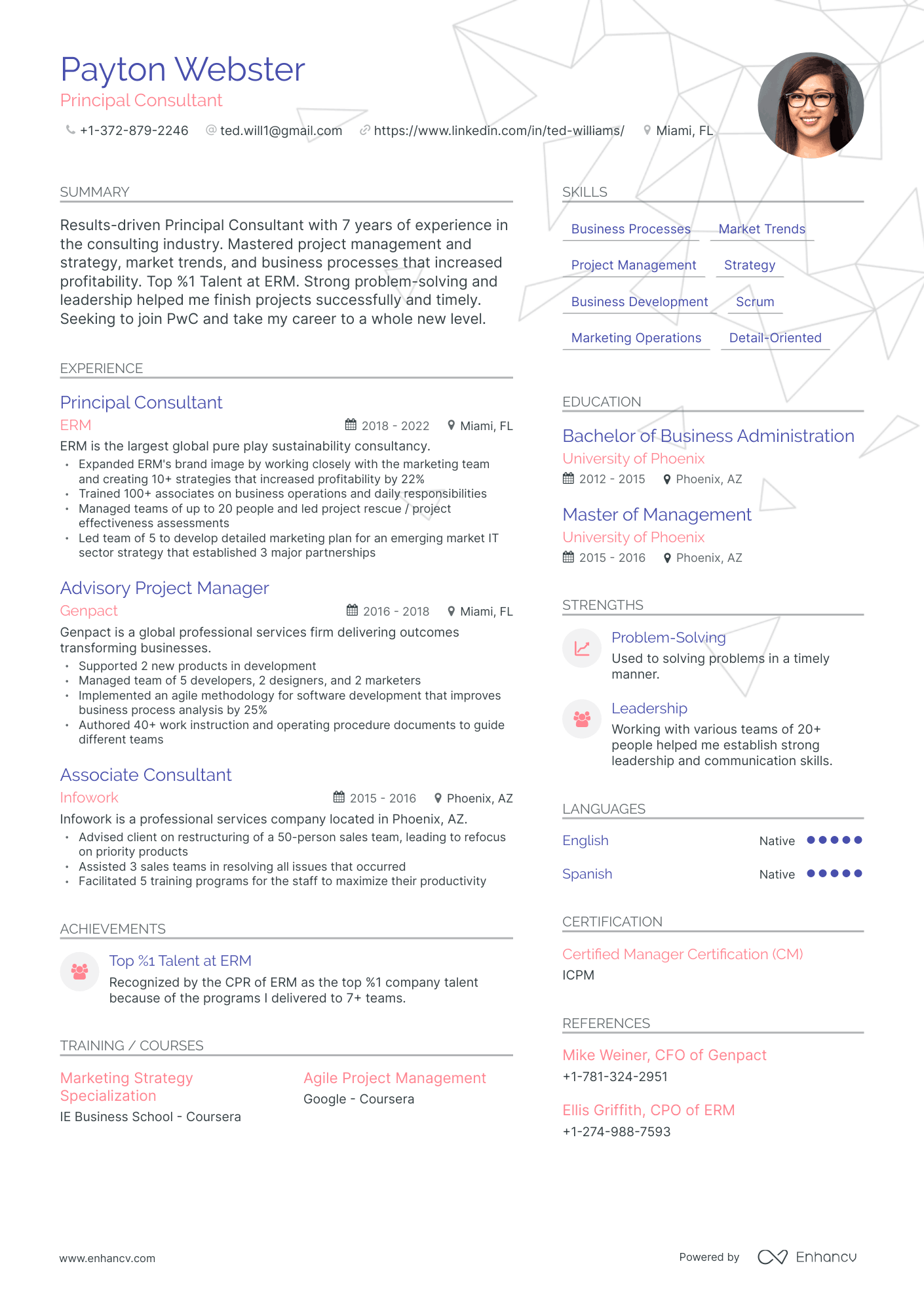

- • Expanded ERM's brand image by working closely with the marketing team and creating 10+ strategies that increased profitability by 22%

- • Trained 100+ associates on business operations and daily responsibilities

- • Managed teams of up to 20 people and led project rescue / project effectiveness assessments

- • Led team of 5 to develop detailed marketing plan for an emerging market IT sector strategy that established 3 major partnerships

- • Supported 2 new products in development

- • Managed team of 5 developers, 2 designers, and 2 marketers

- • Implemented an agile methodology for software development that improves business process analysis by 25%

- • Authored 40+ work instruction and operating procedure documents to guide different teams

- • Advised client on restructuring of a 50-person sales team, leading to refocus on priority products

- • Assisted 3 sales teams in resolving all issues that occurred

- • Facilitated 5 training programs for the staff to maximize their productivity

5 PwC Resume Examples & Guide for 2024

Your PwC resume must clearly reflect your expertise in financial services and accounting. Showcase your experience with big-ticket audits, tax services, or consultancy projects. Demonstrate your proficiency in relevant software and analytical tools used in professional services. It's crucial to highlight your ability to adapt to the fast-paced environment at PwC.

All resume examples in this guide

Traditional

Resume Guide

What you’ll learn here, looking for related resumes, how to write a resume and get hired at pwc, pwc resume formats, an associate project manager header section that meets pwc expectations, pwc raining manager resume summary section that starts the spark, pwc business consultant resume experience, the skills that are a must on a pwc resume, achievements are the groundwork for success in life and in a resume, training / courses section displays your ambition towards growth, education is the starting point of a pwc principal consultant resume, what certifications to add to your resume, languages highlight your communication ability, key takeaways.

PricewaterhouseCoopers, or just PwC, is one of the Big 4 consultancy companies and the world's largest professional services firm by revenue.

If this sounds crazy to think of, look at this fact:

90% of employees at PricewaterhouseCoopers LLP say it is a great place to work

This company has an enormous impact on our society positively.

In fact, one of its values is to build trust in society and solve important problems.

This is why PwC is extremely selective about the people who represent the brand.

Do not get worried! We got you!

Because in just a few short minutes, you will learn how to write the perfect resume so that recruiters will beg you to bring your career to the next level.

Keep reading this guide and learn how to devise the ideal application with a resume builder !

- How to grab the attention of potential recruiters and make your resume stand out

- List skills and strengths that show competence

- The most valuable sections to include in order to succeed

- How to present your strengths and accomplishments and in the right way

- Business Consultant

- Project Analyst

- Associate Project Manager

- Training Manager

- Product Manager

- Commercial Project Manager

- Project Coordinator

- Project Controls Manager

- Program Analyst

- Project Director

- Product Development Manager

So rather than me just talk from the top down, I actually want to engage from the bottom up, which is about making sure that communication and transparency is visible to all of our employees because, as I said, if I can get 39,000 people doing a little bit better each and every day, the place has unbelievable exponential potential.

Bob Moritz, CEO of PwC

Bob Moritz, the CEO of PwC, tells us what is the most valuable aim you have to accomplish with your resume.

Making a difference.

By doing **a little bit better **each day.

This is how you can prove to be the shining gem amidst other applicants.

And it is to show that you can make the most difference in proliferating the goals and values of the company.

Making a difference is one of the 5 values PwC’s company culture adopted. The others are:

- Act with integrity

- Work together

- Reimagine possible

If you have these 5 values as a starting point, you will be on the right track when building your resume. Here are some examples of how exactly you can do that:

- Show that your presence in your prior places of employment has changed them for the better

- Let them see that the principles and experience you bring to the table not only support the company but push it to grow

- Describe you engage your colleagues toward progress and integrity

Push your abilities to the forefront of attention by including them in your Experience and Strength sections!

Learn to not brag about your achievements, but acknowledge them accurately and fairly.

Do not forget to include an Education and Courses section to show that you have put in the effort to acquire competence and have the motivation to grow.

Let references increase your credibility!

Keep on reading and learn how to make your other resume sections !

These are the ideal resume formats for a job at PwC:

- Reverse-chronological resumes give the perfect opportunity for candidates just starting out in the industry.

- Functional resumes present transferable skills for applicants seeking change in their career paths.

- Hybrid resumes are the most widely applicable.

However, do not ignore these brilliant tips:

- Utilize the 12p resume font size and 10’ resume margins

- One-page resumes are the way to go when you lack the 10 years of experience where you can add more pages

- MS Word resume templates are your optimal choice in this case

Top resume sections when applying at PwC:

- Craft an Experience section that highlights the multiple application of your skills

- Let your Achievements speak for themselves

- Try to illustrate your leadership capabilities in your Skills section

- The Reference section should be used to present some social skills to your whole resume

What PwC recruiters want to see on your resume:

- Results in positively expanding a company’s image.

- How do you perform while working in a team, and do you reach objectives?

- Describe a tense situation that made you go that extra mile

- How has your presence aided in conflict resolution?

- What do previous employers and colleagues think of you?

Do you think you can make a powerful first impression on the recruiters just as their eyes fall on your resume?

Well, it is an absolute possibility, and here’s how you can do it!

You are an associate project manager, and one of your main tasks is to ensure that projects will be completed with regard to quality and time frames.

To be a great leader, you have to be clear and precise in your instructions. And the best way to show that to just an initial glance is by stating your name and contacts.

- Phone number

- Email address

The name and email address should be the same as your ID card and social media accounts.

The job title should correspond to the position you are looking to attain, otherwise, it can be whatever you choose.

It is a great choice to also include a link to your LinkedIn profile!

This is exactly what puts you a step ahead of other applicants!

Now take a look at some other tips and tricks on how to craft the best Header section !

2 Associate Project Manager Resume Header Examples

The Summary section has one primary function and one primary function alone.

It is to retain the attention of the recruiters at PwC and make them keep reading.

Being vague with the information you share about yourself here can mean a doomed resume.

That does sound like writing the section would be quite nerve-wracking but you shouldn’t worry.

Because you have this guide to lend you a hand!

Being a training manager has a lot to do with managing people.

But you manage people in order to accomplish a certain goal.

That is why in this section you had better mention your potential for contributing to such firm goals and support those statements with quantitative data from experiences.

We have prepared a couple of pieces of advice on how you can build the perfect training manager resume summary :

- Don’t leave out years of experience

- Use said quantitative data to prove your worth

- Include the skills and talents that you have already mastered

- Let the recruiters know your future expectations of the position in accordance with you

Take a look at the following two examples before you make your own!

2 training manager resume summary examples

The way experiences are usually mentioned on a resume is by just listing the places of your previous employment.

Is that wrong?

No. Looking at it plainly, this is what this section is. But being a business consultant is not something people who look plainly at things choose to do.

Nor is PwC company culture tolerating mediocrity.

Therefore, you shouldn’t be satisfied with just that.

What should you be doing then?

This is the guide that will teach you just that! You have to prove to the recruiters that your words are not just words, but are facts that speak to results.

Present them with these exact results. Don’t let your Experience section be plain facts. Let it be the instrument that puts your true potential through to them.

Describe the measurable progress you have caused in your previous jobs to prove your quantitative worth. The worth you now bring to this position.

To accomplish this desired effect with your Experience section, follow these three tips:

- Use clear statements of facts combined with power and action verbs

- Use numbers correctly

- Show how you have not only managed but been a leader with prior teams

Now, please, have a look at the following two examples.

Business consultant resume experience examples.

- • Coordinated design reviews and wrote many test plans

- • Created tons of strategies and business plans

- • Met with customers to perform an in-depth design review

- • Supported sales teams by delivering marketing presentations and software GAP analysis

Do not list irrelevant information that provides no value.

The candidate above obviously does not take the job offer seriously, as they do nothing to stand out.

On the other hand, the second applicant shows an Experience section that is 10 out of 10.

And they are highly likely to be recognized for their attention to detail in listing such bullet points.

- • Coordinated 100+ design reviews and wrote 20+ test plans

- • Created 10+ strategies, authored 2 business plans, and consistently exceeded client expectations and objectives

- • Met with 200+ customers to perform an in-depth design review to analyze and implement business requirements

- • Supported 3 sales teams by delivering marketing presentations and software GAP analysis weekly

Program analyst resume experience examples

- • Applied quantitative and qualitative analysis to assess the business operations

- • Identified routine problems that, after being solved, reduced expenses

- • Developed and conducted program analysis concerning operating programs

- • Prepared memos, transmittal letters, and management reports

When duties and responsibilities are written professionally, they speak volumes.

When they are not, well, increases the number of no-interview applications.

While the first applicant is vague, the second one impresses with coherent statements backed up with quantitative data.

- • Applied quantitative and qualitative analysis to assess the business operations of 20+ companies

- • Identified 3 routine problems that, after being solved, reduced expenses by 9%

- • Developed and conducted program analysis concerning 10+ operating programs

- • Prepared 100+ memos, 50+ transmittal letters and 40+ management reports

Try to include statements that convey the feeling of authenticity. You might not be a high performer, but one is more than zero. Therefore, if you created just one business plan, describe your efforts that brought it to life.

As we have already said in this guide, your job at PwC might require you to be a leader at one point.

But there are some skills that you have to mention before you can show recruiters that quality.

Your Skills section not only describes you in a few words, but also shows something else quite important.

And that is your ability to proliferate the company’s values while in this role through these skills.

Therefore, try to prove in other sections of your resume that you are indeed a team worker, empathetic individual, or whatever you listed as a soft skill.

Otherwise, you will lose credibility, and the recruiter is less likely to believe in you and your intentions.

Soft skills for PwC resumes:

- Conflict Resolution

Recruiters often use software to scan preliminarily over your resume for these hard skills just to let you through the door.

So definitely be sure to mention the ones listed below if you are the project coordinator or project director.

PwC project coordinator resume's technical skills:

Pwc project director resume's technical skills:.

- Business Development

This is how you mention your strengths without bragging

This section is very easy to lose a handle on and make it sound like bragging.

But you shouldn’t!

This is not the point of the section!

What you should be doing is describing as best you can your personal and professional self positively. Mostly, write about where those two selves overlap.

For example, if you mention leadership, you should let them know how exactly you have worked with a team of people to achieve a goal.

Have you gotten the hang of it?

If you need a bit more support, be sure to check out the two examples below.

As a professional with years of experience in the field, you have doubtlessly received many recognitions and acknowledgments in the industry.

But do you think that actually tells recruiters something?

Your goal here is to show them how exactly you have been exemplary.

Imagine the following entry in your achievement section: \

“Recognized by the CPR of ERM as the top %1 company talent because of the programs I deliver to 7+ teams.”

This simple sentence has got the eyes of the recruiters now glued to your resume!

Naturally, don’t stray too far from the intended job offering for the particular position.

Allow us to explain what we mean by asking you a simple question.

Would you rather have a doctor that has earned a medical degree and has practiced successfully ever since, or would you rather have the same doctor that has decided to learn even further and grow beyond medical school?

The answer is obvious, of course!

And this is exactly what you want to PwC!

You are not just someone who got their degrees and left their interest towards the profession there.

You are the applicant that decided to take further courses and take part in more training.

What does that show?

Commitment? Yes!

And it also shows the desire you have to not stagnate, but instead, evolve.

See exactly how you can show them that evolution through the examples below!

What the Education section does on a fundamental level is to show recruiters some foundational things required for the position of principal consultant.

What the Education section cannot contribute to your resume are:

- the skills you possess in communicating with people

- the leadership potential

- stability you have, necessary to make a project successful

But does it have to?

Of course not.

You have all your other sections for that.

Education serves as the shoes that your resume needs to leave the house.

And that is exactly how you should craft it. Simple, clear, and unimpeachable.

Certificates are exactly what prove that ambition and desire to grow in the Trainings/Courses section of the guide.

You may think that this section is an unnecessary bother.

Don’t! This is a key part of the whole resume.

Because the whole idea of certifications is that you have not only shown the desire to grow, but have also achieved a stellar result in that particular endeavor!

Trust us, PwC recruiters will value that you went the extra mile to earn a certification.

These are some examples of resume certificates that would be useful for an auditor.

Be sure not to skip them over!

Top PwC auditor certificates for your resume:

- Certified Internal Auditor (CIA)

- Certified Management Accountant (CMA)

- Certified Information Systems Auditor (CISA)

- Certification in Risk Management Assurance (CRMA)

- Certificate in International Auditing (Cert IA)

The Languages section is to support your competence in regard to communication.

If you are only proficient in a single language, you probably shouldn’t include this section. But if you can speak freely in a second one, it is a definite must.

And if you know more than two, no matter how poorly, include those too.

This displays your capacity for knowledge and the motivation to proactively seek it out.

Learning a language takes more than just sitting at a desk and reading a textbook.

It represents interactive skills that you have demonstrated through learning said language.

And that is definitely a step further toward your aim of getting hired!

- A concise and powerful summary is the thing that grabs the attention

- Well-listed experiences can take you a long way in the world of context

- There are different types of skills, and you have to find the ones that suit your application best

- Education is not everything, but it is a start

- Use the potency of the courses and certificates section to demonstrate your motivation

Looking to build your own PwC resume?

- Resume Examples

How To List Contract Work on Your Resume

Do resume templates work, what are the parts of a resume, how to write a great linkedin connection message [with examples], keep getting rejected job applications 16 resume mistakes you’re probably making, how to do your references on resume: is it important.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

Search Career Services and Development

- Graduating Students

- Faculty & Staff

- Parents & Families

- Prospective Students

- First Generation

- International

- Students With Disabilities

- Arts, Marketing, Multimedia & Communications

- Business and Economics

- Education & Training

- Entertainment, Hospitality, Performing Arts, & Sports

- Finance & Accounting

- Graduate / Professional School

- Health Professions

- Human Services

- Law & Policy, Government & Public Administration

- Science, Technology, Engineering, Mathematics (STEM) & Kinesiology

- Create a Resume / Cover Letter

- Expand Your Network / Mentor

- Explore Your Interests / Self Assessment

- Find Scholarship & Funding Opportunities

- Negotiate an Offer

- Prepare for an Interview

- Prepare for Graduate School

- Labor Market Insights

- Search for a Job / Internship

- Search for Jobs in Our Database

- Share Your Internship Experience

- Career Outcomes

- CLI/TADA Industry Tour

- International Spring Tour

PwC Japanese Business Network – Associate and Intern Roles – Summer/Fall 2024

- Share This: Share PwC Japanese Business Network – Associate and Intern Roles – Summer/Fall 2024 on Facebook Share PwC Japanese Business Network – Associate and Intern Roles – Summer/Fall 2024 on LinkedIn Share PwC Japanese Business Network – Associate and Intern Roles – Summer/Fall 2024 on X

The Japanese Business Network (JBN) focuses on bringing value-added Audit & Tax services to Japanese companies looking to expand globally, as well as for non-Japanese companies looking to invest in Japan.

The JBN team is also part of the PwC Private sector. As a result, our JBN staff also have the opportunity to work on Audit and Tax engagements for privately held businesses including private equity portfolio companies, family enterprises, and law firms.

Preferred fields of study:

- Business Administration

Preferred skills:

- Business level fluency in Japanese and English

We encourage you to apply as soon as possible. We are accepting applications until locations are closed.

- For many of our opportunities, we recruit on a rolling basis, which means when our roles open, they will fill up as offers are accepted.

- To better manage your candidate experience, we encourage you to apply only to roles for which you have a true interest and for which you wish to be considered.

What to know as you apply

- Use the filters on the left side of PwC’s job site to explore positions and narrow your search.

- For the majority of entry-level roles at PwC, job seekers are required to complete an assessment to be considered for the role. After you submit an application for an entry-level position, you should expect to receive the assessment via email within a few hours.

Preparing for the tidal wave of Canadian tax changes

2024 Canadian ESG Reporting Insights

Findings from the 2024 Global Digital Trust Insights

PwC Canada's Federal budget analysis

Canada’s Draft Sustainability Disclosure Standards

27th Annual Global CEO Survey—Canadian insights

2023 Canadian holiday outlook

Embracing the future of capital markets

Five opportunities facing Canadian government and public-sector organizations

How can Canadian family business founders and owners create the right outcomes

Managed Services

PwC Canada drives adoption of Generative AI with firmwide implementation of Copilot for Microsoft 365

Our purpose, vision and values

Inclusion and diversity

Apply today! Now hiring students and new graduates

We’re empowering women to thrive in tech

Why join our assurance practice?

Loading Results

No Match Found

2024 Federal Budget analysis

On April 16, 2024, the Deputy Prime Minister and Minister of Finance, Chrystia Freeland, presented the government’s budget. The budget:

- increases the capital gains inclusion rate from 1/2 to 2/3, effective June 25, 2024 (up to $250,000 of annual gains for individuals will continue to benefit from the 1/2 inclusion rate)

- raises the lifetime capital gains exemption to $1.25 million and introduces a new 1/3 inclusion rate for up to $2 million of certain capital gains realized by entrepreneurs

- confirms previously announced alternative minimum tax proposals effective January 1, 2024, but softens the impact of these proposals on charitable donations

- provides design and implementation details for the clean electricity investment tax credit

- introduces accelerated capital cost allowance (CCA) for, and relief from interest deductibility limitations for debt incurred to fund the construction of, certain purpose-built rental housing

- provides immediate expensing for the cost of certain patents and computer equipment and software

- gives the Canada Revenue Agency (CRA) additional information gathering powers

This Tax Insights discusses these and other tax initiatives proposed in the budget.

Tax measures

Capital gains inclusion rate.

- Lifetime Capital Gains Exemption

Canadian Entrepreneurs’ Incentive

- Alternative Minimum Tax

Employee Ownership Trust Tax Exemption

Volunteer firefighters tax credit and search and rescue volunteers tax credit, mineral exploration tax credit for flow-through share investors.

- Canada Child Benefit

Disability Supports Deduction

Charities and qualified donees.

- Home Buyers’ Plan

Qualified Investments for Registered Plans

Deduction for tradespeople’s travel expenses, indigenous child and family services settlement, clean electricity investment tax credit, ev supply chain investment tax credit, clean technology manufacturing investment tax credit.

- Accelerated Capital Cost Allowance

Interest Deductions and Purpose-Built Rental Housing

Taxing vacant lands to incentivize construction, confronting the financialization of housing, halal mortgages, non-compliance with information requests, synthetic equity arrangements, mutual fund corporations, canada carbon rebate for small business, avoidance of tax debts, reportable and notifiable transactions penalty, manipulation of bankrupt status.

- Scientific Research and Experimental Development

International

Crypto-asset reporting, withholding for non-resident service providers, international tax reform.

- Extending GST Relief to Student Residences

GST/HST on Face Masks and Face Shields

Previously announced, personal tax measures.

The budget proposes to increase the capital gains inclusion rate from 1/2 to:

- 2/3 for dispositions after June 24, 2024 for corporations and trusts, and

- 2/3 for the portion of capital gains realized after June 24, 2024 in excess of an annual $250,000 threshold for individuals

The $250,000 annual threshold would apply to capital gains realized by an individual, either directly or indirectly via a partnership or trust, net of:

- current year capital losses

- capital losses of other years applied to reduce current year capital gains, and

- capital gains in respect of which the Lifetime Capital Gains Exemption (LCGE), the proposed Employee Ownership Trust Exemption or the proposed Canadian Entrepreneurs’ Incentive is claimed

As a result, the following rates will apply to capital gains earned by individuals in excess of the $250,000 threshold who are subject to the top marginal income tax rate (i.e. on taxable income exceeding: $355,845 in Alberta, $252,752 in British Columbia, $1,103,478 in Newfoundland and Labrador, $500,000 in the Yukon and $246,752 in all other jurisdictions).

The budget also proposes to decrease the stock option deduction to 1/3 to align with the new capital gains inclusion rate. Individuals would continue to benefit from a deduction of 1/2 of the taxable benefit up to a combined $250,000 for both employee stock options and capital gains.

The inclusion rate for net capital losses carried forward and applied against capital gains will be adjusted to reflect the inclusion rate of the capital gains being offset.

Transitional rules will apply to taxation years that begin before June 25, 2024 and end after June 24, 2024 such that capital gains realized before June 25, 2024 would be subject to the 1/2 inclusion rate and capital gains realized after June 24, 2024 (net of any losses) would be subject to a 2/3 inclusion rate. The $250,000 threshold will not be prorated for individuals in 2024 and will apply only against capital gains incurred after June 24, 2024.

Additional details will be provided in the coming months.

Earning capital gains through a Canadian-controlled private corporation (CCPC)

In most jurisdictions, the increase in the capital gains inclusion rate makes it less attractive for individuals to earn capital gains in excess of $250,000 through a CCPC instead of directly. The Appendix shows the resulting income tax deferral (prepayment) and the tax cost for an individual who realizes capital gains in excess of $250,000 and pays tax at the top tax rate.

> Back to top

Lifetime Capital Gains Exemption (LCGE)

The budget proposes to increase the LCGE on eligible capital gains from $1,016,836 to $1,250,000 for dispositions that occur after June 24, 2024. The indexing of the LCGE to inflation will resume in 2026.

The budget introduces the Canadian Entrepreneurs’ Incentive, which will reduce the taxes on capital gains from the disposition of shares by eligible individuals which meet the following conditions:

- at the time of the sale the share was a share of a small business corporation owned directly by an individual

- used principally in an active business carried on primarily in Canada by the CCPC or a related corporation

- certain shares or debts of connected corporations, or

- a combination of these assets

- the individual was a founding investor and the individual held the share for a period of five years prior to the disposition

- at all times since the share subscription until the time immediately before the sale, the individual directly owned shares with a fair market value (FMV) of more than 10% of the FMV of all of the issued and outstanding shares of the corporation and shares entitling the individual to more than 10% of the votes

- throughout the five year period before the disposition the individual was actively engaged in a regular, continuous and substantial basis in the activities of the business

- the share does not represent a direct or indirect interest in a professional corporation, a corporation whose principal asset is the reputation or skill of one or more employees, or a corporation that carries on certain types of businesses including a business operating in the financial, insurance, real estate, food and accommodation, arts, recreation, or entertainment sector, or providing consulting or personal care services

- the share must have been obtained for fair market value consideration

The incentive would provide a capital gains inclusion rate of one half of the prevailing inclusion rate on up to $2 million in capital gains per individual during their lifetime. The $2 million limit will be phased in over 10 years by increments of $200,000 per year reaching $2 million by January 1, 2034.

Applying the proposed 2/3 inclusion rate would result in an inclusion rate of 1/3 for qualifying dispositions. This will apply in addition to the LCGE.

This measure would apply to dispositions that occur after December 31, 2024.

Alternative Minimum Tax (AMT)

The 2023 budget announced amendments to change the calculation of the AMT. Draft legislative proposals were released for consultation in the summer of 2023. (For more information, see our Tax Insights “ Proposed changes to the alternative minimum tax: How will it affect individuals and trusts ”.)

The budget proposes to revise the proposed charitable donation tax credit claim to allow individuals to claim 80% when calculating AMT (as opposed to the previously proposed 50%).

The budget also proposes additional amendments to the AMT proposals including:

- allowing deductions for the Guaranteed Income Supplement, social assistance and workers compensation payments

- fully exempting employee ownership trusts (EOTs) from the AMT, and

- allowing certain disallowed credits under the AMT to be eligible for the AMT carry-forward (i.e. the federal political contribution tax credit, investment tax credits (ITCs), and labour-sponsored funds tax credit)

The amendments would apply to taxation years that begin after December 31, 2023.

The budget also proposes certain technical amendments to the AMT legislative proposals to exempt certain trusts for the benefit of Indigenous groups.

The 2023 budget proposed tax rules to create EOTs. The 2023 Fall Economic Statement proposed to exempt $10 million of capital gains on the sale of a business to an EOT subject to certain conditions.

The budget introduces the conditions for this exemption. The exemption will be available to an individual (other than a trust) on the sale of a business to an EOT where the following conditions are met:

- the individual, a personal trust of which the individual is a beneficiary, or a partnership in which the individual is a member, disposes of shares of a corporation that is not a professional corporation

- the transaction is a qualifying business transfer (as defined in the proposed rules for EOTs) in which the trust acquiring the shares is not already an EOT or a similar trust with employee beneficiaries

- throughout the 24 months immediately prior to the qualifying business transfer, the transferred shares were exclusively owned by the individual claiming the exemption, a related person, or a partnership in which the individual is a member; and over 50% of the FMV of the corporation’s assets were used principally in an active business

- at any time prior to the qualifying business transfer, the individual (or their spouse or common-law partner) has been actively engaged in the qualifying business on a regular and continuous basis for a minimum period of 24 months

- immediately after the qualifying business transfer, at least 90% of the beneficiaries of the EOT are resident in Canada

Where multiple individuals dispose of shares to an EOT as part of a qualifying transfer and meet the conditions above, they may each claim an exemption, however the total exemption in respect of the sale cannot exceed $10 million. The individuals would have to agree on the allocation of the exemption.

If an EOT has a disqualifying event within 36 months of the transfer, the exemption claim will be retroactively denied. If this occurs more than 36 months after a transfer the EOT will be deemed to realize a capital gain equal to the total exempt capital gains. A disqualifying event would result where an EOT loses its status as an EOT or if less than 50% of the FMV of the qualifying business shares is attributable to assets used principally in an active business at the beginning of two consecutive years of the corporation.

The EOT, any corporation owned by the EOT that acquired the transferred shares, and the individual will need to elect to be jointly and severally, or solitarily liable for any tax payable by the individual as a result of an exemption being denied due to a disqualifying event occurring during the first 36 months.

For the purposes of the AMT calculation the capital gain on the transfer would be subject to an inclusion rate of 30% (consistent with the inclusion rate for capital gains eligible for the LCGE).

An individual’s normal reassessment period as it relates to this exemption is proposed to be extended by an additional three years.

The budget also proposes to expand qualifying business transfers to include the sale of shares to a workers cooperative corporation, provided it meets certain conditions.

These measures will apply to qualifying dispositions of shares that occur between January 1, 2024 through December 31, 2026.

The budget proposes to double the volunteer firefighters tax credit and the search and rescue volunteers tax credit to $6,000 for the 2024 and subsequent taxation years; this increases the maximum annual tax savings to $900.

The budget proposes to extend the eligibility for this credit for an additional year, so that it will apply to flow-through share agreements entered into before April 1, 2025.

Canada Child Benefit (CCB)

A CCB recipient is no longer eligible to claim the CCB in respect of a child in the month following the child’s death. The budget proposes to extend eligibility for the CCB to six months after the child’s death, provided the individual continued to be eligible for the CCB.

The budget proposes to extend the list of expenses recognized for the disability supports deduction.

It also provides that expenses for service animals, as defined under the medical expense tax credit (METC) rules, will be recognized under the disability supports deduction. The individual will choose whether to claim under the METC or the disability supports deduction.

A foreign charity may register as a qualified donee for a 24-month period where it received a gift from His Majesty in right of Canada and it is pursuing certain activities in the national interest of Canada. The budget proposes to extend the eligibility of a foreign charity to be considered a qualified donee from 24 months to 36 months. The foreign charity would also be required to submit an annual information return to the CRA that would be made publicly available. The extension will apply to foreign charities registered after April 16, 2024. The reporting requirements will apply to taxation years beginning after April 16, 2024.

The budget also proposes to simplify the issuance of official donation receipts by removing certain requirements.

Home Buyers’ Plan (HBP)

To help first-time home buyers, the budget proposes to:

- increase, from $35,000 to $60,000, the amount that an eligible home buyer can withdraw from their Registered Retirement Savings Plan (RRSP) under the HBP, without subjecting the withdrawal to tax, to buy or build a qualifying home (i.e. a first home or a home for a specified disabled individual), effective for the 2024 and subsequent calendar years, for withdrawals made after April 16, 2024

- temporarily extend the repayment grace period by three years, to five years, under the HBP, so that eligible home buyers who withdraw from their RRSP between January 1, 2022 and December 31, 2025 will have up to five years before they need to start repayments to their RRSP

Registered plans (RRSPs, Registered Retirement Income Funds, Tax-Free Savings Accounts, Registered Education Savings Plans, Registered Disability Savings Plans, First Home Savings Accounts, and Deferred Profit Sharing Plans) can invest only in qualified investments for those plans. Qualified investments include mutual funds, publicly traded securities, government and corporate bonds and guaranteed investment certificates. Over the years the qualified investment rules have been expanded to include additional investments for certain plans and to reflect the introduction of new types of plans, but there are inconsistencies and the qualified investment rules are difficult to understand in some cases.

Specific issues are currently under consideration. Stakeholders are invited to submit comments by July 15, 2024 as to how the qualified investment rules can be modernized on a prospective basis to improve the clarity and coherence of the registered plans regime.

Eligible tradespeople and apprentices in the construction industry are currently able to deduct up to $4,000 in eligible travel and relocation expenses per year by claiming the labour mobility deduction for tradespeople. A private member’s bill (Bill C-241) was introduced to enact an alternative deduction for certain travel expenses of tradespeople in the construction industry, with no cap on expenses, retroactive to the 2022 taxation year.

The budget announces that the government will consider bringing forward amendments to the Income Tax Act (ITA) to provide a single, harmonized deduction for tradespeople’s travel that respects the intent of Bill C-241.

The budget proposes to amend the ITA to exclude from taxation the income of the trusts established under the First Nations Child and Family Services, Jordan’s Principle, and Trout Class Settlement Agreement. This will also ensure that payments received by class members as beneficiaries of the trusts will not be included when computing income for federal income tax purposes.

This measure will apply to the 2024 and subsequent taxation years.

Business tax measures

The 2023 budget proposed a refundable ITC for clean electricity, equal to 15% of the capital cost of eligible property. The 2024 budget provides the design and implementation details of the ITC, including the eligibility criteria. It also includes special rules for property that generates electricity from natural gas with carbon capture and property used to transmit electrical energy between provinces or territories, as well as details of the compliance and recovery process.

The ITC will be available only to eligible Canadian corporations, which are defined as:

- taxable Canadian corporations and pension investment corporations

- provincial and territorial Crown corporations (subject to additional requirements)

- corporations owned by municipalities or Indigenous communities

Property eligible for the ITC includes equipment used to generate electricity from:

- solar, wind or water energy (certain class 43.1 property, but hydroelectric installations would not be subject to a capacity limit)

- concentrated solar energy (as defined for the purposes of the proposed clean technology ITC)

- nuclear fission, including heat generating equipment (as defined for the purposes of the proposed clean technology ITC, without the generating capacity limits and other certain requirements of that credit)

- geothermal energy, including heat generating equipment, if it is used exclusively for that purpose (excluding equipment that is part of a system that extracts fossil fuel for sale)

- specified waste materials, as part of a system

Eligible property also includes equipment that is:

- stationary electricity storage equipment and equipment used for pumped hydroelectric energy storage (excluding any that uses a fossil fuel in operation)

- part of an eligible natural gas energy system (special rules apply)

- used for transmission of electricity between provinces and territories (special rules apply)

Previously proposed labour requirements must be met to qualify for the 15% ITC, otherwise a 5% ITC is available. The ITC will be subject to potential repayment obligations, repayable in proportion to the FMV of the particular property when it has been converted to an ineligible use, exported from Canada, or disposed of.

The ITC will be available for new eligible property (i.e. has not been used for any purposes before its acquisition) that is acquired and becomes available for use after April 15, 2024 and before 2035 in respect of projects that did not begin construction before March 28, 2023.

The budget introduces the EV supply chain ITC, equal to 10% of the cost of buildings used in Canada in the following electric vehicle supply chain segments:

- electric vehicle assembly

- electric vehicle battery production

- cathode active material production

To qualify for the ITC, the taxpayer (or member of a group of related taxpayers) must claim the clean technology manufacturing ITC (CTMITC) in all three of the segments (or must claim the CTMITC in two of the three segments and hold at least a qualifying minority interest in an unrelated corporation that claims the CTMITC in the third segment – the building costs of the unrelated corporation would also qualify for the new ITC).

The ITC is effective for property that is acquired and becomes available for use after December 31, 2023. The ITC will be reduced to 5% for 2033 and 2034 and 0% after 2034. Design and implementation details of the ITC will be provided in the 2024 Fall Economic Statement.

The 2023 budget proposed a clean technology manufacturing ITC, and draft legislative proposals were released in December 2023. The 2024 budget proposes to update the clean technology manufacturing ITC for production of qualifying minerals (such as copper, nickel, cobalt, lithium, graphite and rate earth elements) that occur at polymetallic projects (i.e. projects engaged in the production of multiple minerals) by:

- clarifying that the value of qualifying materials will be used as the appropriate output metric when assessing the extent to which property is used (or expected to be used) for qualifying mineral activities producing qualifying materials

- modifying eligible expenditures to include investments in eligible property used in qualifying mineral activities that are expected to produce primarily qualifying materials at mine or well sites, including tailing ponds and mills located at these sites (50% or more of the financial value of the output comes from qualifying materials)

A safe harbour rule will apply to the recapture rule for all qualifying mineral activities, to mitigate against the effects of mineral price volatility on the potential recapture of the ITC, the details of which will be provided at a later date.

Accelerated Capital Cost Allowance (CCA)

Purpose-built rental housing.

The budget provides an accelerated CCA of 10% for new eligible purpose-built rental projects that begin construction after April 15, 2024 and before January 1, 2031, and are available for use before January 1, 2036.

Eligible property will be new purpose-built rental housing that is a residential complex:

- with at least four private apartment units, or 10 private rooms or suites, and

- in which at least 90% of residential units are held for long-term rental