- Search Search Please fill out this field.

What Is Market Research?

- How It Works

- Primary vs. Secondary

- How to Conduct Research

The Bottom Line

- Marketing Essentials

How to Do Market Research, Types, and Example

:max_bytes(150000):strip_icc():format(webp)/dd453b82d4ef4ce8aac2e858ed00a114__alexandra_twin-5bfc262b46e0fb0026006b77.jpeg)

Joules Garcia / Investopedia

Market research examines consumer behavior and trends in the economy to help a business develop and fine-tune its business idea and strategy. It helps a business understand its target market by gathering and analyzing data.

Market research is the process of evaluating the viability of a new service or product through research conducted directly with potential customers. It allows a company to define its target market and get opinions and other feedback from consumers about their interest in a product or service.

Research may be conducted in-house or by a third party that specializes in market research. It can be done through surveys and focus groups, among other ways. Test subjects are usually compensated with product samples or a small stipend for their time.

Key Takeaways

- Companies conduct market research before introducing new products to determine their appeal to potential customers.

- Tools include focus groups, telephone interviews, and questionnaires.

- The results of market research inform the final design of the product and determine how it will be positioned in the marketplace.

- Market research usually combines primary information, gathered directly from consumers, and secondary information, which is data available from external sources.

Market Research

How market research works.

Market research is used to determine the viability of a new product or service. The results may be used to revise the product design and fine-tune the strategy for introducing it to the public. This can include information gathered for the purpose of determining market segmentation . It also informs product differentiation , which is used to tailor advertising.

A business engages in various tasks to complete the market research process. It gathers information based on the market sector being targeted by the product. This information is then analyzed and relevant data points are interpreted to draw conclusions about how the product may be optimally designed and marketed to the market segment for which it is intended.

It is a critical component in the research and development (R&D) phase of a new product or service introduction. Market research can be conducted in many different ways, including surveys, product testing, interviews, and focus groups.

Market research is a critical tool that companies use to understand what consumers want, develop products that those consumers will use, and maintain a competitive advantage over other companies in their industry.

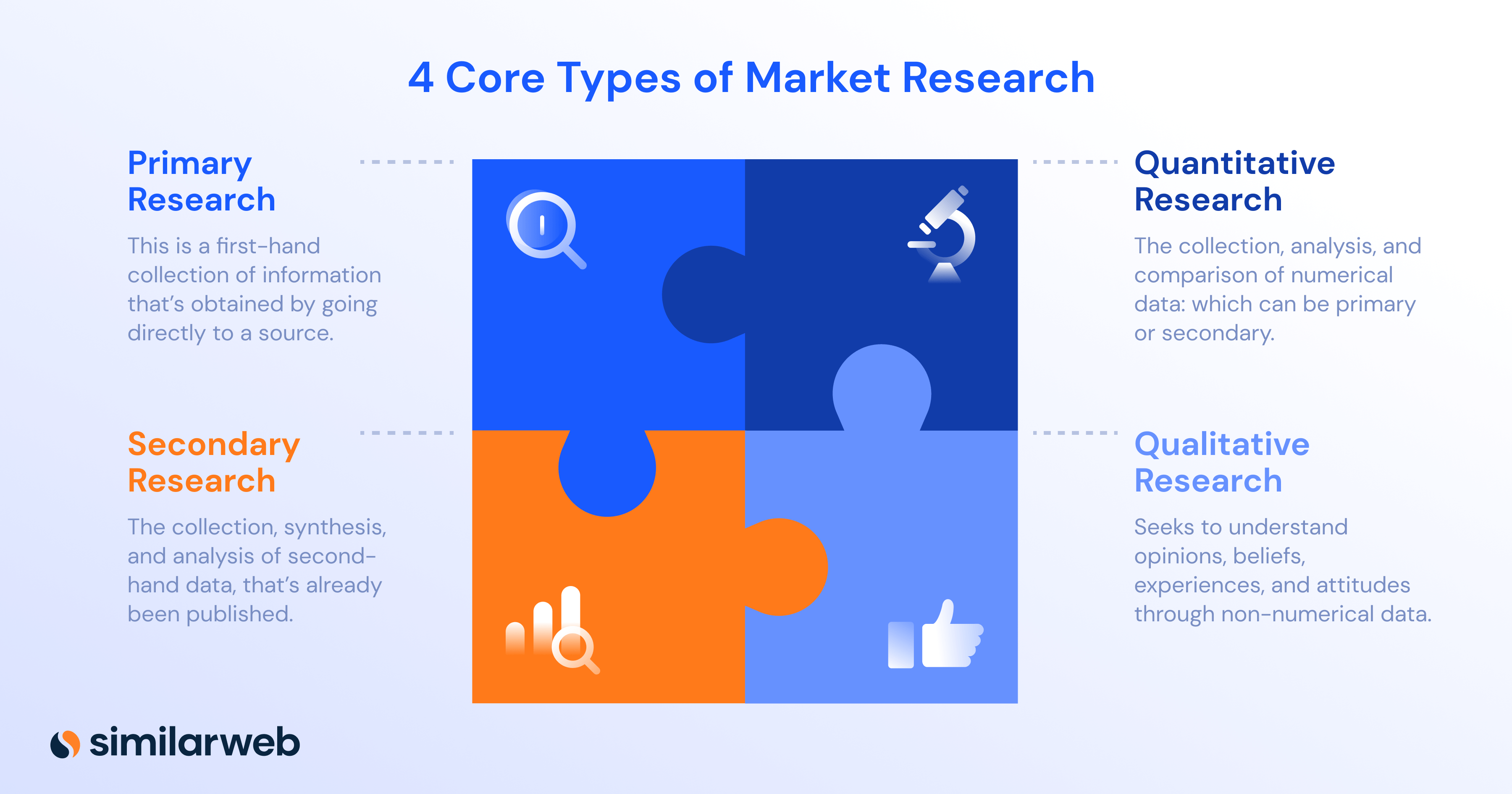

Primary Market Research vs. Secondary Market Research

Market research usually consists of a combination of:

- Primary research, gathered by the company or by an outside company that it hires

- Secondary research, which draws on external sources of data

Primary Market Research

Primary research generally falls into two categories: exploratory and specific research.

- Exploratory research is less structured and functions via open-ended questions. The questions may be posed in a focus group setting, telephone interviews, or questionnaires. It results in questions or issues that the company needs to address about a product that it has under development.

- Specific research delves more deeply into the problems or issues identified in exploratory research.

Secondary Market Research

All market research is informed by the findings of other researchers about the needs and wants of consumers. Today, much of this research can be found online.

Secondary research can include population information from government census data , trade association research reports , polling results, and research from other businesses operating in the same market sector.

History of Market Research

Formal market research began in Germany during the 1920s. In the United States, it soon took off with the advent of the Golden Age of Radio.

Companies that created advertisements for this new entertainment medium began to look at the demographics of the audiences who listened to each of the radio plays, music programs, and comedy skits that were presented.

They had once tried to reach the widest possible audience by placing their messages on billboards or in the most popular magazines. With radio programming, they had the chance to target rural or urban consumers, teenagers or families, and judge the results by the sales numbers that followed.

Types of Market Research

Face-to-face interviews.

From their earliest days, market research companies would interview people on the street about the newspapers and magazines that they read regularly and ask whether they recalled any of the ads or brands that were published in them. Data collected from these interviews were compared to the circulation of the publication to determine the effectiveness of those ads.

Market research and surveys were adapted from these early techniques.

To get a strong understanding of your market, it’s essential to understand demand, market size, economic indicators, location, market saturation, and pricing.

Focus Groups

A focus group is a small number of representative consumers chosen to try a product or watch an advertisement.

Afterward, the group is asked for feedback on their perceptions of the product, the company’s brand, or competing products. The company then takes that information and makes decisions about what to do with the product or service, whether that's releasing it, making changes, or abandoning it altogether.

Phone Research

The man-on-the-street interview technique soon gave way to the telephone interview. A telephone interviewer could collect information in a more efficient and cost-effective fashion.

Telephone research was a preferred tactic of market researchers for many years. It has become much more difficult in recent years as landline phone service dwindles and is replaced by less accessible mobile phones.

Survey Research

As an alternative to focus groups, surveys represent a cost-effective way to determine consumer attitudes without having to interview anyone in person. Consumers are sent surveys in the mail, usually with a coupon or voucher to incentivize participation. These surveys help determine how consumers feel about the product, brand, and price point.

Online Market Research

With people spending more time online, market research activities have shifted online as well. Data collection still uses a survey-style form. But instead of companies actively seeking participants by finding them on the street or cold calling them on the phone, people can choose to sign up, take surveys, and offer opinions when they have time.

This makes the process far less intrusive and less rushed, since people can participate on their own time and of their own volition.

How to Conduct Market Research

The first step to effective market research is to determine the goals of the study. Each study should seek to answer a clear, well-defined problem. For example, a company might seek to identify consumer preferences, brand recognition, or the comparative effectiveness of different types of ad campaigns.

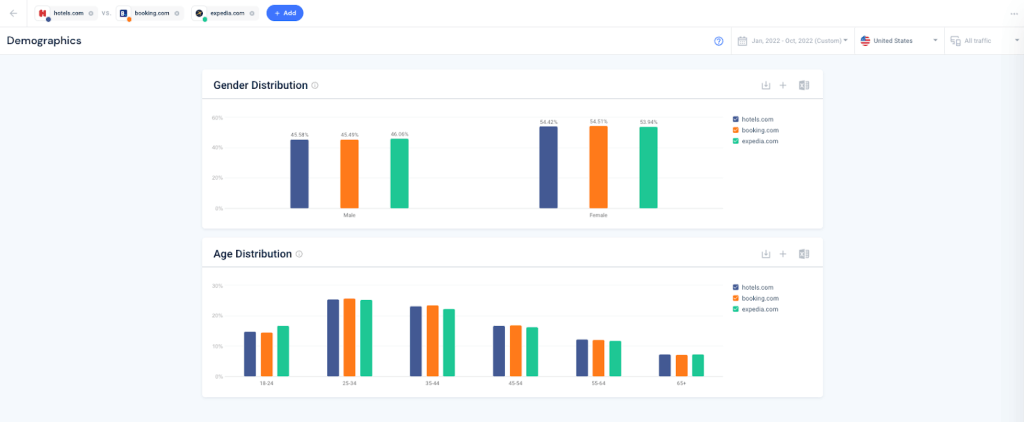

After that, the next step is to determine who will be included in the research. Market research is an expensive process, and a company cannot waste resources collecting unnecessary data. The firm should decide in advance which types of consumers will be included in the research, and how the data will be collected. They should also account for the probability of statistical errors or sampling bias .

The next step is to collect the data and analyze the results. If the two previous steps have been completed accurately, this should be straightforward. The researchers will collect the results of their study, keeping track of the ages, gender, and other relevant data of each respondent. This is then analyzed in a marketing report that explains the results of their research.

The last step is for company executives to use their market research to make business decisions. Depending on the results of their research, they may choose to target a different group of consumers, or they may change their price point or some product features.

The results of these changes may eventually be measured in further market research, and the process will begin all over again.

Benefits of Market Research

Market research is essential for developing brand loyalty and customer satisfaction. Since it is unlikely for a product to appeal equally to every consumer, a strong market research program can help identify the key demographics and market segments that are most likely to use a given product.

Market research is also important for developing a company’s advertising efforts. For example, if a company’s market research determines that its consumers are more likely to use Facebook than X (formerly Twitter), it can then target its advertisements to one platform instead of another. Or, if they determine that their target market is value-sensitive rather than price-sensitive, they can work on improving the product rather than reducing their prices.

Market research only works when subjects are honest and open to participating.

Example of Market Research

Many companies use market research to test new products or get information from consumers about what kinds of products or services they need and don’t currently have.

For example, a company that’s considering starting a business might conduct market research to test the viability of its product or service. If the market research confirms consumer interest, the business can proceed confidently with its business plan . If not, the company can use the results of the market research to make adjustments to the product to bring it in line with customer desires.

What Are the Main Types of Market Research?

The main types of market research are primary research and secondary research. Primary research includes focus groups, polls, and surveys. Secondary research includes academic articles, infographics, and white papers.

Qualitative research gives insights into how customers feel and think. Quantitative research uses data and statistics such as website views, social media engagement, and subscriber numbers.

What Is Online Market Research?

Online market research uses the same strategies and techniques as traditional primary and secondary market research, but it is conducted on the Internet. Potential customers may be asked to participate in a survey or give feedback on a product. The responses may help the researchers create a profile of the likely customer for a new product.

What Are Paid Market Research Surveys?

Paid market research involves rewarding individuals who agree to participate in a study. They may be offered a small payment for their time or a discount coupon in return for filling out a questionnaire or participating in a focus group.

What Is a Market Study?

A market study is an analysis of consumer demand for a product or service. It looks at all of the factors that influence demand for a product or service. These include the product’s price, location, competition, and substitutes as well as general economic factors that could influence the new product’s adoption, for better or worse.

Market research is a key component of a company’s research and development (R&D) stage. It helps companies understand in advance the viability of a new product that they have in development and to see how it might perform in the real world.

Britannica Money. “ Market Research .”

U.S. Small Business Administration. “ Market Research and Competitive Analysis .”

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for April 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/Term-Definitions_Target-market-49a03b58f6d54ddd88d46521f248fc8a.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

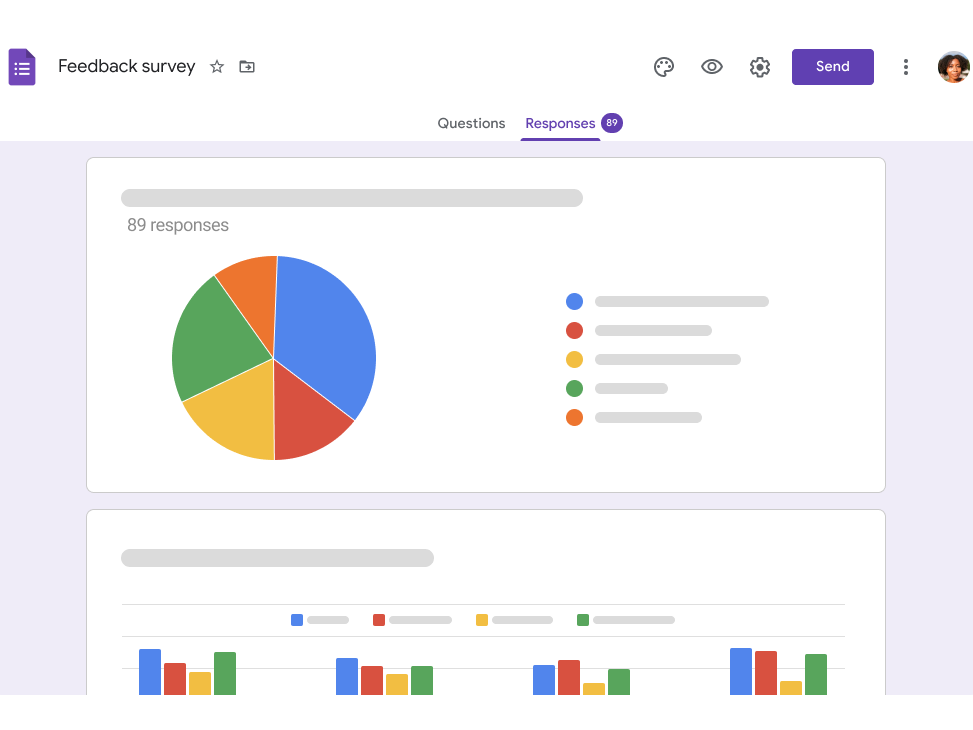

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

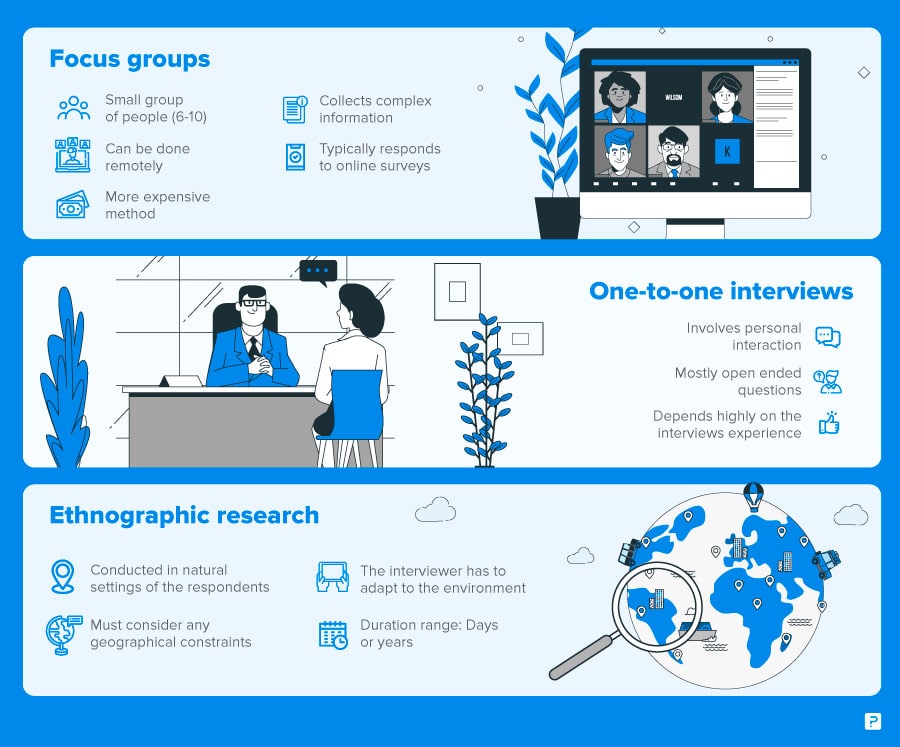

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

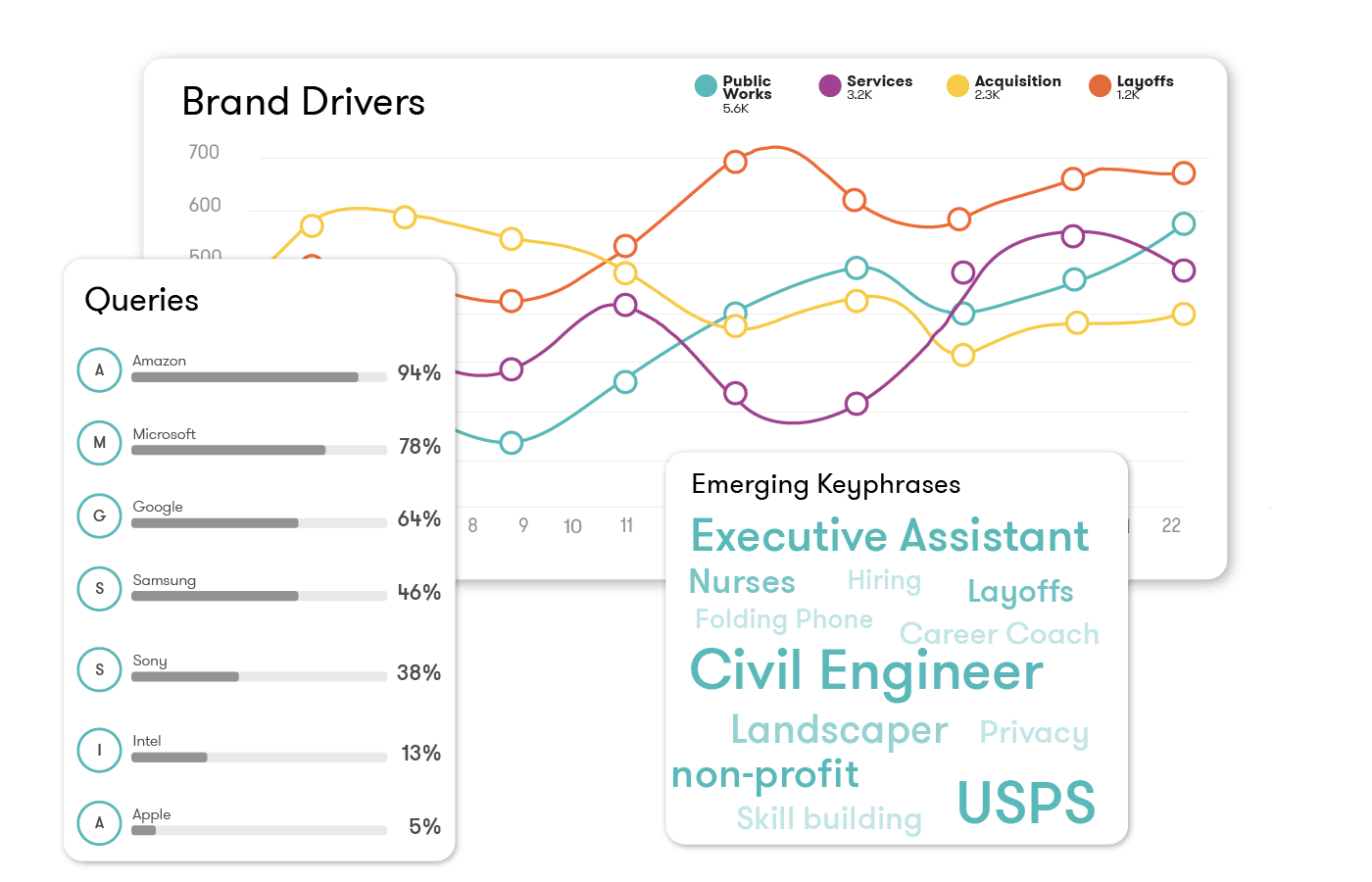

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

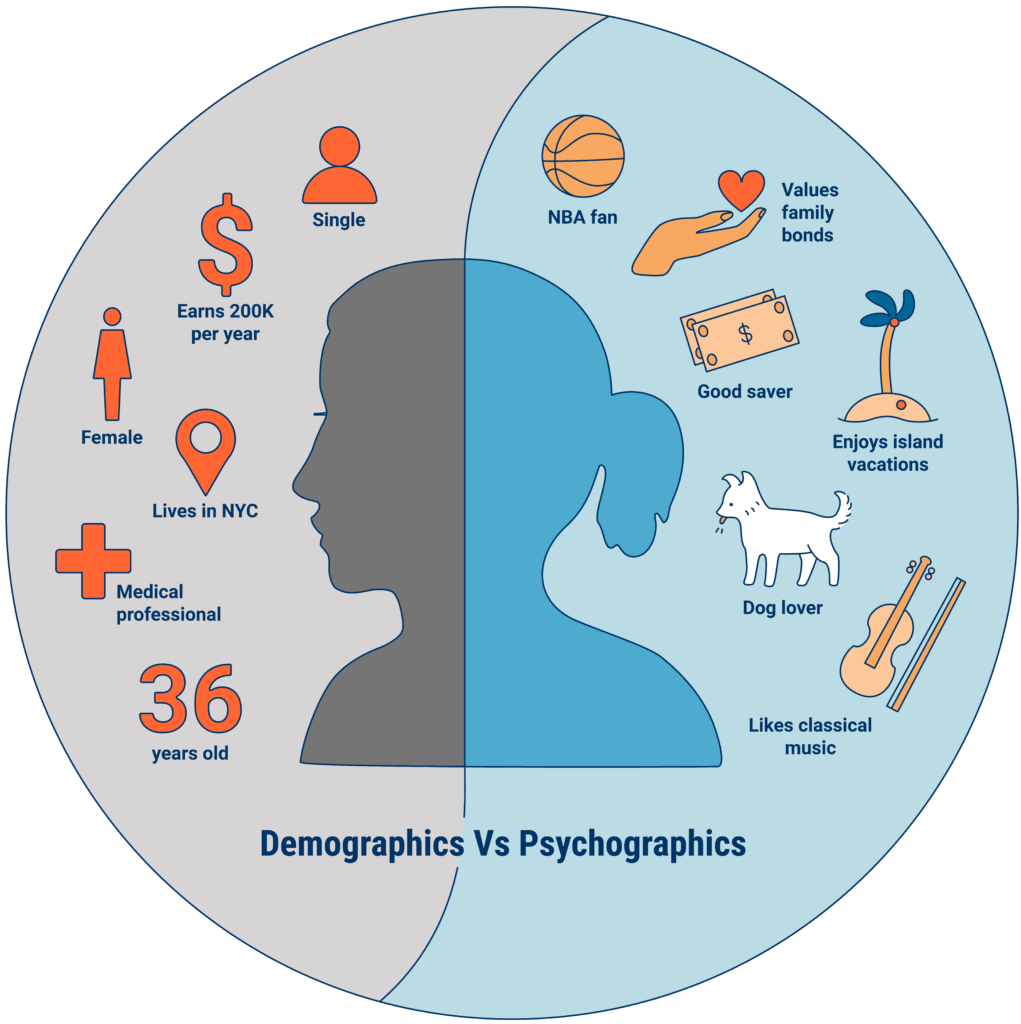

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

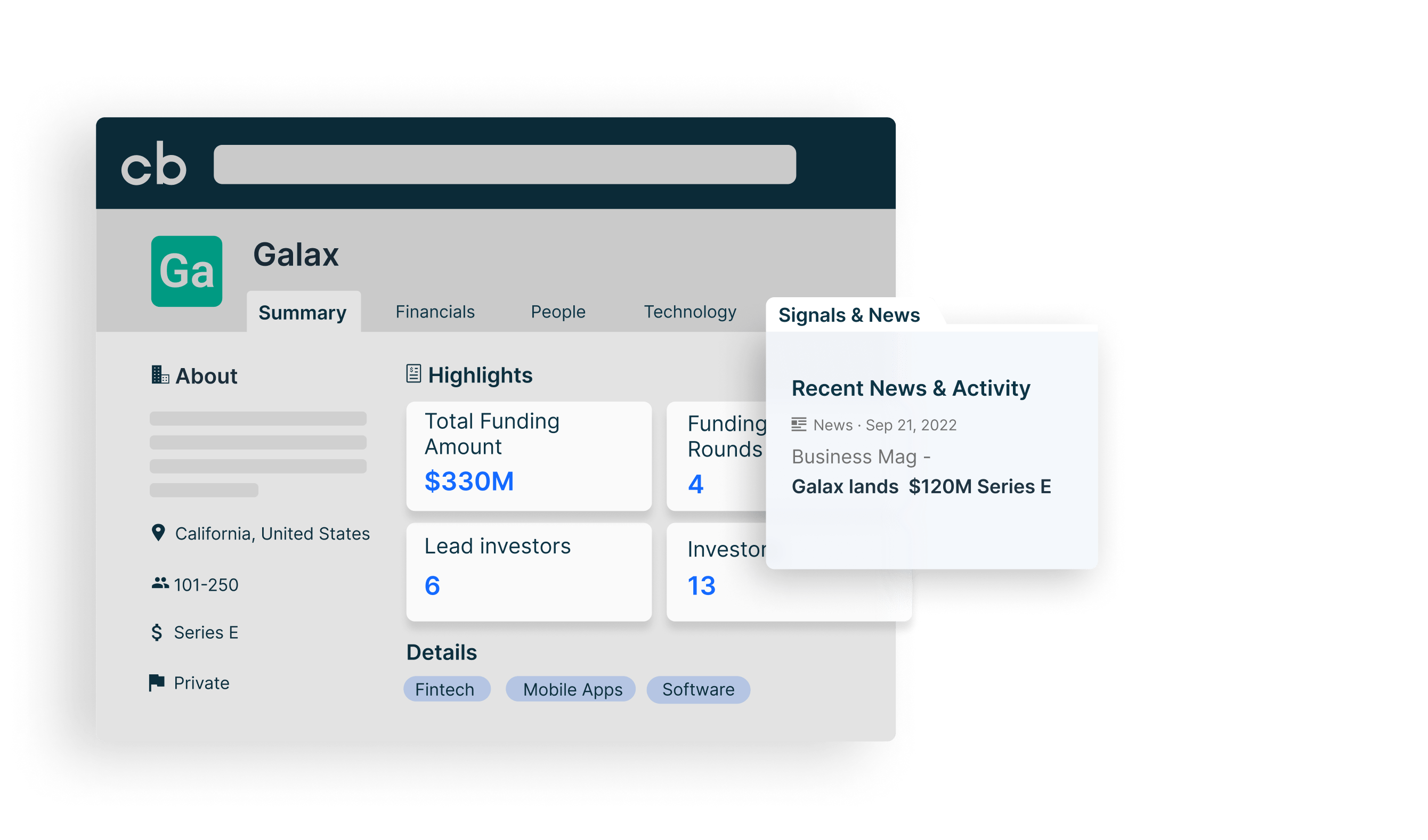

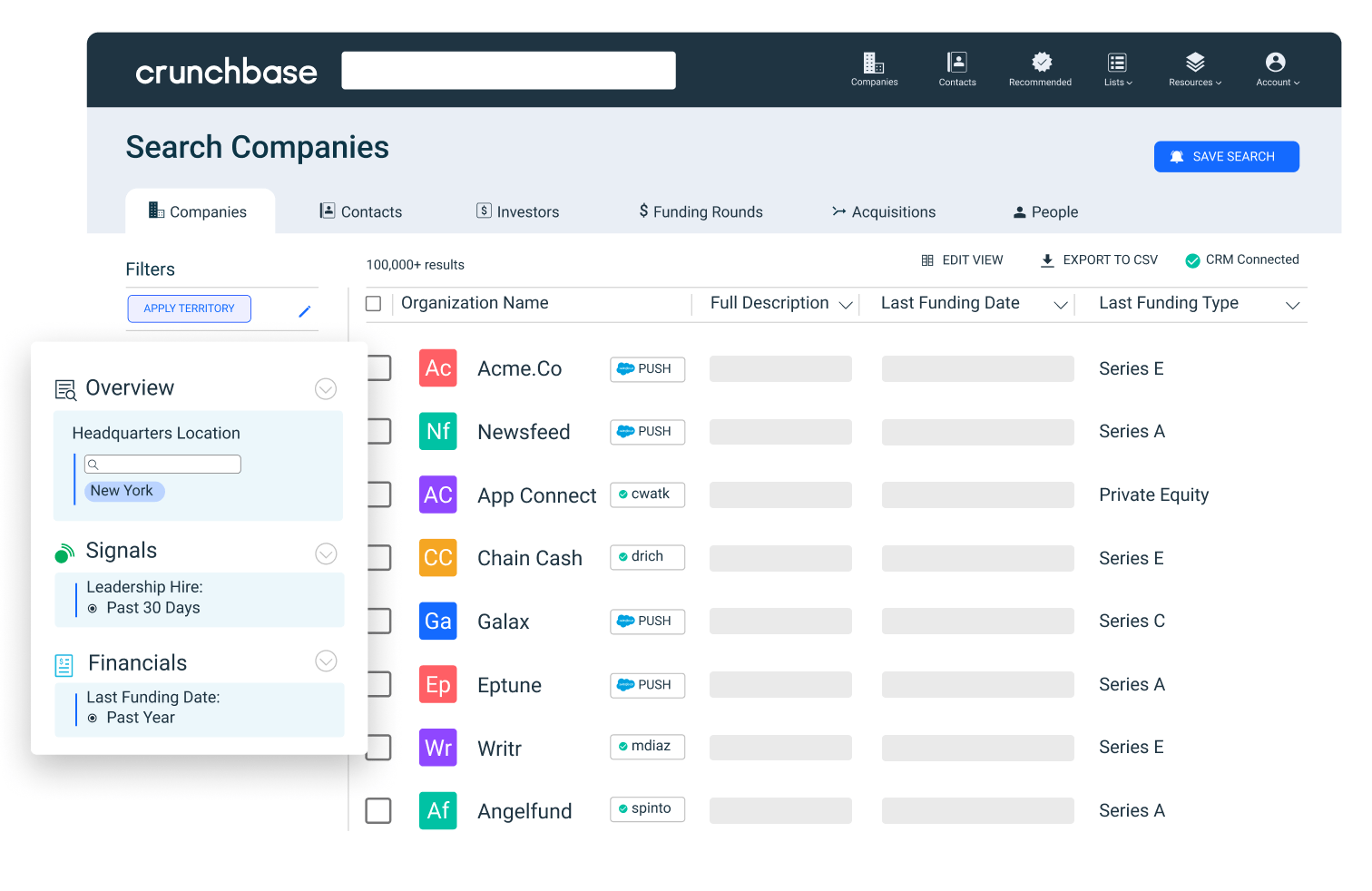

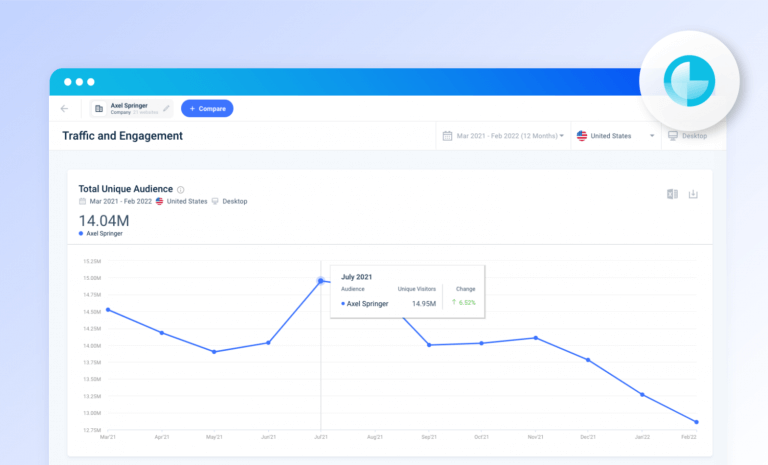

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

Send us an email

How to do market research: The complete guide for your brand

Written by by Jacqueline Zote

Published on April 13, 2023

Reading time 10 minutes

Blindly putting out content or products and hoping for the best is a thing of the past. Not only is it a waste of time and energy, but you’re wasting valuable marketing dollars in the process. Now you have a wealth of tools and data at your disposal, allowing you to develop data-driven marketing strategies . That’s where market research comes in, allowing you to uncover valuable insights to inform your business decisions.

Conducting market research not only helps you better understand how to sell to customers but also stand out from your competition. In this guide, we break down everything you need to know about market research and how doing your homework can help you grow your business.

Table of contents:

What is market research?

Why is market research important, types of market research, where to conduct market research.

- Steps for conducting market research

- Tools to use for market research

Market research is the process of gathering information surrounding your business opportunities. It identifies key information to better understand your audience. This includes insights related to customer personas and even trends shaping your industry.

Taking time out of your schedule to conduct research is crucial for your brand health. Here are some of the key benefits of market research:

Understand your customers’ motivations and pain points

Most marketers are out of touch with what their customers want. Moreover, these marketers are missing key information on what products their audience wants to buy.

Simply put, you can’t run a business if you don’t know what motivates your customers.

And spoiler alert: Your customers’ wants and needs change. Your customers’ behaviors today might be night and day from what they were a few years ago.

Market research holds the key to understanding your customers better. It helps you uncover their key pain points and motivations and understand how they shape their interests and behavior.

Figure out how to position your brand

Positioning is becoming increasingly important as more and more brands enter the marketplace. Market research enables you to spot opportunities to define yourself against your competitors.

Maybe you’re able to emphasize a lower price point. Perhaps your product has a feature that’s one of a kind. Finding those opportunities goes hand in hand with researching your market.

Maintain a strong pulse on your industry at large

Today’s marketing world evolves at a rate that’s difficult to keep up with.

Fresh products. Up-and-coming brands. New marketing tools. Consumers get bombarded with sales messages from all angles. This can be confusing and overwhelming.

By monitoring market trends, you can figure out the best tactics for reaching your target audience.

Not everyone conducts market research for the same reason. While some may want to understand their audience better, others may want to see how their competitors are doing. As such, there are different types of market research you can conduct depending on your goal.

Interview-based market research allows for one-on-one interactions. This helps the conversation to flow naturally, making it easier to add context. Whether this takes place in person or virtually, it enables you to gather more in-depth qualitative data.

Buyer persona research

Buyer persona research lets you take a closer look at the people who make up your target audience. You can discover the needs, challenges and pain points of each buyer persona to understand what they need from your business. This will then allow you to craft products or campaigns to resonate better with each persona.

Pricing research

In this type of research, brands compare similar products or services with a particular focus on pricing. They look at how much those products or services typically sell for so they can get more competitive with their pricing strategy.

Competitive analysis research

Competitor analysis gives you a realistic understanding of where you stand in the market and how your competitors are doing. You can use this analysis to find out what’s working in your industry and which competitors to watch out for. It even gives you an idea of how well those competitors are meeting consumer needs.

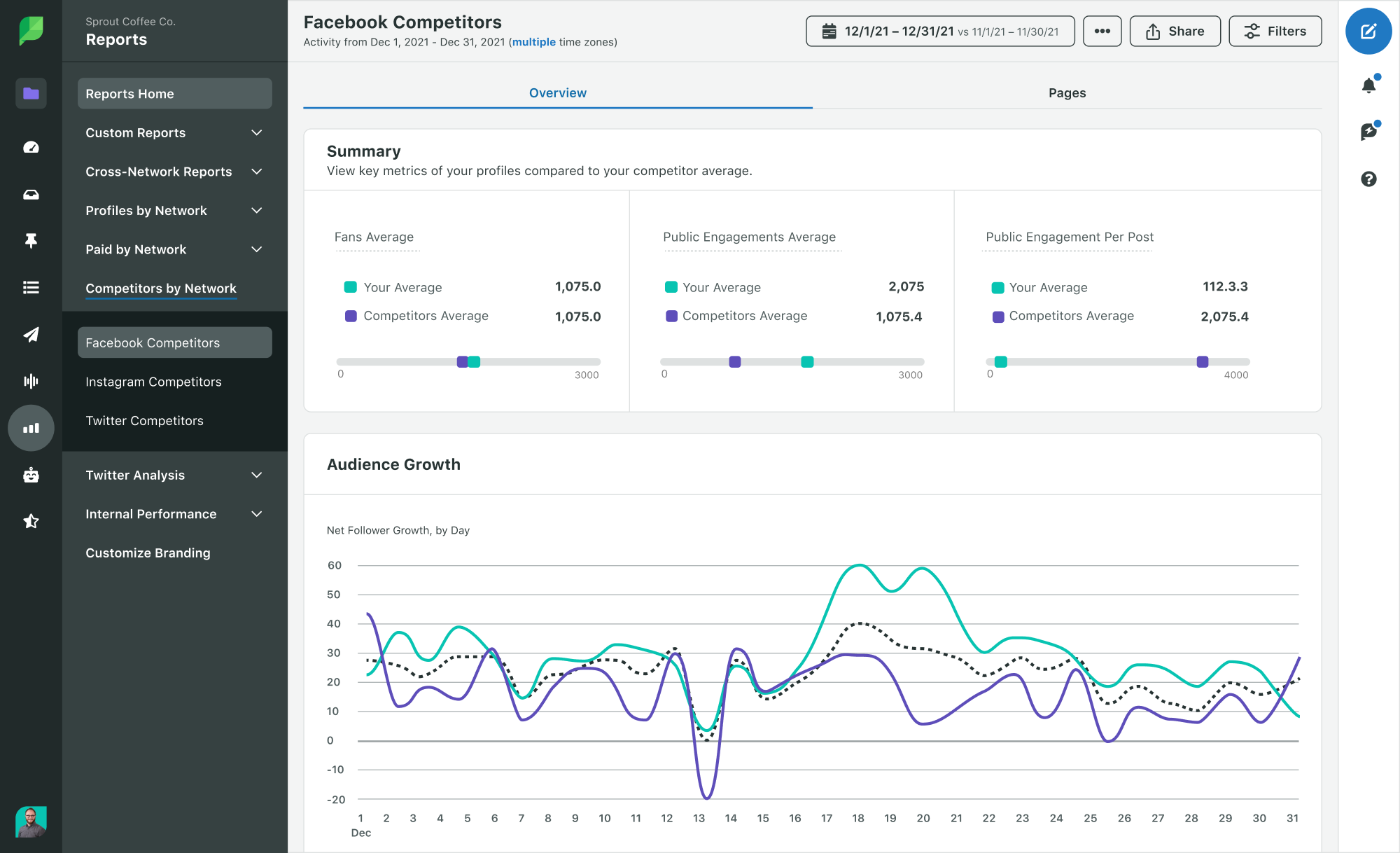

Depending on the competitor analysis tool you use, you can get as granular as you need with your research. For instance, Sprout Social lets you analyze your competitors’ social strategies. You can see what types of content they’re posting and even benchmark your growth against theirs.

Brand awareness research

Conducting brand awareness research allows you to assess your brand’s standing in the market. It tells you how well-known your brand is among your target audience and what they associate with it. This can help you gauge people’s sentiments toward your brand and whether you need to rebrand or reposition.

If you don’t know where to start with your research, you’re in the right place.

There’s no shortage of market research methods out there. In this section, we’ve highlighted research channels for small and big businesses alike.

Considering that Google sees a staggering 8.5 billion searches each day, there’s perhaps no better place to start.

A quick Google search is a potential goldmine for all sorts of questions to kick off your market research. Who’s ranking for keywords related to your industry? Which products and pieces of content are the hottest right now? Who’s running ads related to your business?

For example, Google Product Listing Ads can help highlight all of the above for B2C brands.

The same applies to B2B brands looking to keep tabs on who’s running industry-related ads and ranking for keyword terms too.

There’s no denying that email represents both an aggressive and effective marketing channel for marketers today. Case in point, 44% of online shoppers consider email as the most influential channel in their buying decisions.

Looking through industry and competitor emails is a brilliant way to learn more about your market. For example, what types of offers and deals are your competitors running? How often are they sending emails?

Email is also invaluable for gathering information directly from your customers. This survey message from Asana is a great example of how to pick your customers’ brains to figure out how you can improve your quality of service.

Industry journals, reports and blogs

Don’t neglect the importance of big-picture market research when it comes to tactics and marketing channels to explore. Look to marketing resources such as reports and blogs as well as industry journals

Keeping your ear to the ground on new trends and technologies is a smart move for any business. Sites such as Statista, Marketing Charts, AdWeek and Emarketer are treasure troves of up-to-date data and news for marketers.

And of course, there’s the Sprout Insights blog . And invaluable resources like The Sprout Social Index™ can keep you updated on the latest social trends.

Social media

If you want to learn more about your target market, look no further than social media. Social offers a place to discover what your customers want to see in future products or which brands are killin’ it. In fact, social media is become more important for businesses than ever with the level of data available.

It represents a massive repository of real-time data and insights that are instantly accessible. Brand monitoring and social listening are effective ways to conduct social media research . You can even be more direct with your approach. Ask questions directly or even poll your audience to understand their needs and preferences.

The 5 steps for how to do market research

Now that we’ve covered the why and where, it’s time to get into the practical aspects of market research. Here are five essential steps on how to do market research effectively.

Step 1: Identify your research topic

First off, what are you researching about? What do you want to find out? Narrow down on a specific research topic so you can start with a clear idea of what to look for.

For example, you may want to learn more about how well your product features are satisfying the needs of existing users. This might potentially lead to feature updates and improvements. Or it might even result in new feature introductions.

Similarly, your research topic may be related to your product or service launch or customer experience. Or you may want to conduct research for an upcoming marketing campaign.

Step 2: Choose a buyer persona to engage

If you’re planning to focus your research on a specific type of audience, decide which buyer persona you want to engage. This persona group will serve as a representative sample of your target audience.

Engaging a specific group of audience lets you streamline your research efforts. As such, it can be a much more effective and organized approach than researching thousands (if not millions) of individuals.

You may be directing your research toward existing users of your product. To get even more granular, you may want to focus on users who have been familiar with the product for at least a year, for example.

Step 3: Start collecting data

The next step is one of the most critical as it involves collecting the data you need for your research. Before you begin, make sure you’ve chosen the right research methods that will uncover the type of data you need. This largely depends on your research topic and goals.

Remember that you don’t necessarily have to stick to one research method. You may use a combination of qualitative and quantitative approaches. So for example, you could use interviews to supplement the data from your surveys. Or you may stick to insights from your social listening efforts.

To keep things consistent, let’s look at this in the context of the example from earlier. Perhaps you can send out a survey to your existing users asking them a bunch of questions. This might include questions like which features they use the most and how often they use them. You can get them to choose an answer from one to five and collect quantitative data.

Plus, for qualitative insights, you could even include a few open-ended questions with the option to write their answers. For instance, you might ask them if there’s any improvement they wish to see in your product.

Step 4: Analyze results

Once you have all the data you need, it’s time to analyze it keeping your research topic in mind. This involves trying to interpret the data to look for a wider meaning, particularly in relation to your research goal.

So let’s say a large percentage of responses were four or five in the satisfaction rating. This means your existing users are mostly satisfied with your current product features. On the other hand, if the responses were mostly ones and twos, you may look for opportunities to improve. The responses to your open-ended questions can give you further context as to why people are disappointed.

Step 5: Make decisions for your business

Now it’s time to take your findings and turn them into actionable insights for your business. In this final step, you need to decide how you want to move forward with your new market insight.

What did you find in your research that would require action? How can you put those findings to good use?

The market research tools you should be using

To wrap things up, let’s talk about the various tools available to conduct speedy, in-depth market research. These tools are essential for conducting market research faster and more efficiently.

Social listening and analytics

Social analytics tools like Sprout can help you keep track of engagement across social media. This goes beyond your own engagement data but also includes that of your competitors. Considering how quickly social media moves, using a third-party analytics tool is ideal. It allows you to make sense of your social data at a glance and ensure that you’re never missing out on important trends.

Email marketing research tools

Keeping track of brand emails is a good idea for any brand looking to stand out in its audience’s inbox.

Tools such as MailCharts , Really Good Emails and Milled can show you how different brands run their email campaigns.

Meanwhile, tools like Owletter allow you to monitor metrics such as frequency and send-timing. These metrics can help you understand email marketing strategies among competing brands.

Content marketing research

If you’re looking to conduct research on content marketing, tools such as BuzzSumo can be of great help. This tool shows you the top-performing industry content based on keywords. Here you can see relevant industry sites and influencers as well as which brands in your industry are scoring the most buzz. It shows you exactly which pieces of content are ranking well in terms of engagements and shares and on which social networks.

SEO and keyword tracking

Monitoring industry keywords is a great way to uncover competitors. It can also help you discover opportunities to advertise your products via organic search. Tools such as Ahrefs provide a comprehensive keyword report to help you see how your search efforts stack up against the competition.

Competitor comparison template

For the sake of organizing your market research, consider creating a competitive matrix. The idea is to highlight how you stack up side-by-side against others in your market. Use a social media competitive analysis template to track your competitors’ social presence. That way, you can easily compare tactics, messaging and performance. Once you understand your strengths and weaknesses next to your competitors, you’ll find opportunities as well.

Customer persona creator

Finally, customer personas represent a place where all of your market research comes together. You’d need to create a profile of your ideal customer that you can easily refer to. Tools like Xtensio can help in outlining your customer motivations and demographics as you zero in on your target market.

Build a solid market research strategy

Having a deeper understanding of the market gives you leverage in a sea of competitors. Use the steps and market research tools we shared above to build an effective market research strategy.

But keep in mind that the accuracy of your research findings depends on the quality of data collected. Turn to Sprout’s social media analytics tools to uncover heaps of high-quality data across social networks.

- Leveling Up

- Marketing Disciplines

The 43 best marketing resources we recommend in 2024

Executing a successful demand generation strategy [with examples]

How customer relationship marketing on social media drives revenue

- Other Platforms

SMS marketing 101: What is SMS Marketing (+ examples)

- Now on slide

Build and grow stronger relationships on social

Sprout Social helps you understand and reach your audience, engage your community and measure performance with the only all-in-one social media management platform built for connection.

How To Do Market Research: Definition, Types, Methods

Jan 2, 2024

11 min. read

Market research isn’t just collecting data. It’s a strategic tool that allows businesses to gain a competitive advantage while making the best use of their resources. Research reveals valuable insights into your target audience about their preferences, buying habits, and emerging demands — all of which help you unlock new opportunities to grow your business.

When done correctly, market research can minimize risks and losses, spur growth, and position you as a leader in your industry.

Let’s explore the basic building blocks of market research and how to collect and use data to move your company forward:

Table of Contents

What Is Market Research?

Why is market research important, market analysis example, 5 types of market research, what are common market research questions, what are the limitations of market research, how to do market research, improving your market research with radarly.

Market Research Definition: The process of gathering, analyzing, and interpreting information about a market or audience.

Market research studies consumer behavior to better understand how they perceive products or services. These insights help businesses identify ways to grow their current offering, create new products or services, and improve brand trust and brand recognition .

You might also hear market research referred to as market analysis or consumer research .

Traditionally, market research has taken the form of focus groups, surveys, interviews, and even competitor analysis . But with modern analytics and research tools, businesses can now capture deeper insights from a wider variety of sources, including social media, online reviews, and customer interactions. These extra layers of intel can help companies gain a more comprehensive understanding of their audience.

With consumer preferences and markets evolving at breakneck speeds, businesses need a way to stay in touch with what people need and want. That’s why the importance of market research cannot be overstated.

Market research offers a proactive way to identify these trends and make adjustments to product development, marketing strategies , and overall operations. This proactive approach can help businesses stay ahead of the curve and remain agile as markets shift.

Market research examples abound — given the number of ways companies can get inside the minds of their customers, simply skimming through your business’s social media comments can be a form of market research.

A restaurant chain might use market research methods to learn more about consumers’ evolving dining habits. These insights might be used to offer new menu items, re-examine their pricing strategies, or even open new locations in different markets, for example.

A consumer electronics company might use market research for similar purposes. For instance, market research may reveal how consumers are using their smart devices so they can develop innovative features.

Market research can be applied to a wide range of use cases, including:

- Testing new product ideas

- Improve existing products

- Entering new markets

- Right-sizing their physical footprints

- Improving brand image and awareness

- Gaining insights into competitors via competitive intelligence

Ultimately, companies can lean on market research techniques to stay ahead of trends and competitors while improving the lives of their customers.

Market research methods take different forms, and you don’t have to limit yourself to just one. Let’s review the most common market research techniques and the insights they deliver.

1. Interviews

3. Focus Groups

4. Observations

5. AI-Driven Market Research

One-on-one interviews are one of the most common market research techniques. Beyond asking direct questions, skilled interviewers can uncover deeper motivations and emotions that drive purchasing decisions. Researchers can elicit more detailed and nuanced responses they might not receive via other methods, such as self-guided surveys.

Interviews also create the opportunity to build rapport with customers and prospects. Establishing a connection with interviewees can encourage them to open up and share their candid thoughts, which can enrich your findings. Researchers also have the opportunity to ask clarifying questions and dig deeper based on individual responses.

Market research surveys provide an easy entry into the consumer psyche. They’re cost-effective to produce and allow researchers to reach lots of people in a short time. They’re also user-friendly for consumers, which allows companies to capture more responses from more people.

Big data and data analytics are making traditional surveys more valuable. Researchers can apply these tools to elicit a deeper understanding from responses and uncover hidden patterns and correlations within survey data that were previously undetectable.

The ways in which surveys are conducted are also changing. With the rise of social media and other online channels, brands and consumers alike have more ways to engage with each other, lending to a continuous approach to market research surveys.

3. Focus groups

Focus groups are “group interviews” designed to gain collective insights. This interactive setting allows participants to express their thoughts and feelings openly, giving researchers richer insights beyond yes-or-no responses.

One of the key benefits of using focus groups is the opportunity for participants to interact with one another. They spark discussions while sharing diverse viewpoints. These sessions can uncover underlying motivations and attitudes that may not be easily expressed through other research methods.

Observing your customers “in the wild” might feel informal, but it can be one of the most revealing market research techniques of all. That’s because you might not always know the right questions to ask. By simply observing, you can surface insights you might not have known to look for otherwise.

This method also delivers raw, authentic, unfiltered data. There’s no room for bias and no potential for participants to accidentally skew the data. Researchers can also pick up on non-verbal cues and gestures that other research methods may fail to capture.

5. AI-driven market research

One of the newer methods of market research is the use of AI-driven market research tools to collect and analyze insights on your behalf. AI customer intelligence tools and consumer insights software like Meltwater Radarly take an always-on approach by going wherever your audience is and continuously predicting behaviors based on current behaviors.

By leveraging advanced algorithms, machine learning, and big data analysis , AI enables companies to uncover deep-seated patterns and correlations within large datasets that would be near impossible for human researchers to identify. This not only leads to more accurate and reliable findings but also allows businesses to make informed decisions with greater confidence.

Tip: Learn how to use Meltwater as a research tool , how Meltwater uses AI , and learn more about consumer insights and about consumer insights in the fashion industry .

No matter the market research methods you use, market research’s effectiveness lies in the questions you ask. These questions should be designed to elicit honest responses that will help you reach your goals.

Examples of common market research questions include:

Demographic market research questions

- What is your age range?

- What is your occupation?

- What is your household income level?

- What is your educational background?

- What is your gender?

Product or service usage market research questions

- How long have you been using [product/service]?

- How frequently do you use [product/service]?

- What do you like most about [product/service]?

- Have you experienced any problems using [product/service]?

- How could we improve [product/service]?

- Why did you choose [product/service] over a competitor’s [product/service]?

Brand perception market research questions

- How familiar are you with our brand?

- What words do you associate with our brand?

- How do you feel about our brand?

- What makes you trust our brand?

- What sets our brand apart from competitors?

- What would make you recommend our brand to others?

Buying behavior market research questions

- What do you look for in a [product/service]?

- What features in a [product/service] are important to you?

- How much time do you need to choose a [product/service]?

- How do you discover new products like [product/service]?

- Do you prefer to purchase [product/service] online or in-store?

- How do you research [product/service] before making a purchase?

- How often do you buy [product/service]?

- How important is pricing when buying [product/service]?

- What would make you switch to another brand of [product/service]?

Customer satisfaction market research questions

- How happy have you been with [product/service]?

- What would make you more satisfied with [product/service]?

- How likely are you to continue using [product/service]?

Bonus Tip: Compiling these questions into a market research template can streamline your efforts.

Market research can offer powerful insights, but it also has some limitations. One key limitation is the potential for bias. Researchers may unconsciously skew results based on their own preconceptions or desires, which can make your findings inaccurate.

- Depending on your market research methods, your findings may be outdated by the time you sit down to analyze and act on them. Some methods struggle to account for rapidly changing consumer preferences and behaviors.

- There’s also the risk of self-reported data (common in online surveys). Consumers might not always accurately convey their true feelings or intentions. They might provide answers they think researchers are looking for or misunderstand the question altogether.

- There’s also the potential to miss emerging or untapped markets . Researchers are digging deeper into what (or who) they already know. This means you might be leaving out a key part of the story without realizing it.

Still, the benefits of market research cannot be understated, especially when you supplement traditional market research methods with modern tools and technology.

Let’s put it all together and explore how to do market research step-by-step to help you leverage all its benefits.

Step 1: Define your objectives

You’ll get more from your market research when you hone in on a specific goal : What do you want to know, and how will this knowledge help your business?

This step will also help you define your target audience. You’ll need to ask the right people the right questions to collect the information you want. Understand the characteristics of the audience and what gives them authority to answer your questions.

Step 2: Select your market research methods

Choose one or more of the market research methods (interviews, surveys, focus groups, observations, and/or AI-driven tools) to fuel your research strategy.

Certain methods might work better than others for specific goals . For example, if you want basic feedback from customers about a product, a simple survey might suffice. If you want to hone in on serious pain points to develop a new product, a focus group or interview might work best.

You can also source secondary research via secondary research companies , such as industry reports or analyses from large market research firms. These can help you gather preliminary information and inform your approach.

Step 3: Develop your research tools

Prior to working with participants, you’ll need to craft your survey or interview questions, interview guides, and other tools. These tools will help you capture the right information , weed out non-qualifying participants, and keep your information organized.

You should also have a system for recording responses to ensure data accuracy and privacy. Test your processes before speaking with participants so you can spot and fix inefficiencies or errors.

Step 4: Conduct the market research

With a system in place, you can start looking for candidates to contribute to your market research. This might include distributing surveys to current customers or recruiting participants who fit a specific profile, for example.

Set a time frame for conducting your research. You might collect responses over the course of a few days, weeks, or even months. If you’re using AI tools to gather data, choose a data range for your data to focus on the most relevant information.

Step 5: Analyze and apply your findings

Review your findings while looking for trends and patterns. AI tools can come in handy in this phase by analyzing large amounts of data on your behalf.

Compile your findings into an easy-to-read report and highlight key takeaways and next steps. Reports aren’t useful unless the reader can understand and act on them.

Tip: Learn more about trend forecasting , trend detection , and trendspotting .

Meltwater’s Radarly consumer intelligence suite helps you reap the benefits of market research on an ongoing basis. Using a combination of AI, data science, and market research expertise, Radarly scans multiple global data sources to learn what people are talking about, the actions they’re taking, and how they’re feeling about specific brands.

Our tools are created by market research experts and designed to help researchers uncover what they want to know (and what they don’t know they want to know). Get data-driven insights at scale with information that’s always relevant, always accurate, and always tailored to your organization’s needs.

Learn more when you request a demo by filling out the form below:

Continue Reading

What Are Consumer Insights? Meaning, Examples, Strategy

How Coca-Cola Collects Consumer Insights

Market Intelligence 101: What It Is & How To Use It

9 Top Consumer Insights Tools & Companies

Learn / Blog / Article

Back to blog

How to do market research in 4 steps: a lean approach to marketing research

From pinpointing your target audience and assessing your competitive advantage, to ongoing product development and customer satisfaction efforts, market research is a practice your business can only benefit from.

Learn how to conduct quick and effective market research using a lean approach in this article full of strategies and practical examples.

Last updated

Reading time.

A comprehensive (and successful) business strategy is not complete without some form of market research—you can’t make informed and profitable business decisions without truly understanding your customer base and the current market trends that drive your business.

In this article, you’ll learn how to conduct quick, effective market research using an approach called 'lean market research'. It’s easier than you might think, and it can be done at any stage in a product’s lifecycle.

How to conduct lean market research in 4 steps

What is market research, why is market research so valuable, advantages of lean market research, 4 common market research methods, 5 common market research questions, market research faqs.

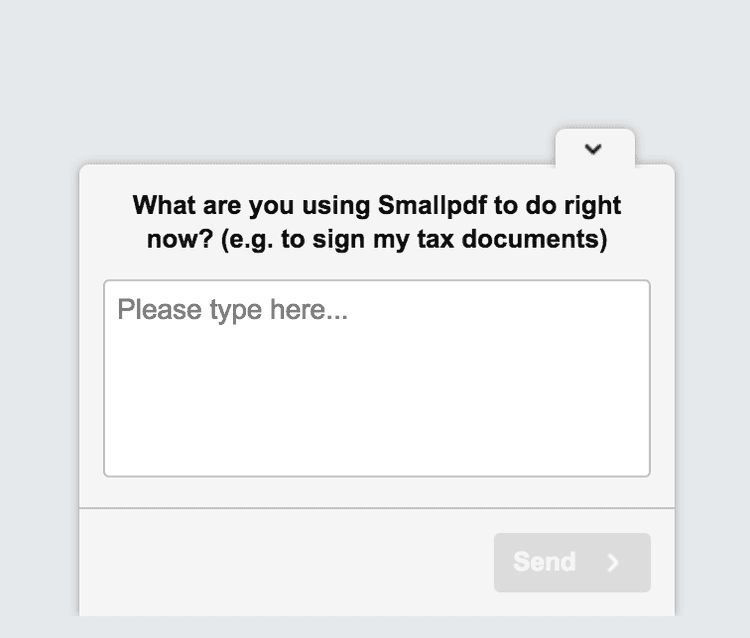

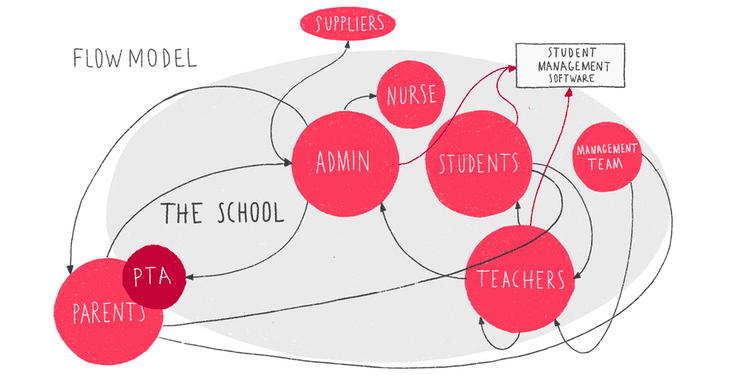

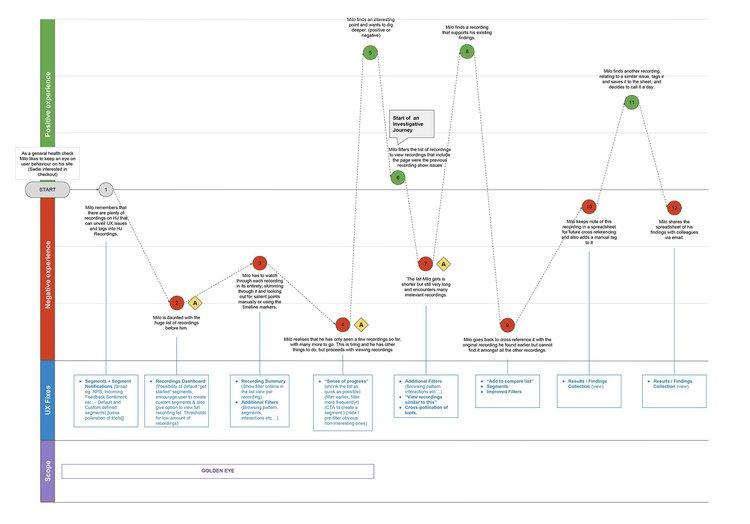

We’ll jump right into our 4-step approach to lean market research. To show you how it’s done in the real world, each step includes a practical example from Smallpdf , a Swiss company that used lean market research to reduce their tool’s error rate by 75% and boost their Net Promoter Score® (NPS) by 1%.

Research your market the lean way...

From on-page surveys to user interviews, Hotjar has the tools to help you scope out your market and get to know your customers—without breaking the bank.

The following four steps and practical examples will give you a solid market research plan for understanding who your users are and what they want from a company like yours.

1. Create simple user personas

A user persona is a semi-fictional character based on psychographic and demographic data from people who use websites and products similar to your own. Start by defining broad user categories, then elaborate on them later to further segment your customer base and determine your ideal customer profile .

How to get the data: use on-page or emailed surveys and interviews to understand your users and what drives them to your business.

How to do it right: whatever survey or interview questions you ask, they should answer the following questions about the customer:

Who are they?

What is their main goal?

What is their main barrier to achieving this goal?

Pitfalls to avoid:

Don’t ask too many questions! Keep it to five or less, otherwise you’ll inundate them and they’ll stop answering thoughtfully.

Don’t worry too much about typical demographic questions like age or background. Instead, focus on the role these people play (as it relates to your product) and their goals.

How Smallpdf did it: Smallpdf ran an on-page survey for a couple of weeks and received 1,000 replies. They learned that many of their users were administrative assistants, students, and teachers.

Next, they used the survey results to create simple user personas like this one for admins:

Who are they? Administrative Assistants.

What is their main goal? Creating Word documents from a scanned, hard-copy document or a PDF where the source file was lost.

What is their main barrier to achieving it? Converting a scanned PDF doc to a Word file.

💡Pro tip: Smallpdf used Hotjar Surveys to run their user persona survey. Our survey tool helped them avoid the pitfalls of guesswork and find out who their users really are, in their own words.

You can design a survey and start running it in minutes with our easy-to-use drag and drop builder. Customize your survey to fit your needs, from a sleek one-question pop-up survey to a fully branded questionnaire sent via email.

We've also created 40+ free survey templates that you can start collecting data with, including a user persona survey like the one Smallpdf used.

2. Conduct observational research

Observational research involves taking notes while watching someone use your product (or a similar product).

Overt vs. covert observation

Overt observation involves asking customers if they’ll let you watch them use your product. This method is often used for user testing and it provides a great opportunity for collecting live product or customer feedback .

Covert observation means studying users ‘in the wild’ without them knowing. This method works well if you sell a type of product that people use regularly, and it offers the purest observational data because people often behave differently when they know they’re being watched.

Tips to do it right:

Record an entry in your field notes, along with a timestamp, each time an action or event occurs.

Make note of the users' workflow, capturing the ‘what,’ ‘why,’ and ‘for whom’ of each action.