The Logic of Finance, Enhancing Decision Quality through Critical Thinking

In corporate finance, CFOs are often required to make decisions that impact their organizations. The quality of these decisions largely depends on one key skill: the ability to think critically. Critical thinking in finance isn’t just about crunching numbers—it’s about using a clear, logical approach to solve problems and make better decisions. In this article, we’ll discuss how CFOs can improve their critical thinking skills to make more informed decisions, with practical examples you can apply in your daily work.

Understand the Problem Before Jumping to Solutions

The first step in critical thinking is to fully understand the problem before trying to fix it. Often, CFOs are under pressure to make quick decisions, which can lead to poor results if the problem isn’t fully understood.

Example: Imagine your company’s profit margins are shrinking. Instead of immediately cutting costs, which might seem like the obvious solution, take the time to analyze why this is happening. Is it because production costs are rising, sales are dropping, or maybe the supply chain is inefficient? By understanding the real cause, you can create a plan that solves the problem, not just the symptoms.

Practical Tip: Before making any major decision, ask yourself, “Do I really understand the problem? What information do I need to make a smart decision?” Make sure your team provides complete reports that cover all aspects of the issue, not just the most obvious ones.

Challenge Assumptions and Biases

Every financial decision is influenced by assumptions and biases, even if we don’t always notice them. Critical thinking involves recognizing and questioning these assumptions to make sure they don’t lead you astray.

Example: Suppose your company is considering merging with a smaller firm. You might assume that the merger will automatically increase your market share. But a critical thinker would question this assumption by considering potential risks, such as whether the two companies’ cultures will clash or if there will be integration issues that could harm the business.

Practical Tip: Regularly check the assumptions behind your decisions. For each major decision, list the key assumptions and ask, “What if this assumption is wrong? What proof do we have to support it?” This can help you avoid costly mistakes and ensure a more solid decision-making process.

Use a Structured Decision-Making Process

To improve the quality of your decisions, it’s helpful to use a structured process that guides you through each step. One such process is the OODA Loop (Observe, Orient, Decide, Act), which is used in both military and business settings.

Example: Let’s say you need to decide whether to invest in a new technology platform. By using the OODA Loop:

- Observe: Gather data about the platform’s features, costs, and benefits.

- Orient: Think about how this technology fits with your company’s goals and current systems.

- Decide: Weigh the pros and cons and make your decision based on the evidence.

- Act: Implement your decision and monitor its impact, being ready to make changes if needed.

Practical Tip: Include the OODA Loop or a similar decision-making process in your regular financial planning meetings. This will help you and your team stay focused and ensure that decisions are made logically and based on facts, not just gut feelings.

Bring in Different Perspectives

Getting different viewpoints is important for critical thinking because it helps you see the full picture and avoid “groupthink.” Encouraging input from different parts of the company can lead to better, more innovative decisions.

Example: If you’re considering a major investment, like opening a new production facility, don’t just rely on financial data. Get input from operations, marketing, and HR to understand the broader implications, such as potential production challenges or the availability of talent in the new area.

Practical Tip: Create a culture of collaboration by holding cross-functional meetings for big financial decisions. Encourage open discussions where team members feel comfortable challenging ideas and offering different viewpoints. This will lead to more informed and balanced decisions.

Keep Learning and Adapting

The business world is always changing, so your approach to decision-making should evolve too. Continuous learning is a key part of critical thinking, allowing you to adjust your strategies based on new information and changing circumstances.

Example: During the COVID-19 pandemic, many CFOs had to quickly adapt to remote work and changing customer behaviors. Those who critically assessed the situation, learned from new trends, and adjusted their strategies were better able to navigate the crisis.

Practical Tip: Make continuous learning a priority for yourself and your team. Stay up to date on industry trends, attend relevant seminars, and encourage your team to do the same. Regularly review past decisions to understand what worked, what didn’t, and why. This will help you make better decisions in the future.

Conclusion

Critical thinking is a must-have skill for CFOs who want to excel in today’s complex financial landscape. By taking the time to fully understand problems, questioning assumptions, using structured decision-making processes, bringing in different perspectives, and committing to continuous learning, you can improve the quality of your decisions and drive better results for your company. As you go about your daily tasks, remember that the best financial decisions are those made with a clear, logical, and critical mindset. Implement these strategies, and you’ll be well-equipped to handle whatever challenges and opportunities come your way.

Members’ Profile: Rowen Pillai

How to keep cash flow strong by managing customer credit risk, members’ spotlight: shivani govender, turning the unpredictable into the manageable for cfos in uncertain times, members spotlight: elizabeth burns, building a culture of ethical performance in organisations.

ELEVATE YOUR BUSINESS WITH

Become part of a international community of finance executives.

- Contractors

- Junior Professional

How to develop critical thinking skills in finance & accounting

Stephen Moir

Share this:.

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to email a link to a friend (Opens in new window)

When it comes to finance and accounting roles, employers are increasingly looking for problem solvers, not a number-crunchers. Over recent years, we have seen an increasing demand for people who can analyse and interpret data and think critically.

What is critical thinking.

A critical thinker is a problem solver. They are able to evaluate complex situations, weigh-up different options and reach logical (and often quite creative) conclusions.

Critical thinkers are highly-valued by employers as they innovate and make improvements, without taking unnecessary risks. Chartered Accountants Australia and New Zealand recently identified that it was in the top 10 attributes that will help you get noticed in the job market.

Why are critical thinking skills important?

Once you have learnt how to develop critical thinking skills you will be better able to add value to data, interpret trends within the business, understand how people and performance intersect and take-on broader commercial outlook that benefits the business.

How to develop critical thinking skills

Critical thinking comes naturally to some people, but it is also a skill than can be practiced. Here are some tips for how to develop your own critical thinking skills :

- Examine: Self-awareness is the foundation of critical thinking. It allows you to play to your strengths and address your weaknesses. Question how and why you do things the way you do.

- Analyse: Look for opportunities to grow and improve. Consider alternative solutions to the problems you encounter in your work.

- Explain: Clear communication is key. Get into the habit of talking through your reasoning and conclusions with colleagues.

- Innovate: Develop an independent mind-set. Find ways to think outside the box and challenge the status quo. Make sure your decisions are well-thought out. A critical thinker is logical as well as creative.

- Learn: Keep an open and well-oiled mind. Brush-up on your problem-solving skills by doing brain-teasers or trying to solve problems backwards. Keep up-to-date with professional learning opportunities . You may also need to unlearn past mindsets in order to grow and move forward.

How to apply critical thinking skills in your current role

Could you implement a new process or procedure that enhances performance or profitability? You might also consider volunteering for a new project or responsibility that gives you the opportunity to innovate and take on a new challenge. It’s a great way to broaden your skillset and gain exposure to other parts of the business.

Surround yourself with other critical thinkers in the organisation and work together towards achieving a problem-solving culture. Ask questions, and always look for opportunities for continual learning.

Changing roles to develop critical thinking skills

At Moir Group, we are passionate about finding the right cultural fit between people and the organisations they work with. If you are a critical thinker, it’s worth looking for a stimulating work environment that encourages innovation and non-conformist thinking when considering your next role.

How to demonstrate critical thinking skills at an interview

During an interview, use examples from your past experiences to demonstrate your problem-solving abilities. Show that you can be analytical, weigh-up pros and cons, consider other view points and be creative in your solutions. Clearly articulating your thought process is key.

Sometimes an interviewer will ask you to simplify the complex as a way of determining your clarity of thought. For example: “How would you explain the state of the economy to a kindergarten child?” In instances like these, the focus will be on how you explain your reasoning, rather than achieving a ‘right’ answer. Learn more here.

If you’re looking to take that next step in your career, we can help. Get in touch with us here .

2 Responses to “How to develop critical thinking skills in finance & accounting”

Hi Stephen,

The above is very useful and very valuable for employers. However my understanding of critical thinking is slightly different from above. I recently listened to a course in critical thinking by Professor Steven Novella of Yale School of Medicine. To keep it simple it is to do with assessing the veracity of views and statements made by oneself, others and media being constantly aware of the many biases, the flaws and fabrications of memory, half truths, unspoken truths, and even lies. So it becomes key to adopt an inquisitive mindset, to look for external evidence that supports argument and not just wishful or hopeful thinking.

Just wanting to add to the debate as this is a really important area.

Hi Richard,

We are pleased that found this article useful. Thanks for your sharing your thoughts about critical thinking.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Moir Group acknowledges Traditional Owners of Country throughout Australia and recognises the continuing connection to lands, waters and communities. We pay our respect to Aboriginal and Torres Strait Islander cultures; and to Elders past and present and encourage applications from Aboriginal and Torres Strait Islander people and people of all cultures, abilities, sex, and genders.

- Search Search Search …

- Search Search …

Critical Thinking and Personal Finance: A Smart Approach to Money Management

In today’s fast-paced world, personal finance is more crucial than ever for long-term financial success and stability. It’s not enough to simply follow traditional financial advice; individuals must apply critical thinking skills to their money management decisions. By analyzing and evaluating their financial situation, people can make informed choices that will improve their overall financial well-being.

Critically thinking about personal finance requires a thorough understanding of one’s income, expenses, savings, and investments. This involves taking a step back, assessing the whole financial picture, and identifying areas that need improvement or adjustment. With a proactive approach and a focus on strategic decision-making, individuals can create a solid foundation for a more secure financial future.

Additionally, it’s essential to stay informed about new opportunities and potential challenges in the financial world. By staying current with economic trends and financial news, individuals can better discern which strategies will work best for their unique situation, reducing the risk of financial setbacks and increasing their chances of long-term financial success.

Understanding Personal Finance

Income and expenses.

When it comes to personal finance, the first step is understanding your income and expenses. Income refers to the money you earn from your job, business, or investments. Expenses are the costs you incur for daily living, such as rent, utilities, groceries, and transportation. To manage your finances effectively, it is crucial to track and categorize your income and expenses. This can help you identify areas where you can cut back on spending, as well as areas where you can potentially increase your earnings. For a clear picture of your financial situation, consider using:

- Budgeting tools : Use apps or spreadsheets to monitor your income and expenses.

- Financial goals : Set short-term and long-term goals to create a sense of direction and motivation.

Debt and Credit

Debt and credit play a significant role in personal finance. Debt is the money you owe, such as loans and credit card balances. Credit is your ability to borrow money for various purposes, like buying a home or financing a car. A healthy credit score is essential for accessing favorable loan terms and interest rates. To maintain good credit and manage your debt effectively, consider:

- Paying debts on time : Avoid late payments and consistently meet your obligations.

- Paying off high-interest debts first : Prioritize paying down debts with the highest interest rates to save money in the long run.

- Monitoring your credit score : Regularly check your credit report for accuracy and take steps to improve your score, such as keeping your credit card balances low and limiting new credit inquiries.

Savings and Investments

Savings and investments are essential components of personal finance, as they contribute to your future financial security. Savings can provide a financial cushion for emergencies or short-term goals, while investments help grow your wealth over the long term. To maximize your savings and investments, consider:

- Building an emergency fund : Aim to have three to six months’ worth of living expenses set aside for unexpected events.

- Saving for specific goals : Set aside money in a designated savings account for short-term goals, such as vacations or home repairs.

- Investing : Allocate a portion of your income to a diversified investment portfolio, which may include stocks, bonds, mutual funds, and real estate.

By focusing on these critical aspects of personal finance— income and expenses, debt and credit, and savings and investments—you can develop a solid foundation for financial success and security. Remember to review and adjust your financial plan regularly to ensure you stay on track and make informed decisions for your future.

Critical Thinking in Finance

Emotional factors.

Critical thinking in finance requires an understanding of the various emotional factors that can influence decision-making. Emotions, such as fear, greed, and anxiety, can often cloud our judgments, leading to poor financial choices. It is important for an individual to be aware of their emotions and the impact they may have on their financial decisions. Practicing self-awareness and emotional intelligence can help one better manage these emotional factors.

Decision-Making Process

The decision-making process in finance involves evaluating various options, weighing the potential risks, and considering the long-term consequences of each decision. Critical thinking plays a crucial role in this process, enabling individuals to analyze financial information and make informed decisions that align with their values and goals.

A structured decision-making process can involve the following steps:

- Identify the financial problem or decision to be made.

- Gather information about the different options.

- Evaluate the pros and cons of each option, taking into consideration factors like personal risk tolerance, values, and long-term goals.

- Choose the option that best aligns with the individual’s values and objectives.

- Implement the chosen option and monitor its progress.

Incorporating critical thinking skills , such as analysis, problem-solving, and logical reasoning, can help promote better financial decision-making and lead to more positive outcomes in one’s personal finances. It is essential for individuals to remain objective and unbiased when evaluating financial options, ensuring that they make decisions that are in their best interest, both in the short and long term.

Budgeting and Cash Flow

Creating a budget.

Creating a budget is an essential step in taking control of your personal finances. A budget is a plan that helps you allocate your income to different living expenses, such as housing, utilities, groceries, and entertainment. To start, list all your sources of income and expenses. Categorize the expenses as either fixed (e.g., rent, mortgage) or variable (e.g., food, clothing). Next, estimate the monthly cost for each expense and compare it to your income. If your income exceeds your expenses, you have a positive cash flow. If not, you will need to adjust your spending to achieve a balanced budget.

Income Sources:

- Investments

Expense Categories:

- Entertainment

Managing Monthly Expenses

Managing your monthly expenses effectively is crucial for maintaining a healthy cash flow and staying within your budget. Start by tracking your spending to identify any patterns or areas where you may be overspending. Use budgeting apps or tools to help you categorize and monitor your expenses. Prioritize essential living expenses and consider cutting back on non-essential items to maintain a positive cash flow.

Some tips for managing monthly expenses include:

- Automate your bill payments – This helps you avoid late fees and ensures timely payment of essential bills.

- Allocate a specific amount for discretionary spending – This can help you maintain a balanced budget by setting limits on non-essential spending.

- Review your expenses regularly – Frequent reviews can help you identify any changes in your spending habits and make adjustments as needed.

By effectively budgeting and managing your cash flow, you can gain better control over your personal finances, avoid financial stress, and achieve your financial goals.

Dealing with Debt

Debt management strategies.

Dealing with debt requires a confident and knowledgeable approach. It’s important to develop a clear plan to tackle existing debt while preventing further accumulation. Consider the following debt management strategies:

- Create a budget : Tracking your income and expenses provides a clear picture of your financial situation, making it easier to identify areas for improvement.

- Prioritize high-interest debt : Focus on paying off debts with the highest interest rates first, as they can accumulate quickly and cost more over time.

- Debt consolidation : Combining multiple debts into a single loan with a lower interest rate can simplify payments and reduce overall interest costs.

- Seek professional help : If managing your debt proves challenging, consider consulting a financial advisor or a credit counseling service for guidance.

Credit Card Debt

Credit card debt is a common and often costly form of unsecured debt. To manage and reduce credit card debt, follow these steps:

- Review your statements : Analyze your credit card statements to identify patterns and areas where you can cut back on spending.

- Pay more than the minimum : Aim to pay more than the minimum payment each month to decrease your debt faster and reduce interest charges.

- Negotiate for a lower interest rate : Contact your credit card issuer to discuss the possibility of a lower interest rate, as this can help lessen the overall amount owed.

- Consider balance transfer options : If available, transferring a high-interest balance to a card with a lower interest rate or promotional period can save on interest costs.

Student Loans

Student loans are a significant source of debt for many individuals. Here are some strategies to manage student loan debt effectively:

- Understand your repayment options : Familiarize yourself with the different repayment plans available for your specific loan type, such as income-driven repayment plans or loan forgiveness programs.

- Pay off higher interest loans first : If you have multiple student loans, prioritize paying off the ones with the highest interest rates to minimize total interest costs.

- Refinance student loans : Refinancing your loans could lead to lower interest rates and potentially more favorable repayment terms.

- Make extra payments : Whenever possible, make extra payments on your student loans to pay them off sooner and reduce the overall interest accrued.

Income Diversification

Side hustles.

Exploring side hustles can be a great way to create multiple streams of income and improve financial stability. Having a side hustle not only provides extra income but also can act as a safety net in times of financial uncertainty. Some common side hustles include freelancing, selling handmade products, or offering consulting services. It is essential to focus on activities that leverage your skills and align with your interests to ensure long-term commitment and success.

Investment Diversification

Another crucial aspect of income diversification is spreading your investments across different asset classes. This practice, known as investment diversification , helps reduce risk and achieve more consistent returns. It typically involves dividing your investments among stocks, bonds, real estate, and other asset classes. By allocating capital across a range of investments, you can minimize the impact of any single investment performing poorly.

A diversified portfolio should also take into consideration international and domestic markets, varying industries, and a mix of both growth and value stocks. It is important to periodically review and rebalance your investment portfolio to ensure optimal diversification and adjust for changes in risk tolerance or financial goals.

Planning for the Future

Retirement planning.

Retirement planning is a crucial aspect of personal finance to ensure a comfortable and secure future. Establish clear financial goals and start saving and investing early in various retirement accounts, such as 401(k)s, IRAs, or annuities. Diversification in investment options like stocks, bonds, and mutual funds can help generate consistent returns, minimize risks, and build a robust portfolio over time. Keep revisiting and adjusting your retirement plan as needed to stay aligned with your financial goals and market changes.

Family Planning

Family planning plays a significant role in shaping your personal finance strategy. Consider the costs of raising children, including education, healthcare, and day-to-day expenses. Set up dedicated savings accounts or invest in specific financial products that cater to each of these requirements. Additionally, planning for your children’s future education expenses early on, by opening 529 plans or custodial accounts, can help you accumulate funds without feeling an overwhelming financial burden.

Managing expenses is a critical component of personal finance. It involves tracking your day-to-day spending, creating a budget, and making informed decisions about where to cut costs or prioritize spending. By consistently monitoring and reducing unnecessary expenses, you can allocate more resources to saving, investing, and achieving your financial goals. Consider using budgeting apps or software for improved financial organization and clarity. This proactive approach can help you stay on top of your expenses and ensure you’re on the right track for a stronger financial future.

Navigating Financial Challenges

When it comes to personal finance, it’s important to have a strategy in place to deal with various financial challenges. Two such challenges that have the potential to significantly impact personal finances are recessions and economic uncertainty, as well as pandemics. By understanding these challenges and how to address them, you can make more informed decisions to safeguard your financial well-being.

Recessions and Economic Uncertainty

Recessions and economic uncertainty can come on suddenly and have lasting effects on individual and household finances. It’s crucial to have a plan for navigating these challenges:

- Diversify your investments : A well-diversified portfolio can help spread risk and reduce the impact of market fluctuations on your overall investment performance.

- Maintain an emergency fund : Having three to six months’ worth of expenses saved in a liquid account can serve as a financial cushion during hard times.

- Reduce high-interest debt : Focusing on paying down high-interest debts, such as credit cards or personal loans, can help improve your financial situation and reduce the strain of accumulating interest during uncertain times.

- Be prepared to adjust your budget : Economic downturns may require tightening your budget to adapt to changes in income and expenses. Regularly reevaluate your budget to ensure it aligns with your financial needs.

Pandemic and Finances

Pandemics, like the recent COVID-19 outbreak, can pose unique financial challenges. These events can lead to sudden income loss and increased expenses, making it essential to reassess your financial plans:

- Identify your financial priorities : Determine which expenses are essential and which can be scaled back during a pandemic. Prioritize necessary living costs like housing, food, and utilities.

- Explore relief options : Many governments and financial institutions offer relief options during times of crisis, such as moratoriums on loan payments or extended deadlines for tax payments. Research and use these options to lessen the financial burden.

- Review your insurance coverage : Ensure you have adequate health, disability, and life insurance coverage to protect yourself and your family from unexpected medical or personal emergencies.

- Stay informed : Keep up-to-date with accurate information about the pandemic from reliable sources and make adjustments to your financial plans as needed.

By taking a proactive approach in addressing recessions, economic uncertainty, and pandemics, you can better protect your personal finances during challenging times. Remember to reassess your financial plans regularly and make adjustments as circumstances change.

Making Smart Purchases

Housing and mortgages.

When considering housing options, it’s essential to be mindful of the costs associated with purchasing a home. One critical aspect to think about is obtaining a mortgage . It’s vital to shop around and compare different lenders’ interest rates and terms to ensure you get the best deal possible. Also, make sure to consider the overall cost of the mortgage, including any fees and closing costs.

Another consideration when buying a home is whether to purchase a brand new or used property . New homes may have additional costs, like property tax or homeowner’s association fees. Used homes, on the other hand, might require more maintenance and repairs. Carefully weighing the pros and cons of each option will help you make a smarter decision.

Vehicle Ownership

In terms of vehicle ownership, there are several factors to consider before purchasing a car. Deciding between a new or used car is an essential step in the process. New cars may offer more advanced features and come with a warranty, but they usually have a higher price tag and suffer from rapid depreciation in value. On the other hand, used cars are generally more affordable, but may not have the latest features and could require more maintenance.

Another essential factor in vehicle ownership is deciding between buying or leasing a car. A lease can be an attractive option for those who want to drive a new car for a lower monthly payment and not have to worry about its resale value. However, leasing can also come with mileage restrictions and may not be the best option for those who plan to keep their vehicle for an extended period.

When determining what type of car payment is most suitable for your budget, it’s essential to be realistic about your financial situation and long-term needs. By critically thinking about your personal finances and making informed decisions, you can make smart purchases when it comes to housing and vehicle ownership.

Managing Financial Products

Bank accounts.

When managing personal finances, it’s essential to have a clear understanding of various bank accounts and their features. Considering both checking and savings accounts can help individuals manage their finances more effectively.

A checking account typically allows for unlimited transactions, providing flexibility in money management. This type of account is beneficial for everyday expenses, bill payments, and managing cash flow. It is crucial to track transactions to avoid overdrafts and maintain a healthy financial status.

On the other hand, a savings account is designed for longer-term goals, such as emergency funds or future expenses. These accounts may offer higher interest rates, helping individuals accumulate savings over time. It’s essential to monitor the account’s balance and growth, as well as to ensure periodic deposits to achieve financial goals.

Insurance Options

When assessing personal finance, it’s vital to evaluate various insurance options to protect against unforeseen events or expenses. Two common types of insurance to consider are health insurance and car insurance.

Health insurance is essential in managing potential medical costs. It’s crucial to find a plan that meets one’s needs and budget. Factors to consider when selecting a health insurance plan include the coverage provided, out-of-pocket costs, provider networks, and any additional benefits. Maintain awareness of deductibles, copays, and policy changes.

Car insurance is a vital component of responsible vehicle ownership. Evaluating different coverage options and understanding their implications on financial security is key. While minimum coverage may satisfy legal requirements, it may not provide adequate financial protection in case of an accident. Consider factors such as collision coverage, liability limits, and deductible amounts when choosing a policy. Keep track of policy renewals and any changes in coverage to maintain adequate protection.

Taking the time to critically think about one’s financial products, such as bank accounts and insurance options, can help in managing personal finances effectively. By evaluating each option and understanding their impact on financial goals, individuals can confidently build a solid foundation for their financial future while remaining neutral and clear-headed.

Tax and Wage Considerations

Income tax planning.

One of the essential aspects of personal finance is effective income tax planning . This involves considering the timing of income, the size of income, and planning for expenditures. By saving for retirement in an Individual Retirement Account (IRA) or other tax-advantaged accounts, you can reduce your taxable income and plan for a more financially secure future. Furthermore, taking advantage of deductions and tax credits can help to minimize the tax burden and provide additional resources for personal financial goals.

Salary and Wage Factors

When it comes to personal finance, understanding your salary and wage situation is crucial. One of the key elements is comparison shopping . This means analyzing the job market and understanding whether your current salary and benefits are competitive compared to other positions in your field. By knowing your worth in the job market, you can negotiate for a higher salary or seek better opportunities elsewhere. Additionally, consider whether your wage or salary is in line with your personal financial goals. For instance, if you aim to save for a down payment on a home or plan for early retirement, ensure that your income can support these initiatives.

In summary, both tax planning and salary considerations play a vital role in managing personal finances effectively. By understanding your income and tax situation, you can make informed decisions and set realistic financial goals for the future.

In today’s complex financial world, it is essential to think critically about personal finance management . Making informed decisions and having a solid financial plan can ensure long-term financial stability and security.

One key aspect of critical thinking in personal finance involves creating an emergency fund . It is crucial to have a financial buffer to cover unexpected expenses and prevent debt accumulation. Setting aside a portion of one’s income for emergencies creates a safety net that can be relied upon in times of need.

Another aspect of critical thinking involves paying off debt. High-interest debt, such as credit card debt, can be financially crippling if not addressed promptly. Prioritizing debt repayment and devising a strategy to eliminate debt is a crucial step in achieving financial freedom.

Besides managing debt and savings, investment in oneself plays a significant role in personal finance. Acquiring new skills, pursuing higher education, and staying updated with industry trends can lead to better job opportunities and income growth. This, in turn, contributes to long-term financial well-being.

Moreover, building additional income streams and being open to new opportunities increases one’s financial resilience. Diversifying income sources helps reduce reliance on a single income stream and provides financial security in case of unexpected job loss or economic downturn.

In conclusion, critically thinking about personal finance involves several aspects, including emergency funds, debt management, self-investment, and income diversification. By adopting these practices and maintaining a clear, confident, and knowledgeable approach to personal finance, individuals can achieve financial stability and security.

Frequently Asked Questions

How can i improve my financial decision-making skills.

Improving financial decision-making skills involves increasing your financial literacy and being objective in evaluating options. Consider reading books or attending seminars on personal finance, and consult with a financial advisor to gain further insights. Continually analyzing your spending habits and making necessary adjustments will contribute to better decision-making skills.

What methods can I use to create a successful budget?

Creating a successful budget requires identifying income sources, tracking expenses, and setting short-term and long-term financial goals. Analyze your spending habits and categorize them into essential and non-essential expenses. Allocate funds accordingly and monitor your progress regularly to make adjustments as needed.

How can I effectively manage debt and credit?

Effective debt and credit management involves creating a plan to prioritize and pay off debts, maintaining a healthy credit score, and developing responsible borrowing habits. Focus on high-interest debts first, while meeting minimum payment requirements for other debts. Regularly review your credit report and promptly correct any discrepancies to maintain a healthy credit score.

What should I consider when planning for long-term financial goals?

When planning for long-term financial goals, consider factors such as anticipated income, expected expenses, inflation, and investment returns. Start by defining clear and realistic goals, such as saving for a down payment on a house or planning for retirement. Develop a strategic plan to reach those goals and review your progress periodically.

How do I build an emergency fund?

An emergency fund should have enough money to cover three to six months of living expenses. To build this fund, set aside a small portion of your paycheck regularly until you reach your desired amount. Store these funds in a separate, easily accessible account. Maintaining an emergency fund provides financial security in the event of unexpected expenses.

How can I make informed investment choices?

Making informed investment choices involves researching available investment options, assessing their risks and rewards, and aligning investment decisions with your financial goals and risk tolerance. Consult with a financial advisor, use online resources, and stay updated with market trends to enhance your investment knowledge. Diversify your investments to mitigate risk and ensure a balanced portfolio.

You may also like

Critical Thinking and Artificial Intelligence

Artificial intelligence has changed the way we think about the world; indeed, the very concept of a machine being able to think […]

What is Critical Thinking?

Critical Thinking: Its Definition, Applications, Elements and Processes Experts and educators argue on the definition of critical thinking for centuries. No matter […]

Critical thinking jokes

Critical thinking can make life smoother and smarter, solving all kinds of academic, professional and everyday problems. But it’s not something you […]

What is Associative Thinking and Why it Matters in Today’s Workplace

Associative thinking is a cognitive process that allows the mind to connect seemingly unrelated concepts and ideas. This type of thinking is […]

This site uses cookies, including third-party cookies, to improve your experience and deliver personalized content.

By continuing to use this website, you agree to our use of all cookies. For more information visit IMA's Cookie Policy .

Change username?

Create a new account, forgot password, sign in to myima.

Multiple Categories

Improving Critical Thinking Skills

November 01, 2021

By: Sonja Pippin , Ph.D., CPA ; Brett Rixom , Ph.D., CPA ; Jeffrey Wong , Ph.D., CPA

Whether working with financial statements, analyzing operational and nonfinancial information, implementing machine learning and AI processes, or carrying out many of their other varied responsibilities, accounting and finance professionals need to apply critical thinking skills to interpret the story behind the numbers.

Critical thinking is needed to evaluate complex situations and arrive at logical, sometimes creative, answers to questions. Informed judgments incorporating the ever-increasing amount of data available are essential for decision making and strategic planning.

Thus, creatively thinking about problems is a core competency for accounting and finance professionals—and one that can be enhanced through effective training. One such approach is through metacognition. Training that employs a combination of both creative problem solving (divergent thinking) and convergence on a single solution (convergent thinking) can lead financial professionals to create and choose the best interpretations for phenomena observed and how to best utilize the information going forward. Employees at any level in the organization, from newly hired staff to those in the executive ranks, can use metacognition to improve their critical assessment of results when analyzing data.

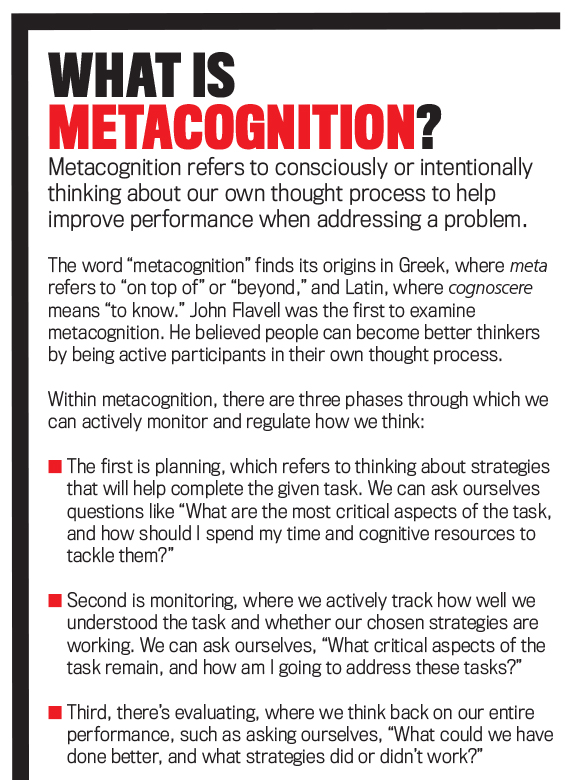

THINKING ABOUT THINKING

Metacognition refers to individuals’ ability to be aware, understand, and purposefully guide how to think about a problem (see “What Is Metacognition?”). It’s also been described as “thinking about thinking” or “knowing about knowing” and can lead to a more careful and focused analysis of information. Metacognition can be thought about broadly as a way to improve critical thinking and problem solving.

In their article “Training Auditors to Perform Analytical Procedures Using Metacognitive Skills,” R. David Plumlee, Brett Rixom, and Andrew Rosman evaluated how different types of thinking can be applied to a variety of problems, such as the results of analytical procedures, and how those types of thinking can help auditors arrive at the correct explanation for unexpected results that were found ( The Accounting Review , January 2015). The training methods they describe in their study, based on the psychological research examining metacognition, focus on applying divergent and convergent thinking.

While they employed settings most commonly encountered by staff in an audit firm, their approach didn’t focus on methods used solely by public accountants. Therefore, the results can be generalized to professionals who work with all types of financial and nonfinancial data. It’s particularly helpful for those conducting data analysis.

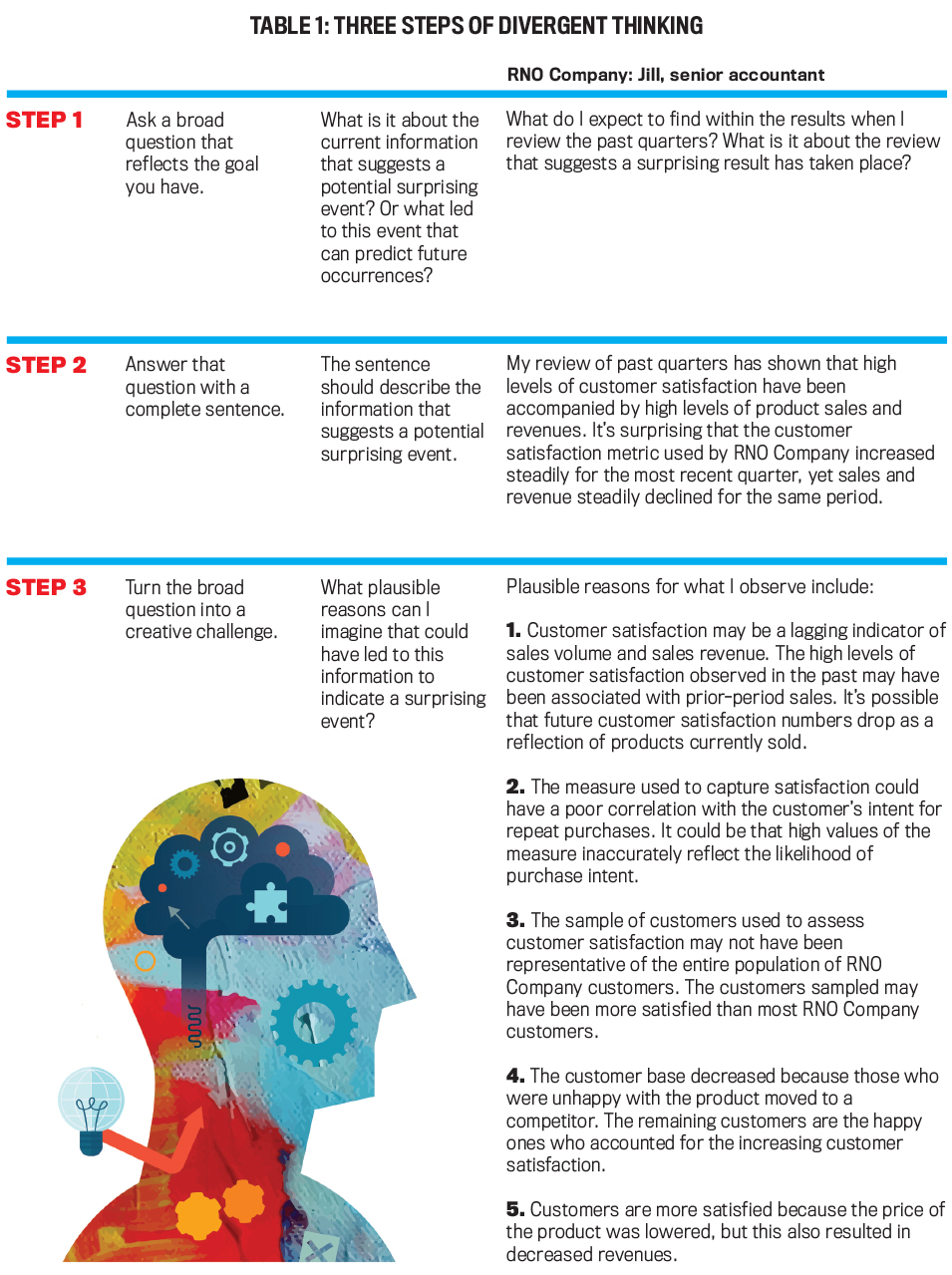

Their approach involved a sequential process of divergent thinking followed by convergent thinking. Divergent thinking refers to creating multiple reasons about what could be causing the surprising or unusual patterns encountered when analyzing data before a definitive rationale is used to inform what actions to take or strategy to use. Here’s an example of divergent thinking:

The customer satisfaction metric employed by RNO Company has increased steadily for the quarter, yet its sales numbers and revenue have declined steadily for the same period. Jill, a senior accountant, conducted ratio and trend analyses and found some of the results to be unusual. To apply divergent thinking, Jill would think of multiple potential reasons for this surprising result before removing any reason from consideration.

Convergent thinking is the process of finding the best explanation for the surprising results so that potential actions can be explored accordingly. The process consists of narrowing down the different reasons by ensuring the only reasons that are kept for consideration are ones that explain all of the surprising patterns seen in the results without explaining more than what is needed. In this way, actions can be taken to address the heart of any problems found instead of just the symptoms. On the other hand, if the surprising result is beneficial to an organization, it can make it easier to take the correct actions to replicate the benefit in other aspects of the business. Here’s an example of convergent thinking:

Washoe, Inc.’s customer satisfaction metric has increased steadily for the quarter, yet sales numbers and revenue have steadily declined for the same period. Roberto found this result to be surprising. After employing divergent thinking to identify 10 potential reasons for this result, such as “the reason that customers seem more satisfied is that the price of goods has been reduced, which also explains the reduction in sales revenue.” To apply convergent thinking, Roberto reviewed each reason that best fit. If the reason doesn’t explain the unusual results satisfactorily, then it will either be modified or discarded. For example, the reduced price of goods doesn’t explain all of the results—specifically, the decrease in units sold—so it needs to either be eliminated as a possible explanation or modified until it does explain all the results.

Exploring strategic or corrective actions based on reasons that completely explain the unusual results increases the chance of correctly addressing the actual issue behind the surprising result. Also, by making sure that the reason doesn’t contain extraneous details, unneeded actions can be avoided.

It’s important to note that a sequential process is required for these types of thinking to be most effective. When encountering a surprising or unexpected result during data analysis, accounting professionals must first focus strictly on divergent thinking—thinking about potential reasons—before using convergent thinking to choose a reason that best explains the surprising result. If convergent thinking is used before divergent thinking is completed, it can lead to reasons being picked simply because they came to mind right away.

LEARNING THE PROCESS

Improving divergent and convergent thinking can benefit employees at any level of an organization. Newer professionals who don’t have as much technical knowledge and experience to draw upon may be more likely to focus on the first explanation that comes to mind (“premature convergent thinking”) without fully considering all of the potential reasons for the surprising results. Experienced individuals such as CFOs and controllers have more technical knowledge and practical experience to rely on, but it’s possible these seasoned employees fall into habits and follow past patterns of thought without fully exploring potential causes for surprising results.

Instructing all accounting professionals on how to think about surprising results can help them have a more complete understanding of the issues at hand that will help guide actions taken in the future. It can lead to a more creative approach when analyzing information and ultimately to better problem solving.

When teaching employees to use divergent and convergent thinking, the goal is to get them to focus on what should be done once they identify information that suggests a surprising result has occurred. The first step is to learn how to properly use divergent thinking to create a set of plausible explanations more likely to contain the actual reason for the surprising results. There’s a three-step method that individuals can follow (see Table 1):

- Ask a broad question that reflects the goal you have: For instance, what is it about the current information that suggests a potential surprising event? Or what led to this event that can help predict future occurrences?

- Answer that question with a complete sentence: Be sure the answer includes a description of the information that suggests a potential surprising event.

- Turn the broad question into a creative challenge: Identify the plausible reasons that could have led to the indications of a surprising event.

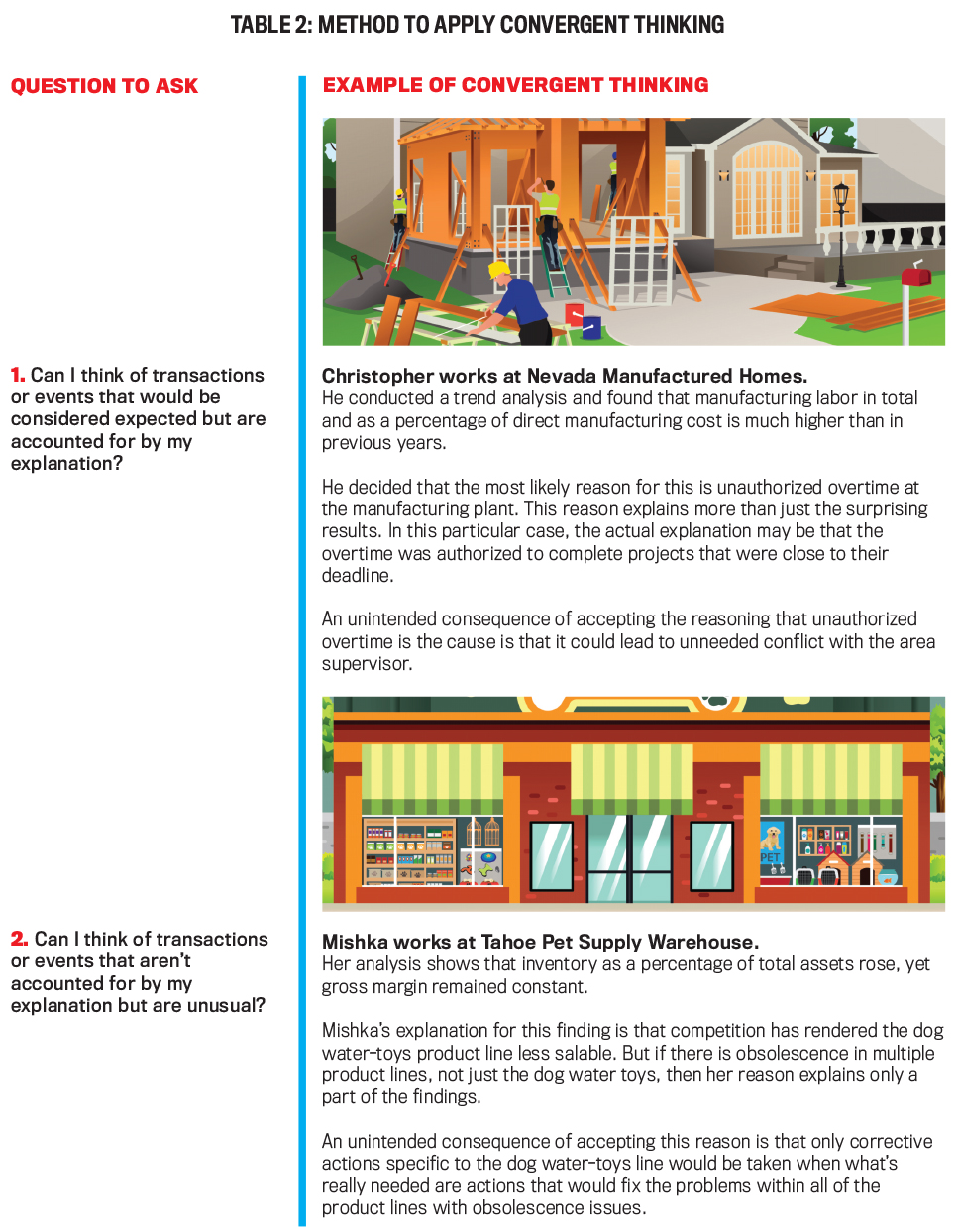

Once employees have a good grasp of how to use divergent thinking, the next step is to instruct them in the proper use of convergent thinking, which involves choosing the best possible reason from the ones identified during the divergent thinking process. Potential reasons need to be narrowed down by removing or modifying those that either don’t fully explain the surprising results or that overexplain the results.

Two simple questions can help individuals screen each of the possible explanations generated in the divergent thinking process (see Table 2):

- Can I think of transactions or events that would be considered expected but are accounted for by my explanation?

- Can I think of transactions or events that aren’t accounted for by my explanation but are unusual?

The first question is designed for an individual to think about whether there are other events outside of the current issue that fit the explanation: “Does the explanation also address phenomena that aren’t related to or outside the scope of the surprising result that’s being studied?” If the answer is “yes,” then this is a case of overexplanation. Consider, for example, a scenario involving an increase in bad debts. Relaxing credit requirements may explain the increase, but they would also explain a growth in sales and falling employee morale due to working massive amounts of overtime to make products for sale.

The second question is designed to think about whether an explanation only accounts for part of the phenomenon being observed: “Does the explanation address only part of what’s being observed while leaving other important details unexplained?” If the answer is “yes,” then it’s an under-explanation. For example, consider a decline in sales. An economic downturn at the same time as the decline may be a possible explanation, but it might only be part of the problem. A drop in product quality or a drop in demand due to obsolescence could also be causing sales to decline.

If the answer to either screening question is “yes,” then the explanation needs to be discarded from consideration or modified to better address the concern. In the case of over-explanation, the reason is too general and may lead to action areas where none is needed while still not addressing the actual issue. For underexplanation, the reason is incomplete because it accounts for only a portion of the phenomenon observed, thus action may only address a symptom and not the actual root problem.

If the answer to both questions is “no,” then the explanation is viable. The chosen reason neither overexplains nor underexplains the issue at hand, making it more likely that the recommended solution or plan of action based on that reason will be more successful at addressing the actual cause of the issue.

Divergent and convergent thinking are two distinct processes that work in conjunction with each other to arrive at potential reasons for the results they observe. Yet, as previously noted, the two ways of thinking must be conducted separately and sequentially in order to obtain optimal results. Divergent thinking must be applied first in order to achieve a diverse set of potential reasons. This will maximize the probability of generating a feasible reason that explains the results correctly. After the set of potential reasons has been generated using the divergent thinking approach, convergent thinking should be used to methodically remove or modify the reasons that don’t fit with the surprising results.

If both divergent thinking and convergent thinking are done simultaneously, premature convergence can lead to a less-than-optimal reason being chosen, which may lead to taking the wrong course of action. Thus, it’s important with training to instruct employees in the use of both divergent thinking and convergent thinking and to use the types of thinking sequentially.

ORGANIZATIONAL TRAINING

Learning to apply divergent and convergent thinking can require a substantial time commitment. The process we’ve described here is designed to enhance critical thinking and problem-solving skills. It outlines a general approach that doesn’t provide specific guidance on the best methods to analyze data or complete a task but rather focuses on successful methods to think of a diverse set of reasons for any surprising results and then how to choose the best explanation for that result in order to be able to recommend the most appropriate actions or solutions.

Individuals can practice the approach we’ve described on their own, but each organization will likely have its own preferred way to approach the analyses. Plumlee, et al., used training modules in their study that could be employed in a concerted effort by a company, with supervisors training their employees. We estimate that a basic training session would take about two hours. Complete training with practice and feedback would require about four hours—which could grow longer with even more for intensive training.

One area where this training could be very effective in helping employees is data analytics. In the past decade, an increasing amount of accounting and financial work involves or relies on data analysis. Data availability has increased exponentially, and companies use or have developed software that generates sophisticated analytical results.

Typical data analysis procedures accounting professionals might be called on to perform include things such as ratio and trend analyses, which compare financial and nonfinancial data over time and against industry information to examine whether results achieved are in line with expectations for strategic actions. Additionally, analyses are forward-looking when performance measures examined are leading indicators.

In order to perform data analytics effectively, accounting professionals must exercise sufficient judgment to critically assess the implications of any surprising results that are found. The quality of judgments and understanding the best ways to conduct and interpret the information uncovered by data analytics have typically been a function of time spent on the job along with training. At the same time, however, it’s commonplace that many of these analyses are performed by newer professionals.

Training in metacognition will help these employees more effectively and creatively reach conclusions about what they’ve observed in their analysis. Since the method discussed provides general instruction, each organization can customize the approach to best fit its own operations, strategies, and goals. Implementing a training program can be worth the investment given the importance of critical thinking throughout the process of evaluating operating results. Avoiding potential failures with interpreting results that could be prevented would seem to warrant the consideration of metacognitive training.

About the Authors

November 2021

- Strategy, Planning & Performance

- Business Acumen & Operations

- Decision Analysis

- Operational Knowledge

Publication Highlights

Lessons from an Agile Product Owner

Explore more.

Copyright Footer Message

Lorem ipsum dolor sit amet

IMAGES

VIDEO

COMMENTS

Discover how CFOs can enhance decision quality through critical thinking. Learn practical tips and strategies to understand problems deeply, challenge assumptions, use structured decision …

Critically thinking about personal finance requires a thorough understanding of one’s income, expenses, savings, and investments. This involves taking a step back, assessing the whole financial picture, and identifying areas that need …

A recent line of accounting education research has extended investigations of cognitive complexity to the effects of giving students appropriate learning challenges for …

Whether working with financial statements, analyzing operational and nonfinancial information, implementing machine learning and AI processes, or carrying out many of their other varied responsibilities, accounting and …