Resume Worded | Proven Resume Examples

- Resume Examples

- Legal Resumes

7 Underwriter Resume Examples - Here's What Works In 2024

Being a financial expert isn’t the only thing that magically lands you a job in the underwriting world. a resume showcasing you in the best light will help you get far in your career if you’re wondering what a successful underwriter resume can look like, all you need is to go through our guide for underwriter resume examples where we provide downloadable resume templates as well as tips to make the best out of your resume.

If you have insurance or have applied for mortgages, your case has been forwarded to an underwriter. These individuals are the backbones of financial investment analysis across many industries. From loan lending and insurance industries to financial sectors, underwriters are the key to great success for many businesses. After all, these are the employees who defend businesses against fraudulent losses and enhance their profit.

To be hired as an underwriter means you need to be more than just a good analyzer. Strong analytical skills, precise financial and accounting skills, and in-depth knowledge of the market are some of the key attributes for underwriters in most sectors. Communication, marketing, and negotiation abilities are essential for a client-facing profession such as an underwriter in the insurance industry.

If you have all these skills yet find the job hunt difficult, your resume needs a makeover so it can speak on your behalf to all the recruiters. Let’s look into different underwriter resume examples and see what makes for an effective resume!

Underwriter Resume Templates

Jump to a template:

- Underwriter

- Loan Underwriter

- Commercial Underwriter

- Credit Underwriter

- Assistant Underwriter

Jump to a resource:

- Keywords for Underwriter Resumes

Underwriter Resume Tips

- Action Verbs to Use

- Related Legal Resumes

Get advice on each section of your resume:

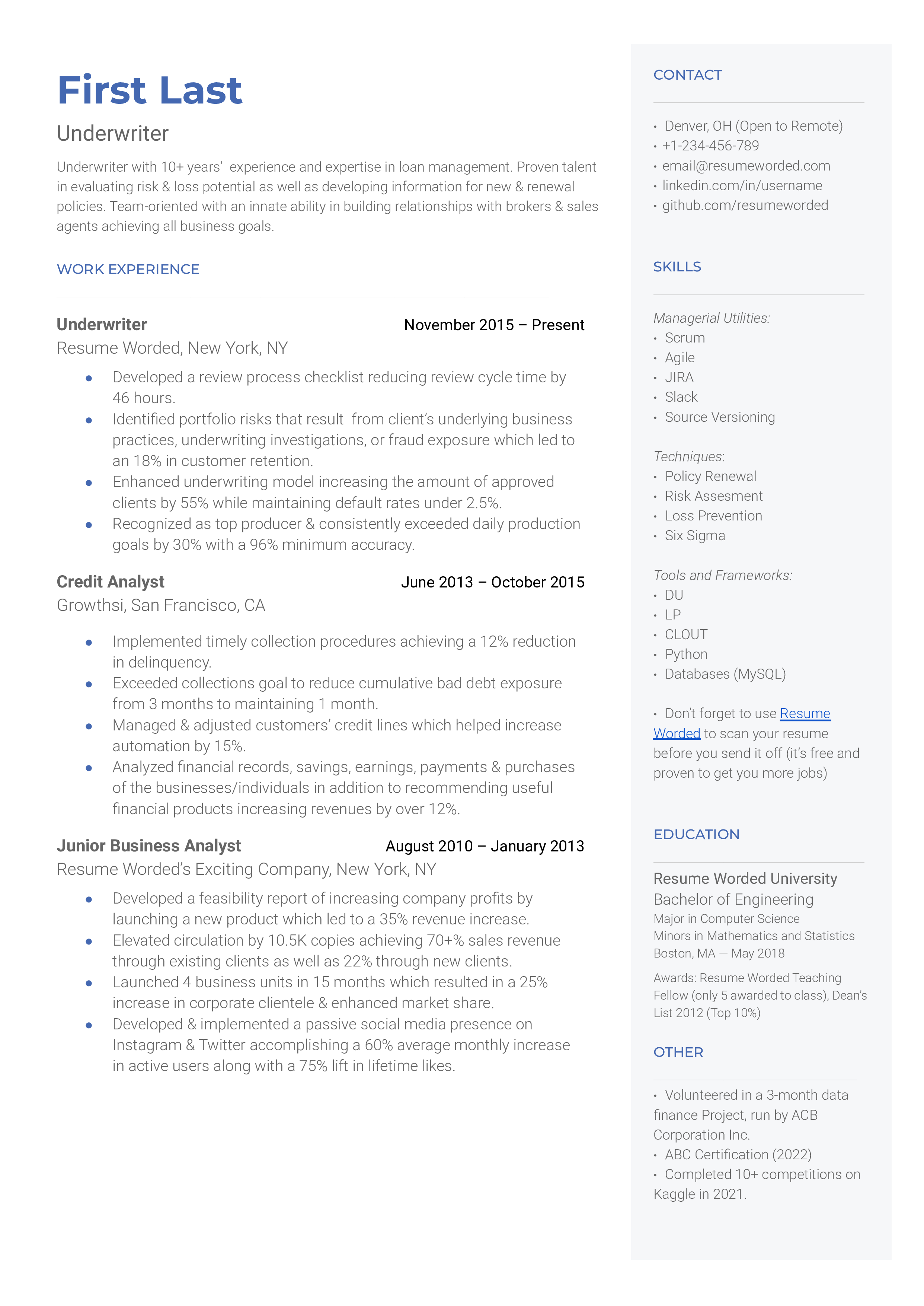

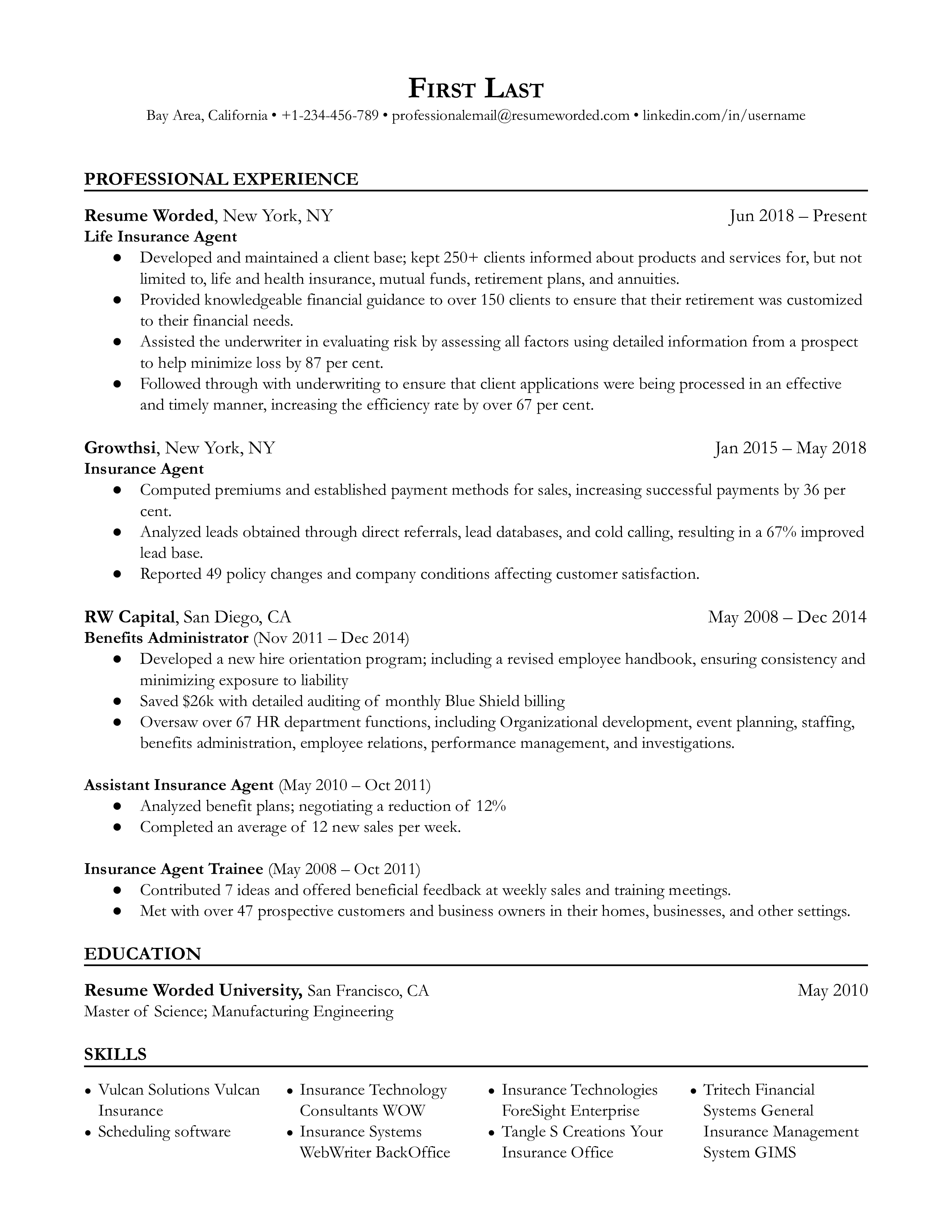

Template 1 of 7: Underwriter Resume Example

In simple terms, the job of an underwriter is to do risk evaluation for a business. Creating risk reports, attentively studying cases, and applying business analysis models to them is what an underwriter is tasked to do. To perform this successfully, underwriters must have a strong analytical skill set that helps them make insightful and quantitative decisions. Typically, to become an underwriter you need a bachelor’s degree in statistical subjects such as economics, math, business, or finance. Let’s look at this underwriter resume template to see what makes a great resume through a recruiter’s lens:

We're just getting the template ready for you, just a second left.

Tips to help you write your Underwriter resume in 2024

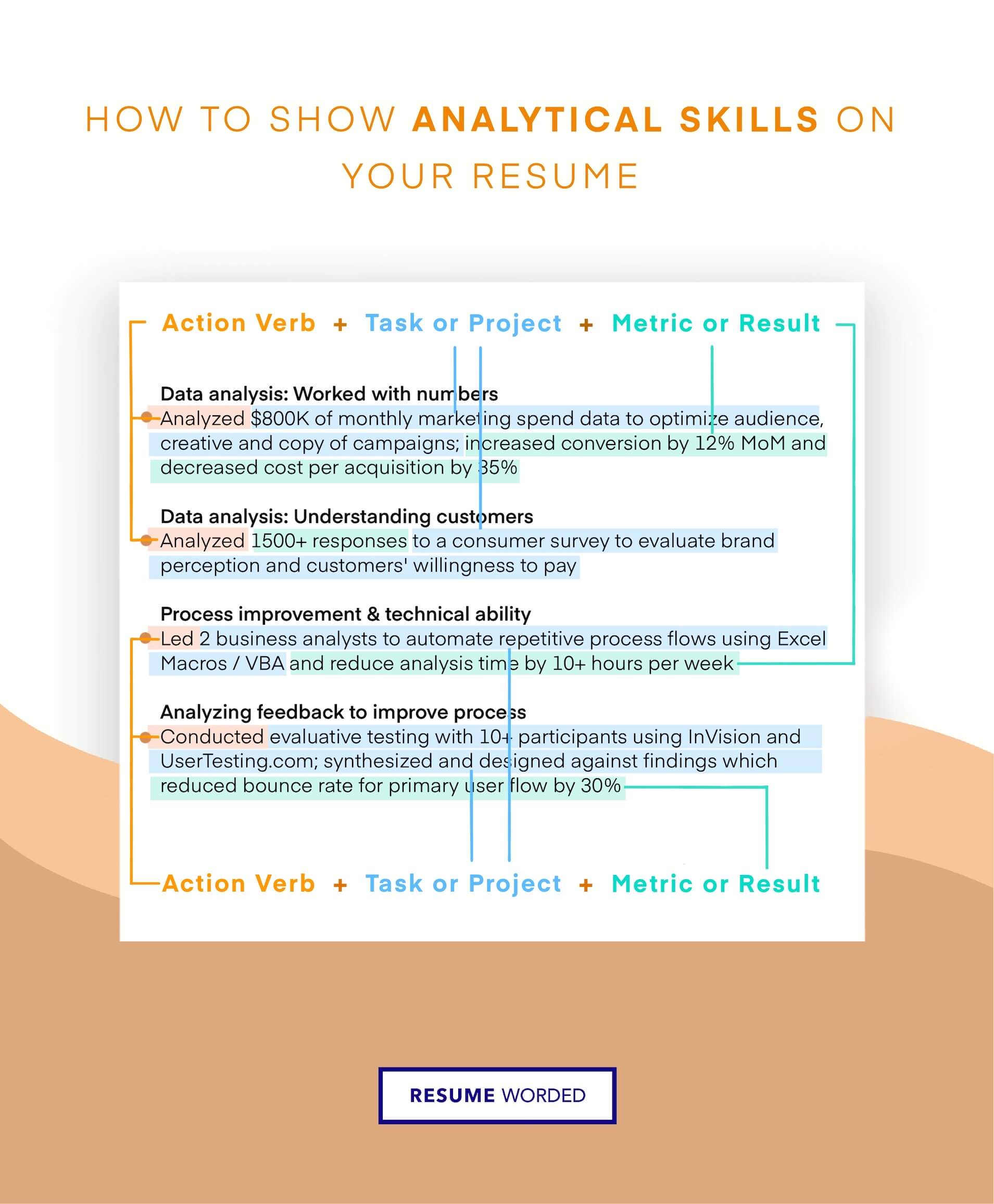

include relevant metrics to show analytical skills.

One way to impress recruiters is to show your impact in numerical figures. For example, mentioning that you improved investment performances by 25% and reduced the ratio of the fraudulent application processes by 40% will make your resume praise your analytical abilities on your behalf.

Long work history with a lot of noteworthy achievements

Rich job experience helps because it shows recruiters that you are knowledgeable about and effective in your profession. Promotions and honors from your previous employers further this effect by demonstrating steady career growth, which is valued in resumes! Examining applicants' complete credit histories is one example.

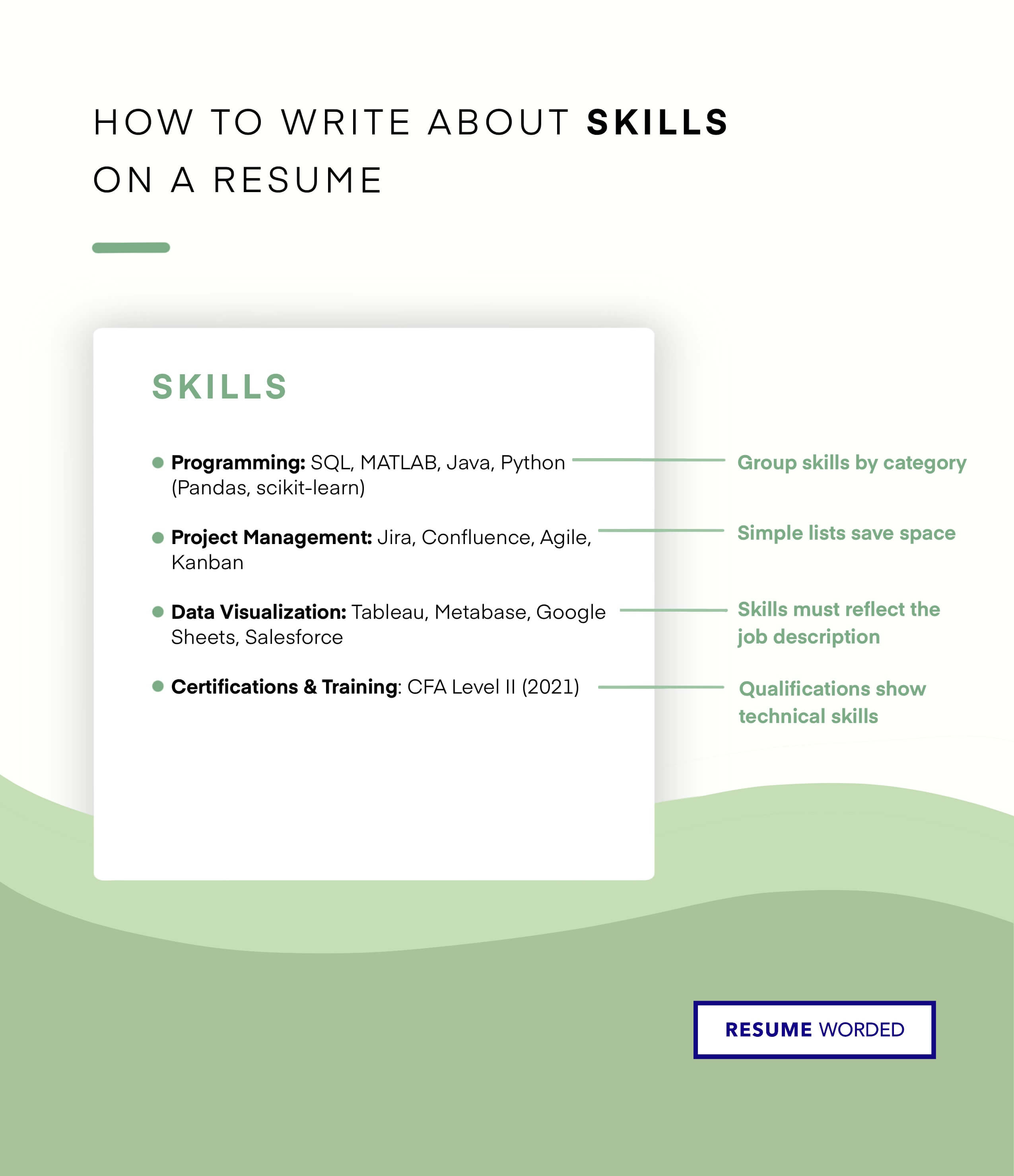

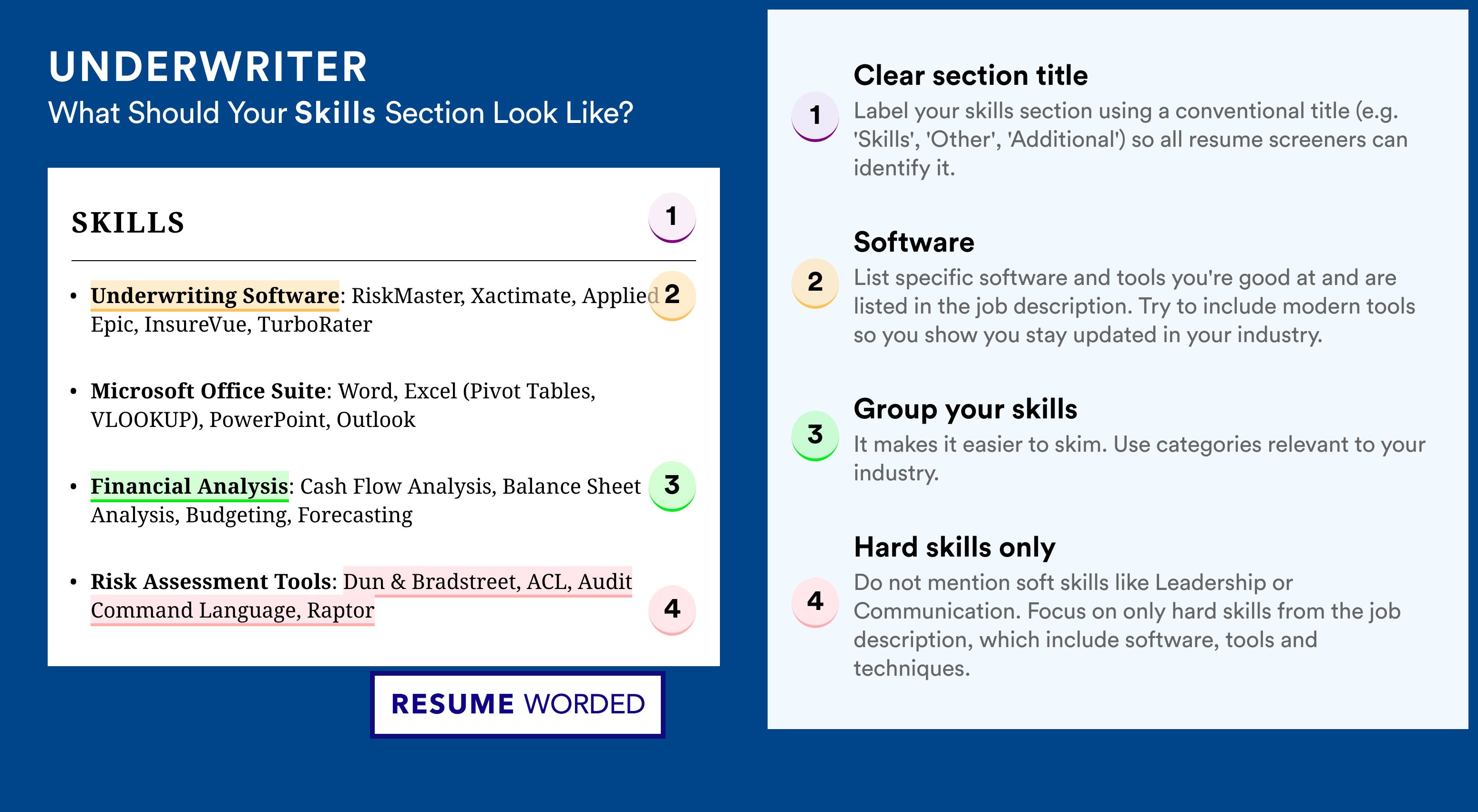

Skills you can include on your Underwriter resume

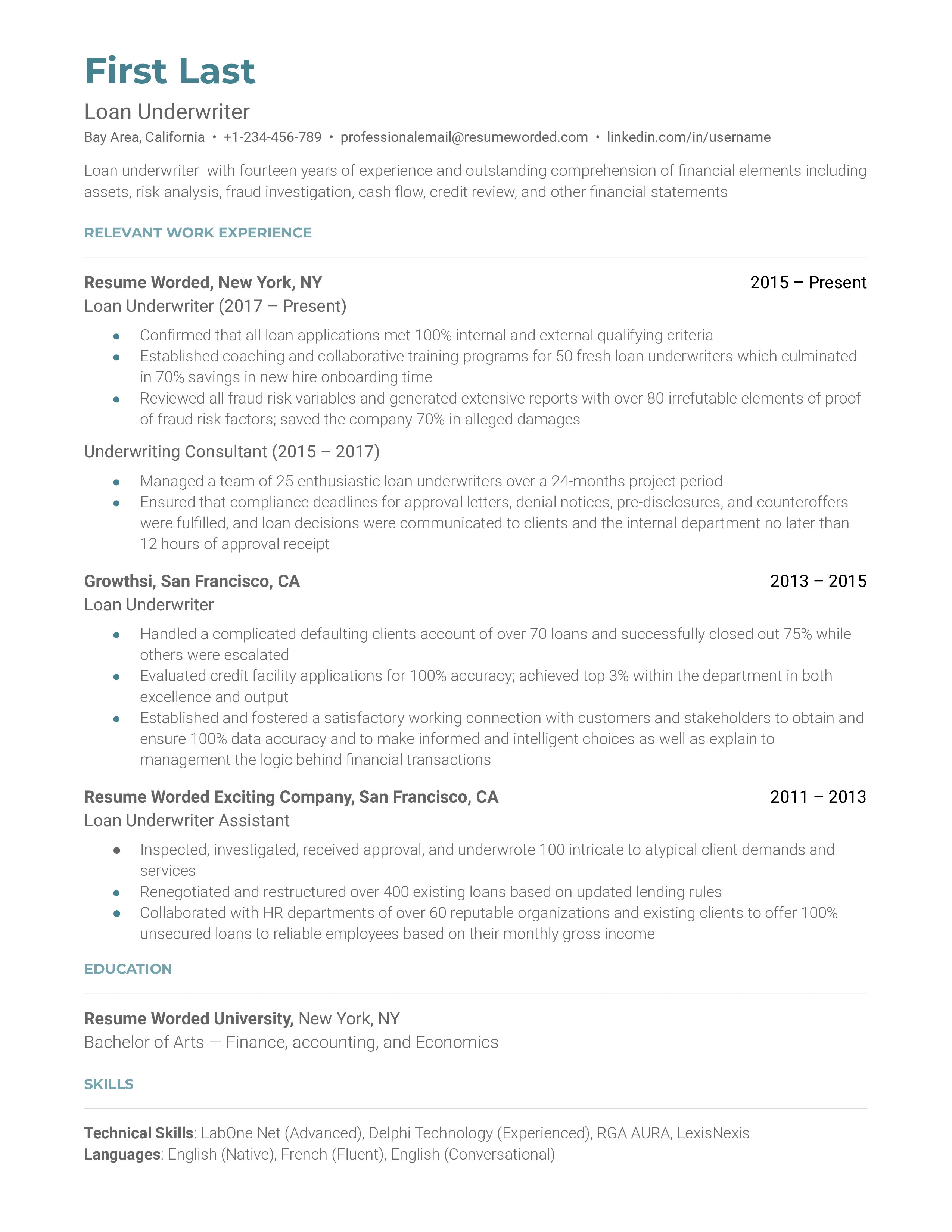

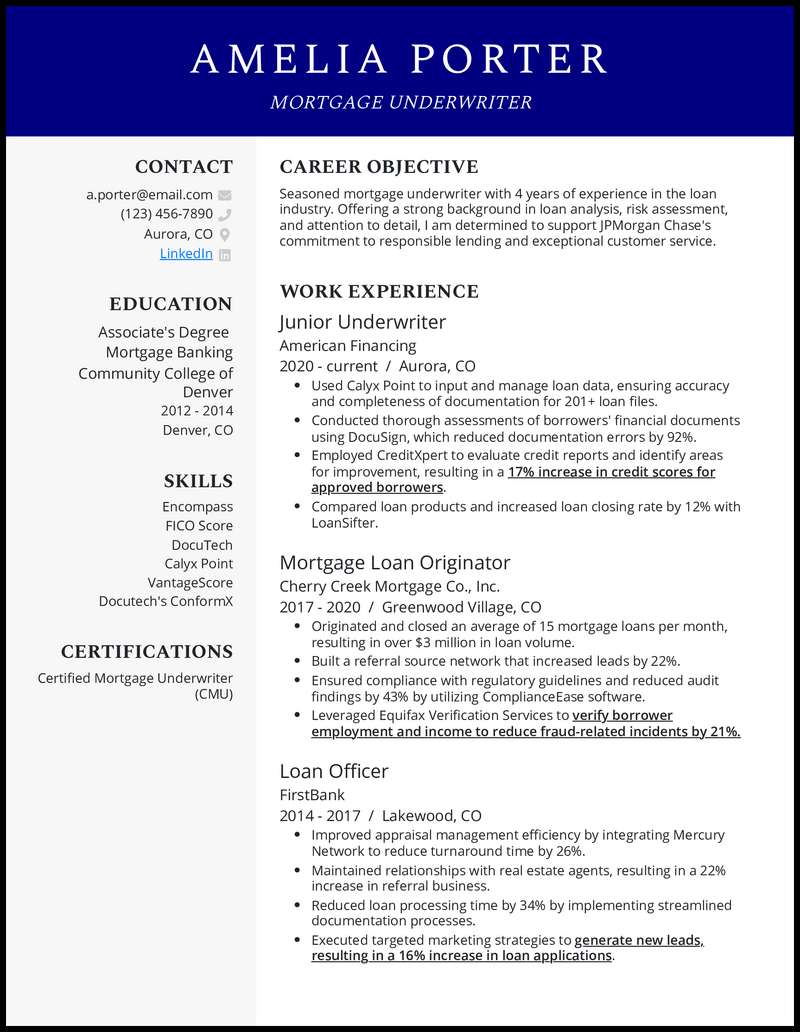

Template 2 of 7: loan underwriter resume example.

Loan underwriters, also known as loan officers, are specialized batch of underwriters. They evaluate loan applications and are responsible for accepting or rejecting these applications. Because loan underwriters have to evaluate these applications themselves, they will meet applicants and discuss personal and financial information that will help them make informed decisions. Loan underwriters must have exceptional interpersonal skills to assist them to get all necessary information from applicants due to the nature of the position. They must also have the capacity to pay attention to even the smallest facts or statistics. Here’s a loan underwriter resume template to help you get a head start!

Tips to help you write your Loan Underwriter resume in 2024

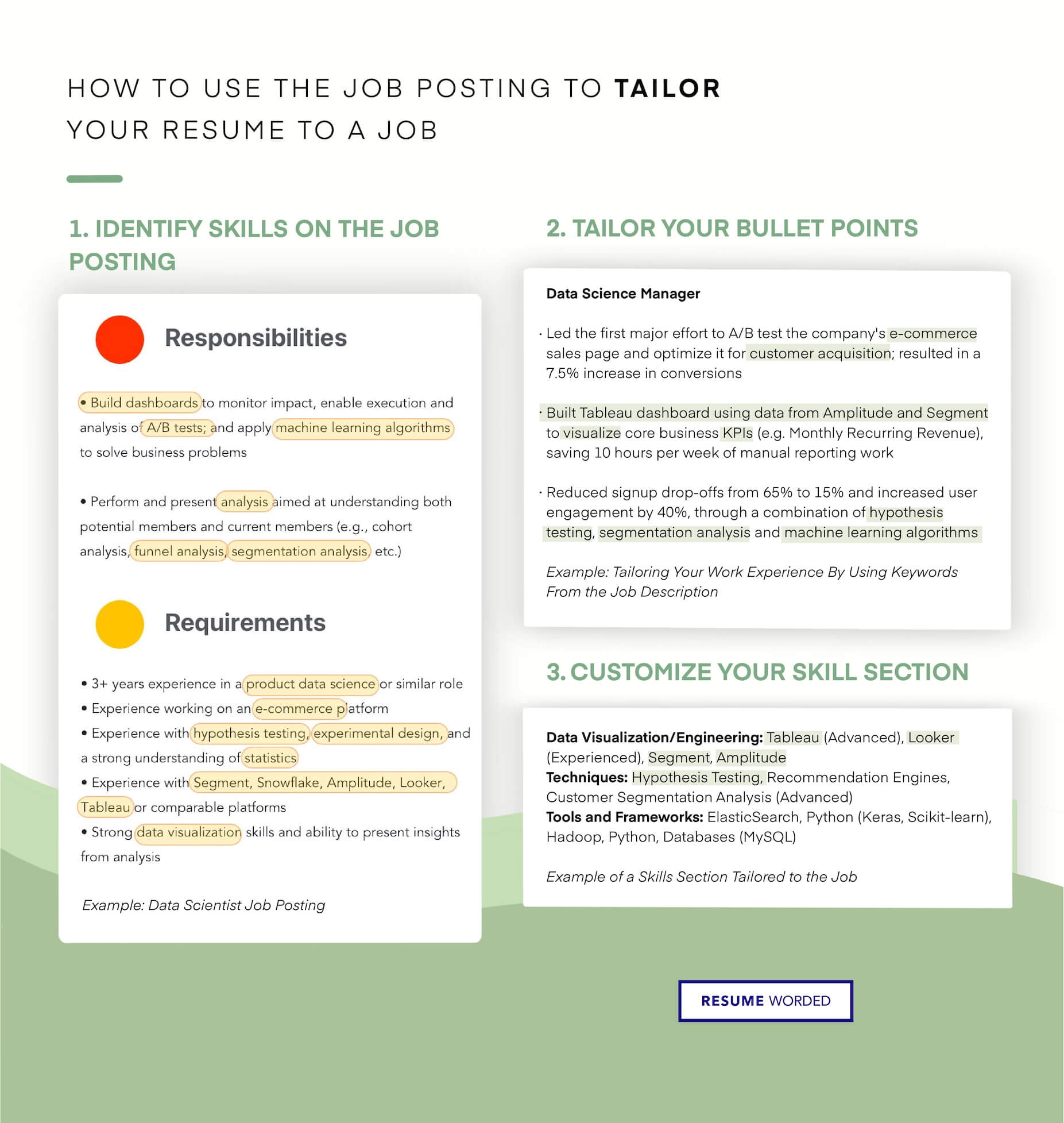

use the skills section carefully to include loan-related keywords.

Job-specific talents should be listed in a part of a loan underwriter's resume. Once more, the hard skills—like your technical proficiency—should be the main focus of this section. In simpler words, this section is where you mention your experience in analyzing, evaluating, researching, and making decisions regarding loan applications.

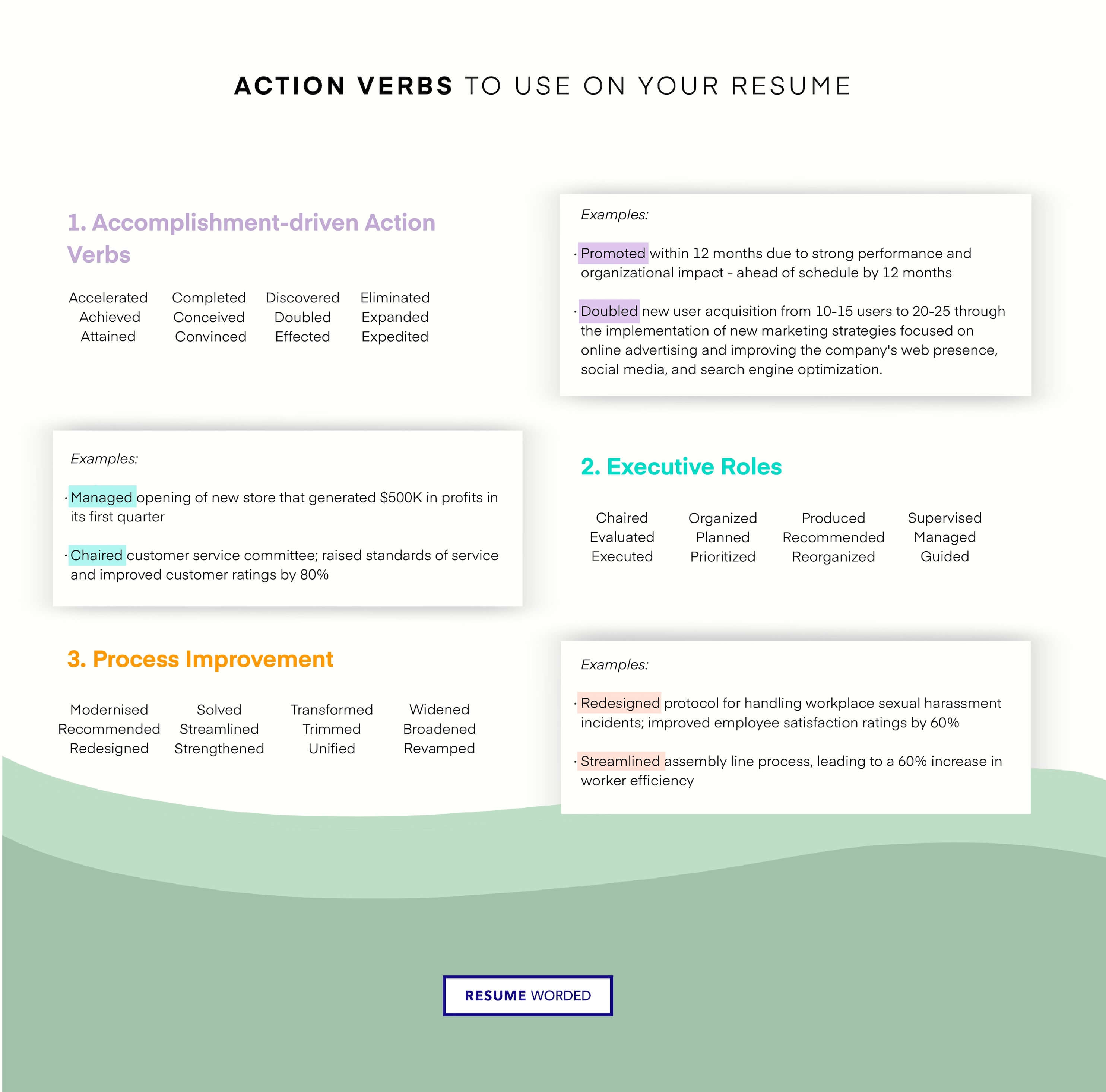

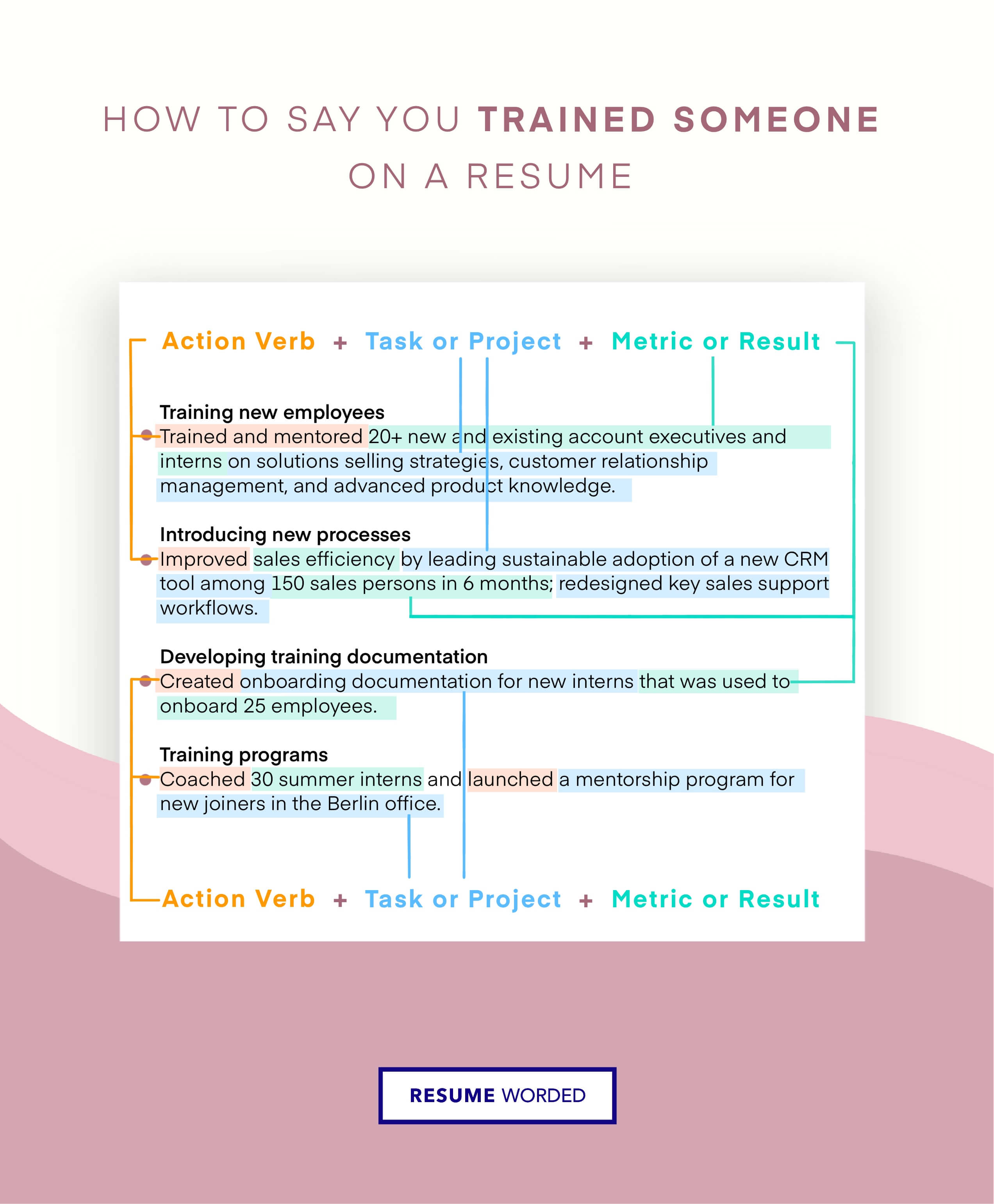

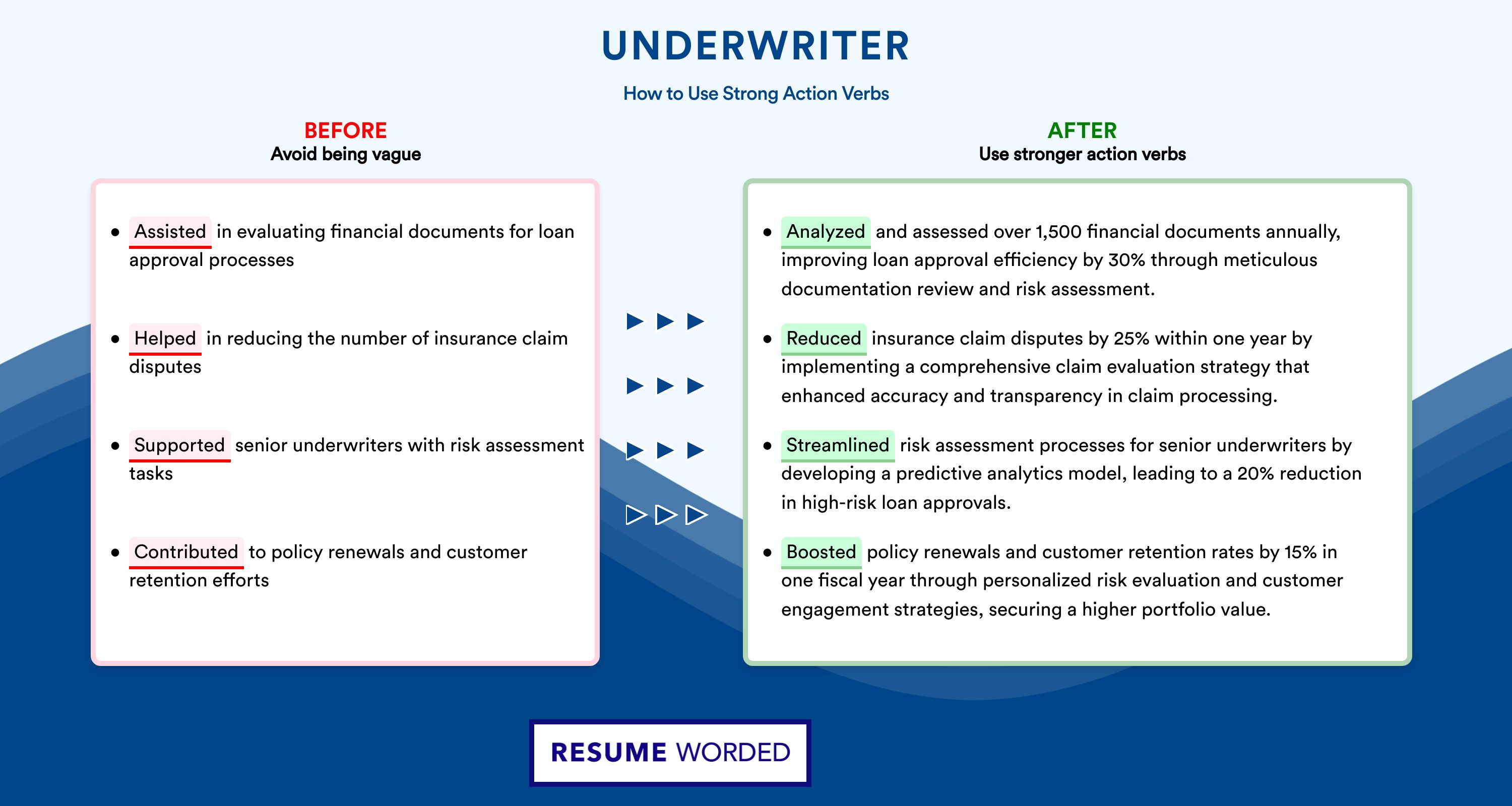

Impress recruiters with strong action verbs relevant to underwriters

Always remember that a recruiter is waiting to read words that set you apart from other applicants. Use action verbs in resumes for loan underwriters that are pertinent to the collection, analysis, and processing of data.

Skills you can include on your Loan Underwriter resume

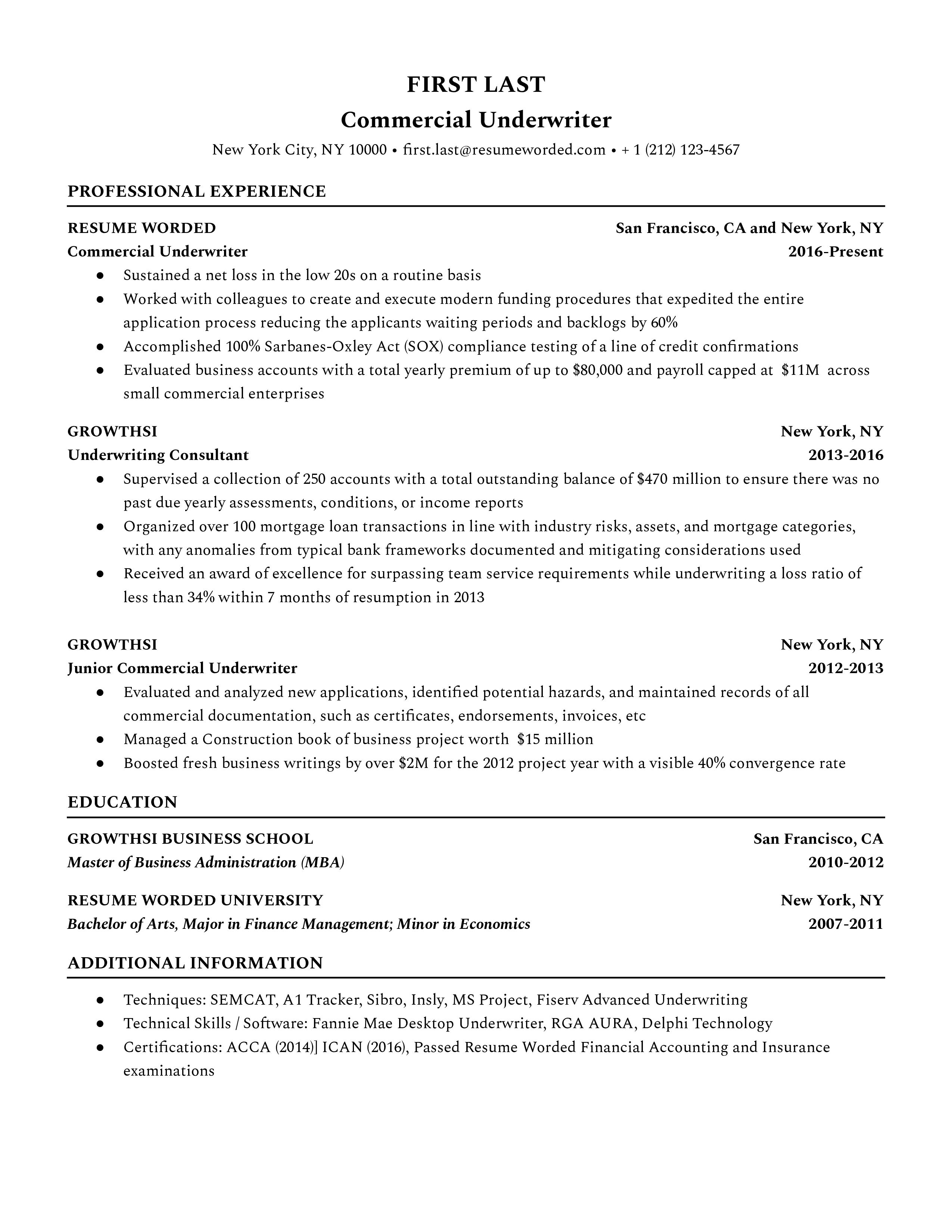

Template 3 of 7: commercial underwriter resume example.

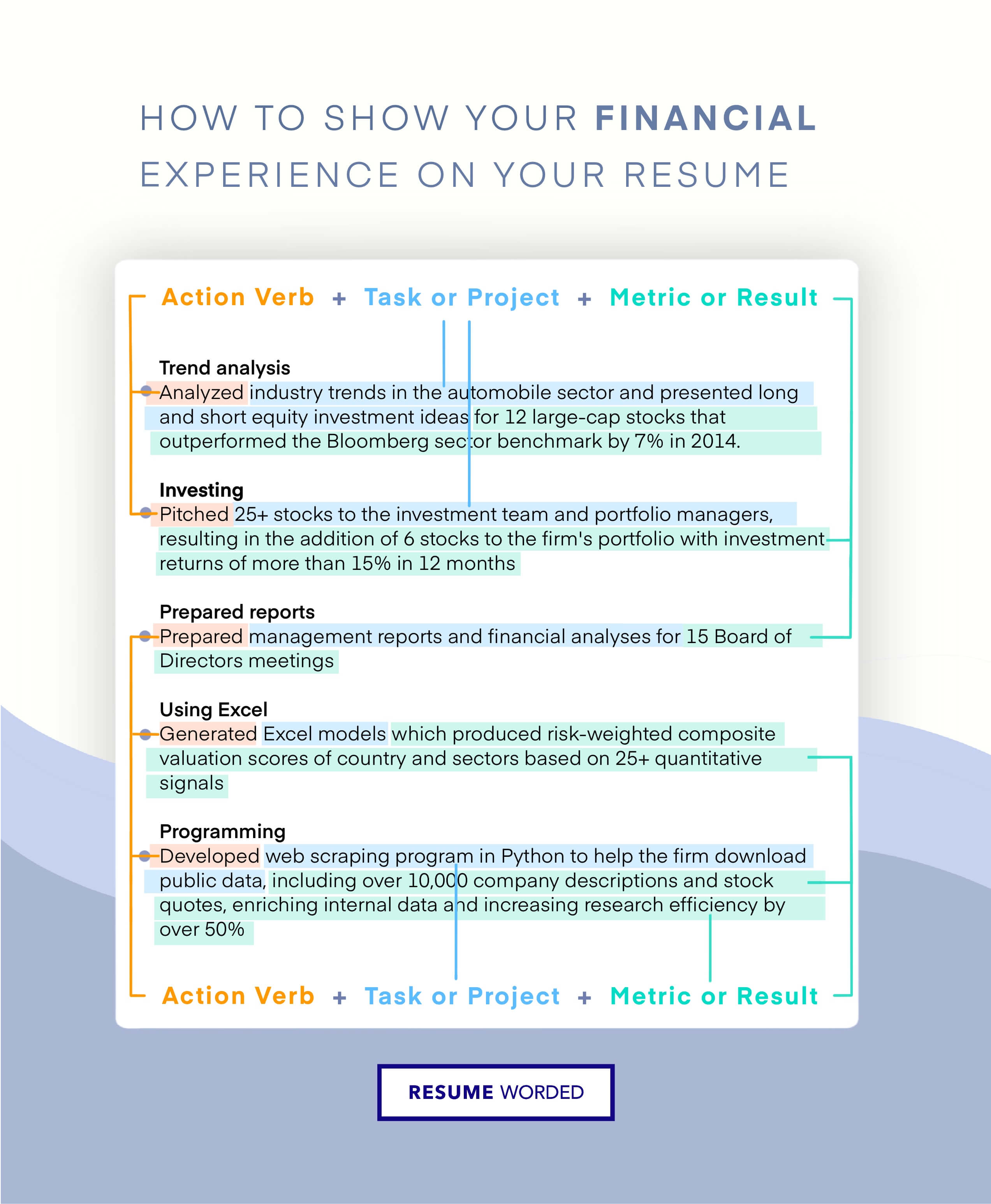

As a commercial underwriter, your role revolves around assessing the risk factors of potential clients for financial services companies. It's a job with ever-changing responsibilities, where you'll be constantly learning and adapting to new policies or risk factors. Recently, there is an increasing demand for analytical skills due to the surge in data-driven decision making in organizations. When composing a resume for this role, it's essential to demonstrate your knowledge of risk assessment and regulatory standards, as well as your ability to handle a high volume of complex information. In an increasingly digitized industry, commercial underwriters who demonstrate proficiency in using advanced underwriting software will stand out. Being able to accurately analyze and predict risk using technology is a crucial aspect of the job. Therefore, your resume should reflect your expertise in both risk assessment and the technology used to facilitate that process.

Tips to help you write your Commercial Underwriter resume in 2024

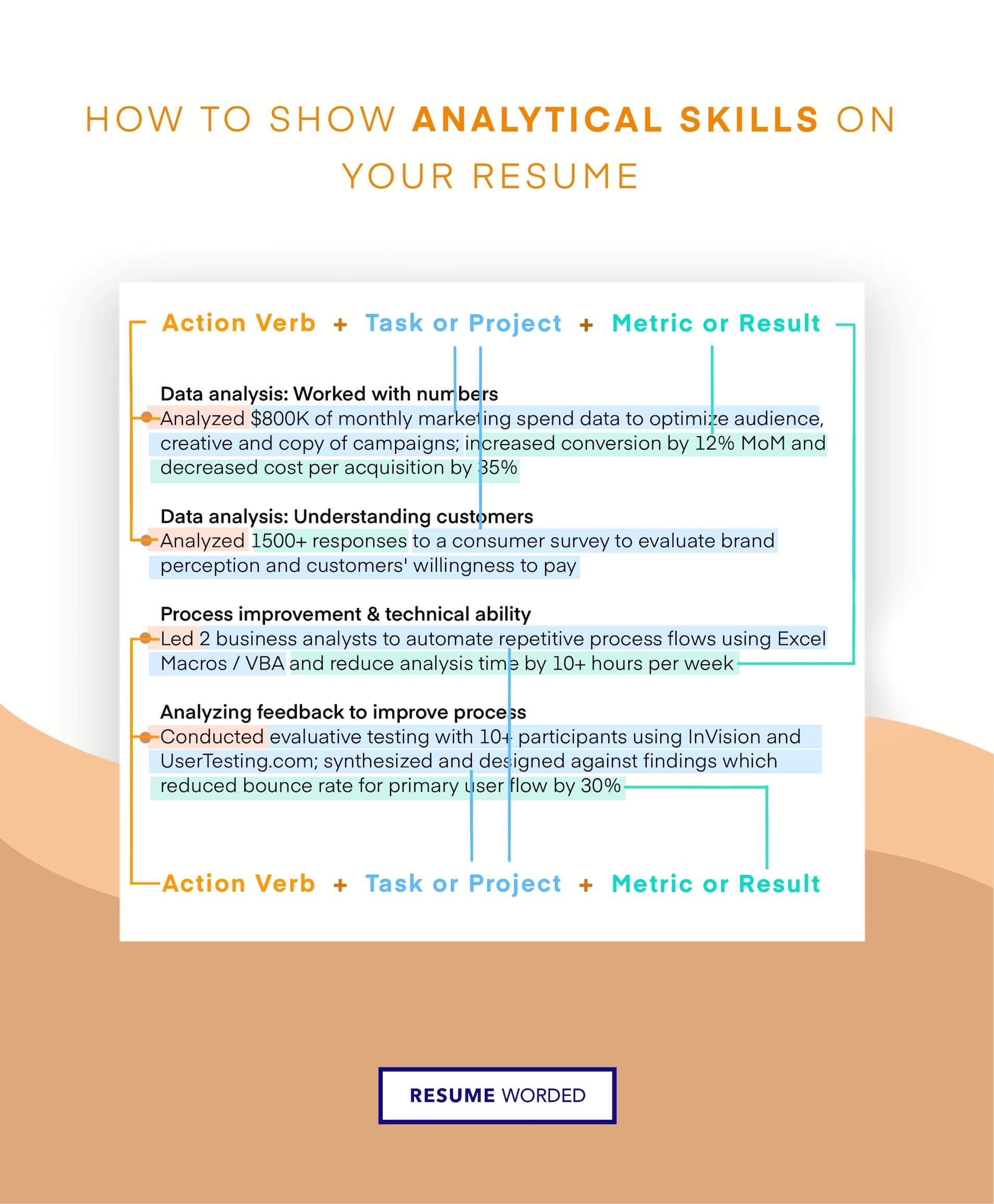

showcase your analytical skills.

As a commercial underwriter, you constantly analyze complex data to make informed decisions. Therefore, your resume should demonstrate your ability to dissect and understand complicated information. You could do this by discussing specific examples of your analytical skills in action.

Highlight your knowledge of underwriting software

Given the rise of technology in the underwriting industry, it’s essential to show your familiarity with relevant software on your resume. Discuss the specific underwriting systems you've used, and how they've assisted you in assessing risk and making decisions.

Skills you can include on your Commercial Underwriter resume

Template 4 of 7: commercial underwriter resume example.

Commercial underwriters conduct risk analyses on mortgage and insurance application forms to decide whether to approve or reject the insurance benefits. In addition to structuring payment contracts, commercial underwriters also check the accuracy of all the data on the application. What will make you successful as a commercial underwriter is having a hawk's eye. To pursue a career in commercial underwriting, you must hold a bachelor's degree in addition to a strong set of hard and soft talents that will make you the greatest in your field. Check out this commercial underwriter resume template we offer if you want a resume that demonstrates these skills!

Tailor your resume to a commercial underwriting one

Specialized knowledge and abilities are needed for commercial underwriting. Highlight your prior expertise in the insurance industry, analytics, and other financial jobs on your resume to demonstrate why you are the best candidate for the job. Make sure to list hard skills in your skills section, such as risk management, investment analysis, and financial modeling.

Lead with academic prowess

Due to the entry-level nature of commercial underwriting, most candidates lack a wide range of prior work experience. To demonstrate that you have the necessary theoretical skills for the position, indicate your university along with the typical four-year degree in finance or economics. You can also list any further related classes you've taken if you’re an entry-level candidate!

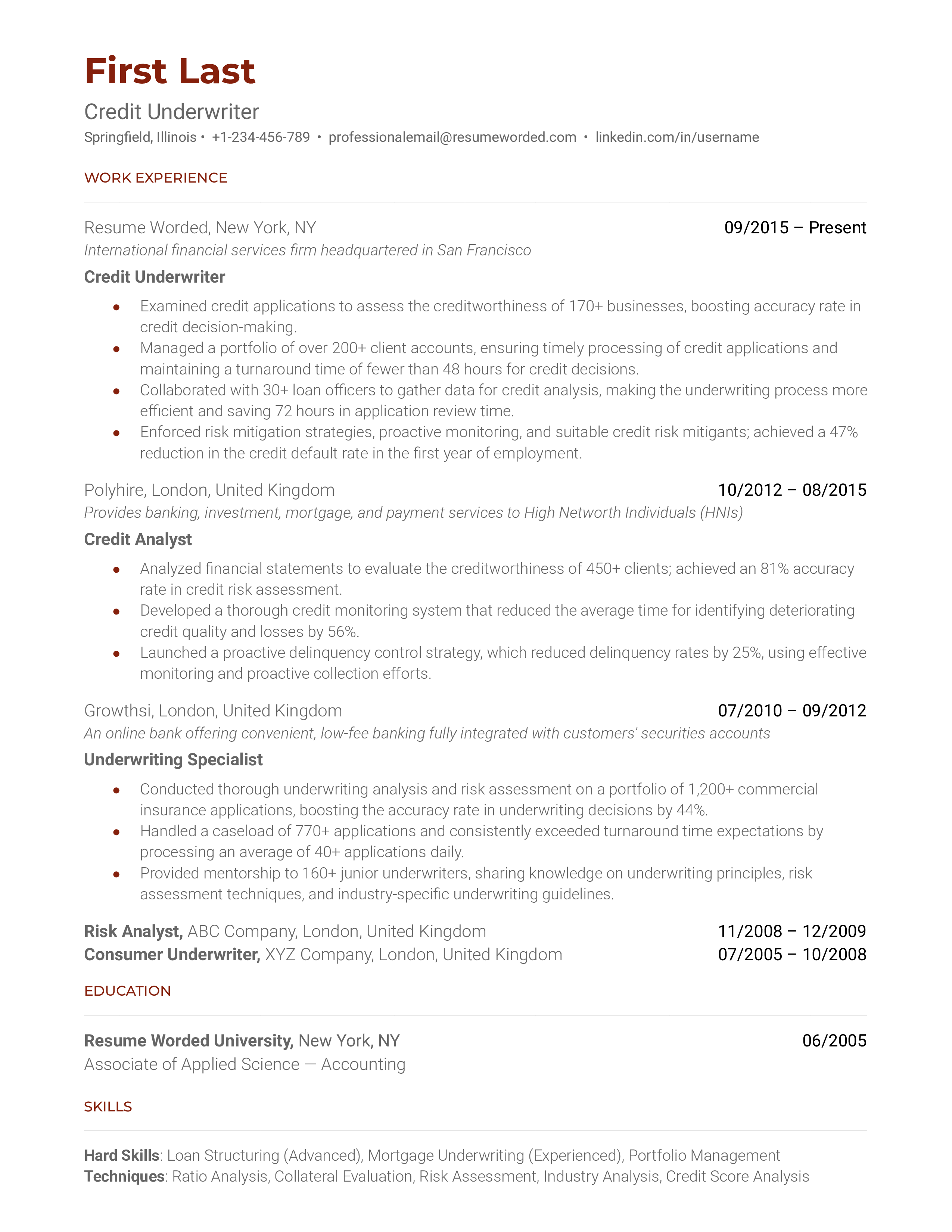

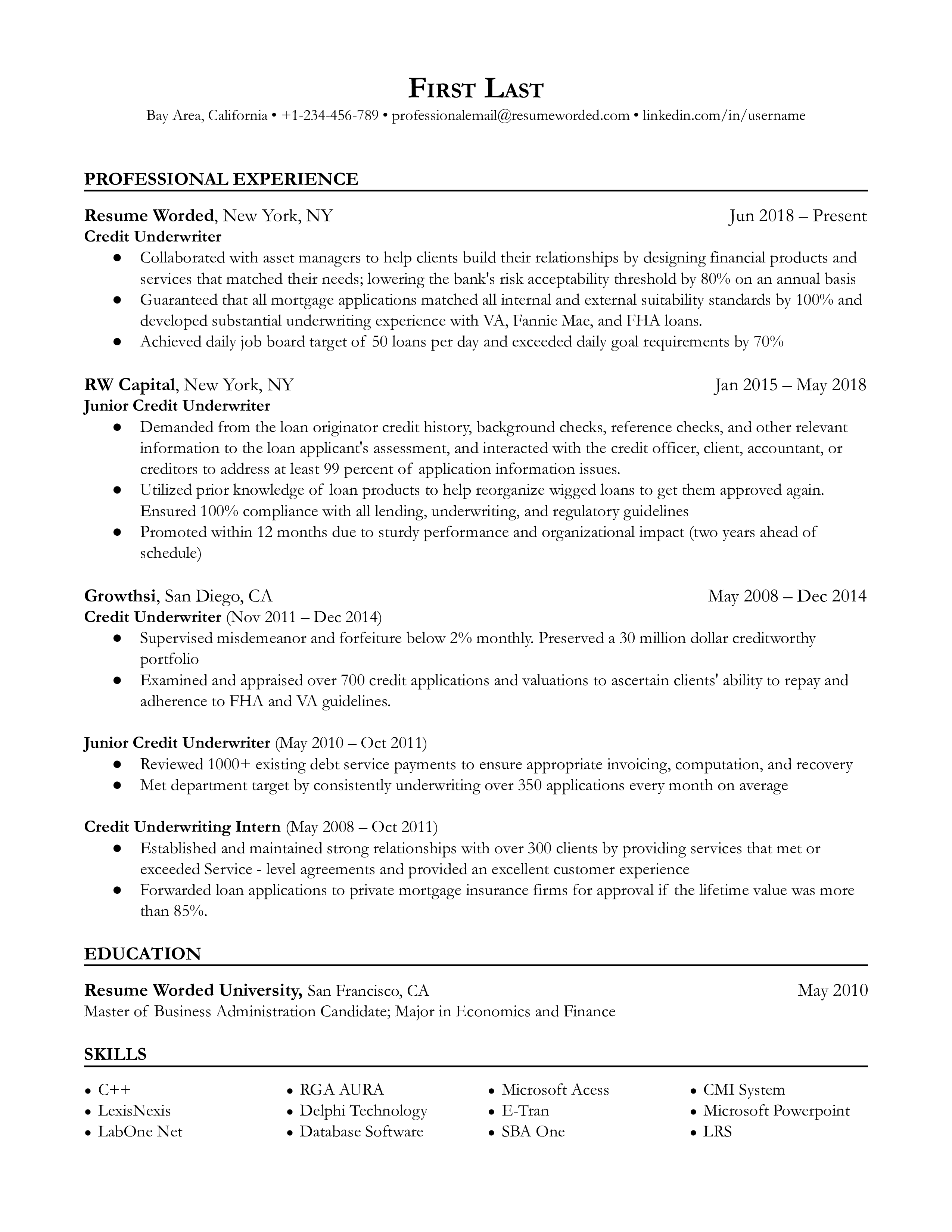

Template 5 of 7: Credit Underwriter Resume Example

As a Credit Underwriter, your job is an essential two-fold process - you're both an investigator and an analyzer. Your resume should reflect this blend, showcasing a meticulous attention to detail as well as a knack for making data-driven decisions. In light of recent trends, many companies are moving towards automating parts of the underwriting process. As a result, there's a higher demand for underwriters who are comfortable with data analytics and digital platforms, so you’ll want to highlight any relevant tech skills. Your resume needs to show that you can morph with the times while still offering the in-depth, individualized analysis that machines can't.

Tips to help you write your Credit Underwriter resume in 2024

highlight quantitative accomplishments.

To stand out, rather than merely stating your responsibilities, you should quantify your achievements. How much money did you save the company? Did you help improve the loan approval process? If yes, by what percentage? The more specific, the better.

Showcase your risk management skills

Underwriting is all about calculated risks. You should make sure to include any experience or training you have in risk assessment and mitigation. This could be anything from courses you've taken, to specific tools or strategies you've used to evaluate potential risks.

Skills you can include on your Credit Underwriter resume

Template 6 of 7: credit underwriter resume example.

Have you ever applied for a loan to buy a car or pay student debt? Perhaps you know people who took out loans from the bank or other private companies. It is the credit underwriter who is reviewing paperwork and other documents for you to be able to access loans! It is your responsibility as a credit underwriter to examine loan applications and, on occasion, run a credit history check on a loan applicant. Additionally, you can be requested to review proof of income and debt. Here’s what a successful resume for a credit underwriter looks like, highlighting all important aspects of value to a recruiter!

State your financial specialty

Credit underwriters must have a strong background in banking and finance, as well as know-how about credit systems. So make sure to utilize your resume well by mentioning that you specialize in underwriting for the banking sector! Make sure to mention it in the introduction and provide evidence of your success in the part about your experience.

Talk about your banking experience outside of underwriting

If you’re an individual who has experience as a banker or financial expert rather than underwriting, don't be shy to talk more about it! A lot of these skills will be transferred into your credit underwriting career and will make you a more able candidate for the position.

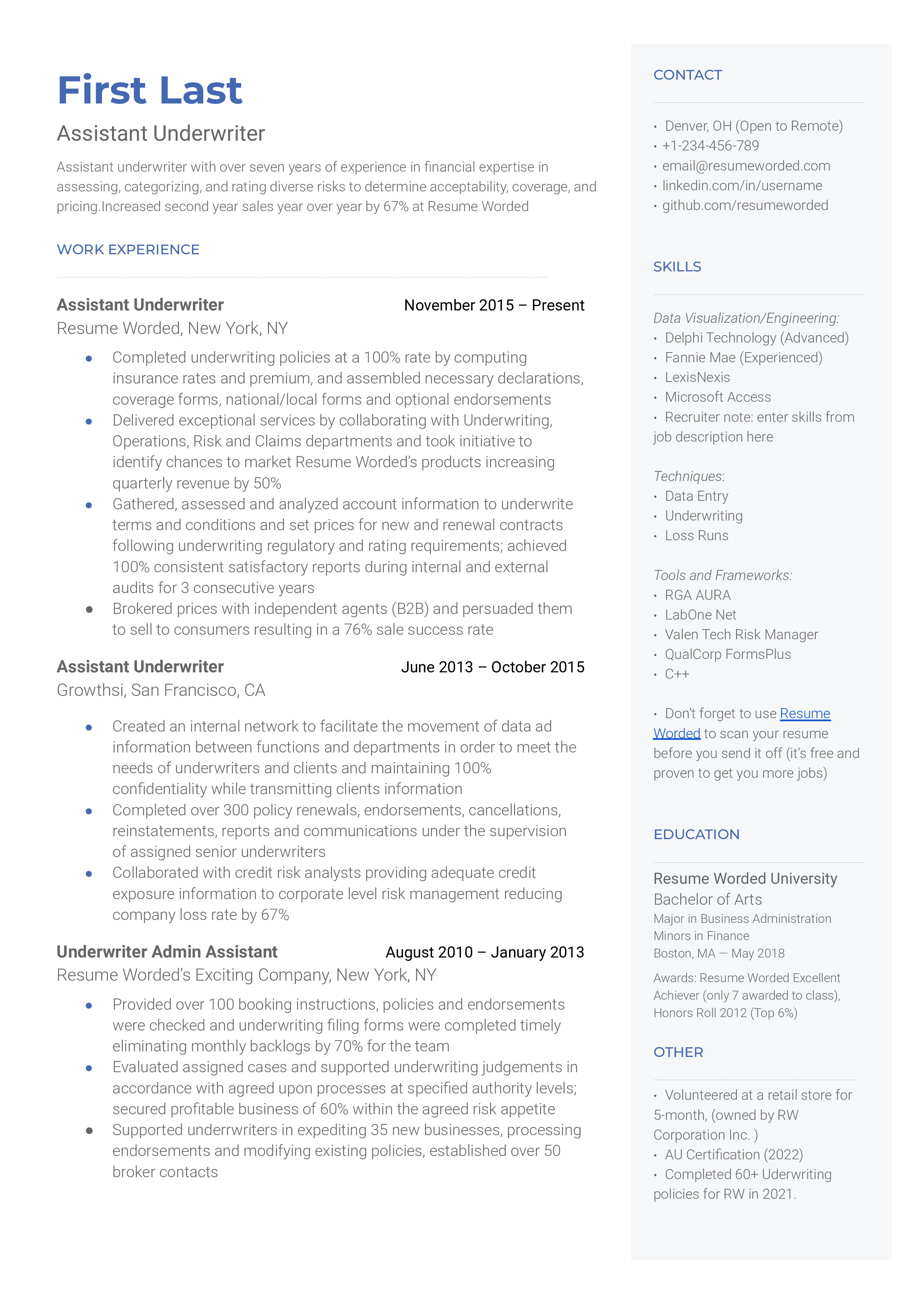

Template 7 of 7: Assistant Underwriter Resume Example

As an entry-level job position, an assistant underwriter does not require a finance degree. But as with all underwriter positions, a strong analytical mind is a requirement in this profession. Your job as an assistant underwriter is to work alongside managers and underwriters to create portfolios by collecting information and doing basic data-entry tasks. To make a great assistant, you should have administrative support skills as well as a resume that highlights your experience as an assistant in relevant fields. Here’s an example of an assistant underwriter's resume template.

Tips to help you write your Assistant Underwriter resume in 2024

mention your assistant underwriter's strengths.

It is advisable to highlight your strengths in assisting in your resume if you don't have a lot of experience to your name. These can involve highlighting your capacity for multitasking or communication as well as your sense of teamwork.

Highlight your regard for sensitive information.

In your personal or professional life, if you work as an underwriter assistant, you will be trusted with sensitive information that should not be shared. Recruiters will be interested in reading about your prior knowledge of and aptitude for handling sensitive material!

Skills you can include on your Assistant Underwriter resume

As a career coach and hiring manager who has worked with top companies like AIG, Chubb, and Travelers, I've seen countless underwriter resumes. The best ones always stand out because they showcase the candidate's unique skills and experience in a clear, compelling way. Here are some tips to help you create a strong underwriter resume that will catch the attention of hiring managers and help you land your dream job.

Highlight your risk assessment skills

Underwriters need to be able to accurately assess risk and make sound decisions. Make sure your resume showcases your risk assessment skills, like this:

- Analyzed complex financial data and risk factors to determine eligibility for $10M+ in annual premiums

- Developed and implemented risk assessment models that reduced loss ratios by 15%

Avoid vague statements that don't give specific examples of your skills:

- Assessed risk for various insurance products

- Made underwriting decisions based on risk analysis

Showcase your industry knowledge

Underwriters need to have a deep understanding of their industry and the products they work with. Use your resume to showcase your industry knowledge and expertise, like this:

- Specialized in underwriting commercial property insurance for construction industry clients

- Developed expertise in underwriting cyber liability policies for technology companies

Avoid generic statements that could apply to any underwriter:

- Worked with various insurance products

- Underwrote policies for different industries

Quantify your impact

Whenever possible, use numbers and metrics to quantify your impact and achievements. This helps hiring managers understand the scope and significance of your work, like this:

- Underwrote $50M in new business annually while maintaining a loss ratio of under 60%

- Reviewed and approved over 100 policies per month with an average turnaround time of 48 hours

Avoid vague statements that don't give a clear picture of your contributions:

- Underwrote a large volume of policies

- Worked quickly and efficiently to review applications

Tailor your resume to the job

Every underwriter job is different, so it's important to tailor your resume to the specific job you're applying for. Look at the job description and highlight the skills and experience that are most relevant to that particular role, like this:

Experienced underwriter specializing in workers' compensation insurance for mid-size to large companies. Skilled at analyzing loss runs, assessing risk exposures, and developing tailored insurance solutions to mitigate risk.

Avoid using the same generic resume for every job application. Customizing your resume shows the hiring manager that you've done your research and are truly interested in that specific role.

Highlight your collaboration skills

Underwriting is a collaborative process that involves working with agents, brokers, and other stakeholders. Use your resume to showcase your collaboration and communication skills, like this:

- Partnered with sales team to develop targeted marketing campaigns that increased new business by 25%

- Collaborated with claims department to identify trends and develop risk mitigation strategies

Avoid focusing solely on your individual contributions. Highlighting your ability to work well with others shows that you're a team player who can contribute to the company's overall success.

Show your technical proficiency

Underwriting involves working with various software programs and tools. Make sure your resume showcases your technical proficiency, like this:

- Proficient in using underwriting software such as Duck Creek and PolicyCenter

- Skilled at using data analysis tools like Excel and Tableau to identify trends and make data-driven decisions

Avoid simply listing the programs you're familiar with. Instead, give specific examples of how you've used these tools to improve your work and drive results.

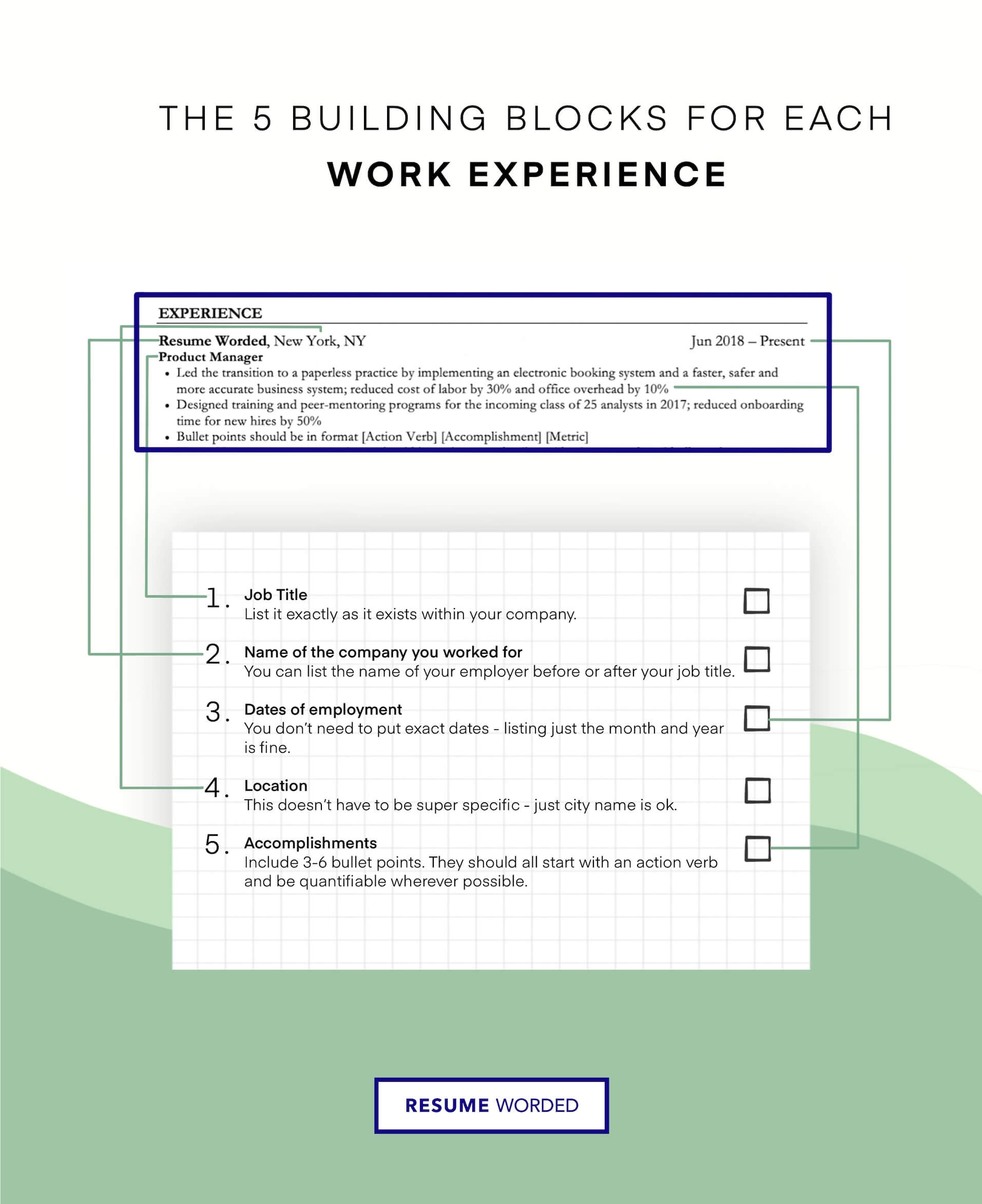

Writing Your Underwriter Resume: Section By Section

header, 1. put your name on its own line.

As an underwriter, attention to detail is crucial. Demonstrate this skill right from the start by ensuring your header is well-organized and easy to read.

- 123-456-7890 | [email protected] | linkedin.com/in/johndoe

Avoid cramming all your details together, which can look messy and unprofessional:

- John Doe 123-456-7890 [email protected] linkedin.com/in/johndoe

2. Include key contact details

As an underwriter, building relationships is essential. Make it easy for hiring managers to get in touch by providing:

- Phone number

- Professional email address

- LinkedIn profile URL

However, avoid oversharing personal details that could introduce bias:

John Doe 123 Main St, Apt 4B, Anytown USA 12345 Married, 2 kids [email protected]

3. Optionally include your professional title

If you have a relevant professional title or certification, consider featuring it in your header:

- John Doe, CPCU

- Senior Underwriter

This quickly conveys your expertise to busy hiring managers. However, avoid keyword-stuffing your header with multiple titles and buzzwords, which looks unprofessional:

John Doe Underwriter | Risk Analyst | Loan Processor Detail-oriented, driven, team player

Remember, your header should be concise and only highlight your most relevant selling points.

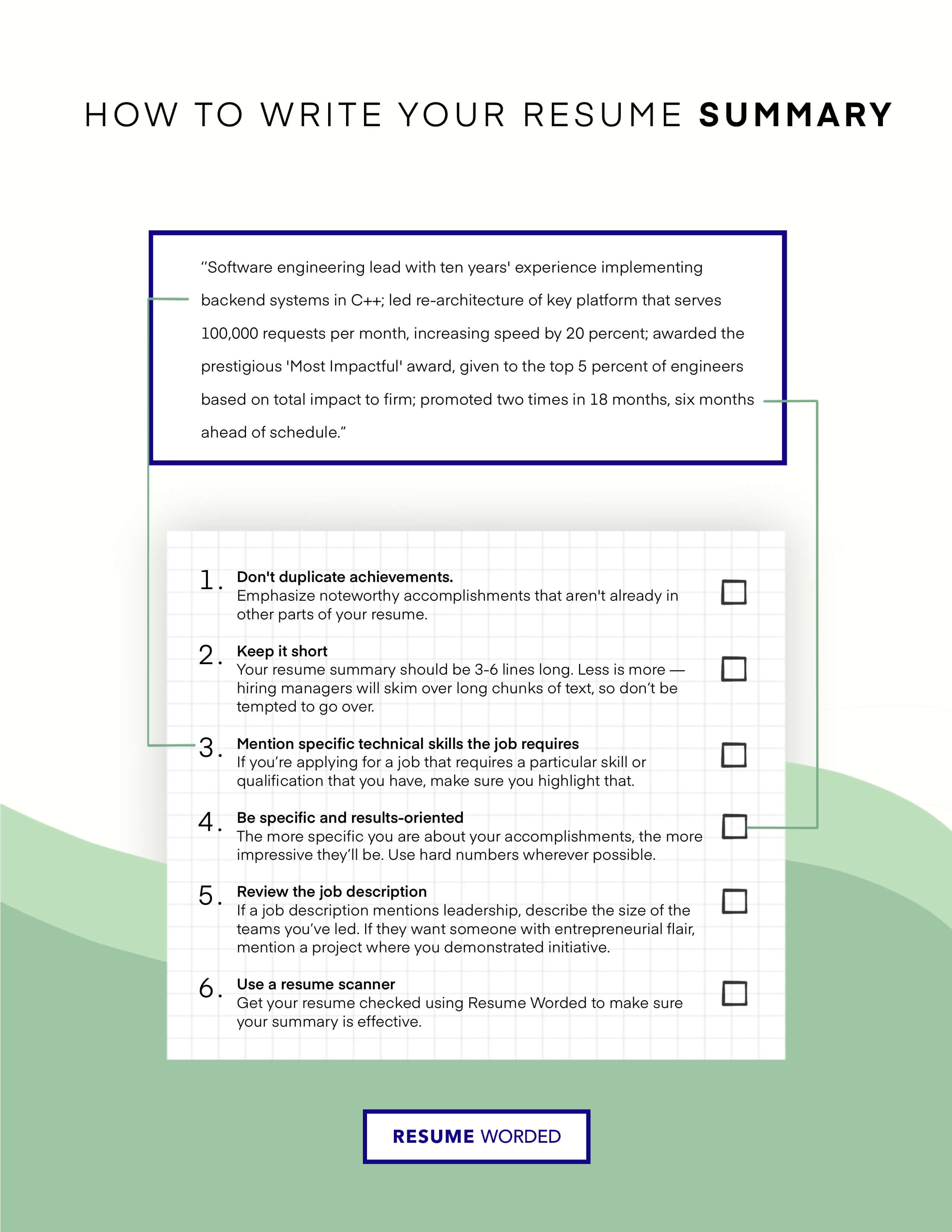

Summary

A resume summary for an Underwriter role is optional. It's a brief statement at the top of your resume that highlights your relevant experience, skills, and achievements. While it's not a must-have, it can be a useful addition if you're a career changer, have a lot of experience, or want to provide context that's not already in your resume.

However, avoid using an objective statement, which is outdated and focuses on what you want rather than what you can offer. Your resume is already a summary of your qualifications, so don't repeat information that's already covered elsewhere. Instead, use the summary to add details that enhance your fit for the role.

To learn how to write an effective resume summary for your Underwriter resume, or figure out if you need one, please read Underwriter Resume Summary Examples , or Underwriter Resume Objective Examples .

1. Tailor your summary to the underwriter role

When crafting your summary for an Underwriter position, it's crucial to align it with the specific requirements of the role. Avoid generic statements that could apply to any job. Instead, showcase your most relevant qualifications and experiences that demonstrate your suitability for this particular position.

Here's an example of a tailored summary for an Underwriter role:

Analytical and detail-oriented Underwriter with 5+ years of experience in risk assessment and policy analysis. Skilled in evaluating complex financial data, identifying potential risks, and making sound underwriting decisions. Proven track record of collaborating with cross-functional teams to optimize workflows and improve profitability.

In contrast, here's an example of a generic summary that lacks focus:

Experienced professional seeking a challenging role in a dynamic organization. Skilled in communication, teamwork, and problem-solving. Committed to delivering excellent results and contributing to company success.

2. Highlight your underwriting expertise and achievements

In your summary, emphasize your specific underwriting skills, knowledge, and accomplishments that set you apart from other candidates. Mention your expertise in risk assessment, financial analysis, policy interpretation, and decision-making.

Quantify your achievements whenever possible to add credibility and impact. For example:

- Analyzed and processed over 100 insurance applications per month, consistently meeting tight deadlines

- Identified and mitigated potential risks, resulting in a 20% reduction in loss ratios

- Collaborated with a team of underwriters to streamline processes, increasing efficiency by 15%

Avoid making vague or unsubstantiated claims, such as:

- Excellent underwriting skills

- Strong work ethic and attention to detail

- Team player with great communication skills

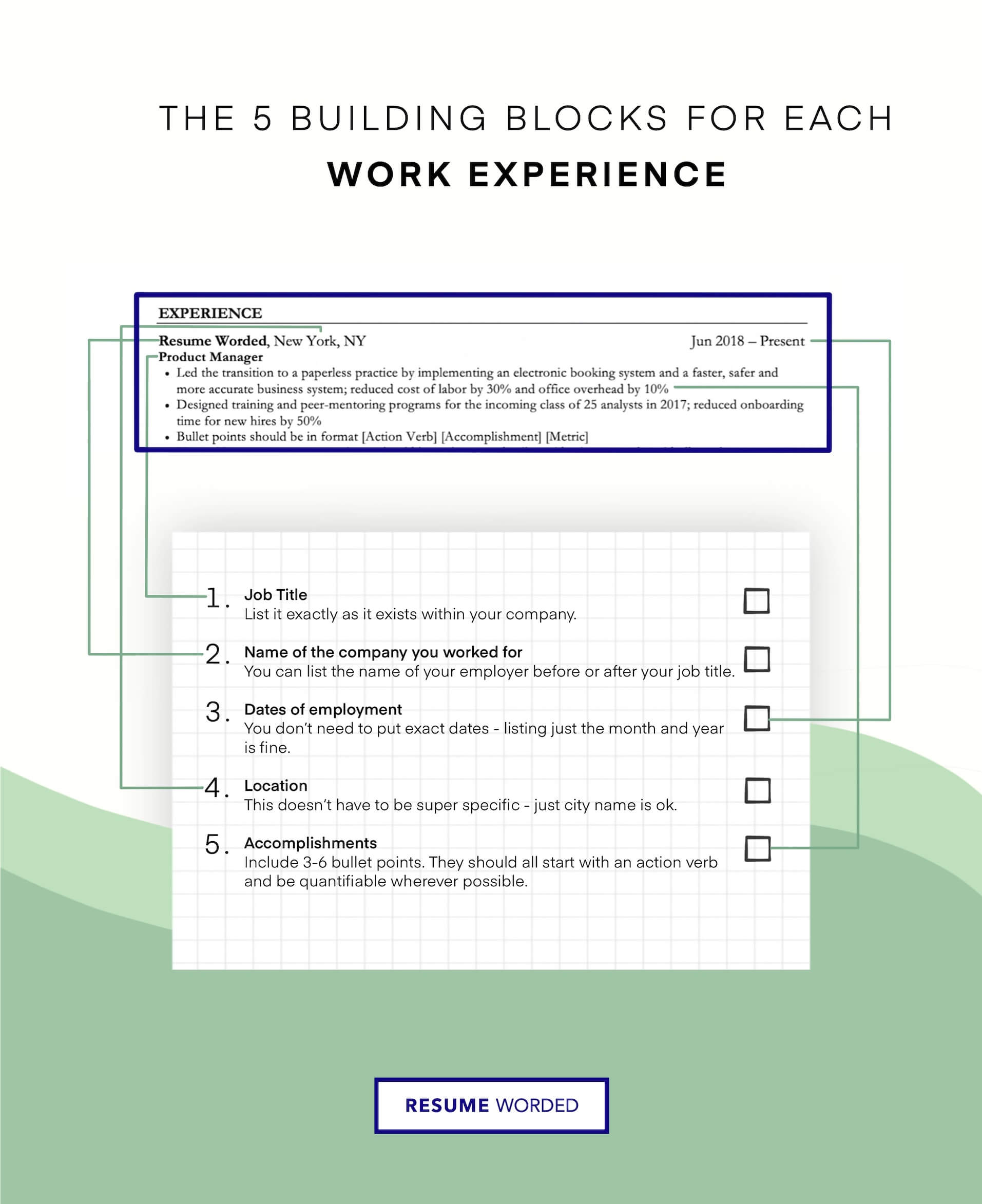

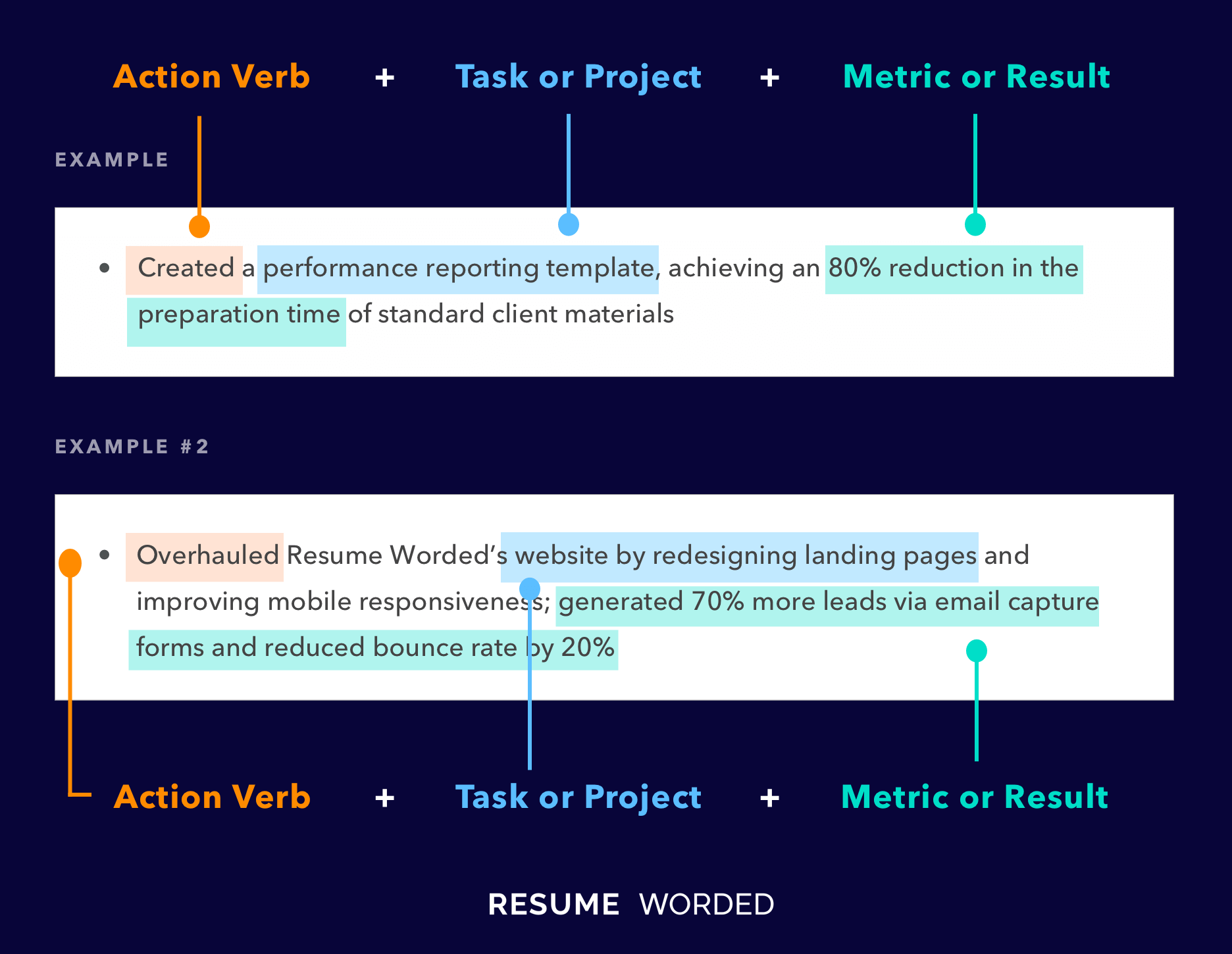

Experience

The work experience section is the heart of your resume. It's where you showcase your relevant experience and accomplishments to prove you're the best candidate for the job. In this section, we'll break down what you need to know to write a compelling work experience section that will catch the attention of hiring managers and help you land your next underwriter job.

1. Highlight your underwriting achievements

When writing your work experience section, focus on your achievements rather than just listing your responsibilities. Hiring managers want to see the impact you made in your previous roles.

Here are some examples of how to showcase your achievements:

- Underwrote 50+ policies per month, achieving a 95% accuracy rate in risk assessment and pricing

- Collaborated with cross-functional teams to develop and implement new underwriting guidelines, resulting in a 15% reduction in loss ratios

- Mentored and trained 5 junior underwriters, contributing to a 20% increase in team productivity

By highlighting your achievements, you demonstrate your value and show hiring managers what you can bring to their organization.

Not sure if your work experience section is hitting the mark? Try our Score My Resume tool for instant expert feedback on your resume. It checks your resume on 30+ key criteria that hiring managers care about.

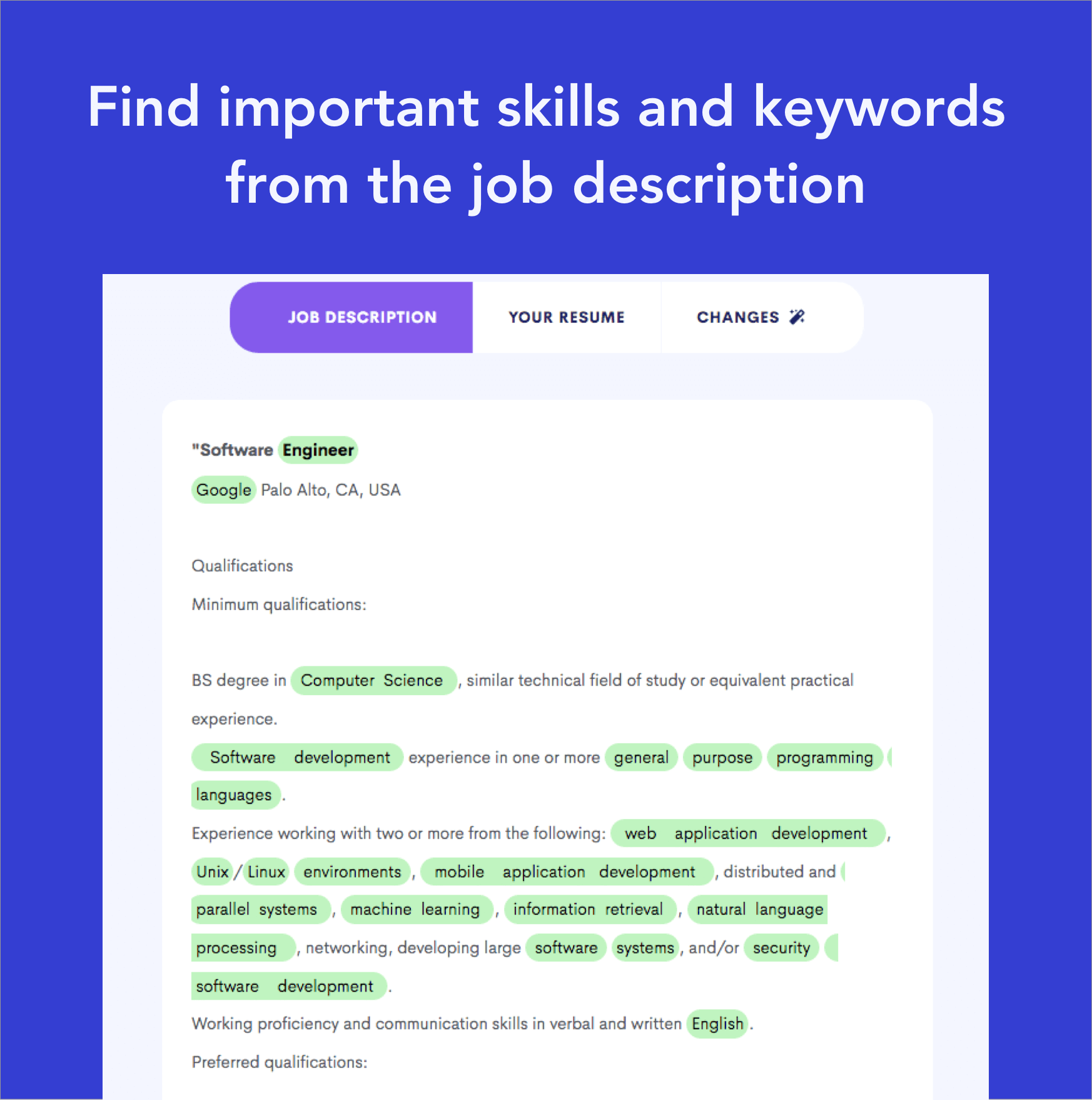

2. Use industry-specific keywords

Incorporating relevant industry keywords in your work experience section can help your resume pass through applicant tracking systems (ATS) and catch the attention of hiring managers. However, be careful not to overdo it or sacrifice readability for the sake of cramming in keywords.

Here are some examples of industry-specific keywords to consider:

- Risk assessment

- Policy analysis

- Claims management

- Reinsurance

- Catastrophe modeling

Conducted thorough risk assessments and policy analysis to determine coverage eligibility and premiums for commercial property and casualty insurance policies. Collaborated with claims management team to investigate and resolve complex claims, minimizing losses for the company.

To ensure your resume has the right keywords for the job you're applying for, try our Targeted Resume tool. It checks your resume against a specific job description and provides personalized recommendations to optimize your resume.

3. Quantify your impact with metrics

Whenever possible, use metrics to quantify your impact and achievements. Numbers help hiring managers understand the scope and scale of your contributions.

Here are some examples of how to incorporate metrics:

- Underwrote $50M in annual premium volume, maintaining a loss ratio of 60% or below

- Reviewed and approved 200+ policies per quarter, ensuring compliance with underwriting guidelines and state regulations

- Identified and mitigated risks on high-value accounts, saving the company $1M+ in potential losses

When you don't have access to specific metrics, you can still provide context by using numbers:

- Underwrote policies for a large insurance company

- Underwrote policies for a top-10 national insurance carrier with $5B+ in annual revenue

Remember to focus on the metrics and numbers that are most relevant to the job you're applying for. If you're unsure which metrics to include, review the job description and look for clues about what the employer values most.

4. Showcase your career progression

Hiring managers love to see candidates who have shown growth and progression in their careers. If you've been promoted or taken on increasing levels of responsibility, make sure to highlight that in your work experience section.

Here's an example of how to showcase career progression:

Underwriter, ABC Insurance (2018-Present) - Promoted to Senior Underwriter in 2020 - Manage a team of 5 junior underwriters, providing training and mentorship - Develop and implement new underwriting guidelines and processes Junior Underwriter, ABC Insurance (2016-2018) - Underwrote personal lines policies, including auto and homeowners insurance - Assisted senior underwriters with risk assessment and policy review - Earned CPCU designation in 2017

By showing your progression, you demonstrate your ability to take on new challenges and grow within an organization.

If you're having trouble fitting all of your relevant experience on one page, focus on your most recent and relevant positions. You can summarize older or less relevant experience in a short bullet point or two, or consider removing it altogether.

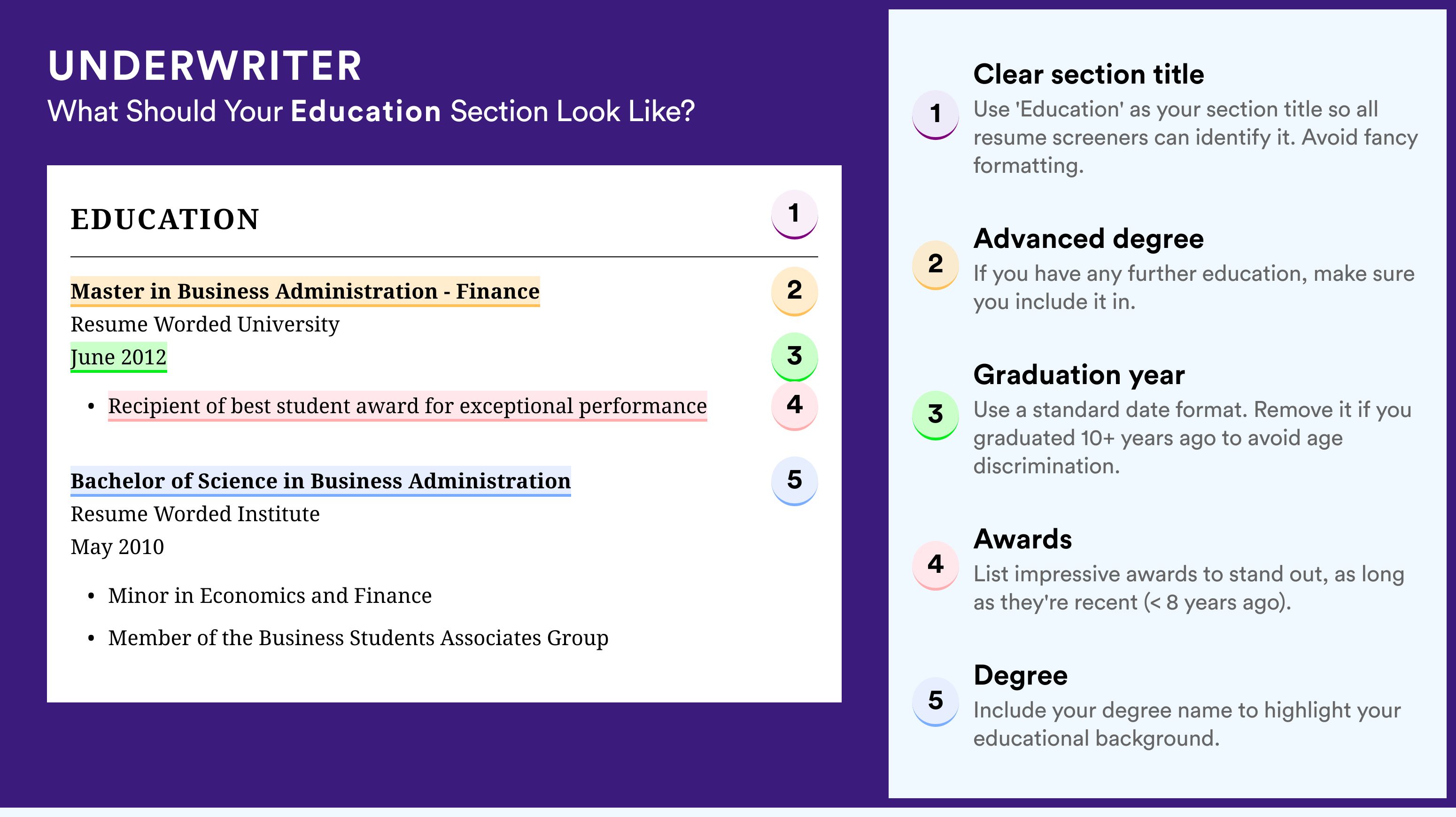

Education

Your education section is a key part of your underwriter resume. It shows hiring managers that you have the necessary background and training for the job. In this section, we'll cover what to include and how to format your education effectively.

1. Put your highest degree first

List your degrees in reverse chronological order, with your most recent or advanced degree first. For example:

Master of Business Administration (MBA) University of California, Los Angeles 2018-2020 Bachelor of Science in Finance University of Southern California 2014-2018

If you have multiple degrees at the same level (like two bachelor's degrees), list the most relevant one to the underwriter position first.

2. Include relevant coursework

If you're a recent graduate or your degree is highly relevant to the underwriter position, consider listing some of the key courses you took. This can help show that you have specific training for the job. For example:

Bachelor of Science in Actuarial Science University of Pennsylvania Relevant coursework: Risk Management, Financial Modeling, Probability Theory, Statistical Methods

However, if you have several years of underwriter experience, it's usually better to focus on your work achievements rather than coursework.

3. Highlight your academic achievements

Did you graduate with honors, a high GPA, or other commendations? Be sure to include those to make your education section stand out. For example:

- Graduated summa cum laude with a 3.95 GPA

- Awarded Outstanding Finance Student of the Year

However, there's no need to include your GPA if it's under 3.5, or honors/awards that aren't very substantial. For example:

- Dean's List: Fall 2016

4. Keep it concise if you're experienced

If you're an experienced underwriter, your work experience should be the main focus of your resume. Keep your education section brief, with just the key details of your degree(s). For example:

MBA, Columbia University BS in Economics, New York University

There's no need to list graduation years, as this can unfortunately lead to age discrimination. And don't include coursework, GPA, or minor academic awards from years ago.

Action Verbs For Underwriter Resumes

Strong action verbs act like keywords that stand out in your resume application. It helps recruiters identify your analytical and statistical performance, making your resume effective. In our guide, we have added important action verbs related to the underwriting profession, such as “analyzed”, “evaluated” and “identified”.

- Administered

- Interviewed

For a full list of effective resume action verbs, visit Resume Action Verbs .

Action Verbs for Underwriter Resumes

Skills for underwriter resumes.

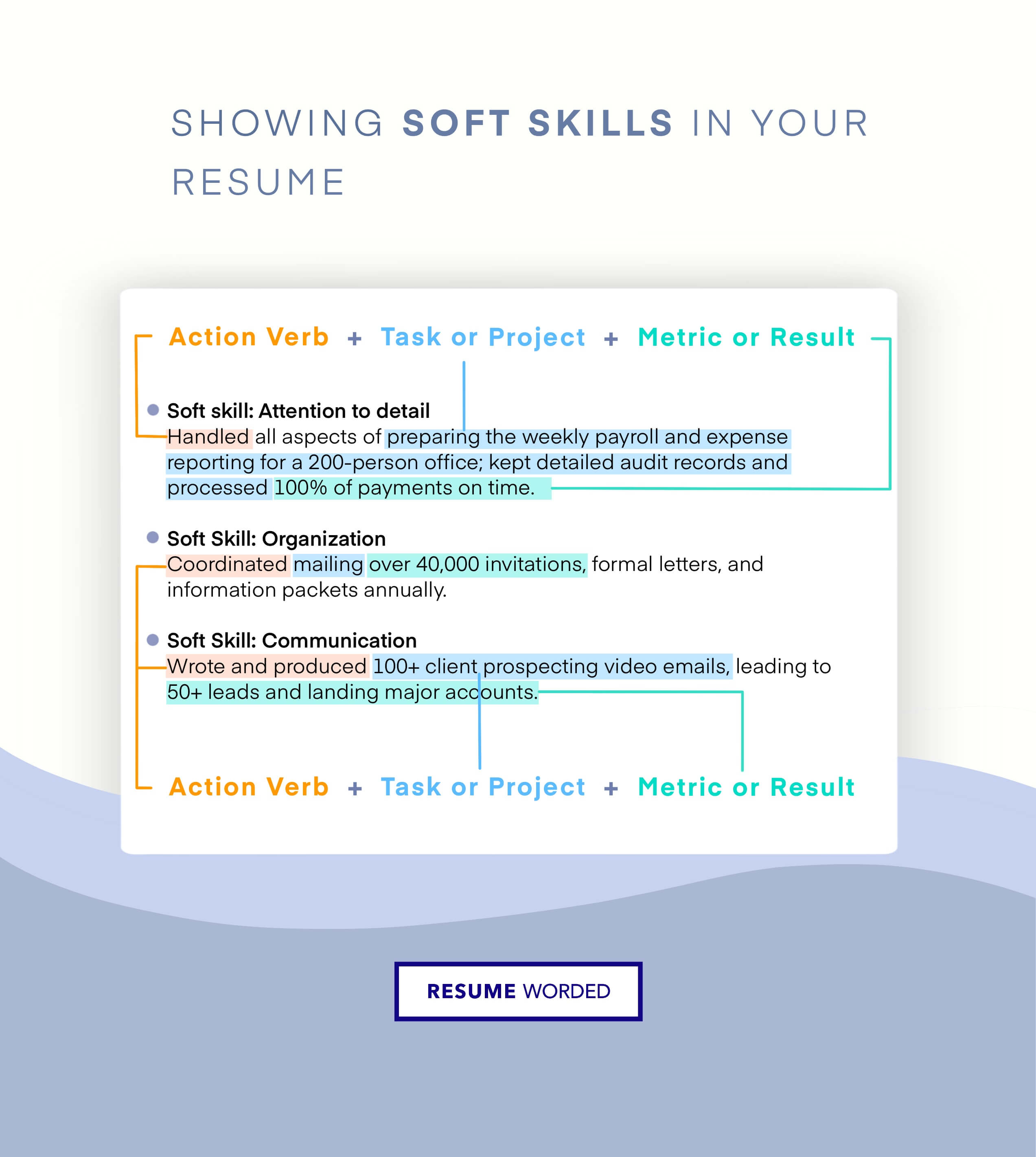

Having the right skills can make all the difference in your underwriting career. The profession relies on being analytical, keen on details, and making precise decisions that help companies avoid undue losses, and those are the skills that recruiters are looking for!

Skills can also mean your mathematical expertise, experience in the field along with software that can help you perform better. Soft skills such as interpersonal skills also make a difference by helping recruiters see both sides of a coin. Below mentioned are skills that you should add to your resume to impress recruiters:

- Underwriting

- Life Insurance

- Term Life Insurance

- Disability Insurance

- Risk Management

- Health Workforce

- General Insurance

- Medical Underwriting

- Whole Life Insurance

- Health Insurance

- Fixed Annuities

- Retirement Planning

- Employee Benefits Design

- Financial Risk

- Property & Casualty Insurance

- Financial Services

- Risk Assessment

How To Write Your Skills Section On an Underwriter Resumes

You can include the above skills in a dedicated Skills section on your resume, or weave them in your experience. Here's how you might create your dedicated skills section:

Skills Word Cloud For Underwriter Resumes

This word cloud highlights the important keywords that appear on Underwriter job descriptions and resumes. The bigger the word, the more frequently it appears on job postings, and the more 'important' it is.

How to use these skills?

Other legal resumes.

- Attorney Resume Guide

- Lawyer Resume Guide

- Legal Assistant Resume Guide

- Policy Analyst Resume Guide

- Compliance Resume Guide

Underwriter Resume Guide

- Regulatory Affairs Resume Guide

- Contract Specialist Resume Guide

- Public Policy Resume Guide

- Underwriter Resume Example

- Loan Underwriter Resume Example

- Commercial Underwriter Resume Example

- Credit Underwriter Resume Example

- Assistant Underwriter Resume Example

- Tips for Underwriter Resumes

- Skills and Keywords to Add

- All Resume Examples

- Underwriter CV Examples

- Underwriter Cover Letter

- Underwriter Interview Guide

- Explore Alternative and Similar Careers

Download this PDF template.

Creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

These professional templates are optimized to beat resume screeners (i.e. the Applicant Tracking System). You can download the templates in Word, Google Docs, or PDF. For free (limited time).

access samples from top resumes, get inspired by real bullet points that helped candidates get into top companies., get a resume score., find out how effective your resume really is. you'll get access to our confidential resume review tool which will tell you how recruiters see your resume..

Writing an effective resume has never been easier .

Upgrade to resume worded pro to unlock your full resume review., get this resume template (+ 6 others), plus proven bullet points., for a small one-time fee, you'll get everything you need to write a winning resume in your industry., here's what you'll get:.

- 📄 Get the editable resume template in Google Docs + Word . Plus, you'll also get all 6 other templates .

- ✍️ Get sample bullet points that worked for others in your industry . Copy proven lines and tailor them to your resume.

- 🎯 Optimized to pass all resume screeners (i.e. ATS) . All templates have been professionally designed by recruiters and 100% readable by ATS.

Buy now. Instant delivery via email.

instant access. one-time only., what's your email address.

I had a clear uptick in responses after using your template. I got many compliments on it from senior hiring staff, and my resume scored way higher when I ran it through ATS resume scanners because it was more readable. Thank you!

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Underwriting Specialist Resume Samples

An Underwriting Specialist must oversee the business results and take necessary actions to ensure profitability. The most common work activities associated to this role are mentioned on the Underwriting Specialist Resume as – handling a large number of global and international accounts; assessing risks and managing profitability, providing timely guidance and support to the policyholders, providing consulting service to underwriters and the service staffs; assessing procedures and products; suggesting enhancements; supervising underwriting activities ; and coaching field staff on underwriting analysis .

The most sought-after skills for the post include – the ability to investigate and resolve complex issues; good judgment skills, very strong marketing and relationship building skills; ambiguity to make right decisions; knowledge of risk management, strong relationship building, and analytical skills; and negotiation skills. Formal education beyond a degree is not usually required.

- Resume Samples

- Underwriting Specialist

Underwriting Specialist Resume

Summary : A Underwriting Specialist position in a company that seeks an ambitious and work conscientious person, where acquired skill and continuing education will be utilized towards growth and advancement.

Skills : Commercial Lines Underwriting / Sales & Marketing Relationship Manager.

Description :

- Promoted to assume expanded responsibilities while continuing to perform all Senior Underwriter tasks.

- Included development / training of underwriters and agents, serving as an expert resource for commercial coverage, and providing backup for the Team Leader position.

- Effectively managed territory's profitability.

- Managed $6M territory comprised of 4 agents.

- Underwrote complex book of business consisting primarily of large packages, contracting, and business auto risks.

- Maintained primary responsibility for $2.5M agency.

- Accounts generated $800K of new business in 2007.

- Successfully earned Associate in Management (AIM) designation and Associate in Underwriting (AU) designation through the Insurance Institute of America.

- Oversaw closing of underperforming agency in 2008.

Sr. Underwriting Specialist Resume

Summary : To secure a challenging Underwriting Specialist position that allows to utilize knowledge and skills developed in the workplace, in order to further career.

Skills : Microsoft Word, Salesforce.

- Processes residential mortgage loans (FHA, VA, Conventional, purchase, refinance) under various programs in a quality consistent with all company policies and procedures as well as meeting all regulatory requirements.

- Maintains a pipeline of loans and is responsible for the timely and compliant flow of such loans through the process.

- Obtains and reviews necessary loan documentation and submits complete packages to Underwriting for loan approval.

- Monitors and ensures closing dates and company deadlines are met.

- Communicates with loan officers, buyers, sellers, title companies, builder and agents.

- Obtains and verifies that all underwriting conditions are received and cleared by the underwriter and prepares the file for submission to the Closing Department.

- Provides excellent customer service by effectively communicating and cooperating with all brokers and AE's.

- Keeps abreast of changes in policies and procedures, standards and regulations applicable to the company and the mortgage industry.

- Understands and applies local, state and federal regulations related to processing mortgage loans.

Jr. Underwriting Specialist Resume

Objective : Hard-working, energetic and have developed strong verbal and written skills. Years of experience with customer service and supervisor/trainer positions.

Skills : Management, Organizing.

- Responsible for pulling initial due diligence information for potential new personal mortgages (credit reports, tax transcripts, appraisals).

- Reviews appraisals and enter information into our loan software.

- Sends the completed and approved appraisals to the borrower.

- Works on FHA, VA, Conventional and USDA purchases and refinances.

- Runs all the required government checks on all parties involved in the loan (SAM searches, Limited Denial of Participation, FHA Connection, FHA Mortgage limits).

- Uses Desktop Underwriter as well.

- Reviews conditions as they come in and ensure have all the information before sending the file to the underwriting again.

- Communicate missing conditions and incomplete conditions to the brokers/lenders.

- Also perform clear to close on loans and send the official approval to the borrower.

Underwriting Specialist I Resume

Objective : Underwriting Specialist that is self motivated, enthusiastic, detail oriented with a positive team player attitude. Able to support a salesperson or a small sales team across all industries. Excellent communication skills, very customer service driven as well as computer literate.

Skills : Insurance Verification, Data Entry.

- Verifies patient benefits for medical claim approval.

- Obtains prior-authorization and pre-certification.

- Adheres to department policies and procedures in order to comply with performance standards to ensure profitable case delivery measures are managed effectively.

- Prioritizes incoming prior-authorization and pre-certification requests as outline in departmental policies, procedures, and workflow guidelines.

- Receives inbound and makes outbound calls to healthcare professionals, commercial and workers' comp carriers, and manufacturer sales representatives.

- Makes accurate, appropriate and timely case notes and database entries.

- Refers requests that require clinical judgment to an Underwriter Supervisor.

- Meets position metrics and turn-around time frames while maintaining a full caseload.

- Maintains strict confidentiality; adheres to all HIPAA guidelines/regulations.

Underwriting Specialist II Resume

Headline : Underwriting Specialist with extensive experience in the Telecommunications, Technology and Insurance industries. Proven track record selling B2B to all levels of management and corporate executives.

- Analyzes applications and risks by determining acceptability of risk in accordance with company guidelines and standards.

- Works in conjunction with Sales Agents on obtaining the any additional evidence of insurability.

- Assists Agents with questions via phone or e mail and escalates issues to management as necessary.

- Negotiates with agents to reach positive and profitable outcomes.

- Notifies agencies of adverse underwriting decisions, rate appeals, underwriting requirements, status and declinations.

- Develops and maintains relationships with all internal departments.

- Provides assistance to other underwriters and to other functional areas.

- Ability to exercises independent judgment and to make critical business decisions effectively.

- Keeps current on state/territory issues and regulations, industry activity and trends.

Underwriting Specialist III Resume

Summary : To enhance the academic community by utilizing skills in education, training, communications, finances, money management, and credit analysis.

Skills : SAS, Tableau, Excel, Business Objects.

- Helped develop and piloted new underwriting referral system and underwriting referral Access database which produced a forty percent efficiency gain in renewal casualty underwriting referrals.

- Developed and piloted new youthful driver rating database and process that indentifies improperly rated youthful drivers, which reduced premium leakage.

- Assisted District Manager and Sales Management in analyzing and recommending corrective actions to improve sales force's key performance indicators.

- Assisted Business Performance consultants and sales management on various report creation and special listings to improve growth, retention and profit; involved extracting data from Business Objects or Focus and analyzing and reporting through Microsoft Access or Excel.

- Assisted Area Manager and State Managers on Planning / Staffing project in order to optimize resource efficiency.

- Identified homeowners and auto policies that were not getting the proper discounts using Focus and Microsoft Access to assist sales force in retaining business.

- Served as key participant in Colorado Foreclosure project by developing an Access database and reports which matched foreclosed property addresses, obtained from independent vendor, with American Family property policy's address in order to improve homeowner's profitability.

- Trained and mentored other underwriters in developing reports, databases and creating focus programs to obtain information.

Asst. Underwriting Specialist Resume

Objective : To obtain a Underwriting Specialist position that would allow to exercise knowledge and education in Business Administration to benefit career and office goals.

Skills : Data Analysis, Process Improvement, UNIX Shell Scripting.

- Creates a clear concise relationship as a Liaison between the Underwriter and the Broker.

- Provides effective verbal/written communication in a timely manner to clear conditions that are needed to close on a FHA, VA and Conventional loan.

- Reviews numerous documents, ordering specific government documents and requesting any additional info needed to meet state and federal guidelines based on the type of loan being processed.

- Operates with MyFAMC internal systems, FEMA Disaster, Web Cert, FHA Connection, VA Portal, Equifax, Desktop Underwriting, LP, UDM, Veri-Tax and NMLS to ensure the proper procedures are being handled and the required documents are ordered immediately.

- Maintains a pipeline of loans ranging from 50+ daily while being responsible to review all documents uploaded and that it will meet the Underwriters approval.

- Communicates with Loan Officers, Account Executives, Brokers, Buyers, Sellers, Title Companies, Builders/Agents, and Appraisers to ensure the loan process is handled smoothly.

- Answers all emails and voicemails within a 2 hour time frame to ensure customer service is maintained and all issues are resolved.

- Handles, processes and clears residential jumbo loans ranging from 400k- 1.6m Exceptional customer service through each interaction via phone or email.

Associate Underwriting Specialist Resume

Headline : To secure a challenging Underwriting Specialist position where Underwriting and Management experience will be fully utilized.

- Responsible for achieving company rate, retention, growth and profitability goals for of multi-line book of business.

- Achieves new business production goals.

- Works independently within the letter of authority.

- Mentors new hires and less experienced staff in all aspects of underwriting, systems, and processes.

- Develops Agent and Broker relationships through visits to the assigned territory.

- Serves as Division subject matter expert for Workers Compensation and rating plans.

- Participates in special projects and assignments.

Lead Underwriting Specialist Resume

Summary : A skilled and experienced credit/financial analyst seeking a Underwriting Specialist position with a company which allows to use knowledge of finance.

Skills : MS Office, Management.

- Underwrites and assesses risk for small and middle market contract surety accounts, as well as some small transactional business.

- Makes appropriate decisions and negotiate terms and conditions within authority limits and make appropriate recommendations to home office outside of those parameters.

- Develops and maintains productive agency/client relationships.

- Effectively assists in executing the sales plan for our branch with emphasis on marketing and sales activity outside the office.

- Accountable for accurate underwriting documentation/information in account management systems.

- Demonstrates superior customer service standards (consistency, quick response, knowledge of product, etc.).

- Regularly participates in industry functions to develop visibility in the marketplace, network with key players in the industry, and continually increase knowledge of the surety industry.

Summary : Proficient in working in fast-paced, team oriented, and high volume environments while managing multiple tasks. Administrative experience in managing teams with the responsibilities of teaching, training, and coordinating groups of people while maximizing efficiency, effectiveness, and overall environment of business performance.

Skills : Customer Service,Strategic Planning, Complex Claim Handling, Account Management.

- Examines documents to determine degree of risk from such factors as applicant financial standing and value and condition of property.

- Declines excessive risks.

- Writes to field representatives, medical personnel, and others to obtain further information, quote rates, or explain company underwriting policies.

- Evaluates possibility of losses due to catastrophe or excessive insurance.

- Decreases value of policy when risk is substandard and specify applicable endorsements or apply rating to ensure safe profitable distribution of risks, using reference materials.

- Reviews company records to determine amount of insurance in force on single risk or group of closely related risks.

- Authorizes reinsurance of policy when risk is high.

Recent Posts

Download this pdf template., creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option., unlock the power of over 10,000 resume samples., take your job search to the next level with our extensive collection of 10,000+ resume samples. find inspiration for your own resume and gain a competitive edge in your job search., get hired faster with resume assistant., make your resume shine with our resume assistant. you'll receive a real-time score as you edit, helping you to optimize your skills, experience, and achievements for the role you want., get noticed with resume templates that beat the ats., get past the resume screeners with ease using our optimized templates. our professional designs are tailored to beat the ats and help you land your dream job..

Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

5 Underwriter Resume Examples Created for 2024

Underwriter Resume

- Underwriter Resumes by Experience

- Underwriter Resumes by Role

- Write Your Underwriter Resume

You effortlessly navigate the complex world of underwriting, ensuring your organization is compliant with the evolving regulatory landscape every step of the way.

Assessing client risk, negotiating contracts, and calculating premiums are things that are now second nature to you. However, you’ll need to tap into a different set of skills to create a stand-out resume that summarizes your strengths.

Good news—we’ve helped many underwriters like you score their dream jobs! Using our sample underwriter resume examples , resume tips , and free cover letter builder , you can land more interviews and, ultimately, the job you desire.

or download as PDF

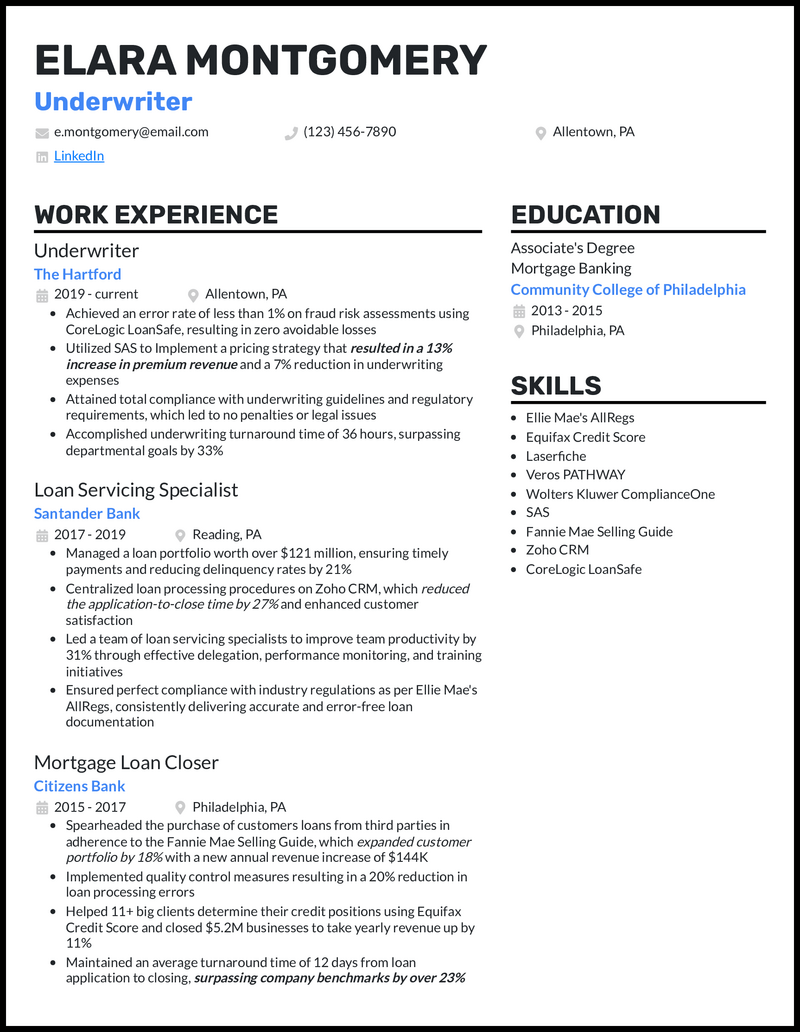

Why this resume works

- Including your role in managing a $121M loan portfolio in your underwriter resume is adequate evidence to attest to your abilities to perform at the highest levels and deliver desirable results.

Entry Level Underwriter Resume

- Leverage your past work experiences and mention how you’ve used tools such as Pipedrive, eFileCabinet, and your negotiation skills to identify customer trends, analyze financial reports, and manage databases. Have any risk navigator projects up your sleeve? Add them too.

Commercial Underwriter Resume

- It’s also a great addition to having any majors or specialization in insurance and risk management. This will prove that you’re flexible and can help prevent and minimize risk as much as possible to ensure a company makes the best financial decisions at all times for its customers.

Mortgage Underwriter Resume

- Therefore, your mortgage underwriter resume should show a track record of closed deals through established and trusted networks built over the years if you’re to make a great impression on hiring managers.

Insurance Underwriter Resume

- Therefore, achieving a 97% customer satisfaction score in your insurance underwriter resume, among other measurable achievements, gives you a niche-specific advantage.

Related resume examples

- Retail Manager

- Retail Sales Associate

- Office Manager

- Office Assistant

- Office Administrator

Fine-tune Your Underwriter Resume to Match the Job

Your work drives companies’ financial decisions when it comes to issuing loans, mortgages, or insurance policies. Lean into your skills and knowledge that guide your process and allow you to make these judgments, avoiding generic terms like “teamwork” or “meticulous.”

Given the analytical nature of underwriting, it’s best to focus primarily on your technical and job-specific skills . Talk about things like regulatory compliance and financial analysis, and don’t forget to mention your software proficiencies, such as underwriting tools, risk management software, or database management systems.

Need some ideas?

15 popular underwriter skills

- Risk Assessment

- Financial Analysis

- Regulatory Compliance

- Database Management

- Microsoft Excel

- RMS Risk Intelligence

- Oracle Database

- Calyx Point

Your underwriter work experience bullet points

No matter the type of underwriting you specialize in, you spend your days analyzing client data, conducting risk assessments, collaborating with brokers and agents, and making decisions on policy issuance. As these tasks are known to recruiters, you’ll make more of an impression if you focus on your achievements instead.

Your work impacts your organization’s bottom line; hence it can be neatly quantified. Use this to your advantage. Show off your effectiveness and the impact you could have on a potential employer by providing concrete metrics.

Whether your strongest achievements are bulletproofing a risk assessment framework, or managing record monthly volumes of loans, this section is where you talk about them, substantiating them with data to convey your unique professional value.

- Highlight instances where your work refining and automating workflows led to reducing underwriting turnaround times.

- Show off improvements to loss ratios that your risk assessment and mitigation strategies resulted in.

- Emphasize the specific software you leveraged to achieve your goals, such as the reduction in claim rates your analysis with Excel and Tableau brought on.

- List instances where your work directly bolstered company financials, such as spearheading an increase in insurance premiums or trimming expenses.

See what we mean?

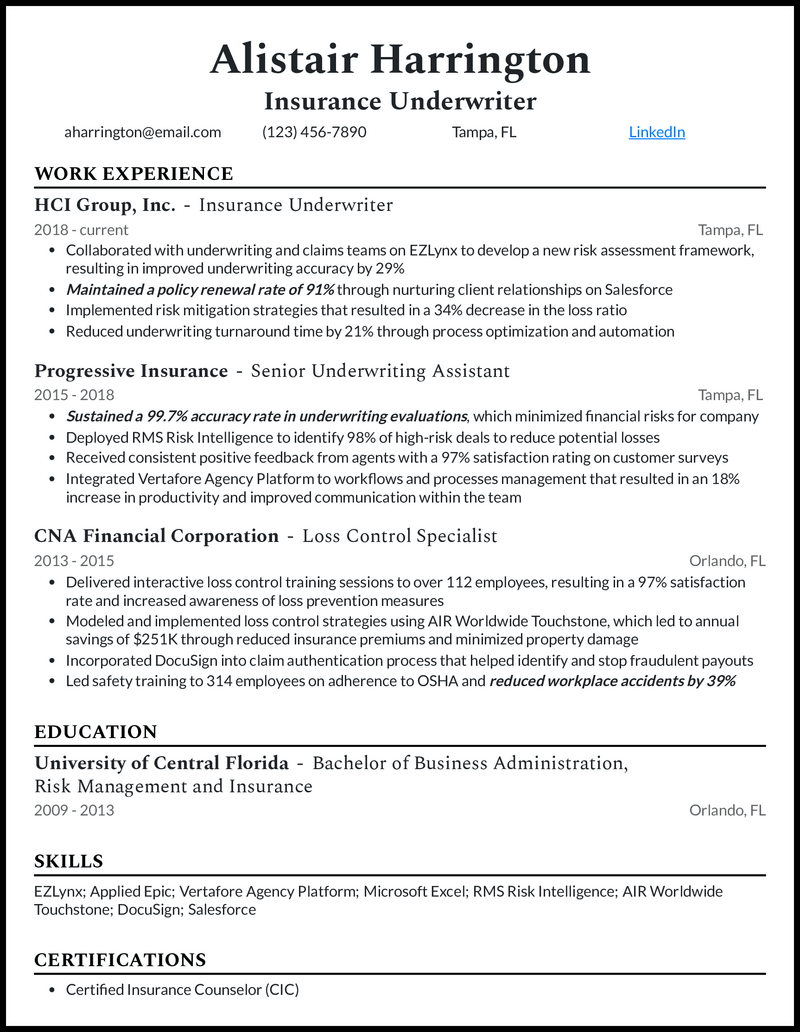

- Implemented risk mitigation strategies that resulted in a 34% decrease in the loss ratio

- Employed CreditXpert to evaluate credit reports and identify areas for improvement, resulting in a 17% increase in credit scores for approved borrowers

- Achieved an error rate of less than 1% on fraud risk assessments using CoreLogic LoanSafe, resulting in zero avoidable losses

- Utilized SAS to implement a pricing strategy that resulted in a 13% increase in premium revenue and a 7% reduction in underwriting expenses

9 active verbs to start your underwriter work experience bullet points

- Implemented

3 Tips for Writing an Underwriter Resume if You’re Just Starting Out

- If you have certifications such as the Chartered Property Casualty Underwriter (CPCU), Associate in Commercial Underwriting (ACU), or specialized certifications such as Certified Mortgage Underwriter (NAMU-CMU), display them prominently in your resume. They may not always be required, but they do showcase your commitment to the role.

- Be selective with which skills you list in your resume , prioritizing those you feel confident in and that each job description emphasizes. For instance, if a role highlights the need for UnderRight proficiency, and it’s something you know you’re good at, then display it at the top of your skills list.

- If you’re applying for your first job as an underwriter, leverage your academic and extracurricular experiences to highlight your skills. For example, reaffirm your catastrophe modeling skills by talking about the college case study you undertook using Applied Epic to forecast potential losses.

3 Tips for Writing an Underwriter Resume if You’re Already Experienced

- With your experience, your work has positively impacted the financials of companies you’ve worked for. Get into the specifics of initiatives you led that affected revenues, such as the fraud detection overhaul you instituted, which led to reduced losses due to fraud.

- Instead of listing “collaboration” or “stakeholder management” in your resume skills , show recruiters that it’s in your repertoire. Talk about instances where you liaised with brokers, loan originators, or policyholders, and the impact your collaboration had.

- Go into detail about your specialty within underwriting. For instance, if you specialize in insurance or mortgage underwriting, talk about specific certifications, courses, or work experience you have that contribute to your expertise.

Pinpoint some of your transferable skills from your other financial roles, such as your ability to work with Microsoft Excel or database management systems—and more generally, your flair for interpreting vast sums of data.

If you do include one, be sure to tailor it to each job description , mentioning the company and role specifically. Include your career highlights and key strengths, such as risk assessment or financial analysis.

Lender policies and federal regulations are constantly evolving. If you’ve taken steps to stay abreast of industry developments, such as attending industry workshops or conferences, mention these to show recruiters your commitment to underwriting.

- Insurance Underwriter Resume Example

Resume Examples

- Common Tasks & Responsibilities

- Top Hard & Soft Skills

- Action Verbs & Keywords

- Resume FAQs

- Similar Resumes

Common Responsibilities Listed on Insurance Underwriter Resumes:

- Analyze and evaluate insurance applications to determine risk and establish premiums

- Review and assess medical records, credit reports, and other documents to determine eligibility for coverage

- Develop and maintain relationships with agents and brokers to ensure accurate and timely processing of applications

- Monitor and review existing policies to ensure compliance with regulations

- Negotiate terms and conditions of coverage with customers

- Develop and implement underwriting guidelines and procedures

- Monitor and analyze industry trends to identify potential risks and opportunities

- Develop and maintain relationships with reinsurers to ensure adequate coverage

- Analyze and evaluate claims to determine coverage and liability

- Prepare and present reports to management on underwriting activities

- Train and mentor junior underwriters on underwriting procedures and processes

Speed up your resume creation process with the AI-Powered Resume Builder . Generate tailored achievements in seconds for every role you apply to.

Insurance Underwriter Resume Example:

- Developed and implemented underwriting guidelines and procedures, resulting in a 20% reduction in processing time and a 15% increase in accuracy of risk assessment.

- Negotiated terms and conditions of coverage with customers, resulting in a 25% increase in policy sales and a 10% increase in customer satisfaction.

- Trained and mentored junior underwriters on underwriting procedures and processes, resulting in a 30% improvement in their performance and a 15% increase in team productivity.

- Analyzed and evaluated insurance applications to determine risk and establish premiums, resulting in a 20% increase in policy sales and a 10% increase in revenue.

- Monitored and reviewed existing policies to ensure compliance with regulations, resulting in a 15% reduction in policy cancellations and a 10% increase in customer retention.

- Prepared and presented reports to management on underwriting activities, resulting in a 25% improvement in decision-making and a 20% increase in operational efficiency.

- Reviewed and assessed medical records, credit reports, and other documents to determine eligibility for coverage, resulting in a 20% reduction in fraudulent claims and a 15% increase in policy accuracy.

- Analyzed and evaluated claims to determine coverage and liability, resulting in a 25% reduction in claim processing time and a 20% increase in customer satisfaction.

- Monitored and analyzed industry trends to identify potential risks and opportunities, resulting in a 30% improvement in risk assessment and a 25% increase in policy sales.

- Risk assessment and analysis

- Underwriting guidelines and procedures

- Negotiation and communication

- Training and mentoring

- Insurance application evaluation

- Regulatory compliance monitoring

- Report preparation and presentation

- Document review and assessment

- Claims analysis and evaluation

- Industry trend analysis

- Customer service and satisfaction

- Time management and efficiency

- Attention to detail

- Decision-making

- Teamwork and collaboration

Top Skills & Keywords for Insurance Underwriter Resumes:

Hard skills.

- Risk Assessment and Analysis

- Underwriting Guidelines and Procedures

- Insurance Policy Review and Analysis

- Financial Analysis and Modeling

- Regulatory Compliance Knowledge

- Claims Investigation and Analysis

- Data Analysis and Interpretation

- Insurance Industry Knowledge

- Loss Control and Prevention

- Contract Review and Analysis

- Customer Service and Communication

- Negotiation and Decision Making

Soft Skills

- Attention to Detail and Accuracy

- Analytical and Critical Thinking

- Decision Making and Risk Assessment

- Communication and Interpersonal Skills

- Time Management and Prioritization

- Adaptability and Flexibility

- Customer Service and Relationship Building

- Problem Solving and Conflict Resolution

- Teamwork and Collaboration

- Organizational and Planning Skills

- Emotional Intelligence and Empathy

- Ethics and Integrity

Resume Action Verbs for Insurance Underwriters:

- Scrutinized

- Investigated

- Collaborated

- Communicated

- Recommended

- Implemented

Generate Your Resume Summary

Resume FAQs for Insurance Underwriters:

How long should i make my insurance underwriter resume, what is the best way to format a insurance underwriter resume, which keywords are important to highlight in a insurance underwriter resume, how should i write my resume if i have no experience as a insurance underwriter, compare your insurance underwriter resume to a job description:.

- Identify opportunities to further tailor your resume to the Insurance Underwriter job

- Improve your keyword usage to align your experience and skills with the position

- Uncover and address potential gaps in your resume that may be important to the hiring manager

Complete the steps below to generate your free resume analysis.

Related Resumes for Insurance Underwriters:

Commercial underwriter, entry level underwriter, insurance underwriter, loan underwriter, mortgage underwriter, senior underwriter, underwriter.

What is an underwriting support specialist and how to become one

An underwriting support specialist is a professional who helps with the loan application process. They review loan documentation to ensure packages are complete and follow up with lenders on outstanding file requests. They also analyze and order various records, such as medical records and criminal background checks, for the underwriting process. This specialist processes and issues policies and endorsements, and coordinates with external vendors to obtain necessary reports. They also maintain logs of activities and correct data entry errors.

How long does it takes to become an underwriting support specialist?

It typically takes 5-6 years to become an underwriting support specialist:

- Years 1-4: Obtaining a Bachelor's degree in a relevant field, such as business, finance, or insurance.

- Year 5: Completing on-site training, which typically lasts 1-3 months.

- Year 6: Accumulating the necessary work experience in duties such as reviewing insurance applications, analyzing data, and communicating with clients and insurance agents.

- Salary $40,401

- Growth Rate 10%

- Jobs Number 104,575

- Most Common Skill Endorsements

- Most Common Degree Bachelor's degree

- Best State New Hampshire

Underwriting Support Specialist career paths

As an underwriting support specialist, there are many careers you can pursue. You could move into an underwriter role, where you would assess the risk of insuring a client or their property. You could also become an account manager, helping clients manage their accounts or work as a project manager, overseeing specific projects. If you're looking for a leadership role, you could become a general manager or operations vice president.

Key steps to become an underwriting support specialist

Explore underwriting support specialist education requirements.

The educational requirements for an underwriting support specialist typically include a high school diploma, certificate, or an associate or bachelor's degree. According to George Miller , Associate Professor of Computer Science at Tiffin University's School of Business, college graduates should have a solid foundation in their field of study, along with good communication skills, critical thinking skills, and the ability to work well in teams.

For those pursuing a career as an underwriting support specialist, majors such as business, accounting, communication, psychology, or secretarial and administrative science can be beneficial. Additionally, obtaining a certification like the Associate in General Insurance can further enhance one's qualifications. Top schools for this field include Stanford University, University of Pennsylvania, Northwestern University, Maine Maritime Academy, and University of Southern California.

Most common underwriting support specialist degrees

Bachelor's

High School Diploma

Start to develop specific underwriting support specialist skills

Underwriting support specialists need a range of skills. They must have strong communication skills, both oral and written, as well as critical thinking skills and be able to work well in teams. They should also have a solid foundation in technology and be able to adapt to changing technology. They use these skills to process and issue policies and endorsements, analyze and order medical records, and interact with clients on a daily basis. They also review loan documentation, coordinate with external vendors, and maintain data integrity for underwriting systems.

Complete relevant underwriting support specialist training and internships

Research underwriting support specialist duties and responsibilities.

Underwriting support specialists perform various tasks such as reviewing loan documentation, ordering medical records, processing policies and endorsements, and analyzing deficiencies on mortgage loans. They also provide technical support for mortgage brokers and account executives and evaluate applications to determine acceptability based on established guidelines. They must have strong communication, problem-solving, and analytical skills, as well as the ability to work as part of a team and pay attention to detail.

- Process documentation within manage database systems and ImageRight system for the legal binding of commercial insurance risk.

- Promote continuity of care by accurately and completely communicating to other caregivers the status of patients for which care is provided.

Prepare your underwriting support specialist resume

When your background is strong enough, you can start writing your underwriting support specialist resume.

You can use Zippia's AI resume builder to make the resume writing process easier while also making sure that you include key information that hiring managers expect to see on an underwriting support specialist resume. You'll find resume tips and examples of skills, responsibilities, and summaries, all provided by Zippi, your career sidekick.

Choose From 10+ Customizable Underwriting Support Specialist Resume templates

Apply for underwriting support specialist jobs

Now it's time to start searching for an underwriting support specialist job. Consider the tips below for a successful job search:

- Browse job boards for relevant postings

- Consult your professional network

- Reach out to companies you're interested in working for directly

- Watch out for job scams

Are you an Underwriting Support Specialist?

Share your story for a free salary report.

Average underwriting support specialist salary

The average Underwriting Support Specialist salary in the United States is $40,401 per year or $19 per hour. Underwriting support specialist salaries range between $30,000 and $54,000 per year.

What Am I Worth?

How do underwriting support specialists rate their job?

Underwriting support specialist reviews.

Lifting wheelchair bound individuals to change pull ups and pampers, cleaning bowel movements. No support from leadership when problems arrive. Over crowding classrooms which causes stress to staff and individuals.

Updated April 25, 2024

Editorial Staff

The Zippia Research Team has spent countless hours reviewing resumes, job postings, and government data to determine what goes into getting a job in each phase of life. Professional writers and data scientists comprise the Zippia Research Team.

Underwriting Support Specialist Related Careers

- Client Support Specialist

- Computer Specialist

- Computer Support Specialist

- Desktop Support Specialist

- Help Desk Specialist

- Litigation Support Specialist

- Operations Support Specialist

- Resolution Specialist

- Senior Support Specialist

- Service Support Specialist

- Signal Support Specialist

- Support Agent

- Support Specialist

Underwriting Support Specialist Related Jobs

- Client Support Specialist Jobs

- Computer Specialist Jobs

- Computer Support Specialist Jobs

- Desktop Support Specialist Jobs

- Help Desk Specialist Jobs

- Litigation Support Specialist Jobs

- Operations Support Specialist Jobs

- Resolution Specialist Jobs

- Senior Support Specialist Jobs

- Service Support Specialist Jobs

- Signal Support Specialist Jobs

- Specialist Jobs

- Support Jobs

- Support Agent Jobs

- Support Specialist Jobs

What Similar Roles Do

- What Does a Client Support Specialist Do

- What Does a Computer Specialist Do

- What Does a Computer Support Specialist Do

- What Does a Desktop Support Specialist Do

- What Does a Help Desk Specialist Do

- What Does a Litigation Support Specialist Do

- What Does an Operations Support Specialist Do

- What Does a Resolution Specialist Do

- What Does a Senior Support Specialist Do

- What Does a Service Support Specialist Do

- What Does a Specialist Do

- What Does a Support Do

- What Does a Support Agent Do

- What Does a Support Specialist Do

- What Does a Support Specialist/Trainer Do

Resume For Related Jobs

- Client Support Specialist Resume

- Computer Specialist Resume

- Computer Support Specialist Resume

- Desktop Support Specialist Resume

- Help Desk Specialist Resume

- Litigation Support Specialist Resume

- Operations Support Specialist Resume

- Resolution Specialist Resume

- Senior Support Specialist Resume

- Service Support Specialist Resume

- Signal Support Specialist Resume

- Specialist Resume

- Support Resume

- Support Agent Resume

- Support Specialist Resume

- Zippia Careers

- Computer and Mathematical Industry

- Underwriting Support Specialist

Browse computer and mathematical jobs

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

- Resume Samples

- Customer Service

Credit Support Specialist Resume Samples

The guide to resume tailoring.

Guide the recruiter to the conclusion that you are the best candidate for the credit support specialist job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies, tailor your resume & cover letter with wording that best fits for each job you apply.

Create a Resume in Minutes with Professional Resume Templates

- Responsible for data entry into various M&T loan systems (including Commercial Scorecard System (CSS), Commercial Loan Approval System (CLAS) and Enterprise Relationship Management (ERM))

- Investigate delinquency status (using various M&T loan systems) for real estate taxes, loan payments, insurance payments, etc. for loans being reviewed/ underwritten by department analysts

- Track performance of delinquency status, verifications etc

- Develop reporting in response to ad hoc requests

- Spread financial statements using Moody’s Risk Analyst by entering data from financial statements received

- Promote an environment that supports diversity and reflects the M&T Bank brand

- Complete other related duties as assigned

- Uses SharePoint workload tool to capture work completed

- At the request of the underwriting center, may assist with the preparation of the RECAP (Record Evidencing Credit Approval Package) shell and basic attachments

- Strives to meet or exceed SLAs (Service Level Agreements), or when not possible, communicates to Commercial Credit Support Center Manager

- May assist in the preparation of Credit Quality Review (CQR) packages

- 1 year Microsoft Office applications (Word, Excel, PowerPoint, Outlook)

- H.S. diploma or GED

- Monitors financial covenant tracking system to ensure compliance

- Assist Sales reps and Account Management with customer inquiries requiring explanation of specific credit policies and decisions related to those policies

- Perform periodic reviews of existing merchants in an effort to manage overall risk

- Assist Sales reps and Account Management with customer inquiries requiring explanation of specific

- Adhere to established procedures and guidelines while providing quality customer service in order to meet and exceed department standards

- Thoroughly describe and document your work by notating all of our systems correctly and efficiently

- Thoroughly describe and document work using call ticketing systems

- Provide general information and support on any VISA related topic or product and direct the customer accordingly

- Strong general knowledge of accounts receivable processes, with an expertise in credit card and cash application

- Ability to exercise independent judgment and employ basic reasoning skills

- Basic knowledge of credit environment, lending operations, and credit administration

- Excellent verbal and written communication skills

- Good analytical and problem-solving skills

- Strong organizational stills

- Ability to multi-task in a high volume transactional environment

- Strong negotiation skills

- Excellent customer service/relations skills

- Ability to work in a teamwork oriented, metric-based environment

5 Credit Support Specialist resume templates

Read our complete resume writing guides

How to tailor your resume, how to make a resume, how to mention achievements, work experience in resume, 50+ skills to put on a resume, how and why put hobbies, top 22 fonts for your resume, 50 best resume tips, 200+ action words to use, internship resume, killer resume summary, write a resume objective, what to put on a resume, how long should a resume be, the best resume format, how to list education, cv vs. resume: the difference, include contact information, resume format pdf vs word, how to write a student resume, senior credit support specialist resume examples & samples.

- Provide World Class Client Service to Merchants via inbound phone calls, email or chat

- Respond to incoming customer requests quickly, proficiently and professionally while meeting specific quality expectations

- Answer merchant questions and resolves customer support problems related to billing, account management and troubleshooting

- Review incoming documents and conditions from merchants for accuracy and compliance

- Credit policies and decisions related to those policies

- Escalate tickets to Specialists as needed

- Update the ticketing system with current status of all ongoing issues and Merchant Contacts

- High School Diploma required, Associate or Bachelor's degree a plus

- 1- 3 years experience with credit underwriting. Prior experience in call center, banking, acquiring or internet environments is preferred. Previous experience with Merchant Acquiring or Credit Card processing is a plus

- Customer service experience required

- Demonstrated commitment to quality and customer service

- Excellent verbal and written communications, interpersonal skills, customer orientation, team interaction, problem solving and multi-tasking skills required

- Must have punctual, regular and consistent attendance

- Respond to inbound telephone calls, many of the calls will generate an outbound call regarding information on aspects of multiple Visa products, including, but not limited to, following up on emergency card and cash services

- Evaluate the nature of each call and determine the appropriate action to complete the call

- Answer general customer service questions from cardholders, explain multiple program features, and where appropriate, transfer the customer to the issuing bank to obtain specific account information or transfer the customer to an appropriate Third Party Service Provider

- Update and maintain cardholder data in appropriate databases

- Use several computer programs to respond to customer inquiries

- Document cases to show action taken

- Serve as escalation point for calls requiring advanced knowledge of product line

- Act as peer mentor to customer service associates