DETERMINANTS OF INFLATION IN CASE OF PAKISTAN

- ARIF KHAN Lahore School of Accountancy and Finance, University of Lahore, Pakistan Author

- GUL ZEB CHAUDHARY Department of Economics, Government of College University (GCU), Lahore, Pakistan Author

Inflation is not only rise in price level but it’s also much complex phenomenon. Bit inflation exist in a natural and it’s like greasing element that bring change in commerce and economy. Economy is badly effected due to the high inflation. Major determinants of economy must be explored in order to control inflation. Recent study aims to put some light on determinants of economic growth particularly in Pakistan using the time series data over the period of 1980-2016.Auto regressive Distributed Lag technique is followed for the empirical analysis. Empirical findings show the long and short run effect of each individual variable on inflation. Empirical results reveal that electricity production from oil resource and Agriculture prices has a positive and significant relationship with inflation while Broad money and real effective exchange rate has a significant but negative relationship with inflation. Results in short run reflect that real effective exchange rate and Govt. expenditure has a positive and significant impact on inflation.

Ahmad, Q. M., Muhammad, S., Noman, M., & Lakhan, G. R. (2014). Determinants of recent inflation in

Pakistan: Revisit. Pakistan Journal of Commerce and Social Sciences.

Ahmed, F., Raza, H., Hussain, A., & Lal, I. (2013). Determinant of inflation in Pakistan: An econometrics analysis, using Johansen cointegration approach. European Journal of Business and Management.

Ali, A & Bibi, C. (2020). Public Policies, Socio-Economic Environment and Crimes in Pakistan: A Time Series

Analysis. Bulletin of Business and Economics, 9(1), 1-11.

Ali, A. & Naeem, M.Z. (2017). Trade Liberalization and Fiscal Management of Pakistan: A Brief Overview. Policy

Brief-Department of Economics, PU, Lahore. 2017 (1), 1-6.

Ali, A. (2011). Disaggregated import demand functions of Pakistan; An empirical Analysis. M-Phil Thesis, NCBA&E, Lahore, Pakistan, 1-70.

Ali, A. (2015). The impact of macroeconomic instability on social progress: an empirical analysis of Pakistan. (Doctoral dissertation, National College of Business Administration & Economics Lahore).

Ali, A. (2018). Issue of Income Inequality Under the Perceptive of Macroeconomic Instability: An Empirical Analysis of Pakistan. Pakistan Economic and Social Review, 56(1), 121-155.

Ali, A. and Bibi, C. (2017). Determinants of Social Progress and its Scenarios under the role of Macroeconomic

Instability: Empirics from Pakistan. Pakistan Economic and Social Review 55 (2), 505-540.

Ali, A., & Ahmad, K. (2014). The Impact of Socio-Economic Factors on Life Expectancy in Sultanate of Oman: An

Empirical Analysis. Middle-East Journal of Scientific Research, 22(2), 218-224.

Ali, A., & Audi, M. (2016). The Impact of Income Inequality, Environmental Degradation and Globalization on Life Expectancy in Pakistan: An Empirical Analysis. International Journal of Economics and Empirical Research, 4 (4), 182-193.

Ali, A., & Audi, M. (2018). Macroeconomic Environment and Taxes Revenues in Pakistan: An Application of ARDL Approach. Bulletin of Business and Economics (BBE), 7(1), 30-39.

Ali, A., & Rehman, H. U. (2015). Macroeconomic instability and its impact on the gross domestic product: an empirical analysis of Pakistan. Pakistan Economic and Social Review, 285-316.

Ali, A., & Şenturk, İ. (2019). Justifying the Impact of Economic Deprivation, Maternal Status and Health infrastructure on Under-Five Child Mortality in Pakistan: An Empirical Analysis. Bulletin of Business and Economics,

(3), 140-154.

Ali, A., & Zulfiqar, K. (2018). An Assessment of Association between Natural Resources Agglomeration and

Unemployment in Pakistan. Pakistan Vision, 19(1), 110-126.

Ali, A., Ahmed, F., & Rahman, F. U. (2016). Impact of Government Borrowing on Financial Development (A case study of Pakistan). Bulletin of Business and Economics (BBE), 5(3), 135-143.

Ali, A., Mujahid, N., Rashid, Y., & Shahbaz, M. (2015). Human capital outflow and economic misery: Fresh evidence for Pakistan. Social Indicators Research, 124(3), 747-764.

Arshad, S., & Ali, A. (2016). Trade-off between Inflation, Interest and Unemployment Rate of Pakistan: Revisited.

Bulletin of Business and Economics (BBE), 5(4), 193-209.

Ashraf, I., & Ali, A. (2018). Socio-Economic Well-Being and Women Status in Pakistan: An Empirical Analysis.

Bulletin of Business and Economics (BBE), 7(2), 46-58.

Ayyoub, M., Chaudhry, I. S., & Farooq, F. (2011). Does Inflation Affect Economic Growth? The case of Pakistan.

Pakistan Journal of Social Sciences (PJSS). Barro, R. J. (1995). Inflation and Economic Growth

Bashir, F., Nawaz, S., Yasin, K., Khursheed, U., Khan, J., & Qureshi, M. J. (2011). Determinants of inflation in Pakistan: An econometric analysis using Johansen co-integration approach. Australian Journal of Business and Management Research.

Bashir, F., Yousaf, F., & Aslam, H. Determinants of Inflation in Pakistan: Demand and Supply Side Analysis.

Bruno, M. and W. Easterly (1996). “Inflation and Growth: In Search of Stable Relationship.” Federal Reserve Bank

of St. Louis Review

Caporin, M. and C. Di Maria (2002). Inflation and Growth: some panel data evidence,

Ellahi, N. (2017). The Determinants of Inflation in Pakistan: An Econometric Analysis. Romanian Economic Journal. Faria, J, R. and F, G. Carneiro (2001). Does High Inflation Affect Growth in the LongRun and Short-Run

Fischer, S. (1993). The Role of Macroeconomic Factors in Growth. Journal of Monetary Economics, Ghosh, A. and P. Steven (1998). Inflation May Be Harmful to Your Growth, IMF Staff Papers, Ghosh, A. and S. Philip (1998). Inflation, Disinflation, and Growth

Ghumro, N. H. (2014). Determinants of Inflation in Pakistan Through Autoregressive Distributed Lagged (ARD)

Ghumro, N. H., & Memon, P. A. (2015). Determinants of Inflation: Evidence from Pakistan using Autoregressive

Distributed Lagged Approach. Sukkur IBA Journal of Management and Business.

Gillman, M., M. Harris, and L. Matyas (2002). Inflation and Growth: Some Theory and Evidence. Berlin: 10th

International Conference on Panel Data.

Gokal, V. and S. Hanif (2004). Relationship between Inflation and Economic Growth, Economics Department, Reserve Bank of Fiji, Suva, Fiji,

Haider, A., Ahmed, Q. M., Jawed, Z., & Malik, A. (2014). Determinants of Energy Inflation in Pakistan: An Empirical

Analysis/Comments. Pakistan Development Review.

Hussain, M. (2005). Inflation and Growth: Estimation of Threshold Point for Pakistan. Pakistan Business Review

Hussain, Manzoor (2005). Inflation and Growth: Estimation of Threshold Point for Pakistan, Economic Policy

Department, State Bank of Pakistan

Islam, R., Ghani, A. B. A., Mahyudin, E., & Manickam, N. (2017). Determinants of Factors that A ffecting Inflation in Malaysia. International Journal of Economics and Financial Issues.

Kassem, M. Ali, A. & Audi, M. (2019). Unemployment Rate, Population Density and Crime Rate in Punjab (Pakistan): An Empirical Analysis. Bulletin of Business and Economics (BBE), 8(2), 92-104.

Kemal, M.A. (2006). Is Inflation in Pakistan a Monetary Phenomenon? The Pakistan Development Review Khan, M. S. and Schimmelpfenning, A. (2006). Inflation in Pakistan. The Pakistan Development Review Khan, M.S. and S.A. Senhadji (2001). Threshold Effects in the Relationship between Inflation and Growth.

Khan,A. H. and M.A. Qasim (1996).Inflation in Pakistan Revisited. The Pakistan Development Review,

Malik, W. S., & Khawaja, M. I. (2006). Money, Output, and Inflation: Evidence from Pakistan [with Comments]. The

Pakistan Development Review.

Malla, Sunil. (1997). Inflation and Economic Growth: Evidence from a Growth Equation, Department of Economics, University of Hawaiâ

Mallik, G. and Chowdhury A. (2001). Inflation and Economic Growth: Evidence from South Asian Countries. Motley, Brian (1998). Growth and Inflation: A Cross-Country Study, Federal Reserve Bank of San Francisco

Mubarik, Y. A. (2005). Inflation and Growth: An Estimate of the Threshold Level of Inflation in Pakistan, State Bank of Pakistan, Research Bulletin,

Munir, Q. et al. (2009). Inflation and Economic Growth in Malaysia: A Threshold Regression Approach,

Nair, M. S. (2014). Inflation Dynamics in India: An Analysis.

Nell, K.S. (2000). Is Low Inflation a Precondition for Faster Growth? The Case of South Africa. Papi, L., & Lim, C. H. (1997). An econometric analysis of the determinants of inflation in Turkey.

Sajid, A. & Ali, A. (2018). Inclusive Growth and Macroeconomic Situations in South Asia: An Empirical Analysis.

Bulletin of Business and Economics (BBE), 7(3), 97-109. Sarel, M. (1996). Nonlinear Effects of Inflation on Economic Growth,

Sürekçi Yamaçlı, D., & Saatçi, M. (2016). Economic Determinants of Consumer Inflation in Turkey: ARDL Analysis.

Business and Economics Research Journal.

Sweidan, O. D. (2004). Does Inflation Harm Economic Growth in Jordan? An Econometric Analysis for the Period

-2000. International Journal of Applied Econometrics and Quantitative Studies.

How to Cite

- Endnote/Zotero/Mendeley (RIS)

Similar Articles

- Mehboob Ul Hassan, Muhammad Waqas Khalid, Ashar Sultan Kayani, Evaluating the Dilemma of Inflation, Poverty and Unemployment , Bulletin of Business and Economics (BBE): Vol. 5 No. 2 (2016)

- Shahid Manzoor Shah, Amir Nazir, Linkages between Food Security and Human Well Bing in South Asia: An Empirical Analysis , Bulletin of Business and Economics (BBE): Vol. 7 No. 4 (2018)

- Muhammad Zahid Naeem, Chan Bibi, Macroeconomic Determinants of Economic Growth under the Perspective of Monetary Policy in Pakistan: An Empirical Analysis , Bulletin of Business and Economics (BBE): Vol. 8 No. 3 (2019)

- Sumera Arshad, Amajd Ali, Trade-off between Inflation, Interest and Unemployment Rate of Pakistan: Revisited , Bulletin of Business and Economics (BBE): Vol. 5 No. 4 (2016)

- Nazia Anjum, Zahid Perviz, Effect of Trade Openness on Unemployment in Case of Labour and Capital Abundant Countries , Bulletin of Business and Economics (BBE): Vol. 5 No. 1 (2016)

- Saba Saleem, Khalil Ahmad, Crude Oil Price and Inflation in Pakistan , Bulletin of Business and Economics (BBE): Vol. 4 No. 1 (2015)

- Muhammad Zeeshan Younas, Muhammad Arshad Khan, Macroeconomic Impacts of External Shocks on Economy: Recursive Vector Autoregressive (RVAR) Analysis , Bulletin of Business and Economics (BBE): Vol. 7 No. 4 (2018)

- Aramish Altaf Alvi, Arooj Fatima, Domestic Saving Under the Perspective of Interest Rate, unemployment and inflation in Pakistan: A Time Series Analysis , Bulletin of Business and Economics (BBE): Vol. 6 No. 1 (2017)

- Muhammad Ibrahim Tiwano, Feroz Khan Laghari, Muhammad Fahad, Shahzaib Akram, Laraib Zaman, Impact of Interest Rate on Stock Price, Analysis of Stock Movement of Fauji Fertilizer and Engro Corporation Limited: Evidence From Pakistan Stock Exchange , Bulletin of Business and Economics (BBE): Vol. 13 No. 1 (2024)

- MANSOOR ALAM KHAN, RIAZ AHMAD, DR. MUHAMMAD AKRAM, HAFIZ MUHAMMAD ISHAQ, THE EFFECT OF MACROECONOMIC INDICATORS ON STOCK MARKET: A STUDY ON ASIAN ECONOMIES , Bulletin of Business and Economics (BBE): Vol. 10 No. 1 (2021)

1-10 of 117 Next

You may also start an advanced similarity search for this article.

Most read articles by the same author(s)

- GUL ZEB CHAUDHARY, MUHAMMAD SOHAIL, DETERMINANTS OF DIVIDEND POLICY: CASE OF THE PHARMACEUTICAL SECTOR OF PAKISTAN , Bulletin of Business and Economics (BBE): Vol. 12 No. 1 (2023)

HEC Recognized Journal

HEC Recognized Y Category 2023-24

Make a Submission

Premium Content

Republic Policy

Constitutional Law

Criminal Law

International Law

Civil Service Law

Recruitment

Appointment

Civil Services Reforms

Legislature

Fundamental Rights

Civil & Political Rights

Economic, Social & Cultural Rights

Focused Rights

Political Philosophy

Political Economy

International Relations

National Politics

- Organization

Abdullah Anwar

Inflation is a critical economic phenomenon that affects the lives of individuals, businesses, and governments worldwide. In Pakistan, inflation has been a persistent challenge, with multifaceted causes and significant consequences for the economy and society. This research paper aims to comprehensively analyze the dynamics of inflation in Pakistan, examining its causes, consequences, and policy implications. Using a combination of quantitative data analysis, literature review, and policy evaluation, this paper provides valuable insights into the factors contributing to inflation in Pakistan and offers policy recommendations to address this complex issue.

This graph shows how just over a year there has been hyperinflation in Pakistan and it is still increasing.

Inflation, defined as the sustained increase in the general price level of goods and services over time, is a macroeconomic phenomenon that affects economies worldwide. It has far-reaching implications for various economic agents, including households, businesses, and governments. The dynamics of inflation are complex, driven by a multitude of factors, and its consequences can be both positive and negative, depending on the rate and stability of inflation. In Pakistan, it has been a persistent challenge with significant economic and social consequences. The country’s diverse population, reliance on agriculture, and fiscal and monetary issues make understanding inflation crucial. Pakistan has experienced fluctuating inflation rates, influenced by factors such as monetary policies, fiscal deficits, global oil prices, and geopolitical tensions. Inflation’s impact extends beyond economics, affecting income distribution, poverty, access to services, and political stability.

Inflation, as a fundamental concept in economics, represents the sustained increase in the general price level of goods and services over time.Inflation is characterized by rising prices, which means that consumers need more money to purchase the same basket of goods and services over time.As prices rise, the purchasing power of money declines. This means that the same amount of money can buy fewer goods and services. Inflation can be caused by changes in both demand and supply. Demand-pull inflation occurs when demand for goods and services exceeds their supply, leading to price increases. Cost-push inflation, on the other hand, results from rising production costs that are passed on to consumers in the form of higher prices. Economists use various indices to measure inflation, with the Consumer Price Index (CPI) and the Producer Price Index (PPI) being common tools. These indices track the prices of a representative basket of goods and services over time. Inflation can be categorized into different types based on its magnitude and persistence. Mild inflation, often considered beneficial for economic growth, is called “creeping inflation.” When inflation rates become excessively high and volatile, it can lead to “hyperinflation,” which has devastating effects on an economy. Understanding the concept of inflation is essential for policymakers and economists when formulating monetary and fiscal policies.

Theories of inflation are pivotal in explaining the underlying mechanisms and driving forces that lead to changes in price levels within an economy. Demand-Pull Theory tells inflation results from excessive demand outstripping supply. Factors like increased spending or government expenditures can lead to demand-pull inflation.Central banks use tools like interest rates to manage it. Cost-Push Theory explains how inflation arises from higher production costs, like wages or energy. These cost increases get passed on to consumers. It’s driven by supply-side factors and is challenging to control with monetary policy alone. The monetary theory also known as the quantity theory of money states that increasing the money supply, without a corresponding rise in economic output, leads to inflation. Central banks monitor and manage the money supply to control inflation. Expectations theory is what people expect about future prices that can influence current inflation. If people foresee higher prices, they may demand higher wages and prices today, fueling inflation.Phillips Curve suggests an inverse relationship between inflation and unemployment in the short term. Policymakers face trade-offs between the two. However, this trade-off is considered temporary.It is essential to note that inflation is often the result of a complex interplay of multiple factors, and different theories may apply in different economic contexts. In the case of Pakistan, understanding these theories and their applicability can provide insights into the causes of inflation, which can inform effective policy responses to manage and control inflationary pressures.

Inflation is a significant concern for emerging market economies, including Pakistan. Emerging markets are often more vulnerable to external shocks, such as fluctuations in global commodity prices and changes in investor sentiment. These external factors can exert upward pressure on inflation. Exchange rate fluctuations can influence inflation in emerging markets. Depreciation of the domestic currency can lead to higher import costs, contributing to inflationary pressures. Balancing inflation control with economic growth poses challenges for central banks in emerging markets. Inadequate infrastructure, supply chain inefficiencies, and regulatory obstacles can limit production and contribute to inflation. Effective inflation control often requires a blend of fiscal and monetary policies tailored to evolving economic conditions by policymakers in emerging markets. Emerging markets often engage in regional and international cooperation to address common challenges, including inflation. Trade agreements and coordination with global financial institutions can play a role in managing inflation. In Pakistan’s context, understanding the unique challenges and dynamics of inflation as an emerging market economy is crucial for policymakers and economists when formulating strategies to manage and control inflationary pressures.

In Pakistan, inflation has had a significant historical presence, shaped by various factors: over the years, Pakistan has experienced fluctuating inflation rates, influenced by both domestic and global factors. Government policies, including fiscal decisions and monetary strategies, have played a vital role in shaping inflation trends. Global factors, such as changes in oil prices and geopolitical tensions, have also left their mark on inflation in Pakistan. The country’s economic structure, with a substantial reliance on agriculture and various fiscal and monetary challenges, has contributed to the inflation dynamics. Inflation in Pakistan has broad socioeconomic consequences, affecting income distribution, access to basic services, and especially political stability. Hence, understanding this historical perspective is crucial for comprehending the unique drivers of inflation in Pakistan.

In Pakistan there are multiple drivers of inflation, this section dissects the primary causes of inflation in the country, categorizing them into monetary, fiscal, and supply-side factors. Monetary factors are central contributors to inflation in Pakistan: One of the primary determinants of inflation is the expansion of the money supply within an economy. When the money supply grows significantly without a corresponding increase in the production of goods and services, it often leads to inflation. This phenomenon is typically associated with excess liquidity in the financial system, which can result from factors such as loose monetary policy or an influx of foreign remittances. The State Bank of Pakistan, as the nation’s central bank, plays a pivotal role in managing inflation. It employs a set of monetary policy tools to control the money supply and influence inflation. Key among these tools are interest rates and reserve requirements. Adjustments in interest rates, such as raising them to curb lending and borrowing, are used to influence overall demand in the economy. Reserve requirements dictate the amount of funds banks must keep in reserve, impacting their lending capacity and, in turn, the money supply. Lastly, fluctuations in exchange rates can have a notable impact on inflation in Pakistan, this depreciation can lead to higher import costs which further contribute to overall inflationary pressures.

Fiscal policies and government actions also contribute to inflation: The level of government spending, especially when not adequately matched by revenue generation, can be a significant driver of inflation. When the government injects a substantial amount of money into the economy through its expenditures, it increases the overall demand for goods and services. If this heightened demand is not met with a corresponding increase in supply, prices tend to rise. Large budget deficits, indicating a misalignment between government revenues and expenditures, can lead to increased borrowing. This borrowing can expand the money supply, potentially contributing to inflation. Effective management of budget deficits is therefore a critical aspect of controlling inflationary pressures. Supply-side factors are essential components of inflation dynamics too: Pakistan’s economy is particularly susceptible to fluctuations in food prices, which can have a significant impact on overall inflation. Supply disruptions, whether due to natural disasters, inefficient supply chains, or inadequate infrastructure, can result in periodic surges in food prices. Given the importance of food in household budgets, such fluctuations often have cascading effects on the general price level. Energy prices, specifically the cost of fuels and electricity, represent a significant supply-side factor influencing inflation in Pakistan. These prices can have a cascading effect on various sectors of the economy, ultimately contributing to overall inflationary pressures.

Exchange rate dynamics are a critical element influencing inflation in Pakistan. Fluctuations in the exchange rate, especially the depreciation of the domestic currency, can have significant consequences for the overall price level within the country. A depreciation of the domestic currency relative to other currencies can lead to higher import costs. As Pakistan relies on imports for a variety of goods, including energy and essential commodities, increased import costs can contribute to inflation. These higher costs are often passed on to consumers through elevated prices for imported goods. Exchange rate changes affect the balance of trade, potentially improving exports but also raising inflation through costlier imports. Exchange rate movements may trigger policy responses by the central bank. For example, if the currency depreciates rapidly, the central bank might intervene to stabilize the exchange rate. These interventions can have implications for monetary policy and money supply growth, which, in turn, can impact inflation.

Global factors, including changes in international commodity prices, geopolitical events, and global economic conditions, exert significant influence on inflation dynamics in Pakistan. Pakistan, like many countries, is sensitive to fluctuations in global commodity prices, particularly oil. A surge in oil prices can lead to higher costs for energy and transportation, which, in turn, contribute to inflation. Conversely, declining commodity prices can help curb inflationary pressures. The state of the global economy can influence Pakistan’s inflation. A robust global economy can stimulate demand for Pakistani exports, potentially improving the country’s trade balance and reducing inflation. Conversely, a global economic downturn can reduce demand for exports, negatively impacting Pakistan’s trade balance and possibly increasing inflation. Political tensions and conflicts in the region or globally can disrupt supply chains and lead to uncertainties in commodity markets, hence creating inflationary pressures in Pakistan. Pakistan is highly sensitive to fluctuations in global oil prices, as oil is a crucial import. When oil prices rise, it increases energy costs, affecting transportation and production. These increased costs are often passed on to consumers, contributing to inflation. Global food price changes, driven by factors like climate events and global supply and demand dynamics, can impact Pakistan’s food inflation as certain food items that are imported would sell at higher prices.

Now we will explore the far-reaching consequences of inflation in Pakistan. Inflation, when not effectively managed, can have significant economic, social, and political implications, impacting various sectors of society. First and foremost we will talk about the economic consequences: one of the most direct economic consequences of inflation is a decrease in the purchasing power of individuals and households. As prices rise, consumers can afford fewer goods and services with the same amount of money, leading to a decline in their standard of living. Then high or unpredictable inflation rates can introduce economic uncertainty. Businesses may find it challenging to plan for the future, make investments, or set prices, which can hinder economic growth and stability. Furthermore, inflation often leads to higher nominal interest rates. Borrowers face increased borrowing costs, potentially constraining investment and economic expansion. Savers, on the other hand, may see reduced real returns on their savings. Lastly, Persistent high inflation can distort investment decisions. Investors may prioritize assets that offer protection against inflation, such as real estate and commodities, rather than productive investments in the real economy.

This graph evidently shows us the hike in food prices in Pakistan as the price of milk has nearly doubled its original amount which shows us the consequences of the inflation.

Moreover, we will talk about the social consequences of inflation: at first, inflation can exacerbate income inequality. Those with fixed or low incomes, such as pensioners and low-wage workers, may struggle to keep pace with rising prices, while those with assets that appreciate during inflation, like real estate or stocks, may see their wealth increase. Hence, inflation can push more people into poverty, especially if wages do not rise commensurately with rising living costs. Vulnerable populations are often hit the hardest. Most importantly, high inflation can strain public services like education and healthcare, making it more challenging for governments to provide essential services to their citizens.

Ultimately we will see the political consequences due to inflation: the first thing that is most likely to take place is public dissatisfaction which when inflation erodes purchasing power and living standards, can lead to public dissatisfaction and protests. Governments may face increased pressure to address inflationary concerns. Furthermore, managing inflation can be politically challenging. Tough measures to control inflation, such as raising interest rates or reducing government spending, can be unpopular but may be necessary to curb rising prices. Above all, persistent inflation can contribute to macroeconomic instability, affecting the overall economic environment and investor confidence. Understanding these consequences of inflation is crucial for policymakers in Pakistan to implement effective measures that strike a balance between economic growth and price stability. Managing inflation is not only an economic imperative but also a key factor in ensuring social and political stability in the country.

Carrying forward from the last paragraph it is essential to manage inflation and it can be accomplished by effective policy-making as it can manage inflation, maintain economic stability, and enhance the well-being of the population. The most essential policies are the monetary policies for example the State Bank of Pakistan (SBP) should adopt a vigilant monetary policy stance. Utilizing interest rates as a tool to control money supply growth and inflation is imperative. When inflationary pressures emerge, the SBP should consider raising interest rates to reduce borrowing and curb demand, thus mitigating inflation. Effective management of exchange rates is pivotal. The central bank should aim for exchange rate stability to minimize the impact of currency depreciation on imported inflation. Timely intervention in the foreign exchange market may be necessary to achieve this stability.

Fiscal policies are principal as well such as,the government should prioritize addressing budget deficits by focusing on revenue generation and adopting prudent fiscal management practices. Reducing the need for borrowing to finance deficits can help contain money supply growth and, consequently, inflation. Furthermore, while subsidies can serve as a short-term measure to alleviate the impact of rising prices on consumers, they should be targeted, efficiently managed, and periodically reviewed to minimize their fiscal burden. Gradual subsidy reform can help ensure fiscal sustainability. With fiscal policies supply-side policies are important too, for instance, infrastructure investment including transportation and logistics, should be a priority. Improved infrastructure can enhance supply chain efficiency, reduce production costs, and contribute to overall price stability. Additionally, enhancing productivity and resilience in the agriculture sector is essential. Investments in irrigation, technology, and market access can mitigate the impact of food price fluctuations and reduce supply-side shocks on inflation.

This chart transparently shows us chronic deflation in China due to their monetary and fiscal policies.

Next up global economic policies should be taken into consideration for example, Pakistan should diversify its export markets and reduce reliance on specific commodities. Efforts to expand the range of exportable goods and services can reduce vulnerability to global price fluctuations. Moreover, maintaining an adequate level of foreign exchange reserves is crucial. These reserves serve as a buffer against excessive exchange rate volatility and speculative attacks on the currency. Inclusive policies and public awareness are much vital as well, investing in education and healthcare to improve human capital and reduce inflation’s impact on healthcare and education expenses. Developing robust social safety nets to protect vulnerable populations from inflation’s adverse effects, in addition to this, Prioritizing transparency in policies and communicating openly with the public to manage inflation expectations. Lastly, promoting financial literacy to empower individuals to make informed financial decisions amid inflation.

However, the most substantial policy would be international collaboration as it would be the most effective in overcoming inflationary hurdles. Collaborating with neighboring countries and international organizations can help address common inflationary challenges, particularly related to food price fluctuations. Sharing information and best practices can lead to more effective responses. Supremely, engaging in trade agreements and regional economic initiatives can promote economic stability and reduce inflationary pressures. Expanding trade opportunities and diversifying trading partners can enhance resilience to global economic fluctuations. These detailed policy implications and recommendations are designed to guide policymakers in Pakistan as they work to effectively manage inflation and create an environment of economic stability and improved living standards for the population.

In this final section, we provide a summary of the key findings and insights from our analysis of the dynamics of inflation in Pakistan, its causes, consequences, and policy implications. In this final section, we provide a summary of the key findings and insights from our analysis of the dynamics of inflation in Pakistan, its causes, consequences, and policy implications. Monetary policy, including interest rate management and exchange rate stability, plays a critical role in controlling inflation. Fiscal policies that address budget deficits and subsidy reform are equally vital.Supply-side policies, such as infrastructure investment and agricultural sector improvements, can mitigate inflationary pressures. Diversifying exports and maintaining foreign exchange reserves are important in managing external shocks. Inclusive policies, including social safety nets and investments in education and healthcare, are crucial for protecting vulnerable populations from the adverse effects of inflation. Public awareness, transparency, and financial literacy are essential for managing inflation expectations and empowering individuals to make informed financial decisions. International collaboration, both regionally and through trade agreements, can enhance economic stability and reduce inflationary pressures. To effectively manage inflation in Pakistan and ensure economic stability and improved living standards for its citizens, policymakers must adopt a holistic and coordinated approach. This includes prudent monetary and fiscal policies that respond to inflationary pressures, additionally, Supply-side measures that enhance productivity and reduce production costs. Investments in education, healthcare, and social safety nets to protect vulnerable populations is vital too. Transparent communication with the public to manage inflation expectations and above all, active engagement in international collaboration and trade agreements to reduce external vulnerabilities. Nevertheless, continued research and adaptation of policies are essential to address the evolving dynamics of inflation in Pakistan. Monitoring global economic conditions, commodity price trends, and regional developments will be crucial for effective policy-making. This research paper provides a comprehensive analysis of inflation in Pakistan, shedding light on its causes, consequences, and policy implications. By understanding the complex dynamics of inflation, policymakers, economists, and stakeholders can develop effective strategies to mitigate its adverse effects and promote sustainable economic growth and social development in Pakistan.

Please, subscribe to the website of republicpolicy.com

Can Nawaz Sharif be a Messiah of Good Governance in Pakistan?

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the Blog

Is Inflation Falling in Pakistan Finally?

India’s Stance on Kashmir Going Deeper into AJK

The Significance of Iran-Pakistan Gas Pipeline

The Challenge of Rising Tariffs and the Economy of Pakistan

The Importance of International Day of Multilateralism and Diplomacy for Peace, 24 April

The Significance of Iran & Pakistan Relations

The Importance of Independent Judiciary and IHC Letter

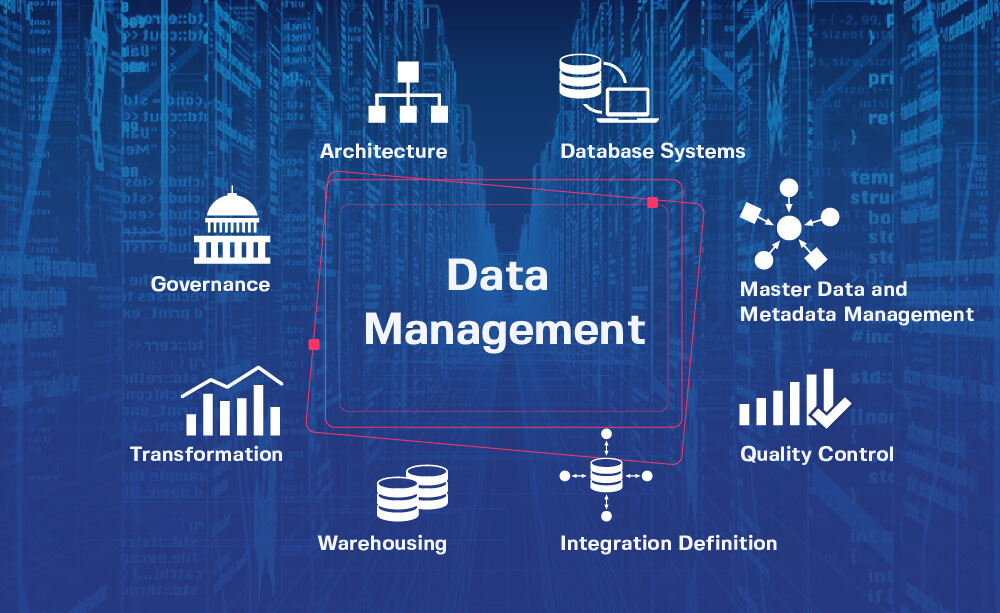

The Significance of Data Protection Framework for Pakistan

Solving Energy Crisis in Pakistan

The UN Partition Plan of Palestine and the State of Palestine

Support our cause.

"Republic Policy Think Tank, a team of dedicated volunteers, is working tirelessly to make Pakistan a thriving republic. We champion reforms, advocate for good governance, and fight for human rights, the rule of law, and a strong federal system. Your contribution, big or small, fuels our fight. Donate today and help us build a brighter future for all."

Qiuck Links

- Op Ed columns

Contact Details

- Editor: +923006650789

- Lahore Office: +923014243788

- E-mail: [email protected]

- Lahore Office: 143-Gull-e-Daman, College Road, Lahore

- Islamabad Office: Zafar qamar and Co. Office No. 7, 1st Floor, Qasim Arcade, Street 124, G-13/4 Mini Market, Adjacent to Masjid Ali Murtaza, Islamabad

- Submission Guidelines

- Terms & Conditions

- Privacy & Policy

Copyright © 2024 Republic Policy

| Developed and managed by Abdcorp.co

Essay on Inflation in Pakistan for Students

by Pakiology | Apr 21, 2024 | Essay | 0 comments

In this essay on inflation in Pakistan, we will look at the causes, effects, and solutions to this issue that has been affecting the country for decades. The term ‘inflation’ refers to a sustained rise in the prices of goods and services in an economy. In Pakistan, inflation has been a major concern since the late 1990s, with the Consumer Price Index (CPI) reaching a peak in 2023. We will explore the various factors that have contributed to inflation in Pakistan, its economic effects, and what can be done to address the issue.

Page Contents

Essay on Inflation Outlines

Causes of inflation in pakistan, effects of inflation, solution to control inflation.

- Introduction

Inflation in Pakistan is caused by several factors, which can be divided into two main categories: domestic and external. The main domestic causes of inflation are an increase in money supply, an increase in government spending, an increase in indirect taxes, and a decrease in economic growth.

The most significant contributor to inflation in Pakistan is an increase in the money supply. When there is too much money chasing after too few goods, prices rise, creating a situation known as demand-pull inflation. An increase in the money supply can be caused by the central bank printing more money or by the government borrowing more money from the public.

In addition, higher government spending can lead to inflation. This occurs when the government prints more money to finance its expenditure or borrows from the public and transfers the cost of this additional spending to businesses and consumers. This leads to higher prices for goods and services. Indirect taxes are another major factor that contributes to inflation in Pakistan. When indirect taxes are increased, prices of goods and services also increase, leading to an overall rise in prices.

Finally, low economic growth can also cause inflation in Pakistan. A weak economy reduces people’s purchasing power, forcing them to buy less, which reduces demand and leads to lower prices. However, when economic growth stalls, businesses are unable to sell their products at the same price as before, leading to a rise in prices.

Overall, inflation in Pakistan is caused by a combination of domestic and external factors. These include an increase in money supply, higher government spending, increases in indirect taxes, and a decrease in economic growth.

The effects of inflation on the economy can be both positive and negative. Inflation erodes the purchasing power of money, meaning that each unit of currency is worth less than it was before. This means that, as the cost of living increases, people can purchase fewer goods and services for the same amount of money. As a result, their standard of living decreases.

Inflation also reduces the real return on investments and savings, which can have a detrimental effect on economic growth. When inflation is high, people prefer to save their money rather than invest in a business or other activities. This reduces the availability of capital and results in slower economic growth.

In addition to decreasing standards of living, inflation can lead to unemployment if companies are not able to increase wages at the same rate as prices rise. This can lead to an increase in poverty, as people struggle to afford necessities. Furthermore, when prices rise faster than wages, it puts pressure on government budgets and can increase public debt.

Inflation can also cause the value of the local currency to depreciate against foreign currencies. This has a direct impact on the cost of imports and makes domestic goods less competitive in international markets. It can also have an indirect impact on exports, as it reduces the competitiveness of local producers in foreign markets.

Inflation is a serious issue in Pakistan, and it needs to be addressed to improve the country’s economic conditions. The following are some of the measures that can be taken to control inflation in Pakistan:

1. Fiscal policy: A strong fiscal policy is necessary for controlling inflation. The government should increase its revenue by implementing taxes on the wealthy and reducing public spending. This will help reduce budget deficits, which will result in lower inflation.

2. Monetary policy: The State Bank of Pakistan should adopt a tighter monetary policy to control inflation. It should raise interest rates so that investors have an incentive to save rather than spend, thus curbing demand-pull inflation.

3. Supply-side measures: There should be an increase in the production of essential commodities and products to meet the demand of consumers. This will help reduce prices and inflation in the long run.

4. Subsidies: The government should provide subsidies to those who are suffering due to the high prices of essential items. This will help them cope with the rising cost of living and ensure that they have access to essential goods and services.

5. Stabilizing exchange rate: A stable exchange rate between foreign currencies and the rupee is necessary for controlling inflation. The State Bank of Pakistan should strive to keep the rupee’s value stable by using currency swaps and other methods.

These measures can go a long way in controlling inflation in Pakistan. By taking these measures, the government can help improve the country’s economic condition and create an environment conducive to investment and growth.

What is inflation in simple words?

Inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.

What are the 4 main causes of inflation?

The 4 main causes of inflation are: Demand-pull inflation: when there is an increase in demand for goods and services that outstrip the economy’s ability to produce them. Cost-push inflation: when the cost of production increases, causing companies to raise prices to maintain their profit margins. Built-in inflation: when businesses expect prices to rise and build that expectation into their prices, causing a self-fulfilling cycle of inflation. Imported inflation: when the cost of imported goods increases, leading to higher prices for consumers.

What are the 5 main causes of inflation?

The 4 main causes of inflation are: 1. Demand-pull inflation 2. Cost-push inflation 3. Built-in inflation 4. Imported inflation 5. Monetary inflation

What is inflation introduction?

Inflation is a phenomenon that has been observed throughout history. It refers to the sustained increase in the general price level of goods and services in an economy over a period of time.

Find more Essays on the following Topics

Ask Your Questions

You might like, democracy in pakistan essay with quotations.

Explore the evolution, challenges, and progress of democracy in Pakistan in this in-depth essay. Gain insights into...

Problems of Karachi Essay | 200 & 500 Words

Explore the multifaceted challenges faced by Karachi in this comprehensive essay. From overpopulation to traffic...

A True Muslim Essay With Quotations 2023

A true Muslim essay is about the qualities of a true Muslim and how they embody the teachings of Islam in their daily...

An Essay on My Mother: A Tribute to Mothers

Mothers are the backbone of a family and a crucial influence in the lives of their children. From an early age,...

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Submit Comment

- class-9-notes

- Friendship quotes

- Scholarships

- Science News

- Study Abroad

- Study in Australia

- SZABMU MDCAT

- UHS Past MCQs

- Universities

- Lok Sabha Elections 2024

- Firstpost Defence Summit

- Entertainment

- Web Stories

- Health Supplement

- First Sports

- Fast and Factual

- Between The Lines

- Firstpost America

1 kg flour for Rs 800, roti for Rs 25: How Pakistan’s inflation is the highest in nearly 50 years

In recent months, inflation in Pakistan has soared to as much as 38 per cent, marking the highest rate in South Asia. Food inflation has surged to 48 per cent, reaching its peak since 2016, according to media reports read more

)

Pakistan’s many troubles continue. The country is facing its worst economic crisis. Amid this, the common man is struggling to make ends meet – the inflation rate is the highest in nearly fifty years.

Affording basic amenities, including meals, is becoming more and more difficult with families. In Karachi, a kilogramme of flour now costs 800 Pakistani rupees (PKR), up from 230 PKR previously. Additionally, a single roti now costs 25 PKR, according to ANI.

Inflation has risen to as much as 38 per cent, the highest rate in South Asia in recent months. Food inflation has reached 48 per cent, the highest level since 2016, according to Dawn.

Devaluing currency exacerbated the cost-of-living crisis

The government’s decision to devalue the currency by over 50 per cent within a year and eliminate subsidies as part of the latest instalment of the International Monetary Fund bailout package has exacerbated the nation’s cost-of-living crisis.

As a result, necessities such as food, shelter, healthcare, and education have become increasingly difficult to afford.

Also Read: How Pakistan’s politico-economic crisis can be an opportunity in disguise for India

Cycle of poverty

At the heart of these challenges lies the question of fair wages. In Pakistan, like in many developing nations, discussions about the significance of fair wages and living incomes are crucial. Fair wages go beyond mere numbers on a paycheck; they symbolise the dignity and worth of human labour.

Consider a scenario where a worker earns a wage that scarcely covers rent, let alone other essential expenses, after enduring long hours of toil. This is the harsh reality for many in Pakistan’s workforce. Without fair wages, workers are ensnared in a cycle of poverty, unable to break free and improve their lives. This not only impacts individuals but also impedes the overall development of the country, according to Dawn.

While some may argue that raising wages could lead to higher business costs and potentially impact profitability, the benefits of fair wages far outweigh the costs. When workers earn enough to meet their basic needs, they become more productive, leading to enhanced efficiency and work quality. Moreover, higher wages translate into greater purchasing power, stimulating demand for goods and services and propelling economic growth.

Paying fair wages is not only a moral imperative but also a legal obligation. The Constitution of Pakistan guarantees the right to fair wages and equal remuneration for equal work.

However, this right remains elusive for many, particularly those working in the informal sector or as daily wage labourers. It is imperative that both the government and businesses ensure that this fundamental right is upheld and enforced across all sectors of the economy.

‘Workers needs to be compensated fairly’

Numerous organisations have undertaken various efforts to implement fair wage policies. These initiatives range from establishing minimum wage standards to providing inflation adjustments and comprehensive benefits packages. Such measures not only benefit workers but also contribute to employee satisfaction, retention, and ultimately, organisational success.

It is crucial to recognise that fair wages foster social cohesion and stability. When workers are compensated fairly, they feel valued and respected, leading to a more harmonious workplace environment. This, in turn, reduces the likelihood of labour disputes and strikes, fostering an environment conducive to business operations and investment, according to Dawn.

Fair wages are also essential for mitigating income inequality, a pressing issue in Pakistan. The chasm between the rich and the poor continues to widen, exacerbating social tensions and impeding social mobility. By ensuring that all workers receive fair compensation for their labour, Pakistan can take significant strides towards narrowing this gap and building a more equitable society.

It is noteworthy that fair wages are not solely the responsibility of the private sector; the government also plays a pivotal role. Through policies and legislation, the government can create an enabling environment for fair wages to flourish. This includes enforcing minimum wage laws, promoting collective bargaining rights, and incentivising businesses to adopt fair wage practices.

Investing in education and skill development is imperative to equip workers with the necessary tools to command fair wages. By improving access to quality education and training programs, Pakistan can empower its workforce and enhance its productivity and earning potential.

The significance of fair wages serves as a clarion call for Pakistan to prioritise this critical issue. Pakistan can forge a more just, prosperous, and sustainable future for all its citizens by ensuring that all workers receive fair compensation for their labour, Dawn reported.

With inputs from ANI

Related Stories

)

WATCH: Pakistan is begging, while India is becoming a superpower, says leader Fazlur Rehman

)

Fuel prices likely to drop in Pakistan due to international market trends

)

Pakistan: Judge abducted by gunmen released from captivity

)

Ishaq Dar becomes Pakistan's Deputy PM, the post which isn't part of the Constitution | Know How

)

- Personal Finance

- Today's Paper

- Partner Content

- Entertainment

- Social Viral

- Pro Kabaddi League

One kg flour for Rs 800, roti for Rs 25: How bad is inflation in Pakistan?

Inflation in pakistan is increasing sharply, making it difficult for people to buy basic necessities for their families' meals.

)

Basic things like food, housing, medical care, and schooling are getting harder for people in Pakistan to pay for.

Listen to This Article

Pakistan tops asia's cost of living chart, struggle for fair wages in pakistan, poverty rate in india between 4.5-5% in 2022-23; rural poverty at 7.2%: sbi, in 9 years, 248 mn moved out of multidimensional poverty: niti aayog, do we need a new line to assess poverty based on ces for 2022-23, wpi-based inflation increases to 0.73% in december on rise in food prices, real wage growth positive for 2nd straight year in 2022: ilo study, troubled by police actions against protesters at us universities: un, harvey weinstein to return to court after ny rape conviction overturned, florida's 6-week abortion ban takes effect, draws doctors' criticism, chinese scientist who published covid-19 virus sequence back in his lab, south korea confirms talks on joining aukus pact with us, uk and australia, a call for action.

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: May 01 2024 | 11:50 AM IST

Explore News

- Suzlon Energy Share Price Adani Enterprises Share Price Adani Power Share Price IRFC Share Price Tata Motors Share Price Tata Steel Share Price Yes Bank Share Price Infosys Share Price SBI Share Price Tata Power Share Price HDFC Bank Share Price

- Latest News Company News Market News India News Politics News Cricket News Personal Finance Technology News World News Industry News Education News Opinion Shows Economy News Lifestyle News Health News

- Today's Paper About Us T&C Privacy Policy Cookie Policy Disclaimer Investor Communication GST registration number List Compliance Contact Us Advertise with Us Sitemap Subscribe Careers BS Apps

- Budget 2024 Lok Sabha Election 2024 IPL 2024 Pro Kabaddi League IPL Points Table 2024

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

Finance ministry projects further easing of inflation rate in Pakistan

The Ministry of Finance has projected a further easing of the inflation rate in Pakistan, with projections indicating it will hover around 18.5-19.5 percent in April 2024. 'The inflation outlook for April 2024 continues a downward trajectory, attributed to the favourable base effect from the previous year and improvements in the domestic supply chain of essential items,' the ministry has stated in its monthly update and outlook report for April 2024. The inflation outlook appears moderate as the government is determined to reduce inflation by actively taking strict administrative measures. Increasing crude oil prices in the international market have prompted the government to raise domestic petrol prices. The rise in petroleum prices is expected to be offset by the government initiative to reduce wheat flour prices and administrative measures.

Inflation is projected to hover around 18.5-19.5 percent in April 2024. However, there are expectations of a gradual easing further to 17.5-18.5 percent in May 2024. For upcoming month, it is expected that imports will get some increasing momentum to stimulate economic activities and exports will continue to observe its improved trend. Moreover, remittances will remain around $2.3-2.5 billion. Considering all these factors, current account will remain in sustainable limit. The fiscal performance during Jul-Feb FY2024 reveals some positive developments alongside various challenges. On the positive side, the revenue collection has increased significantly, particularly, non-tax collection. Similarly, tax collection has not only maintained its pace but also exceeded the target during Jul-Mar FY2024. The revenue performance is an indication of improved economic activity, effective tax administration, and compliance measures. The government is striving hard to maintain this momentum to achieve the target for FY2024 through an effective revenue mobilisation strategy. However, a significant challenge arises from the growing pressure on expenditures, primarily driven by higher mark up payments. This has caused the fiscal deficit to widen during the first eight months of the current fiscal year. However, the primary balance surplus continues to improve indicating that the government can cover its primary expenditures. However, to deal with the challenges, the government is putting all its efforts into enhancing revenue collection, controlling expenditures, and maintaining fiscal discipline. During the first nine months of the current fiscal year, there is a visible sign of moderate recovery in macroeconomic conditions supported by encouraging growth in agriculture, receding inflationary pressures, and stability in external accounts. According to the available quarterly estimates, GDP growth in Q1 and Q2 of FY2024 is estimated at 2.5 percent and 1.0 percent, respectively. The positive momentum in the LSM sector since December 2023 is expected to remain intact for the remaining months of FY2024 mainly due to a significant rise in agriculture produce, higher export demand, improvement in Composite Leading Indicator of Pakistan's main export markets alongwith anticipation of exchange rate stability. The fiscal performance indicates some positive developments on the back of significant growth in revenues; however, growing pressure on expenditures due to higher markup payments presents significant challenges for fiscal management. For a stabilisation path, it is imperative to ensure fiscal consolidation, to lay the foundation for progressing towards higher and sustainable economic growth.

The prioritisation of investment in agricultural infrastructure, diversification, and climate resilience strategies will remain a critical aspect. The other priority areas include enhancing market access, value chain development, and livestock promotion to ensure a sustainable agriculture sector. The LSM cycle usually follows the cyclical movements in the main trading partners, but since it is focused on the main industrial sectors and not on total GDP, it is somewhat more volatile than the cyclical component of GDP in Pakistan's main export markets. The economic situation in the major export markets has been improving since October 2022 and now their cyclical component of GDP is above the neutral 100 benchmark for 3 consecutive month, as evident from the aggregate CLI of those markets. The cyclical component of LSM recorded above the potential level for the months of December and January FY2024, despite the challenging environment for the industrial sector. Nonetheless, the cyclical component of LSM is recorded below potential for February mainly due to the YoY negative growth of high-frequency variables such as cement dispatches, production of automobiles, textile production, etc. in the month of February. However, it is expected that LSM output will show positive YoY growth in the remaining months of the current fiscal year due to better crop production and improved foreign demand. YoY growth of LSM will also benefit in the short term from low base effects in the corresponding months of FY2023.

- Ground Reports

- 50-Word Edit

- National Interest

- Campus Voice

- Security Code

- Off The Cuff

- Democracy Wall

- Around Town

- PastForward

- In Pictures

- Last Laughs

- ThePrint Essential

Islamabad [Pakistan], April 30 (ANI): Pakistan is currently facing its highest inflation rate in nearly fifty years. In recent months, inflation has soared to as much as 38 per cent, marking the highest rate in South Asia. Food inflation has surged to 48 per cent, reaching its peak since 2016, Dawn reported.

The government’s decision to devalue the currency by over 50 per cent within a year and eliminate subsidies as part of the latest instalment of the International Monetary Fund bailout package has exacerbated the nation’s cost-of-living crisis.

In a country where economic challenges often overshadow the daily lives of its citizens, the concept of fair wages has emerged as a ray of hope. Like many developing nations, Pakistan is confronted with the daunting task of addressing poverty, inequality, and social disparities exacerbated by the aforementioned inflation, as reported by Dawn.

At the crux of these challenges lies the question of how much workers are compensated for their labour. Private sector corporations must engage in discussions about the significance of fair wages and living incomes, and why Pakistan must prioritise this vital aspect of economic justice.

A fair wage is not simply a number on a paycheck. It symbolises the dignity and worth of human labour. It ensures that individuals can afford basic necessities such as food, shelter, healthcare, and education for themselves and their families. In Pakistan, where a significant portion of the population struggles to make ends meet, fair wages can make a monumental difference.

Consider a scenario where a worker earns a wage that scarcely covers rent, let alone other essential expenses, after enduring long hours of toil. This is the harsh reality for many in Pakistan’s workforce. Without fair wages, workers are ensnared in a cycle of poverty, unable to break free and improve their lives. This not only impacts individuals but also impedes the overall development of the country, according to Dawn.

While some may argue that raising wages could lead to higher business costs and potentially impact profitability, the benefits of fair wages far outweigh the costs. When workers earn enough to meet their basic needs, they become more productive, leading to enhanced efficiency and work quality. Moreover, higher wages translate into greater purchasing power, stimulating demand for goods and services and propelling economic growth.

Paying fair wages is not only a moral imperative but also a legal obligation. The Constitution of Pakistan guarantees the right to fair wages and equal remuneration for equal work.

However, this right remains elusive for many, particularly those working in the informal sector or as daily wage labourers. It is imperative that both the government and businesses ensure that this fundamental right is upheld and enforced across all sectors of the economy.

Numerous organisations have undertaken various efforts to implement fair wage policies. These initiatives range from establishing minimum wage standards to providing inflation adjustments and comprehensive benefits packages. Such measures not only benefit workers but also contribute to employee satisfaction, retention, and ultimately, organisational success

It is crucial to recognise that fair wages foster social cohesion and stability. When workers are compensated fairly, they feel valued and respected, leading to a more harmonious workplace environment. This, in turn, reduces the likelihood of labour disputes and strikes, fostering an environment conducive to business operations and investment, according to Dawn.

Fair wages are also essential for mitigating income inequality, a pressing issue in Pakistan. The chasm between the rich and the poor continues to widen, exacerbating social tensions and impeding social mobility. By ensuring that all workers receive fair compensation for their labour, Pakistan can take significant strides towards narrowing this gap and building a more equitable society.

It is noteworthy that fair wages are not solely the responsibility of the private sector; the government also plays a pivotal role. Through policies and legislation, the government can create an enabling environment for fair wages to flourish. This includes enforcing minimum wage laws, promoting collective bargaining rights, and incentivising businesses to adopt fair wage practices.

Investing in education and skill development is imperative to equip workers with the necessary tools to command fair wages. By improving access to quality education and training programs, Pakistan can empower its workforce and enhance its productivity and earning potential.

The significance of fair wages serves as a clarion call for Pakistan to prioritise this critical issue. Pakistan can forge a more just, prosperous, and sustainable future for all its citizens by ensuring that all workers receive fair compensation for their labour, Dawn reported. (ANI)

This report is auto-generated from ANI news service. ThePrint holds no responsibility for its content.

Subscribe to our channels on YouTube , Telegram & WhatsApp

Support Our Journalism

India needs fair, non-hyphenated and questioning journalism, packed with on-ground reporting. ThePrint – with exceptional reporters, columnists and editors – is doing just that.

Sustaining this needs support from wonderful readers like you.

Whether you live in India or overseas, you can take a paid subscription by clicking here .

LEAVE A REPLY Cancel

Save my name, email, and website in this browser for the next time I comment.

Most Popular

Why ‘washing machine’ is drowning discourse in ‘koda land’ singhbhum in jharkhand, why ec wants aap to ‘modify’ & resubmit campaign song ‘jail ka jawab vote se denge’, kolkata to california—kalighat krishna, durga, ram go global.

Required fields are marked *

Copyright © 2024 Printline Media Pvt. Ltd. All rights reserved.

- Terms of Use

- Privacy Policy

Pakistan PM Discusses New Loan Programme With IMF Chief

Pakistan's Prime Minister Shehbaz Sharif speaks at the World Economic Forum (WEF) in Riyadh, Saudi Arabia, April 28, 2024. REUTERS/Hamad I Mohammed

By Asif Shahzad

ISLAMABAD (Reuters) -Pakistan Prime Minister Shehbaz Sharif discussed a new loan programme with IMF Managing Director Kristalina Georgieva on Sunday, his office said in a statement.

Sharif and Georgieva met on the sidelines of the World Economic Forum in Riyadh.

Islamabad is seeking a new, larger long-term Extended Fund Facility (EFF) agreement with the fund after a current $3 billion standby arrangement expires this month.

War in Israel and Gaza

"Both sides also discussed Pakistan entering into another IMF program to ensure that the gains made in the past year are consolidated and its economic growth trajectory remains positive," Sharif's office said.

The IMF executive board will meet on Monday to discuss the approval of $1.1 billion of funding for Pakistan, which is the second and last tranche of the standby arrangement.

Islamabad secured the arrangement last summer, helping it to avert a sovereign default.

Pakistan's Finance Minister, Muhammad Aurangzeb, has said Islamabad could secure a staff-level agreement on the new program by early July.

Islamabad says it is seeking a loan over at least three years to help achieve macroeconomic stability and execute long-overdue and painful structural reforms, though Aurangzeb has declined to detail what seize of programme the country seeks.

Islamabad is yet to make a formal request, but the Fund and the government are already in discussions.

If secured, it would be Pakistan's 24th IMF bailout.

The $350 billion economy faces a chronic balance of payments crisis, with nearly $24 billion to repay in debt and interest over the next fiscal year - three-time more than its central bank's foreign currency reserves.

Pakistan's finance ministry expects the economy to grow by 2.6% in the fiscal year ending in June, while average inflation for the year is projected to stand at 24%, down from 29.2% the previous fiscal year.

(Reporting by Asif Shahzad; Editing by Andrew Cawthorne and Hugh Lawson)

Copyright 2024 Thomson Reuters .

Join the Conversation

Tags: Pakistan , Middle East , Saudi Arabia

America 2024

Health News Bulletin

Stay informed on the latest news on health and COVID-19 from the editors at U.S. News & World Report.

Sign in to manage your newsletters »

Sign up to receive the latest updates from U.S News & World Report and our trusted partners and sponsors. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy .

You May Also Like

The 10 worst presidents.

U.S. News Staff Feb. 23, 2024

Cartoons on President Donald Trump

Feb. 1, 2017, at 1:24 p.m.

Photos: Obama Behind the Scenes

April 8, 2022

Photos: Who Supports Joe Biden?

March 11, 2020

Fed: High Inflation Stalls Rate Cut

Tim Smart May 1, 2024

Congress Comes Down on Campus Protests

Aneeta Mathur-Ashton May 1, 2024

University Leaders in Their Own Words

Laura Mannweiler May 1, 2024

April Job Gains Above Forecasts

Nationwide Campus Protests Escalate

Laura Mannweiler April 30, 2024

What to Know: Trump Gag Order Violations

Lauren Camera April 30, 2024

IMAGES

VIDEO

COMMENTS

The main concern of macroeconomic policies is optimum and stable economic growth along with low inflation. Current CPI inflation in Pakistan is recorded at 11.0 percent on a year-on-year basis in ...

This is to certify that the research work presented in the Thesis, entitled "Macroeconometric Analysis and Modelling of Inflation, Unemployment, Investment and Economic Growth in Pakistan" was conducted by Ms. Azra, Reg. no: 1094-313002, under the supervision of Prof.

Pakistan. Introduction. High and sustained economic growth with low. inflation is the central objective of the macroeconomic policy. makers. Therefore, inflation has been one of the most ...

Table 2 reports summary statistics for the variables: average inflation during 1951-2017 has been 7.2 percent, while the average real GDP growth is 4.9 percent. Pakistan has experienced highest inflation of 30 percent in 1974, followed by 26.8 percent in 1975 and 17.0 percent in 2009.

This study examines inflation and the choice of monetary policy regime in Pakistan. Using the annual series of 1970-71 to 2008-09 and the monthly series of 1990:M1- 2007:M9, the study employs unstructured VAR, Time Varying Parameter and State Space models for understanding the dynamics of inflation and monetary policy in Pakistan.

Monetary Policy Channels of Pakistan and Their Impact on Real GDP and Inflation . Karrar Hussain . Kennedy School of Government - Harvard University _____ This paper is an attempt to estimate the relative impact of monetary policy on key economic variables i.e. output and inflation in Pakistan by covering the period from 1964-M1 to 2007-M12.

The study examined the impact of inflation on the monetary policy by using the time series data of 1980-2014. The data source are economic survey of Pakistan and Federal bureau of statistics. Consumer Price Index is the dependent variable (proxy of inflation) while independent variables used in the study are discount rate and broad money supply ...

The survey of literature on inflation in Pakistan shows clearly that the monetarist model has not been adequately tested for Pakistan2 while the structuralist hypo-thesis has been completely ignored. The objective of this study is to undertake a simultaneous study of the monetarist and structuralist hypotheses for Pakistan to

Abstract. The study aims to estimate the degree of infl ation persistence by utilizing the standard econometric tools and different measures of infl ation persistence covering the period from 1957Q1 to 2015Q2. Infl ation persistence is analyzed for both quarter on quarter and year on year infl ation series by exploiting the autoregressive and ...

The aim of the present study is to analyze empirically the significance of the monetarist explanation of inflation in Pakistan. After testing the data for stationarity, the method of least squares is used. Regression analysis shows slight effects of money supply on inflation while, by contrast, structural factors involving wheat, oil and import ...

low inflation rates and unemployment are unimaginable as a result of policy, so it's a choice of policy maker which inflation rate should surrender to acceptable rates of unemployment (Ekpo, 2012).D isproportionate negative link found among "unemployment and inflation" in a under developing country such as Pakistan,

Pakistan Inflation and Growth Rate Line Graph from 1990-2019 . Pakistan has continued with inflation between 9. 97% to 12% during 1990 to 1997 (Fig. 2).

M-Phil Thesis, NCBA&E, Lahore, Pakistan, 1-70. Ali, A. (2015). The impact of macroeconomic instability on social progress: an empirical analysis of Pakistan. (Doctoral dissertation, National College of Business Administration & Economics Lahore). ... N. H. (2014). Determinants of Inflation in Pakistan Through Autoregressive Distributed Lagged ...

In Pakistan, inflation has had a significant historical presence, shaped by various factors: over the years, Pakistan has experienced fluctuating inflation rates, influenced by both domestic and global factors. Government policies, including fiscal decisions and monetary strategies, have played a vital role in shaping inflation trends.

A THESIS SUBMITTED THROUGH THE DEPARTMENT OF AGRICULTURAL ECONOMICS AND RURAL SOCIOLOGY FACULTY OF AGRICULTURAL ... Results indicated that less than half of the inflation 1 1 experienced by Pakistan over the period 1939-60 to 1979-80 could il be attributed to internationa1 factors and thus the scope for ii

The study attempted to investigate the determinants of inflation in case of Pakistan and to check the validity of monetarist stance that inflation is always and everywhere a monetary phenomenon by investigating the impact of oil prices, M2 and GDP on prices. ... E-Thesis Portal. Pakistan Institute of Development Economics, Islamabad. Visit Us ...

Structural Issues: Pakistan faces various structural issues that can contribute to inflation, such as inadequate infrastructure, inefficient agricultural practices, and regulatory barriers. These factors can affect the supply side of the economy and lead to price increases. Inflation Expectations: If people and businesses expect prices to rise ...

Thesis on Inflation and Economic Growth in Pakistan - Free download as PDF File (.pdf), Text File (.txt) or read online for free. Scribd is the world's largest social reading and publishing site.

In this essay on inflation in Pakistan, we will look at the causes, effects, and solutions to this issue that has been affecting the country for decades. The term 'inflation' refers to a sustained rise in the prices of goods and services in an economy. In Pakistan, inflation has been a major concern since the late 1990s, with the Consumer ...

Pakistan's 9-month SBA, approved by the Executive Board on July 12, 2023, successfully provided a policy anchor to address domestic and external imbalances as well as a framework for financial support from multilateral and bilateral partners. ... Inflation, while still elevated, continues to decline, and, with appropriately tight, data-driven ...

SOAS

Graphical Analysis of Inflation from 2008 to 2012 Using CPI. The inflation rate in Pakistan was last reported at 10.8 percent in March of 2012. From 2003 until 2010, the average inflation rate in Pakistan was 10.15 percent reaching an historical high of 25.33 percent in August of 2008 and a record low of 1.41 percent in July of 2003.

In recent months, inflation in Pakistan has soared to as much as 38 per cent, marking the highest rate in South Asia. Food inflation has surged to 48 per cent, reaching its peak since 2016, according to media reports read more People visit a market to buy groceries and other stuff, in Rawalpindi ...

Consequently, the process of globalization has important implications for inflation and its dynamics in Pakistan. Discover the world's research 25+ million members

The report forecasted a meagre growth rate of 1.9 per cent for the current fiscal year, placing Pakistan fourth lowest in the region. Looking ahead, the outlook for the next fiscal year remains grim, with projections of a 15 per cent inflation rate, once again the highest among 46 countries surveyed, and a growth rate of 2.8 per cent, the fifth lowest for FY 2024-25.

Pakistan's central bank is seen delaying the start of its easing cycle and keeping interest rates at a record as concerns linger over inflation accelerating again despite a drop in consumer ...

The Ministry of Finance has projected a further easing of the inflation rate in Pakistan, with projections indicating it will hover around 18.5-19.5 percent in April 2024. 'The inflation outlook ...

Islamabad [Pakistan], April 30 (ANI): Pakistan is currently facing its highest inflation rate in nearly fifty years. In recent months, inflation has soared to as much as 38 per cent, marking the highest rate in South Asia. Food inflation has surged to 48 per cent, reaching its peak since 2016, Dawn reported. The government's decision […]

Pakistan's economy suffered losses of $30 billion because of floods and then it approached international entities in Geneva and other places and had to borrow loans at expensive rates due to the ...

Pakistan's finance ministry expects the economy to grow by 2.6% in the fiscal year ending in June, while average inflation for the year is projected to stand at 24%, down from 29.2% the previous ...