Guide to writing a mortgage letter of explanation (with template)

Your lender asked for a letter of explanation. what now.

When you apply for a home loan, your lender will do a deep dive into your financial history. Depending on what it finds in your bank statements or credit report, additional documentation may be necessary.

You may be asked for a “letter of explanation” during the application process. Fear not. Letters of explanation are fairly standard and nothing to worry about.

However, you want to make sure you write this letter correctly, as it could be crucial to your mortgage approval.

Here’s everything you need to know so you can hit a home run with your letter of explanation.

In this article (Skip to...)

- What is a letter of explanation?

- How to write one

- Sample letter

- Final advice

What is a mortgage letter of explanation?

Commonly referred to as an ‘LOE’ or ‘LOX,’ letters of explanation are often requested by lenders to gain more specific information on a mortgage borrower and their situation.

An LOX can necessary when there is inconsistent, incomplete, or unclear information on a loan application.

Letters of explanation may be required if any red flags turn up during the underwriting process, such as:

- Declining income

- Gaps in your employment history

- Differing names on your credit report

- Large deposits or withdrawals in your bank account

- Recent credit inquiries

- An address discrepancy on your credit report

- Derogatory items in your credit history

- Late payments on credit cards or other debts

- Overdraft fees on an account

There are many other situations where an LOX may be requested, too.

If you need to write one, be sure to ask your loan officer what exactly the underwriter wants to see, and whether you need to provide any supporting documentation along with the letter.

How to write a letter of explanation for your mortgage lender

When it comes to mortgage letters of explanation, less is typically more.

Too much unnecessary information may lead to confusion, or at minimum, additional questions about your file — questions that may have been avoided if it weren’t for some of the details in your letter.

The most important elements of your letter of explanation should include the following:

- Facts — Be honest. Never be tempted to write a letter based on solely on what you may think your lender wants to hear. You shouldn’t fabricate any aspect of your letter. Include correct dates, dollar amounts, and any other pertinent details for your situation

- Resolution — Your lender wants to know how and when the situation that led up to certain events was resolved. For instance, if you were temporarily furloughed during COVID, but you’ve since returned to full employment, you should be able to document your recent paystubs and have your employer verify that you’ll continue working full time for the foreseeable future

- Acknowledgement — This one is important and shouldn’t be left out of your letter. Mortgage underwriters want to know why it is that something happened, and how or why it won’t happen again in the future

Remember that a letter of explanation is a professional document that will go into your loan file.

Be mindful of things like spelling, grammar, and punctuation. Create a letter that’s visually appealing, properly formatted, and communicates the relevant information.

Providing additional documentation with your letter can be helpful. For example, if hospitalization was the culprit behind some missed payments on your credit report, it may be helpful to include hospital bills.

Sample letter of explanation and template

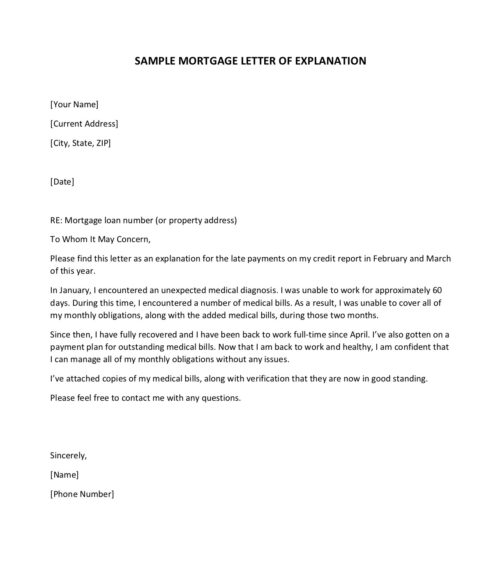

Remember to be honest, formal, and concise when writing a letter of explanation for your mortgage lender.

The exact content will vary based on your situation, but here’s a general letter template you can use as a guide. (Click the image to open a PDF version.)

Remember to include your mailing address, phone number, and the number of your mortgage loan application (or the property address for which you’re applying).

Final advice on writing a letter of explanation

You’ll be asked to submit a pile of documentation during the mortgage loan process, including bank statements, tax returns, pay stubs, and more.

Depending on your financial situation, your lender may also request a letter of explanation. Many first-time home buyers think being asked to provide a letter of explanation means their mortgage application may be doomed.

Remember, this type of request is usually a good thing. The underwriter may be looking for this last item before signing off on your final approval.

When your lender requests a mortgage letter of explanation, remember this first: don’t panic.

Next, double-check with your lender on exactly what is being requested.

Then write a clear, concise letter that’s free of emotional language, negativity, or excessive detail. There’s a good chance that the next time you hear from your lender, it will be to let you know you’re fully approved.

SemiOffice.Com

Your Office Partner

Letter to Bank for Home Loan

Sample application letter to request home loan from the bank for construction, purchase of land, or maintenance of home etc.

Letter to Bank Manager Asking for Home Loan

The Manager Standard Chartered Bank London

Recently I heard that your bank is giving home loan to those who cannot afford to buy home on their own. I am a teacher in local college, and with my salary I can only meet up necessary needs. I bought some land a few years back in London, but could not build house on it due to lack of funds. I want to apply for home loan of at least $20,0000/-. I have very secured job, and I am sure that I would return the loan as per your conditions. Besides, I can fulfill all the terms, and conditions described in bank documents. Kindly grant me this loan so I could build my dream home. I will always appreciate you, and your organization for this service. I look forward to your reply, and approval of my loan application.

Best Regards,

Robert Milton From London U.K

Respected Bank,

With utmost respect, I want to request a loan from your bank of $50,000. This loan is specifically for the purchase of a family home. For the loan security I would like to offer my car to your bank. I shall be highly obliged if I am able to achieve the loan as I fulfill all the requirements of a mortgagor.

Yours Respectfully,

Ellie Robinson

Application for Home Loan to Bank Manager

To Mr. Kevin Gash Branch Manager Standard Chartered California, USA

Sir, I recently heard about the home loan policy that your bank has initiated. I am quite happy to be a client of a bank that makes the life of people easy by such offers. As you might be aware of the fact that I have been serving in the US Military, and I was posted at a different country for a specific purpose. However, I have just returned to my hometown after being retired from the force, and hope to settle down here. For that purpose, I would like to request you to grant me a loan for a specific amount of money so that I can pursue my dream of having a house in the city that I love. I agree to pay all the installments before the given date with interest. I shall be very thankful to you.

George Best

California, USA

/11/Letter_to_Bank_for_Home_Loan-232x300.png?resize=232%2C300&ssl=1)

To, Mr. Steve Jobs, Branch Manager, Standard Chartered Bank,

Respected sir,

I hope this letter finds you in the best of your health. I am planning to buy a home but would not be able to pay the whole money at once. I am doing a full time job in a reputed company as permanent employee, and all of my payment affairs have been done through your bank. I am requesting you to please grant me loan so that I can easily buy the home.

My family, and I would be very grateful to you for helping us in this. Your bank has always been proven the best for us, and hopes it will continue its tradition.

Harry Potter, Account # 12345678990

Letter to bank for monetary loan

The General Manager, Bank of Mumbai May 11,

I wish to apply for monetary loan from the bank to accomplish some important tasks. As you have best knowledge among all of us, I have been working as junior accountant for the bank of Glasgow since 0000. I have always tried my best to complete all assigned works from senior management, and perform duties diligently, and honestly. As soon as I would be able to return this loan, I would do it in first priority.

You are requested to please give approval for the monetary loan of Rs: 0000 from the bank.

I shall be highly thankful to you.

XYZ, Junior accountant

Share this:

Author: david beckham.

I am a content creator and entrepreneur. I am a university graduate with a business degree, and I started writing content for students first and later for working professionals. Now we are adding a lot more content for businesses. We provide free content for our visitors, and your support is a smile for us. View all posts by David Beckham

Please Ask Questions? Cancel reply

Bank Loan Request Letter Sample: Free & Effective

In this article, I’ll share my insights and provide a step-by-step guide, including a practical template, to help you write an effective bank loan request letter.

Key Takeaways

- Understanding Loan Request Letters: Gain insight into the purpose and structure of effective bank loan request letters.

- Step-by-Step Guide: Follow a simple, structured approach to craft your loan request letter.

- Template Included: Use the provided template to create a personalized loan request letter.

- Real-Life Examples: Learn from actual experiences and examples to better understand what banks look for.

Understanding the Purpose of a Loan Request Letter

A bank loan request letter is your opportunity to present a compelling case to the lender. It’s not just about stating your need for funds but about showcasing your financial responsibility, business acumen, and planning skills.

Key Points:

- First Impression: The letter is often the first interaction with the lender.

- Information Conveyance: It conveys crucial information about your financial need and repayment plan.

- Persuasion Tool: A well-written letter can significantly influence the lender’s decision.

Crafting Your Letter: A Step-by-Step Guide

1. gather necessary information.

- Understand the loan requirements.

- Prepare financial statements and business plans.

2. Start with a Professional Format

- Use a formal business letter format.

- Include your contact information and the date.

3. Introduce Yourself and Your Business

- Briefly describe who you are and what your business does.

- Highlight your experience and achievements.

4. State the Purpose of the Loan

- Clearly define why you need the loan.

- Explain how the loan will benefit your business.

5. Detail Your Financial Information

- Include relevant financial statements.

- Showcase your ability to repay the loan.

6. Conclude with a Call to Action

- Politely request the bank to consider your loan application.

- Indicate your availability for further discussions.

7. Proofread and Edit

- Ensure there are no errors or omissions.

- Maintain a professional tone throughout.

Real-Life Example: Success Story

In my experience, one of my clients successfully secured a significant loan by clearly outlining their business growth plan, demonstrating past successes, and providing a detailed repayment strategy. The key was clarity, precision, and a touch of personal storytelling.

Loan Request Letter Template

[Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date]

[Lender’s Name] [Bank’s Name] [Bank’s Address] [City, State, Zip Code]

Dear [Lender’s Name],

I am writing to request a loan of [Amount] for [Purpose of the Loan]. As the owner of [Your Business Name], I have outlined a detailed plan for how these funds will be used and the projected growth they will facilitate.

[Insert a brief description of your business, its history, and any notable achievements.]

The loan will be utilized for [specific use of the loan funds]. This investment is crucial for [reason for the loan], and I have attached a detailed business plan and financial projections to illustrate the potential return on investment.

[Include information about your financial situation, any collateral you are offering, and your plan for repayment.]

I am committed to the success of [Your Business Name] and have a robust plan in place to ensure the timely repayment of the loan. I am available to discuss this application in further detail at your convenience.

Thank you for considering my request. I look forward to the opportunity to discuss this further.

[Your Signature (if sending a hard copy)] [Your Printed Name]

Writing a bank loan request letter is a critical step in securing funding. It’s about presenting a clear, concise, and compelling narrative that aligns your needs with the lender’s requirements. Remember, it’s not just about the numbers; it’s about the story behind them.

I’d love to hear your thoughts and experiences with loan request letters. Have you tried writing one? What challenges did you face? Share your stories in the comments below!

Frequently Asked Questions (FAQs)

Q: What is the Most Important Aspect of a Bank Loan Request Letter?

Answer: The most crucial aspect of a bank loan request letter is clarity in communicating the purpose of the loan.

In my experience, a well-defined objective, backed by a solid business plan and clear financial projections, significantly increases the chances of approval. It’s essential to concisely convey why you need the loan, how you plan to use it, and how you intend to repay it.

Q: How Detailed Should Financial Information Be in the Letter?

Answer: Financial details should be comprehensive yet succinct. From my experience, including key financial statements like income statements, balance sheets, and cash flow projections is vital.

However, the trick is to balance detail with brevity. You want to provide enough information to assure the lender of your financial stability without overwhelming them with data.

Q: Is Personal Information Relevant in a Business Loan Request Letter?

Answer: Yes, to some extent. In my dealings, I’ve noticed that including a brief background about yourself, your experience, and your role in the business helps build a connection with the lender.

It adds a personal touch and can boost your credibility, especially if your personal journey reflects your business acumen and commitment.

Q: How Formal Should the Tone of the Letter Be?

Answer: The tone should be formally professional. In all my letters, I maintain a balance between professionalism and approachability. You want to come across as respectful and serious about your request, yet accessible and personable.

Avoid overly technical jargon or casual language; aim for clear, straightforward communication.

Q: Can Including a Repayment Plan Improve Chances of Loan Approval?

Answer: Absolutely. In my experience, outlining a clear and realistic repayment plan in your letter can significantly improve your chances of approval.

It demonstrates responsibility and foresight, showing the lender that you’ve thought through the financial implications of the loan and have a plan to manage your debts effectively.

Q: Should I Mention Collateral in the Loan Request Letter?

Answer: Yes, mentioning collateral can be beneficial. In my practice, I’ve found that specifying collateral not only increases the credibility of your loan request but also provides the lender with added security, making them more inclined to approve your loan. However, be clear and precise about what you are offering as collateral.

Q: How Long Should a Bank Loan Request Letter Be?

Answer: Ideally, keep it to one page. Throughout my career, I’ve learned that brevity is key. Lenders are busy, and a concise, well-organized letter is more likely to be read and appreciated.

Stick to the essentials and avoid unnecessary details. If more information is needed, the lender will ask for it.

Related Articles

Business request letter sample: free & effective, sample letter to a company requesting something: free & customizable, business plan cover letter sample: free & customizable, payment proposal letter sample: free & effective, congratulations job offer email sample: free & effective, sample request letter for confirmation after probation: free & effective, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

- Search Search Please fill out this field.

How to Write a Loan Letter to Your Bank

How a Letter to the Bank Might Get Your Loan Approved

Why Write a Letter to Your Bank?

- Letter for a Mortgage Application

Parts of a Loan Letter to a Bank

Sample outline for a loan letter.

Maskot / Getty Images

Sometimes getting a loan is as easy as filling out an application. But as dollar amounts increase or the situation gets more complicated, lenders may want reassurance. They could even ask you to explain why your loan is a good idea.

If your bank wants more than the basic information that goes on an application, a letter to the bank could be in order. Some banks specifically request letters, while others might appreciate any extra steps you take to try and win the loan.

Learn how a loan letter can improve your application and what you should include in one.

When you write a loan letter to accompany your application, you have the chance to explain exactly why the lender should approve your request. It gives you an opportunity to:

- Add commentary on topics that do not appear in a standard application

- Explain your financial situation thoroughly

- Lay out your plan for using and repaying the loan

- Address any weak spots in your application or finances

Loan letters can be particularly beneficial for small businesses, which often need capital to grow but may not meet the strict requirements laid out by bank loan applications.

Like a cover letter for a job application, a loan letter is your chance to make your case on your terms.

Loan Letter for a Mortgage Application

If you are applying for a mortgage and your application has some weak spots or unexplained elements, writing a loan letter can increase your chances of approval or of receiving a lower interest rate.

You may need to write a letter to accompany your mortgage application if you have:

- Multiple names on your credit report

- Negative entries in your credit report

- Gaps in employment

- Atypical sources of incomes, such as a small business or freelance work

- A recent change in jobs

- Unusual activity in your bank account

- Former delinquencies or bankruptcies

A loan letter gives you a chance to explain these things and address any concerns they may create for the bank.

When writing a letter to accompany your loan application, you need to both keep things brief and provide sufficient detail to make a convincing argument.

Even while keeping things concise, however, there is still specific information you will want to include.

Who and What

Tell the bank a little bit about yourself. If you're applying for a business loan , be sure to include information about the whole team, including the number of employees and how long you've been in business.

Highlight any strengths, designations, or credentials you've earned, as well as successes in your past. Don't go overboard: just pick just a few of the most impressive and relevant things that come to mind.

Lay out the specific amount that you are requesting for your loan. But sure to include the timeframe, such as $100,000 to be repaid over five years.

Explain exactly how you will use the funds. Your lender needs to know that the money will be put to good use.

For example, if you have been turning away business because you didn't previously have capacity, let your lender know about this unmet demand and your ability to satisfy it.

Demonstrate that you have done some market research and know how the loan will impact your business or personal finances .

Your lender needs to know how you’ll fund the repayment. Will you repay a personal loan from your salary or a business loan from increased revenues?

Be specific about how and why your earnings will increase as a result of the loan.

Your lender will notice if you have bad credit or insufficient income to repay the loan. When you address those issues directly, you signal that you're a serious borrower who understands what's at stake.

Be polite and formal in your language, addressing your letter to the loan officer or specialist that you are working with and ending with "Sincerely" or "Regards." Be sure to include your full legal name, address, and contact information.

Like a cover letter for a resumé, aim to keep your loan letter no longer than one page.

Sample for a Small Business Loan Letter

- Overview : “ACME Enterprises specializes in… and has been in business since 2007...”

- Reason : “I’m writing to request a loan for $100,000…”

- Professional information : “ACME Enterprises was founded by Jane Doe, who has over 10 years of industry experience. The marketing team is led by John Jones, who previously helped grow XYZ Corporation…”

- How funds will be used : “Our goal is to increase the number of daily service visits by purchasing an additional vehicle and related equipment. The total cost of these investments is…”

- Benefit : “Currently we are unable to respond to 30% of requests for service, which results in customers calling our competitors or switching products. We will be able to profitably respond to all of those calls with the additional equipment…”

- Basic financial information : “ACME Enterprises currently operates at a profit. Revenue from the previous year was $X, and net income was $Y…”

- Concerns : Anything else that shows you’ve done your homework and deserve the loan.

- Closing : “Please see the enclosed business plan, and feel free to contact me with any questions you have at…”

You will also need to submit a business plan with your loan application. Think of your introductory letter as an abbreviated version of the business plan.

Sample for a Mortgage Loan Letter

- Personal information : “My spouse and I have recently submitted a mortgage application at XYZ Bank, our full names and contact information are...”

- Basic financial information : “You will see in our application that our joint income for the last ten years has ranged from $X to $Y..."

- Concerns : “I’m writing to explain my irregular income and why this will not impact my ability to repay the mortgage I have applied for…”

- Explanation : "Since 2011, I have been self-employed. My business is ABC Enterprises, which provides freelance ABC services for clients such as... My business has made an annual income of no less than $XX for the last ten years, out of which my personal salary has increased from $X to $Y. In the enclosed business plan, you will see that due to These Market Factors I expect demand to continue increasing as I expand my services..."

- Closing : “Thank you for your time and attention, and feel free to contact me with any questions you have at…”

The lending decision ultimately depends on the financials, such as your credit scores , income, collateral , and ability to repay the amount you borrow. But a loan letter can improve your chances by explaining your situation and the impact the loan will have on those factors.

Letter Solution

Welcome to "Letter Solution" Everything is about letter and application writing.

Bank Loan Application Letter Sample 8+ With Format

One format and 8 sample on bank loan letter.

Table of Contents

Bank Loan Application Letter Sample: Naturally, we take a loan from a bank when we fall into a money crisis. We talk to the branch manager about it. After that, he discussed everything and instructs us on all terms and conditions. Some bank managers tell to submit a request letter with the required documents. And then many people can not write a proper request letter. So I have written the post with a format and six samples that will clear your confusion and create a good idea about any type of bank loan application letter sample. Then you can write a new application in your own way. A well-written request letter for the loan can help you to be approved your application at the time of applying for a loan.

There are different types of loans in the bank. For example

- Business loan

- Personal loan

- Educational loan

- Two-wheeler loan

- Loan against property

When you will apply for a personal loan, eligibility is a must for you.

Personal loan eligibilit:

- You should be salaried person.

- You should have a job under government, public company.

- Your age should be between 25-50 years.

- You need to be an Indian citizen.

- The minimum salary should be 25000 but it depends on the city.

Application Format

Bank loan application letter.

The Bank Manager

[Name of the bank]

[Name of the branch]

[Address of the branch]

Date: …../ …../ ……

Sub: [Application for home loan]

Respected Sir/Madam,

I am ___________ [Your name]. I am a [savings/current] account holder with your branch for _____ years. I am a ______ service man. My monthly salary is deposited in my bank account. I always maintain a good balance in my account. But I need a loan for _____________ [Purpose of the loan].

I am requesting you for an amount Rs. __________ as a loan. I have enclosed all the required documents as you instructed earlier. I have read, got and agree with the term and condition of the bank.

I am waiting for positive response from you.

Thanking you

Yours sincerely

[Name of the applicant]

Contact details

Bank Loan Application Letter Sample

Bank of India

[Branch Name]

[Branch Address]

Date: 00/00/00

Sub: [Request for business loan]

Dear Sir/Madam,

With due respect, I beg to state that I have a current account with your branch. I am a businessman and run three restaurants. I need an amount of Rs. 100000/- as a loan for my business purpose.

I will be thankful to you if you will consider my request as early as possible.

Write A Letter To Bank Manager For Educational Loan

Gabgachi Branch

Delhi-700 071

Date: 12/11/2021

Sub: Application for educational loan

I, Ashutosh Kumar Saha, a permanent resident of Sukanta More, Gabgachi, would like to apply for an education loan for further studies. I have just appeared for my higher secondary board exams and would like to complete a course in B.TEC from a reputed institution in Delhi.

I can come to the branch at your convenience to discuss it required to get a loan in my favor. I will always be grateful to you if you look into the matter and approve my loan.

Ashutosh Kumar Saha

Application For Home Loan

Name of the bank

Name of the branch

Address of the branch

I am prakash saha. I am a savings account holder with your branch for ten years. I am a government serviceman. My monthly salary is deposited in my bank account. I always maintain a good balance in my account. But I need a loan for building my house.

I am requesting you for an amount of Rs. 200000/- [Two Lakh] as a loan. I have enclosed all the required documents as you instructed earlier. I have read, got and agree with the term and conditions of the bank.

I am waiting for a positive response from you.

Application For Personal Loan

It is stated that I would like to request you for a personal loan of Rs. 200000/-. I have a savings account for 15 years with your branch and save a good balance in the first week of the month. I have been working in an I.T company for 20 years and my salary is 25,000/-. I will pay the loan by deduction money by a savings account. I have read the term and conditions and got it. I have enclosed the necessary document as the instruction.

I am waiting for your positive response of hearing.

Yours faithfully

Sample of Bank Loan Application Letter

Sub: [Application for __________________ ]

With a lot of respect, I beg to state that I am an old account holder in your branch. My account number is XXXXXXXXX. Now I am a serviceman. I am doing my job in Malda Sonoscan Nursing Home. My salary is 12000/-. I need a loan amounting to Rs. 80000/- for buying a car. The deduction should be from my salary account.

Therefore I request you to grant me the loan and then I will be obliged to you.

Business Proposal For Bank Loan Sample

Sub: [Application of proposal of the business loan]

I am writing this letter to request a small business loan in the amount of Rs. 80,000/-for the purpose of business development. My current account number is XXXXXXXXX in your branch. I am an account holder for ten years and maintain a good balance in this account.

My company name is [XYZ]. It is a growing business that serves furniture to customers. You can follow our success online at [website name]. 25 workers work here daily.

I have attached all the required documents along with this application as you instructed earlier. So I earnestly request you for a small loan.

I am looking forward to hearing at your convenience.

FAQ’s On Requesting Loan

How do I write a letter requesting a loan?

Answer: It is not a hard matter. Just follow the structure and fill up the place with your right information.

Sub: [Application for_______ ]

Write first paragraph following the format.

Second paragraph

Third paragraph

That is enough for a letter of requesting loan.

What is the difference between application and letter?

Answer: There is a difference between application and letter. A letter is written for communication or giving information to anyone. On the other hand, an application is written to request for something.

How do you end an application letter?

Answer: You end an application letter with “Yours faithfully or your sincerely”. Besides it nowadays to write contact details at the end is very important.

Should I write thank you in advance?

Answer: Yes. You should write “Thank you” in advance for close connotation. It will express your politeness.

- Closing your bank account

- A new pass book

- New check-book

- Transfer bank account

- Opening a joint account

- Bank statement

- Hire a locker

- Change specimen signature

- Renewal of fixed deposit account

- Complaining non-receipt of pass-book

- Stop payment of a lost check

- Reopen account

- Change registered mobile number

I hope you have got the right information and chosen bank loan application letter sample . If you like the post, you can do a little help by sharing it with your friends, relatives and do comment in the below comment box.

- Stop Payment Cheque Letter With Format And Sample

- Closing Bank Account Letter With 20+ Sample

You May Also Like

Application For Opening Account In Bank With 10 Samples

Application For New Passbook With 6+ Sample

Application For Change Mobile Number In Bank With Sample

How to write a letter of explanation for a mortgage

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal finance

- • Mortgages

- • Homeownership/Home Improvement

- • Homebuying

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most — the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more — so you can feel confident when you make decisions as a homebuyer and a homeowner.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- A letter of explanation for a mortgage is a document that provides further details about an applicant’s creditworthiness or financial circumstances.

- The letter of explanation addresses red flags that might derail your approval: why you were unemployed for a period of time or why there’s an unpaid balance on your credit report.

- Not every borrower needs to write a letter of explanation. If you do, your lender will request one.

When you apply for a mortgage, you’ll need to hand over plenty of documentation: your bank statements, tax returns, pay stubs, details on your debts, to name just a few. Depending on your financial situation, your lender could also ask for a letter of explanation.

It’s an important document, one that could make all the difference in your getting money to buy that new home — or not. Here’s how to write a letter of explanation for a mortgage.

What is a letter of explanation?

A mortgage lender might ask you to write a letter of explanation to better understand your finances when deciding whether to approve you for a loan . While your lender’s underwriting department reviews factors such as your credit score and income, those figures might not paint a complete picture of you as a borrower — especially if you haven’t much of a credit history. A letter of explanation helps fill in that picture, offering lenders a deeper understanding of your ability to repay a mortgage.

If a lender asks you to submit a letter of explanation, think of it as a requirement – not an optional request. The lender needs further clarification on some matters, and your response could be the pivotal point in your being granted or refused financing .

Why do you need a letter of explanation for a mortgage?

If your lender asks you to submit a letter of explanation, the request probably reflects a particular piece of info or irregularity in your mortgage application that raised a red flag. A letter of explanation is simply a way to help resolve that red flag, which might include:

- A job change: If you change jobs, particularly in the time frame leading up to closing, you might need to explain why you made the switch.

- Issues on your credit report: Perhaps you were delinquent on past debt payments. Your letter of explanation accounts for your tardiness or other issues.

- A new credit card opening or a high credit card balance: Applying for and opening a new credit card or having a high credit card balance might hurt your credit (which in turn affects what sort of loan interest rate you’ll be offered or if you get a loan offer at all). Your letter of explanation gives valid reasons for these situations, especially if they dinged your credit score.

- A large transaction in your bank account: The lender might want more details on the withdrawal or deposit of a big lump sum that isn’t a regular occurrence.

- An unsteady source of income: If you’re self-employed or an independent contractor, the lender might want a clearer sense of the stability of your earnings.

If any of these potential red flags apply to you, it might be wise to proactively submit a letter of explanation. Put yourself in the shoes of someone reviewing your application : Is there anything that might give them pause?

Let’s say you took eight months off work last year to help care for an elderly parent — an unpaid leave. To the lender reviewing your bank statements, you appear to be unemployed during that time. With a letter of explanation, you can help your lender understand that the decision to temporarily stop working was voluntary. This might alleviate the lender’s concerns about another period of unemployment in the near future.

How to write a letter of explanation

There’s no need to panic if a lender requests a letter of explanation. It’s a common part if being granted conditional approval for the loan. Still, it’s important to do the job right. To begin with, include all the key details of a traditional business letter — whether you’re mailing or emailing it:

- The lender’s name and address

- Your name (as it appears on your application) and any client/reference/file number

- The date you’re submitting the letter and the expected closing date (if you know it)

- A summary statement or short intro that quickly helps an underwriter identify the topic under discussion

- Your current mailing address, email address and phone number

5 tips for a good letter of explanation

Keep the following tips in mind:

- Write honestly: It’s crucial to be transparent. All of the information you provide should be factual and correct. It’s also important that all dates or dollar figures included in your letter are accurate.

- Write briefly: Share the facts, but stick to the facts: There’s no need to write a whole narrative. Keep the letter concise, focusing only on the details that need to be covered. Too much information or unnecessary detail could result in confusion or may spark more questions in the lender’s mind.

- Write professionally: Approach your letter with a heightened degree of formality. Make your past English teachers proud with pristine spelling, capitalization and business-like, careful composition.

- Provide a clear explanation: Your letter should acknowledge and indicate why something happened. If, for instance, you fell behind on loan payments in the past or were out of work for a significant period of time, explain the extenuating circumstances.

- Include resolution details: It’s also a good idea to indicate outcomes, describing how you resolved the challenge or issue: regaining employment or catching up on past due payments, or your plan for doing so.

Sample letter of explanation

While the exact content of your letter depends on your circumstances, you can use this sample letter of explanation to a mortgage lender as a template:

Date Lender name

Lender address

Lender city, state and ZIP code RE: Your Name and Application Number I am writing to explain the absence of any payroll deposits in my [bank name] checking account for the months of January and February of this year. During those two months, complications arising from my son’s birth required me to take an unpaid medical absence from my employer, under the Family and Medical Leave Act (FMLA). I have since returned to work, in my previous position and with full pay. I am attaching another letter from my employer, [its name], which verifies my active status, the date I resumed work, and my salary. I am available to answer any additional questions and look forward to our expected closing date of May 30. Regards, Your Name Your mailing address

Your city, state and ZIP code

Your phone number

If you’ve applied with a co-signer , you’ll need to include the co-signer’s name on the letter, as well.

It’s important to note that you can make a letter of explanation more compelling with supporting data and paperwork. In the example above, the borrower includes a letter from their employer that supports the claim that they have returned to work after an authorized leave of absence.

Whatever your reason for writing a letter of explanation, consider if there is other documentation that can back up your claim, and if you have them, submit them.

What to do if your letter of explanation is rejected

Be prepared: The lender that requests your letter of explanation might ultimately reject it. In this scenario, don’t give up. Review your old explanation for anything you might have accidentally left out. Compose a new letter, with more details and documentation.

If your second try fails, give thought to starting the mortgage application process all over again with a different lender. Just be aware that other lenders might also request a letter of explanation.

If you’re still encountering difficulties in getting loan approval, you might consider postponing your home search and working harder on improving your credit (if that was the main issue). By following best practices — including paying your bills on time, not opening new credit accounts and avoiding high credit card balances — you can raise your credit score and your chances of getting approved for a loan in the future.

Letter of explanation FAQ

What is a late payment letter of explanation, do i need to include documents with my letter of explanation.

Additional reporting by Mia Taylor

Related Articles

How to get preapproved for a mortgage

What is a gift letter for a mortgage?

Documents needed for mortgage preapproval

What is a mortgage proof of funds letter?

Request Letter to Bank Manager for Loan (6+ Samples)

Do you have any bank account that has been active for a long time and your financial position is also not correct at your present time? If yes, and you need a lot of money for some reason, the reason could be anything like education, business, health, wedding expenses, debt consolidation, etc. So there is one solution that the majority of people adopt to apply for a loan.

Are you also applying for a loan? If yes, and you are looking for the format to write a letter to the bank manager for a loan then you should take a sigh of relief because in this post I will provide samples of letters for requesting a bank loan from the bank manager.

Below you can read the given samples and you can use the one you like for your letter. Just pay attention that whatever important details are in the sample letter, you should replace them according to your information so that there is no inaccuracy in your letter.

To submit your letter, you need to visit your respective bank branch with all the documents required for verification and approval of your loan. Without a single visit to your bank branch, there is no chance that you will get a loan approved according to your money amount. So, you have to visit your bank branch.

1. Personal Loan Request Letter to Bank Manager

2. letter to bank manager for loan, 3. application for bank loan for business, 4. loan application letter to bank manager, 5. application for applying loan in bank, 6. requesting letter to bank manager for personal loan, 7. application letter for loan from bank.

From, ABC Near ______, Sector 11, New Delhi.

To, The Branch Manager, Union Bank of India, E Block XYZ Road, New Delhi.

Date:- Date/Month/Year

Subject:- Request to bank manager for a personal loan.

Respected Sir/Madam, My self Prabhas Sahu and I live in “your address”. I have been a savings account holder in your branch for the last 6 years and my account number is ************. I want a personal loan of _____ amount from your bank because I borrowed money from a person and now I want to repay it as soon as possible because he is asking me for money.

I have done some huge amounts of transactions in my bank account over the years. Therefore, I hope you will consider my request and try your best to approve my loan at the earliest.

Thank you in Advance, Yours Obediently Signature Contact No:- XXXXXXXXXX

From, ABC Near ______, Sector 12, Jaipur.

To, The Branch Manager, UCO Bank, F Block XYZ Road, Jaipur.

Subject:- Letter for the loan request to a bank manager.

Dear Sir/Madam, I am a government employee in the Department of Directorate of Information and Public Relations, Jaipur and I am also a current account holder in your branch. I need a loan of an amount ______. You can see in my account how much the average balance is maintained in my account and my salary is also _____ which is credited to this account. My account number is ************.

Therefore, I request you to please understand my problem and try to approve my loan request as soon as possible.

Thanking You, Yours Faithfully Signature Contact No:- XXXXXXXXXX

From, ABC Near ______, Sector 13, Mumbai.

To, The Branch Manager, State Bank of India, G Block XYZ Road, Mumbai.

Subject:- Request letter to bank manager for a loan.

Respected Sir/Madam, I am maintaining a current account in your branch which account holder’s name is _______ and the account number is ************. I am doing a good amount of transactions every month in my account and I also maintain an average balance above Rs. _____. The reason for telling you all this is that I need a business loan of amount _______ from your bank.

Therefore I request you to please accept my concern and try your best to approve my loan. If you do this for me I will be forever grateful to you.

Thanking You, Yours Truly Signature Contact No:- XXXXXXXXXX

From, ABC Near ______, Sector 14, Kolkata.

To, The Branch Manager, Punjab National Bank, H Block XYZ Road, Kolkata.

Subject:- Loan application letter to bank manager for a loan.

Dear Sir/Madam, With all due respect, I want to inform you that my name is “mention your name” and I need a personal loan of amount _____ from your bank. I need this loan because my son’s health is not good and my current financial condition is also not good. You can see that my account has a good number of transactions taking care of it every month. My account number is ************.

So, I urge you to please understand my situation and try to approve my loan request as soon as possible. My blessings are always with you.

Thank you in Advance, Your Trusty Signature Contact No:- XXXXXXXXXX

From, ABC Near ______, Sector 15, Bengaluru.

To, The Branch Manager, Punjab and Sind Bank, J Block XYZ Road, Bengaluru.

Subject:- Application letter for a bank loan to the bank manager.

Respected Sir/Madam, Due to the Coronavirus and also due to the lockdown, my business savings have been completely exhausted. Now I need money to bounce back business. So, I need a business loan from your bank of Rs. ______. My account number is ************. If you need a guarantor then one of my brothers is ready to be my guarantor he is a government employee in the central government.

I hope you will approve my loan request as soon as possible.

Thanking You, Yours Sincerely Signature Contact No:- XXXXXXXXXX

From, ABC Near ______, Sector 16, Chennai.

To, The Branch Manager, Indian Overseas Bank, K Block XYZ Road, Chennai.

Subject:- Requesting to bank manager for a personal loan.

Hello Sir/Madam, I am a Village Development Officer of the district _______ and I belong to “address”. Currently, I live at “your current address”. My bank account has been open in your branch for the last 5 years and I am also doing a good amount of transactions in this account. My account number is ***********. My purpose for writing this letter is that I want a small personal loan of the amount _____. I also provide all the documents that you need to release a personal loan for me.

Therefore, I hope you will approve my request as soon as possible.

Thanking You, Regards Signature Contact No:- XXXXXXXXXX

From, ABC Near ______, Sector 17, Hyderabad.

To, The Branch Manager, Bank of India, L Block XYZ Road, Hyderabad.

Subject:- Application letter for a loan of amount ______.

Respected Sir/Madam, My name is “mention your name” and I am a worker having a monthly salary _____. I need a Rs _____ loan from your bank. My savings bank account number is ************. I have enclosed all the documents that you need for my loan approval.

Therefore, kindly approve my loan because I need urgent money.

Frequently Asked Questions (FAQs)

How do i write a letter to my bank manager for a loan.

First, write the sender’s name and address and after that write the date and subject. By giving respect write the body of the letter describing all the details. Lastly, close the letter by saying thank you.

How do I write a bank loan request?

During the loan request process, you have to write a letter to your bank manager to get a loan and also describe the reason behind getting the loan.

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to print (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to email a link to a friend (Opens in new window)

Related Post

Leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Sample letter to request a home loan from Bank

[Here briefly describe on Sample letter to request a home loan from Bank. You can follow these sample application letter to request a home loan from the bank for construction, purchase of land or maintenance of home etc. You can make any change to the below application as per your needs.

Date…

Bank/Branch manager…

Bank name…

Branch Address…

Sub: Letter to Asking for Home Loan

Recently I heard that your bank is giving a home loan to those who cannot afford to buy a home on their own. I am a teacher in a local school/college and with my salary, I can only meet up necessary needs. (Describe in your own words). I bought some land a few years back in (Area and city name), but could not build a house on it due to lack of funds. (Explain the actual cause and situation). I want to apply for a home loan of at least (Money Amount). I have very secured job and I am sure that I would return the loan as per your conditions. Besides, I can fulfil all the terms and conditions described in bank documents.

Kindly grant me this loan so I could build my dream home. I will always appreciate you and your organization for this service. (Cordially describe your requirements). I look forward to your reply and the approval of my loan application.

Best Regards,

Your Name…

Address…

Address and Contact information…

Another format,

Sub: Letter to Bank for Home Loan

Respected Bank,

Sir, I recently heard about the home loan policy that your bank has initiated. I am quite happy to be a client of a bank that makes the life of people easy by such offers. (Describe in your own words). With utmost respect, I want to request a loan from your bank of (Money Amount). This loan is specifically for the purchase of a family home. For that purpose, I would like to request you to grant me a loan for a specific amount of money so that I can pursue my dream of having a house in the city that I love. (Explain the actual cause and situation).

I agree to pay all the instalments before the given date with interest. I shall be highly obliged if I am able to achieve the loan as I fulfil all the requirements of a mortgagor. (Cordially describe your requirements). I shall be very thankful to you.

George Best,

How to Write a Promotion Letter?

Warning letter to subcontractor for work delay, financial assistance request for organizing cultural show, write a letter to describing the accident, merchandising activities in garments, a leaf in time library activity, prospective strategies for differentiation, annual report 2013 of m.i. cement factory limited, most heavy elements in the universe might come from neutron star collisions, sample resignation letter for career change, latest post, flyback transformer (fbt), global catastrophic risk, astronomers identify the brightest and fastest-growing quasar, the gibraltar arc is moving westward from the mediterranean into the atlantic, a new geological study reveals that scandinavia originated in greenland, mid-ocean ridge (mor).

Search This Blog

Search letters formats here, sample letter to bank requesting reduction of interest in loan.

submit your comments here

Post a comment.

Leave your comments and queries here. We will try to get back to you.

- Homes for sale

- Foreclosures homes

- New construction for sale

- All new construction

- New home construction

- Housing market

- Recently sold homes

- Property records

- Home buying checklist

- Home buyers reveal: 'What I wish I had known before buying my first home'

- First-time home buyer resource center

- More home buying insights

- Success stories

- Seller's marketplace

- See what your home is worth

- Learn how to sell your home

- How to select an agent

- Compare agents & pick the right one

- Selling your home? Don't neglect these 6 maintenance tasks - or else

- More home selling insights

- Apartments for rent

- Manage rentals

- List your rentals

- Screen tenants

- Create a lease

- Collect rent online

- Renters resource center

- Should I rent or buy?

- Debunked! 8 myths about renting you should stop believing immediately

- Rental report

- More renting insights

- Get pre-approved

- Mortgage rates

- Home equity financing rates

- Refinance rates

- Finance advice

- For veterans

Mortgage calculator

Refinance calculator.

- How much house can I afford

- Rent vs. buy

- 6 ways home buyers mess up getting a mortgage

- Mortgage guide

- Learn about home insurance

- More finance insights

- Search for real estate agent

- 6 reasons you should never buy or sell a home without an agent

- Difference between agent, broker & Realtor ®

- Listing vs. buyer agent

- How to find a REALTOR ®

- Real estate agents reveal the toughest home buyers they've ever met

- More news around REALTORS ®

- The latest news

- Housing trends

- Real estate news

- Celebrity real estate

- Unique homes

- Corporate blog

- Home improvement

- 2024 housing market predictions

- 2023 hottest zip codes

- Complete guide on how to sell your home

- Veterans home buyer guide

- USDA home loan guide

- Home insurance guide

- Real estate videos

- Housing resources

Mortgage Rates

Mortgage tools, affordability calculator, rent or buy calculator, veteran home loan center, mortgage tips.

5 Most Common Questions About Mortgages—Answered

Learning the Lingo: Mortgages Explained, From ARMs to Points

Expert Home-Buying Advice for Our Nation's Veterans

How to Buy a Home With Bad Credit (Yes, You Can)

Mortgage Rates by State

- Connecticut

- District of Columbia

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Mortgage Rates by Loan Type

- 30 year fixed

- 20 year fixed

- 15 year fixed

8 Best Low-Interest Personal Loans of April 2024

Take out a personal loan that doesn’t empty your wallet, best low-interest personal loans of 2024, best overall.

On Credible’s Website

Why We Chose It

Upstart doesn’t just offer low-interest personal loans to people with excellent credit: It also offers the best low interest personal loans for bad credit , only requiring a minimum credit score of 300 to apply for a loan. Upstart loans look at factors beyond your financial history, like your employment and education, to get a more thorough picture of your borrowing capabilities. Read our Upstart personal loans review .

- 15-day grace period before late fees are charged

- Fast funding

- Takes into account education and employment in loan decisions

- $10 paper copy fee

- Returned payment fee

- Must have good credit to score lowest APRs

Additional Information

Funding Speed: Next business day

Early Payoff Penalty: None

Late Fee: The greater of 5% of the monthly past due amount or $15

Origination Fee: 0% to 12%

Best for High-Value Loans

Wells fargo.

With the ability to borrow up to $100,000 from Wells Fargo, you’ll be set for nearly any purchase. Wells Fargo personal loan rates are competitive, and you’ll also enjoy a same-day credit decision and fast funding without origination or closing fees. Read our Wells Fargo review .

- 0.25% APR relationship discount

- No closing fee or origination fee

- Same-day credit decision

- Must have excellent credit to obtain lowest APRs

- Possible late fee

- Cashier’s check only available if you don’t have Wells Fargo checking or savings account

Funding Speed: One to three business days

Late Fee: $39

Origination Fee: None

Best for No Late Fees

Happy money.

Happy Money offers transparent loans from credit unions and community-focused lending partners in an effort to put customers first. You won’t pay any application or late fees, and the maximum APR is significantlylower than many other lenders. Read our Happy Money personal loans review .

- No application fee

- No late fees

- Can check rate without a hard credit pull

- Origination fee

- Loans not available in MA and NV

- Takes a while to get funds

Funding Speed: Three to seven business days

Late Fee: None

Origination Fee: 1.5% to 5.5%

Best for Low Maximum APR

Penfed credit union.

While PenFed Credit Union doesn’t offer the lowest personal loan rates, it does offer one of the lowest maximum APRs, which can be comforting if you don’t have a great credit score and know you’ll likely only qualify for loans at the top of that range. You can use your loan for nearly any purpose, all without any hidden fees. Read our PenFed Credit Union review .

- No hidden fees

- Can use loan for numerous purposes

- Can apply with co-borrower to lower rates

- Late and returned payment fees

- $50,000 loan limit applies across all PenFed loan products

- Takes five to seven business days to receive check

Funding Speed: One to two business days

Late Fee: $29

Best for Debt Consolidation

Reach financial.

Reach Financial has one of the lowest starting personal loan rates available, but there’s a catch: you can only use your loan to consolidate debt or refinance credit card debt. The lender takes care of the heavy work for you by automatically paying your creditors directly.

- Free monthly credit score updates

- Pays creditors directly

- Can only use loan to consolidate debt or refinance credit card debt

- No co-borrowing or cosigners

- Website doesn’t offer many details

Funding Speed: 24 hours

Late Fee: $15

Origination Fee: 0% to 8%

Best for Long Repayment

Lightstream.

LightStream loans have a lot going for them, including extremely long repayment terms, high loan amounts and low starting APRs. There’s even a Rate Beat program that will beat any other lender’s APRs by 0.10% if you meet certain requirements. Read our LightStream personal loans review .

- 0.50% APR autopay discount

- Long repayment terms

- Rate Beat program provides 0.10% lower APR than other lenders

- Requires good to excellent credit

- Can’t change payment due dates

- Can’t use loan for education

Funding Speed: Same day

Best Big Bank Loan

Discover personal loans deliver with fast funding and flexible term lengths. It can even pay off your creditors directly so you don’t have to deal with the hassle of cashing a check and forwarding payment to another company. Read our Discover personal loans review .

- Can pay off creditors directly

- Free FICO Score access

- Must have at least $25,000 of annual income

- Co-borrowing not permitted

- Requires income verification

Best Multi-Purpose Loan

TD Bank barely has any limits on what you can use your loan for, giving you freedom with no application fees and fast funding. There are also no prepayment fees, so you can pay off your loan early without any repercussions. Read our TD Bank review .

- Can use loan for wide range of purposes

- Only available in 15 states and Washington, D.C.

- No Sunday customer service

- Can’t use loans for business or education expenses

Funding Speed: One business day

Late Fee: The lesser of 5% of payment due or $10

What Is a Low-Interest Personal Loan?

A low interest personal loan is an installment loan that offers lower-than-average interest rates. Like other personal loans, you’ll borrow a lump sum of cash and then repay it over a set period. When you take out your loan, you’ll sign an agreement with a fixed interest rate, meaning your payments will be predictable every month.

Personal loans with low interest rates can save you a lot of money, as you’ll be paying less in interest. But to get the lowest personal loan rates, you’ll typically need to have a high credit score . You can still get a low-interest personal loan with bad credit, but you’ll likely need to find a lender that looks at other factors beyond your credit score, which can include education and employment history.

What Is Considered a Good Interest Rate On a Personal Loan?

According to the Federal Reserve , as of November 2023, the average 24-month personal loan rate in the United States was 12.35% APR, so any loan with an interest below that amount can qualify as a low-interest loan. Loans under 10% are typically a good rate, and anything under 8% is great. These types of rates are generally reserved for customers with excellent credit, so do whatever you can to raise your credit score before you apply for a loan to increase your chances of a lower rate.

How Do You Compare Low-Interest Personal Loans?

We recommend comparing APRs from three to five lenders to make sure you’re getting the best deal. Most lenders provide an APR range for their low-interest personal loans. But this range is often broad and unhelpful, especially if your credit score isn’t perfect. Some lenders might tease an extremely low APR at the bottom of the range but then have a max APR that exceeds 30%.

Knowing where you fall in that range can be tricky, so if possible, try to check your loan rate directly with the lender. Most only require a soft credit check at this step, so checking your rate typically doesn’t hurt your credit score. You’ll likely need to provide your name and other personal identifying information so the bank can verify who you are.

Once you’ve received a more personalized loan APR, play around with terms and loan amounts. Sometimes, increasing the repayment term or lowering the amount you borrow can change the APR. Collect all of the APRs, terms and loan amounts for each lender into a spreadsheet so you can easily sort by which lender is offering the best loan for your needs.

How to Choose the Best Low-Interest Personal Loan

When looking for the best low interest rate personal loans, you have to consider more than just low APR. Here are some additional factors to think about to find a personal loan that meets all of your needs.

Banks and lenders might charge you many fees to take out a loan. One common one is an origination fee, which is usually a percentage of the total loan amount that you pay when you get your loan. Some lenders also charge a late fee if you fall behind on your payments. Luckily, none of the lenders we’ve selected here charge a prepayment fee, but others might. This is a charge you might have if you pay off your loan early.

Autopay Discounts

Banks like autopay because it means there’s less of a chance you forget to make a payment. Because of that, some offer you a discount on your APR when you set up autopay. Though this is typically a small amount, like 0.25% or 0.50%, it can end up saving you a lot in the big picture. Consider a $5,000, five-year loan with a 9.50% interest rate. You’d save over $73 in interest over the life of the loan with a 0.50% APR discount.

Repayment Terms

You need to make sure you choose a loan that gives you enough time to make repayments. If a lender only offers short terms, you might find the monthly payment isn’t affordable for you. Longer terms lower your monthly payment and can make it easier to afford. Just keep in mind, the longer your term, the more you’ll pay in interest over the life of the loan.

Customer Service

Hopefully, nothing will ever go wrong with your loan or payments. But if it does, you want a lender that has easily accessible and friendly customer service. Check the company’s customer service hours, as well as the ways you can reach them if you have questions. At a minimum, a lender should have a phone number where you can reach a live person, but live chat and email support tickets are also helpful.

Lender Reputation

Lender reputation is important to consider before nailing down the best personal loan for you. Look into online reviews to make sure the lender isn’t shady or unreliable. For example, see if any customers have had problems with extra fees, making payments or speaking with customer service. You might also check websites like the Better Business Bureau to see if there are any outstanding complaints against a bank.

Low-Interest Personal Loan Alternatives

Not everyone qualifies for personal loans with low interest rates—and even if you do, you may not want to be locked into a fixed monthly payment for years. Luckily, there are other options to consider that provide slightly more flexibility. Here are some alternatives to low interest personal loans that might be a better fit for your situation.

Low-Interest Personal Loan vs. 0% Interest Credit Card

A 0% interest credit card gives you a specified intro period where you don’t pay interest on purchases or balance transfers. It can be a great choice if you’re struggling with existing credit card debt. You might also choose it over a low interest personal loan if you just need a few hundred or thousand dollars of capital, don’t meet minimum loan requirements and know you’ll be able to pay off your debt before the intro period is over.

Low-Interest Personal Loan vs. Buy Now, Pay Later

With buy now, pay later , you have the ability to pay for purchases over time with set installment payments. Typically, you’ll pay around 25% of the purchase upfront and make three additional payments to pay off the balance. Buy now, pay later makes the most sense for someone who needs to break a large purchase down into smaller payments to make it more affordable.

Low-Interest Personal Loan vs. Home Equity Loan

If you’re a homeowner, you may be able to cash out some of the equity you’ve built up in your property by taking out a home equity loan . Also called a second mortgage, it allows you to use your house as collateral. Because you’ll be putting your home at risk, this type of loan is best for purposes that will save or earn you money, like paying off high-interest debt or completing a home improvement project.

Low-Interest Personal Loan vs. Family Loan

If you’re lucky enough to have friends or family in a comfortable financial position, you might ask them to loan you some money instead of taking out a loan from a bank. It’s important to treat this like a real loan, so come up with set terms and a repayment schedule that you have notarized. Even if your family member wants to charge you interest, it’ll still likely be cheaper than what a bank charges you.

Frequently Asked Questions

What is the least expensive way to borrow money.

The least expensive way to borrow money is to get a no-interest loan from family or friends. You might also consider opening up a 0% APR credit card, which often gives you several months to make purchases without paying interest. Just keep in mind that after this intro period is over, interest will start to accrue on any remaining balance.

Which Bank Is Offering the Lowest Personal Loan Interest Rate?

Currently, Reach Financial is offering the lowest personal loan interest rate, with APRs starting at 5.99%. But these APRs are reserved for customers with excellent credit profiles. Other banks with low starting APRs include Wells Fargo and LightStream. They both offer APRs starting at 7.49%.

Is There a 0% Personal Loan?

Interest-free personal loans do exist, but they come with strict guidelines and requirements. For example, most 0% loans only offer an intro period with no interest; after that, they charge a high APR. You may also have to pay hefty origination fees to get these types of loans. Some examples of 0% personal loans include retail loans, car loans and buy now, pay later programs.

The post 8 Best Low-Interest Personal Loans of April 2024 first appeared on Newsweek Vault .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Get Student Loan Forgiveness in 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Student loan forgiveness has a mixed track record. Last summer, the Supreme Court struck down a broad plan that would’ve erased up to $20,000 per borrower. Still, student loan forgiveness is more accessible now than ever before. A handful of existing federal student loan forgiveness programs have erased $143.6 billion in student debt for 3.96 million borrowers as of March 21, according to the Education Department, with more to come this year.

The White House is currently trying to push through a narrower forgiveness ‘Plan B’ version of its failed broad forgiveness plan. The proven paths to forgiveness, however, include programs that range from income-driven repayment (IDR) plans — which cap monthly bills at a percentage of your income and forgive your remaining balance after 10 to 25 years — to niche programs for borrowers with certain loan types, jobs or school circumstances.

Here’s how to get student loan forgiveness in 2024 — and what you need to know before pursuing this path.

Check your eligibility

You must have federal student loans to qualify for a forgiveness program. Private student loans aren’t eligible.

To verify you have federal loans, go to StudentAid.gov , and try to log in or recover your account.

Next, check which types of federal student loans you have. If you have certain types of loans, like commercially held FFELP or Perkins loans, you may have to consolidate them before going after forgiveness .

Income-driven repayment

The newest IDR plan — Saving on a Valuable Education, or SAVE — is the most accessible path to forgiveness. All borrowers with federal direct loans are eligible to enroll.

The SAVE plan forgives remaining student debt in as little as 10 years if you have an original balance of $12,000 or less, and in up to 20 or 25 years for other borrowers. While working toward forgiveness, your monthly bills could be $0 per month if you earn less than $32,800 as an individual or $67,500 as a family of four; otherwise, they’ll be capped at 5%-10% of your income.

Public Service Loan Forgiveness

If you work for a qualifying government or nonprofit employer, you could be eligible for Public Service Loan Forgiveness (PSLF) . This program erases your remaining balance after a decade of repayment.

“Generally, the PSLF program is the best one if you have access to it,” says Scott Stark, a financial coach and certified financial planner at Financial Finesse, a workplace financial wellness company.

Other forgiveness programs

Outside of IDR and PSLF, your student loan forgiveness options may include:

Teacher Loan Forgiveness , if you work in a qualifying low-income school.

Borrower defense to repayment , if you think your school defrauded you.

Closed school discharge , if your school closed during or shortly after your time there.

Perkins loan cancellation , if you have Perkins loans and work in public service.

State-based student loan payment assistance , if you work in health care or are willing to relocate to a new area.

Do the math