Published In: Applications

How to Write a Loan Application Letter (with Samples)

Sometimes we need financial assistance to push through with our business idea, education, medical emergencies, or any other personal project or goals that require a huge amount of money for its realization. Basically, it is for this reason that banks and other money lending institutions exist.

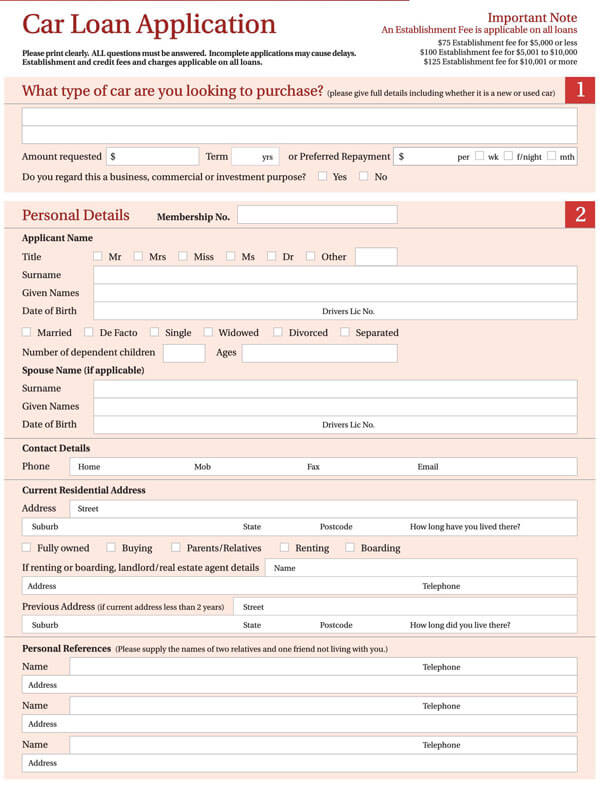

Applying for a loan from any lending institution requires the applicant to first fill out a form. Along with this form, the applicant can attach a loan application letter that provides more details on what he/she intends to do with the money and an overview of how the loan will be paid.

As a loan applicant, you need to learn how to write the loan request letter in a polite and convincing tone to appeal to your lender for your loan to be granted successfully.

What is a Loan Application Letter?

A Loan application letter is a document that informs the financial lending institution of the amount of money you are asking for, a clear outline of what you intend to do with the money, and convinces the bank why you are a good investment risk. Because it is a request, a loan application letter should be written in a polite tone, short and to the point.

The Loan Application Process

Based on the financial institution you choose, the process and time it takes for you to receive funding may vary. However, the typical loan application process may take on the following critical stages:

Pre-qualification stage

Prior to the loan contract, the potential borrower receives a list of items that they need to submit to the lender for them to get a loan. This may include Identification proof, credit score, current employment information, bank statements as well as previous loan statements.

Immediately this information is submitted, the lender reviews the documents and makes a pre-approval- meaning the borrower can move on to the next phase of the loan application process.

Loan application

In the second phase of the loan origination process, the borrower fills-in the loan application form either electronically- through mobile apps, websites, or paper-based. The data collected is then tailored to specific loan products.

The aspects that are included in the loan application form include the following;

The payment method- if it will be personal, through a check, or via online banking.

The payment frequency- There are several payment frequency methods, for example, Monthly installments, annually, or if the loan will be paid once.

The amount of interest accumulated on the loaned amount. This is the amount of money charged by the lender to the borrower on top of the amount which he/she has loaned.

The assets in the form of properties of the borrower will serve as collateral damage/guarantees in case the borrower defaults loan repayment or is unable to make his payments as per the agreed time.

Application processing

Once the application is received by the credit department, it is reviewed for accuracy, genuineness, and completeness. Lenders then use Loan Originating Systems to determine an applicant’s creditworthiness.

Underwriting process

This process only begins after an application is totally completed. In this stage, the lender checks the application in consideration of various accounts, such as an applicant’s credit score, risk scores, and other industry-based criteria. Today, this process is fully automated using Rule Engines and API integrations with credit scoring engines.

Credit Decision

Based on the results from the underwriting phase, the lender makes a credit decision. The loan is either approved, denied, or sent back to the originator for additional information. If the criteria used do not match with what is set in the engine system, there is an automatic change in the loan parameters, for instance, reduced loan amount or a different interest rate on the loaned amount.

Quality Check

Quality check of the loan application process is very critical since lending is highly regulated. The loan application is then sent to the Quality Control Team to analyze critical variables of the loan against internal and external regulations on loans. This is often the last step of the application process before funding is approved.

Loan funding

Once the loan documents are signed by both the borrower and the lender, funds are released shortly after. Nevertheless, business loans, loans on properties, and second mortgage loans may comparatively take more time to be approved due to legal and compliance reasons.

Essential Elements of a Loan Application Letter

Now that you have already understood the complex loan application process, it is important that you know the critical points to include in your loan request letter to convince your lender to give you a business loan.

Here is how to effectively write a loan application letter:

Header and greetings

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting.

In your header, include the following details:

- Your business names

- The physical address of your business

- Business telephone and cell phone numbers

- Lender’s contact details

- Lender’s or Loan Agent’s Name and Title

- A subject line stating the loan amount you are requesting for.

Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Business Loan Request Summary

The body of your business or personal loan request letter should start with a brief summary of your loan request amount, why you need the loan, your basic business information, and why you are an ideal risk investment for the lender. This section should be brief and concise. Only include the relevant information to capture your loan agent’s interest and keep them reading the body of your loan application letter.

Basic Details about your Business

Ideally, this is the third paragraph of your loan application letter. Use a few short and concise sentences to give a clear outline of your business.

Be sure to include the details below:

- The legal name of your business and any DBA that your business uses

- Your business structure- if it is a corporation- partnership, individually owned, etc.

- A summary of what your business does.

- How long your business has been operational

- Total number of employees

- A brief description of your current annual revenue

Once you have provided your basic business information, it is time to write the meat of your business loan request letter- clearly explaining why you need the business loan and how you intend to recuperate the investment.

The purpose of the business loan

In the fourth paragraph of your loan application letter, explain succinctly how you will use the business loan. Additionally, tell the lender why your intended use of the business loan will be a wise business investment.

While detailing this section, be as specific as possible and demonstrate to the lender that you have carefully considered the kind of revenue generation this new debt will accomplish for your business. for instance, don’t just say that you intend to use the loan for working capital. Rather, say that you plan to increase your inventory by 45% or that you need to increase your Human Resources to 4 to generate more income by 6%.

In the same paragraph, inform the lender exactly how the loaned amount will help generate more profits necessary to cover repayment plus the interest accumulated on loan.

Proof that you’ll be able to fully repay the loan

In this section, you need to demonstrate to the lender that you can pay back the loaned amount together with interest as per the agreed repayment period. You will want to use any figures from your latest income statements or balance sheets to prove your business is financially healthy and that it is a low-risk investment decision for your lender. In case you have other existing debts, be sure to mention them and include a business debt schedule if possible. If your business is profitable, highlight that in your letter since it something that most lenders pretty much look for in successful loan applicants.

In addition to that, consider including specific cash flow projections to demonstrate to your lender how you plan to fit repayment of the loaned amount plus interest into your budget.

Sample: Loan Application Letter

Sample 1: business loan application letter.

Samira Mitchell,

Mitchell Face Masks Limited,

4680 Forest Road

939, New York.

January 17, 2021

Mr. Wesley Kingston

Guarantor Trust Bank

679, New York State

Ref: Loan Request for $10,000

Exactly two years ago, I started my small face mask vending business in our local market. Over the last two years, my business has picked up really well to an extent where I need to expand to a bigger face mask vending company.

It is for this reason that I am writing this letter. I am confident that there is a great market niche for face masks, especially due to the current worldwide Novel Covid-19 Pandemic. Thus far, I have had many repeat customers, new customer links through referrals, and my client base has grown rapidly. Generally, there is an increase in demand for my products; therefore, I am requesting for a loan amounting to $10,000 to be able to supply more and satisfy all my clients.

This money, along with the amount that I have saved up from my profits, will enable me to lease a large, modern storefront and to import supplies that will help me launch my business plan.

I have attached my business plan, my latest business balance sheets, current business schedules, as well as my credit history statements for your perusal and review. If you have any questions or need any further clarifications, please contact me directly on (111) 345 679 or email me at Mitchel.facemasksltd.co.ke. Thank you for your consideration.

Samira Mitchel.

Sample 2: Personal Loan Application Letter

Dear Michael,

It is common for everyone to face difficult situations and bitter realities in life. I am currently facing a situation where everything seems bleak, and there seems to be no way out of this difficult situation. I am in debt, and I need to pay at least 30% of my house’s mortgage will be taken over by the bank, and I am currently ailing and weak, I’ll not be able to survive such a nervewrecking situation.

The only way I can avoid such a fate is by paying the full amount that is needed by the bank. I can be able to do so if I am allowed to take out a loan from the office, which is a privilege that the company has granted to all the employees. I would be thankful if the company allows me to borrow the money against my monthly pay.

Mr Brandon Brown

Do’s and Don’ts of Writing a Loan Request Letter

A loan application letter may increase or break your chances of receiving funding from any lending institution. This is because it is the first thing that lenders look for in the underwriting process when you submit an application. That said, you must know the dos and don’ts of writing a winning loan request letter to help you receive the funding that you really need.

- Check your personal and business credit scores before sending a loan request letter and take the necessary steps to improve them.

- Have all your financial statements ready, including cash flow statements, business balance sheets, P$L statements, etc

- Make sure to submit all your relevant credentials along with your loan application request letter.

- Always provide the correct and factual information to avoid fraudulent consequences.

- Don’t make your letter too long and unnecessarily wordy

- Don’t use an informal format while writing the loan application letter. Instead, follow the proper rules on writing formal letters

- Don’t include any false information in your loan request letter- be it your business’s current financial health, assets, and liabilities that may be used as collateral damage in case you default payment or why you need the money.

Things to Remember When Writing a Loan Application Letter

Generally, you should always consider the following essential tips if you want to write a winning loan application letter:

- The loan application letter is a formal document. Therefore, observe the proper rules of writing a formal letter.

- Clearly state your intent to borrow a given amount of money

- Provide a vivid but brief description of why you need the money. Your explanation should be concise, genuine, and transparent. While at it, explain how you plan to use the loaned amount and be very sincere about it.

- Explain why your business is a low-risk investment decision for the lender.

- Enumerate your assets and liabilities

- Include the time, date, manner, and method that you will use to make your payment.

Free Loan Application Letter Templates

Are you looking to get some financing for your business or personal emergency? Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need. Download our templates today to help you get started!

Collateral is defined as something that helps secure a loan. Generally, based on the type of lending institution you pick, the lender will give you less than your pledged asset value. Lenders every so often quote an acceptable loan to value ratio, meaning that if you borrow against your house, for example, and it worth $400,000, you will be given a loan amounting to $380,000. Again, this depends on the bank.

The prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the loan’s maturity date. These do not usually apply if you pay extra principal on your loaned amount in small amounts at a time. However, it is good that you counter check with your lender.

Every lender follows a different criterion to approve a business or personal loan. The application process depends on several factors; therefore, the time taken to receive funding in your account may take anywhere from a few minutes to several days. This depends on the type of institution you choose and the type of loan you are asking for.

Acquiring a loan is sometimes a necessity in one’s business or personal life. Nonetheless, it is not always easy to get a loan as lenders are wary of granting loans due to loan repayment defaults and fraudulent borrowers. This article has provided you with great insight on loan application letters, the loan application process, essential tips for writing a winning loan application letter, and the dos and don’ts of writing a convincing loan request letter. If you keep these things in mind every time you are thinking of applying for a loan, you are sure to get the funds you need to ensure the smooth running of your business and sort any personal emergency that may come your way.

Related Documents

Word & Excel Templates

Printable Word and Excel Templates

Loan Application Letter

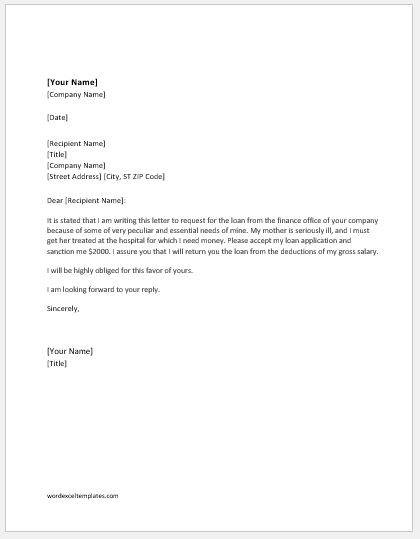

Applying for the loan requires you to provide a lot of documentation. Some organizations ask you to fill out the loan application form, while in some cases, you have to write a loan application letter to the institute to apply for the loan.

The loan application letter allows you to add all the details that you are required to provide. The letter is written to the loan manager of the company, and he then decides whether he should accept the application or not. The letter should include the personal information of the applicant, and since it is a formal letter, it should be written to the point by avoiding unnecessary details. The lender should follow a standard format while writing the loan application letter. The loan manager should be told about the intended use of the money.

The first paragraph of the letter should state the reason for lending the money. It should be assured in the letter that you will not use this money for any illegal purpose. The date on which the applicant will return the borrowed money should be mentioned in the letter.

You should also include information about you in the letter that can make the reader feel that you are a trustworthy person. Here is a sample letter that can help you learn about the structure and format of the letter.

Loan application letter:

Dear [Recipient’s Name],

It is stated that I am writing this letter to request a loan from the finance office of your company because of some of my very peculiar and essential needs. My mother is seriously ill, and I must get her treated at the hospital, for which I need money. Please accept my loan application and sanction me $2000. I assure you that I will return you the loan from the deductions of my gross salary.

I will be highly grateful for this favor of yours.

I am looking forward to your reply.

[Your Name]

Preview and Details of Template

File: Word ( .doc ) 2003 + and iPad Size: 31 KB

More options

I am writing this letter to get a loan from your bank branch situated in New Jersey. Currently, I am working as a sales executive for ABC Organization and need a $10,000 loan. I am in utmost need of this amount as I have to meet the surgery expenses of my father. I have gone through all the requirements related to the loan process and have enclosed the necessary documents along with this email. Please let me know what other documents I need to send you, and you can call me at any time for further queries. I hope you will give a positive response to my request.

This application is a request to ask for a loan from your organization. I am Christiana Roseland, and I am currently running a bakery in New Jersey. I am planning to open a new branch according to the rising demand of people. For this purpose, I need $70,000/- and I will return the amount in installments. I have thoroughly read the rules and policies for the loan process and hopefully, I will return the entire amount within the given time period and the financial pronouncement has been affixed with this application. Waiting to get positive feedback from you.

This letter is a request for a loan application to construct a house. I am the managing director at ABC Company, and my monthly salary is not adequate to meet the construction expenses. I will return the due amount according to the company’s rules and policies and will not let you be disappointed. I contacted the admin office to find out the details, and Mr. Jackson has provided me with all the information. If you need additional information, you can ask me at any time. Thank you for taking my request into account.

Dear Madam, I, Darcy Louis, work in the security office of your company. I live in Valley Stream and travel two hours daily to come to the office. I do not have a personal vehicle, and sometimes it creates a lot of difficulties, and I often arrive late to the workplace. I want to apply for a loan because I have to buy a motorcycle. I need $10,000 in this regard. I have chosen a six-month installment plan, and 20% of my salary will be deducted each month. I request that you accept my loan application. I will be grateful to you. Thanking in anticipation.

Dear Sir, I am Dorothy John, and I live in Toronto. I am running a branch of ABC School. The strength of students is increasing with each session, and it is becoming difficult to adjust to the large number of students in a limited space. Therefore, I need to open a new branch adjacent to the current school and construct a new building, but I do not have enough money. I learned about your loan policy and want to apply for it. I have attached the needed documents along with the application. I am hoping to hear a quick response from you.

I am Julia Hughes, and I am writing this message to ask for a loan from your bank. I have an account in your Brooklyn branch, and my account number is [#]. I have a small business marketing in Brooklyn, and I intend to open a new branch in the Netherlands. Hence, it can be a source of ease for hundreds of people. The savings I have and the loan I am asking for will be of great help in expanding my business. Kindly send me an email detailing all the formalities for the loan process. I would like to ask you to send me a confirmation message so I may visit your branch on an immediate basis.

- Ramadan Office Schedule Announcement Letters/Emails

- Letter to Friend Expressing Support

- Letter to Employer Requesting Mental Health Accommodation

- Letter Requesting Reference Check Information

- Letter Requesting Salary Certificate

- Letter Requesting Recommendation from Previous Employer

- One Hour Off Permission Letter to HR

- Advice Letter to Subordinate on Effective Communication

- Advice Letter to Subordinate on Time Management

- Letter to Patient for Feedback/Responding Survey/Online Form

- Cold and Cough Leave Message to Boss

- Secret Santa Messages to Coworkers

- Warning Letter for Insufficient Adherence to Instructions

- Undertaking Letter for Company

- Query Letter for Misconduct

Letters.org

The Number 1 Letter Writing Website in the world

Sample Loan Application Letter

Last Updated On December 25, 2019 By Letter Writing Leave a Comment

Loan application is written when the applicant wants to seek monetary assistance in the form of loan mostly on a mortgage of property. Since it is a request, the letter should be written in a polite tone.

Use the following tips and samples to write an effective loan application letter to a bank manager or a company.

Sample Loan Application Letter Writing Tips:

- As loan application letter is formal, the phrases and words should be chosen carefully.

- The language used should be simple and easy to understand

- The content of the letter should be short and straightforward.

Sample Loan Application Letter Template

__________ (Branch Manager’s name) __________ (Branch address) __________ __________

______________ (Your name) ______________ (Your address) __________________

Date __________ (date of writing letter)

Dear Mr. /Ms_____________ (name of the concerned person),

I have a savings account in your bank with account no._________ for the past …………… years. I want to apply for a ……………..(type of loan) loan for ………………….(state purpose) .

If you can inform me about the details and formalities required for seeking the loan, I shall make all the arrangements and meet you at the earliest.

Looking forward to meeting you,

Thanking you,

Yours Sincerely,

___________ (Your name)

Sample Loan Application Letter Sample, Email and Example/Format

Pavan Kumar 3214 Breeze apts Worli Hyderabad

The Branch Manager, Axis Bank, Station Road Branch, Hyderabad

30th September 2013

Subject: Loan application letter

Dear Sir/Madam,

I have a savings account in your bank for the last five years. I want to avail a home loan from your bank. I would like to know the details to seek a home loan from your bank.

I am a salaried employee, and I work for a central government organisation as a research scientist. You can verify my salary certificate and other details.

As the home loan interest rates have down, I would like to utilise this opportunity to buy a house. I have already booked a flat in Banjara Hills Hyderabad, and I need about Rs 35 lakhs as the loan amount. With my pay scale, I think I am eligible to seek a loan for this amount.

If you can send your representative to my place, we can discuss and finalise the loan. I shall keep all the documents ready so that there will not be a delay in processing the loan.

Looking forward to hearing from you,

_____________

Pavan Kumar

Email Format

A loan application letter is written to ask for financial credit service on some secured mortgage basis. As it is our requirement, the words should be so humble and sincere that the banker or the lender acquires total trust on the applicant. Loan application letter helps the loan applier to appeal for the various types of loans whichever he wishes to depend upon certain conditions.

I have sent this letter to you to explain my reasons behind requesting a loan modification on my mortgage. I wish to purchase a Mercedes Benz 300 Limousine costing Rs 56 lakhs. I am seeking an interest reduction down to 6.25% from my current 8.80%. I feel it is a fair percentage for you, and it is just within my means.

Without a reduction on the interest, I will not be able to afford the monthly payments. I have to choose between a loan modification and a foreclosure. I would far prefer the former, and you probably would as well. 6.25% is the most I will be able to manage, even if I cut all of my expenses out of the picture. Please consider my application seriously, and I hope to hear more from you on the matter.

Yours Faithfully,

____________

Jimmie Verna Melendez.

Related Letters:

- Sample Application Letter

- Sample Job Application Cover Letter

- Sample College Application Letter

- Sample Application Cover Letter

- Sample Scholarship Application Letter

- Job Application Letter

- Transfer Application

- Application Letter by Fresher

- Application Letter for Referral

- Business Application Letter

- College Application Letter

- Credit Application Letter

- General Application Letter

- Good Application Letter

- Grant Application Letter

- Letter Of Intend Application

- Job Application E-Mail Template

- Job Application Letter Format

- Job Application Letter Template

- Receptionist Application Letter

- Solicited Application Letter

- Summer Job Application Letter

- Work Application Letter

- Unsolicited Application Letter

- Corporation Application Letter

Leave a Reply Cancel reply

You must be logged in to post a comment.

Letter Solution

Welcome to "Letter Solution" Everything is about letter and application writing.

Bank Loan Application Letter Sample 8+ With Format

One format and 8 sample on bank loan letter.

Table of Contents

Bank Loan Application Letter Sample: Naturally, we take a loan from a bank when we fall into a money crisis. We talk to the branch manager about it. After that, he discussed everything and instructs us on all terms and conditions. Some bank managers tell to submit a request letter with the required documents. And then many people can not write a proper request letter. So I have written the post with a format and six samples that will clear your confusion and create a good idea about any type of bank loan application letter sample. Then you can write a new application in your own way. A well-written request letter for the loan can help you to be approved your application at the time of applying for a loan.

There are different types of loans in the bank. For example

- Business loan

- Personal loan

- Educational loan

- Two-wheeler loan

- Loan against property

When you will apply for a personal loan, eligibility is a must for you.

Personal loan eligibilit:

- You should be salaried person.

- You should have a job under government, public company.

- Your age should be between 25-50 years.

- You need to be an Indian citizen.

- The minimum salary should be 25000 but it depends on the city.

Application Format

Bank loan application letter.

The Bank Manager

[Name of the bank]

[Name of the branch]

[Address of the branch]

Date: …../ …../ ……

Sub: [Application for home loan]

Respected Sir/Madam,

I am ___________ [Your name]. I am a [savings/current] account holder with your branch for _____ years. I am a ______ service man. My monthly salary is deposited in my bank account. I always maintain a good balance in my account. But I need a loan for _____________ [Purpose of the loan].

I am requesting you for an amount Rs. __________ as a loan. I have enclosed all the required documents as you instructed earlier. I have read, got and agree with the term and condition of the bank.

I am waiting for positive response from you.

Thanking you

Yours sincerely

[Name of the applicant]

Contact details

Bank Loan Application Letter Sample

Bank of India

[Branch Name]

[Branch Address]

Date: 00/00/00

Sub: [Request for business loan]

Dear Sir/Madam,

With due respect, I beg to state that I have a current account with your branch. I am a businessman and run three restaurants. I need an amount of Rs. 100000/- as a loan for my business purpose.

I will be thankful to you if you will consider my request as early as possible.

Write A Letter To Bank Manager For Educational Loan

Gabgachi Branch

Delhi-700 071

Date: 12/11/2021

Sub: Application for educational loan

I, Ashutosh Kumar Saha, a permanent resident of Sukanta More, Gabgachi, would like to apply for an education loan for further studies. I have just appeared for my higher secondary board exams and would like to complete a course in B.TEC from a reputed institution in Delhi.

I can come to the branch at your convenience to discuss it required to get a loan in my favor. I will always be grateful to you if you look into the matter and approve my loan.

Ashutosh Kumar Saha

Application For Home Loan

Name of the bank

Name of the branch

Address of the branch

I am prakash saha. I am a savings account holder with your branch for ten years. I am a government serviceman. My monthly salary is deposited in my bank account. I always maintain a good balance in my account. But I need a loan for building my house.

I am requesting you for an amount of Rs. 200000/- [Two Lakh] as a loan. I have enclosed all the required documents as you instructed earlier. I have read, got and agree with the term and conditions of the bank.

I am waiting for a positive response from you.

Application For Personal Loan

It is stated that I would like to request you for a personal loan of Rs. 200000/-. I have a savings account for 15 years with your branch and save a good balance in the first week of the month. I have been working in an I.T company for 20 years and my salary is 25,000/-. I will pay the loan by deduction money by a savings account. I have read the term and conditions and got it. I have enclosed the necessary document as the instruction.

I am waiting for your positive response of hearing.

Yours faithfully

Sample of Bank Loan Application Letter

Sub: [Application for __________________ ]

With a lot of respect, I beg to state that I am an old account holder in your branch. My account number is XXXXXXXXX. Now I am a serviceman. I am doing my job in Malda Sonoscan Nursing Home. My salary is 12000/-. I need a loan amounting to Rs. 80000/- for buying a car. The deduction should be from my salary account.

Therefore I request you to grant me the loan and then I will be obliged to you.

Business Proposal For Bank Loan Sample

Sub: [Application of proposal of the business loan]

I am writing this letter to request a small business loan in the amount of Rs. 80,000/-for the purpose of business development. My current account number is XXXXXXXXX in your branch. I am an account holder for ten years and maintain a good balance in this account.

My company name is [XYZ]. It is a growing business that serves furniture to customers. You can follow our success online at [website name]. 25 workers work here daily.

I have attached all the required documents along with this application as you instructed earlier. So I earnestly request you for a small loan.

I am looking forward to hearing at your convenience.

FAQ’s On Requesting Loan

How do I write a letter requesting a loan?

Answer: It is not a hard matter. Just follow the structure and fill up the place with your right information.

Sub: [Application for_______ ]

Write first paragraph following the format.

Second paragraph

Third paragraph

That is enough for a letter of requesting loan.

What is the difference between application and letter?

Answer: There is a difference between application and letter. A letter is written for communication or giving information to anyone. On the other hand, an application is written to request for something.

How do you end an application letter?

Answer: You end an application letter with “Yours faithfully or your sincerely”. Besides it nowadays to write contact details at the end is very important.

Should I write thank you in advance?

Answer: Yes. You should write “Thank you” in advance for close connotation. It will express your politeness.

- Closing your bank account

- A new pass book

- New check-book

- Transfer bank account

- Opening a joint account

- Bank statement

- Hire a locker

- Change specimen signature

- Renewal of fixed deposit account

- Complaining non-receipt of pass-book

- Stop payment of a lost check

- Reopen account

- Change registered mobile number

I hope you have got the right information and chosen bank loan application letter sample . If you like the post, you can do a little help by sharing it with your friends, relatives and do comment in the below comment box.

- Stop Payment Cheque Letter With Format And Sample

- Closing Bank Account Letter With 20+ Sample

You May Also Like

Application For Opening Account In Bank With 10 Samples

Application For New Passbook With 6+ Sample

Application For Change Mobile Number In Bank With Sample

Guide to writing a mortgage letter of explanation (with template)

Your lender asked for a letter of explanation. what now.

When you apply for a home loan, your lender will do a deep dive into your financial history. Depending on what it finds in your bank statements or credit report, additional documentation may be necessary.

You may be asked for a “letter of explanation” during the application process. Fear not. Letters of explanation are fairly standard and nothing to worry about.

However, you want to make sure you write this letter correctly, as it could be crucial to your mortgage approval.

Here’s everything you need to know so you can hit a home run with your letter of explanation.

In this article (Skip to...)

- What is a letter of explanation?

- How to write one

- Sample letter

- Final advice

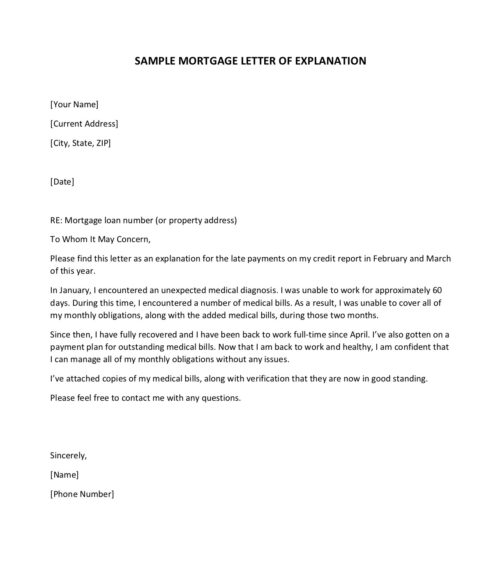

What is a mortgage letter of explanation?

Commonly referred to as an ‘LOE’ or ‘LOX,’ letters of explanation are often requested by lenders to gain more specific information on a mortgage borrower and their situation.

An LOX can necessary when there is inconsistent, incomplete, or unclear information on a loan application.

Letters of explanation may be required if any red flags turn up during the underwriting process, such as:

- Declining income

- Gaps in your employment history

- Differing names on your credit report

- Large deposits or withdrawals in your bank account

- Recent credit inquiries

- An address discrepancy on your credit report

- Derogatory items in your credit history

- Late payments on credit cards or other debts

- Overdraft fees on an account

There are many other situations where an LOX may be requested, too.

If you need to write one, be sure to ask your loan officer what exactly the underwriter wants to see, and whether you need to provide any supporting documentation along with the letter.

How to write a letter of explanation for your mortgage lender

When it comes to mortgage letters of explanation, less is typically more.

Too much unnecessary information may lead to confusion, or at minimum, additional questions about your file — questions that may have been avoided if it weren’t for some of the details in your letter.

The most important elements of your letter of explanation should include the following:

- Facts — Be honest. Never be tempted to write a letter based on solely on what you may think your lender wants to hear. You shouldn’t fabricate any aspect of your letter. Include correct dates, dollar amounts, and any other pertinent details for your situation

- Resolution — Your lender wants to know how and when the situation that led up to certain events was resolved. For instance, if you were temporarily furloughed during COVID, but you’ve since returned to full employment, you should be able to document your recent paystubs and have your employer verify that you’ll continue working full time for the foreseeable future

- Acknowledgement — This one is important and shouldn’t be left out of your letter. Mortgage underwriters want to know why it is that something happened, and how or why it won’t happen again in the future

Remember that a letter of explanation is a professional document that will go into your loan file.

Be mindful of things like spelling, grammar, and punctuation. Create a letter that’s visually appealing, properly formatted, and communicates the relevant information.

Providing additional documentation with your letter can be helpful. For example, if hospitalization was the culprit behind some missed payments on your credit report, it may be helpful to include hospital bills.

Sample letter of explanation and template

Remember to be honest, formal, and concise when writing a letter of explanation for your mortgage lender.

The exact content will vary based on your situation, but here’s a general letter template you can use as a guide. (Click the image to open a PDF version.)

Remember to include your mailing address, phone number, and the number of your mortgage loan application (or the property address for which you’re applying).

Final advice on writing a letter of explanation

You’ll be asked to submit a pile of documentation during the mortgage loan process, including bank statements, tax returns, pay stubs, and more.

Depending on your financial situation, your lender may also request a letter of explanation. Many first-time home buyers think being asked to provide a letter of explanation means their mortgage application may be doomed.

Remember, this type of request is usually a good thing. The underwriter may be looking for this last item before signing off on your final approval.

When your lender requests a mortgage letter of explanation, remember this first: don’t panic.

Next, double-check with your lender on exactly what is being requested.

Then write a clear, concise letter that’s free of emotional language, negativity, or excessive detail. There’s a good chance that the next time you hear from your lender, it will be to let you know you’re fully approved.

Business Loan Application Letter Sample: Free & Effective

In this article, I’ll guide you through the process step-by-step, drawing from my personal experiences, and provide you with a handy template to get you started. Whether you’re a seasoned business owner or just starting out, these insights will help you craft a compelling letter that stands out to lenders.

Key Takeaways

- Understand Your Audience: Know the lender’s requirements and tailor your letter accordingly.

- Be Clear and Concise: Communicate your business’s needs and how the loan will be used in a straightforward manner.

- Provide Detailed Information: Include pertinent details about your business and your plan for the loan.

- Use a Professional Tone: Maintain a formal tone throughout the letter to convey seriousness and professionalism.

- Follow a Structured Format: Use a clear and logical structure to make your letter easy to read and understand.

- Include Supporting Documents: Attach essential documents that can vouch for your business’s credibility and financial health.

Step-by-Step Guide to Writing a Business Loan Application Letter

Step 1: understand the lender’s requirements.

Before you begin writing, it’s crucial to understand the lender’s criteria. Each financial institution has its unique set of requirements for loan applications. Familiarize yourself with these to tailor your letter effectively.

Step 2: Start with Your Contact Information

Begin your letter with your contact information at the top, followed by the date and the lender’s details. This establishes a professional tone from the outset.

Your Name Your Business Name Your Business Address City, State, Zip Code Date Lender’s Name Lender’s Institution Lender’s Address City, State, Zip Code

Step 3: Craft a Compelling Introduction

In the opening paragraph, introduce yourself and your business. Clearly state the purpose of your letter – to apply for a business loan – and the amount you are requesting. This sets the stage for the details that follow.

Step 4: Detail Your Business Plan

This is where you shine. Outline your business plan, emphasizing how the loan will contribute to your business’s growth. Be specific about how you intend to use the funds. Will they be used for expanding operations, purchasing equipment, or maybe for bolstering your working capital? Lenders want to see that you have a clear plan in place.

Step 5: Showcase Your Business’s Financial Health

Include a brief overview of your business’s financial status. Highlight your revenue, profit margins, and financial projections. This demonstrates to lenders that you have a viable business capable of repaying the loan.

Step 6: Mention Collateral (If Applicable)

If you’re offering collateral against the loan, specify what it is. This could be equipment, real estate, or inventory. Detailing the collateral reassures lenders about the security of their investment.

Step 7: Conclude with a Call to Action

End your letter by thanking the lender for considering your application and expressing your willingness to provide further information if needed. Include a polite request for a meeting or a conversation to discuss the application further.

Step 8: Professional Sign-Off

Sign off your letter with a professional closing, such as “Sincerely,” followed by your name and position within the company.

Template for a Business Loan Application Letter

[Your Name] [Your Business Name] [Your Business Address] [City, State, Zip Code] [Date]

[Lender’s Name] [Lender’s Institution] [Lender’s Address] [City, State, Zip Code]

Dear [Lender’s Name],

I am writing to apply for a business loan of [Loan Amount] for [Your Business Name]. As [Your Position] of the company, I am committed to guiding our business to new heights, and this loan is a crucial step in our growth strategy.

Our plan is to allocate the loan towards [Specific Use of Loan]. This investment is projected to [Expected Outcome of Loan Investment], enhancing our profitability and ensuring our ability to repay the loan.

Enclosed with this letter, you will find our business plan, financial statements, and cash flow projections, providing a comprehensive view of our business’s financial health and growth potential.

Thank you for considering our loan application. I am looking forward to the opportunity to discuss this further and am happy to provide any additional information required.

[Your Name] [Your Position] [Your Contact Information]

Tips from Personal Experience

- Personalize Your Letter: While using a template is helpful, adding personal touches that reflect your business’s unique aspects can make your letter stand out.

- Be Transparent: Honesty about your business’s current financial situation and how you plan to use the loan builds trust with lenders.

- Proofread: A letter free from grammatical errors and typos shows attention to detail and professionalism.

I’d love to hear your thoughts or experiences with writing business loan application letters. Do you have any tips to share or questions about the process? Feel free to leave a comment below.

Frequently Asked Questions (FAQs)

Q: What is a business loan request?

Answer: A business loan request is a formal request made by a business to a lender or financial institution for a loan to finance business operations or expansion.

Q: What information is typically included in a business loan request?

Answer: A business loan request typically includes information about the business, including its financial history, plans for the loan proceeds, and a projected financial statement.

It may also include personal financial information about the business owner or owners.

Q: How is a business loan request typically made?

Answer: A business loan request is typically made in writing, through a loan application or business plan submitted to a lender or financial institution.

Q: What documentation is required to support a business loan request?

Answer: Documentation that may be required to support a business loan request can include financial statements, tax returns, and personal financial information.

It may also include business plan, projected financial statement, and any collateral that the business can offer.

Q: What are the potential outcomes of a business loan request?

Answer: The potential outcomes of a business loan request can include the lender or financial institution approving the loan, denying the loan, or offering a modified loan amount or terms.

The interest rate, repayment period, and other terms of the loan will be based on the creditworthiness of the business and the lender’s lending policies.

Q: What is a business loan request letter?

Answer : A business loan request letter is a formal written document submitted by an individual or a business to a financial institution or lender, seeking financial assistance in the form of a loan.

It outlines the purpose of the loan, the amount requested, and provides supporting information to convince the lender of the borrower’s creditworthiness.

Q: How do I start a business loan request letter?

Answer : To start a business loan request letter, begin by addressing it to the appropriate person or department at the lending institution.

Use a formal salutation such as “Dear [Lender’s Name]” or “To Whom It May Concern.” Introduce yourself or your business and clearly state the purpose of the letter, which is to request a loan.

Q: How should I structure a business loan request letter?

Answer : A business loan request letter should follow a professional and organized structure. It typically includes an introduction, a body, and a conclusion.

The introduction should clearly state the purpose of the letter and provide essential details about yourself or your business.

The body of the letter should elaborate on the loan request, including the amount needed, the purpose of the loan, and any supporting information or documents.

Finally, the conclusion should express appreciation for the lender’s time and consideration, while offering your contact information for further communication.

Q: What tone should I use in a business loan request letter?

Answer : A loan request letter should maintain a formal and professional tone throughout. It should be respectful, concise, and polite. Avoid using overly technical jargon or informal language.

It is important to demonstrate professionalism and credibility to increase your chances of a favorable response.

Q: How long should a business loan request letter be?

Answer : A business loan request letter should be concise and to the point, typically ranging from one to two pages.

Avoid excessive details or unnecessary information that may distract from the main purpose of the letter. Keep the content focused, clear, and persuasive.

Q: What is the purpose of a business loan request letter?

Answer : The purpose of a business loan request letter is to formally request financial assistance from a lender or financial institution.

It serves as a written proposal, outlining the borrower’s need for funds, the purpose of the loan, and the borrower’s ability to repay.

The letter aims to persuade the lender that the loan is a viable investment with a solid repayment plan and potential for positive outcomes.

Q: How important is a business loan request letter?

Answer : A business loan request letter is crucial when seeking a loan from a lender or financial institution.

It acts as a formal request, providing essential information about the borrower, the purpose of the loan, and the borrower’s ability to repay.

A well-written and persuasive loan request letter increases the likelihood of the loan being approved, as it demonstrates professionalism, credibility, and a clear understanding of the borrower’s financial needs.

Related Articles

Personal loan request letter sample: free & effective, request letter for working capital loan: the simple way, personal loan paid in full letter sample: free & effective, sample letter to bank requesting extension of time for loan payment: free & effective, ask someone for money in a letter sample: free & effective, business loan request letter sample: free & customizable, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

- Loan Agreement

- Loan Application

- Loan Application Letter

- Loan Letter

- Loan proposal

- Personal Loan Agreement

Loan Application Template in Word

Secure Your Financial Future with Our Professionally-Written Loan Application Templates. Our Basic and Formal Document Samples Come with Editable or Replaceable Content in Word, Making It Simple to Create Loan Application Review Forms, Personal Loan Application Letters, Car Loan Application Letters, and Business Loan Application Letters. Download for Free and Print Your Customized Loan Application Today!

Get Access to All MS Word Templates

Get Instant Access to 50,000+ MS Word Templates

- Access to 1 Million+ Templates & Tools

- 500,000+ Microsoft 365 Templates including Excel, Powerpoint, Publisher, Outlook & PDF

- Unlimited access to Design & Documents AI editors

- Professionally Made Content and Beautifully Designed

- Instant Download & 100% Customizable

IMAGES

VIDEO

COMMENTS

Name of Loan Officer. Name of Financial Institution or Bank. Address of Financial Institution or Bank. City, State, Zip Code. RE: Loan Application for $100,000. Dear [Loan Officer's Name], I am writing to formally request a loan of $100,000. As a loyal customer for the past 20 years, I have always trusted this institution with my financial ...

An application letter for a loan is a formal letter written to a financial institution by a borrower requesting a loan, payable in a specified amount of time. ... Loan Application Letter Sample. Make your small business loan application more polished with our simple sample letters. They're crafted to help you convey your needs professionally ...

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting. In your header, include the following details: Your name. Your business names. The physical address of your business. Business telephone and cell phone numbers.

Embark on your financial journey with confidence using Template.net's Loan Application Letter Templates. Our offerings, seamlessly editable and fully customizable, empower you to articulate your borrowing needs effortlessly. Harness the potential of our Ai Editor Tool, ensuring each application reflects your unique narrative. Streamline your loan process with precision - because financial ...

PDF. Download Now. If you are planning to craft an effective loan application letter in pdf, it would be easier for you to make one if you refer to the loan application letters available on this page. These sample loan are available in PDF and loan word formats, thus making it easier for you to access and edit these should you deem it appropriate.

Here is a sample letter that can help you learn about the structure and format of the letter. Loan application letter: Dear [Recipient's Name], It is stated that I am writing this letter to request a loan from the finance office of your company because of some of my very peculiar and essential needs. My mother is seriously ill, and I must get ...

Loan Application Letter Templates. When you are writing a Loan Application Letter, you need to write to the right authority. If you are working in a company, you can write a Loan Application Letter addressing your Hr. You can take loans for various reasons, such as housing loans or vehicle loans. So, make sure you state why you need the loan in ...

Subject: Loan application letter. Dear Sir/Madam, I have a savings account in your bank for the last five years. I want to avail a home loan from your bank. I would like to know the details to seek a home loan from your bank. I am a salaried employee, and I work for a central government organisation as a research scientist.

In the loan application letter template provided, Steven mentions the money will cover staff, rent, and marketing for his small business. Your closing should reiterate what your letter hopes to accomplish and thank the reader for his or her time. At a large bank, a loan officer may read multiple such letters in a day, so keep this portion brief ...

Sub: [Application of proposal of the business loan] Respected Sir/Madam, I am writing this letter to request a small business loan in the amount of Rs. 80,000/-for the purpose of business development. My current account number is XXXXXXXXX in your branch.

City, State, Zip Code. Home : 000-000-0000 Cell: 000-000-0000. [email protected]. Dear Mrs. Loper, Exactly one year ago I began a small cloth diaper company out of my own home. Over the last year my business has grown significantly to the point where I now need to expand. I am writing this letter to ask for a loan so that I can expand my business.

Step 3: Structure Your Letter. A well-structured letter is key. Generally, it should include: Introduction: Briefly introduce yourself and state the purpose of the letter. Body: Detail your financial situation, loan purpose, and repayment plan. Conclusion: Summarize your request and express gratitude.

Address of Bank or Lending Institution. City, State, Zip Code. RE: Application for loan of $50,000. Dear Name of Loan Officer: This letter is a formal request that you favorably consider my loan application. I have been a patron of this bank for the past 20 years.

To simplify this process, think about following this free business loan request letter sample as a guide. Of course, you'll need to edit and adapt this template to match the specifics of your business and the loan you intend to pursue. The format of a business loan request letter will typically be on printed 8.5 x 11 inch paper.

Here are a few websites offering examples of business loan application letters you can refer to when writing your own loan request letter: If you're wondering how to write a letter to a bank manager for a loan, check out RequestLetters.com. LiveCareer offers a loan application sample letter as well. Refer to these loan request samples, too.

Remember to be honest, formal, and concise when writing a letter of explanation for your mortgage lender. Start your mortgage application today. The exact content will vary based on your situation ...

Step 2: Start with Your Contact Information. Begin your letter with your contact information at the top, followed by the date and the lender's details. This establishes a professional tone from the outset. Example: Your Name. Your Business Name. Your Business Address. City, State, Zip Code. Date.

Follow the steps to write a letter for loan approval: 1. Add basic information about the business. The first step to drafting a communicative, informative and persuasive business loan request letter is to begin with a header and a greeting. An effective header includes some lines, providing the basics of your business loan request.

Simplify and streamline the loan application process with our Loan Application Letter template. Whether requesting a loan, providing documentation, or communicating loan details, our structured format ensures professional and detailed loan-related communication. Employ the template to present financial information, requirements, and intentions clearly, assisting in a well-articulated and ...

Related: How To Write a Letter in Block Format (With Example) 2. Create a header. A cover letter accompanies a resume, each being an extension of the other. Thus, as your resume contains a header, so does your cover letter. Begin by clicking into the header area of a new document. The header consists of two lines.

Loan Application Letter. Access to 1 Million+ Templates & Tools. 500,000+ Microsoft 365 Templates including Excel, Powerpoint, Publisher, Outlook & PDF. Unlimited access to Design & Documents AI editors. Professionally Made Content and Beautifully Designed. Instant Download & 100% Customizable. Secure Your Financial Future with Our ...