AI Summary to Minimize your effort

Free GST PDF Ebook - Download GST Explained PDF

Updated on : Nov 22nd, 2023

Goods and Services Tax or GST as it is popularly known, is the newest taxation system in India. To help you understand all about this new taxation system we have created a GST Book. It is in PDF format and easily downloadable free of cost. You can read it online or download it for future read.

This Ebook contains:

- GST vs the Current Indirect Tax Structure

- Why is GST a big deal?

- Time, Place, and Value of Supply

- Registering under GST

- GST Returns – How and When to File Them

- Mixed Supply and Composite Supply

- Composition Levy

- What is Aggregate Turnover

- Input Tax Credit in Detail

- Reverse Charge

- What is GST Compliance Rating?

- Impact of GST on Manufacturers and FMCG Industry.

About the Author

I preach the words, “Learning never exhausts the mind.” An aspiring CA and a passionate content writer having 4+ years of hands-on experience in deciphering jargon in Indian GST, Income Tax, off late also into the much larger Indian finance ecosystem, I love curating content in various forms to the interest of tax professionals, and enterprises, both big and small. While not writing, you can catch me singing Shāstriya Sangeetha and tuning my violin ;). Read more

Public Discussion

Get involved!

Share your thoughts!

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

- Draft and add content

- Rewrite text

- Chat with Copilot

- Create a summary

- Copilot in Word on mobile devices

- Frequently asked questions

- Create a new presentation

- Add a slide or image

- Summarize your presentation

- Organize your presentation

- Use your organization's branding

- Copilot in PowerPoint for mobile devices

- Draft an Outlook email message

- Summarize an email thread

- Suggested drafts in Outlook

- Email coaching

- Get started with Copilot in Excel

- Identify insights

- Highlight, sort, and filter your data

- Generate formula columns

- Summarize your OneNote notes

- Create a to-do list and tasks

- Create project plans in OneNote

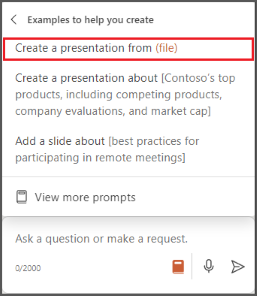

Create a new presentation with Copilot in PowerPoint

Note: This feature is available to customers with a Copilot for Microsoft 365 license or Copilot Pro license.

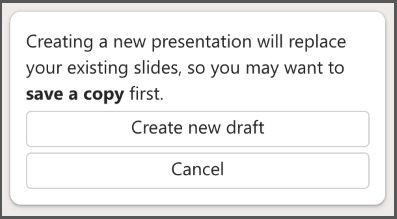

Create a new presentation in PowerPoint.

Select Send . Copilot will draft a presentation for you!

Edit the presentation to suit your needs, ask Copilot to add a slide , or start over with a new presentation and refine your prompt to include more specifics. For example, "Create a presentation about hybrid meeting best practices that includes examples for team building.”

Create a presentation with a template

Note: This feature is only available to customers with a Copilot for Microsoft 365 (work) license. It is not currently available to customers with a Copilot Pro (home) license.

Copilot can use your existing themes and templates to create a presentation. Learn more about making your presentations look great with Copilot in PowerPoint .

Enter your prompt or select Create presentation from file to create a first draft of your presentation using your theme or template.

Edit the presentation to suit your needs, ask Copilot to add a slide , organize your presentation, or add images.

Create a presentation from a file with Copilot

Note: This feature is only available to customers with a Copilot for Microsoft 365 (work) license. It is not currently available to customers with a Copilot Pro (home) license.

With Copilot in PowerPoint, you can create a presentation from an existing Word document. Point Copilot in PowerPoint to your Word document, and it will generate slides, apply layouts, create speaker notes, and choose a theme for you.

Select the Word document you want from the picker that appears. If you don't see the document you want, start typing any part of the filename to search for it.

Note: If the file picker doesn't appear type a front slash (/) to cause it to pop up.

Best practices when creating a presentation from a Word document

Leverage word styles to help copilot understand the structure of your document.

By using Styles in Word to organize your document, Copilot will better understand your document structure and how to break it up into slides of a presentation. Structure your content under Titles and Headers when appropriate and Copilot will do its best to generate a presentation for you.

Include images that are relevant to your presentation

When creating a presentation, Copilot will try to incorporate the images in your Word document. If you have images that you would like to be brought over to your presentation, be sure to include them in your Word document.

Start with your organization’s template

If your organization uses a standard template, start with this file before creating a presentation with Copilot. Starting with a template will let Copilot know that you would like to retain the presentation’s theme and design. Copilot will use existing layouts to build a presentation for you. Learn more about Making your presentations look great with Copilot in PowerPoint .

Tip: Copilot works best with Word documents that are less than 24 MB.

Welcome to Copilot in PowerPoint

Frequently Asked Questions about Copilot in PowerPoint

Where can I get Microsoft Copilot?

Copilot Lab - Start your Copilot journey

Need more help?

Want more options.

Explore subscription benefits, browse training courses, learn how to secure your device, and more.

Microsoft 365 subscription benefits

Microsoft 365 training

Microsoft security

Accessibility center

Communities help you ask and answer questions, give feedback, and hear from experts with rich knowledge.

Ask the Microsoft Community

Microsoft Tech Community

Windows Insiders

Microsoft 365 Insiders

Find solutions to common problems or get help from a support agent.

Online support

Was this information helpful?

Thank you for your feedback.

Quick Links

- OM's for constitution of Committees

- Press Release

- Model All India GST Audit Manual 2023

- Public Information

- First Discussion Paper on GST (2009)

- Comments of DoR on First Discussion Paper (2010)

- Revenue Neutral Rate- CEA Report

Search form

GST Council neither makes telephonic calls nor sends any e-mail or message to any individual seeking payment of GST amount.

The General Public is hereby notified & forewarned not to respond to such fake calls/ e-mail to deposit amounts in individual bank accounts.

Beware of these fraudulent activities!!!

GST Council is not responsible in any way for any such fraudulent incidents and complaints, if any, in this regard may be made to the Police."

- State Government GST Website

- Advance Rulings

- HSN/SAC Code/ GST Rate Finder

- GST System Statistics

- Stakeholders Consultation

Repealed Acts

IMAGES

VIDEO

COMMENTS

The Journey to GST. First Discussion Paper was released by the. 2006. Announcement. Empowered Committee 2011. of GST for the first time was made by the then Union Finance Minister, during budget of 2006-07 that it. 2009. Constitution (115th Amendment) Bill introduced and subsequently lapsed. would introduced from 1 April 2010.

GST Council - Decisions (1/2) Threshold limit for exemption to be Rs. 20 lac (Rs. 10 lac for special category States) Compounding threshold limit to be Rs. 50 lac with - Government may convert existing Area based exemption schemes into reimbursement based scheme Four tax rates namely 5%, 12%, 18% and 28% Some goods and services would be exempt

GST PPT - Presentations on Goods & Service Tax. GST - The Goods and Services Tax - is the mother of all tax reforms in India. It is crucial for all businesses to understand the implications of GST on their brands. Since GST is a new law and crucial processes like return filing and invoicing have been changed, it is even more important ...

GST on Goods. Intra-State Supply. Dual tax -CGST-SGST. Registered office not relevant; location of goods is relevant. Intra-State supply, if 'from' and 'to' in one State. Inter-State Supply. One tax -IGST (higher rate) Movement for 'delivery' relevant; even stock- transfer taxable. Imports -basic customs + IGST.

IT based system- GST portal-registration, returns and refunds Inherited complexity due to pre-GST structure. Separate registrations in each State as opposed to single nationwide registration in pre-GST regime in service sector. Legal provisions and GST rates kept close to the pre-GST regime. Tax rates below the revenue neutral rate. 11

number of taxes (GST replaced 17 taxes), reduced amount of tax, and face less tax-on-tax incidences. The uniform GST rates across the states further reduced the tax burden and compliance cost3. While GST achieved these laudable objectives, however, any system of this size and complexity would need constant improvements with a focus on

Compensation = (State's Revenue for FY 2015-16)* 14%x -State's Revenue (for x year) Revenue of all taxes subsumed in GST by the State for 2015 - 16 as the base. Assumption of 14% Annual Growth Rate. Compensation to be provided through Cess. Cess only on few specified luxury and sin goods.

levy and collect the GST. 3.1 The assignment of concurrent jurisdiction to the Centre and the States for the levy of GST required a unique institutional mechanism that would ensure that decisions about the structure, design and operation of GST are taken jointly. For it to be effective, such a mechanism also needed to have

THE INSTITUTE OF COST ACCOUNTANS OF INDIA

GST Power Point Presentation. Oct 19, 2009 • Download as PPT, PDF •. 535 likes • 338,119 views. AI-enhanced description. P. praveendel. The document discusses Goods and Services Tax (GST) in India. It provides an overview of the current taxation system and its drawbacks. It describes the proposal for GST, which would combine multiple ...

Understanding Goods and Services Tax (Presentation) This document is the same as the presentation released by CBIC above. This document titled ' Understanding Goods and Services Tax (Presentation) ' provides you an overview of the GST journey, features of the GST act, its design and benefits. This presentation, released by Ministry of Broadcasting and Communication, provides a snapshot of:

Sr. No. 1. Form/Functionality Withdrawal of application for cancellation of registration in FORM REG-16 by taxpayers Providing effective date of Suspension in Taxpayer Profile 2. Refunds, Registration, Returns and Payments Functionality made available for Taxpayers Earlier all taxpayers registered as Companies were mandatorily required to use ...

S. Madhavan/ R. Muralidharan Executive Director PricewaterhouseCoopers Pvt. Ltd. 2nd Floor, Vatika Triangle Sushant Lok - 1, Block A Mehrauli Gurgaon Road Gurgaon - 122002 Tel: +91 124 3050000/ 4630000 Fax: +91 124 3050200 Email - [email protected] [email protected].

As already noted, prior to the introduction of GST, the indirect tax system of India suffered from various limitations. There was a burden of tax-on-tax in the pre-GST system of Central excise duty and the sales tax system of the States. GST has taken under its wings a profusion of indirect taxes of the Centre and the States.

CGST, UTGST, IGST, SGST & GST Compensation Law recommended. Formula for calculating compensation finalized. Tax rates. Four tax rates namely 5%, 12%, 18% and 28%. Some goods and services would be exempt. Separate tax rate for precious metals. Cess over the peak rate of 28% on specified luxury and demerit goods.

GST PPT - Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online. The document provides an overview of Goods and Services Tax (GST) in India through a presentation with several slides. It discusses that GST was invented in France in 1950 and implemented there in 1954, and over 160 countries now have GST.

FEATURES OF CAA…. v CAB passed by Rajya Sabha on 03.08.2016 & Lok Sabha on 08.08.2016 v Notified as Constitution (101st Amendment ) Act, 2016 on 08.09.2016 v Key Features: q Concurrent jurisdiction for levy & collection of GST by the Centre & the States - Article 246A q Centre to levy & collect IGST on supplies in the course of

Gst ppt. Mar 15, 2016 • Download as PPTX, PDF •. 457 likes • 451,785 views. AI-enhanced description. Hirak Parmar. GST (Goods and Services Tax) is proposed as India's biggest tax reform. It will replace existing indirect taxes and provide a comprehensive indirect tax levy. GST is proposed as a dual GST with the center and states ...

Object Moved This document may be found here

Free GST PDF Ebook - Download GST Explained PDF. By Annapoorna | Updated on: Nov 22nd, 2023 | 3 min read. Goods and Services Tax or GST as it is popularly known, is the newest taxation system in India. To help you understand all about this new taxation system we have created a GST Book. It is in PDF format and easily downloadable free of cost.

Edit the presentation to suit your needs, ask Copilot to add a slide, or start over with a new presentation and refine your prompt to include more specifics.For example, "Create a presentation about hybrid meeting best practices that includes examples for team building." Create a presentation with a template

T IIJJ . Title: Z: 3East Dreast dr _ 12-19-23 Model (1) Author: Gino Jr Created Date

PPT on 48 GST Council - 14th Feb; PPT on Overview of GST - 3-3-23; PPT on GST and Co-operative Federalism 5.4.23; PPT on 50th GST Council Meeting on Fitment Comittee; PPT on Finance Bill 2023 f (w.e.f. 1.10.2023) PPT on Recent Amendment - Oct'23 & Nov'23; PPT on Role of GST Council and Recent amendment in GST as on 29.11.2023; Important Changes ...

SDS Rate Study Presentation To utilize the full functionality of a fillable PDF file, you must download the form, and fill in the form fields using your default browser. About Mental Health

Sony Group Portal

4. INTERNATIONAL PERSPECTIVES ON GST / VAT: 4.1 VAT and GST are used inter-changeably as the latter denotes comprehensiveness of VAT by coverage of goods and services. France was the first country to implement VAT, in 1954. Presently, more than 160 countries have implemented GST / VAT in some form or the other. The most popular form of

Metro 2028 MCP Overview 2028 Games MCP Goals: −Leave a permanent legacy after the Games −Enable all spectators and workforce to get to the 2028 Games by public transit,

Microsoft PowerPoint - TR2024_Presentation_ NASI 0515 FINAL 2.pptx - Last saved by user Author: 628641 Created Date: 5/15/2024 10:12:20 AM ...