Skip navigation

- Log in to UX Certification

World Leaders in Research-Based User Experience

The use and misuse of focus groups.

January 1, 1997 1997-01-01

- Email article

- Share on LinkedIn

- Share on Twitter

Focus groups are a somewhat informal technique that can help you assess user needs and feelings both before interface design and long after implementation. In a focus group, you bring together 6–9 users to discuss issues and concerns about the features of a user interface. The group typically lasts about 2 hours and is run by a moderator who maintains the group's focus.

Focus groups often bring out users' spontaneous reactions and ideas and let you observe some group dynamics and organizational issues. You can also ask people to discuss how they perform activities that span many days or weeks: something that is expensive to observe directly. However, they can only assess what customers say they do and not the way customers actually operate the product. Since there are often major differences between what people say and what they do, direct observation of one user at a time always needs to be done to supplement focus groups .

In This Article:

Narrow view, getting focused, other issues.

Although focus groups can be a powerful tool in system development, you shouldn't use them as your only source of usability data . People with an advertising or marketing background often rely solely on focus groups to expose products to users. Thus, because advertising and marketing people frequently contribute to website development, focus groups are often used to evaluate web projects. Unfortunately, focus groups are a rather poor method for evaluating interface usability. It is thus dangerous to rely on them as your only method in a web design project. Traditional market research targets products for which usability is a minor concern. When judging, for example, which proposals a politician should support, how sweet a chocolate bar should be, or whether to show a new Mercedes braking in snow or in rain, you need expose a group of consumers only to different versions of the proposal, candy, or commercial, ask them which they prefer, and listen to their reasons as to why they prefer one or the other.

Software products, websites, and other interactive systems also need to be liked by customers, but no amount of subjective preference will make a product viable if users can't use it. To assess whether users can operate an interactive system, the only proper methodology is to watch one user at a time use the system. Because focus groups are groups, individuals rarely get the chance to explore the system on their own; instead, the moderator usually provides a product demo as the basis for discussion. Watching a demo is fundamentally different from actually using the product : There is never a question as to what to do next, and you don't have to ponder the meaning of numerous screen options.

Consider, for example, the problem of windowing versus scrolling as methods for changing the information visible on the screen. The windowing principle says that to see the information in the beginning of a file, the user moves the window to the top of the file. Scrolling, on the contrary, says that to see the beginning of the file, you scroll down the screen until the desired content becomes visible. In other words, the command to get to the top of the file should be called UP (or shown as an upward-pointing arrow) if windowing is preferred, whereas the same command should be called DOWN if scrolling is preferred.

When they actually carry out the task, most users perform better in the windowing model (which is therefore used in most current GUI standards). But if you give a demo of moving text files to people new to computers, many of them will say that the scrolling model characterizes what they are seeing (since they see the text move down to get to the beginning). If GUIs had been designed by focus groups, we would have ended up with a suboptimal command.

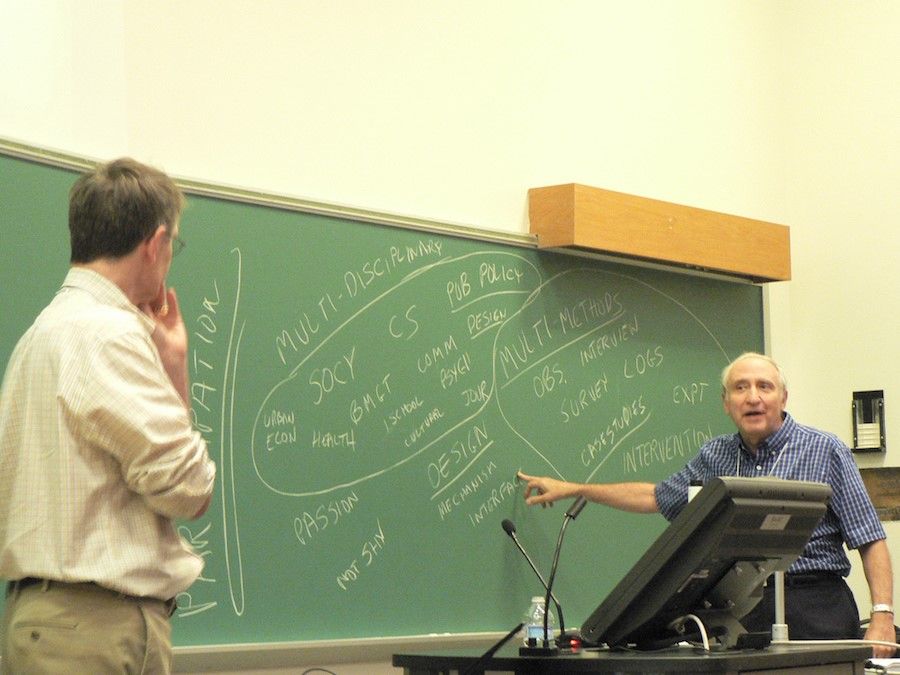

In interactive systems development, the proper role of focus groups is not to assess interaction styles or design usability, but to discover what users want from the system. For example, in developing Sun's new online documentation system, we ran a focus group with system administrators to discover:

- their thoughts and preferences on issues such as distributing and replicating huge documentation files across multiple servers

- whether or not they needed faster access to local copies of the documentation on specific client machines

These questions would never emerge in a usability test (although we did run usability studies to see if administrators could operate the system). We could have investigated the needs of system administrators in other ways — including field trips to customer locations — but it was more efficient to have a focus group discuss the problems in a single session.

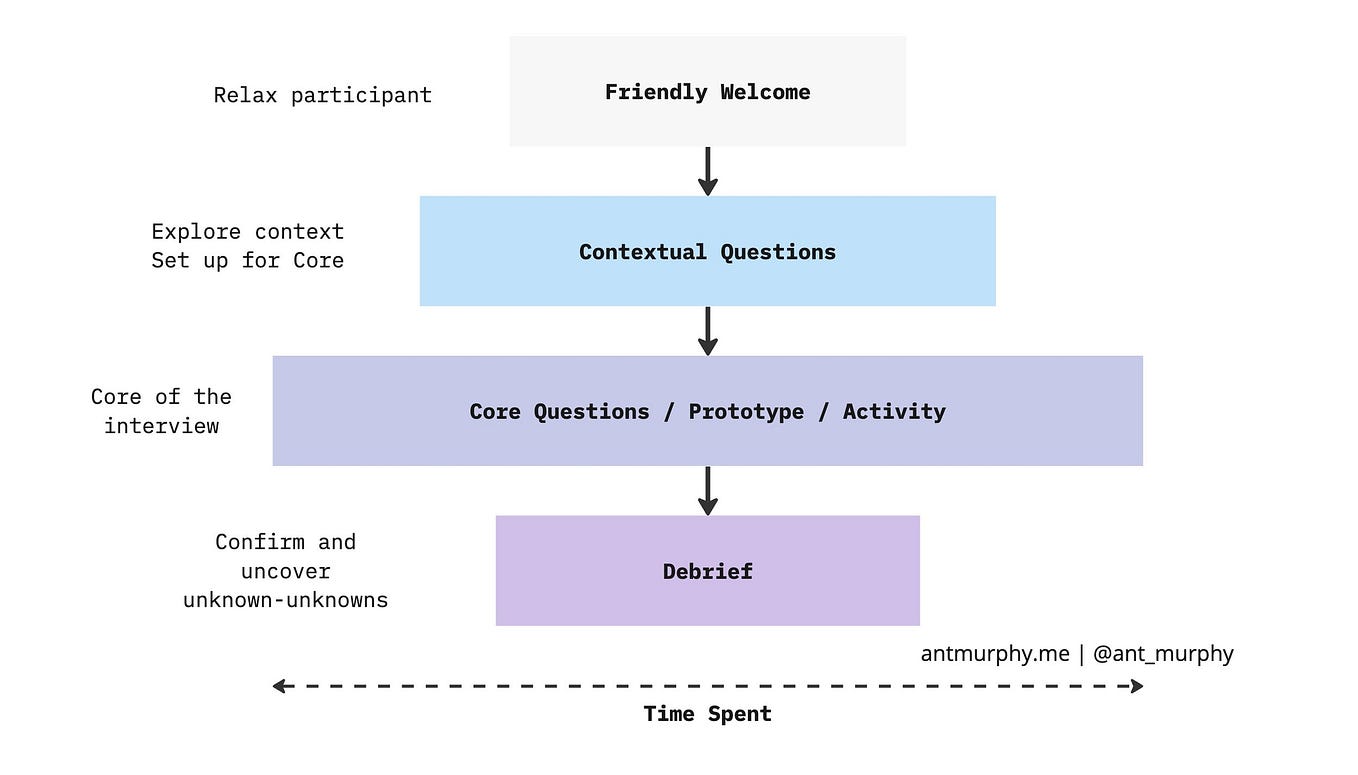

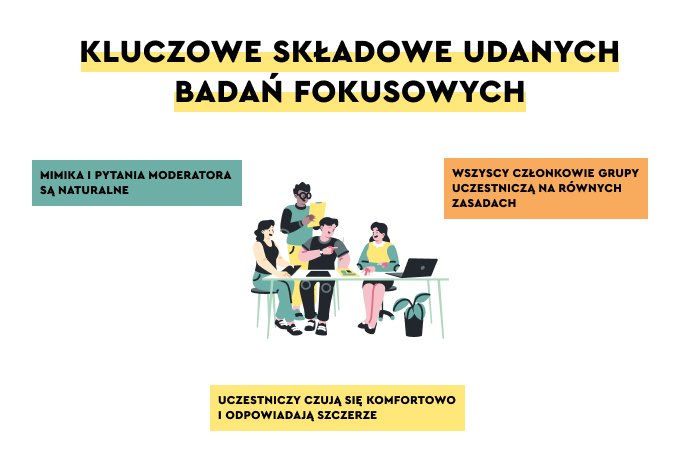

For participants, the focus-group session should feel free-flowing and relatively unstructured, but in reality, the moderator must follow a preplanned script of specific issues and set goals for the type of information to be gathered. During the group session, the moderator has the difficult job of keeping the discussion on track without inhibiting the flow of ideas and comments. The moderator also must ensure that all group members contribute to the discussion and must avoid letting one participant's opinions dominate. After the session, data analysis can be as simple as having the moderator write a short report summing up the prevailing mood in the group, illustrated with a few colorful quotes. You can also do more detailed analyses, but the unstructured nature of the groups make this difficult and time-consuming.

Focus groups require several representative users. Because you need a flowing discussion and various perspectives, the initial focus group should have at least 6 users . Typically, you should run more than one focus group , because the outcome of any single session may not be representative and discussions can get sidetracked.

As with any method based on asking users what they want — instead of measuring or observing how they actually use things — focus groups can produce inaccurate data because users may think they want one thing when they need another . You can minimize this problem by exposing users to the most concrete examples of the technology being discussed as possible.

For example, Irene Greif ran focus groups to assess a version management facility for Lotus 1-2-3. The new features were presented to the focus group as a way to let multiple users compare alternative views of a spreadsheet across computer networks. Initially, group members were skeptical about these ideas and expressed distrust in networks and nervousness about what other people would do to their spreadsheets. After seeing a prototype and scenarios of version management in use, participants moved from skepticism to enthusiasm.

A cheap way to approximate a focus group is to rely on email, websites, or online communities. For example, Yia Yang started a project on undo facilities by posting on the British academic network, asking users which undo facilities they used and how they liked them. Posting questions to a group with an interest in the issues can generate considerable discussion. A disadvantage is that online discussions are difficult (or impossible) to keep confidential unless they take place on an intranet, behind a firewall.

Another disadvantage to this approach is bias . Internet users tend to be people with above-average interest in computers, and participants in online discussion groups tend to have above-average involvement in the group's topic.

Although online discussions are unlikely to reflect the average user's concerns, they can be a good way of getting in touch with power users . These users have needs that will sometimes surface later for the average user. Thus, addressing the power users' needs may be a way of getting a head start on future usability work.

Focus Groups: A Practical Guide for Applied Research (5th edition), by Richard A. Krueger and Mary Anne Casey.

See also: Cost of running a focus group

Related Courses

Discovery: building the right thing.

Conduct successful discovery phases to ensure you build the best solution

User Research Methods: From Strategy to Requirements to Design

How to pick the best UX research method for each stage in the development process

Usability Testing

Learn how to plan, conduct, and analyze your own studies, whether in person or remote

Related Topics

- Research Methods Research Methods

Learn More:

Always Pilot Test User Research Studies

Kim Salazar · 3 min

Level Up Your Focus Groups

Therese Fessenden · 5 min

Inductively Analyzing Qualitative Data

Tanner Kohler · 3 min

Related Articles:

Open-Ended vs. Closed Questions in User Research

Maria Rosala · 5 min

Formative vs. Summative Evaluations

Alita Joyce · 5 min

UX Research Methods: Glossary

Raluca Budiu · 12 min

Quantifying and Comparing Ease of Use Without Breaking the Bank

Christian Rohrer · 18 min

UX Research Cheat Sheet

Susan Farrell · 10 min

Scanning Patterns on the Web Are Optimized for the Current Task

Kara Pernice · 16 min

Advisory boards aren’t only for executives. Join the LogRocket Content Advisory Board today →

- Product Management

- Solve User-Reported Issues

- Find Issues Faster

- Optimize Conversion and Adoption

Conducting a focus group for UX research

UX focus groups are an essential part of product design, allowing designers and developers to gather valuable insights into the needs and preferences of their target audience.

By bringing together a group of individuals who represent the user base, the UX team can observe their behavior, listen to their feedback, and gain a deeper understanding of their needs and preferences.

Conducting UX focus groups can provide numerous benefits, including identifying usability issues, gaining insights into user behavior, and generating ideas for product improvement.

However, to ensure the success of a focus group, you’ll need to carefully plan your group and select the right participants.

By the end of this guide, you’ll have a solid understanding of the importance of UX focus groups, how to plan, set up, and conduct them effectively, and how to use the data gathered for the greatest benefits.

Introduction to UX focus groups and their importance in product design

Online focus groups, in-person focus groups.

- Benefits of conducting UX focus groups

How to choose focus group participants

Planning and setting up a successful focus group, conducting the focus group sessions, example scenario: healthcare tech startup, analyzing the data collected from the focus groups, tips for reporting and presenting focus group findings to stakeholders.

Focus groups allow for drawing out ideas and information that may not be easily shared in interviews or surveys. As a somewhat informal technique, they can assess user needs and feelings both before and after interface design.

Focus groups generate qualitative data in the form of notes, transcripts, audio, and video recordings, which can be synthesized into recommendations for product directions or opportunities.

Typically consisting of 5–10 users and lasting about two hours, focus groups are moderated to maintain focus. They can elicit spontaneous reactions, ideas, and group dynamics, and can explore activities that span over a longer time period, which may be expensive to observe directly. The dynamics among group members can reveal unconscious ideas your team has taken for granted, and their reactions can shed light on important considerations for development teams.

Unlike interviews, the value of focus groups lies in group discussion and interactions among members. However, there is a risk of participants influencing each other or inhibiting honest feedback.

Therefore, it’s important to supplement focus groups with direct observation of individual users because there may be differences between what people say and what they actually do, which is also an important consideration for a UX design team.

Over 200k developers and product managers use LogRocket to create better digital experiences

Types of focus groups

In the field of UX research, focus groups serve a different purpose compared to traditional market research focus groups.

While the latter aims to gather feedback on product ideas and determine their value to target customers, UX research focus groups implement user testing to identify opportunities for improvement in specific elements, aspects, or behaviors of a product or feature. So, to get the data you need, you might need to decide which type of focus group you should go with, be it an online or in-person focus group.

Online focus groups offer convenience but may exclude some potential participants due to poor internet connection, lack of a desktop device, or limited digital literacy. This could result in lower participation rates or difficulties in using unfamiliar online meeting tools or whiteboard platforms.

Online focus groups might be better when the budget is tight because skips the need to rent a place to gather, pay for catering, cover travel costs, and so on. More importantly, if there is a need to check the website or app prototype and gather data on it from different regions, it might be more convenient to use online focus groups.

In-person focus groups are limited to participants within a commutable distance, particularly if the study does not provide travel funding or adequate notice for those commuting from further away. Any shortcomings of in-person focus groups can be overridden with money, but the costs may skyrocket.

On the other hand, when a UX team needs to gather data on the user using one prototype, like a specific device with an app on it, the in-person interview might be the only option.

For example, if you have your first prototype of VR glasses and you want to check how users interact with its interface and how they use it, you will need to bring everyone together to try it because they won’t be able to test it at home.

What are the benefits of conducting UX focus groups

- Focus groups are a good way to draw out ideas and information that participants may not be willing or able to share in an interview or survey

- Being in a small group setting makes people more comfortable and encourages them to discuss sensitive or personal topics

- Focus groups can uncover ideas that were previously unconscious and shed light on the importance of certain considerations

- They are straightforward to organize, usually inexpensive, and provide immediate results

- Results are often more appealing than raw data and provide extensive interaction among participants

- Moderators guide the discussion according to research objectives, and the process can be observed in real-time

Recruiting participants for a focus group involves identifying the individuals who can answer your research questions. For early-stage development, highly diverse individuals are preferred within the target market.

Screener surveys should focus on filtering participants based on traits that are relevant to the research question, rather than just demographics. Online communities can be a cheaper way to generate discussion and get in touch with appropriate users.

To create a balanced group, it is important to consider introverted and extroverted participants and conduct a group with only self-identified introverts if necessary.

When recruiting, researchers should select participants based on specific traits or characteristics, such as age, occupation, experience, education, and ethnicity. The ultimate goal is to get feedback from the target audience/demographics that might benefit the UX research the most.

To plan and execute a successful focus group, it’s crucial to prepare in advance by ensuring all logistics are in place, such as writing materials, user devices, and recording equipment.

Making participants feel comfortable is key, so greet them warmly and provide refreshments and necessary tools like pens and paper or internet access.

Before deciding on a focus group study, ensure it’s the right method to meet your research goals, which should be specific, practical, and actionable. The location of the group will impact group dynamics, so choose a comfortable, distraction-free space that mimics where participants typically discuss the subject matter.

Group size affects the discussion, so aim for 5 to 10 participants and conduct 3 to 6 groups depending on your study requirements.

Communicate effectively with participants, including sending them clear information on time, date, location, and research topic, and obtain their documented informed consent.

To get the most out of your focus group sessions, it’s important to plan ahead and follow a few key steps:

- Determine the goal of the focus group and create a list of questions to meet those objectives

- Choose a suitable location and time for the focus group, and keep the session to about two hours with the allotted time for each question

- Start with an icebreaker to help participants feel comfortable sharing feedback, and take notes for easy reference and sharing

- Have a prototype prepared for users to interact with, and use a moderator to keep the conversation on track and encourage participation

UX focus groups are essential for understanding your product from the user’s perspective and gaining valuable feedback. When conducted properly, they provide insight into your target users and what they really need.

Conducting focus groups is a common approach used in three distinct situations: during the initial stages of a research study, while developing a plan of action for research, and after the study’s completion to establish the results.

As an illustration, let’s consider a healthcare tech startup that is creating a mobile app to help people manage their mental health.

The startup selects a group of individuals that match their target user demographics, such as people with a mental health issues history, for a productive discussion. The moderator asks questions about the types of features they would like to see in a mental health app and how they prefer to interact with it. Group members discuss why they do or do not find certain features appealing and how they feel about specific user interface design elements.

Based on the feedback, the startup can create a mobile app that caters to the specific needs and wants of its target users.

Questions that you might ask during the focus group meeting will usually be divided into four parts. For our example scenario, they might look like this:

- Primary question : What are your thoughts on the idea of a mobile app to manage mental health?

- Probe questions : Can you describe your experience with mental health apps, if any? What features do you think are essential for a mental health app to have? How do you currently manage your mental health, if at all?

- Questions to follow up : Could you elaborate on why you find this feature appealing? How important is it for you to have privacy and confidentiality while using a mental health app? What would make you switch from your current mental health management method to using a mobile app?

- Questions for the conclusion : To summarize, what are the top three features that you would like to see in the app? Is there anything that we have not discussed yet that you would like to add to the conversation?

Analyzing UX focus group data can be challenging due to the high volume of data your group will produce. To effectively analyze the data, have both the video and transcript to capture nonverbal communication accurately.

Focus group note-taking tips, such as drawing a seating chart, recording observations about group dynamics, and noting down key points and themes, can make analysis easier.

Reviewing notes after each session and using qualitative coding to tag the data can help to organize, tabulate, and analyze patterns and themes. Themes and categories to consider include likes and dislikes, emotive words, mental models, problems/issues, and ideas/opportunities.

When analyzing the data, consider the words used, the intensity of feelings behind responses, the frequency of certain comments, and the context of particular responses. Analyzing each session individually and then conducting a meta-analysis of key insights and themes can provide valuable insights.

When sharing your UX focus group findings, remember that the value of focus groups lies in their ability to provide big-picture, qualitative information about people. Key things to consider:

- Use your initial research questions as a guide and focus on the key insights, themes, and takeaways that relate back to your study goals

- If your focus groups involve group activities, consider including the outputs of these activities in your final report

- Sharing video clips and key quotes can also help stakeholders connect with the data, but always contextualize the information for people who weren’t in the room

Your job as a researcher is to help people make sense of the research, and that is why make sure to use some visuals and charts to appeal to stakeholders and keep their attention on the most important findings.

Wrapping up

To sum up, focus groups are an important UX research method that can uncover valuable insights for product design. They allow for group discussions and interactions among participants and they generate qualitative data that can be synthesized into recommendations for product directions or opportunities.

If this article has you doubting whether a focus group is right for your use case, there are plenty of other UX research methods to consider. You may find another method that’s better for your budget or situation.

And for those of you ready to conduct your next focus group, we hope you carry this advice into your study.

Header image source: IconScout

LogRocket : Analytics that give you UX insights without the need for interviews

LogRocket lets you replay users' product experiences to visualize struggle, see issues affecting adoption, and combine qualitative and quantitative data so you can create amazing digital experiences.

See how design choices, interactions, and issues affect your users — get a demo of LogRocket today .

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Facebook (Opens in new window)

- #ux research

Stop guessing about your digital experience with LogRocket

Recent posts:.

Figma Dev Mode: What it can and can’t do for a UX designer

Figma Dev Mode has an easy-to-work-with UI and layout and makes collaboration with other team members far easier.

Creating user friendly support documents that relieve customer support strain

Ideally, UX designers should collaborate with customer support agents more often to improve user experience. Here’s how they can start.

Reimagining Gantt charts for UX project management

Gantt charts, if applied correctly, can be a strategic asset for keeping your head above the waves of complexities in UX projects.

13 UX Podcasts to subscribe to in 2024

Interested in everything UX design? Check out these 13 UX podcasts that are sure to be a blast to listen to.

Leave a Reply Cancel reply

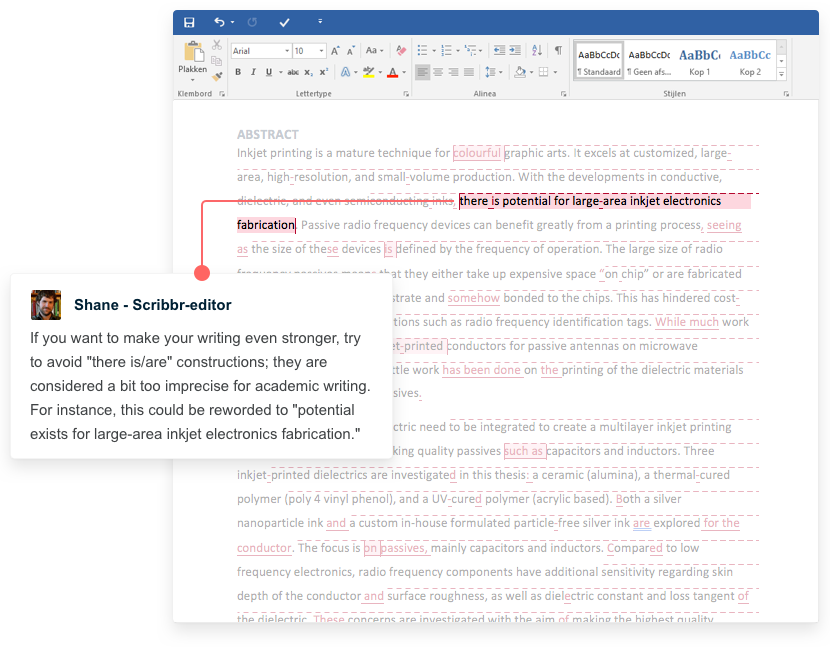

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

Methodology

- What Is a Focus Group? | Step-by-Step Guide & Examples

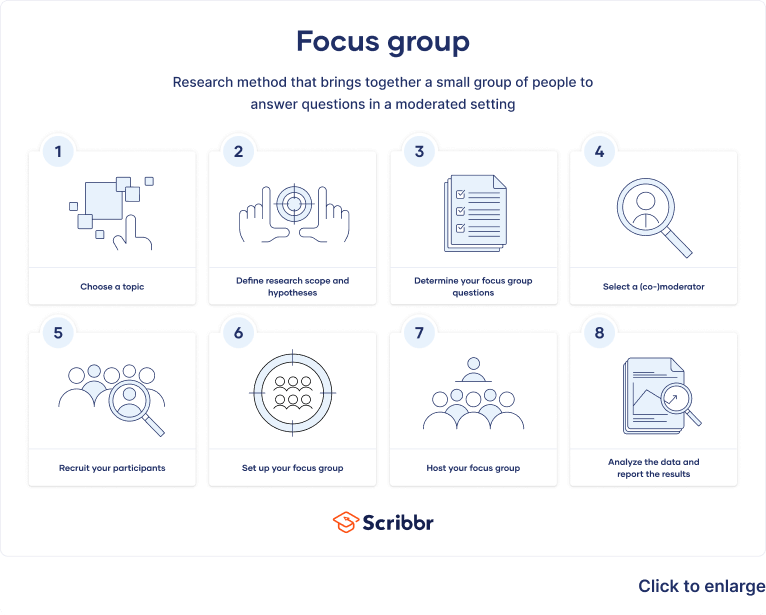

What is a Focus Group | Step-by-Step Guide & Examples

Published on December 10, 2021 by Tegan George . Revised on June 22, 2023.

A focus group is a research method that brings together a small group of people to answer questions in a moderated setting. The group is chosen due to predefined demographic traits, and the questions are designed to shed light on a topic of interest.

Table of contents

What is a focus group, step 1: choose your topic of interest, step 2: define your research scope and hypotheses, step 3: determine your focus group questions, step 4: select a moderator or co-moderator, step 5: recruit your participants, step 6: set up your focus group, step 7: host your focus group, step 8: analyze your data and report your results, advantages and disadvantages of focus groups, other interesting articles, frequently asked questions about focus groups.

Focus groups are a type of qualitative research . Observations of the group’s dynamic, their answers to focus group questions, and even their body language can guide future research on consumer decisions, products and services, or controversial topics.

Focus groups are often used in marketing, library science, social science, and user research disciplines. They can provide more nuanced and natural feedback than individual interviews and are easier to organize than experiments or large-scale surveys .

Receive feedback on language, structure, and formatting

Professional editors proofread and edit your paper by focusing on:

- Academic style

- Vague sentences

- Style consistency

See an example

Focus groups are primarily considered a confirmatory research technique . In other words, their discussion-heavy setting is most useful for confirming or refuting preexisting beliefs. For this reason, they are great for conducting explanatory research , where you explore why something occurs when limited information is available.

A focus group may be a good choice for you if:

- You’re interested in real-time, unfiltered responses on a given topic or in the dynamics of a discussion between participants

- Your questions are rooted in feelings or perceptions , and cannot easily be answered with “yes” or “no”

- You’re confident that a relatively small number of responses will answer your question

- You’re seeking directional information that will help you uncover new questions or future research ideas

- Structured interviews : The questions are predetermined in both topic and order.

- Semi-structured interviews : A few questions are predetermined, but other questions aren’t planned.

- Unstructured interviews : None of the questions are predetermined.

Differences between types of interviews

Make sure to choose the type of interview that suits your research best. This table shows the most important differences between the four types.

Topics favorable to focus groups

As a rule of thumb, research topics related to thoughts, beliefs, and feelings work well in focus groups. If you are seeking direction, explanation, or in-depth dialogue, a focus group could be a good fit.

However, if your questions are dichotomous or if you need to reach a large audience quickly, a survey may be a better option. If your question hinges upon behavior but you are worried about influencing responses, consider an observational study .

- If you want to determine whether the student body would regularly consume vegan food, a survey would be a great way to gauge student preferences.

However, food is much more than just consumption and nourishment and can have emotional, cultural, and other implications on individuals.

- If you’re interested in something less concrete, such as students’ perceptions of vegan food or the interplay between their choices at the dining hall and their feelings of homesickness or loneliness, perhaps a focus group would be best.

Once you have determined that a focus group is the right choice for your topic, you can start thinking about what you expect the group discussion to yield.

Perhaps literature already exists on your subject or a sufficiently similar topic that you can use as a starting point. If the topic isn’t well studied, use your instincts to determine what you think is most worthy of study.

Setting your scope will help you formulate intriguing hypotheses , set clear questions, and recruit the right participants.

- Are you interested in a particular sector of the population, such as vegans or non-vegans?

- Are you interested in including vegetarians in your analysis?

- Perhaps not all students eat at the dining hall. Will your study exclude those who don’t?

- Are you only interested in students who have strong opinions on the subject?

A benefit of focus groups is that your hypotheses can be open-ended. You can be open to a wide variety of opinions, which can lead to unexpected conclusions.

The questions that you ask your focus group are crucially important to your analysis. Take your time formulating them, paying special attention to phrasing. Be careful to avoid leading questions , which can affect your responses.

Overall, your focus group questions should be:

- Open-ended and flexible

- Impossible to answer with “yes” or “no” (questions that start with “why” or “how” are often best)

- Unambiguous, getting straight to the point while still stimulating discussion

- Unbiased and neutral

If you are discussing a controversial topic, be careful that your questions do not cause social desirability bias . Here, your respondents may lie about their true beliefs to mask any socially unacceptable or unpopular opinions. This and other demand characteristics can hurt your analysis and lead to several types of reseach bias in your results, particularly if your participants react in a different way once knowing they’re being observed. These include self-selection bias , the Hawthorne effect , the Pygmalion effect , and recall bias .

- Engagement questions make your participants feel comfortable and at ease: “What is your favorite food at the dining hall?”

- Exploration questions drill down to the focus of your analysis: “What pros and cons of offering vegan options do you see?”

- Exit questions pick up on anything you may have previously missed in your discussion: “Is there anything you’d like to mention about vegan options in the dining hall that we haven’t discussed?”

Prevent plagiarism. Run a free check.

It is important to have more than one moderator in the room. If you would like to take the lead asking questions, select a co-moderator who can coordinate the technology, take notes, and observe the behavior of the participants.

If your hypotheses have behavioral aspects, consider asking someone else to be lead moderator so that you are free to take a more observational role.

Depending on your topic, there are a few types of moderator roles that you can choose from.

- The most common is the dual-moderator , introduced above.

- Another common option is the dueling-moderator style . Here, you and your co-moderator take opposing sides on an issue to allow participants to see different perspectives and respond accordingly.

Depending on your research topic, there are a few sampling methods you can choose from to help you recruit and select participants.

- Voluntary response sampling , such as posting a flyer on campus and finding participants based on responses

- Convenience sampling of those who are most readily accessible to you, such as fellow students at your university

- Stratified sampling of a particular age, race, ethnicity, gender identity, or other characteristic of interest to you

- Judgment sampling of a specific set of participants that you already know you want to include

Beware of sampling bias and selection bias , which can occur when some members of the population are more likely to be included than others.

Number of participants

In most cases, one focus group will not be sufficient to answer your research question. It is likely that you will need to schedule three to four groups. A good rule of thumb is to stop when you’ve reached a saturation point (i.e., when you aren’t receiving new responses to your questions).

Most focus groups have 6–10 participants. It’s a good idea to over-recruit just in case someone doesn’t show up. As a rule of thumb, you shouldn’t have fewer than 6 or more than 12 participants, in order to get the most reliable results.

Lastly, it’s preferable for your participants not to know you or each other, as this can bias your results.

A focus group is not just a group of people coming together to discuss their opinions. While well-run focus groups have an enjoyable and relaxed atmosphere, they are backed up by rigorous methods to provide robust observations.

Confirm a time and date

Be sure to confirm a time and date with your participants well in advance. Focus groups usually meet for 45–90 minutes, but some can last longer. However, beware of the possibility of wandering attention spans. If you really think your session needs to last longer than 90 minutes, schedule a few breaks.

Confirm whether it will take place in person or online

You will also need to decide whether the group will meet in person or online. If you are hosting it in person, be sure to pick an appropriate location.

- An uncomfortable or awkward location may affect the mood or level of participation of your group members.

- Online sessions are convenient, as participants can join from home, but they can also lessen the connection between participants.

As a general rule, make sure you are in a noise-free environment that minimizes distractions and interruptions to your participants.

Consent and ethical considerations

It’s important to take into account ethical considerations and informed consent when conducting your research. Informed consent means that participants possess all the information they need to decide whether they want to participate in the research before it starts. This includes information about benefits, risks, funding, and institutional approval.

Participants should also sign a release form that states that they are comfortable with being audio- or video-recorded. While verbal consent may be sufficient, it is best to ask participants to sign a form.

A disadvantage of focus groups is that they are too small to provide true anonymity to participants. Make sure that your participants know this prior to participating.

There are a few things you can do to commit to keeping information private. You can secure confidentiality by removing all identifying information from your report or offer to pseudonymize the data later. Data pseudonymization entails replacing any identifying information about participants with pseudonymous or false identifiers.

Preparation prior to participation

If there is something you would like participants to read, study, or prepare beforehand, be sure to let them know well in advance. It’s also a good idea to call them the day before to ensure they will still be participating.

Consider conducting a tech check prior to the arrival of your participants, and note any environmental or external factors that could affect the mood of the group that day. Be sure that you are organized and ready, as a stressful atmosphere can be distracting and counterproductive.

Starting the focus group

Welcome individuals to the focus group by introducing the topic, yourself, and your co-moderator, and go over any ground rules or suggestions for a successful discussion. It’s important to make your participants feel at ease and forthcoming with their responses.

Consider starting out with an icebreaker, which will allow participants to relax and settle into the space a bit. Your icebreaker can be related to your study topic or not; it’s just an exercise to get participants talking.

Leading the discussion

Once you start asking your questions, try to keep response times equal between participants. Take note of the most and least talkative members of the group, as well as any participants with particularly strong or dominant personalities.

You can ask less talkative members questions directly to encourage them to participate or ask participants questions by name to even the playing field. Feel free to ask participants to elaborate on their answers or to give an example.

As a moderator, strive to remain neutral . Refrain from reacting to responses, and be aware of your body language (e.g., nodding, raising eyebrows) and the possibility for observer bias . Active listening skills, such as parroting back answers or asking for clarification, are good methods to encourage participation and signal that you’re listening.

Many focus groups offer a monetary incentive for participants. Depending on your research budget, this is a nice way to show appreciation for their time and commitment. To keep everyone feeling fresh, consider offering snacks or drinks as well.

After concluding your focus group, you and your co-moderator should debrief, recording initial impressions of the discussion as well as any highlights, issues, or immediate conclusions you’ve drawn.

The next step is to transcribe and clean your data . Assign each participant a number or pseudonym for organizational purposes. Transcribe the recordings and conduct content analysis to look for themes or categories of responses. The categories you choose can then form the basis for reporting your results.

Just like other research methods, focus groups come with advantages and disadvantages.

- They are fairly straightforward to organize and results have strong face validity .

- They are usually inexpensive, even if you compensate participant.

- A focus group is much less time-consuming than a survey or experiment , and you get immediate results.

- Focus group results are often more comprehensible and intuitive than raw data.

Disadvantages

- It can be difficult to assemble a truly representative sample. Focus groups are generally not considered externally valid due to their small sample sizes.

- Due to the small sample size, you cannot ensure the anonymity of respondents, which may influence their desire to speak freely.

- Depth of analysis can be a concern, as it can be challenging to get honest opinions on controversial topics.

- There is a lot of room for error in the data analysis and high potential for observer dependency in drawing conclusions. You have to be careful not to cherry-pick responses to fit a prior conclusion.

If you want to know more about statistics , methodology , or research bias , make sure to check out some of our other articles with explanations and examples.

- Student’s t -distribution

- Normal distribution

- Null and Alternative Hypotheses

- Chi square tests

- Confidence interval

- Quartiles & Quantiles

- Cluster sampling

- Stratified sampling

- Data cleansing

- Reproducibility vs Replicability

- Peer review

- Prospective cohort study

Research bias

- Implicit bias

- Cognitive bias

- Placebo effect

- Hawthorne effect

- Hindsight bias

- Affect heuristic

- Social desirability bias

A focus group is a research method that brings together a small group of people to answer questions in a moderated setting. The group is chosen due to predefined demographic traits, and the questions are designed to shed light on a topic of interest. It is one of 4 types of interviews .

As a rule of thumb, questions related to thoughts, beliefs, and feelings work well in focus groups. Take your time formulating strong questions, paying special attention to phrasing. Be careful to avoid leading questions , which can bias your responses.

There are various approaches to qualitative data analysis , but they all share five steps in common:

- Prepare and organize your data.

- Review and explore your data.

- Develop a data coding system.

- Assign codes to the data.

- Identify recurring themes.

The specifics of each step depend on the focus of the analysis. Some common approaches include textual analysis , thematic analysis , and discourse analysis .

Every dataset requires different techniques to clean dirty data , but you need to address these issues in a systematic way. You focus on finding and resolving data points that don’t agree or fit with the rest of your dataset.

These data might be missing values, outliers, duplicate values, incorrectly formatted, or irrelevant. You’ll start with screening and diagnosing your data. Then, you’ll often standardize and accept or remove data to make your dataset consistent and valid.

The four most common types of interviews are:

- Structured interviews : The questions are predetermined in both topic and order.

- Focus group interviews : The questions are presented to a group instead of one individual.

It’s impossible to completely avoid observer bias in studies where data collection is done or recorded manually, but you can take steps to reduce this type of bias in your research .

Scope of research is determined at the beginning of your research process , prior to the data collection stage. Sometimes called “scope of study,” your scope delineates what will and will not be covered in your project. It helps you focus your work and your time, ensuring that you’ll be able to achieve your goals and outcomes.

Defining a scope can be very useful in any research project, from a research proposal to a thesis or dissertation . A scope is needed for all types of research: quantitative , qualitative , and mixed methods .

To define your scope of research, consider the following:

- Budget constraints or any specifics of grant funding

- Your proposed timeline and duration

- Specifics about your population of study, your proposed sample size , and the research methodology you’ll pursue

- Any inclusion and exclusion criteria

- Any anticipated control , extraneous , or confounding variables that could bias your research if not accounted for properly.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

George, T. (2023, June 22). What is a Focus Group | Step-by-Step Guide & Examples. Scribbr. Retrieved March 25, 2024, from https://www.scribbr.com/methodology/focus-group/

Is this article helpful?

Tegan George

Other students also liked, what is qualitative research | methods & examples, explanatory research | definition, guide, & examples, data collection | definition, methods & examples, unlimited academic ai-proofreading.

✔ Document error-free in 5minutes ✔ Unlimited document corrections ✔ Specialized in correcting academic texts

- Get in touch

- Enterprise & IT

- Banking & Financial Services

- News media & Entertainment

- Healthcare & Lifesciences

- Networks and Smart Devices

- Education & EdTech

- Service Design

- UI UX Design

- Data Visualization & Design

- User & Design Research

- In the News

- Our Network

- Voice Experiences

- Golden grid

- Critical Thinking

- Enterprise UX

- 20 Product performance metrics

- Types of Dashboards

- Interconnectivity and iOT

- Healthcare and Lifesciences

- Airtel XStream

- Case studies

Data Design

- UCD vs. Design Thinking

User & Design Research

Focus groups.

A Focus group refers to a group of 10 or fewer individuals who gather in a room to discuss a product, service, concept or merely an idea. A focus group is a qualitative research method to find out different attitudes, responses about a subject. The Focus group can either react or discuss a series of survey questions or are given statements on which they share opinions.

Quick details: Focus Groups

Structure: Structured, Semi-structured

Preparation: Questions/ Topics, Participant recruitment

Deliverables: Recordings, Transcripts, Documentation

More about Focus groups

A focus group may also be given a product or service to try and then elicit reactions, feelings and general attitude towards that product or service in a group.

Focus groups are usually conducted by or on behalf of a business or organization, for market research. An experienced and skilled design research company who specializes in focus groups, can prove to be extremely valuable in planning, conducting, recruiting and evaluating data collected from focus group sessions and further translating them into insights for the business or organization to use.

Focus groups are traditionally carried out face-to-face, but online focus groups through web chat and forums are becoming increasingly popular. They are also more cost effective for organizations.

Focus groups are most helpful in situations where an immediate response can be used to improve a product, service offering, a campaign or even a simple concept.

Advantages of Focus groups

1. firsthand customer interaction.

Businesses can interact with their customers firsthand through focus groups. Working face-to-face with real customers and not an imaginary character can reveal deeper insights into the opinion as well as the behavior of their customers.

2. Deep Insights

An observant researcher can interpret the participant’s mood from their body language as well as tone of voice.

3. Time and Cost effective

Interviewing large groups of people together is more time and cost effective than interviewing people individually. Focus groups are quite useful in quick data collection from the group.

4. Simulated Customer Experience

In order to test a product, idea or service, customer experience can be simulated within a focus group and feedback can be collected on that experience for improvement even before the new product, service or concept is launched in the market. Of course, some elements must be controlled during the simulation but this approach can lead to data that can help tweak the offering .

5. Adaptive Conversation

The facilitator can steer the conversation or discussion on the idea under considered in the desired direction .

6. Variety of thoughts

Depending on the diversity of your focus group, the thoughts or opinions could be just as diverse .

Disadvantages of Focus groups

1. very situation specific.

Unlike most other design research methods, focus groups are applicable in all cases .

2. Not in-depth

Compared to in-depth interviews, focus groups do not allow the facilitator to dig deeper with every participant in the limited time allotted for the focused discussion.

3. Peer pressure

A few participants of a focus group may not express their opinions openly, get influenced by the opinions of other participants or sometimes not express themselves at all in a focus group discussion.

4. Relatively costly

Compared to surveys, focus group discussions are more expensive to execute as they also involve paying a fee to the participants of the focus group .

Think Design's recommendation

Focus groups is a very effective method when you need to get opinions of respondents in a group. Usually, users’ opinions about a product, service or a brand are influenced by several people and in real life, users do discuss these among peers. Focus group is a way of capturing those dynamics and is usually used for validating something.

Focus groups as a technique has recently been criticized due to an inherent issue: that generally, one of the participants is much more dominating than the others and tends to influence the entire group. In such a case, the outcome may be representative of such participant and not the entire group. However, we do believe that focus group is still one of the most widely used research methods and continue to be so. It does need an experienced moderator so that any challenges while conducting it are mitigated.

Was this Page helpful?

Related methods.

- Card Sorting

- Concurrent Probing

- Contextual Inquiry

- Dyads & Triads

- Extreme User Interviews

- Fly On The Wall

- In-depth Interviews

- Personal Inventory

- Retrospective Probing

- Unfocus Group

- User Testing/ Validation

- Word Concept Association

Services & Expertise

Ui ux design, service design.

We use cookies to ensure that we give you the best experience on our website. If you continue we'll assume that you accept this. Learn more

Recent Tweets

Sign up for our newsletter.

Subscribe to our newsletter to stay updated with the latest insights in UX, CX, Data and Research.

Get in Touch

Thank you for subscribing.

You will be receive all future issues of our newsletter.

Thank you for Downloading.

One moment….

While the report downloads, could you tell us…

What are Focus Groups in User Experience Research?

A focus group is a qualitative research method that aims to gather quick user insights from a variety of people in a short period of time.

Focus groups are designed to gain an understanding of customer opinions and perceptions of new concepts or ideas. They are typically used during the design and early stages of the research phase to gain consensus on customer perception. Focus groups are also useful after the product has been implemented since it helps to gather user insights on a functioning product.

The goal of a focus group is to get many participants in a room to gather as many different ideas and perspectives as possible. However, having too many people can limit the ability to gather feedback from all participants. After all, there isn’t a linear relationship between the number of participants and the number of insights. We found that the ideal group size for a focus group is 8 – 10 people.

It is also recommended to facilitate three or four different focus groups to ensure a good mix of perspectives and ideas.

Preparing for your Focus Group

Focus groups require the researcher to create a list of questions, or a discussion guide, to structure the group conversation. However, feel free to let conversations evolve as they will without researcher intervention. The session should generally last from 60 to 90 minutes.

Once you have the objectives for your focus group, you should start recruiting for it. If you’d like to learn more about recruiting participants for high-quality user insights, read this post.

Also, you should select a location that is convenient for your participants. If you don’t have space in your office, you can find conference rooms on sites like Breather .

Once you’ve done that, send a follow-up invitation with the proposed agenda, topics for discussion, and location details. It’s a good idea to send over the topic ahead of time so participants can opt out, especially if it’s a sensitive topic.

Conducting the Focus Group

While conducting the focus group, ask permission to record the session so you can reference it in the future. It will be helpful to refer to the recording in the synthesis phase in case there are any gaps in your notes.

If co-workers want to join, have them sit on the outskirts of the room, quietly taking notes. As a facilitator, it’s difficult to take notes while conducting the focus group so leave room for breaks so your co-workers can ask questions .

During the session, encourage equal participation among the group. If a few people dominate the conversation, call on others to participate. Also, consider a round-table approach in which you go around the table, giving each person a chance to answer each question.

Lastly, avoid abrupt topic changes. Even though you created a discussion guide, allow the conversation to naturally unfold. This is how you will gain the most valuable user insights.

Following the Session

After the focus group, review any notes and recordings. Write down any points of group consensus, surprises or unexpected topics and review with your co-workers.

Advantages of Conducting a Focus Group

As a socially-oriented research method, focus groups capture real-life data in a social setting. The research team will be able to see how participants speak about a particular topic. Typically, points of consensus will be highlighted during the focus group.

Focus groups generate quick results. Unlike moderated sessions, where you’ll spend hours and hours gathering user insights from 6-8 individual participants, focus groups yield similar insights in an hour or two. Focus groups produce a large amount of data on a topic in a short period of time.

Group conversations often bring out aspects of a topic or reveal information about a subject that may not have been anticipated by the researcher or emerged from individual interviews.

Lastly, it provides access to comparisons that participants make between personal experiences. This can be very valuable and provide access to consensus and diversity of experiences on a topic.

Limitations of Conducting a Focus Group

Focus groups are a poor method for evaluating interface usability. Instead, they should be used to evaluate concepts, ideas, and brand perception. In order to conduct a usability study to test prototypes and websites, opt for a moderated or unmoderated session. You’ll be able to easily conduct both types of studies with a comprehensive user testing software.

Another downside of conducting a focus group is that group dynamics can be swayed with strong opinions. Participants may not want to disagree with the larger group but they would be more willing to share their opinion in a one-on-one setting.

You must be diligent with the participants you select since they must be comfortable interacting openly. If they are shy and don’t speak their mind, you won’t be able to surface those valuable user insights that you’re looking for.

As with most facilitated research, moderators can inadvertently influence the data, since they have the ability to sway comments and take the conversation in a different direction.

Lastly, groups can be difficult to pull together since you have to coordinate and schedule participants so that they are in the same room at the same time.

Usability testing methods

International user testing

Idea validation

User Research

Moderated interviews

Unmoderated user research

User research recruiting

Prototype testing

Usability testing

Concept testing

UX research

User Testing Templates

First Impressions Test

Brand Perception Questions

Competitor Testing Questions

Concept Testing Questions

Persona Interview Questions

Website Navigation Menu

Logo Testing Questions

Pricing Model Test

Company Name Test

Start getting user feedback today

What Is a Focus Group and How to Conduct It? (+ Examples)

Appinio Research · 14.09.2023 · 19min read

Have you ever wondered how businesses gain deep insights into consumer behavior, preferences, and opinions? Introducing focus groups—a powerful tool that unlocks the authentic voices of participants and reveals invaluable qualitative data. In this guide, we'll walk you through every step of the focus group process, from meticulous planning and skillful moderation to insightful analysis and actionable recommendations. Whether you're a researcher, marketer, or decision-maker, this guide equips you with the knowledge and strategies to harness the potential of focus groups and make informed, impactful decisions.

What is a Focus Group?

At its core, a focus group is a structured conversation involving a small group of individuals who share their thoughts, feelings, and experiences regarding a particular subject. The primary purpose of a focus group is to uncover nuanced insights that might not emerge through other research methods . You're essentially providing a platform for participants to express themselves freely, leading to a richer, more holistic understanding of the topic.

Why are Focus Groups Important in Market Research?

Focus groups play a pivotal role in market research . They allow you to delve into consumers' motivations, desires, and pain points, helping businesses tailor their products and services to better meet customer needs. Unlike quantitative data, focus groups provide qualitative context, shedding light on "why" people feel the way they do.

Focus groups serve as invaluable tools for gaining insights into people's opinions, attitudes, and perceptions. They bring together a diverse group of participants to engage in open discussions on a specific topic, offering qualitative data that goes beyond quantitative surveys.

Benefits of Conducting Focus Groups

Conducting focus groups offers a range of benefits that contribute to informed decision-making and improved outcomes:

- Rich Insights: Focus groups elicit detailed responses, offering a deeper understanding of participants' perspectives.

- Real-time Interaction: Observing participants' interactions in real-time provides valuable non-verbal cues that text-based surveys can't capture.

- Group Dynamics: Group discussions can stimulate new ideas as participants bounce thoughts off each other.

- Uncovering Unconscious Factors: Focus groups can reveal subconscious opinions or emotions that participants might not even be aware of.

- Flexible Approach: The open-ended nature of focus groups allows for unexpected insights to emerge.

How to Set Up a Focus Group?

Before you embark on your focus group journey, thorough planning and meticulous preparation are crucial to ensuring the success of your sessions. Let's delve deeper into each step of this vital phase.

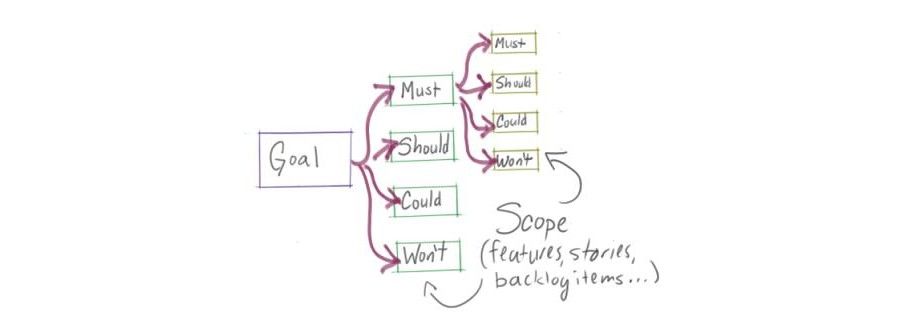

1. Identify Research Objectives

Research objectives serve as the compass guiding your focus group sessions. Clearly define what you aim to achieve through these discussions. Are you seeking insights into customer preferences, testing a new product concept, or exploring perceptions of a brand? Align your objectives with the overarching goals of your research to maintain focus and relevance.

2. Select Participant Demographics

Choosing the right participants is instrumental in obtaining diverse and representative insights. Consider the characteristics that are relevant to your research objectives. These may include:

- Income level

By selecting participants who mirror your target audience, you enhance the accuracy and applicability of your findings.

3. Recruit Participants

Effective participant recruitment is crucial for the success of your focus groups. Utilize various channels such as social media, online forums, email lists, and professional networks. Craft clear and compelling recruitment messages that communicate the focus group's purpose and participation benefits. Ensure that participants are genuinely interested, reliable, and willing to engage in open discussions.

4. Create Discussion Guidelines

Discussion guidelines provide structure to your focus group sessions while allowing for spontaneous conversations. Clearly outline the scope of the discussion, the key topics you intend to cover, and any specific areas of interest. Having a flexible framework ensures that discussions remain on track while permitting organic exploration of the subject matter.

5. Choose a Skilled Moderator

The role of the moderator is pivotal in shaping the dynamics and outcomes of your focus group. Opt for a skilled moderator who possesses strong facilitation and interpersonal skills. The moderator should be capable of guiding discussions, managing group dynamics, and ensuring that all participants have an equal opportunity to contribute. A skilled moderator can navigate unexpected twists in the conversation and encourage deeper insights.

How to Design a Focus Group?

Designing your focus group sessions requires thoughtful consideration of various elements to create an environment conducive to rich discussions.

1. Determine Group Size

The size of your focus group impacts the quality of interactions and the depth of insights. Aim for a balance between having a sufficiently diverse group and maintaining a manageable discussion. Generally, a group of 6 to 10 participants is optimal, allowing for a variety of viewpoints without overwhelming the conversation.

2. Select the Location

The choice of location plays a significant role, particularly for in-person focus groups. Select a comfortable and neutral venue that minimizes distractions and fosters open dialogue. If virtual sessions are more practical, ensure that the online platform is user-friendly and accessible to all participants, regardless of their technical proficiency.

3. Set the Duration

The duration of your focus group session impacts participant engagement and the quality of insights. Sessions typically last between 1 to 2 hours, striking a balance between allowing participants to delve into the topic without exhausting their attention spans. Longer sessions may lead to participant fatigue, which can hinder the quality of responses.

4. Prepare Stimuli (if applicable)

If your research involves presenting stimuli such as visuals, prototypes, or samples, careful preparation is essential. Ensure that your material is ready and relevant to the discussion topics. Stimuli can serve as conversation starters and tangible references for participants, enriching the depth of their responses.

5. Develop Open-Ended Questions

Crafting open-ended questions is an art that drives meaningful conversations. These questions encourage participants to openly share their thoughts, feelings, and experiences. Avoid closed-ended or leading questions, as they limit the scope of responses. Developing thoughtful and open-ended prompts creates opportunities for participants to express themselves authentically.

As you move forward with your focus group journey, remember that every aspect of planning and designing contributes to the quality of insights you'll gain. Your meticulous preparation sets the stage for rich, valuable discussions that uncover nuances and perspectives that quantitative data alone can't provide.

How to Conduct a Focus Group?

With your meticulous planning in place, it's time to bring your focus group to life. Conducting a focus group involves skillful facilitation, attentive moderation, and the ability to navigate diverse perspectives.

Let's explore the intricacies of this process and how to ensure a successful session.

Icebreaker Activities

Begin your focus group session with engaging icebreaker activities. Icebreakers serve multiple purposes, from easing participants into the conversation to creating a comfortable atmosphere for open sharing.

Some common icebreaker activities include:

- Introduction Round: Have each participant introduce themselves, sharing their name, background, and a fun fact related to the topic.

- "Two Truths and a Lie": Participants share two factual statements and one false statement about themselves, prompting discussion as others guess the lie.

Establishing Group Norms

Setting clear group norms from the outset creates a respectful and productive discussion environment. Norms ensure participants feel valued, heard, and safe sharing their viewpoints.

- Active Listening: Encourage attentive listening by asking participants to refrain from interrupting while others speak.

- Respectful Interaction: Emphasize the importance of respectful disagreement and constructive feedback.

- Confidentiality: Stress that participants should keep the discussion content confidential, fostering an environment of trust.

- Equal Participation: Encourage balanced participation by ensuring everyone has a chance to share their thoughts.

Moderator's Role and Techniques

The role of the moderator is pivotal in guiding discussions while maintaining a balanced and focused conversation. A skilled moderator employs various techniques to facilitate meaningful interactions:

- Active Listening: The moderator listens attentively to participants' responses, demonstrating that their opinions are valued.

- Probing: The moderator asks follow-up questions to dig deeper into participants' responses and uncover underlying motivations.

- Reflection: Summarizing participants' contributions shows that their thoughts are being accurately captured.

- Redirecting: If discussions veer off-topic, the moderator gently guides the conversation back to the main subject.

Encouraging Balanced Participation

Balanced involvement ensures that all participants have the opportunity to contribute. Some individuals naturally dominate discussions, while others might hesitate to speak up.

Techniques to encourage balanced participation include:

- Direct Questions: Address specific questions to participants who haven't spoken much, inviting their input.

- Round-Robin Sharing: Go around the group, giving each participant a chance to share their thoughts on a particular topic.

- Thought Pairing: Ask participants to pair up and share their perspectives with a partner before sharing with the larger group.

Probing for Deeper Insights

As discussions progress, employing probing techniques helps uncover deeper insights beneath surface-level responses. Probing involves asking follow-up questions that encourage participants to elaborate on their thoughts and feelings:

- "Why" Questions: Ask participants to explain the reasoning behind their opinions. For example, "Why do you think this approach would be effective?"

- "Tell Me More" Prompt: Encourage participants to elaborate by simply asking them to share more details about a specific point they made.

- Hypothetical Scenarios: Present hypothetical scenarios related to the topic and ask participants how they would respond, leading to more nuanced insights.

By skillfully employing these techniques, you can create an environment where participants feel comfortable expressing their opinions and where discussions naturally flow, leading to in-depth insights that you can later analyze.

How to Collect Focus Group Data?

With your focus group sessions successfully conducted, the next phase involves extracting meaningful insights from the rich discussions. We'll look at popular data collection and analysis methods to ensure that your findings are both accurate and actionable.

Recording and Transcribing Sessions

Recording focus group sessions is essential to capture participants' responses in their own words and preserve the nuances of the conversation.

- Recording: Use audio or video recording equipment to capture the entire discussion. Ensure that participants are comfortable with being recorded and understand the purpose of the recording.

- Transcribing: Transcribe the recorded sessions verbatim. Transcriptions provide a textual version of the discussions, which is easier to review and analyze.

Identifying Key Themes and Patterns

As you review the transcribed discussions, focus on identifying emerging themes and patterns. Themes are recurring topics or ideas that participants discuss, while patterns involve the connections between these themes. Look for insights that align with your research objectives.

- Open Coding: Start with open coding, where you assign preliminary labels to sections of the text corresponding to certain themes.

- Axial Coding: Organize the open codes into broader categories or themes, establishing relationships between them.

- Selective Coding: Refine the codes further, focusing on the most significant themes and their connections.

Coding and Categorizing Responses

Coding and categorization involve systematically organizing participants' responses based on identified themes and patterns. This process allows you to aggregate and compare the data, making it easier to draw conclusions.

- Codebook Development: Create a codebook that outlines the themes, definitions, and examples for each code.

- Applying Codes: Read through the transcribed data and apply the relevant codes to sections corresponding to each theme.

- Categorization: Group similar codes together to form categories that encapsulate broader concepts.

Using Qualitative Analysis Software

Qualitative analysis software can streamline the process of coding, categorization, and data management. Platforms like Appinio offer features that enhance the efficiency and accuracy of your analysis:

- Code Management: Software allows you to easily create, apply, and modify codes.

- Search and Retrieval: Quickly search for specific keywords or themes within the transcribed data.

- Visualization: Some tools provide visual representations of the data, making it easier to identify patterns and trends.

Extracting Actionable Insights

From the coded and categorized data, you can extract actionable insights that inform decision-making. These insights are drawn from the participants' perspectives and can lead to improvements in products, services, or strategies:

- Quoting Participant Responses: Use direct quotes from participants to illustrate key points and provide authenticity to your findings.

- Patterns and Trends: Identify overarching patterns and trends that provide a holistic understanding of participants' opinions.

- Identify Opportunities: Look for opportunities for innovation, improvements, or addressing pain points that participants highlight.

By meticulously analyzing the transcribed data and extracting meaningful insights, you bridge the gap between raw conversation and actionable recommendations that can drive positive change.

How to Analyze Focus Group Data?

As you move into the interpretation and reporting phase of your focus group research, you'll synthesize the gathered insights into a coherent narrative. Here's how you can effectively interpret and communicate your findings to various stakeholders.

1. Summarize Findings

Summarizing the key findings of your focus group sessions provides a concise overview of the insights gathered. Focus on the most salient themes, patterns, and opinions that emerged during the discussions. This summary sets the stage for more in-depth exploration in the subsequent sections.

2. Relate Findings to Research Objectives

Connect the dots between your findings and the initial research objectives you established. Highlight how each identified theme or pattern addresses specific research goals. This linkage reinforces the relevance of your insights and underscores the value of your focus group research.

3. Provide Rich Descriptions

Enrich your report with detailed descriptions of participants' responses. These descriptions add depth and context to your findings, helping stakeholders understand the nuances of participants' opinions and perspectives. Paint a vivid picture of the discussions to ensure your audience gains a comprehensive understanding.

4. Incorporate Participant Quotes

Incorporating direct quotes from participants adds authenticity and humanizes your findings. Quotes allow stakeholders to hear participants' voices firsthand, making the insights more relatable. Select quotes that encapsulate key points, emotions, or unique perspectives shared during the focus group discussions.

5. Make Data-Driven Recommendations

Formulate actionable recommendations based on the insights extracted from your focus group data. These recommendations should be grounded in the participants' perspectives and aligned with your research objectives. Whether refining a marketing strategy, modifying a product feature, or enhancing customer service, your recommendations should be informed and practical.

How to Lead a Focus Group?

Conducting focus groups comes with its own set of challenges. By adhering to best practices, you can navigate these challenges effectively and ensure the integrity of your research.

- Ensure Objectivity and Impartiality: Maintain objectivity throughout your focus group research. As the moderator, your role is facilitating discussions, not influencing outcomes. Avoid expressing personal opinions or steering the conversation in a particular direction.

- Minimize Groupthink and Bias: Be vigilant about group dynamics that might lead to groupthink, where participants conform to the majority opinion. Encourage diverse viewpoints and foster an environment where participants feel comfortable expressing dissenting views.

- Deal with Dominant Participants: In some focus groups, specific individuals may dominate the conversation. Gently redirect the discussion to ensure all participants have an equal contribution opportunity. Use techniques like directly addressing quieter participants for their input.

- Address Sensitive Topics: When discussing sensitive topics, create a supportive and nonjudgmental environment. Approach these discussions with empathy and use considerate language. Clearly communicate that participants are free to share their thoughts without fear of judgment.

- Adapt to Virtual Focus Groups: Virtual focus groups offer convenience but present unique challenges. Ensure participants are comfortable with the technology and provide clear instructions for joining the virtual session. Be prepared to troubleshoot technical issues that may arise.

Navigating these best practices and challenges ensures that your focus group research is conducted ethically, rigorously, and effectively.

Focus Group Examples

Let's explore how focus groups can be applied across various domains to extract valuable insights and drive informed decisions.

Example 1: SaaS Product Development

Imagine a SaaS company aiming to enhance its project management software. To gather insights for improvements, they conduct a focus group with current users:

- Planning: The company identifies research objectives, including user experience enhancement and feature preferences.

- Participants: They recruit a diverse group of existing users, ranging from freelancers to project managers.

- Discussion: The focus group discusses pain points, desired features, and overall user satisfaction.

- Analysis: The company analyzes transcribed discussions, identifying recurring themes like seamless collaboration and customizable dashboards.

- Insights: These insights lead to data-driven decisions, resulting in feature updates like improved collaboration tools and a user-customizable interface.

Example 2: Business Strategy Alignment

A retail chain considers expanding its product offerings. To align their business strategy with customer preferences, they conduct a focus group:

- Planning: The company defines research objectives to understand customer preferences and potential demand.

- Participants: They select a mix of loyal and potential new customers from various demographics.

- Discussion: The focus group explores participants' shopping habits, preferences, and thoughts on the proposed products.

- Analysis: The company identifies patterns, discovering that participants value eco-friendly products and unique offerings.

- Insights: Equipped with insights, the retail chain refines its expansion strategy to include sustainable products and innovative offerings, resonating with customer expectations.

Example 3: Academic Research

An academic researcher is exploring attitudes toward online learning. They decide to use focus groups to delve into students' perspectives:

- Planning: The researcher outlines research objectives centered around understanding students' experiences with online learning.

- Participants: A mix of online and in-person students with varying academic backgrounds and preferences.

- Discussion: The focus group conversations revolve around challenges, advantages, and suggestions for enhancing online education.

- Analysis: The researcher uncovers recurring themes, such as the importance of interactive content and effective communication.

- Insights: The researcher contributes to developing more engaging online courses, prioritizing interactive elements and clear communication channels.

These examples showcase the versatility of focus groups in capturing nuanced insights across diverse domains. Whether it's shaping software features, refining business strategies, or informing academic research, focus groups provide a platform to tap into authentic participant perspectives, resulting in well-informed decisions and strategies.

Focus groups are not just discussions—they're windows into understanding, catalysts for improvement, and sources of innovation. Following the steps outlined in this guide, you've gained the tools to orchestrate meaningful conversations, extract nuanced insights, and translate those insights into actionable recommendations. Remember, each participant's voice adds a unique brushstroke to the canvas of insights, and your role as a skilled moderator brings those brushstrokes to life.

As you venture into focus groups, approach each session with curiosity and openness. Listen actively, probe gently, and navigate group dynamics with finesse. Whether you're fine-tuning a marketing campaign, shaping the next product iteration, or charting the course for your organization's future, the authentic perspectives gathered through focus groups will guide your way. Embrace the art of facilitation, savor the richness of discussion, and let the insights gained propel you toward confident decisions and successful outcomes. Your commitment to the power of dialogue ensures that participants' voices continue to shape meaningful change.

How to Conduct a Focus Group online in Minutes?

Discover the revolutionary way to conduct focus groups and gain invaluable insights in just minutes. Appinio , a dynamic real-time market research platform, empowers companies to tap into consumer perspectives swiftly and effectively.