Build my resume

- Resume builder

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

5 Underwriter Resume Examples Created for 2024

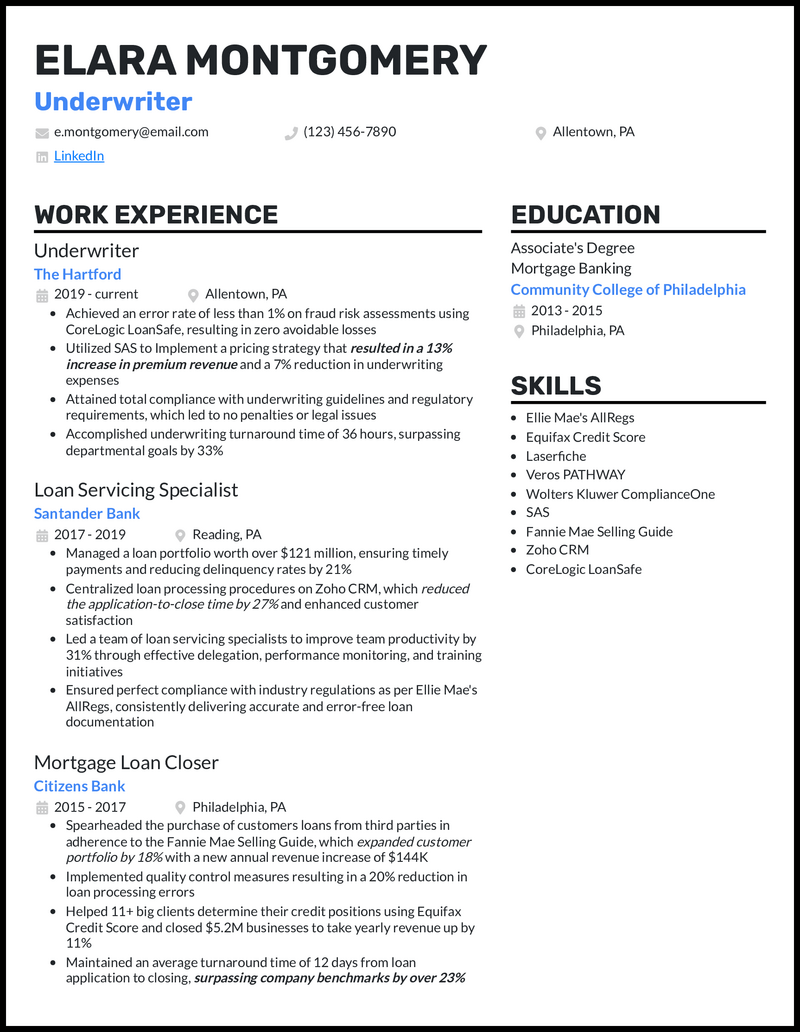

Underwriter Resume

- Underwriter Resumes by Experience

- Underwriter Resumes by Role

- Write Your Underwriter Resume

You effortlessly navigate the complex world of underwriting, ensuring your organization is compliant with the evolving regulatory landscape every step of the way.

Assessing client risk, negotiating contracts, and calculating premiums are things that are now second nature to you. However, you’ll need to tap into a different set of skills to create a stand-out resume that summarizes your strengths.

Good news—we’ve helped many underwriters like you score their dream jobs! Using our sample underwriter resume examples , resume tips , and free cover letter builder , you can land more interviews and, ultimately, the job you desire.

or download as PDF

Why this resume works

- Including your role in managing a $121M loan portfolio in your underwriter resume is adequate evidence to attest to your abilities to perform at the highest levels and deliver desirable results.

Entry Level Underwriter Resume

- Leverage your past work experiences and mention how you’ve used tools such as Pipedrive, eFileCabinet, and your negotiation skills to identify customer trends, analyze financial reports, and manage databases. Have any risk navigator projects up your sleeve? Add them too.

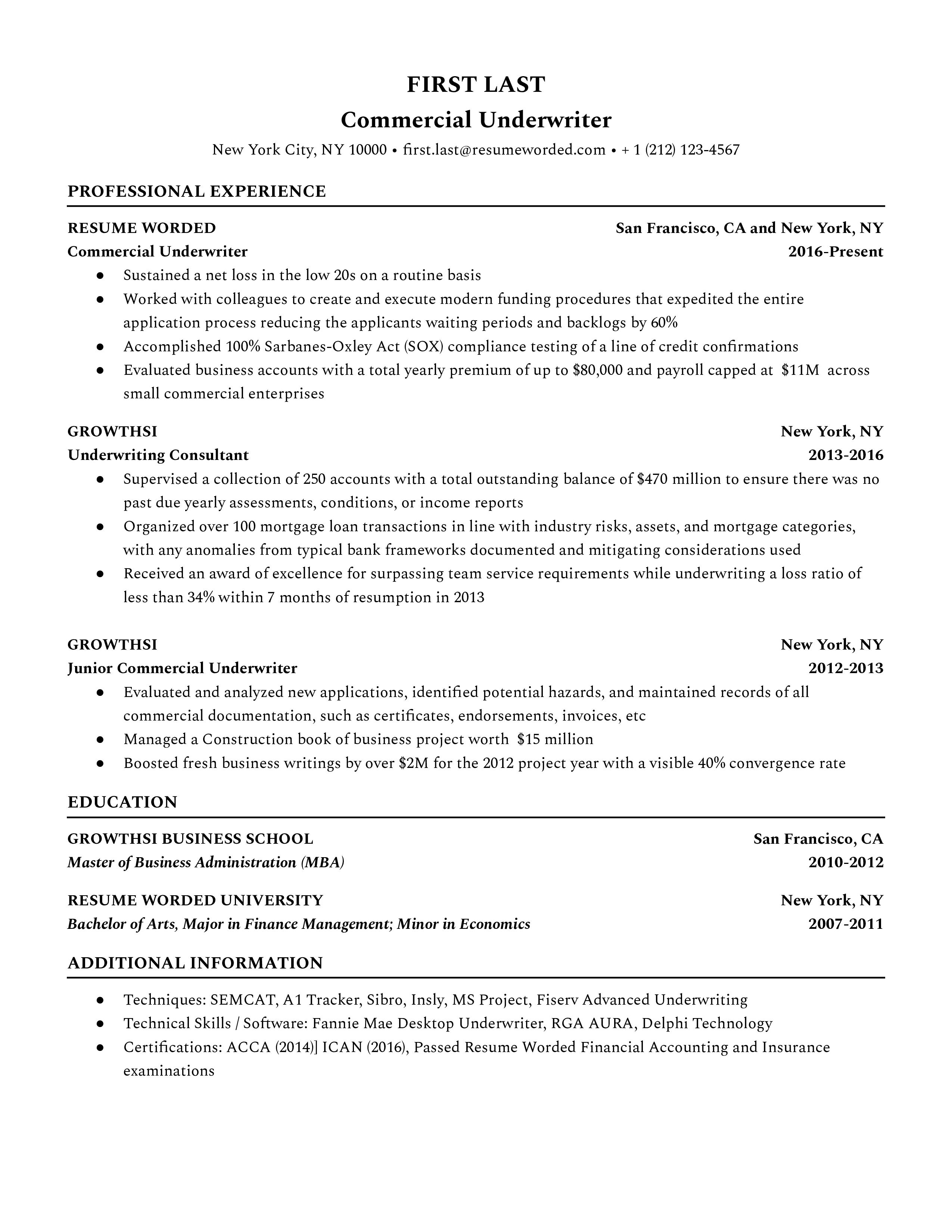

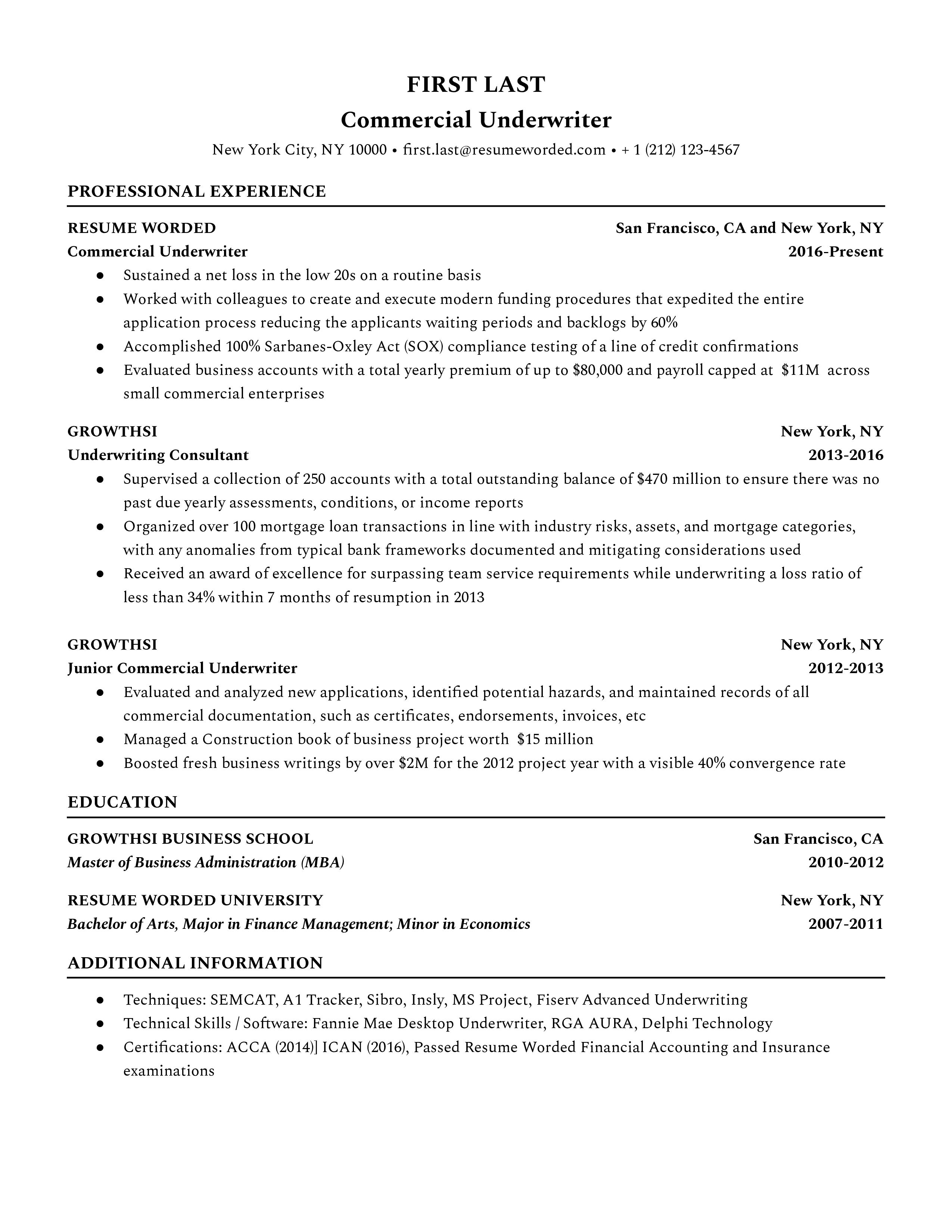

Commercial Underwriter Resume

- It’s also a great addition to having any majors or specialization in insurance and risk management. This will prove that you’re flexible and can help prevent and minimize risk as much as possible to ensure a company makes the best financial decisions at all times for its customers.

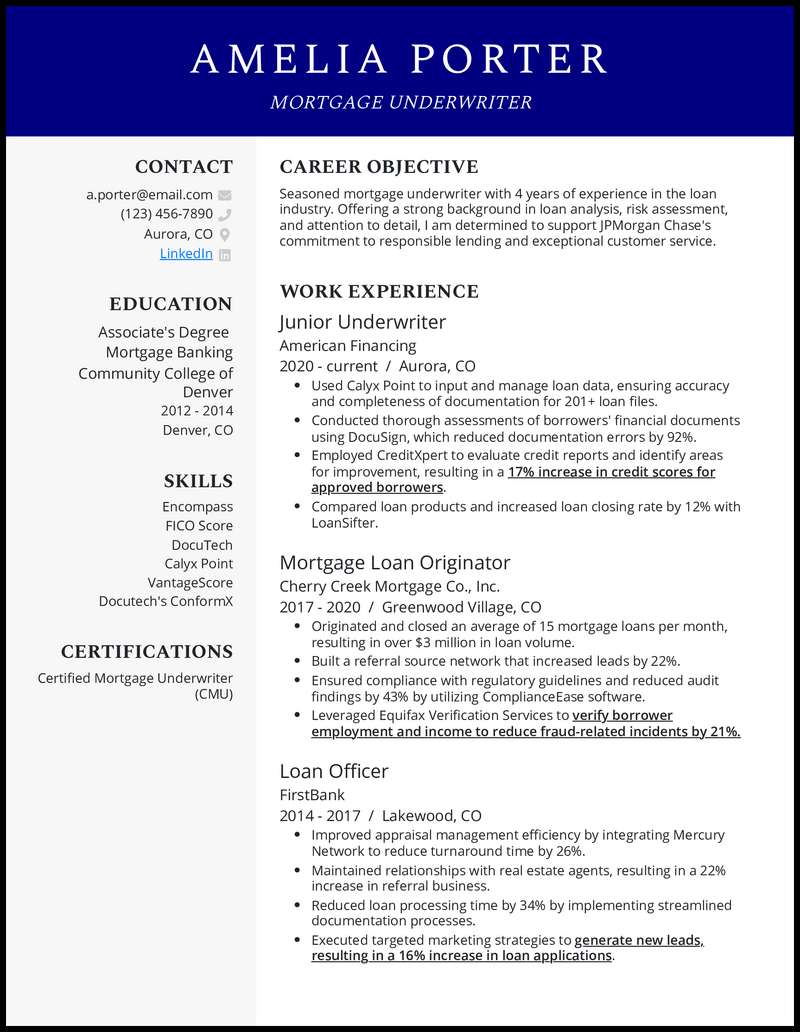

Mortgage Underwriter Resume

- Therefore, your mortgage underwriter resume should show a track record of closed deals through established and trusted networks built over the years if you’re to make a great impression on hiring managers.

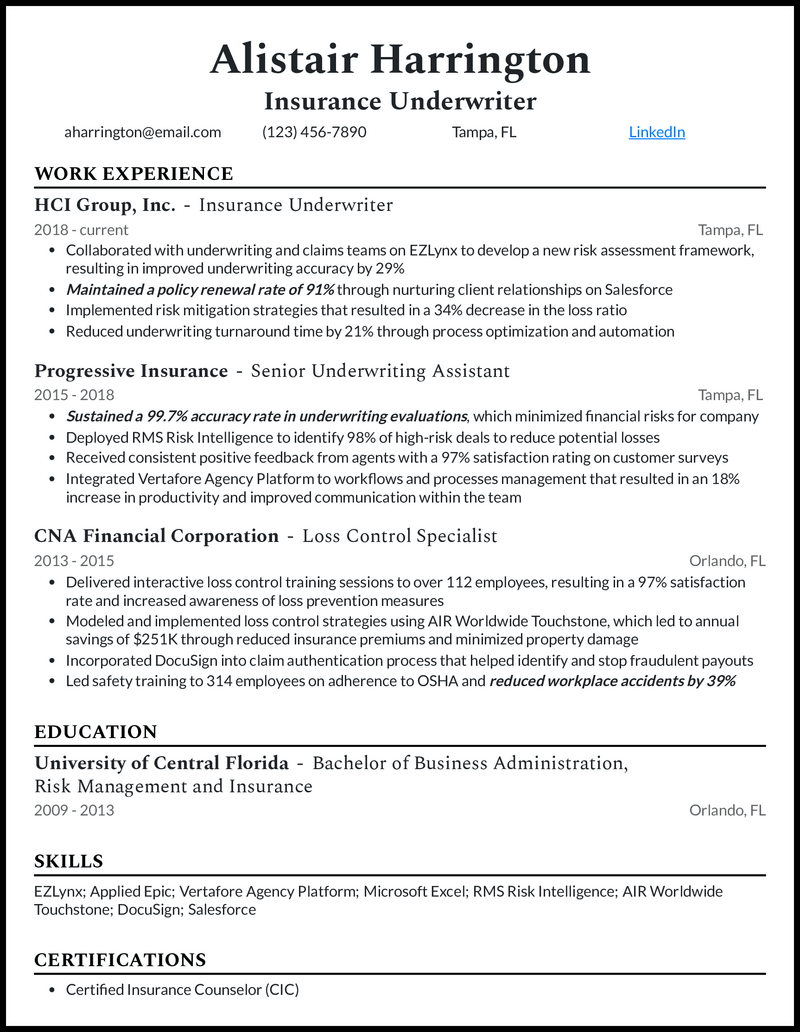

Insurance Underwriter Resume

- Therefore, achieving a 97% customer satisfaction score in your insurance underwriter resume, among other measurable achievements, gives you a niche-specific advantage.

Related resume examples

- Retail Manager

- Retail Sales Associate

- Office Manager

- Office Assistant

- Office Administrator

Fine-tune Your Underwriter Resume to Match the Job

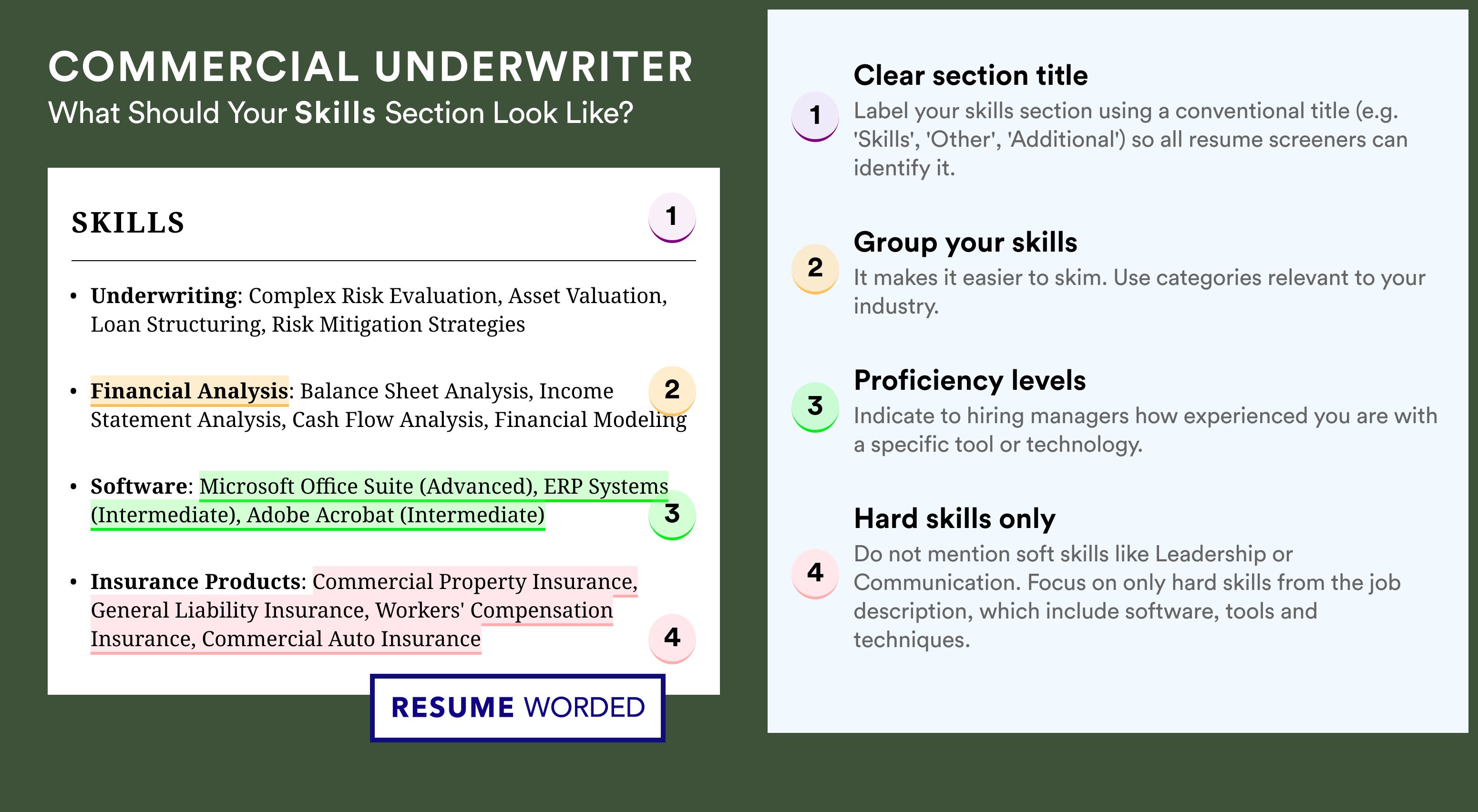

Your work drives companies’ financial decisions when it comes to issuing loans, mortgages, or insurance policies. Lean into your skills and knowledge that guide your process and allow you to make these judgments, avoiding generic terms like “teamwork” or “meticulous.”

Given the analytical nature of underwriting, it’s best to focus primarily on your technical and job-specific skills . Talk about things like regulatory compliance and financial analysis, and don’t forget to mention your software proficiencies, such as underwriting tools, risk management software, or database management systems.

Need some ideas?

15 popular underwriter skills

- Risk Assessment

- Financial Analysis

- Regulatory Compliance

- Database Management

- Microsoft Excel

- RMS Risk Intelligence

- Oracle Database

- Calyx Point

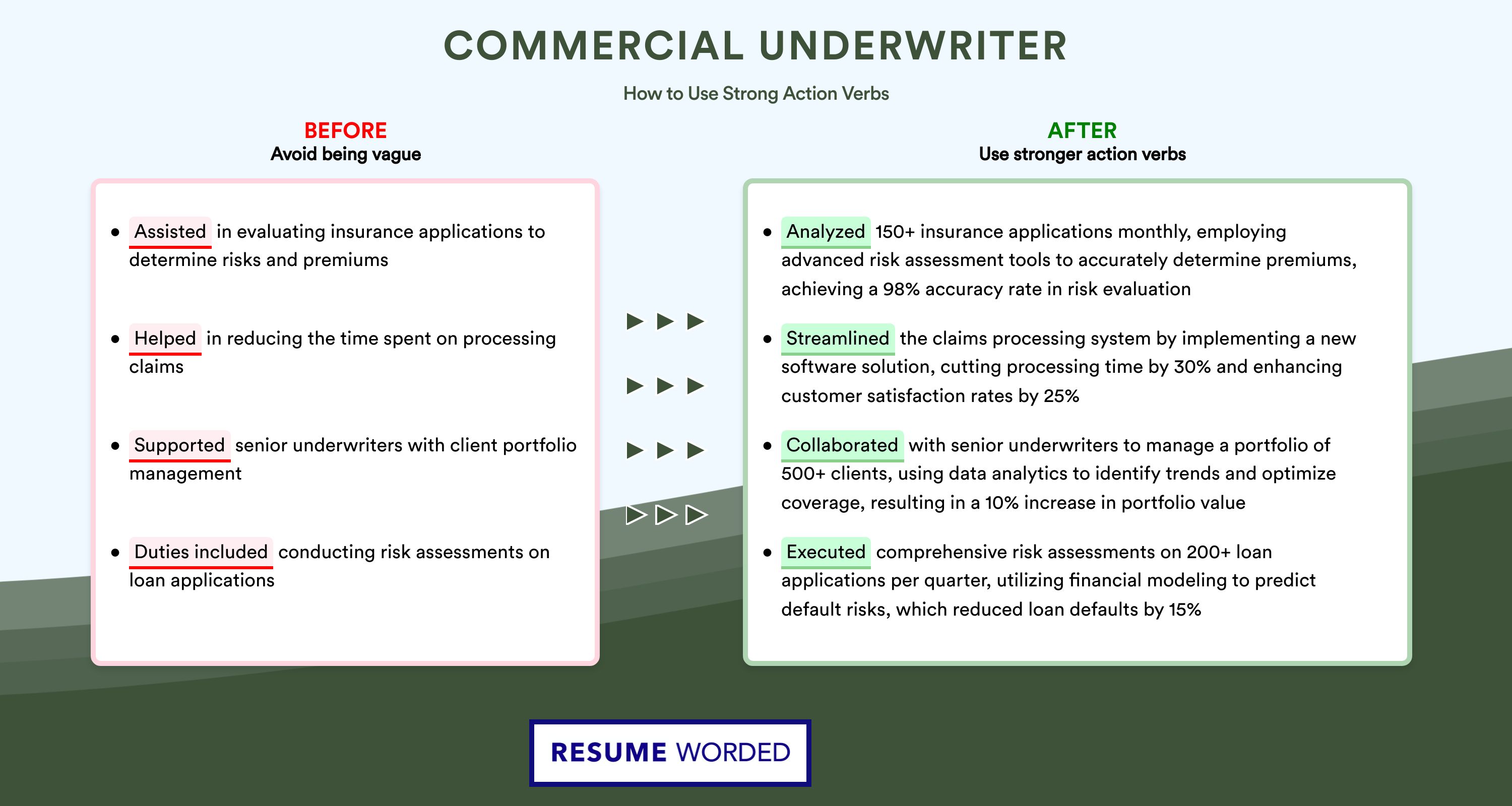

Your underwriter work experience bullet points

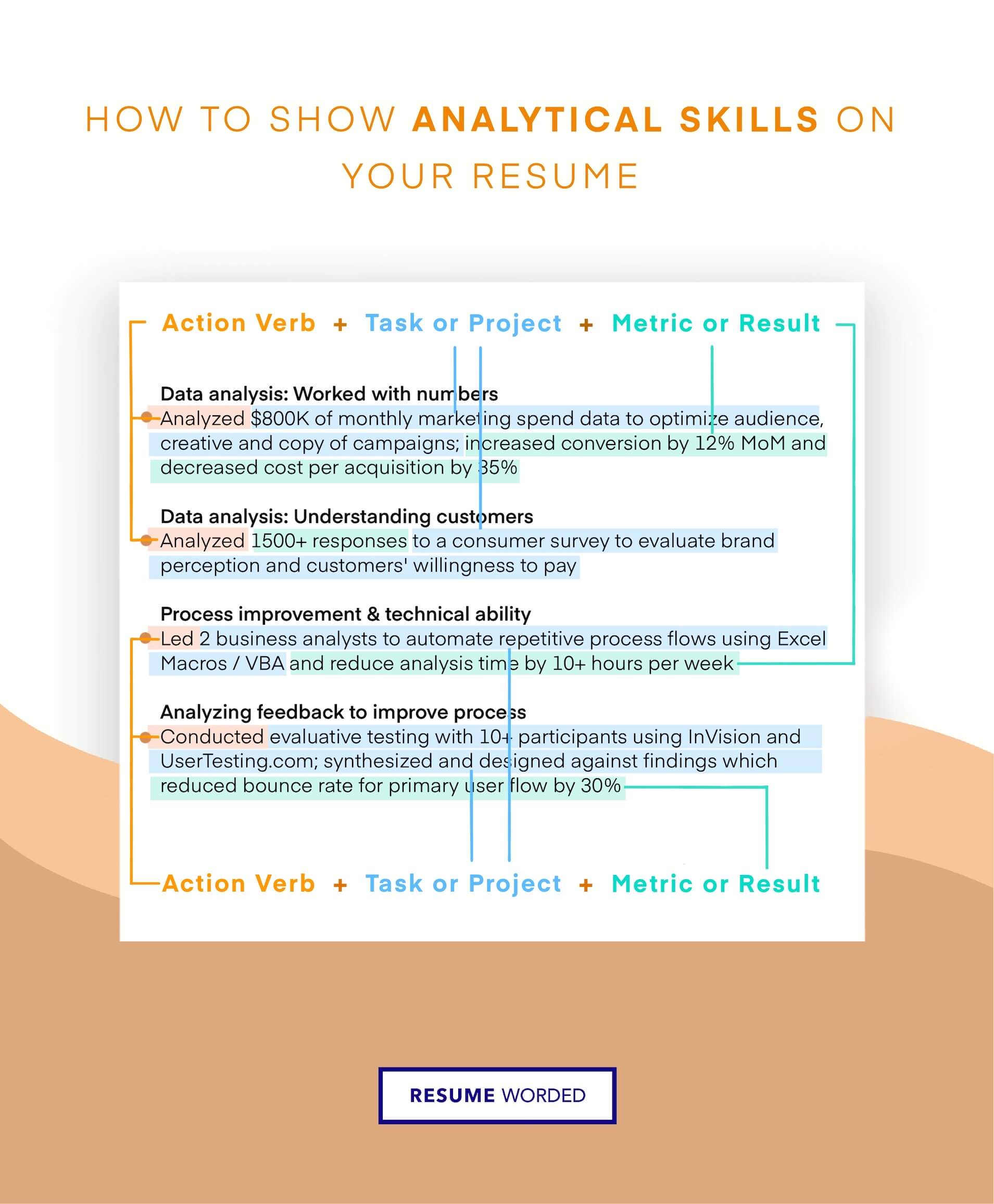

No matter the type of underwriting you specialize in, you spend your days analyzing client data, conducting risk assessments, collaborating with brokers and agents, and making decisions on policy issuance. As these tasks are known to recruiters, you’ll make more of an impression if you focus on your achievements instead.

Your work impacts your organization’s bottom line; hence it can be neatly quantified. Use this to your advantage. Show off your effectiveness and the impact you could have on a potential employer by providing concrete metrics.

Whether your strongest achievements are bulletproofing a risk assessment framework, or managing record monthly volumes of loans, this section is where you talk about them, substantiating them with data to convey your unique professional value.

- Highlight instances where your work refining and automating workflows led to reducing underwriting turnaround times.

- Show off improvements to loss ratios that your risk assessment and mitigation strategies resulted in.

- Emphasize the specific software you leveraged to achieve your goals, such as the reduction in claim rates your analysis with Excel and Tableau brought on.

- List instances where your work directly bolstered company financials, such as spearheading an increase in insurance premiums or trimming expenses.

See what we mean?

- Implemented risk mitigation strategies that resulted in a 34% decrease in the loss ratio

- Employed CreditXpert to evaluate credit reports and identify areas for improvement, resulting in a 17% increase in credit scores for approved borrowers

- Achieved an error rate of less than 1% on fraud risk assessments using CoreLogic LoanSafe, resulting in zero avoidable losses

- Utilized SAS to implement a pricing strategy that resulted in a 13% increase in premium revenue and a 7% reduction in underwriting expenses

9 active verbs to start your underwriter work experience bullet points

- Implemented

3 Tips for Writing an Underwriter Resume if You’re Just Starting Out

- If you have certifications such as the Chartered Property Casualty Underwriter (CPCU), Associate in Commercial Underwriting (ACU), or specialized certifications such as Certified Mortgage Underwriter (NAMU-CMU), display them prominently in your resume. They may not always be required, but they do showcase your commitment to the role.

- Be selective with which skills you list in your resume , prioritizing those you feel confident in and that each job description emphasizes. For instance, if a role highlights the need for UnderRight proficiency, and it’s something you know you’re good at, then display it at the top of your skills list.

- If you’re applying for your first job as an underwriter, leverage your academic and extracurricular experiences to highlight your skills. For example, reaffirm your catastrophe modeling skills by talking about the college case study you undertook using Applied Epic to forecast potential losses.

3 Tips for Writing an Underwriter Resume if You’re Already Experienced

- With your experience, your work has positively impacted the financials of companies you’ve worked for. Get into the specifics of initiatives you led that affected revenues, such as the fraud detection overhaul you instituted, which led to reduced losses due to fraud.

- Instead of listing “collaboration” or “stakeholder management” in your resume skills , show recruiters that it’s in your repertoire. Talk about instances where you liaised with brokers, loan originators, or policyholders, and the impact your collaboration had.

- Go into detail about your specialty within underwriting. For instance, if you specialize in insurance or mortgage underwriting, talk about specific certifications, courses, or work experience you have that contribute to your expertise.

Pinpoint some of your transferable skills from your other financial roles, such as your ability to work with Microsoft Excel or database management systems—and more generally, your flair for interpreting vast sums of data.

If you do include one, be sure to tailor it to each job description , mentioning the company and role specifically. Include your career highlights and key strengths, such as risk assessment or financial analysis.

Lender policies and federal regulations are constantly evolving. If you’ve taken steps to stay abreast of industry developments, such as attending industry workshops or conferences, mention these to show recruiters your commitment to underwriting.

Resume Templates

Resume samples

Create and edit your resume online

Generate compelling resumes with our AI resume builder and secure employment quickly.

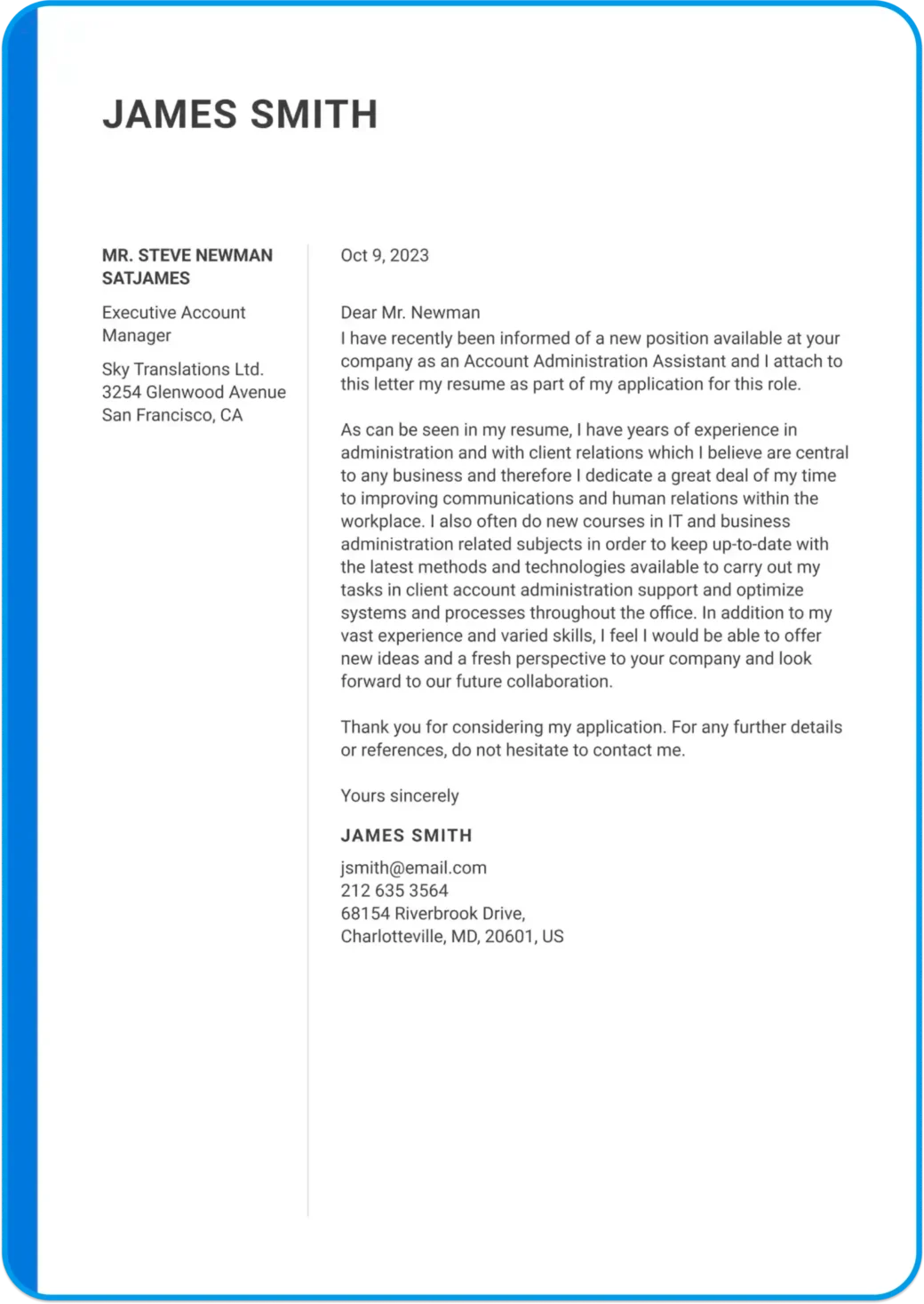

Write a cover letter

Cover Letter Examples

Cover Letter Samples

Create and edit your cover letter

Use our user-friendly tool to create the perfect cover letter.

Featured articles

- How to Write a Motivation Letter With Examples

- How to Write a Resume in 2024 That Gets Results

- Teamwork Skills on Your Resume: List and Examples

- What Are the Best Colors for Your Resume?

Latests articles

- Top 5 Tricks to Transform Your LinkedIn Profile With ChatGPT

- Using ChatGPT to Prepare for Interviews: Top Tips and Steps

- How to Create an Effective Cover Letter with ChatGPT

- 10 Jobs in High Demand in 2024: Salaries and Expected Growth

Dive Into Expert Guides to Enhance your Resume

Underwriter Resume Examples

Use our remarkable resume examples to guide you in writing an equally impressive resume

Underwriting Resume Samples

1. Candidate seeking insurance underwriter position

Able and result-oriented underwriter with two years of experience in the corporate world of insurance. Possess remarkable numerical, analytical, and communication skills, and are looking forward to advancing my career in the prestigious Acme Insurance company.

- Performed underwriting for life assurance applications for term and permanent products

- Offered professional advice to clients concerning various forms of life assurance

- Assisted in training interns and new team members regarding company policies

- Drew up insurance policies, invoices, certificates, and endowments as per company policy

2. Candidate seeking mortgage underwriter position

Competent and meticulous mortgage underwriter with a proven track record in risk assessment and documentation review. Have over six years of experience with a specialization in conventional and FHA loans and the ability to collaborate with team members to facilitate timely and effective compliant loan package completion.

- Demonstrate remarkable follow-up with borrowers and loan processors through all phases in the underwriting process

- Ensures that all submitted loan applications conformed to the external and internal eligibility stipulations.

- Accomplished the third-highest loan-funding rate in the 2017-2018 FY, totalling to $10 million.

Underwriter Resume Vocabulary & Writing Tips

Action verbs are highly recommended while writing a resume; they make your sections more impactful and specific. The right vocabulary will also clarify your professional abilities and accomplishments, not to mention impress the underwriter that will be on the recruiting committee. Use these action verbs and vocabulary for your underwriter resume .

Words to Use

- Risk assessment

- Insurance proposals

- Lending/underwriting

- Cash flow analysis

- Debt-to-income ratios

- Account service

- Credit analysis

- Conforming/non-conforming loans

- Loan-to-Value ratios

- Insurance claim forms

- Communication skills

- Loan-volume growth

- eligibility

- Attention to detail

- Repayment capacity

Action Verbs

- Demonstrate

- Investigate

- Collaborate

Underwriter Resume Tips and Ideas

Underwriters work primarily for insurance, banks, and mortgage companies, where their main role is to review insurance or loan applications, analyze various risks, and determine the most profitable coverage for their employers. Your underwriter resume should demonstrate your ability to carry out these tasks:

- Screening applicants based on company criteria

- Measuring the degree of risk associated with each applicants by obtaining information from them and using specialized software

- Designing insurance policies and premiums depending on applicants’ degree of risk

This job requires strong numerical and statistical abilities, as well as attention to detail and analytical skills. Depending with your employer and the area of work (life, motor vehicle, re-insurance), you may require to have a bachelor’s degree in actuarial science, a technical field, economics, business, finance, or any other related field. Experience is also a plus; if you have just left school, you can apply for an assistant underwriter position.

If you have the qualifications above and would like to start or keep your career rolling in the right direction, you need to create a professional underwriter resume . A well-designed and formal resume will communicate your abilities to the hiring manager and convince them to call you in for an interview. You can use our resume generators and writing tips to get you a stellar resume in minutes.

- Reverse chronological.

- You can use online resume templates to avail more information on the chronological resume format

- Neat resume design

- Margins and white space

- Legibility and ease of skimming

- Resume fonts types and size

- Subheadings and bullets

- Contact information

- Resume professional summary

- Work history

- Education background

- Additional skills and certifications

- Volunteer work

- Hobbies and interests

Resume Length

The reverse-chronological resume format is often the best resume order for a professional underwriter resume . This resume format is widely recognized and preferred by HR managers in most fields. Using such a resume format will help you impress the manager at first glance. It also emphasizes your work experience by placing it at the very beginning of the resume.

An underwriter is expected to have impeccable organizational skills and attention to detail. Your resume format will be the first indicator of these qualities, and submitting an illegible and messy resume will eliminate any chance you had at getting an interview.

Designing a resume is as easy as having a legible, neat, and appealing resume layout . White space is crucial in ensuring your resume does not look stuffed, so ensure your design or resume template allows for plenty of it. For consistency and neatness, use one formal resume format throughout your entire document. Fonts you can apply include Georgia, Cambria, and Calibri in a legible size like (pt 12).

Using subtitles at the start of each section will guide the reader quickly to desired areas, and bulleted points will make your resume easier to skim through. Typos in a resume must be eliminated, so proofread your resume thoroughly. Finally, save it in PDF format to conserve its delicate layout across all devices.

A photo is not required on your resume as you do not need one to apply for an underwriter position.

Sections of a Underwriter Resume

Resume sections are the specific parts of a resume that hold various categories of information about your professional attributes, abilities, and accomplishments. These are designed to help you organize your details in a format that is easy to read and follow. Different professions have varying requirements when it comes to resume sections. You can use these sections to provide adequate information in your underwriter resume:

- Resume header (your profession): write it in bold to avoid mix-ups in mass recruitments

- Contact information: Include your name and the contacts you use for professional purposes (email, mailing address, and phone number). Include your location (city, state, zip code).

- Resume professional summary:

- Professional background or work experience

- Academic background

- Additional skills and certifications: extra certifications or competencies that you possess and are relevant to the job requirements

The volunteer experience or internships sections help add weight to the work experience section if you just graduated and have had little time in the workforce . Your hobbies and interests are also optional, though they will provide the recruiters with an idea of your personality.

An underwriter resume should be one page long . A recruiter will take a maximum of six seconds to skim your resume, which is why you should be as brief and straight to the point as possible. Use columns to fit all your details neatly on your letter page, and do not go below font size 11.

Underwriter Resume Section Headings

This is the 3-4 line section at the top that serves as your pitch to the recruiters. This section can make or break your first impression, so be sure to use positive adjectives to portray your soft skills, your professional title, and quantifiable achievements. Refer to our resume examples for outstanding summary statement examples.

Work experience

The work experience section is critical in any job application. It provides the hiring panel with proof that you can adequately handle the tasks in the vacancy as you have handled them before. For this section, ensure that you include work stints that are relevant to the advertised position. Also show your ability to cooperate with colleagues, interpersonal, numerical, and analytical skills using the right action verbs. Use 3-7 bulleted points for each position you have held in the past, and use reverse-chronological order.

Your education section helps the recruiters to determine the authenticity of your qualifications and may actually go a long way in getting you an interview. Start with your highest academic qualification, college name and location, then the years of study or year expected to graduate. If you have little experience, write the courses you are taking that are relevant to the position.

Struggling with Resume Writing?

Ease the process with our templates

Related Professions

Mortgage Broker Discover how to create an effective mortgage broker resume that expertly depicts your skills in finance, risk management, and the mortgage process. Updated on December 28, 2023 Mortgage Broker

Underwriter resume examples for 2024

Underwriting is all about analyzing data to make wise credit decisions. As an underwriter, you'll need strong analytical skills to review loan apps, income/asset documentation, credit reports, and other data. You'll also need excellent organizational and interpersonal skills to communicate clearly with the rest of your mortgage team.

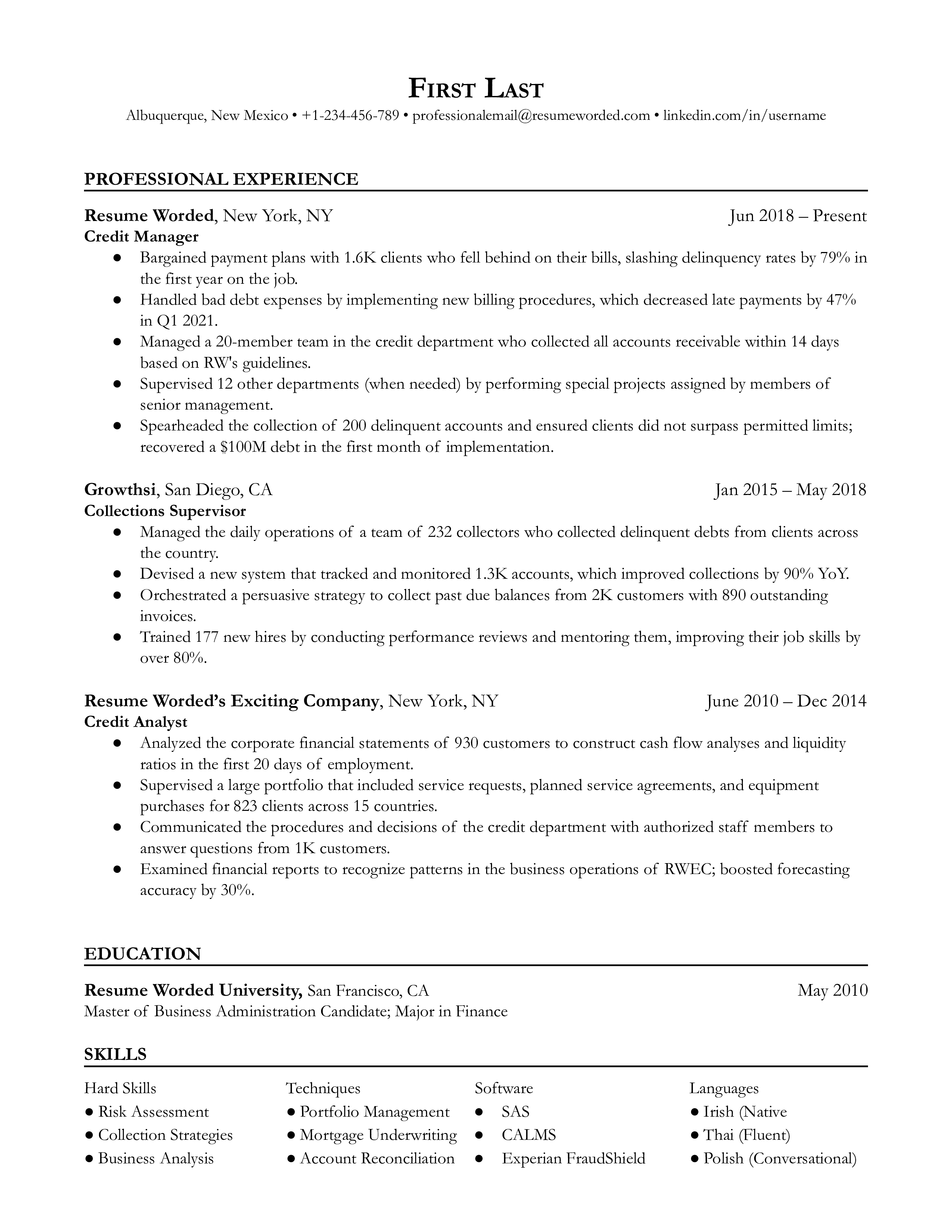

Underwriter resume example

How to format your underwriter resume:.

- Use the job title 'Underwriter' in your resume to match your application.

- Focus your work experience on specific achievements, such as determining inconsistencies, verifying document accuracy, and exercising judgment for final decisions.

- Keep your resume concise and relevant, aiming to fit all information on one page.

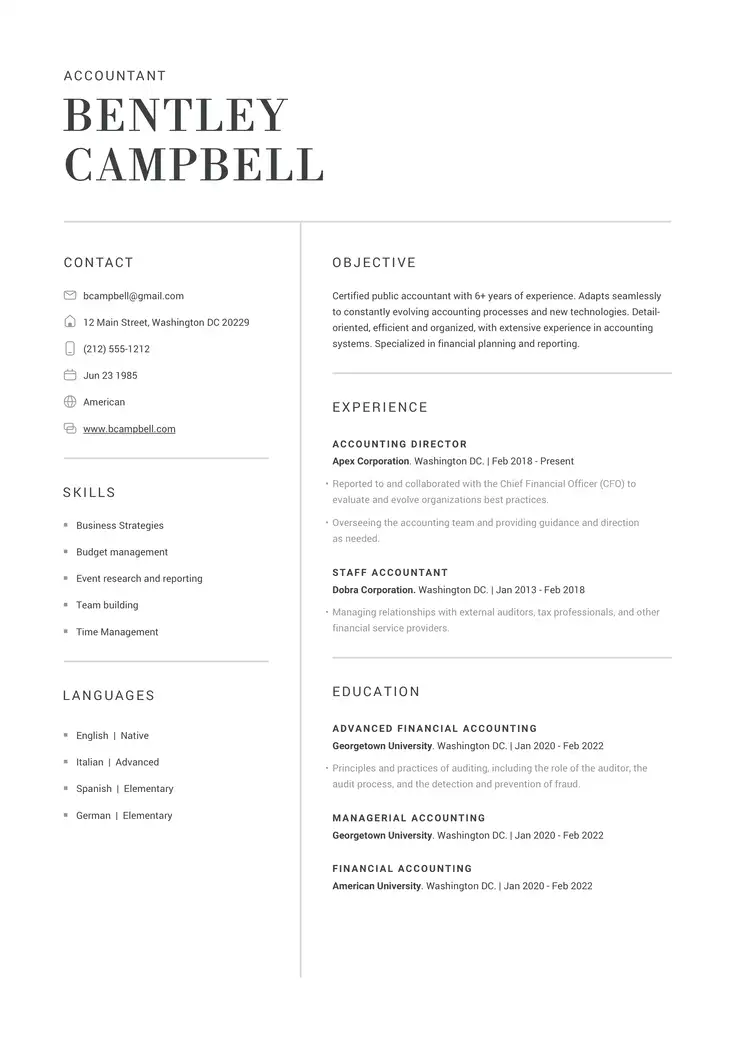

Choose from 10+ customizable underwriter resume templates

Choose from a variety of easy-to-use underwriter resume templates and get expert advice from Zippia’s AI resume writer along the way. Using pre-approved templates, you can rest assured that the structure and format of your underwriter resume is top notch. Choose a template with the colors, fonts & text sizes that are appropriate for your industry.

Entry level underwriter resume example

Professional underwriter resume example, resume tips to land the job:.

- Choose work experience over a resume objective when deciding between the two, especially if you want your underwriter resume to fit on one page. However, it's acceptable for senior level underwriter resumes to be two full pages long

- Use short and succinct bullet points instead of long, wordy paragraphs to make it easy for recruiters to understand your key accomplishments as an underwriter in 30 seconds

- Start each bullet point with a verb such as 'Underwrote', 'Analyzed', or 'Reviewed' to describe your accomplishments as an underwriter

Underwriter resume format and sections

1. add contact information to your underwriter resume.

Underwriter Resume Contact Information Example # 1

Dhruv Johnson

[email protected] | 333-111-2222 | www.linkedin.com/in/dhruv-johnson

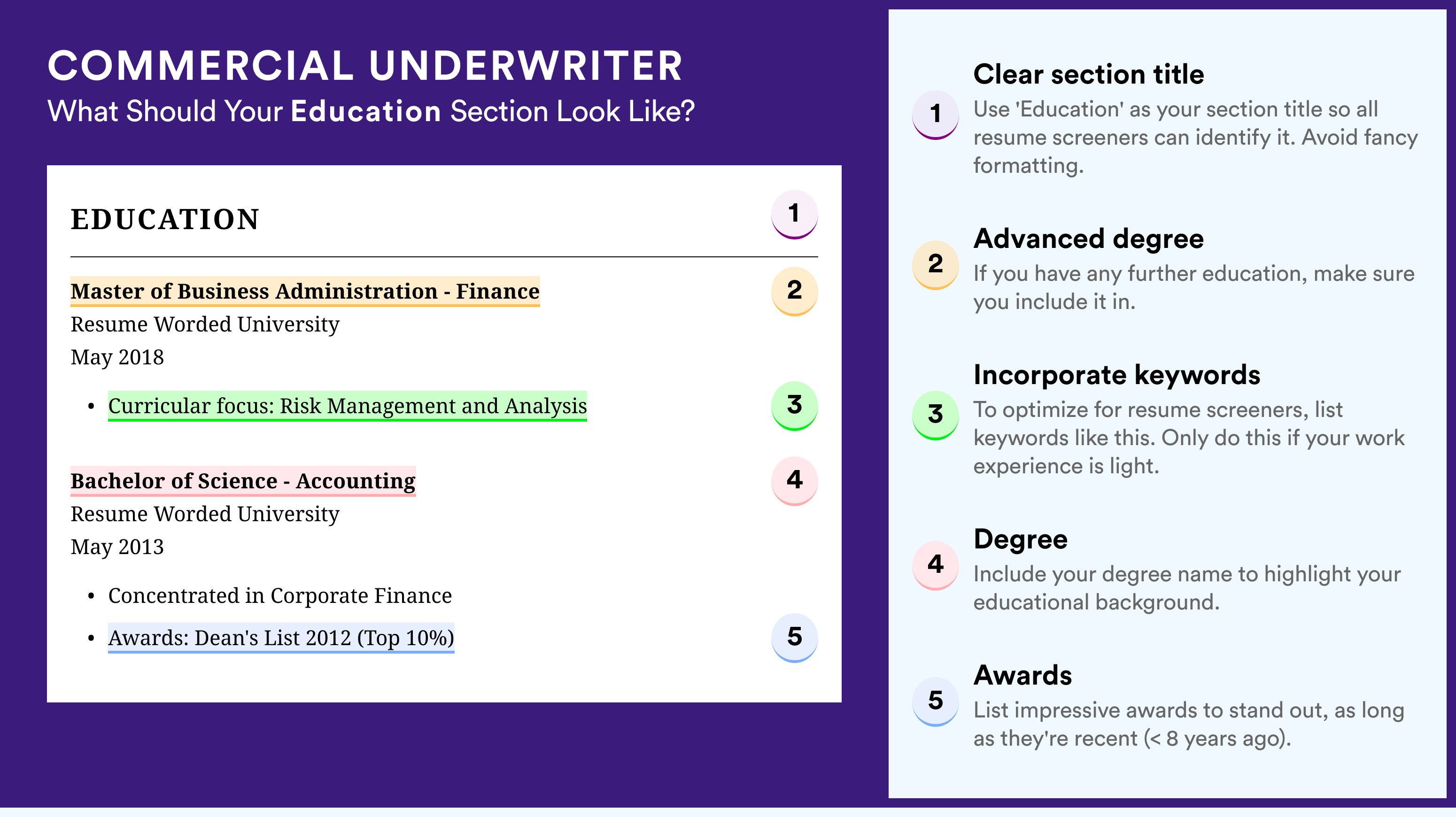

2. Add relevant education to your underwriter resume

Your resume's education section should include:

- The name of your school

- The date you graduated ( Month, Year or Year are both appropriate)

- The name of your degree

If you graduated more than 15 years ago, you should consider dropping your graduation date to avoid age discrimination.

Optional subsections for your education section include:

- Academic awards (Dean's List, Latin honors, etc. )

- GPA (if you're a recent graduate and your GPA was 3.5+)

- Extra certifications

- Academic projects (thesis, dissertation, etc. )

Other tips to consider when writing your education section include:

- If you're a recent graduate, you might opt to place your education section above your experience section

- The more work experience you get, the shorter your education section should be

- List your education in reverse chronological order, with your most recent and high-ranking degrees first

- If you haven't graduated yet, you can include "Expected graduation date" to the entry for that school

Check More About Underwriter Education

Underwriter Resume Relevant Education Example # 1

Bachelor's Degree In Business 2008 - 2011

Ashford University San Diego, CA

Underwriter Resume Relevant Education Example # 2

Master's Degree In Finance 2010 - 2011

University of California - Davis Davis, CA

3. Next, create an underwriter skills section on your resume

Your resume's skills section should include the most important keywords from the job description, as long as you actually have those skills. If you haven't started your job search yet, you can look over resumes to get an idea of what skills are the most important.

Here are some tips to keep in mind when writing your resume's skills section:

- Include 6-12 skills, in bullet point form

- List mostly hard skills ; soft skills are hard to test

- Emphasize the skills that are most important for the job

Hard skills are generally more important to hiring managers because they relate to on-the-job knowledge and specific experience with a certain technology or process.

Soft skills are also valuable, as they're highly transferable and make you a great person to work alongside, but they're impossible to prove on a resume.

Example of skills to include on an underwriter resume

Customer service is the process of offering assistance to all the current and potential customers -- answering questions, fixing problems, and providing excellent service. The main goal of customer service is to build a strong relationship with the customers so that they keep coming back for more business.

An investor guideline refers to general standards, strategies, and parameters relating to investments; the set guidelines get altered from time-to-time.

Underwriting guidelines are a set of rules and requirements an insurer provides to its agents and underwriters. The underwriter then uses these instructions to judge the prospective insured, whether to accept, modify or reject it. These guidelines help the insurers set the criteria for the customer and let them know the amount of money that should be offered to the client, or whether not to offer an insurance policy in the first place.

A financial statement is a report of an individual or a company that includes all the information about the declared assets, the use of money, income, and also the contribution of shareholders over a certain period.

The Federal Housing Administration (FHA) stands for a government agency in the United States that offers housing insurance to FHA-approved lenders who follow certain conditions.

A loan application is a form of request presented by a person to a financial institution for the approval of a loan. This application form carries detailed information regarding the petitioner's identification information, financial competence, and sources of income that indicate whether he can return the loan back or not.

Top Skills for an Underwriter

- Customer Service , 10.8%

- Investor Guidelines , 5.7%

- Mortgage Loans , 5.5%

- Underwriting Guidelines , 5.1%

- Other Skills , 72.9%

4. List your underwriter experience

The most important part of any resume for an underwriter is the experience section. Recruiters and hiring managers expect to see your experience listed in reverse chronological order, meaning that you should begin with your most recent experience and then work backwards.

Don't just list your job duties below each job entry. Instead, make sure most of your bullet points discuss impressive achievements from your past positions. Whenever you can, use numbers to contextualize your accomplishments for the hiring manager reading your resume.

It's okay if you can't include exact percentages or dollar figures. There's a big difference even between saying "Managed a team of underwriters" and "Managed a team of 6 underwriters over a 9-month project. "

Most importantly, make sure that the experience you include is relevant to the job you're applying for. Use the job description to ensure that each bullet point on your resume is appropriate and helpful.

- Operated a cherry/order picker to organize millwork department.

- Directed the Team Depot team.

- Prepared biweekly 25+ hourly employee payroll using Paychex payroll software.

- Updated Standard Operating Procedures for Home Depot Stores.

- Supported Windows 98, Micros, Aloha, MS Server 2000, UNIX, and SQL.

- Implemented automated and manual underwriting strategies in underwriting conventional, FHA, VA, Alt-A and 2nd products.

- Increased the branch's productivity to $50+ million per month by training staff in procedures, systems and company policies.

- Cleared necessary conditions after underwriting, Verified employment and debt to income to confirm within guidelines.

- Reduced cost and prevented loss by utilizing broker credit report prior to initial approval.

- Worked directly with the title and escrow officers on each file.

- Responded to questions/inquiries from agency, claims, general departments, producers and others in the insurance industry.

- Involved in the continual education training of Agents and Staff for such information as policies, procedures, and rating.

- Trained in handling cancellations, mortgagee requests, added endorsements, additional insured, and all aspects of client business insurance.

- Acted as liaison between in house underwriters and agents.

- Trained over 12 Agency Recruiting Assistants and provided direction to other assistants regarding workflow and procedures.

- Reviewed all documents to certify that FHA, VA, or Conventional guidelines were met.

- Processed Commercial, Construction, FHA, VA, Residential and Foreclosure bailout loan files.

- Ensured funding procedures are followed and verification of loan closing with Settlement Agents/Attorneys by reviewing and balancing the HUD-1 Settlement Statement.

- Worked FNMA, Conventional loans.

- Worked for Citigroup for 15-years and held various positions including leadership roles.

5. Highlight underwriter certifications on your resume

Specific underwriter certifications can be a powerful tool to show employers you've developed the appropriate skills.

If you have any of these certifications, make sure to put them on your underwriter resume:

- Chartered Property Casualty Underwriter (CPCU)

- Certified Professional, Life and Health Insurance Program (CPLHI)

- Certified Residential Underwriter (CRU)

- International Accredited Business Accountant (IABA)

- Associate in Commercial Underwriting (AU)

- Associate in Insurance Services (AIS)

- Associate in Risk Management (ARM)

- Certified Medical Office Manager (CMOM)

- Registered Professional Liability Underwriter (RPLU)

- Chartered Life Underwriter (CLU)

6. Finally, add an underwriter resume summary or objective statement

A resume summary statement consists of 1-3 sentences at the top of your underwriter resume that quickly summarizes who you are and what you have to offer. The summary statement should include your job title, years of experience (if it's 3+), and an impressive accomplishment, if you have space for it.

Remember to emphasize skills and experiences that feature in the job description.

Common underwriter resume skills

- Customer Service

- Investor Guidelines

- Mortgage Loans

- Underwriting Guidelines

- Financial Statements

- Credit Decisions

- Underwriting Process

- Financial Analysis

- Excellent Interpersonal

- Strong Analytical

- Income Documentation

- Loan Applications

- Tax Returns

- Excellent Organizational

- Credit Worthiness

- Credit Reports

- Credit Analysis

- Credit Risk

- Origination

- Underwriting Decisions

- Renewal Business

- Due Diligence

- Return Analysis

- Strong Negotiation

- Automated Underwriting

- Insurance Policies

- Loan Packages

- Underwriting Authority

- Risk Analysis

- Loan Decisions

- Loan Approval

- Cash Flow Analysis

- Underwriting Systems

- Commercial Property

- Enterprise Risk Management

- Federal Regulations

- Freddie Mac

- Conventional Loans

- Bank Statements

- Program Guidelines

Entry level underwriter resume templates

Professional underwriter resume templates

Underwriter Jobs

Links to help optimize your underwriter resume.

- How To Write A Resume

- List Of Skills For Your Resume

- How To Write A Resume Summary Statement

- Action Words For Your Resume

- How To List References On Your Resume

Underwriter resume FAQs

What does an underwriter do, what skills does an underwriter need, search for underwriter jobs.

Updated April 25, 2024

Editorial Staff

The Zippia Research Team has spent countless hours reviewing resumes, job postings, and government data to determine what goes into getting a job in each phase of life. Professional writers and data scientists comprise the Zippia Research Team.

Underwriter Related Resumes

- Bank Officer Resume

- Closer Resume

- Commercial Loan Officer Resume

- Commercial Underwriter Resume

- Consumer Loan Underwriter Resume

- Credit Officer Resume

- Loan Officer Resume

- Loan Originator Resume

- Mortgage Banker Resume

- Mortgage Underwriter Resume

- Personal Lines Underwriter Resume

- Quality Control Auditor Resume

- Senior Credit Analyst Resume

- Senior Loan Processor Resume

- Underwriting Manager Resume

Underwriter Related Careers

- Bank Officer

- Commercial Loan Officer

- Commercial Underwriter

- Consumer Loan Underwriter

- Credit Officer

- Foreclosure Specialist

- Loan Administrator

- Loan Analyst

- Loan Officer

- Loan Originator

- Mortgage Banker

- Mortgage Consultant

- Mortgage Underwriter

- Personal Lines Underwriter

Underwriter Related Jobs

Underwriter jobs by location.

- Underwriter Alpine

- Underwriter Bridgewater

- Underwriter Des Moines

- Underwriter Glendale

- Underwriter Grandville

- Underwriter Greensboro

- Underwriter Kearns

- Underwriter Lincoln Park

- Underwriter Overlea

- Underwriter Oyster Bay

- Underwriter Parker

- Underwriter Parma

- Underwriter Roanoke

- Underwriter Urban Honolulu

- Underwriter Westbury

- Zippia Careers

- Business and Financial Industry

- Underwriter

- Underwriter Resume

Browse business and financial jobs

Insurance Underwriter Resume Sample

The resume builder.

Create a Resume in Minutes with Professional Resume Templates

Work Experience

- Develop and maintain positive and constructive working relationships with the company’s marketing professionals and their production sources in order to attract and retain clients

- Property and Casualty underwriting insurance experience

- Current P&C insurance license required

- Maintain an in-depth technical knowledge of medical underwriting practices, clinical testing and current medical procedures in order to satisfy proper risk assessment

- General servicing skills and etiquette

- Maintain an awareness of the customer’s business and insurance needs, noting all briefing information provided by Senior Servicing and Broking Manager

- Account Executive/ underwriting experience required

- Success driven individual who has demonstrated 1-3 years of success in a commercial underwriting role

- Performs all aspects of underwriting assigned programs for clients

- Develops client specific pricing models based on actuarial norms

- Trains and mentors Underwriting team members

- Manages client renewal lists; prepares renewal information and requests updates from insurance markets

- Replies to incoming correspondence and independently responds as required

- Work closely with the firm’s producers as well as case design team to transition from design to implementation

- Assist in the oversight of the delivery of the firm’s in force reviews for existing clients

- Success driven individual who has demonstrated 3-8 years of success in a commercial underwriting role

- Develop and execute marketing plan to drive new and renewal business, including in-person visits, telemarketing and distribution of marketing materials for insurance company partners

- Evaluate, classify, and rate each risk to determine acceptability, coverage, and pricing

- Mentor and train Assistant Underwriters as needed

- Review all incoming submissions for eligibility

- Process alternative market applications for quote according to various markets

Professional Skills

- Excellent relationship building and communication skills are required along with the ability to explain your assessments

- Demonstrate relevant experience in managing underwriting risks

- Negotiation skills and problem solving ability

- Teamwork/Rapport building skills

- Strong development and understanding of risk management, economics, finance and accounting

- Experienced working under pressure within a demanding environment

- Experience in insurance underwriting or financial analysis and forecasting

How to write Insurance Underwriter Resume

Insurance Underwriter role is responsible for insurance, research, design, planning, compensation, training, credit, finance, travel, health. To write great resume for insurance underwriter job, your resume must include:

- Your contact information

- Work experience

- Skill listing

Contact Information For Insurance Underwriter Resume

The section contact information is important in your insurance underwriter resume. The recruiter has to be able to contact you ASAP if they like to offer you the job. This is why you need to provide your:

- First and last name

- Telephone number

Work Experience in Your Insurance Underwriter Resume

The section work experience is an essential part of your insurance underwriter resume. It’s the one thing the recruiter really cares about and pays the most attention to. This section, however, is not just a list of your previous insurance underwriter responsibilities. It's meant to present you as a wholesome candidate by showcasing your relevant accomplishments and should be tailored specifically to the particular insurance underwriter position you're applying to. The work experience section should be the detailed summary of your latest 3 or 4 positions.

Representative Insurance Underwriter resume experience can include:

- Proven time management skills with the ability to prioritise

- Experience with Microsoft Office Applications (Word, Excel and Power Point)

- Excellent project management abilities to meet deadlines

- Interacting and negotiating with carrier on pricing flexibility and alternatives

- Distributing new business quotes to agents and regularly following up on status

- Reviewing new business inspections for eligibility and compliance with guidelines

Education on an Insurance Underwriter Resume

Make sure to make education a priority on your insurance underwriter resume. If you’ve been working for a few years and have a few solid positions to show, put your education after your insurance underwriter experience. For example, if you have a Ph.D in Neuroscience and a Master's in the same sphere, just list your Ph.D. Besides the doctorate, Master’s degrees go next, followed by Bachelor’s and finally, Associate’s degree.

Additional details to include:

- School you graduated from

- Major/ minor

- Year of graduation

- Location of school

These are the four additional pieces of information you should mention when listing your education on your resume.

Professional Skills in Insurance Underwriter Resume

When listing skills on your insurance underwriter resume, remember always to be honest about your level of ability. Include the Skills section after experience.

Present the most important skills in your resume, there's a list of typical insurance underwriter skills:

- Advanced computer skills that include Excel and other MS Office applications

- Good understanding surrounding the general principles of underwriting

- Strong understanding and ability to read marketplace environments

- Actual underwriting experience with a focus on Property Cat business in the re-insurance industry

- Proven underwriting knowledge

- Detail-oriented with excellent follow up practices

List of Typical Experience For an Insurance Underwriter Resume

Experience for personal insurance underwriter resume.

- Provide assigned brokers with necessary training

- Assist with book transfers

- Manage and perform financial risk analysis of prospective lease product line customers and prepare quotes

- Meet with sales and customers to propose rates and answer program questions as required

- Participate, analyze and provide recommendations on large loss calls and renewals as necessary

- Handle Ombudsman complaints

- Motivated creative thinker

List of Typical Skills For an Insurance Underwriter Resume

Skills for personal insurance underwriter resume.

- Evaluate the experience of a risk against the class of business

- Evaluate program loss experience

- Finding the most competitive market to quote the account

- Ensuring policy transactions such as binders or endorsements are issued and changes are documented and recorded correctly

- Review all underwriting data and accept, decline or modify risks referred from the company’s automated underwriting system

- Provide support to new agents regarding underwriting criteria and markets

Skills For Insurance Programs Underwriter Resume

- Keeps up to date on regulatory changes, industry bulletins, product changes and other ongoing training

- Work in an automated environment utilizing predictive analytics to quickly assess risk characteristics for personal lines risks

- Communicate with agents as needed to service agents and assist the account executive to assure overwhelming service

- Utilize data from established reports or QlikSense to aid in underwriting decisions and agency development

- Relevant track record in negotiation, team work, customer resolution and conflict handling

- Risk assessment on all of ANZ’s intermediated life products including Life, Trauma, Total Permanent Disability and Disability Income cover

- Detailed understanding of reinsurance and primary insurance

- Manage underwriting referral volumes within agreed SLA’s

- Correspond with agent/markets regarding additional information and market changes

Skills For Life Insurance Senior Underwriter Resume

- Maintain working knowledge of available markets

- Prepare proposals and process binding requests from agents

- Support renewal process for expiring business and retain renewals

- Review inspection reports to verify we are insuring what the documentation states

- Request required information in order to complete the underwriting file

- To work under pressure to provide quality fast-paced underwriting solutions to commercial clients

- Utilize online rating systems of various carriers

- Quote, bind and issue new and renewal business per underwriting guidelines

Skills For Senior Underwriter, Commercial Insurance Resume

- Work closely with marketing and the field in order to maintain profitability and premium growth

- Handle underwriting decisions on new business, renewals and referrals that fall outside the guidelines and within delegated authority levels

- Provide technical underwriting support for team members

- Handle underwriting edit referrals

- Service existing RPA customers in assigned territory with their additional RPA needs

- Perform training and educational meetings on product line as required

- Develop and support marketing efforts and process and improvements for additional revenue opportunities and cost savings

- Certification or licenses as required by jurisdictions

Skills For Underwriter Lead-real Estate Casualty Insurance Resume

- Experience in risk analysis, financial analysis, loss control or a sales related role within a risk management, insurance underwriting, or claims environment

- Participate in special projects and assume additional responsibilities as necessary from time to time for the improvement of the sales and underwriting performance of personal lines underwriting

- Underwriting Commercial Insurance with a Wholesaler or MGA

- Many opportunities for career advancement

- Commercial minded with flair for negotiations and attention to detail

- Analyze new and renewal insurance applications to determine eligibility for coverage, available terms and conditions for pricing in accordance with established market underwriting guidelines

- Process policies, endorsement and cancellations

Skills For Underwriter, Commercial Insurance Resume

- Read inspection reports to determine if the risk is acceptable

- Agent/Broker Relationships: Develops and maintains successful relationships with Agents and Brokers by providing stewardship with service partners, including initial setup of service commitments, and regular visits

- Continuous Improvement: Actively participates in continuous improvement by fully engaging in daily huddles, generating suggestions, following appropriate procedures and work

- Develop and execute marketing plans to drive new and renewal business, including in-person visits, telemarketing and distribution of marketing materials for insurance company partners

- Responsible for handling incoming calls related to, underwriting and coverage's

- Assume responsibility for incoming inquiries via phone, email, fax, etc. from agents and Insureds

Skills For Underwriter Lead-commercial Insurance Resume

- Utilizes internal and external resources to confirm building information and characteristics are in line with our guidelines

- Audits personal lines policies which have been automatically accepted to confirm correct information and rating has been applied

- Review New Business applications for accuracy, determine if policies meet eligibility guidelines and accept, reject, and/or adjust coverage as necessary

- Instruct agents on company guidelines and procedures, be an available resource to agents on a daily basis

- Maintain understanding of State guidelines, including available discounts, selection/rejection requirements, State specific forms, and updates to underwriting guidelines and rating factors

- Review required documentation for policy changes, follow up with the Underwriters and modify policies as necessary

Skills For Lending Insurance Underwriter Resume

- Processes and maintains assigned workflow in a timely manner

- Maintains positive internal and external work relationships

- Consults with field representatives, insurance agents, brokers and other insurance or inspection companies to obtain further information, quote rates or explain company underwriting policies

- To effectively decide which insurer’s product would be most suitable for client’s needs

- To clear terms for quotes sent by the executives within the the new business, renewals and Certsure teams with due reference to premium, terms & conditions and policy endorsements

Skills For Senior Life Insurance Underwriter Resume

- To provide effective support to others in the team and to the new business, renewals and Certsure teams

- Interfacing with agents via email and phone on insurance coverage needs

- To provide solutions to queries and technical assistance for other departments

- To liaise with insurers and maintain relationships

- Prepare quotes for agents and answer questions that arise

- Work efficiently in a high volume, fast paced environment

Skills For Specialty Insurance Underwriter Resume

- Research and develop coverage forms, rules and rates for DOI compliance

- Issue and coordinate insurance certificates

- Recommend risks above their letter of authority. Typically these individuals hold Level I or Level II authority levels

- Handle assigned workload within quality, productivity and service standards as established by the business centers

- In conjunction with business center management and field marketing, and Sales Executives assist with broker management including monitoring of loss ratio and broker exceptions

- Preparation of home office referrals substantiating decision for consideration

Related to Insurance Underwriter Resume Samples

Commercial insurance resume sample, director insurance resume sample, loan underwriter resume sample, director, assurance resume sample, financial services insurance resume sample, associate, assurance resume sample, resume builder.

Resume Worded | Proven Resume Examples

- Resume Examples

- Legal Resumes

- Underwriter Resume Guide & Examples

Commercial Underwriter Resume Examples: Proven To Get You Hired In 2024

Jump to a template:

- Commercial Underwriter

- General Insurance Underwriter

Get advice on each section of your resume:

Jump to a resource:

- Commercial Underwriter Resume Tips

Commercial Underwriter Resume Template

Download in google doc, word or pdf for free. designed to pass resume screening software in 2022., commercial underwriter resume sample.

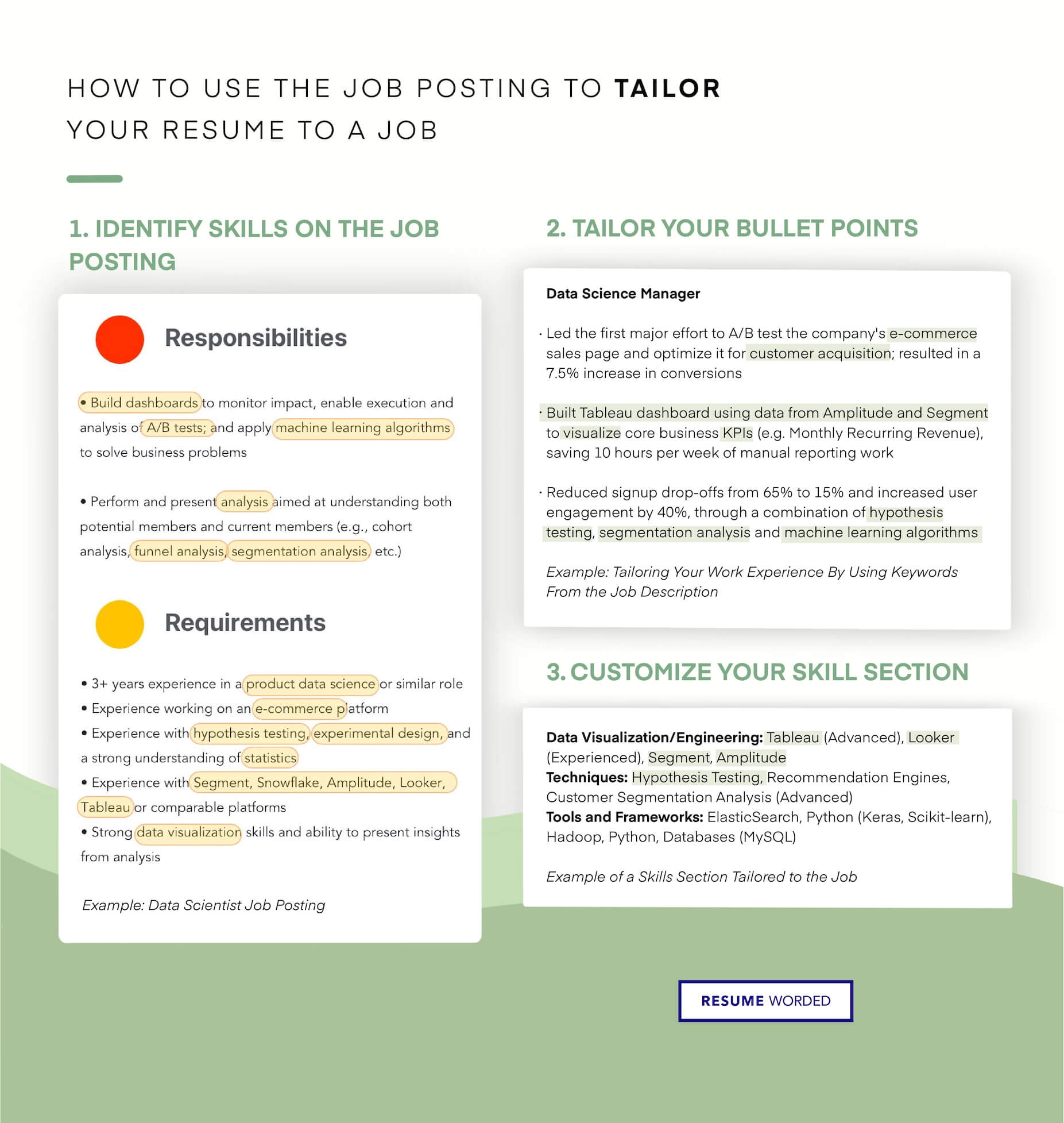

As a commercial underwriter, your role revolves around assessing the risk factors of potential clients for financial services companies. It's a job with ever-changing responsibilities, where you'll be constantly learning and adapting to new policies or risk factors. Recently, there is an increasing demand for analytical skills due to the surge in data-driven decision making in organizations. When composing a resume for this role, it's essential to demonstrate your knowledge of risk assessment and regulatory standards, as well as your ability to handle a high volume of complex information. In an increasingly digitized industry, commercial underwriters who demonstrate proficiency in using advanced underwriting software will stand out. Being able to accurately analyze and predict risk using technology is a crucial aspect of the job. Therefore, your resume should reflect your expertise in both risk assessment and the technology used to facilitate that process.

We're just getting the template ready for you, just a second left.

Recruiter Insight: Why this resume works in 2022

Tips to help you write your commercial underwriter resume in 2024, showcase your analytical skills.

As a commercial underwriter, you constantly analyze complex data to make informed decisions. Therefore, your resume should demonstrate your ability to dissect and understand complicated information. You could do this by discussing specific examples of your analytical skills in action.

Highlight your knowledge of underwriting software

Given the rise of technology in the underwriting industry, it’s essential to show your familiarity with relevant software on your resume. Discuss the specific underwriting systems you've used, and how they've assisted you in assessing risk and making decisions.

Commercial underwriters conduct risk analyses on mortgage and insurance application forms to decide whether to approve or reject the insurance benefits. In addition to structuring payment contracts, commercial underwriters also check the accuracy of all the data on the application. What will make you successful as a commercial underwriter is having a hawk's eye. To pursue a career in commercial underwriting, you must hold a bachelor's degree in addition to a strong set of hard and soft talents that will make you the greatest in your field. Check out this commercial underwriter resume template we offer if you want a resume that demonstrates these skills!

Tailor your resume to a commercial underwriting one

Specialized knowledge and abilities are needed for commercial underwriting. Highlight your prior expertise in the insurance industry, analytics, and other financial jobs on your resume to demonstrate why you are the best candidate for the job. Make sure to list hard skills in your skills section, such as risk management, investment analysis, and financial modeling.

Lead with academic prowess

Due to the entry-level nature of commercial underwriting, most candidates lack a wide range of prior work experience. To demonstrate that you have the necessary theoretical skills for the position, indicate your university along with the typical four-year degree in finance or economics. You can also list any further related classes you've taken if you’re an entry-level candidate!

General Insurance Underwriter Resume Sample

As a hiring manager who has recruited for companies like Chubb, AIG, and Zurich Insurance Group, I've seen countless resumes for commercial underwriter positions. The best resumes showcase a candidate's ability to assess risk, analyze financial data, and make sound underwriting decisions. Here are some tips to help your resume stand out:

Highlight your underwriting expertise

Emphasize your experience in assessing risk and making underwriting decisions. Provide specific examples of the types of risks you've analyzed and the decisions you've made.

- Analyzed property and casualty risks for commercial clients with annual revenues exceeding $50 million

- Made underwriting decisions on complex risks, resulting in a 15% increase in profitability for the commercial lines division

Avoid generic statements that don't showcase your specific expertise:

- Assessed risk for various clients

- Made underwriting decisions

Showcase your industry knowledge

Demonstrate your understanding of the commercial insurance industry and the specific markets you've worked in. Highlight any specialized knowledge or certifications you have.

- Earned Chartered Property Casualty Underwriter (CPCU) designation, demonstrating advanced knowledge of property and casualty insurance

- Developed expertise in underwriting risks for the construction industry, resulting in a 20% growth in premium volume for that sector

Avoid simply listing your certifications or industry experience without context:

- 5 years of experience in commercial insurance

Quantify your impact

Use metrics to showcase the impact you've had in your previous roles. This could include the size of the accounts you've managed, the revenue you've generated, or the loss ratios you've achieved.

- Managed a portfolio of 50 commercial accounts with total annual premiums of $10 million

- Achieved a loss ratio of 60%, outperforming the company average by 10 percentage points

Avoid using vague or unquantified statements:

- Managed a large portfolio of accounts

- Achieved a low loss ratio

Highlight your analytical skills

Commercial underwriting requires strong analytical skills to assess risk and make data-driven decisions. Showcase your experience with data analysis and risk assessment.

- Analyzed loss runs and financial statements to assess risk and determine appropriate premiums and deductibles

- Developed a risk assessment model that improved underwriting accuracy by 25%

Avoid simply stating that you have strong analytical skills without providing evidence:

- Strong analytical skills

- Experienced in data analysis

Demonstrate your communication skills

Commercial underwriters need to communicate effectively with clients, brokers, and colleagues. Highlight your experience with client-facing communication and collaboration.

- Conducted regular risk assessment meetings with clients to review coverage needs and risk management strategies

- Collaborated with a team of underwriters and actuaries to develop new commercial insurance products, resulting in a 15% increase in market share

Avoid generic statements about communication skills:

Excellent communication skills

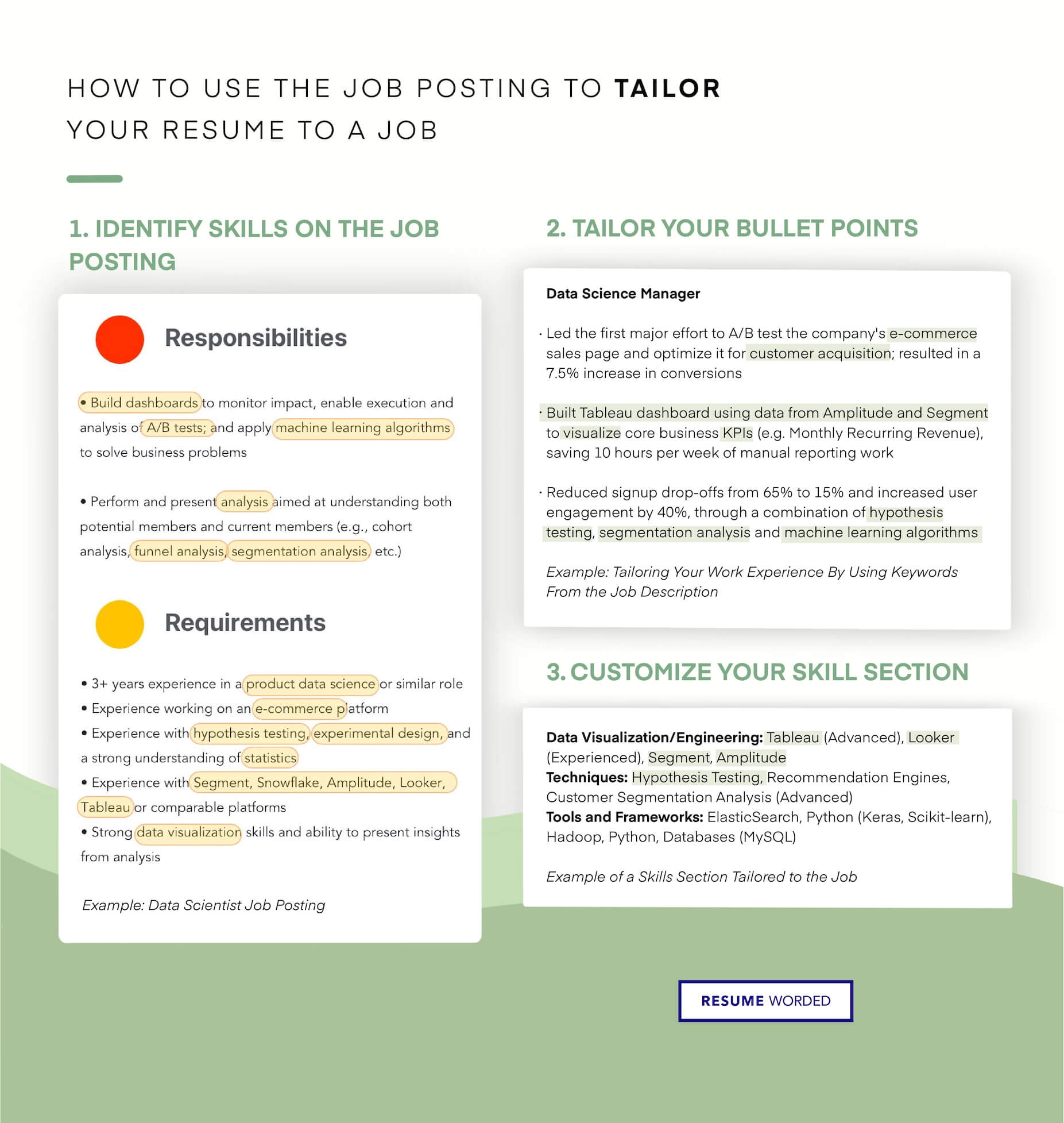

Tailor your resume to the job description

Review the job description carefully and tailor your resume to highlight the specific skills and experience that the employer is looking for. Use similar language and terminology as the job description.

For example, if the job description emphasizes experience with a specific type of commercial insurance, such as property or liability, make sure to highlight your experience in that area:

- 5+ years of experience underwriting commercial property risks, including real estate, construction, and manufacturing

- Specialized in underwriting liability risks for the healthcare industry, including hospitals, clinics, and long-term care facilities

Avoid submitting a generic resume that doesn't speak directly to the job requirements.

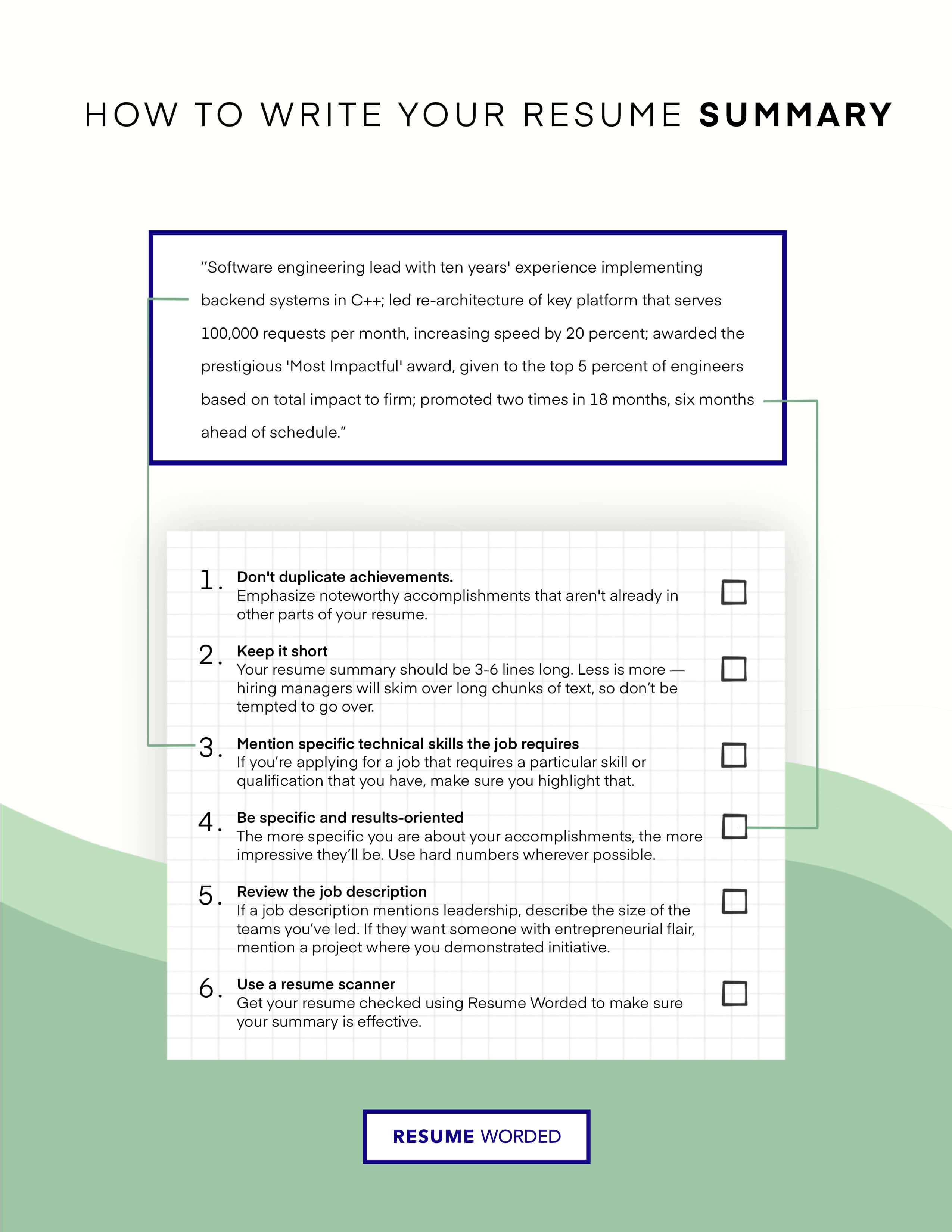

Writing Your Commercial Underwriter Resume: Section By Section

summary.

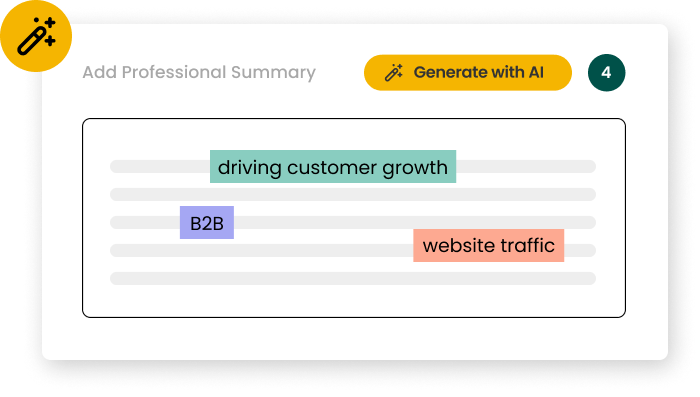

A summary section on your resume is optional, but can be a strategic way to provide additional context about your career journey, especially if you're changing careers or industries. It's also a chance to highlight key skills and experiences that are most relevant to the commercial underwriter role you're targeting.

However, avoid using an objective statement, which is an outdated approach that focuses on what you want from an employer. Instead, think of your summary as a snapshot of your most impressive and relevant qualifications. Keep it concise - no more than a few sentences or a short paragraph.

To learn how to write an effective resume summary for your Commercial Underwriter resume, or figure out if you need one, please read Commercial Underwriter Resume Summary Examples , or Commercial Underwriter Resume Objective Examples .

1. Tailor your summary to commercial underwriting

While it can be tempting to use the same generic summary for every job application, that's a missed opportunity. Instead, customize your summary to the specific commercial underwriter position and company.

Review the job description and company website, and mirror the language they use. For example:

- Experienced professional seeking a challenging role in a fast-paced environment.

This summary could apply to almost any job or industry. But consider this tailored approach:

- Commercial underwriter with 5+ years of experience assessing risk for property & casualty insurance. Skilled in analyzing financial statements, loss runs, and risk reports. Seeking to leverage my expertise to help XYZ Company maintain a profitable portfolio.

2. Highlight key skills and knowledge areas

Your summary is the perfect place to spotlight the specific skills and knowledge that make you a strong candidate for commercial underwriting roles. Consider including:

- Types of insurance and industries you specialize in (e.g. construction, real estate, manufacturing)

- Underwriting processes and best practices you're well-versed in

- Knowledge of relevant regulations and compliance issues

- Proficiency with industry-specific software or databases

Weaving in these keywords will also help your resume perform better in applicant tracking systems. For example:

Analytical and detail-oriented commercial underwriter with deep knowledge of construction and real estate risks. Adept at evaluating loss exposures, interpreting financial data, and collaborating with agents and brokers. Proficient in Xactimate, RiskMeter, and MS Office.

Experience

The work experience section is the heart of your resume. It's where you show hiring managers what you've accomplished in previous roles and how you can drive results for their company. When writing your work experience section, it's important to focus on your achievements and the skills that are most relevant to the commercial underwriter position you're applying for.

1. Highlight underwriting accomplishments with metrics

When describing your work experience, focus on your accomplishments rather than just listing your job duties. Whenever possible, quantify your achievements with metrics to show the impact you made.

- Underwrote 50+ policies per month while maintaining a loss ratio of less than 60%

- Collaborated with a team of 5 underwriters to develop a new risk assessment model that reduced losses by 15%

- Identified a new market segment opportunity, resulting in $2M in new premiums

By using specific numbers and percentages, you give hiring managers a clear picture of your capabilities and the value you can bring to their organization.

2. Use strong action verbs relevant to underwriting

When describing your work experience, use strong action verbs that are relevant to the commercial underwriting field. This helps showcase your expertise and makes your resume more impactful.

Instead of using generic phrases like:

- Responsible for evaluating risk

- Worked on pricing insurance policies

Use industry-specific action verbs like:

- Analyzed risk exposure for commercial property policies

- Calculated premiums and developed rating plans for liability coverage

3. Showcase your industry knowledge and technical skills

Commercial underwriting requires a deep understanding of the industry and proficiency in various technical skills. Make sure to highlight your knowledge and capabilities in your work experience section.

For example:

- Conducted risk assessments for construction and manufacturing clients, demonstrating expertise in COPE (Construction, Occupancy, Protection, Exposure) analysis

- Utilized predictive modeling and data analytics tools to identify risk trends and make data-driven underwriting decisions

By showcasing your industry knowledge and technical proficiencies, you demonstrate to hiring managers that you have the skills needed to succeed in the role.

4. Highlight career growth and leadership experience

Hiring managers value candidates who have a track record of career progression and leadership experience. If you've been promoted or taken on leadership roles in your previous positions, make sure to highlight this in your work experience section.

Commercial Underwriter, ABC Insurance (2018-Present) Senior Underwriting Analyst, ABC Insurance (2016-2018) - Promoted to Commercial Underwriter role after demonstrating strong performance and leadership potential - Mentored and trained a team of 3 junior underwriting analysts, resulting in a 20% increase in productivity

By showcasing your career growth and leadership experience, you demonstrate your potential to take on more responsibility and drive success in the role you're applying for.

Education

The education section of your commercial underwriter resume should be concise and highlight your relevant academic background. This section is particularly important if you are a recent graduate or have limited work experience. Here are some tips to help you craft an effective education section:

1. List degrees relevant to commercial underwriting

Include your degree(s) that are most relevant to a career in commercial underwriting, such as:

- Bachelor's degree in Business Administration, Finance, Economics, or a related field

- Master's degree in Business Administration (MBA) with a concentration in Finance or Risk Management

If you have multiple degrees, list them in reverse chronological order, with the most recent degree first.

2. Include graduation year for recent graduates

If you graduated within the past 1-2 years, include your graduation year to show that your education is current and relevant. For example:

Bachelor of Science in Finance, XYZ University, Graduated 2022

However, if you have several years of work experience, you can omit the graduation year to avoid potential age discrimination.

3. Highlight relevant coursework and projects

If you have completed coursework or projects that are directly relevant to commercial underwriting, consider mentioning them in your education section. For example:

- Completed courses in Risk Management, Financial Analysis, and Insurance Law

- Collaborated on a capstone project analyzing risk exposure for a commercial real estate portfolio

This can help demonstrate your knowledge and skills to potential employers, especially if you have limited work experience in the field.

4. Keep it brief for experienced professionals

If you are a senior-level commercial underwriter with extensive work experience, your education section should be brief and to the point. For example:

MBA, Finance Concentration, ABC University B.S., Economics, XYZ University

There is no need to list graduation years, as your work experience will be the primary focus of your resume.

- MBA, Finance Concentration, ABC University, Graduated 1995

- B.S., Economics, XYZ University, Graduated 1992

- Relevant Coursework: Principles of Finance, Intro to Business

Skills

The skills section of your resume is a critical component that can make or break your chances of landing an interview. As a commercial underwriter, you need to showcase your technical expertise, industry knowledge, and relevant soft skills to stand out from the competition. Here are some tips to help you craft a compelling skills section that will catch the attention of hiring managers and demonstrate your value as a candidate.

1. Highlight your underwriting expertise

When applying for a commercial underwriter position, it's essential to showcase your underwriting skills front and center. Hiring managers want to see that you have the technical knowledge and experience to assess risk, analyze financial statements, and make sound underwriting decisions.

Here's an example of how to highlight your underwriting skills:

Risk assessment Financial analysis Underwriting guidelines Policy interpretation Reinsurance

Avoid generic or outdated skills that don't demonstrate your expertise, such as:

Microsoft Office Customer service Teamwork

2. Include industry-specific skills

As a commercial underwriter, you'll be working with clients in specific industries, such as construction, manufacturing, or healthcare. Showcasing your knowledge of industry-specific risks, regulations, and trends can help you stand out from other candidates and demonstrate your value to potential employers.

Here are some examples of industry-specific skills to include:

Construction : Builders risk, surety bonds, workers' compensation Manufacturing : Product liability, business interruption, supply chain risk Healthcare : Medical malpractice, cyber liability, regulatory compliance

3. Optimize for applicant tracking systems

Many companies use applicant tracking systems (ATS) to screen resumes for relevant skills and keywords. To increase your chances of passing the ATS and landing an interview, it's important to include the right terminology in your skills section.

Here are some tips for optimizing your skills section for ATS:

- Use exact keywords from the job description

- Avoid using abbreviations or acronyms

- Use a simple, clear format without graphics or tables

Here's an example of a skills section that may not pass an ATS: Experienced in assessing risk Proficient in financial analysis Knowledge of UW guidelines

Here's an example of an ATS-friendly skills section: Risk assessment Financial analysis Underwriting guidelines

Skills For Commercial Underwriter Resumes

Here are examples of popular skills from Commercial Underwriter job descriptions that you can include on your resume.

- Commercial Banking

- Financial Analysis

- Directors and Officers Liability Insurance

- Workers Compensation

- Reinsurance

- Professional Liability

- Risk Management

- Casualty Insurance

Skills Word Cloud For Commercial Underwriter Resumes

This word cloud highlights the important keywords that appear on Commercial Underwriter job descriptions and resumes. The bigger the word, the more frequently it appears on job postings, and the more likely you should include it in your resume.

How to use these skills?

Similar resume templates, credit analyst.

Underwriter

- Compliance Resume Guide

- Contract Specialist Resume Guide

- Legal Assistant Resume Guide

- Attorney Resume Guide

- Regulatory Affairs Resume Guide

Resume Guide: Detailed Insights From Recruiters

- Underwriter Resume Guide & Examples for 2022

Improve your Commercial Underwriter resume, instantly.

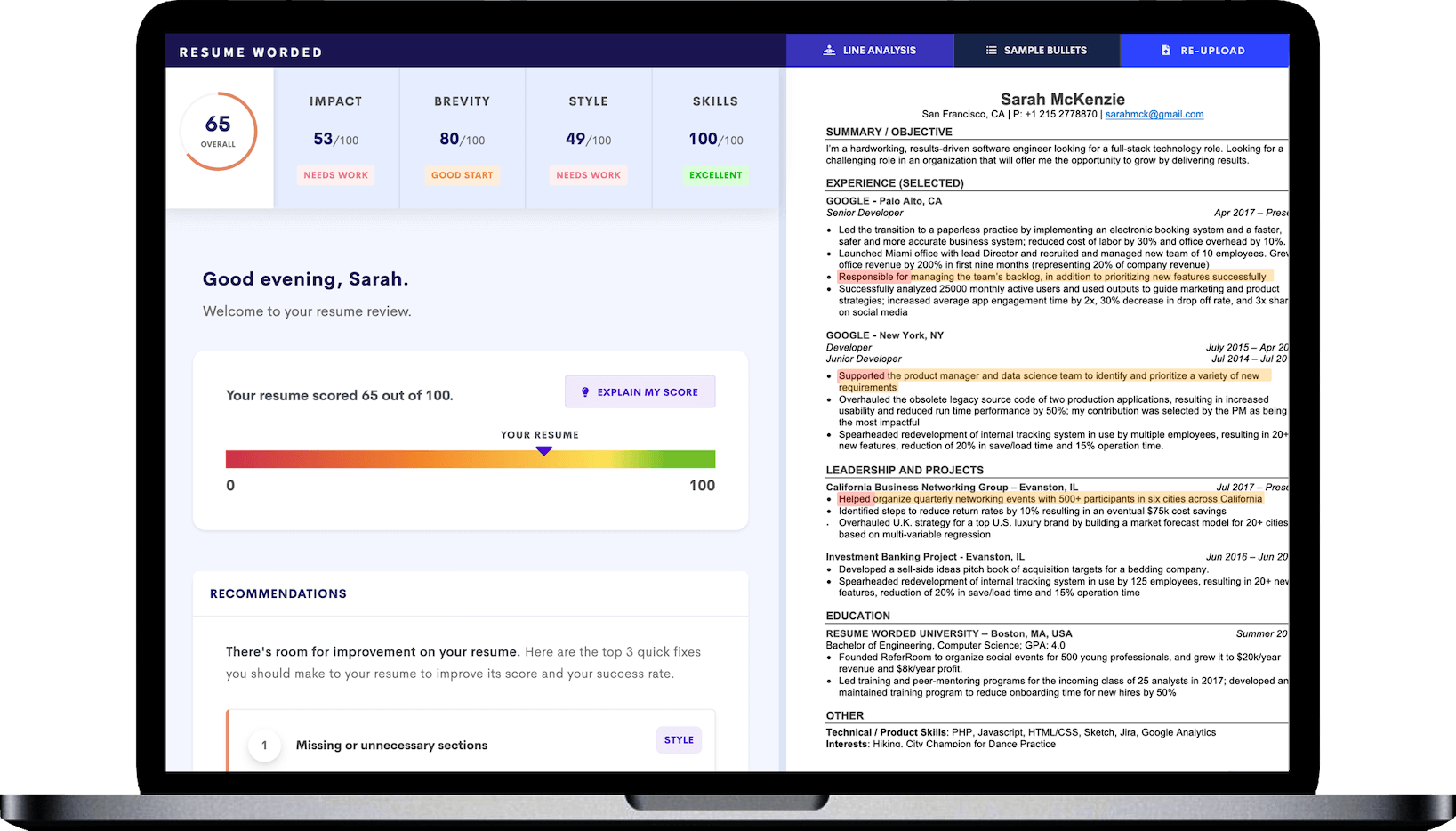

Use our free resume checker to get expert feedback on your resume. You will:

• Get a resume score compared to other Commercial Underwriter resumes in your industry.

• Fix all your resume's mistakes.

• Find the Commercial Underwriter skills your resume is missing.

• Get rid of hidden red flags the hiring managers and resume screeners look for.

It's instant, free and trusted by 1+ million job seekers globally. Get a better resume, guaranteed .

Commercial Underwriter Resumes

- Template #1: Commercial Underwriter

- Template #2: Commercial Underwriter

- Template #3: Commercial Underwriter

- Template #4: General Insurance Underwriter

- Skills for Commercial Underwriter Resumes

- Free Commercial Underwriter Resume Review

- Other Legal Resumes

- Commercial Underwriter Interview Guide

- Commercial Underwriter Sample Cover Letters

- Alternative Careers to a Commercial Underwriter

- All Resumes

- Resume Action Verbs

Download this PDF template.

Creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

These professional templates are optimized to beat resume screeners (i.e. the Applicant Tracking System). You can download the templates in Word, Google Docs, or PDF. For free (limited time).

access samples from top resumes, get inspired by real bullet points that helped candidates get into top companies., get a resume score., find out how effective your resume really is. you'll get access to our confidential resume review tool which will tell you how recruiters see your resume..

Writing an effective resume has never been easier .

Upgrade to resume worded pro to unlock your full resume review., get this resume template (+ 6 others), plus proven bullet points., for a small one-time fee, you'll get everything you need to write a winning resume in your industry., here's what you'll get:.

- 📄 Get the editable resume template in Google Docs + Word . Plus, you'll also get all 6 other templates .

- ✍️ Get sample bullet points that worked for others in your industry . Copy proven lines and tailor them to your resume.

- 🎯 Optimized to pass all resume screeners (i.e. ATS) . All templates have been professionally designed by recruiters and 100% readable by ATS.

Buy now. Instant delivery via email.

instant access. one-time only., what's your email address.

I had a clear uptick in responses after using your template. I got many compliments on it from senior hiring staff, and my resume scored way higher when I ran it through ATS resume scanners because it was more readable. Thank you!

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

- Resume Samples

Junior Underwriter Resume Samples

The guide to resume tailoring.

Guide the recruiter to the conclusion that you are the best candidate for the junior underwriter job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies, tailor your resume & cover letter with wording that best fits for each job you apply.

Create a Resume in Minutes with Professional Resume Templates

- Identifying and reporting trends in decline submission errors

- Assuring compliance with anti-money laundering and Sanctions laws and regulations

- Analyzing various scenarios and suggesting potential alternate offers for files recommended for decline

- Maintaining a strong focus on continued growth and learning of essential underwriting knowledge

- Bilingual (English and French both spoken and written)

- Discuss relevant underwriting issues with borrower, mortgage consultant and real estate professional. Keep mortgage consultants updated on the status of their loans

- Review and analyze documentation provided on each loan including the 1003, credit report, income and asset documentation, purchase agreement, title report, etc. to make an informed lending decision in compliance with NPF polices and guidelines

- Maintain accurate pipeline by documenting conversation log and tracking loan progress

- Review and collect underwriting conditions and submit conditions to underwriting for final approval

- Submit for underwriting approval

- Communicate, prepare and mail out commitment letter, notice of incompleteness or declination

- Update systems to reflect accurate information

- Upon receipt of final approval, prepare authorization to close and send to all parties

- Review credit, income, assets, disclosures

- Rendering assistance to lending officers on credit matters and loans involving unusual situations or requiring close scrutiny

- Providing credit information and references for customers, loan officers, or other agencies as requested

- Obtain data to perform portfolio concentration analysis

- Performs financial statement analyses, typically involving various complex and interlocking relationships

- Inform Loan Officers of relevant trends of specific loans, portfolios or industries

- Reviewing and responding to general underwriting scenarios

- Assisting with other responsibilities and projects as identified by management

- Excellent oral and written communication skills, ability to build strong interpersonal relationships

- Excellent written and verbal communication skills with an ability to present ideas clearly and concisely

- Possess excellent technical and computer skills including a high level of proficiency in Microsoft Excel, Word and PowerPoint

- Excellent Excel knowledge

- Basic to intermediate technical knowledge of systems and procedures

- Be in good standing

- Ability to make recommendations to guidelines, processes, and procedures to positively affect the top and bottom line of the organization

- Ability to add, subtract, multiply, and divide in all units of measure, using whole numbers, common fractions and decimals. Ability to compute rate ratio and percent

- Good verbal and written communication skills

- Excellent communication, negotiation and problem-solving skills

9 Junior Underwriter resume templates

Read our complete resume writing guides

How to tailor your resume, how to make a resume, how to mention achievements, work experience in resume, 50+ skills to put on a resume, how and why put hobbies, top 22 fonts for your resume, 50 best resume tips, 200+ action words to use, internship resume, killer resume summary, write a resume objective, what to put on a resume, how long should a resume be, the best resume format, how to list education, cv vs. resume: the difference, include contact information, resume format pdf vs word, how to write a student resume, junior underwriter resume examples & samples.

- Obtain new and modified mortgage insurance certificates from mortgage insurance carriers prior to issuing clear to close

- Review conditions submitted on loans from Loan Processors and signs off the condition when appropriate

- Calculate borrower’s income and debt-to-income ratios based on acceptable NPF and agency practices

- Document lending decisions and completes required screens in the LOS that include the accurate completion of the 1008 as well as adding and/or creating applicable conditions of the loan approval

- Work closely with Loan Processors to answer loan specific underwriting questions, to discuss specific conditions or documentation requested and to resolve problems

- Run, read and interpret Automated Underwriting Decision results (DU/LP)

- Adhere to underwriting guidelines to fulfill agency requirements

- Display excellent verbal, written and interpersonal communication skills

- Maintain and cultivate an effective working relationship with internal and external customers

- Embrace company culture

- Be able to adjust work and thought process to accommodate changes in the lending environment

- Consistently meet or exceed established minimum productivity levels as determined and required by management for both underwriting of files and condition management

- Assists Underwriting Department with any additional tasks necessary

- Minimum of 2 years in mortgage lending experience, preferably with emphasis on underwriting and credit analysis

- Knowledge of loan regulatory guidelines

- Ability to analyze and interpret credit reports, income documentation, asset statements, residential appraisal reports and other mortgage loan documentation

- Professional written, verbal and interpersonal communication skills

- Proficient running, reading and interpreting DU/LP recommendations

- Working knowledge of the mortgage process

- Prepares underwriting report consisting of property and demographic analysis, credit analysis, borrower’s income and asset profile and financial analysis of the loan. Calculates effective gross income, net operating income, annual debt service, debt service coverage ratios, break-even occupancy ratios and cash on return

- Review corporate and individual tax returns, review property rent rolls and operating statements, analyze credit reports and payment history, determines creditworthiness of borrowers and may assess financial risk involved with the deal