- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Tax Professional Resume Examples

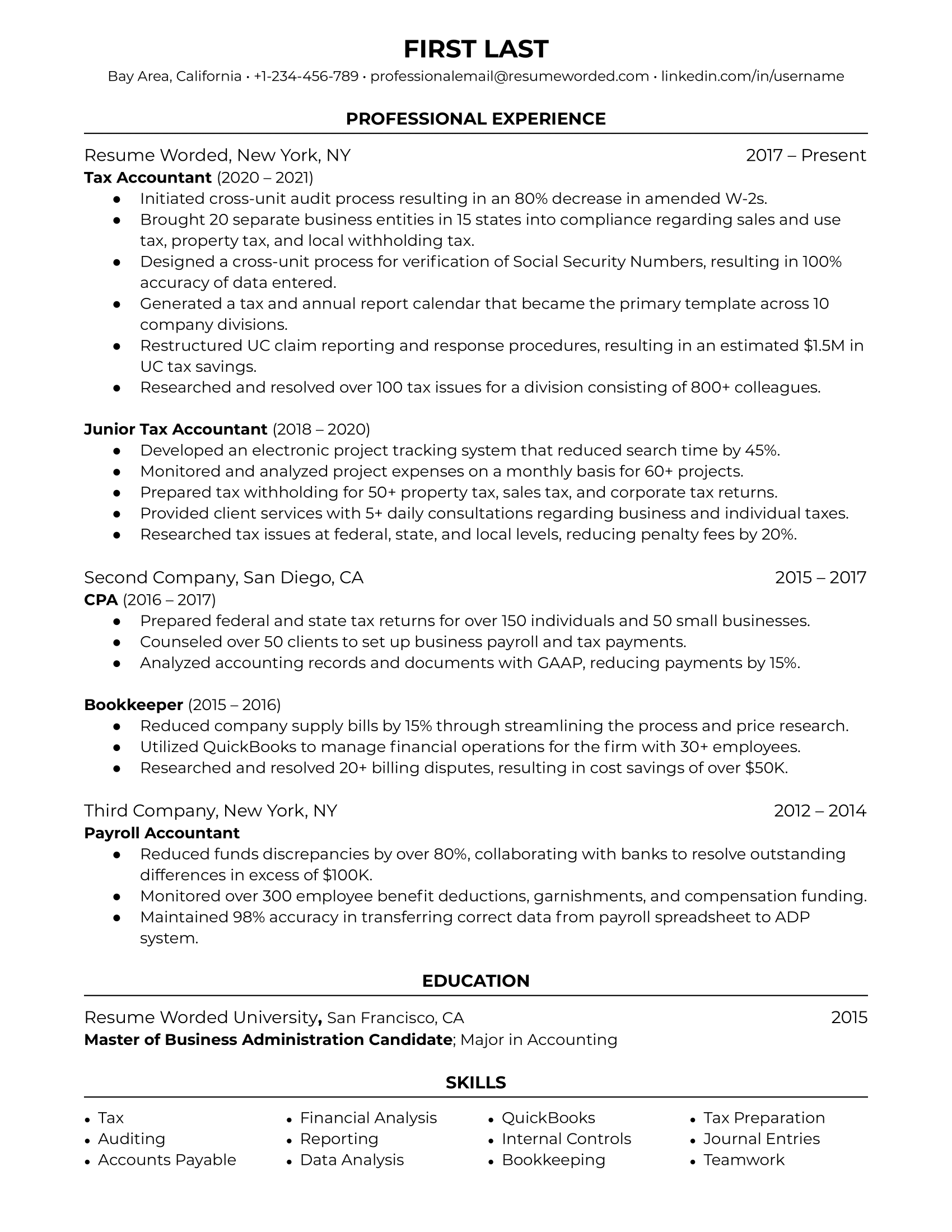

Writing a resume as a tax professional is no easy feat. It takes precision, accuracy and an understanding of the tax process in order to create a successful resume. A great resume can open doors to job opportunities, interviews and new career opportunities. Writing a resume as a tax professional is different from any other profession and requires many specific sections and details to effectively showcase your skills and knowledge. This guide will provide you with tips, advice and examples on how to write a tax professional resume that stands out from the competition.

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples .

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

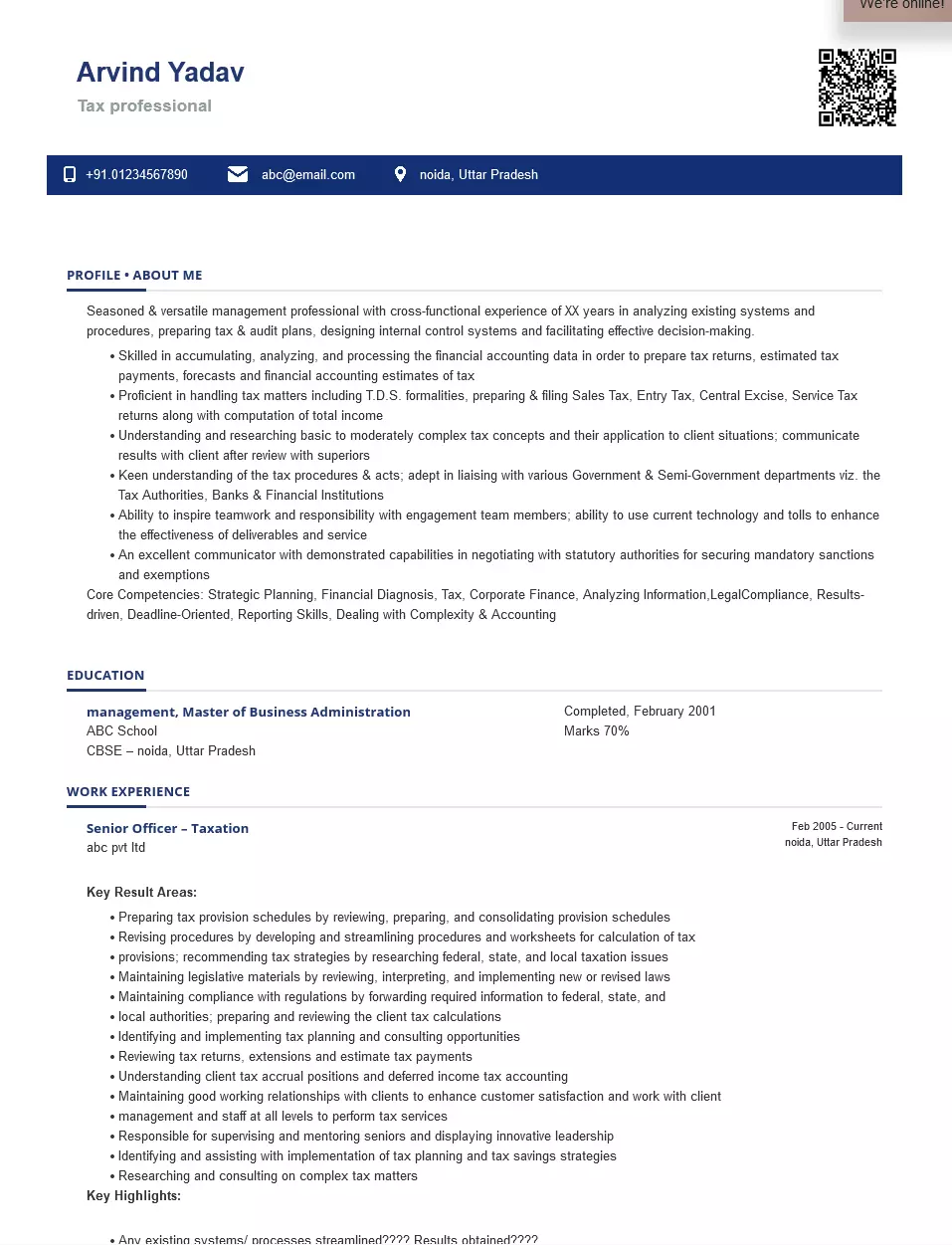

Tax Professional

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: [email protected]

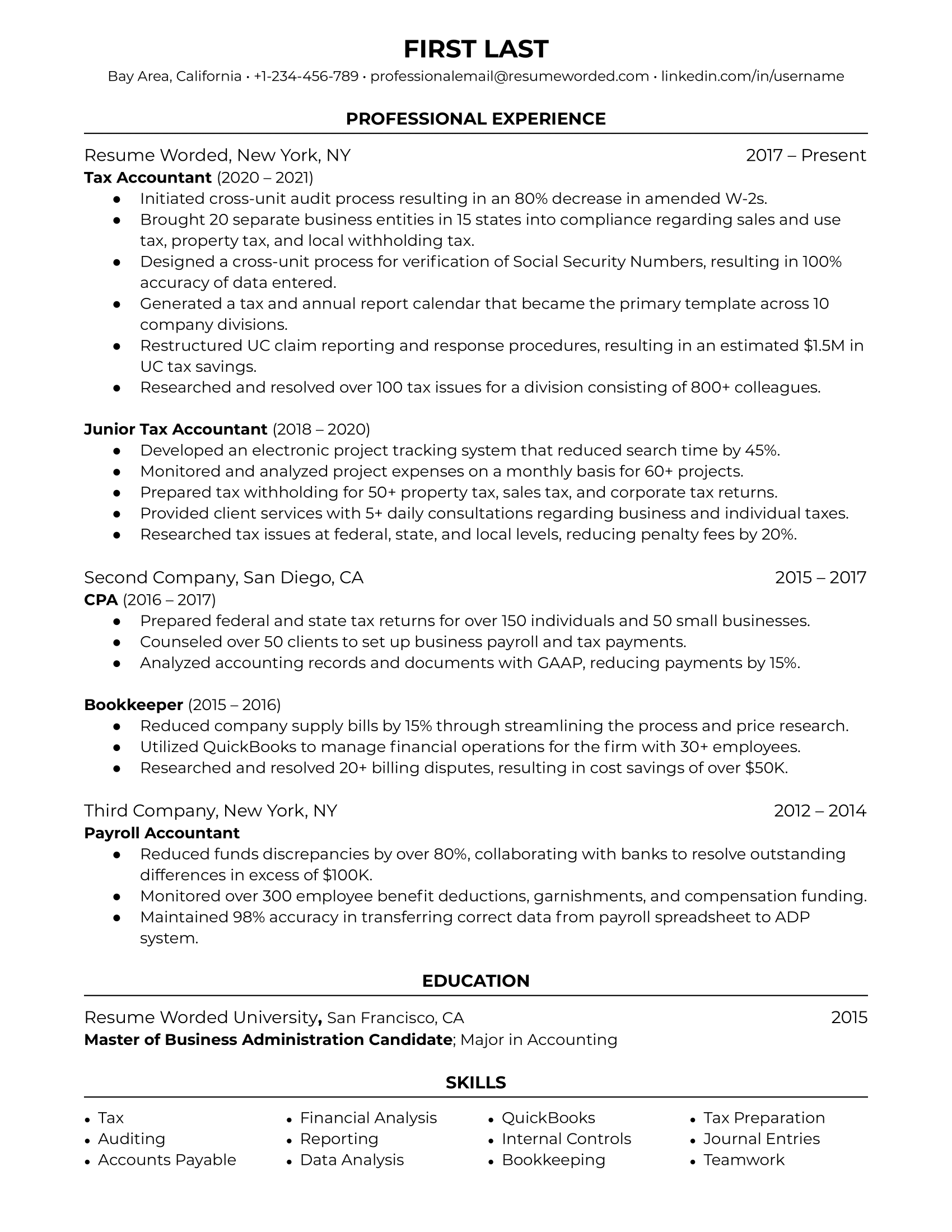

A highly detail- oriented and experienced Tax Professional with 6 years of expertise in the field. Experienced in tax research and analysis, preparation of financial statements and tax returns. Possesses a deep knowledge of taxation principles, tax preparation software and forms. Adept at working independently as well as collaboratively in a team setting.

Core Skills :

- Tax preparation

- Tax research

- Financial statement preparation

- Tax return filing

- Tax software expertise

- Tax law knowledge

- Cost accounting

Professional Experience :

Tax Associate, ABC Financial Group, Dallas, TX, 2016 – present

- Provide tax support to clients, including preparation of tax returns

- Analyze tax scenarios and advise clients on the most efficient tax strategies

- Handle all aspects of tax preparation, including gathering documents and filing returns

- Research tax issues and perform detailed analysis

- Prepare financial statements for businesses and individuals

- Monitor changes in tax laws and regulations and update clients accordingly

Senior Tax Accountant, XYZ Group, Dallas, TX, 2013 – 2016

- Prepared tax returns for individuals, trusts, and businesses

- Responsible for ensuring accuracy and compliance on all tax returns

- Performed detailed analysis of tax scenarios and advised clients of potential savings

- Researched and interpreted tax laws and regulations

- Developed and maintained strong relationships with clients and colleagues

Education :

Master of Science in Taxation, University of Texas at Dallas, Dallas, TX, 2013 Bachelor of Science in Accounting, University of Texas at Dallas, Dallas, TX, 2011

Create My Resume

Build a professional resume in just minutes for free.

Tax Professional Resume with No Experience

Dedicated and motivated recent graduate searching for a job as a Tax Professional. Possess a Bachelor’s Degree in Accounting and have a good understanding of tax laws and regulations. Eager to learn and utilize new skills in a professional environment.

- Strong understanding of current tax regulations

- Excellent analytical and problem- solving skills

- Good communication and interpersonal skills

- Proficient with Microsoft Office and other accounting software

- Excellent time management and organizational skills

Responsibilities :

- Gather and analyze data from financial reports, documents, and other sources

- Prepare and review individual and business tax returns

- Keep up to date with current tax laws and regulations in order to provide accurate advice

- Provide advice to clients on tax- related issues

- Research complicated tax issues and formulate solutions

- Ensure compliance with tax regulations and filing deadlines

Experience 0 Years

Level Junior

Education Bachelor’s

Tax Professional Resume with 2 Years of Experience

Results- driven tax professional with 2+ years of experience in preparing and filing corporate and individual income tax returns. Proven expertise in analyzing complex tax codes, accurately preparing and submitting federal, state, and local tax forms, and performing tax calculation and forecasting. Highly organized, detail- oriented, and adept in multitasking in a fast- paced environment.

- Proficient in accounting software (Sage, QuickBooks, Microsoft Office)

- Excellent data analysis, problem- solving, and communication skills

- Highly organized and capable of meeting tight deadlines

- Comprehensive understanding of tax regulations and compliance standards

- Strong negotiation and interpersonal skills

- Accurately prepared and submitted federal, state, and local income tax returns

- Assessed and reported on the impact of changes in tax legislation and regulations

- Calculated taxes owed and prepared tax returns, ensuring accuracy and compliance with applicable laws

- Monitored tax payments and filings, and updated internal databases

- Researched and identified tax credits, deductions, and incentives to minimize tax liabilities

- Interpreted and applied tax regulation to client’s financial data

- Provided guidance and recommendations to clients on tax planning and filing strategies

Experience 2+ Years

Tax Professional Resume with 5 Years of Experience

Dynamic and experienced Tax Professional with five years of experience in preparing, filing and analyzing taxes for a variety of clients. Possess an in- depth knowledge of tax laws and regulations and the ability to use this knowledge to create sound tax strategies. Demonstrated expertise in preparing complex tax returns and financial statements. Proven ability to work well with clients, explain complicated tax issues, and lead projects.

- Tax preparation and filing

- Tax planning and analysis

- Tax laws and regulations

- Client relations

- Tax strategies

- Prepared and filed taxes for clients

- Conducted research and analysis to identify potential tax deductions

- Advised clients on optimal tax strategies

- Developed tax strategies to minimize tax liabilities and maximize refunds

- Reviewed and analyzed financial statements and tax returns

- Produced accurate and timely tax returns

- Provided expert advice and counsel on tax issues

- Resolved client inquiries and issues

- Built and maintained relationships with clients

- Ensured compliance with federal, state, and local tax regulations

Experience 5+ Years

Level Senior

Tax Professional Resume with 7 Years of Experience

A highly motivated and dedicated Tax Professional with 7 years of experience in preparing and filing taxes for individuals, businesses and trust entities. Possesses the ability to review and analyze financial statements, tax returns and other documents to identify and resolve discrepancies. With a comprehensive understanding of federal, state and local tax codes, laws and regulations, able to develop comprehensive, compliant and accurate tax strategies. Possesses strong communication and interpersonal skills allowing them to effectively collaborate with a range of clients from individuals to multi- million dollar companies.

- Analyzing financial statements and tax returns

- Advising clients on strategies for minimizing taxes

- Preparing and filing tax returns for individuals, businesses and trust entities

- Performing research to identify and resolve discrepancies

- Implementing tax strategies to minimize taxes

- Complying with federal, state and local tax codes, laws and regulations

- Understanding of accounting principles and practices

- Strong communication and interpersonal skills

- Prepare and file federal, state, and local income tax returns for individuals, businesses and trust entities

- Provide tax advice and develop strategies to minimize taxes

- Analyze financial statements and tax returns to identify and resolve discrepancies

- Research and communicate changes in tax laws and regulations

- Review and update all records to ensure accuracy and compliance

- Provide technical guidance and support to staff on complex tax issues

- Develop and implement tax strategies for individuals and businesses

- Identify and recommend areas for improvement in accounting and tax processes

Experience 7+ Years

Tax Professional Resume with 10 Years of Experience

Highly skilled and knowledgeable Tax Professional with 10 years of experience in the field. Expertise in tax regulations and preparatory and audit practices. Possess a deep understanding of financial statements and tax implications on decisions and investments. Skilled in analyzing and interpreting complex financial statements quickly and accurately. Able to manage clients in a professional and empathetic manner, providing the best solutions and advice.

- Tax Preparation

- Tax Planning

- Financial Statement Analysis

- Tax Problem Resolution

- Tax Regulations

- Cash Flow Management

- Investment Analysis

- Client Relations

- Negotiation and Persuasion

- Preparing and filing tax returns for clients

- Analyzing financial and tax statements to identify potential savings

- Researching tax regulations and filing requirements

- Identifying areas of potential risk and proposing solutions to mitigate liabilities

- Conducting audits of clients’ financial records

- Negotiating and appealing audit findings

- Developing tax strategies and offering advice on minimizing liability

- Resolving complex tax disputes

- Developing and maintaining effective client relationships

- Evaluating investment opportunities and advising clients on the most profitable decisions

Experience 10+ Years

Level Senior Manager

Education Master’s

Tax Professional Resume with 15 Years of Experience

A highly experienced Tax Professional with 15 years of experience in the field. Skilled in working with various tax filing systems and experienced in tax return preparation, problem solving and working with clients. Excellent problem solving skills and an eye for detail that helps uncover potential problems. Highly organized and able to multi- task in order to meet deadlines. Familiar with the latest tax laws and regulations.

- Tax Filing Systems

- Tax Return Preparation

- Problem Solving

- Client Service

- Tax Laws and Regulations

- Organizational Skills

- Deadline Management

- Perform tax return preparation and filing for clients.

- Evaluate and analyze client information to ensure accuracy and compliance with the latest tax laws and regulations.

- Assist in resolving complex tax issues.

- Review financial information and documents for accuracy.

- Research and develop strategies for tax planning.

- Negotiate with the IRS and other government agencies to secure favorable settlements.

- Advise clients on various tax strategies to minimize their tax liabilities.

- Provide clients with assistance in understanding and interpreting tax regulations.

- Maintain current knowledge of all changes in tax laws, regulations and procedures.

- Prepare and present information to clients in a clear and concise manner.

Experience 15+ Years

Level Director

In addition to this, be sure to check out our resume templates , resume formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

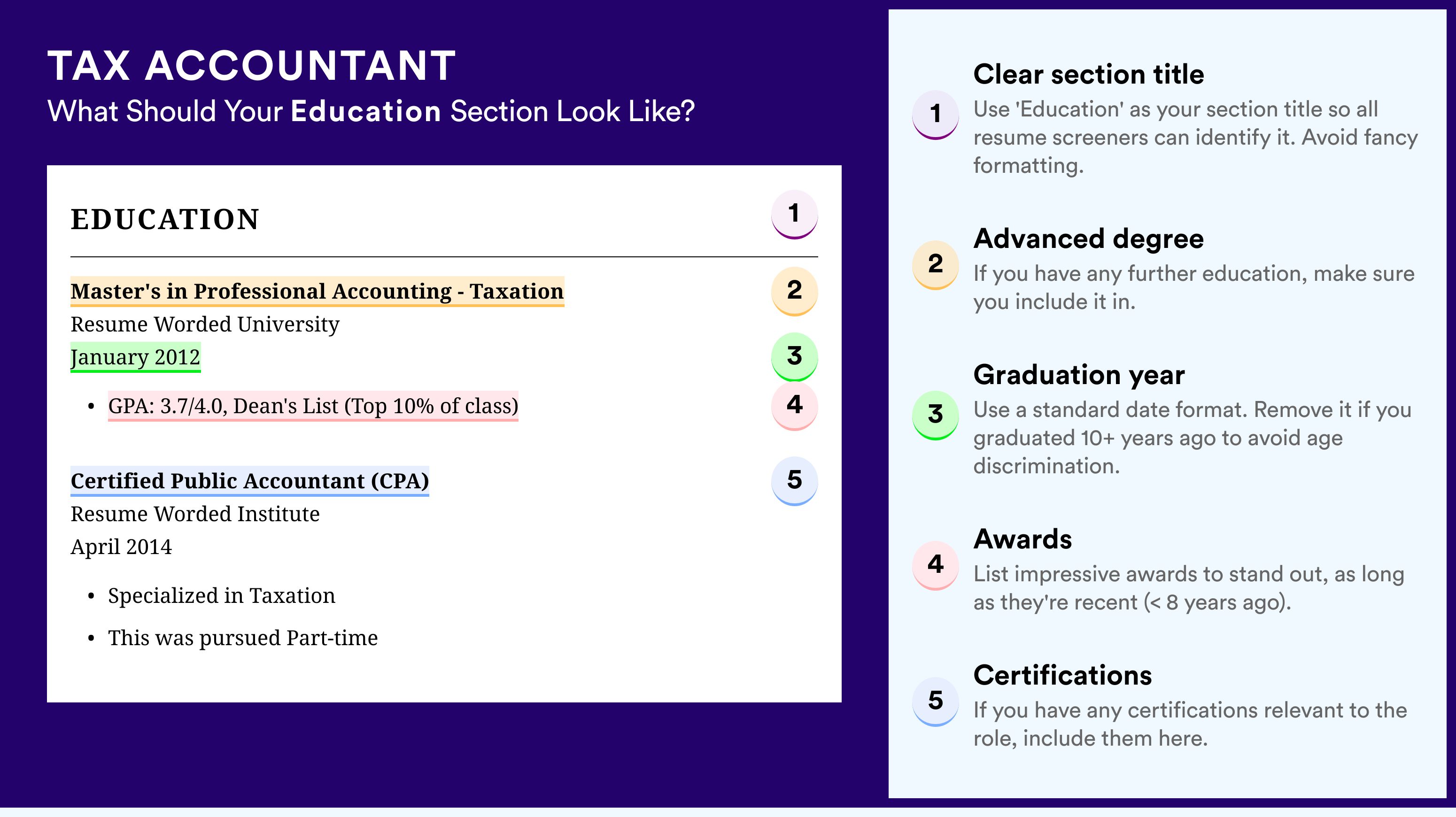

What should be included in a Tax Professional resume?

A tax professional resume should include the following information, which can help to demonstrate the individual’s suitability for the role:

- Professional summary: A brief overview of the individual’s experience, qualifications and areas of expertise.

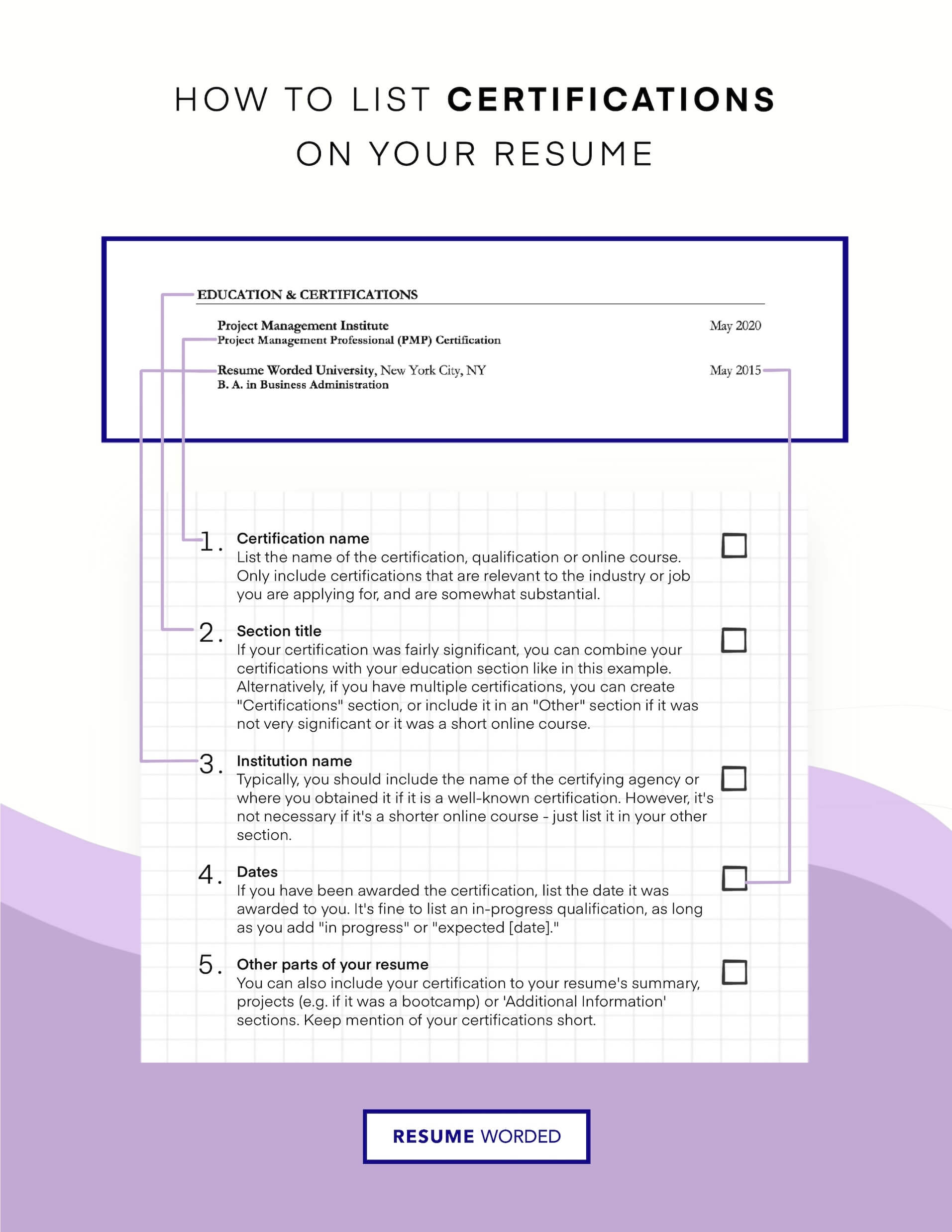

- Education and qualifications: Details of any relevant qualifications, courses and certifications that the individual has completed.

- Work experience: A list of previous roles held and the responsibilities undertaken in each role, as well as any relevant achievements.

- Skills and knowledge: Technical and practical skills pertinent to the role, such as an understanding of taxation law, knowledge of taxation software, and the ability to keep records and accounts.

- Professional memberships: Any professional associations the individual is affiliated with, such as the American Institute of Certified Public Accountants (AICPA).

- Additional skills: Soft skills such as communication, problem-solving and team-working, as well as any other skills or knowledge that could be beneficial in the role.

By including the above information in a tax professional resume, potential employers can quickly assess an individual’s suitability for the position.

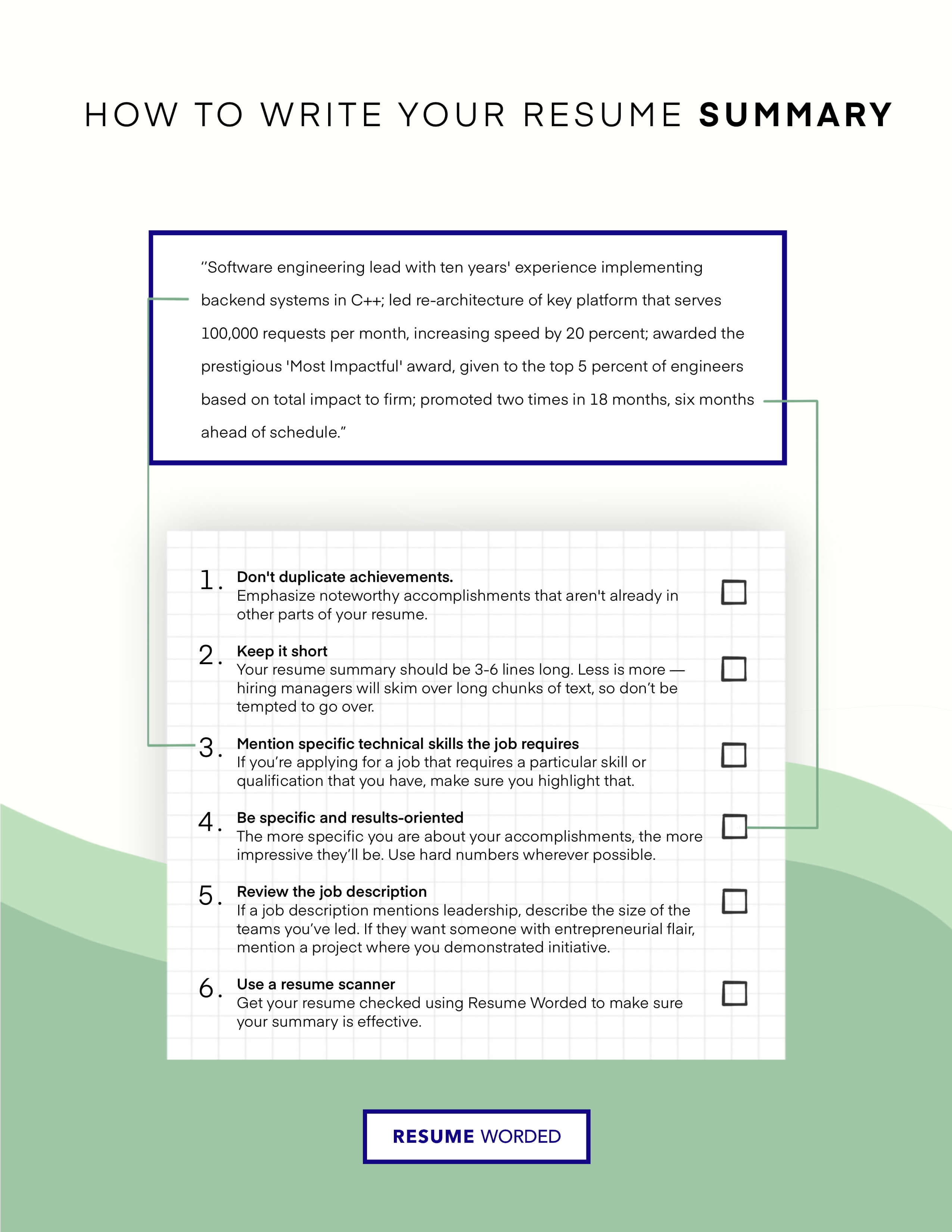

What is a good summary for a Tax Professional resume?

A Tax Professional resume should be concise, yet comprehensive enough to accurately communicate a candidate’s accomplishments, experience, and qualifications to potential employers. A good summary should highlight the candidate’s expertise in preparing and filing complex tax returns, as well as their understanding of federal and state tax codes. Additionally, the summary should include any specialty certifications or credentials the candidate holds, as well as relevant references or experience that might be applicable to the job. Finally, the summary should emphasize the Tax Professional’s attention to detail, accuracy, and ability to meet deadlines. When writing a summary for a Tax Professional resume, it is important to include this information in an easy-to-read, succinct format that entices potential employers to read further.

What is a good objective for a Tax Professional resume?

A tax professional is a skilled person who is responsible for preparing and filing taxes for clients, as well as providing advice on tax law and strategies to optimize clients’ tax liabilities. A good objective for a tax professional’s resume should demonstrate the candidate’s ability to offer effective tax advice and strategies, as well as the ability to efficiently and accurately prepare and file taxes.

- Demonstrate knowledge of tax law and accounting standards

- Have the ability to analyze financial information and make recommendations

- Possess strong organizational and communication skills

- Provide sound tax advice to clients

- Accurately prepare and file taxes

- Utilize tax preparation software programs, such as TurboTax and ProSeries

- Remain up-to-date on the latest tax law changes and regulations

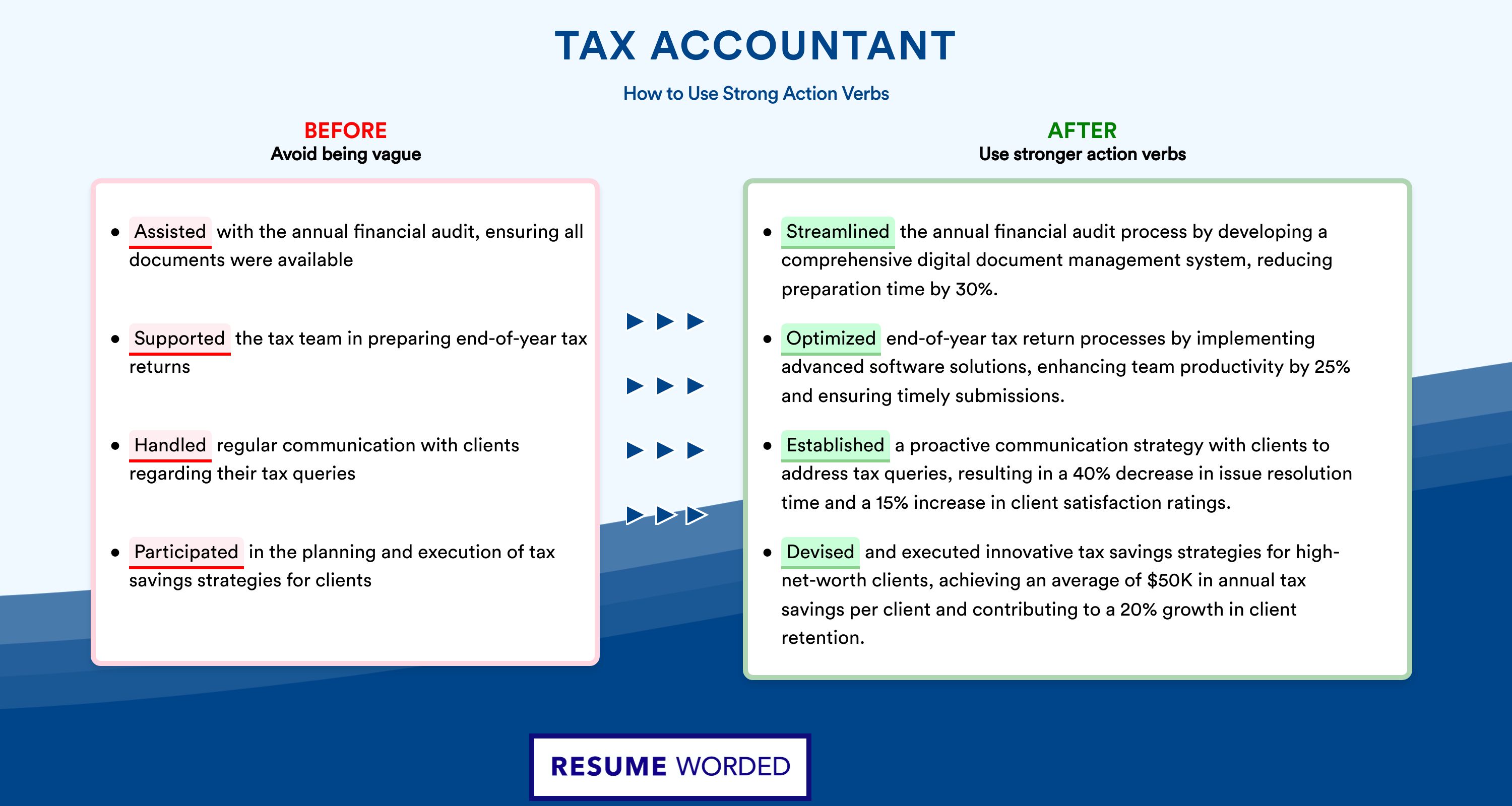

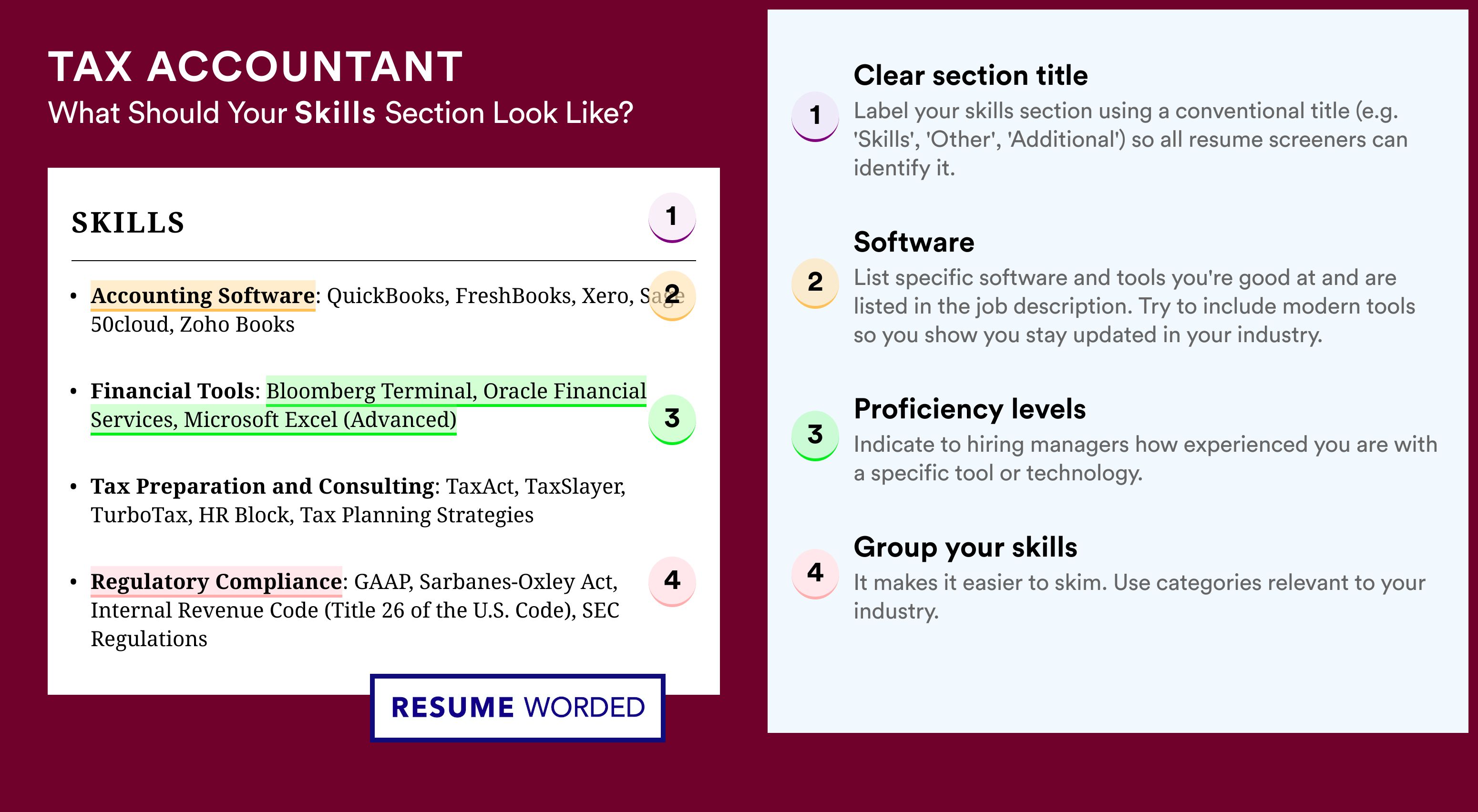

How do you list Tax Professional skills on a resume?

Tax professionals are a highly valued asset in the corporate world, and their services are in high demand. Whether you’re a tax accountant, tax advisor, or tax specialist, you need to make sure your resume accurately reflects your tax professional skills.

Here’s how to list Tax Professional skills on a resume:

- Knowledge of relevant laws, regulations and standards: Tax professionals must be well-versed in all relevant laws and regulations that affect their work.

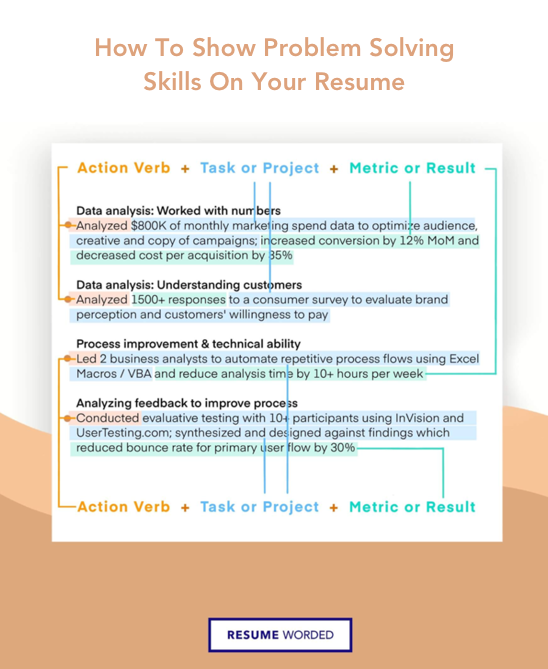

- Analytical and problem-solving skills: Being able to identify potential tax issues and resolve them quickly is an essential skill for tax professionals.

- Attention to detail: Mistakes in tax forms or calculations can cost companies a lot of money. Tax professionals must have an eye for detail to ensure accuracy.

- Communication skills: Tax professionals must be able to explain complex financial or legal concepts in simple terms to both colleagues and clients.

- Organization and time management skills: Keeping track of deadlines, organizing documents and managing client accounts are all important skills for tax professionals.

By listing these Tax Professional skills on a resume, you’ll be sure to capture the attention of potential employers and show that you’re a qualified and competent professional.

What skills should I put on my resume for Tax Professional?

Having an impressive tax professional resume is key to standing out from other candidates and getting the job you want. To make sure your resume stands out, there are certain skills that employers are looking for. Here are some of the skills you should include in your resume when applying for tax professional positions:

- Tax Preparation: Tax preparation is the process of filing income taxes for individuals and businesses. As a tax professional, you must have the knowledge and experience to accurately fill out tax returns and navigate complex tax codes.

- Tax Law Knowledge: Working as a tax professional requires a solid understanding of tax laws, as you must be able to answer clients’ questions and guide them through their own taxes.

- Research Skills: In addition to being up to date on the latest tax laws, you must also possess the skills to research and resolve tax-related issues. This includes being able to identify the most beneficial tax strategies for clients and understanding the implications of certain tax laws.

- Communication Skills: As a tax professional, you must be comfortable working with clients and communicating with them to ensure their taxes are done accurately and efficiently. This includes being able to explain complex tax concepts in layman’s terms.

- Time Management: Being a tax professional involves juggling multiple tasks and deadlines. You must have the ability to manage your time effectively to ensure that all tasks are completed on time and that client taxes are accurate and filed properly.

By including these skills in your resume, you’ll be able to demonstrate to employers that you have the knowledge and experience they’re looking for in a tax professional.

Key takeaways for an Tax Professional resume

A tax professional resume is a summary of your skills and experience that can be used when applying for jobs in the field of tax management or preparation. While some employers might focus on the technical aspects of your resume, the focus must be on the overall content and presentation of your resume. Here are some key takeaways for creating a tax professional resume that highlights your experience and qualifications:

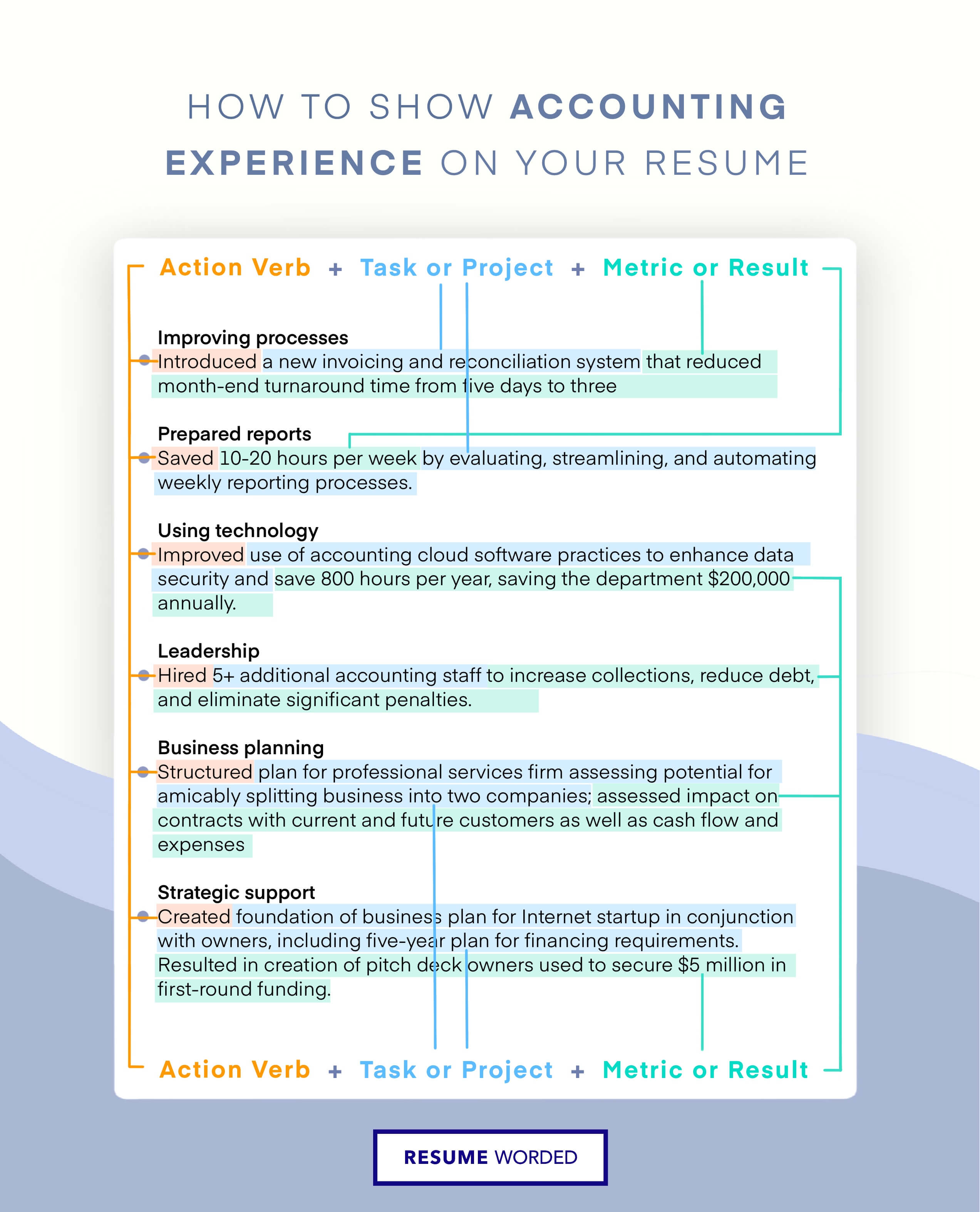

- Emphasize Your Skills: Showcase the skills you have that are essential for a tax professional; such as tax preparation, financial analysis, and research. Highlight any experience or training you have had that is relevant to the job you are applying for.

- Demonstrate Your Experience: Include past job experiences that are related to tax-related activities. Make sure to include any certifications, awards, or honors you have received.

- Detail Your Education: Provide a thorough overview of your educational background, including the name of the institutions you attended, your degree program, and any courses you took that are relevant to the job.

- Include Professional References: Include references from your past employers, mentors, or advisors. Make sure to include contact information for each reference.

- Proofread and Edit: Pay attention to detail and make sure there are no errors in your resume. Check for spelling and grammar mistakes, as well as any typos.

By following these key takeaways, you can create a tax professional resume that stands out from the competition and helps you land the job of your dreams. Good luck!

Let us help you build your Resume!

Make your resume more organized and attractive with our Resume Builder

Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

5 Tax Preparer Resume Examples to Edit Free for 2024

Tax Preparer Resume

- Tax Associate

- Tax Manager

- Entry Level Tax Preparer

- Write Your Tax Preparer Resume

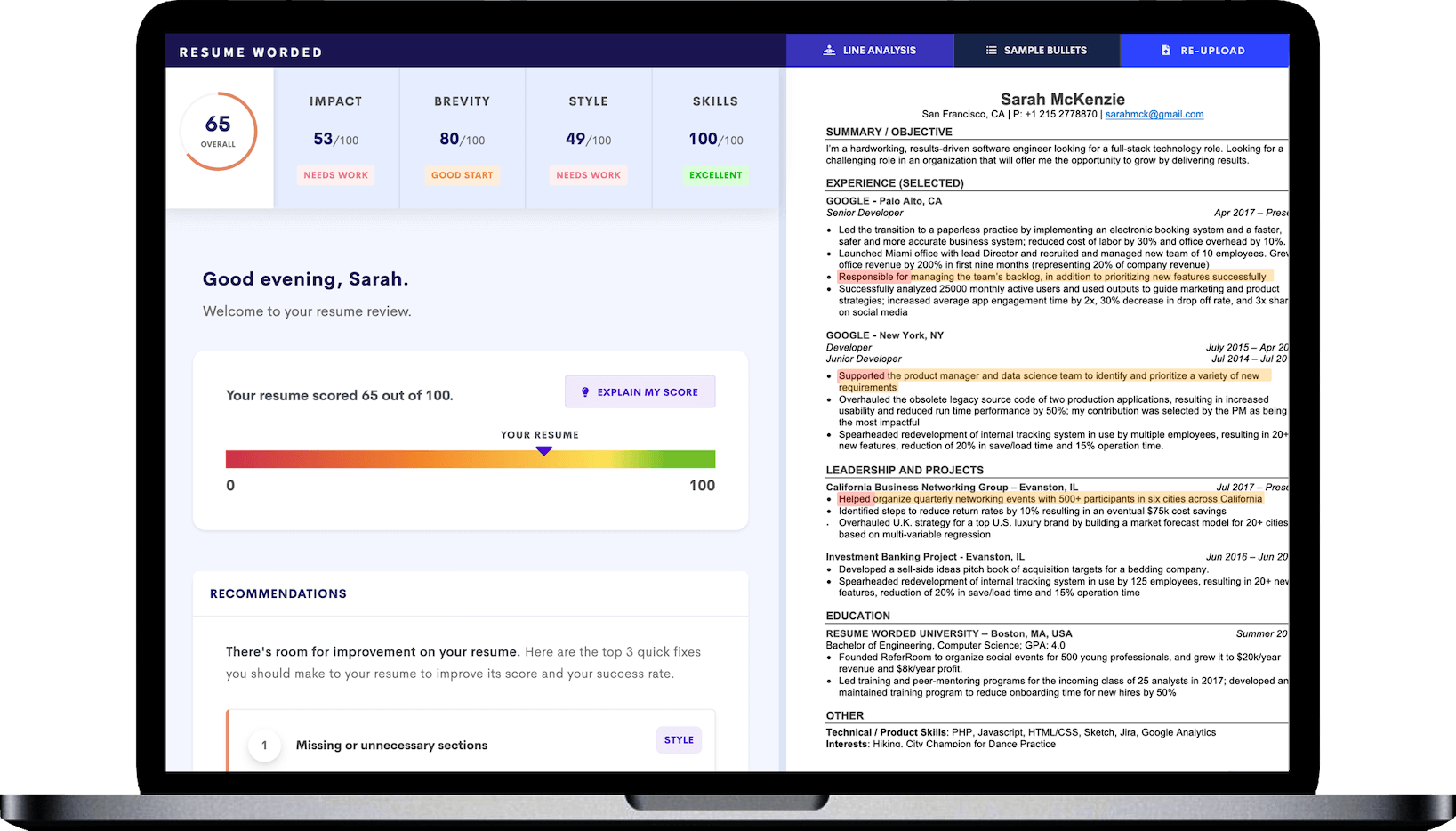

You know all the tax rules and regulations like the back of your hand. Your meticulous attention to detail ensures accurate returns and minimal effort for your clients.

You excel at maximizing deductions, minimizing liabilities, and seamlessly managing audits when they pop up. However, crafting a resume that captures your tax-savvy prowess requires a different kind of know-how.

Luckily, just as you help people get their numbers in order, we’re here to help you through the job-seeking maze. With our ai cover letter generator and expert tax preparer resume examples , you can learn how to stand out and land the roles you want.

or download as PDF

Why this resume works

- The next step is to show resolve in your tax preparer resume. Add any internship experience that you managed to get during the same year of graduation. If it’s for accounting, in particular, highlight your knowledge of the subject by mentioning how you handled hundreds of bank statements accurately.

Tax Associate Resume

- For your tax associate resume, clearly list down all the software you use for tax returns such as H&R Block Tax Software. You can further add more depth by including extra tools like CCH Axcess Tax that help users prepare industry-compliant tax returns. Lastly, mention the tools you use for keeping records such as Excel or Google Sheets.

Tax Manager Resume

- Put your managerial skills on display here by using quantifiable work experience such as “improving the client satisfaction rate by 36% as per feedback” to prove your ability to keep clients happy. You can also add similar bullet points that show your contribution to reducing response times in your tax manager resume.

Tax Intern Resume

- For instance, how do you stay abreast of the latest tax trends? By adding the necessary skills and tools you leveraged to not just be updated but also understand any changes in tax policies.

Entry Level Tax Preparer Resume

- Have a special ability such as an eye for detail? Add it in! Show your expertise in paying attention by using metrics where you were able to identify profitable tax benefits that others missed out on. You can also make use of other metrics in your entry level tax preparer resume that highlight your critical thinking skills.

Related resume examples

- Financial analyst

- Finance manager

Adapt Your Tax Preparer Resume to Tick All the Boxes

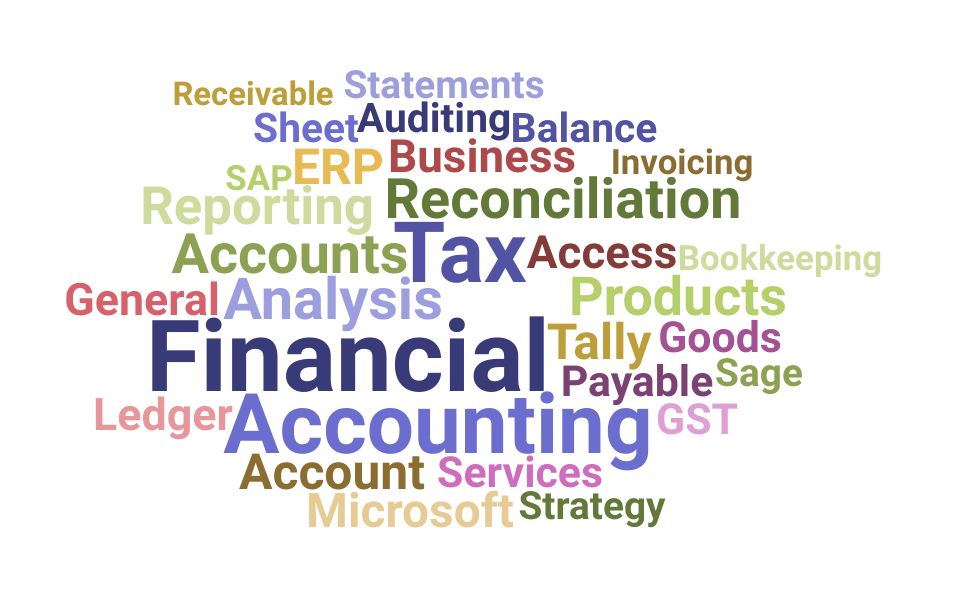

Your role as a tax preparer demands a unique set of skills , and you know better than anyone what those skills are. Since this is a technical role, it’s totally fine to get into the nitty-gritty. Impress hiring managers by emphasizing your proficiency in tax codes, IRS regulations, and the latest accounting software.

Detail your knack for uncovering deductions, managing audits, and ensuring precision in financial documentation. To make sure you truly stand out, it’s essential to tailor your resume to each application, mirroring the skills mentioned in the job description .

If the company needs an auditing pro, highlight your auditing skills, or if it needs impeccable documentation, emphasize your dedication to thorough record keeping.

Need a few ideas?

15 top tax preparer skills

- Tax Code Proficiency

- IRS Regulations

- Audit Management

- Data Analysis

- Microsoft Excel

- Tax Research

- Data Security

- TaxWise E-Filing

- Bloomberg Tax

Your tax preparer work experience bullet points

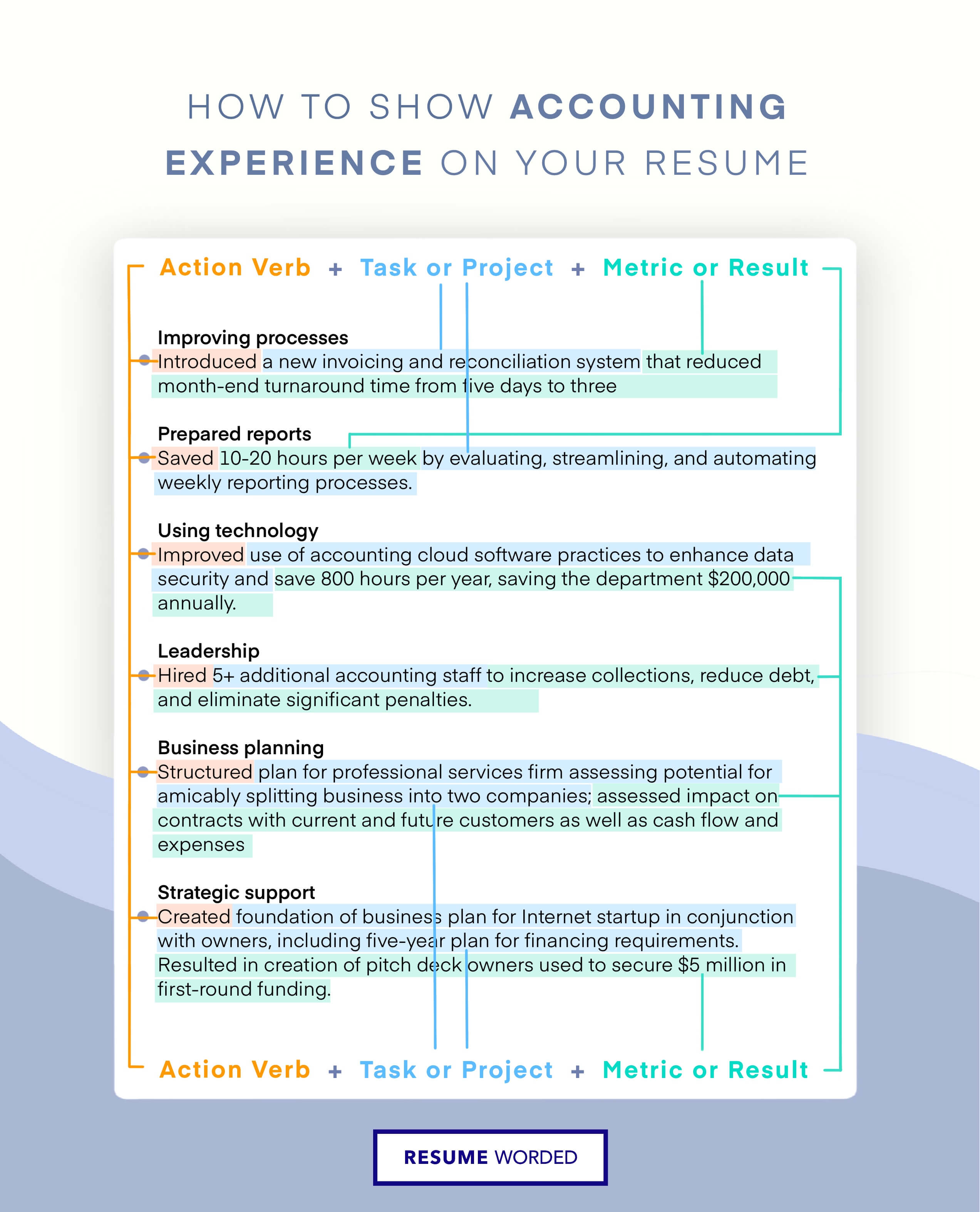

From navigating intricate tax codes to orchestrating flawless financial audits, successfully completing a job as a tax preparer is no small feat. Hiring managers know this, so there’s no better way to impress them than by highlighting your greatest successes and happiest clients.

Showcase achievements like optimizing client deductions, ensuring accuracy in tax returns, or even streamlining the audit process.

Then, to seal the deal, add specific numbers and percentages that make it clear just how successful you were—after all, you didn’t just ensure accuracy, but you reduced errors by 78%.

- Show off your attention to detail by talking about the percentage of error-free tax returns you’ve consistently delivered.

- Highlight client satisfaction with metrics like feedback surveys, customer retention, or return customers.

- Showcase the percentage of successful audits managed without major discrepancies to show that you’re no stranger to keeping everything in order.

- Specify the average time taken to complete and file tax returns to express that you’re not just on point, but you’re also quick.

See what we mean?

- Managed a portfolio of 71 clients, delivering tax planning and advisory services that led to an average of 16% cut in tax liabilities

- Leveraged Wolters Kluwer CCH’s electronic filing feature, resulting in a $107 reduction in paper filing costs and a 92% e-filing rate

- Maintained a ledger of 546 client accounts within Zoho Books, reducing outstanding receivables by 29% with regular follow-ups and collections efforts

- Coordinated with IRS representatives to address and resolve e-filing anomalies, shrinking penalty charges for clients by 29%

9 active verbs to start your tax preparer work experience bullet points

- Implemented

- Collaborated

- Facilitated

- Streamlined

3 Tips for Writing a Tax Preparer Resume as a Beginner

- Academic achievements demonstrate your dedication to mastering tax-related concepts. As such, if you excelled in classes like Tax Accounting or Advanced Financial Reporting, make sure to mention them alongside your GPA and any extra coursework.

- If you’ve worked on tax-related projects on your own time or gained experience through internships, highlight this. Describe how you applied your knowledge in practical scenarios, whether it’s optimizing deductions for a mock client or assisting in tax audits.

- Craft a clear and concise career objective that reflects your passion for the job. Show off your desire to apply your knowledge in a practical setting and emphasize your commitment to accuracy, compliance, and client satisfaction.

3 Tips for Writing a Tax Preparer Resume as a Seasoned Professional

- Showcase memberships to organizations like the National Association of Tax Professionals (NATP) or relevant certifications you hold, such as the IRS Annual Filing Season Program (AFSP) or Certified Financial Planner (CFP). These validate both your skills and your passion for the industry.

- Show that you’re an effective communicator with some well-placed work experience bullet points. Whether it’s resolving complex tax inquiries or providing proactive tax planning advice, emphasize that you were able to build long-lasting client relationships.

- Mention any tax-related seminars you go to, workshops you take part in, or conferences you attend to emphasize your dedication to the field and commitment to staying on top of your game.

ATS scans for relevant terms (such as IRS, audits, QuickBooks, etc) so align your skills and experiences with those in the job description . Using a clean and professional resume format without flashy graphics also helps the software read your resume effectively.

Absolutely! Always quantify your achievements, whether it’s the accuracy rate in tax returns, client satisfaction scores, or successful audit rates. These kinds of numbers add substance to your accomplishments.

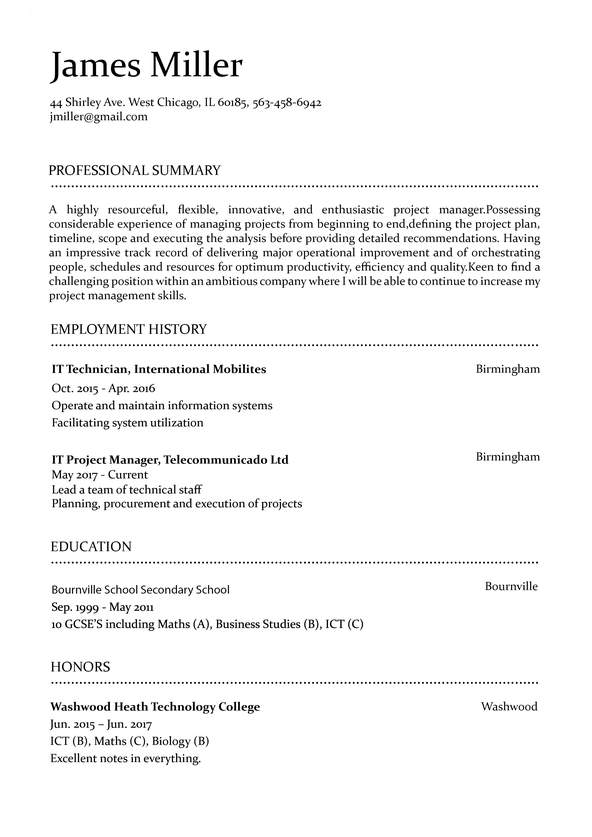

Tax preparation is about clarity and accuracy, so use a resume template with a format that clearly presents your contact information, career summary , skills, work experience , and education. This makes sure that hiring managers can quickly see your qualifications and assess your suitability for the role.

- Tax Preparer Resume Example

Resume Examples

- Common Tasks & Responsibilities

- Top Hard & Soft Skills

- Action Verbs & Keywords

- Resume FAQs

- Similar Resumes

Common Responsibilities Listed on Tax Preparer Resumes:

- Prepare and file individual, corporate, and partnership tax returns

- Analyze financial information to determine tax liability

- Research and interpret tax laws and regulations

- Identify and maximize tax credits and deductions

- Prepare and review estimated tax payments

- Respond to IRS inquiries and notices

- Prepare tax projections and forecasts

- Prepare and review quarterly and year-end tax reports

- Assist clients with tax planning and compliance

- Develop and maintain relationships with clients

- Stay current on changes in tax laws and regulations

- Provide tax advice and guidance to clients

Speed up your resume creation process with the AI-Powered Resume Builder . Generate tailored achievements in seconds for every role you apply to.

Tax Preparer Resume Example:

- Developed and implemented tax planning strategies for high net worth individuals, resulting in a 15% reduction in tax liability and a 20% increase in client satisfaction.

- Conducted thorough research and analysis of tax laws and regulations to identify and maximize tax credits and deductions, resulting in a 25% increase in tax savings for clients.

- Provided expert guidance and advice to clients during IRS audits, resulting in a 90% success rate in resolving disputes and avoiding penalties.

- Managed a portfolio of 50+ corporate clients, preparing and filing their tax returns accurately and on time, resulting in a 95% client retention rate.

- Developed and maintained strong relationships with clients, resulting in a 30% increase in referrals and new business opportunities.

- Provided ongoing tax planning and compliance advice to clients, resulting in a 10% increase in overall client satisfaction.

- Prepared and filed individual, corporate, and partnership tax returns for 200+ clients, ensuring compliance with all tax laws and regulations and achieving a 99% accuracy rate.

- Conducted regular tax projections and forecasts for clients, resulting in a 15% increase in tax savings and a 20% increase in client satisfaction.

- Stayed up-to-date on changes in tax laws and regulations, providing timely and accurate advice to clients and ensuring compliance with all new requirements.

- Tax planning and strategy development

- Tax law research and analysis

- Tax credit and deduction maximization

- IRS audit guidance and support

- Corporate tax return preparation and filing

- Client relationship management

- Tax compliance advice

- Individual and partnership tax return preparation

- Tax projections and forecasting

- Knowledge of current tax laws and regulations

- Attention to detail and accuracy

- Time management and organization

- Strong communication and interpersonal skills

- Problem-solving and critical thinking

- Adaptability and ability to stay current with industry changes

Top Skills & Keywords for Tax Preparer Resumes:

Hard skills.

- Tax Law Knowledge

- Tax Preparation Software Proficiency

- Financial Analysis

- Attention to Detail

- Communication Skills

- Organization and Time Management

- Customer Service

- Accounting Principles

- Research and Investigation

- Problem Solving

- Compliance and Regulations

Soft Skills

- Analytical Thinking

- Time Management and Prioritization

- Communication and Interpersonal Skills

- Customer Service Orientation

- Adaptability and Flexibility

- Problem Solving and Critical Thinking

- Ethics and Integrity

- Organization and Planning

- Teamwork and Collaboration

- Stress Management

- Technical Aptitude and Computer Skills

Resume Action Verbs for Tax Preparers:

- Communicated

Generate Your Resume Summary

Resume FAQs for Tax Preparers:

How long should i make my tax preparer resume, what is the best way to format a tax preparer resume, which keywords are important to highlight in a tax preparer resume, how should i write my resume if i have no experience as a tax preparer, compare your tax preparer resume to a job description:.

- Identify opportunities to further tailor your resume to the Tax Preparer job

- Improve your keyword usage to align your experience and skills with the position

- Uncover and address potential gaps in your resume that may be important to the hiring manager

Complete the steps below to generate your free resume analysis.

Related Resumes for Tax Preparers:

Tax accountant, tax advisor, tax analyst, tax associate, tax consultant, tax manager, senior tax accountant.

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

- Resume Samples

- Tax and Revenue

Tax Professional Resume Samples

The guide to resume tailoring.

Guide the recruiter to the conclusion that you are the best candidate for the tax professional job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies, tailor your resume & cover letter with wording that best fits for each job you apply.

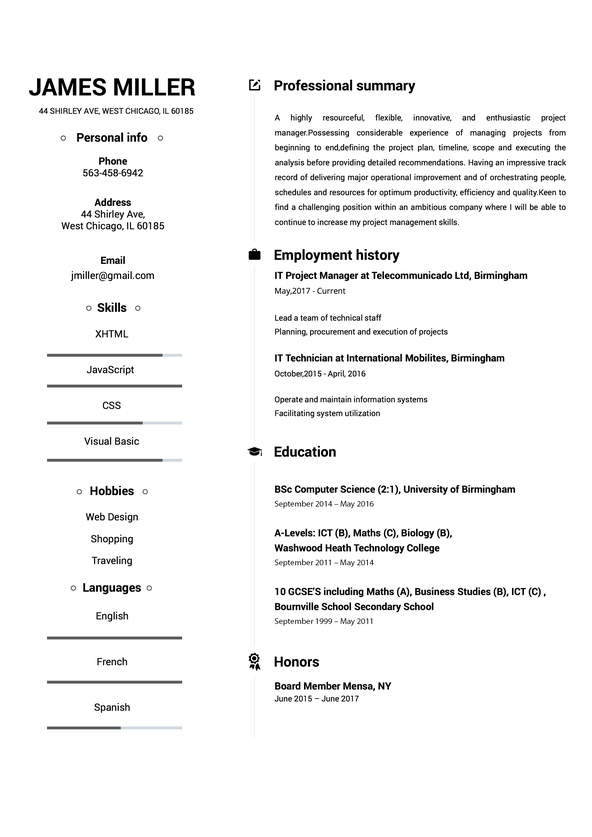

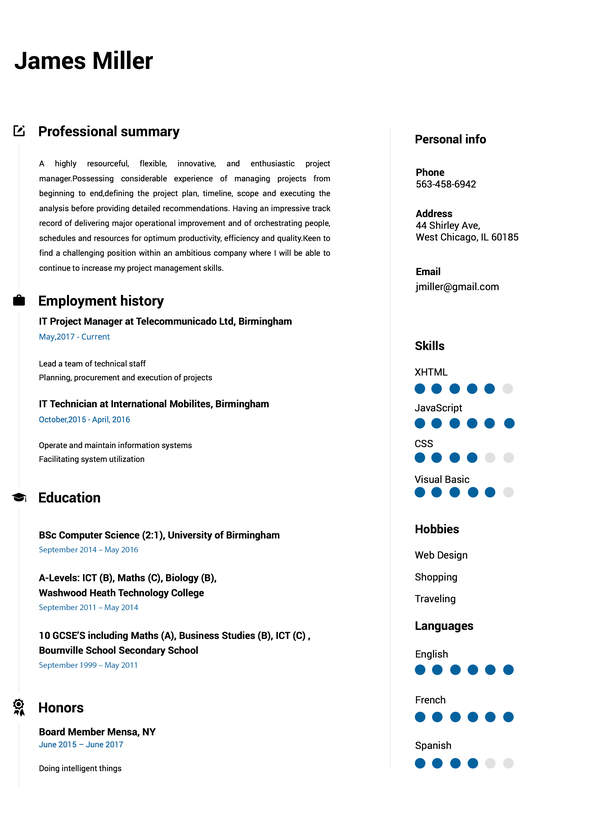

Create a Resume in Minutes with Professional Resume Templates

- Working with outside service providers

- Tax compliance management, oversight and preparation for a high volume of tax adjustments and returns in a time sensitive environment

- Assist with preparation of unitary and combined state and local tax returns

- Assist with preparation of unitary and combined state and localtax returns

- Preparation of federal and state income tax returns and tax return work papers for multiple legal entities across different businesses

- Preparation of income tax accounting calculations and work papers in accordance with ASC 740

- Tax provision management and preparation, including separate company financial statements, monthly and quarterly ETR calculations

- Reporting of tax on hedge gains and losses on CTA and assist in the analysis of tax (non)gross ups treatment for hedges on CTA

- Organizational Change Management

- Liaise between external service providers and tax technology team to ensure accurate reporting, testing & communication between the groups

- Assist in all U.S. tax audit related matters

- Assist in the quarterly and yearend review of tax on CTA disclosures for Other Comprehensive Income (OCI)

- Management of the Current and Deferred tax provision process on CTA of foreign consolidated subsidiaries (including entities that are disregarded into the US and foreign subsidiaries whose earnings are not indefinitely reinvested) and equity method investments

- Assist with international tax compliance software testing and enhancements

- Work constructively with the team to evaluate and improve personal and team performance

- Manage various external service providers with respect to Transfer Pricing, Acquisitions, Divestitures and Financing Arrangements

- Provide feedback to the engagement team to improve compliance with basic principles and practices

- Assist the Global tax team with research of specific Canadian Income Tax issues

- Assist with preparation of all data necessary for filing income & franchise tax returns

- Manages tasks independently and within budget

- Provide support and leverage to team members and others on engagements

- Strong problem solving, High analytical ability to identify, correlate, and interpret specialized financial and tax data

- Strong verbal and written communication skills and the ability to effectively communicate in person

- Results-oriented approach with keen attention to high quality, details and accuracy

- Resilient and self confident with the ability to perform successfully in a fast-paced environment

- Ability to conduct local marketing activities and attract new clients

- Successful completion of the H&R Block Tax Knowledge Assessment or Income Tax Course²

- Successful completion of the H&R Block Tax Knowledge Assessment or equivalent

- Ability to effectively communicate in person and in writing

- Strong interpersonal and relationship building skills

- Ability to multitask

2 Tax Professional resume templates

Read our complete resume writing guides

How to tailor your resume, how to make a resume, how to mention achievements, work experience in resume, 50+ skills to put on a resume, how and why put hobbies, top 22 fonts for your resume, 50 best resume tips, 200+ action words to use, internship resume, killer resume summary, write a resume objective, what to put on a resume, how long should a resume be, the best resume format, how to list education, cv vs. resume: the difference, include contact information, resume format pdf vs word, how to write a student resume, senior tax professional resume examples & samples.

- Bachelor’s Degree or higher

- 3 years of tax experience

- CPA or CPA Candidate

- Experience in the financial services industry

- Proficiency in SAP, CorpTax, MS Excel, Access, Word, Power Point and Outlook

- Reviewing annual U.S. Forms5471, 8621, 8858, 8865, 1120-F, and required disclosures and statements

- Calculating Subpart F incomeand other deemed foreign inclusions to U.S. taxable income on a quarterlybasis

- Requesting various legal,financial, and tax information from planning colleagues and foreigncontrollers

- Analyzing and supporting taxbasis, cumulative Earnings and Profits, and tax pools of foreign corporations

- Working with and developing aSr. Tax Professional I to meet deliverablesQualifications

- Bachelors Degree or higher in Accounting

- 5 years of tax experience (2 years international)

- Experience in financial services industry

- Proficiency in CCH / RIA Tax Research, SAP, CorpTax, and Microsoft Office

- Bachelor's Degree or higher in Finance or Accounting

- 5 years of tax or pulblic accounting experience

- Experience in ASC 740/FAS 109

- CPA or CPA eligible

- Experience in Public Accounting, Banking or Financial services

- Bachelor’s Degree or higher in Accounting, Information Systems, IT or equivalent

- 5 years of Info Systems/Tax Compliance/Business experience

- Excellent communication and analytical skill

- Strong technology skills including tax software, Excel and GL reporting systems

- Experience with CorpTax USC/AGP software administration

- Posting Date: 08/06/2014

z .filled Senior Tax Professional Resume Examples & Samples

- Legal entity income tax expense models

- Preparation of quarterly income tax rate reconciliations

- Assistance with preparation of quarterly management accounting entries

- Analyses of current income tax and deferred tax balances

- Works on activities and projects with others within the business unit

- May lead projects and coordinate resources

- This role is not eligible for My Work and must be located in Charlotte, NC***

- MUST have 5+years of tax experience, including 2+ years in accounting for income tax

- Knowledge of ASC Subtopic 740, Income Tax

- Highly skilled in MS Excel

Domestic Tax Professional Resume Examples & Samples

- Calculate monthly effective tax rates

- Preparation and review of quarterly tax provisions as partof regulatory call reports

- 5-8+ years of domestic corporate tax experience, preferablyin a large corporate environment or a large accounting firm

- Strong analytic, organizational and interpersonal skills

- Experience covering complex tax issues in a real-time environment

- MS or MBA in Tax preferred

Seasonal tax Professional Resume Examples & Samples

- Excellent communication skills; desired willingness for client contact

- Expert PC skills; proficiency with the MS Office suite and Adobe

- Strong teamwork and collaboration skills

- Bachelor's or graduate degree in accounting, finance or related field preferred

- Minimum of 1-2 years related experience in public accounting or corporate tax department

- CPA certification is preferred

- Experience managing multiple client engagements

Fortune Co Seeks Tax Professional Resume Examples & Samples

- Assist with preparation of federal and state tax return schedules and related work-papers

- Obtain all necessary reports from GL system

- Respond timely to all federal and state tax notices

- Assist with preparation of quarterly estimated tax payments and extensions schedules and related work-papers

- Assist with preparation of various FAS109 schedules and related work-papers

- Review changes in deferred tax account balances

- Assist with special projects from time to time

- Work closely with various outside service providers

- Research tax issues as necessary and provide write-up

- Responsible for updating any tax procedures related to position

International Tax Professional Resume Examples & Samples

- Review and reconcile tax on CTA to the firm’s books and records

- Assist Domestic and International Tax compliance teams on the computation and review of certain taxable gains and losses for tax return purposes (e.g., Sec 987, Sec 988 and Sec 986(c))

- Assist with IRS audit information requests relating to Sec 987 and other foreign currency issues

- Monitor and validate legal entity population and analyze tax on CTA implications for entity restructurings, repatriations and liquidations as well as changes in APB 23 assertions

- Analyze tax implications for changes in functional currency

- Maintenance of Federal /State/Non-US tax rates for CTA within Tax Data warehouse

- Maintain procedure documentation and service level agreements with stakeholders relating to reporting of tax on CTA

- Bachelor’s degree in accounting. Masters in tax a plus

- 4-7 years of hands on experience in (i) US international tax compliance, (ii) income tax accounting and (iii) corporate accounting in a public accounting firm or corporate environment

- Financial services experience preferred

- Excellent analytical, organizational and communication skills, including the ability to simplify and communicate complex business information

- Working knowledge of Microsoft and Excel

- Leadership role on his/her own foreign tax credit business unit coverage

- Liaise with tax and business units controllers on items affecting the Firm’s foreign tax credit analysis

- Liaise between external service providers and tax technology team to ensure accurate reporting, testing & communication between the groups

- Manage compliance related issues and tax planning analysis for Morgan Stanley’s foreign subsidiaries and their hybrid subsidiaries in various jurisdictions

- Prepare applicable US tax returns for assigned non-US entities (Form 5471, 8865, 8858 etc.) and other associated US tax compliance tasks

- Coordinate with the domestic compliance group with respect to any US inclusion items, such as subpart F, dividends and section 956 inclusions

- Coordinate with members of the global tax group in projecting estimated tax liability of each legal entity and incorporate that in effective tax rate calculations

- Gather data for purposes of U.S. information reporting with regard to CFCs, CFPs and minority investments; Ensure that any tax law changes or structural changes are appropriately reported on the relevant US tax returns

- Strong analytical, organizational and interpersonal skills

- Self-motivated and a strong team player

- 5-7 years International Tax compliance or accounting experience

- Calculate monthly and quarterly effective tax rates

- Reconciliation and validation of income tax accounts and balance sheet tax accounts

- Bachelors or Master’s degree in accounting, finance or other business discipline; taxation experience a plus

- A minimum of 6 - 8 years of experience in Federal income tax compliance in a - CPA firm or corporate environment

- Ability to interact effectively with all levels of personnel

- Experience with Corptax Provision

- 4-7 years of hands on experience in US international tax compliance, income tax accounting and corporate accounting in a public accounting firm or corporate environment

- Ability to simplify and communicate complex business information

- Strong time management and multitasking skills

- Ensure that client requests are addressed on a timely basis

- Identify opportunities and come up with ideas to provide added value to the client

- Secure and enhance client relationships at the appropriate level and present a positive impression of EY

- Build strong internal relationships within EY TAX Services and with other services across the organization in order to identify and capitalize on cross selling opportunities

- Leverage knowledge from individuals, databases and other sources

- Tax compliance management, oversight and preparation for a high volume of tax adjustments, federal and state corporate income tax returns in a time sensitive environment

- 6-9+ years of domestic corporate income tax experience, preferably in a large corporate environment or a sophisticated accounting firm

- In depth review of legal entity non-US tax provisions and Current & Deferred tax balances maintained in tax provision software

- Review of legal entity attributes including Tax Credits, NOL and related Valuation Allowance analyses

- Preparation and review of Forms 5471, 8865 and 8858 in relation to non-US subsidiaries

- Bachelor’s degree in accounting; Masters in taxation and CPA preferred

- 3-5 years of hands-on experience in ASC 740, Income Taxes and international tax compliance

- Financial services background preferred

- At least 6 years of experience including state compliance, controversy, and tax technology

- Ability to multi-task and be flexible with shifting priorities

- Experience with the financial service industry

- Corptax USC including preparing returns and updating custom ranges, custom groups, and return calculation logic

Tax Professional Resume Examples & Samples

- A minimum of 4 years relevant experience in tax environment (both Indirect and Income Taxes), including substantial experience with a Big Four Firm or reputable MNC; experience in both Big Four and MNC would be a plus

- Thorough knowledge and experience in China tax law and practices

- Familiar with construction site project/real estate industry is a plus

- Thorough knowledge of business controls in a tax environment

- Ability to adopt for dynamic changing environment

- Familiarity with IT industry business models (Hardware, Software and Services) is highly advantageous

- Preparation of book/tax differences for various deferred cash and equity compensation plans and employee benefits plans

- Tracking book and tax basis for various equity and partnership investments

- Corresponding with taxing authorities on deficiency notices

- Special projects such as REMIC schedule Q tracking and tax depreciation calculations

- Bachelors or Master’s degree in Accounting, Finance or other business discipline; taxation experience a plus

- A minimum of 2 to 4 years of experience in a CPA firm or corporate Tax Department

- Solid computer/technology skills, especially Excel

- Financial services background preferred, but not required

- Experience with CorpTax Compliance and Provision is preferred, but not required

- Responsible for daily tax operations for BJ branch, achieve expected tax results, maintain process compliance and audit readiness at all time

- Provides business insight and advice to manager

- In charge of local tax returns, and tax incentive

- Develop and undertake special tax and accounting projects

- Familiar with tax laws and regulations as well general company laws, SAFE rules

- 3 + years working knowledge of accounting and tax principles

- Strong communication and negotiation skills, demonstrated ability to present results in both orally and in writing

- Self-motivated, willing to work under pressure

- Skilled in spreadsheet, word processing, presentation, etc

- Qualifications (Education/Major/Certificates)

- Bachelor\'s Degree in Tax/Accounting/Finance major

- 3+ years experience in Tax Accounting in MNC

Indirect Tax Professional Resume Examples & Samples

- A minimum of 6 years relevant experience in tax environment, fworking experience in firm or MNC is preferred

- Rich experience in tax compliance

- Able to translate technical decisions /strategies into business terms and implications

- Able to prioritize, multi-task, and take ownership of the projects

- Good written and verbal English & Chinese communication skills

- Compilation of monthly federal consolidated deferred tax balances for regulatory reporting purposes

- Calculation of consolidated Federal and State tax provision

- Reconciliation and validation of income tax accounts and deferred tax balances

- Coordination and communication of income tax accounting matters with members of department’s tax compliance teams

- Identify and advise on income tax accounting process enhancements

- Other related tax accounting project management and analysis

- A minimum of 4-7 years’ experience in Federal income tax compliance/accounting or corporate accounting in a CPA firm or corporate environment

- Experience with CorpTax Provision is preferred

- Preparation of book/tax differences for various business unit coverages from commodities, fixed income, insurance and broker/dealer

- Preparation of consolidated and separate company financial statement footnotes

- A minimum of 4 years of experience in a CPA firm or corporate Tax Department

- Tax Litigation, Compliance and Advisory

- Excellent Communication, people management and leadership skills

- Atleast 7 years of experience in International Tax

- Bachelors degree in Law

- Preparing annual U.S. Forms 5471, 8621, 8858, 8865, 1120-F, and required disclosures and statements

- Calculating Subpart F income and other deemed foreign inclusions to U.S. taxable income on a quarterly basis

- Requesting various legal, financial, and tax information from planning colleagues and foreign controllers

- Analyzing and supporting tax basis, cumulative Earnings and Profits, and tax pools of foreign corporations

- Keeping track of corporate resolutions and capital movements for assigned entities

- Preparing responses to IRS audit inquiries for assigned entities

- Researching tax issues and supporting planning initiatives and business unit support team on special projects

- Working closely with a Sr. Tax Professional II and Tax Manager to meet deliverables

- Bachelor’s Degree or higher in Accounting/Finance

- Public Accounting Experience

- SAP/eLedger

- Advanced Excel, Modeling, Data Manipulation

- Forecast/Planning Experience

- Comfort working with Complex Financial Products

- Must have 3+ years of tax experience (Big 4 a plus) minimum

- Bachelors degree in Accounting is required. CPA, or CPA candidate preferred

- Excellent verbal and written communication skills along with good time management required

- Proficient computer skills including Excel, Word and tax return preparation and research software

- Familiarity with CorpTax a plus

Experienced Tax Professional Resume Examples & Samples

- Current CPA Certification (preferred, not required) or eligibility to sit for the CPA exam

- 3+ years of experience in Public Accounting preparing and reviewing tax returns including Corporation, Partnership, LLC and complex individual returns

- Experience working with construction-industry clients a plus

- Experience with ProSystems Tax software a plus

Audit & Tax Professional Resume Examples & Samples

- Prepare and file Form 5500 returns while managing client deadline expectations and budgets

- Oversee and review Form 5500 preparation and supervise staff as the practice expands

- Develop and maintain a relationship with the client and proactively work with the client’s management to gather necessary information, as well as actively look for additional business development opportunities

- Provide annual Form 5500 updates at Whitley Penn’s Annual Employee Benefit Conference in all markets

- Respond to DOL and IRS inquiries

- Supervise, train and mentor Staff, including the review of staff prepared work papers and evaluate performances

- Must be highly dedicated with a positive attitude, self-motivated, a team player who takes initiative and willing to learn

- Proven experience in Tax

- Professional qualification and a willingness to complete (eg ICEW, CIOT, CIMA, ATT or equivalent)

- Full ACA or CIOT qualification

- Newly qualified seeking first role

- Must have 3-5+ years of experience in doing corporate state and federal tax returns

- Must have Bachelors Degree

- Strong communication skills both written and verbal. Ability to work with key stakeholders

- Have strong organization skills and be able to work in a fast paced, deadline environment

- Demonstrated leadership skills and ability to work well with a team. Demonstrated mentoring/coach skills

- Experienced with strong MS Excel, perform look ups, pivot and macros (as most of the analysis is spreadsheet driven)

- Master degree desired

- AFIT experience

- Experience with SAP, EPM

- Bachelor's Degree in Accounting

- 5+ years of current or recent CPA firm or family office tax experience servicing HNW individuals and related taxes

- Hands-on mindset

- Prior preparation and review experience

- Subchapter C, including section 367

- Subpart F income

- The foreign tax credit system

- Working with senior business leaders, finance and legal teams to clearly articulate tax concepts

- Calculating the tax consequences of a deal for use in financial modeling

- Assisting the preparation of the tax section of diligence reports

- Reviewing financial statements and valuation reports

- Working with external counsel to draft relevant contract provisions

- Developing structuring plans to guide execution in a manner that meets the business and other functional teams needs

- Working with tax accounting to ensure that transactions are properly recorded in the books and records; and

- Collaborating within IBM Tax to ensure that all projects are accurately reported on IBM's tax returns and are properly documented for audit

- At least 3 years experience in technical tax (subchapter C, including section 367 subpart F income, the foreign tax credit system)

- At least 3 years experience in tax research

- At least 3 years experience in tax and legal writing

- Licensed in Law or Accounting (CPA)

- Master's Degree in Law

- At least 5 years experience in technical tax (subchapter C, including section 367 subpart F income, the foreign tax credit system)

- At least 5 years experience in tax research

- At least 5 years experience in tax and legal writing

- Candidate must have a minimum of 5 years of corporate income tax experience

- Ability to analyze state & federal tax law, GAAP accounting, and operational data is necessary

- MS Excel - perform look ups, pivot and macros (as most of the analysis is spreadsheet driven)

- Proficient doing tax research (preferably with RIA Checkpoint or BNA)

- Can multitask and prioritize work load in a dynamic environment in order to meet internal and external deadlines

- AC740 experience

- Bachelor degree with finance related education background, not limited to Tax, but accounting, financial, statistics, auditing etc

- Dedicated, hard working, quick learning

- Able to work under demanding envirement, willing to devote him/herself into the details

- 1-2 years working experience is a plus

- Preparation of transfer pricing reports & documentation

- Assisting in economic analyses of quantitative and qualitative data and reporting results

- Assisting in audits by providing tax controversy support

- Participation in projects relevant to dispute resolution and Advance Pricing Agreements (APAs)

- Minimum of 3+ years of tax experience (Federal, State tax returns for large companies)

- Strong MS Excel skills (Pivots, v-look ups, macros)

- Good multi-tasking skills, organized and self motivated

- Proficiency in CorpTax, SAP, EPM ideal

- Certified Public Accountant (CPA) or Master of Business Administration (MBA) and 5 years relevant experience; or

- Bachelor’s/Master’s degree in relevant field and 10 years relevant experience

- Advanced Microsoft Office skills including Excel and Word

- Ability to problem-solve, self-start, work independently, and meet deadlines

- Being customer-service oriented (internal and external) is essential

- Ability to accommodate long hours, especially at month- and year-end

- Ability to communicate verbally and in writing at all levels inside and outside the organization

- Basic familiarity with Microsoft Office Suite

- Computer skills, commensurate with Essential Functions, including the ability to learn a validated system

- Ability to work extended hours beyond normal work schedule to include, but not limited to evenings, weekends, extended shifts, and/or extra shifts; sometimes on short notice

- Ability to work under specific time constraints

Direct Tax Professional for Global Financing Resume Examples & Samples

- Language: English Fluent, additional languages are an advantage

- Excellent interpersonal skills with ability to interact and communicate in an effective manner

- Commitment to deadlines and flexibility to prioritize work

- Advanced organizing, analytical skills and learning agility

- Solid IT skills and excellent Excel knowledge

- Professional working standards and integrity

- Preferred Bachelors degree in the field of Economics (Tax or Accounting is an advantage - other tax qualifications or experience will be considered a plus, e.g. leasing and factoring accounting and taxation.)

- Preferred 2 years experience - Tax Accounting / Corporate Direct Taxes in a multinational company

- Must have a Bachelors in Accounting or other business degree

- Minimum of 5+ years of tax experience

- Strong proficiency in MS Excel (i.e. V-look ups, Pivot Tables, Macro’s) and MS Access experience

- Excellent multi-tasking, organized, and self-motivated

- Excellent analytical and communication skills along with good time management required

- Familiarity with CorpTax

- Ability to function in a paperless environment

- Apply tax knowledge to intermediate level corporate and partnership returns and all levels of individual returns

- Review basic tax return engagements

- Perform complete & efficient reviews of individual and business tax returns while providing guidance to other staff

Employment Tax Professional Resume Examples & Samples

- Engaging directly with employers and executives of EY clients in relation to complex employment tax related matters, including e.g. employment tax compliance, PAYE audits, management of workforce reduction programs and international assignments

- Advising on executive and employee share incentive schemes, benefits-in-kind, etc

- Experience of advising multi-nationals and interacting with, Human Resource and Finance managers

- A determination to build a career in Tax within Employment Tax

- Work effectively in a team sharing responsibility, providing support, maintaining communication and update other senior team members on progress

- Build strong internal relationships within other departments and teams across the organization

- Continually develop personal skills through training, experience and coaching

- Support in the preparation of transfer pricing documentation files

- 1-3 years of working experience in transfer pricing or in a tax/advisory position

- Strong academic record in Business/Economics/Statistics/Accounting/Finance/Mathematics - Related postgraduate studies will be considered as an asset

- Working experience in a big 4 environment will be considered an asset

- Excellent communication and prioritization skills

- 3 to 5 years’ of experience in tax field – working experience in a BIG4 will be considered as an asset

- Strong academic record including a university degree in Business Administration, Banking and Finance, Accounting and Finance – postgraduate studies in Business Administration, Banking and Finance, Accounting and Finance will be considered as an asset

- Substantial MS office knowledge

- Excellent written and verbal communication skills in Greek and English

- Self-motivation and desire to exceed expectations

Tax Professional Assistant Resume Examples & Samples

- Must have reading and math skills sufficient to begin and finish the tax return interview

- Ability to communicate effectively in person and on the phone

- Previous experience with Windows-based computer programs

- Must meet all continuing education requirements of the position

- Additional state and local requirements may apply

- Additional course work in math, accounting, or finance is preferred

- Experience in accounting, finance, bookkeeping or tax

- Tax planning and audit support

- Experience working in a fast-paced environment

- Experience completing complex returns (individual, trust, partnership)

- 5+ years experience in accounting, finance, bookkeeping or tax

Test REQ DO NOT Apply Tax Professional Resume Examples & Samples

- Experience completing individual returns

- Successful completion of the H&R Block Tax Knowledge Assessment or equivalent

- CPA or Enrolled Agent certification

- Sales and/or marketing experience

- Bachelor's degree in Business (Accounting, Finance etc.)

- Master's degree in taxation or completion of the CPA In-Depth Tax Course Level 1 and 2

- Professional Accounting designation

- At least four years of relevant experience

- Experience with Tax research tools and tax preparation software (i.e. TaxPrep, Tax Find, Formula Trix, Taxnet Pro)

- Proficient in the use of Microsoft Excel

- Qualified in a recognised tax (CTA) or accounting (ACA, ACCA, ACMA) qualification

- Proven post qualification experience working in the tax department of a professional accounting firm or in the tax department of a large company (preferably a multinational company)

- Experience of dealing with HMRC on Transfer Pricing matters would be preferred

- Knowledge of R&D tax credits

- Ensure property tax renditions are timely filed, including working with outside consultants,

- Review all appraisal notices received from appraisal offices and evaluate the need for appeals

- Accounting degree preferred

- Minimum 5+ years experience in CPA firm or large corporate organization

- Sales & use tax compliance experience preferred

- Experience with accounting for fixed assets preferred

- Some property tax experience preferred

- Spanish preferred

- Knowledge of and familiarity with US income and non-income tax requirements

- Knowledge of and familiarity with Canadian income and GST/HST/RST/PST tax requirements

- Familiarity with Oracle and HFM accounting software

- Familiarity with MS Office, Corptax, SOVOS Taxware, DMA MiSos and Corpsales sales & use tax software

- Knowledge of and familiarity with US state and local sales & use tax exemptions for CA, TX & PA as well as other states generally

- Knowledge of and familiarity with US federal and state tax regulations mandating asset classes, useful lives and federal/state/local differences as well as IFRS classifications

Expatriate Tax Professional Resume Examples & Samples

- Preparation and delivery of global tax cost estimates for bids and tax accrual purposes

- Worldwide assignee compliance tracking and follow up

- Communicate mobility and tax policies clearly and concisely to both assignees and management

- Prepare expatriate cost reconciliations for project billings and close out

- Preparation of tax equalization splits between projects

- Tax equalization tracking, coordination and explanation for assignees and project management

- Coordinate with tax vendor and payroll regarding imputed assignment income, state tax residency, hypothetical withholding, additional tax payment, and tax gross-ups

- International Taxable Business Traveler Tracking

- Invoice processing

- Preparation of secondment agreements

- Review articles and research international tax law changes effecting global expatriate locations

- Individual Tax advice and planning for projects

- BA/BS in Business, Accounting, or related required

- 1+ Years of Accounting Experience

- International Expatriate Tax Experience

- Attention to detail and strong data analytic skills

- Team player, self-starter with strong initiative

- Strong Microsoft office skills

- Individual income tax experience with a full understanding of IRS Section 911

- Ability to work in a fast paced, multi-tasking team environment

- Technical Competencies: General knowledge of accounting principles and/or regulations impacting each engagement or project, financial markets, analysis and reporting of financial data. Understand internal software systems including Pfx Fixed Assets, GoFileRoom, Pfx Engagement, Pfx Tax, etc. Proficiency with Microsoft (MS) Windows and Office products

- Leading with Impact: Sets an example and exhibits behaviors for others to emulate

- Ownership Mindset: Engineers productive change and positive results

- Growing the Business: Focuses efforts on managing work and key relationships to exceed expectations

- Delegate work to Associates on routine assignments. The Senior continues to work with a mentor for professional and career development

- Experience: A minimum of two years of experience as an Associate

- Certifications/Licenses: Eligible to sit for CPA exam preferred

- Analyze IBM purchase / sales transactions and work with internal / external customers to ensure compliance with US state / local tax laws

- Perform tax research utilizing RIA Checkpoint, state websites and other tax resources

- Compile analytics and trends of sales /use tax payments, state specific projects and refund claims

- Research and analyze IBM purchase transactions for sales tax compliance

- Work with vendor requests for tax only payments and providing exemption certificate documentation

- Initiate and follow through with requested system changes to ensure compliance with state/local tax laws

- Review and validate customer exemption documentation

- Resolving issues related to sales tax charged to customers

- Perform Quarterly Controls testing (SOX) for World Wide Business Controls

- Analyze purchase activity to identify trends and potential tax savings

- Review tax publications and rate / law changes for assigned states to identify any impact to IBM processes, initiate changes needed to IBM systems and internal process documents

- Microsoft Office, Word, Excel

- Demonstrate analytical and communication skills

- Industry experience in sales/use tax knowledge

- Accounting / Finance coursework and income tax class

- Basic knowledge of RIA Checkpoint or other online tax research source

- Basic knowledge of Sarbanes-Oxley controls / testing process

Sales & Use Tax Professional Resume Examples & Samples

- Extensive sales and use tax preparation

- Timely submission of tax documents to meeting filing requirements

- Prepare complex account reconciliations for sales and use tax accounts

- Identify, communicate, and conduct strategic audits/refunds to recover sales/use tax exposure amounts and overpayments

- Compile, organize, document, and communicate business data for state and local taxing authorities to lead and conduct assigned business sales and use tax audits to minimize sales/use tax exposure amounts and over payments

- Bachelor's Degree in Accounting or Finance, Advanced Degree or certificate preferred

- 4+ years of Sales and Use Tax experience in a high volume setting

- Demonstrated advanced knowledge of sales & use tax compliance/audits/consulting concepts, practices, and procedures

- Demonstrated advanced knowledge of sales & use tax compliance/audits best practices and procedures

- Experience with Vertex and Lawson

- Advanced skills in Excel, Word, Outlook, and Power Point

Payroll Tax Professional Resume Examples & Samples

- Review and follow up on various payroll tax notices received from different government agencies. Work with state/federal/local agencies and payroll vendor to resolve the tax issues

- Bachelor's Degree in Accounting or Finance required

- Minimum of 5 years Accounting, Finance or Payroll experience required

- Superior mathematical ability, problem resolution, accuracy, and attention to detail as well as a demonstrated ability to work well in a close team environment

Preseason Tax Professional Resume Examples & Samples

- Knowledge and experience with a Windows-based computer system preferred

- Experience working in a fast-paced customer service environment preferred

- Successful completion of the H&R Block Tax Knowledge Assessment, H&R Block Income Tax Course, or equivalent²

- Additional experience for this position is acquired through training upon hiring

- Reviewing and prepararing annual U.S. Forms 5471, 8858, 8865, 1120-F and required elections and disclosures

- Reviewing and calculating subpart F income and other deemed and actual foreign inclusions to U.S. taxable income on a quarterly and annual basis

- Requesting various legal, financial, and tax information from tax planning, lines of business contacts and foreign controllers

- Analyzing, reviewing, and maintaining tax basis, cumulative Earnings and Profits and tax pools of foreign corporations

- Researching tax issues and supporting the tax planning team and their initiatives through modeling

- Preparing responses to IRS audit inquiries

- Supervising and mentoring tax staff and coordinating tax staff deliverables

- BS/BA Finance/Accounting

- Taxation Experience

- People Management/Supervisory Experience

- Comfort working with complex Financial Products

- 6+ years of federal or state tax compliance and/or financial reporting experience in a public accounting firm or industry

- Experience preparing federal book/tax difference adjustments including ASC740 balance sheet proofs (must have ASC740 exp)

- Experience preparing quarterly provision and forecast calculations

- Proficiency in CorpTax, SAP, and MS Office suite

- Strong communication skills and ability to develop strong partnerships with peers, managers and stakeholders

- Comfortable working in a fast paced, dynamic environment

- Degree in Accounting or Taxation and/or CPA certification preferred

- Two years of experience in corporate taxation or public accounting required

- Sound technical knowledge of federal, state and local corporate income tax laws and regulations required

- Experience in preparation of income tax provision and all types of income and franchise tax returns preferred

- Detail oriented with strong analytical and problem solving skills required

- Good interpersonal and oral/written communication skills necessary

- Proficiency in tax research tools (i.e CheckPoint, CCH) preferred

- Microsoft Excel proficiency (pivot tables, v lookups, sum/if, if/then) required

- Experience with OneSource or GoSystems income tax return preparation software preferred

- Ability to prioritize and manage multiple tasks required

- Minimum of 3 years experience in IT/Business with experience in financial services industry a plus

- Good knowledge of Content Server fundamentals, including core capabilities and limitations

- Knowledge and experience with Content Server Users and Groups Administration

- Knowledge and experience with Content Server information security model

- Knowledge and experience with Content Server workflow features and concepts

- Knowledge and experience with Content Server Categories & Attributes Administration

- Knowledge and experience with Content Server Records Management implementation

- Excellent communication and analytical skills and a strong attention to detail

- Experienced with Bank of America Desktop Support procedures

- Experience in a Tax department, Corptax USC, MS Office 2013, Oracle SQL, Tableau, MicroStrategy, SAP

- Experience with OpenText Content Server version 10.x and the following areas

- Prior work experience with University of Colorado or other higher education institution

- Prior payroll experience and prior international tax work experience

- Experience with PeopleSoft HCM, International Tax Navigator

- Experience applying federal and State tax laws, immigration laws as they relate to taxes, international tax treaties, and international taxation

Corporate Tax-tax Professional Resume Examples & Samples

- Tax compliance management, oversight and the preparation for a high volume of state and local returns including several combined/unitary state tax returns in a time sensitive environment

- Calculate monthly and quarterly state marginal tax rates and state effective tax rates

- Preparation and review of quarterly tax provisions as part of consolidated tax provision

- Special projects such as Amended Returns (RARs)

- Bachelor’s degree or higher

- 4-5 Public Accounting Experience (Big 4 preferred)

- Taxation experience required, GAAP accounting knowledge

- Tax software

- 2-3 years of Sales and Use Tax law Knowledge/Experience

- Ability to work independently/Good Judgement

- Attention to detail/Analytical/Research Skills

- Good communication skills and process improvement skills

- Abilitiy to absorb info from several sources to come to logical decision

- Experience in preparing / reviewing complex state tax returns

- Ability to summarize complex problems in a clear, concise manner Ability to research tax issues and identify risks

- Critical problem solver Strong analytical skills

- Bachelors degree or higher

- Minimum 2 years experience in BAC LETT preferred

- 6+ years tax experience (Big 4 and bank experience preferred)

- Experience with CorpTax / Microsoft Office

Related Job Titles

- ResumeBuild

- Tax Professional

5 Amazing tax professional Resume Examples (Updated 2023) + Skills & Job Descriptions

Build your resume in 15 minutes, tax professional: resume samples & writing guide, bernie bailey, employment history.

- Prepare and file tax returns for individuals and businesses

- Keep up to date with the latest changes in tax legislation

- Develop and implement tax strategies to minimize tax liabilities

- Identify potential tax credits and deductions

- Monitor tax law changes and advise clients on the impact of such changes

- Respond to inquiries from the IRS and other government agencies

- Research and interpret tax laws and regulations to ensure compliance

- Assist clients with tax preparation software

Do you already have a resume? Use our PDF converter and edit your resume.

Roger Hawkins

- Provide tax planning advice to clients

- Maintain client records and prepare tax reports

Professional Summary

- Develop and maintain relationships with clients

- Prepare and submit estimated tax payments

- Analyze financial data to determine tax liability and develop strategies to minimize tax burden

- Prepare financial statements, including income statements and balance sheets

Richard Richards

- Represent clients in audits, appeals, and tax collection disputes

Percy Daniels

Not in love with this template? Browse our full library of resume templates

Table of Content

- Introduction

- Resume Samples & Writing Guide

- Resume Example 1

- Resume Example 2

- Resume Example 3

- Resume Example 4

- Resume Example 5

- Jobs Description

- Jobs Skills

- Technical Skills

- Soft Skills

- How to Improve Your Resume

- How to Optimize Your Resume

- Cover Letter Example

tax professional Job Descriptions; Explained