Newly Launched - AI Presentation Maker

AI PPT Maker

Powerpoint Templates

PPT Bundles

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

- Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Top 10 Paper Industry PowerPoint Presentation Templates in 2024

Introducing our fully editable and customizable PowerPoint presentation templates specifically designed for the Paper Industry. These comprehensive slides offer a visually appealing and professional layout, making it easy for businesses, educators, and industry professionals to convey their ideas effectively. Our templates cover various aspects of the paper industry, including production processes, sustainability practices, market trends, and technological advancements. Whether you are presenting to stakeholders, conducting training sessions, or sharing insights at industry conferences, our templates provide a versatile platform that can be tailored to meet your specific needs. Use cases include showcasing the lifecycle of paper production, discussing the environmental impact and recycling initiatives, or illustrating the latest innovations in paper technology. With an array of customizable charts, graphs, and images, you can easily present data and engage your audience. The intuitive design ensures that even those with minimal design experience can create stunning presentations that captivate and inform. Elevate your communication in the paper industry with our expertly crafted PowerPoint templates, designed to help you make a lasting impression while effectively sharing your message.

Raw Material Icon Powerpoint Ppt Template Bundles

If you require a professional template with great design, then this Raw Material Icon Powerpoint Ppt Template Bundles is an ideal fit for you. Deploy it to enthrall your audience and increase your presentation threshold with the right graphics, images, and structure. Portray your ideas and vision using eleven slides included in this complete deck. This template is suitable for expert discussion meetings presenting your views on the topic. With a variety of slides having the same thematic representation, this template can be regarded as a complete package. It employs some of the best design practices, so everything is well-structured. Not only this, it responds to all your needs and requirements by quickly adapting itself to the changes you make. This PPT slideshow is available for immediate download in PNG, JPG, and PDF formats, further enhancing its usability. Grab it by clicking the download button.

Our Raw Material Icon Powerpoint Ppt Template Bundles are topically designed to provide an attractive backdrop to any subject. Use them to look like a presentation pro.

- Garbage Truck

- Wooden Logs

- Coffee Beans

Related Products

Product Line Diversification And Packaging Icon

Introducing our Product Line Diversification And Packaging Icon set of slides. The topics discussed in these slides are Product Line Extension Packaging This is an immediately available PowerPoint presentation that can be conveniently customized. Download it and convince your audience.

Our Product Line Diversification And Packaging Icon are topically designed to provide an attractive backdrop to any subject. Use them to look like a presentation pro.

- Product Line Extension Packaging

Packaging Strategy Powerpoint Ppt Template Bundles

Deliver a credible and compelling presentation by deploying this Packaging Strategy Powerpoint Ppt Template Bundles. Intensify your message with the right graphics, images, icons, etc. presented in this complete deck. This PPT template is a great starting point to convey your messages and build a good collaboration. The twelve slides added to this PowerPoint slideshow helps you present a thorough explanation of the topic. You can use it to study and present various kinds of information in the form of stats, figures, data charts, and many more. This Packaging Strategy Powerpoint Ppt Template Bundles PPT slideshow is available for use in standard and widescreen aspects ratios. So, you can use it as per your convenience. Apart from this, it can be downloaded in PNG, JPG, and PDF formats, all completely editable and modifiable. The most profound feature of this PPT design is that it is fully compatible with Google Slides making it suitable for every industry and business domain.

Our Packaging Strategy Powerpoint Ppt Template Bundles are topically designed to provide an attractive backdrop to any subject. Use them to look like a presentation pro.

- Effective Custom Packaging Strategies

- Smart Packaging Strategy Benefits

- Cost Efficient Packaging Strategy

- Product Packaging For Brand Strategy

- Packaging Strategy Impact On Supply Chain

- Packaging Strategies To Save Transportation Costs

- Packaging Strategy On Customer Purchase Decision

- Packing Strategy Challenges For Sustainability

Brochures And Banners Printing Proposal Powerpoint Presentation Slides

Presenting Brochures And Banners Printing Proposal PowerPoint Presentation Slides. The template is compatible with Google Slides which makes it easily accessible at once. It is readily available in both standard and widescreen. Open and save the proposal into various file formats like PDF, JPG, and PNG. The template is completely customizable, so you can change the colors, font, font size, and font types of the proposal as per your requirements.

Display your expertise in printing and build rapport with new clients by using our content ready Brochures And Banners Printing Proposal PowerPoint Presentation Slides. With the help of this well informed brochures printing proposal PPT layout, you can showcase the different types of paper you use for printing such as economy white paper, value white paper, premium white paper, and colored paper. Use the banners printing proposal presentation template to mention the various packages and flexible payment options your company offers to the clients. Take advantage of our engaging brochures & banners printing proposal PPT theme to highlight the variety of additional printing your company offers that includes book printing, signage, business cards, flyers, large format printing, and screen printing, digital printing, offset printing, labels,and banners. Employ this professionally designed brochures & banners printing proposal PowerPoint presentation templates to illustrate your techniques for stimulating employee productivity that consists of print management software, management information systems, and automated artwork verification. Talk about the high-quality printing services you offer at reasonable prices and hold the interest of the customers. Included here are the proposal outline that covers the topics like project summary, printing services, printing packages, cost estimate, company overview, client testimonials, work contract, payment terms, etc. By using this attractive brochures & banners printing service proposal PPT layout, you can present your printing samples and some of the previous projects that grab the attention of your clients. Use banners printing services PPT theme to describe why the clients choose your services over your competitors. Take help of the brochures printing services proposal PowerPoint layout to list out your highly-skilled and proficient workers that complete every task efficiently and before the deadline. Deliver an astounding proposal and stand out from your competitors by downloading our ready to use brochures and banners printing proposal PowerPoint presentation slides.

- Proposal Templates

Package Ofring Powerpoint Ppt Template Bundles

If you require a professional template with great design, then this Package Ofring Powerpoint Ppt Template Bundles is an ideal fit for you. Deploy it to enthrall your audience and increase your presentation threshold with the right graphics, images, and structure. Portray your ideas and vision using nine slides included in this complete deck. This template is suitable for expert discussion meetings presenting your views on the topic. With a variety of slides having the same thematic representation, this template can be regarded as a complete package. It employs some of the best design practices, so everything is well-structured. Not only this, it responds to all your needs and requirements by quickly adapting itself to the changes you make. This PPT slideshow is available for immediate download in PNG, JPG, and PDF formats, further enhancing its usability. Grab it by clicking the download button.

Our Package Ofring Powerpoint Ppt Template Bundles are topically designed to provide an attractive backdrop to any subject. Use them to look like a presentation pro.

- Social Media Marketing Package

- Salary Package

- Digital Marketing Package

- Cloud Computing Software Packages

- Project Management Tools

Package Icon Powerpoint Ppt Template Bundles

If you require a professional template with great design, then this Package Icon Powerpoint Ppt Template Bundles is an ideal fit for you. Deploy it to enthrall your audience and increase your presentation threshold with the right graphics, images, and structure. Portray your ideas and vision using twelve slides included in this complete deck. This template is suitable for expert discussion meetings presenting your views on the topic. With a variety of slides having the same thematic representation, this template can be regarded as a complete package. It employs some of the best design practices, so everything is well-structured. Not only this, it responds to all your needs and requirements by quickly adapting itself to the changes you make. This PPT slideshow is available for immediate download in PNG, JPG, and PDF formats, further enhancing its usability. Grab it by clicking the download button.

Our Package Icon Powerpoint Ppt Template Bundles are topically designed to provide an attractive backdrop to any subject. Use them to look like a presentation pro.

- Product Delivery

- Shipment Box

- Postal Mail

- Parcel Return

Enterprise digitalization powerpoint presentation slides

Presenting our illustrative enterprise digitalization PowerPoint template. This PPT presentation is available for download in both standard and widescreen formats. You can easily edit the content inside the PPT design. It is compatible with all prominent presentation software, including Microsoft Office and Google Slides, among others. This PPT slide can also be edited for print and digital formats such as JPEG, PNG, and PDF.

Our enterprise digitalization PPT template helps you to assess current business performance. It especially assists manufacturing firms in improving their workflow performance by implementing advanced technological solutions. SlideTeam has designed this enterprise digital transformation PPT slideshow explains why technological transformation is crucial for an organization’s success in the long run. It discusses the technological trends driving the manufacturing industry to keep you up to speed. This digital enterprise trends PPT theme highlights the areas where transformation can actually prove fruitful. It also lends suggestive ways you can employ to develop a course of action concerning the manufacturing process, inventory management, workplace safety, and similar activities. Our digital transformation model PPT layout explains the steps you should follow to effectively implement the transformation strategy to suit your business objectives. It further discusses the barriers in the process and their potential solutions to eliminate any shortcomings. Download our digitalization ppt set today.

- Enterprise Digitalization

- performance

- manufacturing

News paper icon showing form of media

Presenting this set of slides with name News Paper Icon Showing Form Of Media. The topics discussed in these slides are News Media, Television, Radio Frequency. This is a completely editable PowerPoint presentation and is available for immediate download. Download now and impress your audience.

Focus on analysis with our News Paper Icon Showing Form Of Media. They draw your attention to critical aspects.

- Radio Frequency

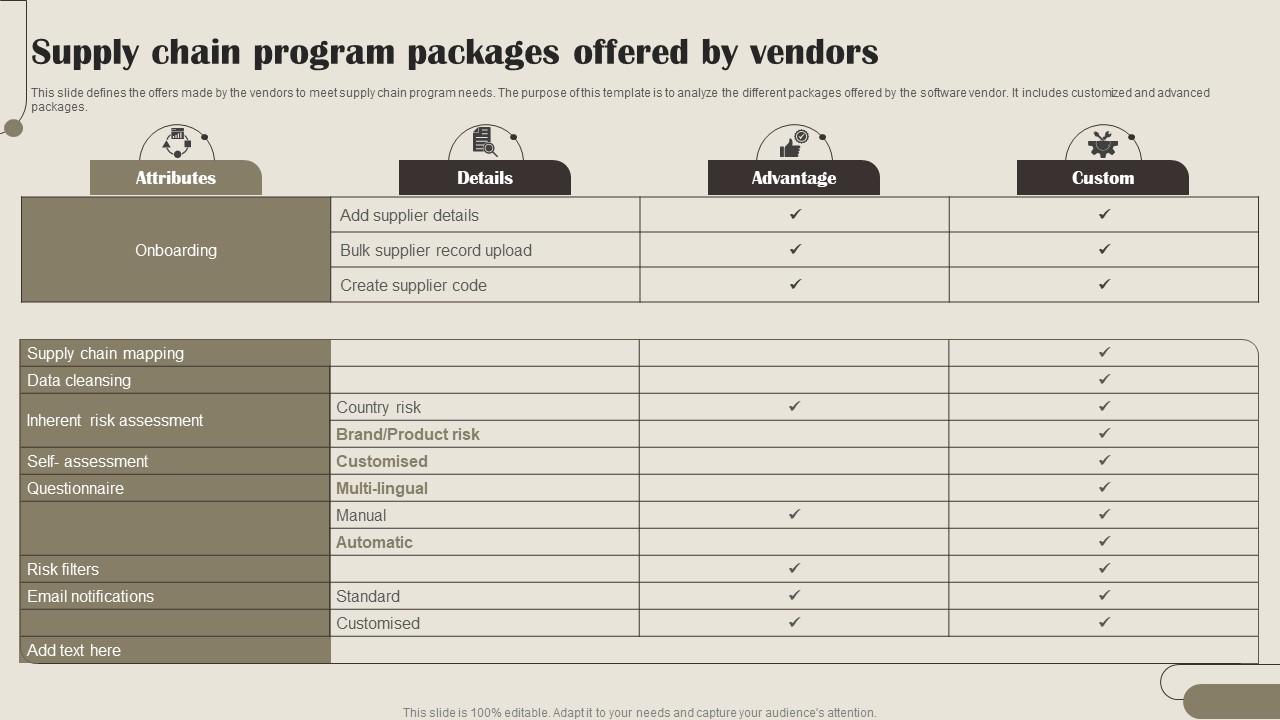

Supply Chain Program Packages Offered By Vendors

This slide defines the offers made by the vendors to meet supply chain program needs. The purpose of this template is to analyze the different packages offered by the software vendor. It includes customized and advanced packages. Presenting our well structured Supply Chain Program Packages Offered By Vendors. The topics discussed in this slide are Supply Chain Mapping, Inherent Risk Assessment, Email Notifications. This is an instantly available PowerPoint presentation that can be edited conveniently. Download it right away and captivate your audience.

This slide defines the offers made by the vendors to meet supply chain program needs. The purpose of this template is to analyze the different packages offered by the software vendor. It includes customized and advanced packages.

- Supply Chain Mapping

- Inherent Risk Assessment

- Email Notifications

Paper Receipt Monotone Icon In Powerpoint Pptx Png And Editable Eps Format

Make your presentation profoundly eye-catching leveraging our easily customizable Paper receipt monotone icon in powerpoint pptx png and editable eps format. It is designed to draw the attention of your audience. Available in all editable formats, including PPTx, png, and eps, you can tweak it to deliver your message with ease.

This Paper receipt monotone icon in powerpoint pptx png and editable eps format is a 100 percent editable icon. The downloaded file will have this icon in EPS, PNG and Powerpoint pptx format and is perfect for your next project. It has a simple yet stylish design.

- Report Icon

- Document Icon

- Text Sheet Icon

Pulp, paper, and packaging in the next decade: Transformational change

From what you read in the press and hear on the street, you might be excused for believing the paper and forest-products industry is disappearing fast in the wake of digitization. The year 2015 saw worldwide demand for graphic paper decline for the first time ever, and the fall in demand for these products in North America and Europe over the past five years has been more pronounced than even the most pessimistic forecasts.

But the paper and forest-products industry as a whole is growing, albeit at a slower pace than before, as other products are filling the gap left by the shrinking graphic-paper 1 The graphic-paper segment includes newsprint, printing, and writing papers. market (Exhibit 1). Packaging is growing all over the world, along with tissue papers, and pulp for hygiene products. Although a relatively small market as yet, pulp for textile applications is growing. And a broad search for new applications and uses for wood and its components is taking place in numerous labs and development centers. The paper and forest-products industry is not disappearing—far from it. But it is changing, morphing, and developing. We would argue that the industry is going through the most substantial transformation it has seen in many decades.

In this article, we outline the changes we see happening across the industry and identify the challenges CEOs and their leadership teams will need to manage over the next decade.

Changing industry structure

The structure of the industry landscape is changing. The changes are not dramatic individually, but the accumulation of changes over the long term has now reached a point where they are making a difference.

Consolidation has been a major factor in many segments of the industry. The big have become bigger in their chosen areas of focus. At the aggregate level, the world’s largest paper and forest-products companies have not grown much, if at all, and several of them have reduced in size. What they have done is focus their efforts on fewer segments. As a result, concentration levels in specific segments have generally, if not universally, increased (Exhibit 2). In some segments such as North American containerboard and coated fine paper, ownership concentration as defined by traditional approaches to drawing segment boundaries may be reaching levels where it would be difficult for companies to find further acquisition opportunities that could be approved by competition authorities.

A grouping of companies has emerged that is not identical to, but partly overlaps with, the group of largest companies, and is drawn from various geographies and market segments. Companies in this group have positioned themselves for further growth through high margins and low debt (Exhibit 3). Our analysis suggests the financial resources available to some members of this group for strategic capital expenditure could be five to ten times greater than other top players in the industry. This potentially represents a powerful force for change in the industry, and over the next few years it will be interesting to see how these companies choose to spend their resources. Some of these companies with large war chests and sizable annual cash flows deployable for strategic capex might even face a challenge to find opportunities on a scale that matches these resources.

Where there are leaders, there are also laggards. We believe the pronounced differences in performance among companies across the industry continues to pique the interest of investors and private-equity players in an industry that is already undergoing substantial restructuring and M&A.

Changing market segments

Whether companies are well positioned for further growth or still needing to earn the right to grow, they can expect demand to grow for paper and board products over the next decade. The graphic-paper market will continue to face declining demand worldwide, and our research has yet to find credible arguments for a specific floor for future demand. But this decline should be balanced by the increase in demand for packaging—industrial as well as consumer—and tissue products. All in all, demand for fiber-based products is set to increase globally, with some segments growing faster than others (Exhibit 4).

That picture is not without its uncertainties. One hazy spot in the demand skies might be concerns over how fast demand will grow in China. Expectations of growth from only a few years ago have proved a bit too optimistic, not only in graphic papers but also in tissue papers and packaging. And recently, as a result of turmoil in the market for recycled fiber, Chinese users of corrugated packaging have reduced their consumption, through weight reductions and use of reusable plastic boxes. Given China’s weight in the global paper and board market, even relatively modest changes can have significant impact.

How these demand trends will translate into industry profitability will of course be heavily influenced by the industry’s supply actions. Supply movements are notoriously difficult to forecast more than a few years out, but we believe the following observations are relevant to this discussion.

- Graphic papers, particularly newsprint and coated papers but also uncoated papers, will continue to face a severe decline in demand and significant pressure to restructure production capacity. We are likely to see continuing machine conversions into packaging and specialty papers, as well as more innovative structural moves that include innovations in distribution and the supply chain. Such structural changes are already having an impact and the profitability of graphic-paper companies has reemerged from several years in the doldrums. The turbulence in graphic papers has meanwhile spilled over to packaging and tissue segments, with capacity increases in segments that don’t really need it.

- Consumer packaging and tissue will be driven largely by demographic shifts and consumer trends such as the demand for convenience and sustainability. It will grow roughly on par with GDP. We expect innovation to be a critical success factor, particularly in light of recent concerns over plastic packaging waste, which could harbor both opportunities and challenges for fiber-based consumer packaging. But we are uncertain how far packaging players can drive innovation by themselves. Clearly, they can take the lead on materials development, but they may need to follow the lead of—and cooperate with—retailers and consumer-goods companies in areas such as formats, use, and technology. At the same time, the inflow of capacity from the graphic-paper segment will need to be managed.

- Transport and industrial packaging will also see opportunities for innovation and a certain amount of value-creating disruption in the intersection between sustainability requirements, e-commerce, and technology integration. We estimate that e-commerce will drive roughly half of the demand growth in transport packaging over the next several years. As packaging adapts to this particular channel, it will have to find new solutions to a variety of issues, such as how to handle last-mile deliveries, the sustainability choice between fiber-based and lightweight plastic packaging, and the potential merging of transport (secondary) and consumer (primary) packaging, to name but a few.

- Fiber has gone through some turbulent times in the past two years, largely to the delight of pulp producers and to the chagrin of users. Hardwood and softwood prices alike have seen steady increases since 2017, due to some slow start-up of capacity (hardwood pulp), limited capacity additions, and a certain measure of industry psychology. In the past two years, prices globally went through what we would term a “fly-up regime,” whereby prices are significantly and unusually higher than the cost of the marginal producer. Such situations, seen from time to time in many other basic-materials industries, are rarely long lived. Indeed, since the beginning of 2019, prices have come down—in China drastically so.

Would you like to learn more about our Paper & Forest Products Practice ?

But even with a readjustment of the market, the midterm prospects are likely to be in favor of the producers, with little new capacity until 2021–22 and some softwood capacity that is likely to be converted to other products, such as pulp for textile applications. For softwood particularly, challenges in expanding the forest supply are constraining new supply. Also, the fact that much of the industry’s softwood-production assets are aging and need complete renewal or substantial upgrades could further contribute to scarcity, especially since the scale of the investments required is a potential roadblock to them being made.

The lingering question is whether such supply-side challenges can trigger an accelerated development of applications that are less dependent on wood-fiber pulp.

Challenges for the next decade

In such an environment, what are the key challenges senior executives will need to address? What are the key battles they will have to fight? The paper and forest-products industry is often labelled a “traditional” industry. Yet given the confluence of technological changes, demographic changes, and resource concerns that we anticipate over the next decade, we believe the industry will have to embrace change that is, in character, as well as pace, vastly different from what we have seen before—and anything but traditional. This will pose significant challenges for CEOs regarding how they manage their companies.

We argue that there are three broad themes that paper and forest-products CEOs will have to address through 2020 and beyond:

- Managing short-to-medium-term “grade turbulence”

Finding the next level of cost optimization

- Finding value-creating growth roles for forest products in a fundamentally changing business landscape

Managing short-to-medium-term ‘grade turbulence’

The past couple of years have seen increased instability in forest-products segments. The negative impact of digital communications on graphic paper has led many companies to steer away from the segment and into higher-growth areas, either through conversion of machines or through redirection of investment funds. This is leading to a higher level of uncertainty and overcapacity in, for example, packaging grades. The instability has also been exacerbated by the capacity additions that primarily Asian producers have made despite the slowing demand growth in that region.

A case in point is virgin-fiber cartonboard. Several producers in Europe have converted machines away from graphic paper and into this segment, creating further oversupply in Europe and leading producers to redouble their efforts to sell to export markets. This is happening just as increasing capacity in Asia, and particularly in China, looks set to displace imports that have traditionally come into the region, mainly from Europe and North America. Some of the new Asian capacity could even find its way into export markets.

This development is likely to persist for several years until markets again find more of an equilibrium, and it poses challenging questions for companies. What, if any, safe havens exist for my products? How do I protect home-market volumes? How do I protect my export volumes? What is the appropriate pricing strategy to use in the different regions?

For CEOs looking to move into a new market segment, it will be equally important to make the right assessment of which segments to enter as they shift their footing. Where will I be the most competitive? How will my entry change market dynamics, and will this matter to me?

On the raw-materials (fiber) side, we have already described the past couple of years’ turbulence in virgin pulp. If that might seem to trend toward stabilization, the situation in recycled fibers is still very uncertain. As China, and gradually other Asian countries, have increasingly restricted the import of recovered fiber (as well as plastics and other recovered materials), the dynamics have shifted. While prices of old corrugated containers (OCC) and other papers for recycling have plummeted in North America and Europe, prices of domestic Chinese OCC have increased drastically, challenging both the price and availability of recycled-based corrugated board. In response, companies have set up capacity to produce recycled-fiber pulp to export to China, while the country is jacking up its import of containerboard for corrugated packaging, as well as virgin fiber for strengthening purposes.

This of course affects how companies, in any country, think about their fiber-supply strategies as well as their product focus.

Even though we see new ways of creating value in the forest-products industry, low cost is, and will remain, a critical factor for high financial performance. One of the characteristics shared by companies with high margins and high returns is that they have access to low-cost raw materials, primarily fiber. This will continue to be a high-priority area, albeit with some twists compared with today.

Beyond the price increases of the past couple of years, fresh fiber is facing other, more long-term, cost issues. It is unclear whether plantation land in the southern hemisphere (primarily for short-fiber wood) will continue to be available at current low prices. And as companies go to more remote areas to acquire inexpensive land, such as in Brazil, their infrastructure and logistics costs increase. Will higher productivity and yield allow the global industry to add ever more low-cost capacity, or are we going to see a gradual increase in raw-material costs? For long-fiber products, the difficulties to expand long-fiber pulp capacity will make such assets very valuable over the next several years. But at what point will development of the material properties of short-fiber pulps make them rival more expensive long-fiber pulps in a number of major applications?

Operating costs for paper and board production are another area where companies need to get a tighter grip. Despite the fact that this area receives continual focus from management, our experience suggests there is still significant potential for cost reduction by using conventional approaches to work smarter and reduce waste in the production chain. This is particularly the case in areas that are less the focus of management attention, such as converting.

Many companies need to go beyond the conventional approaches to a next level of cost optimization—and many are ready to take this step. Most if not all paper and forest-products companies have completed large fixed-cost reduction programs. But there are often broader systemic issues that companies still need to address to be able to build sustainable operating models. In addition, in some segments many companies fail to reduce fixed costs as quickly as capacity disappears. By radically rethinking the operating model, companies can significantly shift their fixed-cost structure. By doing so, they can set a very different starting point in terms of flexibility and agility for when market volumes go through their normal cyclical swings.

The paper and forest-products industry has much to gain from embracing digital manufacturing : according to our estimates, this could reduce the total cost base of a producer by as much as 15 percent. New applications such as forestry monitoring using drones or remote mill automation present tremendous opportunities for increased efficiency and cost reductions. This is also the case in areas where big data can be applied, for instance, to solve variability and throughput-related issues in each step of the integrated production flows (Exhibit 5). The industry is well placed to join the digital revolution, as paper and pulp producers typically start from a strong position when it comes to collected or collectable data.

At the customer-facing end, the opportunity for innovation is huge and has the potential to transform existing industries and create new ones, especially in packaging segments. Digital developments will also help disrupt previous B2B2C value chains, paving the way for direct B2C relationships between paper-product makers and end consumers, for example, in tissue products.

The digital world is unfamiliar territory to most paper industry CEOs. To avoid too much doodling with small uncoordinated efforts, it is necessary to undertake a thought-through program, preferably guided by digitally experienced people either on the top-management team or board.

Finding value-creating growth roles for forest products

For any paper-company CEO who looks out ten years, the really different challenges will not be around cost containment. Global trends are moving the industry into a new landscape, where the challenges and opportunities for finding value-creating growth roles for forest products are changing radically. For example, the industry’s historic linear value chains are giving way to more collaborative structures with players in and outside the industry. We believe examples will include new producer and distributor collaborations; pulp players collaborating more innovatively with non-integrated players; paper and packaging companies collaborating more intensively with retailers, consumer-goods companies, and technological experts; and new products such as bio-refinery products requiring novel go-to-market partnerships. Here are some interesting examples of how these and other trends could play out.

Staying relevant (and increasing relevancy) in a fast-changing packaging world. The packaging market is multifaceted and continuously morphing. Digital developments influence it both by stimulating demand for packaging used in e-commerce and by enabling the integration into packaging of sensors and other technology. E-commerce has highlighted new packaging topics such as improved product safety, the “un-boxing” experience, counterfeiting measures, optimization for last-mile delivery , and a growing interest—at least from the large e-commerce-based retailers—in the possibility of merging primary and secondary packaging. At the same time, the packaging industry has to deal with increasing pressures around cost, resource conservancy, and sustainability. That last topic has gained huge momentum in the past couple of years as concerns over plastic waste have added to the concern over CO 2 emissions from fossil-based packaging materials. Consumer-goods companies, retailers, packagers, and policy makers alike are now exploring a wide range of possible solutions for what tomorrow’s packaging will look like.

The opportunity for forest-products companies to develop a differentiated and distinct customer value proposition in this landscape has never been greater. Packaging-materials CEOs will have to address a number of choices and trade-offs as they seek the appropriate strategic posture. Should you be a pure upstream player or a packaging-solutions provider? Should you focus on fiber-based packaging only or providing multi-substrate solutions? Should you be at the forefront of technology integration and application development in packaging or focus on materials development?

To stay relevant, many companies in packaging are trying to move closer to the brand owner or end user. Only a few companies are positioned to successfully make this move, however, and even they should be cautious. We are already seeing brand owners and leading customers challenging the benefits of packaging companies coming with consumer-facing ideas such as complete packaging concepts. Some of these players would prefer packaging companies to focus instead on core competencies such as materials development or interfaces with other substrates such as plastics.

How the paper and forest-products industry thrives in the digital age

Finding the right path in next-generation bio-products. Wood is a biomaterial with exciting properties, from the log on down to fibers, micro- and nanofibers, and sugar molecules. A healthy niche industry making bio-products has existed for many years alongside large-volume pulp, paper, and board products. We are in the midst of an explosion of research activity to develop new bio-products, ranging from applications for nanofibers to composite materials and lignin-based carbon fiber. New processes are being designed to extract hemicellulose as feedstock for sugars and chemical production while still keeping the cellulose parts of the wood chip for pulp products.

We believe wood-based products will find new ways to enlarge their footprint in a more sustainable global economy. But the challenges are legion, particularly for finding cost-effective production methods that can withstand competition not only from oil-based materials but also from other biomaterials. Finding the right balance between developing the “new” and safeguarding the “old” will be a crucial undertaking for executives running companies with access to fresh fiber.

Finding growth in adjacent areas. Over the past decade or two we have seen the larger forest-products companies performing a focus adjustment. Most companies have moved from being fairly broad conglomerates present in various forest-products segments to focusing on a few core businesses. To find value-creating growth in the next two decades, we expect companies to start broadening their corporate portfolio again, but broadening it around the core businesses they have been working on, so as to create differentiated customer value propositions. Finding value-creating adjacencies to the core business will be a challenging exercise in creativity and business acumen for executive teams.

Finding new value-creating growth for forest products will also put the spotlight on a number of functional executive topics. We believe the following will be most important.

- Innovation: The forest-products industry has not been known for a fast-paced innovation agenda. By and large it hasn’t been necessary, as markets and demand characteristics have changed relatively slowly. In the future, however, innovation in products, processes, organizational setup, and business models will be imperative. For many companies, getting efficient innovation practices and organization up to speed will be an important challenge.

Talent management: The different skills required over the next ten to 15 years, dictated by developments such as new business models in an online world, increased need for innovation and commercialization of products, and digitalization’s impact on everything from manufacturing processes to the content of work will put particular onus on the talent pool of forest-products companies. Installing an executive team that is able to understand new demands across customer businesses, digital, bio-products that cater to completely different value chains, and cross-industry collaboration will be a major task for CEOs and boards.

One particular war-for-talent battle that can become a key differentiator is the content of work. Our research on the future of work highlights that already today, around 60 percent of all tasks, that is, not entire jobs or roles but their components, can be automated. And looking to the coming ten to 15 years, more than 30 percent of physical and manual skills risk becoming obsolete while technological skills will continue to grow very quickly. This will provide a critical and likely success-defining reskilling challenge for companies in the industry.

- Commercial excellence: Paper and forest-products companies will need to transform their commercial interface to stay relevant, particularly in packaging and downstream paper. They will need to put in place a more professionalized and skilled organization that focuses on value creation instead of focusing primarily on sales volumes.

We believe the paper and forest-products industry is moving into an interesting decade, one that will see nothing less than a transformation of large parts of the industry. There will be many barriers to overcome and metaphorical cliffs to fall off. But the companies that are able to navigate through successfully can look forward to an industry that has a new sense of purpose and an increasingly vital role to play.

This article was updated in August 2019; it was originally published in May 2017.

Stay current on your favorite topics

Peter Berg is a director of knowledge in McKinsey’s Stockholm office, where Oskar Lingqvist is a senior partner. Together they lead McKinsey’s global Paper & Forest Products Practice.

Explore a career with us

Related articles.

Winning with new models in packaging

Precision forestry: A revolution in the woods

Got any suggestions?

We want to hear from you! Send us a message and help improve Slidesgo

Top searches

Trending searches

9 templates

fall pumpkin

59 templates

dia de muertos

24 templates

indigenous peoples day

8 templates

16 templates

frankenstein

20 templates

Pulp and Paper Industry

It seems that you like this template, pulp and paper industry presentation, free google slides theme, powerpoint template, and canva presentation template.

Download the Pulp and Paper Industry presentation for PowerPoint or Google Slides. The world of business encompasses a lot of things! From reports to customer profiles, from brainstorming sessions to sales—there's always something to do or something to analyze. This customizable design, available for Google Slides and PowerPoint, is what you were looking for all this time. Use the slides to give your presentation a more professional approach and have everything under control.

Features of this template

- 100% editable and easy to modify

- Different slides to impress your audience

- Contains easy-to-edit graphics such as graphs, maps, tables, timelines and mockups

- Includes 500+ icons and Flaticon’s extension for customizing your slides

- Designed to be used in Google Slides, Canva, and Microsoft PowerPoint

- Includes information about fonts, colors, and credits of the resources used

How can I use the template?

Am I free to use the templates?

How to attribute?

Attribution required If you are a free user, you must attribute Slidesgo by keeping the slide where the credits appear. How to attribute?

Register for free and start downloading now

Related posts on our blog.

How to Add, Duplicate, Move, Delete or Hide Slides in Google Slides

How to Change Layouts in PowerPoint

How to Change the Slide Size in Google Slides

Related presentations.

Premium template

Unlock this template and gain unlimited access

Create your presentation Create personalized presentation content

Writing tone, number of slides.

Register for free and start editing online

IMAGES

VIDEO

COMMENTS

The document provides an overview of the pulp and paper industry, including its history, production process, properties and uses of products, environmental impacts, and steps being taken to address sustainability.

Pulp and Paper industry. The environmental impact of paper is significant, which has led to changes in industry and behavior at both business and personal levels. With the use of modern technology such as the printing press and the highly mechanized harvesting of wood, disposable paper has become a cheap commodity.

Explore our fully editable and customizable PowerPoint presentations tailored for the paper industry, designed to enhance your presentations with professional visuals and insightful content.

The document discusses the paper and pulp industry. It describes the key manufacturing steps including timber collection, de-barking, chipping, chemical and mechanical pulping processes, refining, and papermaking.

The paper and forest-products industry is not disappearing—far from it. But it is changing, morphing, and developing. We would argue that the industry is going through the most substantial transformation it has seen in many decades.

Download the Pulp and Paper Industry presentation for PowerPoint or Google Slides. The world of business encompasses a lot of things! From reports to customer profiles, from brainstorming sessions to sales—there's always something to do or something to analyze.