Econometrics for Business Analytics

Chapter 7 hypothesis testing.

Hypothesis testing is the most important thing you learned in business statistics. It is the foundation of the statistical world.

Hypothesis testing tells us if the treatment effect we observed is statistically significant .

A statistical hypothesis is an assumption about a population parameter. This assumption may or may not be true. Hypothesis testing refers to the formal procedures used by statisticians to accept or reject statistical hypotheses.

7.1 Statistical Hypotheses

The best way to determine whether a statistical hypothesis is true would be to examine the entire population. Since that is often impractical, researchers typically examine a random sample from the population. If sample data are not consistent with the statistical hypothesis, the hypothesis is rejected.

There are two types of statistical hypotheses.

- Null hypothesis. The null hypothesis, denoted by Ho, is usually the hypothesis that sample observations result purely from chance.

- Alternative hypothesis. The alternative hypothesis, denoted by H1 or Ha, is the hypothesis that sample observations are influenced by some non-random cause.

7.2 Case Study: Birthweight and Smoking

There is a lot of evidence that smoking is bad for one’s health. What is less certain is the effect of smoking on birthweight.

You might ask, “how is this hard to measure or why is it controversial?”

The issue is with reporting. If you are a pregnant mother, how honestly would you respond to the question of “Do you smoke?”

It is easy to see that mothers may lie about how much or even if they smoked while pregnant.

7.2.1 Load the Data

First, let’s load the data.

7.2.2 Difference in Birthweight by Smoking Status

Compare birthweight by smoking status, we can see that smoker babies are smaller, but there is overlap.

7.2.3 Differences in Birthweight by Smoking Status

7.2.4 Differences in Birthweight by Smoking Status

How can we assess whether this difference is statistically significant?

Let’s compute a summary table

7.2.5 Differences in Birthweight by Smoking Status

The standard deviation is good to have, but to assess statistical significance we really want to have the standard error.

If we use a confidence interval around the sample means, there is less overlap between the two groups. \[\bar{x}\pm se*t_{\alpha /2} \]

7.2.6 T-test for Birthweight by Smoking Status

In this case study, we have been looking at a sample of mothers, some who smoke and some who do not. These are samples and not populations. Therefore, we need to use a two sample t-test.

This difference is looking quite significant. To run a two-sample t-test, we can simple use the t.test() function.

7.2.7 Interpreting Output

There are a few things from the output we can note.

First, is the p-value. The p-value tells us the likelihood that the null hypothesis (in this case no difference between groups) is true. For p-values less than 5 percent, we can reject the null hypothesis and state there is a statistically significant difference between the two groups.

The p-value in our t-test was 0.0070025, which is less than 1 percent so we can reject the null hypothesis.

Our study finds that birth weights are on average higher in the non-smoking group compared to the smoking group (t-statistic 2.73, p=0.007, 95 % CI [78.6, 489]g)

7.3 Standard Levels of significance

Levels of significance, \(\alpha\) , are commonly - \(\alpha\) = 0.10 is marginally significant - \(\alpha\) = 0.05 is significant - \(\alpha\) = 0.01 is very significant

We reject the null hypothesis \(H_0\) if the p-value \(< \alpha\) .

The significance level represents the probability of committing a Type I error that we are willing to accept. A Type I error is rejecting the null hypothesis when the null hypothesis is true.

7.4 Warning

7.4.1 can we accept the null hypothesis.

Some researchers say that a hypothesis test can have one of two outcomes: you accept the null hypothesis or you reject the null hypothesis. Many statisticians, however, take issue with the notion of “accepting the null hypothesis.” Instead, they say: you reject the null hypothesis or you fail to reject the null hypothesis.

Why the distinction between “acceptance” and “failure to reject?” Acceptance implies that the null hypothesis is true. Failure to reject implies that the data are not sufficiently persuasive for us to prefer the alternative hypothesis over the null hypothesis.

Think of it this way. In court, we say a person is either guilty or not guilty. We do not say the person is innocent. That is, we conclude that either there is enough evidence to say the person is guilty or there isn’t enough evidence (fail to reject).

- Search Search Please fill out this field.

What Is Econometrics?

Understanding econometrics.

- Limitations

- Econometrics FAQs

The Bottom Line

- Corporate Finance

- Financial Analysis

Econometrics: Definition, Models, and Methods

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Econometrics is the use of statistical and mathematical models to develop theories or test existing hypotheses in economics and to forecast future trends from historical data. It subjects real-world data to statistical trials and then compares the results against the theory being tested.

Depending on whether you are interested in testing an existing theory or in using existing data to develop a new hypothesis, econometrics can be subdivided into two major categories: theoretical and applied. Those who routinely engage in this practice are commonly known as econometricians.

Key Takeaways

- Econometrics is the use of statistical methods to develop theories or test existing hypotheses in economics or finance.

- Econometrics relies on techniques such as regression models and null hypothesis testing.

- Econometrics can also be used to try to forecast future economic or financial trends.

- As with other statistical tools, econometricians should be careful not to infer a causal relationship from statistical correlation.

- Some economists have criticized the field of econometrics for prioritizing statistical models over economic reasoning.

Investopedia / Michela Buttignol

Econometrics analyzes data using statistical methods in order to test or develop economic theory. These methods rely on statistical inferences to quantify and analyze economic theories by leveraging tools such as frequency distributions , probability, and probability distributions , statistical inference, correlation analysis, simple and multiple regression analysis, simultaneous equations models, and time series methods.

Econometrics was pioneered by Lawrence Klein , Ragnar Frisch, and Simon Kuznets . All three won the Nobel Prize in economics for their contributions. Today, it is used regularly among academics as well as practitioners such as Wall Street traders and analysts.

An example of the application of econometrics is to study the income effect using observable data. An economist may hypothesize that as a person increases their income, their spending will also increase.

If the data show that such an association is present, a regression analysis can then be conducted to understand the strength of the relationship between income and consumption and whether or not that relationship is statistically significant—that is, it appears to be unlikely that it is due to chance alone.

Methods of Econometrics

The first step to econometric methodology is to obtain and analyze a set of data and define a specific hypothesis that explains the nature and shape of the set. This data may be, for example, the historical prices for a stock index, observations collected from a survey of consumer finances, or unemployment and inflation rates in different countries.

If you are interested in the relationship between the annual price change of the S&P 500 and the unemployment rate, you'd collect both sets of data. Then, you might test the idea that higher unemployment leads to lower stock market prices. In this example, stock market price would be the dependent variable and the unemployment rate is the independent or explanatory variable.

The most common relationship is linear, meaning that any change in the explanatory variable will have a positive correlation with the dependent variable. This relationship could be explored with a simple regression model, which amounts to generating a best-fit line between the two sets of data and then testing to see how far each data point is, on average, from that line.

Note that you can have several explanatory variables in your analysis—for example, changes to GDP and inflation in addition to unemployment in explaining stock market prices. When more than one explanatory variable is used, it is referred to as multiple linear regression . This is the most commonly used tool in econometrics.

Some economists, including John Maynard Keynes , have criticized econometricians for their over-reliance on statistical correlations in lieu of economic thinking.

Different Regression Models

There are several different regression models that are optimized depending on the nature of the data being analyzed and the type of question being asked. The most common example is the ordinary least squares (OLS) regression, which can be conducted on several types of cross-sectional or time-series data. If you're interested in a binary (yes-no) outcome—for instance, how likely you are to be fired from a job based on your productivity—you might use a logistic regression or a probit model. Today, econometricians have hundreds of models at their disposal.

Econometrics is now conducted using statistical analysis software packages designed for these purposes, such as STATA, SPSS, or R. These software packages can also easily test for statistical significance to determine the likelihood that correlations might arise by chance. R-squared , t-tests , p-values , and null-hypothesis testing are all methods used by econometricians to evaluate the validity of their model results.

Limitations of Econometrics

Econometrics is sometimes criticized for relying too heavily on the interpretation of raw data without linking it to established economic theory or looking for causal mechanisms. It is crucial that the findings revealed in the data are able to be adequately explained by a theory, even if that means developing your own theory of the underlying processes.

Regression analysis also does not prove causation, and just because two data sets show an association, it may be spurious. For example, drowning deaths in swimming pools increase with GDP. Does a growing economy cause people to drown? This is unlikely, but perhaps more people buy pools when the economy is booming. Econometrics is largely concerned with correlation analysis, and it is important to remember that correlation does not equal causation.

What Are Estimators in Econometrics?

An estimator is a statistic that is used to estimate some fact or measurement about a larger population. Estimators are frequently used in situations where it is not practical to measure the entire population. For example, it is not possible to measure the exact employment rate at any specific time, but it is possible to estimate unemployment based on a randomly-chosen sample of the population.

What Is Autocorrelation in Econometrics?

Autocorrelation measures the relationships between a single variable at different time periods. For this reason, it is sometimes called lagged correlation or serial correlation, since it is used to measure how the past value of a certain variable might predict future values of the same variable. Autocorrelation is a useful tool for traders, especially in technical analysis.

What Is Endogeneity in Econometrics?

An endogenous variable is a variable that is influenced by changes in another variable. Due to the complexity of economic systems, it is difficult to determine all of the subtle relationships between different factors, and some variables may be partially endogenous and partially exogenous. In econometric studies, the researchers must be careful to account for the possibility that the error term may be partially correlated with other variables.

Econometrics is a popular discipline that integrates statistical tools and modeling for economic data, and it is frequently used by policymakers to forecast the result of policy changes. Like with other statistical tools, there are many possibilities for error when econometric tools are used carelessly. Econometricians must be careful to justify their conclusions with sound reasoning as well as statistical inferences.

The Nobel Prize. " Simon Kuznets ."

The Nobel Prize. " Ragnar Frisch ."

The Nobel Prize. " Lawrence R. Klein ."

Statistics How To. " Endogenous Variable and Exogenous Variable ."

:max_bytes(150000):strip_icc():format(webp)/regression-4190330-ab4b9c8673074b01985883d2aae8b9b3.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Toroidally focused ultrasonic flaw detectors

- Acoustic Methods

- Published: 28 July 2011

- Volume 47 , pages 308–310, ( 2011 )

Cite this article

- A. V. Shevelev 1 &

- Zh. V. Zatsepilova 2

33 Accesses

Explore all metrics

New-type toroidally focused ultrasonic flaw detectors, whose application provides an appreciable increase in the flaw detection rate with retention of high sensitivity to flaws, are considered. The construction of a flaw detector is presented, the sizes of a gauge for the formation of the toroidal surface of a lens are given, and the technology of the manufacturing of a toroidal lens is described.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Remote diagnostics of soft solids using nonlinear acoustic methods

Ultrasonic flaw detection: adjustment and calibration of equipment using samples with cylindrical drilling.

Influence of Pitch of Ultrasonic Antenna Array on Efficiency of Extraction of a Signal from Structural Noise in Flaw Detection

Ermolov, I.N., Aleshin, N.P., and Potapov, A.I., Nerazrushayushchii control’ (Nondestructive Testing), book 2: Akusticheskie metody kontrolya (Acoustic Testing), Moscow: Vysshaya shkola, 1991.

Google Scholar

Nerazrushayushchii kontrol’ (Spravochnik) (Nondestructive Testing: Handbook), Klyuev, V.V., Ed., vol. 3: Ul’trazvukovoi kontrol’ (Ultrasonic Testing), Moscow: Mashinostroenie, 2006.

Download references

Author information

Authors and affiliations.

Elektrostal Polytechnic Institute, Branch of the National University of Science and Technology “MISIS”, ul. Pervomaiskaya 7, Elektrostal, Moscow oblast, 144000, Russia

A. V. Shevelev

Elektrostal Heavy Engineering Plant JSC, ul. Krasnaya 19, Elektrostal, Moscow oblast, 144005, Russia

Zh. V. Zatsepilova

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Zh. V. Zatsepilova .

Additional information

Original Russian Text © A.V. Shevelev, Zh.V. Zatsepilova, 2011, published in Defektoskopiya, 2011, Vol. 47, No. 5, pp. 19–22.

Rights and permissions

Reprints and permissions

About this article

Shevelev, A.V., Zatsepilova, Z.V. Toroidally focused ultrasonic flaw detectors. Russ J Nondestruct Test 47 , 308–310 (2011). https://doi.org/10.1134/S1061830911050093

Download citation

Received : 14 January 2011

Published : 28 July 2011

Issue Date : May 2011

DOI : https://doi.org/10.1134/S1061830911050093

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- ultrasonic flaw detectors

- focusing lens

- flaw detection

- nondestructive testing

- inspection of pipes

- Find a journal

- Publish with us

- Track your research

- History of cooperation

- Areas of cooperation

- Procurement policy

- Useful links

- Becoming a supplier

- Procurement

- Rosatom newsletter

© 2008–2024Valtiollinen Rosatom-ydinvoimakonserni

- Rosatom Global presence

- Rosatom in region

- For suppliers

- Preventing corruption

- Press centre

Rosatom Starts Life Tests of Third-Generation VVER-440 Nuclear Fuel

- 16 June, 2020 / 13:00

This site uses cookies. By continuing your navigation, you accept the use of cookies. For more information, or to manage or to change the cookies parameters on your computer, read our Cookies Policy. Learn more

IMAGES

VIDEO

COMMENTS

1. INTRODUCTION. This review highlights many current approaches to hypothesis testing in the econometrics literature. We consider the general problem of testing in the classical Neyman-Pearson framework, reviewing the key concepts in Section 2. As such, optimality is defined via the power function.

In this course, you will learn why it is rational to use the parameters recovered under the Classical Linear Regression Model for hypothesis testing in uncertain contexts. You will: - Develop your knowledge of the statistical properties of the OLS estimator as you see whether key assumptions work. - Learn that the OLS estimator has some ...

Introduction to Econometrics Hypothesis testing October 18, 2016 1/26. ... I First step in hypothesis testing: state explicitly the hypothesis to be tested I Null hypothesis: statement of the range of values of the regression coefficient that would be expected to occur if

Hypothesis Testing in Econometrics. This article reviews important concepts and methods that are useful for hypothesis testing. First, we discuss the Neyman-Pearson framework. Various approaches to optimality are presented, including finite-sample and large-sample optimality. Then, we summarize some of the most important methods, as well as ...

There are 5 main steps in hypothesis testing: State your research hypothesis as a null hypothesis and alternate hypothesis (H o) and (H a or H 1 ). Collect data in a way designed to test the hypothesis. Perform an appropriate statistical test. Decide whether to reject or fail to reject your null hypothesis. Present the findings in your results ...

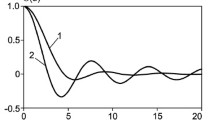

βφ(θ) = Eθ φ(X) = Z φ(x)dPθ(x) . Thus, βφ(θ) is the probability of rejecting H0 if θ is true. The level constraint of a test φ is expressed as Eθ φ(X) ≤ α for all θ ∈ Ω0 . (1) A test satisfying (1) is said to be level α. The supremum over θ ∈ Ω0 of the left side of (1) is the size of the test φ.

Chapter 7. Hypothesis Testing. Hypothesis testing is the most important thing you learned in business statistics. It is the foundation of the statistical world. Hypothesis testing tells us if the treatment effect we observed is statistically significant. A statistical hypothesis is an assumption about a population parameter.

hypothesis test - we can use our data to see if we can reject various hypothesis about our data (for example, a hypothesis may be that the mean of a distribution is 7 or that education ... This is likely the type of econometrics that you encountered in your undergraduate courses. 2.Structural estimation - This type of econometrics is much ...

11-6/78 Part 11: Hypothesis Testing - 2 Broad Approaches Bayesian: Does not reach a firm conclusion. Revises odds. Prior odds compares strength of prior beliefs in two states of the world Posterior odds compares revised beliefs Symmetrical treatment of competing ideas Not generally practical to carry out in meaningful situations Classical: All or nothing; reject the theory or do not reject it.

Econometrics is the application of statistical and mathematical theories in economics for the purpose of testing hypotheses and forecasting future trends. It takes economic models, tests them ...

This video provides some insight into hypothesis testing in econometrics and statistics. Check out https://ben-lambert.com/econometrics-course-problem-sets-a...

Chapter 16 shows how to test a hypothesis about a single slope parameter in a regression equation. This chapter explains how to test hypotheses about more than one of the parameters in a multiple regression model. ... One of the central tasks in economics is explaining savings behavior. National savings rates vary considerably across countries ...

Testing the null hypothesis H: β= b. against the alternative H: β< b: We reject the null H 0and accept the alternative H, if t ≤ t (α, n−2), where t (α, n−2) is the t-critical value, t ...

Hypothesis Testing in Econometrics. Joseph P. Romano, A. Shaikh, Michael Wolf. Published 24 September 2009. Economics. Econometrics: Econometric & Statistical Methods - General eJournal. TLDR. Some of the most important methods for hypothesis testing, as well as resampling methodology, which is useful to set critical values are summarized, and ...

Learn hypothesis testing in econometrics with Queen Mary University of London. Understand OLS estimator properties, diagnostic testing, and decision-making in uncertain contexts. 4-week course. ... Explain what hypothesis testing is - Explain why the OLS is a rational approach to hypothesis testing - Perform hypothesis testing for single ...

Hypothesis testing concerns the question of whether data appear to favor or disfavor a particular description of nature. ... The vast majority of all testing problems in econometrics can be formulated in terms of a partition of the parameter space into two sub-vectors 8 = (e;, 0;)' where the null hypothesis specifies values, $' for 8,, but ...

Call this - a value. For a 95% confidence interval say this would be 0.95. From statistical tables we can find critical values such that any random variable which follows a t-distribution falls between these two values with a probability of 1 - a . Denote these critical values by ta and t. /2, N 1 - a / 2, N.

Offered by Queen Mary University of London. In this course, you will learn why it is rational to use the parameters recovered under the ... Enroll for free.

The equation is specified as a function of the variables in the indeps list on the OLS command.Note: The variable names actually represent the coefficients involved in the hypothesis test. If a hypothesis test involving the intercept coefficient is required then the name CONSTANT can be used to represent the intercept.. The SHAZAM output reports a t-test statistic and a p-value for a 2-sided test.

Features of the macrostructure and microstructure of uranium dioxide powders are considered. Assumptions are made on the mechanisms of the behavior of powders of various natures during pelletizing. Experimental data that reflect the effect of these powders on the quality of fuel pellets, which is evaluated by modern procedures, are presented. To investigate the structure of the powders, modern ...

In this study, the possibility of sintering industrial pressed uranium dioxide pellets using microwave radiation for the production of nuclear fuel is shown. As a result, the conditions for sintering pellets in an experimental microwave oven (power 2.9 kW, frequency 2.45 GHz) were chosen to ensure that the characteristics of the resulting fuel pellets meet the regulatory requirements for ...

New-type toroidally focused ultrasonic flaw detectors, whose application provides an appreciable increase in the flaw detection rate with retention of high sensitivity to flaws, are considered. The construction of a flaw detector is presented, the sizes of a gauge for the formation of the toroidal surface of a lens are given, and the technology of the manufacturing of a toroidal lens is described.

The life tests started after successful completion of hydraulic tests (hydraulic filling) of the mock-up with the aim to determine RK3+ hydraulic resistance. Life tests are carried out on a full-scale research hot run-in test bench V-440 and will last for full 1500 hours. The aim of tests is to study mechanical stability of RK3+ components ...