Essay on Financial Literacy for Students and Children

Importance of financial literacy, an introduction to financial literacy.

We go to schools, colleges, universities to complete our educated and start earning our livelihood. We take up jobs, practise professions or start our own businesses so that we can earn money to make our living. But which of these institutions make us capable of managing our own hard-earned money? Probably a very few of them.

Our ability to effectively manage our money by drawing systematic budgets, paying off our debts, making buying and selling decisions and ultimately becoming financially self-sustainable is known as financial literacy.

Financial literacy is knowing the basic financial management principles and applying them in our day-to-day life.

Financial Literacy – What does it Involve?

From simple practices like keeping a track of our expenses and understanding the need to spend money if we like a product to striking a balance between the value of time saved and money lost, paying our taxes and filing of tax returns, finalizing the property deals, etc – everything becomes a part of financial literacy.

Get the huge list of 500+ Essay Topics here

As human beings, we are not expected to know the nitty-gritty of financial management. But managing our own money in a way that it does not affect us and our family in a negative way is important. We certainly do not want to end up having a day with no money at hand and hunger in our stomach.

Why is Financial Literacy so Important?

Financial literacy can enable an individual to build up a budgetary guide to distinguish what he buys, what he spends, and what he owes. This subject additionally influences entrepreneurs, who incredibly add to financial development and strength of our economy.

Financial literacy helps people in becoming independent and self-sufficient. It empowers you with basic knowledge of investment options, financial markets, capital budgeting, etc.

Understanding your money mitigates the danger of facing a fraud-like situation. A few strategies are anything but difficult to accept, particularly when they’re originating from somebody who is by all accounts learned and planned. Basic knowledge of financial literacy will help people with foreseeing the risks and argue/justify with anyone learned and well-informed.

What should you read on / get informed about in Financial Literacy?

- Budgeting and techniques of budgeting

- Direct and indirect taxation system

- Direct tax slabs

- Income and expense tracking

- Loans and debt – EMI management

- Interest rate systems: fixed versus floating

- Business and organisational transaction studies

- Elementary Book-keeping and Accountancy

- Cash in-flow and out-flow Statements

- Investment & personal finance management

- Asset management:

- Business negotiation skills and techniques

- Make or buy decision-making

- Financial markets

- Capital structure – owner’s funds and borrowed funds

- Fundamentals of Risk Management

- Microeconomics and Macroeconomics fundamentals

While there are various media to learn about financial literacy, we recommend that you join a short-term, weekend programme which helps you get financially literate.

Customize your course in 30 seconds

Which class are you in.

- Travelling Essay

- Picnic Essay

- Our Country Essay

- My Parents Essay

- Essay on Favourite Personality

- Essay on Memorable Day of My Life

- Essay on Knowledge is Power

- Essay on Gurpurab

- Essay on My Favourite Season

- Essay on Types of Sports

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

Important Addresses

Harvard College

University Hall Cambridge, MA 02138

Harvard College Admissions Office and Griffin Financial Aid Office

86 Brattle Street Cambridge, MA 02138

Social Links

If you are located in the European Union, Iceland, Liechtenstein or Norway (the “European Economic Area”), please click here for additional information about ways that certain Harvard University Schools, Centers, units and controlled entities, including this one, may collect, use, and share information about you.

- Application Tips

- Navigating Campus

- Preparing for College

- How to Complete the FAFSA

- What to Expect After You Apply

- View All Guides

- Parents & Families

- School Counselors

- Información en Español

- Undergraduate Viewbook

- View All Resources

Search and Useful Links

Search the site, search suggestions, alert: harvard yard closed to the public.

Please note, Harvard Yard gates are currently closed. Entry will be permitted to those with a Harvard ID only.

Last Updated: May 03, 11:02am

Open Alert: Harvard Yard Closed to the Public

Financial Literacy

Helping you prepare for life..

We want financial literacy to be a part of your life. To that end, we have focused our resources on providing support and education on financial understanding for all students. The more you know, and the more tools you have at your disposal, the better prepared you will be for life at and beyond Harvard.

In this guide, you'll find information on budgeting, credit, saving and investing, and taxes.

A budget is, simply put, a plan for your money. By tracking income and expenses you can create a plan for your spending and saving.

Why do you need a budget?

If you have ever found yourself looking at your bank account and wondering where your money went, a budget can help. The most common cause of financial problems is spending more than you are earning. With a flexible, sensible budget, you can control of your money and avoid financial stress. It can help you limit spending and ensure there is enough money to do the things that you want.

How to get started

- Build a starting budget with your best guess of what you spend in a month (on average), separated into categories like books, personal expenses, rent, phone, and entertainment.

- Track your expenses for a few months. Then, compare these figures with your previous projections. You may be surprised to see where your guesses were higher or lower.

- Once you have tracked your expenses, compare these to your income. If you are spending more than you are earning, you need to make changes.

- Be honest about "needs" vs. "wants". Enjoying a store-bought coffee every single day is nice, but you could save up to $80/month by reducing this purchase from daily to weekly.

- Review your monthly budget for any necessary changes. Remember: a budget is fluid, meaning that it will (and should) adjust as your income and goals adjust.

Determining How Much Disposable Income You Have

Consider setting some of your income aside in a savings account, and putting limits on how much you can spend on non-essential items.

Let’s say you buy a cup of coffee on most days, grab a quick bite a couple times a week, and go out on Saturday nights for fun with friends. Your yearly spending may look like this:

- Coffee 4x/week @ $2.50 = $520

- Quick late-night snack 3x/week @ $6.50 = $1,014

- Weekend Fun @ $25-30 each weekend = $1,560

Your total spending would be $3,094 per year, or $12,376 for the four years of college--enough to buy a car. Considering this, make sure you’re being thoughtful about how you want to spend and save your money!

Moving forward with a flexible budget

For your budget to be useful, you need to follow it for more than a few months. Tracking your daily purchases only takes a few minutes. It takes even less time with a budgeting app that links to your bank and credit card accounts and automatically categorizes your purchases. Finding it hard to stick to your budget? Some of your figures may be unrealistic so review and adjust as needed. Perhaps you need to allocate more towards books and travel, and less on clothing. The best budget is one that grows and changes to meet your needs

What can you do now?

Setting up financial goals will help you plan and prioritize what’s important to you, and how you should set up a budget to align with your interests. Goals will also help you be more aware of how you spend your money day-to-day. It’s a good idea to write out these goals, and to stay mindful of them as you go through college!

If you like a pen and paper approach, you can try a simple tracking sheet like this one from Balance Pro or a more comprehensive budget worksheet like this one from the Harvard University Employees Credit Union . If you prefer a phone app, there are many to choose from and most are free. Read reviews to determine what makes the most sense for you.

Credit is a major factor in today's economy and is your reputation as a borrower. In order to have the best reputation, credit wise, you should take the time to learn about managing your credit. This is especially important when it comes time to rent an apartment, finance a car, buy a house, or even find a job. The sooner you start building your credit profile, the better off you'll be in the future.

Credit Report vs. Credit Score

A credit report is a detailed report of your credit history. It has personal information, employment history, and a list of open and closed credit accounts. You can get a free copy of your credit report once per year from each of the three credit reporting bureaus: Equifax, Experian, and Transunion. The website to check is www.annualcreditreport.com . It’s a good idea to review your report at least once per year to ensure accuracy and check for fraud. If someone were to fraudulently open a line of credit in your name, you might never know without checking your report.

A credit score is a snapshot of your credit risk at a point in time, based off of your credit report. Credit scores such as FICO range from 300-850, with the majority of Americans scoring between 600-800. For lenders, a higher score means a lower chance of default.

Lenders often charge higher interest rates when taking on higher risk, so a low credit score means a more expensive loan. Conversely, a higher credit score means a less expensive loan. With solid credit history you can pay less for many credit products like private loans, credit cards, insurance, auto loans, and mortgages.

Do Your Research

Before applying for a credit card, compare each potential card’s annual fees, interest rates, special rewards, and credit limit. Little differences can have major impacts. Once you choose a credit card and begin using it, make your payments on time and pay off your balance each month. Failure to do so can result in large fees and do serious damage to your credit score. Try not to carry a balance on the card; instead, make occasional and sensible purchases.

Components of Your Credit Score

- Payment History (35%) This is the largest factor and thus the best way to improve your score: make consistent, on-time payments. If you are more than 30 days late even once, that record remains on your credit report for 7 years and could result in a drop of 90 points or more in your credit score.

- Amount of Debt (30%) How much debt you have relative to your available credit makes up the second largest factor in your score. A good rule of thumb is to keep your debt utilization ratio ( amounts owed/total credit limit ) below 30%. Pretend you have two credit cards and both have a limit of $500. To stay within 30% you would spend no more than $300 between the two cards.

- Length of Credit History (15%) Lenders like to see long relationships with other lenders. One easy thing you can do to build credit history is open a no-annual-fee credit card, charge a few dollars each month, and pay it in full each month when the bill comes.

- New Credit (10%) Anytime you apply for a line of credit and a lender does what is called a "hard pull" on your credit score, your score can drop by a few points. This isn’t a big deal as new credit only makes up 10% of your score, but if you do this often enough it can substantially impact your score and ability to secure new credit. This information remains on your report for 2 years.

- Credit Mix (10%) Lenders like to see a variety of credit accounts in good standing because it signals that you are a responsible borrower. A person who is making on-time monthly payments on a credit card, an auto loan, and a student loan is considered less risky. Your access to different types of credit may be limited as a student, and most lenders realize this.

U.S. News and World Report Student Credit Card Survey

Each year, U.S. News and World Report conducts a survey of students who own a credit card. From the results, they identify and address common credit topics such as credit scores, costs of credit, and providing tools that help guide students with credit card best practices. View the survey and guide here .

Helpful Reads

For more information on effective credit building as a student, the following articles are useful.

- CreditCards.com Presents: 10 Ways Students Can Build Good Credit

- A College Student’s Guide to Building Credit

Saving and Investing

Figuring out how to secure your financial well being is one of the most important things you can do.

For many people, the path to financial security is with saving and investing. As a student, these topics may not yet be on your radar, but saving is a key concept for financial well-being. If you make saving a regular habit, even a small amount, you are building a foundation for financial success.

Tips on getting started with saving and investing

- Pay yourself first: This means that for every paycheck you receive, commit to putting an amount (even a small amount) aside in a savings account. An effective way of doing this is to have a set amount of your paycheck directly deposited into a savings account, separate from what you use for everyday expenses. You will be surprised how quickly your savings can grow.

- Keep track of your saving: People who track their savings tend to save more because it is on their mind. With online and mobile banking, there should be no excuse not to know exactly how much money you have.

- Set Goals: Setting financial goals is crucial. As a student, you may only have a few financial goals, but this is the perfect opportunity to hone your skills. Think of this scenario: You want to pay off a student loan before graduation, how will you accomplish this? How much do you need to work? To save? The better you do now, the easier accomplishing future goals will become.

Thinking ahead

Even now there may be long range financial goals that you start saving for. Here are some tips for investing in your long term financial goals.

- Plan ahead: As with any endeavor, advance planning is a way to figure out what you want, when you want it, and what you can do to achieve it. The sooner you start planning, the sooner you start accomplishing.

- Understand the time value of money /compound interest: This is the principle that a dollar today is worth more than a dollar in the future, because the dollar received today can earn interest up until the time the future dollar is received. The longer the time frame for investment, the more you can increase the income potential of your investment. On the flip side, waiting to invest can make it more difficult to achieve your financial goals. Discover how much waiting to save could cost you with the SEC compound interest calculator .

- Understand your objectives: As a general rule, the shorter your time frame for investing, the more conservative you should be. For example if you are in your twenties and trying save for a down payment on a house, you are going to want to put your money in a vehicle that ensures the least risk of losing your principle investment. When your time frame for investing is long, you can consider less conservative options. Retirement savings are an example. Starting young allows you to save for a longer period and allows time to make up for potential loses in a less conservative environment.

Do you need to file taxes? Are you aware of the tax benefits for Education? Find out the answers to these important tax related questions.

U.S. Federal Taxes: Overview

If you are planning to work in the US, then navigating the tax code is going to be a large part of your financial well being. Gathered here are aspects of the tax code that deal with education and college related expenses. While the information here is a good start, it is only a broad overview and not a complete guide to filing taxes. For specific questions or additional information, you may wish to visit the IRS website or consult a tax professional. International students should consult the Taxes & Social Security page of the Harvard International Office website.

Do I need to file taxes?

Determining whether or not you need to file taxes depends on two things: how much money you earned and how much was taken out (aka “withheld”) for taxes.

If your earned income is over a certain limit as determined by the IRS, you may be required to file taxes regardless of how much was withheld from your paycheck.

- As an example, a typical Harvard undergraduate was required to file (2018) taxes if their income (including taxable scholarships ) was equal to or greater than $12,000.

- The IRS strongly suggests that you file taxes, even if you are not required to do so. By filing your taxes, you may be eligible for a refund of some or all of the income withheld.

Types of tax benefits for education

The information provided here is intended only to get you started to learn about potential tax benefits related to higher education. It is important to note that there are eligibility restrictions and we strongly suggest visiting the IRS website directly for the most comprehensive information about tax benefits for higher education.

American Opportunity Credit

- This is a credit of up to $2,500 per eligible student based on Qualified Education Expenses paid during the tax year. The American Opportunity Credit can only be used for up to four years per eligible student.

Lifetime Learning Credit

- This is a credit of up to $2,000 per eligible student based on Qualified Education Expenses paid during the tax year. The Lifetime Learning Credit does not have a limit on the number of years it can be used per eligible student.

Tuition and Fees Deduction

- This is a deduction of up to $4,000 from your Adjusted Gross Income (AGI) based on amounts paid for Qualified Education Expenses. This deduction can be claimed for multiple students and the maximum deduction in a tax year is $4,000.

Student Loan Interest Deduction

- If you are a student making payments on an education loan that is accruing interest, you may be able to deduct some or all of the interest you paid that year from your taxes.

- Your parents may be able to deduct some or all of the interest they paid on their loans, taken on your behalf, if they still claim you as a dependent. The current limit is $2,500 per year, subject to income restrictions.

Important questions to consider

What are Qualified Education Expenses?

When filing taxes, you should know what counts as “qualified” and what doesn’t. This can be confusing because the definition of “qualified” is contextual. For example, the IRS may have a different definition of “qualified” than a 529 plan or other education savings plan provider.

What does the IRS count as Qualified Education Expenses?

- Per IRS guidelines, the expenses that you paid directly (or with a loan) for tuition, fees, and other related expenses count as qualified education expenses.

- The IRS website states that the following expenses do not qualify: room, board, insurance, medical expenses (including student health fees), transportation, and personal/living/family expenses.

What are Credits and Deductions?

Credits and deductions are two different ways to reduce your tax liability.

A deduction reduces the amount of income you have that is subject to tax. The actual benefit is tied to your tax bracket. In other words, if you are in the 25% tax bracket and have a Deduction of $1,000, your benefit is a $250 reduction in your taxes (25% of $1,000.)

A credit on the other hand reduces the amount of income tax you have to pay in a 1:1 ratio. In other words, if you have a $1,000 Credit, then your benefit is a $1,000 reduction in your taxes.

As a general rule, you should seek out credits before deductions, since the benefit is usually larger (i.e. to your advantage).

Additional Resources and Information

The information provided here is taken from the IRS website and is intended solely as a guideline. Because tax laws are constantly changing, information found here may change. For the most up to date and comprehensive information, we strongly suggest visiting the IRS website , or consult a tax professional should you have specific questions.

http://sfs.harvard.edu/taxes

http://www.irs.gov/Individuals/Education-Credits

IRS Publication 970 (Tax Benefits for Education)

http://www.irs.gov/Individuals/Qualified-Ed-Expenses

Throughout the year, we offer events on a wide range of financial literacy topics. Some events are in person and some are virtual, but all are geared toward helping you understand, manage, and move forward with your financial life.

- First-Year Finance - A session delivered in the fall of your first year which provides an overview of all things Financial Aid. We also cover credit, budgeting, and the various financial literacy programs that we have available. Take advantage of this wonderful opportunity to ask questions and learn more about Harvard’s generous financial aid offerings.(This session has been cancelled for fall 2020).

- Money Management 201 – You’re getting ready to graduate and you have borrowed to help cover the cost of education. Is your financial health in order? Join us at one of our Spring semester sessions where we explain debt, loan repayment, and a host of other financial literacy topics. Regardless of whether you’re joining the work force, taking time off to travel, or prepping for grad school, these sessions are invaluable as you start your life post-Harvard.

- University Efforts - In June 2011 the Directors of Financial Aid at each Harvard School as well as the University Financial Aid Liason’s Office decided to work on Financial Literacy as a University wide endeavor. One result of this collaboration was a university resource on financial wellness .

Related Guides

Financial aid fact sheet.

Get the facts about Harvard College's revolutionary financial aid program.

Guide to Debt Management

Loans are never required, but if you choose to take out loans, we want to help you "borrow smart". Here are some helpful tips on debt management.

Understanding Your Financial Aid Award

Let's review some of our financial aid terminology to help you fully understand your financial aid award letter.

If you're seeing this message, it means we're having trouble loading external resources on our website.

If you're behind a web filter, please make sure that the domains *.kastatic.org and *.kasandbox.org are unblocked.

To log in and use all the features of Khan Academy, please enable JavaScript in your browser.

Financial Literacy

Welcome to financial literacy, unit 1: welcome to financial literacy, unit 2: budgeting and saving, unit 3: consumer credit, unit 4: financial goals, unit 5: loans and debt, unit 6: insurance, unit 7: investments and retirement, unit 8: scams & fraud, unit 9: careers and education, unit 10: taxes and tax forms, unit 11: teacher resources, unit 12: additional resources.

What Is Financial Literacy and Why Should You Care?

In celebration of Financial Literacy Month, we’re featuring #FinLit-focused stories and tips to inspire readers.

With April being Financial Literacy Month, you may start to see a spattering of references to financial education all over the internet.

What is the definition of financial literacy? It means understanding how to earn, spend, save, manage and invest money. It also means understanding how the economy works.

If you’re like me, you get really excited about financial literacy and the possibilities it can create for all of us.

With that being said, I fully acknowledge that many will not share my excitement in this area. Most articles on personal finance or financial literacy will go right into how to set a budget, the benefits of saving, and the impact of interest rates. At that point, the majority of individuals lose interest (pun intended) and move on to something else.

In an attempt to keep your attention, let’s spend some time looking at the “ why ” of financial literacy, not just the “ how .”

Financial literacy is about improving your life

While this subject may not be as exciting to you as it is to me, hopefully we can at least agree that money can have a significant impact on our everyday lives. My personal belief is that money doesn’t necessarily buy happiness; it isn’t just about buying that brand new car or newest gadget. However, money can allow a person to have more flexibility, reduce stress and improve relationships.

Living beyond our means can contribute to bankruptcy, divorce and massive stress. Additionally, the burden of student loan debt can keep first-time homebuyers out of the market, thus putting a drag on the economy .

Meanwhile, living with minimal debt and a savings cushion can provide you with the peace of mind and security of being financially free. Therefore, financial literacy isn’t just about getting better with money to buy more stuff—it’s about getting better with money to improve many different aspects of life.

- Financial literacy to a child may mean teaching the basics of spending, saving and giving.

- To some adults, financial literacy may mean helping someone open up a bank account or preventing someone from engaging with a predatory lender.

- For others, financial literacy could be learning how to budget or track spending—allowing you to develop a savings cushion, invest in your company’s pre-tax retirement account, or save up for a new vehicle.

As you can see, financial literacy is important at all ages. And beginning to teach these concepts to children can instill lasting habits: A study by Cambridge University researchers (PDF) showed that behaviors around money form in children as early as age 7. If you happen to be older than 7 (shout-out to all the loyal readers who are not), it’s never too late to learn.

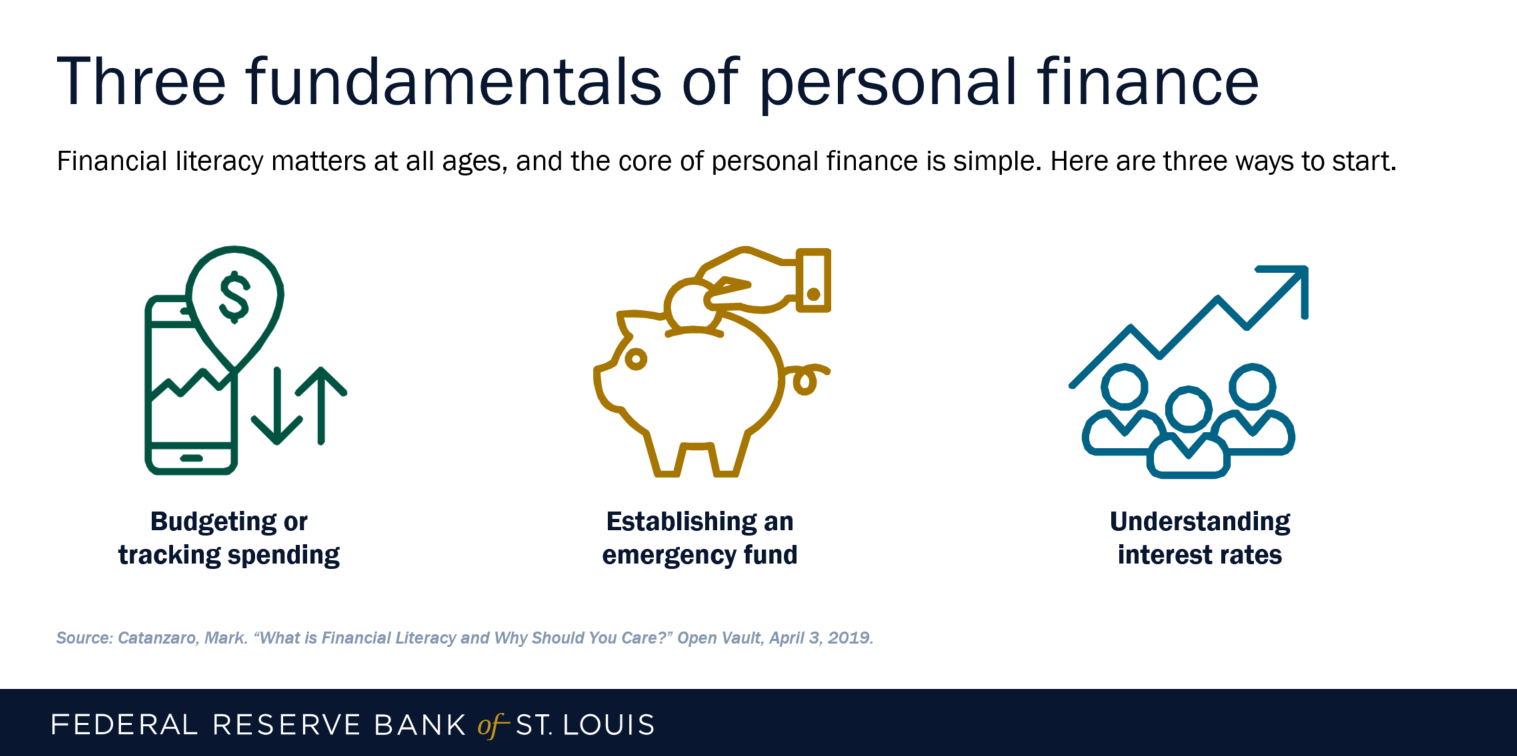

Three core principles for your personal finances

Let’s face it, there’s a lot of conflicting information out there about personal finance. But the better educated you are about finances, the better decisions you’ll make. The core of personal finance is simple: Save more Spend less than you earn and then invest the difference. Editor's note: This language was updated for accuracy.

The doing is the hard part.

It can be tough to go out and make a higher income when you’re barely able to scrape by on your current paycheck. Even with a higher income, slowly paying down debt requires a lot of discipline when spending beyond our means is a constant temptation. Finally, investing can be confusing with so many options in the marketplace. I know this may be challenging depending on income level, amount of debt, or other life situations that come up. We are all on a different path on our financial journeys, which is why it’s called personal finance.

Not sure where to get started? Here are three core financial literacy principles that may help improve anyone’s personal financial situation.

1. Budget or track your spending

I know what you’re thinking: “See, I knew you would talk about budgeting!” Yes, there is a reason why almost every discussion on financial literacy focuses on budgeting or tracking your spending. If you don’t know where your money is going, then how can you make improvements to your financial situation? Budgeting is where you plan out your expenditures ahead of time.

For those who may not want to budget, simply tracking your spending after the money is spent can give you a snapshot of where your money is going. It’s amazing how those random $10 or $20 purchases can add up when left unchecked.

Some of you may already be on a tight budget; others may be able to cut out unnecessary expenses and use that money to pay down debt, build savings or invest. Below are a few resources from the Federal Reserve if you’re looking to get started.

- Budgeting 101 Online Course for Consumers

- Piggy Bank Primer: Saving and Budgeting Lesson for Grades 2-4

- Katrina’s Classroom

2. Establish an emergency fund

Now that you are budgeting or tracking your spending, hopefully you can find a little cushion to save up an emergency fund of $1,000 to $2,000. The Federal Reserve Board issued a report on the economic well-being of U.S. households indicating that 40 percent of Americans could not cover a $400 emergency expense without selling or borrowing something.

Establishing an emergency fund is a critical step to help with the unexpected costs that always seem to come up. A flat tire, leaking toilet or unexpected medical expense can be right around the corner. An emergency fund can significantly reduce the stress of these unexpected situations. Ideally, you’ll want to work your way up to having three to six months of emergency savings to protect yourself or your family in case of a job loss, significant medical event or other large and unexpected expenditure.

3. Develop an understanding of interest rates

Last year I wrote a post on the power of compound interest . Compound interest is known as the “eighth wonder of the world” because investing even a few hundred dollars per month in your 20s can leave you a millionaire by the time you retire. On the other hand, high interest loans could cripple a person for years. While there is a time and place for debt, not having a plan to get out of high-interest debt can lead to financial turmoil.

I remember a point in my life where the basics of interest rates were very confusing. The difference of a 3 percent interest rate on a money market account versus a 3 percent interest rate on a car loan wasn’t clear. Interest rate percentages are used interchangeably and, at least to me, it wasn’t obvious the positive or negative effect that interest rates had on an investment or debt.

According to a working paper from the National Bureau of Economic Research, less than one-third of young adults possess basic knowledge of interest rates, inflation and risk diversification . Financial literacy can help you understand these topics, allowing you to make better financial decisions.

First individuals, then families, then the economy

Personal finance is as much behavioral as it is about the numbers. Having a strong understanding of financial literacy will allow you to make better financial decisions that can hopefully improve your day-to-day life. At the macro level, financial literacy can result in stronger family balance sheets, which lead to a stronger overall economy (PDF).

While the concepts of personal finance are simple, research shows there is a long way to go in spreading financial literacy. Take time this April to educate yourself or a friend on personal finance-related topics. The St. Louis Fed’s economic education team has a variety of resources that can assist you or someone else on the journey to becoming more financially literate.

Notes and References

1 Editor's note: This language was updated for accuracy.

Mark Catanzaro is a senior manager in the St. Louis Fed’s Supervision and Regulation division. His academic background includes economics and finance.

Related Topics

This blog explains everyday economics, consumer topics and the Fed. It also spotlights the people and programs that make the St. Louis Fed central to America’s economy. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Media questions

All other blog-related questions

Financial Literacy: The Importance in the Modern World Essay

In previous years, the issue of investing has become popular among beginning investors who follow the advice of bloggers and put their money in unsafe securities or individuals who hope for the burgeoning future of NFTs and cryptocurrency. However, instead of blindly following the advice of impostor financial advisors or buying securities without having knowledge about them, the public should focus on overall financial literacy. From a very young age, every person should learn how to use their money wisely and how it can help not only save but multiply the savings and have enough for a carefree retirement.

The first reason why acquiring the skills of financial literacy is essential is its protection against inflation. At the given moment, the rate of inflation is 7.7%, which means that if money is simply in the deposit account, at the end of the year, its value will decrease by this number (U.S. Inflation Calculator). This is why if people desire to make a big purchase after having enough money for it, eventually, they will be trapped in a vicious circle of constant saving since the prices will be rising together with inflation.

Another point that representatives of younger generations must understand is that financial literacy enables skills of wise saving for retirement. According to The New York Times, schools do not have obligatory courses on 401(k)s and Individual Retirement Accounts, despite the fact that the majority of employees are now responsible for their own retirement plans (Lieber and John). As a result, many children, adolescents, and adults are unaware of the fact that if they start investing $5,000 annually at the age of twenty-two, by the age of 67, they will accumulate approximately $1 million dollars (Lieber and John). However, if they start at thirty-two and invest the same amount of money, they will only manage to generate $500,000 (Lieber and John). Thus, this is the compound interest effect that many people with a lack of financial literacy fail to understand.

Moreover, it is vital to see the benefits of saving in order to have a safety cushion. According to Forbes, two out of three Americans are spending their savings because they are concerned about inflation (Campisi). As a result, these individuals who refuse to save will not have an emergency fund, and if there is a crisis situation, they will have to seek loans. In comparison, those who have basic financial literacy skills know that panicking is the worst enemy, and they are prepared for such scenarios, which is why financial literacy is crucial.

Still, it is important to review other valid opinions regarding investing and saving. While it can be a helpful skill, sometimes financial literacy, along with consistent investing, can be disrupted by certain risks. For instance, the financial crisis of 2008 led to a loss of $2 trillion dollars (Merle). However, it is noteworthy that the results of such outcomes were external factors rather than personal actions.

Hence, it is necessary to learn the fundamentals of financial literacy from a young age in order to have a carefree retirement, emergency funds, and protection against inflation. I believe that it is unfortunate that children do not acquire this knowledge at school and, therefore, it should be either personal or parental responsibility to either learn or teach such skills. With such an approach, both children and adults will be more careful with money and be prepared for any hardship or crisis, being able to grow into financially independent people.

Works Cited

Campisi, Natalie. 2 Out Of 3 Americans Say They’re Blowing Through Savings to Cope With Inflation—Do This Instead . Forbes, 2022. Web.

Lieber, Ron and Todd S. John. How to Win at Retirement Savings . The New York Times, n.d. Web.

Merle, Renae. A Guide to the Financial Crisis — 10 Years Later . The Washington Post. Web.

U.S. Inflation Calculator. Current US Inflation Rates: 2000-2022 . U.S. Inflation Calculator, n.d. Web.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2023, December 27). Financial Literacy: The Importance in the Modern World. https://ivypanda.com/essays/financial-literacy-the-importance-in-the-modern-world/

"Financial Literacy: The Importance in the Modern World." IvyPanda , 27 Dec. 2023, ivypanda.com/essays/financial-literacy-the-importance-in-the-modern-world/.

IvyPanda . (2023) 'Financial Literacy: The Importance in the Modern World'. 27 December.

IvyPanda . 2023. "Financial Literacy: The Importance in the Modern World." December 27, 2023. https://ivypanda.com/essays/financial-literacy-the-importance-in-the-modern-world/.

1. IvyPanda . "Financial Literacy: The Importance in the Modern World." December 27, 2023. https://ivypanda.com/essays/financial-literacy-the-importance-in-the-modern-world/.

Bibliography

IvyPanda . "Financial Literacy: The Importance in the Modern World." December 27, 2023. https://ivypanda.com/essays/financial-literacy-the-importance-in-the-modern-world/.

- The Art of Failure

- Cryptocurrency Schemes Creating Artificial Bubbles

- “Cryptocurrency and the Problem of Intermediation” by Harwick

- Aspects of the 2008 Financial Crisis

- Essential Points From the Financial Crisis

- Economic Aspect of a Vaccine Cost

- Strategies to Save and Protect Money

- Auctions for Selling Products and Gathering Data

What is Financial Literacy?

On This Page

Financial Health

Introduction to Budgeting

Tracking Your Spending

Why track spending? A monthly budget is just a plan – your actual spending behavior may be completely different. So if you don’t track your spending, you won’t necessarily know where you got off track or how to fix it. We all make important financial decisions every day. Tracking spending helps you find spending habits that can have long-term consequences that you may not expect.

Over a month, there are countless ways to spend more than you planned, including spending on things that weren’t even included in your budget. Small expenses can add up in ways you wouldn’t expect, and tracking your spending is a great step in making the most of your spending plan.

There’s no doubt that tracking your spending does take work, and it’s easy to feel like you just don’t have the time. But tracking spending is one of the best ways to stay on track and to avoid lasting credit card debt. Think of it this way – avoiding credit card debt by sticking to a spending plan means you automatically get a 15, 20, or even 30 percent discount on whatever you would have bought on a credit card and paid off over a year. That’s a great deal for anyone.

If you've created a budget using this website's Monthly Budget Calculator, your figures have been saved and are available for review at any time. You’ve already done some serious financial planning. Now it just needs a reality check in comparison with your actual spending.

Tracking Your Spending The best way to get an accurate picture of your spending is to track it for at least one month.

Some spending is easy to track - rent or mortgage payments, car insurance, and utility bills are typically paid by check or bank draft, so there's always a record available. Other other hand, groceries, dinners out, coffee or vending machine snacks can be a lot harder to track, especially if you use cash. If you don't pay for absolutely everything with a credit or debit card, it's often easiest to keep each and every receipt. Then, at the end of the day or week, total all of your receipts and categorize each expense.

This website also offers a Budget Tracking tool that's a simple, effective way to track your spending. Once you have totals for each category in your budget, you can enter the figures in our Budget Tracking Tool for a comparison with your planned monthly budget figures. We'll also give you feedback on cash flow, luxury spending, and other factors as well. You can enter expenses at any time during the month or save it all for the end. Your results are saved on a monthly basis, making it easy to track your progress over time.

Other options for budget tracking include:

- Paper and pen. Using your a checkbook register, debit or credit card transactions, and receipts, write down every expense.

- Spreadsheet. Programs like Microsoft Excel can be simple and easy ways to track (and total) expenses. Many online banking services allow you to download your expenses into an Excel, tab-delimited, or comma-delimited spreadsheet - a great way to automate the entry of a good portion of your spending. Then you'd just need to enter cash expenses.

- Online tools. Services like Mint.com allow you to aggregate expenses across accounts into one place. To do so, you'll need to hand over your user names, passwords, and security challenge questions - something many people hesitate to do.

Dealing with Setbacks One word of caution - while you will eventually want your income to exceed the amount of money you spend, that's not always possible for full-time college students. In fact, trying too hard to lower college debt is not necessarily a great idea, especially if it means working more than 20 hours per week at a part-time job. Studies have shown that working more than 20 hours per week is likely to cause academic performance to suffer. Full-time students who work around nine hours per week tend to have the best academic performance, even better than students who do not work at all. Having some financial stress is normal for college students, but if finances interfere with your school work, or if you have to put necessary expenses on credit cards, you may want to consider speaking with someone in your school's aid office. Other financial options may be available to help you succeed both financially and academically. If you're a part-time student with a full-time job, one strategy for dealing with financial setbacks is to set up an emergency fund – a savings account with cash set aside to cover the unexpected. Most experts suggest having three months (or more) of your salary in your emergency fund. If you don't have savings, most banks offer the ability to automatically divert a portion of your income into a savings account. Starting with as little as 5% of your paycheck into the fund is a great place to start.

A budget is not something most people can just make once and be done – there’s a process of trial and error until you find a budget that meets your spending goals. But remember, if you overspend one month, just make up for it by spending less over the following days or weeks – don’t give up. Sooner or later, you’ll find the perfect budget for your unique goals, challenges, and opportunities.

Choosing a Bank or Credit Union

Checking and Savings Accounts

Credit vs. Debit Cards

Credit and debit cards look alike, and they are used in virtually identical ways. But there are some significant differences that make them both important tools to have in your financial toolbox.

By definition, spending with a credit card means you are spending borrowed money. Many people use credit cards and pay off their balances each month in full, incurring no fees or interest. Others carry balances from month to month, meaning they're paying interest on money they've already spent, and could be charged a fee for missing a payment. These "revolvers," as they are called in the credit card industry, are a gold mine for credit card companies, earning them billions of dollars per year in interest and fees.

On the other hand, spending with a debit card means you're spending your money - it comes directly from your checking account. When the money is gone, it's gone. When used properly, spending with debit cards can be part of a solid strategy for spending within a budget and staying out of unplanned debt. But be careful of something called "courtesy overdraft protection."

Courtesy overdraft protection is a fee-based service most financial institutions offer to help consumers avoid declined transactions. Here's how it works - if you overdraw your account, the charge will not be declined. Rather, the bank will loan you enough money to cover the transaction for a fee - typically around $35. No matter how small the overdraft, the same fee applies. If you don't have a credit card, courtesy overdraft protection might be useful in an emergency, but it is an extremely expensive loan in the vast majority of cases. You may also be charged multiple fees before you realize your account is overdrawn.

When you open your deposit account, the bank may ask you if you want courtesy overdraft protection for ATM and certain debit card purchases you make that overdraw your account. If you agree, the bank may pay those transactions and charge you overdraft fees. If you do not agree, the bank will decline those transactions and not charge you fees. You can change your mind about whether you want the service at any time. Some banks may offer you these options on all transactions that overdraw your account, not just ATM and certain debit card purchases.

So unless you don't have enough money in your checking account to make a purchase, why would you ever need to use a credit card? Fraud protection is one important reason, as are protections from damaged or undelivered merchandise you purchase. Thanks to the Fair Credit Billing Act, you have little or no liability for unauthorized charges, damaged goods, or for merchandise that was never delivered. Credit card issuers also provide dispute settlement when you ordered something that wasn't what was promised or if a merchant refuses to refund your money. These protections are especially important for mail order transactions or in cases of identity theft.

If your debit card is stolen, your liability coverage depends greatly on when you report unauthorized activity to your financial institution. In the worst case scenario, meaning you don't discover fraudulent charges for more than 60 days after the bank sent you a statement showing the unauthorized activity, you could be responsible for all charges made after the 60 days. Even if you report fraudulent charges before the 60-day limit, you could be responsible for up to $500 if you know your card is being used and you do not promptly tell the bank. Be sure to get full details from your financial institution, and monitor your account activity closely by reviewing your statements or using online banking.

A good strategy is to use a debit card for everyday purchases and to use a credit card for internet and mail order purchases - just make sure to pay off your credit card balance to avoid interest charges.

Credit Reports and Scores

Whether buying a pack of gum at a quickie mart, financing a car, or paying for a home or a college education, most people use some form of credit daily. Credit offers a way for us to get the things we want without having to carry cash, and it allows us to buy things we might not be able to afford all at once by paying over time.

What is credit? At the most basic level, credit is a promise that you will repay any loan according to the terms of the agreement between you and a lender.

If a friend has ever asked if they could borrow your money, you may have asked yourself whether they could pay you back. Lenders ask themselves similar questions and have devised a system to rate the likelihood that people will repay their debts. This system consists of credit reports and credit scores.

Credit Reports

A credit report is a financial report card that contains detailed personal and financial information dating back seven years or more. You have three credit reports assembled by the three major credit reporting bureaus - Experian, Equifax, and TransUnion. Credit report information includes:

- Social Security number and date of birth.

- Current and previous addresses.

- Current and previous employers.

- Recent credit inquiries.

- Tax or legal issues, including bankruptcies, liens, and foreclosures.

- Active loans and lines of credit, including the percentage of available credit used.

- Loan repayment history.

- Details of accounts that have been referred to a collection agency.

A credit report filled with missed payments and other harmful items will make it more challenging to get loans, and loans will be more expensive since the interest rate will be higher to offset the increased risk of default. And the penalties don't stop there - banks, insurance companies, credit card companies, utilities, landlords, and even employers can access and use your credit report to make decisions about you. About half of all employers use credit reports as a factor in making hiring decisions.

Given the pervasive use of credit reports, it's easy to understand the importance of maintaining a favorable report.

Reviewing your credit reports at least once yearly is a good idea. By doing so, you can spot errors and even identity theft. Call the credit bureau immediately if you find errors on your credit report. Under the Fair Credit Reporting Act, the bureaus have 30 days to investigate and correct any erroneous information.

Credit reporting agencies are required to offer a free report once per year through the government-mandated AnnualCreditReport.com website. The agencies may also try to sell you services as you review your report, but these extras are not required.

Many websites offer so-called "free" credit reports and scores, but most of those sites try to sign you up for a credit monitoring service. These services are unnecessary for most and often cost $150 or more annually.

Credit Scores

If your credit report is like a report card, your credit score is your overall credit grade. A credit score is a three-digit number that summarizes everything about your credit report into one number. Credit scores typically range between 300 and 850, with around 700 being average. The higher the score, the better.

The most commonly known score was created by the Fair Isaac Corporation, which is why credit scores are sometimes called FICO scores. While there are various credit score providers, scores are determined based on factors including:

- Payment history - Whether you pay your bills on time. Late payments can lower your score.

- Credit utilization - The ratio of credit you're using compared to your limit.

- Length of credit history - How long you've had credit. The longer, the better.

- New credit - Opening new accounts can temporarily lower your average account age and score.

- Credit mix - Having different types of credit (credit cards, loans, mortgages, etc) can improve your score.

The interest rate you receive on most loans is based, to a large degree, on your credit score. Building and maintaining a solid credit history is the only way to earn a high credit score. Review our Maintaining and Improving Your Credit Score topic for more details.

While access to your credit reports is free via the AnnualCreditReport.com website, there's no government mandate to provide free credit scores. Here's how you can check your score:

- Credit Reporting Agencies – You can purchase a score directly from Equifax, Experian, and TransUnion.

- Credit Card Providers - Many issuers offer free credit scores as a part of their services. These are often available in the account management section of your online account.

- Paid Services - There are many services that, for a monthly fee, provide you with access to your credit score and credit monitoring services. Be cautious and research thoroughly before paying for any services to avoid scams.

- Free Online Platforms - Websites and apps like Credit Karma, Credit Sesame, and WalletHub offer free access to your credit score. These platforms provide VantageScore, which is slightly different from the FICO score used by many lenders but can still give you a good idea of your credit standing.

- Directly from FICO - The Fair Isaac Corporation (FICO) is behind the most commonly used credit score model. You can purchase your FICO score from their website.

- Credit Unions and Banks - Some banks and credit unions offer their members or customers free credit scores.

When creating a new account to access your credit score, you must provide sensitive personal information. Always use strong, unique passwords and take advantage of the platform's additional security features. And be wary of services that claim to offer "free" scores but require credit card information. Some might enroll you in a trial service that could incur charges if not canceled.

Remember, while your credit score is a crucial part of your financial health, reviewing the full report is essential to check for errors or signs of fraud. Regularly monitoring both ensures you're informed and can take action when necessary.

Managing Accounts

Actively managing your accounts ensures that you always know your account balances, even when the true balance may differ from the amount printed on your last statement or ATM receipt.

How could your bank not know the true balance? Think about mailing a check to pay a bill. For all practical purposes, that money has been spent - it’s just a matter of time before the postal service delivers the check and it’s deposited. But your financial institution doesn’t know that a check has been written until it’s been presented to the bank for payment, so your account balance isn’t telling the whole story at all times. The same is true with any debit card transactions made without entering your PIN - it will generally take a day or two for the money to be withdrawn from your account and reflected on your statement.

By tracking your deposits, transfers, and withdrawals, you can make sure that you don’t spend more money than you have. Otherwise, you could be charged overdraft fees, your transactions could be declined, or you could even be charged late payment or bounced check fees from merchants. It is ultimately your responsibility to monitor your account activity.

Most banks offer the option of either electronic or paper statements. No matter which type of statement you prefer, remember to save your statements for a minimum of three years and up to seven years. Bank statements are often needed for tax returns, financial aid verification and in the event of a tax audit.

Online Financial Services

Most banks and credit unions offer online banking tools that make managing your accounts easier than ever. While online account management is not the only way to effectively manage your accounts, it does have many advantages.

- 24 Hour Account Access - Rather than waiting for a statement, calling an automated information line, or visiting an ATM, online account management gives you near real-time access to your balance and transactions.

- Electronic Bill Payment - Paying bills online not only saves stamps, it helps to reduce the chances that you will miss a payment as the result of a move or trip away from home.

- Automated Alerts - You can often set up alerts for common situations. For example, you may be able to set up an alert when your balance reaches a certain threshold or as a reminder to pay a bill.

- Exporting Account Information - You can easily export your transactions to a money management program such as Quicken or even to a simple spreadsheet for easy tracking over time.

- Staying Organized - Taking full advantage of the online services offered by your financial institution is usually the easiest way to stay organized, reducing the risk of missed payments that could hard your credit report and credit score.

If you bank online exclusively, meaning you never receive paper statements, make sure you understand how long your statements will be available online. If they’re available for just one year, for example, you will need to download them periodically and store them yourself. Otherwise, you will likely have to pay a retrieval fee for older statements if you need them later.

How to Manage Your Account in Three Steps

Ideally, you’ll write down every purchase and save every receipt, always knowing your true account balance – especially if your account balance is often near zero. Otherwise, you’ll want to review your transactions at least once per month using your statement or an online banking portal.

When reviewing your account information, you should:

- Make sure all charges are correct and were initiated by you. Unrecognized charges could be the result of identity theft or a compromised account and should be reported to your bank, and possibly law enforcement, immediately.

- Confirm that any deposits were credited to your account. If a deposit doesn’t appear, take your deposit receipt to your bank or credit union for assistance.

- Verify that all checks you have written have been deposited. If a check hasn’t cleared after a couple of weeks, you’ll want to verify that it was received.

Performing these simple tasks regularly helps to ensure that you are in complete control of your account.

Students and Credit Cards

Maintaining and Improving Your Credit Score

Building and maintaining a solid credit score opens the door to the best interest rates when you need to borrow money.

How much of a difference can a credit score make? The difference can be dramatic, especially for major purchases like a home or car. For example, buying a home with fair (versus excellent) credit may result in a higher interest rate – meaning higher monthly payments and overall cost. Even one extra point of interest on a typical mortgage could cost $150,000 over the life of a 30-year loan.

To build and maintain your score, consider these tips:

Pay Bills on Time

Consistent, timely payments are the most important factor when calculating your credit score. And loan and credit card payments are just part of the picture – your payment history for telephone, cable, gas, electric, and other bills can also impact your score.

If you're confident you'll have the money in your checking account when your bills are due, one strategy to avoid late payments is to pay them automatically via bank draft. This approach is convenient and great for bills that are similar from month to month (like student loans, mortgages, utility bills, and car payments).

For credit card bills, which could vary significantly based on your spending, another option is to set up automatic minimum payments. Paying the minimum avoids the possibility of a late fee, even if you don't have enough money to pay the entire bill when it's due. Just remember to pay the remainder of the balance manually, perhaps with the help of a recurring reminder in your calendar.

Avoid High Credit Utilization

The credit utilization ratio is the percentage of a credit line that's in use. For example, if your credit card has a $10,000 limit and the balance is $5,000, your credit utilization ratio is 50%.

Maintaining a low credit utilization ratio is key for a good credit score. Experts recommend keeping your credit utilization below 30% across all your credit cards and lines of credit. If your utilization ratio is high, pay down balances as soon as possible.

On the other hand, if you consistently pay your credit card bill in full and are confident that you're managing credit responsibly, requesting a credit limit increase can help lower your credit utilization ratio, potentially improving your credit score.

Limit Hard Credit Inquiries

A hard credit inquiry occurs when an organization reviews your credit report as part of its decision-making process. These inquiries can slightly reduce your credit score for a short period, typically a few points, and can remain on your credit report for two years.

Hard credit inquiries can be triggered by:

- Applying for a Credit Card

- Mortgage Applications

- Auto Loan Applications

- Personal Loan Applications

- Student Loan Applications

- Renting a Home or Apartment

- Setting up Utilities

- Applying for a Business Loan

- New Cell Phone Contracts

- Applying for Home Equity Loans and Lines of Credit

It's essential to be aware of actions that can lead to hard inquiries, especially if you plan to make a significant financial move soon, like buying a home.

Multiple hard inquiries in a short time can lower your score, so only apply for credit when you genuinely need it. But in certain situations, like looking for a new car, mortgage, or utility provider, getting quotes from multiple lenders is smart. The good news is that most credit scoring models count all of those inquiries as just one inquiry for a set period of time - usually 14 to 45 days. So don't hesitate to shop around within a defined window when seeking a major new financial commitment.

Think Twice About Cancelling Credit Cards

A popular way to simplify your financial life is to limit yourself to one credit card. After all, multiple cards mean more bills to manage (so it could be easier to miss a payment), and numerous cards may make it easier to use more credit than planned.

When reducing the number of credit cards you actively use, it's tempting to officially cancel the unused accounts. But doing so could potentially lower your credit score. That's because an important component of your credit score is tied to the length of your credit. In many cases, the best way to "cancel" a card is to pay off the outstanding balance and use it only for emergencies.

Monitor Your Credit Report

Knowing what's on your credit report is vital for spotting inaccurate information and unauthorized use of your identity to obtain credit. You can get free access to your Experian, Equifax, and TransUnion reports once per year at AnnualCreditReport.com.

Suppose you've been denied credit based on information in your credit report. In that case, the lender is required under the Fair Credit Reporting Act to provide you with the name of the credit reporting agency and how to get a free report.

If you find inaccurate information on your credit report or suspect identity theft, contact the credit bureau right away.

Can't Pay? Be Proactive

Financial hardships can happen to anyone. Contact the lender immediately if you have an emergency and can't pay a bill. There are no guarantees, but many lenders and utility companies are willing to work with borrowers during tough times, especially if you reach out proactively.

Before you call, have a clear summary of why you can't pay and what you'd like the creditor to do to help. For example, if you can't afford a $100 minimum payment, perhaps you could afford a $40 minimum payment.

If you're experiencing an ongoing financial hardship, seeking financial counseling from a reputable nonprofit organization can help you to avoid lasting damage to your credit.

Identity Theft

You've probably heard the term "identity theft" or "ID theft" in the media. It's a serious problem that costs victims in the United States billions of dollars per year.

Identity theft occurs when someone uses your personal information without your authorization to get credit cards, loans, cell phones and just about anything that requires detailed personal financial information. This can potentially leave you responsible for someone else's spending spree. It can take months or even years to repair the damage done by identity thieves, during which time you could be denied loans or even jobs as the result of their actions.

Identity theft starts with the misuse of your personal information, such as your name, Social Security number, credit card numbers, or other financial account information. For identity thieves, this information is as good as gold, allowing them to either make charges to your accounts or to open new bank or credit accounts.

Skilled identity thieves may use a variety of methods to get your information, including:

- Dumpster Diving - They rummage through trash looking for bills or other paper with your personal information on it.

- Skimming - They steal credit/debit card numbers by using a special storage device when processing your card.

- Phishing - They pretend to be legitimate financial institutions or companies and send spam or pop-up messages to get you to use a computer to reveal your personal information.

- Changing Your Address - They divert your billing statements to another location by completing a change of address form.

- Old-Fashioned Stealing - They steal wallets or purses, mail, pre-approved credit offers, or tax information. They steal personnel records or bribe employees who have access.

- Pretexting - They use false pretenses to obtain your personal information from financial institutions, telephone companies, and other sources.

Types of Identity Theft One type of identity theft involves the use of your existing credit card, checking, or debit card accounts to make unauthorized purchases. Credit card fraud typically occurs when a physical card is either lost or stolen. If you don’t realize the card is missing, it may be impossible to know there’s a problem until you review your credit card statement or a charge has been declined. Another type of credit card fraud involves stealing your account number through a device connected to credit card terminals, enabling the thief to make a duplicate of your card. Luckily, credit card holders are rarely responsible for unauthorized charges on credit card accounts when reported within 60 days of the date your credit card company transmitted your account statement reflecting the fraudulent transaction(s).

Debit card fraud can occur when a thief obtains your debit card and uses it to drain your account or make a purchase with a merchant. Generally, if you notify your bank within two business days of learning of the loss or theft of your card, you may be liable for up to $50 of the stolen money. If you notify your bank between two business days of learning of the loss or theft of your card and 60 days of the date your bank transmitted your account statement reflecting the fraudulent transaction, you could be liable for up to $500. You must report unauthorized transfers within 60 days of the date your bank transfers within 60 days of the date your bank transmitted your statement reflecting the fraudulent transaction(s) to avoid liability for subsequent transactions. However, time and dollar amount limits may vary depending on the specifics of the incident and the state law where you live.

Check fraud is another form of identity theft. A thief may steal your checks, forge your name and drain your account. Or a thief to whom you wrote a check, may alter it to take out more money than you intended to pay. If you report check fraud within 30 days of the date of your bank transmitted your checking account statement listing the fraudulent transaction(s), you are generally not liable for any portion of the money stolen. Nonetheless, depending on the circumstances, your bank can investigate to determine if you are entitled to a reimbursement. It is important to review your bank statements and promptly notify your bank of any discrepancies.

Each form of identity theft we described involves stealing money from an existing account. Another form of identity theft involves a thief using your identity to opening new accounts. This type of identity theft can take longer to discover and may be much more difficult to fix.

Signs of Financial Trouble

How can you tell if you are in serious financial trouble? Here are some clues:

- Your expenses (food, housing, debt payments) are more than your income. As the result, each month leaves you further in debt.

- You can afford to make only the minimum payments or have to skip payments on your debt because of lack of cash.

- Your credit card interest rates have been increased because of missed payments, making it difficult to pay even the minimum amount due.

- You are getting calls from collection agencies.

- You are using credit cards to pay for items that should be accounted for in your household budget (gas, food, payments to other bills, etc.).

- You are forced to open additional lines of credit to make ends meet because your existing lines of credit are maxed out.

Many people experience a period of financial stress. Whether you have short-term difficulties or have a problem you've been dealing with for years, there are steps you can take to fix your situation - from creating a personal debt reduction plan to seeking the help of a credit counseling agency. We also offer detailed information on creating a debt reduction plan and choosing a credit counseling agency in the Library.

Another question to consider is whether you may have a spending problem. Compulsive spending is a condition that may require more than "do it yourself" help. You may find our compulsive spending assessment helpful in identifying potentially destructive spending behaviors. Adapted from a Debtors Anonymous checklist, the assessment offers objective feedback on over a dozen key feelings and behaviors that could be a sign of a serious problem.

Want to bring Financial Literacy 101 to your college or university?

Student Log In

Add a Course

Administrator Log In

Decision Partners Log In

- Personal Finance

- Financial Literacy

The Ultimate Guide to Financial Literacy for Adults

Learn the skills now that you need for a more financially secure life

- Search Search Please fill out this field.

What Is Financial Literacy?

Personal finance basics.

- Bank Accounts

- Credit Cards

- How to Start Investing

- Frequently Asked Questions (FAQs)

The Bottom Line

Caleb has been the Editor-in-Chief of Investopedia since 2016. He is an award-winning media executive with more than 20 years of experience in business news, digital publishing, and documentaries. Caleb is the on the Board of Governors and Executive Committee of SABEW (Society for Advancing Business Editing & Writing), and his awards include a Peabody, EPPY, SABEW Best in Business, and two Emmy nominations.

:max_bytes(150000):strip_icc():format(webp)/CopyofCaleb_Final-CalebSilver-5c09a16346e0fb000182c90c.jpg)

We know that the earlier you learn the basics of how money works, the more confident and successful you’ll be with your finances later in life. It’s never too late to start learning, but it pays to have a head start. The first steps into the world of money start with education.

Banking, budgeting, saving, credit, debt, and investing are the pillars that support most of the financial decisions that we’ll make in our lives. At Investopedia, we have more than 30,000 articles, terms, Frequently Asked Questions (FAQs), and videos that explore these topics. We’ve spent more than 20 years building and improving our resources to help you make smart financial and investing decisions.

This guide is a great place to start, and today is a great day to do it. Let’s begin with financial literacy —what it is and how it can improve your life.

Key Takeaways

- Financial literacy is the ability to understand and make use of a variety of financial skills.

- Those with higher levels of financial literacy are more likely to spend less income, create an emergency fund, and open a retirement account than those with lower levels.

- Some of the basics of financial literacy and its practical application in everyday life include banking, budgeting, handling debt and credit, and investing.

Financial literacy is the ability to understand and make use of a variety of financial skills, including personal financial management, budgeting, and investing. It also means comprehending certain financial principles and concepts, such as the time value of money , compound interest , managing debt, and financial planning.

Achieving financial literacy can help individuals to avoid making poor financial decisions. It can help them become self-sufficient and achieve financial stability. Key steps to attaining financial literacy include learning how to create a budget, track spending, pay off debt, and plan for retirement.

Educating yourself on these topics also involves learning how money works, setting and achieving financial goals, becoming aware of unethical/discriminatory financial practices, and managing financial challenges that life throws your way.

The Importance of Financial Literacy

In its National Financial Capability Study the Financial Industry Regulatory Authority (FINRA) found that Americans’ with higher levels of financial literacy were more likely to make ends meet, spend less of their income, create a three-month emergency fund, and open a retirement account than those with lower financial literacy.

Making informed financial decisions is more important than ever. Take retirement planning. Many workers once relied on pension plans to fund their retirement lives, with the financial burden and decision-making for pension funds borne by the companies or governments that sponsored them.

Today, few workers get pensions; instead some are offered the option of participating in a 401(k) plan . This involves decisions that employees themselves have to make about contribution levels and investment choices. Those without employer options need to actively seek out and open individual retirement accounts (IRAs) and other tax-advantaged retirement accounts .

Add to this people’s increasing life spans (leading to longer retirements), Social Security benefits that barely support basic survival, complicated health and other insurance options, more complex savings and investment instruments to select from—and a plethora of choices from banks, credit unions, brokerage firms, credit card companies, and more.

It’s clear that financial literacy is a must for making thoughtful and informed decisions, avoiding unnecessary levels of debt, helping family members through these complex decisions, and having adequate income in retirement.

Personal finance is where financial literacy translates into individual financial decision-making. How do you manage your money? Which savings and investment vehicles are you using? Personal finance is about making and meeting your financial goals, whether you want to own a home, help other members of your family, save for your children’s college education, support causes that you care about, plan for retirement, or anything else.

Among other topics, it encompasses banking, budgeting, handling debt and credit, and investing. Let’s take a look at these basics to get you started.

Introduction to Bank Accounts

A bank account is typically the first financial account that you’ll open. Bank accounts can hold and build the money you'll need for major purchases and life events. Here’s some background on bank accounts and why they are step one in creating a stable financial future.

Why Do I Need a Bank Account?

Though the majority of Americans do have bank accounts, 6% of households in the United States still don’t have one. Why is it so important to open a bank account? Because it’s safer than holding cash. Assets held in a bank are harder to steal, and in the U.S., they’re generally insured by the Federal Deposit Insurance Corporation (FDIC) . That means you should always have access to your cash, even if every customer decided to withdraw their money at the same time.

Many financial transactions require you to have a bank account to:

- Use a debit or credit card

- Use payment apps like Venmo or PayPal

- Write a check

- Buy or rent a home

- Receive your paycheck from your employer

- Earn interest on your money

Online vs. Brick-and-Mortar Banks

When you think of a bank, you probably picture a building. This is called a brick-and-mortar bank. Many brick-and-mortar banks also allow you to open accounts and manage your money online.

Some banks are only online and have no physical buildings. These banks typically offer the same services as brick-and-mortar banks, aside from the ability to visit them in person.

Which Type of Bank Can I Use?

Retail banks : This is the most common type of bank at which people have accounts. Retail banks are for-profit companies that offer checking and savings accounts, loans, credit cards, and insurance. Retail banks can have physical, in-person buildings that you can visit or they can be online only. Most offer both options. Banks’ online technology tends to be advanced, and they often have more locations and ATMs nationwide than credit unions do.

Credit unions : Credit unions provide savings and checking accounts, issue loans, and offer other financial products, just like banks do. However, they are not-for-profit organizations owned by their members. Credit unions tend to have lower fees and better interest rates on savings accounts and loans. Credit unions are sometimes known for providing more personalized customer service, though they usually have far fewer branches and ATMs.

Assets held in a credit union are insured by the National Credit Union Administration (NCUA) , which is equivalent to the FDIC for banks.

What Types of Bank Accounts Can I Open?

There are three main types of bank accounts that the average person may want to open:

1. Savings account : A savings account is an interest-bearing deposit account held at a bank or other financial institution. Savings accounts typically pay a low interest rate, but their safety and reliability make them a sensible option for saving available cash for short-term needs.

They may have some legal limitations on how often you can withdraw money . However, they’re generally very flexible so they’re ideal for building an emergency fund, saving for a short-term goal like buying a car or going on vacation, or simply storing extra cash that you don’t need in your checking account.