How to Start a Battery Manufacturing Business

- Small Business

- Setting Up a New Business

- Starting a Business

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

Loss & Waste Analysis in Manufacturing

Consumer behavior in the economy, why is the presence of small businesses important for large businesses.

- How to Fix an HP Pavilion Laptop With a Bad Battery

- How to Make Money Recycling Batteries

Battery manufacturing is one of the fastest-growing industries worldwide. A decade ago, consumers used batteries for their laptops, phones and other gadgets. Today, these energy storage devices are powering cars, medical equipment and even houses. Starting a small battery plant can be a great way to stay at the forefront of technology, but don't expect it to be easy.

The first step to starting a battery manufacturing business is to research the practices in this industry and acquire technical know-how. Next, decide on a business model and devise a strategy to produce, distribute and market your products.

Research the Battery Manufacturing Process

Batteries play a key role in the transition to a more renewable world. Financial analysts expect the global battery market to reach $310.8 billion by 2027, reports Grand View Research . The rising popularity of green energy solutions, such as electric cars and solar panel systems, is fueling this industry.

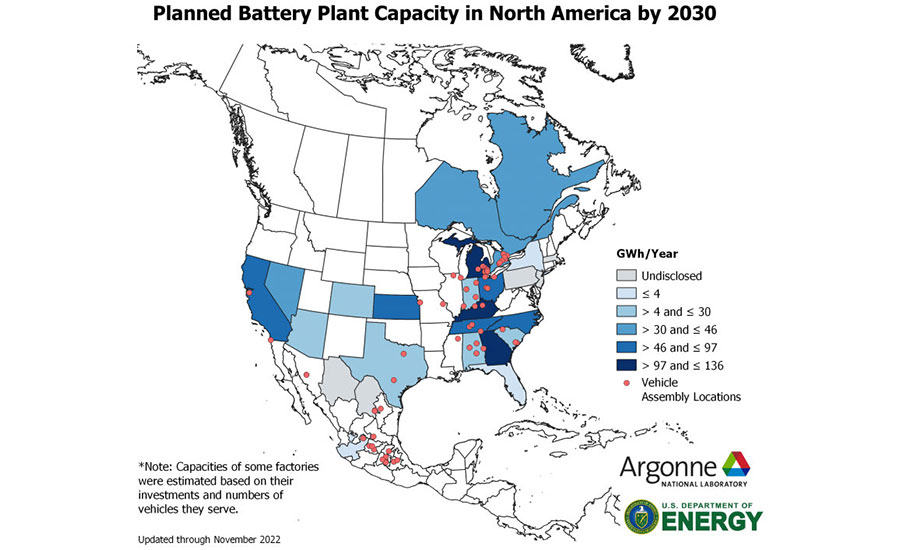

Over 80 percent of the global lithium-ion battery production takes place in China, according to Reuters . The European Union is planning to invest billions in this technology over the next few years. American companies, especially startups, are testing new battery technologies while exploring various business models. For example, some are selling the intellectual property behind their technology.

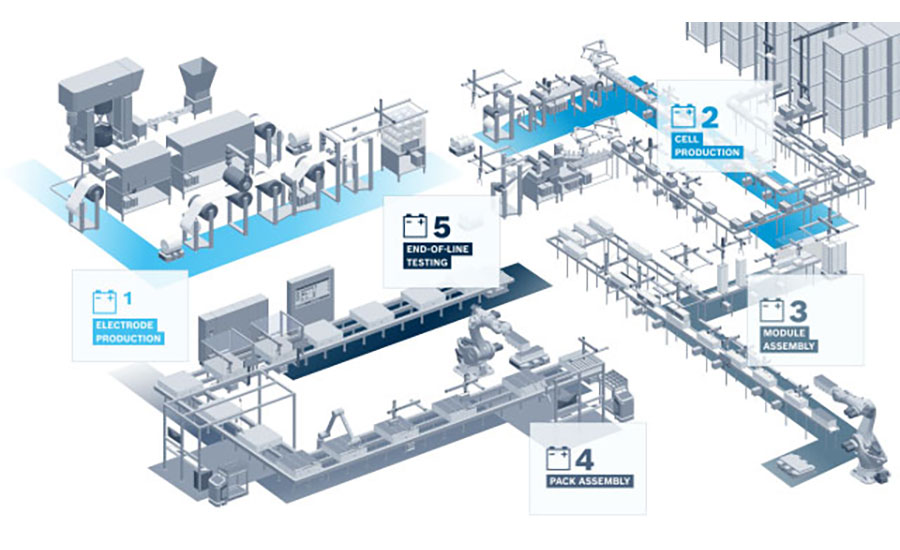

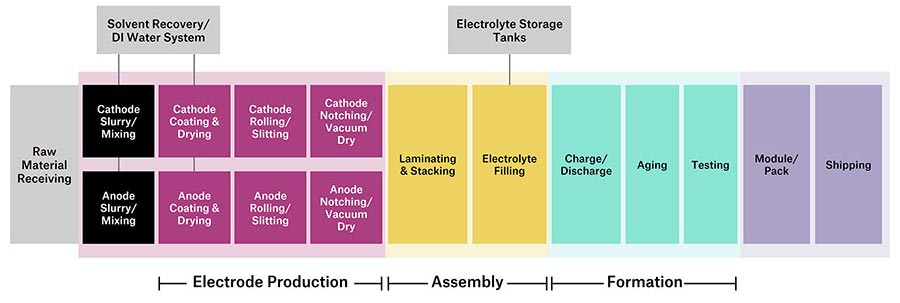

Make sure you are familiar with battery manufacturing before choosing a business model. Decide whether you want to produce primary or secondary batteries, what types of electrochemical cells you're going to use and what kind of equipment is necessary. Generally, the battery-making process involves the manufacture of anodes, cathodes, conducting parts and mechanical components, explains the U.S. Environmental Protection Agency .

A small factory can produce individual components and sell them to larger manufacturers, or build the whole thing. The latter option requires a larger investment and more advanced technology. Business models and manufacturing practices in this industry differ between fixed batteries, in-vehicle batteries and those used in the consumer electronics sector.

Draft a Business Plan

Once you have decided on a business model, write down your ideas and conduct further research. Look for industry reports, hard data and other resources related to the battery production market. Determine who you want to sell your products to and which distribution channels to use. Define your unique selling proposition, key activities, revenue streams, potential partnerships and other aspects.

If, say, you manufacture rechargeable batteries, you may highlight that your products are friendly to the environment. Moreover, they tend to last longer and produce less waste than their non-rechargeable counterparts. This could be your unique selling proposition.

Think about your business structure, too. Battery production is a high-risk activity because of the materials used. The Occupational Safety and Health Administration warns that lead exposure may cause nervous system damage, anemia, seizures and other ailments. Considering these risks, it makes sense to start a limited liability company (LLC) or a corporation rather than a sole proprietorship. If you set up an LLC or a corporation, you cannot be held personally liable in case of a lawsuit.

Consider the Legal Aspects

Your business plan should also cover any licenses, permits and approvals required for operating a battery plant. The legal requirements depend on the state where you're going to operate, as well as on your business model, services, battery production equipment and other factors. Make sure that your facility complies with OSHA standards and other legal regulations.

In addition to these aspects, think about your insurance needs, manpower requirements, marketing strategy, growth plans and more. Reach out to multiple vendors and request quotes for the supplies and equipment you need. The largest lithium producers are located in Chile, Australia, China and Argentina, reports Forbes . Roughly 4 percent of the world's lithium reserves are found in the U.S. Therefore, you may need to import this chemical, which requires extensive paperwork and additional expenses.

All in all, battery manufacturing is a complex industry that requires both technical and legal know-how. The simplest option would be to sell the intellectual property behind your processes. You may also study other companies in the battery business to see how they do things. Reach out to a commercial lawyer and discuss your options before getting started.

- Grand View Research:Battery Market Size Worth $310.8 Billion by 2027

- Reuters: European Battery Makers Power up for a Green Recovery

- U.S. Environmental Protection Agency: Battery Manufacturing Effluent Guidelines

- Occupational Safety and Health Administration: Battery Manufacturing Hazards

- Occupational Safety and Health Administration: Battery Manufacturing Standards

- Forbes: The World’s Top Lithium Producers

- Private labeling might suit your start-up needs better than a full-blown battery-manufacturing facility.

- Explore safety hazards associated with battery manufacturing. Assure that you avoid unnecessary injuries and face lead-contamination issues associated with battery manufacturing. Familiarize yourself with Department of Labor's OSHA standard 29 CFR 1910 to assure compliance with current battery-manufacturing requirements.

Andra Picincu is a digital marketing consultant with over 10 years of experience. She works closely with small businesses and large organizations alike to help them grow and increase brand awareness. She holds a BA in Marketing and International Business and a BA in Psychology. Over the past decade, she has turned her passion for marketing and writing into a successful business with an international audience. Current and former clients include The HOTH, Bisnode Sverige, Nutracelle, CLICK - The Coffee Lover's Protein Drink, InstaCuppa, Marketgoo, GoHarvey, Internet Brands, and more. In her daily life, Ms. Picincu provides digital marketing consulting and copywriting services. Her goal is to help businesses understand and reach their target audience in new, creative ways.

Related Articles

How to find resource hogs on the android, how to start a battery recycling business, how to start a car-building company, how is it possible for a laptop to explode, how to factory restore a velocity cruz, market analysis for solar panel companies, what are the dangers of taking the battery out of a cell phone, how to start your business in energy sales, how to check the battery status on my ipod touch, most popular.

- 1 How to Find Resource Hogs on the Android

- 2 How to Start a Battery Recycling Business

- 3 How to Start a Car-Building Company

- 4 How Is It Possible for a Laptop to Explode?

Starting an Energy Storage Battery Business: A Comprehensive Guide

The energy storage battery business is a rapidly growing industry, driven by the increasing demand for clean and reliable energy solutions. This comprehensive guide will provide you with all the information you need to start an energy storage business, from market analysis and opportunities to battery technology advancements and financing options. By following the steps outlined in this guide, you can build a successful battery business and contribute to the global shift towards sustainable energy.

1. Introduction to Energy Storage Battery Business

Energy storage, particularly in the form of battery systems, plays a vital role in the transition to clean energy. These systems enable the storage of energy generated from renewable sources, such as solar and wind power, and release it when needed, ensuring a consistent and reliable supply of electricity. As the demand for sustainable energy solutions grows, starting an energy storage battery business presents numerous opportunities for entrepreneurs and investors alike.

1.1 Importance of Energy Storage in the Clean Energy Transition

Energy storage systems are essential for maximizing the value of renewable energy sources, which are often intermittent in nature. By storing the energy generated during periods of high solar or wind output, battery systems can ensure a continuous supply of clean energy even during times of low renewable generation. This helps to reduce the reliance on fossil fuels for electricity generation, leading to a significant reduction in greenhouse gas emissions.

1.2 Market Demand and Growth Potential

The global energy storage market has witnessed exponential growth in recent years, driven by factors such as the increasing adoption of renewable energy technologies, advancements in battery technologies, and supportive government policies and incentives. According to market research, the energy storage market is expected to continue its rapid expansion in the coming years, offering significant business opportunities for entrepreneurs and investors.

2. Market Analysis and Opportunities

Before starting an energy storage battery business, it's crucial to conduct a thorough market analysis to identify potential opportunities and challenges. This will help you understand the current market landscape, industry trends, and areas of growth, enabling you to make informed decisions when developing your business plan.

2.1 Industry Trends and Developments

The energy storage industry is witnessing several key trends and developments, including:

- Increasing adoption of renewable energy technologies, driving the demand for energy storage solutions

- Technological advancements in battery technologies, leading to improved performance and reduced costs

- Supportive government policies and incentives for energy storage deployment

- Growing interest from investors and financing institutions in the energy storage sector

2.2 Market Segmentation and Target Customers

The energy storage market can be segmented based on technology, application, end-user, and region. Identifying your target customers and understanding their specific needs and requirements is crucial for developing tailored battery storage solutions and successfully penetrating the market.

Potential target customers for your energy storage battery business may include:

- Utility companies looking to integrate renewable energy sources into their grids

- Commercial and industrial customers seeking to reduce their energy costs and carbon footprint

- Residential customers interested in implementing solar-plus-storage systems for increased energy independence

- Government and public sector entities aiming to enhance grid reliability and resilience

3. Battery Technology Advancements

The success of your energy storage battery business will largely depend on the quality and performance of the battery systems you offer. Keeping abreast of the latest advancements in battery technology is essential for staying ahead of the competition and meeting the evolving needs of your customers.

3.1 Lithium-ion Batteries

Lithium-ion batteries are currently the most popular choice for energy storage systems, due to their high energy density, long cycle life, and relatively low cost. These batteries are widely used in various applications, including electric vehicles, consumer electronics, and grid-scale energy storage. As the demand for lithium-ion batteries continues to grow, ongoing research and development efforts are focused on improving their performance, safety, and cost-effectiveness.

3.2 Alternative Battery Technologies

In addition to lithium-ion batteries, several alternative battery technologies are being developed and commercialized, offering unique advantages and capabilities. Some of these include:

- Flow batteries: These rechargeable batteries use liquid electrolytes to store and release energy, providing longer cycle life and easier scalability compared to lithium-ion batteries.

- Compressed air energy storage (CAES): CAES systems store energy by compressing air in underground reservoirs, which can be released to generate electricity when needed.

- Flywheels: These mechanical devices store energy in the form of rotational energy, offering fast charge and discharge capabilities and high power output for short durations.

4. Steps to Start an Energy Storage Business

Starting an energy storage battery business involves several key steps, including:

- Conducting market research and analysis

- Developing a comprehensive business plan

- Securing necessary permits and licenses

- Selecting and sourcing battery technologies and components

- Establishing manufacturing and assembly facilities

- Developing sales and marketing strategies

- Building a skilled and knowledgeable team

- Implementing quality control and safety measures

- Securing financing and investment for business growth

5. Key Challenges in the Battery Business

As with any business venture, starting an energy storage battery business comes with its own set of challenges. Some of the key challenges to consider when entering the battery industry include:

- Intense competition from established players in the market

- Rapidly evolving technologies and changing customer requirements

- Complex regulatory and compliance requirements

- Supply chain and raw material availability constraints

- High initial investment and ongoing operational costs

6. Financing Options for Battery Businesses

Securing sufficient financing is a critical aspect of starting and growing a successful energy storage battery business. There are various financing options available for battery businesses, including:

- Bank loans and lines of credit

- Government grants and incentives

- Venture capital and private equity investments

- Crowdfunding and peer-to-peer lending platforms

- Strategic partnerships and joint ventures

7. Battery Storage Solutions and Applications

Energy storage battery systems can be deployed in various applications and sectors, providing numerous benefits and value propositions. Some of the key applications for battery storage solutions include:

- Peak demand management and demand charge reduction for commercial and industrial customers

- Solar-plus-storage systems for maximizing renewable energy generation and utilization

- Backup power supply for critical facilities and infrastructure during grid outages

- Grid support services, such as frequency regulation and voltage control

- Non-wires alternatives for deferring or avoiding costly grid infrastructure upgrades

8. Battery Manufacturing Process

The battery manufacturing process involves several stages, from raw material sourcing and component production to assembly, testing, and quality control. Developing an efficient and cost-effective manufacturing process is essential for ensuring the competitiveness and profitability of your energy storage battery business.

9. Battery Industry Regulations and Compliance

Complying with industry regulations and standards is a crucial aspect of operating a successful energy storage battery business. Some of the key regulatory considerations for battery businesses include:

- Environmental and safety regulations for battery manufacturing and disposal

- Grid interconnection and permitting requirements for energy storage systems

- Product safety and performance standards, such as UL and IEC certifications

- Compliance with local, national, and international laws governing the transportation and sale of batteries

10. Future Outlook for the Energy Storage Battery Business

The outlook for the energy storage battery business remains highly promising, driven by the ongoing global transition to clean energy and the growing demand for reliable and cost-effective energy storage solutions. As the industry continues to evolve, new technologies and business models will emerge, offering exciting opportunities for entrepreneurs and investors in the energy storage battery space.

By following the steps outlined in this guide and staying informed about the latest industry trends and developments, you can build a successful energy storage battery business and contribute to the global shift towards sustainable energy.

- 3C batteries (1)

- 48C Advanced Energy Project Credits (1)

- ActiveBalancing (1)

- Advanced Storage Solutions (1)

- advanced technologies (1)

- African market (1)

- AI Algorithms (1)

- AI in Energy Storage (1)

- air conditioning (1)

- All-in-One Energy Storage (1)

- American electricity market (1)

- ancillary services market (1)

- application scenarios (2)

- Arnstadt (1)

- automotive industry (1)

- backup generators (1)

- Backup power (1)

- batteries (2)

- Battery Discharge (1)

- Battery Energy Storage (1)

- Battery Energy Storage Systems (1)

- Battery Energy Storage Systems (BESS) (1)

- battery factory (1)

- battery industry event (1)

- battery management system (3)

- battery management systems (1)

- battery market (1)

- battery materials (1)

- battery pack (1)

- Battery Storage Safety (1)

- Battery technologies (1)

- battery technology advancements (1)

- battery type (1)

- BatteryLongevity (1)

- BatteryManagementSystem (1)

- BatterySafety (1)

- BatteryTechnology (1)

- BESS (1)

- Birmingham Exhibition (1)

- BMSArchitecture (1)

- Brazil energy storage (1)

- Burkina Faso (1)

- Capacity (1)

- capacity rule (1)

- carbon management (1)

- carbon neutrality goals (1)

- CATL (1)

- CE marking (1)

- certification (1)

- certifications (1)

- Charge Current (1)

- Charge/Discharge Rate (1)

- Chemical Storage (1)

- China electricity market (1)

- China International Battery Fair (1)

- CIBF 2023 (1)

- Clean energy (6)

- clean energy incentives (1)

- Clean Energy Revolution (1)

- clean energy solutions (1)

- Climate Goals (1)

- Climate Legislation (1)

- Commercial (1)

- Commercial Energy Storage (2)

- CompleteCurrentControl (1)

- Compressed Air Energy Storage (CAES) (1)

- consumer batteries (1)

- Containerized Energy Storage (1)

- Continuous Discharge Duration (1)

- conversion efficiency (1)

- Cooperation (1)

- cost composition (1)

- cost parity (1)

- cost reduction (1)

- Cost-effective storage (1)

- critical power (2)

- CSA certification (1)

- Customized Energy Storage (1)

- DC bus voltage (1)

- Decarbonization (1)

- Decarbonized future (1)

- Demand Forecasting (1)

- Department of Energy (1)

- DesignConsiderations (1)

- development strategies (1)

- Direct Pay (1)

- Discharge Current (1)

- discharge curve (1)

- Distributed Energy (1)

- Dongguan Lithium Valley (2)

- dual carbon goal (1)

- Dubai World Trade Center (1)

- efficient energy storage (1)

- Electric Vehicle Charging (1)

- Electric Vehicles (2)

- Electricity Costs (1)

- Electricity Infrastructure Operations Center (1)

- electricity market (1)

- electricity price mechanism (1)

- electricity prices (1)

- electricity supply (1)

- electrochemical energy storage (1)

- Electrochemical Storage (1)

- Energy Certification (1)

- Energy Community Adder (2)

- energy companies (1)

- energy consumption (1)

- energy consumption management (1)

- energy crisis (1)

- Energy Demand (1)

- Energy Demands (1)

- energy density (2)

- energy distribution (1)

- Energy Efficiency (1)

- energy industry (1)

- Energy Industry Solutions (1)

- energy investment (1)

- Energy Landscape (1)

- Energy Management System (3)

- energy management systems (1)

- energy professionals (1)

- energy sector (1)

- energy solutions (2)

- Energy storage (16)

- Energy Storage Batteries (3)

- Energy storage battery business (1)

- Energy Storage Battery Industry (1)

- Energy Storage Battery Technology (1)

- energy storage business model (1)

- Energy Storage Cabinets (1)

- energy storage capacity (1)

- Energy Storage Certification (1)

- Energy Storage Challenges (1)

- energy storage components (1)

- energy storage converters (1)

- energy storage equipment (1)

- Energy Storage Incident (1)

- energy storage industry (4)

- energy storage market (1)

- Energy Storage Products (1)

- energy storage profitability (1)

- energy storage projects (1)

- Energy storage research (1)

- Energy Storage Solution (2)

- Energy Storage Solutions (4)

- Energy Storage System (3)

- energy storage system solutions (1)

- Energy Storage Systems (5)

- Energy Storage Technologies (2)

- Energy Supplies (1)

- Energy Supply Challenges (1)

- Energy Transition (1)

- energy trends (1)

- EnergyEfficiency (1)

- EnergyStorage (1)

- Environmental Innovation (1)

- environmental sustainability (1)

- ESS chain (1)

- EU countries (1)

- European battery factory (1)

- European electricity market (1)

- European Market (1)

- European Solar Market (1)

- Exhibitors (1)

- Extended Tax Credits (1)

- field study (1)

- financing options (1)

- fire protection systems (1)

- Flexibility (2)

- Flow batteries (2)

- Flywheel Energy Storage (1)

- Fossil Fuel Emissions (1)

- fossil fuels (1)

- generation side (1)

- Germany (2)

- Gigawatts (1)

- Global Carbon Emissions (1)

- global energy storage (1)

- global market share (1)

- global power batteries (1)

- government officials (1)

- Government Support (1)

- granular silicon (1)

- Green Energy Initiatives (1)

- Green Living (1)

- Green Technology (2)

- Greenhouse Gas Emission Verification (1)

- grid (1)

- Grid reliability (2)

- grid resilience (1)

- grid side (1)

- Grid Stability (3)

- Grid Storage Launchpad (1)

- grid voltage (1)

- grid-connected (1)

- Guide (1)

- high-voltage battery (1)

- higher discharge rate (1)

- Home Energy Storage (3)

- Home Energy Storage Benefits (1)

- household energy storage (2)

- hydropower (1)

- I&C energy storage (1)

- IEC 62619 (2)

- IEEE 1547 (1)

- inductive loads (1)

- Industrial (1)

- industrial and commercial energy storage (1)

- industrial and commercial track (1)

- Industrial Energy Storage (6)

- Industry Trends (1)

- IndustryStandards (1)

- Inflation Reduction Act (1)

- Inflation Reduction Act (IRA) (1)

- installed energy storage (1)

- integrated energy storage cabinet (1)

- integration (1)

- intelligent solutions (1)

- Intermittency (1)

- International Energy Agency (1)

- International Energy Agency (IEA) (1)

- International Energy Storage Exhibition (1)

- Intersolar (1)

- Intersolar Europe 2023 (1)

- Intersolar Middle East (1)

- Intertek (1)

- inverter (2)

- inverter power (1)

- Investment (1)

- Investment Tax Credits (1)

- ISO 14001 (1)

- ISO 9001 (1)

- ITC (1)

- Johannesburg (1)

- large size silicon (1)

- large-scale energy storage (1)

- Leveraging Solar Power (1)

- life cycles (1)

- LiFePO4 batteries (1)

- lithium batteries (1)

- lithium iron phosphate batteries (2)

- Lithium Prices (1)

- Lithium Valley (14)

- Lithium Valley Products (1)

- Lithium Valley Technology (1)

- Lithium-ion alternatives (1)

- Lithium-Ion Batteries (3)

- lithium-ion battery cells (1)

- lithium-ion voltage (1)

- load capacity (1)

- Long Beach California (1)

- Long Duration Energy Storage (1)

- Long-duration storage (2)

- Low-carbon Future (1)

- low-voltage battery (1)

- LS Energy Solutions (1)

- M&A project (1)

- manufacturing equipment (1)

- Market Opportunities (1)

- market-oriented (1)

- Mechanical Storage (1)

- MEE (1)

- merger agreement (1)

- Microgrids and Distributed Energy (1)

- Middle East Energy Summit (1)

- Mobile Energy Storage (1)

- Multiple-MPPT (1)

- Na+ battery (1)

- Net Zero Emissions (2)

- Netherlands (1)

- new energy battery technology (1)

- Next-generation batteries (1)

- North America (1)

- NREL (1)

- off-grid (1)

- oil and gas (1)

- operating efficiency (1)

- optical storage (1)

- Pacific Northwest National Laboratory (1)

- PassiveBalancing (1)

- Peak Times (1)

- peak-valley price difference (1)

- Photovoltaic (PV) Solar Power (1)

- photovoltaic components (1)

- photovoltaic installations (1)

- plug-and-play (1)

- policy certainty (1)

- polysilicon (1)

- power batteries (1)

- power battery company (1)

- power battery developments (1)

- power conversion system (1)

- power density (1)

- Power Generation (2)

- power match (1)

- power supply (1)

- power system (1)

- power systems (1)

- power transmission (1)

- Power/Energy (1)

- Predictive Analytics (1)

- Product Carbon Footprint Certificate (1)

- product line (1)

- product upgrades (1)

- production capacity (2)

- production process (1)

- profit model (1)

- Pumped Hydro Storage (1)

- quality management system (1)

- R&D team (1)

- raw materials (1)

- regional energy transformation (1)

- Reliability testing (1)

- Reliable Power Supply (1)

- renewable energy (18)

- renewable energy capacity (1)

- Renewable Energy Industry (1)

- Renewable energy integration (2)

- renewable energy investment (1)

- renewable energy policies (1)

- renewable energy production (1)

- Renewable Energy Revolution (1)

- Renewable Energy Solutions (1)

- renewable energy sources (1)

- Renewable Energy Storage (1)

- RenewableEnergy (1)

- renewables sector (1)

- Residential & Commercial Energy Storage (1)

- residential energy storage (2)

- rural energy storage (1)

- safer energy storage (1)

- Sandton Convention Centre (1)

- Scalability (1)

- service life (1)

- shadow scan function (1)

- signing ceremony (1)

- silicon materials (1)

- silicon wafers (1)

- single-cluster battery management (1)

- Single-MPPT (1)

- smarter energy storage (1)

- SNEC Exhibition (1)

- Sodium-ion batteries (1)

- Sodium-ion Battery (1)

- Solar & Storage Live 2023 (1)

- Solar Capacity (1)

- solar cells (1)

- Solar Energy (2)

- Solar Energy Industry (2)

- solar energy products (1)

- solar energy storage (1)

- Solar Energy Technologies (1)

- Solar Generation (1)

- Solar Installations (1)

- solar integration (1)

- solar modules (1)

- solar panel energy storage (1)

- solar power (2)

- Solar PV (1)

- Solar Show Africa 2023 (1)

- Solar Sustainability (1)

- solar trends (1)

- Solar-Plus-Storage Integration (1)

- Solid-State Batteries (1)

- South African Minister of Energy (1)

- Stacked High-Voltage Battery (1)

- standardization (1)

- StateEstimation (1)

- Storage Installations (1)

- Storage Ratio (1)

- Storage Systems (1)

- Strategy Director (1)

- SUMEC (1)

- Supplier Conference (1)

- supply chain cost (1)

- Supply Chain Traceability (1)

- surge power (1)

- Surplus Energy (1)

- Sustainability (1)

- Sustainable Development (1)

- Sustainable Energy (2)

- Sustainable Future (1)

- Sustainable Power Grid (1)

- sustainable power solutions (1)

- Sustainable Practices (1)

- Sustainable Technology (1)

- SustainableEnergy (1)

- system structure (1)

- TD (1)

- technical components (1)

- Technological Innovation (2)

- technology exchange (1)

- Temporary Power Solutions (1)

- ternary lithium batteries (1)

- Thermal Storage (1)

- Thuringia (1)

- Transferability (1)

- transparent reporting (1)

- TUV certification (1)

- Types of Energy Storage Systems (1)

- UK (1)

- UK Legislation (1)

- UL 1973 (2)

- UL 9540A (1)

- US Federal Government (1)

- US manufacturers (1)

- US public investments (1)

- user side (1)

- Utilities (1)

- voltage match (1)

- wholesale market (1)

- Wind Capacity (1)

- Wind Energy (1)

- Wind Generation (1)

- Wind Installations (1)

- wind power (1)

- winter energy demand (1)

- Zero Emissions (1)

- Zonsen Power (1)

- ZZonsen Power (1)

one-stop energy storage systems & solutions

Recent posts.

[ Placeholder content for popup link ] WordPress Download Manager - Best Download Management Plugin

Click one of our contacts below to chat on WhatsApp

Social Chat is free, download and try it now here!

How To Write a Business Plan for Battery Manufacturing (for electric vehicles) in 9 Steps: Checklist

By henry sheykin, resources on battery manufacturing (for electric vehicles).

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

- SWOT Analysis

- Business Model

- Marketing Plan

Welcome to our blog post on how to write a business plan for battery manufacturing in the electric vehicle industry. As the demand for electric vehicles continues to soar globally, manufacturing high-capacity, durable, and eco-friendly batteries has become a promising business opportunity. In this article, we will guide you through the essential steps to create a comprehensive business plan that will revolutionize the electric vehicle industry. But first, let's take a look at the latest statistical information about the industry's growth.

The electric vehicle industry has experienced exponential growth in recent years, with global electric vehicle sales reaching 2.1 million units in 2019. This represents a 40% increase compared to the previous year. The market is expected to continue its upward trajectory, with an estimated CAGR of 22.6% from 2020 to 2027. This staggering growth presents a tremendous opportunity for battery manufacturers looking to make their mark in the industry.

To capitalize on this booming industry, it is crucial to have a well-thought-out business plan. The nine steps we will cover in this article will help you navigate the complexities of battery manufacturing for electric vehicles, ensuring your business is poised for success. From identifying your target market to creating robust financial projections, each step is essential in laying the groundwork for your battery manufacturing venture.

So, let's dive in and explore how you can write a business plan that will revolutionize the electric vehicle industry. By following this comprehensive checklist, you'll be well-equipped to tackle the challenges and seize the opportunities that lie ahead.

Step 1: Identify the target market and assess its potential

Step 2: Conduct thorough market research

Step 3: Analyze the competition and identify key differentiators

Step 4: Determine the funding requirements and potential sources of capital

Step 5: Evaluate the regulatory and legal landscape

Step 6: Assess the feasibility and scalability of battery manufacturing operations

Step 7: Develop a holistic business strategy and value proposition

Step 8: Identify key industry partnerships and supply chain management

Step 9: Create a comprehensive financial plan and projections

Identify The Target Market And Assess Its Potential

Identifying the target market for your battery manufacturing business is a critical first step in developing a successful business plan. Understanding the potential demand for your batteries will help you tailor your products and marketing strategies to meet the specific needs of your customers.

- Research demographic and geographic factors: Conduct market research to identify the demographic and geographic factors that contribute to the demand for electric vehicles. Consider factors such as population density, income levels, and government incentives.

- Analyze industry trends: Stay updated on the latest trends in the electric vehicle industry to assess the potential growth and demand for batteries. This includes tracking the adoption rates of electric vehicles and understanding the projected market growth.

- Identify customer segments: Determine the specific types of customers who are likely to purchase your batteries. This could include electric vehicle manufacturers, fleet operators, or individual consumers.

- Evaluate customer needs: Assess the needs and preferences of your target market. Identify the key features and benefits they expect from batteries, such as longer range, faster charging, or enhanced durability.

- Seek input from potential customers and industry experts to validate your assumptions and gain insights into market needs.

- Consider conducting surveys or focus groups to gather feedback and understand customer preferences.

- Keep an eye on emerging markets and niche segments within the electric vehicle industry that may present unique opportunities.

By thoroughly identifying the target market and assessing its potential, you can develop a business plan that aligns with the needs and demands of your customers. This will position your battery manufacturing business for success in a rapidly evolving industry.

Conduct Thorough Market Research

Conducting thorough market research is a critical step in developing a successful business plan for battery manufacturing in the electric vehicle industry. It involves gathering valuable insights and data about the market, including the demand for electric vehicles and the current battery manufacturing landscape.

Market research helps in identifying the size and potential of the target market. This information is crucial for understanding the potential customer base and determining the viability of entering the battery manufacturing industry. In addition, it provides insights into customer preferences, trends, and buying behavior , which can help in developing a competitive advantage.

During market research, it is important to gather data on competitors and their products . This involves analyzing their market share, pricing strategies, distribution channels, and any unique features or technologies they offer. Understanding the competition is crucial in identifying key differentiators for your battery manufacturing business.

Market research methodologies can vary, but typically include a combination of primary and secondary research. Primary research involves gathering data through surveys, interviews, focus groups, and observations. Secondary research, on the other hand, involves analyzing existing data from industry reports, market studies, and government publications.

When conducting market research, it is important to explore various sources of information to ensure a comprehensive understanding of the market. This can include online databases, industry associations, trade publications, and government resources.

Tips for conducting thorough market research:

- Identify the relevant market segments and demographics to focus your research efforts.

- Ensure the sample size in surveys or interviews is large enough to provide statistically significant results.

- Use reliable and up-to-date sources for secondary research.

- Consider partnering with market research firms or consultants for expert analysis and insights.

- Regularly update your market research to stay abreast of changing trends and dynamics.

In conclusion, conducting thorough market research is a vital step in developing a sound business plan for battery manufacturing in the electric vehicle industry. It provides valuable insights into the market potential, customer preferences, competition, and industry trends. By utilizing various research methodologies and accessing reliable sources of information, you can make informed decisions and develop a solid foundation for your battery manufacturing business.

Analyze The Competition And Identify Key Differentiators

When venturing into battery manufacturing for electric vehicles, it is crucial to analyze the competition in order to identify key differentiators that will set your business apart from others in the market.

Begin by conducting a comprehensive analysis of existing battery manufacturers, both within the electric vehicle industry and in other sectors. This will provide insights into their manufacturing processes, product offerings, pricing strategies, and customer base. Understanding your competition will allow you to assess their strengths and weaknesses, and identify areas where your business can excel.

Identify the Unique Selling Points (USPs) that will differentiate your batteries from those of other manufacturers. This could be a higher energy density, longer lifespan, faster charging capabilities, or greater environmental sustainability. Highlight these USPs in your marketing and communication efforts to attract potential customers.

Research the target market to understand their preferences and needs. This will help you tailor your battery manufacturing process and product to meet their specific requirements. For example, if the market is dominated by electric vehicle manufacturers that prioritize energy efficiency, your battery's energy density may become a key differentiator.

Consider partnering with industry experts or research institutions to gain access to cutting-edge technologies and expert knowledge. Collaborating with established players or organizations can differentiate your business by showcasing advancements in battery technology or manufacturing processes.

Tips for Analyzing Competition and Identifying Key Differentiators:

- Regularly monitor the market and keep track of new entrants and changes in the industry landscape.

- Engage with potential customers and gather feedback on their experiences with existing battery manufacturers.

- Stay updated on industry trends and innovations to identify emerging opportunities.

- Conduct a thorough SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis of your competitors to understand their positioning and market share.

By analyzing the competition and identifying key differentiators, you can position your battery manufacturing business as a leader in the industry and attract customers who value the unique features and benefits your batteries offer.

Determine The Funding Requirements And Potential Sources Of Capital

When starting a battery manufacturing business for electric vehicles, it's crucial to determine the funding requirements and explore potential sources of capital. This will ensure that you have the necessary financial resources to launch and sustain your operations.

1. Assess your funding requirements: Begin by estimating the total cost of starting and operating your battery manufacturing business. Consider factors such as facility costs, equipment purchases, raw material expenses, hiring employees, and marketing efforts. It's important to have a clear understanding of the financial resources needed to establish and scale your operations.

2. Explore different funding options: Once you have assessed your funding requirements, it's time to explore potential sources of capital. Consider traditional funding options such as bank loans, lines of credit, or grants. Additionally, research venture capitalists, angel investors, or crowdfunding platforms that specialize in supporting clean energy and manufacturing ventures.

- Prepare a compelling business plan that highlights the potential market demand and the unique selling points of your battery manufacturing business. This will attract potential investors or lenders.

- Consider approaching government agencies or organizations that provide grants or subsidies for sustainable energy initiatives. They may offer financial support or tax incentives for businesses like yours.

- Network with industry experts, attend relevant conferences, and join entrepreneurial communities to tap into potential funding connections.

3. Evaluate potential partnerships: In addition to traditional funding sources, consider exploring partnerships with strategic investors or established players in the electric vehicle industry. Collaborations can provide both financial support and valuable expertise, opening doors to a network of potential customers and industry connections.

4. Prepare a financial forecast: It's crucial to create a comprehensive financial plan and projections that showcase the viability and profitability of your battery manufacturing business. This will help potential investors or lenders understand the potential return on their investments.

By determining the funding requirements and exploring potential sources of capital, you will be well-equipped to secure the financial resources needed to bring your revolutionary battery manufacturing business for electric vehicles to life.

Evaluate The Regulatory And Legal Landscape

When starting a battery manufacturing business for electric vehicles, it is crucial to thoroughly evaluate the regulatory and legal landscape to ensure compliance with the relevant laws and regulations. This step is essential as it helps you navigate the complexities of the industry and minimizes the risk of legal issues arising in the future.

Here are a few important aspects to consider:

- Industry-specific regulations: Familiarize yourself with the specific regulations governing battery manufacturing for electric vehicles. This includes safety standards, environmental regulations, production guidelines, and labeling requirements. Compliance with these regulations ensures product quality and consumer safety.

- Intellectual property: Conduct a thorough search to ensure that your battery design and technology do not infringe upon any existing patents. Consider consulting with legal experts to protect your intellectual property through patents, trademarks, or copyrights. This safeguards your competitive advantage and prevents potential legal disputes.

- Import and export regulations: If you plan to import or export batteries or raw materials, research the international trade regulations and customs requirements for different jurisdictions. This knowledge will help you streamline your supply chain and avoid any legal complications during transportation or customs clearance.

- Environmental regulations: Battery manufacturing involves the use of chemicals and raw materials that may have an impact on the environment. Ensure compliance with environmental standards and waste management regulations to minimize the ecological footprint of your operations. Implementing sustainable practices not only benefits the environment but also enhances your brand reputation.

- Engage with legal professionals specializing in battery manufacturing or environmental law to help you navigate the complexities of the legal landscape.

- Maintain a proactive approach to stay updated on any new regulations or legal developments that may affect your business operations.

- Create internal protocols and procedures to guarantee compliance with all applicable laws and regulations, including safety protocols for handling and storing batteries.

By evaluating the regulatory and legal landscape, you demonstrate your commitment to ethical practices and build a solid foundation for your battery manufacturing business. This step not only ensures legal compliance but also contributes to the long-term sustainability and success of your venture.

Assess The Feasibility And Scalability Of Battery Manufacturing Operations

Before proceeding with the manufacturing of batteries for electric vehicles, it is essential to carefully evaluate the feasibility and scalability of your operations. This step is crucial in determining whether your business can thrive in the competitive market and sustain long-term success.

Firstly, assess the availability of resources required for battery manufacturing such as raw materials, equipment, and skilled labor. It is imperative to establish reliable supply chains to ensure a smooth production process. Additionally, consider the availability and accessibility of suitable manufacturing facilities and infrastructure, as this will directly impact your operational efficiency.

- Conduct a thorough assessment of the existing battery manufacturing industry to identify any potential gaps or opportunities for innovation. This will help you determine how your business can differentiate itself from competitors.

Furthermore, evaluate the technological feasibility of your battery manufacturing process. Keep in mind that the electric vehicle industry is constantly evolving, with advancements in battery technology occurring at a rapid pace. Stay updated with the latest industry trends and ensure that your manufacturing process incorporates cutting-edge technologies to produce high-quality, durable, and eco-friendly batteries.

Consider the scalability of your operations, especially as the demand for electric vehicles and associated batteries is expected to grow significantly. Determine whether your manufacturing process has the flexibility and capacity to meet increasing market demand without compromising on product quality or production timelines. This assessment will help you plan for future expansion and ensure a sustainable business model.

- Take into account the potential challenges and risks associated with scaling up your battery manufacturing operations. Develop contingency plans to mitigate these risks and ensure a smooth transition to larger production volumes.

Overall, assessing the feasibility and scalability of battery manufacturing operations is crucial in determining the viability of your business. By carefully evaluating available resources, technological feasibility, and scalability potential, you can lay a strong foundation for a successful battery manufacturing venture in the electric vehicle industry.

Develop A Holistic Business Strategy And Value Proposition

Developing a holistic business strategy and value proposition is crucial for the success of your battery manufacturing venture in the electric vehicle industry. It involves considering various factors that will set your business apart from the competition and attract customers.

1. Define your mission and vision: Clearly articulate your mission statement, which represents the purpose and goals of your battery manufacturing business. Additionally, establish a compelling vision that outlines the future you envision for your company.

2. Conduct a SWOT analysis: Perform a comprehensive analysis of your business's strengths, weaknesses, opportunities, and threats. This will help you identify areas where you excel and areas that require improvement or strategic considerations.

3. Identify your target market: Understand the needs and preferences of the electric vehicle market and identify the specific segments you want to target. This will enable you to tailor your products and marketing efforts to effectively meet their demands.

4. Determine your unique value proposition: Differentiate your battery manufacturing business by identifying the unique features and benefits your products offer. Clearly communicate how your batteries are high-capacity, durable, and eco-friendly, emphasizing the value they bring to electric vehicle manufacturers and consumers.

5. Establish pricing and revenue models: Develop a pricing strategy that accounts for factors such as manufacturing costs, market demand, and competitor pricing. Additionally, consider revenue models such as one-time sales, subscription-based services, or licensing agreements to maximize profitability.

6. Outline marketing and sales strategies: Determine how you will promote and sell your batteries to electric vehicle manufacturers. Define your marketing channels, messaging, and sales tactics that will effectively reach and persuade your target market.

7. Create a comprehensive operational plan: Detail the operational processes involved in battery manufacturing, including production capacity, quality control measures, and supply chain management. This will ensure efficiency and scalability as your business grows.

- Regularly evaluate and adapt your business strategy based on market trends and customer feedback.

- Collaborate with industry experts and seek their advice to refine your strategy and value proposition.

- Continually innovate and invest in research and development to stay ahead of the competition and address evolving customer needs.

In conclusion, developing a holistic business strategy and value proposition is essential for success in the battery manufacturing industry for electric vehicles. By defining your mission, understanding your target market, and creating a unique value proposition, you can position your business as a leader in providing high-capacity, durable, and eco-friendly batteries.

Identify Key Industry Partnerships And Supply Chain Management

Identifying key industry partnerships and establishing a robust supply chain management system are crucial steps in the success of a battery manufacturing business for electric vehicles. Collaborating with the right partners and optimizing the supply chain can streamline operations, enhance efficiency, and ensure the availability of raw materials and components.

Identify Potential Industry Partners:

- Conduct research and identify potential partners who possess expertise in battery manufacturing, electric vehicle technologies, or related industries.

- Assess their track record, reputation, and the value they can bring to your business.

- Consider partnering with established manufacturers, research institutions, or even startups with innovative technologies that can complement your battery manufacturing operations.

Evaluate Supply Chain Options:

- Analyze the different stages of the supply chain involved in battery manufacturing, including sourcing raw materials, manufacturing components, assembly, quality control, and distribution.

- Evaluate the reliability, cost-effectiveness, and sustainability of potential suppliers at each stage.

- Consider factors like proximity to suppliers to minimize transportation costs, supplier capacity and scalability, and their commitment to eco-friendly practices.

- Establish long-term partnerships with suppliers to ensure a consistent and reliable supply chain.

- Consider diversifying your supplier base to mitigate risks associated with potential disruptions.

- Develop strong communication channels and establish clear expectations with industry partners and suppliers.

- Regularly review and assess the performance of your partners and suppliers to identify areas of improvement and optimize the supply chain.

Identifying key industry partnerships and optimizing the supply chain management system will not only help in ensuring a smooth flow of operations but also enable the delivery of high-quality batteries to meet the increasing demand in the electric vehicle market.

Create A Comprehensive Financial Plan And Projections

Creating a comprehensive financial plan and projections is crucial for any business, especially in the battery manufacturing industry. It allows you to assess the financial viability of your business and make informed decisions about its future.

Here are some key steps to follow when creating your financial plan:

- 1. Determine your startup costs: Identify all the expenses involved in setting up your battery manufacturing operations, such as equipment costs, facility rental, raw material procurement, and employee salaries. This will help you estimate how much capital you need to acquire.

- 2. Outline your revenue streams: Analyze your target market and competition to identify potential sources of revenue. Will you be selling batteries directly to electric vehicle manufacturers or through distributors? Are there any opportunities for providing maintenance or recycling services?

- 3. Forecast sales and pricing: Estimate the quantity of batteries you expect to sell and determine the pricing strategy. Consider factors such as market demand, production capacity, and pricing trends in the industry.

- 4. Calculate production costs: Break down your manufacturing process and determine the costs associated with each stage. This includes raw material costs, labor costs, energy expenses, and overhead costs.

- 5. Create a profit and loss statement: Use the sales forecast and production costs to create a profit and loss statement. This will help you understand your projected revenue, expenses, and profitability.

- 6. Develop cash flow projections: Determine the cash inflows and outflows of your business on a monthly or quarterly basis. This will help you identify potential cash flow gaps and plan for working capital needs.

Tips for Creating a Comprehensive Financial Plan:

- Consult with financial professionals or hire an experienced financial advisor to guide you through the process.

- Consider conducting sensitivity analyses to assess the impact of different market scenarios on your financial projections.

- Regularly review and update your financial plan as your business evolves.

- Seek feedback from potential investors or lenders to ensure your projections are realistic and align with their expectations.

In conclusion, creating a comprehensive financial plan and projections is an essential step in building a successful battery manufacturing business. It provides you with a roadmap for financial success, helps you attract investors, and ensures the sustainability of your operations in the long run.

In conclusion, writing a business plan for battery manufacturing in the electric vehicle industry requires careful consideration and detailed analysis. By following the nine steps outlined in this checklist, you can ensure that your business plan is comprehensive and well-researched. This will help you assess the market potential, understand the competition, secure funding, and establish a strong foundation for your battery manufacturing operations.

Start by identifying the target market and conducting thorough market research to gain insights into customer needs and preferences. Analyze the competition and identify key differentiators that will set your batteries apart from others in the market. Determine the funding requirements and explore potential sources of capital, considering both traditional and alternative financing options.

Next, evaluate the regulatory and legal landscape to ensure compliance with industry standards and regulations. Assess the feasibility and scalability of battery manufacturing operations, taking into account factors such as production capacity, resource requirements, and technological advancements.

Develop a holistic business strategy and value proposition that encompasses factors like product quality, pricing, distribution channels, and marketing efforts. Identify key industry partnerships and establish efficient supply chain management practices to ensure a steady flow of raw materials and components.

Lastly, create a comprehensive financial plan and projections that demonstrate the profitability and sustainability of your battery manufacturing venture. This should include detailed cost estimates, revenue forecasts, and cash flow projections.

- Identify the target market

- Conduct market research

- Analyze the competition

- Determine funding requirements

- Evaluate the regulatory landscape

- Assess feasibility and scalability

- Develop a business strategy

- Identify industry partnerships

- Create a financial plan

By following these steps, you will be well-equipped to write a comprehensive business plan that positions your battery manufacturing venture for success in the electric vehicle industry.

$169.00 $99.00 Get Template

Related Blogs

- Starting a Business

- KPI Metrics

- Running Expenses

- Startup Costs

- Pitch Deck Example

- Increasing Profitability

- Sales Strategy

- Rising Capital

- Valuing a Business

- How Much Makes

- Sell a Business

- How To Avoid Mistakes

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

- Energy & Mining

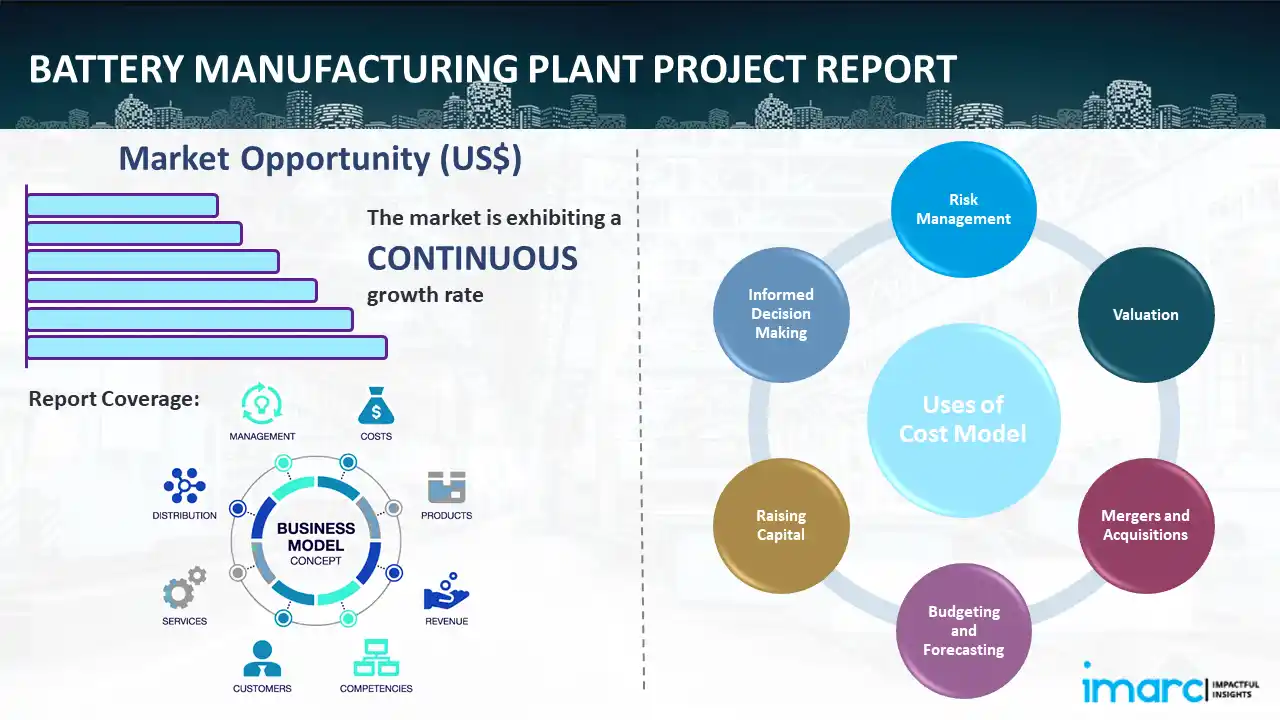

Battery Manufacturing Plant Project Report

Battery manufacturing plant project report 2024: industry trends, plant setup, machinery, raw materials, investment opportunities, cost and revenue.

- Report Description

- Table of Contents

- Methodology

- Request Sample

Report Overview:

IMARC Group’s report, titled “Battery Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue” provides a complete roadmap for setting up a battery manufacturing plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc. The report also provides detailed insights into project economics, including capital investments, project funding, operating expenses, income and expenditure projections, fixed costs vs. variable costs, direct and indirect costs, expected ROI and net present value (NPV), profit and loss account, financial analysis, etc.

A battery is a device that converts chemical energy confined within its active materials directly into electric energy through an electrochemical oxidation-reduction reaction. It is manufactured from numerous electrochemical cells that are connected to external inputs and outputs. It helps reduce greenhouse gas emissions by efficiently storing electricity generated from both conventional and renewable energy sources while providing a source of power for electric vehicles (EVs). It also assists in storing excess power in the battery system to allow the production and usage of renewable energy to be delinked from low consumption periods. As a result, the battery is widely utilized in various devices, such as mobile phones, electronic cameras, automobiles, watches, sporting goods, electric toothbrushes, smoke detectors, and flashlights.

At present, the increasing usage of uninterruptible power supply (UPS) devices in various sectors for continuous power supply represents one of the key factors supporting the growth of the market. Besides this, there is a rise in the demand for lead acid batteries for critical applications due to their high reliability, low cost and energy density, and lightweight. This, along with the increasing utilization of lead acid batteries in nuclear submarines across the globe, is propelling the growth of the market. In addition, governing agencies of various countries are promoting the usage of electric vehicles (EVs) to reduce greenhouse gas emissions. They are also providing incentives to the owners of EVs, which is contributing to the growth of the market. Moreover, there is an increase in the demand for UPS due to the rising construction of offices, industrial plants, schools, and colleges around the world. This, coupled with the escalating demand for electricity on account of the growing population, is positively influencing the market. Apart from this, the rising demand for portable electronics, such as smartphones, liquid crystal displays (LCDs), tablets, and wearable devices, is strengthening the growth of the market. Additionally, the growing demand for rechargeable batteries, such as starting, lighting, and ignition (SLI) batteries, in the automotive sector is offering a favorable market outlook.

The following aspects have been covered in the report on setting up a battery manufacturing plant:

- Market Trends

- Market Breakup by Segment

- Market Breakup by Region

- Price Analysis

- Impact of COVID-19

- Market Forecast

The report provides insights into the landscape of the battery industry at the global level. The report also provides a segment-wise and region-wise breakup of the global battery industry. Additionally, it also provides the price analysis of feedstocks used in the manufacturing of battery, along with the industry profit margins.

- Product Overview

- Unit Operations Involved

- Mass Balance and Raw Material Requirements

- Quality Assurance Criteria

- Technical Tests

The report also provides detailed information related to the process flow and various unit operations involved in a battery manufacturing plant. Furthermore, information related to mass balance and raw material requirements has also been provided in the report with a list of necessary quality assurance criteria and technical tests.

- Land, Location and Site Development

- Plant Layout

- Machinery Requirements and Costs

- Raw Material Requirements and Costs

- Packaging Requirements and Costs

- Transportation Requirements and Costs

- Utility Requirements and Costs

- Human Resource Requirements and Costs

The report provides a detailed location analysis covering insights into the land location, selection criteria, location significance, environmental impact, and expenditure for setting up a battery manufacturing plant. Additionally, the report provides information related to plant layout and factors influencing the same. Furthermore, other requirements and expenditures related to machinery, raw materials, packaging, transportation, utilities, and human resources have also been covered in the report.

- Capital Investments

- Operating Costs

- Expenditure Projections

- Revenue Projections

- Taxation and Depreciation

- Profit Projections

- Financial Analysis

The report also covers a detailed analysis of the project economics for setting up a battery manufacturing plant. This includes the analysis and detailed understanding of capital expenditure (CapEx), operating expenditure (OpEx), income projections, taxation, depreciation, liquidity analysis, profitability analysis, payback period, NPV, uncertainty analysis, and sensitivity analysis. Furthermore, the report also provides a detailed analysis of the regulatory procedures and approvals, information related to financial assistance, along with a comprehensive list of certifications required for setting up a battery manufacturing plant.

Report Coverage:

Key questions answered in this report:.

- How has the battery market performed so far and how will it perform in the coming years?

- What is the market segmentation of the global battery market?

- What is the regional breakup of the global battery market?

- What are the price trends of various feedstocks in the battery industry?

- What is the structure of the battery industry and who are the key players?

- What are the various unit operations involved in a battery manufacturing plant?

- What is the total size of land required for setting up a battery manufacturing plant?

- What is the layout of a battery manufacturing plant?

- What are the machinery requirements for setting up a battery manufacturing plant?

- What are the raw material requirements for setting up a battery manufacturing plant?

- What are the packaging requirements for setting up a battery manufacturing plant?

- What are the transportation requirements for setting up a battery manufacturing plant?

- What are the utility requirements for setting up a battery manufacturing plant?

- What are the human resource requirements for setting up a battery manufacturing plant?

- What are the infrastructure costs for setting up a battery manufacturing plant?

- What are the capital costs for setting up a battery manufacturing plant?

- What are the operating costs for setting up a battery manufacturing plant?

- What should be the pricing mechanism of the final product?

- What will be the income and expenditures for a battery manufacturing plant?

- What is the time required to break even?

- What are the profit projections for setting up a battery manufacturing plant?

- What are the key success and risk factors in the battery industry?

- What are the key regulatory procedures and requirements for setting up a battery manufacturing plant?

- What are the key certifications required for setting up a battery manufacturing plant?

Report Customization

While we have aimed to create an all-encompassing report, we acknowledge that individual stakeholders may have unique demands. Thus, we offer customized report options that cater to your specific requirements. Our consultants are available to discuss your business requirements, and we can tailor the report's scope accordingly. Some of the common customizations that we are frequently requested to make by our clients include:

- The report can be customized based on the location (country/region) of your plant.

- The plant’s capacity can be customized based on your requirements.

- Plant machinery and costs can be customized based on your requirements.

- Any additions to the current scope can also be provided based on your requirements.

Why Buy IMARC Reports?

- The insights provided in our reports enable stakeholders to make informed business decisions by assessing the feasibility of a business venture.

- Our extensive network of consultants, raw material suppliers, machinery suppliers and subject matter experts spans over 100+ countries across North America, Europe, Asia Pacific, South America, Africa, and the Middle East.

- Our cost modeling team can assist you in understanding the most complex materials. With domain experts across numerous categories, we can assist you in determining how sensitive each component of the cost model is and how it can affect the final cost and prices.

- We keep a constant track of land costs, construction costs, utility costs, and labor costs across 100+ countries and update them regularly.

- Our client base consists of over 3000 organizations, including prominent corporations, governments, and institutions, who rely on us as their trusted business partners. Our clientele varies from small and start-up businesses to Fortune 500 companies.

- Our strong in-house team of engineers, statisticians, modeling experts, chartered accountants, architects, etc. has played a crucial role in constructing, expanding, and optimizing sustainable manufacturing plants worldwide.

India Dairy Market Report Snapshots Source:

Statistics for the 2022 India Dairy market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports.

- India Dairy Market Size Source

- --> India Dairy Market Share Source

- India Dairy Market Trends Source

- India Dairy Companies Source

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Purchase options

Benefits of Customization

Personalize this research

Triangulate with your data

Get data as per your format and definition

Gain a deeper dive into a specific application, geography, customer, or competitor

Any level of personalization

Get in Touch With Us

UNITED STATES

Phone: +1-631-791-1145

Phone: +91-120-433-0800

UNITED KINGDOM

Phone: +44-753-713-2163

Email: [email protected]

Client Testimonials

IMARC made the whole process easy. Everyone I spoke with via email was polite, easy to deal with, kept their promises regarding delivery timelines and were solutions focused. From my first contact, I was grateful for the professionalism shown by the whole IMARC team. I recommend IMARC to all that need timely, affordable information and advice. My experience with IMARC was excellent and I can not fault it.

The IMARC team was very reactive and flexible with regard to our requests. A very good overall experience. We are happy with the work that IMARC has provided, very complete and detailed. It has contributed to our business needs and provided the market visibility that we required

We were very happy with the collaboration between IMARC and Colruyt. Not only were your prices competitive, IMARC was also pretty fast in understanding the scope and our needs for this project. Even though it was not an easy task, performing a market research during the COVID-19 pandemic, you were able to get us the necessary information we needed. The IMARC team was very easy to work with and they showed us that it would go the extra mile if we needed anything extra

Last project executed by your team was as per our expectations. We also would like to associate for more assignments this year. Kudos to your team.

.webp)

We would be happy to reach out to IMARC again, if we need Market Research/Consulting/Consumer Research or any associated service. Overall experience was good, and the data points were quite helpful.

The figures of market study were very close to our assumed figures. The presentation of the study was neat and easy to analyse. The requested details of the study were fulfilled. My overall experience with the IMARC Team was satisfactory.

The overall cost of the services were within our expectations. I was happy to have good communications in a timely manner. It was a great and quick way to have the information I needed.

My questions and concerns were answered in a satisfied way. The costs of the services were within our expectations. My overall experience with the IMARC Team was very good.

I agree the report was timely delivered, meeting the key objectives of the engagement. We had some discussion on the contents, adjustments were made fast and accurate. The response time was minimum in each case. Very good. You have a satisfied customer.

.webp)

We would be happy to reach out to IMARC for more market reports in the future. The response from the account sales manager was very good. I appreciate the timely follow ups and post purchase support from the team. My overall experience with IMARC was good.

IMARC was a good solution for the data points that we really needed and couldn't find elsewhere. The team was easy to work, quick to respond, and flexible to our customization requests.

- Competitive Intelligence and Benchmarking

- Consumer Surveys and Feedback Reports

- Market Entry and Opportunity Assessment

- Pricing and Cost Research

- Procurement Research

- Report Store

- Aerospace and Defense

- Agriculture

- Chemicals and Materials

- Construction and Manufacturing

- Electronics and Semiconductors

- Energy and Mining

- Food and Beverages

- Technology and Media

- Transportation and Logistics

Quick Links

- Press Releases

- Case Studies

- Our Customers

- Become a Publisher

United States

134 N 4th St. Brooklyn, NY 11249, USA

+1-631-791-1145

Level II & III, B-70, Sector 2, Noida, Uttar Pradesh 201301, India

+91-120-433-0800

United Kingdom

30 Churchill Place London E14 5EU, UK

+44-753-713-2163

Level II & III, B-70 , Sector 2, Noida, Uttar Pradesh 201301, India

We use cookies, including third-party, for better services. See our Privacy Policy for more. I ACCEPT X

How to Start a Battery Manufacturing Business

- Conduct market research to identify the target audience and analyze competitors.

- Create a comprehensive business plan to attract funding, partners, suppliers, or customers.

- Secure adequate equipment, supplies, R&D, marketing, and personnel funding.

- Set up a production facility that meets industry standards & regulations.

- Test and certify battery quality, performance, and safety before selling.

Batteries are crucial in many everyday gadgets, from smartphones to cars. They power our lives and enable us to stay connected, work, and play for hours. With the increasing demand for batteries worldwide, the battery manufacturing industry is a lucrative business opportunity for entrepreneurs. But where do you start?

This blog post will explore starting a battery manufacturing business from scratch, including market research, business planning, funding, manufacturing processes, and marketing strategies.

Conducting Market Research

Without market research, you will never truly understand your target audience or their needs, which could affect your business operations, resulting in a possible loss of revenue and, ultimately, failure. If you are planning to start a battery manufacturing business, it is vital to conduct thorough market research to succeed in a highly competitive market.

Identify Your Target Audience

The first step towards conducting meaningful market research is understanding your target audience. This information will help you manufacture products that meet their needs and expectations. In the case of a battery manufacturing business, you need to identify what type of batteries are in demand and what type of consumers is willing to buy them. Your research could include understanding their preferences, habits, and lifestyles and what drives their buying decisions.

Competitive Analysis

As mentioned earlier, the battery manufacturing business is highly competitive; therefore, understanding your competitors is crucial. Conducting a competitive analysis will help you identify your competitors’ strengths and weaknesses and also assist in positioning your business correctly in the market. A thorough competitive analysis can help you understand your competitors’ pricing strategies, distribution methods, and market share, among other factors.

Creating a Business Plan

Once you have conducted market research, you must create a comprehensive business plan. It should outline your business’s mission, vision, values, and goals. It should also include the organization structure, staffing plan, financial projections, and marketing strategy. A business plan can help you attract funding, partners, suppliers, or customers. It can also guide you through the startup phase and help you make informed decisions throughout the operation of the business.

Securing Funding

Starting a battery manufacturing business requires significant equipment, supplies, R&D, marketing, and personnel investment. You need to secure adequate funding to launch and sustain your business. There are several sources of funding, including equity financing, debt financing, grants, subsidies, and venture capital. You need to evaluate each option’s risks, benefits, terms, and conditions and choose the most suitable one for your business.

Setting up a Production Facility

Once you have secured funding, you need to set up a production facility that meets the standards and regulations of the industry. Your facility should include machinery, tools, safety equipment, quality control measures, and storage facilities. You also need to source the raw materials, chemicals, and components required to manufacture batteries.

You may need to hire skilled technicians, engineers, or scientists to help you develop and optimize the production process. Testing and certifying your batteries’ quality, performance, and safety-critical y before selling them to the market.

In addition to hiring the right people, you must make a solid plan for your packaging. In this case, you may consider using a thermal shipping box to ensure your product is safely delivered. This is a great way to protect your batteries from extreme temperatures and other elements that could damage them during transit.

Marketing and Sales Strategies

Your business is only as good as its marketing and sales strategies. If you do not have the right approach, succeeding in a competitive marketplace will be difficult. Here are a few marketing strategies you can use:

Leverage Social Media