Need a consultation? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- E1 Treaty Trader Visa

- E2 Treaty Investor Visa

- Innovator Founder Visa

- UK Start-Up Visa

- UK Expansion Worker Visa

- Manitoba MPNP Visa

- Start-Up Visa

- Nova Scotia NSNP Visa

- British Columbia BC PNP Visa

- Self-Employed Visa

- OINP Entrepreneur Stream

- LMIA Owner Operator

- ICT Work Permit

- LMIA Mobility Program – C11 Entrepreneur

- USMCA (ex-NAFTA)

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Online Boutique

- Mobile Application

- Food Delivery

- Real Estate

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Templates

How to Write a Business Plan to Start a Bank

Published Feb.29, 2024

Updated Sep.10, 2024

By: Alex Silensky

Average rating 5 / 5. Vote count: 5

No votes so far! Be the first to rate this post.

Table of Content

Bank Business Plan Checklist

A bank business plan is a document that describes the bank’s goals, strategies, operations, and financial projections. It communicates the bank’s vision and value proposition to potential investors, regulators, and stakeholders. A SBA business plan should be clear, concise, and realistic. It should also cover all the essential aspects of the bank’s business model.

Here is a checklist of the main sections that you should keep in mind while building a bank business plan:

- Executive summary

- Company description

- Industry analysis

- Competitive analysis

- Service or product list

- Marketing and sales plan

- Operations plan

- Management team

- Funding request

- Financial plan

Sample Business Plan for Bank

The following is a bank business plan template that operates in the USA. This bank business plan example is regarding ABC Bank, and it includes the following sections:

Executive Summary

ABC Bank is a new bank for California’s SMBs and individuals. We offer convenient banking services tailored to our customers’ needs and preferences. We have a large target market with over 500,000 SMBs spending billions on banking services annually. We have the licenses and approvals to operate our bank and raised $20 million in seed funding. We are looking for another $30 million in debt financing.

Our goal is to launch our bank by the end of 2024 and achieve the following objectives in the first five years of operation:

- Acquire 100,000 customers and 10% market share

- Generate $100 million in annual revenue and $20 million in net profit

- Achieve a return on equity (ROE) of 15% and a return on assets (ROA) of 1.5%

- Expand our network to 10 branches and 50 ATMs

- Increase our brand awareness and customer loyalty

Our bank has great potential to succeed and grow in the banking industry. We invite you to read the rest of our microfinance business plan to learn about how to set up a business plan for the bank and how we will achieve our goals.

Industry Analysis

California has one of the biggest and most active banking industries in the US and the world. According to the Federal Deposit Insurance Corp , California has 128 financial institutions, with total assets exceeding $560 billion.

The California banking industry is regulated and supervised by various federal and state authorities. However, they also face several risks and challenges, such as:

- High competition and consolidation

- Increasing regulation and compliance

- Rising customer demand for digital and mobile banking

- Cyberattacks and data breaches

- Environmental and social issues

The banking industry in California is highly competitive and fragmented. According to the FDIC, the top 10 banks and thrifts in California by total deposits as of June 30, 2023, were:

Customer Analysis

We serve SMBs who need local, easy, and cheap banking. We divide our customers into four segments by size, industry, location, and needs:

SMB Segment 1 – Tech SMBs in big cities of California. These are fast-growing, banking-intensive customers. They account for a fifth of our market share and a third of our revenue and are loyal and referable.

SMB Segment 2 – Entertainment SMBs in California’s entertainment hubs. These are high-profile, banking-heavy customers. They make up a sixth of our market and a fourth of our revenue and are loyal and influential.

SMB Segment 3 – Tourism SMBs in California’s tourist spots. These are seasonal, banking-dependent customers. They represent a quarter of our market and a fifth of our revenue and are loyal and satisfied.

SMB Segment 4 – Other SMBs in various regions of California. These are slow-growing, banking-light customers. They constitute two-fifths of our market and a quarter of our revenue and are loyal and stable.

Competitive Analysis

We compete with other banks and financial institutions that offer similar or substitute products and services to our target customers in our target market. We group our competitors into four categories based on their size and scope:

1. National Banks

- Key Players – Bank of America, Wells Fargo, JPMorgan Chase, Citibank, U.S. Bank

- Strengths – Large customer base, strong brand, extensive branch/ATM network, innovation, robust operations, solid financial performance

- Weaknesses – High competition, regulatory costs, low customer satisfaction, high attrition

- Strategies – Maintain dominance through customer acquisition/retention, revenue growth, efficiency

2. Regional Banks

- Key Players – MUFG Union Bank, Bank of the West, First Republic Bank, Silicon Valley Bank, East West Bank

- Strengths – Loyal customer base, brand recognition, convenient branch/ATM network, flexible operations

- Weaknesses – Moderate competition, regulatory costs, customer attrition

- Strategies – Grow market presence through customer acquisition/retention, revenue optimization, efficiency

3. Community Banks

- Key Players – Mechanics Bank, Bank of Marin, Pacific Premier Bank, Tri Counties Bank, Luther Burbank Savings

- Strengths – Small loyal customer base, reputation, convenient branches, ability to adapt

- Weaknesses – Low innovation and technology adoption

- Strategies – Maintain niche identity through customer loyalty, revenue optimization, efficiency

4. Online Banks

- Key Players – Ally Bank, Capital One 360, Discover Bank, Chime Bank, Varo Bank

- Strengths – Large growing customer base, strong brand, no branches, lean operations, high efficiency

- Weaknesses – High competition, regulatory costs, low customer satisfaction and trust, high attrition

- Strategies – Disrupt the industry by acquiring/retaining customers, optimizing revenue, improving efficiency

Market Research

Our market research shows that:

- California has a large, competitive, growing banking market with 128 banks and $560 billion in assets.

- Our target customers are the SMBs in California, which is 99.8% of the businesses and employ 7.2-7.4 million employees.

- Our main competitors are national and regional banks in California that offer similar banking products and services.

We conclude that:

- Based on the information provided in our loan officer business plan , there is a promising business opportunity for us to venture into and establish a presence in the banking market in California.

- We should focus on the SMBs in California, as they have various unmet banking needs, preferences, behavior, and a high potential for growth and profitability.

Operations Plan

Our operational structure and processes form the basis of our operations plan, and they are as follows:

- Location and Layout – We have a network of 10 branches and 50 ATMs across our target area in California. We strategically place our branches and ATMs in convenient and high-traffic locations.

- Equipment and Technology – We use modern equipment and technology to provide our products and services. We have computers and software for banking functions; security systems to protect branches and ATMs; communication systems to communicate with customers and staff; inventory and supplies to operate branches and ATMs.

- Suppliers and Vendors – We work with reliable suppliers and vendors that provide our inventory and supplies like cash, cards, paper, etc. We have supplier management systems to evaluate performance.

- Staff and Management – Our branches have staff like branch managers, customer service representatives, tellers, and ATM technicians with suitable qualifications and experience.

- Policies and Procedures – We have policies for customer service, cash handling, card handling, and paper handling to ensure quality, minimize losses, and comply with regulations. We use various tools and systems to implement these policies.

Management Team

The following individuals make up our management team:

- Earl Yao, CEO and Founder – Earl is responsible for establishing and guiding the bank’s vision, mission, strategy, and overall operations. He brings with him over 20 years of banking experience.

- Paula Wells, CFO and Co-Founder – Paula oversees financial planning, reporting, analysis, compliance, and risk management.

- Mark Hans, CTO – Mark leads our technology strategy, infrastructure, innovation, and digital transformation.

- Emma Smith, CMO – Emma is responsible for designing and implementing our marketing strategy and campaigns.

- David O’kane, COO – David manages the daily operations and processes of the bank ensuring our products and services meet the highest standards of quality and efficiency.

Financial Projections

Our assumptions and drivers form the basis of our financial projections, which are as follows:

Assumptions: We have made the following assumptions for our collection agency business plan :

- Start with 10 branches, 50 ATMs in January 2024

- Grow branches and ATMs 10% annually

- 10,000 customers per branch, 2,000 per ATM

- 5% average loan rate, 2% average deposit rate

- 80% average loan-to-deposit ratio

- $10 average fee per customer monthly

- $100,000 average operating expense per branch monthly

- $10,000 average operating expense per ATM monthly

- 25% average tax rate

Our financial projections are as per our:

- Projected Income Statement

- Projected Cash Flow Statement

- Projected Balance Sheet

- Projected Financial Ratios and Indicators

Select the Legal Framework for Your Bank

Our legal structure and requirements form the basis of our legal framework, which are as follows:

Legal Structure and Entity – We have chosen to incorporate our bank as a limited liability company (LLC) under the laws of California.

Members – We have two members who own and control our bank: Earl Yao and Paula Wells, the founders and co-founders of our bank.

Manager – We have appointed Mark Hans as our manager who oversees our bank’s day-to-day operations and activities.

Name – We have registered our bank’s name as ABC Bank LLC with the California Secretary of State. We have also obtained a trademark registration for our name and logo.

Registered Agent – We have designated XYZ Registered Agent Services LLC as our registered agent authorized to receive and handle legal notices and documents on behalf of our bank.

Licenses and Approvals – We have obtained the necessary licenses and approvals to operate our bank in California, including:

- Federal Deposit Insurance Corporation (FDIC) Insurance

- Federal Reserve System Membership

- California Department of Financial Protection and Innovation (DFPI) License

- Business License

- Employer Identification Number (EIN)

- Zoning and Building Permits

Legal Documents and Agreements – We have prepared and signed the necessary legal documents and agreements to form and operate our bank, including:

- Certificate of Formation

- Operating Agreement

- Membership Agreement

- Loan Agreement

- Card Agreement

- Paper Agreement

Keys to Success

We analyze our market, customers, competitors, and industry to determine our keys to success. We have identified the following keys to success for our bank.

Customer Satisfaction

Customer satisfaction is vital for any business, especially a bank relying on loyalty and referrals. It is the degree customers are happy with our products, services, and interactions. It is influenced by:

- Product and service quality – High-quality products and services that meet customer needs and preferences

- Customer service quality – Friendly, professional, and helpful customer service across channels

- Customer experience quality – Convenient, reliable, and secure customer access and transactions

We will measure satisfaction with surveys, feedback, mystery shopping, and net promoter scores. Our goal is a net promoter score of at least 8.

Operational Efficiency

Efficiency is key in a regulated, competitive environment. It is using resources and processes effectively to achieve goals and objectives. It is influenced by:

- Resource optimization – Effective and efficient use and control of capital, staff, and technology

- Process improvement – Streamlined, standardized processes measured for performance

- Performance management – Managing financial, operational, customer, and stakeholder performance

We will measure efficiency with KPIs, metrics, dashboards, and operational efficiency ratios. Our goal is an operational efficiency ratio below 50%.

Partner with OGSCapital for Your Bank Business Plan Success

Highly efficient service.

Highly Efficient Service! I am incredibly happy with the outcome; Alex and his team are highly efficient professionals with a diverse bank of knowledge.

Are you looking to hire business plan writers to start a bank business plan? At OGSCapital, we can help you create a customized and high-quality bank development business plan to meet your goals and exceed your expectations.

We have a team of senior business plan experts with extensive experience and expertise in various industries and markets. We will conduct thorough market research, develop a unique value proposition, design a compelling financial model, and craft a persuasive pitch deck for your business plan. We will also offer you strategic advice, guidance, and access to a network of investors and other crucial contacts.

We are not just a business plan writing service. We are a partner and a mentor who will support you throughout your entrepreneurial journey. We will help you achieve your business goals with smart solutions and professional advice. Contact us today and let us help you turn your business idea into a reality.

Frequently Asked Questions

How do I start a small bank business?

To start a small bank business in the US, you need to raise enough capital, understand how to make a business plan for the bank, apply for a federal or state charter, register your bank for taxes, open a business bank account, set up accounting, get the necessary permits and licenses, get bank insurance, define your brand, create your website, and set up your phone system.

Are banks profitable businesses?

Yes, banks are profitable businesses in the US. They earn money through interest on loans and fees for other services. The commercial banking industry in the US has grown 5.6% per year on average between 2018 and 2023.

Download Bank Business Plan Sample in pdf

OGSCapital’s team has assisted thousands of entrepreneurs with top-rated document, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Bank Business Plan Template

Written by Dave Lavinsky

Bank Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their banks.

If you’re unfamiliar with creating a bank business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a bank business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Bank Business Plan?

A business plan provides a snapshot of your bank as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Bank Business

If you’re looking to start a bank or grow your existing bank, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bank to improve your chances of success. Your bank business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Banks

With regards to funding, the main sources of funding for a bank are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for banks.

Finish Your Business Plan Today!

How to write a business plan for a bank.

If you want to start a bank or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your bank business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of bank you are running and the status. For example, are you a startup, do you have a bank that you would like to grow, or are you operating a chain of banks?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the bank industry.

- Discuss the type of bank you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of bank you are operating.

For example, you might specialize in one of the following types of banks:

- Commercial bank : this type of bank tends to concentrate on supporting businesses. Both large corporations and small businesses can turn to commercial banks if they need to open a checking or savings account, borrow money, obtain access to credit or transfer funds to companies in foreign markets.

- Credit union: this type of bank operates much like a traditional bank (issues loans, provides checking and savings accounts, etc.) but banks are for-profit whereas credit unions are not. Credit unions fall under the direction of their own members. They tend to serve people affiliated with a particular group, such as people living in the same area, low-income members of a community or armed service members. They also tend to charge lower fees and offer lower loan rates.

- Retail bank: retail banks can be traditional, brick-and-mortar brands that customers can access in-person, online, or through their mobile phones. They also offer general public financial products and services such as bank accounts, loans, credit cards, and insurance.

- Investment bank: this type of bank manages the trading of stocks, bonds, and other securities between companies and investors. They also advise individuals and corporations who need financial guidance, reorganize companies through mergers and acquisitions, manage investment portfolios or raise money for certain businesses and the federal government.

In addition to explaining the type of bank you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of clients with positive reviews, reaching X number of clients served, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the bank industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bank industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your bank business plan:

- How big is the bank industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your bank? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your bank business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, small businesses, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bank you operate. Clearly, corporations would respond to different marketing promotions than individuals, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Bank Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other banks.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes trust accounts, investment companies, or the stock market. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of bank are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide loans and retirement savings accounts?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bank business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of bank company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide savings accounts, auto loans, mortgage loans, or financial advice?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your bank. Document where your company is situated and mention how the site will impact your success. For example, is your bank located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your bank marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bank, including reconciling accounts, customer service, accounting, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to sign up your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your bank to a new city.

Management Team

To demonstrate your bank’s potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing banks. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a bank or successfully running a small financial advisory firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer sign up bonuses? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your bank, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bank:

- Cost of furniture and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your bank location lease or a list of accounts and loans you plan to offer.

Writing a business plan for your bank is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the bank industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful bank.

Don’t you wish there was a faster, easier way to finish your Bank business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Crafting a Business Plan for Bank Approval: A Step-by-Step Guide

Get Full Bundle

| $169$99 | $59$39 | $39$29 | $15$9 | $25$15 | $15$9 | $15$9 | $15$9 | $19 |

Total Bundle:

Launching a successful banking business requires meticulous planning and preparation. Before drafting your business plan, it's crucial to follow a comprehensive 9-step checklist that covers essential elements such as market research, financial projections, and stakeholder partnerships. By addressing these key areas upfront, you'll be well-equipped to navigate the complexities of the banking industry and set your venture on the path to long-term success.

Steps Prior To Business Plan Writing

| Step | Key Considerations |

|---|---|

| Conduct thorough market research and analysis | Analyze the current banking landscape, including market trends, competitor activities, and customer preferences. Gather data on the target market's demographics, financial behaviors, and pain points. Quantifiable metrics: Market size, growth rate, customer segmentation, and competitive benchmarking. |

| Identify target customers and their financial needs | Clearly define the bank's target customer base, including their specific financial requirements, risk profiles, and preferred banking channels. Quantifiable metrics: Customer segmentation, average account balances, and transaction volumes. |

| Determine the unique value proposition and competitive advantages | Identify the bank's unique offerings, services, and features that differentiate it from competitors. Assess the competitive landscape and pinpoint the bank's competitive advantages. Quantifiable metrics: Pricing, product features, and customer satisfaction ratings. |

| Assess the regulatory environment and obtain necessary licenses | Thoroughly understand the applicable banking regulations, compliance requirements, and necessary licenses or permits to operate in the target market. Quantifiable metrics: Regulatory capital requirements, licensing fees, and compliance reporting timelines. |

| Develop a detailed financial projection and funding strategy | Prepare comprehensive financial projections, including revenue streams, operating expenses, capital requirements, and funding sources. Quantifiable metrics: Projected income statements, balance sheets, cash flow statements, and funding sources (e.g., equity, debt, or a combination). |

| Assemble a strong management team with relevant expertise | Identify and recruit a diverse and experienced management team with a proven track record in the banking industry. Quantifiable metrics: Years of relevant experience, educational qualifications, and previous accomplishments. |

| Establish partnerships with key stakeholders and service providers | Develop strategic partnerships with financial institutions, technology providers, regulatory bodies, and other relevant stakeholders to enhance the bank's capabilities and reach. Quantifiable metrics: Number of partnerships, revenue-sharing arrangements, and service-level agreements. |

| Create a comprehensive operational plan and infrastructure | Outline the bank's operational processes, including branch network, digital banking platforms, risk management frameworks, and customer service protocols. Quantifiable metrics: Branch locations, technology investments, operational efficiency metrics, and customer satisfaction scores. |

| Define a clear marketing and customer acquisition strategy | Develop a robust marketing strategy to effectively reach and attract the target customer base, including branding, advertising, and customer acquisition channels. Quantifiable metrics: Marketing budget, customer acquisition costs, and customer retention rates. |

Conduct Thorough Market Research and Analysis

Developing a successful bank business plan begins with a comprehensive understanding of the market landscape. As a startup Community Trust Microbank , it is crucial to conduct in-depth market research and analysis to identify the unique opportunities and challenges within the financial services industry, particularly in the underserved communities you aim to serve.

The first step is to analyze the overall banking and financial services market in your target geographic area. This includes examining market size, growth trends, competitive landscape, and the evolving needs and preferences of potential customers. By gathering and analyzing data from reliable industry sources, government reports, and customer surveys, you can gain valuable insights into the current state of the market and identify untapped segments or underserved niches that your bank can potentially target.

- Utilize industry research reports, market studies, and financial data to understand the size, growth, and dynamics of the local banking market.

- Conduct customer surveys and focus groups to gather in-depth insights into the financial needs, pain points, and preferences of your target demographic.

- Analyze the competitive landscape, including the strengths, weaknesses, and unique value propositions of existing banks and financial institutions in the region.

Next, it is crucial to identify your target customer segments and their specific financial needs. By segmenting the market based on factors such as income level, age, occupation, and financial behavior, you can develop a deep understanding of your potential customers and tailor your bank's products and services to meet their unique requirements. This targeted approach will enable you to craft a compelling value proposition and differentiate your Community Trust Microbank from the competition.

Furthermore, you should assess the regulatory environment in which your bank will operate. This includes understanding the relevant laws, regulations, and licensing requirements governing the financial services industry in your region. By proactively addressing these regulatory considerations, you can ensure that your bank operates in compliance with all applicable laws and regulations, minimizing potential legal and financial risks.

By conducting thorough market research and analysis, you will be well-equipped to develop a robust bank business plan that aligns with the needs of your target customers, the competitive landscape, and the regulatory environment. This foundation will serve as a crucial starting point for the subsequent steps in the bank business planning process.

| Bank Business Plan Get Template |

Identify Target Customers and Their Financial Needs

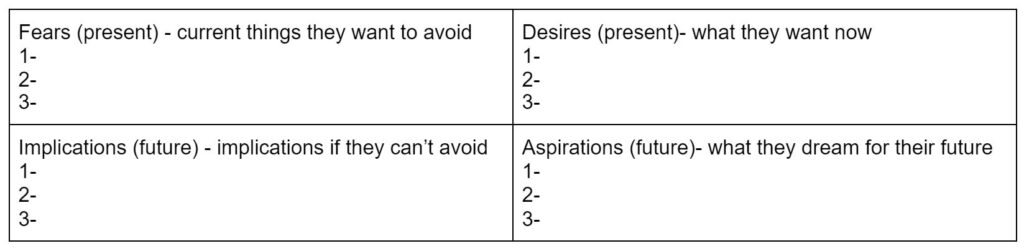

Identifying your target customers and understanding their unique financial needs is a critical step in developing a successful business plan for your bank. This process involves in-depth market research and analysis to gain insights into the demographics, behaviors, and pain points of the individuals and businesses you aim to serve.

When it comes to the banking industry, the target customer base can vary significantly depending on the bank's strategic focus and positioning. For example, Community Trust Microbank aims to cater to economically underserved communities, with a specific emphasis on providing tailored financial services and education to those who may have limited access to traditional banking options.

To identify your target customers and their financial needs, consider the following key steps:

- Conduct Comprehensive Market Research : Gather data on the local and regional demographics, including income levels, employment trends, and financial literacy rates. Analyze the competitive landscape to understand the existing banking options and their strengths and weaknesses.

- Segment the Market : Divide your potential customer base into distinct segments based on factors such as age, income, geographic location, and financial needs. This will help you develop targeted products and services that address the specific requirements of each segment.

- Engage with the Community : Reach out to community organizations, local businesses, and industry groups to better understand the financial challenges and pain points faced by your target customers. This feedback can be invaluable in shaping your product and service offerings.

- Analyze Customer Behavior and Preferences : Gather data on customer behavior, such as transaction patterns, channel preferences, and pain points in their current banking experiences. Use this information to identify opportunities to provide innovative and tailored solutions that address their unmet needs.

- Leverage data-driven insights to create customer personas that represent your ideal target segments, including their demographics, financial goals, and pain points.

- Continuously monitor and update your understanding of your target customers as their needs and preferences evolve over time.

By thoroughly understanding your target customers and their financial needs, you can develop a business plan that aligns your bank's products, services, and operations to deliver a compelling value proposition and drive sustainable growth.

Determine the Unique Value Proposition and Competitive Advantages

Crafting a strong and differentiated value proposition is a crucial step in developing a successful business plan for Community Trust Microbank. This process involves identifying the unique benefits and features that set the bank apart from its competitors, and aligning them with the specific financial needs and preferences of the target customer base.

To determine the unique value proposition, the bank should start by conducting a thorough analysis of the local market and the competitive landscape. This includes evaluating the current offerings, pricing structures, and pain points of existing financial institutions serving the underserved communities. By understanding the gaps in the market and the unmet needs of the target customers, the bank can position itself as the preferred solution.

- Analyze the market and competition to identify unique opportunities and pain points of the target customers.

- Leverage the bank's expertise in microfinance and financial literacy to develop tailored products and services that address the specific needs of the community.

- Emphasize the bank's commitment to empowering economically underserved individuals and fostering sustainable economic growth within the community.

One of the key competitive advantages that Community Trust Microbank can leverage is its specialized focus on microfinance and financial education. By offering small-scale loans, minimal fees, and comprehensive financial literacy programs, the bank can position itself as a trusted partner that empowers individuals to take control of their financial well-being and achieve their economic goals.

Additionally, the bank can highlight its deep understanding of the local community and its ability to tailor its products and services to meet the unique needs of its clients. This can include offering flexible repayment schedules, providing personalized guidance, and fostering close relationships with borrowers to ensure their long-term success.

- Emphasize the bank's specialized expertise in microfinance and its commitment to financial education and empowerment.

- Highlight the bank's deep understanding of the local community and its ability to customize solutions to meet their specific needs.

- Leverage the bank's community-focused approach and its reputation as a trusted partner to differentiate it from larger, impersonal financial institutions.

By clearly articulating the unique value proposition and competitive advantages, Community Trust Microbank can create a compelling and differentiated business plan that resonates with its target customers and sets it up for long-term success. This strategic positioning will be a key driver in attracting funding, building partnerships, and establishing the bank as a leader in the community banking space.

Assess the regulatory environment and obtain necessary licenses

Navigating the regulatory landscape is a critical step in establishing a successful bank. The banking industry is highly regulated, and compliance with various laws, rules, and regulations is essential to ensure the legitimacy and stability of your financial institution. Before you can start drafting your business plan, it's crucial to thoroughly understand the regulatory requirements that apply to your bank.

The first step is to research the specific licensing and regulatory requirements in your jurisdiction. This may include obtaining a banking charter, securing necessary licenses and permits, and complying with capital adequacy requirements, anti-money laundering (AML) regulations, and consumer protection laws. Depending on the scope and nature of your bank's operations, you may need to obtain licenses at the federal, state, and even local levels.

- Familiarize yourself with the Federal Deposit Insurance Corporation (FDIC) requirements for obtaining a bank charter and deposit insurance.

- Understand the Community Reinvestment Act (CRA) and its impact on your bank's lending and community engagement practices.

- Ensure compliance with Know Your Customer (KYC) and Customer Due Diligence (CDD) regulations to prevent financial crimes.

It's also essential to stay up-to-date with any changes in the regulatory environment, as new laws and regulations can significantly impact your bank's operations and compliance requirements. Regularly monitoring industry news, consulting with legal and compliance experts, and participating in industry associations can help you stay informed and adapt to the evolving regulatory landscape.

Obtaining the necessary licenses and permits can be a complex and time-consuming process, so it's important to start this step early in your business planning. Failure to comply with regulatory requirements can result in hefty fines, legal penalties, and even the revocation of your banking license, which can be devastating for your business. By proactively addressing the regulatory environment, you can ensure that your bank is positioned for long-term success and compliance.

According to the Federal Reserve , the average time it takes to obtain a new bank charter in the United States is 12-18 months . This timeline can vary depending on the complexity of your bank's operations and the specific regulatory requirements in your jurisdiction. It's crucial to factor in this timeline when developing your business plan and funding strategy.

In addition to the initial licensing and regulatory requirements, your bank will also need to establish ongoing compliance processes and procedures. This may include regular reporting, audits, and maintaining adequate capital reserves. By prioritizing regulatory compliance from the outset, you can ensure that your bank operates within the bounds of the law and avoids costly penalties or legal issues down the line.

| Bank Financial Model Get Template |

Develop a Detailed Financial Projection and Funding Strategy

Crafting a comprehensive financial plan is a crucial step in developing a successful business plan for Community Trust Microbank. This step involves creating detailed financial projections and outlining a robust funding strategy to ensure the bank's long-term viability and growth.

Financial Projections: Developing accurate financial projections is essential for the bank's success. This includes forecasting revenue streams, operating expenses, capital expenditures, and cash flow for the first 3-5 years of operation. These projections should be based on thorough market research, industry benchmarks, and realistic assumptions about the bank's growth trajectory.

Key elements of the financial projections should include:

- Income Statement: Projecting the bank's anticipated revenue, expenses, and net income over time.

- Balance Sheet: Forecasting the bank's assets, liabilities, and equity to ensure a strong financial position.

- Cash Flow Statement: Estimating the bank's cash inflows and outflows to maintain sufficient liquidity.

- Capital Requirements: Determining the amount of capital needed to meet regulatory requirements and fund the bank's operations and growth.

- Utilize historical data, industry benchmarks, and sensitivity analysis to ensure the financial projections are realistic and account for potential risks and uncertainties.

- Consult with financial experts, such as accountants or financial advisors, to validate the assumptions and methodology used in the financial projections.

Funding Strategy: Alongside the financial projections, the business plan should outline a comprehensive funding strategy to secure the necessary capital to launch and sustain the bank's operations. This may include a combination of the following funding sources:

- Equity Financing: Raising capital from investors, such as venture capitalists, angel investors, or community development financial institutions (CDFIs).

- Debt Financing: Obtaining loans or lines of credit from banks, government agencies, or other financial institutions.

- Grants and Subsidies: Exploring opportunities for grants or subsidies from government programs, foundations, or other organizations that support community development initiatives.

- Ensure the funding strategy aligns with the bank's growth plans and regulatory requirements, such as maintaining adequate capital ratios.

- Develop a plan for ongoing funding needs, including potential future rounds of financing or refinancing options.

By developing detailed financial projections and a comprehensive funding strategy, Community Trust Microbank can demonstrate the financial viability and sustainability of its business model, which will be crucial in securing the necessary funding and support to launch and grow the bank successfully.

Assemble a Strong Management Team with Relevant Expertise

Assembling a strong management team is a crucial step in developing a comprehensive business plan for your bank. The individuals you bring on board will be responsible for steering the organization towards success, ensuring effective operations, and making strategic decisions that align with your overall vision.

When building your bank's management team, it is essential to prioritize relevant expertise and a proven track record. Your team should possess a diverse range of skills and experience that complement each other, covering areas such as finance, operations, risk management, compliance, and customer service.

- Aim to assemble a team with a mix of industry veterans and emerging talent to leverage both experience and fresh perspectives.

- Carefully evaluate each candidate's qualifications, leadership abilities, and alignment with your bank's core values and mission.

- Consider appointing a seasoned Chief Executive Officer (CEO) to provide strategic direction and oversee the overall management of the bank.

In the banking industry, regulatory compliance is of paramount importance. Your management team should have a deep understanding of the relevant laws, regulations, and industry standards that govern the financial services sector. This expertise will ensure that your bank operates in a compliant and risk-averse manner, mitigating potential legal and reputational issues.

Moreover, your management team should possess the ability to effectively manage financial projections, develop sound risk management strategies, and implement robust operational processes. These capabilities will be crucial in ensuring the long-term sustainability and profitability of your bank.

According to a study by the Kauffman Foundation , 92% of successful startups have a management team with prior industry experience. This underscores the importance of assembling a team with the right mix of skills, expertise, and industry knowledge to drive your bank's success.

By carefully curating your management team, you will be well-positioned to navigate the complexities of the banking industry, capitalize on market opportunities, and build a thriving and resilient financial institution that serves the needs of your target community.

Establish partnerships with key stakeholders and service providers

Establishing strategic partnerships is a crucial step in the development of a successful bank business plan. By aligning with key stakeholders and service providers, community-focused banks like Community Trust Microbank can leverage valuable resources, expertise, and networks to enhance their service offerings and reach a wider customer base.

One of the primary partnerships for a community bank should be with local community organizations, non-profits, and government agencies that serve the target underserved population. These partnerships can provide valuable insights into the unique financial needs and challenges faced by the community, as well as facilitate referrals and co-marketing opportunities. For example, Community Trust Microbank could partner with local housing authorities, job training programs, and small business development centers to identify potential clients and offer tailored financial services.

Additionally, building relationships with financial service providers, such as payment processors, credit bureaus, and regulatory compliance specialists, can help Community Trust Microbank streamline its operations, ensure regulatory compliance, and offer a more comprehensive suite of services to its clients. These partnerships can also provide access to specialized technology, data, and industry expertise that may be beyond the bank's internal capabilities.

Another key partnership for a community bank is with local banking institutions, credit unions, and alternative financial providers. By collaborating with these entities, Community Trust Microbank can explore opportunities for referrals, co-lending, and shared infrastructure, ultimately expanding its reach and resources without the need for significant capital investment.

- Identify potential partners that align with your bank's mission and target market, and that can provide complementary services or resources.

- Develop formal partnership agreements that clearly outline the roles, responsibilities, and benefits for both parties.

- Regularly review and evaluate the effectiveness of your partnerships to ensure they continue to support your bank's growth and strategic objectives.

By cultivating a robust network of strategic partnerships, Community Trust Microbank can leverage the expertise, resources, and customer base of its partners to enhance its own capabilities, reduce operational costs, and ultimately better serve the financial needs of its target community. This collaborative approach is a key component of a comprehensive bank business plan that prioritizes community engagement and sustainable growth.

| Bank Pitch Deck |

Create a Comprehensive Operational Plan and Infrastructure

Establishing a robust operational plan and infrastructure is a critical step in developing a successful bank business plan. This encompasses the detailed planning and implementation of the bank's day-to-day operations, technology systems, and physical infrastructure to support its financial services and customer experience.

To create a comprehensive operational plan and infrastructure for your bank, consider the following key elements:

- Operational Processes and Workflows: Clearly define the bank's core operational processes, including account opening, loan origination, transaction processing, customer service, and compliance. Develop standardized workflows and procedures to ensure efficiency, consistency, and regulatory compliance.

- Technology and Systems: Invest in a robust and scalable technology infrastructure, including core banking systems, customer relationship management (CRM) software, data management and analytics tools, and cybersecurity measures. Ensure seamless integration and automation across the bank's operations.

- Branch and Facility Planning: Determine the optimal number, location, and design of the bank's physical branches and facilities to serve the target market effectively. Consider factors such as accessibility, visibility, and cost-efficiency.

- Staffing and Training: Assemble a skilled and experienced team to manage and execute the bank's operations, including roles in customer service, risk management, compliance, and IT support. Develop comprehensive training programs to ensure employees are equipped with the necessary knowledge and skills.

- Partnerships and Outsourcing: Identify opportunities to collaborate with third-party service providers, such as payment processors, credit bureaus, and regulatory compliance experts, to enhance the bank's operational capabilities and efficiency.

- Regularly review and update the bank's operational plan to adapt to changing market conditions, technological advancements, and regulatory requirements.

- Implement robust risk management and business continuity strategies to ensure the bank's operations can withstand unexpected disruptions or crises.

- Leverage data and analytics to continuously optimize the bank's operational processes and identify areas for improvement.

By developing a comprehensive operational plan and infrastructure, Community Trust Microbank can ensure the efficient and effective delivery of its financial services, while maintaining a strong focus on serving the needs of its target market and fostering sustainable growth.

Define a Clear Marketing and Customer Acquisition Strategy

Developing a comprehensive marketing and customer acquisition strategy is a crucial step in the business plan for your bank. This strategy will serve as the foundation for effectively reaching and engaging your target audience, ultimately driving growth and success for your financial institution.

To define your marketing and customer acquisition strategy, you'll need to start by thoroughly understanding your target customers. Conduct in-depth market research to identify their demographics, financial needs, and preferred channels of engagement. This will help you tailor your marketing efforts to resonate with your audience and address their specific pain points.

- Leverage data analytics and customer segmentation to create personalized marketing campaigns that speak directly to your target audience.

- Explore various marketing channels, such as social media, content marketing, and local community outreach, to reach your customers where they are most active.

- Prioritize building a strong brand identity that communicates your bank's unique value proposition and resonates with your target customers.

In addition to your marketing strategy, you'll need to develop a comprehensive customer acquisition plan. This plan should outline the specific tactics and channels you'll use to attract new customers and onboard them effectively. Consider implementing a multi-pronged approach that combines digital marketing, referral programs, strategic partnerships, and community engagement initiatives.

To ensure the success of your customer acquisition efforts, it's crucial to set clear targets and key performance indicators (KPIs). Regularly track and analyze your marketing and customer acquisition metrics, such as website traffic, lead conversion rates, and new account openings. Use this data to continuously refine your strategies and optimize your efforts for maximum impact.

By defining a clear and well-executed marketing and customer acquisition strategy, you can position your bank for sustainable growth and long-term success. Remember to stay agile, adapt to changing market conditions, and continuously innovate to meet the evolving needs of your target customers.

Related Blogs

- 7 Mistakes to Avoid When Starting a Bank in the US?

- What Are The Top 9 Business Benefits Of Starting A Bank Business?

- What Are The Nine Best Ways To Boost A Bank Business?

- What Are Nine Methods To Effectively Brand A Bank Business?

- Bank Business Idea Description in 5 W’s and 1 H Format

- Get Your Dream Bank Business: Proven Checklist!

- What Are The Reasons For The Failure Of Bank Businesses?

- How To Fund Or Get Money To Start A Bank Business?

- How To Name A Bank Business?

- Bank Owner Earnings: A Comprehensive Guide

- Opening a Bank: What You Need to Prepare for a Smooth Start

- 7 Strategic KPIs for Banks to Monitor

- What to Know About Bank Operating Expenses

- What Are The Top Nine Pain Points Of Running A Bank Business?

- Unlock Your Bank Business Potential: Perfect Your Pitch Deck Now!

- How Banks Can Increase Profitability and Improve Services

- What Are Nine Strategies To Effectively Promote And Advertise A Bank Business?

- The Complete Guide To Bank Business Financing And Raising Capital

- Strategies To Increase Your Bank Sales & Profitability

- What Are The Best Nine Strategies For Scaling And Growing A Bank Business?

- How To Sell Bank Business in 9 Steps: Checklist

- What Are The Essential Startup Costs For A New Bank?

- What Are The Key Factors For Success In A Bank Business?

- Valuing a Bank Business: Step-by-Step Guide

- Banking Without Cash: Your Complete Guide to No Money Accounts

| Expert-built startup financial model templates |

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

Financial modeling spreadsheets and templates in Excel & Google Sheets

- Your cart is empty.

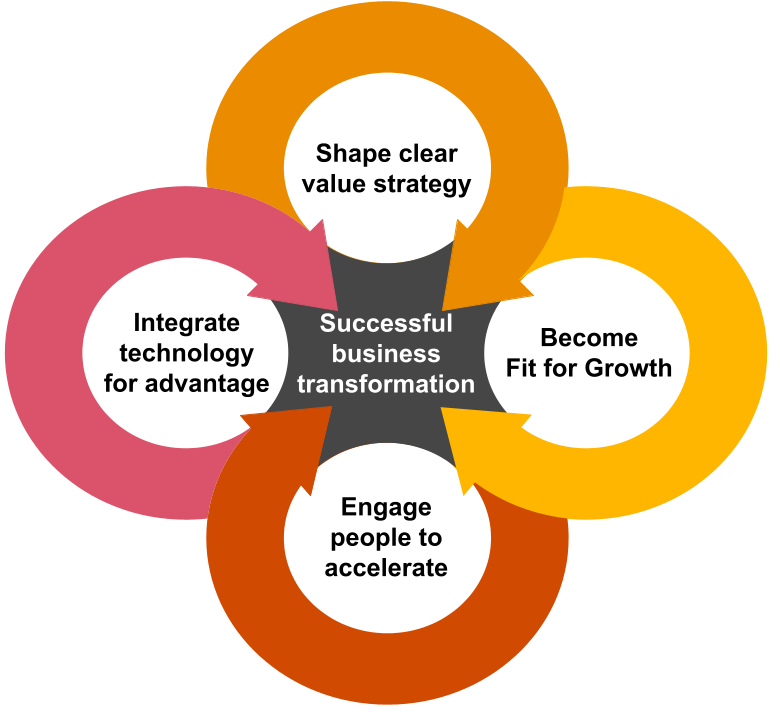

Bank Business Plan: Transformative Strategies for Modern Businesses

A Bank Business Plan requires innovative strategies to thrive in today’s digital marketplace. Embracing digital transformation is key for modern banking success.

Crafting a robust Bank Business Plan is vital for financial institutions seeking to stay relevant in the fast-evolving banking sector. By integrating transformative strategies, banks can harness technology’s power, optimize customer experiences, and improve operational efficiency. This shift towards modernization necessitates a plan that addresses the digital demands of consumers while also targeting sustainable growth.

A successful strategy focuses on embracing digital services, fostering fintech partnerships, and ensuring cybersecurity. In our introduction, we will outline the steps necessary for banks to craft a plan that positions them at the forefront of innovation, meeting the expectations of tech-savvy customers and standing out in a competitive market.

Credit: appinventiv.com

Introduction To Bank Business Planning

Embarking on the journey of a bank business plan involves a thorough understanding of both the financial landscape and the evolutionary processes that continue to shape it. In this era of rapid digital transformation, traditional banking frameworks are undergoing a seismic shift, necessitating a strategic approach to ensure success. The convergence of technology, customer needs, and regulatory environments has propelled the importance of a comprehensive bank business plan to the forefront of organizational priorities. This guide serves to dissect the pivotal elements, offering insight into devising a transformative strategy for modern banking enterprises.

Understanding The Importance Of Strategic Planning

In a sector governed by meticulous regulation, strategic planning stands as the cornerstone of banking operations. A well-crafted strategy not only provides a roadmap for navigating the complex financial landscape but also establishes a clear vision and goals for future growth. It ensures agility in a competitive market, the capability to respond to unforeseen challenges, and the foresight to seize emerging opportunities. The stark difference between banks with a robust strategic plan and those without is evident in their performance and resilience, making strategic planning an indispensable facet of bank business planning.

The Evolution Of Banking And Its Impact On Business Plans

The banking landscape has transformed dramatically over the years, influenced by technological advancements and changing consumer behaviors. The digital age has introduced novel banking channels and products, compelling banks to revisit their business models. This evolution impacts the development of business plans, requiring an acute emphasis on inclusivity of modern trends. Banks must now integrate technological innovation , data analytics , and cybersecurity into their core strategic objectives to remain relevant and competitive.

Essential Components Of A Bank Business Plan

A bank business plan is an intricate tapestry woven from multiple crucial elements. Each component plays a specific role in the formation of a cohesive and effective strategy:

- Executive Summary : A compelling overview articulating the bank’s mission, vision, and key objectives.

- Market Analysis : A deep dive into market trends, customer demographics, and competitive landscapes.

- Organization and Management : An outline of the bank’s organizational structure, governance policies, and leadership team.

- Products and Services : A comprehensive portfolio of banking products and service offerings.

- Marketing Plan : Strategies for customer acquisition, retention, and brand positioning.

- Operations Plan : Operational workflows, technology infrastructure, and branch network optimization.

- Financial Plan : Projections of the bank’s financial health, including balance sheets, income statements, and cash flow analyses.

- Risk Management Framework : Identifying potential risks and outlining mitigation strategies.

Together, these components formulate the backbone of a bank business plan, setting the stage for sustainable growth and operational excellence in a rapidly evolving sector.

Credit: digitalregulation.org

Leveraging Technology For Competitive Advantage

In the dynamic realm of banking, leveraging technology stands as the linchpin for gaining a competitive edge. Banks around the globe are transforming their business plans to not only keep pace with technological advancements but to anticipate future trends. This forward-thinking approach is pivotal in ensuring that they remain relevant and effective in an industry where customer demands and digital landscapes evolve rapidly. Engaging with technological innovation paves the way for enhanced efficiency, security, and customer satisfaction.

Investing In Fintech Innovations

Fintech , a portmanteau of financial technology, has spurred a revolution in the banking sector. By investing in fintech innovations, banks can offer a myriad of new services that address specific needs and improve overall service delivery. This could include everything from blockchain technology for secure transactions to AI-driven investment advisors. Embracing these innovations not only streamlines operations but also opens new revenue streams and reduces costs through automation.

Enhancing Customer Experience Through Digital Banking

The shift towards digital banking is a response to the growing demand for convenient and fast service. Enhancements in this space can yield significant improvements in customer satisfaction and retention. Features such as mobile banking apps, online account management, and 24/7 customer service chatbots contribute to a seamless banking experience that empowers customers with control and accessibility.

Implementing Advanced Data Analytics For Better Decision-making

Banks sit on vast amounts of data that can be harnessed to garner insights about customer behavior, market trends, and risk management. By implementing advanced data analytics , financial institutions can extract this valuable information and make data-driven decisions that optimize performance and minimize risk. Tailored marketing campaigns, personalized financial advice, and preemptive fraud detection are just a few of the benefits that a robust analytics strategy can deliver.

Cybersecurity Measures To Protect Digital Assets

As banking operations become increasingly digitized, the threat landscape expands correspondingly. Investing in cybersecurity measures is no longer optional but imperative. Robust security protocols, continuous monitoring, and incident response plans are essential to safeguard digital assets against ever-evolving threats. Educating customers about security best practices also plays a crucial role in maintaining a secure digital banking environment.

Operational Excellence In Banking

Operational Excellence in Banking is a critical component in the ever-evolving financial landscape where efficiency and customer satisfaction are paramount. To remain competitive, modern banks must constantly refine their operations, leveraging technology and innovative strategies to streamline processes. This maximizes profitability, enhances customer experience, and adapts to the changing regulatory environment. Embracing transformative operational approaches can be the linchpin for banks aiming to thrive in today’s dynamic economic conditions.

Streamlining Back-office Operations For Efficiency

Enhancing back-office functions is crucial for banks to improve performance and reduce costs. Banks today can integrate technological solutions , like automation and data analytics, to streamline repetitive tasks, minimize errors, and optimize workflow. Regularly reviewing and updating operational procedures ensures that banks remain agile and can quickly adapt to new market demands or changes in regulatory requirements.

- Process Automation: Implementing robotic process automation (RPA) to handle tasks such as data entry, account reconciliation, and report generation.

- Digital Document Management: Transitioning to paperless systems to increase accessibility and security while cutting down on physical storage space and retrieval times.

Adopting Lean Banking Principles

Incorporating lean principles into banking operations fosters a culture of continuous improvement. This methodology focuses on eliminating waste and enhancing value to the customer through streamlined processes. By analyzing each step in a process, banks can identify non-value-adding activities and devise strategies to eliminate them, which results in faster service delivery and higher customer satisfaction.

- Value Stream Mapping: Visualizing the entire process to pinpoint inefficiencies.

- Continuous Improvement: Encouraging feedback and suggestions from all levels of staff to improve banking processes.

Workforce Management And Talent Acquisition Strategies

Workforce management and strategic talent acquisition play pivotal roles in achieving operational excellence. Banks need to ensure that their employees are not only skilled but also adaptable to the changing technological landscape. Embracing digital training platforms, promoting a culture of learning, and adopting flexible workforce models are key to staying ahead of the curve. Additionally, attracting top talent is essential for innovation and driving business growth.

- Employee Training: Utilizing e-learning tools to continuously upskill employees.

- Flexible Work Arrangements: Offering remote work options to attract a broader range of applicants.

Sustainability Initiatives In Banking Operations

The move towards sustainability is no longer optional for banks; it’s a necessity for meeting the demands of customers and regulators alike. Implementing sustainable practices in operations not only benefits the environment but also leads to cost savings and a stronger brand reputation. Initiatives can include reducing energy consumption, investing in green technology, and developing products that support sustainable development goals.

| Initiative | Impact |

|---|---|

| Energy Efficiency Programs | Reduction in operational costs and carbon footprint |

| Paperless Banking | Decreased waste and enhanced customer convenience |

Growth And Expansion Strategies

Bank business plans are no longer just balance sheets and ledger entries. In this era of unprecedented change and opportunities, transformative strategies are the driving force for growth and expansion in the banking sector. Shifts in consumer behavior, technological advancements, and regulatory landscapes require banks to think outside the traditional paradigms. Here we delve into the potent strategies that can catapult a bank’s growth trajectory skywards.

Developing A Multi-channel Distribution Approach

In today’s digital era, customers expect seamless access across platforms. The most successful banks are those that embrace omnichannel banking , providing a consistent experience whether the customer visits in person, logs onto a website, or accesses services via a mobile app. A multi-channel distribution approach can significantly enhance customer satisfaction and loyalty.

- Optimizing physical branch locations for high-value services

- Investing in robust online banking platforms

- Launching user-friendly mobile banking applications

Exploring Acquisitions And Partnerships

Acquisitions and partnerships can be transformative, offering banks a fast track to growth. Through strategic acquisitions, banks can quickly expand their customer base, enter new markets, or acquire new technologies. Partnerships, on the other hand, can bring in fresh expertise and innovation— necessary ingredients for modern banking services.

- Identifying synergistic opportunities in similar or complementary markets

- Pooling resources and knowledge with fintech firms to foster innovation

- Navigating regulatory environments for smooth mergers and collaborations

Diversifying Banking Products And Services

Diversification is a cornerstone strategy to mitigate risks and capture new market segments. Offering a varied portfolio of products and services can help banks tap into different customer needs and preferences. This strategy also buffers against market volatilities.

Key areas for diversification may include:

| Product/Service | Benefits |

|---|---|

| Insurance and Investment Products | Provides a more holistic financial service offering |

| Wealth and Asset Management | Attracts high-net-worth individuals and institutional clients |

| Specialty Financing (e.g., green loans) | Positions the bank as a socially responsible institution |

International Expansion And Global Market Entry

International markets offer new frontiers for growth . However, entering a new market requires a well-formed strategy that considers local regulations, cultural nuances, and competitive landscapes. Banks can leverage their home market successes to gain credibility and momentum in international markets.

- Conducting thorough market analysis and due diligence

- Establishing partnerships with local financial institutions

- Customizing offerings to meet the needs and expectations of local customers

Risk Management And Regulatory Compliance

In the dynamic landscape of the banking sector, Risk Management and Regulatory Compliance are two pillars critical to the sustainable growth and stability of any financial institution. In an environment where the wheels of change are constantly in motion, banks must evolve to adopt transformative strategies that not only meet the current demands but also foresee and mitigate future challenges. A robust bank business plan must meticulously address these components to ensure profitability, reputational integrity, and customer loyalty.

Staying Ahead Of Regulatory Changes

Banks operate in a heavily regulated environment, where changes are both frequent and impactful. Remaining proactive in monitoring regulatory updates is crucial. Awareness and understanding of both domestic and international regulatory shifts can teach banks to adapt quickly , maintaining compliance and ensuring uninterrupted business operations.

- Stay informed through regulatory publications and updates

- Engage in industry discussions and forums

- Deploy regulatory change management software

Building A Risk-averse Culture

A risk-averse culture is foundational to the longevity and success of any bank. Cultivating an environment where every stakeholder prioritizes risk management deters potential threats before they materialize into losses. Elements of a risk-averse culture include:

- Regular training for employees on risk awareness

- Transparent communication channels for risk reporting

- Encouragement of diligent decision-making at all levels

Integrating Risk Management Into The Business Model

Seamless integration of risk management into a bank’s business model ensures that risk evaluation is a continual process . Strategic planning sessions should always factor in risk assessments. This amalgamation necessitates:

| Strategy Component | Risk Management Integration |

|---|---|

| Product Development | Conducting risk assessments for new products |

| Market Expansion | Evaluating geopolitical and economic risks |

| Technology Adoption | Ensuring cybersecurity measures are in place |

Compliance As A Competitive Edge

In a market where trust is paramount, exceling in compliance can distinguish a bank from its competitors. Forward-thinking institutions leverage their adherence to regulations as a testament to their reliability and commitment to customer safety. The compliance-first approach stimulates confidence among stakeholders and can open doors to new markets and customer segments.

Financial Management And Investment

Steering the financial ship of a bank amidst the turbulent waters of the modern economy demands a robust plan and refined strategies. Financial Management and Investment are critical components that require meticulous attention for any bank business plan. These encompass decisions on capital allocation, managing assets and liabilities effectively, maximizing profits, and nurturing a bank-wide understanding of financial prudence. Let’s explore some transformative strategies that can create waves of success for modern businesses in banking.

Capital Planning And Investment Strategies

Banks need to design astute Capital Planning and Investment Strategies to thrive. This entails:

- Identifying optimal capital requirements to support anticipated growth and regulatory demands.