investment banking Recently Published Documents

Total documents.

- Latest Documents

- Most Cited Documents

- Contributed Authors

- Related Sources

- Related Keywords

Human Versus Machine: A Comparison of Robo-Analyst and Traditional Research Analyst Investment Recommendations

We provide the first comprehensive analysis of the properties of investment recommendations generated by “Robo-Analysts,” which are human-analyst-assisted computer programs conducting automated research analysis. Our results indicate that Robo-Analyst recommendations differ from those produced by traditional “human” research analysts across several important dimensions. First, Robo-Analysts produce a more balanced distribution of buy, hold, and sell recommendations than do human analysts and are less likely to recommend “glamour” stocks and firms with prospective investment banking business. Second, automation allows Robo-Analysts to revise their recommendations more frequently than human analysts and incorporate information from complex periodic filings. Third, while Robo-Analysts’ recommendations exhibit weak short-window return reactions, they have long-term investment value. Specifically, portfolios formed based on the buy recommendations of Robo-Analysts significantly outperform those of human analysts. Overall, our results suggest that automation in the sell-side research industry can benefit investors.

10. Teil: Rahmenbedingungen des Investment Banking

The prospect of investment banking and arbitration in the space economy.

Morgan Stanley estimates that the global space industry could generate revenues of more than $1 trillion or more by 2040, up from over $400 billion currently. Do declining launch costs, technological advancements and a rising interest in the public sector make space the next trillion-dollar economy? The dynamics of the space sector has led wall street analysts to forecast that the space industry could become the next trillion-dollar industry by 2040. As of January 2018, the global space economy grew more than 8%, generating $414.75 billion in space activities.With unmanned scientific exploration, high levels of private funding advancement in technology the implications of investment for a more accessible, low cost into outer space is significant, with potential opportunities for improvement of the resources in space for profit-making and expansion of business concerns, the expanding interest of public sector migrate into the shift from private finding to public and herald the entrance of traditional finance There are fortunes and resources in the space economy which aids the activities of humans, as well as the bold exploration of countries to expand research and understand the limits use and the extent to the use in the space economy.This paper seeks to explore the prospects of investment banking activities in the growing space economy, seeing the growing development of exchange-traded funds already being explored in the space economy and the new regulations allowing Wall Street to do Venture Capital which expands the exploration of capital and buttresses the objective of raising capital by a major player, Space X which raised about $44 Billion and so grows the prospect of more banking activity. Furthermore, the possibilities that are inherent in the eventual proliferation of investment banking activities in the space industry will be addressed. In attempting to do justice to such a lofty idea, the universal need for funding in the world of business will be examined as a representation of the intersection between banking interests and space interests. The interplay of factors such as risk and understanding of business processes in the dynamics of any relationship between investment banking and the space industry will also be examined. The purpose of such analysis will be to afford an understanding of the role that investment banking has to play in the space industry, as an over text to the elements and characteristics of space activities that define the rate of the growth of the influence and applicability of investment banking to the peculiar needs and unique concerns associated with the pursuit of profitable business in the space economy. Lastly, this paper looks to give an account of the evolution of Space Dispute Arbitration, and how the existing legal mechanisms in force for directing arbitral awards have evolved in scope and flexibility since the first satellite launch. In general, and as a statement of fundamental purpose, this paper will attempt to provide a wide and sufficiently detailed representation of what the space industry is, the dynamics of space arbitration and how its resultant economic sector functions, in order to hypothesize on the part that investment banking has to play in its growth and in the maximization of its resultant profits for all shareholders involved.”

ENSURING STABLE ECONOMIC DEVELOPMENT THROUGH THE EFFICIENT FUNCTIONING OF THE BANKING SECTOR

Abstract. The article explores ways to ensure stable economic development through the efficient functioning of the banking sector. The concept of stable development and efficiency of the banking system is revealed. The key principles of macroprudential and microprudential policy are analyzed and the main advantages of each of them are determined. The tools for implementing macroprudential policy to ensure sustainable economic development are described. The peculiarities of the application of rating assessment, the role of state-owned banks and investment banking as the most optimal measures to ensure economic development are outlined. Promising digital technologies in the banking system, which have a long-term strategic nature of development, are presented. It is confirmed that the development of the country’s economy depends on many factors of the internal organization of the microeconomic environment. Among the aspects of qualitatively increasing the competitiveness of the national economy, an important component is the emphasis on the policy of strengthening the efficiency of the market sector. The infrastructure of the market and financial sector consists of instruments of financial influence, as well as additional comprehensive measures aimed at creating a multi-channel system of various institutions and institutions, a structured real financial services sector given the overall stability of the banking system. The quality and efficiency of the financial sector can be determined, in particular, by the indicators of the peculiarities of the creation of market goods and services, which create an opportunity to create market relations at optimal prices. We concluded that the last important factor for the prospect of sustainable economic development through the efficient functioning of the banking system is the use of digital technologies, because the world is rapidly transitioning from traditional to digital economy, so the banking system must be transformed into modern realities using current innovative technologies. . Keywords: stable economic development, banking system, investment banking, rating assessment, macroprudential policy. JEL Classification O16, O29, G21 Formulas: 0; fig.: 0; tabl.: 7; bibl.: 12.

Perspectives on Corporate, Social, and Employee Purpose among Investment Bankers: A Qualitative Research Study

There are increasing calls to re-establish the role and responsibility of banks towards society to repair trust and enhance financial stability. Through in-depth interviews with senior investment bankers, this study asks what bankers themselves think about the corporate (i.e. the industry’s core business), social (i.e. its moral responsibilities to wider society), and employee (i.e. bankers’ own feelings of purposefulness) purposes of the investment banking industry. Existing research tells us that there are significant reciprocal benefits to organisations, employees, and society at large when the three are aligned. The study’s findings suggest that while there have been important shifts in corporate and social purposes over time, bankers remain sceptical about their banks’ underlying motives and this has resulted in multiple disconnects. Perhaps surprising, the study finds that meaningful work that is also socially focused is something that investment bankers are seeking in some way. These insights should prompt banks to ensure that social purposes reflect and align with their corporate purposes; to move beyond rhetoric and virtue-signalling to action; and to help employees identify their contribution to it all.

Female leaders as ‘Superwomen’: Post-global financial crisis media framing of women and leadership in investment banking in UK print media 2014–2016

Analysis of the contribution of information technology in investments.

This research paper is made with the view of analyzing the contributions of technology in investment sector. Furthermore it tries to answer the big questions like whether technology help to get higher returns from the investments in the stock market? or what is next in investing? or what is the role of technology in investment banking?.

The Role of Investor Protections on the Value of Investment Banking Relationships: International Evidence

On the regulation of investment banking in russia.

Analytical documents of the Bank of Russia and financial statements of large Russian banks indicate the growth in incomes from operations with securities within the gross share of revenues of commercial banks. In the world, there are cases of excessive activity of commercial banks in the security market (the Great Depression of 1929–1933 in the USA, default on state treasury bills in Russia on the 17th August 1998), which led to negative consequences for bank clients. The author analyzed peculiarities of investment transactions conducted by commercial banks in Russia. The author gives recommendations to reduce financial risks for the commercial banks’ customers and promote the attractiveness of the investment banking products. The author’s concept of regulation of banking activity in Russia consists of two directions: regulation of classical banking (income from lending operations exceeds income from operations in the securities market) and regulation of investment banking (the predominance of investment operations). The author justifies the necessity of the introduction of mandatory insurance of funds invested in equity securities of Russian issuers admitted to circulation on the Moscow Stock Exchange in the event of bankruptcy of issuers. The paper critically evaluates the recommendation of the Bank of Russia that professional participants in the securities market should not offer complex investment products to unqualified investors as this restricts the application of derivative securities for hedging financial risks. The author suggests the requirements for the equity capital of professional participants of the securities market and the methodology for calculating the equity capital separately for classical and investment banks.

A Study and Analysis of Investment Banking and Regional Development Among European Economy

Investment banks are financial intermediaries that specialize in the sale of securities and the issuance and underwriting of new shares to raise capital financing. Investment banking is a special segment of banking that assists individuals or organizations to raise capital in the main market. In the tea market, new securities are issued and act on behalf of customers, thus playing an important role in the secondary market. Investment banks undertake new debt or equity securities for all types of businesses, support the sale of securities, and facilitate mergers and acquisitions by institutional and individual investors. Investment banking organizations act as intermediaries between investors and capital markets. Investment banks are becoming important in European capital markets due to many factors including the perception of investment banks among investors and the various other functions implemented by investment banks. The research paper aims to show the role of investment banks in the current scenario. This study is descriptive in nature and uses auxiliary data. The study reveals the growth, development, function and role of investment banking in the European economy. The main objective of this investigation is to clarify how investment banks play a role in increasing a country’s resources and economic growth. It analyzes the various functions performed by investment banks. Investment banks connect the people who sell securities with their investors. Investment banks add liquidity to the market. Investment banks promote savings and investment and eliminate capital shortages. Mobilize small, scattered savings in the community so you can invest in productive businesses. He concluded that the role of investment banks in economic development is important.

Export Citation Format

Share document.

Home » Blog » Dissertation » Topics » Finance » Investment Banking » 80 Investment Banking Research Topics

80 Investment Banking Research Topics

FacebookXEmailWhatsAppRedditPinterestLinkedInWelcome to the realm of academic exploration and financial intricacies, where research and topics intertwine to shape the future of investment banking knowledge. For students embarking on the journey of crafting a thesis or dissertation at the undergraduate, master’s, or doctoral level, investment banking offers many captivating avenues to explore. This guide will delve into […]

Welcome to the realm of academic exploration and financial intricacies, where research and topics intertwine to shape the future of investment banking knowledge. For students embarking on the journey of crafting a thesis or dissertation at the undergraduate, master’s, or doctoral level, investment banking offers many captivating avenues to explore.

This guide will delve into the dynamic landscape of potential research topics that align with your academic pursuits and contribute to the ever-evolving realm of financial strategies and market trends. Whether you’re aiming to dissect the nuances of risk assessment, analyze the impacts of regulatory changes, or uncover the realms of emerging technologies in finance, this article will serve as your compass, pointing you toward compelling and relevant research topics that have the potential to redefine the contours of the investment banking domain.

A List Of Potential Research Topics In Investment Banking :

- The Role of Investment Banks in Corporate Governance: A Review of Board Interactions and Influence

- Sovereign Wealth Funds and Investment Banking Activities

- The Role of Investment Banks in Infrastructure Financing

- Quantitative vs. Qualitative Approaches to Investment Banking Research

- Regulatory Responses to Pandemic-Induced Market Volatility in Investment Banking

- Role of Investment Banks in Islamic Finance

- The Impact of Fintech Integration on Investment Banking Services

- The Evolution of Investment Banking: A Historical Review of Industry Transformations

- Role of Investment Banks in Facilitating Initial Coin Offerings (ICOs)

- Government Policies and their Influence on UK Investment Banking Strategies

- Financial Innovation and its Implications for Investment Banking

- Regulatory Changes in the UK Investment Banking Industry: A Post-Brexit Analysis

- Green Finance Initiatives and Sustainable Investment Banking in the UK

- Green Finance and Sustainable Investment Banking Practices

- Investment Banking and Cybersecurity: Mitigating Financial Risks

- Brexit’s Impact on Investment Banking Operations in the UK

- Evaluating the Effectiveness of Digital Platforms in Retail Investment Banking

- Fintech Disruption in Investment Banking Services

- Foreign Exchange Market and Investment Banking Strategies

- Role of Investment Banks in Leveraged Buyouts (LBOs)

- The Future of UK Investment Banking in the Face of Global Economic Uncertainties

- Role of Investment Banks in Financing Startups and Innovations

- Cross-Border Capital Flows and Investment Banking Activities

- Quantitative vs. Qualitative Approaches to Investment Banking Research: A Methodological Review

- Investment Banking Compensation Models and Performance

- Regulatory Reforms and Their Impact on Investment Banking Operations

- Credit Risk Assessment Models in Investment Banking: A Comparative Study

- Resilience of Investment Banking Operations during the Pandemic: Lessons Learned

- Investment Banking and Income Inequality: A Socioeconomic Perspective

- Cultural Influences on Cross-Border Investment Banking Transactions

- Investment Banking and Intellectual Property Financing

- Role of Investment Banks in Emerging Markets Financing

- Investor Behavior and Sentiment in the Post-COVID-19 Investment Banking Landscape

- Cross-Border Mergers and Acquisitions: Investment Banking Facilitation

- Investment Banking and Corporate Governance: Exploring Board Interactions

- Role of UK Investment Banks in Cross-Border Mergers and Acquisitions

- Technological Innovations and Transformation of Investment Banking

- The Influence of Behavioral Economics on Investment Banking Strategies

- Ethics and Transparency in Investment Banking Practices

- Technological Resilience and Cybersecurity Measures in Post-Pandemic Investment Banking

- IPO Performance and Long-Term Returns: An Investment Banking Perspective

- Credit Default Swaps and Risk Management in Investment Banking

- Legal and Regulatory Challenges in Investment Banking Across Borders

- IPO Underpricing: A Study of Investment Banking Practices

- Regulatory Reforms in Investment Banking: Analyzing the Efficacy of Post-Crisis Changes

- FDI and Investment Banking: Exploring Cross-Linkages

- Reviewing the Impact of Investment Banking Analyst Recommendations on Stock Performance

- Evaluating the Role of Investment Banks in Project Finance

- Private Equity Investments and Value Creation in Investment Banking

- Investment Banking and Cross-Border Taxation Issues

- Mergers and Acquisitions in the Investment Banking Industry: Trends and Analysis

- Measuring Efficiency and Performance of Investment Banking Units

- Impact of COVID-19 on Investment Banking Deal Flow and M&A Activities

- Fintech Disruption in Investment Banking: A Comprehensive Review of Technological Innovations

- Volatility and Risk Management in Investment Banking Operations

- Evaluating the Effectiveness of Investment Banking Analyst Recommendations

- Role of Investment Banks in Restructuring Distressed Companies

- Risk Management Strategies in Complex Derivative Transactions

- Investment Banking and Environmental, Social, and Governance (ESG) Factors

- Role of Investment Banks in Debt Securitization

- Evaluating the Impact of Insider Trading Regulations on Investment Banking

- Corporate Restructuring and Investment Banking Advisory

- A Critical Review of Investment Banking Compensation Models: Balancing Risk and Reward

- Regulatory Compliance Challenges in Investment Banking

- Digital Transformation and Remote Work in Post-Pandemic Investment Banking

- Analysis of Debt Capital Market Trends in Investment Banking

- Credit Rating Agencies and Their Impact on Investment Banking

- Market Microstructure and High-Frequency Trading in Investment Banking

- Portfolio Diversification Strategies in Investment Banking

- Behavioural Biases and Their Influence on Investment Banking Decision-making

- Diversity and Inclusion Initiatives in UK Investment Banking Organizations

- Digital Banking Disruption and Customer Engagement: A UK Investment Banking Perspective

- The Future of Cryptocurrencies in Investment Banking

- Impact of Central Bank Policies on Investment Banking Operations

- Virtual IPOs and Roadshows: Shifting Practices in Post-Pandemic Investment Banking

- Comparative Study of Investment Banking Practices in London and Other Financial Hubs

- Systemic Risk and the Financial Crisis: An In-depth Review of Investment Banking’s Role

- Technological Adoption and Efficiency in Investment Banking Operations

- Investment Banking and Financial Crisis: Lessons from the Past

- Fintech Collaboration in the UK Investment Banking Landscape

In conclusion, the diverse array of Investment Banking research topics across various degree levels offers ample opportunities for in-depth exploration and analysis. These topics address critical challenges within the financial sector and provide valuable insights for shaping future strategies, policies, and decision-making processes. Whether investigating market trends, risk management strategies, regulatory frameworks, or the evolving role of technology, students at different academic levels can contribute meaningfully to this dynamic field, fostering innovation and driving advancements in Investment Banking.

Order Investment Banking Dissertation Now!

External Links:

- Download the Investment Banking Dissertation Sample For Your Perusal

Research Topic Help Service

Get unique research topics exactly as per your requirements. We will send you a mini proposal on the chosen topic which includes;

- Research Statement

- Research Questions

- Key Literature Highlights

- Proposed Methodology

- View a Sample of Service

Ensure Your Good Grades With Our Writing Help

- Talk to the assigned writer before payment

- Get topic if you don't have one

- Multiple draft submissions to have supervisor's feedback

- Free revisions

- Complete privacy

- Plagiarism Free work

- Guaranteed 2:1 (With help of your supervisor's feedback)

- 2 Installments plan

- Special discounts

Other Posts

- 80 Banking and Finance Research Topics August 30, 2023 -->

- 80 Behavioral Finance Research Topics August 26, 2023 -->

- 80 Corporate Finance Research Topics August 25, 2023 -->

- 80 Finance Research Topics July 28, 2023 -->

- 80 Financial Derivatives Research Topics August 28, 2023 -->

- 80 Financial Econometrics Research Topics August 29, 2023 -->

- 80 Financial Economics Research Topics August 29, 2023 -->

- 80 Financial Management Research Topics August 29, 2023 -->

- 80 Financial Markets Research Topics August 25, 2023 -->

- 80 Financial Risk Management Research Topics August 28, 2023 -->

- 80 Fintech and Digital Finance Research Topics August 26, 2023 -->

- 80 International Finance Research Topics August 26, 2023 -->

- 80 Islamic Finance Research Topics August 28, 2023 -->

- 80 Microfinance Research Topics August 30, 2023 -->

- 80 Personal Finance Research Topics August 25, 2023 -->

- 80 Public Finance Research Topics August 26, 2023 -->

- 80 Quantitative Finance Research Topics August 26, 2023 -->

- 80 Real Estate Finance Research Topics August 26, 2023 -->

- 80 Sustainable Finance Research Topics August 28, 2023 -->

WhatsApp us

Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

typedaily.com

20 investment banking dissertation topics.

More often than not, it is said that smart businesspeople are those who have money tied up in assets and not those who have banked all cash. This is true in every way you want to look at it. But is here is something to look into. Does it then mean that those who invest wisely have a deeper grasp of investment banking or this is something you can learn along the way and change from worse to better? In recent times, investment banking has become an area of concern among stakeholders in different sectors of an economy. In their approaches and views, a country can best be developed through investment banking. But as a student of finance or any business related career, do you understand what this mean? Given a chance, can you craft a powerful essay on this subject nonetheless? Students are supposed to understand a subject deeply so that when they are assigned say investment banking dissertation topics, they are able to partake on it with ease and fast. Notably, a lot has been done on this area and this should get you seeking answers to the following issues;

- How can you come up with a unique topic on investment banking? With a lot of research having been carried out in this area and many more underway, one sure path to successful project writing is coming up with a unique topic. There are many approaches to this. You can for instance choose to review existing publications from which you can identify a knowledge gap.

- Do you have what it takes in terms of academic writing skills and creativity? Well, when it comes to getting better grades at school and in this case, project writing, there is no better way to do it except through excellent skills of writing and being creative at it. This is something you can achieve through extensive reading of not only investment banking related journals but also past academic projects in this area

- In order to get good grades in this project, you must also appreciate the need to consult and discuss as ways of generating ideas that work. Sometimes the best topics for an internet banking dissertation is realized through dissertation. This is therefore an approach worthy of consideration.

To this end, I therefore list below a few topics on this subject to help you get started, so take a look further for more details;

- A look into the future of investment banking with the advent of technology in financial accounting is a topic worth writing on

- Secondly, an investigative paper on how larger global financial institutions can be outshined by smaller banks is something to think about.

- A paper reviewing shortcomings of European Union in protecting smaller financial institutions

- How do bigger banks contribute to collapse of smaller financial institutions? You can partake on this study through a case study approach

- A look at insider trading in the investment banking sector

- A look into competing forces in the operations of the Wall Street

- An investigative paper into struggle for power and influence in investment financial institutions.

- The question of monopoly in investment banking. How can competition be leveled?

- The relationship between capitalism and Investment banking from an economist perspective.

Brand-new ideas

- Find writing help online

Original Topic Questions

- Outstanding English dissertation titles

- Open access

- Published: 18 June 2021

Financial technology and the future of banking

- Daniel Broby ORCID: orcid.org/0000-0001-5482-0766 1

Financial Innovation volume 7 , Article number: 47 ( 2021 ) Cite this article

40k Accesses

52 Citations

4 Altmetric

Metrics details

This paper presents an analytical framework that describes the business model of banks. It draws on the classical theory of banking and the literature on digital transformation. It provides an explanation for existing trends and, by extending the theory of the banking firm, it illustrates how financial intermediation will be impacted by innovative financial technology applications. It further reviews the options that established banks will have to consider in order to mitigate the threat to their profitability. Deposit taking and lending are considered in the context of the challenge made from shadow banking and the all-digital banks. The paper contributes to an understanding of the future of banking, providing a framework for scholarly empirical investigation. In the discussion, four possible strategies are proposed for market participants, (1) customer retention, (2) customer acquisition, (3) banking as a service and (4) social media payment platforms. It is concluded that, in an increasingly digital world, trust will remain at the core of banking. That said, liquidity transformation will still have an important role to play. The nature of banking and financial services, however, will change dramatically.

Introduction

The bank of the future will have several different manifestations. This paper extends theory to explain the impact of financial technology and the Internet on the nature of banking. It provides an analytical framework for academic investigation, highlighting the trends that are shaping scholarly research into these dynamics. To do this, it re-examines the nature of financial intermediation and transactions. It explains how digital banking will be structurally, as well as physically, different from the banks described in the literature to date. It does this by extending the contribution of Klein ( 1971 ), on the theory of the banking firm. It presents suggested strategies for incumbent, and challenger banks, and how banking as a service and social media payment will reshape the competitive landscape.

The banking industry has been evolving since Banca Monte dei Paschi di Siena opened its doors in 1472. Its leveraged business model has proved very scalable over time, but it is now facing new challenges. Firstly, its book to capital ratios, as documented by Berger et al ( 1995 ), have been consistently falling since 1840. This trend continues as competition has increased. In the past decade, the industry has experienced declines in profitability as measured by return on tangible equity. This is partly the result of falling leverage and fee income and partly due to the net interest margin (connected to traditional lending activity). These trends accelerated following the 2008 financial crisis. At the same time, technology has made banks more competitive. Advances in digital technology are changing the very nature of banking. Banks are now distributing services via mobile technology. A prolonged period of very low interest rates is also having an impact. To sustain their profitability, Brei et al. ( 2020 ) note that many banks have increased their emphasis on fee-generating services.

As Fama ( 1980 ) explains, a bank is an intermediary. The Internet is, however, changing the way financial service providers conduct their role. It is fundamentally changing the nature of the banking. This in turn is changing the nature of banking services, and the way those services are delivered. As a consequence, in order to compete in the changing digital landscape, banks have to adapt. The banks of the future, both incumbents and challengers, need to address liquidity transformation, data, trust, competition, and the digitalization of financial services. Against this backdrop, incumbent banks are focused on reinventing themselves. The challenger banks are, however, starting with a blank canvas. The research questions that these dynamics pose need to be investigated within the context of the theory of banking, hence the need to revise the existing analytical framework.

Banks perform payment and transfer functions for an economy. The Internet can now facilitate and even perform these functions. It is changing the way that transactions are recorded on ledgers and is facilitating both public and private digital currencies. In the past, banks operated in a world of information asymmetry between themselves and their borrowers (clients), but this is changing. This differential gave one bank an advantage over another due to its knowledge about its clients. The digital transformation that financial technology brings reduces this advantage, as this information can be digitally analyzed.

Even the nature of deposits is being transformed. Banks in the future will have to accept deposits and process transactions made in digital form, either Central Bank Digital Currencies (CBDC) or cryptocurrencies. This presents a number of issues: (1) it changes the way financial services will be delivered, (2) it requires a discussion on resilience, security and competition in payments, (3) it provides a building block for better cross border money transfers and (4) it raises the question of private and public issuance of money. Braggion et al ( 2018 ) consider whether these represent a threat to financial stability.

The academic study of banking began with Edgeworth ( 1888 ). He postulated that it is based on probability. In this respect, the nature of the business model depends on the probability that a bank will not be called upon to meet all its liabilities at the same time. This allows banks to lend more than they have in deposits. Because of the resultant mismatch between long term assets and short-term liabilities, a bank’s capital structure is very sensitive to liquidity trade-offs. This is explained by Diamond and Rajan ( 2000 ). They explain that this makes a bank a’relationship lender’. In effect, they suggest a bank is an intermediary that has borrowed from other investors.

Diamond and Rajan ( 2000 ) argue a lender can negotiate repayment obligations and that a bank benefits from its knowledge of the customer. As shall be shown, the new generation of digital challenger banks do not have the same tradeoffs or knowledge of the customer. They operate more like a broker providing a platform for banking services. This suggests that there will be more than one type of bank in the future and several different payment protocols. It also suggests that banks will have to data mine customer information to improve their understanding of a client’s financial needs.

The key focus of Diamond and Rajan ( 2000 ), however, was to position a traditional bank is an intermediary. Gurley and Shaw ( 1956 ) describe how the customer relationship means a bank can borrow funds by way of deposits (liabilities) and subsequently use them to lend or invest (assets). In facilitating this mediation, they provide a service whereby they store money and provide a mechanism to transmit money. With improvements in financial technology, however, money can be stored digitally, lenders and investors can source funds directly over the internet, and money transfer can be done digitally.

A review of financial technology and banking literature is provided by Thakor ( 2020 ). He highlights that financial service companies are now being provided by non-deposit taking contenders. This paper addresses one of the four research questions raised by his review, namely how theories of financial intermediation can be modified to accommodate banks, shadow banks, and non-intermediated solutions.

To be a bank, an entity must be authorized to accept retail deposits. A challenger bank is, therefore, still a bank in the traditional sense. It does not, however, have the costs of a branch network. A peer-to-peer lender, meanwhile, does not have a deposit base and therefore acts more like a broker. This leads to the issue that this paper addresses, namely how the banks of the future will conduct their intermediation.

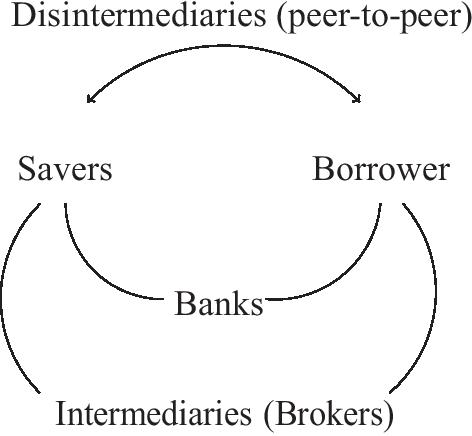

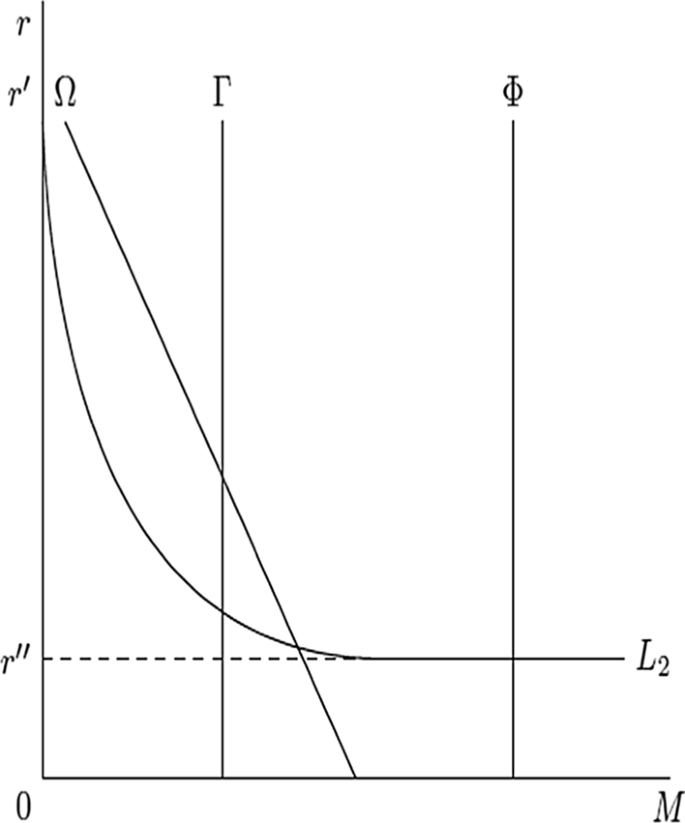

In order to understand what the bank of the future will look like, it is necessary to understand the nature of the aforementioned intermediation, and the way it is changing. In this respect, there are two key types of intermediation. These are (1) quantitative asset transformation and, (2) brokerage. The latter is a common model adopted by challenger banks. Figure 1 depicts how these two types of financial intermediation match savers with borrowers. To avoid nuanced distinction between these two types of intermediation, it is common to classify banks by the services they perform. These can be grouped as either private, investment, or commercial banking. The service sub-groupings include payments, settlements, fund management, trading, treasury management, brokerage, and other agency services.

How banks act as intermediaries between lenders and borrowers. This function call also be conducted by intermediaries as brokers, for example by shadow banks. Disintermediation occurs over the internet where peer-to-peer lenders match savers to lenders

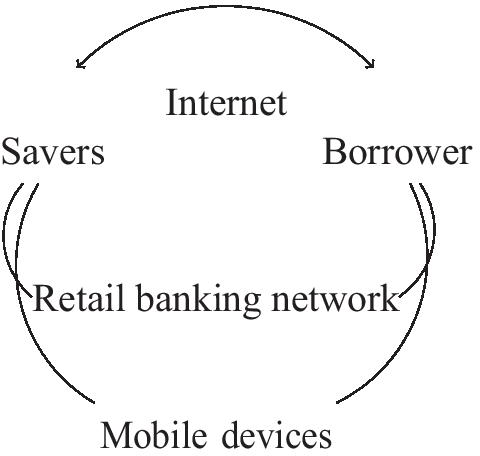

Financial technology has the ability to disintermediate the banking sector. The competitive pressures this results in will shape the banks of the future. The channels that will facilitate this are shown in Fig. 2 , namely the Internet and/or mobile devices. Challengers can participate in this by, (1) directly matching borrows with savers over the Internet and, (2) distributing white labels products. The later enables banking as a service and avoids the aforementioned liquidity mismatch.

The strategic options banks have to match lenders with borrowers. The traditional and challenger banks are in the same space, competing for business. The distributed banks use the traditional and challenger banks to white label banking services. These banks compete with payment platforms on social media. The Internet heralds an era of banking as a service

There are also physical changes that are being made in the delivery of services. Bricks and mortar branches are in decline. Mobile banking, or m-banking as Liu et al ( 2020 ) describe it, is an increasingly important distribution channel. Robotics are increasingly being used to automate customer interaction. As explained by Vishnu et al ( 2017 ), these improve efficiency and the quality of execution. They allow for increased oversight and can be built on legacy systems as well as from a blank canvas. Application programming interfaces (APIs) are bringing the same type of functionality to m-banking. They can be used to authorize third party use of banking data. How banks evolve over time is important because, according to the OECD, the activity in the financial sector represents between 20 and 30 percent of developed countries Gross Domestic Product.

In summary, financial technology has evolved to a level where online banks and banking as a service are challenging incumbents and the nature of banking mediation. Banking is rapidly transforming because of changes in such technology. At the same time, the solving of the double spending problem, whereby digital money can be cryptographically protected, has led to the possibility that paper money will become redundant at some point in the future. A theoretical framework is required to understand this evolving landscape. This is discussed next.

The theory of the banking firm: a revision

In financial theory, as eloquently explained by Fama ( 1980 ), banking provides an accounting system for transactions and a portfolio system for the storage of assets. That will not change for the banks of the future. Fama ( 1980 ) explains that their activities, in an unregulated state, fulfil the Modigliani–Miller ( 1959 ) theorem of the irrelevance of the financing decision. In practice, traditional banks compete for deposits through the interest rate they offer. This makes the transactional element dependent on the resulting debits and credits that they process, essentially making banks into bookkeeping entities fulfilling the intermediation function. Since this is done in response to competitive forces, the general equilibrium is a passive one. As such, the banking business model is vulnerable to disruption, particularly by innovation in financial technology.

A bank is an idiosyncratic corporate entity due to its ability to generate credit by leveraging its balance sheet. That balance sheet has assets on one side and liabilities on the other, like any corporate entity. The assets consist of cash, lending, financial and fixed assets. On the other side of the balance sheet are its liabilities, deposits, and debt. In this respect, a bank’s equity and its liabilities are its source of funds, and its assets are its use of funds. This is explained by Klein ( 1971 ), who notes that a bank’s equity W , borrowed funds and its deposits B is equal to its total funds F . This is the same for incumbents and challengers. This can be depicted algebraically if we let incumbents be represented by Φ and challengers represented by Γ:

Klein ( 1971 ) further explains that a bank’s equity is therefore made up of its share capital and unimpaired reserves. The latter are held by a bank to protect the bank’s deposit clients. This part is also mandated by regulation, so as to protect customers and indeed the entire banking system from systemic failure. These protective measures include other prudential requirements to hold cash reserves or other liquid assets. As shall be shown, banking services can be performed over the Internet without these protections. Banking as a service, as this phenomenon known, is expected to increase in the future. This will change the nature of the protection available to clients. It will change the way banks transform assets, explained next.

A bank’s deposits are said to be a function of the proportion of total funds obtained through the issuance of the ith deposit type and its total funds F , represented by α i . Where deposits, represented by Bs , are made in the form of Bs (i = 1 *s n) , they generate a rate of interest. It follows that Si Bs = B . As such,

Therefor it can be said that,

The importance of Eq. 3 is that the balance sheet can be leveraged by the issuance of loans. It should be noted, however, that not all loans are returned to the bank in whole or part. Non-performing loans reduce the asset side of a bank’s balance sheet and act as a constraint on capital, and therefore new lending. Clearly, this is not the case with banking as a service. In that model, loans are brokered. That said, with the traditional model, an advantage of financial technology is that it facilitates the data mining of clients’ accounts. Lending can therefore be more targeted to borrowers that are more likely to repay, thereby reducing non-performing loans. Pari passu, the incumbent bank of the future will therefore have a higher risk-adjusted return on capital. In practice, however, banking as a service will bring greater competition from challengers and possible further erosion of margins. Alternatively, some banks will proactively engage in partnerships and acquisitions to maintain their customer base and address the competition.

A bank must have reserves to meet the demand of customers demanding their deposits back. The amount of these reserves is a key function of banking regulation. The Basel Committee on Banking Supervision mandates a requirement to hold various tiers of capital, so that banks have sufficient reserves to protect depositors. The Committee also imposes a framework for mitigating excessive liquidity risk and maturity transformation, through a set Liquidity Coverage Ratio and Net Stable Funding Ratio.

Recent revisions of theory, because of financial technology advances, have altered our understanding of banking intermediation. This will impact the competitive landscape and therefor shape the nature of the bank of the future. In this respect, the threat to incumbent banks comes from peer-to-peer Internet lending platforms. These perform the brokerage function of financial intermediation without the use of the aforementioned banking balance sheet. Unlike regulated deposit takers, such lending platforms do not create assets and do not perform risk and asset transformation. That said, they are reliant on investors who do not always behave in a counter cyclical way.

Financial technology in banking is not new. It has been used to facilitate electronic markets since the 1980’s. Thakor ( 2020 ) refers to three waves of application of financial innovation in banking. The advent of institutional futures markets and the changing nature of financial contracts fundamentally changed the role of banks. In response to this, academics extended the concept of a bank into an entity that either fulfills the aforementioned functions of a broker or a qualitative asset transformer. In this respect, they connect the providers and users of capital without changing the nature of the transformation of the various claims to that capital. This transformation can be in the form risk transfer or the application of leverage. The nature of trading of financial assets, however, is changing. Price discovery can now be done over the Internet and that is moving liquidity from central marketplaces (like the stock exchange) to decentralized ones.

Alongside these trends, in considering what the bank of the future will look like, it is necessary to understand the unregulated lending market that competes with traditional banks. In this part of the lending market, there has been a rise in shadow banks. The literature on these entities is covered by Adrian and Ashcraft ( 2016 ). Shadow banks have taken substantial market share from the traditional banks. They fulfil the brokerage function of banks, but regulators have only partial oversight of their risk transformation or leverage. The rise of shadow banks has been facilitated by financial technology and the originate to distribute model documented by Bord and Santos ( 2012 ). They use alternative trading systems that function as electronic communication networks. These facilitate dark pools of liquidity whereby buyers and sellers of bonds and securities trade off-exchange. Since the credit crisis of 2008, total broker dealer assets have diverged from banking assets. This illustrates the changed lending environment.

In the disintermediated market, banking as a service providers must rely on their equity and what access to funding they can attract from their online network. Without this they are unable to drive lending growth. To explain this, let I represent the online network. Extending Klein ( 1971 ), further let Ψ represent banking as a service and their total funds by F . This state is depicted as,

Theoretically, it can be shown that,

Shadow banks, and those disintermediators who bypass the banking system, have an advantage in a world where technology is ubiquitous. This becomes more apparent when costs are considered. Buchak et al. ( 2018 ) point out that shadow banks finance their originations almost entirely through securitization and what they term the originate to distribute business model. Diversifying risk in this way is good for individual banks, as banking risks can be transferred away from traditional banking balance sheets to institutional balance sheets. That said, the rise of securitization has introduced systemic risk into the banking sector.

Thus, we can see that the nature of banking capital is changing and at the same time technology is replacing labor. Let A denote the number of transactions per account at a period in time, and C denote the total cost per account per time period of providing the services of the payment mechanism. Klein ( 1971 ) points out that, if capital and labor are assumed to be part of the traditional banking model, it can be observed that,

It can therefore be observed that the total service charge per account at a period in time, represented by S, has a linear and proportional relationship to bank account activity. This is another variable that financial technology can impact. According to Klein ( 1971 ) this can be summed up in the following way,

where d is the basic bank decision variable, the service charge per transaction. Once again, in an automated and digital environment, financial technology greatly reduces d for the challenger banks. Swankie and Broby ( 2019 ) examine the impact of Artificial Intelligence on the evaluation of banking risk and conclude that it improves such variables.

Meanwhile, the traditional banking model can be expressed as a product of the number of accounts, M , and the average size of an account, N . This suggests a banks implicit yield is it rate of interest on deposits adjusted by its operating loss in each time period. This yield is generated by payment and loan services. Let R 1 depict this. These can be expressed as a fraction of total demand deposits. This is depicted by Klein ( 1971 ), if one assumes activity per account is constant, as,

As a result, whether a bank is structured with traditional labor overheads or built digitally, is extremely relevant to its profitability. The capital and labor of tradition banks, depicted as Φ i , is greater than online networks, depicted as I i . As such, the later have an advantage. This can be shown as,

What Klein (1972) failed to highlight is that the banking inherently involves leverage. Diamond and Dybving (1983) show that leverage makes bank susceptible to run on their liquidity. The literature divides these between adverse shock events, as explained by Bernanke et al ( 1996 ) or moral hazard events as explained by Demirgu¨¸c-Kunt and Detragiache ( 2002 ). This leverage builds on the balance sheet mismatch of short-term assets with long term liabilities. As such, capital and liquidity are intrinsically linked to viability and solvency.

The way capital and liquidity are managed is through credit and default management. This is done at a bank level and a supervisory level. The Basel Committee on Banking Supervision applies capital and leverage ratios, and central banks manage interest rates and other counter-cyclical measures. The various iterations of the prudential regulation of banks have moved the microeconomic theory of banking from the modeling of risk to the modeling of imperfect information. As mentioned, shadow and disintermediated services do not fall under this form or prudential regulation.

The relationship between leverage and insolvency risk crucially depends on the degree of banks total funds F and their liability structure L . In this respect, the liability structure of traditional banks is also greater than online networks which do not have the same level of available funds, depicted as,

Diamond and Dybvig ( 1983 ) observe that this liability structure is intimately tied to a traditional bank’s assets. In this respect, a bank’s ability to finance its lending at low cost and its ability to achieve repayment are key to its avoidance of insolvency. Online networks and/or brokers do not have to finance their lending, simply source it. Similarly, as brokers they do not face capital loss in the event of a default. This disintermediates the bank through the use of a peer-to-peer environment. These lenders and borrowers are introduced in digital way over the internet. Regulators have taken notice and the digital broker advantage might not last forever. As a result, the future may well see greater cooperation between these competing parties. This also because banks have valuable operational experience compared to new entrants.

It should also be observed that bank lending is either secured or unsecured. Interest on an unsecured loan is typically higher than the interest on a secured loan. In this respect, incumbent banks have an advantage as their closeness to the customer allows them to better understand the security of the assets. Berger et al ( 2005 ) further differentiate lending into transaction lending, relationship lending and credit scoring.

The evolution of the business model in a digital world

As has been demonstrated, the bank of the future in its various manifestations will be a consequence of the evolution of the current banking business model. There has been considerable scholarly investigation into the uniqueness of this business model, but less so on its changing nature. Song and Thakor ( 2010 ) are helpful in this respect and suggest that there are three aspects to this evolution, namely competition, complementary and co-evolution. Although liquidity transformation is evolving, it remains central to a bank’s role.

All the dynamics mentioned are relevant to the economy. There is considerable evidence, as outlined by Levine ( 2001 ), that market liberalization has a causal impact on economic growth. The impact of technology on productivity should prove positive and enhance the functioning of the domestic financial system. Indeed, market liberalization has already reshaped banking by increasing competition. New fee based ancillary financial services have become widespread, as has the proprietorial use of balance sheets. Risk has been securitized and even packaged into trade-able products.

Challenger banks are developing in a complementary way with the incumbents. The latter have an advantage over new entrants because they have information on their customers. The liquidity insurance model, proposed by Diamond and Dybvig ( 1983 ), explains how such banks have informational advantages over exchange markets. That said, financial technology changes these dynamics. It if facilitating the processing of financial data by third parties, explained in greater detail in the section on Open Banking.

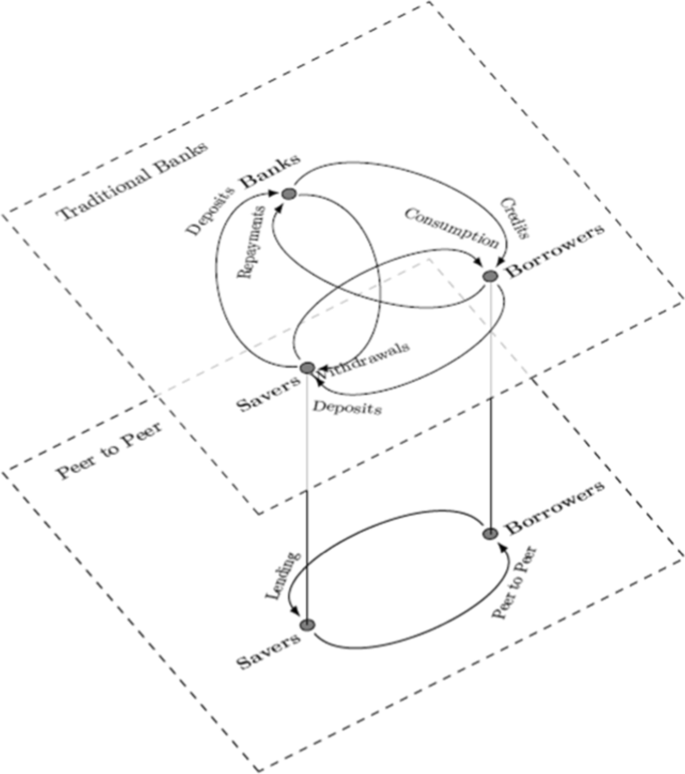

At the same time, financial technology is facilitating banking as a service. This is where financial services are delivered by a broker over the Internet without resort to the balance sheet. This includes roboadvisory asset management, peer to peer lending, and crowd funding. Its growth will be facilitated by Open Banking as it becomes more geographically adopted. Figure 3 illustrates how these business models are disintermediating the traditional banking role and matching burrowers and savers.

The traditional view of banks ecosystem between savers and borrowers, atop the Internet which is matching savers and borrowers directly in a peer-to-peer way. The Klein ( 1971 ) theory of the banking firm does not incorporate the mirrored dynamics, and as such needs to be extended to reflect the digital innovation that impacts both borrowers and severs in a peer-to-peer environment

Meanwhile, the banking sector is co-evolving alongside a shadow banking phenomenon. Lenders and borrowers are interacting, but outside of the banking sector. This is a concern for central banks and banking regulators, as the lending is taking place in an unregulated environment. Shadow banking has grown because of financial technology, market liberalization and excess liquidity in the asset management ecosystem. Pozsar and Singh ( 2011 ) detail the non-bank/bank intersection of shadow banking. They point out that shadow banking results in reverse maturity transformation. Incumbent banks have blurred the distinction between their use of traditional (M2) liabilities and market-based shadow banking (non-M2) liabilities. This impacts the inter-generational transfers that enable a bank to achieve interest rate smoothing.

Securitization has transformed the risk in the banking sector, transferring it to asset management institutions. These include structured investment vehicles, securities lenders, asset backed commercial paper investors, credit focused hedge and money market funds. This in turn has led to greater systemic risk, the result of the nature of the non-traded liabilities of securitized pooling arrangements. This increased risk manifested itself in the 2008 credit crisis.

Commercial pressures are also shaping the banking industry. The drive for cost efficiency has made incumbent banks address their personally costs. Bank branches have been closed as technology has evolved. Branches make it easier to withdraw or transfer deposits and challenger banks are not as easily able to attract new deposits. The banking sector is therefore looking for new point of customer contact, such as supermarkets, post offices and social media platforms. These structural issues are occurring at the same time as the retail high street is also evolving. Banks have had an aggressive roll out of automated telling machines and a reduction in branches and headcount. Online digital transactions have now become the norm in most developed countries.

The financing of banks is also evolving. Traditional banks have tended to fund illiquid assets with short term and unstable liquid liabilities. This is one of the key contributors to the rise to the credit crisis of 2008. The provision of liquidity as a last resort is central to the asset transformation process. In this respect, the banking sector experienced a shock in 2008 in what is termed the credit crisis. The aforementioned liquidity mismatch resulted in the system not being able to absorb all the risks associated with subprime lending. Central banks had to resort to quantitative easing as a result of the failure of overnight funding mechanisms. The image of the entire banking sector was tarnished, and the banks of the future will have to address this.

The future must learn from the mistakes of the past. The structural weakness of the banking business model cannot be solved. That said, the latest Basel rules introduce further risk mitigation, improved leverage ratios and increased levels of capital reserve. Another lesson of the credit crisis was that there should be greater emphasis on risk culture, governance, and oversight. The independence and performance of the board, the experience and the skill set of senior management are now a greater focus of regulators. Internal controls and data analysis are increasingly more robust and efficient, with a greater focus on a banks stable funding ratio.

Meanwhile, the very nature of money is changing. A digital wallet for crypto-currencies fulfills much the same storage and transmission functions of a bank; and crypto-currencies are increasing being used for payment. Meanwhile, in Sweden, stores have the right to refuse cash and the majority of transactions are card based. This move to credit and debit cards, and the solving of the double spending problem, whereby digital money can be crypto-graphically protected, has led to the possibility that paper money could be replaced at some point in the future. Whether this might be by replacement by a CBDC, or decentralized digital offering, is of secondary importance to the requirement of banks to adapt. Whether accommodating crytpo-currencies or CBDC’s, Kou et al. ( 2021 ) recommend that banks keep focused on alternative payment and money transferring technologies.

Central banks also have to adapt. To limit disintermediation, they have to ensure that the economic design of their sponsored digital currencies focus on access for banks, interest payment relative to bank policy rate, banking holding limits and convertibility with bank deposits. All these developments have implications for banks, particularly in respect of funding, the secure storage of deposits and how digital currency interacts with traditional fiat money.

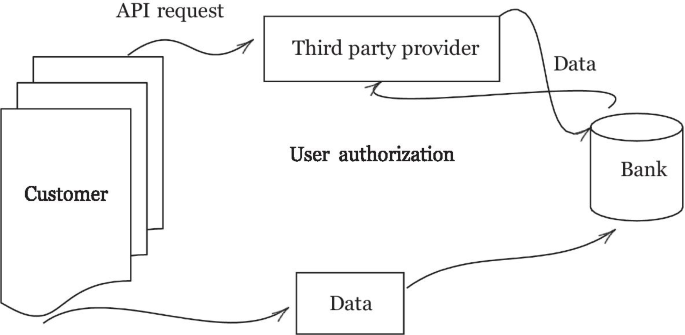

Open banking

Against the backdrop of all these trends and changes, a new dynamic is shaping the future of the banking sector. This is termed Open Banking, already briefly mentioned. This new way of handling banking data protocols introduces a secure way to give financial service companies consensual access to a bank’s customer financial information. Figure 4 illustrates how this works. Although a fairly simple concept, the implications are important for the banking industry. Essentially, a bank customer gives a regulated API permission to securely access his/her banking website. That is then used by a banking as a service entity to make direct payments and/or download financial data in order to provide a solution. It heralds an era of customer centric banking.

How Open Banking operates. The customer generates data by using his bank account. A third party provider is authorized to access that data through an API request. The bank confirms digitally that the customer has authorized the exchange of data and then fulfills the request

Open Banking was a response to the documented inertia around individual’s willingness to change bank accounts. Following the Retail Banking Review in the UK, this was addressed by lawmakers through the European Union’s Payment Services Directive II. The legislation was designed to make it easier to change banks by allowing customers to delegate authority to transfer their financial data to other parties. As a result of this, a whole host of data centric applications were conceived. Open banking adds further momentum to reshaping the future of banking.