Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

Methodology

- Survey Research | Definition, Examples & Methods

Survey Research | Definition, Examples & Methods

Published on August 20, 2019 by Shona McCombes . Revised on June 22, 2023.

Survey research means collecting information about a group of people by asking them questions and analyzing the results. To conduct an effective survey, follow these six steps:

- Determine who will participate in the survey

- Decide the type of survey (mail, online, or in-person)

- Design the survey questions and layout

- Distribute the survey

- Analyze the responses

- Write up the results

Surveys are a flexible method of data collection that can be used in many different types of research .

Table of contents

What are surveys used for, step 1: define the population and sample, step 2: decide on the type of survey, step 3: design the survey questions, step 4: distribute the survey and collect responses, step 5: analyze the survey results, step 6: write up the survey results, other interesting articles, frequently asked questions about surveys.

Surveys are used as a method of gathering data in many different fields. They are a good choice when you want to find out about the characteristics, preferences, opinions, or beliefs of a group of people.

Common uses of survey research include:

- Social research : investigating the experiences and characteristics of different social groups

- Market research : finding out what customers think about products, services, and companies

- Health research : collecting data from patients about symptoms and treatments

- Politics : measuring public opinion about parties and policies

- Psychology : researching personality traits, preferences and behaviours

Surveys can be used in both cross-sectional studies , where you collect data just once, and in longitudinal studies , where you survey the same sample several times over an extended period.

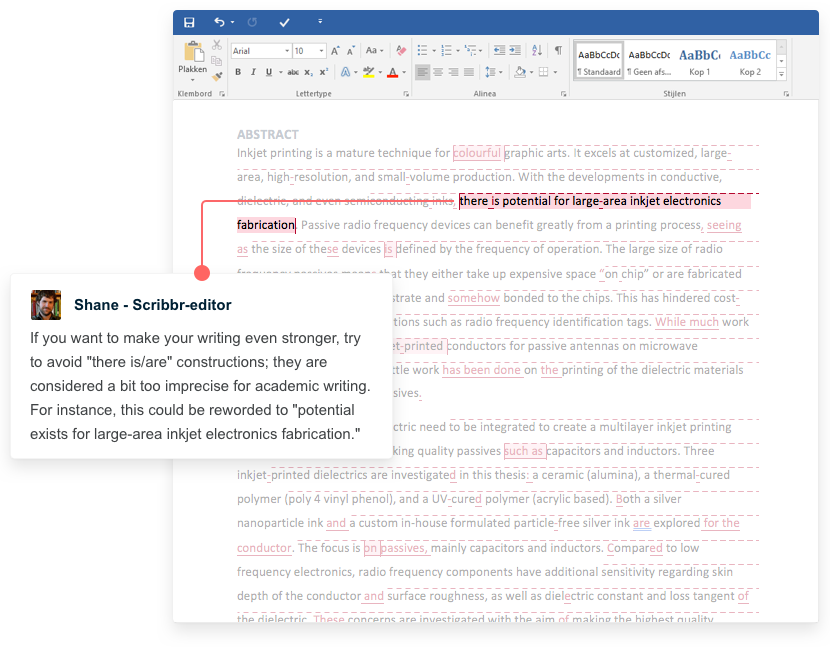

Receive feedback on language, structure, and formatting

Professional editors proofread and edit your paper by focusing on:

- Academic style

- Vague sentences

- Style consistency

See an example

Before you start conducting survey research, you should already have a clear research question that defines what you want to find out. Based on this question, you need to determine exactly who you will target to participate in the survey.

Populations

The target population is the specific group of people that you want to find out about. This group can be very broad or relatively narrow. For example:

- The population of Brazil

- US college students

- Second-generation immigrants in the Netherlands

- Customers of a specific company aged 18-24

- British transgender women over the age of 50

Your survey should aim to produce results that can be generalized to the whole population. That means you need to carefully define exactly who you want to draw conclusions about.

Several common research biases can arise if your survey is not generalizable, particularly sampling bias and selection bias . The presence of these biases have serious repercussions for the validity of your results.

It’s rarely possible to survey the entire population of your research – it would be very difficult to get a response from every person in Brazil or every college student in the US. Instead, you will usually survey a sample from the population.

The sample size depends on how big the population is. You can use an online sample calculator to work out how many responses you need.

There are many sampling methods that allow you to generalize to broad populations. In general, though, the sample should aim to be representative of the population as a whole. The larger and more representative your sample, the more valid your conclusions. Again, beware of various types of sampling bias as you design your sample, particularly self-selection bias , nonresponse bias , undercoverage bias , and survivorship bias .

There are two main types of survey:

- A questionnaire , where a list of questions is distributed by mail, online or in person, and respondents fill it out themselves.

- An interview , where the researcher asks a set of questions by phone or in person and records the responses.

Which type you choose depends on the sample size and location, as well as the focus of the research.

Questionnaires

Sending out a paper survey by mail is a common method of gathering demographic information (for example, in a government census of the population).

- You can easily access a large sample.

- You have some control over who is included in the sample (e.g. residents of a specific region).

- The response rate is often low, and at risk for biases like self-selection bias .

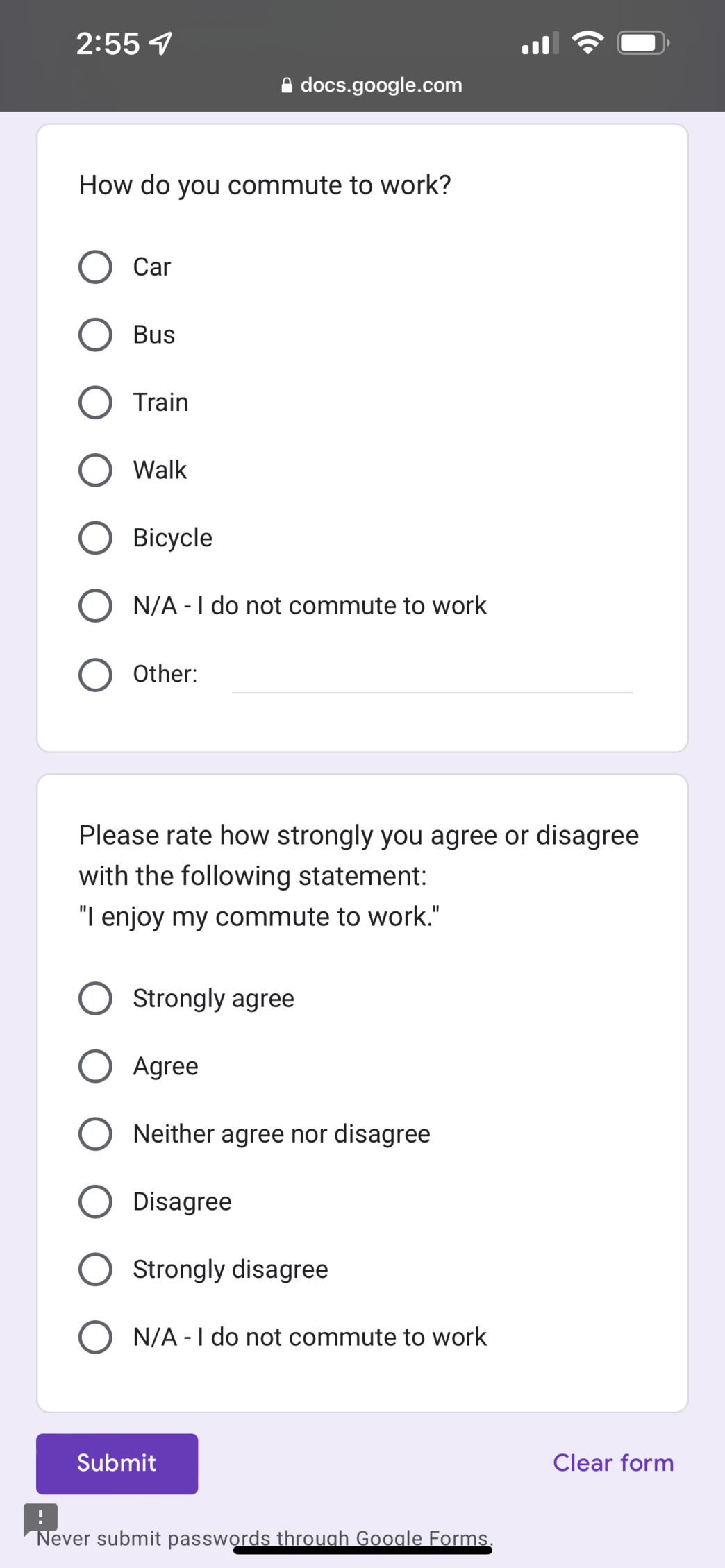

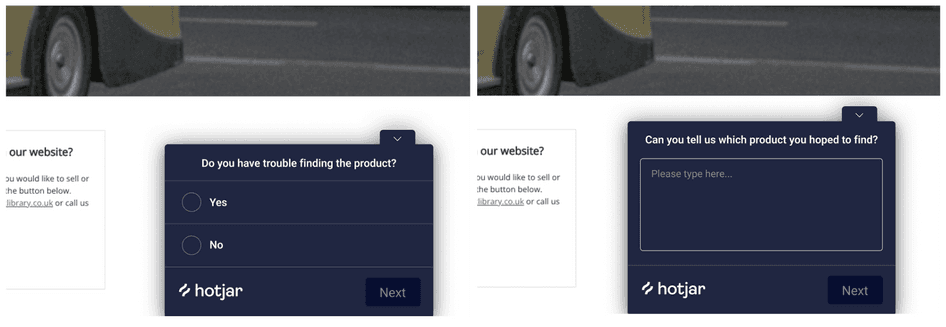

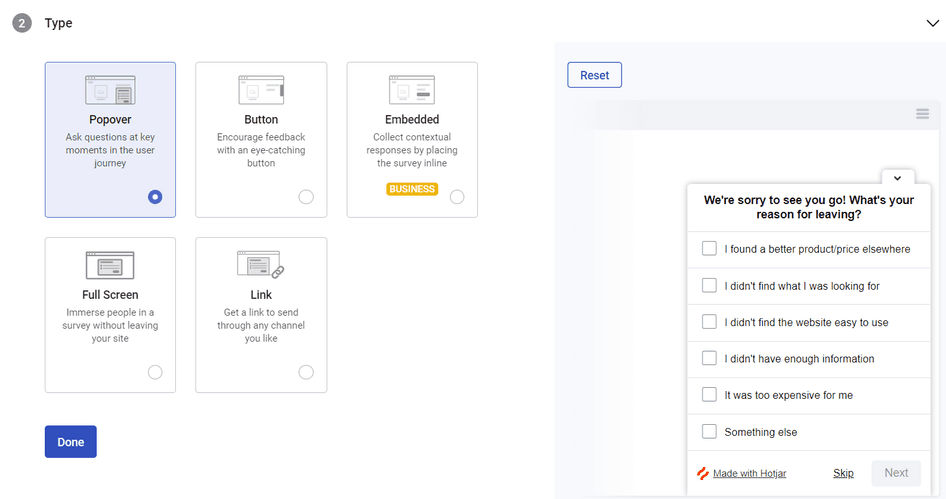

Online surveys are a popular choice for students doing dissertation research , due to the low cost and flexibility of this method. There are many online tools available for constructing surveys, such as SurveyMonkey and Google Forms .

- You can quickly access a large sample without constraints on time or location.

- The data is easy to process and analyze.

- The anonymity and accessibility of online surveys mean you have less control over who responds, which can lead to biases like self-selection bias .

If your research focuses on a specific location, you can distribute a written questionnaire to be completed by respondents on the spot. For example, you could approach the customers of a shopping mall or ask all students to complete a questionnaire at the end of a class.

- You can screen respondents to make sure only people in the target population are included in the sample.

- You can collect time- and location-specific data (e.g. the opinions of a store’s weekday customers).

- The sample size will be smaller, so this method is less suitable for collecting data on broad populations and is at risk for sampling bias .

Oral interviews are a useful method for smaller sample sizes. They allow you to gather more in-depth information on people’s opinions and preferences. You can conduct interviews by phone or in person.

- You have personal contact with respondents, so you know exactly who will be included in the sample in advance.

- You can clarify questions and ask for follow-up information when necessary.

- The lack of anonymity may cause respondents to answer less honestly, and there is more risk of researcher bias.

Like questionnaires, interviews can be used to collect quantitative data: the researcher records each response as a category or rating and statistically analyzes the results. But they are more commonly used to collect qualitative data : the interviewees’ full responses are transcribed and analyzed individually to gain a richer understanding of their opinions and feelings.

Next, you need to decide which questions you will ask and how you will ask them. It’s important to consider:

- The type of questions

- The content of the questions

- The phrasing of the questions

- The ordering and layout of the survey

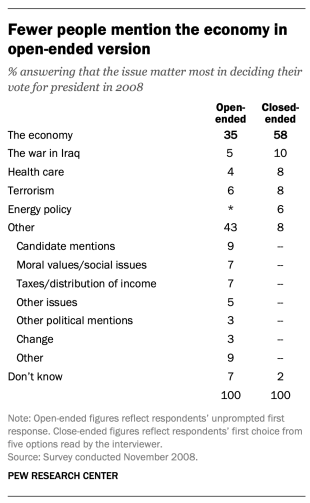

Open-ended vs closed-ended questions

There are two main forms of survey questions: open-ended and closed-ended. Many surveys use a combination of both.

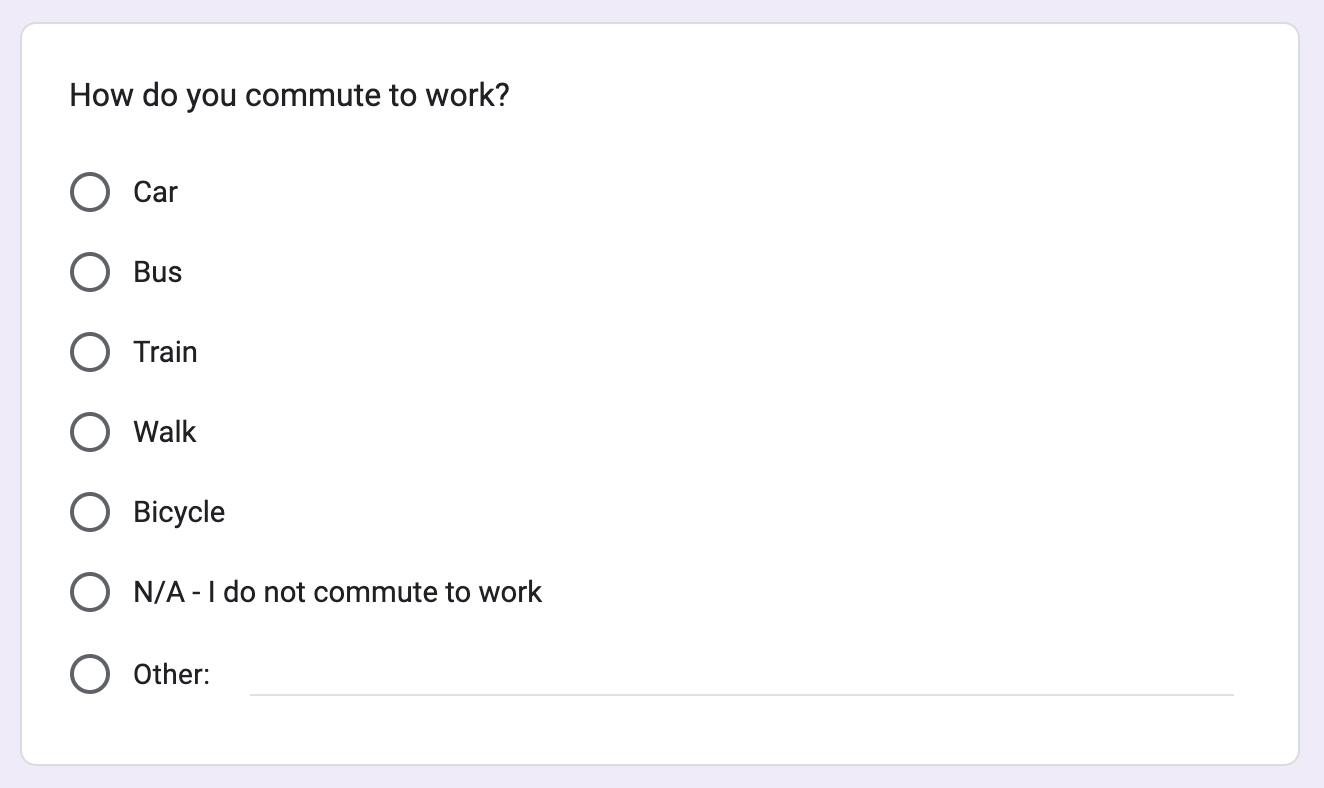

Closed-ended questions give the respondent a predetermined set of answers to choose from. A closed-ended question can include:

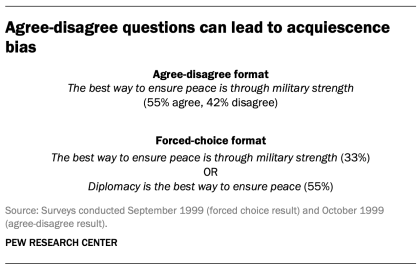

- A binary answer (e.g. yes/no or agree/disagree )

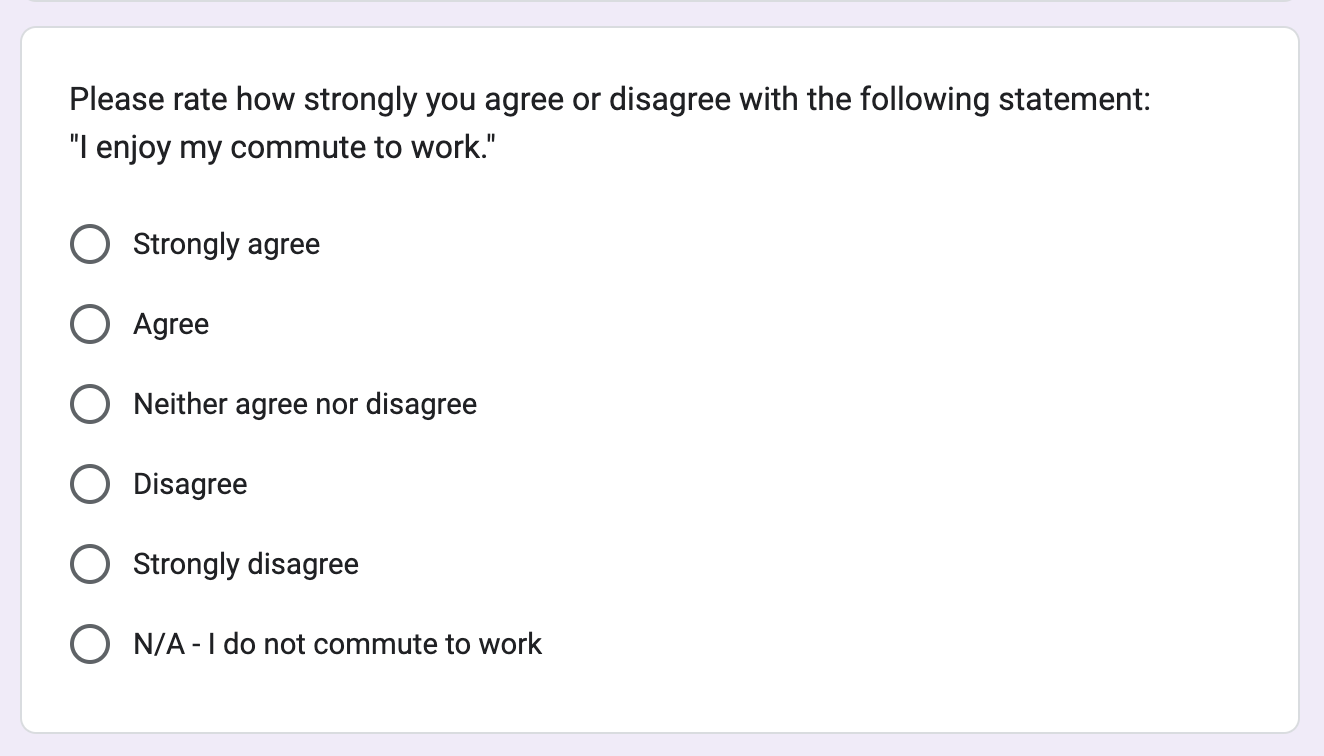

- A scale (e.g. a Likert scale with five points ranging from strongly agree to strongly disagree )

- A list of options with a single answer possible (e.g. age categories)

- A list of options with multiple answers possible (e.g. leisure interests)

Closed-ended questions are best for quantitative research . They provide you with numerical data that can be statistically analyzed to find patterns, trends, and correlations .

Open-ended questions are best for qualitative research. This type of question has no predetermined answers to choose from. Instead, the respondent answers in their own words.

Open questions are most common in interviews, but you can also use them in questionnaires. They are often useful as follow-up questions to ask for more detailed explanations of responses to the closed questions.

The content of the survey questions

To ensure the validity and reliability of your results, you need to carefully consider each question in the survey. All questions should be narrowly focused with enough context for the respondent to answer accurately. Avoid questions that are not directly relevant to the survey’s purpose.

When constructing closed-ended questions, ensure that the options cover all possibilities. If you include a list of options that isn’t exhaustive, you can add an “other” field.

Phrasing the survey questions

In terms of language, the survey questions should be as clear and precise as possible. Tailor the questions to your target population, keeping in mind their level of knowledge of the topic. Avoid jargon or industry-specific terminology.

Survey questions are at risk for biases like social desirability bias , the Hawthorne effect , or demand characteristics . It’s critical to use language that respondents will easily understand, and avoid words with vague or ambiguous meanings. Make sure your questions are phrased neutrally, with no indication that you’d prefer a particular answer or emotion.

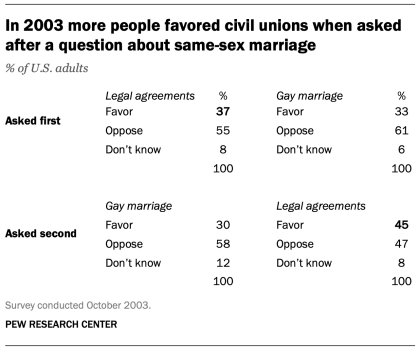

Ordering the survey questions

The questions should be arranged in a logical order. Start with easy, non-sensitive, closed-ended questions that will encourage the respondent to continue.

If the survey covers several different topics or themes, group together related questions. You can divide a questionnaire into sections to help respondents understand what is being asked in each part.

If a question refers back to or depends on the answer to a previous question, they should be placed directly next to one another.

Before you start, create a clear plan for where, when, how, and with whom you will conduct the survey. Determine in advance how many responses you require and how you will gain access to the sample.

When you are satisfied that you have created a strong research design suitable for answering your research questions, you can conduct the survey through your method of choice – by mail, online, or in person.

There are many methods of analyzing the results of your survey. First you have to process the data, usually with the help of a computer program to sort all the responses. You should also clean the data by removing incomplete or incorrectly completed responses.

If you asked open-ended questions, you will have to code the responses by assigning labels to each response and organizing them into categories or themes. You can also use more qualitative methods, such as thematic analysis , which is especially suitable for analyzing interviews.

Statistical analysis is usually conducted using programs like SPSS or Stata. The same set of survey data can be subject to many analyses.

Finally, when you have collected and analyzed all the necessary data, you will write it up as part of your thesis, dissertation , or research paper .

In the methodology section, you describe exactly how you conducted the survey. You should explain the types of questions you used, the sampling method, when and where the survey took place, and the response rate. You can include the full questionnaire as an appendix and refer to it in the text if relevant.

Then introduce the analysis by describing how you prepared the data and the statistical methods you used to analyze it. In the results section, you summarize the key results from your analysis.

In the discussion and conclusion , you give your explanations and interpretations of these results, answer your research question, and reflect on the implications and limitations of the research.

If you want to know more about statistics , methodology , or research bias , make sure to check out some of our other articles with explanations and examples.

- Student’s t -distribution

- Normal distribution

- Null and Alternative Hypotheses

- Chi square tests

- Confidence interval

- Quartiles & Quantiles

- Cluster sampling

- Stratified sampling

- Data cleansing

- Reproducibility vs Replicability

- Peer review

- Prospective cohort study

Research bias

- Implicit bias

- Cognitive bias

- Placebo effect

- Hawthorne effect

- Hindsight bias

- Affect heuristic

- Social desirability bias

A questionnaire is a data collection tool or instrument, while a survey is an overarching research method that involves collecting and analyzing data from people using questionnaires.

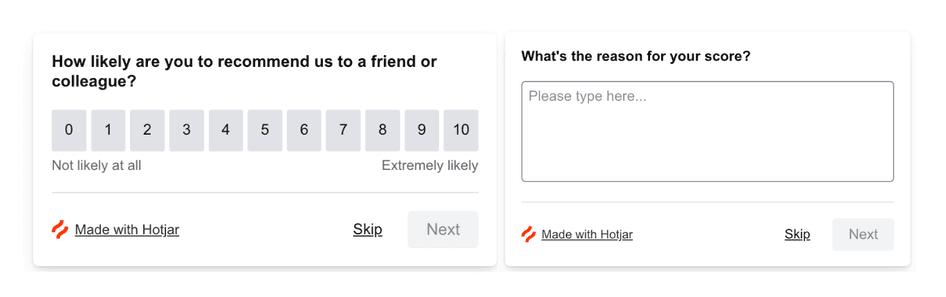

A Likert scale is a rating scale that quantitatively assesses opinions, attitudes, or behaviors. It is made up of 4 or more questions that measure a single attitude or trait when response scores are combined.

To use a Likert scale in a survey , you present participants with Likert-type questions or statements, and a continuum of items, usually with 5 or 7 possible responses, to capture their degree of agreement.

Individual Likert-type questions are generally considered ordinal data , because the items have clear rank order, but don’t have an even distribution.

Overall Likert scale scores are sometimes treated as interval data. These scores are considered to have directionality and even spacing between them.

The type of data determines what statistical tests you should use to analyze your data.

The priorities of a research design can vary depending on the field, but you usually have to specify:

- Your research questions and/or hypotheses

- Your overall approach (e.g., qualitative or quantitative )

- The type of design you’re using (e.g., a survey , experiment , or case study )

- Your sampling methods or criteria for selecting subjects

- Your data collection methods (e.g., questionnaires , observations)

- Your data collection procedures (e.g., operationalization , timing and data management)

- Your data analysis methods (e.g., statistical tests or thematic analysis )

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

McCombes, S. (2023, June 22). Survey Research | Definition, Examples & Methods. Scribbr. Retrieved April 15, 2024, from https://www.scribbr.com/methodology/survey-research/

Is this article helpful?

Shona McCombes

Other students also liked, qualitative vs. quantitative research | differences, examples & methods, questionnaire design | methods, question types & examples, what is a likert scale | guide & examples, "i thought ai proofreading was useless but..".

I've been using Scribbr for years now and I know it's a service that won't disappoint. It does a good job spotting mistakes”

- Privacy Policy

Buy Me a Coffee

Home » Survey Research – Types, Methods, Examples

Survey Research – Types, Methods, Examples

Table of Contents

Survey Research

Definition:

Survey Research is a quantitative research method that involves collecting standardized data from a sample of individuals or groups through the use of structured questionnaires or interviews. The data collected is then analyzed statistically to identify patterns and relationships between variables, and to draw conclusions about the population being studied.

Survey research can be used to answer a variety of questions, including:

- What are people’s opinions about a certain topic?

- What are people’s experiences with a certain product or service?

- What are people’s beliefs about a certain issue?

Survey Research Methods

Survey Research Methods are as follows:

- Telephone surveys: A survey research method where questions are administered to respondents over the phone, often used in market research or political polling.

- Face-to-face surveys: A survey research method where questions are administered to respondents in person, often used in social or health research.

- Mail surveys: A survey research method where questionnaires are sent to respondents through mail, often used in customer satisfaction or opinion surveys.

- Online surveys: A survey research method where questions are administered to respondents through online platforms, often used in market research or customer feedback.

- Email surveys: A survey research method where questionnaires are sent to respondents through email, often used in customer satisfaction or opinion surveys.

- Mixed-mode surveys: A survey research method that combines two or more survey modes, often used to increase response rates or reach diverse populations.

- Computer-assisted surveys: A survey research method that uses computer technology to administer or collect survey data, often used in large-scale surveys or data collection.

- Interactive voice response surveys: A survey research method where respondents answer questions through a touch-tone telephone system, often used in automated customer satisfaction or opinion surveys.

- Mobile surveys: A survey research method where questions are administered to respondents through mobile devices, often used in market research or customer feedback.

- Group-administered surveys: A survey research method where questions are administered to a group of respondents simultaneously, often used in education or training evaluation.

- Web-intercept surveys: A survey research method where questions are administered to website visitors, often used in website or user experience research.

- In-app surveys: A survey research method where questions are administered to users of a mobile application, often used in mobile app or user experience research.

- Social media surveys: A survey research method where questions are administered to respondents through social media platforms, often used in social media or brand awareness research.

- SMS surveys: A survey research method where questions are administered to respondents through text messaging, often used in customer feedback or opinion surveys.

- IVR surveys: A survey research method where questions are administered to respondents through an interactive voice response system, often used in automated customer feedback or opinion surveys.

- Mixed-method surveys: A survey research method that combines both qualitative and quantitative data collection methods, often used in exploratory or mixed-method research.

- Drop-off surveys: A survey research method where respondents are provided with a survey questionnaire and asked to return it at a later time or through a designated drop-off location.

- Intercept surveys: A survey research method where respondents are approached in public places and asked to participate in a survey, often used in market research or customer feedback.

- Hybrid surveys: A survey research method that combines two or more survey modes, data sources, or research methods, often used in complex or multi-dimensional research questions.

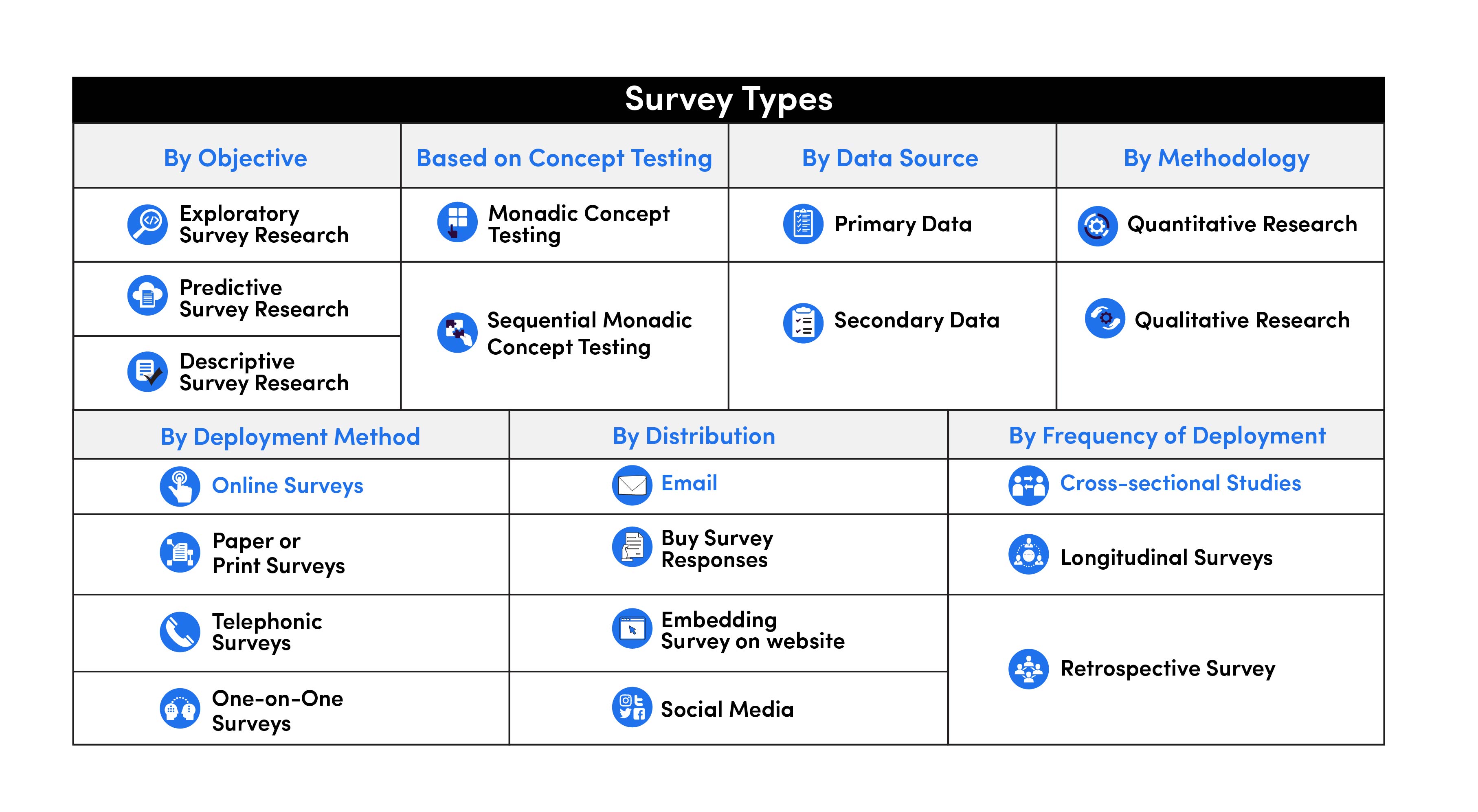

Types of Survey Research

There are several types of survey research that can be used to collect data from a sample of individuals or groups. following are Types of Survey Research:

- Cross-sectional survey: A type of survey research that gathers data from a sample of individuals at a specific point in time, providing a snapshot of the population being studied.

- Longitudinal survey: A type of survey research that gathers data from the same sample of individuals over an extended period of time, allowing researchers to track changes or trends in the population being studied.

- Panel survey: A type of longitudinal survey research that tracks the same sample of individuals over time, typically collecting data at multiple points in time.

- Epidemiological survey: A type of survey research that studies the distribution and determinants of health and disease in a population, often used to identify risk factors and inform public health interventions.

- Observational survey: A type of survey research that collects data through direct observation of individuals or groups, often used in behavioral or social research.

- Correlational survey: A type of survey research that measures the degree of association or relationship between two or more variables, often used to identify patterns or trends in data.

- Experimental survey: A type of survey research that involves manipulating one or more variables to observe the effect on an outcome, often used to test causal hypotheses.

- Descriptive survey: A type of survey research that describes the characteristics or attributes of a population or phenomenon, often used in exploratory research or to summarize existing data.

- Diagnostic survey: A type of survey research that assesses the current state or condition of an individual or system, often used in health or organizational research.

- Explanatory survey: A type of survey research that seeks to explain or understand the causes or mechanisms behind a phenomenon, often used in social or psychological research.

- Process evaluation survey: A type of survey research that measures the implementation and outcomes of a program or intervention, often used in program evaluation or quality improvement.

- Impact evaluation survey: A type of survey research that assesses the effectiveness or impact of a program or intervention, often used to inform policy or decision-making.

- Customer satisfaction survey: A type of survey research that measures the satisfaction or dissatisfaction of customers with a product, service, or experience, often used in marketing or customer service research.

- Market research survey: A type of survey research that collects data on consumer preferences, behaviors, or attitudes, often used in market research or product development.

- Public opinion survey: A type of survey research that measures the attitudes, beliefs, or opinions of a population on a specific issue or topic, often used in political or social research.

- Behavioral survey: A type of survey research that measures actual behavior or actions of individuals, often used in health or social research.

- Attitude survey: A type of survey research that measures the attitudes, beliefs, or opinions of individuals, often used in social or psychological research.

- Opinion poll: A type of survey research that measures the opinions or preferences of a population on a specific issue or topic, often used in political or media research.

- Ad hoc survey: A type of survey research that is conducted for a specific purpose or research question, often used in exploratory research or to answer a specific research question.

Types Based on Methodology

Based on Methodology Survey are divided into two Types:

Quantitative Survey Research

Qualitative survey research.

Quantitative survey research is a method of collecting numerical data from a sample of participants through the use of standardized surveys or questionnaires. The purpose of quantitative survey research is to gather empirical evidence that can be analyzed statistically to draw conclusions about a particular population or phenomenon.

In quantitative survey research, the questions are structured and pre-determined, often utilizing closed-ended questions, where participants are given a limited set of response options to choose from. This approach allows for efficient data collection and analysis, as well as the ability to generalize the findings to a larger population.

Quantitative survey research is often used in market research, social sciences, public health, and other fields where numerical data is needed to make informed decisions and recommendations.

Qualitative survey research is a method of collecting non-numerical data from a sample of participants through the use of open-ended questions or semi-structured interviews. The purpose of qualitative survey research is to gain a deeper understanding of the experiences, perceptions, and attitudes of participants towards a particular phenomenon or topic.

In qualitative survey research, the questions are open-ended, allowing participants to share their thoughts and experiences in their own words. This approach allows for a rich and nuanced understanding of the topic being studied, and can provide insights that are difficult to capture through quantitative methods alone.

Qualitative survey research is often used in social sciences, education, psychology, and other fields where a deeper understanding of human experiences and perceptions is needed to inform policy, practice, or theory.

Data Analysis Methods

There are several Survey Research Data Analysis Methods that researchers may use, including:

- Descriptive statistics: This method is used to summarize and describe the basic features of the survey data, such as the mean, median, mode, and standard deviation. These statistics can help researchers understand the distribution of responses and identify any trends or patterns.

- Inferential statistics: This method is used to make inferences about the larger population based on the data collected in the survey. Common inferential statistical methods include hypothesis testing, regression analysis, and correlation analysis.

- Factor analysis: This method is used to identify underlying factors or dimensions in the survey data. This can help researchers simplify the data and identify patterns and relationships that may not be immediately apparent.

- Cluster analysis: This method is used to group similar respondents together based on their survey responses. This can help researchers identify subgroups within the larger population and understand how different groups may differ in their attitudes, behaviors, or preferences.

- Structural equation modeling: This method is used to test complex relationships between variables in the survey data. It can help researchers understand how different variables may be related to one another and how they may influence one another.

- Content analysis: This method is used to analyze open-ended responses in the survey data. Researchers may use software to identify themes or categories in the responses, or they may manually review and code the responses.

- Text mining: This method is used to analyze text-based survey data, such as responses to open-ended questions. Researchers may use software to identify patterns and themes in the text, or they may manually review and code the text.

Applications of Survey Research

Here are some common applications of survey research:

- Market Research: Companies use survey research to gather insights about customer needs, preferences, and behavior. These insights are used to create marketing strategies and develop new products.

- Public Opinion Research: Governments and political parties use survey research to understand public opinion on various issues. This information is used to develop policies and make decisions.

- Social Research: Survey research is used in social research to study social trends, attitudes, and behavior. Researchers use survey data to explore topics such as education, health, and social inequality.

- Academic Research: Survey research is used in academic research to study various phenomena. Researchers use survey data to test theories, explore relationships between variables, and draw conclusions.

- Customer Satisfaction Research: Companies use survey research to gather information about customer satisfaction with their products and services. This information is used to improve customer experience and retention.

- Employee Surveys: Employers use survey research to gather feedback from employees about their job satisfaction, working conditions, and organizational culture. This information is used to improve employee retention and productivity.

- Health Research: Survey research is used in health research to study topics such as disease prevalence, health behaviors, and healthcare access. Researchers use survey data to develop interventions and improve healthcare outcomes.

Examples of Survey Research

Here are some real-time examples of survey research:

- COVID-19 Pandemic Surveys: Since the outbreak of the COVID-19 pandemic, surveys have been conducted to gather information about public attitudes, behaviors, and perceptions related to the pandemic. Governments and healthcare organizations have used this data to develop public health strategies and messaging.

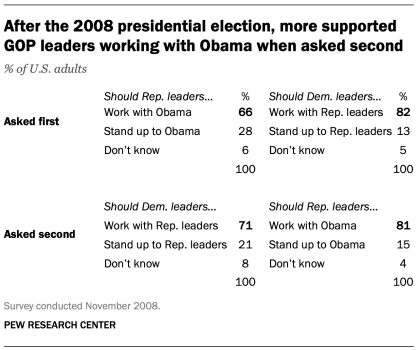

- Political Polls During Elections: During election seasons, surveys are used to measure public opinion on political candidates, policies, and issues in real-time. This information is used by political parties to develop campaign strategies and make decisions.

- Customer Feedback Surveys: Companies often use real-time customer feedback surveys to gather insights about customer experience and satisfaction. This information is used to improve products and services quickly.

- Event Surveys: Organizers of events such as conferences and trade shows often use surveys to gather feedback from attendees in real-time. This information can be used to improve future events and make adjustments during the current event.

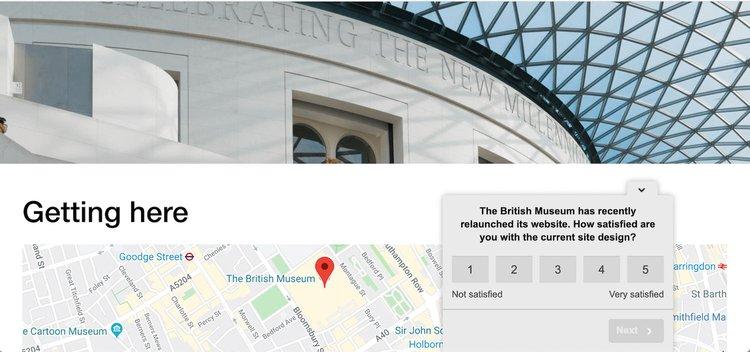

- Website and App Surveys: Website and app owners use surveys to gather real-time feedback from users about the functionality, user experience, and overall satisfaction with their platforms. This feedback can be used to improve the user experience and retain customers.

- Employee Pulse Surveys: Employers use real-time pulse surveys to gather feedback from employees about their work experience and overall job satisfaction. This feedback is used to make changes in real-time to improve employee retention and productivity.

Survey Sample

Purpose of survey research.

The purpose of survey research is to gather data and insights from a representative sample of individuals. Survey research allows researchers to collect data quickly and efficiently from a large number of people, making it a valuable tool for understanding attitudes, behaviors, and preferences.

Here are some common purposes of survey research:

- Descriptive Research: Survey research is often used to describe characteristics of a population or a phenomenon. For example, a survey could be used to describe the characteristics of a particular demographic group, such as age, gender, or income.

- Exploratory Research: Survey research can be used to explore new topics or areas of research. Exploratory surveys are often used to generate hypotheses or identify potential relationships between variables.

- Explanatory Research: Survey research can be used to explain relationships between variables. For example, a survey could be used to determine whether there is a relationship between educational attainment and income.

- Evaluation Research: Survey research can be used to evaluate the effectiveness of a program or intervention. For example, a survey could be used to evaluate the impact of a health education program on behavior change.

- Monitoring Research: Survey research can be used to monitor trends or changes over time. For example, a survey could be used to monitor changes in attitudes towards climate change or political candidates over time.

When to use Survey Research

there are certain circumstances where survey research is particularly appropriate. Here are some situations where survey research may be useful:

- When the research question involves attitudes, beliefs, or opinions: Survey research is particularly useful for understanding attitudes, beliefs, and opinions on a particular topic. For example, a survey could be used to understand public opinion on a political issue.

- When the research question involves behaviors or experiences: Survey research can also be useful for understanding behaviors and experiences. For example, a survey could be used to understand the prevalence of a particular health behavior.

- When a large sample size is needed: Survey research allows researchers to collect data from a large number of people quickly and efficiently. This makes it a useful method when a large sample size is needed to ensure statistical validity.

- When the research question is time-sensitive: Survey research can be conducted quickly, which makes it a useful method when the research question is time-sensitive. For example, a survey could be used to understand public opinion on a breaking news story.

- When the research question involves a geographically dispersed population: Survey research can be conducted online, which makes it a useful method when the population of interest is geographically dispersed.

How to Conduct Survey Research

Conducting survey research involves several steps that need to be carefully planned and executed. Here is a general overview of the process:

- Define the research question: The first step in conducting survey research is to clearly define the research question. The research question should be specific, measurable, and relevant to the population of interest.

- Develop a survey instrument : The next step is to develop a survey instrument. This can be done using various methods, such as online survey tools or paper surveys. The survey instrument should be designed to elicit the information needed to answer the research question, and should be pre-tested with a small sample of individuals.

- Select a sample : The sample is the group of individuals who will be invited to participate in the survey. The sample should be representative of the population of interest, and the size of the sample should be sufficient to ensure statistical validity.

- Administer the survey: The survey can be administered in various ways, such as online, by mail, or in person. The method of administration should be chosen based on the population of interest and the research question.

- Analyze the data: Once the survey data is collected, it needs to be analyzed. This involves summarizing the data using statistical methods, such as frequency distributions or regression analysis.

- Draw conclusions: The final step is to draw conclusions based on the data analysis. This involves interpreting the results and answering the research question.

Advantages of Survey Research

There are several advantages to using survey research, including:

- Efficient data collection: Survey research allows researchers to collect data quickly and efficiently from a large number of people. This makes it a useful method for gathering information on a wide range of topics.

- Standardized data collection: Surveys are typically standardized, which means that all participants receive the same questions in the same order. This ensures that the data collected is consistent and reliable.

- Cost-effective: Surveys can be conducted online, by mail, or in person, which makes them a cost-effective method of data collection.

- Anonymity: Participants can remain anonymous when responding to a survey. This can encourage participants to be more honest and open in their responses.

- Easy comparison: Surveys allow for easy comparison of data between different groups or over time. This makes it possible to identify trends and patterns in the data.

- Versatility: Surveys can be used to collect data on a wide range of topics, including attitudes, beliefs, behaviors, and preferences.

Limitations of Survey Research

Here are some of the main limitations of survey research:

- Limited depth: Surveys are typically designed to collect quantitative data, which means that they do not provide much depth or detail about people’s experiences or opinions. This can limit the insights that can be gained from the data.

- Potential for bias: Surveys can be affected by various biases, including selection bias, response bias, and social desirability bias. These biases can distort the results and make them less accurate.

- L imited validity: Surveys are only as valid as the questions they ask. If the questions are poorly designed or ambiguous, the results may not accurately reflect the respondents’ attitudes or behaviors.

- Limited generalizability : Survey results are only generalizable to the population from which the sample was drawn. If the sample is not representative of the population, the results may not be generalizable to the larger population.

- Limited ability to capture context: Surveys typically do not capture the context in which attitudes or behaviors occur. This can make it difficult to understand the reasons behind the responses.

- Limited ability to capture complex phenomena: Surveys are not well-suited to capture complex phenomena, such as emotions or the dynamics of interpersonal relationships.

Following is an example of a Survey Sample:

Welcome to our Survey Research Page! We value your opinions and appreciate your participation in this survey. Please answer the questions below as honestly and thoroughly as possible.

1. What is your age?

- A) Under 18

- G) 65 or older

2. What is your highest level of education completed?

- A) Less than high school

- B) High school or equivalent

- C) Some college or technical school

- D) Bachelor’s degree

- E) Graduate or professional degree

3. What is your current employment status?

- A) Employed full-time

- B) Employed part-time

- C) Self-employed

- D) Unemployed

4. How often do you use the internet per day?

- A) Less than 1 hour

- B) 1-3 hours

- C) 3-5 hours

- D) 5-7 hours

- E) More than 7 hours

5. How often do you engage in social media per day?

6. Have you ever participated in a survey research study before?

7. If you have participated in a survey research study before, how was your experience?

- A) Excellent

- E) Very poor

8. What are some of the topics that you would be interested in participating in a survey research study about?

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

9. How often would you be willing to participate in survey research studies?

- A) Once a week

- B) Once a month

- C) Once every 6 months

- D) Once a year

10. Any additional comments or suggestions?

Thank you for taking the time to complete this survey. Your feedback is important to us and will help us improve our survey research efforts.

About the author

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

Questionnaire – Definition, Types, and Examples

Case Study – Methods, Examples and Guide

Observational Research – Methods and Guide

Quantitative Research – Methods, Types and...

Qualitative Research Methods

Explanatory Research – Types, Methods, Guide

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Market Research

- Artificial Intelligence

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- What is a survey?

- Survey Research

Try Qualtrics for free

What is survey research.

15 min read Find out everything you need to know about survey research, from what it is and how it works to the different methods and tools you can use to ensure you’re successful.

Survey research is the process of collecting data from a predefined group (e.g. customers or potential customers) with the ultimate goal of uncovering insights about your products, services, or brand overall .

As a quantitative data collection method, survey research can provide you with a goldmine of information that can inform crucial business and product decisions. But survey research needs careful planning and execution to get the results you want.

So if you’re thinking about using surveys to carry out research, read on.

Get started with our free survey maker tool

Types of survey research

Calling these methods ‘survey research’ slightly underplays the complexity of this type of information gathering. From the expertise required to carry out each activity to the analysis of the data and its eventual application, a considerable amount of effort is required.

As for how you can carry out your research, there are several options to choose from — face-to-face interviews, telephone surveys, focus groups (though more interviews than surveys), online surveys , and panel surveys.

Typically, the survey method you choose will largely be guided by who you want to survey, the size of your sample , your budget, and the type of information you’re hoping to gather.

Here are a few of the most-used survey types:

Face-to-face interviews

Before technology made it possible to conduct research using online surveys, telephone, and mail were the most popular methods for survey research. However face-to-face interviews were considered the gold standard — the only reason they weren’t as popular was due to their highly prohibitive costs.

When it came to face-to-face interviews, organizations would use highly trained researchers who knew when to probe or follow up on vague or problematic answers. They also knew when to offer assistance to respondents when they seemed to be struggling. The result was that these interviewers could get sample members to participate and engage in surveys in the most effective way possible, leading to higher response rates and better quality data.

Telephone surveys

While phone surveys have been popular in the past, particularly for measuring general consumer behavior or beliefs, response rates have been declining since the 1990s .

Phone surveys are usually conducted using a random dialing system and software that a researcher can use to record responses.

This method is beneficial when you want to survey a large population but don’t have the resources to conduct face-to-face research surveys or run focus groups, or want to ask multiple-choice and open-ended questions .

The downsides are they can: take a long time to complete depending on the response rate, and you may have to do a lot of cold-calling to get the information you need.

You also run the risk of respondents not being completely honest . Instead, they’ll answer your survey questions quickly just to get off the phone.

Focus groups (interviews — not surveys)

Focus groups are a separate qualitative methodology rather than surveys — even though they’re often bunched together. They’re normally used for survey pretesting and designing , but they’re also a great way to generate opinions and data from a diverse range of people.

Focus groups involve putting a cohort of demographically or socially diverse people in a room with a moderator and engaging them in a discussion on a particular topic, such as your product, brand, or service.

They remain a highly popular method for market research , but they’re expensive and require a lot of administration to conduct and analyze the data properly.

You also run the risk of more dominant members of the group taking over the discussion and swaying the opinions of other people — potentially providing you with unreliable data.

Online surveys

Online surveys have become one of the most popular survey methods due to being cost-effective, enabling researchers to accurately survey a large population quickly.

Online surveys can essentially be used by anyone for any research purpose – we’ve all seen the increasing popularity of polls on social media (although these are not scientific).

Using an online survey allows you to ask a series of different question types and collect data instantly that’s easy to analyze with the right software.

There are also several methods for running and distributing online surveys that allow you to get your questionnaire in front of a large population at a fraction of the cost of face-to-face interviews or focus groups.

This is particularly true when it comes to mobile surveys as most people with a smartphone can access them online.

However, you have to be aware of the potential dangers of using online surveys, particularly when it comes to the survey respondents. The biggest risk is because online surveys require access to a computer or mobile device to complete, they could exclude elderly members of the population who don’t have access to the technology — or don’t know how to use it.

It could also exclude those from poorer socio-economic backgrounds who can’t afford a computer or consistent internet access. This could mean the data collected is more biased towards a certain group and can lead to less accurate data when you’re looking for a representative population sample.

When it comes to surveys, every voice matters.

Find out how to create more inclusive and representative surveys for your research.

Panel surveys

A panel survey involves recruiting respondents who have specifically signed up to answer questionnaires and who are put on a list by a research company. This could be a workforce of a small company or a major subset of a national population. Usually, these groups are carefully selected so that they represent a sample of your target population — giving you balance across criteria such as age, gender, background, and so on.

Panel surveys give you access to the respondents you need and are usually provided by the research company in question. As a result, it’s much easier to get access to the right audiences as you just need to tell the research company your criteria. They’ll then determine the right panels to use to answer your questionnaire.

However, there are downsides. The main one being that if the research company offers its panels incentives, e.g. discounts, coupons, money — respondents may answer a lot of questionnaires just for the benefits.

This might mean they rush through your survey without providing considered and truthful answers. As a consequence, this can damage the credibility of your data and potentially ruin your analyses.

What are the benefits of using survey research?

Depending on the research method you use, there are lots of benefits to conducting survey research for data collection. Here, we cover a few:

1. They’re relatively easy to do

Most research surveys are easy to set up, administer and analyze. As long as the planning and survey design is thorough and you target the right audience , the data collection is usually straightforward regardless of which survey type you use.

2. They can be cost effective

Survey research can be relatively cheap depending on the type of survey you use.

Generally, qualitative research methods that require access to people in person or over the phone are more expensive and require more administration.

Online surveys or mobile surveys are often more cost-effective for market research and can give you access to the global population for a fraction of the cost.

3. You can collect data from a large sample

Again, depending on the type of survey, you can obtain survey results from an entire population at a relatively low price. You can also administer a large variety of survey types to fit the project you’re running.

4. You can use survey software to analyze results immediately

Using survey software, you can use advanced statistical analysis techniques to gain insights into your responses immediately.

Analysis can be conducted using a variety of parameters to determine the validity and reliability of your survey data at scale.

5. Surveys can collect any type of data

While most people view surveys as a quantitative research method, they can just as easily be adapted to gain qualitative information by simply including open-ended questions or conducting interviews face to face.

How to measure concepts with survey questions

While surveys are a great way to obtain data, that data on its own is useless unless it can be analyzed and developed into actionable insights.

The easiest, and most effective way to measure survey results, is to use a dedicated research tool that puts all of your survey results into one place.

When it comes to survey measurement, there are four measurement types to be aware of that will determine how you treat your different survey results:

Nominal scale

With a nominal scale , you can only keep track of how many respondents chose each option from a question, and which response generated the most selections.

An example of this would be simply asking a responder to choose a product or brand from a list.

You could find out which brand was chosen the most but have no insight as to why.

Ordinal scale

Ordinal scales are used to judge an order of preference. They do provide some level of quantitative value because you’re asking responders to choose a preference of one option over another.

Ratio scale

Ratio scales can be used to judge the order and difference between responses. For example, asking respondents how much they spend on their weekly shopping on average.

Interval scale

In an interval scale, values are lined up in order with a meaningful difference between the two values — for example, measuring temperature or measuring a credit score between one value and another.

Step by step: How to conduct surveys and collect data

Conducting a survey and collecting data is relatively straightforward, but it does require some careful planning and design to ensure it results in reliable data.

Step 1 – Define your objectives

What do you want to learn from the survey? How is the data going to help you? Having a hypothesis or series of assumptions about survey responses will allow you to create the right questions to test them.

Step 2 – Create your survey questions

Once you’ve got your hypotheses or assumptions, write out the questions you need answering to test your theories or beliefs. Be wary about framing questions that could lead respondents or inadvertently create biased responses .

Step 3 – Choose your question types

Your survey should include a variety of question types and should aim to obtain quantitative data with some qualitative responses from open-ended questions. Using a mix of questions (simple Yes/ No, multiple-choice, rank in order, etc) not only increases the reliability of your data but also reduces survey fatigue and respondents simply answering questions quickly without thinking.

Find out how to create a survey that’s easy to engage with

Step 4 – Test your questions

Before sending your questionnaire out, you should test it (e.g. have a random internal group do the survey) and carry out A/B tests to ensure you’ll gain accurate responses.

Step 5 – Choose your target and send out the survey

Depending on your objectives, you might want to target the general population with your survey or a specific segment of the population. Once you’ve narrowed down who you want to target, it’s time to send out the survey.

After you’ve deployed the survey, keep an eye on the response rate to ensure you’re getting the number you expected. If your response rate is low, you might need to send the survey out to a second group to obtain a large enough sample — or do some troubleshooting to work out why your response rates are so low. This could be down to your questions, delivery method, selected sample, or otherwise.

Step 6 – Analyze results and draw conclusions

Once you’ve got your results back, it’s time for the fun part.

Break down your survey responses using the parameters you’ve set in your objectives and analyze the data to compare to your original assumptions. At this stage, a research tool or software can make the analysis a lot easier — and that’s somewhere Qualtrics can help.

Get reliable insights with survey software from Qualtrics

Gaining feedback from customers and leads is critical for any business, data gathered from surveys can prove invaluable for understanding your products and your market position, and with survey software from Qualtrics, it couldn’t be easier.

Used by more than 13,000 brands and supporting more than 1 billion surveys a year, Qualtrics empowers everyone in your organization to gather insights and take action. No coding required — and your data is housed in one system.

Get feedback from more than 125 sources on a single platform and view and measure your data in one place to create actionable insights and gain a deeper understanding of your target customers .

Automatically run complex text and statistical analysis to uncover exactly what your survey data is telling you, so you can react in real-time and make smarter decisions.

We can help you with survey management, too. From designing your survey and finding your target respondents to getting your survey in the field and reporting back on the results, we can help you every step of the way.

And for expert market researchers and survey designers, Qualtrics features custom programming to give you total flexibility over question types, survey design, embedded data, and other variables.

No matter what type of survey you want to run, what target audience you want to reach, or what assumptions you want to test or answers you want to uncover, we’ll help you design, deploy and analyze your survey with our team of experts.

Ready to find out more about Qualtrics CoreXM?

Get started with our free survey maker tool today

Related resources

Survey bias types 24 min read, post event survey questions 10 min read, best survey software 16 min read, close-ended questions 7 min read, survey vs questionnaire 12 min read, response bias 13 min read, double barreled question 11 min read, request demo.

Ready to learn more about Qualtrics?

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, automatically generate references for free.

- Knowledge Base

- Methodology

- Doing Survey Research | A Step-by-Step Guide & Examples

Doing Survey Research | A Step-by-Step Guide & Examples

Published on 6 May 2022 by Shona McCombes . Revised on 10 October 2022.

Survey research means collecting information about a group of people by asking them questions and analysing the results. To conduct an effective survey, follow these six steps:

- Determine who will participate in the survey

- Decide the type of survey (mail, online, or in-person)

- Design the survey questions and layout

- Distribute the survey

- Analyse the responses

- Write up the results

Surveys are a flexible method of data collection that can be used in many different types of research .

Table of contents

What are surveys used for, step 1: define the population and sample, step 2: decide on the type of survey, step 3: design the survey questions, step 4: distribute the survey and collect responses, step 5: analyse the survey results, step 6: write up the survey results, frequently asked questions about surveys.

Surveys are used as a method of gathering data in many different fields. They are a good choice when you want to find out about the characteristics, preferences, opinions, or beliefs of a group of people.

Common uses of survey research include:

- Social research: Investigating the experiences and characteristics of different social groups

- Market research: Finding out what customers think about products, services, and companies

- Health research: Collecting data from patients about symptoms and treatments

- Politics: Measuring public opinion about parties and policies

- Psychology: Researching personality traits, preferences, and behaviours

Surveys can be used in both cross-sectional studies , where you collect data just once, and longitudinal studies , where you survey the same sample several times over an extended period.

Prevent plagiarism, run a free check.

Before you start conducting survey research, you should already have a clear research question that defines what you want to find out. Based on this question, you need to determine exactly who you will target to participate in the survey.

Populations

The target population is the specific group of people that you want to find out about. This group can be very broad or relatively narrow. For example:

- The population of Brazil

- University students in the UK

- Second-generation immigrants in the Netherlands

- Customers of a specific company aged 18 to 24

- British transgender women over the age of 50

Your survey should aim to produce results that can be generalised to the whole population. That means you need to carefully define exactly who you want to draw conclusions about.

It’s rarely possible to survey the entire population of your research – it would be very difficult to get a response from every person in Brazil or every university student in the UK. Instead, you will usually survey a sample from the population.

The sample size depends on how big the population is. You can use an online sample calculator to work out how many responses you need.

There are many sampling methods that allow you to generalise to broad populations. In general, though, the sample should aim to be representative of the population as a whole. The larger and more representative your sample, the more valid your conclusions.

There are two main types of survey:

- A questionnaire , where a list of questions is distributed by post, online, or in person, and respondents fill it out themselves

- An interview , where the researcher asks a set of questions by phone or in person and records the responses

Which type you choose depends on the sample size and location, as well as the focus of the research.

Questionnaires

Sending out a paper survey by post is a common method of gathering demographic information (for example, in a government census of the population).

- You can easily access a large sample.

- You have some control over who is included in the sample (e.g., residents of a specific region).

- The response rate is often low.

Online surveys are a popular choice for students doing dissertation research , due to the low cost and flexibility of this method. There are many online tools available for constructing surveys, such as SurveyMonkey and Google Forms .

- You can quickly access a large sample without constraints on time or location.

- The data is easy to process and analyse.

- The anonymity and accessibility of online surveys mean you have less control over who responds.

If your research focuses on a specific location, you can distribute a written questionnaire to be completed by respondents on the spot. For example, you could approach the customers of a shopping centre or ask all students to complete a questionnaire at the end of a class.

- You can screen respondents to make sure only people in the target population are included in the sample.

- You can collect time- and location-specific data (e.g., the opinions of a shop’s weekday customers).

- The sample size will be smaller, so this method is less suitable for collecting data on broad populations.

Oral interviews are a useful method for smaller sample sizes. They allow you to gather more in-depth information on people’s opinions and preferences. You can conduct interviews by phone or in person.

- You have personal contact with respondents, so you know exactly who will be included in the sample in advance.

- You can clarify questions and ask for follow-up information when necessary.

- The lack of anonymity may cause respondents to answer less honestly, and there is more risk of researcher bias.

Like questionnaires, interviews can be used to collect quantitative data : the researcher records each response as a category or rating and statistically analyses the results. But they are more commonly used to collect qualitative data : the interviewees’ full responses are transcribed and analysed individually to gain a richer understanding of their opinions and feelings.

Next, you need to decide which questions you will ask and how you will ask them. It’s important to consider:

- The type of questions

- The content of the questions

- The phrasing of the questions

- The ordering and layout of the survey

Open-ended vs closed-ended questions

There are two main forms of survey questions: open-ended and closed-ended. Many surveys use a combination of both.

Closed-ended questions give the respondent a predetermined set of answers to choose from. A closed-ended question can include:

- A binary answer (e.g., yes/no or agree/disagree )

- A scale (e.g., a Likert scale with five points ranging from strongly agree to strongly disagree )

- A list of options with a single answer possible (e.g., age categories)

- A list of options with multiple answers possible (e.g., leisure interests)

Closed-ended questions are best for quantitative research . They provide you with numerical data that can be statistically analysed to find patterns, trends, and correlations .

Open-ended questions are best for qualitative research. This type of question has no predetermined answers to choose from. Instead, the respondent answers in their own words.

Open questions are most common in interviews, but you can also use them in questionnaires. They are often useful as follow-up questions to ask for more detailed explanations of responses to the closed questions.

The content of the survey questions

To ensure the validity and reliability of your results, you need to carefully consider each question in the survey. All questions should be narrowly focused with enough context for the respondent to answer accurately. Avoid questions that are not directly relevant to the survey’s purpose.

When constructing closed-ended questions, ensure that the options cover all possibilities. If you include a list of options that isn’t exhaustive, you can add an ‘other’ field.

Phrasing the survey questions

In terms of language, the survey questions should be as clear and precise as possible. Tailor the questions to your target population, keeping in mind their level of knowledge of the topic.

Use language that respondents will easily understand, and avoid words with vague or ambiguous meanings. Make sure your questions are phrased neutrally, with no bias towards one answer or another.

Ordering the survey questions

The questions should be arranged in a logical order. Start with easy, non-sensitive, closed-ended questions that will encourage the respondent to continue.

If the survey covers several different topics or themes, group together related questions. You can divide a questionnaire into sections to help respondents understand what is being asked in each part.

If a question refers back to or depends on the answer to a previous question, they should be placed directly next to one another.

Before you start, create a clear plan for where, when, how, and with whom you will conduct the survey. Determine in advance how many responses you require and how you will gain access to the sample.

When you are satisfied that you have created a strong research design suitable for answering your research questions, you can conduct the survey through your method of choice – by post, online, or in person.

There are many methods of analysing the results of your survey. First you have to process the data, usually with the help of a computer program to sort all the responses. You should also cleanse the data by removing incomplete or incorrectly completed responses.

If you asked open-ended questions, you will have to code the responses by assigning labels to each response and organising them into categories or themes. You can also use more qualitative methods, such as thematic analysis , which is especially suitable for analysing interviews.

Statistical analysis is usually conducted using programs like SPSS or Stata. The same set of survey data can be subject to many analyses.

Finally, when you have collected and analysed all the necessary data, you will write it up as part of your thesis, dissertation , or research paper .

In the methodology section, you describe exactly how you conducted the survey. You should explain the types of questions you used, the sampling method, when and where the survey took place, and the response rate. You can include the full questionnaire as an appendix and refer to it in the text if relevant.

Then introduce the analysis by describing how you prepared the data and the statistical methods you used to analyse it. In the results section, you summarise the key results from your analysis.

A Likert scale is a rating scale that quantitatively assesses opinions, attitudes, or behaviours. It is made up of four or more questions that measure a single attitude or trait when response scores are combined.

To use a Likert scale in a survey , you present participants with Likert-type questions or statements, and a continuum of items, usually with five or seven possible responses, to capture their degree of agreement.

Individual Likert-type questions are generally considered ordinal data , because the items have clear rank order, but don’t have an even distribution.

Overall Likert scale scores are sometimes treated as interval data. These scores are considered to have directionality and even spacing between them.

The type of data determines what statistical tests you should use to analyse your data.

A questionnaire is a data collection tool or instrument, while a survey is an overarching research method that involves collecting and analysing data from people using questionnaires.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the ‘Cite this Scribbr article’ button to automatically add the citation to our free Reference Generator.

McCombes, S. (2022, October 10). Doing Survey Research | A Step-by-Step Guide & Examples. Scribbr. Retrieved 15 April 2024, from https://www.scribbr.co.uk/research-methods/surveys/

Is this article helpful?

Shona McCombes

Other students also liked, qualitative vs quantitative research | examples & methods, construct validity | definition, types, & examples, what is a likert scale | guide & examples.

Business growth

Marketing tips

How to conduct your own market research survey (with example)

After watching a few of those sketches, you can imagine why real-life focus groups tend to be pretty small. Even without any over-the-top personalities involved, it's easy for these groups to go off the rails.

So what happens when you want to collect market research at a larger scale? That's where the market research survey comes in. Market surveys allow you to get just as much valuable information as an in-person interview, without the burden of herding hundreds of rowdy Eagles fans through a product test.

Table of contents:

What is a market research survey?

Why conduct market research, primary vs. secondary market research.

6 types of market research surveys

How to write and conduct a market research survey

Tips for running a market research survey.

Market research survey campaign example questions

Market research survey template

Use automation to put survey results into action

A market research survey is a questionnaire designed to collect key information about a company's target market and audience that will help guide business decisions about products and services, branding angles, and advertising campaigns.

Market surveys are what's known as "primary research"—that is, information that the researching company gathers firsthand. Secondary research consists of data that another organization gathered and published, which other researchers can then use for their own reports. Primary research is more expensive and time-intensive than secondary research, which is why you should only use market research surveys to obtain information that you can't get anywhere else.

A market research survey can collect information on your target customers':

Experiences

Preferences, desires, and needs

Values and motivations

The types of information that can usually be found in a secondary source, and therefore aren't good candidates for a market survey, include your target customers':

Demographic data

Consumer spending data

Household size

Lots of this secondary information can be found in a public database like those maintained by the Census Bureau and Bureau of Labor Statistics . There are also a few free market research tools that you can use to access more detailed data, like Think with Google , Data USA , and Statista . Or, if you're looking to learn about your existing customer base, you can also use a CRM to automatically record key information about your customers each time they make a purchase.

If you've exhausted your secondary research options and still have unanswered questions, it's time to start thinking about conducting a market research survey.

The first thing to figure out is what you're trying to learn, and from whom. Are you beta testing a new product or feature with existing users? Or are you looking to identify new customer personas for your marketers to target? There are a number of different ways to use a marketing research survey, and your choice will impact how you set up the questionnaire.

Here are some examples of how market research surveys can be used to fill a wide range of knowledge gaps for companies:

A B2B software company asks real users in its industry about Kanban board usage to help prioritize their project view change rollout.

A B2C software company asks its target demographic about their mobile browsing habits to help them find features to incorporate into their forthcoming mobile app.

A printing company asks its target demographic about fabric preferences to gauge interest in a premium material option for their apparel lines.

A wholesale food vendor surveys regional restaurant owners to find ideas for seasonal products to offer.

Market surveys are what's known as "primary research"—that is, information that the researching company gathers firsthand. Secondary research consists of data that another organization gathered and published, which other researchers can then use for their own reports.

Primary research is more expensive and time-intensive than secondary research, which is why you should only use market research surveys to obtain information that you can't get anywhere else.

Lots of this secondary information can be found in a public database like those maintained by the Census Bureau and Bureau of Labor Statistics . There are also a few free market research tools that you can use to access more detailed data, like Think with Google , Data USA , and Statista .

Or, if you're looking to learn about your existing customer base, you can also use a CRM to automatically record key information about your customers each time they make a purchase.

6 types of market research survey

Depending on your goal, you'll need different types of market research. Here are six types of market research surveys.

1. Buyer persona research

A buyer persona or customer profile is a simple sketch of the types of people that you should be targeting as potential customers.

A buyer persona research survey will help you learn more about things like demographics, household makeup, income and education levels, and lifestyle markers. The more you learn about your existing customers, the more specific you can get in targeting potential customers. You may find that there are more buyer personas within your user base than the ones that you've been targeting.

2. Sales funnel research

The sales funnel is the path that potential customers take to eventually become buyers. It starts with the target's awareness of your product, then moves through stages of increasing interest until they ultimately make a purchase.

With a sales funnel research survey, you can learn about potential customers' main drivers at different stages of the sales funnel. You can also get feedback on how effective different sales strategies are. Use this survey to find out:

How close potential buyers are to making a purchase

What tools and experiences have been most effective in moving prospective customers closer to conversion

What types of lead magnets are most attractive to your target audience

3. Customer loyalty research

Whenever you take a customer experience survey after you make a purchase, you'll usually see a few questions about whether you would recommend the company or a particular product to a friend. After you've identified your biggest brand advocates , you can look for persona patterns to determine what other customers are most likely to be similarly enthusiastic about your products. Use these surveys to learn:

The demographics of your most loyal customers

What tools are most effective in turning customers into advocates

What you can do to encourage more brand loyalty

4. Branding and marketing research

The Charmin focus group featured in that SNL sketch is an example of branding and marketing research, in which a company looks for feedback on a particular advertising angle to get a sense of whether it will be effective before the company spends money on running the ad at scale. Use this type of survey to find out:

Whether a new advertising angle will do well with existing customers

Whether a campaign will do well with a new customer segment you haven't targeted yet

What types of campaign angles do well with a particular demographic

5. New products or features research

Whereas the Charmin sketch features a marketing focus group, this one features new product research for a variety of new Hidden Valley Ranch flavors. Though you can't get hands-on feedback on new products when you're conducting a survey instead of an in-person meeting, you can survey your customers to find out:

What features they wish your product currently had

What other similar or related products they shop for

What they think of a particular product or feature idea

Running a survey before investing resources into developing a new offering will save you and the company a lot of time, money, and energy.

6. Competitor research

You can get a lot of information about your own customers and users via automatic data collection , but your competitors' customer base may not be made up of the same buyer personas that yours is. Survey your competitors' users to find out:

Your competitors ' customers' demographics, habits, and behaviors

Whether your competitors have found success with a buyer persona you're not targeting

Information about buyers for a product that's similar to one you're thinking about launching

Feedback on what features your competitors' customers wish their version of a product had

Once you've narrowed down your survey's objectives, you can move forward with designing and running your survey.

Step 1: Write your survey questions

A poorly worded survey, or a survey that uses the wrong question format, can render all of your data moot. If you write a question that results in most respondents answering "none of the above," you haven't learned much.

You'll find dozens of question types and even pre-written questions in most survey apps . Here are a few common question types that work well for market surveys.

Categorical questions

Also known as a nominal question, this question type provides numbers and percentages for easy visualization, like "35% said ABC." It works great for bar graphs and pie charts, but you can't take averages or test correlations with nominal-level data.

Yes/No: The most basic survey question used in polls is the Yes/No question, which can be easily created using your survey app or by adding Yes/No options to a multiple-choice question.