- e-ATM Order

- Share Market News

- FindYourMojo

- Live Webinar

- Relax For Tax

- Budget 2024

- One Click Mutual Fund

- Retirement Solutions

- Execution Algos

- One Click F&O

- Apply IPO through UPI

- Sovereign Gold Bonds

- New Bonds on Offer

- Government Securities

- Exchange Traded Bonds

- ICICI Bank FD

- Top Performing NPS Schemes

- NPS Calculator

- NPS Important FAQ and Disclosures

- Equity Trending News

- Self learning

- Customer Service

- Corporate Services

- Open Account

- Masters of the Street

- Features and Products

- Will Drafting

- Goal Planner

- Retirement Planning

- Brokerage Fees and Charges

- Business Partner

- Business Partner Opportunity

- Business Partner Earning Calculator

- Business Partner App

- Partner Universe

- Insurance – POSP

- Global Invest

- Company Snapshot

- Report Details

South Indian Bank Ltd Research Report Q3

- SECTOR : Banks

- BSE : 532218

- NSE : SOUTHBANK

Chg: -0.2 (-0.72 %)

Entry Price

Recommend date.

South Indian Bank (SIB) reported a stable set of Q3FY20 numbers with healthy growth in net interest income at | 602 crore; up 16% YoY, led by ~60 bps YoY improvement in margin on the back of change in asset mix. The bank reported steady business traction with credit & deposit growth stable at 9% & 11% to | 65334 crore & | 80451 crore, respectively. The bank’s strategy of gaining higher share in retail & MSME advances coupled with retailisation of liability has been working well with credit growth within retail & MSME being higher than overall credit growth at 18% YoY & 17% YoY to | 19834 crore & | 25787 crore, respectively. In contrast, the corporate book has see de-growth of 7% YoY to | 19713 crore. Retail deposit & CASA growth has been improving at 13% YoY. Accordingly, the CASA ratio increased 90 bps YoY to 25.2%.

Copyright© 2022. All rights Reserved. ICICI Securities Ltd. ®trademark registration in respect of the concerned mark has been applied for by ICICI Bank Limited

Stock Research Report for South Indian Bank Ltd

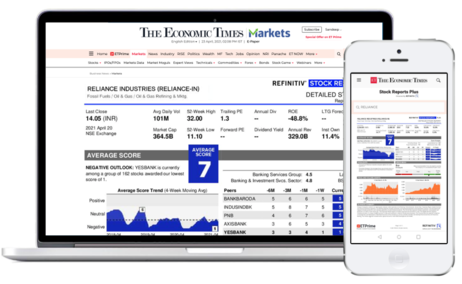

Stock score of South Indian Bank Ltd moved down by 1 in 3 months on a 10 point scale (Source: Refinitiv). Get detailed report on South Indian Bank Ltd by subscribing to ETPrime .

Get 4000+ Stock Reports worth ₹ 1,499* with ETPrime at no extra cost for you

*As per competitive benchmarking of annual price. T&C apply

Make Investment decisions

with proprietary stock scores on earnings, fundamentals, relative valuation, risk and price momentum

Find new Trading ideas

with weekly updated scores and analysts forecasts on key data points

In-Depth analysis

of company and its peers through independent research, ratings, and market data

The South Indian Bank Limited (the Bank) is a banking company. The Bank is engaged in providing a range of banking and financial services, including retail banking, corporate banking, and treasury operations. The Company operates through four segments: Treasury, Corporate/ Wholesale Banking, Retail Banking and Other Banking Operations. The Treasury segment consists of interest earnings on investments portfolio of the bank, gains or losses on investment operations and earnings from foreign exchange business. The Corporate / Wholesale Banking segment provides loans to corporate segment. The Retail Banking segment provides loans to non-corporate customers. The Other Banking Operations segment includes income from para banking activities, such as debit cards, third party product distribution and associated costs. The Bank has a network of approximately 942 banking outlets and approximately 1,175 automated teller machines (ATMs) in India.

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here .

- Super Investors

- Account

- Consolidated Standalone

- Share Holding

- Balance Sheet

- Corp. Action

South Indian Bank share price

NSE: SOUTHBANK BSE: 532218 SECTOR: Bank - Private 164k 591 176

Price Summary

₹ 27.89

₹ 26.9

₹ 36.9

₹ 14.02

Ownership Stable

Valuation expensive, efficiency optimal, financials average, company essentials.

₹ 7170.25 Cr.

₹ 32.67

₹ 3012.08 Cr.

₹ 4.27

Add Your Ratio

Your Added Ratios

Index presence.

The company is present in 7 Indices.

NIFTYMICRO250

NIFTYTOTALMCAP

NIFTYFULLSMALLCAP100

S&P MIDSMLCAP

- Price Chart

- Volume Chart

Price Chart 1d 1w 1m 3m 6m 1Yr 3Yr 5Yr

Volume chart 1d 1w 1m 3m 6m 1yr 3yr 5yr, pe chart 1w 1m 3m 6m 1yr 3yr 5yr, pb chart 1w 1m 3m 6m 1yr 3yr 5yr, peer comparison, group companies.

Track the companies of Group.

Cost of Liabilities %

Peg ratio earnings growth, it implies that the company is overvalued and vice versa.'>, advances growth %.

Share Holding Pattern

Promoter pledging %, strengths.

- Good Capital Adequacy Ratio of 17.25 %.

- The company has delivered good Profit growth of 94.9638766224443 % over the past 3 years.

Limitations

- The bank has a very low ROA track record. Average ROA of 3 years is 0.285754225485285 %

- CASA Growth of -0.226465579240397 % YoY, which is very low.

- Company has a low ROE of 4.75839329177992 % over the last 3 years.

- The Bank has a high NPA ; Average NPA of the last 3 years stands at 3.18 %.

- Low other Income proportion of 11.2347206541013 %.

- High Cost to income ratio of 60.5897852614055 %.

- The company has delivered poor Income growth of -2.33211786211379 % over the past 3 years.

- Poor Advances growth of 2.70155795990226 % in last 3 years.

Quarterly Result (All Figures in Cr.)

Profit & loss (all figures in cr. adjusted eps in rs.), balance sheet (all figures are in crores.), corporate actions dividend bonus rights split, investors details promoter investors, annual reports.

- Annual Report 2023 20 Oct 2023

- Annual Report 2023 10 Aug 2023

- Annual Report 2021 30 Jul 2021

- Annual Report 2020 2 Oct 2020

- Annual Report 2019 9 Jan 2020

- Annual Report 2018 9 Jan 2020

- Annual Report 2017 2 Apr 2021

Ratings & Research Reports

- Credit Report By: CRISIL 9 Jan 2020

- Credit Report By: CARE 9 Jan 2020

- Credit Report by:INDIA RATINGS & RESEARCH 25 Aug 2020

- Credit Report By:CARE 20 Oct 2023

- Credit Report By:FITCH 18 Aug 2022

- Credit Report By:CARE 18 Aug 2022

- Credit Report By:CRISIL 18 Aug 2022

- Research Ventura 26 May 2021

- Research Prabhudas Lilladhar 9 Jan 2020

- Research Nirmal Bang Institutional 9 Jan 2020

- Research Chola Wealth Direct 9 Jan 2020

Company Presentations

- Concall Q3FY24 2 Feb 2024

- Concall Q3FY22 22 Feb 2022

- Concall Q3FY22 1 Feb 2022

- Concall Q2FY24 30 Oct 2023

- Concall Q2FY21 20 Jan 2021

- Concall Q2FY20 9 Jan 2020

- Concall Q1FY24 20 Oct 2023

- Concall Q1FY21 20 Jan 2021

- Presentation Q4FY21 24 May 2021

- Presentation Q4FY20 29 Jun 2020

- Presentation Q3FY24 19 Jan 2024

- Presentation Q3FY22 27 Jan 2022

- Presentation Q3FY21 27 Jan 2021

- Presentation Q2FY24 20 Oct 2023

- Presentation Q2FY22 25 Oct 2021

- Presentation Q2FY21 16 Oct 2020

- Presentation Q2FY20 9 Jan 2020

- Presentation Q1FY23 1 Aug 2022

- Presentation Q1FY21 9 Jul 2020

Company News

South indian bank stock price analysis and quick research report. is south indian bank an attractive stock to invest in.

The Indian Banking sector is rising rapidly due to infrastructure spending, favorable government policy, rising disposable income and increasing consumerism and easier access to credit.

The banking industry is in boom with growing demand across India. But is it the right time to invest in banking stocks is the question to be asked? We can look into more details and dig a little deeper into the analysis of the stock.

Let’s look at how South Indian Bank is performing and if it is the right time to buy the stock of South Indian Bank with detailed analysis.

For Banking companies, The primary source of Income is interest earned on various loans given to individuals and corporates. South Indian Bank has earned Rs 7233.1794 Cr. revenue in the latest financial year. South Indian Bank has posted Poor revenue growth of - 2.33211786211379 % in last 3 Years.

In terms of advances, South Indian Bank reported 16.3535575928033 % YOY, rise . If you see 3 years advance growth, it stands at 2.70155795990226 %.

Currently, South Indian Bank has a CASA ratio of 32.980487151128 %. It’s overall cost of liability stands at 4.27906883631537 %. Also, the total deposits of South Indian Bank from these accounts stood at Rs 91651.353 Cr.

South Indian Bank has a Poor ROA track record. The ROA of South Indian Bank is at 0.746171505212114 %.

The Lender is inefficiently managing it’s overall asset portfolio. The Gross NPA and Net NPA stood at 5.14 % and 1.86 % respectively as on the latest financial year.

One other important measure of banks’ financial health is provisioning coverage ratio. The YoY change in provision and contingencies is negative at - 80.5264874880278 % which means it has decreased from the previous year.

Non-Interest income or other incomes are very important for banks as it gives a regular source of income for bank with no additional risk. Other income of South Indian Bank decreased and is currently at Rs 812.6275 Cr.

South Indian Bank has a Good Capital Adequacy Ratio of 17.25 .

The best metric which provides insights about bank’s valuation is P/B ratio. Currently South Indian Bank is trading at a P/B of 0.8391 . The historical average PB of South Indian Bank was 0.363111325371129 .

Share Price : - The current share price of South Indian Bank is Rs 27.4 . One can use valuation calculators of ticker to know if South Indian Bank share price is undervalued or overvalued.

Brief about South Indian Bank

The south indian bank ltd. financials: check share price, balance sheet, annual report, quarterly results, shareholding, company profile and news for company analysis.

The South Indian Bank Ltd. is a prominent financial institution headquartered in Thrissur, Kerala, India. Established in 1929, the bank has grown over the years and has become one of the leading private sector banks in the country. With a strong focus on customer service and innovation, The South Indian Bank has built a robust reputation and a loyal customer base.

The South Indian Bank Ltd. - Share Price

Stay updated with the latest share prices of The South Indian Bank Ltd. with our user-friendly interface. Our website provides real-time data, allowing investors to make informed decisions about buying or selling the bank's shares. The share price is a crucial factor that investors consider when evaluating a stock's potential.

The South Indian Bank Ltd. - Balance Sheet

Review the balance sheet of The South Indian Bank Ltd. to gain insights into its financial position. Our website offers a pre-built screening tool that allows investors to examine the bank's balance sheet and assess its strength. With a comprehensive understanding of the balance sheet, investors can make informed decisions about their investment in the bank.

The South Indian Bank Ltd. - Annual Report

Access the annual reports of The South Indian Bank Ltd. on our website. These reports provide a comprehensive overview of the bank's performance, achievements, and future goals. Our platform allows investors to download these reports and analyze them thoroughly, enabling long-term investors to evaluate the bank's growth trajectory.

The South Indian Bank Ltd. - Dividend

Dividends play a significant role in attracting long-term investors. By offering a share of profits to its shareholders, The South Indian Bank Ltd. highlights its commitment to wealth creation. Stay updated with the bank's dividend information on our website, which provides real-time data and historical records of dividend payments.

The South Indian Bank Ltd. - Quarterly Result

Keep track of the quarterly results of The South Indian Bank Ltd. Our website provides quarterly reports, allowing investors to analyze the bank's performance throughout the year. These reports offer valuable insights into revenue, profits, and other key financial metrics. Investors can utilize our premium features, such as the fair value calculation tools, to evaluate the bank's performance thoroughly.

The South Indian Bank Ltd. - Stock Price

Stay informed about the stock price fluctuations of The South Indian Bank Ltd. on our website. Our platform offers a visually appealing price chart that allows investors to monitor the bank's stock performance over different timeframes. By analyzing historical price trends, investors can identify patterns and make informed decisions regarding their investment in the bank.

The South Indian Bank Ltd. - Price Chart

Gain a visual representation of The South Indian Bank Ltd.'s stock price movement with our intuitive price chart. The chart provides a comprehensive overview of stock performance over time, enabling investors to spot trends and patterns. Utilize the chart to assess the bank's stock price movements before making investment decisions.

The South Indian Bank Ltd. - News

Stay updated with the latest news and updates about The South Indian Bank Ltd. on our website. Our platform curates news from reliable sources and presents them in an organized manner, allowing investors to stay informed about events and developments that may impact the bank's performance. Our objective is to provide investors with a comprehensive resource for staying up-to-date with the latest news related to the bank.

The South Indian Bank Ltd. - Concall Transcripts

Access the conference call transcripts of The South Indian Bank Ltd. on our website. These transcripts offer detailed insights into discussions between the bank's management and analysts. By reviewing these transcripts, investors can gain a deeper understanding of the management's perspective and strategic plans, thereby aiding in their investment decision-making process.

The South Indian Bank Ltd. - Investor Presentations

Download investor presentations of The South Indian Bank Ltd. from our website. These presentations are an essential resource for gaining insights into the bank's financial performance, growth strategies, and future outlook. By analyzing these presentations, investors can make well-informed decisions about investing in the bank.

The South Indian Bank Ltd. - Promoters

The South Indian Bank Ltd. has a strong and committed group of promoters who play a crucial role in the bank's success. Our website provides detailed information about the bank's promoters, including their background, expertise, and contributions to the bank's growth. Understanding the promoters' profile can help investors gain confidence in their investment decision.

The South Indian Bank Ltd. - Shareholders

Gain insights into the shareholders of The South Indian Bank Ltd. Our website provides comprehensive information about the bank's major shareholders, including institutional investors, mutual funds, and individual investors. Evaluating the bank's shareholder base can provide investors with an understanding of the market sentiment and the level of confidence in the bank's growth potential.

Note: The South Indian Bank Ltd. is committed to providing investors with comprehensive resources for stock analysis. Our website offers premium features such as fair value calculation using tools like DCF Analysis, BVPS Analysis, Earnings multiple approach, and DuPont analysis. These tools aid in evaluating the bank's financials and determining its fair value. Additionally, investors can access annual reports, concall transcripts, investor presentations, credit ratings, and research reports, which are available for download on our website.

Ratio Delete Confirmation

- Trending Stocks

- HDFC Bank INE040A01034, HDFCBANK, 500180

- Jio Financial INE758E01017, JIOFIN, 543940

- Infosys INE009A01021, INFY, 500209

- Vodafone Idea INE669E01016, IDEA, 532822

- Indian Renew INE202E01016, IREDA, 544026

- Mutual Funds

- Commodities

- Futures & Options

- Cryptocurrency

- My Portfolio

- My Watchlist

- FREE Credit Score ₹100 Cash Reward

- My Messages

- Price Alerts

- Chat with Us

- Download App

Follow us on:

- Global Markets

- Indian Indices

- Economic Calendar

- Technical Trends

- Big Shark Portfolios

- Stock Scanner

- Auri ferous Aqua Farma , 519363

- INSTANT LOANS UPTO ₹ 5 Lakhs

- Remove Ads Get Premium Content Go Pro @₹99

- Top Stories Technical Trends

- Financial Times Opinion

- Learn GuruSpeak

- Webinar Interview Series

- Business In The Week Ahead Research

- Technical Analysis Personal Finance

- My Subscription My Offers

- Home FII & DII Activity

- Earnings Webinar

- Web Stories

- Tax Calculator

- Silver Rate

- Storyboard18

- Home Tech/Startups

- Auto Research

- Opinion Politics

- Personal Finance

- Home Performance Tracker

- Top ranked funds My Portfolio

- Top performing Categories Forum

- MF Simplified

- Home Gold Rate

- Trade like Experts

- Pharma Industry Conclave Unlocking opportunities in Metal and Mining

- Pitchcraft REA

- Advanced Technical Charts

- International

- Go pro @₹99

- Elections 2024

- Moneycontrol /

- Banks - Private Sector /

+151.15 (+0.69%)

+599.34 (+0.83%)

South Indian Bank Ltd.

BSE: 532218 | NSE: SOUTHBANK | Represents Equity.Intra - day transactions are permissible and normal trading is done in this category Series: EQ | ISIN: INE683A01023 | SECTOR: Bank - Private Bank - Private

- Portfolio | Watchlist

- Set SMS Alert

- Today's L/H

- F&O Quote

- Historical Prices

- Pre Opening Session Prices

- Technical Chart

- Moving Average

- Pivot Table

- Moving Averages

- Board meetings

- Announcements

- Mgmt Interviews

- Research reports

- Balance sheet

- Profit & Loss

- Quarterly Results

- Half Yearly Results

- Nine Months Results

- Yearly Results

- Capital Structure

- Financial Graphs

- Directors report

- Chairman's speech

- Auditors report

- Top Public SH

- Large deals

- Competition

- Latest price

- Stock Performance

- Total assets

- Fund Manager holdings

Prev. Close

27.35 (456)

27.40 (8045)

27.40 (75214)

- Result in New Format

- Result in Old Format

- Consolidated

Results of South Ind Bk

Ashok Leyland partners with South Indian Bank for dealer financing

Bulk deals: Citigroup Global Markets Mauritius buys shares in RBL Bank and South Indian Bank

Working with affected partner banks to reinstate co-branded card services: OneCard CEO

Bulk deals: Vanguard Index Funds buys stake in Sundaram Finance

South Indian Bank slumps over 3% after Q1 results

Five key trends from Q2 earnings of banks

South Ind Bk Standalone December 2021 Net Interest Income (NII) at Rs 572.87 crore, down 3.94% Y-o-Y

South Ind Bk Standalone September 2021 Net Interest Income (NII) at Rs 527.15 crore, down 20.5% Y-o-Y

South Indian Bank Q2 Net Profit to Rs. 37.2 cr: Prabhudas Lilladher

South Indian Bank Q3 Net Profit may dip 46.6% YoY to Rs. 48.4 cr: Prabhudas Lilladher

Banks' Q1 earnings to be hit by higher NPA provisions, low credit growth: Analysts

South Ind Bank Q3 net may rise 10%, loan growth seen below 10%

Should one add or avoid South Indian Bank after a weak Q1?

Analysis of Federal Bank Q3 numbers

Centrum Wealth picks Karur Vysya, Citi Union Bk as winners

Results of Banks - Private Sector Sector

Reduce AU Small Finance Bank; target of Rs 580: HDFC Securities

Hold IDFC Bank; target of Rs 67: Edelweiss

Buy IndusInd Bank; target of Rs 1809: HDFC Securities

Buy Indusind Bank; target of Rs 2000: Motilal Oswal

Dhanlaxmi Bank Oct-Dec net loss narrows to Rs 8 cr

City Union Bank Q3 net profit up 12% at Rs 127 cr

J&K Bank posts Q3 net loss at Rs 498 crore

J&K Bank Q3 net loss seen at Rs 151 cr, NII may fall 6%

ICICI Bank Q3 profit seen down 28%, slippages may hit earnings

Karur Vysya Bank Q3 net may dip 12%, loan growth may take a hit

Kotak Mahindra Bank Q3 profit seen up 27%, loan growth key

Rise in NPAs not too negative for ICICI Bank, analysts say

Flexible product mix helped Kotak keep slippages in check: Diwan

HDFC Bank growth to be led by volume; Q3 show stable: Experts

'Housing finance cos, private sector banks standouts of Q3'

Quick links

- Stock Views

- Brokerage Reports

Corporate Action

- Board Meetings

Information

- Company History

- Listing Info

- Large Deals

- Shareholding

- Top Shareholders

- Promoter Holding

- Balance Sheet

- Nine Monthly Results

Annual Report

- Directors Report

- Chairman's Speech

- Auditors Report

- Notes to Accounts

- Finished Goods

- Raw Materials

- Board of Directors

Peer Comparison

- Price Performance

- Total Assets

- Price of SBI on previous budgets

Related Searches

You got 30 day’s trial of.

- Ad-Free Experience

- Actionable Insights

- MC Research

You are already a Moneycontrol Pro user.

- SOUTH INDIAN BANK LTD.

- SECTOR : BANKING AND FINANCE

- INDUSTRY : BANKS

South Indian Bank Ltd.

NSE: SOUTHBANK | BSE: 532218

Mid-range Performer

27.40 -0.20 ( -0.72 %)

25.70% Fall from 52W High

31.6M NSE+BSE Volume

NSE 19 Apr, 2024 3:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Operating Revenue TTM

Below industry Median

Net profit TTM

Net Profit Margin TTM %

Revenue Growth (TTM)

Low in industry

Net Profit TTM Growth %

South Indian Bank Ltd. quarterly, annual results, revenue, profit, P&L, Balance Sheet, Cash Flow, Annual Reports, Margins - 15 Years history

IMAGES

VIDEO

COMMENTS

See 8 recent research reports for SOUTHBANK, BSE:532218 South Indian Bank Ltd. from 3 source(s) ... South Indian Bank, is a private sector bank headquartered in Thrissur, Kerala. The bank has 1,443 ATMs and 928 branches, with around 84% of them in South India. Currently, the bank is having a loan book size of ~Rs61,602cr and a deposit base of ...

South Indian Bank Ltd. has an average target of 35.00 from 3 brokers. See 8 latest analyst research reports for SOUTHBANK, BSE:532218 South Indian Bank Ltd.. Upvote, discuss and comment with all investors for free.

South Indian Bank Ltd Research Report. Q3. South Indian Bank (SIB) reported a stable set of Q3FY20 numbers with healthy growth in net interest income at | 602 crore; up 16% YoY, led by ~60 bps YoY improvement in margin on the back of change in asset mix. The bank reported steady business traction with credit & deposit growth stable at 9% & 11% ...

the earliest banks in South India. The establishment of the Bank was in alignment with the Swadeshi movement. The Bank is predominantly present in Kerala and south of India and is gradually expanding its presence in the country. The Bank operates in corporate, personal, business loans and agricultural segment. Segment-wise break up of loan book ...

The South Indian Bank Ltd. - Get live share price today, stock analysis, stock rating, price valuation, performance, fundamentals, market cap, shareholding, and financial report. Portfolio Please wait...

Stock Research Report for South Indian Bank Ltd. Stock score of South Indian Bank Ltd moved down by 1 in 3 months on a 10 point scale (Source: Refinitiv). ... The South Indian Bank Limited (the Bank) is a banking company. The Bank is engaged in providing a range of banking and financial services, including retail banking, corporate banking, and ...

See 5 recent research reports for SOUTHBANK, BSE:532218 South Indian Bank Ltd. from 2 source(s) with an average share price target of 22.

Bank's shares are listed on The Stock Exchange Mumbai (BSE) and The National Stock Exchange of India Ltd. Mumbai (NSE). South Indian Bank has 924 branches, 1171 ATMs and 122 CDMs/CRMs across India and a representative office in Dubai, UAE. South Indian Bank is a pioneer in technology-based banking, offering an array of digital products and ...

Meanwhile, during this quarter Bank could improve the Provision Coverage Ratio to 60.11% as on 30.06.2021 as against 58.73% as on 31.03.2021. The Capital Adequacy Ratio of the Bank stands comfortable at 15.47% as on June 30, 2021. Bank plans to raise additional capital during FY 21-22 to further strengthen the capital base.

Daily Updates of the Latest Projects & Documents. In 2016, South Indian Bank (SIB), a mid-sized private bank (currently third largest in southern India), looked to transform its retail and small and medium enterprise .

The study utilizes secondary data from the banks' annual reports over five years, from 2017-18 to 2021-22. ... However, regarding asset quality and earnings, HDFC Bank outperforms South Indian ...

JETIR1809468 Journal of Emerging Technologies and Innovative Research (JETIR) www.jetir.org 449 A STUDY ON FINANCIAL PERFORMANCE OF SOUTH INDIAN BANK LTD. ... For this study, data for 10 years has been collected from annual reports of South Indian Bank Ltd from the year 2012- 13 to 2016-17. 2.2 TOOLS USED

South Indian Bank has earned Rs 7,233.18 Cr. revenue in the latest financial year. South Indian Bank has posted Poor revenue growth of -2.33 % in last 3 Years. In terms of advances, South Indian Bank reported 16.35 % YOY, rise . If you see 3 years advance growth, it stands at 2.70 %. Currently, South Indian Bank has a CASA ratio of 32.98 %.

The purpose of this article is twofold: first, to examine South Indian Bank's financial performance, and second, to compare South Indian Bank's performance to that of HDFC Bank. The study ...

South Indian Bank

A Study on The Financial Performance of The South Indian Bank. Prasad M and Bijin Philip*. April 26, 2023. DOI : 10.56831/PSEN-02-049. View PDF. Abstract. Every country's financial system relies on the banking sector. It has an impact on the economy of the country by providing loans, infrastructure, and investment.

All Research Reports Stock and sector reports. Recent broker upgrades ... New buy/sell calls and IPO reports. New buy calls New sell calls New hold/acc calls New IPO reports ... SOUTH INDIAN BANK LTD. SECTOR : BANKING AND FINANCE. INDUSTRY : BANKS.

Get South Indian Bank latest Quarterly Results, Financial Statements and South Indian Bank detailed profit and loss accounts. ... RESEARCH Advice Broker Research ... Download Annual Report in PDF ...

The Company provides services to The South Indian Bank in the operational areas of Telecalling, Business Development , Data Entry Operations and I.T.Support. The company had onboarded 147 personnel during the Financial Year 21-22 and there were 136 personnel in the rolls, as at 31.03.2022.

The study uses South Indian Bank's financial data for the five years from 31st March 2017 to 31st March 2021. The researchers have collected the last five years' Balance Sheet and P&L account from the Bank's annual report. The researchers have adopted ratio analysis to analyze the profitability and efficiency of the South Indian Bank.

Get South Indian Bank latest Key Financial Ratios, Financial Statements and South Indian Bank detailed profit and loss accounts. ... RESEARCH Advice Broker Research ... Download Annual Report in ...

Annual Report for the FY 2019-20. Annual Report for the FY 2018-19. Annual Report for the FY 2017-18. Annual Report for the FY 2016-17. Annual Report for the FY 2015-16. Annual Report for the FY 2014-15. Annual Report for the FY 2013-14. Annual Report for the FY 2012-13. Annual Report for the FY 2011-12.

All Research Reports Stock and sector reports. Recent broker upgrades Recent broker downgrades ... South Indian Bank Ltd. quarterly, annual results, revenue, profit, P&L, Balance Sheet, Cash Flow, Annual Reports, Margins - 15 Years history Trendlyne. Stay ahead of the market ...