- Corporations

- Definitions

EIN Letter (What It Is And How To Get A Copy: Explained)

What is EIN Letter ?

What is an example of an EIN verification letter?

How do you get a new one?

In this article, I will break down the EIN Letter so you know all there is to know about it!

Keep reading as I have gathered exactly the information that you need!

Let me explain to you what is an EIN letter from IRS and why it’s important!

Are you ready?

Let’s get started!

Table of Contents

What Is An EIN Letter

An EIN letter can either refer to the Form CP 575 which is a letter sent by the IRS shortly after having assigned an EIN number to your or your business or it can refer to an EIN Verification Letter which is a letter sent by the IRS when Form CP 575 is misplaced.

Companies and some individuals get an EIN number (Employment Identification Number) representing a nine-digit number assigned to them by the IRS.

The EIN number is used to identify your company or sole proprietorship with the tax authorities, government agencies, banks, and other stakeholders.

The EIN letter (whether we are referring to CP 575 or the EIN Verification Letter) is a document that officially confirms your company’s EIN number.

At some point in time in your business, you may need to present this official EIN letter to banks, financial institutions, investors, suppliers, vendors, or others.

How EIN Letters Work

Now that we know what is an EIN letter, let’s see how it works.

Original EIN Letter

When you first apply for an Employer Identification Number, the IRS will send you an official confirmation of the EIN letter assigned to your company in a document called CP 575.

The CP 575 document is sent to you within 8 to 10 weeks following the approval of your EIN application.

It’s crucial to keep the CP 575 document in a safe place as the IRS will only mail this to you once.

If you lose or misplace your CP 575 , you will need to ask for a replacement EIN letter but this letter will no longer be a CP 575 but an EIN Verification Letter.

Replacement EIN Letter

No matter how careful we are, it’s possible that we lose paperwork from time to time.

The same is true for your EIN letter.

If you happen to lose your original EIN letter, you’ll need to ask the IRS for a replacement copy.

However, the IRS will not replace your original EIN letter by issuing once more the same CP 575 Form.

Instead, the IRS will issue an EIN Verification Letter in the form of a 147C Letter .

This letter is essentially the official substitute of the CP 575 form allowing you to officially confirm your company’s EIN letter should banks and lenders ask.

Why Is An EIN Letter Important

An EIN letter is an important document that is issued to your company by the IRS.

When the IRS assigns a tax identification number to your company (an EIN), it will officially confirm that assignment by sending a letter (an EIN letter).

The confirmation of your company’s EIN in a letter is like getting the confirmation of Social Security Number for individuals.

In the same way that an SSN is a crucial number for individuals, EIN is a crucial number for companies.

When you get your IRS EIN letter, it’s important that you keep this document in a safe place as you may be asked to show the original of this document in the normal course of business.

For example, financial institutions may ask you for your original Employer Identification Letter, lenders may ask for it, you may need it to open a business bank account, get a business license or permit, and many other things.

If you are asked for an original EIN confirmation letter and you do not have one, you will need to go through the process of contacting the IRS to get a replacement copy sent to you.

So be sure to always have your original Employer Identification Number confirmation letter handy.

How To Get EIN Letter From IRS

You are asking: how do I get a copy of my EIN letter from the IRS?

To get your original EIN letter, you’ll need to apply for an Employer Identification Number.

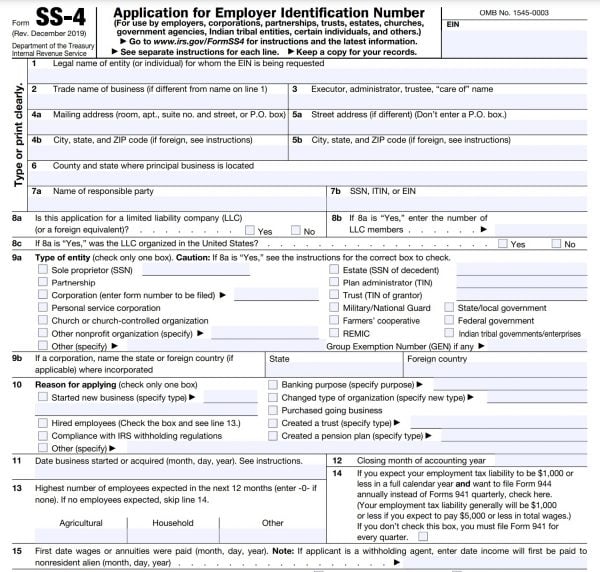

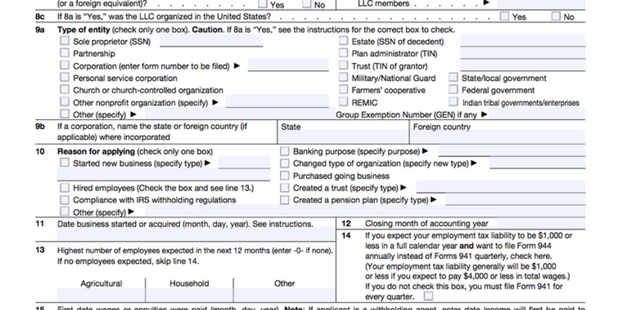

You do that by completing the SS-4 Form called Application for Employer Identification Number.

Once the IRS approves your EIN application, you will get your EIN Letter (CP 575) in the mail.

If you have lost your CP 575 and need to get a copy of the EIN letter, the best way is to call the IRS.

Here is how to get EIN letter from IRS:

- Call the IRS customer service line at 1-800-829-4933

- When the IRS answers, identify your business and answer any IRS questions to locate your company file

- Request EIN letter

- If your contact information has not changed, the IRS will send a replacement EIN letter to your company’s address on file

If your company’s address has changed or contact information needs to be updated, you must submit Form 8822 to the IRS before getting an IRS EIN letter replacement.

EIN Letter Sample

What does the IRS EIN letter look like?

If you are wondering what an EIN letter looks like, here is a sample copy of the original EIN letter sent to you by the IRS.

As you can see from this letter, the IRS indicates that they have assigned an Employer Identification Number to the company or business.

The EIN number will be used to identify the business, business accounts, tax returns , and documents.

The IRS invites you to permanently keep your EIN letter.

IRS EIN Letter Takeaways

So there you have it folks!

What does an EIN letter mean?

How to get EIN letter from IRS if you lost or misplaced your EIN ?

In essence, an EIN letter is the official confirmation of your company’s tax ID number (essentially the Employer Identification Number).

The first official letter confirming your company’s EIN is in the 575 Form.

However, if you lose or misplace your first official EIN letter, you can ask the IRS for a copy.

The IRS will then send you another EIN confirmation letter this time called the 147C letter (as the 575 Form is only issued once).

You may need your EIN letter in some cases to open a bank account, apply for licenses or business permits, get loans, or for other reasons.

Make sure that you keep your EIN letter in a safe place so you don’t lose it.

If you do lose your original letter, don’t worry, you can contact the IRS to get copy of EIN letter .

Now that you know what is an EIN letter, why it’s important, and how to get a copy of EIN letter, good luck with your business!

My Investing, Business, and Law Blog

By the way, on this blog, I focus on topics related to starting a business, business contracts, and investing, making money geared to beginners, entrepreneurs, business owners, or anyone eager to learn.

I started this blog out of my passion to share my knowledge with you in the areas of finance, investing, business, and law, topics that I truly love and have spent decades perfecting.

You may find useful nuggets of wisdom to help you in your entrepreneurship journey and as an investor.

Looking For Real Actionable Tips To Reach Your Financial And Business Goals?

If you’re interested in my actionable tips, guides, and knowledge on how to achieve your financial and business goals, subscribe to my blog and I’ll share with you my premium and exclusive content that will blow you away!

I’d love to share the insider knowledge that I’ve acquired over the years helping you achieve your business and financial goals.

Now, let’s look at a summary of our findings.

Understanding EIN Letter

If you enjoyed this article on EIN Letter , I recommend you look into the following terms and concepts. Enjoy!

You May Also Like Related to Employer Identification Number Letter

147C Letter By Name Title Business license Capital accounts Capital expenditures Cash distribution CP 575 Deductible expenses Federal payroll taxes How to start a business Its signature Managing partner Non-recourse debt Partnership basis calculation Partnership vs corporation Self-employment taxes Sole proprietorship Tax A reorganization Tax ID Number Tax-exempt income Tax-free reorganization Wholesale license Author

Related to Business

Business credit card Business lawyer Business taxes Commercial bank account Contract to hire EIN lookup Employee ID E-signature Find my EIN number Form 1120 Form 11-C Form 637 Form 720 Form 8822 Form 940 Form 941 Form 944 Form 990-T Responsible party SS4 form Types of businesses W2 contract What is EIN What is an INC What is an LLC What is SSN Author

RELATED ARTICLES

What is contract manufacturing (all you need to know), types of business strategy (all you need to know), is it cc’d or cc’ed (explained: all you need to know), most popular, what is a special purpose entity (all you need to know), what is corporate raiding (explained: all you need to know), what are golden shares (explained: all you need to know), what is a targeted repurchase (explained: all you need to know), what is a friendly takeover (explained: all you need to know), editor's picks, what does “she her hers” mean in a signature (all you need to know), what is business scope (explained: all you need to know), convertible preferred stock (overview: what it is and how it works), poison pill (what it is and how it works: all you need to know), capital stock (best overview: what is it, definition, examples).

- Privacy Policy

- Terms of Use

EIN Verification Letter: Everything You Need to Know

There are a lot of details to take care of when you start a business: choosing your business name, getting any necessary business licenses, and perhaps even forming a business entity. Getting your Employer Identification Number (EIN) may be one of those items on your to-do list; you’ll be able to check it off when you get your EIN verification letter from the IRS.

When you do, what happens next? Here’s what you need to know about your EIN verification letter.

What is an EIN Verification Letter?

An EIN verification letter (CP 575) can refer to two things. It can either refer to the letter you get from the IRS assigning an Employer Identification Number (EIN) for your business for the first time. It can also refer to a copy of the information because you forgot or lost the EIN for your business.

Oftentimes you will just need to provide your EIN number, but there may be certain instances when you need to produce your EIN verification letter, so it is a good idea to have it stored somewhere safe and accessible.

What is an EIN?

An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number (or TIN), and is used to identify a business entity. An EIN is a nine-digit number the Internal Revenue Service assigns in the following format: XX-XXXXXXX.

Think of it as the Social Security number for your business.

An EIN is free from the Internal Revenue Service. You can apply online for an EIN at IRS.gov or you can file Form SS-4 . The EIN application also includes a section that explains whether your business needs an EIN.

Some business formation services will apply for an EIN when you form your LLC or corporation, and there may be a fee for that service.

Why Small Business Owners Need It

An EIN number is extremely important for a variety of processes. It is important to have this number when you are doing things like:

- Filing your business tax returns

- Opening a bank account for your business

- Applying for a business license

- Ordering from vendors

- Setting up payroll

- Applying for a business loan

- Getting a business license

- Establishing a Keogh/Solo 401(k)

While some types of businesses may not need an EIN (especially if you are self-employed as a sole proprietor), it’s usually a good idea to get one. It will help separate your business and personal finances.

You don’t need an EIN to establish business credit ; in fact, your business credit reports may or may not list your business employer ID number. But when you apply for a small business loan , business credit card , or other types of financing, the lender will often request an EIN if your business has one.

If you form a business entity, you’ll often need to get an EIN. Find the best business formation resources here .

Compare Business Formation Services

Form an LLC, corporation, or nonprofit, and get an EIN, business license, or registered agent service. Use Nav to find the right business formation service for your business.

Who Needs to See Your EIN Verification

There are not many instances where you will need to show your EIN verification letter. Oftentimes you will only need to report your EIN number when it’s requested.

However, there are times you may need to provide the actual letter. These may include:

- Due diligence proceedings

- Certain loan applications

- Business licenses

- Certain vendor relationships

- Opening business bank accounts

Because you may be asked to provide your EIN confirmation letter, it’s a good idea to keep a copy handy so you can access it when needed. It’s also helpful to keep it on hand in case you want to make sure you’re providing the correct EIN when it’s requested.

How to Get Your EIN Verification Letter

When you are first assigned your EIN by the IRS you’ll get a letter confirming that. (You may see it referred to as IRS letter 147c).

A company can get an EIN number for free one of four ways.

- Complete the EIN online application form on the IRS website.

- For international companies, call the IRS directly.

- Fill out IRS form SS-4 and mail it to the IRS.

- Get it through your business formation service that requests it on behalf of your business.

Note that all businesses whose principal business, office or agency, or legal residence (in the case of an individual) is located in the United States or in one of the U.S. Territories can apply for an EIN online.

Once you complete your online application, you’ll get your EIN immediately. You’ll then be able to download, save and print your confirmation notice. Once you’ve completed the application, you will receive your EIN immediately. You can then download, save, and print your confirmation notice.

When you get your EIN verification letter, read it carefully to make sure all the information is correct, then store it in a safe place and make sure access to the EIN is limited. (It can be used to commit identity theft so just like you protect your SSN and personal information, protect your EIN.)

How to Get a Copy of Your EIN Verification Letter (If You’ve Lost It)

If you already have an EIN but have lost it, you can call the IRS at (800) 829-4933 and select EIN from the list of options. Tell the person who assisted you that you received your EIN from the Internet but have lost it. They can confirm your EIN.

If you also need a copy of the letter, contact the IRS Business and Specialty Tax Line to get the form you need to request the confirmation.

Using Your Verification Letter

You could potentially operate a business for years without any need to supply a copy of the letter that assigned your EIN.

Most of the time you will only need to provide your EIN number when it’s requested.

If you do need to use the original verification letter make sure you are only providing it to a reliable and trustworthy person/company. While EINs are a matter of public record, you should still be careful as these numbers can be used for illegal purposes.

Additional Tips for Small Business Owners (FAQs)

What’s the difference between an itin and an ein.

Both are a type of tax id number but an EIN is used to identify a business entity.The IRS issues individual taxpayer identification numbers (ITINs) to individuals who are required to have a U.S. taxpayer identification number for tax filing purposes, but who aren’t eligible to obtain a Social Security number (SSN) from the Social Security Administration (SSA).

An example would be a non-resident business owner who needs to file income tax returns.

Can I use an EIN instead of an SSN?

The IRS warns that an EIN is for use in connection with business activities only. Do not use your EIN in place of your social security number (SSN).

Can I use an SSN instead of an EIN?

If your business isn’t required to get an EIN, then you’ll use your SSN to file your personal tax forms, which will include information about your business. (Most sole proprietorships, for example, report business income on Schedule C with their 1040 tax return.)

When do I need a new EIN?

Generally, businesses need a new EIN when ownership or business structure has changed.

Generally, businesses don’t need a new EIN if they change their business name, move to a new location or operate multiple businesses.

If you change your address or if you change the responsible party for the entity after you receive your EIN, you’ll use IRS Form 8822-B, Change of Address or Responsible Party – Business, to notify the IRS of the new address.

If there is a change in the legal name of your business, you’ll need to write to the IRS notifying it of the change, with the request signed by an authorized person. Partnerships or corporations also need to include the Articles of Amendment filed with the state that authorized the name change.

How do I protect my EIN?

Business id theft is a growing problem. Unfortunately, there’s no way to “lock” your EIN to prevent it from being used improperly. But It is a good idea to check your EIN number at least once a year to make sure no one is using it illegally.

But you can do two things to help protect your business:

- Monitor your business credit reports with multiple commercial credit reporting agencies. New accounts you don’t recognize could be a sign of business id theft.

- Request your tax transcript to see if there is any activity you don’t recognize.

Access the business and personal credit data that lenders are actually seeing

Actively build business credit history, improve the metrics that matter, and access your best financing options – only at Nav.

Does an EIN make my business legit?

There are a number of steps you can take to set up your business properly for long-term success. Getting your EIN is often one of those steps.

Read: A 15-Step Checklist for a Legit Business

Gerri Detweiler

Education Consultant, Nav

Known as a financing and credit expert, Gerri Detweiler has been interviewed in more than 4000 news stories, and answered over 10,000 credit and lending questions online. Her articles have been widely syndicated on sites such as MSN, Forbes, and MarketWatch. She is the author or coauthor of five books, including Finance Your Own Business: Get on the Financing Fast Track. She has testified before Congress on consumer credit legislation.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name and email in this browser for the next time I comment.

NorthOne is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A., Member FDIC.

How to Find Your EIN Verification Letter From The IRS

Table of Contents

One of the many steps involved in starting a business is obtaining an employer identification number (EIN), which is also known as a federal tax identification number. This unique nine-digit number is used for all sorts of things required to run a legitimate business. After applying for your EIN, you’ll receive an EIN verification letter from the IRS.

You should hold onto this letter for as long as you own your business. But thankfully, if you lose it, you’re not totally out of luck. This article will cover everything you need to know about EINs and what to do if you lose your EIN confirmation letter from the IRS.

The basics of employer identification numbers

You can think of an EIN as being the equivalent of a Social Security number for your business. It allows your business to pay state and federal taxes—which is why the IRS sends verification letters—along with other essential aspects of your daily business.

In addition to paying taxes, you need an EIN to hire employees, open a bank account, and to apply for a business license. Of course, not all businesses need employees, but a business owner can get in a ton of trouble for operating without a license or not paying taxes. Additionally, having a business bank account is a smart way to help ensure you run a successful organization.

How to apply for an EIN

The IRS has taken a number of steps to make EIN applications easy for business owners. These are the options you have when applying for your EIN:

- Apply online: Filling out the online application is the easiest way to get an EIN. The information is validated upon completion of the application, so you receive your EIN immediately. However, keep in mind that you won’t get the confirmation letter until it arrives in the mail. This application process is available for entities with principal locations in the U.S. or U.S. Territories.

- Apply by fax: If you’re a taxpayer with access to a fax machine, you can fill out Form SS-4 and fax it back to the IRS. You’ll just want to ensure that all of the information is correct, as this option doesn’t have instantaneous confirmation like the online application. If your application is approved and you provide your fax number, the IRS will fax you back within four business days with your confirmation.

- Apply by mail: You can also submit Form SS-4 through the mail. However, the mail can be a bit slow at times, so this method of EIN processing takes around four weeks to complete. Again, you’ll want to double-check that every field is filled out correctly on your SS-4 form.

- Apply by telephone: International applicants can also apply by telephone Monday through Friday from 6:00 a.m. to 11:00 p.m. Eastern Time. This method simply involves telling an IRS agent all of your answers to the questions on Form SS-4. Applicants calling in must be authorized to receive EINs (which we’ll cover in the next section).

What is an EIN confirmation letter from the IRS?

The EIN verification letter from the IRS is a document that’s sent to business owners upon receiving their EIN. If you know your EIN off the top of your head, this letter will likely only be needed one time. You’ll just need to present a physical copy to open your business bank account.

However, that nine-digit number isn’t always easy to remember, so it’s not a bad idea to keep the verification letter in a safe place. Plus, you’ll need it if you need to open up a new business bank account.

How do I get my EIN confirmation letter?

Keeping your EIN verification letter from the IRS in a secure location (like a safe deposit box) is the best way to ensure you never lose it. But with so many documents to keep track of, it’s not out of the ordinary for these confirmation letters to go missing.

Although you don’t want to find yourself in bad standing with the IRS, the agency is fairly understanding when it comes to needing a new copy of your EIN confirmation letter, so they make it easy to get a new copy. Here are the steps to take if you misplace your IRS EIN confirmation letter:

- Call the IRS: If you need to contact the IRS, it’ll have to be over the phone. To get a copy of your verification letter, you can call them toll-free at 1-800-829-4933. This is the “business and specialty tax line.”

- Speak to an agent: Once you’re on the phone with an IRS agent, tell them you need a 147c letter—the document number for a new copy of your EIN verification letter from the IRS—and give them your EIN.

- Confirm your identity: Only authorized individuals can request a 147c letter. Even if you know your EIN, the agent will need to ask some questions to verify your identity. Examples of people who can request a 147c letter are business owners, partners in an LLC, corporate officers or anyone who has power of attorney over a company. In addition to providing your EIN, you’ll need to tell the agent your name, business address and the type of tax return you file.

- Choose how you’d like to receive your letter: Even though it’s the fastest way to receive documents, the IRS will never email you any sensitive information, so your only two options for receiving your 147c letter are through the mail or via fax. It’s not uncommon for mail from the IRS to take several weeks to arrive, so we recommend choosing the fax option if you need your 147c letter sooner rather than later.

What if my address has changed?

Getting a 147c letter is a bit more complicated if either your business address or personal address has changed since you started your company. If your business address changed, you’ll need to file Form 8822-B. And if your personal address changed, you’ll need to file Form 8822. You can download both of these forms online, but you’ll need to print them and mail them back to the IRS.

Can I get a copy of my EIN letter from the bank?

We get it—calling the IRS or waiting by the mailbox for your EIN verification letter from the IRS can be tedious. Thankfully, your bank can help you out! Although they can only provide you with a scan of your letter, this may be enough to accomplish whatever task you initially needed the document for.

Of course, you’ll want to verify that a scanned copy of the letter will suffice, but only waiting for a few minutes to get the document compared to several weeks is obviously preferable.

Get the small business banking help you need

The options are nearly limitless when you need to open up a small business bank account , but for a seamless banking experience, be sure to choose NorthOne. We’re committed to helping small businesses succeed and making life easier for business owners. Apply for an account today to start taking advantage of our innovative financial and organizational tools. Just be sure to submit your EIN verification letter from the IRS when you apply!

Eytan Bensoussan

Related posts, how to start a bookkeeping business in 8 steps, s corp vs. llc: what’s the difference and which one is the best fit for your business, partnership vs llc: the key differences to know, what is a c corporation and how to start one, how to find your articles of organization easily, 13 best recession-proof businesses in 2024.

Username or Email Address

Remember Me

Registration is closed.

- Open an Account

147C Letter – IRS EIN Verification

Searching for your misplaced EIN verification letter, also known as the IRS 147c letter? You’re not alone. Many business owners and tax professionals need to request a replacement EIN confirmation document. Thankfully, retrieving your 147c letter from the IRS is a straightforward process.

This comprehensive guide will simplify everything you need to rapidly get a replacement 147c letter. We’ll explain what the EIN verification letter contains, why you may need it, who can request it, and detail the fastest options to obtain your personalized 147c letter from the IRS.

So if you’ve lost your original Employee Identification Number (EIN) confirmation notice from the IRS and need another copy, you’re in the right place. Let’s dive in and demystify the entire 147c letter request process.

What is a 147c Letter?

An IRS 147c letter, also referred to as an EIN verification letter, is an official document sent from the Internal Revenue Service. It displays your business’s assigned nine-digit federal Employer Identification Number (EIN).

This EIN confirmation notice also includes your business entity’s complete registered legal name and address listed in the IRS database.

Essentially, whenever you successfully receive a federal EIN for tax and identification purposes, the IRS automatically mails your business this 147c verification letter. It serves as formal proof and acknowledgment from the IRS that your corporation, LLC, partnership or other business structure secured an official EIN.

Why do you need an IRS 147c Letter?

There are several important reasons you may need to acquire an EIN verification letter (147c) for your business:

- Opening a Business Bank Account – Most financial institutions require IRS confirmation of your EIN before opening a business bank or credit account under your company’s name and tax ID number. The 147c letter satisfies this prerequisite.

- Applying for Business Licenses – Local, state and federal licensing bureaus commonly mandate verified EIN documentation when processing applications for company licenses, permits or registrations.

- Proof of EIN for Tax Filings – Both the IRS and state taxing agencies can request your 147c letter to validate the legal business name and EIN matching their records when processing company tax documents.

- Legal Verification of Business Entity – Courts, government institutions and third parties frequently require formal IRS verification when confirming the legitimate existence of an organization’s tax identification.

In other words, despite having an EIN, many agencies and businesses will not formally recognize the legal status of your corporation or LLC without IRS-stamped validation. Whether opening a bank account, registering your company vehicle or simply proving your business life, expect to routinely provide a copy your 147c letter.

Who can request a 147c Letter?

Only authorized owners or representatives can retrieve a replacement EIN verification notice from the IRS. Typically, this means:

- A principal owning at least 20% equity share in the business

- An officer, member or partner listed in the company’s formal registration

- A designated Power of Attorney (POA) or Third Party Designee officially affiliated with the business

Minority shareholders, unofficial LLC members, employees, contractors or associates generally cannot request EIN confirmation directly from the IRS. However, with proper permissions, these informal affiliations can still obtain the 147c letter through an authorized representative listed above.

If no principal owner or officer remains active in the company, registered POAs may still qualify to receive a 147c notice on its behalf. Either way, the IRS will only issue replacement EIN letters to verified identities authorized under the business’s official registration.

How to get IRS 147c Letter (3 fast options)

Now that you understand what the form contains and why you need it, let’s explore the fastest ways to get your hands on an EIN verification letter (147c) from the IRS.

The IRS provides three reliable methods to quickly obtain your replacement 147c notice: call them directly, utilize a POA, or request through a professional tax service provider.

Option 1: Call the IRS directly

Calling the IRS Business and Specialty Tax line is the simplest way owners and principal officers can directly request a new 147c letter:

- Verify your government ID and personal details are available (SSN, ITIN, EIN, address etc.)

- Prepare answers to all potential IRS identity confirmation questions

- Call 1-800-829-4933, then press 1 for English or 2 for Spanish, followed by pressing 3 for all other questions

- Clarify the reason for your call is to request an updated 147c EIN verification letter

- Provide your fax number or verify mailing address for fastest IRS letter delivery

As long as you pass the standard security checks, the agent can instantly fax your new 147c letter or place a mail request to your registered business address. Just inform them of your preferred method to receive the refreshed EIN confirmation notice.

Expect a faxed 147c letter within minutes or mailed verification within 5-7 business days. Remember, only owners or partners can directly call the IRS through this process.

Option 2: Utilize an IRS Power of Attorney

If you cannot or prefer not to call the IRS directly, authorizing a Power of Attorney (POA) provides another path to securing your necessary 147c letter.

Here are the step-by-step instructions when using an IRS-approved POA representative:

- Identify an appropriate POA for your business (tax preparer, lawyer, trusted affiliate etc.)

- Fully complete IRS Form 2848 Power of Attorney with your POA

- Write “147c letter” next to Tax Form Number on section 3 of your 2848 POA form

- Provide your POA with access to all required identity verification details

- Call the IRS together at 1-800-829-4933, select language option, then press 3

- Your POA informs the agent they will speak on your behalf with POA form ready

- Fax your Form 2848 during the call when requested

- Answer all IRS security checks through your representative POA

- Request your updated 147c EIN verification letter delivery method

- Receive your refreshed letter instantly via fax or in 5-7 days by mail

This approach allows someone to securely obtain your 147c confirmation on your behalf. Make sure to fully prepare your chosen POA representative in advance.

IRS 147c letter sample

Option 3: Retain Professional Tax Services

Finally, specialized tax preparation firms frequently provide 147c letter retrieval services for businesses nationwide. Their IRS connections and specialized staff simplify the entire EIN verification process.

Although paid services can seem inconvenient, this hands-off approach requires no effort from you. Reputable providers like H&S Accounting & Tax Services can swiftly procure your refreshed IRS notice containing up-to-date legal business details.

Professional tax services also help correctly update any changed information with the IRS, guaranteeing your new 147c letter contains current company data. Their expertise ensures you receive a valid 147c suitable for all legal and institutional purposes.

In certain cases, tax experts may directly expedite letter requests through dedicated IRS processing channels not available elsewhere. This yields the fastest and most reliable 147c letter turnaround.

While costs vary between providers, paying reliable tax professionals removes all hassle getting your urgently needed EIN verification letter reissued correctly.

147c Letter request turnaround times

Outside of professional services, how long does it take to receive your EIN confirmation after placing a 147c letter request?

The good news is the IRS can instantly fax your refreshed letter minutes after approving an owner’s call or POA request. This electronic copy usually satisfies most needs requiring the EIN notice.

For a physical mailed copy, expect your official 147c envelope from the IRS within 5-7 business days after successful telephone or POA requests.

So if you need fast verification, request fax delivery and receive IRS confirmation of your EIN almost instantly. Otherwise, standard mail provides you an official document for more stringent bureaucratic demands.

Bottom Line: Verifying your business EIN is simple

Obtaining a replacement copy of your critical IRS 147c EIN verification letter is a quick and easy process. Now that you understand what this notice contains, why you need it, and how to request it, you can confidently prove and validate your registered business identification at any time.

Whether you handle the straightforward phone call directly or use a specialized service for convenience, the IRS makes retrieving your 147c confirmation simple and fast. With this guide’s help getting a refreshed letter, you can keep your company compliance and financial operations running smoothly.

What is the Care-of name? Back to top The Care-of name is a specific person or department within your organization to which the mail should be directed.

Individual income tax returns:

Customer login

Tax Pro login

Business tips

Obtaining Your EIN Verification Letter (Form 147C) from the IRS

8 minute read

Copy Article URL

Obtaining Your EIN Verification Letter From the IRS Form 147C: Request an EIN, Copy of EIN By Using IRS Letter 147C

Kristal Sepulveda, CPA

November 14, 2023

An Employer Identification Number (EIN) Verification Letter or EIN confirmation letter, also known as Form 147C, is a document issued by the Internal Revenue Service (IRS) to confirm the validity of your EIN. It is essential proof of your business's identity to conduct various financial and tax-related activities. This article will guide you through obtaining your EIN Verification Letter and help you understand its significance.

What is an EIN Verification IRS Letter 147C?

An EIN Verification Letter is an official document provided by the IRS that serves as confirmation of your business's EIN - a unique nine-digit number assigned to business entities for tax filing and reporting purposes. The letter includes important details such as the legal name of the business and its EIN, which are crucial for interacting with the IRS and other entities.

Understanding the purpose of an EIN Number Verification Letter

An EIN Verification Letter's primary purpose is to authenticate a business entity's existence and legitimacy. It provides third parties, such as financial institutions, vendors, and government agencies, with assurance regarding the accuracy of the EIN and the associated business entity.

Why do you need an EIN Verification Letter?

Businesses often require an EIN Verification Letter when opening bank accounts, applying for business loans, obtaining permits and licenses, or engaging in certain types of financial transactions. It is a vital piece of documentation that ensures smooth business operations and compliance with legal and regulatory requirements.

How does the IRS use the EIN Verification Letter?

From the IRS's perspective, the EIN Verification Letter is a means of validating the accuracy of the information provided by business entities . It helps the IRS confirm the identity of businesses and ensures that they are fulfilling their tax obligations in a lawful manner.

Want To Organize Your Business's Finances? Download A Free Balance Sheet Excel Template Here

How to request an ein verification letter.

If you need to request an EIN Verification Letter, the process involves contacting the IRS and submitting the necessary documentation to obtain the letter. Here are the steps for requesting an EIN Verification Letter:

Steps for requesting an EIN Verification Letter

To request your EIN Verification Letter, you'll need to complete Form SS-4, Application for Employer Identification Number, which is available on the IRS website or through their office. Once completed, you can submit the form to the IRS either online, by mail, fax, or in person.

Where to submit the request for an EIN Verification Letter?

The submission of Form SS-4 and the request for an EIN Verification Letter should be directed to the IRS Business and Specialty Tax Line or the appropriate IRS office, based on your business's location and the method of submission chosen.

Timeframe for receiving the EIN Verification Letter

Once the IRS processes your request, you can expect to receive your EIN Verification Letter within a reasonable timeframe. It's important to plan ahead and consider the time required for the IRS to review and respond to your request.

Want To Stay On Top Of Your Business's Accounts? Download A Free Chart Of Accounts Excel Template Here

When do you need to request a 147c letter need a 147c letter.

There are specific situations and events that may necessitate the need for a 147C Letter from the IRS. Understanding when you require this document is crucial to ensuring your business operations remain compliant and unhindered.

Events that require a 147C Letter from the IRS

Several circumstances, such as changes in business structure, tax audits, opening new business accounts, or interactions with government agencies, may require a 147C Letter from the IRS as part of the verification process.

How to identify if you need a 147C letter?

If you are unsure whether a particular situation or transaction requires a 147C Letter, it is advisable to consult with tax professionals, legal advisors, or directly with the IRS to determine the appropriate course of action. Proactively understanding the circumstances that warrant a 147C Letter can prevent potential disruptions in business activities .

Consequences of not having a 147C Letter when required

Failing to obtain a 147C Letter when needed can lead to delays in crucial business processes, denials of important applications, or even legal and financial repercussions. It is essential to be aware of the instances where a 147C Letter is mandatory and ensure timely compliance.

How to Contact the IRS for EIN Verification Letter?

When reaching out to the IRS to request an EIN Verification Letter or address related issues, it is important to understand the available options for communication and the information required for effective correspondence.

Options for contacting the IRS

You can contact the IRS through various channels, including phone, mail, online inquiries, or in-person visits to IRS offices. Each communication method has its own procedures and requirements, so selecting the most suitable option based on your specific needs is essential. The most common method is applying online via irs.gov.

Information required when calling the IRS for EIN Verification Letter

When contacting the IRS, you'll need to provide specific details such as your EIN, business name, contact information, and the purpose of your request. This information helps IRS agents process your request efficiently and accurately.

Resolving issues related to the EIN Verification Letter

In the event of errors, delays, or discrepancies related to your EIN Verification Letter, it's important to engage with the IRS promptly to address and resolve the issues. Working closely with IRS agents can help expedite the resolution process and prevent potential complications.

Common Errors and Issues when Requesting an EIN Verification Letter

While requesting an EIN Verification Letter, it's essential to be mindful of common errors and issues that may arise during the process. Being aware of these potential pitfalls can help you navigate the process more effectively.

Typical mistakes made when requesting an EIN Verification Letter

Errors such as incorrect information on the Form SS-4, incomplete documentation, or inaccuracies in the application details can lead to delays or rejections in issuing the EIN Verification Letter. Reviewing your submission thoroughly can help mitigate these issues.

Dealing with errors on the EIN Verification Letter

If you encounter errors or discrepancies on the EIN Verification Letter you receive, it's crucial to address them promptly by contacting the IRS. Providing clear explanations and supporting documentation can aid in rectifying any inaccuracies present in the letter.

Appealing a decision regarding the EIN Verification Letter

In situations where you disagree with the IRS's decision regarding your EIN Verification Letter, you have the right to appeal the decision through established procedures. Seeking professional guidance and understanding the appeals process can help effectively present your case.

Key Takeaways: Understanding Your Employer Identification Number Verification Letter

- CP 575 and 147C Letter : The CP 575 is the initial notice you receive from the IRS when you are assigned an EIN. If you need a copy, you can request a 147C letter, also known as an EIN Verification Letter.

- Getting a Copy of Your EIN : If you already have an EIN but require proof of your EIN, you can contact the IRS Business and Specialty Tax Line to request a copy of your EIN, specifically the CP 575 or 147C letter.

- EIN Verification Letter 147C : The IRS 147C letter is a document that serves as official proof of your EIN. If you need your 147C letter, you can request one from the IRS.

- Applying for an EIN : The way to get an EIN is through the IRS, and you can apply for an EIN if you don't remember your EIN or need a new one.

- Requesting EIN Confirmation Letter : If you need to provide your EIN to a third party or for official purposes, request an EIN confirmation letter, which the IRS will mail to you.

- Contact the IRS for EIN Issues : To receive your 147C letter or any documentation of your EIN, contact the IRS to request it. The IRS support team can guide you through the process.

- Form 2848 and EIN Representation : To allow someone else to request a copy of your EIN, you can use IRS Form 2848, which grants power of attorney.

- Understanding Your IRS Correspondence : The IRS send EIN Verification Letter as a way to provide official proof of your EIN. Remember, the IRS will never email 147C letters for security reasons.

- EIN Verification for Business Needs : If you need to prove your EIN for tax forms with the IRS or for business verification, the 147C letter or a copy of your CP 575 notice serves as a replacement for the original EIN notice.

- Receiving and Using Your EIN Documentation : Once you receive your verification letter, it's crucial to keep it for records as it is essential for maintaining good standing with the IRS and for various business needs.

- IRS Agent Communication : When you contact the IRS to request a copy or clarification, the IRS agent will ask for specific information to verify your identity and business details.

- Ensuring Compliance and Proof of Identity : It's important to recall your EIN or have a copy from the IRS for various transactions and interactions, as most financial institutions in the US accept 147C letters as well as other forms like Form 8821 or Form 2848.

How can Taxfyle help?

Finding an accountant to file your taxes is a big decision . Luckily, you don't have to handle the search on your own.

At Taxfyle , we connect individuals and small businesses with licensed, experienced CPAs or EAs in the US. We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will handle filing taxes for you.

Get started with Taxfyle today , and see how filing taxes can be simplified.

Legal Disclaimer

Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice. The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice. You should consult your own legal, tax or accounting advisors before engaging in any transaction. The content on this website is provided “as is;” no representations are made that the content is error-free.

Was this post helpful?

Did you know business owners can spend over 100 hours filing taxes, it’s time to focus on what matters..

With Taxfyle, the work is done for you. You can connect with a licensed CPA or EA who can file your business tax returns. Get $30 off off today.

Want to put your taxes in an expert’s hands?

Taxes are best done by an expert. Here’s a $30 coupon to access to a licensed CPA or EA who can do all the work for you.

Is this article answering your questions?

Thanks for letting us know.

Whatever your questions are, Taxfyle’s got you covered. If you have any further questions, why not talk to a Pro? Get $30 off today.

Our apologies.

Taxes are incredibly complex, so we may not have been able to answer your question in the article. Fortunately, the Pros do have answers. Get $30 off a tax consultation with a licensed CPA or EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have.

Do you do your own bookkeeping?

There’s an easier way to do bookkeeping..

Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands. Get $30 off today.

Why not upgrade to a licensed, vetted Professional?

When you use Taxfyle, you’re guaranteed an affordable, licensed Professional. With a more secure, easy-to-use platform and an average Pro experience of 12 years, there’s no beating Taxfyle. Get $30 off today.

Are you filing your own taxes?

Do you know if you’re missing out on ways to reduce your tax liability.

Knowing the right forms and documents to claim each credit and deduction is daunting. Luckily, you can get $30 off your tax job.

Get $30 off your tax filing job today and access an affordable, licensed Tax Professional. With a more secure, easy-to-use platform and an average Pro experience of 12 years, there’s no beating Taxfyle.

How is your work-life balance?

Why not spend some of that free time with taxfyle.

When you’re a Pro, you’re able to pick up tax filing, consultation, and bookkeeping jobs on our platform while maintaining your flexibility.

Why not try something new?

Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs.

Is your firm falling behind during the busy season?

Need an extra hand.

With Taxfyle, your firm can access licensed CPAs and EAs who can prepare and review tax returns for your clients.

Perhaps it’s time to scale up.

We love to hear from firms that have made the busy season work for them–why not use this opportunity to scale up your business and take on more returns using Taxfyle’s network?

by this author

Share this article

Subscribe to taxfyle.

Sign up to hear Taxfye's latest tips.

By clicking subscribe, I agree to Taxfyle's Terms of Service , Privacy Policy , and am opting in to receive marketing emails.

Get our FREE Tax Guide for Individuals

Looking for something else? Check out our other guides here .

By clicking download, I agree to Taxfyle's Terms of Service , Privacy Policy , and am opting in to receive marketing emails.

File simpler.

File smarter., file with taxfyle..

2899 Grand Avenue, Coconut Grove, FL 33133

Copyright © 2024 Tickmark, Inc.

- Meet the Team

- Event Speaking

- Testimonials

- Bookkeeping

- S-Corp Formation

- Virtual CFO

How can I get a copy of my EIN Verification Letter (147C) from the IRS?

If you have lost your federal employer identification number , you can contact the IRS to request a copy of the EIN confirmation letter.

To request a copy of the EIN Verification Letter (147C), complete the following steps:

- Call the IRS Business & Specialty Tax Line toll-free at 1-800-829-4933 between the hours of 7 am and 7 pm in your local time zone.

- When the call is answered, press 1 for English

- Next, you will be asked to press 1 for information related to your FEIN or EIN

- Next, select option 3 – You have a FEIN or EIN but need a confirmation number

- You will need to have the FEIN or EIN number, name, and address you have been using on your 941 forms, W‐2 forms, and or 1099 forms.

- Once your information has been verified, the IRS agent will offer to fax the letter to you immediately or snail mail you a copy of the letter.

Only an owner or a Power of Attorney (POA) can request a 147C Letter. If you would like a POA to request your EIN Verification Letter (147C), both you and your POA will need to complete the IRS Form 2848 and have it ready to send to the IRS via fax during the phone call with the IRS.

For more information on how to retrieve your EIN Verification Letter, visit this IRS resource .

- Rental Property and the 199A Deduction

- How to Deduct Real Estate Losses

Amy Northard, CPA

The Accountant for Creatives® + taxes + bookkeeping + consulting + Hang out with me over on Instagram !

Comments are closed.

We’re not your parent’s accountant. When you hire us, you will be treated with care during every step of the process.

- Find out more about us.

- Invite us to speak at your event.

- Sign up for free tax tips and advice.

News & Tax Tips

- Can I Put Unused 529 Money into a Retirement Account?

- Can My Business Deduct Meals and Entertainment Expenses?

- Are Stock Certificates Required for S-Corporations?

- Know Your Worth® Course

- S-Corp Reasonable Compensation

© 2024 The Accountants for Creatives®. Privacy and Terms .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

IRS Form SS-4 Instructions: What It Is and How to Find Yours

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is IRS Form SS-4?

IRS Form SS-4, Application for Employer Identification Number, is an IRS form businesses use to apply for an employer identification number (EIN). Business lenders may require an IRS Form SS-4 notice to verify a business’s EIN when evaluating a loan application.

Applying for a small business loan can be overwhelming, but there are a few things you can do in advance to make applying for a business loan go smoothly. Along with filing your most recent year’s business income tax return (and any past due tax returns , too), you’ll also want to locate and make copies of the documents your lender is likely to request. Among these documents is your IRS Form SS-4. Lenders often ask for the IRS Form SS-4 notice you receive after filing the form, not the form itself.

Here’s everything you need to know about IRS Form SS-4, why it’s important to your lenders, and how to obtain yours.

IRS Form SS-4, “Application for Employer Identification Number,” is the form businesses use to apply for an employer identification number (EIN). A business's EIN is its business tax ID number for use when filing small business taxes.

What is an EIN and why apply for it?

An employer identification number, aka an EIN, is a unique, nine-digit number that many types of businesses need for tax purposes.

If a business has employees, it needs an EIN to pay and file payroll taxes. And certain types of business entities need an EIN to file a business income tax return.

Sole proprietorships and single-person LLCs with no employees are the only types of business entities that are exempt from this requirement.

All U.S.-based businesses have the option of getting an EIN.

There are lots of benefits to having an EIN. For example, with an EIN, you can streamline your bookkeeping processes by separating your personal and business finances, open a business bank account, establish business credit, and even speed up your business loan application.

How to use IRS Form SS-4

You can get the IRS Form SS-4 on the IRS website. The form is only one page long.

Expect to provide information like:

Your business’s legal name and address

Name of applicant and their SSN, ITIN , or EIN

Type of entity

Reason for applying for an EIN

Date your business started

Highest number of expected employees in the next year

Principal business activity

Principal type of products or services sold or rendered

Also, note that business owners themselves don’t need to apply for their business’s EIN—you can delegate that task to any responsible party, which the IRS defines as the individual or entity that “controls, manages, or directs the applicant entity and the disposition of its funds and assets.” [0] IRS.gov . . Accessed May 10, 2022. View all sources You can apply via mail, fax, or phone (phone for international applicants only).

Why lenders ask for a copy of the IRS Form SS-4

Lenders need to verify EINs, which is why they often request a business’s IRS Form SS-4. However, when a lender asks for your IRS Form SS-4, it's not asking for a copy of your EIN application; it wants the notice the IRS sends out once it assigns your EIN. (Because IRS Form SS-4 is referenced on this notice, the notice itself is often referred to as Form SS-4.)

Why you need IRS Form SS-4 to verify your EIN

Lenders can't just use a tax return to verify an EIN. Clerical errors and typos happen. It’s possible that your tax preparer entered your EIN incorrectly, and the IRS hasn’t notified you of the error yet. This is a common error for returns filed on paper rather than electronically. It can take the IRS months—sometimes even longer—to identify the error and notify you of it.

The SS-4 allows lenders to go straight to the source of the information, which can speed up the underwriting process.

What if you don’t have an SS-4 notice?

If you’re a sole proprietor or an LLC with no employees, you might not have an EIN (these are the only two types of business entities that aren’t required to get an EIN for tax purposes). In that case, the loan will be in your name, and your lender will use your social security number in lieu of an EIN.

But for all other kinds of business entities, the business is a separate and distinct legal entity from the individual. Even if you provide a personal guarantee for a loan, you’ll still need to complete the loan application in the corporation's name, using the corporation’s EIN instead of your Social Security number. That requires an SS-4.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

How to get an IRS Form SS-4 notice: Instructions

Look on your hard drive or cloud-based filing system. If you applied for your EIN online, you received an IRS Form SS-4 notice — along with your EIN — immediately as a PDF.

U.S.-based banks require a copy of the IRS Form SS-4 notice in order to open a business bank account. Your banker may be able to get you a copy.

Your accountant might have completed your EIN application form for you and may have a copy.

Call the IRS Business and Specialty Tax Line at (800) 829-4933. After providing your EIN and identifying information about your business, the IRS sends a copy of your EIN assignment letter by mail or by fax. For security purposes, the letter will be sent to the address or fax number the IRS has on file for your business.

» MORE: See our list of IRS phone numbers

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

On a similar note...

How to Get a Copy of Your EIN W-9 From the IRS

- Small Business

- Business & Workplace Regulations

- Get a License

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Dismount a UDF Partition

How to send gmail to onenote, how to close a sole proprietorship in indiana.

- How to Send an Invitation From an Outlook Calendar to a Gmail Account

- How to Get a W2 From a Company That Is Not Around Anymore

Whenever a business is hired to do work, it must supply its Employer Identification Number (EIN) so the employer can report money paid to the Internal Revenue Service. This requires two documents, the EIN assignment letter that a business receives from the Internal Revenue Service when an EIN is initially requested and an IRS Form W-9. The W-9 can be downloaded from the IRS website, and the business must then provide a completed W-9 to every employer it works for to verify its EIN for reporting purposes.

Apply for an Employer Identification Number

Apply for an EIN on the IRS website. Go to the IRS website. Navigate to the section that allows businesses to apply for an EIN online. Use the electronic system to fill out Form SS-4, "Application for Employer Identification Number." The system will request basic information, including the name and address of the business, the entity type, in what state it was formed and the name, address and Social Security number of a responsible party.

The system assigns an EIN immediately upon transmission of the application. It notifies you of the number and generates an official EIN assignment letter from the IRS in PDF form.

Save a Copy of the EIN Assignment

Save a copy of the EIN assignment letter to your hard drive. Do not exit the application system or close the PDF window without saving the letter locally. The online PDF version of the EIN assignment letter is the only version the IRS will provide.

The letter is an official business document that you will need to open a bank account and for many other purposes. Print a copy of the letter for your business records book.

Obtain a Copy of Your Assignment Letter

Contact the IRS for a copy of your EIN assignment letter. If you have misplaced your EIN number or assignment letter, you can contact the IRS for a replacement. Download the hard copy instructions for Form SS-4. Look for the contact information for the IRS business service center for your area of the country. Call the local office or send a written letter, requesting a replacement EIN assignment letter.

Download Form W-9

Download an IRS Form W-9 from the IRS website. Form W-9 is a one-page template that enables businesses to present basic information to an employer so the employer can report payments to the IRS. The form requests the business' name, address and its assigned EIN, and is signed by a responsible party.

Provide a Copy of Completed W-9

Complete Form W-9 and provide a copy when requested. Form W-9 is completed by the business and provided to the employer or client that hires the business to do a job. The employer keeps the W-9 on file, using the information on it to complete a year-end report to the IRS on all payments made to contractors. Provide a W-9 to every employer that hires you. (Refs. 1, 5)

- FindLaw: Independent Contractors -- Overview

- SBA.gov: Independent Contractors vs. Employees

- IRS.gov: Apply for an Employer Identification Number (EIN) Online

- IRS.gov: Form SS-4

- IRS.gov: Instructions for the Requester of Form W-9

- SBA.gov: Starting & Managing a Business

- FindLaw: Forming and Operating a Small Business

Terry Masters has been writing for law firms, corporations and nonprofit organizations since 1995. Her online articles specialize in legal, business and finance topics. She holds a Juris Doctor and a Bachelor of Science in business administration with a minor in finance.

Related Articles

How to send a fax in ubuntu, how to get receipt of payment for work done, how to get a tax id verification letter, reasons to convert a pdf to microsoft word, how to recover a document on a shared server folder, how to fax with a mac air, how to verify an employer tax id number, how to verify a business license, what is the law about sending w-2 statements, most popular.

- 1 How to Send a Fax in Ubuntu

- 2 How to Get Receipt of Payment for Work Done

- 3 How to Get a Tax ID Verification Letter

- 4 Reasons to Convert a PDF to Microsoft Word

What Is the EIN Confirmation Letter: Everything You Need to Know

You receive an EIN Confirmation Letter once you have completed the Employer Identification Number (EIN) application on the IRS website. 3 min read updated on February 01, 2023

You receive an EIN Confirmation Letter once you have completed the Employer Identification Number (EIN) application on the IRS website. Upon completion, you will have the options for downloading and saving the Tax ID certificate. The confirmation letter, along with saved copies of your Federal Tax ID Number should be kept alongside all your other Limited Liability Company documents.

For every EIN application processed by the IRS, the agency sends out a confirmation letter called CP 575. The EIN confirmation letter is sent to the address provided on the SS-4 form, eight to ten weeks following the issuance of the Federal Tax ID Number. However, if you choose to apply online, a copy of the letter is viewable, printable, and ready for download directly from the IRS website as soon as the process is complete. Aside from serving as a documented proof of your LLC 's EIN assignment, a bank or a vendor may request to see a copy of the letter.

What Happens If You Lose Your Federal Tax ID Certificate?

If for whatever reason you need a replacement for a lost or never-received EIN confirmation letter, you can call the Internal Revenue Service, and they will send the verification letter to you. The copy is sent to the contact information you provided at the time you filed to have the application processed initially. If there has been a change of mailing address or fax number since that time, file Form 882 2 to update the IRS so that they can send the letter to the appropriate destination.

The Business & Specialty Tax Line is available Monday through Friday from 7 a.m. to 7 p.m. local time and handles all requests for a replacement of lost or misplaced EIN confirmation letters. The number to call is (800) 829-4933. If you want to contact the IRS directly, you can do so by calling (267) 941-1099 and ask for a 147C letter.

For security, you will need to verify your identity when contacting the IRS. Some of the security questions you may be required to answer include, but are not limited to, the following:

- Your name and position with the company

- The kind of income tax form you file for the business

- Name and address of the LLC

After adequately identifying yourself, the phone representative you have connected with will look up the number and send the confirmation letter replacement right away. There is no cost for receiving a copy.

If your need for the copy confirmation is dire, another option is to contact your bank or accountant. Either of the two may have kept a copy of your original Tax ID certificate, and you can merely get what you need from either of those sources.

Even if you applied online, for protection against fraudulent conduct, the Internal Revenue Service does not offer online verification. Alternatively, if you initially completed your EIN application online , your email's inbox or archive folder would be a superb place to check for the confirmation email the IRS would have sent to you when your Employer Identification Number was first issued.

A Few More Things To Know About the EIN

You cannot apply for an EIN until after your LLC has state approval. An important thing to remember is that although you must obtain a Tax ID if you have hired employees, your LLC does not need to have employees to be assigned an Employer Identification Number.

The EIN is nine digits long, just like a person's Social Security Number. To distinguish the two, the EIN is written starting with two numbers, then a hyphen, followed by the remaining seven digits. So here's an example of the EIN format: 12-3456789.

Although the IRS does not require businesses to pay a fee for to receive an EIN, there are quite a few websites that will complete the application for you at costs ranging from $50 to $100.

If you already have an EIN from a former taxation identity, it is likely due to a connection with a Sole Proprietorship . You want to close that Tax ID number out. After you have received state approval for your LLC, obtain a new number, which will be a completely different EIN for your Limited Liability Company .

If you need help with EIN Confirmation Letter, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Copy of EIN Letter From IRS

- Where Do I Find My LLC Number? Everything You Need to Know

- Applying For Ein For LLC

- Application for Tax ID

- Get Federal Tax ID for LLC

- How to Get an EIN

- EIN Number Florida

- Application for Tax ID Number

- EIN Number Lookup NY

- Apply for EIN for LLC

- The Excel Capital Team

- Partner With Us

- Small Business Loans

- Unsecured Business Loans

- Business Line of Credit

- Bad Credit Business Loans

- Merchant Cash Advance

- Equipment Financing

- Invoice Factoring

- Business Education

- Business Blog

- Business Loan Calculators

- Write For Us

SS4 Letter – What is it and how to get a copy of yours

When running a business it’s important to understand what legal documents are crucial to keep on file one of the most frequently used is the SS-4 Letter.

When starting a new business the IRS makes you file a variety of forms to register an entity for tax purposes.

The most basic of these forms is a form SS-4. Essentially this is your EIN or Tax ID registration Card.

This form must be kept in a secure place because you will be required to provide the Form SS-4 during various phases of your business.

Acquiring a small business loan is one of them. The business loan process can be a bit overwhelming at times.

You need to research your loan options, gather documentation, and complete paperwork.

The thing is, more of us have enough on our plate and the loan process is wholly unfamiliar to us. Especially when it comes to the documentation that needs to be gathered to apply for a loan.

One such document is Form SS-4, which lenders may request when submitting your application.

What does a ss-4 form look like?

Here is what an ss-4 letter looks like after it is filed and submitter –

If you’re unsure of how to get your Form SS-4 Letter, don’t worry, we’ve got you covered.

You might be thinking what is Form SS-4? Or, What is an ss4 letter?

Form SS-4/ ss4 letter is an IRS form that corporations use to apply for an employer identification number (or EIN) Also known as an SS4 IRS Notification Letter which lists your EIN number and is a formal confirmation you may need frequently.

An EIN is required for several reasons, including:

- Federal tax reporting

- Opening a business bank account

- And applying for a business license

In a nutshell, your EIN is what the IRS uses to identify your business and Form SS-4 Letter is the official IRS form that allows you to obtain an EIN number.

How do you know if you need an EIN? An EIN is required for your business if:

- You have employees

- You’re applying to obtain a business bank account, license, or credit

- Or operate as either a partnership or corporation

- Are operating under any class of incorporation (LLC, S-Corp, C Corp, Non profit ) instead of being a sole proprietor

How to get a copy of your Form SS-4 / EIN Assignment Letter

If you don’t have a copy of Form SS-4 , or have not yet applied for an EIN, you can now use the IRS’ online application tool to submit your Form SS-4 and obtain it.

If you do not wish to apply online through the online application tool on the IRS website you can complete a form and send it off it to the department of treasury.

This is IRS Form SS-4:

If your lender requires a Form SS-4 copy, you’ll need to provide a copy or obtain proof of having submitted the form to the IRS.

Keep in mind that the IRS won’t give you a copy of Form SS-4 itself if you’ve already filled it out previously, but rather an EIN assignment letter which will serve as proof to lenders of having submitted Form SS-4 to the IRS and obtained your EIN.

Here’s how to obtain a copy of your EIN assignment letter:

Step 1: Grab your EIN

First, you’re going to need your EIN handy, so if you don’t know it you can find it on either:

- Any bank accounts that you opened under the corporation required a Tax ID – call your bank to retrieve a copy.

- Or prior corporate tax returns

Once you have your EIN, you’re ready for the next step.

Step 2: Call the IRS

Now, it’s time to take your EIN and call the IRS’ Business & Specialty Tax Line at (800) 829-4933.

The B&S Tax Line is open between 7 A.M. and 7 P.M., Monday through Friday, so make sure you call between those days and hours.

Step 3: Provide the B&S Tax Specialist with your information

Next, once you’ve been connected with a B&S Tax specialist, provide them with the requested information about your company for verification. This will include your EIN and is the reason you gathered it in the previous step.

You’ll also need to verify that you yourself are an authorized contact from within the company. This typically means you’ll be asked to provide your title in the company.

Step 4: Request a copy of your EIN assignment letter

Once verified, all you need to do is request a copy of your EIN assignment letter from the specialist.

It’s important that you not try to request a copy of Form SS-4 as the IRS doesn’t authorize providing copies of completed tax documents like Form SS-4 letter. You need to request a copy of your EIN assignment letter specifically.

Also, keep in mind that, in most cases, the IRS will mail the requested letter copy to the corporate address on file. You can also offer an alternative address or business fax, though, if you need it faster for your loan application.

Get your Form SS-4 Letter

Obtaining a copy of Form SS-4 is just one document required to apply for and obtain a business loan. However, as you can see it’s not at all difficult to obtain. All it requires a bit of know-how and some time spent on the phone.

Whether you’re already beginning the process of obtaining a business loan or are considering it for the future, it’s wise to begin collecting the necessary documents now so you’ll have less to worry about later.

Plus, you’ll avoid any potential delays when applying, which is especially important if you’ll need the funds fast when it comes time to apply.

The Form SS-4 Letter is very important to keep on hand. You never know when you will need it.

See What Your Business Qualifies For

Check out our funding calculators, unsecured business loan calculator.

SBA Loan Calculator

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Future Developments

Indian tribal governments/enterprises..

Forms SS-4 and SS-4(sp) absorb Form SS-4PR.

Pub. 51 and Pub. 80 rolled into Pub. 15, plus new Pub. 15(sp).

Purpose of Form

Apply for an EIN online.

Keep Form SS-4 information current.

File only one Form SS-4.

EIN applied for, but not received.

How To Apply for an EIN