- Sample Business Plans

- Real Estate & Rentals

Real Estate Investment Business Plan

Real estate has been one of the fastest-growing industries in recent times. So, if considering starting a real estate investment business—this is the right time.

Whether you’re a seasoned investor to get into real estate or a rookie aiming to set your foot in this rapidly growing market, you need a solid business plan to make your real estate investing business a runaway success.

Need assistance writing your business plan? Worry not.

We have prepared a real estate investment business plan template to help you get started.

Let’s cut to the chase: download this template, follow step-by-step instructions, and finish the first draft of your plan.

recognize opportunities and deal with challenges in an effective way. It’ll also help you devise an investment strategy that brings you maximum returns.

Real Estate Industry Overview 2023

Here is an overview of the current state of the real estate industry in 2023:

Market size and growth potential:

Employment scenario:, key players:.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

Things to Consider Before Writing a Real Estate Investment Business Plan

Select the right property location.

Selecting the right location to invest in is one of the primary requirements for a real estate business’s success. You should select the location based on what is the potential of infrastructural development in the area. Is it a preferable location for commercialization and urbanization or not? You should always keep these things in mind to ensure the maximum possible returns on your investment.

Know the purpose of your investment

Knowing what you want by investing in real estate is the first step toward making a proper plan. After all, a proper purpose gives you a well-defined goal to work towards and makes it easier to decide what steps you’ll need to take. Hence, decide why you want to invest in real estate. Whether it is for primary income, secondary income, planning for the future, etc.

Do your research

Research is essential if you want to thrive in the real estate business. Doing your research helps you understand what you are getting yourself into and how your different decisions can impact your business. It also helps you make a better and more fact-based plan.

Know all of your options

Although a lot of people go for long-term investments, it might not be the right thing depending on various factors. But that doesn’t mean that you have to give up on your idea of real estate investment. You can simply look into the other options like real investment trust, real investment company stocks, and so on and pick the option that works for you.

How Can a Real Estate Investment Business Plan Help You?

You may want to start investing as soon as possible, after all, investments take time to grow, right? But just like a stitch in time saves nine, a real estate investment business plan can help your investment business prosper in the future even if it seems time-consuming at the moment.

It can help you design a proper business model and formulate a great business growth strategy. Moreover, it can also help you track your progress along the way.

All in all, it can make your investments way smoother than going about without a business plan.

Chalking out Your Business Plan

The real estate sector is one of the most profitable sectors to invest in. Many investors swear by it as a bankable source of secondary income.

Not just that, the real estate investment market increased from 9.6 trillion dollars in 2019 to 10.5 trillion dollars in 2020. Although it may take time, investment in the housing market can help your money grow.

And though the above information invests in the real estate sector as a rosy prospect, it can go horribly wrong without a proper business plan and investment strategy.

Read on to find out what a business plan can do for your investment business.

Real estate investment business plan outline

This is the standard real estate investment business plan outline which will cover all important sections that you should include in your business plan.

- Purpose of the Plan

- Introduction

- The Problem

- The Solution

- A fundamental change in the US housing market

- All three legs of the apartment investment stool are in place

- Weak Housing Market

- Competitive Advantage

- Business Model

- Growth Opportunity

- Corporate Structure Overview

- Source and Use of Funds

- Return on Investment

- Mission Statement

- Business Objectives

- Legal Structure

- Company Ownership

- Location and Premises

- Intellectual Property

- CREI Business Model

- Revenue Projections

- The Amount of Investment Funds Requested

- Business Benefits

- Investment Repayments

- Good Investment Trends in Apartment Rentals

- Rent Spikes Coming For a Good Investment in Apartment Buildings

- Apartments Continue as Good Investment Through 2012 and Beyond

- Apartment Buildings Going From Good Investment to Great

- Filling Basic Needs Makes for a Good Investment

- More Americans renting by choice

- The Apartment Building Investment Triple Opportunity Is Right Now

- Internet Growth Allows Renters to Locate Good Apartments

- Industry Participants

- Competitive Advantages

- Strategic Initiatives?

- Brand Strategy

- Provide Individuals, Families, and Businesses with Quality Rental Properties at an Affordable Price.

- Positioning Statement

- Pricing Strategy

- Sales Strategy

- Sales Forecast

- Sales Programs

- Strategic Alliances

- Social networking websites

- Email campaigns

- SEO (Search Engine Optimization) PPC

- Banner advertisements

- Search Engine Optimization

- Organizational Structure

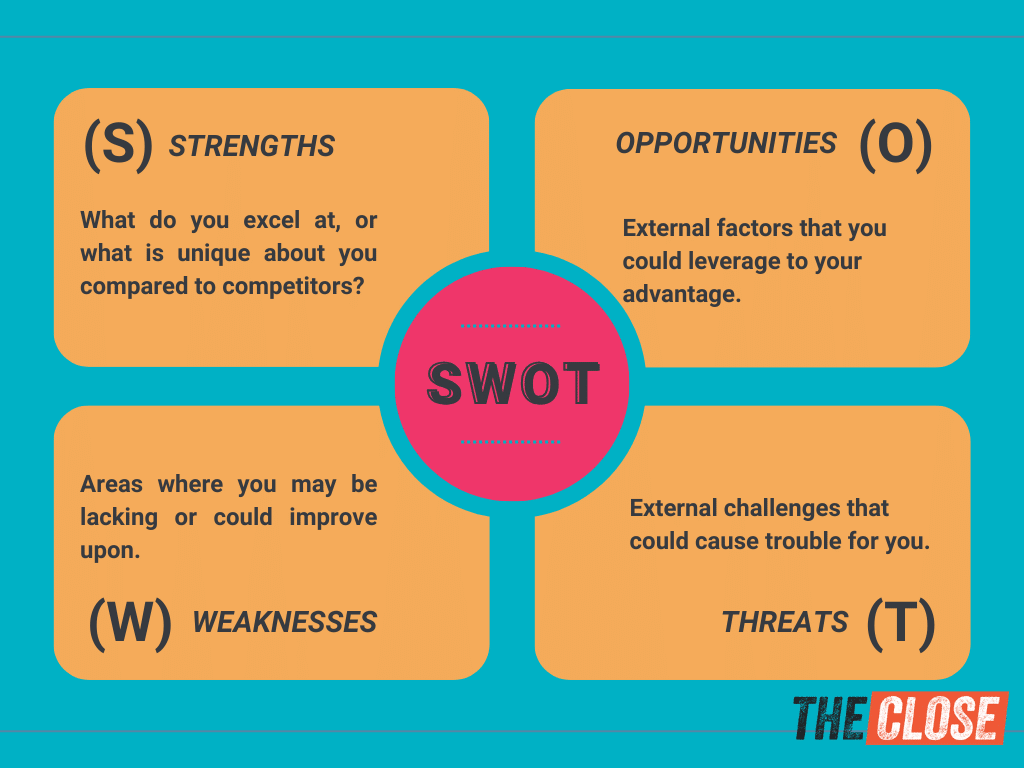

- SWOT Analysis

- Key Assumptions

- Key Financial Indicators

- Explanation of Break-even Analysis

- Business Ratios

- Long-term Plan and Financial Highlights

- Projected Income Statement

- Projected Cash Flow

- Projected Balance Sheet

How to Write a Real Estate Investment Business Plan?

A real estate investment business plan consists of several key areas that must be included in it and add things that would be unique to you and your business.

Also, there are several ways in which you can write a business plan including online business plan software and pre-designed templates. You can choose the method that works best for your individual needs.

What to Include in a Real Estate Investment Business Plan?

Although a business plan should be customized as per the needs of an individual and market situation, there are certain areas that every real estate investment business plan must include. They are as follows:

1. Executive Summary

The executive summary section is the first and foremost section of your business plan. It consists of what your entire business stands for. It focuses on everything ranging from opportunities and threats, competitive advantages your business has, the structure of the current market as well as the financial needs of the business.

Most importantly for a real estate investment business plan, it would also consist of the prospective return of investment one can expect from the business as well as the expected duration of time for that growth to happen.

2. Business Concept and Revenue Model

This section would include the type of investment concept and revenue model you plan on following with your business. So, before writing this section it is a good practice to analyze the current trends in the market as well as your own finances, to find the concept that fits the best for you in the current market situation.

In this section, you can also include methods of tracking the progress of your investments.

3. Market Analysis

Whenever one starts a new business it is mandatory to carry out market analysis to flourish in it. It not only helps you in understanding the market, but it also helps you in choosing the right strategy for your own business.

For example, in the US rent spikes and increasing demand for rental accommodations make the rent department an extremely profitable segment in the real estate market. A thorough analysis of the market can thus help you choose the most favorable market segment as well as the best locality to invest in.

4. Growth Strategy

In this section, you should include the milestones you plan on having for your investment business. It helps you set well-defined tasks to achieve those milestones and keeps you motivated while doing the same. Also, with the help of milestones, you can always pinpoint when and where you are going wrong and need a shift in direction.

5. Web Plan

Having a web presence can be immensely helpful in building your network and reaching out to potential partners and organizations that can help you grow.

For building an online presence you can use various tools like social media, email marketing, optimized web pages, etc.

6. Management Summary

This segment includes information regarding the roles and responsibilities of the people in your business. The people in your business are a major aspect that decides its success or downfall, therefore a thorough detail of their work and progress is an essential part of your business plan.

7. SWOT Analysis

Carrying out a SWOT analysis before writing your business plan can make the process faster, easier, and way more well-defined. Hence, including it in your business plan is always a good idea.

8. Financial analysis

Even though financial analysis is crucial for any business, it is especially important for investment businesses. In this section, you can include the time required to reach the break-even point, the projected growth of your business, long-term finances as well and strategies to deal with potential changes in the market.

Download a sample real estate investment business plan

Need help writing your business plan from scratch? Here you go; download our free real estate investment business plan pdf to start.

It’s a modern business plan template specifically designed for your real estate investment. Use the example business plan as a guide for writing your own.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Write your business plan with Upmetrics

Using a business planning app like Upmetrics is the best way to draft your business plan. This incredible tool comes with step-by-step instructions and a library of 400+ customizable business plan templates to help you get started.

So what are you waiting for? Download your example and draft a perfect business plan.

Related Posts

Real Estate Investment Financial Plan

Real Estate Development Business Plan

Real Estate Agent Business Plan

Party Rental Business Plan

Business Plan Presentation Making Guide

Small Business Plan Writers

Frequently Asked Questions

Do you need a business plan for real estate investing.

Indeed. Whether you plan to start a real estate investing, development, or mortgage broker business—you need a solid business plan to make your real estate business a runaway success. You can use Upmetrics’ real estate & rental business plan templates to get started writing your plan.

What's the importance of a marketing strategy in a real estate investment business plan?

Marketing strategy is a key component of your real estate investment business plan. Whether it is about achieving certain business goals or helping your investors understand your plan to maximize their return on investment—an impactful marketing strategy is the way to do it!

Here are a few pointers to help you understand the importance of having an impactful marketing strategy:

- It provides your business an edge over your competitors.

- It helps investors better understand your business and growth potential.

- It helps you develop products with the best profit potential.

- It helps you set accurate pricing for your products or services.

What is the easiest way to write your real estate investment business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any real estate investment business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business planning tool .

How do I write a good market analysis in a real estate investment business plan?

Market analysis is one of the key components of your business plan that requires deep research and a thorough understanding of your industry.

We can categorize the process of writing a good market analysis section into the following steps:

- Stating the objective of your market analysis—e.g., investor funding.

- Industry study—market size, growth potential, market trends, etc.

- Identifying target market—based on user behavior and demographics.

- Analyzing direct and indirect competitors.

- Calculating market share—understanding TAM, SAM, and SOM.

- Knowing regulations and restrictions

- Organizing data and writing the first draft.

Writing a marketing analysis section can be overwhelming, but using ChatGPT for market research can make things easier.

About the Author

Vinay Kevadiya

Vinay Kevadiya is the founder and CEO of Upmetrics, the #1 business planning software. His ultimate goal with Upmetrics is to revolutionize how entrepreneurs create, manage, and execute their business plans. He enjoys sharing his insights on business planning and other relevant topics through his articles and blog posts. Read more

Turn your business idea into a solid business plan

Explore Plan Builder

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

- Buyer Agent 101

- Listing Agent 101

- Getting Your License

- Open Houses

- Stats + Trends

- Realtor Safety

- Social Media

- Website Marketing

- Referral Marketing

- Property Marketing

- Branding + PR

- Marketing Companies

- Purchasing Leads

- Prospecting

- Paid Advertising

- Generate Listings

- Generate Buyer Leads

- Apps + Software

- Lead Gen Companies

- Website Builders

- Predictive Analytics

- Brokerage Tech

- Building a Brokerage

- Recruiting Agents

- Lead Generation

- Tech Reviews

- Write for Us

All products mentioned at The Close are in the best interest of real estate professionals. We are editorially independent and may earn commissions from partner links.

7 Steps to Writing a Real Estate Business Plan (+ Template)

As a licensed real estate agent in Florida, Jodie built a successful real estate business by combining her real estate knowledge, copywriting, and digital marketing expertise. See full bio

- Do Agents Really Need a Business Plan?

- Write a Real Estate Business Plan in 7 Easy Steps

- Identify Who You Are as a Real Estate Agent

- Analyze Your Real Estate Market

- Identify Your Ideal Client

- Conduct a SWOT Analysis

- Establish Your SMART Goals

- Create Your Financial Plan

- Track Your Progress & Adjust as Needed

- Bringing It All Together

Are you ready to take your business to the next level? I’ve got just the thing to help you— a foolproof real estate business plan. But before you start thinking, “Ugh, not a boring business plan for real estate,” hear me out. I’ve got a template that’ll make the process a breeze. Plus, I’ll walk you through seven easy steps to craft a plan to put you ahead of the game and have you achieve your wildest real estate dreams in no time. Your success story starts now.

Key Takeaways:

- A well-crafted business plan is your roadmap to success. It guides your decisions and keeps you focused on your goals.

- Create a solid plan by defining your mission, vision, and values, analyzing your market and ideal client, conducting a SWOT analysis, setting SMART goals, and creating a financial plan.

- Regularly track your progress, review your key performance indicators (KPIs), stay flexible, and seek accountability to ensure long-term success.

- Remember, your Realtor business plan should evolve with your business. Embrace change and stay focused on your goals to make your real estate dreams a reality.

Do Agents Really Need a Real Estate Business Plan?

Absolutely. Your real estate agent business plan is your roadmap to success. Without it, you risk losing direction and focus in your real estate career.

A well-crafted business plan helps you:

- Understand your current position in the market

- Set clear and achievable goals

- Create a roadmap for success

- Track your progress and performance

- Make informed decisions and adjustments

Think of your real estate business planning as your GPS, guiding you from your current situation to your desired destination. It serves as your North Star, keeping you focused and on track, even in challenging times. Invest the time to create a solid business plan, and you’ll be well-positioned to succeed in your market and achieve your goals. Your future self will appreciate the effort you put in now.

Before we dive into this section, get our real estate business plan template ( click here to go back up to grab it ) and work through it as I explain each section. I’ll give you some direction on each element to help you craft your own business plan.

1. Identify Who You Are as a Real Estate Agent

Let’s start with your “why.” Understanding your purpose for choosing real estate is crucial because it is the foundation for your business plan and guides your decision-making process. Defining your mission, vision, and values will help you stay focused and motivated as you navigate your real estate career.

Mission: Your mission statement defines your purpose for choosing real estate. It clearly states what you’re trying to do, the problem you want to solve, and the difference you want to make.

Ex: Wanda Sellfast’s mission is to empower first-time homebuyers in Sunnyvale, California, to achieve their dream of homeownership and build long-term wealth through real estate.

Vision: Your vision statement focuses on the ultimate outcome you want to achieve for your clients and community.

Ex: Wanda Sellfast’s vision is a Sunnyvale, where everyone has the opportunity to own a home and build a stable, secure future, creating a more inclusive and prosperous community for all.

Values: Your core values are the guiding principles that shape your behavior, decisions, and interactions with clients and colleagues.

Ex: Wanda Sellfast’s core values include:

- Integrity: Being honest, transparent, and ethical in all dealings.

- Dedication: Being devoted to clients’ success and going the extra mile.

- Community: Building strong, vibrant communities and giving back.

Clearly defining your mission, vision, and values lays the foundation for a strong and purposeful real estate business that will help you positively impact your clients’ lives and your community.

2. Analyze Your Real Estate Market

As a real estate pro, you must deeply understand your local market. This knowledge includes knowing key metrics such as average days on market, average price points, common home styles and sizes, and demographic trends. When someone asks about the market, you should be able to confidently roll those numbers off your tongue without hesitation.

To quickly become the local expert, choosing specific farm areas to focus on is crucial. Concentrate your marketing efforts and build your local knowledge in a handful of communities and neighborhoods.

Some places to do research include:

- Your local MLS: Check your hot sheet daily

- Zillow: Check out the Premier Agents who show up in your neighborhood

- Social media: Who is targeting their posts to your area?

- Direct mail: Check your mailbox for flyers and postcards

- Drive by: Drive through your farm areas to see who has signs in yards

Once you’ve identified your target areas, start conducting comparative market analyses (CMAs) to familiarize yourself with the properties and trends in those neighborhoods. That way, you’ll provide accurate insights to your clients and make informed decisions in your business.

Remember to research your competition. Understand what other agents working in the same area are doing, who they’re targeting, and identify any gaps in their services. This understanding will help you differentiate yourself from your competition and better serve your clients’ needs. In our real estate business planning template, I ask you to examine and record:

- Trends: Track key metrics, such as days on market and average sold prices, to stay informed about your specific market.

- Market opportunities: Identify situations where there are more buyers and sellers (or vice versa) in the marketplace so you can better advise your clients and find opportunities for them and your business.

- Market saturation: Recognize areas where there may be an oversupply of certain property types or price points, allowing you to adjust your strategy accordingly.

- Local competition: Analyze your competitors’ strengths, weaknesses, and gaps in their services to identify opportunities for differentiation and possibilities to create a more meaningful impact.

Remember, real estate is hyper-local. While national and state news can provide some context, your primary focus should be on specific needs and trends within your target areas and the clients you want to serve. By thoroughly analyzing your local real estate market, you’ll be well-equipped to make informed decisions, provide valuable insights to your clients, and ultimately build a successful and thriving business.

3. Identify Your Ideal Client

When creating your real estate business plan, it’s crucial to identify your ideal client. You can’t be everything to everyone, no matter how much you think you should. And trust me, you certainly don’t want to work with every single person who needs real estate advice. By focusing on your ideal client, you’ll create a targeted marketing message that effectively attracts the right people to your business—those you want to work with.

Think of your target market as a broad group of people who might be interested in your services, while your ideal client is a specific person you are best suited to work with within that group. To create a detailed profile of your ideal client, ask yourself questions like:

- What age range do they fall into?

- What’s their family situation?

- What’s their income level and profession?

- What are their hobbies and interests?

- What motivates them to buy or sell a home?

- What are their biggest fears or concerns about the real estate process?

Answering these questions will help you create a clear picture of your ideal client, making it easier to tailor your marketing messages and services to meet their needs. Consider using this ideal client worksheet , which guides you through the process of creating a detailed client avatar. This will ensure you don’t miss any important aspects of their profile, and you can refer back to it as you develop your marketing plan .

By incorporating your ideal client into your overall business plan, you’ll be better equipped to make informed decisions about your marketing efforts, service offerings, and growth strategies. This clarity will help you build stronger relationships with your clients, stand out from the competition, and ultimately achieve your real estate business goals.

4. Conduct a SWOT Analysis

If you want to crush it in this business, you’ve got to think like an entrepreneur. One of the best tools in your arsenal is a SWOT analysis. It sounds ominous, but don’t worry, it’s actually pretty simple. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. It’s all about taking a good, hard look at yourself and your business.

By conducting a SWOT analysis as part of your real estate business plan, you’ll have a clear picture of your current situation and your future goals. And don’t just do it once and forget about it—review and update it regularly to stay on top of your game.

5. Establish Your SMART Goals

If you want to make it big in real estate, setting goals is an absolute must . But not just any goals— I’m talking about SMART goals . SMART stands for Specific , Measurable , Achievable, Relevant , and Time-bound . It’s like a recipe for success, ensuring your goals are clear, realistic, and have a deadline.

Your SMART goals are an integral part of your overall business plan for real estate. They should be stepping stones to help you achieve your long-term vision and mission. So, analyze your SWOT analysis, ideal client, and market, and craft goals that will help you dominate your niche.

Example Smart Goal: Close 10 transactions in the next quarter.

Make sure to provide as many details as possible behind your goals. Don’t just say, “I want to sell more houses.” That’s too vague. In the example above, the goal is specific: “close 10 transactions.”

If you can’t measure your progress, how will you know if you’re crushing it or falling behind? Ensure your goals have numbers attached to track your success or see where you need to focus more energy. “Close 10 transactions” has a specific number, so you have a way to measure your progress.

I know you’ve got big dreams for your real estate business , but Rome wasn’t built in a day. Set goals that stretch you beyond your comfort zone but are still achievable. This way, you’ll gain confidence, build momentum, and push yourself to new heights. Closing 10 transactions in a quarter is a lofty goal, but it’s still achievable. Your goals should stretch you but still be within your reach.

Relevant goals are the ones that actually move the needle for your business. Sure, becoming the next TikTok sensation might be a lot of fun, but unless TikTok generates most of your clients, it won’t help you close more deals. Your goals should be laser-focused on the activities and milestones that will help you grow your real estate career. In the example above, the goal is specifically related to real estate.

Deadlines are your friend. Without a timeline, your goals are just wishes. Give yourself a precise end date and work backward to create a plan of action. In the example, the deadline for achieving the goal is the end of the current quarter. If you don’t achieve the goal, you can evaluate where the shortfall was and reset for the next quarter.

“Setting goals is the first step in turning the invisible into the visible.”

Tony Robbins

Remember, just like your SWOT analysis, your goals aren’t set in stone. Review and adjust them regularly to stay on track and adapt to business and market changes.

6. Create Your Financial Plan

Financial planning might not be your idea of a good time, but this is where your real estate business plan really comes together. Thanks to all the research and strategizing you’ve done, most of the heavy lifting is already done. Now, it’s just a matter of plugging in the numbers and ensuring everything adds up.

In this real estate business plan template section, you’ll want to account for all your operating expenses. That means everything from your marketing budget to your lead generation costs. Don’t forget about the little things (like printer ink, file folders, thank you cards, etc.)—they might seem small, but they can add up quickly. Some typical expenses to consider include:

- Marketing and advertising (business cards, website , social media ads )

- Lead generation ( online leads , referral fees, networking events )

- Office supplies and equipment (computer, printer, software subscriptions )

- Transportation (gas, car maintenance, parking)

- Professional development (training, courses, conferences )

- Dues and memberships (MLS fees, association dues)

- Insurance (errors and omissions, general liability)

- Taxes and licenses (business licenses, self-employment taxes)

Once you’ve figured out your expenses, it’s time to reverse-engineer the numbers and determine how many deals you need to close each month to cover your costs. If you’re just starting out and don’t have a track record to go off of, no worries! This planning period allows you to set a budget and create a roadmap for success.

Pro tip: Keep your personal and business finances separate. Never dip into your personal cash for business expenses. Not only will it make tax time a nightmare, but it’s way too easy to blow your budget without even realizing it.

If you’re evaluating your starting assets and realizing they don’t quite match your startup costs, don’t panic. This new insight is just a sign that you must return to the drawing board and tweak your strategy until the numbers line up. It might take some trial and error, but getting your financial plan right from the start is worth it.

7. Track Your Progress & Adjust as Needed

You’ve worked hard and created a killer real estate business plan, and you’re ready to take on the world. But remember, your business plan isn’t a one-and-done deal. It’s a living, breathing document that needs to evolve as your business grows and changes. That’s why it’s so important to track your progress and make adjustments along the way.

Here are a few key things to keep in mind:

- Set regular check-ins: Schedule dedicated time to review your progress and see how you’re doing against your goals, whether weekly, monthly, or quarterly.

- Keep an eye on your KPIs: Your key performance indicators (KPIs) are the metrics that matter most to your business. Things like lead generation, conversion rates, and average sales price can give you a clear picture of your performance.

- Celebrate your wins: When you hit a milestone or crush a goal, take a moment to celebrate. Acknowledging your successes will keep you motivated and energized.

- Don’t be afraid to pivot: If something isn’t working, change course. Your real estate business plan should be flexible enough to accommodate new opportunities and shifting market conditions.

- Stay accountable: Find an accountability partner, join a mastermind group, or work with a coach to help you stay on track and overcome obstacles.

“It’s the small wins on the long journey that we need in order to keep our confidence, joy, and motivation alive.”

Brendon Burchard

Remember, your real estate business plan is your roadmap to success. But even the best-laid plans need to be adjusted from time to time. By tracking your progress, staying flexible, and keeping your eye on the prize, you’ll be well on your way to building the real estate business of your dreams.

How do I start a real estate business plan?

Use this step-by-step guide and the downloadable real estate business plan template to map your business goals, finances, and mission. Identify your ideal client so you can target your marketing strategy. Once you’ve completed all the business plan elements, put them into action and watch your real estate business grow.

Is starting a real estate business profitable?

In the most simple terms, absolutely yes! Real estate can be an extremely profitable business if it’s run properly. But you need to have a roadmap to follow to keep track of your spending vs income. It’s easy to lose track of expenses and overextend yourself when you don’t have a set plan.

How do I jump-start my real estate business?

One of the easiest ways to jump-start any business is to set clear goals for yourself. Use this guide and the downloadable template to ensure you have clear, concise, trackable goals to keep you on track.

How do I organize my real estate business?

Start by setting some SMART goals to give yourself a concrete idea of what you see as success. Then, make sure you’re using the right tools—customer relationship manager (CRM), website, digital document signing, digital forms, etc., and make sure you have them easily accessible. Try keeping most of your business running from inside your CRM. It’s much easier to keep everything organized if everything is in one place.

Now, you have a step-by-step guide to creating a real estate business plan that will take your career to the next level. Taking the extra time to map your path to success is an essential step in helping you achieve your goals. Spend the extra time—it’s worth it. Now, it’s time to do the work and make it happen. You’ve got this!

Have you created your real estate business plan? Did I miss any crucial steps? Let me know in the comments!

As a licensed real estate agent in Florida, Jodie built a successful real estate business by combining her real estate knowledge, copywriting, and digital marketing expertise.

51 Comments

Add comment cancel reply.

Your email address will not be published. Required fields are marked *

Related articles

The complete guide to 1031 exchange rules.

It's crucial to understand 1031 exchange rules so you can better serve your real estate investor clients—so we've broken them down for you, in plain English.

Ace Your Exam with Our Free Real Estate Practice Exam

Take our free real estate practice exam & apply our tips and hacks from our pro to ace your state's real estate licensing exam in 2023.

16 Open House Scripts & Tools That Actually Get Phone Numbers

If you want to connect with new prospects and get more leads at your next open house, check out this list of 15 scripts and ice breakers that will actually get you phone numbers and email addresses. Plus, we include three tools that can make the process even smoother.

Success! You've been subscribed.

Help us get to know you better.

How to Write a Real Estate Investment Business Plan: Complete Guide

- Tweet Share Share

Last updated on September 19, 2024

Building an investing business without a real estate investment business plan is sort of like riding a bike without handlebars.

You might be able to do it… but why would you?

It’s far easier and more practical to set out on your venture with a business plan that outlines things like your lead-flow, where you’ll find funding, and which market(s) you’ll operate.

Plus, according to Entrepreneur, having a business plan increases your chances of growth by 30%.

Download Now: Free marketing plan video and a downloadable guide

So don’t skip this critical first step.

Here’s how to do it.

Real Estate Investment Business Plan Guide

In this article we’re going to discuss:

- What is a real estate investment business plan?

- Create your mission and vision

- Run market analysis

- Choose your business model(s)

- Determine your business goals

- Find funding / Cash buyers

- Identify lead-flow source

- Gather property analysis information

- Create your brand

- Set growth milestones

- Plan to Delegate

What is a Real Estate Investment Business Plan and Why Does it Matter?

A real estate investment business plan is a document that outlines your goals, your vision, and your plan for growing the business .

It should detail the real estate business model you’re going to pursue, your chosen method for lead-gen, how you’ll find funding, and how you plan to close deals.

The kit and caboodle.

It shouldn’t be overly complicated.

Whether this real estate investment business plan is only for your personal use or to present to someone else, simplicity is best. Be thorough, be clear, but don’t over-explain what you’re going to do.

As far as why you should have a business plan , consider that it gives you a 30% better chance of growing your business.

Also, consider that setting out without a plan would be like — full of unexpected twists and turns — is that something you want to do?

Probably not.

It’s worth taking a few days or weeks to put together a business plan, even if it’s just for your own sake. By the time you’re complete, you’ll have greater confidence in the business you’re setting out to build.

And an entrepreneur’s confidence is everything.

How to Create Your Real Estate Investment Business Plan

Now we get into the nitty-gritty.

How do you create your real estate investment business plan? Here are the 10 steps!

1. Create Your Mission & Vision

This can be considered your “summary” section. You might not think that you need a mission statement or vision for your real estate business.

And you don’t.

We know a lot of real estate investors (many of our members, in fact) don’t have a clear mission or vision that they’ve outlined — and they’re successful regardless.

But if you’re just getting started…

Then we think it’s a worthwhile use of your time.

Because if you don’t know why you’re going to build your real estate investing business, if you don’t see what purpose it serves on a personal and professional level, then it’s not going to be very exciting to you.

You can either use this time to create a mission for your business… or a mission statement for you as it relates to growing your business (depending on your goals).

For instance…

- Our mission is to create affordable house opportunities in the Roseburg, Oregon community.

- Our mission is to provide homeowners with an exceptional experience when selling their properties for cash.

Or you could go a more personal route…

- My mission is to create a business that supports my family.

- My mission is to build a company that gives me more time for what matters most to me.

Or you could do both…

- My mission is to create a business that supports my family, and my business’ mission is to provide homeowners with an exceptional experience when selling their properties for cash.

Either way, it’s good to think about this before getting started.

Because if you know why you’re going to build your business — and if, ideally, that reason resonates with you — then you’ll be more excited and determined to work hard toward your goals.

It is also an excellent opportunity to outline the core values you’ll adhere to within your business as Brian Rockwell does on his website …

With this information in hand, you’re ready to move on to the next step.

2. Run Competitive Market Analysis

Which market are you going to operate in?

That might be an easy question to answer — if you’re just going to operate in the town where you live, fair enough.

But it’s worth keeping in mind that today’s technology has made it possible to become a real estate investor in any market from pretty much any location (remotely).

So if the market you’re in is lacking in opportunity, then you might consider investing elsewhere.

How do you know which market to choose?

Here are the 10 top real estate markets for investors, according to our own Carrot member data of over 7000 accounts, based on lead volume…

- Atlanta, GA

- Houston, TX

- Chicago, IL

- Charlotte, NC

- New York, NY

- Los Angeles, CA

- Orlando, FL

- Philadelphia, PA

- Phoenix, AZ

And here are the top 20 states…

- North Carolina

- Pennsylvania

- Oregon

That’ll give you some ideas.

But what makes a market good or bad for real estate investors? Here are some metrics to pay attention to when you’re doing your research.

- Median Home Value — This will tell you how much the average home sells for in the market, which will impact whether you’ll be willing to operate there. Because obviously, you want to play with numbers that feel reasonable to you.

- Median Home Value Increase Year Over Year — Ideally, you want to invest in a market where homes are appreciating every year. And a positive increase in this metric is a good sign that the properties you invest in will continue to increase in value.

- Occupied Housing Rate — A high housing occupancy rate means it’s easy to find tenants, and there’s a healthy demand for housing. That’s a good sign.

- Median Rent — This is the average cost of rent in the market and will give you a good idea of how much you’ll be able to charge on any rentals you own.

- Median Rent Increase Year Over Year — If you’re going to buy rentals, it’s a good sign if rental costs increase every year.

- Population Growth — When the population grows, it creates demand for housing, both rentals and on the MLS. That’s a good sign for a real estate investor.

- Job Growth — Job growth is a sign of a healthy economy and indicates that you’ll have an easier time capitalizing on your real estate investments.

Fortunately, all of this research is super easy to do on Google.

You can just type in the market and the metric in Google and you’ll get meaningful results.

Thank god for technology.

Want more freedom & impact?

From Mindset to Marketing, join our CEO as he unlocks the best stories, tactics, and strategies from America’s top investors and agents on the CarrotCast . If you want to grow your business, you need to check it out!

3. Choose Your Business Model(s)

There’s not just one real estate business model .

There are many.

And the market you’re in — as well as your business goals — will determine which business model you choose.

Here’s a brief overview of each…

- Wholesaling — Is a prevalent business model in the real estate world. Wholesalers find deals and flip them to other cash buyers for an assignment fee, typically somewhere between $5,000 to $10,000. It’s low risk and requires little capital upfront (you can get started with as little as $2,000).

- Wholetailing — Wholetailing is a mix between wholesaling and house flipping. A wholetailer will find a deal, do some very minor repairs (if any), and sell the house on the MLS themselves. It results in large profits with far less work. But wholetail deals are hard to come by.

- BRRRR — This stands for Buy, Rehab, Rent, Refinance, Repeat. It’s a long-term process for buying and holding rental properties. It’s a great way to build net worth and create generational wealth.

- Flipping — House flipping is the most popularized real estate investing method. It consists of purchasing distressed properties, fixing them up, and selling them at a good profit on the MLS, often making upwards of $100,000 per deal. However, this method involves much more risk than the other methods and each deal takes a lot longer to complete.

If you’re just getting started, then we recommend choosing just one business model and doing that until you’ve mastered it.

Down the road, you will likely want to use multiple business models.

We know the most successful real estate investors are wholesalers, wholesalers, flippers, and they own some rental properties.

That allows them to make the most of every opportunity that comes their way.

But again… to start, just choose one.

4. Determine Your Business Goals

At this point, you should have a pretty clear idea of why you’re going to build your real estate investing business.

Are you going to build it because you want to make an impact in your community? Because you want more financial freedom? Because you want more time freedom?

All of the above?

Whatever the case, now it’s time to set some goals related to your mission for the business.

Remember the SMART acronym for goal setting…

Start by thinking about how much money you’d like to make per month — this should be the first income threshold that you’re excited to hit.

Let’s pretend you said $10,000 per month.

Okay, now take a look at your business model. How many properties do you need to have cash-flowing to hit that number? How many deals do you have to do per month? How many flips?

Try to be as realistic with your numbers as possible.

Here are some baselines to consider for the different business models at the $10k/month threshold…

- Wholesaling – 2-3 Deals Per Month

- Wholetailing – 2-3 Deals Per Month

- BRRRR – $1 Million in Assets

- Flipping – 1-2 Flips Per Year

Now you have a general idea of the results you’ll need to hit your first income threshold.

But we haven’t talked about overhead costs.

How much will you need to spend to get those results?

Your answer to that question will be influenced by the market analysis you already did. But it’s pretty standard for the price of finding a deal to hover around $2,000 for a real estate investor (if you’re doing your own advertising).

So now you’re spending $2,000 per deal, or whatever your specific number is. That’s going to have an impact on how much money you’re making. So now we can adjust your goals to be more realistic for hitting that $10k per month marker…

- Wholesaling – 4-5 Deals Per Month

- Wholetailing – 4-5 Deals Per Month

- BRRRR – $1.5 Million in Assets

- Flipping – 2-3 Flips Per Year

The idea here is to figure out how many deals you’ll have to do per month to hit your income goals.

Then work that back into figuring out how much you’ll need to spend every month to realistically and predictably hit your goals.

At $2k per deal and intending to hit $10k/month, here’s what your deal-finding costs might look like…

- Wholesaling – 4-5 Deals Per Month – $8k-$10k/month

- Wholetailing – 4-5 Deals Per Month – $8k-$10k/month

- BRRRR – $1.5 Million in Assets – $6k-$8k/month

- Flipping – 2-3 Flips Per Year – $4k-$6k/month

That should give you a baseline.

How do those numbers look?

If they feel too high for you right now, lower your initial goal — you want to make your first goal something that you know you can accomplish.

Then, as you gain experience, you can increase your goals and make more money down the road.

Free Real Estate Marketing Plan Template

Take our short survey to find out where you struggle most with your online marketing strategy. Generate your free marketing plan video and downloadable guide to increase lead generation and conversion, gain momentum, and stand out in your market:

Download your marketing plan template here.

5. Find Funding / Cash Buyers

Are you going to fund your own deals or find private investors ? Or maybe you’re going to get a business loan from a bank?

If you’re just starting as a wholesaler or wholetailer, then it’s recommended funding your own first few deals — that should only cost $2,000 to $5,000… and why overcomplicate things in the beginning when you’re still trying to learn the ropes?

However, as a wholesaler or wholetailer, you’ll still need to find some cash buyers.

Here’s a great video that’ll teach you how to do that…

To consistently grow your cash buyer list (which is an important part of the wholesaling and wholestailing business model), we also recommend creating a buyer website like this…

Learn more about creating your cash buyer website with Carrot over here .

To scale, you might seek out other sources of funding.

Here are some options…

- Bank Loan — Getting a loan from a bank might be the most straightforward strategy if you’re just getting started. But keep in mind that the requirements for a loan on an investment property will be more stringent than the requirements were for your primary residence mortgage. And the interest rate will likely be higher as well. For that reason, you might seek out some of the other options.

- Hard Money — Hard money loans come from companies that specifically serve real estate investors. They are easier and faster to secure than a bank loan and hard money lenders typically base their approval of the loan on the quality of the investment property rather than the investor’s financial standing.

- Private Money — Whereas a hard money loan comes from a company; a private money loan comes from an individual with a good chunk of capital they’re looking to invest. That could be a friend, family member, coworker, and acquaintance. Interest rates and terms on these loans are typically very flexible and the interest rate is usually quite good. Private money is an excellent option for real estate investors looking to scale their business.

But before you seek out funding from those sources, get clear on what exactly you’re going to use those funds for.

Finding funding is even more critical. In fact — if you’re flipping properties or using the BRRRR method.

(It’s a key part of the BRRRR method)

You’ll likely want to use hard money or private money to fund your deals as you grow your business.

But how do you find and secure those loans?

Hard money lenders are easy to find — just Google for hard money lenders in your area and call the companies that pop up to get more details.

Private money (which usually has more favorable terms than hard money) is a bit trickier to find but not at all impossible.

To find private money lenders, you can…

- Tell Friends & Family — This should be the first thing you do. Tell everyone you can about the business you’re building and the returns you can offer investors. Then ask them if they know anyone who might be interested in investing.

- Network — After you’ve exhausted all your friends and family, make a point of getting to know people everywhere you go. The easiest way to do this is to wear branded clothing so people ask about what you do. Talk to people at coffee shops, grocery stores, movie theaters, and anywhere else that you frequent. You never know who you might meet.

- Attend Foreclosure Auctions — Foreclosure auctions are jam-packed with people who have cash-on-hand to buy properties. These people might also be interested in investing in your real estate endeavors. Or they might know where to find private money. Either way, it’s in your interest to build relationships with these people. Attend foreclosure auctions and bring some business cards.

Here are some tips on finding private money lenders…

6. Identify Lead-Flow Source

Now let’s talk about how you will generate a consistent flow of motivated leads for your business.

Because no matter which of the business models you’ve chosen… you’re going to need to find motivated sellers.

And you’re going to need to find those people every single month.

There are essentially two parts to a successful lead generation strategy for real estate investing business.

Both pieces are critical…

- The Short Term — We call this “hamster-wheel marketing” because it requires you to keep working and spending money to generate leads. Examples include Facebook ads, direct mail, bandit signs, cold calling, driving for dollars, and other tit-for-tat strategies that will burn you out if you’re not careful.

- The Long Term — We call this “evergreen marketing” because it requires an upfront investment… but that investment pays off for years and years to come. Examples include increasing brand awareness for your business in your target market(s) and improving your website’s SEO , so that motivated sellers find you .

Short-term tactics are critical when you’re first starting — in fact, they are likely going to be your only source of leads for at least the first few months.

Here are some more details on the most popular and effective methods…

- Tax default mailing lists

- Vacant house lists

- Expired listing lists

- Pre-foreclosure lists

- Out-of-state landlord lists

- Cold Calling — This might be more uncomfortable than stubbing your toe on a piece of furniture, but it can still be effective for finding motivated sellers. We have an article all about colding calling — it even has scripts for you to use.

- Facebook Ads — Facebook ads is another excellent method for generating leads so long as you have a high-converting website to send them to . If you don’t, get yourself a Carrot website . Each Carrot site is built to convert. Here are some more details about running successful ads on Facebook for your real estate investing business.

- Google Ads — Google Ads is one of the most popular platforms for real estate professionals needing to provide quick results with a minimal to high investment depending on markets.

But over time, the goal is to invest in more long-term evergreen marketing tactics so that you can get off the hamster wheel and build a more sustainable business.

Check out the video below to learn more about the critical distinction between short-term and long-term marketing.

At Carrot, we’ve created an online marketing system that makes generating leads super easy and simple for real estate investors.

And it’s 100% evergreen.

Here’s an example of one of our members’ websites that converts like crazy…

Try our free Marketing Plan Generator here.

7. Gather Property Analysis Information

We just talked about how you can generate leads.

But once someone calls you, once you’re checking out a property… How will you know if the property is a good fit for your chosen business model?

After all, not every property will be a fit.

First, ask the following questions when the seller calls…

- What is the address of the house you want to sell?

- How many bedrooms, bathrooms does it have?

- Does it have a garage, basement, or pool?

- If you were going to list it with a Realtor, what repairs and/or updating would you say would be needed?

- How much is owed on the house?

- Do you have an asking price in mind?

- Is the house behind on payments?

- If I come out and look at the property and make you a cash offer to buy it ‘As-Is’ and close as soon as you want, what would be the least you would be willing to take?

That will provide you with a lot of critical information about what you’re dealing with.

Next, once you’re off the phone, do a bit of due diligence and look at what nearby properties of similar size have sold for in the last 90 days or so — that should give you a ballpark idea for the after-repair value of the property.

If you decide that the property sounds promising, you’ll want to walk through it and take pictures of anything and everything that’ll need to be repaired.

Back at the office, estimate the cost of those repairs — here’s a great resource from REISift that’ll help you estimate rehab costs .

You’ll need to go through this entire process regardless of your business model so that you understand your max offer on the property.

So how do you calculate your max offer?

Use the 75% rule — check out this video from Ryan Dossey…

With that, you’ll know how much to pay for the property, how much to spend on repairs, and how much it’ll sell for.

The more you streamline this part of the process, the better.

8. Create Your Brand

Building a company is one thing.

Building an easily recognizable brand and known to be reputable in your marketplace is quite another.

But that’s an integral part of the process. Consider some of these statistics…

- Using a signature color can increase brand recognition by 80 percent.

- It takes about 50 milliseconds (0.05 seconds) for people to form an opinion about your website.

- Consistent presentation of a brand has seen to increase revenue by 33 percent.

- 66 percent of consumers think transparency is one of the most attractive qualities in a brand.

When it comes to building a real estate investing brand, your goals are to…

- Establish Rapport

- Create Easy Recognizability

- Dominate The Conversation

The first step in this process is building an online presence – that means creating a high-converting website (i.e., one that systematically turns visitors into leads by capturing their contact information), running advertisements, and ranking in Google for important keywords.

That’s what we can help you with at Carrot .

Out of the box, our website templates are built to convert visitors into leads – and you can customize them however you want with your branding materials…

You’ll even receive immediate text notifications when someone signs up to be a lead so that you can contact them right away (speed is the name of the game!).

Having a high-converting website is ground zero for brand-building success. If you don’t have a website that systematically converts visitors into leads, then every dollar you spend on advertising is going to be wasted.

So that’s where we start.

Once you’ve got your website up and running, then – if you’re a Carrot Member and subscribe to the Content Tools add-on – we’ll provide you with blog posts every single month that are written to rank in Google for high-value keywords relevant to your specific market …

You just upload, make some minor tweaks, and publish – and the more you publish, the more traffic you’ll drive.

To help you become a true authority in your market, we also have the following tools…

- Keyword Ranking Tracker

- SEO Tool For Optimizing All Pages

- Text Notifications For Leads

- World-Class Support

- Campaign Tracking Links

- Coaching Calls

We want to make generating leads as easy as possible for you… so you can focus on closing deals and growing your business.

You can try us here risk-free for 30 days.

If you get yourself a Carrot website, that’ll take care of the “Dominate The Conversation” part of the branding process.

But what about these parts?

Super easy.

Establishing rapport is simply a matter of putting testimonials and case studies on your website. The more of these you have, the more people will trust your brand when they arrive on your website for the first time.

As for creating an easily recognizable brand, create a simple branding package…

- Brand Colors

And then be consistent across all platforms. Use the same colors, font, logo, and brand name on everything – online and offline.

That’ll make it feel like you’re everywhere – which is what you want.

So there you go.

That’s how you create a brand identity as a real estate investor. You’ll know you’ve done it right if people are coming to you out of nowhere – because a friend of a friend told them about you.

And if you want a brand that dominates your market without all of the footwork, we’ve got just the thing – it’s called the Authority Leader Plan … and we’ll do everything for you.

9. Set Growth Milestones

Okay – let’s pretend that you’ve taken all of the steps above.

You’ve got yourself a functioning business and brand with funding, you’ve got consistent lead-flow, and you’re even closing some deals.

Now what?

Well… you want to grow, of course!

You don’t just want to do one deal per month… you want to do three, five, or even ten deals per month.

You want to make more money, increase your net worth, grow your business, and have a significant impact.

How do you do that?

First, you set new goals and milestones for your business’ growth – how many deals do you want to be doing per month in 6 months? In a year?

Then break those goals down by quarter – and turn them into actionable to-dos.

For example, if you’re currently doing one deal per month and you want to be doing five deals per month by the end of Q2, here’s what your goals might look like…

- Send 10,000 Mailers Per Month

- Spend $5,000 on Facebook Ads Per Month

- Hire Salesperson To Answer Phone

- Hire Acquisition Manager

- Create Workflow Process

Or maybe it’ll look a bit different. Make your to-dos as realistic as possible so that if you do those things … you’re virtually guaranteed to hit your goals.

After all, what’s the point of having goals if you’re not going to hit them?

All in all…

Set milestone goals to grow your business, turn those into to-dos and break them down by quarter. The next and final step of your real estate investment business plan might be even more important…

10. Plan To Delegate

At some point, every real estate investor has to come to terms with a straightforward fact…

You can’t build the business of your dreams on your own . You need to delegate .

You’ve got to partner with other people, build critical relationships, hire people, manage people, create systems and processes to streamline your team’s workflow, and lots more.

One of the most important areas that deserve a highlight is your client communications and satisfaction. Consider setting up a robust cloud contact center software to manage all the communications that will lead to long-term partnerships.

Building a business isn’t so much about hustling and bustling as it is about putting the right pieces in the right place.

How do you scale your business?

The answer is quite simple: you do the same things you’re doing now… but at scale – that means hiring people, training people, and creating clean-cut systems.

That’s how you grow your business.

Automate, delegate, and step outside of your business as much as possible to build a real estate investment company that serves you rather than enslaves you.

Final Thoughts on Real Estate Investment Business Plan

What more is there?

You know how to create a mission and vision statement, run market analysis, choose an REI business model, set goals, find funding, generate leads, analyze properties, create a brand, set long-term growth milestones, and delegate.

All that’s left is action.

And reach out anytime with questions – we’re always here to help!

Featured Resource

Free Real Estate Marketing Plan

Generate your free marketing plan video and a downloadable guide to increase lead generation and conversion, gain momentum, and stand out in your market!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Sum of 2 + 3 *

Build Your Investing Team

- Property managers

- Syndications

How to Write a Business Plan for a Real Estate Investment Company

Written on July 10, 2019 by Marcus Maloney

How to Develop a Business Plan

Industry information.

- The Cromford Report: This provides detailed information to track the history and current status of the greater Phoenix residential resale market and offers unique insight into its future direction.

- Arizona Multiple Listing Service (ARMLS) : This provides industry information regarding real estate activity, such as number of units sold, active listings, days on market, etc.

- What is the average selling price in an area?

- Have any drastic changes to the job and population growth occurred?

- How have days on market for resale units fluctuated, if at all?

Business Model

- Strategic Vision: Ideas for the direction and activities of business development.

- Guiding Principles & Values: A broad philosophy that encompass your personal beliefs and values and guides an organization throughout its life in all circumstances, irrespective of changes in its goals, strategies, or type of work.

- Mission: This describes the company's function, markets, and competitive advantages. It also includes business goals and philosophies.

- Financials: This specifies start-up costs, projected revenue, and pro forma.

- Goals: This describes what the business expects to accomplish.

Strategy Implementation & Evaluation

The bottom line.

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

How to Write a Real Estate Business Plan + Example Templates

Elon Glucklich

7 min. read

Updated August 1, 2024

Free Download: Sample Real Estate Business Plan Template

Owning property – it’s one of the cornerstones of the global economy. And with real estate accounting for roughly $3.7 trillion worldwide, it’s no wonder so many people get into the real estate business.

But the real estate industry is constantly evolving, with new technologies and market trends shaping the way people buy, sell and manage properties. Whether you’re looking to start a home buying and selling business, a commercial real estate investment firm, a property management company or real estate investment trust, you need a well-thought-out business plan that not only outlines the steps to create a comprehensive and effective business structure, but also accounts for real estate’s unique challenges and opportunities.

A real estate business plan shares many similarities with a standard business plan. Here on Bplans, we’ve got a great guide already on how to write a traditional business plan .

In this article, we’ll outline the key points to consider when creating a comprehensive and effective business plan for your real estate business. You can also download our free real estate business plan template .

- Understand licensing requirements

Your business plan will certainly include a company description – this is where you’ll outline your business, including its legal structure, management team and more.

What’s your area of expertise?

Go into detail describing the area or areas of the real estate market you plan to operate in: residential sales, commercial leasing, property management, or more niche markets like luxury real estate or vacation rentals. Your business may want to mix two or more of these segments.

Once you’ve identified your niche, you’ll need to obtain any necessary licenses and permits. This process can be time-consuming and complex, so it’s best to research the requirements ahead of time and create a plan to ensure you’re compliant with all regulations. License and permit requirements vary by state and locality, so be sure to check with your local government to ensure you have all the necessary paperwork filed.

- Get a good team

Depending on the market segment or segments you’re targeting for your real estate business, you’ll need to identify the team members that will help you get your business off the ground.

Brokers, contractors, legal and financial advice

If your plan calls for purchasing properties, you’ll need a team of real estate agents or brokers. Document how they will help you find and acquire real estate, as well as how they can assist with marketing and selling properties once they’re in your portfolio.

You will also want to document how contractors and inspectors will help you assess the condition of properties you are considering purchasing, and provide estimates for repairs or renovations.

Real estate markets are rife with legal hurdles, so you will want an experienced real estate attorney to help you navigate these issues. Document how you will be able to draft contracts and review lease agreements, and the guidance you will receive on zoning laws and regulations

Finally, an accountant can help you manage your finances, including bookkeeping, taxes, and financial planning. They can also advise you on the best business structure for your company.

- Plan for visibility in a crowded space

With so much competition, it’s essential to develop and document a strategic marketing plan for promoting your real estate services.

Your marketing plan should detail the channels and tactics you’ll deploy to reach your target audience and convert them into clients. Identify the most effective marketing channels to reach your target audience, such as social media, email marketing, search engine optimization (SEO), and content marketing.

Embrace online lead generation

These days, a vast majority of prospective buyers start their search online when looking for properties. So you’ll want to detail how you will optimize your web presence. You can also outline a content marketing plan that will position your company as an expert in the areas your target markets are interested in. These could include topical blog posts, articles, social media posts, videos and other content types to engage potential clients and showcase your expertise. All of these will make it easier for clients to find you.

Document your entire sales process

Of course, there will be plenty of in-person work to do, too.

With long sales lead times, you will also want to describe your sales process and how you will meet sales targets. This should include prospecting methods, lead generation techniques, and follow-up strategies. Establish a client relationship management (CRM) system to manage leads, schedule client consultations, property showings, offer negotiations and contract signings so you can demonstrate that you will be able to manage and transactions effectively.

- Show how you will stay ahead of the market

Demonstrating in your business plan that you have conducted a thorough market analysis is crucial. To conduct an effective market analysis for your business plan, you should investigate the current state of the real estate market in your target area, including property prices, sales volumes and inventory levels. You will also want to examine the competitive landscape in your target area by analyzing other real estate businesses offering similar services.

Understand your customers’ needs

Next, determine the economic conditions and needs of the specific customer segments you want to serve, whether they’re first-time homebuyers, luxury property investors or commercial property renters. The more you understand how your target audience feels about the real estate market in your area, the better you will be able to tailor your services.

You will also need to show your knowledge of external factors like mortgage rates, and local, state and federal government regulations that may impact the real estate market. These factors all contribute to market volatility, so showing how you will manage market shifts and adjust your strategies will better position you to mitigate potential risks by identifying them in your business plan and documenting contingency plans.

- Create a financial plan to secure funds

It’s hard to operate a successful real estate business without access to capital. And you can’t expect to receive any – whether through a bank loan or investment – without a detailed analysis of your financial projections and funding requirements.

Think long-term

A 3-5 year financial forecast will demonstrate that you have a long-term vision for your business. Be sure to base your financials on market research and up-to-date industry data. You may also want to consider different scenarios, like best-case, worst-case and most likely outcomes to account for potential fluctuations in the market.

The forecasts should include: profit and loss statements, which illustrate your business’s revenue, expenses, and net profit or loss over a specific period; cash flow projections, which help you determine your business’s ability to generate positive cash flow; and balance sheets, which provide a snapshot of your business’s financial health, including its assets and liabilities.

Speak the language of investors

If you are writing your business requires specifically to secure outside funding, you should clearly specify the purpose and amount needed in this section. Describe how the funds will be used, whether for purchasing property, hiring staff or launching a marketing campaign. And detail the type of funding you are seeking, whether it’s a loan, equity investment or a combination. Include information on your desired terms, repayment schedule and any collateral you can provide.

Above all, be transparent about your funding needs and show potential investors or lenders how their investment will contribute to your business’s success and generate a return on investment.

- Real estate business plan templates and examples

Because of the intense competition, changing market conditions and startup funding needed, it’s important to write a comprehensive business plan if you’re considering starting a business in the real estate industry. Taking the time to plan out your business before getting started will minimize your risk and maximize your potential for financial success.

To help get you started, download our free home real estate business plan template . You can also download the business plan template in Word form and use it as a foundation for your own business plan.

In addition to these resources, you may want to brush up on how to write specific sections of a traditional business plan. If so, take a look at our step-by-step guide on how to write a business plan .

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Elon is a marketing specialist at Palo Alto Software, working with consultants, accountants, business instructors and others who use LivePlan at scale. He has a bachelor's degree in journalism and an MBA from the University of Oregon.

Table of Contents

Related Articles

12 Min. Read

Free Amazon FBA Business Plan PDF [2024 Template + Sample Plan]

7 Min. Read

How to Write a Cleaning Service Business Plan + Free Sample Plan PDF

5 Min. Read

How to Write a Personal Shopper Business Plan + Example Templates

How to Write an Assisted Living Business Plan + Free Sample Plan PDF

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

IMAGES

VIDEO

COMMENTS

We have prepared a real estate investment business plan template to help you get started. Let’s cut to the chase: download this template, follow step-by-step instructions, and finish the first draft of your plan. recognize opportunities and deal with challenges in an effective way.

What should you include in a real estate investment business plan? The 8 elements of an effective real estate investment business plan; Key considerations for writing a real estate investment business plan; Download your free real estate investment one page sample business plan

Download a free real estate investment business plan template. It's part of our library of over 550 industry-specific sample business plans. Don't bother with copy and paste.

Use this step-by-step guide and the downloadable real estate business plan template to map your business goals, finances, and mission. Identify your ideal client so you can target your marketing strategy.

A real estate investment business plan is a document that outlines your goals, your vision, and your plan for growing the business. It should detail the real estate business model you’re going to pursue, your chosen method for lead-gen, how you’ll find funding, and how you plan to close deals.

It also includes business goals and philosophies. Financials: This specifies start-up costs, projected revenue, and pro forma. Goals: This describes what the business expects to accomplish. These all are easily identifiable but somewhat difficult to incorporate in a business plan. It takes thought and plenty of self-awareness.

In this article, we’ll outline the key points to consider when creating a comprehensive and effective business plan for your real estate business. You can also download our free real estate business plan template .