Copyright 2021 - Hecterra Publishing Inc. - Privacy Statement - Terms of Service

- News and Community

- Job Opportunities

- Esri Canada GIS Centre of Excellence

- Equity, Diversity, Inclusion & Decolonization (EDID)

- Degree Programs

- Awards & Scholarships

- Program Counselling

Urban Development Program

- Internships

- Frequently Asked Questions

- Students' Association

- International Exchange

- Course Information

- Program Information

- Future Students

- Scholarships and Awards

- Research Areas

- Graduate Handbook

- Current Students

- Research Labs

- Research Funding

- Administration

- Full Time Faculty

- Part Time Faculty

- Adjunct Faculty

- Cross Appointments

- Emeritus Faculty

- Visiting Professors and Post-docs

- Graduate Students

- Health and Safety

- Map and Data Centre

- Dept Intranet (Restricted)

- Undergraduate

- Collaborative Specializations

- PhD in Geography and Environment (Hazards, Risk and Resilience

- MA or MSc in Geography and Environment

- PhD in Geography and Environment

- MA or MSc in Geography and Environment (Environment and Sustainability)

- PhD in Geography and Environment (Environment and Sustainability)

- MA in Geography and Environment (Migration and Ethnic Relations)

- PhD in Geography and Environment (Migration and Ethnic Relations)

- MSc in Geography and Environment (Hazards, Risk, and Resilience)

The PhD in Geography and Environment (Hazards, Risk and Resilience) is a multidisciplinary enrichment program designed for current graduate PhD students who wish to become specialists in the field of natural hazards and risks, and who wish to gain an appreciation of the interdisciplinary nature of disaster risk reduction problems and solutions. The student earns a degree in the home department plus credit for participation in the collaborative specialization. Currently, the participating departments are Civil & Environmental Engineering , Earth Sciences , Geography and Environment and Statistical & Actuarial Sciences .

The collaborative specialization will enhance the education and research of graduate students interested in natural hazards, risks, and resilience and is designed with four goals in mind:

- Learn about the engineering, physical and quantitative science, and social science aspects of hazards, risks, and resilience as well as their interconnectivity;

- Conduct quantitative research in hazard, risks, and resilience;

- Learn from a diverse, multidisciplinary group of faculties working in these areas at Western; and

- Develop their own multidisciplinary network of colleagues by interacting with other students from several distinct subject areas participating in the collaborative specialization.

Program Progression Registration and enrolment is always concurrent and in addition to participation in a home degree program; the student earns a degree in the home department plus credit for successful completion of the specialization on their transcript and parchment.

Supervision

Doctoral students are supervised through a Thesis Advisory Committee of at least two, consisting of the Supervisor and another faculty member knowledgeable in the area of research. A member of the Advisory Committee must be listed as a member of the Hazards, Risk and Resilience list of Faculty Advisors . The Supervisor is responsible for overseeing the student's academic program, especially the thesis research and thesis preparation.

Department of Geography and Environment Social Science Centre Rm 2322, Western University London, Ontario, Canada, N6A 5C2 Tel: 519-661-3423 [email protected] Privacy | Web Standards | Terms of Use | Accessibility

Dept. Intranet (restricted)

SSC Accessibility

Contact Information

- Graduate Education Council

- Staff Directory

Program Contacts

- Regulations

- SGPS Membership

- Institutional Quality Assurance Process

- Explore our Programs

- How to Apply

- Visiting Students

- International Applicants

- New Students

- Affordability Calculator

- Fees and Tuition

- Western Funding

- External Funding

- Financial Assistance

- Receiving Payment

- Income Tax Reporting

- Compensating Graduate Students

- International Funding Opportunities

- Thesis Guide

- Course Registration

- Graduate Supervision Handbook

- Leave of Absence

- Part-time Status

- Master's to Doctoral Transfer

- Thesis Defense Only Status

- Applying to Graduate

- Voluntary Withdrawal

- Dual-Credential Degrees

- Collaborative Specializations

- Inspiring Minds

- Virtual Qualitative Research Module Series

- Thinking Globally Acting Locally

- Western Opportunities

- External Opportunities

- The Appointment Process

- Policies and Procedures

- Resources for Supervisors

- Postdoctoral Association at Western

- STUDY navigating academia

- PLAY finding friends and fun

- PLAN time finances and housing

- CONNECT with community

- SELF-CARE prioritize yourself

- Online Learning

- Own Your Future

- Internship Program

- Competitive Edge

- Funding & Fees

- Postdoctoral Services

- Life & Community

- Career Development

- Hazards, Risks, and Resilience Collaborative Specialization

Meet our Students

Program inquiries.

Interested in a particular program? Visit the program website to learn more:

Program Directory

Application Inquiries

Inquiries related to the online application can be directed to SGPS at:

Email: [email protected] Phone: 519-850-2341 Fax: 519-661-3730

Equity, Diversity, Inclusion and Decolonization

The School of Graduate and Postdoctoral Studies is committed to equity, diversity, inclusion and decolonization in all aspects of graduate and postdoctoral studies. For more information regarding these commitments please visit grad.uwo.ca/edi-d .

- Hazards, Risks, and Resilience

Program Websites

- School of Graduate and Postdoctoral Studies

Participating Degrees

- Civil and Environmental Engineering MESc

- Civil and Environmental Engineering PhD

- Geography and Environment MA

- Geography and Environment MSc

- Geography and Environment PhD

- Geophysics MSc

- Geophysics PhD

- Statistics MSc

- Statistics PhD

- Learn about the engineering, physical and quantitative science, and social science aspects of hazards, risks, and resilience as well as their interconnectivity;

- Conduct quantitative research in hazard, risks, and resilience;

- Learn from a diverse, multidisciplinary group of faculties working in these areas at Western; and

- Develop their own multidisciplinary network of colleagues by interacting with other students from several distinct subject areas participating in the collaborative specialization.

The details of the specialization can be found at https://www.uwo.ca/multihazard_risk_resilience/ .

Program Length

- 3 or 6 terms (1 or 2 years) for Master's students

- 12 terms (4 years) for PhD students

Program Design

- Full-time study

- Thesis-Based

Funding Information

Students are first required to enter their home programs. The current participating departments are: Civil & Environmental Engineering, Earth Sciences, Geography, and Statistical & Actuarial Sciences. The funding for their studies depends on their home departments.

Tuition and Fees

Tuition and fee schedules (per term) are posted on the Office of the Registrar's website at http://www.registrar.uwo.ca/student_finances/fees_refunds/fee_schedules.html

Graduate Student Affordability Calculator

Use this helpful tool to estimate how much money you will need to pay for your tuition, fees, housing, food, and other necessities for a 12-month (three term) academic year.

Admission Requirements

The Collaborative Specialization in Hazards, Risks, and Resilience is not a direct entry program. Graduate students may apply following admission to and registration in a home program (department), where the student will have a lead research supervisor, complete a research thesis and earn a graduate degree in a specific discipline. See https://www.uwo.ca/multihazard_risk_resilience/ .

English Language Proficiency

- The requirements to the home programs need to be met.

Application Deadline

- Please see the individual home program deadlines.

School of Graduate and Postdoctoral Studies 1151 Richmond Street London, Ontario, Canada, N6A 3K7 Tel: 519-661-2102 (General) | 519-850-2341 (Admissions Inquiries) Privacy | Web Standards | Terms of Use | Accessibility

- Graduate School

- Prospective Students

- Graduate Degree Programs

Doctor of Philosophy in Resources, Environment and Sustainability (PhD)

Canadian immigration updates.

Applicants to Master’s and Doctoral degrees are not affected by the recently announced cap on study permits. Review more details

Go to programs search

The Institute for Resources, Environment and Sustainability (IRES) at the University of British Columbia (UBC) is a problem-focused and curiosity-driven interdisciplinary research institute and graduate program, with interest and expertise in a wide range of topics under the realm of environment and sustainability. Our mission is to foster sustainable futures through integrated research and learning about the linkages among human and natural systems, and to support decision making from local to global scales. More often than not, we achieve this through collaborations across students and faculty in a manner that recognizes our collective skills, intellectual histories and methodological approaches, and yet encourages our interdependencies as we consider real world problems.

For specific program requirements, please refer to the departmental program website

What makes the program unique?

Over fifty percent of our core faculty are Canada Research Chairs and faculty mentoring has led to a high success rate of our students winning major fellowships and scholarships. There are multi-year funding packages offered for top applicants to the RES program. RES has over 400 alumni since the graduate program started in 1994.

Joining UBC was a great deal for me because the University has high academic standards and a global reputation for producing cutting-edge research, competent graduate students and world leaders, and providing a conducive environment for personal and professional growth. The University has offered me a chance to work with world-class professors and students and financially support my research.

Jerry Achar

Quick Facts

Program Enquiries

Admission information & requirements, 1) check eligibility, minimum academic requirements.

The Faculty of Graduate and Postdoctoral Studies establishes the minimum admission requirements common to all applicants, usually a minimum overall average in the B+ range (76% at UBC). The graduate program that you are applying to may have additional requirements. Please review the specific requirements for applicants with credentials from institutions in:

- Canada or the United States

- International countries other than the United States

Each program may set higher academic minimum requirements. Please review the program website carefully to understand the program requirements. Meeting the minimum requirements does not guarantee admission as it is a competitive process.

English Language Test

Applicants from a university outside Canada in which English is not the primary language of instruction must provide results of an English language proficiency examination as part of their application. Tests must have been taken within the last 24 months at the time of submission of your application.

Minimum requirements for the two most common English language proficiency tests to apply to this program are listed below:

TOEFL: Test of English as a Foreign Language - internet-based

Overall score requirement : 100

IELTS: International English Language Testing System

Overall score requirement : 7.0

Other Test Scores

Some programs require additional test scores such as the Graduate Record Examination (GRE) or the Graduate Management Test (GMAT). The requirements for this program are:

The GRE is not required.

Prior degree, course and other requirements

Prior degree requirements.

RES does not admit applicants to the PhD program unless they have completed a thesis-based master's degree prior to the RES PhD program start.

Course Requirements

There are no specific prerequisites for the RES PhD program other than you must have completed a thesis-based Masters degree from a recognized institution. As we are an interdisciplinary program, we accept applications from all disciples and backgrounds. Anyone interested in studying environmental/sustainability problems in an interdisciplinary way is encouraged to apply.

Document Requirements

The RES program requires all applicants to submit a thesis proposal with their application. Details of this can be found here: https://ires.ubc.ca/graduate-program/prospective-students/how-to-apply/

2) Meet Deadlines

3) prepare application, transcripts.

All applicants have to submit transcripts from all past post-secondary study. Document submission requirements depend on whether your institution of study is within Canada or outside of Canada.

Letters of Reference

A minimum of three references are required for application to graduate programs at UBC. References should be requested from individuals who are prepared to provide a report on your academic ability and qualifications.

Statement of Interest

Many programs require a statement of interest , sometimes called a "statement of intent", "description of research interests" or something similar.

Supervision

Students in research-based programs usually require a faculty member to function as their thesis supervisor. Please follow the instructions provided by each program whether applicants should contact faculty members.

Instructions regarding thesis supervisor contact for Doctor of Philosophy in Resources, Environment and Sustainability (PhD)

Citizenship verification.

Permanent Residents of Canada must provide a clear photocopy of both sides of the Permanent Resident card.

4) Apply Online

All applicants must complete an online application form and pay the application fee to be considered for admission to UBC.

Tuition & Financial Support

Financial support.

Applicants to UBC have access to a variety of funding options, including merit-based (i.e. based on your academic performance) and need-based (i.e. based on your financial situation) opportunities.

Program Funding Packages

All full-time students who begin a UBC-Vancouver PhD program in September 2024 or later will be guaranteed a minimum funding package of $24,000 for each of the first four years of their PhD. This guaranteed minimum doctoral funding package may consist of any combination of internal or external awards, teaching-related work (TA), Research assistantships (RA), and Graduate Academic Assistantships (GAA).

Additional funding opportunities for PhD applicants may come from UBC’s Four Year Doctoral Fellowship (4YF) : an $18,200 stipend plus full tuition coverage per year, for four consecutive years.

RES students have also been highly successful in receiving support from the most prestigious funding agencies. Many of our students are Social Sciences and Humanities Research Council (SSHRC) or Natural Sciences and Engineering Research Council (NSERC) recipients, and in recent years we have seen our students receive both Vanier Canada Graduate Scholarships and the Trudeau Foundation Doctoral Scholarship , the most highly-regarded scholarships in Canada. You can review a detailed list of the most commonly applied to scholarships on our website.

In addition to external scholarships and funding options noted above, RES typically distributes one-time entrance awards to the majority of incoming students. The amount of these awards varies year to year, however over the last three years the awards have been in the range of $3000-$5000.

It is important for applicants to the RES program to confirm the details of any funding package that may be available to them prior to accepting an offer of admission to the program.

Average Funding

- 8 students received Teaching Assistantships. Average TA funding based on 8 students was $6,018.

- 19 students received Research Assistantships. Average RA funding based on 19 students was $17,172.

- 12 students received Academic Assistantships. Average AA funding based on 12 students was $4,726.

- 32 students received internal awards. Average internal award funding based on 32 students was $13,925.

- 16 students received external awards. Average external award funding based on 16 students was $30,208.

Scholarships & awards (merit-based funding)

All applicants are encouraged to review the awards listing to identify potential opportunities to fund their graduate education. The database lists merit-based scholarships and awards and allows for filtering by various criteria, such as domestic vs. international or degree level.

Graduate Research Assistantships (GRA)

Many professors are able to provide Research Assistantships (GRA) from their research grants to support full-time graduate students studying under their supervision. The duties constitute part of the student's graduate degree requirements. A Graduate Research Assistantship is considered a form of fellowship for a period of graduate study and is therefore not covered by a collective agreement. Stipends vary widely, and are dependent on the field of study and the type of research grant from which the assistantship is being funded.

Graduate Teaching Assistantships (GTA)

Graduate programs may have Teaching Assistantships available for registered full-time graduate students. Full teaching assistantships involve 12 hours work per week in preparation, lecturing, or laboratory instruction although many graduate programs offer partial TA appointments at less than 12 hours per week. Teaching assistantship rates are set by collective bargaining between the University and the Teaching Assistants' Union .

Graduate Academic Assistantships (GAA)

Academic Assistantships are employment opportunities to perform work that is relevant to the university or to an individual faculty member, but not to support the student’s graduate research and thesis. Wages are considered regular earnings and when paid monthly, include vacation pay.

Financial aid (need-based funding)

Canadian and US applicants may qualify for governmental loans to finance their studies. Please review eligibility and types of loans .

All students may be able to access private sector or bank loans.

Foreign government scholarships

Many foreign governments provide support to their citizens in pursuing education abroad. International applicants should check the various governmental resources in their home country, such as the Department of Education, for available scholarships.

Working while studying

The possibility to pursue work to supplement income may depend on the demands the program has on students. It should be carefully weighed if work leads to prolonged program durations or whether work placements can be meaningfully embedded into a program.

International students enrolled as full-time students with a valid study permit can work on campus for unlimited hours and work off-campus for no more than 20 hours a week.

A good starting point to explore student jobs is the UBC Work Learn program or a Co-Op placement .

Tax credits and RRSP withdrawals

Students with taxable income in Canada may be able to claim federal or provincial tax credits.

Canadian residents with RRSP accounts may be able to use the Lifelong Learning Plan (LLP) which allows students to withdraw amounts from their registered retirement savings plan (RRSPs) to finance full-time training or education for themselves or their partner.

Please review Filing taxes in Canada on the student services website for more information.

Cost Estimator

Applicants have access to the cost estimator to develop a financial plan that takes into account various income sources and expenses.

Career Outcomes

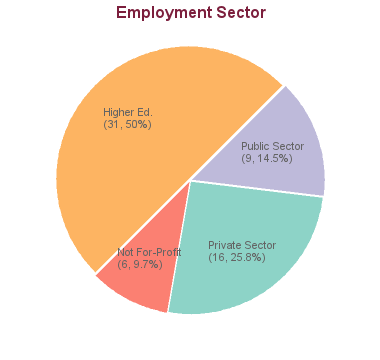

71 students graduated between 2005 and 2013: 1 graduate is seeking employment; for 8 we have no data (based on research conducted between Feb-May 2016). For the remaining 62 graduates:

Sample Employers in Higher Education

Sample employers outside higher education, sample job titles outside higher education, phd career outcome survey, career options.

Our current students, alumni and faculty lead and serve on numerous international, national, non-governmental organizations (NGO) and regional bodies dedicated to protecting the environment and improving well-being.

Alumni on Success

Glen Hearns

Job Title Self Employed

Employer Self Employed

Enrolment, Duration & Other Stats

These statistics show data for the Doctor of Philosophy in Resources, Environment and Sustainability (PhD). Data are separated for each degree program combination. You may view data for other degree options in the respective program profile.

This program went through a name change in previous years that may have included curriculum changes. It was previously known as: Doctor of Philosophy in Resource Management and Environmental Studies until 2015. Historical data on this page may include data collected under the previous name(s) of the program.

ENROLMENT DATA

Upcoming doctoral exams, wednesday, 8 may 2024 - 12:00pm - 316, liu institute for global issues, 6476 nw marine drive.

- Research Supervisors

Advice and insights from UBC Faculty on reaching out to supervisors

These videos contain some general advice from faculty across UBC on finding and reaching out to a supervisor. They are not program specific.

This list shows faculty members with full supervisory privileges who are affiliated with this program. It is not a comprehensive list of all potential supervisors as faculty from other programs or faculty members without full supervisory privileges can request approvals to supervise graduate students in this program.

- Boyd, David (Human rights)

- Chan, Kai (Natural environment sciences; Human Ecology; Ecology and Quality of the Environment; Social and Cultural Factors of Environmental Protection; Applied Ethics; Values and Lifestyles; Sustainable Development; conservation finance; Conservation science; cultural ecosystem services; Ecosystem services; environmental assessment; environmental values; incentive programs; payments for ecosystem services; resilience; social-ecological systems; sustainability science)

- Chang, Stephanie (All other social sciences, n.e.c.)

- Donner, Simon (Atmospheric sciences; Oceanography; Other media and communication; Climate Science; climate change impacts; Climate policy; Coastal Ecosystems; Marine Environment; Climate modelling and prediction; Science communication; Net-zero emissions; Coral reefs)

- Gantois, Joséphine (Human Dimensions of Biodiversity Conservation)

- Giang, Amanda (Atmospheric sciences; Mechanical engineering; Natural environment sciences; Atmospheric Pollutants; Chemical Pollutants; Climate Changes and Impacts; Public Policies; Social and Cultural Factors of Environmental Protection)

- Harris, Leila (Critical identity, ethnic and race studies; Gender, sexuality and education; Human rights, justice, and ethical issues; Africa; Development Policies; Drinking Water; Environmental justice; equity and social justice; Ethics and Fundamental Issues of Law and Justice; Fresh Water; Gender Relationship; gender and social difference; Ghana; International development; participatory resource management; Resources Management; Social Contract and Social Justice; Social and Cultural Factors of Environmental Protection; South Africa; Turkey and Middle East; Water; water governance; water politics)

- Johnson, Mark (Geology; Natural environment sciences; Agriculture; Biogeochemistry; Carbon cycle; Climate Changes and Impacts; data science; Ecohydrology; Ecology and Quality of the Environment; Fresh Water; Ground Water and Water Tables; Hydrological Cycle and Reservoirs; Land and Soil; land use; Running Water Hydrosystem; Water and Sustainability)

- Kandlikar, Milind (Climate change impacts and adaptation; Product life cycle; Environmental policy; Research, science and technology policy; Environmental impacts; Air Quality and Climate Change; Technological Risk; Technology and Development)

- Kremen, Claire (Natural environment sciences; Zoology; agroecological farming systems; Reconciliation of agricultural land use with biodiversity conservation; sustainable landscapes)

- Oberg, Gunilla (History and philosophy of science (including non-historical philosophy of science); Other earth and related environmental sciences, n.e.c.; Indigenous peoples environmental knowledge; All other social sciences, n.e.c.; Science and knowledge production; Scientific controversies surrounding the evaluation of chemical risk (epistemic and ontological); Indigenous data justice as related to chemicals regulation & management; Social and cultural factors of chemicals regulation & management; Vocabulary, Knowledge, Significance and Thought Building; environmental health; The challenge of teaching science as a process and not a deliverer of irrefutable facts; The role of deliberation in science)

- Ramankutty, Navin (Natural environment sciences; Public administration; Public policy; Public security policy; Agriculture; Climate Changes and Impacts; Climate impacts; Environment and Society; Global food security; Land use change; Sustainable agriculture)

- Satterfield, Theresa (Sustainable development, environmental health, First Nation & land management, social and cultural consequences of contamination)

- Wittman, Hannah (Sociology and related studies; Farming systems research; food sovereignty; Sustainable agriculture; socio-ecological systems; Agroecology)

- Zhao, Jiaying (Natural environment sciences; Psychology and cognitive sciences)

Doctoral Citations

Sample thesis submissions.

- A critical physical geography of conservation, water, and scientific research in the Bale Mountains, Ethiopia

- Advancing equity in water demand management among local governments in British Columbia, Canada

- Crop yield estimation in the Canadian Prairies : assessing the relative importance of scale, satellite and biophysical data

- Agricultural data governance, data justice, and the politics of novel agri-food technologies in Canada

- Understanding relationships between people and nature in the context of privately protected areas in Peru

- Messaging for wildlife conservation : leveraging attitudes, intentions, and actions for transformative change

- Inequality in global access to food and its implications for climate change and Sustainable Development Goals

- Interactions between the land surface and the near-surface atmosphere : implications for evaporative demand and evapotranspiration under a changing climate

- Exploring complexity in changing practices of care : a mixed methods inquiry into rights, relations, and knowledge in protected area conservation

- Just in principle? : assessing the contributions of organic farming to socio-ecological sustainability in Canadian agriculture

- Multi-hazard perspectives on risk perception, disaster preparedness, and emergency management

Related Programs

Same specialization.

- Master of Arts in Resources, Environment and Sustainability (MA)

- Master of Science in Resources, Environment and Sustainability (MSc)

At the UBC Okanagan Campus

- Doctor of Philosophy (PhD), Sustainability

Further Information

Specialization.

Resources, Environment and Sustainability fosters sustainable futures through integrated research and learning concerning the linkages among human and natural systems and supports decision making for local to global scales. RES provides a home for graduate students focusing on the integration of the biophysical (ecological), socio-economic, and political realities of resource management within the context of a sustainable, healthy environment.

UBC Calendar

Program website, faculty overview, academic unit, program identifier, classification, social media channels, supervisor search.

Departments/Programs may update graduate degree program details through the Faculty & Staff portal. To update contact details for application inquiries, please use this form .

Charlotte Milne

I chose to come to UBC thanks to its unique placement as a university that advocates for and prioritizes the inclusion of Indigenous sciences alongside Western practices. I came for my fantastic supervisor Prof. Stephanie Chang, thanks to her world-renowned expertise in disaster risk and...

UBC is an incredible, world class university, and I’m so grateful to have landed here. Especially through my lab (Climate and Coastal Ecosystems) with Dr. Simon Donner and my colleagues at IRES, I have an amazing support network and a multitude of resources to access for my research. Through...

I decided to study at UBC for several professional and personal reasons. The Institute for Resources, Environment, and Sustainability at UBC is a highly interdisciplinary environment with a commitment to applied and problem-oriented research, and it is important to me that my work helps to solve...

Curious about life in Vancouver?

Find out how Vancouver enhances your graduate student experience—from the beautiful mountains and city landscapes, to the arts and culture scene, we have it all. Study-life balance at its best!

- Why Grad School at UBC?

- Application & Admission

- Info Sessions

- Research Projects

- Indigenous Students

- International Students

- Tuition, Fees & Cost of Living

- Newly Admitted

- Student Status & Classification

- Student Responsibilities

- Supervision & Advising

- Managing your Program

- Health, Wellbeing and Safety

- Professional Development

- Dissertation & Thesis Preparation

- Final Doctoral Exam

- Final Dissertation & Thesis Submission

- Life in Vancouver

- Vancouver Campus

- Graduate Student Spaces

- Graduate Life Centre

- Life as a Grad Student

- Graduate Student Ambassadors

- Meet our Students

- Award Opportunities

- Award Guidelines

- Minimum Funding Policy for PhD Students

- Killam Awards & Fellowships

- Policies & Procedures

- Information for Supervisors

- Dean's Message

- Leadership Team

- Strategic Plan & Priorities

- Vision & Mission

- Equity, Diversity & Inclusion

- Initiatives, Plans & Reports

- Graduate Education Analysis & Research

- Media Enquiries

- Newsletters

- Giving to Graduate Studies

Strategic Priorities

- Strategic Plan 2019-2024

- Improving Student Funding

- Promoting Excellence in Graduate Programs

- Enhancing Graduate Supervision

- Advancing Indigenous Inclusion

- Supporting Student Development and Success

- Reimagining Graduate Education

- Enriching the Student Experience

Initiatives

- Public Scholars Initiative

- 3 Minute Thesis (3MT)

- PhD Career Outcomes

- Great Supervisor Week

Fanshawe College

Insurance and Risk Management

Program Overview

Program details, full time offerings, i am a domestic* applicant and i am ready to apply to fanshawe .

- Review the Admission Requirements to ensure you meet the program requirements.

- Check the Program Details for availability and campus locations.

- Click the Apply now below to visit OntarioColleges.ca. The Admissions office will email you with next steps, your Fanshawe student ID number and other details.

*Domestic applicants include Canadian citizens, permanent residents, protected persons and Convention refugees.

I am an international applicant and I’m ready to apply to Fanshawe!

- Apply now through Fanshawe College’s VAS (Virtual Application System). Our International Centre will assess your application and, if accepted, provide you with a Letter of Admission as soon as possible.

- Share this Program

- Connect With Us

Your Learning Experience

Insurance and Risk Management is a one-year Ontario College Graduate Certificate program that will prepare students for careers as brokers/agents, risk managers, underwriters, loss adjusters or loss prevention inspectors. If you want to make a difference and build a future in a fast-paced, dynamic environment, this program is for you.

You’ll even graduate with credits that can be used toward the Chartered Insurance Professionals (CIP) designation offered by the Insurance Institute of Canada and the Canadian Risk Management (CRM) designation from the Global Risk Management Institute Inc. (GRMI) .

Available in a traditional in-class format with a September and January admission.

Graduates of Fanshawe’s Insurance and Risk Management program can pursue a career as an agent/broker, claims adjuster, risk manager, underwriter, and more. Graduates have the knowledge and skills to begin in a variety of entry-level positions in a variety of commercial industries or the government.

Did you know Fanshawe consistently ranks high in graduate employment rates among large colleges in Ontario?

Here are some examples of career opportunities for graduates of Fanshawe’s Insurance and Risk Management program:

Loss Adjuster Help those suffering from a loss receive entitled compensation and assistance to return to where they were before the loss occurred. Investigate insurance claims due to losses such as fires and car accidents. Arrange interim solutions and make recommendations regarding payment of benefits.

Insurance Broker / Agent Help consumers choose the right insurance coverage to protect their cars, homes, businesses and belongings and manage all aspects of the insurance transaction.

Risk Manager Protect the assets of organizations and identify potential risk exposures that may cause accident or loss. Recommend and implement preventative measures to minimize costs and damage should a loss occur.

Program coordinator:

Cyndi Hornby, C.I.P., CRM Phone: 519-452-4430 x4641

The graduate has reliably demonstrated the ability to:

1. Analyze the role played by the property and casualty insurance industry in the Canadian and global economy.

2. Use current and relevant insurance industry-specific terminology in all stakeholder communications.

3. Identify, select and apply risk management concepts to the four major categories of risk: hazard, operational, financial and strategic.

4. Assess the techniques risk management professionals use to finance the negative consequences of risk events in multifaceted scenarios.

5. Recommend assessment and treatment techniques for the major categories of risk faced by an organization, with an emphasis on hazard risk.

6. Evaluate the clauses, terms and conditions of various insurance policy wordings in order to determine the appropriate coverage for complex risks.

7. Articulate an effective process to successfully address the adjustment, negotiation and settlement of an insurance claim.

8. Justify the acceptance or rejection of an application for insurance.

9. Evaluate the needs of a commercial and/or personal client in order to plan and recommend an insurance program that provides protection from identified exposures.

10. Lead a diverse work group, and motivate others to achieve personal and organizational goals.

11. Prepare and deliver an effective sales presentation using professional sales techniques.

Business - Insurance

Business - Insurance (Co-op)

Customer Service Fundamentals - Insurance

Academic school.

Program Coordinator:

Zan Vania, BA, B.Ed, CIP, CRM

Academic Advisor: Sarah Davies

Transfer Opportunities

Study & Work Abroad

Admission Requirements

A Two- or Three-Year College Diploma, or a Degree (Note: minimum 'C+' average or cumulative 2.5 GPA) OR Acceptable combination of related work experience and post-secondary education as judged by the College* OR Five years of work experience in the financial services or insurance industry as judged by the College to be equivalent* Note:

- *Applicants may be required to submit a resume and cover letter that includes details of work experience.

- English Language Requirements

Learn More about English Language Requirements

Recommended Academic Preparation

- It is highly recommended that students be proficient in the following areas before entry into the program: - Mathematics - Business Communication - Computer applications, particularly Microsoft Word, Excel and PowerPoint

Recommended Personal Preparation

- Strong interpersonal skills

- Ability to work in a team environment

- Exposure to business world through part time employment or business related courses.

- Presentation/public speaking skills

Advanced Standing

- Applicants may apply for advanced standing on the basis of previous academic achievement at another institution and/or Prior Learning Assessment and Recognition (PLAR). Advanced standing qualifies the applicant for direct entry to a second or higher level of the program.

Applicant Selection Criteria

Where the number of eligible applicants exceeds the available spaces in the program, the Applicant Selection Criteria will be:

- Preference for Permanent Residents of Ontario

- Receipt of Application by February 1st (After this date, Fanshawe College will consider applicants on a first-come, first-served basis until the program is full)

- Achievement in the Admission Requirements

Tuition Summary

*Total program costs are approximate, subject to change and do not include the health and dental plan fee, bus pass fee or program general expenses.

Contact/Questions

- The Fanshawe Advantage

- What we offer

- Living in London

- Campus Life

- Signature Learning Experiences

- London Campus

- The Good Foundation Inc Theatre

- The Chefs Table

- FAQ for Students

- Continuing Education Courses

- Toronto@ILAC

- Alumni Benefits

- Pathway Quiz

- Pathways Chart

- Getting Started

- eLearning Coordinators

- Build a Custom Viewbook

- Full-Time Programs

- Course Registration

- Continuing Education Programs

- Declare Your Program

- OCT Additional Qualification Courses

- School Within A College

- Chartered Managers Canada (CIM)

- National Payroll Institute (NPI)

- Global Risk Management Institute Inc.

- Home Inspection Certification

- The Canadian Investment Funds

- The Human Resources Professionals Association (HRPA)

- Canadian College of Health Information Management

- MyPath Programs in Huron/Bruce

- MyPath Programs in Woodstock

- MyPath Programs in Simcoe

- Microcredentials

- OntarioLearn

- Graduate Studies

- Online Learning

- Don Crich Skill Trades Accelerator

- Information for Prospective Students

- Preparatory Programs

- Corporate Training

- Pre-Apprenticeship

- Supportive Care Assistant

- Women of Steel

- Access Studies

- Academic Upgrading - Simcoe/Norfolk

- Academic Upgrading - St.Thomas/Elgin

- Academic Upgrading - Woodstock

- Transfer to Fanshawe

- Transfer Within Fanshawe

- Transfer From Fanshawe

- Prior Learning Assessment and Recognition (PLAR)

- Pathways Scholarships

- Course Outlines

- How We Communicate

- Application Timeline

- Admission Process

- Competitive Programs

- Accept Your Offer

- WRIT Frequently Asked Questions

- WRIT Assessment Online

- Clinical/Field Pre-Placement Process: International Students

- Clinical/Field Pre-placement Health Forms

- How to Register

- Blended Courses: Band 1

- Blended Courses: Band 2

- Blended Courses: Band 3

- Blended Courses: Band 4

- Blended Courses: Band 5

- Blended Courses: Compressed S1

- Blended Courses: Compressed S2

- Online Courses: Compressed S1

- Online Courses: Compressed S2

- Online Courses: Full

- Degree General Education Resources

- Diploma Students: Part-time & Overload — All Courses

- General Education Bands

- External/Internal Credits

- WRIT Place-Out Students

- First Nations, Métis and Inuit Applicants

- Part-Time Tuition Fees

- Ancillary Fees

- International Fee Exemption

- Fee Dates & Payment Options

- Withdrawals & Refunds

- Scholarships

- Schulich Builders Scholarships

- Students with special circumstances

- Financial Literacy

- Canerector Scholars Program

- The Joyce Family Foundation Bursary

- Academic Calendars

- Dates To Remember

- Course Withdrawal Dates

- English Equivalency Assessment

- Employment Ontario Assessment Centres

- Available Programs

- Apply to Better Jobs Ontario

- Grades and Transcripts

- Freedom of Information

- Occupation-specific Language Training (OSLT)

- Bridge Training Programs

- Civilian Military Leadership Pilot Initiative (CMLPI)

- Military-Connected Student in Trades Pilot Project (MCSTPP)

- Contact Admissions

- Health Services

- Student Wellness Centre

- Counselling Services

- Sexual Violence and Support

- Registering with Accessibility

- Alternate Format

- Accommodating Applicants and Students

- Funding Opportunities

- Services for Deaf Students

- Transitions Programs

- Academic Advisors

- Apprentices Learning Supports

- Academic Support Contacts

- Job Seekers

- InSPIRE Mentoring

- Rising Leaders

- Career Exploration Consulting

- Community Career Exploration

- Career Services Workshops

- Career Services FAQ

- Career Services Contacts

- Co-op Structure

- Co-operative Education Contacts

- Community and Career Employment Services - Simcoe/Norfolk

- Career Launcher

- Co-curricular Record

- Pre-Orientation Prep

- Orientation

- International Arrival and Orientation

- Prepare to Learn

- Summer College

- Indigenous Action Plan

- First Nations and Agencies

- Indigenous Acknowledgement

- Indigenous Education Council

- Kalihwíy̲o̲ (Innovation Village)

- Explore the Culture

- Contact Indigenous Learning

- Office of the Ombuds

- Traditional Residence

- Townhouse Residence

- Apply for Residence

- Frequently Asked Questions

- Off-Campus Housing Listings

- Housing Links & Resources

- Fanshawe Student Union

- Campus Security Services

- Food Services

- Retail Services

- Locker Information and Regulations

- The Test Centre

- Positive Space Resources

- Fanshawe International Digital Ambassador

- Fanshawe College Abroad

- Programs and Admission Requirements

- Tuition and Fees

- Document Submission Deadlines

- English for Academic Purposes (EAP)

- University Application

- Entrance Scholarships

- Health Insurance Plan

- International Employment and Co-op Education

- International Centre

- Withdrawal and Refund Policy

- Outbound Exchange Opportunities

- Why Go Abroad

- Inbound Exchange Students

- Outbound Exchange Students

- Other Opportunities Abroad

- Contact Fanshawe International

- About Fanshawe

- Connect with Recruitment

- Online Tools

31 Best universities for Risk Management in Canada

Updated: February 29, 2024

- Art & Design

- Computer Science

- Engineering

- Environmental Science

- Liberal Arts & Social Sciences

- Mathematics

Below is a list of best universities in Canada ranked based on their research performance in Risk Management. A graph of 173K citations received by 6.17K academic papers made by 31 universities in Canada was used to calculate publications' ratings, which then were adjusted for release dates and added to final scores.

We don't distinguish between undergraduate and graduate programs nor do we adjust for current majors offered. You can find information about granted degrees on a university page but always double-check with the university website.

1. University of Toronto

For Risk Management

2. University of British Columbia

3. University of Alberta

4. University of Waterloo

5. McGill University

6. Simon Fraser University

7. York University

8. Western University

9. HEC Montreal

10. Laval University

11. McMaster University

12. Queen's University

13. University of Ottawa

14. University of Calgary

15. University of Quebec in Montreal

16. Memorial University of Newfoundland

17. University of Montreal

18. University of Saskatchewan

19. University of Manitoba

20. Concordia University

21. Wilfrid Laurier University

22. Dalhousie University

23. University of Guelph

24. University of Victoria

25. Ryerson University

26. Carleton University

27. Brock University

28. University of Sherbrooke

29. University of New Brunswick

30. University of Windsor

31. University of Regina

The best cities to study Risk Management in Canada based on the number of universities and their ranks are Toronto , Vancouver , Edmonton , and Waterloo .

Business subfields in Canada

- Skip to main content

- All countries /

- North America /

- Business and Management /

- Management /

- Risk Management

11 Universities in Canada offering Risk Management degrees and courses

More Information

Are you looking for Risk Management courses? Here you can find course providers offering full-time, part-time, online or distance learning options.

You've reached your limit of 10 Favourites

MacEwan University

Bow valley college, york university.

THE World Ranking: 351

Conestoga College

Fanshawe College

Queen's University

THE World Ranking: 251

Wilfrid Laurier University

New Brunswick Community College

Northern College

University of Calgary

THE World Ranking: 201

University of Toronto

THE World Ranking: 21

There are more Risk Management courses available in North America

- New Brunswick

- Study level:

- All study levels

- Postgraduate

- Undergraduate

- Career based/Vocational

- Study mode:

- Online/Distance

Filter your results

Tell us about you.

- Nationality Select country Select country

- My current qualification is from Select country Yes No Select country Select country

- Current qualification {0} is not applicable for the study level you selected below. Qualification Qualification

- Grade type (only one grade type for your qualification) Grade type Grade type

- My score (current or expected) Please select Please select Please select Please select Please select Please select

Tell us your preferences

- Subject Risk Management

Qualification

- Destination Canada

- Study options

- Annual tuition fees

Subject areas

Destination.

- The UConn School of Business has grown to become one of the most comprehensive business schools in the country.

- NEW: Want to study in your home country for a foreign qualification? Find out more about cross-border study!

Master of Financial Risk Management

Develop the strengths a fast-moving economy demands – and leading organizations are looking for – in this intensive, ten-month full-time program. At the intersection of risk management and finance, the Rotman MFRM provides an ideal balance of technical expertise and communications skills that will help launch your career.

- Student life

- MFRM stories

Get the competitive edge for your finance career

Over the past decade, changes across the global financial system have created a growing demand for professionals who can define, assess and manage risk. The Rotman Master of Financial Risk Management is a focused degree designed for quantitatively-strong students eager to hone their skills for the innovation-focused economy.

Apply Now Start in September 2024

"Risk management expertise is a critical skill required by all financial institutions. This specialization has never been in greater demand."

- Sonia Baxendale, President and CEO, Global Risk Institute in Financial Services

Program overview

The Master of Financial Risk Management is a full-time program that runs from September to June.

Rotman Risk Management project

The applied Risk Management project is a chance for students to tackle a real issue that is relevant and of interest to financial institutions.

Industry connections

As a Rotman student, you'll benefit from the strong ties between the school and the finance industry.

The finance faculty at Rotman is a mix of leading academics and seasoned industry professionals. Risk management and trading are core research strengths at the school.

Finance lab

Our state-of-the-art BMO Financial Group Finance Research and Trading Lab allows you to hone your investment, trading and hedging strategies through access to information on the global markets and tools developed by Rotman experts.

Rotman FinHub: Financial Innovation Hub in Advanced Analytics

Bringing together FinTech practitioners with researchers and students interested in financial innovation issues, the hub explores financial applications of new technologies including blockchain, machine learning, big data and quantum computing.

What we're looking for

MFRM Admissions criteria

We look for students with strong quantitative skills, a solid academic track record, and a high potential for professional achievement in risk management.

How to apply

Master of Financial Risk Management: how to apply and important deadlines

MFRM Admissions Events

Our Master of Financial Risk Management admission events are a fun way to learn more about the program. Connect with faculty, current students and the admissions team. Join us!

Fees and financial support

Learn about the fees and expenses for the MFRM program, and the financial support available to you as a Rotman student.

International applicants

Canada, with its sound fiscal situation and solid economic performance is a model for the world and a safe haven in the light of recent financial turmoil. It also happens to be a great place to live. Find out why you should make Toronto, Canada your next home, and the steps you need to take to get here.

Transform your potential

In a competitive market, it takes serious focus, drive and leadership to take your career to the next level. Located just blocks from Canada's business centre and part of the University of Toronto, the Rotman School is ideally positioned to help you connect with top employers.

➔ Download the MFRM Program Brochure

Prepare for Career Success

Getting ahead.

Our dedicated Career Services team is committed to working closely with you to achieve your career goals, and to develop the self-marketing tools and strategies that will benefit you throughout your professional life.

"In terms of the caliber of the class, you just need to look at my fellow students and what they’re doing now. They’re working in some prestigious institutions – the major banks, the central bank and insurance companies. They’re all covered."

- Jie (Jacky) Chen, MFRM '17, Investment Risk Analyst, OP Trust

Ways to engage

Our career services team will work with you to help you discover and define your vision for professional success. Through one-on-one coaching sessions, career development workshops and employer engagement events, you’ll gain the skills and strategies you need to achieve your goals.

Career services provides students with career support through a range of offerings:

Individual career coaching appointments

- Self-assessment and defining your career objectives

- Resume and cover letter review

- Networking techniques

- Interview preparation

- Behavioural Mock interviews

- Job offer and negotiation advice

Career and professional development workshops

- Crafting your professional networking pitch

- Advanced LinkedIn training

- Technical interview preparation

- Mock interviews with industry professionals

- Career panels and workshops in risk and finance

Employer engagement opportunities

- Exclusive networking events

- Mock interviews with industry panels

- Career panels

- Industry-specific speaker events

Online career resources

- Research tools

- Career development webinar and videos

As a graduate of the Rotman MFRM program you will have lifelong career support that will benefit you throughout your entire professional career.

Graduate profiles

Careers in risk

As a graduate, you will be well-positioned for career opportunities in risk management, as well as any area of finance that requires a thorough understanding of financial theory, and well developed quantitative and analytical skills.

- How well do you know risk?

- Are You Job-Market Ready? Become an Expert in Financial Risk Management

- Sound Risk Management: a critical capability for success

- How networking helped this MFRM ’19 grad gain clarity on her career and make the move to Shanghai

- Three MFRM ’17 grads on the fast track in their careers

Roles graduates have secured varied roles in a number of industries, including:

Asset Management

Canadian pension plan investment board (cppib) .

- Investment Analyst, External Portfolio Management

East Coast Fund Management

- Associate, Investment Operations

Greystone Managed Investments Inc.

- Senior Analyst, Fixed Income & Multi-Asset

Ontario Teachers’ Pension Plan (OTPP)

- Investment Associate, Capital Markets

- Investment Associate, Total Fund Management

- Investment Analyst, Strategy & Risk

- Financial Analyst, Risk Analytics

Bank of Canada

Bank of tokyo-mitsubishi ufj.

- Manager, Risk Analytics

BMO Bank of Montreal

- Assistant Consultant (Contract via Financial Risk Group)

- Senior Analyst, Counterparty Credit Risk – Platform Upgrade

- Senior Analyst, Structural Market Risk, Production Support

Central 1 Credit Union

- Credit and Counterparty Risk Analyst

- Treasury Analyst

- Analyst - Capital Risk

- Program Analyst, Operational Risk

- Regulatory Reporting Analyst, OTC Derivatives, Documentation

Royal Bank of Canada (RBC)

- Enterprise Recovery & Resolution Planning Analyst

- Global Trading Client Management

- Senior Analyst, Enterprise Risk Validation

- Analyst for Regulatory Solutions at RBC Investor & Treasury Services

- Senior Analyst, Group Treasury

Toronto-Dominion (TD)

- Risk Analyst

- Senior Consultant, Financial Services Risk Management

- Consultant Intern

- New Associate - Technology (Risk Assurance)

- Fixed Income Analyst

Manulife Financial

- Senior Analyst (Risk)

- Risk Management Analyst

- Verification Analyst, Financial Risk Management

MFRM advisory board

The board seeks to raise the profile of Rotman’s MFRM program, facilitate networking and employment opportunities for students, and highlight the multiple ways in which the school is engaged in the risk management field.

Real-world results

Offered over ten months, the MFRM program is designed to prepare ambitious recent graduates and young professionals for careers in risk management and finance. All courses are developed with practitioner input.

MFRM Program overview

MFRM Course descriptions

The curriculum will allow you to master the complex issues involved in risk management and trading. All courses are developed with practitioner input.

As a Rotman student, you'll benefit from the strong ties between the school and the finance industry. Through speaking events with industry executives, an integrated project on a real-world business challenge, and exposure to faculty who span both business and academia, you’ll learn from some of the top leaders in the industry.

The state-of-the-art BMO Financial Group Finance Research and Trading Lab allows you to hone your skills in real time. With access to information on the global markets and simulation tools developed by Rotman experts, the lab provides opportunities to practice investment, trading and hedging strategies in a simulated and highly realistic environment.

Self development lab

Learn how to inspire others into action. The SDL offers an extensive schedule of workshops designed to nurture your communication and interpersonal skills through feedback-based learning.

MFRM Student View

This page is divided by the program structure, in which you are able to navigate the diverse student experiences through each and every step of the MFRM program.

Master of Financial Risk Management, Class of 2023 profile

MFRM classes consist of students progressing straight from undergraduate studies and early career professionals with a few years of related work experience. All students have a strong quantitative background, with studies in subjects such as business/commerce, engineering and economics. Classes are a mix of domestic students and international student representing a number of countries. A number of international students have previously studied in Canada.

Average Age

Work experience

36 % of class with work experience

Average undergrad GPA

Average GMAT/GRE

Not required for admission. Average based on scores from 20% of admitted class.

Professional designation

of class working towards professional designation such as CFA or FRM.

Academic background

Business/Commerce - 56.7% Math - 29.9% Economics - 9% Engineering - 3% Accounting - 2%

Nationalities represented

Canada Bangladesh Barbados China India Iran

Israel Jordan Mauritius Russian Federation Taiwan

International/Domestic Students

Welcome to the Rotman community

As part of the Rotman MFRM class, you will find yourself challenged and motivated to excel by the calibre of your classmates — peers who will become your lifelong network of friends and business contacts.

As part of the Rotman family, you will also have opportunities to interact with our powerful network of students and alumni who are working professionals and leaders in the finance community.

Student life begins at Rotman with an orientation event. You'll learn about Rotman, meet your classmates, and get to know what you should expect from your MFRM experience.

Case competitions

Rotman students participate in international case competitions – and even organize our own. The Rotman International Trading Competition is just one of the high-profile events hosted at the School each year. Competitions deepen your school experience, and allow you to test and sharpen your skills in real time.

Trading competition

The Rotman International Trading Competition is an annual event that brings teams of students and their faculty advisors from universities worldwide to participate in a unique 3-day simulated market challenge. Participating in the competition is fun and engaging giving you the chance to meet people with the same interests as you from all over the world.

Rotman student clubs

Rotman has a number of different student clubs and associations, run by student that you are able to participate in. They range from clubs around specific industries, regions, and social activities.

Rotman speaker events

Attending events at Rotman is a great way to deepen your knowledge and stay connected to the latest issues in finance and the wider business community. Take advantage of the speaker series events as well as a range of guest speaker events featuring experts from all over the world who publish and write on business matters.

Read about MFRM students, alumni and the Rotman School

What is it really like to be part of an MFRM class? Find out by reading about the experiences of current class members and graduates.

"Your classmates are the future leaders of the finance services industry."

- Djordje Calic, MFRM '19, Analyst, Financial Trading, TransCanada

MFRM ambassadors

Hear from current Master of Financial Risk Management students on why they decided to choose Rotman as the launchpad for their career.

MFRM Student & alumni stories

At Rotman, our students are our key strength. Learn more about them in regularly updated feature stories.

Read articles about current students, faculty, and the MFRM program.

Rotman in the news

Each week, our faculty share their groundbreaking research, published work and their authoritative insight into an exceptionally wide range of management issues. Take a moment to find out what's happening this week at Rotman.

Applications for 2024 entry are now closed. Strong domestic candidates may still be considered .

Connect with the Admissions Office for more information .

Applications are closed for fall 2024.

Applications due:

- February 7, 2024

Apply now to start in September 2024.

Your path to the mfrm.

Connect with our Admissions Team

Attend an Admissions Event

Download our Brochure

- 10 months, full-time

- September, one intake per year

Program fee (2023 entry)

- Domestic = $39,850 CAD

- International = $70,370 CAD

Employment rate

- 100% (Class of 2022, within six months of graduation)

- #1 in Canada

- #4 in North America

- #18 in the world

QS World University Rankings: Masters in Finance Rankings 2023

Get the latest insights, research & analysis. Rotman Insights Hub

PhD in administration - Finance

Phd in administration — finance.

- Tuition fees and Funding

- Students wanted

You have your sights set on excellence and you’re planning on a career in academia or business, in the field of finance?

Do your PhD in a specialization that trains highly qualified and innovative researchers, in a stimulating environment with outstanding resources, at the cutting edge of knowledge in finance.

Your PhD in short

- Offered in English.

- Offered by HEC Montréal jointly with Concordia and McGill universities and the Université du Québec à Montréal (UQAM). This partnership gives you access to resources (faculty and courses) rarely available elsewhere in the world.

- Full-time program allowing you to complete your studies in 4 or 5 years.

- Tuition fees waived and competitive funding for the first four years of your studies.

- Option of spending one or two terms at one of the top business schools in North America, between your 3 rd and 5 th years.

- Option of taking part in the HEC – McGill Doctoral Finance Workshops, annual events held jointly by the Department of Finance and the McGill University Desmarais Global Finance Research Centre.

For a career in academia or business

Most of the 38 graduates from this doctoral program hold positions as professors at Canadian or foreign universities.

They are employed at such prestigious institutions as the University of British Columbia (Canada), St Mary’s University (Canada), the University of Wisconsin (USA), KAIST College of Business (Korea), VU University Amsterdam (Netherlands), NEOMA Business School (France), ESG UQAM (Canada), York University (Canada) and Rowe School of Business (Canada).

Graduates who have chosen to work in the private sector hold positions with Bloomberg, the Caisse de dépôt et placement du Québec, Desjardins, Ernst & Young, and the National Bank of Canada, for example.

Among the best

PhD students in this specialization benefit from:

- Close supervision by professors in the Department of Finance, who hold degrees from such top-tier institutions as the London School of Economics, MIT, Swiss Finance Institute, University of Toronto, University of British Columbia, University of California San Diego and Wharton.

- A series of seminars featuring presentations by internationally renowned scholars.

- Access to the leading suppliers of financial data, including WRDS, OptionMetrics, CRSP, Compustat, I/B/E/S and NYSE TAQ — as well as to the trading room, supplied with Bloomberg data.

- The Computing and Data Mining Laboratory (LACED).

Varied research interests

The main research interests of the professors in the Department of Finance cover the following themes:

- Asset pricing

- Banking and insurance

- Capital market theory

- Corporate finance

- Financial econometric

- Financial markets and institutions

- Household finance

- Market microstructure

- Portfolio and risk management

Current students in this specialization

World-class research in finance

HEC Montréal offers doctoral students in finance an exceptional scientific milieu, through its research chairs and professorships.

- Canada Research Chair in Risk Management , directed by Professor Georges Dionne

- Financial Big Data Analysis : Professor Vincent Grégoire

- Financial Risk Factors and Derivatives: Professor Christian Dorion

- Personal Finance : Professor Philippe d’Astous

- Quantitative Corporate Finance : Professor Pascal François

- Sustainable Finance: Professor Iwan Meier

The 21 researchers in this specialization are known for their excellence. Their work has recently been published in the world’s top finance journals:

- The Journal of Financial Economics

- The Review of Financial Studies

- The Journal of Financial and Quantitative Analysis

- The Review of Finance

Be part of innovative research

Researchers in this specialization work closely with several research groups and knowledge transfer hubs, including:

- Financial Education Lab

- Retirement and Savings Institute

The Department of Finance houses the Canadian Derivatives Institute .

- The Canadian Derivatives Institute promotes the sound use of derivative instruments, reinforces the expertise of stakeholders and contributes to the development of the risk management and derivatives sectors across Canada.

- It also holds an annual conference on a wide range of issues associated with derivatives attended by the world’s top researchers.

- 100% distance

- Côte-des-Neiges

- Questions about our PHD Program?

- Download our brochure

Future students, follow us

Share this page

IMAGES

VIDEO

COMMENTS

Risk Management graduate and post-graduate programs and degrees offered in Canada. Browse and compare over 10,000 master's, graduate certificate, doctorate (PHD) and residency programs offered in universities, faculties and research centres across Canada.

The main mission of the PhD program in Accounting at the Haskayne School of Business, University of Calgary, is to prepare prospective faculty members for positions at reputable business schools in Canada and around the world. Our graduates teach and research in schools such as American University of Cairo, Concordia University, Mount Royal ...

A PhD in Risk Management prepares students to develop an understanding of successful research in academia and industry, both in theoretical and applied aspects of insurance, risk management, and employee benefits. While that description might not sound action-packed, keep in mind that risk management is a premier degree program in today's ...

The David and Joan Lynch School of Engineering Safety and Risk Management at the University of Alberta offers the only integrated ESRM program of its kind in Canada. The School was founded in 2016 after having been in operation as the ESRM program that was established by the Faculty of Engineering in 1988.

The PhD in Geography and Environment (Hazards, Risk and Resilience) is a multidisciplinary enrichment program designed for current graduate PhD students who wish to become specialists in the field of natural hazards and risks, and who wish to gain an appreciation of the interdisciplinary nature of disaster risk reduction problems and solutions.

The PhD in Management is a challenging 5 year program which features course-work, cutting edge research training, and close working relationships with some of the best management academics in the world. The success of our program is evidenced in the impressive careers of our graduates. 88%. of Rotman PhD graduates in academic positions.

Learn about the research interests and projects of the faculty members in risk management and insurance at the University of Calgary. Find out how they apply theory and methodologies from economics, law, finance, psychology, and statistics to various topics such as fire losses, insurance, and financial risk management.

The Collaborative Specialization in Hazards, Risks, and Resilience is a multidisciplinary enrichment program designed for current graduate students (Masters and PhD) who wish to become specialists in the field of natural hazards and risks, and who wish to gain an appreciation of the interdisciplinary nature of disaster risk reduction problems and solutions.

Rotman Finance offers top-tier training from some of the world's leading experts in fields such as risk management, corporate governance, delegated asset management, and behavioural finance. The PhD Program in Finance at the Rotman School trains prospective scholars to become highly skilled and innovative researchers and teachers, and to prepare them for careers as faculty members at premier ...

The Rotman Finance area has created an interdisciplinary research team within the University of Toronto (UofT) to focus on liquidity risk management and its integration with other types of risk including market and credit risk. The research has been funded by a three-year grant from the Global Risk Institute which helps fund PhD students ...

Completion of the Graduate Management Admission Test (GMAT*) with a recommended minimum score of 650, with high scores on both verbal and quantitative subcomponents. (Many successful applicants have earned scores of 700 and above). As an alternative to a GMAT score, results on the Graduate Record Exam (GRE) will be considered.

The Institute for Resources, Environment and Sustainability (IRES) at the University of British Columbia (UBC) is a problem-focused and curiosity-driven interdisciplinary research institute and graduate program, with interest and expertise in a wide range of topics under the realm of environment and sustainability. Our mission is to foster sustainable futures through integrated research and ...

Insurance and Risk Management is a one-year Ontario College Graduate Certificate program that will prepare students for careers as brokers/agents, risk managers, underwriters, loss adjusters or loss prevention inspectors. If you want to make a difference and build a future in a fast-paced, dynamic environment, this program is for you.

8 Universities in Canada offering postgraduate Risk Management degrees and courses. Plan your studies abroad now. ... View 1 Risk Management courses. 60582. Views. 141. Favourites. courses. ... Graduate Certificates & Diplomas; Masters Degrees; MBA; Doctoral Degrees; Study mode: On Campus; Online/Distance;

Below is a list of best universities in Canada ranked based on their research performance in Risk Management. A graph of 173K citations received by 6.17K academic papers made by 31 universities in Canada was used to calculate publications' ratings, which then were adjusted for release dates and added to final scores.

PhD students have the opportunity to make a significant and lasting contribution to the field of management. We provide a collaborative, supportive and intellectually stimulating research environment for the discovery and dissemination of knowledge applicable to the business community. The Haskayne funding package is one of the most generous ...

Find exclusive scholarships for international PhD students pursuing Risk Management studies in Canada. Search and apply online today. Explore; Decide; Apply; Explore. View disciplines. Agriculture & Forestry ; ... Vanier Canada Graduate Scholarship. Read more about eligibility . Canadian Government. Location not available. Provided by ...

11 Universities in Canada offering Risk Management degrees and courses. Plan your studies abroad now. You are currently browsing our site with content tailored to students in your country

Canada, with its sound fiscal situation and solid economic performance is a model for the world and a safe haven in the light of recent financial turmoil. ... Careers in risk. As a graduate, you will be well-positioned for career opportunities in risk management, as well as any area of finance that requires a thorough understanding of financial ...

Conestoga College. Kitchener, Ontario, Canada. This page shows a selection of the available Masters programmes in Canada. If you're interested in studying a Risk Management degree in Canada you can view all 7 Masters programmes. You can also read more about Risk Management degrees in general, or about studying in Canada.

This page shows a selection of the available PhDs in Canada. If you're interested in studying a Management Studies degree in Canada you can view all 16 PhDs. You can also read more about Management Studies degrees in general, or about studying in Canada. Many universities and colleges in Canada offer English-taught PhD's degrees.

Do your PhD in a specialization that trains highly qualified and innovative researchers, in a stimulating environment with outstanding resources, at the cutting edge of knowledge in finance. ... Canada Research Chair in Risk Management, directed by Professor Georges Dionne; Research Professorships. Financial Big Data Analysis : ...

Master in Business Administration (MBA)0. Master in Management (MIM)0. Operations and Quality Management0. Project Management0. Public Administration0. Retail Management0. Risk Management0. Strategic Management0. Supply Chain Management & Logistics0.