- Open access

- Published: 28 January 2023

Forex market forecasting using machine learning: Systematic Literature Review and meta-analysis

- Michael Ayitey Junior 1 ,

- Peter Appiahene 1 ,

- Obed Appiah 1 &

- Christopher Ninfaakang Bombie 1

Journal of Big Data volume 10 , Article number: 9 ( 2023 ) Cite this article

24k Accesses

3 Citations

5 Altmetric

Metrics details

When you make a forex transaction, you sell one currency and buy another. If the currency you buy increases against the currency you sell, you profit, and you do this through a broker as a retail trader on the internet using a platform known as meta trader. Only 2% of retail traders can successfully predict currency movement in the forex market, making it one of the most challenging tasks. Machine learning and its derivatives or hybrid models are becoming increasingly popular in market forecasting, which is a rapidly developing field.

While the research community has looked into the methodologies used by researchers to forecast the forex market, there is still a need to look into how machine learning and artificial intelligence approaches have been used to predict the forex market and whether there are any areas that can be improved to allow for better predictions. Our objective is to give an overview of machine learning models and their application in the FX market.

This study provides a Systematic Literature Review (SLR) of machine learning algorithms for FX market forecasting. Our research looks at publications that were published between 2010 and 2021. A total of 60 papers are taken into consideration. We looked at them from two angles: I the design of the evaluation techniques, and (ii) a meta-analysis of the performance of machine learning models utilizing evaluation metrics thus far.

The results of the analysis suggest that the most commonly utilized assessment metrics are MAE, RMSE, MAPE, and MSE, with EURUSD being the most traded pair on the planet. LSTM and Artificial Neural Network are the most commonly used machine learning algorithms for FX market prediction. The findings also point to many unresolved concerns and difficulties that the scientific community should address in the future.

Based on our findings, we believe that machine learning approaches in the area of currency prediction still have room for development. Researchers interested in creating more advanced strategies might use the open concerns raised in this work as input.

Introduction

The foreign exchange or forex market is the largest financial market in the world where currencies are bought and sold simultaneously. It is even larger than the stock market; According to the 2019 Triennial Central Bank Survey of FX and Over-the-Counter (OTC) derivatives markets, it has a daily volume of $6.6 trillion [ 7 ]. It is a non-centralized market that operates 24 h a day except the weekend, which makes it unique from other financial markets. Because of its high volatility, nonlinearity, and irregularity, the forex market, unlike stocks, is one of the most complex markets [ 1 ]. The traits of Forex show differences compared to the stock, bond, and other financial markets. These differences make forex traders have more trading opportunities and advantages for profitable trades. Some of these advantages include no commissions, no middlemen, no fixed lot size, low transaction costs, high liquidity, almost instantaneous transactions, low margins/high leverage, 24-h operations, no insider trading, limited regulation, and online trading opportunities [ 73 ]. In the forex market, currency pairs are traded, with the base currency being the first listed currency and the quote currency being the second. Currency pairs compare the value of one currency to another (the base currency to the quote currency). When the prices depreciate, a quote currency is bought against the base currency, which leads to profit, and when the prices elevate, the base currency is bought against the quote currency [ 1 ]. Two main types of techniques are used to forecast future values for a typical financial time series, which are fundamental analysis and technical analysis. Fundamental analysis is a method of examining economic, social, and political issues that may influence currency prices in the forex market. In contrast, technical analysis involves using historical data price chart, which provides a roadmap for past price behavior. To forecast the future, a technical analyst looks to the past. Predicting the direction of a currency pair's movement is the most important choice in Forex. Predicting currency movement correctly can bring many benefits to traders and vice versa. In past and recent years, the research community has been highly active in predicting the forex market using machine-learning models. On one hand, many verifiable types of research have been conducted with the aim of understanding and predicting currency trends in the forex market using machine-learning models. According to Zhelev and Avresky [ 77 ], the cited literature in the field of deep learning is a basic foundation for solving the challenging problem of prediction of forex price. While the research community has spent a lot of time studying the methodologies used by researchers and practitioners in the context of predictive models in the forex market, there isn't much information on how to forecast currency pair movement in the forex market using machine-learning models and Meta-Analysis. To address this gap in knowledge, we conducted a Systematic Literature Review (SLR) on the use of machine learning (ML) techniques for forex market forecasting, with the goal of (i) understanding and summarizing current algorithms and models, and (ii) analyzing its evaluation metrics and open challenges to guide future research. Our SLR is to provide a complete examination of I machine learning as it has been considered in previous research, and (ii) the training processes used to train and assess machine learning algorithms. We also give a meta-analysis of the performance of the machine learning models that have been developed so far, as judged by their assessment criteria. In addition to examining the state of the art, we critically examined the approaches that have been applied thus far.

Research questions posed for our systematic literature review

Related research.

Our objective is to conduct a systematic literature review to comprehend and summarize studies on machine learning prediction models in the forex market. It's worth noting, however, that some secondary research on machine learning algorithms and deep learning has been proposed. [ 18 , 27 , 44 , 54 , 59 ].

According to Fletcher [ 18 ] when including advanced exogenous financial information to estimate daily FX carry basket returns, committees of discriminative techniques such as Support Vector Machines (SVM), Relevance Vector Machines (RVM), and Neural Networks) perform well.

Panda et al. [ 44 ] conducted a second SLR on Exchange Rate Prediction utilizing ANN and Deep Learning Methodologies, and offered novel approaches that were distinct according to them from 2000 to 2019, for predicted exchange rate projection the effects observed during the protected period within examined are displayed using newly proposed models such as Artificial Neural Network (ANN), Functional Link Artificial Neural Network (FLANN), Hidden Markov Model (HMM),

Support Vector Regression (SVR), an Auto-Regressive (AR) model. Some of the suggested novel neural network models for forecasting, on the other hand, took into account theoretical support and a methodical approach in model creation. This results in the transmission of new deep neural network models.

Islam et al. [ 27 ] conducted a SLR, which looked at recent advances in FOREX currency prediction using machine-learning algorithms. They utilized a keyword-based search approach to filter out popular and relevant research from papers published between 2017 and 2019. They also used a selection algorithm to decide which papers should be included in the review. They analyzed 39 research articles published on "Elsevier," "Springer," and "IEEE Xplore" that forecasted future FOREX prices within the specified time frame based on the selection criteria. According to their findings, in recent years, academics have been particularly interested in neural network models, pattern-based approaches, and optimization methodologies. Many deep learning algorithms, like the gated recurrent unit (GRU) and long short-term memory (LSTM), have been thoroughly investigated and show great promise in time series prediction.

Evaluating the Performance of Machine Learning Algorithms in Financial Market Forecasting was the subject of Ryll & Seidens [ 54 ] study, more than 150 related publications on utilizing machine learning in financial market forecasting were reviewed in this study. They created a table across seven primary factors outlining the experiments done in the studies based on a thorough literature review. They provide a simple, standardized syntax for textually describing machine-learning algorithms by listing and classifying distinct algorithms. They conducted rank analyses to analyze the comparative performance of different algorithm classes based on performance criteria acquired from publications included in the survey. In financial market forecasting, machine-learning algorithms beat most classic stochastic methods, according to their findings. They also discovered evidence that recurrent neural networks outperform feed-forward neural networks and support vector machines on average, implying that there are exploitable temporal relationships in financial time series across asset classes and countries. The same is true when comparing the benefits of different machine learning architectures.

Sezer et al. [ 59 ] did a thorough evaluation of DL studies for financial time series forecasting implementations. Convolutional Neural Networks (CNNs), Deep Belief Networks (DBNs), and Long-Short Term Memory (LSTM) were used to categorize the papers. Their findings show that, despite the fact that financial forecasting has a lengthy study history, overall interest in the DL community is increasing as a result of the use of new DL models,thus, there are numerous chances for researchers. They also attempted to predict the field's future by highlighting potential bottlenecks and opportunities in order to aid interested scholars.

Berradi et al. [ 6 ] suggested that giving the latest research of deep learning techniques applied to the financial market field can help investors to make an accurate decision. They gathered all the recent articles related to deep learning techniques applied to forecasting the financial market, which includes the stock market, stock index, commodity forecasting, and Forex. Their main goal was to find the most models used recently to solve the prediction problem using RNN, their characteristics, and their novelty. They gave all aspects that involve the process of forecasting beginning with preprocessing, the input features, the deep learning techniques, and the evaluation metrics employed. Their finding is that the hybrid model outperforms the traditional machine learning techniques, which leads to the conclusion that there is a very strong relationship between the combination of all the approaches and better prediction performance.

The goal of Henrique et al. [ 23 ] is to present methods for selecting the most important advances in machine learning applied to financial market prediction to present a review of the articles chosen, clarify the knowledge flow that the literature follows, and propose a classification for the articles. In addition, their study provides an overview of the best approaches for applying machine learning to financial time series forecasting as determined by the literature. The publications were then objectively assessed and categorized into the following categories: markets utilized as test data sources, predictive variables, predicted variables, methodologies or models, and performance metrics used in comparisons. In all, 57 papers from 1991 to 2017 were examined and categorized, spanning the specialist literature. Based on searches of connected article databases, no reviews employing such objective methodologies as main route analysis on the topic provided here were discovered according to them. The most cited articles, those with the highest bibliometric coupling and co-citation frequencies, the most recently published articles, and those that are part of the primary path of the literature studied knowledge flow were all discussed in the study. It should be highlighted that they were objective and straightforward survey methodologies, independent of the researcher's expertise, that could be used not just for preliminary research but also as knowledge validation for seasoned experts. In addition, the prediction algorithms and key performance measures for each article were presented. In addition to using neural and SVM networks, the authors used data from the North American market extensively. Similarly, the majority of the forecasts are based on stock indexes. New suggested models will likely be compared to neural and SVM network benchmarks, using data from the North American market, as one of the probable findings regarding the categorization presented in the research. The examination of the behavior of forecasts in developing markets, such as those of the BRICS, as well as the application of novel models in financial market prediction, continues to provide research opportunities.

Kaushik [ 32 ] presents a comprehensive review of contemporary research on Machine Learning and Deep Learning for exchange rate forecasting, based on peer-reviewed publications and books. The paper examines how Machine Learning and Deep Learning algorithms vary in projecting exchange rates in the FOREX market. SVM, Deep learning approaches such as Feedforward Neural networks, and hybrid ensembles have superior prediction accuracy than standard time series models, according to research. Future research should be conducted to assess the performance of these models, according to the authors,however, no single forecasting model consistently stands out as the best when evaluated using different criteria and on different currency pairs, and decisions based on the models' predictions should be used with caution.

Regarding the publications mentioned above, it's worth noting that none of them focused specifically on machine-learning methods for the FX market from 2010 to 2021. Fletcher [ 18 ] concentrated on discriminative approaches (Support Vector Machines (SVM), Relevance Vector Machines (RVM), and Neural Networks) without examining other machine learning algorithms critically.

Islam et al. [ 27 ] took into account machine learning in the context of forex trading, highlighting Regression Methods, Optimization Techniques, SVM Method, Neural Network Chaos Theory, Pattern-based Methods, and Other Methods, but the period under consideration was from 2017 to 2019, but there has been a lot of work in this area over the last two decades. Panda et al. [ 44 ] concentrated on deep learning and hybrid techniques, as well as a few other machine learning algorithms, but the number of publications chosen was insufficient for the period under evaluation.

The research published by Sezer et al. [ 59 ] focused on deep learning research by looking at Convolutional Neural Networks (CNNs), Deep Belief Networks (DBNs), and Long-Short Term Memory (LSTM): however, there are other deep learning models such as Radial Basis Function, Multi-layer Perceptron, and many more deep learning methods that have been used in forex market prediction that were not looked at by the article.

Contributions

The following are the contributions by this SLR:

We took a critical look at 60 primary articles or studies that present machine learning forecasting models in the forex market. Researchers can use them as a beginning stage to expand the knowledge on the topic.

We give a comprehensive summary of the primary studies found. This section is divided into three sections: I machine learning methodologies, (ii) evaluation strategies, and (iii) performance analysis of the presented models.

Based on our findings, we offer guidance and recommendations to help further research in the field.

Research methodology

In this study, a systematic literature review was employed as a research approach since it is a defined and methodical way of discovering, evaluating, and studying existing material in order to investigate a certain research issue or phenomenon Barbara [ 5 ].

We followed the SLR rules that were proposed by Barbara [ 5 ]. In addition, we incorporated the process of systematic reference inclusion, often known as "snowballing," as outlined by [ 71 ].

We adopted the SLR guidelines proposed by [ 71 ].

The following subsections describe the process followed.

Search strategy

A technique was proffered to retrieve all published articles/papers/literature associated with the topic. Our primary studies retrieval techniques involve search terms and phrase identification, databases to be searched, search and paper picking strategy adopted for the study.

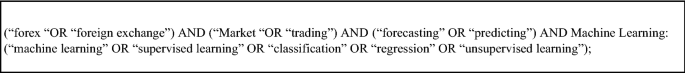

Identifying search terms and phrases

To find the relevant search terms and phrases we followed five steps outlined by Barbara [ 5 ]:

We found alternative spellings and/or synonyms for all major terms and phrases;

We double-checked the keywords in any important paper;

In cases where a database supports it, we employed Boolean operators for conjunction, such as the OR, AND operator for concatenation of major phrases and operator for concatenation of alternative spellings and synonyms If necessary, we combined the search string into a summary form.

Results for a). To better tailor our search keywords, we first defined the population, intervention, and outcome. Specifically:

Results for b). The alternative spellings and synonyms identified are:

Forex: (“forex “OR “foreign exchange”).

Market: (“Market “OR “trading”).

forecasting: (“forecasting” OR “predicting”)

Machine Learning: (“machine learning” OR “supervised learning” OR “classification” OR “regression” OR “unsupervised learning”);

Results for c). We searched through the keywords in the relevant papers/articles and couldn't come up with any further spellings or synonyms to add to the list of terms to consider.

Results for d). The following search query was created using Boolean operators:

Results for e). We also defined the short search string reported below, due to the IEEE Xplore digital library's search term limitation:

Resources searched

In an SLR, selecting appropriate resources to search for germane material is critical. All available literature relevant to our study topics was selected and searched using the following resources:

Google Scholar ( https://scholar.google.com )

IEEE Xplore digital library ( https://ieeexplore.ieee.org )

ScienceDirect ( https://www.sciencedirect.com )

Microsoft Academic ( https://academic.microsoft.com )

ACM digital library ( https://www.acm.org )

Our decision to use these databases was based on our desire to collect as many publications as possible in order to adequately conduct our systematic literature review.

Because they contain a massive amount of literature related to our research questions, such as journal articles, conference proceedings, books, and other materials, the chosen sources or databases are recognized as one of the most representative for Forex market forecasting research and are used in many other SLRs.

Article selection process

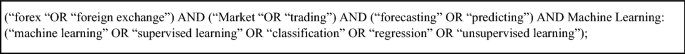

Figures 1 , 2 and 3 depicts the article selection procedure used in this study. The selection procedure is described in depth in the subsections that follow.

We gathered the main research in the digital libraries specified in “ Resources searched ” section using the search strings given in “ Identifying search terms and phrases ” section. The search technique was restricted by a chronological range, therefore publications from 2010 to 2021 were examined. Table 1 second column displays the search results generated by the digital libraries: As you can see, we downloaded a total of 120 documents related to the query.

We started by removing non-relevant publications from the complete list of retrieved sources using the exclusion criteria (detailed reported in “ Resources searched ” section). The exclusion criteria were applied after reading the title, abstract, and keywords of the 120 publications discovered. Table 1 shows data source and search results with 120 initial papers and 20 removed, leaving 100 for the second step of screening, which included the inclusion criteria. This approach yields our final search string, which consists of 60 articles (60 percent of the papers discovered in the previous stage).

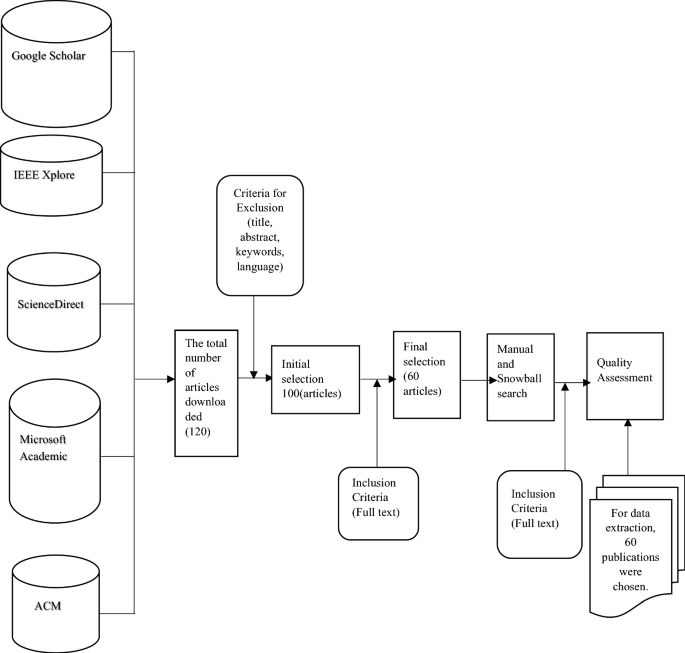

Showing conceptual framework for data extraction from the primary studies

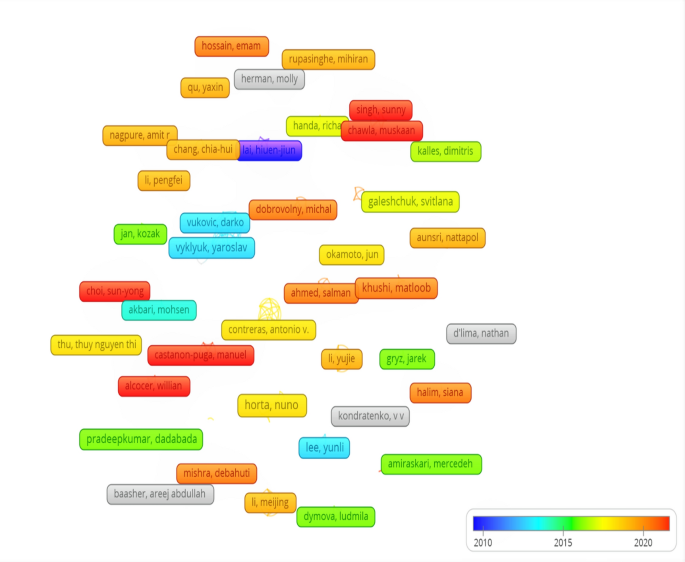

VOSviewer ( http://www.vosviewer.com/ ) was used to undertake a bibliographic coupling analysis. The number of references that are common across the publications evaluated is represented by the size and color of the nodes. The number of referenced references that two publications have in common is indicated by the link's strength

Point c should be critically looked at.

We employed a snowballing strategy to seek for possible missing papers [ 71 ]. The technique of identifying more sources using a paper's reference list or citations is known as snowballing [ 71 ]. In our context, we employed both forward and backward snowballing: with the former, we included articles that were referred to in the initially selected papers, and with the latter, we included publications that were referenced in the initially selected papers. We followed the same method as before, scanning the titles, abstracts, and keywords of the snowballed papers and applying the exclusion/inclusion criteria again: as a consequence, several publications were recognized as requiring further examination.

Given a collection of 60 sources identified using search string and then supplemented with those collected via snowballing. As a result, 60 papers made it through all of the stages.

We used the last filtering, i.e., the quality assessment step, after we had determined the set of final articles to evaluate in the SLR, to ensure that all of the final articles provided the data required to answer our research questions (see “ Evaluation of the study's quality ” section). As a result of this phase, we were able to compile the final list of articles for our study. Until this point, all 60 sources found had passed the quality check. As a result, our SLR is based on 60 studies. “Extraction of data” section details the data extraction procedure. The next subsections include (i) inclusion/exclusion criteria, (ii) the procedure's quality evaluation method, and (iii) the data extraction process.

Inclusion and exclusion criteria

An article has to meet the following criteria to be useful in answering our research questions.

A. Exclusion criteria: We omitted sources that satisfied the following limits from our research:

Articles about predicting methods other than machine learning.

Articles written in a language besides English.

Articles that aren't available in their whole.

B. Sources that complied with the following restrictions were considered for inclusion in our research:

All the articles, written in English, report machine learning techniques for forex market forecasting;

Articles that provide new strategies for improving the performance of existing machine learning algorithms for forecasting FX markets. It's worth noting that we included a wide range of publications (for example, journal, conference, workshop, and short papers) in order to compile a comprehensive collection of relevant resources.

Evaluation of the study's quality

After the final selection process, the quality of the publications was assessed. The legitimacy and completeness of the selected publications were assessed using the checklist below.

Q1: Does the machine learner classifier have a well-defined definition?

Q2: Can you tell me about the evaluation methodologies.

Consider the scenario in which research uses MAE, RMSE as an assessment statistic.

Extraction of data

We began extracting the data needed to address our study questions once we had chosen the final publications to be utilized for the SLR. We depended on the data in particular.

Table 2 shows the extraction form used in the selected publications, such as the machine learning algorithm.

Extraction of data form

Once we'd decided on the final papers for the SLR, we started extracting the data we'd need to answer our research questions. We used the data extraction form shown in Table 2 in particular. In addition to information on the specific aspects under examination, such as the machine learning approach employed in the selected publications, we have left aside a section for characterizing baseline models of the analyzed study. This made it easy to find a baseline model of prior research as well as future research direction.

Conceptual framework for data extraction

In this part, we offer a brief description of the demographics of the articles that passed the inclusion/exclusion criteria and the quality evaluation before providing the findings of the SLR with regard to the examined research topics.

Characteristics of the population

The final list of relevant primary studies evaluated in this SLR is presented in Tables 3 and 4 , with columns 'Year' and 'Book/Book Chapter/ Conf./Article/Thesis' indicating the year of publication and the periodicals in which the study was published. As can be seen, all of the articles evaluated were published between 2010 and 2021; 80% of this primary research were published after 2014, perhaps indicating a developing tendency that is now establishing itself as a more established subject. In conclusion We determined that the application of machine learning techniques for FX market prediction still poses open difficulties based on the quantity and types of papers released by the research community.

RQ1—Algorithm for machine learning

The first research question of our SLR was connected to the machine learners utilized in the literature, as identified in the primary papers. We wanted to know I whose machine learning method was used, (ii) what deep learning (Neural Network and related algorithms) was used, and (iii) what additional machine learning strategies were used. The outcomes of our analyses are detailed in the subsections below.

Beyond the 60 primary considered from 2010 to 2021, some papers published in 2022 as shown in Table 5 used machine learning algorithms including the authors publication were also looked at but did not affect the analysis of the initial 60 papers.

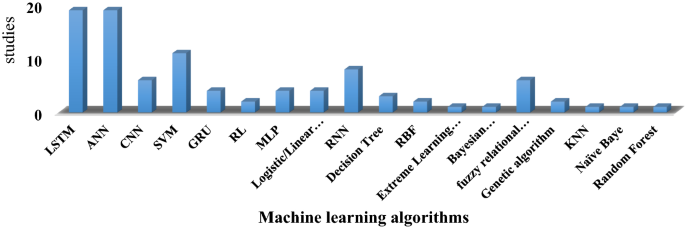

RQ2.3 Machine Learning algorithms

Our investigation revealed that a wide range of machine learning methods were applied. The bar chart in Fig. 4 displays the algorithms utilized in the primary investigations, as well as their frequency of presence. The machine learning method, the primary research in which it was utilized, and the number of primary studies that employed it are all listed in Table 6 . It's worth noting that many or hybrid algorithms may have been utilized in single primary research.

Bar chart reporting the number of primary studies and the machine learning algorithm adopted in each

LONG SHORT MEMORY NEURAL NETWORK (LSTM) as it is possible to these was investigated and used by 19 primary studies. A possible reason lies into the output of this type of models, which has shown a great performance and to properly analyze non-linear data, its ability to overcome the varnishing gradient problem pose by other neural networks.

ARTIFICIAL NEURAL NETWORK (ANN) as a deep learning model was also used by 19 primary studies indicating a growing trend in the use of it in the forex market prediction.

CONVOLUTIONAL NEURAL NETWORK is one of the deep learning algorithms that has not receive massive usage in the forex market, this model was use by 6 of our primary studies but can be further exploited in the foreign exchange market.

SUPPORT VECTOR MACHINE (SVA) was also used a number of times, 11 primary studies used this algorithm which is the third most used algorithm according to Figs. 4 , 5 , 6 and 7 . This classifier, as previously described by Farhat [ 17 ] can attain very high performance.

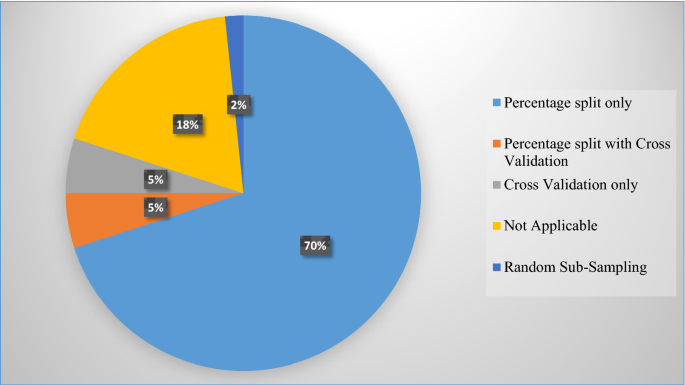

Validation approaches used in primary investigations are depicted in a pie chart

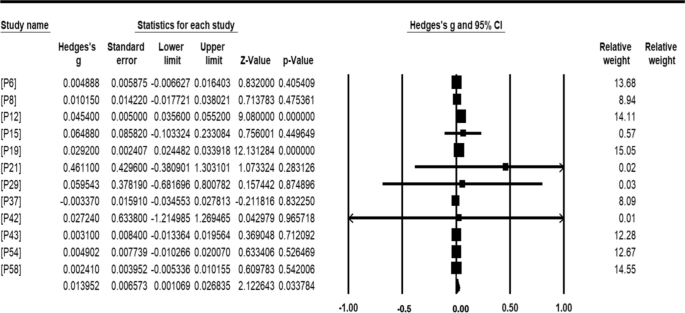

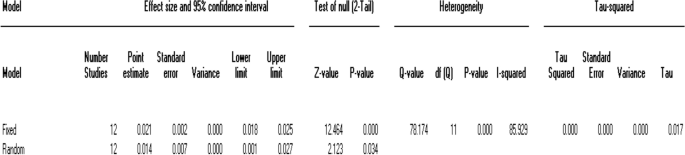

Results of meta-analysis based on MAE as Hedge's g and RMSE as Standard error

GRU stands for GATED RECURRENT UNIT and is a type of RNN with a gating mechanism. Compared to LSTMs, GRUs do not contain an output gate [ 57 ], four primary studies exploited this algorithm for their work.

REINFORCEMENT LEARNING (RL) this algorithm has not been exploited much as only two of our primary studies made use of it showing more opportunity in the use of this algorithm in the forex market.

MULTILAYER PERCEPTRON (MLP) is a feedforward artificial neural network (ANN) with three layers of nodes: input, hidden layer, and output layer. Except for the input nodes, each node in our selection is a neuron with a nonlinear activation function. Four key papers used this approach in their research.

LOGISTIC/LINEAR REGRESSION this machine learning algorithm was used by 4 of our primary studies, not popular in forex prediction.

RECURRENT NEURAL NETWORK Unlike traditional feedforward neural networks, RNNs have memory. Information fed into them persists, and the network can draw on this to make inferences. 8 papers from our primary studies used RNN for forex prediction.

DECISION TREE As may be seen, three key research studied Decision Trees. The output of these types of models, which consists of a rule describing the requirements for making a choice, could be one reason.

FUNCTION ON A RADIAL BASE NEURAL NETWORK (RBF) is a real-valued function whose value is solely determined by the distance between the input and a fixed point, such as the origin or another fixed point known as the center. This neural network was used by two of our key studies for their prediction models since any function that satisfies the property is a radial function.

EXTREME LEARNING MACHINES, BAYESIAN COMPRESSED VECTOR, K-NEAREST NEIGHBOR, NAÏVE BAYE AND RANDOM FOREST these are the least use algorithms according to our primary studies, from our studies we noticed that these algorithms were used in only one paper each showing the unpopularity in forex prediction.

FUZZY RELATIONAL MODEL was combined with other machine learning algorithms in predicting the forex market, 6 papers adopted this model in our primary studies.

The GENETIC ALGORITHM is a search heuristic based on Charles Darwin's natural selection hypothesis. This algorithm mimics the natural selection process, in which the most fit individuals are chosen for reproduction in order to create offspring for the following generation. It was combined with other machine learning models in predicting currency direction. 2 of our primary studies made us of this algorithm.

RQ2-dataset

Currency pairs are grouped into two thus the major and the minor, the major pairs are the four most heavily traded currency pairs in the forex (FX) market. The EUR/USD, USD/JPY, GBP/USD, and USD/CHF are the four major pairs at the moment. The EUR/USD is the most widely traded currency pair in the world, accounting for more than 20% of all forex transactions. The USD/JPY is a distant second, followed by the GBP/USD and, with a minor part of the global currency market, the USD/CHF. 75 percent of all forex trades are made on the big pairings. Minor currency pairs are ones which leave out the United States dollar, and they are normally less liquid. Examples include the euro and Swiss franc (EUR/CHF), Canadian dollar and Japanese yen (CAD/JPY), or pound sterling and Australian dollar (GBP/AUD etc.

Table 7 show the major currency pairs and corresponding primary papers/ articles that made use of dataset of them. From the table 42 papers made use of the EUR/USD currency pair and we can clearly say that according to our finding, it is the most traded and used currency pair. 18 papers made use of datasets of USD/GBP which is the next most traded pair after EUR/USD from our primary studies. USD/JPY came third as the next most used dataset from our study with 13 papers making use of its dataset. Last is USD/CHF dataset with 10 papers making use of it. From our study, we found out that some papers/articles made use of more than one dataset of the major currency pair. Some papers combined both minor and major pairs.

RQ3—evaluation setup

Our third research question revolves around the machine learning forecasting model evaluation strategies. It refers to:

validation techniques,

evaluation metrics adopted, and

datasets exploited.

RQ3.1—validation techniques

70% of the pie chart which is made up of 42 primary studies used percentage split only as a validation technique which is the most used validation technique in the 60 primary studies. 3 of the primary studies made use of percentage split and cross-validation representing 5% of the total primary studies. Articles that used cross-validation only represent 5% of the total primary studies which is just 3 articles. Some primary studies were designed as systems that did not make use of any validation techniques and that took 18% of the primary studies representing 11 papers or studies, one validation technique.

that came up only is Random sub-sampling validation that is just 2% of the total primary studies. Papers that used percentage split divided the dataset into two parts (Training and Test dataset) with the large part for training with the other part for the test. K-Fold cross-validation was used with K being set to 10. In this approach, the technique divides the original data set into ten equal-sized subsets at random. One of the ten subsets is kept as a test set, while the other nine are utilized as training sets. The cross-validation is then done ten times, with each of the ten subsets serving as the test set exactly once [ 26 ].

Table 8 shows evaluation metrics adopted by the primary studies, the most widely used are Mean Absolute Error (MAE), Mean Absolute Percentage Error (MAPE), Root Mean Square Error (RMSE), and Mean Square Error (MSE). Studies [P20], [P27], [P28], [P29], [P31], [P33], [P34], [36], [P37], [P43], [P44] adopted evaluations metrics that didn’t appear in any other primary paper aside them.

RQ4—meta-analysis of performance

The last research topic of our study was a statistical meta-analysis of machine learning algorithm performance in Forex market forecasting. A complete re-execution of the prediction models on a shared dataset with common assessment criteria would have been perfect for this sort of investigation, allowing them to be benchmarked. This, however, is not covered by a Systematic Literature Review; the purpose is to combine the findings of the major investigations. We looked at the effects of I the machine learning algorithm and (ii) the validation approach in this research. A statistical meta-analysis seeks to combine several studies to improve the estimates of impact sizes and clarify uncertainty when separate research disagrees. While individual studies are frequently insufficient to establish solid generalizable results, their combination may result in a lower random error and smaller confidence ranges. Meta-analyses have another significant flaw: they are unable to compensate for poor study design and bias in the individual research. If the studies are carried out and evaluated appropriately, the benefits vastly outweigh the minor drawbacks. We used the recommendations provided in the book to conduct the meta-analysis. In a meta-analysis, the first step is to calculate the result of interest and summary statistics from each of the individual studies. Not all prior research evaluated the performance of the presented models in the same way, as described in the evaluation metrics. To have a common baseline, we utilized Mean Square Error, Root Mean Square Error, and other metrics that were used in most of the other sources. To make a fair comparison, we looked at all of the publications and the metrics used. Papers that evaluated the effectiveness of machine learning model prediction in terms of Mean Absolute Error (MAE), Mean Absolute Percentage Error (MAPE), Root Mean Square Error (RMSE), and so on.

The analysis is based on twelve studies. The standardized difference in means (d) is the effect size index. The results of this analysis will be generalized to comparable studies. Therefore, the random-effects model was employed for the analysis. If we assume that the true effects are normally distributed (in d units), we can estimate the prediction interval. For all of the values in the primary studies, we utilized Comprehensive Meta-Analysis v3 to derive effect size estimates. It's worth mentioning that effect sizes must be normalized in order to be comparable across research. We used Hedges' g as the standardized measure of effect magnitude to achieve this goal. There are three main statistics recorded here which are the Q-value with its degrees and P-value, the I-square statistics, and finally Tau-square however these statistics don’t tell us how much the effect size varies. In our case the Q-value is 78.174, the degree of freedom is 12 and P-value is 0.0. The next statistic recorded is I-square which is 85.929 in our analysis. Finally, the last statistic recorded is Tau-square which is the variance of true effects in our case Tau-squared is 0.017. The prediction interval tells how much the test size varies here we will report that the true effect size is 0.05 and 0.95. In our meta-analysis, the mean effect size using the Hedge's g is 0.013952 with the Mean Absolute Error of each selected study using the Hedges g value. A 0.5 effect size indicates that the treatment group's mean is half a standard deviation higher than the control group's mean, the effect sizes imply that the mean of the treatment group is half a standard deviation higher than the mean of the control group (Table 9 ).

The application of machine learning techniques for forex market forecasting was the subject of a systematic literature review in this research. It focused on three particular features of how prior research performed experiments on forex forecasting models, namely I which machine learning model was used, (ii) which sorts of assessment procedures were used, and (iii) what validation approaches were used. Our research was based on publications that were published between 2010 and 2021. We looked at 60 publications out of a total of 120 that proposed machine learning algorithms for FX market forecasting. Existing studies were examined, as well as unresolved topics that need to be addressed in a future study. The research shows that deep learning models like ANN, LSTM, MLP-Neural Networks, and Radial Basis Function are more suited for forecasting the forex market than other machine learning algorithms like KNN and Nave Baye. The results are encouraging. To make the research field more precise, we have offered a list of steps to take. As a result, we conclude that the conclusions on the use of percentage split are suspect, and that the dataset should be divided into three parts: training, test, and validation test. In this regard, we hope that our findings may serve as a springboard for further investigation.

Availability of data and materials

The datasets used and/or analyzed which are the primary studies have been referenced in Table 2 column citation during the current study and are available from the corresponding author on reasonable request.

Acknowledgements

Grateful to the department of computer science and informatics university of energy and natural resources, to all individuals who assisted in one way or the other to see this work through to completion God bless you.

This research did not receive funding from any source.

Author information

Authors and affiliations.

University of Energy and Natural Resources, Sunyani, Ghana

Michael Ayitey Junior, Peter Appiahene, Obed Appiah & Christopher Ninfaakang Bombie

You can also search for this author in PubMed Google Scholar

MAJ searched through publication databases for the primary studies and also use inclusion and exclusion criteria to select the final studies for the research and assisted in performing the meta-analysis. PA played a supervisory role and assisted in designing data extraction form for retrieving interested information from the primary studies. OA analyzed and performed the bibliometric coupling for knowing the relationship that exists between the individual authors of each primary studies. CNB performed the meta-analysis of the twelve selected primary studies and reported the results. All authors read and approved the final manuscript.

Authors' information

MAJ is a master of philosophy in computer science student at the department of computer science and informatics at university of energy and natural resources at Sunyani Ghana. PA is the head of department for computer science and informatics at the university of energy and natural resources at Sunyani Ghana and direct supervisor to the corresponding author. OA co-supervisor to the main supervisor of the corresponding author and also coordinator for graduate studies of the department of computer science and informatics at university of energy and natural resources at Sunyani Ghana. CNB an assistant lecturer and a PHD candidate.

Corresponding author

Correspondence to Michael Ayitey Junior .

Ethics declarations

Ethics approval and consent to participate.

Not applicable.

Consent for publication

Competing interests.

The authors declare that they have no competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Ayitey Junior, M., Appiahene, P., Appiah, O. et al. Forex market forecasting using machine learning: Systematic Literature Review and meta-analysis. J Big Data 10 , 9 (2023). https://doi.org/10.1186/s40537-022-00676-2

Download citation

Received : 13 January 2022

Accepted : 25 December 2022

Published : 28 January 2023

DOI : https://doi.org/10.1186/s40537-022-00676-2

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Systematic Literature Review

- Forex market

- Machine learning

- Meta-analysis

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Exchange Rate Mechanism-A Review of Literature

Related Papers

Veerangna Singh

Hariharan Narayanan

The rate at which one currency is exchanged for another currency is termed as Exchange rate. There are two major types of exchange rates known as Fixed exchange rate and Fluctuating exchange rate. Gold plays a vital role in exchange rate. The exchange rate regime starts from Gold Standard and goes through various phases. Bretton Woods System plays a vital role in the exchange rate regime. This paper concentrates on the evolution of exchange mechanism and its classification until 2010.

Journal of Accounting & Marketing

Khakan Najaf

isara solutions

International Res Jour Managt Socio Human

This paper studies the long-run and short-run dynamics of fluctuation in exchange rate in post-liberalized Indian economy. Annual data of all the variables were used for the analysis. Vector Error Correction Model was used for empirical analysis. The result of empirical analysis shows the existence of long-run relationship between exchange rate and its determinants.

Abhyuday Somwanshi

Financial Management from an Emerging Market Perspective

AARF Publications Journals

Accurate prediction of foreign exchange rate is critical for formulating robust monetary policies and developing effective trading and hedging strategies in the foreign exchange market. The models that are found in this investigation aims to show the effect of the increase or decrease in the independent variables on the dependent variable, exchange rate and hence to predict the exchange rate. The independent variables are the following: Debt to Gross Domestic Product, Balance of Payment, Gross Domestic Product growth (annual %), Inflation, Net Foreign Assets, Remittances, Foreign Direct Investment as a % of Gross Domestic Product received in year from 2007 to 2016.

Nirav Desai

This paper attempts to study the factors driving the Rupee exchange rate and reasons for its sustained depreciation over the period since 1993. A statistical analysis is carried out to identify significant factors and regression models are developed to validate the assumptions. Solutions that can mitigate the depreciation of the Rupee are presented

praveen thakur

RELATED PAPERS

Lawrence Drzal

The Pharma Innovation Journal

Nazneen Peerzade

AFRE (Accounting and Financial Review)

Plants (Basel, Switzerland)

Farzin Shabani

2018 IEEE-RAS 18th International Conference on Humanoid Robots (Humanoids)

Michele Maimeri

Psychology and aging

Lucette Toussaint

Scandinavian journal of immunology

Kripitch Sutummaporn

Applied Sciences

Ayanabha Jana

dyah Purwanti

The American Journal of Drug and Alcohol Abuse

Felice Alfonso Nava

Frida Agung Rakhmadi

BMC Ear, Nose and Throat Disorders

Ziemowit Cieślik

American Journal of Clinical Pathology

Philip Cornford

The Journal of Steroid Biochemistry and Molecular Biology

Guillermo Guadalupe Casas Hernandez

siti maryam

[i2] Investigación e Innovación en Arquitectura y Territorio

Revista I2 Investigación e Innovación en Arquitectura y Territorio

Journal of Cereal Research

Ankit Phansal

The Journal of Thoracic and Cardiovascular Surgery

Neuza Lopes

Zbornik radova Građevinskog fakulteta

besim Demirovic

zafer yükseler

Mohamed Moncef Ben Khelifa

See More Documents Like This

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

Moderation analysis of exchange rate, tourism and economic growth in Asia

Bosede Ngozi Adeleye

1 Dept of Accountancy, Finance and Economics, University of Lincoln, Lincoln, United Kingdom

2 Lincoln International Business School, University of Lincoln, Lincoln, United Kingdom

Jimoh Sina Ogede

3 Dept of Economics, Olabisi Onabanjo University, Ago-Iwoye, Nigeria

Mustafa Raza Rabbani

4 Dept of Accounting and Finance, British University of Bahrain, Sar, Kingdom of Bahrain

Lukman Shehu Adam

5 Dept of Economics and Development Studies, Kwara State University, Malete, Nigeria

Maria Mazhar

6 School of Economics, Quaid-i-Azam University, Islamabad, Pakistan

Associated Data

All relevant data are within the paper and its Supporting Information files.

This study brings novelty to the tourism literature by re-examining the role of exchange rate in the tourism-growth nexus. It differs from previous tourism-led growth narrative to probe whether tourism exerts a positive effect on economic growth when the exchange rate is accounted for. Using a moderation modelling framework, instrumental variables general method of moments (IV-GMM) and quantile regression techniques in addition to real per capita GDP, tourism receipts and exchange rate, the study engages data on 44 Asian countries from 2010 to 2019. Results from the IV-GMM show that: (1) tourism exerts a positive effect on growth; (2) exchange rate depreciation hampers growth; (3) the interaction effect is positive but statistically not significant; and (4) results from EAP and SA samples are mixed. For the most part, constructive evidence from the quantile regression techniques reveals that the impact of tourism and exchange is significant at lower quantiles of 0.25 and 0.50 while the interaction effect is negative and statistically significant only for the SA sample. These are new contributions to the literature and policy recommendations are discussed.

1. Introduction

The tourism and hospitality industry has experienced development and expansion making it one of the biggest and fastest-growing sectors [ 1 ]. Many countries and destinations have grown in popularity, resulting in an increase in the number of visitors and tourism receipts. The tourism sector has the potentials to make significant contributions to economic growth and development through a variety of channels. It is a “currency earning sector” that permits the use of human and physical capital stock to drive innovation and development. Simultaneously, the tourism sector is either directly or indirectly related to other sectors like transportation, accommodation, or retailing through trickledown effect [ 2 ]. It also influences spending, and expands trade and global competitiveness [ 3 ]. International tourism, in particular, is a source of foreign exchange generation which improves the balance of payment position [ 4 ] and eases the acquirement of advance technologies and capital goods that can be used in other manufacturing processes [ 5 , 6 ]. Furthermore, it plays an important role in stimulating investments in new infrastructure and enhancing competition thereby creating jobs and improving overall living standard [ 2 ].

Similarly, the exchange rate influences economic growth. In this paper, an improvement/increase in the exchange rate indicates the appreciation of a domestic currency against a foreign currency. It is a significant indicator of economic progress as it essentially mirrors the competitiveness between a domestic economy and the rest of world. The exchange rate reflects a standard exchange among purchasers and merchants of foreign currency in the foreign exchange market of a particular country. Particularly, non-oil trades, oil exporters, international tourist expenditures, and foreign remittances all drive inflow of foreign currency. According to Rapetti et al. [ 7 ] the growth effect of exchange rate specifically the real exchange rate (RER) is both growth-amplifying and growth-dwindling. The exchange rate can significantly affect a country’s balance of payments position particularly if the country’s reliance on imported goods is high. In these circumstances, a more competitive RER would aid in relieving foreign exchange bottlenecks that would otherwise stymie the development process.

The connection between tourism and the exchange rate is not far-fetched. International tourism receipts are significant sources of foreign exchange earnings and highly linked to the exchange rate. Changes in exchange rates greatly affect tourism demand in a destination as changes in the exchange rate will have an impact on the currency value of the country of origin. Any adjustments in the exchange rate will prompt an appreciation or depreciation of the tourist’s currency, affecting transportation costs and the tourist’s decisions to visit the country. Thus, the exchange rate has an impact on the number of tourists’ visits as well as tourism receipts [ 8 ]. Less flexible exchange rates are supposed to advance global exchange and tourism by lessening vulnerability in worldwide transactions, wiping out exchange costs, and expanding market transparency. Furthermore, the exchanges rate mimics the relative price differential (as it affects global economic environment, purchasing power and overall wealth of tourists), which tourists have insufficient information about since they make travel arrangements in their own currency in advance before leaving their country. In this way, low-uncertainty exchange rate regimes could promote international tourism flows [ 9 ] that in turn speed up the development process through foreign direct investment and globalization [ 10 ].

Tourism as a commodity is very susceptible to exchange rate shocks which affects tourists’ inclination to visit a foreign country. We, therefore, hypothesize that changes in the exchange rate will influence the impact of tourism on economic growth. To the best of our knowledge, this is the first study to empirically test this hypothesis. That is, does the exchange rate tilt the tourism-growth dynamics? To probe the discourse, an unbalanced panel data on 44 Asian economies from 2010 to 2019 comprising tourism receipts, per capita GDP (proxy for economic growth), official exchange rate and a set of control variables is used. To ensure the robustness of the results, a blend of econometrics techniques is deployed. To control for possible endogeneity of the tourism variable, the instrumental variable technique nested within the generalised method of moments (IV-GMM) is used [ 11 – 13 ]. Lastly, the quantile estimator [ 14 – 16 ] is used in the event that the dependent variable has a non-normal distribution. This empirical approach makes the study novel and holistic in ensuring a critical examination of its core arguments. The rest of the paper is structured as follows: section 2 discusses the literature; section 3 outlines the data and empirical model; section 4 discusses the results, and section 5 concludes.

2. Literature review

Tourism activities are considered as one of the most important sources of economic growth and foreign exchange earnings around the globe [ 2 , 6 , 17 ]. The literature on tourism development and its impact on exchange rate and economic growth has increased exponentially in the last three decades [ 18 , 19 ]. The studies on tourism and growth nexus have proliferated mainly due to the fact that international tourism has grown over the years despite some ephemeral shocks [ 20 ]. The tourism growth literature mainly focuses on the causal relationship between tourism and economic growth [ 19 , 21 – 23 ] whereas, tourism and exchange rate literature focus mainly on exchange rate volatility and tourist flows [ 24 – 26 ]. We divide our literature review into two parts; the first part consists of available literature on tourism and economic growth whereas, the second part consists of tourism and exchange rate.

2.1 Tourism and economic growth

This section discusses the literature on tourism economics focusing on economic growth and tourism nexus. From a theoretical perspective, Lanza and Pigliaru [ 27 ] were among the first to document the tourism-growth nexus. They find that countries with high tourism sectors experienced high economic growth. They developed a Lucas type-two sector model where tourism is taken as one of the sectors which depends on the endowments of natural resources such that countries with abundant natural resources have high growth potential and achieve a faster rate of growth. Perles-Ribes et al. [ 28 ] studied the tourism and economic growth nexus using autoregressive distributed lag (ARDL) and Toda-Yamamoto model for the period 1957 to 2014 taking into consideration the economic crises. Their findings revealed a bi-directional relationship between economic growth and tourism development. There are many studies proposing the hypothesis that growth of tourism in the country is directly linked to economic prosperity [ 29 ]. The study reports that there is bidirectional causality between tourism and economic growth. Fuinhas et al. [ 22 ] report that in the long run, high frequency of tourist arrivals in the country leads to positive economic growth. In another study, Naseem [ 30 ] concludes that in the long run, tourism receipts, number of tourist arrivals, and total expenditure have a strong positive relationship with economic growth. The study empirically examined the data from Saudi Arabia and validated the popular hypothesis that tourism leads to economic growth in the country. Similar findings were obtained by [ 31 – 35 ], where they concluded that tourism has a positive impact on the economic growth of the country. The study by Sahni et al. [ 36 ] used a quantile regression approach and concluded that tourism growth has a more pronounced effect on economic growth below the threshold and above the threshold. The study further concluded that countries with lower economic growth have more benefits from tourism development. The study by Selvanathan et al. [ 37 ], applied ARDL, vector error correction model (VECM) and panel frameworks and concluded that in the long run tourism development positively contributes to growth. Tourism development is the significant predictor of the economic growth and financial development at frequency rather than the low frequency [ 38 ]. On the contrary, Croes et al. [ 39 ], revealed that tourism development has a very short term effect on economic development and a negative and indirect link to human development. Similar findings were obtained by Kyara et al. [ 23 ] where it was revealed that there is a unidirectional causality relationship between tourism development and economic growth.

2.2 Tourism and exchange rate

The effects of exchange rate on tourism development can differ across the country, territory and within the tourism jurisdiction [ 38 ]. The real and nominal appreciation of the currency leads to a negative impact on the tourism development in the country [ 40 ]. Exchange rate has asymmetric impact on tourism on tourism development in developing countries such as, India, Bangladesh, Pakistan and Nepal in the short run [ 41 ]. Boskurt et al. [ 42 ] applied dynamic common correlated effects (DCCE) approach in their study on demand and exchange rate shocks on tourism development and concluded that effects of the exchange rate shocks are temporary on the tourism development. To examine the response of tourism demand to exchange rate fluctuation in South Korea, Chi [ 43 ] used ARDL model and concluded that tourists are sensitive to the appreciation of the Korean Won, whereas they are insensitive to its depreciation. The findings of the study imply that foreign visitors in Korea are loss averse and with increase or decrease in the exchange rate volatility tend to affect the tourism demand in an asymmetric manner. Dogru et al. [ 44 ] used ARDL approach to examine the trade balance and exchange rate taking evidence from tourism development. The study concluded that depreciation and appreciation of the US Dollar affects the bilateral tourism with Canada, Mexico, and the United Kingdom (UK). The study further concluded that in the long-run the appreciation of the US dollar negatively affects the tourism trade balance with Canada and the UK while it does not affect the tourism development with Mexico in the long-run. A study by Belloumi [ 45 ], examined tourism receipts and exchange rate nexus in Tunisia and concluded that there is a cointegrating relationship between tourism and economic growth. An increase in foreign direct investment (FDI) and appreciation of the exchange rate contracts the tourism demand of the country while in the long-run the depreciation of domestic currency and decrease in FDI inflow results in more tourist inflow [ 41 ]. Similar findings were obtained by [ 46 ] and [ 47 ] where they revealed that reduction in FDI inflow and depreciation of foreign exchange rate results in positive tourism development.

2.3 Tourism, exchange rate and economic growth

There are few studies that investigated the nexus of exchange rate, tourism development and economic growth [ 23 , 48 , 49 ]. Primayesa et al. [ 50 ] probed the dynamic relationship among real exchange rate, economic growth and tourism development in Indonesia using variance decomposition and impulse response function approach. The study revealed that in explaining the tourism shock in Indonesia, the real exchange rate is less important than the economic growth. The study further concluded that the shock of economic growth and real exchange rate has a positive effect on tourism activity in the short- and long-term. Harvey et al. [ 25 ] applied bounds testing approach to cointegration and error-correction modelling to examine whether tourism development and exchange rate promote the economic growth in Brunei Darussalam, Indonesia, Malaysia, and the Philippines. The study revealed the Philippines is the only country that has the positive long-run and short-run impact from the tourism industry and exchange rate.

3. Data and methodology

This study uses data on nine variables sourced from World Development Indicators (WDI) for 44 countries located in East Asia and the Pacific (EAP) and South Asia (SA) from 2010 to 2019. Availability of sufficient data on the variables of interest–per capita GDP, tourism receipts, and official exchange rate—justify the inclusion of a country in the sample and to explore the heterogeneity of the sample countries, we disaggregate the full sample into EAP with 36 countries and SA having 8 countries. The countries are East Asia and the Pacific (36): American Samoa, Australia, Brunei Darussalam, Cambodia, China, Fiji, French Polynesia, Guam, Hong Kong SAR, China, Indonesia, Japan, Kiribati, Korea, Dem. People’s Rep., Korea, Rep., Lao PDR, Macao SAR, China, Malaysia, Marshall Islands, Micronesia, Fed. States, Mongolia, Myanmar, Nauru, New Caledonia, New Zealand, Northern Mariana Islands, Palau, Papua New Guinea, Philippines, Samoa, Singapore, Solomon Islands, Thailand, Timor-Leste, Tonga, Vanuatu, Vietnam. South Asia (8): Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan, Sri Lanka.

3.1 Dependent variable

Real GDP per capita is the proxy for economic growth. Studies on tourism-growth nexus have widely used it [ 51 – 53 ] likewise, those on exchange rate-growth relationship [ 54 , 55 ].

3.2 Main explanatory variables

From World Development Indicators, International tourism, receipts (% of total exports) is defined as: expenditures by inbound visitors including payments to foreign carriers for international transport. In other words, this composite variable captures the spendings of inbound tourists to Asia and the Pacific, among others. In line with the literature [ 56 – 60 ], tourism receipts which is the first main explanatory variable is proxied by tourism receipts in current US dollars. Existing literature have found a positive relationship between different dimensions of tourism and economic growth [ 61 – 65 ]. The second key explanatory variable is exchange rate [ 42 , 66 – 68 ]. The exchange rate captures the competitiveness of a country in the international market [ 69 – 73 ]. Lastly, to address the study questions, an interaction term of tourism receipts with exchange rate (TRPT*XR) is included to determine if exchange rate moderates the impact of tourism on growth.

3.3 Control variables

The set of control variables align with those used in growth models: mobile phone subscription [ 5 , 74 , 75 ], individuals using the Internet [ 76 , 77 ], labour force participation [ 78 ] (Niebel, 2018), foreign direct investment net inflows [ 79 ], domestic credit to the private sector [ 80 – 83 ] and services trade [ 84 , 85 ]. We expect positive coefficients in line with existing literature. Table 1 details the variables used.

Source: Authors’ Compilation from World Bank [ 86 ] World Development Indicators (WDI)

3.4 Empirical model

We specify two baseline linear models that expresses economic growth as a function of tourism receipts, exchange rate and a set of control variables which satisfies the first objective:

Where, ln PC it = natural logarithm of per capita GDP; ln TRPT it = natural logarithm of tourism receipts; XR it = official exchange rate; Z ′ it and K ′ it = vector of control variables in natural logarithms; α i , γ i = parameters to be estimated; φ t , δ t = year dummies (which controls for common shocks such as the global financial crises of 2007–2009), and u it , e it = general error term. To satisfy the second objective, we add an interaction term ( TRPT*XR ) to Eq [ 1 ] and the model becomes:

Where, R ′ it = vector of control variables in natural logarithms; η i = parameters to be estimated; ω t = year dummies (which controls for common shocks such as the global financial crises of 2007–2009), and v it = general error term. From Eq [ 3 ], η 3 provides two information. First, the sign of the coefficient indicates if exchange rate exerts a significant moderation effect on economic growth. That is, whether the interaction of both variables intensifies or hinders growth. Secondly, the magnitude of the coefficient may sustain or sway the impact of tourism on growth which is derived as:

3.5 Estimation techniques and strategy

Specifically, our econometric strategy consists of a three-step procedure. First, we examine linear impact of tourism on economic growth. Next, we estimate the linear effect of exchange rate on economic growth. Lastly, we perform the moderation analysis to show the interaction effect on economic growth. We engage these analyses using two techniques: the instrumental variables-two-step generalised method of moments (IV-GMM) techniques and the quantile estimator [ 14 – 16 ]. Specifically, the IV-GMM technique is used to correct for cross-sectional dependence, endogeneity, autocorrelation and heteroscedasticity in the data [ 11 , 87 ]. It uniquely deploys the ivreg2 routine in Stata version 16 developed by Baum, Schaffer, and Stillman [ 12 , 13 ]. The routine performs several variants of single-equation linear regression models including the generalized method of moments (GMM). Hence, the GMM variant which implements the two-step feasible GMM estimation (that is, gmm2s option) is adopted to ensure that our results are devoid of endogeneity, heteroscedasticity and autocorrelation [ 12 ]. On the other hand, the quantile regression is deployed to examine the potentially differential effects of tourism and exchange rate at different levels of growth. The quantile regression model is a defined solution to minimize the equation for the θ th regression quantile, 0< θ <1 and expressed thus:

Where, y t is the dependent variable and x t is a k x 1 vector of explanatory variables.

4. Results and discussions

4.1 summary statistics and correlation analysis.

The upper panel of Table 2 contains the correlation matrix’s results, illustrating the relationship between the regressors and the outcome variables. Our findings indicate a negative correlation between per capita GDP and official exchange rate, implying that rising income will decrease the exchange rates in Asia. Likewise, individuals use the internet and the official exchange rate. Trade in services is negatively associated with tourism receipts, official exchange rate, FDI, and MOB. These findings suggest that increasing individuals using the internet and trade in services will impact the official exchange rate, tourism receipts, FDI, and MOB.

*** p<0.01

** p<0.05

* p<0.1

ln = Natural logarithm; PC = per capita GDP; TRPT = tourism receipts; XR = Official exchange rate; DC = Domestic credit to the private sector; LAB = labour force participation rate; FDI = foreign direct investment; MOB = mobile phone subscriptions; NET = individuals using the Internet; TRS = trade in services; 9.08E+09 = 9,080,000,000.00

Source: Authors’ Computations

The lower panel of Table 2 indicates the summary statistics for the variables from 2010 to 2019. The average of per capita GDP, tourism receipts, official exchange rate, domestic credit to the private sector, labour force participation, foreign direct investment, mobile phone subscriptions, internet users, and trade in services are 12398.47, 9080000, 1295.02, 71.42, 69.06, 1540000, 92490468, 38.86, and 30.269, respectively, from the entire sample. At the same time, the standard deviation provides information on the deviation from sample averages.

4.2 IV-GMM results

Table 3 displays results for the instrumental variables-two-step generalised method of moments (IV-GMM). Across the Full, EAP, and SA samples, tourism receipts and exchange rate are instrumented with their first difference and level terms. Limiting to the variables of interest, the summary of the linear models from the full sample shows tourism receipts as a significant positive predictor of economic growth. The findings indicate that a percentage change leads to 0.88% rise in economic growth, on average, ceteris paribus . We argue that a well-structured tourist sector together with investments in modern infrastructure will boost growth supporting Tugcu [ 88 ], Alfaro [ 89 ], Calero and Turner [ 90 ], Cheng and Zhang [ 91 ], and Scarlett [ 92 ] all of which argue in favour of tourism-driven growth. The exchange rate shows a significant negative effect on growth. According to the findings, a percentage-point change in the exchange rate results in a 0.00005% drop in economic growth. The reason for this is not far-fetched. Exchange rate fluctuations influence potential travellers’ decisions to alter their destination or shorten their vacation resulting in revenue loss for economies. This may result in adjustments to visitors’ travel plans while in a particular nation [ 93 ]. These findings corroborate those of Lin, Liu, and Song [ 94 ], Meo et al. [ 95 ], Sharma and Pal [ 96 ], Chi [ 43 ], and Seraj and Coskuner [ 97 ]. For EAP countries, tourism increases economic growth by 0.62%, on average, ceteris paribus . On the other hand, the coefficient of the exchange rate is negative and significant at 1 per cent, which supports the argument of Vieira et al. [ 98 ] and Seraj and Coskuner [ 97 ]. These studies contend that local currency appreciation will decrease the spending power of international tourists with consequent decline on tourism demand and economic growth. In South Asia, the effect of tourism on growth is positive but statistically not significant but exchange rate significantly boosts growth by 0.007%, on average, ceteris paribus . This finding contradicts Seraj and Coskuner [ 97 ] and suggests that currency appreciation is growth-enhancing. For the moderation models, columns [ 3 , 6 , 9 ] reveal that the interaction effect is positive but statistically not different from zero for the full and EAP samples while it decreases growth in South Asia which contradicts Sharma, Vashishat, and Rishad [ 99 ]. In other words, the conditional effect of tourism on growth reduces when exchange rate appreciates in South Asia.

t -statistics in (); -5.40e-05 = 0.0000540; ln = Natural logarithm; PC = real per capita GDP; TRPT = tourism receipts; XR = Official exchange rate; DC = Domestic credit to the private sector; LAB = labour force participation rate; FDI = foreign direct investment; MOB = mobile phone subscriptions; NET = individuals using the Internet; TRS = trade in services.

On the reliability of the instruments used to validate the robustness of our estimations, we controlled for identification and exclusion restrictions which are indispensable for robust GMM estimations [ 12 , 13 ]. Having used the IV-GMM estimation in ivreg2 , the appropriate test of overidentifying restrictions and testing the validity of instruments used is the Hansen J statistic: the GMM criterion function. From the lower panel of Table 3 , the p -value of the Hansen-J statistic across the six models ranges between 0.085 and 0.3874 which is clearly above 0.05. Hence, it fails to reject the null hypothesis of instruments validity indicating that the instruments used are valid and robust to our analysis.

4.3 Quantile regression results

Table 4 presents the quantile regression results across the 25th, 50th, and 75th quantiles of economic growth. The topmost panel displays the full sample results where tourism significantly improves growth at the 25 th and 50 th quantiles by 0.23% and 0.12%, respectively. Noticeably, the positive effect of tourism receipts declines along the distribution. On the other hand, exchange rate appreciation shows a reducing effect on growth at the 25 th and 50 th quantiles by -0.000051% and -0.000059%, respectively. This reducing effect is larger at the 50 th quantile indicating that economic growth vulnerable to exchange rate fluctuations. Following our findings, we hypothesise that variations in the official exchange rate affects tourist purchasing decisions and economic growth in the long-run [ 100 ]. On the interaction effect, we find no significant impact on growth corroborating the results shown in Table 3 .

I-statistics in (); ln = Natural logarithm; PC = per capita GDP; TRPT = tourism receipts; XR = Official exchange rate; DC = Domestic credit to the private sector; LAB = labour force participation rate; FDI = foreign direct investment; MOB = mobile phone subscriptions; NET = individuals using the Internet; TRS = trade in services.

The results of East Asia and the Pacific displayed in the middle panel indicate that tourism significantly increases growth at the 25 th and 50 th quantiles by 0.44% and 0.31%, respectively. A reducing positive effect is observed similar to that of the full sample. Also, exchange rate appreciation shows a reducing effect on growth at the 25 th and 50 th quantiles by -0.000061% and -0.000067%, respectively. Similar to the full sample, this reducing effect is larger at the 50 th quantile and we find no significant interaction effect on growth. From the lowest panel, the results from South Asia indicate that tourism significantly increases growth at the 50 th and 7 th quantiles by 0.17% and 0.19%, respectively. An increasing positive effect is observed contrary to the full and EAP samples. Likewise, exchange rate appreciation increases economic growth across all the quantiles, though with a declining trend from 0.0087% to 0.0075%. Contrary to the full and EAP samples, a significant negative interaction effect is observed across the quantiles supporting the results shown in Table 3 .

5. Conclusion and policy recommendation

This current study highlights the role of exchange rate in influencing the effect of tourism on economic growth in Asia. To the best of our knowledge, this is the first study that critically evaluates the influence of exchange rate on the tourism-growth nexus. That is, it gauges the nonlinear effect of tourism on economic growth when the exchange rate is accounted for. This position differs from other tourism-growth studies [ 22 , 27 – 30 , 101 , 102 ] that investigated the direct and linear effect of tourism on economic growth but aligns with Adeleye et al. [ 103 ] who examined a similar nexus on Sri Lanka. For the most part, these studies affirm that tourism exerts a direct and positive effect on economic growth. However, we expand the frontiers of knowledge having recognized that the exchange rate is an important macroeconomic policy instruments for promoting sustainable economic growth and encouraging tourism flows as it serves as an essential factor influencing the decision of tourists regarding tourism destinations. To this end, this paper examines the moderating effect of exchange rate and tourism receipts on economic growth in Asia from 2010 to 2019. From the full sample, findings from IV-GMM and quantile regressions techniques revealed that tourism significantly boosts economic growth, and the exchange rate indicates a negative effect. Deductively, we conclude that tourism is growth-enhancing which supports the tourism-led growth conjecture and that exchange rate appreciation is also growth-reducing. On the interaction effect, though the coefficient is positive but statistically insignificant it suggests that currency appreciation may possess inherent potentials in sustaining the positive effect of tourism on economic growth. Results from the East Asia and the Pacific and South Asia are diverse.

Based on the findings, the following recommendations are made for the government and stakeholders in Asia: (1) Provide a sound and efficient financial system which does not only provide adequate funding for promoting the tourism sector but also ensure easy accessibility to aid foreign tourist’s transaction. (2) Initiate investment incentive policies for the tourism sector which will reduce the operating cost, investment outlay and provide security for the investment of tourist investors. (3) Initiate a well-managed exchange rate system that supports tourism flows and economic growth. For further studies and subject to data availability, the role of government regulation, real exchange rate and competitiveness in relation to the tourism-growth dynamics may be undertaken.