Stock Research Report for Jindal Steel And Power Ltd

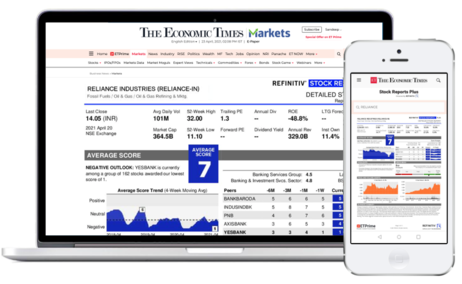

Stock score of Jindal Steel And Power Ltd moved down by 1 in 3 months on a 10 point scale (Source: Refinitiv). Get detailed report on Jindal Steel And Power Ltd by subscribing to ETPrime .

Get 4000+ Stock Reports worth ₹ 1,499* with ETPrime at no extra cost for you

*As per competitive benchmarking of annual price. T&C apply

Make Investment decisions

with proprietary stock scores on earnings, fundamentals, relative valuation, risk and price momentum

Find new Trading ideas

with weekly updated scores and analysts forecasts on key data points

In-Depth analysis

of company and its peers through independent research, ratings, and market data

Jindal Steel and Power Limited is an India-based steel producer. It operates through three segments: Iron and steel products, Power, and Others. The Iron and steel products segment comprise of manufacturing of Steel products, sponge iron, pellets, and castings. The Power segment comprises of business of power generation. The Others segment comprises mainly aviation, machinery division, and real estate. It is involved in mining of iron ore. It is also engaged in manufacturing of cement, lime, plaster, basic iron, and structural metal products. It also manufactures steam generators, except central heating hot water boiler. Its product portfolio includes rails, parallel flange beams and columns, plates and coils, angles and channels, wire rods, round bars, speed floors, Jindal panther thermos mechanically treated (TMT) rebars, Jindal panther cement, fabricated sections and semi-finished. It also has a power portfolio, comprising independent power plants and captive power projects.

- Domestic Query

- Export Query

- Raw Material Query

- Other Query

Back to Investor Page

01. Financials Information

- JINDAL STEEL & POWER LTD.

- SECTOR : METALS & MINING

- INDUSTRY : IRON & STEEL/INTERM.PRODUCTS

Jindal Steel & Power Ltd.

NSE: JINDALSTEL | BSE: 532286

Strong Performer

921.30 -22.30 ( -2.36 %)

New 52W High in past week

1.2M NSE+BSE Volume

NSE 09 May, 2024 3:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

High in industry

TTM PE Ratio

Above industry Median

TTM PEG Ratio

PEG TTM is much higher than 1

Price to Book Ratio

Low volatility

- Corporate Announcements

- Analyst Calls

- Gainers/Losers

- Individuals

- Institutions

- Small & Mid Cap

- Diversified Equity

- Company Reports

Jindal Steel & Power Ltd - Strategy, SWOT and Corporate Finance Report

SWOT Analysis

- September 2023

- ID: 5178393

- Description

Table of Contents

Related topics.

- Purchase Options

- Ask a Question

- Recently Viewed Products

Key Highlights

- Detailed information on Jindal Steel & Power Ltd required for business and competitor intelligence needs

- A study of the major internal and external factors affecting Jindal Steel & Power Ltd in the form of a SWOT analysis

- An in-depth view of the business model of Jindal Steel & Power Ltd including a breakdown and examination of key business segments

- Intelligence on Jindal Steel & Power Ltd's mergers and acquisitions (MandA), strategic partnerships and alliances, capital raising, private equity transactions, and financial and legal advisors

- News about Jindal Steel & Power Ltd, such as business expansion, restructuring, and contract wins

- Large number of easy-to-grasp charts and graphs that present important data and key trends

Reasons to Buy

- Gain understanding of Jindal Steel & Power Ltd and the factors that influence its strategies.

- Track strategic initiatives of the company and latest corporate news and actions.

- Assess Jindal Steel & Power Ltd as a prospective partner, vendor or supplier.

- Support sales activities by understanding your customers' businesses better.

- Stay up to date on Jindal Steel & Power Ltd's business structure, strategy and prospects.

- Company Snapshot

- Jindal Steel & Power Ltd: Company Overview

- Jindal Steel & Power Ltd: Overview and Key Facts

- Jindal Steel & Power Ltd: Overview

- Jindal Steel & Power Ltd: Key Facts

- Jindal Steel & Power Ltd: Key Employees

- Jindal Steel & Power Ltd: Key Employee Biographies

- Jindal Steel & Power Ltd: Major Products and Services

- Jindal Steel & Power Ltd: Company History

- Jindal Steel & Power Ltd: Management Statement

- Jindal Steel & Power Ltd: Key Competitors

- Jindal Steel & Power Ltd: Company Analysis

- Jindal Steel & Power Ltd: Business Description

- Jindal Steel & Power Ltd: SWOT Analysis

- Jindal Steel & Power Ltd: SWOT Overview

- Jindal Steel & Power Ltd: Strengths

- Jindal Steel & Power Ltd: Weaknesses

- Jindal Steel & Power Ltd: Opportunities

- Jindal Steel & Power Ltd: Threats

- Jindal Steel & Power Ltd: Corporate Financial Deals Activity

- Jindal Steel & Power Ltd: Financial Deals Overview

- Jindal Steel & Power Ltd: Top Deals 2019 - 2023YTD*

- Jindal Steel & Power Ltd: Capital Raising

- Jindal Steel & Power Ltd: Divestments

- Jindal Steel & Power Ltd: Recent Developments

- Jindal Steel & Power Ltd: News and Events Summary

- Jindal Steel & Power Ltd: Contracts

- Jindal Steel & Power Ltd: Corporate Governance

- Jindal Steel & Power Ltd: Financial Performance

- Jindal Steel & Power Ltd: Regulatory and Legal Events

- Jindal Steel & Power Ltd: Strategy and Operations

- Contact the Analyst

- Methodology

- About the Analyst

ASK A QUESTION

We request your telephone number so we can contact you in the event we have difficulty reaching you via email. We aim to respond to all questions on the same business day.

Request a Quote

YOUR ADDRESS

YOUR DETAILS

PRODUCT FORMAT

DOWNLOAD SAMPLE

Please fill in the information below to download the requested sample.

- Option Chain

- Daily Reports

- Press Releases

09-May-2024 15:30

10-May-2024 | 83.4800

09-May-2024 17:00

Lac Crs 390.06 | Tn $ 4.67

09-May-2024

- A+ | Reset | A-

- High Contrast | Reset

- Mutual Fund

You will be redirected to another link to complete the login

Quote - Equity

- In Top 10 today

Special Pre Open Session

- Price mentioned in band is Indicative Equilibrium Price (IEP) as on

Series : ( )

Announcements.

- Announcements XBRL

Annual Reports

Business responsibility and sustainability report, board meetings, corporate actions.

- Company Directory

Corporate Governance

Corporate information, daily buy back, event calendar, financial results, financial results comparision.

- Further Issues XBRL Fillings

Insider Trading

Investor complaints, promoter encumbrance details.

- Issue Offer Documents / Issue Summary Documents

Related Party Transactions

- SAST Regulations

Statement of Deviation/Variation

- System Driven Disclosures - PIT

- System Driven Disclosures - SAST

Secretarial Compliance

Share transfers, shareholder's meetings, shareholding patterns, unitholding patterns, voting results, intraday chart, security status, financial results (amount in cr.), shareholding patterns (in %), deals today --> block deals.

- For Block Deals - Morning Block Deal Window (first session): This window shall operate between 08:45 AM to 09:00 AM.

- Afternoon Block Deal Window (second session): This window shall operate between 02:05 PM to 2:20 PM.

To Read all the information, please Click here

Corporate Announcements

Announcement xbrl.

- All Values are in ₹ Lakhs.

Insider Trading (PIT) - Annual

No data found.

- Transfer Agent details

- Price mentioned in band is Indicative Equilibrium Price (IEP). The equilibrium price shall be the price at which the maximum volume can be matched.

- ATO stands for “At the Open”, any “market order” placed to buy or sell a stock gets traded as ATO

- Click here for more on Pre-Open Market Call Auction

(Period to )

( period to ), data for 52 week period:, yearly data for period:, monthly data for period :, delivery position, value at risk (%), industry classification, quick links, quick links, for investors, for corporates, for members, old website, quick links for investors.

Dashboard for end of day reports download, quick market snapshot and important announcements.

Market Snapshot

Volume (Lakhs)

Value (Lakhs)

FFM .Cap (Lakhs)

Quick Links for Corporates

Dashboard for tracking corporate filings

Latest Corporate Filings

Showing 0 of 5 selected companies, latest circulars, quick links for members, members message area.

Exchange has published Member Help Guide and new FAQs for Access to Markets. Visit the link: https://www.nseindia.com/trade/all-member-faqs

Contact for Support

Accessibility Tools

Contrast scheme:, text to audio:, mouse trail:.

Jindal Steel And Power Ltd

- World category India launches second part of critical minerals auction worth $362 bln February 29, 2024

- Business category Jindal Power offers $1.68 bln for distressed Indian coal-fired power plant, say sources February 6, 2024

- World category India's Jindal Steel Q3 profit jumps as lower costs offset weak sales January 31, 2024

- World category India's SAIL posts Q2 profit on strong domestic infrastructure demand, lower costs November 10, 2023

- World category India's Jindal Steel beats Q2 profit estimates on lower costs October 31, 2023

- Markets category India sets lithium mining royalty at 3% of LME prices October 11, 2023

- Markets category India's Jindal Steel posts drop in Q1 profit on higher expenses, fall in prices August 11, 2023

- World category India planning $1.5 bln industrial water transport corridor in east- sources July 17, 2023

Almost there...

Due to regulatory restrictions regarding the distribution of financial research, this report is restricted to a specific region or investor type. Get access to exclusive reports by answering the questions below.

Are you a professional investor?

Select your country, create a free researchpool account to access full reports, get a personalised dashboard and follow providers or companies, in order to access this report please create an account..

This combination of email and password didn't match our records. Your account might not be activated. If so, please click on the link we sent you via email. You can also request a password reset or a new activation email using the links below.

Initiating coverage: Jindal Steel and Power (Outperformer) - At the cusp of a turnaround

Jindal Steel and Power (JSPL), is on the verge of a turnaround (after 4 years of losses), and will report profits FY19E onwards on the back of 28% CAGR in steel volumes over FY17-20E, in our view. We believe firm steel prices, improving operating performance in steel business and positive Free Cash Flow (FCF) generation from Jindal Power (JPL – 96.4% subsidiary) and Jindal Shadeed (JSPL’s 100% Middle East subsidiary) will propel consolidated EBITDA to 34% CAGR over FY17-20E. We value the consolidated entity at Rs315/share on sum of the parts (SoTP) basis - while the steel business is valued at Rs218/sh (6.5x FY20E EV/EBITDA), JPL is valued on a DCF basis at Rs97/share. We initiate coverage with an Outperformer rating.

Turnaround in FY19E on low capex and high utilisation: JSPL is at the fag end of its capex cycle. With the successful commissioning of the company’s 2.5mtpa Basic Oxygen Furnace (BOF) at Angul (Odisha), JSPL’s crude steel capacity has risen to 8.6mtpa. Higher volumes from enhanced capacity along with our estimate of firm steel prices and positive FCF will result in superior financial performance. We expect JSPL to report consolidated net profit of Rs8.8bn in FY19E and increase further to Rs20.4bn in FY20E from Rs25.4bn loss in FY17. Monetising assets and raising equity further turn the tide for JSPL.

Deleveraging to start from FY19E onwards: Superior operating performance (34% consolidated EBITDA CAGR over FY17-20E) coupled with minimal capex will help JSPL deleverage from FY19E onwards. We expect consolidated net debt to reduce from Rs 453bn (Rs470/sh) in FY17 to Rs 384bn (Rs399/sh) in FY20E.

Initiate with Outperformer; target price of Rs315: JSPL’s turnaround in FY19E will come on the back of volume growth and lower operating costs in the steel business, in our view. With the company deleveraging from FY19E onwards, we estimate net debt/EBITDA will reduce from 10.4x in FY17 to 3.7x in FY20E. Our SoTP-based target price is derived from Rs218/sh valuation of the company’s steel business (6.5x FY20E EV/EBITDA) and from DCF-based value of Rs97/sh for the power subsidiary (JPL).

Key risks to our view are a delay in ramp up of steel volumes at Angul and adverse court judgements against JSPL in coal block allocation cases and indirect ownership of Sarda mines.

Jindal Steel & Power is engaged in the manufacture of rails, parallel flange beams and columns, plates and coils, angles and columns, rebars, wire rods, fabricated secions, speedfloor, semi-finished products, power, minerals and sponge iron.

IDFC Securities Ltd., a subsidiary of the Infrastructure Development Finance Company (IDFC) wherein the Government of India holds a 20% interest, is India's leading equities broker catering to most of the prominent financial institutions, both foreign and domestic investing in Indian equities. A research team of experienced and dedicated experts ensures the flow of critically investigated stock ideas and portfolio strategies for our clients. Our coverage spans across various growth sectors such as agriculture, automobiles, Consumer Goods, Technology, Healthcare, Infrastructure, Media, Power, Real Estate, Telecom, Capital Goods, Logistics, Cement amongst other sectors. Our clients value us for our strong research-led investment ideas, superior client servicing track record and exceptional execution skills.

MOSL: JINDAL STEEL & POWER (Buy)-Management meeting update

JINDAL STEEL & POWER: Management meeting update (JSP IN, Mkt Cap USD4.8b, CMP INR357, TP INR478, 34% Upside, Buy) Cautious near-term demand, but pent-up demand inevitable Near-term demand is tepid and demand decline is seen (especially last month) due to (a) the ban on construction in the NCR region due to severe pollution levels, (b) an extended monsoon, (c) weak sentiment in the international market - consumers are adopting the wait-and-watch policy, and (d) sufficient inventory lying with traders, who, in a falling market, would try and liquidate rather than accumulate. However, pe...

A double requalification allows JINDAL STEEL & POWER to improve to Slightly Positive

JINDAL STEEL & POWER (IN), a company active in the Steel industry, has received a double requalification by the independent financial analyst theScreener. Its fundamental valuation is now 3 out of 4 stars while its market behaviour can be considered as defensive. theScreener believes that the gain of a star(s) and an improvement in the market risk perception allows upgrading the general evaluation to Slightly Positive. As of the analysis date October 1, 2021, the closing price was INR 401.70 and its potential was estimated at INR 471.03.

MOSL: JINDAL STEEL AND POWER (Buy)-Deleveraging to continue

JINDAL STEEL AND POWER: Deleveraging to continue (JSP IN, Mkt Cap USD5.5b, CMP INR400, TP INR495, 24% Upside, Buy) JPL's divestment to support a further decline in debt JSP's 1QFY22 result was strong as expected, with the highest ever EBITDA/t of INR28,098/t (7% above our estimate). However, standalone EBITDA fell 7% QoQ to INR45.3b due to a 16% QoQ decline in volume. Adjusted for the JPL divestment, net debt fell only 4% QoQ to INR152b due to an increase in working capital. We raise our FY22E EBITDA by 13% on expectations of higher steel prices in the fiscal. Strong cash flows, coupl...

- Shirish Rane

GMR Infrastructure's Q3FY20 results (Outperformer) - Air traffic growth improved at the airports; deleveraging process gains momentum

Q3FY20 result highlights Airport traffic recovered in Q3FY20 with Delhi Airport witnessing a 7% yoy growth in passenger (vs 5% decline in H1FY20) and Hyderabad Airport reporting a 9% growth in passenger traffic (vs 4.9% in H1FY20). Note that traffic was subdued in H1 because of Jet Airways shutdown of operations. GMR Infrastructure (GMR) revenues grew by 11% yoy to Rs16.7bn aided by strong non aero revenues growth of 12% and 138% yoy growth in rental revenues. EBITDA for airport business was Rs6.7bn, +28% yoy Energy Business - Warora and Kamalanga PLF for Q3FY20 was 81% (vs 75% in Q3FY1...

- Bhoomika Nair

Ambuja Cement's Q4CY19 results (Outperformer) - In line; cost efficiencies at play

Q4CY19 result highlights Adj PAT +54% yoy to Rs4.55bn: was above estimates on lower tax (shifted to new tax regime) while operational performance was in-line. Volume increased 6.7% yoy: to 6.54mn tons led by pickup in demand in North and East, growing ahead of industry (mkt share gains). Realisations +2.7% yoy: to Rs4795/t due to sharp price hikes across regions in 1HCY19. This was further augmented by 14% yoy growth in premium products. Hence, revenue was up 9.5% yoy to Rs31.4bn. However, on a qoq basis realisations fell by Rs198/t (-4% qoq) as prices have corrected across regions from p...

- Nitin Agarwal

Event update: Aurobindo Pharma (Outperformer) - Unit IV receives EIR; positive outcome

Event Unit IV has received an Establishment Inspection Report (EIR) with Voluntary Action Initiated (VAI) status by USFDA Key highlights With the receipt of this status, FDA will now start granting new ANDA approvals from this facility. Notably, in mid-November, the USFDA had conducted a surprise inspection for nearly 10 days in Unit 4, post which it had issued 14 observations. While our read of the observations suggested that most of these were primarily procedural, market has been concerned around potential escalation of the issues into an OAI which, in turn, would have impacted revenu...

Sign-up for free to access full reports immediately

Unfortunately, this report is not available for the investor type or country you selected.

Report is subscription only.

Thank you, your report is ready.

ResearchPool Subscriptions

Get the most out of your insights, why subscribe.

- Access premium insights from a wide range of providers on one convenient platform

- Easily search, browse and choose exactly the research that you want to consume

- Get unbundled research at competitive prices –separate from dealing commissions and other ancillary services

How to subscribe

- Contact us to get started on your subscription

This report is only available to subscribers

Monthly Stainless Trivia

Fill in your answer below

Research & Development

The gears of our R&D division are always in motion to place Jindal Stainless on the pedestal of not only being India’s leading stainless steel manufacturing company but also an epitome of a game-changing approach that redefines industry standards. This is made possible by discovering ways to work smart, increase efficiency, and cut down on costs - factors that contribute to improving the quality of our end products that in turn are synonymous with being the benchmark of industry standards.

Research & Development

The past decade has been vocal about us developing environmentally friendly and resource-saving products. Guided by the agenda of replacing general-purpose stainless steel, expanding the demand for our existing products, research and development of stainless steel, and catering to the ever-changing market needs, our R&D department puts the dream of a progressive India into motion by producing more features and solution-led technology for our esteemed customers.

For product development and metallurgy to meet both social and economic needs, we have adhered to continuous upgradation of quality, processes, services, and product innovation to develop new stainless steel products at competitive costs. Cross-fertilization of knowledge between production, quality control, and commercial units, in order to maintain global standards, and to study steel market research has been the guiding principle of the R&D function at Jindal Stainless.

As strong as stainless steel, the unthwarted focus of Jindal Stainless’ Research & Development Department lies in:

- Steering ahead of the conventional to develop high-value products for the niche markets. Investing in initiatives that promote quality upgradation of existing products to enable enhanced global expansion as well as acceptance.

- Devoting resources to introspect and tweak the manufacturing technology in order to reduce cost via process development, optimisation, and refinement.

- Providing a competitive edge to the company via technology enhancement to increase quality production.

- Foster growth and develop new market segments through knowledge sharing with customers and assist them in their operations and applications of our products.

In order to be at the pinnacle of the stainless steel industry scenario in India, the R&D division closely interacts with reputed national and international laboratories, scientific institutions, and universities to avail expert services and knowledge for critical investigations and to regularly analyse steel research. Sustaining a long-term supply partnership with our customers, we are forever on our toes to continually innovate and patent our ever-growing oeuvre of products and services.

Enquiry Form

As we wish to provide as good service as possible it is important that we have accurate information about you and your company. Hence we would like you to enter information as correctly and accurately as possible.

We at Jindal Stainless Ltd are committed to providing quality products and services to our business partners. To make this happen your suggestions are most important. Please spare a few moments of your time and share with us any feedback you may have about our products or services and we'd be happy to hear from you.

Your details!

If you require a response please enter your details here. Alternatively, please leave this part blank if you wish to remain anonymous.

COMMENTS

Jindal Steel & Power Ltd. share price target. Jindal Steel & Power Ltd. has an average target of 762.60. The consensus estimate represents a downside of -18.13% from the last price of 931.50. View 8 reports from 5 analysts offering long-term price targets for Jindal Steel & Power Ltd..

Stock Research Report for Jindal Steel And Power Ltd. Stock score of Jindal Steel And Power Ltd moved down by 1 in a week on a 10 point scale (Source: Refinitiv). Get detailed report on Jindal Steel And Power Ltd by subscribing to ETPrime. Get 4000+ Stock Reports worth₹ 1,499* with ETPrime at no extra cost for you.

Annual Report 2021: 04. Annual Report 2020: 05. Annual Report 2019: 06. Annual Report 2018: 07. Annual Report 2017: 08. Annual Report 2016: 09. Annual Report 2015: 10. Annual Report 2014: 11. Annual Report 2013: 12. Annual Report 2012: 13. Annual Report 2011: 14. Annual Report 2010: 15. Annual Report 2009: 16. Annual Report 2008: 17. Annual ...

9 Improving Realizations and Demand Triggering Expansions 5.6 6.3 7.5 5.4 6.1 7.3 FY19 FY20 FY21 Production Sales Scale-up in Standalone operations The Indian steel sector is slated to post double-digit demand growth of 15-17% in fiscal 2022 after dropping by 6% in fiscal 2021 With respect to steel end use segments, the double-digit recovery expected in FY22 is to be driven by 16-18% rise from ...

01. Financials Information. 06. Annual Reports S.No. 01. Annual Report 2022-23: 02. Annual Report 2021-22

See 8 latest analyst research reports for JINDALSTEL, BSE:532286 Jindal Steel & Power Ltd.. Upvote, discuss and comment with all investors for free. ... Jindal Steel & Power's (JSPL) Q1FY24 EBITDA of INR 26.3bn was 6% and 16% ahead of our and consensus' estimates. Key points: 1) EBITDA/t (adj.) of INR 14,485 was ahead of our estimate of INR ...

JINDAL STEEL & POWER LIMITED ANNUAL REPORT STRATEGIC REPORT 2019 Chairman's Insight Naveen Jindal Chairman Dear Shareholders, 2019 is a year of celebrations for all of us at JSPL as we complete glorious 30 years of our existence. It was in 1989 that the visionary leader Shri O. P. Jindal paved the way of the growth trajectory that we have

Jindal Steel & Power: INTEGRATED ANNUAL REPORT FOR THE FINANCIAL YEAR 2022-23 AND NOTICE OF THE 44TH ANNUAL GENERAL MEETING ... SHARE. Integrated Annual Report for the financial year 2022-23 and Notice of the 44th Annual General Meeting. Other Categories. Advice; Columns; Fund Research; ... Value Research Stock Advisor is a premium service that ...

Jindal Steel & Power Ltd (JSPL) is a steel manufacturer and power producer, which produces steel products, sponge iron, pellets and castings, and plans, implements, develops and operates power plants. Its steel product portfolio includes TMT bars, long track rails and heads hardened rails, parallel flange beams and column, angles and channels ...

Jindal Steel & Power Limited Share Price Today, Live NSE Stock Price: Get the latest Jindal Steel & Power Limited news, company updates, quotes, offers, annual financial reports, graph, volumes, 52 week high low, buy sell tips, balance sheet, historical charts, market performance, capitalisation, dividends, volume, profit and loss account, research, results and more details at NSE India.

Jindal Steel & Power (JSP) is an Indian industrial powerhouse with a dominant presence in the steel, mining, and infrastructure sectors. The company produces best-in-class, cost-effective steel through backward and forward integration. It is undertaking ambitious expansion plans and is known as one of the most efficient & innovative steel ...

2 November 2020 1 11 August 2021 1QFY22 Results Update | Sector: Metals Jindal Steel and Power Amit Murarka - Research analyst ([email protected]) Basant Joshi - Research analyst ([email protected]) Investors are advised to refer through important disclosures made at the last page of the Research Report.

Jindal Power offers $1.68 bln for distressed Indian coal-fired power plant, say sources. February 6, 2024. World.

Jindal Steel and Power Ltd. plans to incur a significant capex to enhance its crude steel capacity to 15.9 million tonne from current 9.6 mt and strengthen raw material integration and product enrichment. The planned capex could result in volume growth and a reduction in structural costs. With the planned capex, JSPL will increase its flat steel capacity to 7.7 mt from 2.2 mt to cater to ...

Jindal Power's separation is in progress and awaiting clearances from lenders and the consequent cash receipt of INR30b would be used to reduce the debt. JSPL is open to sale of Botswana thermal coal assets but lack of debt funding for coal mines globally has resulted in a limited number of prospective buyers as per the management.

Jindal Steel & Power 28 September 2023 4 JSP is also expected to spend around INR15-16b on Monnet Power, which is in close vicinity to the Angul facility, which will further drive cost synergies for JSP. JSP, which has been predominantly a long steel manufacturer, will increase the share of flat steel to ~65-70% (most of the expansion in plates).

It has also been ranked fourth as per Total Income in the Iron and Steel sector by Dun & Bradstreet. 1.1 GROUP: Jindal Steel and Power is a part of the Jindal Group, founded by O. P. Jindal (1930-2005). In 1969, he started Pipe Unit Jindal India Limited at Hisar, India,one of the earlier incarnations of his business empire.

Jindal Steel and Power (JSPL), is on the verge of a turnaround (after 4 years of losses), and will report profits FY19E onwards on the back of 28% CAGR in steel volumes over FY17-20E, in our view. We believe firm steel prices, improving operating performance in steel business and positive Free Cash Flow (FCF) generation from Jindal Power (JPL - 96.4% subsidiary) and Jindal Shadeed (JSPL's ...

Jindal Steel and Power Limited (JSPL) is an India-based steel producer. The Company's segments include Iron & Steel, Power and Other. The ... This research report has been prepared and distributed by Edelweiss Broking Limited ("Edelweiss") in the capacity of a Research Analyst as per Regulation 22(1) of SEBI (Research Analysts) Regulations 2014 ...

The ongoing capacity expansion at Angul (Odisha) will significantly enhance Jindal Steel and Power Ltd.'s crude steel capacity by over 65% to 15.9 million tonne. The planned expansion, which is expected to be completed by Q3 FY26, will catapult JSPL to the fourth largest steel manufacturer in India. The stock trades at 5.2 times FY26E enterprise value/Ebitda and 1.3 times FY26E price/book.

Project Report On Jindal Steel & Power Ltd. - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. Detailed Report on Jindal Steel and Power Ltd.

Jindal Steel & Power Limited Corporate Office: Jindal Centre, 12 Bhikaiji Cama Place, New Delhi 110 066 CIN: L27105HR1979PLC009913 T: +91 11 4146 2000 F: +91 11 2616 1271 W: www.jindalsteelpower.com E: [email protected] Registered Office: O. P. Jindal Marg, Hisar, 125 005, Haryana August 5, 2023 . BSE Limited

Research & Development. The past decade has been vocal about us developing environmentally friendly and resource-saving products. Guided by the agenda of replacing general-purpose stainless steel, expanding the demand for our existing products, research and development of stainless steel, and catering to the ever-changing market needs, our R&D department puts the dream of a progressive India ...