- Publish in FFI Practitioner

Family Business Cases

The case studies included here are brief vignettes that can be used by professionals as conversation starters or for in-depth analysis in the consulting process.

Ghosts and Possession in the Family System

Thanks to the FFI Asian Circle Virtual Study Group members Yukio Fujimi, Chikako Kishihara, and FFI Fellow Kazuyoshi Takei for this week’s edition.

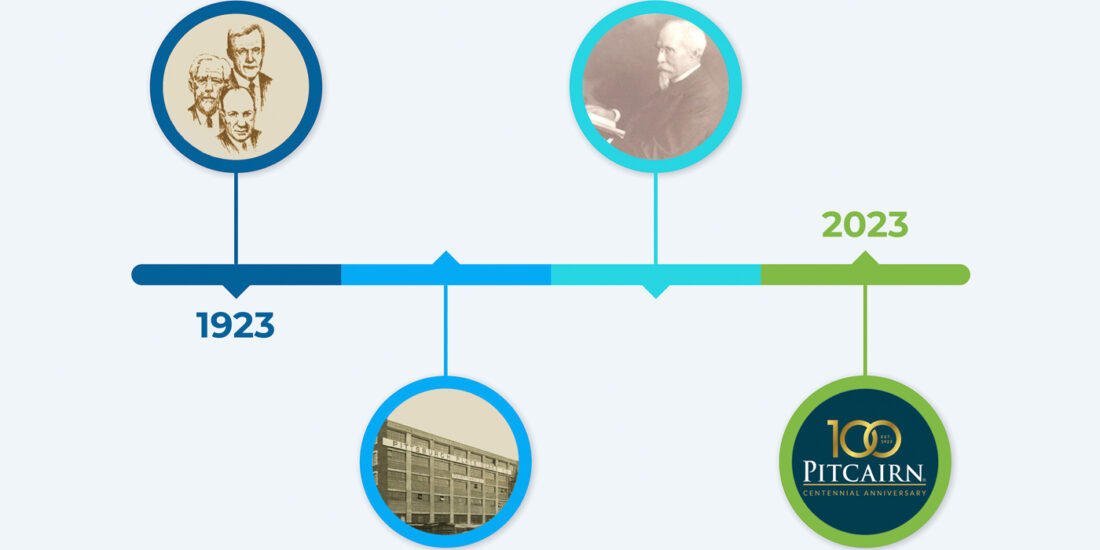

Celebrating 100 Years: How Pitcairn evolved from a 19th century operating company to a 21st century multi-family office

Today, we’re featuring an interview and a podcast with Dirk Junge, former CEO and Executive Chairman of the Pitcairn board, and Leslie Voth, currently Chairman, CEO and President of Pitcairn.

Chief Emotional Officers in Asia’s Collectivist Cultures

Thanks to the FFI Asian Circle Virtual Study Group members, Linda Salim and Kimberly Go for this week’s edition that examines the important role of the Chief Emotional Officer (CEO) in Asian family enterprises.

Education and Development: Preparing NextGen members for family enterprise ownership

What should family enterprise clients do to help ensure members of the next generation are prepared to assume ownership of the enterprise when the time comes?

Balancing Representation with Qualification on Family Business Boards

In this week’s FFI Practitioner, contributors Omar Romman and Ben Francois explore the topic of how to balance family member and independent director participation on the board.

Challenges of the Sandwich Generation in Leading a Family Enterprise

Thanks to the FFI Asian Circle Virtual Study Group and Yirhan Sim for this week’s edition that features a family enterprise case that demonstrates the challenges experienced by the “sandwich generation” through the transition to lead a family enterprise.

Professionalizing Family Businesses: How to orchestrate, change, and get things done

In this week’s FFI Practitioner, Paolo Morosetti addresses the topic of family enterprise professionalization.

How to Break a Vicious Intergenerational Cycle in Family Enterprises

In this week’s FFI Practitioner, Eduardo Gentil, Bruna Tokunaga Dias, and Renata Brecailo share their observations about a common challenge facing intergenerational enterprising families

Cases for Clients: 2022

In this week’s edition, we continue our periodic series featuring a selection of family business cases previously published in FFI Practitioner.

Keeping the Entrepreneurial Flame Alive: Insights from the Loy Family in Malaysia

Thank you to this week’s contributors from the FFI Asian Circle Virtual Study Group, Mita Dixit and Esther Kong.

Personal Life Crisis: How it can affect leadership in the Family Enterprise

Thanks to Steven Rolfe for this week’s edition about the importance of recognizing the impacts that a family business leader’s personal life crisis can have on the entire enterprise. In his article, Steven shares two examples and his reflections for practitioners to consider when their clients are confronted with such a scenario.

Five Sisters and Two Executors: A case study

Thanks to Vijay Sathe, Alfredo Enrione, Donna Finley for this week’s edition, which is a case study about how five sisters, who suddenly and unexpectedly inherited their father’s businesses, and how they dealt with the influence of two executors to reach harmonious ownership of the family enterprise.

From Safety, Through Sustainability to Stewardship: The Triple-S journey of Jebsen & Jessen Family Enterprise

Thanks to Marta Widz and Sameh Abadir from IMD for this article based on the Jebsen & Jessen Family Enterprise story, which illustrates how responsible leadership and early awareness can coalesce to pioneer safety, environmental sustainability, and stewardship strategies and thus lead to impactful social innovation.

How Corporate Governance Helps in Decision Making: A case study

This week, we are pleased to share a case study that demonstrates how effective corporate and family governance can help clarify decision-making protocols in family enterprises. Thanks to Roberto Vainrub for sharing this case with practical implications for advisors.

Education and the Rules for Engagement: A case study on ways to encourage young entrepreneurs

Thanks to Ricardo Mejia for this case study discussing how education and clear rules of engagement may still be the best strategy for developing young entrepreneurs in family enterprises.

Commentary #5 on Professionalizing the Business Family: A research report sponsored by the FFI 2086 Society

This week, we are pleased to continue the series of commentaries on the 2086 Society sponsored research “Professionalizing the Business Family: The Five Pillars of Competent, Committed and Sustainable Ownership.”

Family Businesses in the Times of Crisis and Global Recession: A story of resilience and sustainability

This week, we are pleased to share a family business case illustrating how Firmenich, the world’s largest privately-owned perfume and taste company, has utilized their concentrated family ownership and governance model to navigate worldwide crises.

Succession Planning Using OKR Leadership: A case study

In this week’s edition, we are pleased to share a piece about OKR Leadership, a management methodology that can help advisors organize and measure their clients’ succession planning process.

Cases for Clients: 2020

For this week’s edition, we are pleased to continue our series featuring a diverse selection of family business cases previously published in FFI Practitioner.

Case Study: The Seibu Group – The fall of the Seibu Empire

Thanks to this week’s contributor, Morio Nishikawa, for providing this case study about the Seibu Group, a Japanese family-owned business that faced a variety of legal challenges beginning in 1993 as the country’s laws changed, and the company’s practices and protocols were not updated.

It’s Hard to Fix the Family Business Without Offending the Family

Harvard Business School case studies are often set in large corporations, where the wide range of problems encountered by managers serve as lessons for MBA students. A recent case finds equally beneficial lessons in a much different setting: a small family-owned Vietnamese restaurant in Boston’s inner-city neighborhood of Dorchester.

Challenges lie in navigating complex family relationships, transitioning from first- to second-generation ownership, understanding how unwritten processes and procedures work, dealing with problematic financial accounting, and facing the possibility of deteriorating service as the patriarch pulls away.

“This is much harder than anything I find in my big-company cases, and it’s all in bold relief,” says Harvard Business School Baker Foundation Professor Leonard A. Schlesinger, who coauthored the case, Pho Hoa Dorchester , with 2017 MBA students Michael Raiche and Roger Zhu.

Pho Hoa and Pho Linh, a smaller restaurant located in Quincy, Massachusetts, are owned as franchises by Thanh Le, who emigrated from Vietnam to the United States in 1981. Opened in 1992, Pho Hoa has been run with few formal processes in place and no regular income statement reporting, forecasting, or budgeting.

Thanh, wanting to take a well-deserved retirement after 25 years of hard work, has named his eldest son, Tam, CEO and general manager of both restaurants. The question of ownership, however, has not been broached—and the son fears that doing so could jeopardize his business and personal relationship with his father.

“The son has this acute sensitivity of how does he make the restaurant better without everyone getting angry”

When the case opens, Tam Le is grappling with a host of operational challenges at Pho Hoa that include poor service and variable food delivery times for the menu’s wide array of 150 items. While his father has stepped aside, Tam’s uncle continues to manage the restaurant’s employees and the front of the house. As the case notes, the uncle’s experience and institutional knowledge offer huge potential benefits—but Tam isn’t sure how accepting he will be to the proposed changes.

“When his father managed the food flow, they were fast,” Schlesinger says. “Now they have terrible inconsistencies. How do you take the father’s tacit and profound knowledge and somehow figure out a way to build it into the place?”

What’s a manager to do?

It’s a professional manager’s nightmare. Because the financial numbers aren’t necessarily accurate, “one of the most significant issues is that we really don’t know how well or poorly the business is doing,” says Schlesinger. (An electronic point-of-sale register, purchased through a Vietnamese connection and installed in 2014, is rarely used, the case notes.)

Furthermore, Than is more interested in protecting his cash flow than making improvements. “The son has this acute sensitivity of how does he make the restaurant better without everyone getting angry,” Schlesinger says.

Another issue to be dealt with is that Pho Hoa pays an annual $40,000 franchising fee, although the franchisor adds little to the restaurant’s operations. “These are cultural issues,” says Schlesinger; the case mentions the father’s long-standing relationship with the Vietnamese American franchise owners and the common sense of purpose and responsibility shared by the Vietnamese community as a whole.

“None of these decisions are rational, economically,” he adds. “But good luck trying to get people to change them.”

Blame it on the alcohol

Schlesinger’s student coauthors worked with Tam Le as part of the HBS Neighborhood Business Partnership, a field-based second-year course led by Schlesinger and Senior Lecturer Kristin Mugford. (The case was the end product of an independent project after the course was completed.)

In their initial efforts to boost Pho Hoa’s revenues, increasing lackluster alcohol sales seemed a good place to start. But Raiche and Zhu quickly saw the problem: The servers (largely recent Vietnamese immigrants) assumed that the Vietnamese clientele would never order alcohol, so they didn’t bring the wine and beer list to them. Often, this behavior extended to non-Vietnamese clientele as well, with servers rarely if ever asking for drink orders. The solution seemed obvious: Ask servers to offer the drinks menu along with the food menu, include links on the food menu to alcohol selections, and ask for drink orders.

It didn’t stick. “[The students] came into the restaurant two weeks after implementing this solution, sat down, and didn’t get a drinks menu,” Schlesinger says, smiling. “Then the [school] term ended.”

“We realized that identifying the business issue at hand was relatively easy,” says Raiche. “The minutia required to make it happen was the difficult part.”

Many cases studied at HBS show an existing system, with processes, hierarchy, and incentives that require tweaks of some sort, he continues. “In a small business, those processes might not even be in place. There might not even be an org chart. You’re starting the process with a blank slate.”

“It was a humbling experience,” adds Zhu. “The relationship that Mike and I developed with Tam provided some insight into the typical challenges of a small business that I think will be useful to students who take the course in the future.”

Contemplating change at Pho Hoa

Like any good HBS case, “Pho Hoa” doesn’t present a pat answer to the business challenges at hand. It does note that Tam Le has already turned around Pho Linh, the Quincy restaurant, by decreasing the number of menu items, hiring new staff at higher wages, and renovating the restaurant’s interior.

As his father scales back involvement in Pho Hoa, Tam realizes that significant change is needed to the restaurant’s finances and operations to ensure sustainability, to say nothing of growing revenues—although he has plenty of plans in that regard, including increasing beverage sales, expanding takeout and delivery, and introducing a “small plates” concept.

But why should any of this matter to Harvard MBA students, most of whom will not (most likely) find themselves running a small neighborhood restaurant?

“The viability of these businesses is absolutely critical to neighborhood stabilization and development in a way that big-box retailers can’t possibly be,” Schlesinger responds. “And the learning opportunity for students is incredibly rich. This is the quintessential general manager observation experience. We’re telling students to go take a look, figure it out, and find the problem. Then see if you can get the proprietor to share your point of view. In fact, see if you can get anyone’s attention.”

“No, this isn’t typical HBS fare, but that’s primarily why Mike and I were attracted to the course,” says Zhu. “It’s focused on a segment—and not an insignificant one—that is a big driver of the economy.”

Related Reading:

Managing the Family Business: Entrepreneurs Needed for Long-Run Success Five Steps to Better Family Negotiations Family CEOs Spend Less Time at Work

What do you think?

What can business leaders learn from the complexities of running a family business? Add your comment to this story below.

- 26 Apr 2024

Deion Sanders' Prime Lessons for Leading a Team to Victory

- 02 Apr 2024

- What Do You Think?

What's Enough to Make Us Happy?

- 11 Sep 2017

- Research & Ideas

Why Employers Favor Men

- 25 Jan 2022

More Proof That Money Can Buy Happiness (or a Life with Less Stress)

- 24 Jan 2024

Why Boeing’s Problems with the 737 MAX Began More Than 25 Years Ago

- Small Business

- Entrepreneurship

- Family Business

- Family and Family Relationships

- Management Succession

- Family Ownership

- Food and Beverage

- United States

Sign up for our weekly newsletter

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Build a Family Business That Lasts

- Rob Lachenauer

Judging from how they’re portrayed in the media, it would be easy to dismiss family businesses as hotbeds of power-playing, backstabbing, and favor-currying, ultimately destined to fail; think of the Murdochs and News Corp, or the Redstones and National Amusements, to name just two. But many family businesses have enjoyed success for decades, even centuries. The authors explore five aspects of ownership that are crucial to whether a family business thrives or perishes: the type of ownership (whether a sole owner, a partnership, or another arrangement); the governance structure; how “success” is defined; what information the owners will (and won’t) communicate to other family members and stakeholders; and how to handle the transition to the next generation.

Companies that endure do these five things right.

Idea in Brief

The paradox.

Family businesses are famous for power plays, backstabbing, and dramatic implosions. Yet some are among the most enduring companies in existence.

Why It Matters

Family-controlled firms represent some 85% of the world’s businesses. In the United States they employ 62% of the workforce.

The Keys to Longevity

The owners of a family business have the right to: decide on an ownership type, structure governance, define success, determine what to communicate, and plan the transfer of power to the next generation. Misunderstanding or misapplying these rights can destroy the work of generations—and exercising them wisely can lead to long-term success.

Given their portrayals in the media, it might be easy to dismiss family businesses as hotbeds of power playing, favor currying, and back-stabbing—preoccupations that can hurt the company, the family, or both. Think of the Murdochs and NewsCorp, or the Redstones and National Amusements, to name just two. But despite the headline-grabbing tales, many family businesses have enjoyed success for decades, even centuries. For instance, the Italian winemaker Marchesi Antinori, established in 1385, has thrived as a family business for more than 600 years. Similar examples can be found across the globe just within the alcohol business; they include Gekkeikan in Japan (founded in 1637), Berry Bros & Rudd in the United Kingdom (1698), and Jose Cuervo in Mexico (1795).

- JB Josh Baron is a co-founder and partner of BanyanGlobal Family Business Advisors and a Visiting Lecturer in Executive Education at Harvard Business School. He is a co-author of The Harvard Business Review Family Business Handbook (Harvard Business Review Press, 2021).

- Rob Lachenauer is a founding partner of BanyanGlobal Family Business Advisors and co-author of The Harvard Business Review Family Business Handbook (Harvard Business Review Press, 2021).

Partner Center

Journal of Family Business Management

Issue(s) available: 41 – From Volume: 1 Issue: 1 , to Volume: 14 Issue: 2

- Issue 2 2024

- Issue 1 2024

- Issue 4 2023

- Issue 3 2023

- Issue 2 2023

- Issue 1 2023 The Future of Family Business: marketing challenges in times of crisis

- Issue 4 2022

- Issue 3 2022 Family Business in Tourism and Hospitality

- Issue 2 2022

- Issue 1 2022

- Issue 4 2021

- Issue 3 2021 Enhancing policies and measurements of family business: Macro, meso or micro analysis

- Issue 2 2021

- Issue 1 2021

- Issue 4 2020 Cross-cultural and entrepreneurial strategies towards new family business performance: An Asian context

- Issue 3 2020

- Issue 2 2020

- Issue 1 2020

- Issue 4 2019

- Issue 3 2019

- Issue 2 2019

- Issue 1 2019 New Insights on SMEs: Finance and Family SMEs in a Changing Economic Landscape

- Issue 3 2018

- Issue 2 2018

- Issue 1 2018

- Issue 3 2017

- Issue 2 2017

- Issue 1 2017

- Issue 3 2016

- Issue 2 2016 Family business governance: role, relevance and impact

- Issue 1 2016

- Issue 2 2015

- Issue 1 2015

- Issue 2 2014

- Issue 1 2014

- Issue 2 2013

- Issue 1 2013 Taking a hard look at soft issues in family business

- Issue 2 2012

- Issue 1 2012

- Issue 2 2011

- Issue 1 2011

The role of in-laws in family business continuity: a perspective

The purpose is to provide a brief summary on the current research development regarding the role of in-laws in family firms’ continuity. Additionally, I provide a perspective on…

Managing a Gen-Z workforce – what family firms need to know: a perspectives article

This paper highlights the opportunities and challenges for family firms in managing Generation Z (Gen-Z) employees. This perspective article explores several considerations for…

Corporate entrepreneurship and family businesses: a perspective article

Family businesses play a pivotal role in the world’s economy, contributing to 70% of its GDP. Their success in the current environment demands the enactment of entrepreneurial and…

Psychological ownership in family firms: a perspective article

This article explores psychological ownership (PO) in family firms (FFs); its impact on interpersonal relationships, attitudes and behaviors within the organization; and its…

Internal communication and family business: a perspective article

Family businesses require internal communication (IC) to guide and provide direction, and the unique nature of involving both family and nonfamily employees add complexity…

Money education in the business family: a perspective article

The primary aim is to renew academic discourse on financial education in business families. It emphasizes the need for effective financial literacy programs to foster a healthier…

Regional development and family business: a perspective article

This perspective article aims to summarise the understanding of the link between regional development and family business and explore potential pathways for further investigations.

Entrepreneurial resilience (ER) and family business: a perspective article

This paper highlights the need for future studies researching the subject of resilience in family firms on different levels.

Analysis of trends that turn an entrepreneurship idea into a family business: an article in perspective

This article examines some of the trends that allow to understand and analyze the evolution of the idea of entrepreneurship to become a family business.

First (latent) generation and family business: a perspective article

Family businesses are characterized by the simultaneous presence of the family and the business system. The literature analyses sporadically the family support during the creation…

Generation Alpha and family business: a perspective article

This paper discusses the key features of Generation Alpha from the perspective of their implications for future family business.

Corporate governance and family business: a perspective article

The governance of family businesses has attracted considerable scrutiny among scholars and practitioners. This paper explores influences that have defined corporate governance…

Scoping the links between acquisitive crime, criminal predation and family business

The stereotypes of the dodgy businessman and businessman gangster are established typologies in both the criminology and family business literature, but nevertheless, there is…

Hotel housekeepers in family hotel business: a perspective article

The purpose of this research is to delve into the scientific literature on hotel housekeepers in family hotel businesses to suggest new research directions in this field.

Revolutionizing family businesses with artificial intelligence: a perspective article

This perspective article addresses the essential need to comprehend what artificial intelligence (AI) entails and how it can revolutionize the family business sector.

The wealth creator and family business: a perspective article

The principal objective of this study is to identify and recommend auspicious research directions within the field of family business research, with a specific focus on the wealth…

Family business in the Arabian Gulf region

The purpose of the paper is to provide some insights into the importance of family business in the transition of the Gulf Cooperation Council (GCC) region into a diversified…

AI-driven sustainability brand activism for family businesses: a future-proofing perspective article

Artificial intelligence (AI) and sustainable business represent the irrefutable future of all forward looking businesses in the world today. In this perspective article, the…

African family dynamics and family business – a perspective article

Despite the potential benefits of family businesses, their dynamics present peculiar challenges that hinder the realisation of their full potential. This paper sought to assess…

Post-entry decisions in international entrepreneurship and family business: a perspective article

This perspective article aims to provide an overview of the interplay between international entrepreneurship and the dynamics of family businesses, with a particular focus on…

Generation AI and family business: a perspective article

This perspective article responds to the emergence of artificial intelligence (AI) as a significant opportunity for growth among family businesses, highlighting the need for…

Family entrepreneurship: a perspective article

The author synthesizes research at the genesis of the field of family entrepreneurship, allowing to distinguish it from the field of family business. Indeed, family…

A decision-making framework in family-owned hotels for evaluating and selecting suppliers and strategic partners

This paper presents a comprehensive decision-making framework designed for family-owned hotels, specifically focusing on evaluating and selecting suppliers and strategic partners…

The influence of family firm CEOs’ transformational leadership on employee engagement: the mediating role of psychological safety

This study aims to unravel a potential determinant of employee engagement in family firms. In particular, we focus on the role of the CEO by studying the influence of CEO…

Evaluation of the performance of Spanish family businesses portfolios

The primary objective of this study is to analyze the performance and risk characteristics of portfolios composed of Spanish family businesses (FBs) when sustainability and…

Nurturing family business resilience through strategic supply chain management

The study aspires to enhance comprehension of the intricate interplay between supply chain management (SCM) and resilience in family businesses, thereby offering valuable insights…

Entrepreneurial orientation and socioemotional wealth as enablers of the impact of digital transformation in family firms

The research aims to investigate how digital transformation (DT), entrepreneurial orientation (EO) and socioemotional wealth (SEW) impact the financial performance of family firms…

Relationship between the implementation of formal board processes and structures and financial performance: the role of absolute family control in Colombian family businesses

We investigate the effect of the adoption of formal board structure and board processes on firm performance in Colombian family firms, in a context where firms can choose specific…

The African philosophy of Ubuntu and family businesses: a perspective article

This perspective article underscores the importance of conducting studies that examine the African philosophy of Ubuntu among indigenous African family businesses. The article…

Are family businesses more gender inclusive in leadership succession today? A perspective article

Through this exploration, this article seeks to contribute to facilitate a greater female participation in power and leadership positions in the context of succession by…

Dynamic capabilities and family businesses: a perspective article

The individual perspective of dynamic capabilities and family firms could be useful to shed light on the relationship between these topics, considering not only the heterogeneity…

Sustainability performance disclosure and family businesses: a perspective article

The deeper understanding of the disclosure of external and internal dynamics of family firms necessarily places the issue of sustainability as one of the most pressing needs from…

Sustainability in family business settings: a strategic entrepreneurship perspective

Family business sustainability is a critical issue. This study considers if adopting a strategic entrepreneurship orientation can support the sustainability of a family business.

Integrating UN Sustainable Development Goals into family business practices: a perspective article

This paper explores the potential for family businesses (FBs) to play a pivotal role in advancing the United Nations (UN) Sustainable Development Goals (SDGs). It seeks to…

Intersecting bonds: a perspective on polygamy's influence in Arab Middle East family firm succession

The aim of this study is to explore and elucidate the influence of polygamy on the succession dynamics of family businesses in the Arab world, offering insights that may be…

Environmental responsibility of family businesses: a perspective paper

This perspective paper explores ongoing research into stimuli that promote environmental responsibility in family business contexts. It also delineates emerging patterns and…

Factors affecting high-quality entrepreneurial performance in small- and medium-sized family firms

The purpose of this paper is to measure the high-quality entrepreneurial efficiency of family-owned small- and medium-sized enterprises (SMEs) while exploring the potential…

Intra-family communication in challenging times and family business: a perspective article

This perspective article highlights the importance of future research that explores how intra-family communication in family businesses was affected during challenging times such…

European family business owners: what factors affect their job satisfaction?

This research aims to better understand the factors and determinants that shape the job satisfaction of European family business owners.

Financial management and family business: a perspective article

This study aims to review major themes and findings of research into financial management of family business and to suggest new directions for future research.

Relationship between different resource and capability configurations and competitiveness – comparative study of Hungarian family and nonfamily firms

The purpose of this paper is to identify different types of resource and capability configurations among Hungarian family and nonfamily firms and explore which compositions can be…

Family business succession: opportunities from the Victorian wine industry

This paper aims to examine the opportunities of continuous family succession in operating small-to-medium-sized wineries (SMWs) in Victoria, Australia.

Unravelling the determinants of family firms' governance: the family protocol

Family businesses are essential to the global economy but often grapple with family-related issues, especially during succession. This study explores how governance tools like the…

Crisis management in family firms: do religion and secularization of family decision-makers’ matter?

The unique dynamics of family firms (FFs) shape the management of financial crises. Religious and secular reasons, as a defining characteristic of this type of firm, provide a…

Exploring the effect of family control on debt financing within large firms: a transnational study in emerging markets

This paper aims to analyze the effect of family control and influence dimension of the socioemotional wealth (SEW) on capital structure of large listed firms in the North African…

Tourism/Hospitality and family business: a perspective article

This perspective article provides a compact view on past and promising future research of family business in tourism/hospitality research, an industry that is dominated and driven…

The relationship between the use of technologies and digitalization strategies for digital transformation in family businesses

Analyzing the effect of digitalization strategies and barriers to digital transformation (DT) on the use of technologies, in the Brazilian context, is necessary to broaden the…

Transgenerational value transmission in business-owning families: an indigenous African perspective

This study aims to investigate the favourable conditions that influence transgenerational value transmission (TVT), value acceptance and value similarity between generations in…

The effect of the Covid-19 epidemic on auditing quality and the reaction of family vs non-family businesses to Covid-19: the case of Jordan

The purpose of this paper is to provide new scientific knowledge concerning the impact of the Covid-19 pandemic on auditing quality as determined by audit fees for both family…

Board functions in governance arenas: a comparative case study of four Swedish family firms

The purpose of this paper is to explore board functions and their location in family firms.

Ethnic fashion designers, entrepreneurs and family businesses: an African marketing perspective

The purpose of the perspective article is to review relevant literature on family business and ethnic fashion and establish links across identity (defined as culture, tradition…

The state of family business research in the Visegrád countries

The institutional context in which family firms operate influences their behaviour and performance, yet literature reviews seldom analyse family firms on a regional basis. To fill…

Learning from family business researchers

This article provides commentary from well-known family business researchers on what they have learnt about the family business field and tips for the future.

Importance of traditions and family business at Christmas: a quantitative analysis of practices and values in Portugal

Christmas is the most consumed event of the year, always full of traditions, namely family ones, which are very significant. In this way, it is intended to find out the importance…

Parental influence on next-generation family members in South African Black-owned family businesses

There are many factors that contribute to a person's career choice. The decision of whether or not to join the family business is certainly most influenced by parents. The aim of…

Not all crises are the same: the effects of crisis triggered successions in family firms

Although succession planning can be important for the continuity of family firms, not all family business have the opportunity to engage in this planning. Sometimes, these…

The family-level of generational involvement: impact on the nexus between entrepreneurial orientation and business performance among small family businesses

The aim of this study was to obtain evidence of the practical significance of the generational involvement (GI) of top management teams (TMT) on the nexus between entrepreneurial…

Navigating the path of family business research: a personal reflection

This article provides a personal response to the questions raised by Ratten et al . (2023) on what family business researchers have learnt about the family business field and tips…

The effect of board diversity and tenure on environmental performance. Evidence from family and non-family firms

The aim of this paper is to examine the effect of structural and demographic board diversity as well as board tenure on family firms' environmental performance, by analyzing the…

Formal advisors and succession process in family firms

This study explores the roles of formal advisors (FAs) in the succession process of family firms and the factors that determine them.

Navigating towards hyperautomation and the empowerment of human capital in family businesses: a perspective article

This paper aims to explore the past and future impacts of automation on family businesses, with a focus on the opportunities for human capital empowerment.

The influence of family dynamics on business performance: does effective leadership matter?

Family businesses have a dual objective of profit making and providing opportunities for family members. This duality leads to a conflict that may bring poor team work and…

Drivers of knowledge transfer for succession in family business: a perspective article

This study aims to identify various factors that have driven the knowledge transfer process for succession purposes in family business since the 1920s and discuss their…

Does female descendent entrepreneur's self-compassion and financial literacy matter for succession success?

Present study investigated the influence of female descendent entrepreneur's self-compassion on the perceived succession success of small-family businesses (S-FB) with the…

Conceptualizing recourses as antecedents to the economic performance of family-based microenterprise – the moderating role of competencies

The development of family-based microenterprises has attracted the attention of regulators, microfinance institutions and other stakeholders in either developing or least…

The adoption of governance mechanisms in family businesses: an institutional lens

Despite agreement on the importance of adopting governance structures for developing competitive advantage, we still know little about why or how governance mechanisms are adopted…

Migrant family entrepreneurship – mixed and multiple embeddedness of transgenerational Turkish family entrepreneurs in Berlin

By combining manifold approaches from migrant entrepreneurship and family business studies, the purpose of the paper is to shed some light upon the contextual features of…

Encouraging consumer loyalty: the role of family business in hospitality

The aim of this paper is to understand the importance of consumer loyalty in the specific context of Hotel Family Business. This study proposes a conceptual model to examine how…

No hard feelings? Non-succeeding siblings and their perceptions of justice in family firms

Family farms, in which business and family life are intricately interwoven, offer an interesting context for better understanding the interdependence between the family and…

Next-generation leadership development: a management succession perspective

This research study focusses on the succession challenges in small-medium outboard marine businesses of Malaysian Chinese family ownership. The founder-owners face challenges in…

Promoting family business in handicrafts through local tradition and culture: an innovative approach

The purpose of the study is to investigate the potentiality and dimensions of promoting handicraft family business practices in handicraft as well as the extent to highlight the…

Family entrepreneurial resilience – an intergenerational learning approach

The purpose of this paper is to explore leadership succession in families in business. Although there is a vast amount of research on leadership succession, no attempt has been…

Embeddedness and entrepreneurial traditions: Entrepreneurship of Bukharian Jews in diaspora

The purpose of this paper is to explore how entrepreneurship traditions evolve in diaspora.

Family equity as a transgenerational mechanism for entrepreneurial families

The purpose of this paper is to investigate the process of family equity creation and its role for transgenerational entrepreneurship.

Retaining the adolescent workforce in family businesses

The purpose of this study is to critically explore the linkage between adolescent work, parent–child relationships and offspring career choice outcomes in a family business…

Online date, start – end:

Copyright holder:, open access:.

- Associate Professor Vanessa Ratten

Further Information

- About the journal (opens new window)

- Purchase information (opens new window)

- Editorial team (opens new window)

- Write for this journal (opens new window)

We’re listening — tell us what you think

Something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Family Business Cases

Insights and Perspectives from the United Arab Emirates

- © 2023

- Khaula Alkaabi ORCID: https://orcid.org/0000-0002-0490-079X 0 ,

- Veland Ramadani ORCID: https://orcid.org/0000-0002-8495-9141 1

Geography and Urban Sustainability Department, United Arab Emirates University, Al Ain City, United Arab Emirates

You can also search for this editor in PubMed Google Scholar

Faculty of Business and Economics, South East European University, Tetovo, North Macedonia

- Curates a unique collection of family business case studies from the United Arab Emirates

- Offers unconventional wisdom on the impact of family business issues on their performance

- Provides learning objectives with discussion topics and further reading material

Part of the book series: Springer Business Cases (SPBC)

578 Accesses

This is a preview of subscription content, log in via an institution to check access.

Access this book

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

Table of contents (14 chapters)

Front matter, al masaood group: through diversification and geographical expansion to success.

- Khaula Alkaabi, Abdul Samad Farooq

Barjeel Aerial Photography Services: A Successful Geospatial Data Acquisition Company

- Marwa Mohammed Al Suwaidi, Cristina I. Fernandes

Innovation Floor: 4.0 Technologies and Information Solutions

- Khaled Khamis Al Arafati, Léo-Paul Dana

Secuira Technologies: Re-innovating Smart Technology

- Abdulla Al Naqbi, Cristina Blanco González Tejero

Safe City Group: Enable Cities Safety

- Aaesha Saif Ahmed Shehhi, Veland Ramadani

MetaTouch: A Case of Successful Transformation of a Research Idea into a Start-Up During the COVID-19 Pandemic

- Fady Alnajjar, Yehya Al Marzooqi

Nayel & Bin Harmal Group: Integrated Services in the Construction Sector

- Hessa Alkalbani, Eiman Almazrouei, Veland Ramadani

DAMAC Group: Symbol of Successful Development

- Sara Omar Aljaberi, Khaula Alkaabi

Pronto Carwash Company: Your Ride to the Mobility Car Wash

- Asma Mohammed Al Madhaani, Mahra Al-Ali

CADD Emirates Computers: Providing Cutting-Edge Technology Solutions and Services for a Digital-First World

- Mariam Slayem Alblooshi, Abeer Alyammahi

Bin Ham Group: Building a Legacy of Excellence in United Arab Emirates Investments

- Aysha Nadheer, Fatima S. Alawani, Ramo Palalić

iSpatial Tech: GEO-AI-Enabled Solutions for Smart Cities

- Reda Maroufi, Jaber Mohammed Alketbi, Marco Valeri

Juma Al Majid Holding Group: Story of Success and Achievement

- Esra Qasemi, Hafsah Alderei, Grisna Anggadwita

M Glory Holding: The Aspiration to Establish an Automobile Manufacturing Industry in the United Arab Emirates

- Khaula Alkaabi, Majida Alazazi

- Business Environment

- Case Studies

- Entrepreneurship

- Family Business

- GCC Countries

- Gulf Cooperation Council Countries

- United Arab Emirates

About this book

Editors and affiliations.

Khaula Alkaabi

Veland Ramadani

About the editors

Khaula Alkaabi is a Professor of Transportation Geography at the Department of Geography and Urban Sustainability, United Arab Emirates University (UAEU), United Arab Emirates. She held the position of Chair of the Geography Department from 2013 to 2017 and served as the Chief Innovation Officer for UAEU from 2015 to 2022. Her research interests include air transportation, land use planning, spatial analysis, GIS applications, drone applications, tourism, urban development, economic geography, entrepreneurship, innovation, etc. She has published in Journal of the Knowledge Economy, Frontiers in Built Environment, Arab World Geographer, Journal of Enterprising Communities, Transportation Research Part F, Journal of Transport Geography , among others. Dr. Alkaabi has received several research grants, academic honors, and rewards.

Veland Ramadani is a Full Professor of Entrepreneurship and Family Business at the Faculty of Business and Economics, South-East European University, North Macedonia. His research interests include entrepreneurship, small business management and family businesses. He authored or co-authored around 200 research articles and book chapters, twelve textbooks and twenty-five edited books. He has published in Journal of Business Research, Technological Forecasting and Social Change, Review of Managerial Science, Management Decision, Technology in Society, International Journal of Entrepreneurial Behavior & Research, among others. He has received the Award for Excellence 2016 - Outstanding Paper by Emerald Group Publishing. In 2017, he was appointed as a member of the Supervisory Board of Development Bank of North Macedonia, where for ten months served as an acting Chief Operating Officer (COO) as well. He was ranked, three times in a row, among the Top 2% of the most influential researchers in the World, based on a study conducted by Elsevier BV & Stanford University, USA.

Bibliographic Information

Book Title : Family Business Cases

Book Subtitle : Insights and Perspectives from the United Arab Emirates

Editors : Khaula Alkaabi, Veland Ramadani

Series Title : Springer Business Cases

DOI : https://doi.org/10.1007/978-3-031-39252-8

Publisher : Springer Cham

eBook Packages : Business and Management , Business and Management (R0)

Copyright Information : The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG 2023

Hardcover ISBN : 978-3-031-39251-1 Published: 06 December 2023

eBook ISBN : 978-3-031-39252-8 Published: 05 December 2023

Series ISSN : 2662-5431

Series E-ISSN : 2662-544X

Edition Number : 1

Number of Pages : XVIII, 222

Number of Illustrations : 1 b/w illustrations, 86 illustrations in colour

Topics : Family Business , Business Strategy/Leadership , Organization

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Should family members be in charge of family businesses? We analyzed 175 studies to understand when having a family CEO pays off

Assistant Professor of Management and Entrepreneurship, University of Louisville

Assistant Professor Of Management, University of North Texas

Professor of Management, Mississippi State University

Associate Professor of Management and Dean Paul R. Gowens Excellence Professor in Business, Texas State University

Associate Professor of Strategy and Entrepreneurship, University of Arkansas

Disclosure statement

The authors do not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.

Mississippi State University and Texas State University provide funding as members of The Conversation US.

View all partners

From Hermes to Smuckers to the fictional Waystar Royco of HBO’s “Succession,” family businesses often choose their CEOs from the ranks of kin. But is this a good business decision? As researchers who study entrepreneurship and management , we wanted to know whether keeping leadership in the family pays off for businesses. So we reviewed 175 studies on the topic to see whether family CEOs really are the best choice for family businesses. We found that the answer is yes – sometimes .

Our analysis, which looked at nearly 40 years of research, confirmed that family CEOs tend to prioritize a noneconomic goal: keeping the business in the family. This suggests that nonfamily CEOs – leaders brought in from the wider business community, selected based on characteristics such as past performance – may be more interested in prioritizing purely economic goals, such as boosting stock prices.

We also found that companies led by family CEOs tend to have more concern with corporate social responsibility but invest less in innovation and international growth. They also have more debt on average. All of these things could have important business implications. For example, investing less in research and development could lead to worse economic outcomes .

Does that mean that family CEOs are bad for business? Not at all. When looking directly at economic outcomes, we found mixed results – some studies showed that family CEOs had positive effects, and others showed negative ones. Based on our understanding of the literature, my colleagues and I think it all depends on the goals that family companies themselves pursue.

Why it matters

While researchers don’t always agree on what counts as a family company, we define them as businesses that are governed or managed by one or more families, that pursue goals set by a dominant leadership coalition, and whose leaders want to pass the enterprise on to future generations. By any definition, family businesses are extremely common: The majority of businesses around the world are owned or operated by families .

Nearly 90% of U.S. businesses are considered family operated, according to the U.S. Census Bureau, as are about 1 in every 3 Fortune 500 companies . Some of the most famous businesses in the world are family companies, such as Nike, Dell Technologies and LVMH. The leadership decisions at these businesses have ripple effects across the entire economy.

From an individual company’s perspective, the decision to appoint a family CEO – or not – is rarely easy. On the one hand, family companies often want to stay in business – and under family control – for generations. On the other hand, they often need to satisfy investors who expect strong economic outcomes over the shorter term.

We believe that one of the most important things a family company can do is to understand its own goals and priorities. While that’s easier said than done, if a business has ill-defined goals, that can set a new CEO up for failure – whether they’re in the family or not. That’s because they’re likely to pursue strategies that the family, the company or the company’s shareholders don’t really want.

What still isn’t known

The evidence on whether family CEOs are good for family companies’ bottom line is mixed, which suggests they’re sometimes effective and sometimes not. Researchers need to study how the combination of the characteristics such as age, education, political ideology and personality operate to influence family CEO performance in their family businesses.

Our team plans to conduct more research on family CEOs and their characteristics to understand when they’re good for business – and when family companies should opt for someone from outside.

The Research Brief is a short take on interesting academic work.

- Family firms

- Quick reads

- Family businesses

- Research Brief

- Family business

- Chief executive officer (CEO)

Assistant Editor - 1 year cadetship

Executive Dean, Faculty of Health

Nutrition Research Coordinator – Bone Health Program

Lecturer/Senior Lecturer, Earth System Science (School of Science)

Sydney Horizon Educators (Identified)

- About Our Business

- Board of Advisors

- Our Services

- Document Templates

- Useful Links

- A father who changed his mind

- The solution was there all along

- When unplanned events met an unplanned future

- It's The Right Way

- Information & Resources

- Advisor Locator Map

Latest News

Quick reference links.

- Business Plan Template

- Succession Planning Best Practice

- Tax Relief - Business Succession

- Other Document Templates

- Privacy Policy

Need Help ?

- Testimonials

The Global Network for Advanced Management

Examining family businesses: a case study.

Family firms are common across Asia; many of the region’s largest organizations are family owned. In a series from HKUST Business School and its Tanoto Center for Asian Family Business and Entrepreneurship Studies, faculty analyze the advantages of the structure and the challenges facing family businesses today, and they discuss what other family businesses across the world can learn from successes in Asia.

Winnie Peng

In 2008, the then head of Harilela Enterprises, Dr Hari Harilela, was in his 80s and pondering how to ensure a smooth succession that would eventually place Aron, his only son, at the head of the business and the family.

Preparing for succession

Hari knew that in this role, his relatively young son would have to deal with senior family and board members while driving the business agenda forward smoothly. However, Hari also felt he was leaving Aron a good platform from which to achieve his vision ‑- an excellent asset base that was only slightly leveraged, the esteemed reputation of the Harilela name, a strong personal education, and ten years of hands-on experience in the business.

Business History

The roots of the Harilela Group date back to 1922, when Hari’s father, Naroomal Mirchandani (he later changed his name to Harilela), left his hometown of Hyderabad, in what is now Pakistan, for China. In Canton (today’s Guangzhou) he opened a small business trading in antiques, jade, amber, embroidery and other curios. In 1934, he moved his business to Hong Kong and, to make ends meet, Naroomal and his two oldest sons, George and Hari, sold personal essentials, such as soap, outside the British army barracks. Subsequent attempts to successfully establish shops were curtailed by the World War II and the Japanese occupation.

After the war, the Harilela brothers acquired exclusive contracts to make uniforms for British soldiers in Hong Kong, and were soon one of the largest importers of British textiles. With American involvement in the Korean and later the Vietnam wars, the Harilelas also won contracts to make uniforms for their troops.

The family then diversified into real estate, purchasing their first hotel property, the Imperial Hotel, in 1960. In 1965, they bought the site for what is today the Holiday Inn Golden Mile on Nathan Road. Though its opening was delayed until 1975, rising property prices in the 1970s and 1980s ensured it was a commercial success. By 2008, the Harilela portfolio included hotels across Southeast Asia, and in Canada, the UK, and Australia. The Group was also beginning to invest in hotels in mainland China for the first time.

While more than 90% of the family’s wealth was in hotels and real estate, various branches of the family had also invested in other businesses, including event merchandising, travel agencies, import-export trading, restaurants, and banking and securities.

Governance and Ownership Structure

The Harilela Group was owned collectively by the family and was structured in a unique way. The six brothers made up the group’s board, with Hari as chairman. Any brother wishing to resign his position could nominate a family member as his replacement, with the board size never exceeding six. An informal handcuff agreement prohibited the sale of shares to anyone not a member of the Harilela family.

However, while each of the brothers had a seat on the board, they did not hold equal interests in the Group. Hari controlled 56% of shares in the flagship Harilela Hotels Ltd., with the other brothers holding differing ratios. Despite this, each brother had the same voting power on the board. Directors’ fees and salaries were age-related, and investment funds were drawn from each of the brothers proportionate to their ownership, with profits distributed in the same way. Hari, however, had voluntarily redistributed some of his shares to other brothers. This, and other decisions, were made with an eye to preserving family harmony.

Another unwritten tradition was that board seats were passed on to the wives of deceased brothers. They then decided to whom, within their branch of the family, the directorship should pass - or they could take up the position themselves.

Though the women in the family owned shares, a majority of them had chosen not to participate in the family business. Some younger members, however, were beginning to take a keener interest.

The mansion that kept the family together

At a time when a collective family residence already seemed an outmoded concept, four generations of the Harilela clan, 70 relatives in total, still lived together in a 100,000-sq ft. mansion in Kowloon Tong. The original mansion was built as a result of a promise Hari made to his mother. “As we were together in poverty, we should not separate in wealth," he said.

Aron Harilela

Aron, who was almost 40 in 2008, had been educated in the UK from the age of 13 up to the completion of his doctorate. Hari felt an overseas education had helped make his son independent and self-disciplined, and given him an analytical approach. His Indian heritage, with its customs, philosophy, respect for others and tolerance, had been passed down to him by his mother, Padma.

From the age of 18, Aron had used his free time to work in room service, the kitchen, restaurants and housekeeping. When he returned permanently to Hong Kong on the completion of his studies, he first received special training in the head office, before being made an Executive Director, reporting directly to the board. One of his key responsibilities in this role was to oversee the group’s expansion. In 1997, Aron led the purchase of a major London property, which became the Sheraton Belgravia. This acquisition was a significant commercial success, and by 2008 Aron was spearheading the Group’s China business.

Challenges facing the family business

DIVERSIFICATION

With his father a strong believer in staying ahead of market trends, in 2008 Aron was not only defining a diversification plan for China, but also eyeing the Indian market. Aron’s growth strategy had two components: to expand the core hospitality business into new geographical markets, and to keep an open mind about diversification into unrelated areas. He felt the leadership team of a privately-controlled group could be opportunistic and flexible.

With plans in place to build ten 3-star hotels in secondary cities in China within the next five to 10 years, Aron was also working on a similar strategy for India and eyeing investment possibilities in Thailand.

Aron’s diversification strategy was sparked by the entry of private equity firms and specialized real estate investment funds into the property market. This had dramatically raised prices, and virtually converted property into a financial product, with the emphasis on quick returns in the short term. Not only was this approach at odds with the group’s long-term focus, with its lower capital base, the Group was also at a disadvantage when competing with cash-rich financial investors. Aron was therefore consider moving up the value chain and venturing into the management of hotels, and, possibly, into residential property.

Like his father, Aron preferred internally-generated funds, as opposed to debt, as the engine for growth. Some of Hari’s other brothers, however, acknowledged that lack of access to capital markets could now constrain the Group’s growth. Again, Aron’s view was pragmatic. He foresaw the Group probably remaining private, but wasn’t averse to floating companies formed for specialized segments ‑ investments in China being an example.

In certain matters such as punctuality, punctiliousness, and strategic thinking, Aron admitted to benefiting from exposure to western ideas and education. On the other hand, qualities such as active listening, and the philosophy of right versus wrong leading to karma, had come to him through his family.

The Group’s philosophy had been to hire staff who demonstrated a high degree of personal integrity and sincerity, and who were willing to serve long term. Its management style was benevolent paternalism, with a helping hand offered to staff in times of need.

Aron acknowledged that, probably in the distant future, the group could consider hiring an outside CEO - though a more modern governance structure would need to be in place first. Similarly, working with joint venture partners on projects where the Group’s experience was limited was another possibility.

These sorts of moves raised the question of rewarding external hires without diluting the family’s financial control of the business - especially as it was thought that informal lock-in arrangements might not be effective or sustainable in the long run.

Challenges to family unity

Hari believed tolerance was key to keeping the family and the business together. So, while the brothers had their disagreements, they always worked their way through them together.

In 2008, Aron’s view was that a more formal structure with a greater division of labor and a hierarchical structure was required to keep the family working together harmoniously. In addition, at this time the brothers on the board were considering introducing a formal “non-compete” clause to ensure that future growth and family harmony were not impaired by family members managing competing businesses. And, with independent directors already on the boards of some group subsidiaries, a decision over whether or not they could hold other positions, including chairmanships, was being weighed up.

Aron saw his relative youthfulness as an asset not a problem, as it would allow him to act as the bridge between the older and younger generations, and help draw the family’s bright youngsters into the business. However, as members of the younger generation increasingly studied and worked all around the world, and therefore grew up separately, keeping the family together, with a shared vision and purpose, was becoming much more difficult.

Hong Kong University of Science and Technology Business School Hong Kong SAR China

Other currencies, pricing terms.

The price is based on current exchange rates but is only an approximation. Please contact us for a final price

- Work & Careers

- Life & Arts

- Currently reading: Post Office scandal exposes ethical dilemmas of general counsel

- Meet the top FT 20 in-house legal leaders

- Emerging AI risks require vigilance from in-house legal counsel

- Lawyers take frontline role in business response to cyber attacks

- In-house lawyers grapple with ESG demands

- Wanted: in-house legal leaders who can interpret world events

- Geopolitical upheaval recasts chief legal officer role

Post Office scandal exposes ethical dilemmas of general counsel

- Post Office scandal exposes ethical dilemmas of general counsel on x (opens in a new window)

- Post Office scandal exposes ethical dilemmas of general counsel on facebook (opens in a new window)

- Post Office scandal exposes ethical dilemmas of general counsel on linkedin (opens in a new window)

- Post Office scandal exposes ethical dilemmas of general counsel on whatsapp (opens in a new window)

Rafe Uddin in London

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Post Office executives played a leading role in publicly defending their organisation over the hundreds of prosecutions it brought against the sub-postmasters who ran its branches, based on the flawed Horizon accounting system.

But, behind the scenes, it was in-house lawyers who took on the task of briefing senior executives on the robustness of its Horizon software. They were also responsible for commissioning relevant audits and setting out the UK state-owned organisation’s approach to litigation.

More than 900 people were convicted of a range of offences, including theft and false accounting, in cases involving data from Fujitsu’s flawed Horizon system, which was introduced in 1999. More than 700 prosecutions were brought by the Post Office itself.

However, it was another lawyer — James Hartley, partner and head of dispute resolution at law firm Freeths — who represented 555 of the sub-postmasters in a landmark 2019 High Court case in which the extent of the IT scandal emerged. The judge ruled that several “bugs, errors and defects” meant there was a “material risk” that the Horizon system was to blame for faulty data used in the Post Office prosecutions.

“It’s quite a complex web of obligation, responsibility and culpability,” says Hartley, reflecting on the reach of the affair into the legal profession. “Somewhere along the way, lawyers have stepped over the red line.”

Now, a public inquiry into the scandal is gaining momentum as it takes evidence from senior Post Office executives, government ministers and figures from Fujitsu, ahead of its conclusion this summer.

In the coming months, the inquiry will hear testimony from several former general counsel at the Post Office, each of whom will give evidence against the backdrop of a debate about whether the role of an in-house lawyer needs to be more strictly regulated.

Susan Crichton, the Post Office’s general counsel between 2010 and 2013, will appear today at Aldwych House in London to respond to claims that, under her watch, the business brought prosecutions against sub-postmasters despite concerns surrounding Horizon.

Audio recordings shared with the inquiry, of conversations between Crichton and forensic accountants Second Sight in 2013, suggest she briefed the company’s chief executive that claims made by accused sub-postmasters about the Horizon system were, in fact, true.

Their discussions include the detail, long denied by the Post Office, that third parties could access systems remotely and alter transaction data. Sub-postmasters successfully argued in court that they could not be held solely responsible for any shortfalls because of this third-party access.

Crichton’s evidence is also expected to spell out some of the difficulties that existed for general counsel in raising concerns, particularly when executives fail to act in response.

Chris Aujard, Crichton’s successor, is scheduled to appear at the inquiry tomorrow. Jane MacLeod, who succeeded Aujard, is due to appear in June, shortly after current counsel Ben Foat takes the stand.

Somewhere along the way, lawyers have stepped over the red line James Hartley, Freeths

Contemporaneous documents suggest that there may have been opportunities for the Post Office to prevent litigation.

The Post Office’s general counsel were involved in commissioning half a dozen reports and reviews by external auditors and consultants, including BAE Systems, Deloitte, EY, and Second Sight, in the decade leading up to the 2019 High Court case.

Some of these reports found faults with internal systems and how they were managed. External lawyers in 2013 warned the Post Office that the business was at risk of breaching its obligations as a prosecutor over improper practices, if any decision were made to shred documents, which prevented disclosure.

Richard Moorhead, a professor of law and professional ethics at the University of Exeter, says matters should be reported “up the ladder” and that general counsel need to act as a “moral compass” within an organisation. “They need to speak up if they think things are being done which are improper and ensure the client hears those things,” he says.

Moorhead, who sits on the government-appointed Horizon Compensation Advisory Board, is a vocal critic of the lawyers involved in the Post Office Horizon scandal.

He adds that there were occasions when in-house lawyers at the Post Office should have sought to “blow the whistle” once it became obvious that errors in the Horizon system could account for shortfalls.

General counsel play a prominent role in shaping the legal strategy of a company or organisation and advising executives on the best approach to compliance and handling legal risk. But there is sometimes tension between serving the business and acting in the public’s interest.

In the aftermath of the Enron and WorldCom fraud scandals in the early 2000s, US regulators introduced new security laws that required general counsel to report adverse information to audit committees, directors and other officials when senior leadership was unresponsive.

[GCs] need to speak up if they think things are being done which are improper and ensure the client hears those things Richard Moorhead, University of Exeter

Brian Cheffins, a professor of corporate law at the University of Cambridge, says the new rules produced a playbook for in-house lawyers who had been “stonewalled internally”, particularly as these individuals could find themselves in “deep water” when misgovernance became evident.

But Cheffins is opposed to plans to set out general counsel’s obligations formally, and warns that doing so risks duplicating duties that already exist elsewhere.

General counsel in the UK operate under the same rules as any solicitor or barrister advising a client, which stipulate acting with integrity in ensuring that senior figures are briefed on unpalatable information. The Horizon affair has reminded lawyers of their duties when advising executives.

Hartley says: “In-house lawyers need to recalibrate their thinking on where that red line is so they know when to turn around to the person they’re advising and say, ‘No, we cannot do that’.”

Post Office general counsel: in the spotlight

Susan Crichton In 2012-2013 she was involved in instructing Second Sight to conduct an independent investigation into Horizon. The forensic accountants raised concerns but these were not actioned by the business despite executives being briefed. Crichton left the Post Office to take on a similar role at TSB Bank in 2013; she retired in 2018.

Chris Aujard After becoming general counsel in 2013, he was tasked with winding down a mediation scheme set up for affected sub-postmasters and removing Second Sight from its role investigating the Post Office. Meeting minutes from 2014 showed he was present when executives discussed setting aside £1mn in “token payments” to mitigate any reputational damage.

Jane MacLeod In position as general counsel when 555 sub-postmasters brought a suit against the Post Office, MacLeod was responsible for overseeing the business’s initial response. The public inquiry will explore her handling of disclosure and response to litigation when she gives evidence in June. She resigned from the Post Office in 2019.

Ben Foat Appointed to general counsel in 2019, Foat previously served as the business’s legal director. He appeared at the inquiry in the middle of last year after widespread disclosure failures resulted in weeks of delays to evidence. Sir Wyn Williams, chair of the inquiry, has since threatened officials with criminal penalties if such problems recur.

Promoted Content

Explore the series.

Follow the topics in this article

- Corporate governance Add to myFT

- Law Add to myFT

- Post Office scandal Add to myFT

- Legal services Add to myFT

- Rafe Uddin Add to myFT

International Edition

IMAGES

VIDEO

COMMENTS

This study using the 2007 and 2012 Survey of Business Owners records finds that while immigrant-owned businesses have a modestly different industry composition than native-owned businesses, there are ten-fold differences across states in terms of the share of businesses owned by immigrants. 31 Jul 2017. HBS Case.

Family businesses can go under for many reasons, including conflicts over money, poor management, and fighting about the succession of power from one generation to the next. But there are ...

The case studies included here are brief vignettes that can be used by professionals as conversation starters or for in-depth analysis in the consulting process. Family Business Cases, ... This week, we are pleased to share a family business case illustrating how Firmenich, the world's largest privately-owned perfume and taste company, has ...

The purpose of this case study is to investigate issues that arise at the time of transition of ownership, business and wealth in a multigenerational closely held family business (CHFB).

by Julia Hanna. Navigating complex relationships and understanding unwritten processes are among the many challenges of transitioning a family-owned business to the next generation. Len Schlesinger, Michael Raiche, and Roger Zhu discuss the dilemmas of a small Vietnamese restaurant in the case study "Pho Hoa Dorchester.".

There are three case study approaches in FB research, namely "positivistic" ("qualitative. positivist"), "interpretivist," and "critical realist" types of research. These types reflect. different philosophical assumptions regarding the nature of social reality and what it means to.

by. Josh Baron. and. Rob Lachenauer. From the Magazine (January-February 2021) Courtesy of Jorge Mayet and Richard Taittinger Gallery, New York. Summary. Judging from how they're portrayed in ...

De Massis A., Kotlar J. (2014). The case study method in family business research: Guidelines for qualitative scholarship. Journal of Family Business Strategy, 5(1 ... Woods A. (2002). Successional issues within Asian family firms learning from the Kenyan experience. International Small Business Journal, 20(1), 77-94. Crossref. Google Scholar

Family businesses represent a significant percentage of GDP and employability in. developed economies, and their c ontinuity and transition to a new generation is a crucial. challenge. This study ...

Our findings show that the most common for m of qualitative research in the family business. field is case study. Out of 67 qualitative studies, 57 were qualitative case studies and in six. mixed ...

Case Study: Walmart Inc. Sam Walton started his family business as a single discount store with the idea of selling more for less in Rogers, Arkansas, in 1962 and eventually became the largest global retailer in the world. ... A commentary on "Comparing the agency costs of family and non-Family firms: Conceptual issues and exploratory ...

Issue 1 2013 Taking a hard look at soft issues in family business . Volume 2 . Issue 2 2012. Issue 1 2012. Volume 1 . Issue 2 2011. ... a comparative case study of four Swedish family firms Jenny Ahlberg, Sven-Olof Yrjö Collin, Elin Smith, ... By combining manifold approaches from migrant entrepreneurship and family business studies, the ...

This study systematizes and classifies the state-of-the-art of knowledge about innovation and succession in family businesses. Our systematic literature review details the existing knowledge and establishes new points of departure for future research. This research analyzes 32 articles retrieved from the Web of Science database and makes recourse to bibliographic coupling through the VOS ...

This book provides insights into family businesses in the United Arab Emirates (UAE) using a unique collection of case studies that help gain a comprehensive understanding of UAE family firms' profiles and the ways they respond to everyday challenges and future disruptions. Cases treat different issues from the perspective of family businesses ...

Researchers need to study how the combination of the characteristics such as age, education, political ideology and personality operate to influence family CEO performance in their family businesses.

Mental health issues in family businesses and business families have been studied in multiple disciplines within the past three decades. This article systematically reviews 51 articles on mental health issues in family businesses and business families, published in a wide variety of psychology, entrepreneurship, and management journals.

Another key approach to mitigating bias is to combine interviews with direct observations.For example, in the study on goal-setting processes in family firms (Kotlar & De Massis, 2013), direct interviews were combined with non-participant observations.Specifically, informants were followed during family and business meetings (e.g., meetings of the board of directors, family meetings, and ...

These case studies are a small sample of the issues that Family Business Ireland have enabled these businesses to resolve. A prerequisite for dealing with such issues is the creation of an environment of trust and confidentiality - it is this, above all else, that we advocate for family business owners and business advisors. This case study is ...

A family business case study: Bottling family resilience. Operating a business in volatile, uncertain, complex, and ambiguous (VUCA) markets requires strategic agility. Leaders in these companies must continually assess current strategies against a changing landscape, and run experiments to inexpensively explore alternative strategies.

Family businesses in Slovakia have been facing problems for a. long time; most often it is the changing legislatio n, a n umber of constraints, lack. of s killed lab or, low la w enforcement, lack ...

Bob Croslin. In October 2009, Michael Plummer Jr. delivered the eulogy at the funeral of his father, Michael Sr., who had died of a heart attack. A few days later, he walked into his father's ...

Family firms are common across Asia; many of the region's largest organizations are family owned. In a series from HKUST Business School and its Tanoto Center for Asian Family Business and Entrepreneurship Studies, faculty analyze the advantages of the structure and the challenges facing family businesses today, and they discuss what other family businesses across the world can learn from ...

Article Family Business Performance Management Resilience. The COVID-19 pandemic and family business performance. This study examines the impact of the COVID-19 pandemic on corporate financial performance using a unique, cross-country, and longitudinal sample of 3350 listed firms worldwide. ... Case Study Strategy Business Transformation.

The most expensive state to raise a family of four isn't New York, California or Hawaii — it's Massachusetts, according to a recent SmartAsset study. To live comfortably in Massachusetts, a ...

Faculty of Business Economics. 72270 Travnik, Bosnia and Herzegovina. [email protected] a. Abstra ct. Purpose: e aim of this paper is to determine, theoretically and empirically, which ...

Brian Cheffins, a professor of corporate law at the University of Cambridge, says the new rules produced a playbook for in-house lawyers who had been "stonewalled internally", particularly as ...