Free Business Plan Excel Template [Excel Download]

Written by Dave Lavinsky

A business plan is a roadmap for growing your business. Not only does it help you plan out your venture, but it is required by funding sources like banks, venture capitalists and angel investors.

Download our Ultimate Business Plan Template here >

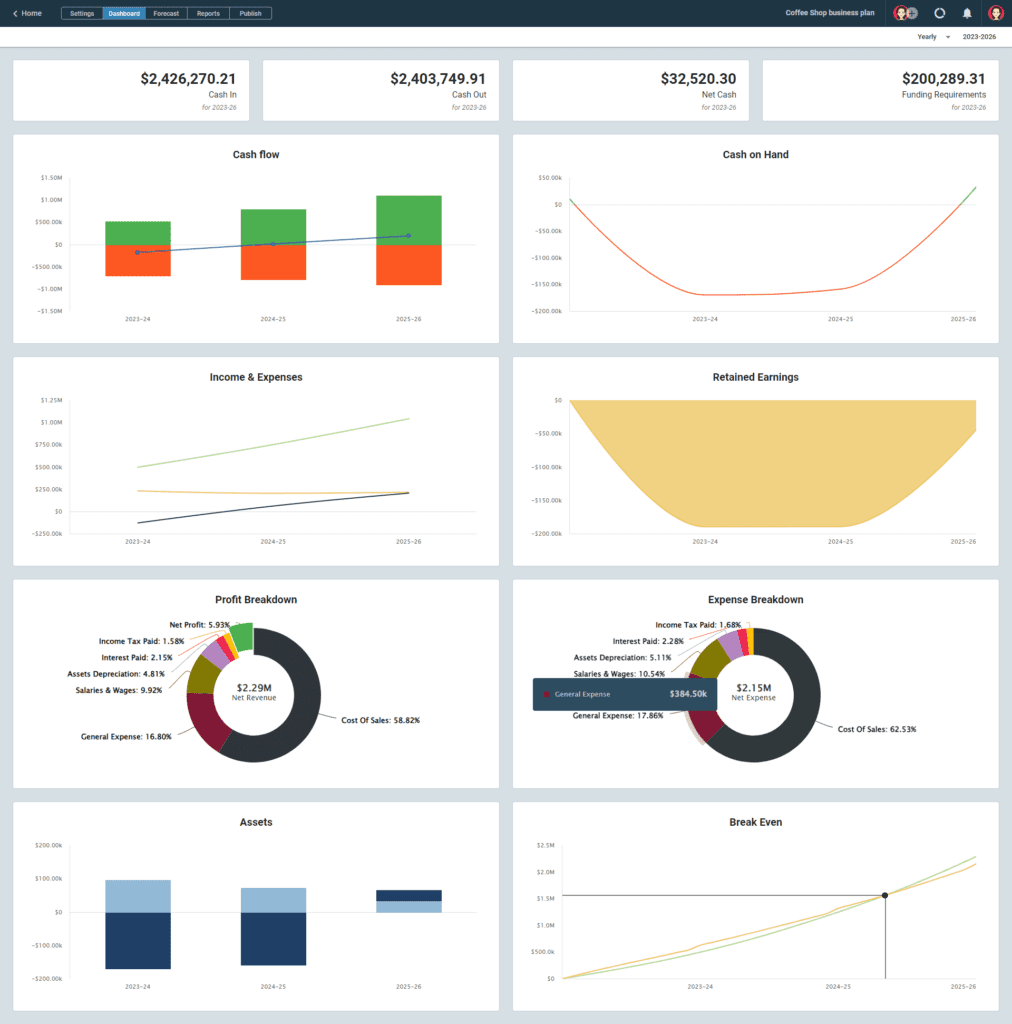

The body of your business plan describes your company and your strategies for growing it. The financial portion of your plan details the financial implications of your business: how much money you need, what you project your future sales and earnings to be, etc.

Below you will be able to download our free business plan excel template to help with the financial portion of your business plan. You will also learn about the importance of the financial model in your business plan.

Download the template here: Financial Plan Excel Template

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less! It includes a simple, plug-and-play financial model and a fill-in-the-blanks template for completing the body of your plan.

What’s Included in our Business Plan Excel Template

Our business plan excel template includes the following sections:

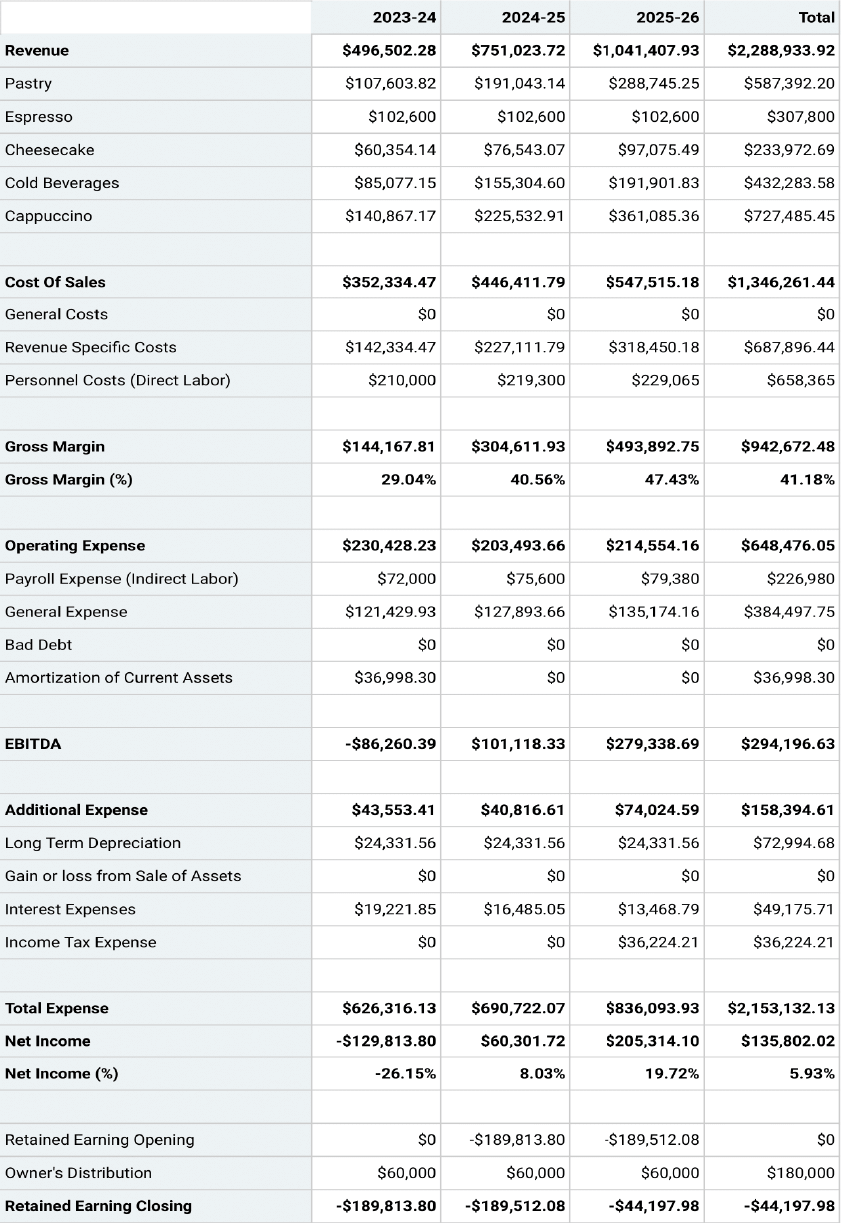

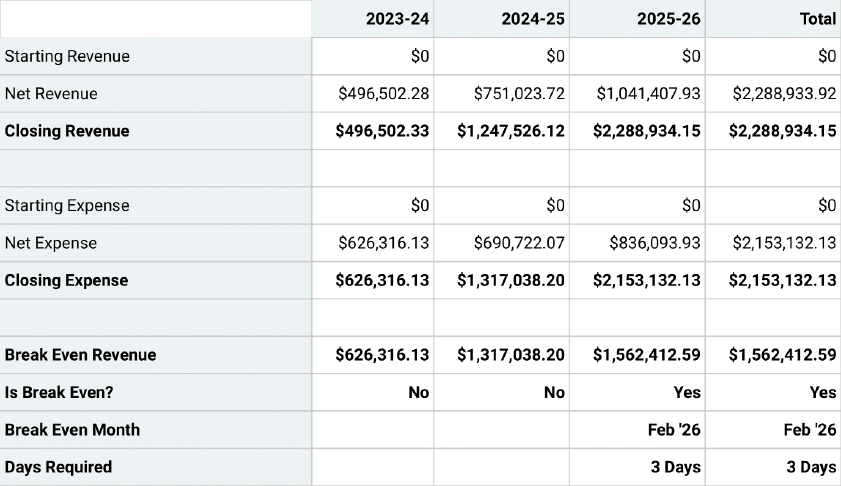

Income Statement : A projection of your business’ revenues, costs, and expenses over a specific period of time. Includes sections for sales revenue, cost of goods sold (COGS), operating expenses, and net profit or loss.

Example 5 Year Annual Income Statement

Cash Flow Statement : A projection of your business’ cash inflows and outflows over a specific period of time. Includes sections for cash inflows (such as sales receipts, loans, and investments), cash outflows (such as expenses, salaries, and loan repayments), and net cash flow.

Example 5 Year Annual Cash Flow Statement

Balance Sheet : A snapshot of your business’ financial position at a specific point in time. Includes sections for assets (such as cash, inventory, equipment, and property), liabilities (such as loans, accounts payable, and salaries payable), and owner’s equity (such as retained earnings and capital contributions).

Example 5 Year Annual Balance Sheet

Download the template here: Business Plan Excel Template

The template is easy to customize according to your specific business needs. Simply input your own financial data and projections, and use it as a guide to create a comprehensive financial plan for your business. Remember to review and update your financial plan regularly to track your progress and make informed financial decisions.

Finish Your Business Plan Today!

The importance of the financial model in your business plan.

A solid financial model is a critical component of any well-prepared business plan. It provides a comprehensive and detailed projection of your business’ financial performance, including revenue, expenses, cash flow, and profitability. The financial model is not just a mere set of numbers, but a strategic tool that helps you understand the financial health of your business, make informed decisions, and communicate your business’ financial viability to potential investors, lenders, and other stakeholders. In this article, we will delve into the importance of the financial model in your business plan.

- Provides a roadmap for financial success : A well-structured financial model serves as a roadmap for your business’ financial success. It outlines your revenue streams, cost structure, and cash flow projections, helping you understand the financial implications of your business strategies and decisions. It allows you to forecast your future financial performance, set financial goals, and measure your progress over time. A comprehensive financial model helps you identify potential risks, opportunities, and areas that may require adjustments to achieve your financial objectives.

- Demonstrates financial viability to stakeholders : Investors, lenders, and other stakeholders want to see that your business is financially viable and has a plan to generate revenue, manage expenses, and generate profits. A robust financial model in your business plan demonstrates that you have a solid understanding of your business’ financials and have a plan to achieve profitability. It provides evidence of the market opportunity, pricing strategy, sales projections, and financial sustainability. A well-prepared financial model increases your credibility and instills confidence in your business among potential investors and lenders.

- Helps with financial decision-making : Your financial model is a valuable tool for making informed financial decisions. It helps you analyze different scenarios, evaluate the financial impact of your decisions, and choose the best course of action for your business. For example, you can use your financial model to assess the feasibility of a new product launch, determine the optimal pricing strategy, or evaluate the impact of changing market conditions on your cash flow. A well-structured financial model helps you make data-driven decisions that are aligned with your business goals and financial objectives.

- Assists in securing funding : If you are seeking funding from investors or lenders, a robust financial model is essential. It provides a clear picture of your business’ financials and shows how the funds will be used to generate revenue and profits. It includes projections for revenue, expenses, cash flow, and profitability, along with a breakdown of assumptions and methodology used. It also provides a realistic assessment of the risks and challenges associated with your business and outlines the strategies to mitigate them. A well-prepared financial model in your business plan can significantly increase your chances of securing funding as it demonstrates your business’ financial viability and growth potential.

- Facilitates financial management and monitoring : A financial model is not just for external stakeholders; it is also a valuable tool for internal financial management and monitoring. It helps you track your actual financial performance against your projections, identify any deviations, and take corrective actions if needed. It provides a clear overview of your business’ cash flow, profitability, and financial health, allowing you to proactively manage your finances and make informed decisions to achieve your financial goals. A well-structured financial model helps you stay on top of your business’ financials and enables you to take timely actions to ensure your business’ financial success.

- Enhances business valuation : If you are planning to sell your business or seek investors for an exit strategy, a robust financial model is crucial. It provides a solid foundation for business valuation as it outlines your historical financial performance, future projections, and the assumptions behind them. It helps potential buyers or investors understand the financial potential of your business and assess its value. A well-prepared financial model can significantly impact the valuation of your business, and a higher valuation can lead to better negotiation terms and higher returns on your investment.

- Supports strategic planning : Your financial model is an integral part of your strategic planning process. It helps you align your financial goals with your overall business strategy and provides insights into the financial feasibility of your strategic initiatives. For example, if you are planning to expand your business, enter new markets, or invest in new technologies, your financial model can help you assess the financial impact of these initiatives, including the investment required, the expected return on investment, and the timeline for achieving profitability. It enables you to make informed decisions about the strategic direction of your business and ensures that your financial goals are aligned with your overall business objectives.

- Enhances accountability and transparency : A robust financial model promotes accountability and transparency in your business. It provides a clear framework for setting financial targets, measuring performance, and holding yourself and your team accountable for achieving financial results. It helps you monitor your progress towards your financial goals and enables you to take corrective actions if needed. A well-structured financial model also enhances transparency by providing a clear overview of your business’ financials, assumptions, and methodologies used in your projections. It ensures that all stakeholders, including investors, lenders, employees, and partners, have a clear understanding of your business’ financial performance and prospects.

In conclusion, a well-prepared financial model is a crucial component of your business plan. It provides a roadmap for financial success, demonstrates financial viability to stakeholders, helps with financial decision-making, assists in securing funding, facilitates financial management and monitoring, enhances business valuation, supports strategic planning, and enhances accountability and transparency in your business. It is not just a set of numbers, but a strategic tool that helps you understand, analyze, and optimize your business’ financial performance. Investing time and effort in creating a comprehensive and robust financial model in your business plan is vital for the success of your business and can significantly increase your chances of achieving your financial goals.

Filter by Keywords

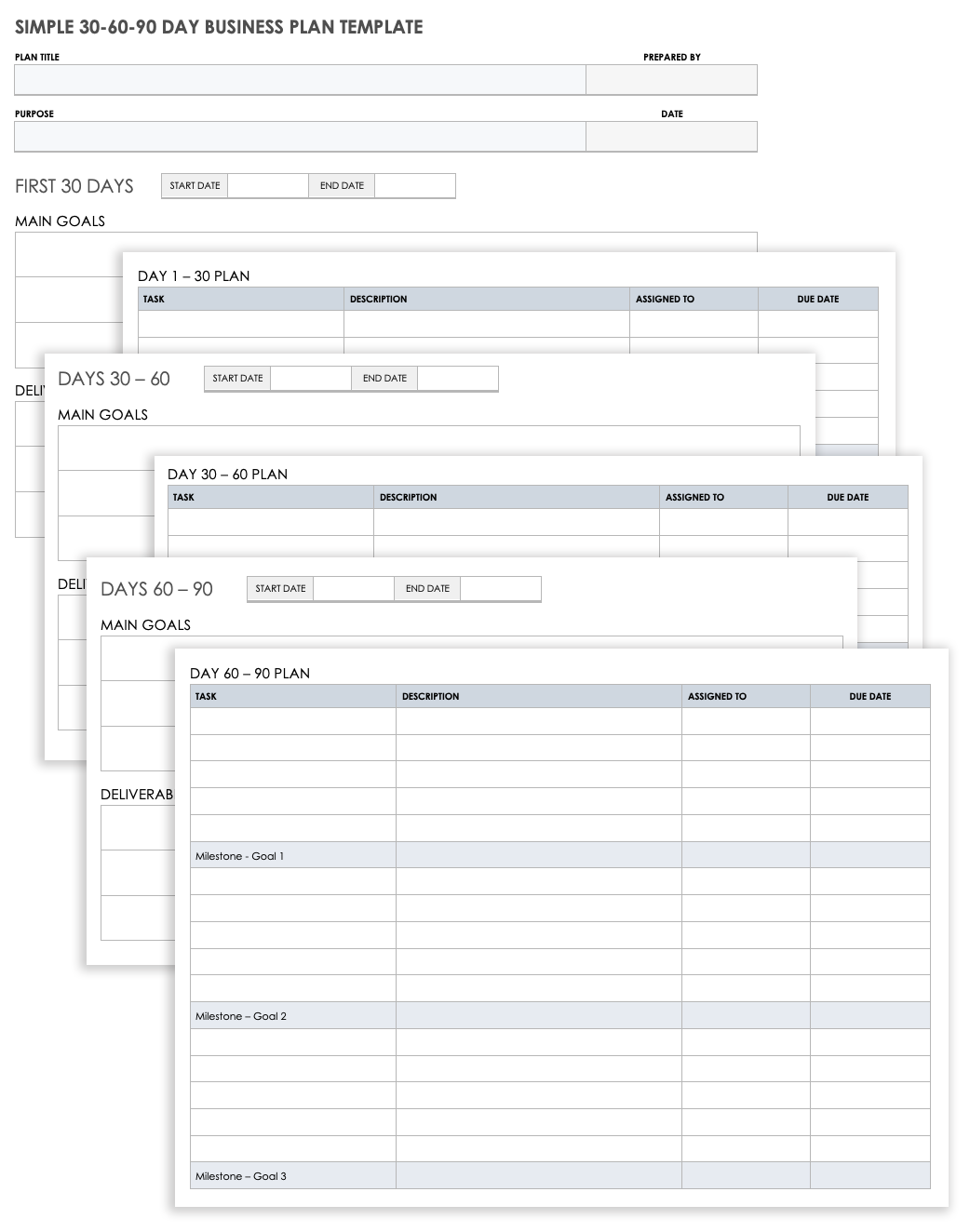

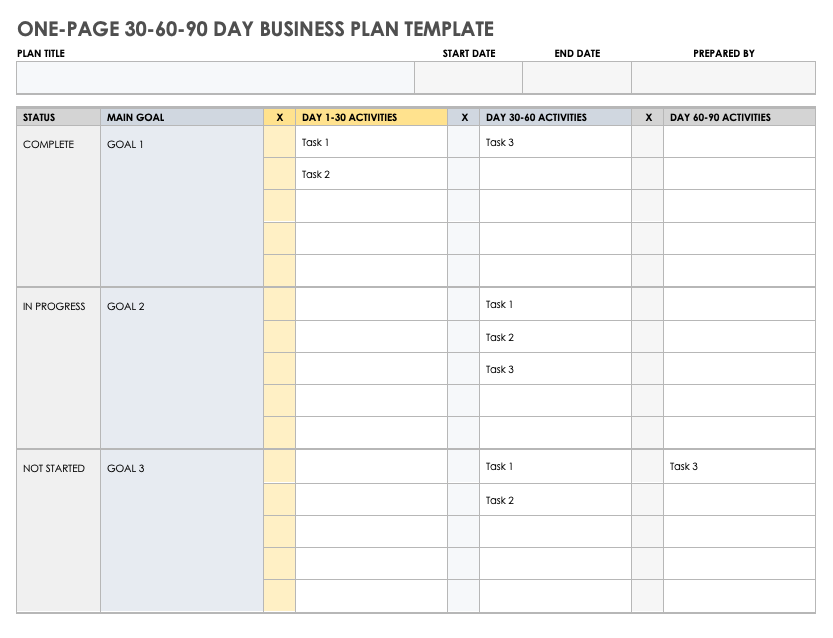

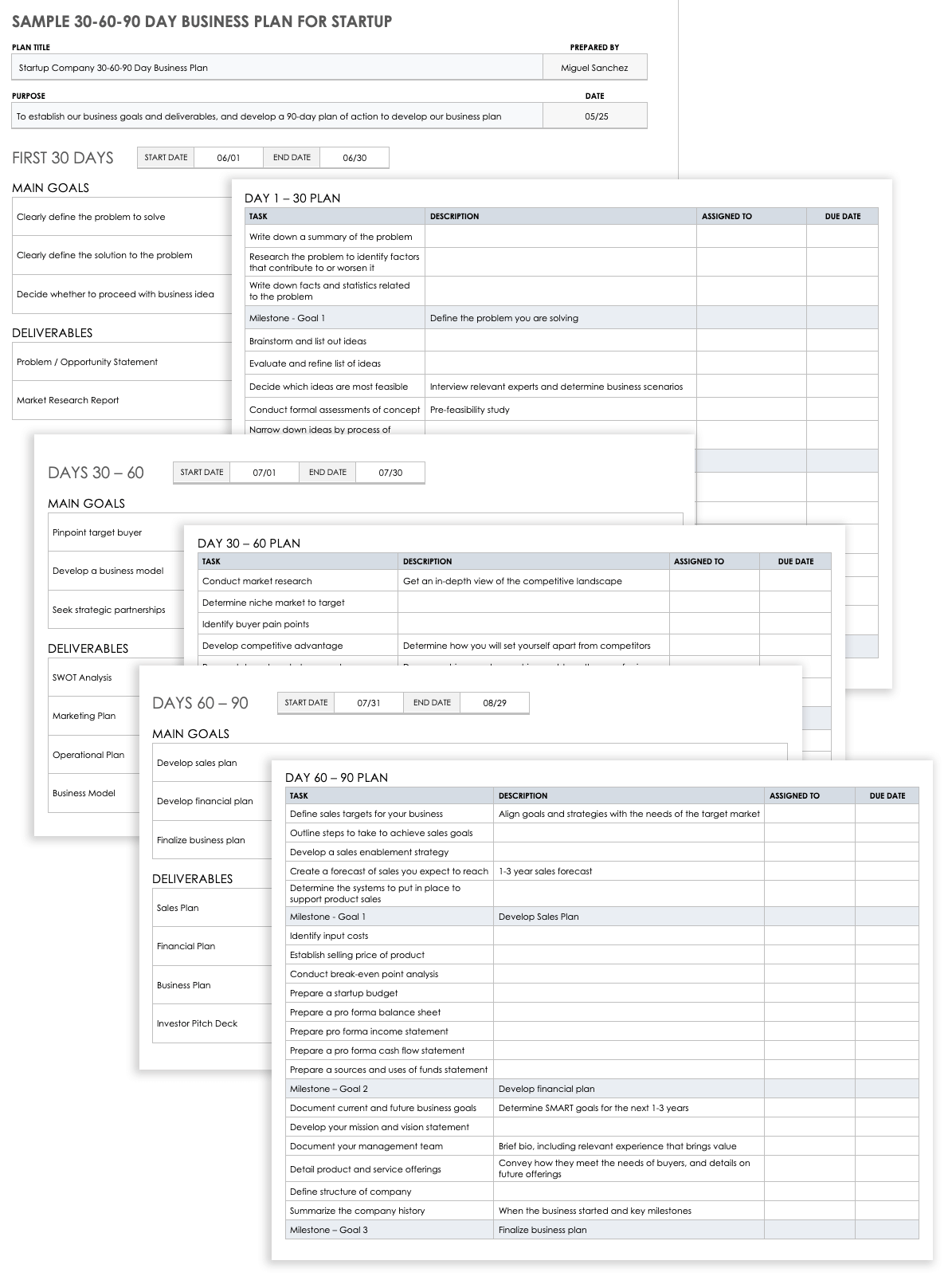

10 Free Business Plan Templates in Word, Excel, & ClickUp

Praburam Srinivasan

Growth Marketing Manager

February 13, 2024

Turning your vision into a clear and coherent business plan can be confusing and tough.

Hours of brainstorming and facing an intimidating blank page can raise more questions than answers. Are you covering everything? What should go where? How do you keep each section thorough but brief?

If these questions have kept you up at night and slowed your progress, know you’re not alone. That’s why we’ve put together the top 10 business plan templates in Word, Excel, and ClickUp—to provide answers, clarity, and a structured framework to work with. This way, you’re sure to capture all the relevant information without wasting time.

And the best part? Business planning becomes a little less “ugh!” and a lot more “aha!” 🤩

What is a Business Plan Template?

What makes a good business plan template, 1. clickup business plan template, 2. clickup sales plan template, 3. clickup business development action plan template, 4. clickup business roadmap template, 5. clickup business continuity plan template, 6. clickup lean business plan template, 7. clickup small business action plan template, 8. clickup strategic business roadmap template , 9. microsoft word business plan template by microsoft, 10. excel business plan template by vertex42.

A business plan template is a structured framework for entrepreneurs and business executives who want to create business plans. It comes with pre-arranged sections and headings that cover key elements like the executive summary , business overview, target customers, unique value proposition, marketing plans, and financial statements.

A good business plan template helps with thorough planning, clear documentation, and practical implementation. Here’s what to look for:

- Comprehensive structure: A good template comes with all the relevant sections to outline a business strategy, such as executive summary, market research and analysis, and financial projections

- Clarity and guidance: A good template is easy to follow. It has brief instructions or prompts for each section, guiding you to think deeply about your business and ensuring you don’t skip important details

- Clean design: Aesthetics matter. Choose a template that’s not just functional but also professionally designed. This ensures your plan is presentable to stakeholders, partners, and potential investors

- Flexibility : Your template should easily accommodate changes without hassle, like adding or removing sections, changing content and style, and rearranging parts 🛠️

While a template provides the structure, it’s the information you feed it that brings it to life. These pointers will help you pick a template that aligns with your business needs and clearly showcases your vision.

10 Business Plan Templates to Use in 2024

Preparing for business success in 2024 (and beyond) requires a comprehensive and organized business plan. We’ve handpicked the best templates to help you guide your team, attract investors, and secure funding. Let’s check them out.

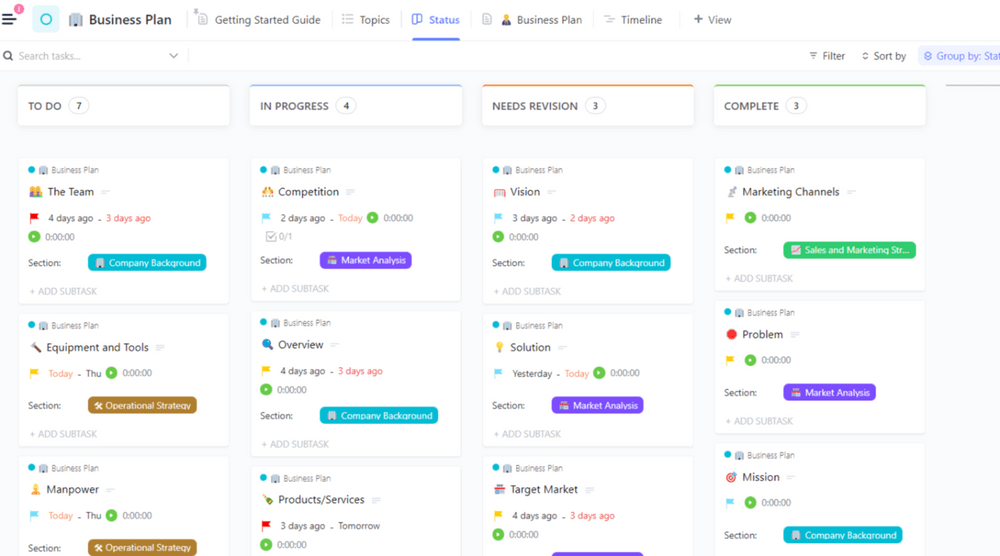

If you’re looking to replace a traditional business plan document, then ClickUp’s Business Plan Template is for you!

This one-page business plan template, designed in ClickUp Docs , is neatly broken down into the following sections:

- Company description : Overview, mission, vision, and team

- Market analysis : Problem, solution, target market, competition, and competitive advantage

- Sales and marketing strategy : Products/services and marketing channels

- Operational plan : Location and facilities, equipment and tools, manpower, and financial forecasts

- Milestones and metrics: Targets and KPIs

Customize the template with your company logo and contact details, and easily navigate to different sections using the collapsible table of contents. The mini prompts under each section guide you on what to include—with suggestions on how to present the data (e.g., bullet lists, pictures, charts, and tables).

You can share the document with anyone via URL and collaborate in real time. And when the business plan is ready, you have the option to print it or export it to PDF, HTML, or Markdown.

But that’s not all. This template is equipped with basic and enterprise project management features to streamline the business plan creation process . The Topics List view has a list of all the different sections and subsections of the template and allows you to assign it to a team member, set a due date, and attach relevant documents and references.

Switch from List to Board view to track and update task statuses according to the following: To Do, In Progress, Needs Revision, and Complete.

This template is a comprehensive toolkit for documenting the different sections of your business plan and streamlining the creation process to ensure it’s completed on time. 🗓️

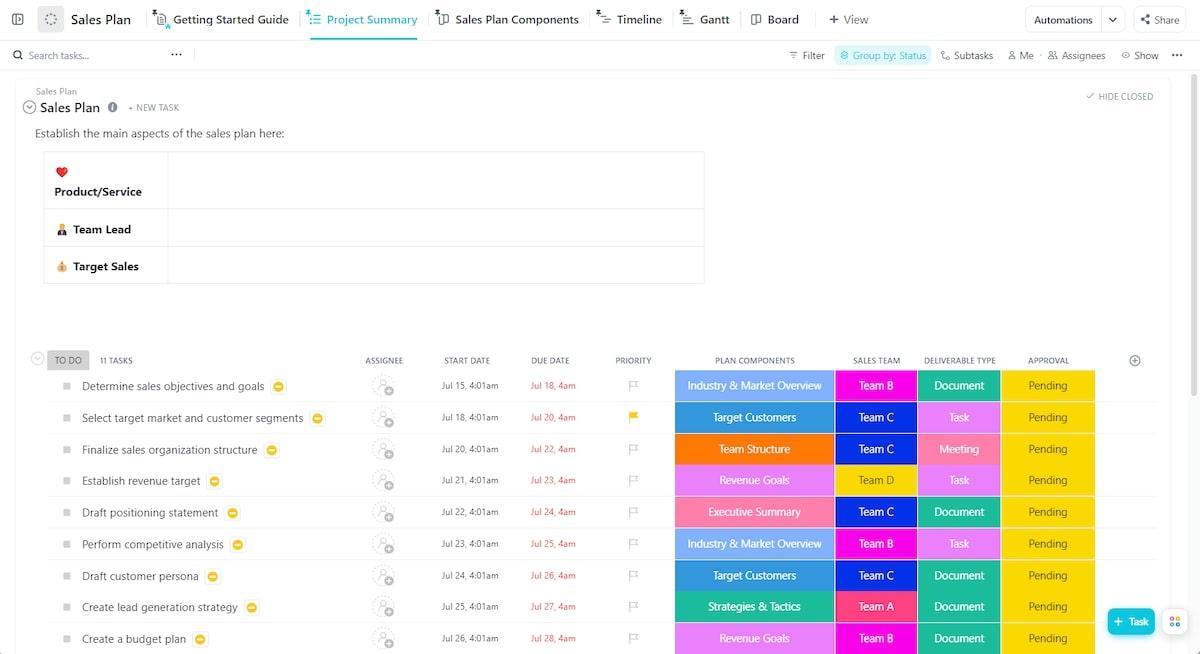

If you’re looking for a tool to kickstart or update your sales plan, ClickUp’s Sales Plan Template has got you covered. This sales plan template features a project summary list with tasks to help you craft a comprehensive and effective sales strategy. Some of these tasks include:

- Determine sales objectives and goals

- Draft positioning statement

- Perform competitive analysis

- Draft ideal customer persona

- Create a lead generation strategy

Assign each task to a specific individual or team, set priority levels , and add due dates. Specify what section of the sales plan each task belongs to (e.g., executive summary, revenue goals, team structure, etc.), deliverable type (such as document, task, or meeting), and approval state (like pending, needs revisions, and approved).

And in ClickUp style, you can switch to multiple views: List for a list of all tasks, Board for visual task management, Timeline for an overview of task durations, and Gantt to get a view of task dependencies.

This simple business plan template is perfect for any type of business looking to create a winning sales strategy while clarifying team roles and keeping tasks organized. ✨

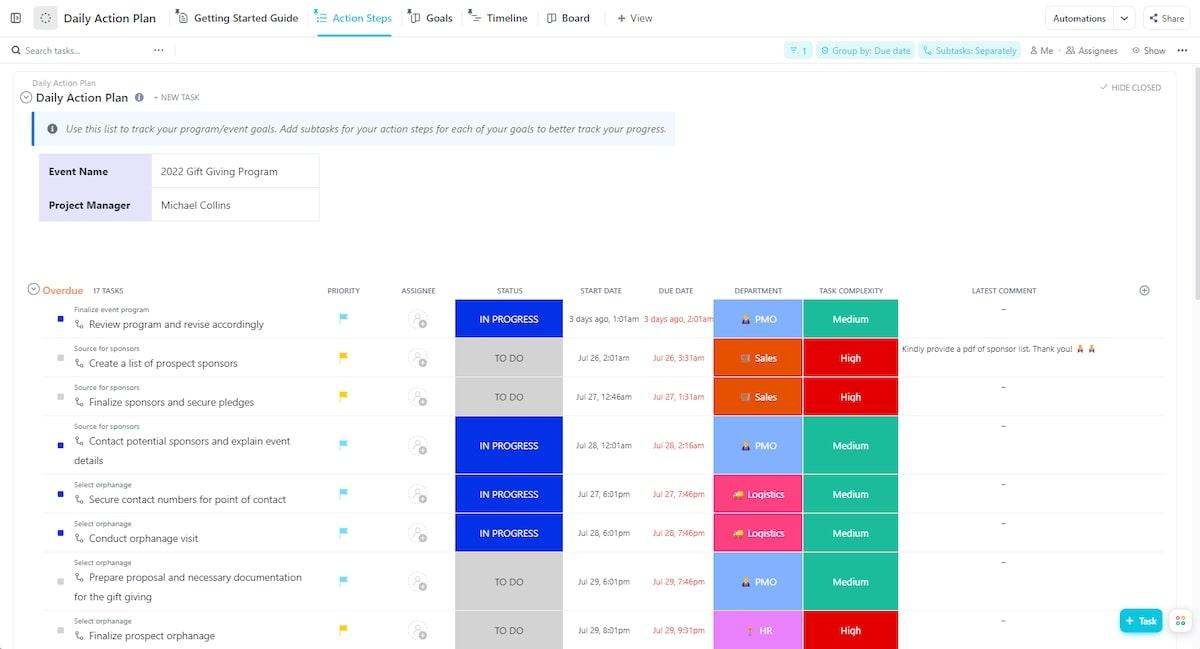

Thinking about scaling your business’s reach and operations but unsure where or how to start? It can be overwhelming, no doubt—you need a clear vision, measurable goals, and an actionable plan that every member of your team can rally behind.

Thankfully, ClickUp’s Business Development Action Plan Template is designed to use automations to simplify this process so every step toward your business growth is clear, trackable, and actionable.

Start by assessing your current situation and deciding on your main growth goal. Are you aiming to increase revenue, tap into new markets, or introduce new products or services? With ClickUp Whiteboards or Docs, brainstorm and collaborate with your team on this decision.

Set and track your short- and long-term growth goals with ClickUp’s Goals , break them down into smaller targets, and assign these targets to team members, complete with due dates. Add these targets to a new ClickUp Dashboard to track real-time progress and celebrate small wins. 🎉

Whether you’re a startup or small business owner looking to hit your next major milestone or an established business exploring new avenues, this template keeps your team aligned, engaged, and informed every step of the way.

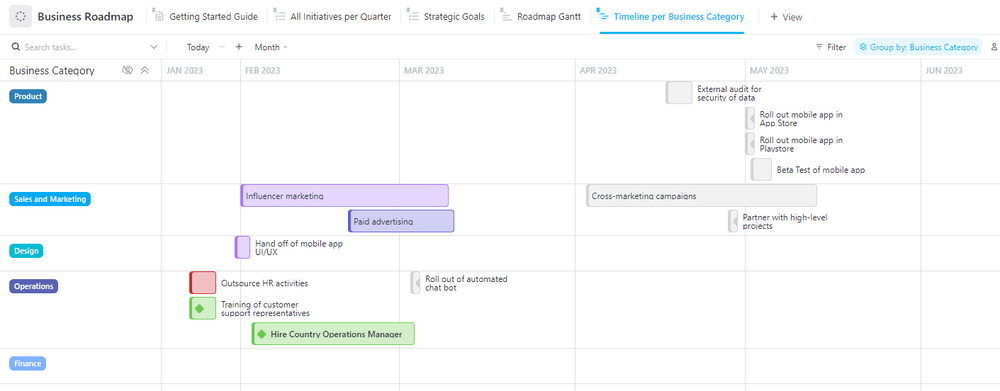

ClickUp’s Business Roadmap Template is your go-to for mapping out major strategies and initiatives in areas like revenue growth, brand awareness, community engagement, and customer satisfaction.

Use the List view to populate tasks under each initiative. With Custom Fields, you can capture which business category (e.g., Product, Operations, Sales & Marketing, etc.) tasks fall under and which quarter they’re slated for. You can also link to relevant documents and resources and evaluate tasks by effort and impact to ensure the most critical tasks get the attention they deserve. 👀

Depending on your focus, this template provides different views to show just what you need. For example, the All Initiatives per Quarter view lets you focus on what’s ahead by seeing tasks that need completion within a specific quarter. This ensures timely execution and helps in aligning resources effectively for the short term.

This template is ideal for business executives and management teams who need to coordinate multiple short- and long-term initiatives and business strategies.

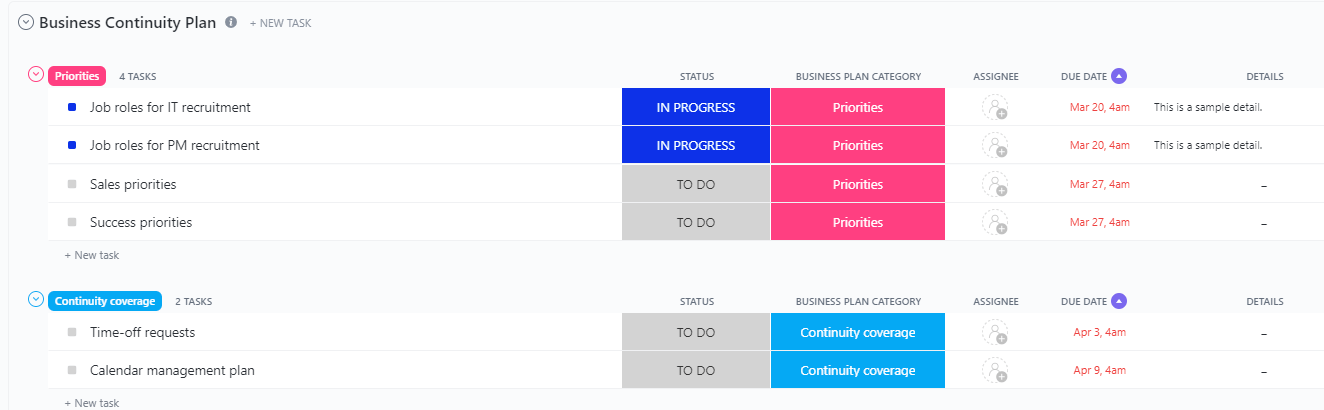

In business, unexpected threats to operations can arise at any moment. Whether it’s economic turbulence, a global health crisis, or supply chain interruptions, every company needs to be ready. ClickUp’s Business Continuity Plan Template lets you prepare proactively for these unforeseen challenges.

The template organizes tasks into three main categories:

- Priorities: Tasks that need immediate attention

- Continuity coverage: Tasks that must continue despite challenges

- Guiding principles: Resources and protocols to ensure smooth operations

The Board view makes it easy to visualize all the tasks under each of these categories. And the Priorities List sorts tasks by those that are overdue, the upcoming ones, and then the ones due later.

In times of uncertainty, being prepared is your best strategy. This template helps your business not just survive but thrive in challenging situations, keeping your customers, employees, and investors satisfied. 🤝

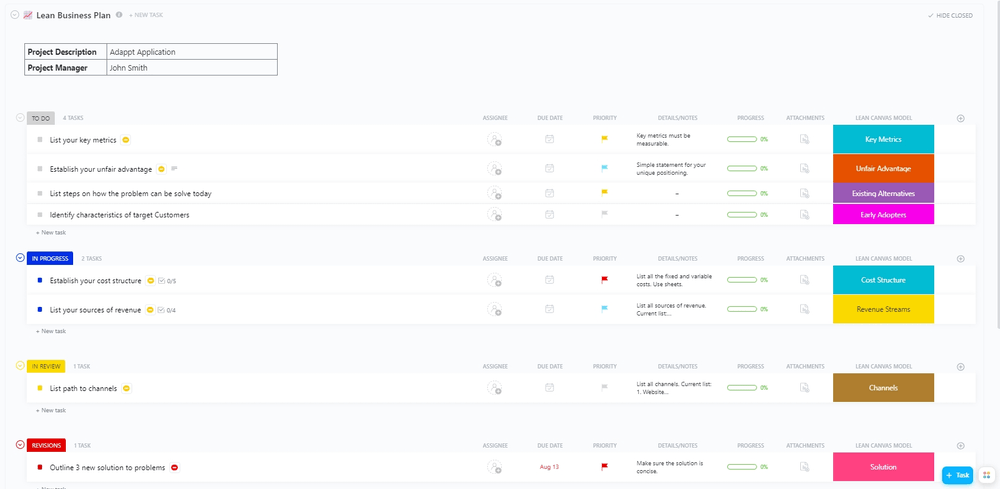

Looking to execute your business plan the “lean” way? Use ClickUp’s Lean Business Plan Template . It’s designed to help you optimize resource usage and cut unnecessary steps—giving you better results with less effort.

In the Plan Summary List view, list all the tasks that need to get done. Add specific details like who’s doing each task, when it’s due, and which part of the Business Model Canvas (BMC) it falls under. The By Priority view sorts this list based on priorities like Urgent, High, Normal, and Low. This makes it easy to spot the most important tasks and tackle them first.

Additionally, the Board view gives you an overview of task progression from start to finish. And the BMC view rearranges these tasks based on the various BMC components.

Each task can further be broken down into subtasks and multiple checklists to ensure all related action items are executed. ✔️

This template is an invaluable resource for startups and large enterprises looking to maximize process efficiencies and results in a streamlined and cost-effective way.

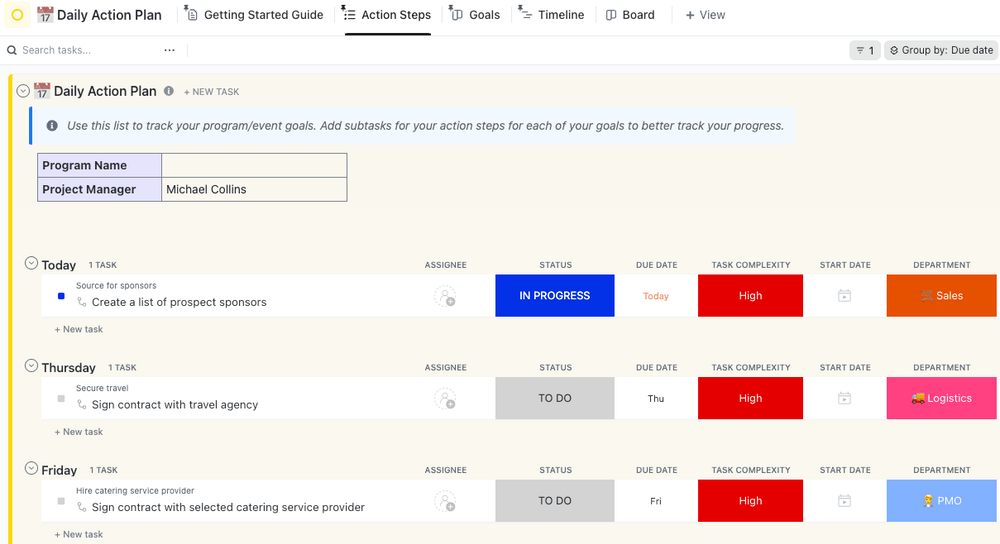

The Small Business Action Plan Template by ClickUp is tailor-made for small businesses looking to transform their business ideas and goals into actionable steps and, eventually, into reality.

It provides a simple and organized framework for creating, assigning, prioritizing, and tracking tasks. And in effect, it ensures that goals are not just set but achieved. Through the native dashboard and goal-setting features, you can monitor task progress and how they move you closer to achieving your goals.

Thanks to ClickUp’s robust communication features like chat, comments, and @mentions, it’s easy to get every team member on the same page and quickly address questions or concerns.

Use this action plan template to hit your business goals by streamlining your internal processes and aligning team efforts.

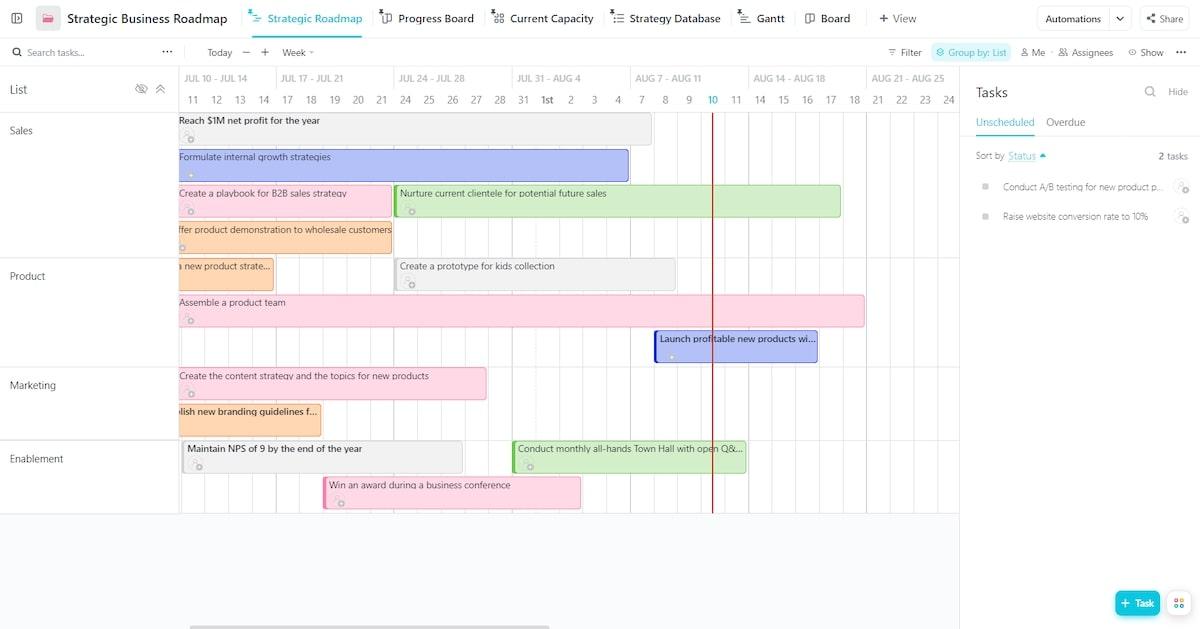

For larger businesses and scaling enterprises, getting different departments to work together toward a big goal can be challenging. The ClickUp Strategic Business Roadmap Template makes it easier by giving you a clear plan to follow.

This template is packaged in a folder and split into different lists for each department in your business, like Sales, Product, Marketing, and Enablement. This way, every team can focus on their tasks while collectively contributing to the bigger goal.

There are multiple viewing options available for team members. These include:

- Progress Board: Visualize tasks that are on track, those at risk, and those behind

- Gantt view: Get an overview of project timelines and dependencies

- Team view: See what each team member is working on so you can balance workloads for maximum productivity

While this template may feel overwhelming at first, the getting started guide offers a step-by-step breakdown to help you navigate it with ease. And like all ClickUp templates, you can easily customize it to suit your business needs and preferences.

Microsoft’s 20-page traditional business plan template simplifies the process of drafting comprehensive business plans. It’s made up of different sections, including:

- Executive summary : Highlights, objectives, mission statement, and keys to success

- Description of business: Company ownership and legal structure, hours of operation, products and services, suppliers, financial plans, etc.

- Marketing: Market analysis, market segmentation, competition, and pricing

- Appendix: Start-up expenses, cash flow statements, income statements, sales forecast, milestones, break-even analysis, etc.

The table of contents makes it easy to move to different sections of the document. And the text placeholders under each section provide clarity on the specific details required—making the process easier for users who may not be familiar with certain business terminology.

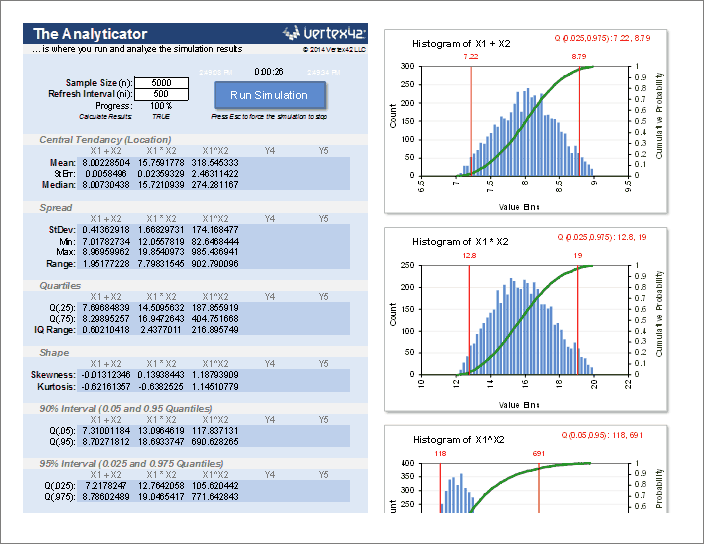

No business template roundup is complete without an Excel template. This business plan template lets you work on your business financials in Excel. It comes with customizable tables, formulas, and charts to help you look at the following areas:

- Highlight charts

- Market analysis

- Start-up assets and expenses

- Sales forecasts

- Profit and loss

- Balance sheet

- Cash flow projections

- Break-even analysis

This Excel template is especially useful when you want to create a clear and visual financial section for your business plan document—an essential element for attracting investors and lenders. However, there might be a steep learning curve to using this template if you’re not familiar with business financial planning and using Excel.

Try a Free Business Plan Template in ClickUp

Launching and running a successful business requires a well-thought-out and carefully crafted business plan. However, the business planning process doesn’t have to be complicated, boring, or take up too much time. Use any of the above 10 free business plan formats to simplify and speed up the process.

ClickUp templates go beyond offering a solid foundation to build your business plans. They come with extensive project management features to turn your vision into reality. And that’s not all— ClickUp’s template library offers over 1,000 additional templates to help manage various aspects of your business, from decision-making to product development to resource management .

Sign up for ClickUp’s Free Forever Plan today to fast-track your business’s growth! 🏆

Questions? Comments? Visit our Help Center for support.

Receive the latest WriteClick Newsletter updates.

Thanks for subscribing to our blog!

Please enter a valid email

- Free training & 24-hour support

- Serious about security & privacy

- 99.99% uptime the last 12 months

Professor Excel

Let's excel in Excel

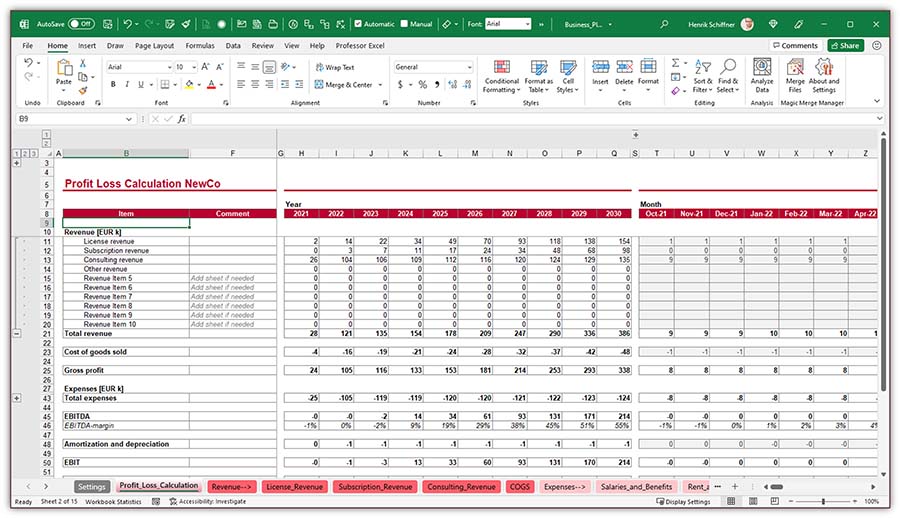

Business Plan: How to Create Great Financial Plans in Excel

I guess, you are about to write a business plan and that is why you have come to this page. Very good – because in this article I am going to write down my experience with business plans and what I have learned creating them with Microsoft Excel. As I will point out again further down, I will only concentrate on the financial part of business plans. Specifically, how to set it up in Excel. Of course, you can also download an Excel template .

Parts of business plans

As you reached this page I suppose you already have a rough idea of what a business plan is. So, we will skip this part here.

A business plan is a formal written document containing the goals of a business, the methods for attaining those goals, and the time-frame for the achievement of the goals.” https://en.wikipedia.org/wiki/Business_plan

But one comment concerning the scope of this article: The formal business plan has usually many different parts, in which you describe the business idea and product, the market, competition, legal construct and so on. But typically, investors are most interested in the financial part. They want to know first, what they can get out of it. Of course, the other parts are also very important, but the financial topics usually put everything described in the other sections into numbers.

I’m not going further into the details of all the other parts than then financial section here. Specifically, we will dive into the basics of the financial part and how to model it in Excel.

Please scroll down to download the business plan template. We are going to explore all the following advice with this template.

How to create a business plan in Excel

Advice 1: be clear about the purpose and the recipient of the business plan.

Before you start opening Excel, make sure that you are 100% clear of the purpose this business plan. Is the business plan just for you? Or do you create it for someone else, for example an investor or bank? Although the next steps might still be the same, the focus might be different. For example: Maybe you have a very good understanding of the major assumptions because you have been working in this field for some time. But for someone external you still need to validate them. Of course, in both cases the assumptions should be realistic and goals should be achievable. But maybe for your own peace of mind you would choose more pessimistic assumptions if the plan was only for you.

Advice 2: Go top-down in terms of line items

Now, let’s start in Excel. But how do we start?

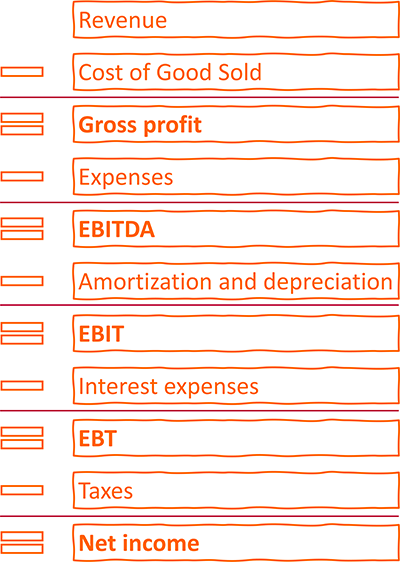

My approach is to go top-down. I usually use a basic P&L (“Profit- and loss” calculation) structure to start with, having some placeholders for revenue and costs.

Specifically, I go through the following parts (also shown on the right-hand side).

Let’s assume that you develop and sell Excel add-ins: 50 EUR per license – once-off. You would now start with assumptions of how many you can sell per month and the price. This is your first revenue item. At this point in time, I would leave it like this. We can later drill further down as much as we need (for example modeling discounts, the connection between marketing spending and number of units sold, price changes, etc.).

If we have multiple products, we calculate them in a similar manner.

Cost of goods sold

Cost of goods sold – or COGS – refers to the direct costs of producing the goods sold. Depending on the complexity you could also summarize cost of sales here or keep it separately.

Often, the COGS are directly linked to the number of units produced so you could refer to the numbers already calculated for the revenues.

In our example from above, we don’t have any direct costs for producing the Excel add-ins because we develop them ourselves and our salary will be regarded under “Salaries and Benefits”.

All other expenses

The structure of the expenses highly depends on your business. I usually start with these:

- Salaries and Benefits

- Rent and Overhead

- Marketing and Advertising

- Other expenses

Again, these items might look completely different for you. Example: if you travel a lot for your business, you might plan travel costs separately.

Subtracting costs from the revenue leads to the EBITDA (earnings before interest, taxes, depreciation, and amortization). This is one of the important financial performance indicators.

Amortization and depreciation

If you buy any assets for your business (for example machines, computers, even cars), you usually plan to use them over a certain period. When you first buy them, let’s say for 1,000 USD, you basically just exchange money for assets in the same amount. The problem: The assets will decrease in value the longer you use them. Within the cost items above, you don’t regard the acquisition value. So, how to regard them in your business plan?

You only regard the annual decrease of value. If you plan to use your 1,000 USD item for 5 years, you could (plainly speaking), each year regard 200 USD as depreciation.

Please note: If you later plan your cash, you have to make sure that you fully regard the initial sales price and not the depreciation.

The key difference between amortization and depreciation is that amortization is used for intangible assets, while depreciation is used for tangible assets. https://www.fool.com/knowledge-center/whats-the-difference-between-amortization-deprecia.aspx

Subtracting the amortization and depreciation from the EBITDA leads to the second key performance indicator, the EBIT (earnings before interest and tax).

Interest and taxes

Eventually, you have to prognose your interest costs (for example what you have to pay for bank loans) and your taxes, which is typically just a percentage of the EBT (the earning before taxes).

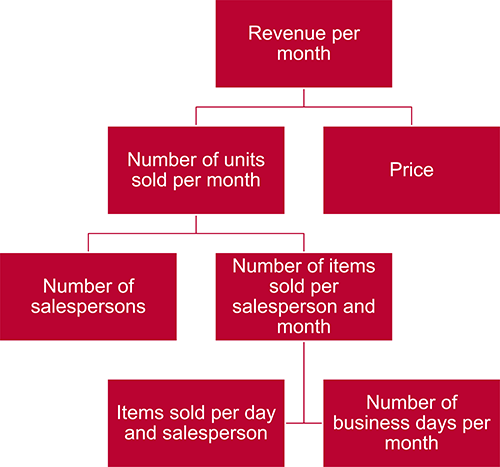

Advice 3: Think about the business drivers carefully

Good business plans are driver based.

Business drivers are the key inputs and activities that drive the operational and financial results of a business. Common examples of business drivers are salespeople, number of stores, website traffic, number and price of products sold, units of production, etc. https://corporatefinanceinstitute.com/resources/knowledge/modeling/business-drivers/

Let me explain with an example: You want to plan the revenues. You have two different options:

- Revenue per month is split into number of units sold times price per unit.

- Number of units sold is further split into number of salespersons and number of items sold per salesperson and month, and so on.

- Or you could just write a number and every following year you assume a growth in percentage (e.g. +2% per year).

Let’s finish this section with some final comments:

- Choose drivers that are measurable. You will most probably later on compare the drivers to reality and therefore make sure that they are not impossible to measure.

- Figure out, which driver has most impact. You should focus on those first. Driver with no or very limited impact can be skipped initially.

- Are drivers depending on each other? If yes, it should be modeled accordingly.

Advice 4: Choose the smallest period from the beginning in your business plan

So far, we have been focusing on the line items, for example costs, revenue, or drivers. Now, let’s talk about the time frame.

The question is: Should you plan on annual, monthly or any other basis? Or a mix?

I have seen many business plans doing it something like this:

- Plan on monthly basis for the first 24 to 36 months.

- Switch to annual planning for the years 3/4 to 5.

Most business plans are not going beyond 5 years planning period.

My recommendation: Plan on monthly basis for the full period. There will be a point in time when you need to break it down into months. And it is always easier to sum up 12 months for annual values than to drill down from years to months.

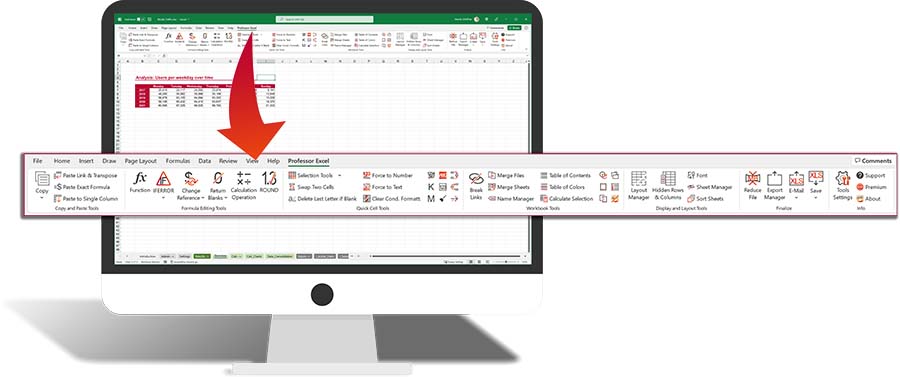

Do you want to boost your productivity in Excel ?

Get the Professor Excel ribbon!

Add more than 120 great features to Excel!

Advice 5: Keep a unified, professional business plan structure

This advice should count for most Excel models: Try to keep the same structure throughout the whole Excel file.

- Structure of worksheets: Make sure that most worksheets are set up with the same structure. For example, start with a headline in cell B2, years starting in column H, content in row 10.

- Layout / format of cells: Make sure you use a consistent formatting. For example, Excel provides cell styles – use them. For more recommendations about professional formatting, please refer to this article .

- Universal settings and assumptions should be consolidated on one sheet (for example tax rates, start date, company name).

Advice 6: Document business plan assumptions well

I can not say this often enough: Document your assumptions! Not only the values or variables, also your thoughts behind them. Why have you chosen this value? What is it based on? What is it used for?

Advice 7: Gross vs. net values

This question I am asked quite frequently: Should you use gross or net values? That means, include tax in revenues and costs?

Typically, you only work with net values, excluding VAT. For Germany with a tax rate of 19%, for example, if you invoice 119 EUR to a customer, you would only regard 100 EUR. Also, for costs, you would only regard net values.

Then, in your business plan, you start with revenue minus costs and eventually reach the EBT (earning before tax, please scroll up to see the P&L). From this, you calculate your company tax.

Advice 8: Think ahead

Some more things you should keep in mind when creating your business plan.

- Business plans are “living documents”. Keep in mind that at some point in the future you have to update it or extend it.

- Validate your assumptions: After some time, you will come back to your plan having real life figures. Now, it’s time to compare and – if necessary – adjust the plan.

- a valuation (“Discounted Cash Flow model”),

- liquidity planning,

- bank loan simulations,

- financial dashboards,

- budget planning,

- maybe even the first real official P&L (at least when it comes to the line items of your business plan)

- and much more…

Download business plan template

So, after reading all this description and advice, it’s time to start. Probably many things I have written above sounds like common sense, right? But I can assure you: Doing it and regarding as much advice as possible is not necessarily simple.

That’s why I have decided to create a template. I have pre-filled it with an imaginary example.

I know, there are countless Excel business plan templates around. So, why should you use this one?

- This template is very flexible: I have always included place holders so that you can add much more items if needed.

- In terms of the time frame, I have created monthly columns for up to ten years. Typically, you need less. Then just hide the extra columns.

- Also, I have created a consistent structure throughout the model.

- No fancy Excel functions and formulas, mainly just plain links.

Please feel free to take a look at it. If you like it, just use it. If not, please feel free to create your individual business plan – you now know how to do it!

Download link: Click here to start the download .

Image by koon boh Goh from Pixabay

Image by mohamed Hassan from Pixabay

Image by Memed_Nurrohmad from Pixabay

Henrik Schiffner is a freelance business consultant and software developer. He lives and works in Hamburg, Germany. Besides being an Excel enthusiast he loves photography and sports.

Leave a comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Privacy Overview

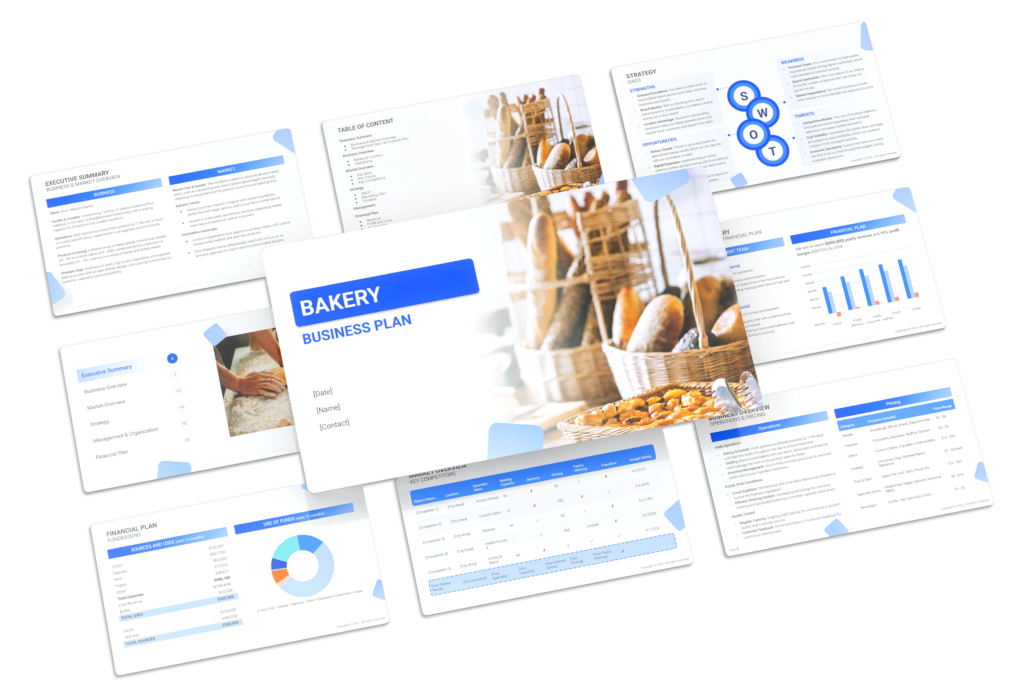

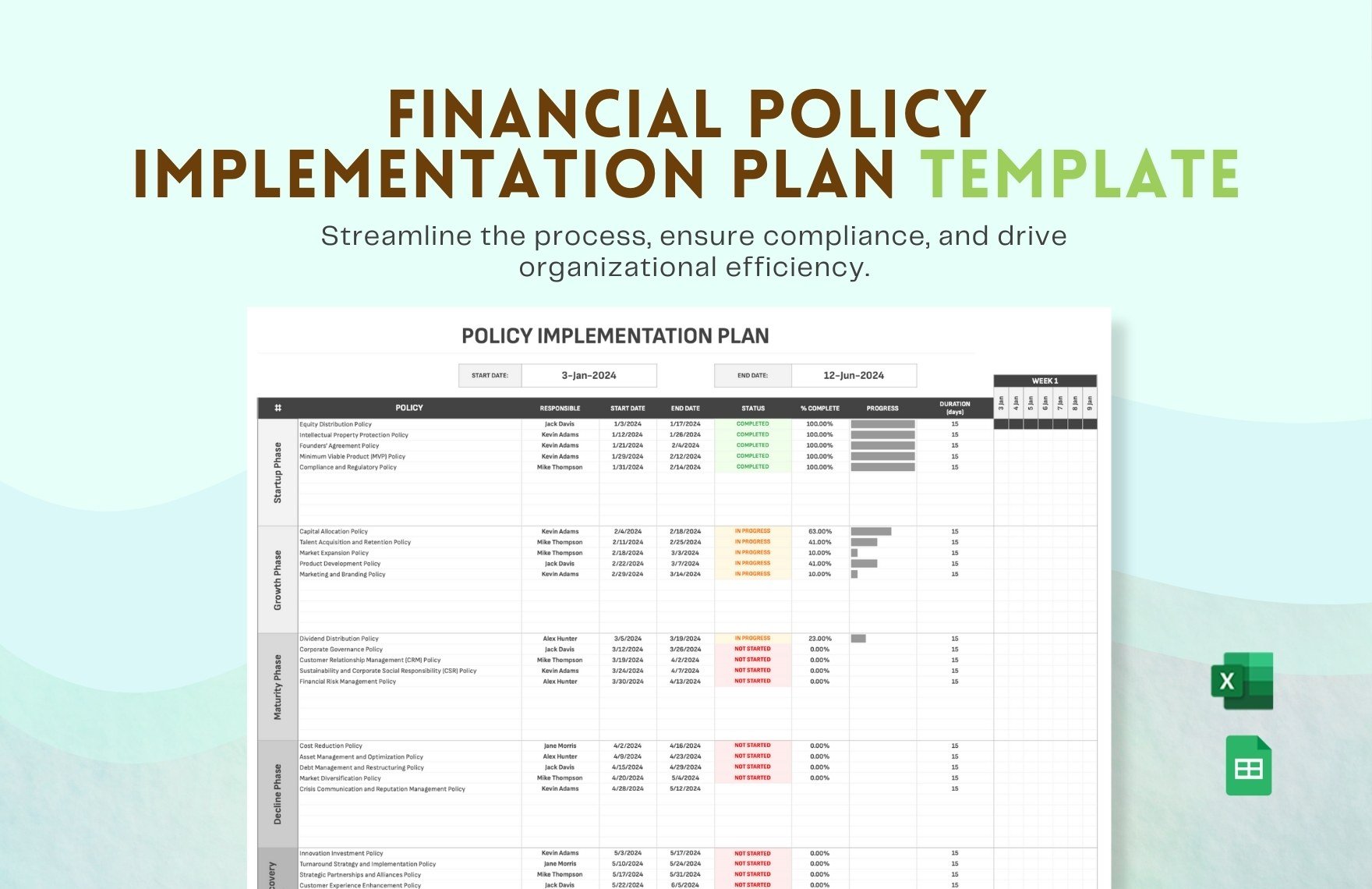

Expert-built business plan and financial model templates

Download the template for your business. Customise it. Get funded.

Try restaurant business plan ecommerce financial model Dunkin' Donuts franchise financial model

Trusted by 12,000+ entrepreneurs, consultants and investors

Vetted by professionals at leading organizations

BuSINESS PLANS

Professional powerpoint business plan templates to raise funding.

- 30+ slides already completed

- Business overview

- Updated market research

- Sales & marketing plan

- SWOT, competitive landscape

Financial models

Easy-to-use excel financial models for serious entrepreneurs.

- Profit and loss

- Cash flow statement

- Balance sheet

- Business valuation (DCF)

- 20+ charts and metrics

Privacy Overview

Create a business plan

You've been dreaming of starting your own business. You've started with some concrete steps, and you're ready to put your proposal together. But how do you start, and how do you know when you have the right information?

How to get it done

Create a business plan with templates in Word:

Start with a template

Download these templates from the Office Templates site to create your plan:

Fill in your Business plan .

Analyze your market with the Business market analysis template .

Detail your financials in a Financial plan .

Divide up the work and track deliverables with this Business plan checklist .

Wrap up with this Business startup checklist .

Need a little help?

Learn how to:

Start a document from a template .

Apply themes to change your plan's look.

Related resources

Related article

Must follow steps for starting a successful business

Buy Microsoft 365

Get Microsoft 365

Get help setting up

Training and in-person help

Need more help?

Want more options.

Explore subscription benefits, browse training courses, learn how to secure your device, and more.

Microsoft 365 subscription benefits

Microsoft 365 training

Microsoft security

Accessibility center

Communities help you ask and answer questions, give feedback, and hear from experts with rich knowledge.

Ask the Microsoft Community

Microsoft Tech Community

Windows Insiders

Microsoft 365 Insiders

Was this information helpful?

Thank you for your feedback.

Popular Keywords

Total Results

No Record Found

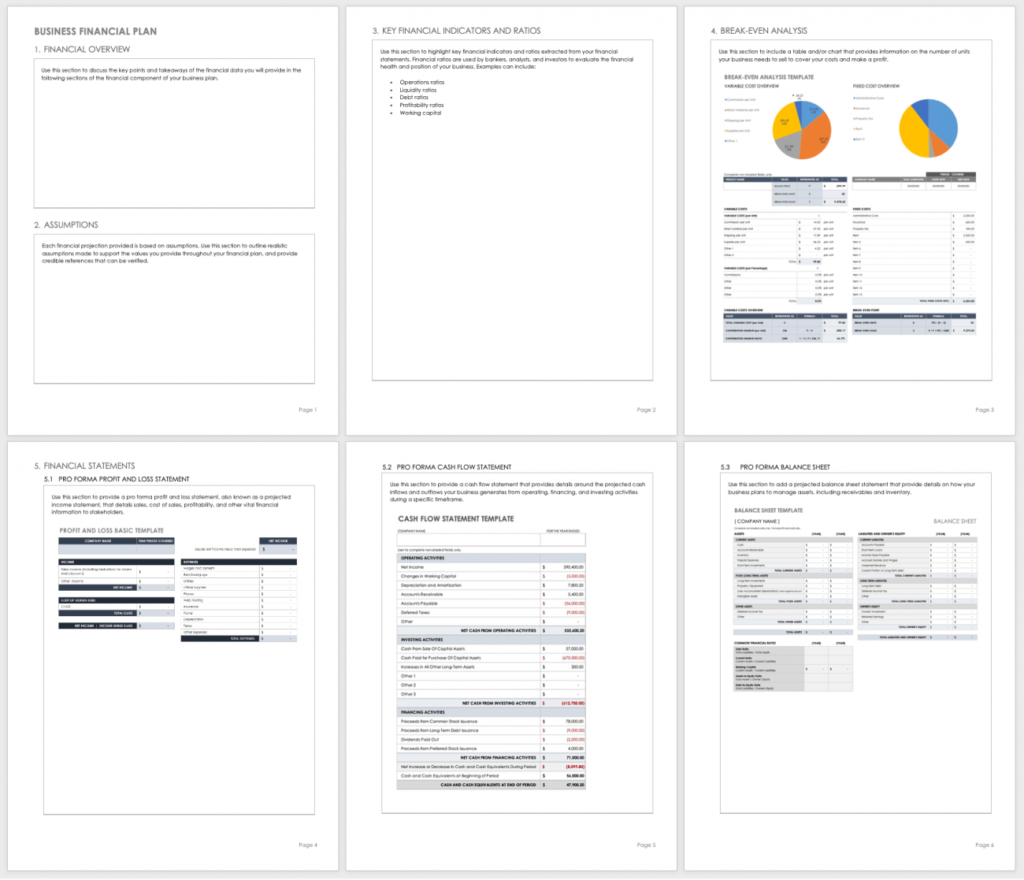

Home » Business management » Business Financial Plan

Download Business Financial Plan Template In Excel

- Accounting , Business management , Financial Management

Supercharging Your Strategy: Download The Business Financial Plan Template In Excel

Planning is paramount to business success. A detailed, robust financial plan not only paves the way for smooth operations but also acts as a roadmap for growth, investment, and potential risks. However, creating an exceptional financial plan can often seem a complex and overwhelming task. That’s where our Business Financial Plan Template comes in.

Overview of the Business Financial Plan Template

Our template is a comprehensive, easy-to-use tool designed to make financial planning as straightforward as possible. It includes multiple sections, each one tailored to capture critical aspects of your business financials. The sections are:

- Financial Overview: This is where you lay out your financial objectives and strategies.

- Financial Assumptions: Outline the assumptions made in creating the financial plan.

- Key Financial Indicators and Ratios: Highlight the important financial indicators that measure the health of your business.

- Break-even Analysis Report: A graphical presentation and tabular analysis that shows when your business is expected to start making a profit.

- Financial Statements: Detailed income statements, balance sheets, and cash flow statements.

- Pro Forma Cash Flow Statement: A projected cash flow statement that provides insight into your business’s future cash position.

- Pro Forma Balance Sheet: A projected balance sheet that helps you plan for future financial stability and potential risks.

The Benefits of Using the Business Financial Plan Template

Here are a few reasons why our Business Financial Plan Template is an excellent tool for businesses:

- Comprehensive: The template covers all the critical aspects of financial planning, ensuring you don’t overlook any crucial details.

- Ease of Use: No need for extensive financial planning experience – the template is designed to be simple, direct, and easy to use.

- Cost-Efficient: A free tool that gives you insights akin to professional financial planning without the hefty cost.

- Visual Representation: Graphical presentations and tabular analyses allow for better understanding and communication of your financial standing.

- Forecasting: Pro Forma Cash Flow and Balance Sheets give you a glimpse of future financial possibilities, allowing for more informed decision-making.

Who Can Use This Template?

Our Business Financial Plan Template is a versatile tool designed for anyone looking to create a detailed, effective financial plan. It’s perfect for:

- Startups: To attract investors, manage funds, and understand when they can expect to start making a profit.

- Established businesses: To analyze performance, strategize for growth, and communicate financial information to stakeholders.

- Consultants: To help clients create robust financial plans and provide valuable financial insights.

- Students: To learn about financial planning and apply theoretical knowledge to practical scenarios.

Financial planning is the backbone of any successful business strategy. It allows you to foresee challenges, strategize for growth, and communicate your business’s financial health to stakeholders. With our free Business Financial Plan Template, you have a comprehensive, easy-to-use tool at your fingertips. This template simplifies the often complex process of financial planning, allowing you to focus on what you do best: growing your business. Remember, good planning today leads to better results tomorrow. So download our template and start paving your path to business success.

Download this Business Financial Plan template in Excel Format

Our easy to use editable Excel templates and save your significant amount of time and effort. Here’s how to download and use one of our templates:

Download this free Excel Template : Once you’ve browsed through our collection of templates and find the one that best fits your needs. Once you’ve found the template you want, click on the download button.

Replace sample data with your actual data: Once the template is downloaded, open it in Excel. You’ll see that it is already set up with sample data. To start analyzing your own data, simply replace the sample data with your actual data.

Customize the template: Our templates are completely editable, which means you can customize them to fit your specific needs. For example, you can change the formatting, add or remove columns, or create new charts and graphs.

Use the Excel template: Once you’ve fed in your data and customized the template, you’re ready to start using it for data analysis. Use the various tools and features of Excel to analyze and visualize your data, and make informed business decisions.

Save and share: Once you’ve finished working on the template, save it to your computer and share it with other members of your team or stakeholders as needed.

Click Download Button To Get Business Financial Plan Excel Template

Instruction :

All Excel templates and tools are sole property of xlsxtemplates.com. User can only download and use the excel templates for their Personal use only. All templates provided by XLSX templates are free and no payment is asked. However, you are not allowed to distribute or share in any other website for sole purpose of generating revenue from it.

You can also download and use our 1000 Best PowerPoint Presentation Templates and 500 Resume Samples from PPTXTemplates.com Completely Free. All our templates are designed by Professionals

- Tags budget excel template free download , business plan template , download excel invoice template free , download excel templates , excel budget template , excel business financial plan template , excel business planner template , excel financial template , excel template , excel templates , excel templates for business , excel templates free download , financial model excel , financial projection template for a business plan , invoice excel template free download

Business Financial Plan Template

Excel Template Category

Business management, data analysis, decision matrix, educational, event budget, excel addins, excel chart, excel planners, excel templates, federal income tax, financial calculator, financial management, financial statement, gantt chart, gst templates, health and fitness, home & personal, human resource, inventory management, invoice templates, list & checklist, personal finance, project management, sales & marketing, social media, timesheet & payroll, download free editable excel templates | popular templates.

Insurance Quote

Introduction: Streamlining Insurance Quotations An insurance quote is a vital document in the insurance industry, serving as a preliminary estimate of premiums for potential clients.

Freelance Quotation

Introduction: Mastering Freelance Quotations In the world of freelancing, creating an effective quotation is crucial for outlining the scope and cost of your services to

Fencing Quotation

Introduction: Navigating Fencing Service Quotations A fencing service quotation is an essential tool for businesses in the fencing industry. It provides potential clients with a

Event Planning Quotations

Introduction: Excelling with Event Planning Quotations An event planning quote is a critical document for event planners, detailing proposed services and costs for organizing an

Construction Quote

Introduction: Optimizing Construction Quotations A construction quote is a fundamental document in the construction industry, serving as a formal proposal of costs for construction services

Cleaning Quote

Introduction: Perfecting Cleaning Service Quotations Creating an effective cleaning service quotation is crucial in the cleaning business. It serves as a formal proposal outlining the

Free editable professional Excel templates can be a useful tool for businesses , organizations, and individuals looking to streamline their data management and reporting processes. These templates can provide a pre-designed and pre-formatted framework for storing and organizing data, as well as for creating charts, graphs, and other visualizations to help communicate that data more effectively.

One advantage of using professional Excel templates is that they are often designed by experienced professionals who understand best practices for data management and visualization. This means that the templates are likely to be well-organized, easy to understand, and aesthetically pleasing, which can make working with them more efficient and enjoyable.

Another advantage is that these templates are often fully editable, allowing users to customize them to meet the specific needs of their organization or project. This can include adding or deleting rows and columns, changing the formatting and layout, and adding custom formulas and functions .

Some examples of professional Excel templates that may be available for free include budgeting templates for personal or business use , project management templates for tracking tasks and deadlines, and sales tracking templates for analyzing and forecasting sales data. There are also a wide variety of templates available for specific industries, such as real estate, marketing , human resource , Payroll management and among others.

Overall, free editable professional Excel templates can be a valuable resource for anyone looking to improve their data management and analysis skills. By providing a pre-designed and customizable framework for storing, organizing, and visualizing data, these templates can help users save time and make more informed decisions.

Free Excel Templates

Welcome to Excel Templates – your ultimate destination for all things related to Excel! We pride ourselves on being a comprehensive, 100% free platform dedicated to providing top-notch, easily editable Excel templates, step-by-step tutorials, and useful macro codes. With fresh templates uploaded daily, we aim to meet every conceivable Excel need you may have. Whether you’re a student, a business professional, or someone looking to make sense of their data, our range of templates has you covered. Dive into the world of Excel Templates today and transform your number-crunching experience into an effortless journey of discovery and efficiency. Join our growing community and elevate your Excel game now.

- Basic Excel Tutorials

- Excel Formulas

- Excel Shortcuts

- Advance Excel Tips

- Finance Tips

- Excel Macros Codes

- Pivot Table Tips

DMCA Policy

Privacy Policy

© 2023 xlsxtemplates all rights reserved

Financial management

Keeping your finances in check is easy to start-and maintain- when you use an excel budget planning template in your financial management routine. customize an excel template to suit your unique financial management needs, whether you're balancing the books of a small business or keeping track of your household budget..

Budget your personal and business finances using these templates

Manage your finances using Excel templates. Stay on track for your personal and business goals by evaluating your income and expenses. Use these templates to add in pie charts and bar graphs so that you can visualize how your finances change over time. Create infographics that show what categories are included in your budget and the types of factors that incorporate each category. Download your financial management template so that you can access it and edit it as you need.

FinModelsLab

Industry-Specific Financial Model Templates in Excel

Food & Beverage Financial Models

Healthcare Financial Models

Agriculture Financial Models

Marketplace Financial Models

Hospitality Financial Models

E-Commerce Financial Models

Beauty & Sport Financial Models

Subscription Box Financial Models

Real Estate Financial Models

Services Financial Models

Retail Financial Models

Software as a Service Financial Models

- Financial Models

- Business Plans

Restaurant Financial Model

Boutique hotel financial model, clinic financial model, saas financial model, grocery marketplace financial model, medical practice financial model, hotel financial model, dropshipping financial model, massage therapy financial model, solar panel financial model, clothing manufacturing financial model, brewery financial model, medical equipment manufacturing financial model, fintech financial model, frozen food financial model, e-commerce financial model, cannabis financial model, juice production financial model, mobile application financial model, daycare financial model, meat processing plant financial model, coffee roasting financial model, consulting agency financial model, digital marketing agency financial model, financial model for 3 statements, 3 statement projection tool, three-way financial analysis model, three statement financial plan, vegetables farming financial model, our happy customers.

I have been doing capital raising in a wide variety of industries and have been involved on 4 Private Equity Funds. Financial models tend to be either too simplistic or too complicated and useless. But this model is the perfect mix of simplistic and intuitive with enough detail for large project funding analysis. It could even be used as a budgeting tool for smaller mining companies. Well Done! And Thank You very much!

Great financial model template with the most complete set of charts that will ever need! Monthly breakdowns for all the financial statements and a cash valuation. Summary tabs with all the main information you need for a business plan! Could be improved with the addition of financial ratios.

What an incredible find in FinModelsLab! The ASC model is perfect for modeling our healthcare practice… enthusiastically recommend!!!

The spear sheet is just what I needed. I am able to plug in my numbers and the video shows you where to place all information. I can now send the pro-forma to investors. Love it thank you

Henry was a life-saver. If you have a very difficult financial modeling project that you need delivered fast, go with Henry. He will get it done.

Henry is very good at forecasting and business modelling. His communication and responsiveness are excellent.

Henry was the best financial expert for us when it came to financial analysis and building financial complex models for our start-up.

Excellent CFO I have ever come across. He has an eye to detail and is an expert when to comes to financial modeling & planning.

A complete and easy to use Restaurant financial model that gives you clear view and guide when preparing business plan numbers

I really feel there is no finance challenge Henry can't overcome, and I look forward to working with him on many more projects and entrepreneurial initiatives.

Henry is incredibly talented and hard working. He is one of the top-notch players in his niche, He pushed out a rock solid deliverable.

Industry-specific Financial Model Templates in Excel, Business Plan Templates, Excel Dashboards and Pitch Decks

FinModelsLab provides a wide range of industry-specific financial model templates in Excel as well as Excel dashboards, Business Plan Templates, and Pitch Deck Templates. Creating a business plan with detailed financial projections and pitch deck presentation or Excel dashboard is time-consuming. That is why we created a web repository with 1500+ business templates for a wide range of usage cases. We spent 10 000+ hours creating industry-specific financial forecasting model templates in Excel which offers a well-structured as well as best practice financial modeling know-how to users such as c-level executives, entrepreneurs, investors, startup founders, and many more, who are looking for assistance in creating financial projections template.

In today's fast-paced business landscape, effective financial modeling and planning are crucial for the success and growth of any organization. With accurate financial projections, businesses can make informed decisions, secure funding, and navigate potential challenges with confidence. At FinModelsLab, we understand the significance of financial modeling, which is why we offer a comprehensive collection of industry-specific financial model templates in Excel.

The Importance of Financial Modeling

Financial modeling serves as the foundation for strategic decision-making, providing insights into the financial health and performance of a business. It allows organizations to forecast revenue, project expenses, assess profitability, and evaluate potential risks and opportunities. By modeling different scenarios, businesses can optimize their resources, identify growth strategies, and plan for the future.

Addressing the Need for Industry-Specific Templates

Generic financial templates may not capture the unique requirements and dynamics of specific industries. That's where industry-specific financial model templates become invaluable. At FinModelsLab, we recognize the importance of tailoring financial models to the nuances of different sectors. Our extensive collection includes a wide range of industry-specific templates, ensuring that businesses have the tools they need to accurately project revenues, analyze costs, and plan for success in their respective sectors.

- Comprehensive financial model templates designed for specific industries.

- Templates catering to diverse sectors such as manufacturing, e-commerce, healthcare, and more.

- Industry-specific financial model templates for startups, small businesses, and established enterprises.

By providing industry-specific financial model templates, we empower businesses to make informed decisions based on reliable and relevant data, ultimately increasing their chances of success in the marketplace.

About FinModelsLab

At FinModelsLab, we pride ourselves on being a trusted and reliable source for financial model templates. With our commitment to excellence and a comprehensive collection of over 3500+ business templates, we empower entrepreneurs, startups, investors, and professionals to create accurate and detailed financial projections.

Reliable Financial Projections Templates

Our platform offers a vast selection of financial projections templates that cater to various industries and business models. Each template is designed by our team of financial experts, ensuring that they meet industry standards and best practices. Whether you are starting a new venture or seeking to optimize your existing business, our templates provide a solid foundation for projecting revenues, estimating costs, and analyzing profitability.

A Wide Range of Business Templates

With a collection of 3500+ business templates, we cover a diverse range of industries, including manufacturing, e-commerce, SaaS, healthcare, and more. Our templates address different aspects of financial modeling, such as cash flow analysis, income statements, balance sheets, and valuation models. This comprehensive assortment enables users to find the templates that best align with their specific business needs.

- 3500+ business templates available for different industries and usage cases.

- Templates for startups, small businesses, investors, and c-level executives.

- Templates covering various financial aspects, including cash flow, income statements, and valuation models.

With FinModelsLab, you can access a wide range of financial projections templates and find the resources necessary to make informed financial decisions for your business.

Expertise and Dedication

At FinModelsLab, we have invested over 10,000 hours of meticulous effort and dedication into creating our financial model templates. This extensive investment of time and expertise reflects our commitment to providing high-quality resources for financial modeling and planning.

Well-Structured Financial Model Templates

Our financial model templates are designed with a well-structured framework that follows industry best practices. Each template encompasses a comprehensive set of financial projections, ensuring that businesses can accurately forecast revenues, expenses, and cash flows. By leveraging our well-structured templates, users can save time and effort, focusing on analyzing the data rather than building models from scratch.

Best Practice Financial Modeling Knowledge

Our team of financial experts brings in-depth knowledge and expertise in financial modeling. We follow best practices and incorporate industry standards into our templates, ensuring that users have access to reliable and accurate financial projections. Whether you are a c-level executive, entrepreneur, investor, or professional seeking robust financial models, our templates provide the necessary guidance and insights to support your decision-making process.

Serving a Diverse Audience

Our financial model templates cater to a diverse audience, including c-level executives, entrepreneurs, investors, and professionals from various industries. We understand the unique needs and challenges faced by different stakeholders, and our templates are tailored to address those requirements. By serving a wide range of users, we aim to empower businesses of all types and sizes to make informed financial decisions and achieve their goals.

- Financial model templates for c-level executives, entrepreneurs, and investors.

- Templates designed to meet the diverse needs of different industries and usage cases.

- Best practice financial modeling knowledge incorporated into every template.

With our expertise and dedication, FinModelsLab strives to provide users with the necessary tools and knowledge to excel in financial modeling and planning.

Benefits of Using Financial Model Templates

Utilizing financial model templates offers significant advantages when it comes to creating accurate financial projections for your business. At FinModelsLab, we understand the importance of these benefits and strive to provide users with the resources they need to succeed.

Accurate Financial Projections Made Easy

Our financial model templates are specifically designed to assist users in creating accurate financial projections. By leveraging these templates, businesses can input their data and variables, which are then automatically calculated to generate comprehensive projections. This process reduces the risk of errors and ensures that the resulting financial projections are reliable and precise.

Time-Saving Pre-Built Templates

Time is a valuable resource for any business, and our pre-built financial model templates help save significant time and effort. Instead of starting from scratch, users can access ready-to-use templates that already include the necessary formulas, calculations, and structure. This allows users to focus on analyzing the projections and making informed decisions, rather than spending excessive time building complex financial models.

Convenience and Ease of Excel for Financial Modeling

Excel has long been recognized as a powerful tool for financial modeling, and our templates capitalize on this convenience. With Excel as the foundation, users can benefit from a familiar and user-friendly interface, making it easier to work with the templates and customize them according to their specific needs. Excel also provides flexibility for users to adapt the templates as their business evolves, ensuring the models remain relevant over time.

- Templates designed to assist in creating accurate financial projections.

- Pre-built templates save time and effort by eliminating the need to start from scratch.

- Excel-based templates provide a convenient and user-friendly platform for financial modeling.

By utilizing our financial model templates, businesses can leverage the benefits of accuracy, time-saving efficiency, and the convenience of working with Excel, ultimately aiding in their financial planning and decision-making processes.

Wide Range of Templates

At FinModelsLab, we offer a diverse selection of financial model templates to cater to various industries and specific business needs. Our extensive range ensures that businesses can find templates tailored to their industry, whether they are a startup, small business, or established enterprise.

Diverse Selection of Industry-Specific Templates

We understand that different industries have unique financial considerations. That's why we provide a wide range of industry-specific financial model templates. From manufacturing to e-commerce, healthcare to SaaS, our templates cover various sectors, ensuring that businesses can create accurate financial projections that align with the dynamics of their industry. These industry-specific templates include revenue forecasts, expense breakdowns, and other relevant financial data, allowing businesses to gain valuable insights and make informed decisions.

Relevance for Startups and Financial Planning

Startups face unique challenges and financial planning is crucial for their success. Our templates include startup-specific financial model templates designed to assist entrepreneurs in their financial planning journey. These templates consider the specific needs of startups, including revenue drivers, cost structures, and funding requirements. By utilizing our startup financial model templates, entrepreneurs can create comprehensive financial projections, pitch to investors, and develop a solid financial strategy for their business.

- A wide range of industry-specific financial model templates.

- Templates catering to startups with startup-specific financial projections.

- Templates covering various industries, including manufacturing, e-commerce, healthcare, SaaS, and more.

Whether you are starting a new venture or operating an established business, our diverse selection of financial model templates ensures that you have the resources needed to create accurate financial projections and drive your business forward.

Importance of Financial Statements

Financial statements play a vital role in business plans, providing a comprehensive view of a company's financial health and performance. At FinModelsLab, we understand the significance of financial statements and offer templates that facilitate the creation of robust and accurate financial statements for your business plan.

Significance of Financial Statements in Business Plans

Financial statements are essential components of any business plan as they present a clear picture of a company's financial position. These statements, including the income statement, balance sheet, and cash flow statement, allow stakeholders to assess the company's profitability, liquidity, and overall financial stability. Financial statements provide crucial information for investors, lenders, and potential partners, aiding in informed decision-making and demonstrating the viability and potential of the business.

Creating Comprehensive Financial Statements with Templates

Our templates are specifically designed to assist users in creating comprehensive financial statements for their business plans. These templates offer a structured framework and predefined formulas that simplify the process of compiling financial data and generating accurate statements. By utilizing our templates, users can input their financial information, and the templates automatically calculate key metrics and generate professional-looking financial statements. This ensures that your business plan is well-supported with accurate and visually appealing financial information.

- The significance of financial statements in business plans for assessing financial health and performance.

- Templates designed to aid in the creation of comprehensive financial statements.

- Financial statements as crucial components for investors, lenders, and potential partners.

With our financial statement templates, you can confidently present a clear and compelling financial snapshot of your business, showcasing its potential and strengthening your business plan.

Excel-Based Financial Templates

At FinModelsLab, we provide a wide range of financial templates that are specifically designed in Excel format, offering users easy customization and flexibility. Our Excel-based templates empower businesses to create accurate and tailored financial models, enabling effective financial planning and decision-making.

Easy Customization and Flexibility

All our financial templates are available in Excel format, which provides users with the ability to easily customize and adapt the templates to suit their specific needs. Excel's intuitive interface allows users to input their own data, adjust formulas, and make modifications as required. Whether it's adding new variables, changing assumptions, or incorporating specific industry metrics, Excel enables users to tailor the templates to their unique requirements, ensuring that the resulting financial models are precise and relevant to their business.

Advantages of Using Excel for Financial Modeling

Excel has long been recognized as a powerful tool for financial modeling, and there are several advantages to utilizing it for your financial planning needs. Excel offers a wide range of built-in functions and formulas, making complex calculations and projections more accessible. Its spreadsheet format provides a structured and organized way to present and analyze financial data, allowing for easy data entry, manipulation, and visualization. Excel's widespread familiarity among professionals also ensures that users can collaborate, share, and present their financial models seamlessly.

- Templates provided in Excel format for easy customization and adaptability.

- Excel's flexibility allows users to tailor templates to their specific needs.

- Advantages of using Excel include built-in functions, structured presentation, and widespread familiarity.

By leveraging our Excel-based financial templates, businesses can benefit from the ease of customization, flexibility, and the robust capabilities of Excel, ultimately enabling them to create accurate and dynamic financial models that drive better financial planning and decision-making.

Financial Forecasting and Planning

Financial forecasting plays a crucial role in effective business planning and decision-making. At FinModelsLab, we recognize the significance of financial forecasting, and we offer a wide range of forecast templates in Excel format to assist businesses in their financial planning endeavors.

The Role of Financial Forecasting in Business Planning

Financial forecasting is a vital component of business planning as it allows organizations to anticipate future financial outcomes based on historical data, market trends, and key assumptions. By creating comprehensive financial forecasts, businesses can gain valuable insights into revenue projections, expense management, and cash flow dynamics. These forecasts help in identifying potential risks, setting realistic targets, and making informed strategic decisions to drive business growth.

Availability of Forecast Templates in Excel

Our forecast templates, available in Excel format, provide businesses with a convenient and efficient way to create accurate financial forecasts. These templates are designed to simplify the forecasting process by incorporating pre-built formulas and intuitive interfaces. Users can input their data, adjust variables, and instantly generate forecasts based on different scenarios. The flexibility of Excel allows for easy customization of the templates to align with specific business needs, ensuring that the resulting forecasts are tailored and reliable.

- The importance of financial forecasting in business planning and decision-making.

- Forecast templates available in Excel format for convenient and accurate financial forecasting.

- Financial forecasts as valuable tools for identifying risks, setting targets, and making strategic decisions.

By utilizing our forecast templates in Excel, businesses can streamline their financial forecasting processes, gain valuable insights, and enhance their overall planning capabilities.

Tailored for Startups

At FinModelsLab, we understand the unique financial planning needs of startups, and we offer a range of templates specifically tailored to meet those needs. Our startup-specific financial projections templates provide startups with a solid foundation for their financial planning and enable them to make informed decisions to drive growth and success.

Relevance of the Templates for Startups' Financial Planning

Startups face distinctive challenges and requirements when it comes to financial planning. Our templates address these specific needs by providing startup founders and entrepreneurs with a comprehensive framework to forecast revenue, estimate expenses, and project cash flow. These templates incorporate startup-specific assumptions and variables, allowing startups to create accurate financial projections that align with their business models, growth strategies, and funding requirements.

Startup-Specific Financial Projections Template

Our startup-specific financial projections template is a valuable resource for startups seeking to create robust financial forecasts. This template encompasses key startup metrics, such as customer acquisition costs, customer lifetime value, and funding rounds, to accurately project revenue, expenses, and funding needs over a defined period. By leveraging this template, startups can effectively communicate their financial projections to potential investors, demonstrate their growth potential, and secure the funding necessary to fuel their development.

- Templates specifically tailored to meet the unique financial planning needs of startups.

- Importance of accurate financial projections for startups to make informed decisions.

- Startup-specific financial projections template incorporating key startup metrics.

Our startup-focused templates empower entrepreneurs and startup founders to navigate the financial landscape with confidence, ensuring that their financial planning aligns with their business goals and positions them for long-term success.

Excel-Based Financial Modeling

Excel is a powerful tool for financial modeling, and at FinModelsLab, we leverage the capabilities of Excel to provide comprehensive and effective financial model templates. Our Excel-based financial models offer numerous benefits for businesses, empowering them to make informed financial decisions and drive success.

Benefits of Using Excel for Financial Modeling

Excel provides a range of benefits that make it an ideal platform for financial modeling. Its built-in functions and formulas allow for complex calculations, enabling accurate financial projections and analysis. The spreadsheet format of Excel provides a structured and organized way to present and manipulate financial data, making it easier to input and track variables, assumptions, and key metrics. Excel's flexibility also allows for scenario analysis, sensitivity testing, and the creation of dynamic charts and graphs, enhancing the visibility and understanding of financial models.

Availability of Excel Financial Model Templates

Our Excel financial model templates provide businesses with ready-to-use frameworks for various financial modeling purposes. These templates are designed to streamline the financial modeling process, incorporating best practices and industry-specific assumptions. By leveraging our Excel financial model templates, businesses can save valuable time and effort in building their own models from scratch, while still having the flexibility to customize and adapt the templates to their specific needs.

- Excel's capabilities for complex calculations, accurate projections, and analysis.

- The structured format of Excel for organized financial data management.

- Excel's flexibility for scenario analysis, sensitivity testing, and visual representation.

- Availability of ready-to-use Excel financial model templates for streamlined financial modeling.

By utilizing our Excel-based financial model templates, businesses can harness the power of Excel and benefit from its robust features to create accurate, dynamic, and customizable financial models that drive better financial decision-making and planning.

In today's competitive business landscape, financial modeling is essential for informed decision-making and successful planning. At FinModelsLab, our industry-specific financial model templates in Excel offer a range of benefits to empower businesses and individuals in their financial projections and planning endeavors.

Reaping the Benefits of Industry-Specific Financial Model Templates

Our industry-specific financial model templates provide users with a host of advantages. By utilizing these templates, businesses can save valuable time and effort, as our templates are pre-built with best practices and industry-specific assumptions. This enables users to create accurate and reliable financial projections that align with their unique needs and goals. Whether you are a c-level executive, entrepreneur, investor, or startup founder, our templates offer a well-structured and comprehensive financial modeling know-how, supporting your financial planning and decision-making processes.

Explore Our Wide Range of Templates

We invite you to explore our extensive collection of 3500+ business templates, including financial modeling Excel templates and financial projections template Excel. Our diverse selection ensures that you will find the right template for your industry and specific use case. Whether you are starting a new venture, seeking funding, or managing an existing business, our templates provide the foundation you need for accurate financial projections and comprehensive planning.

- The benefits of using industry-specific financial model templates for informed decision-making and successful planning.

- Time-saving advantages through pre-built templates with best practices and industry-specific assumptions.

- Wide range of 3500+ business templates, including financial modeling Excel templates and financial projections template Excel.

Begin your journey towards effective financial modeling and planning by exploring our wide range of templates. Empower your business with accurate financial projections and make confident decisions to drive growth and success.

Why is a Financial Plan Important to Your Small Business?