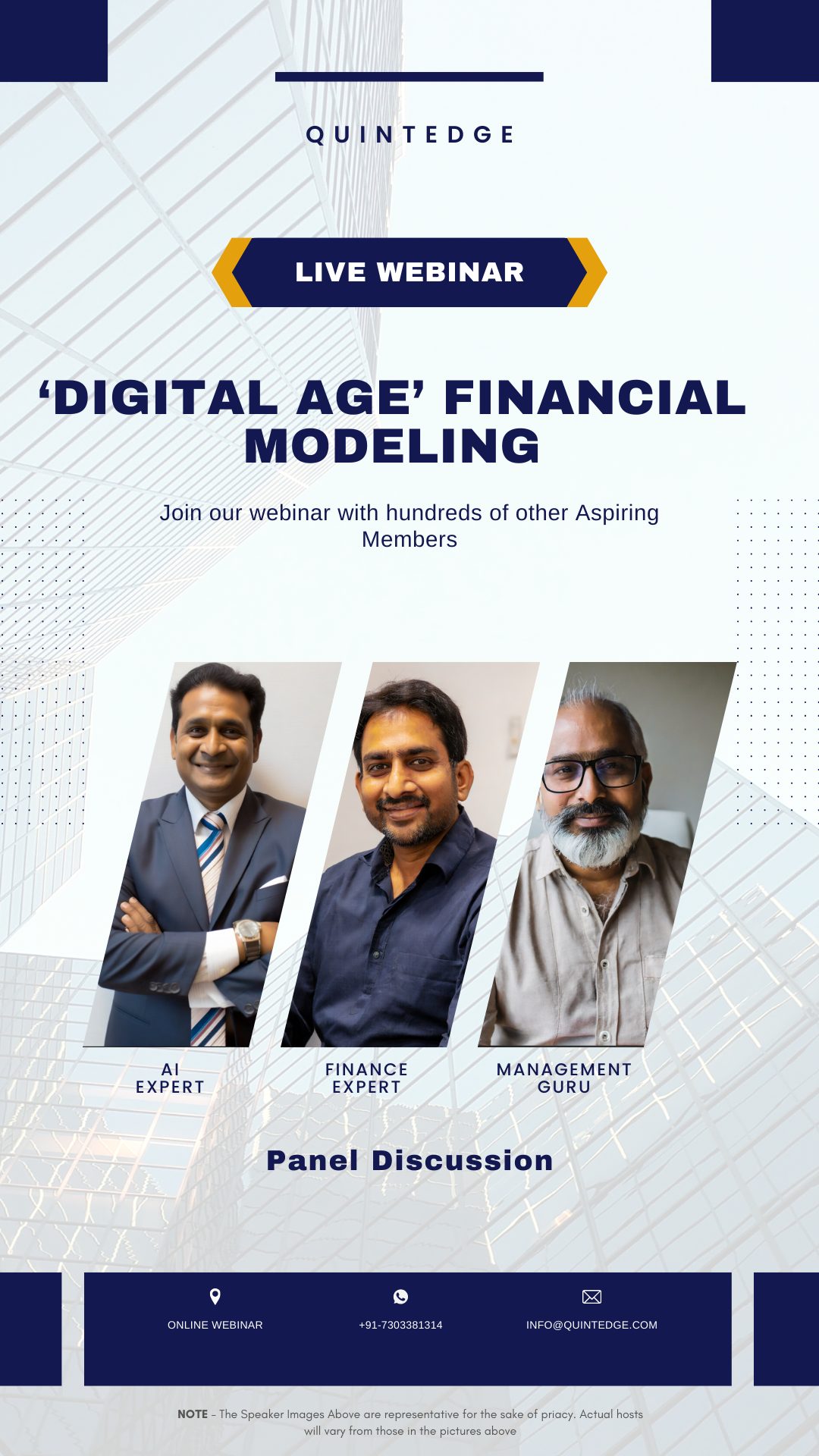

Advance Your Finance Career

The ultimate finance certification platform to enhance your career. Obtain the necessary skills, tools, and resources to become a certified financial analyst, investment banker, or investment analyst.

Start Learning For Free

Build expertise with 365 financial analyst.

Enroll in Expert-Led Online Finance Courses

Acquire Verifiable Career Certificates

Build a Strong Financial Analyst Resume

Discover New Job Opportunities

Our Graduates Work At

Choose the best career track for you.

Financial analyst jobs demand strong accounting, financial forecasting, analysis, and reporting abilities. Acquire the necessary knowledge and skills to build a financial analysis career.

Acquire the expertise to research, evaluate and analyze investment prospects and become a highly valued investment analyst or associate.

Develop the skills for this challenging career by learning financial modeling, investment banking, and corporate finance.

Four Steps to Landing Your Dream Job in Finance

365 Financial Analyst provides you with the tools and resources to become a highly sought-after financial analyst, investment banker, or investment analyst.

Get on the Right Career Track

Enjoy a structured learning journey with our financial analyst, investment banker, and investment analyst career tracks.

Pass the Exams

Test what you’ve learned in our finance courses and prove you can apply the acquired skills.

Obtain Verifiable Certificates of Achievement

Receive a 365 Financial Analyst certification that validates your proficiency in the field and catches the attention of employers.

Build a Standout Resume

Create a professional and compelling resume with our resume builder to increase your chances of securing your dream job in finance.

Ready to Launch Your Finance Career?

Choose from various online finance courses on financial analysis, investment banking, business analysis, accountancy, private equity analysis, asset management, credit risk analysis, business control, and auditing.

Featured Courses

Data Analysis with Excel Pivot Tables

Learn how to work with pivot tables and create world-class business analysis and reporting.

Math for Finance

Learn how to apply mathematical concepts and techniques in finance through real-world case studies and hands-on exercises. Acquire the skills and knowledge to navigate the complex financial landscape and make informed decisions in this high-stakes field.

Financial Ratio Analysis

In this course, you will learn to evaluate a company’s financial position and overall performance using ratio analysis. We will guide you through the process of calculating and interpreting various efficiency, liquidity, solvency, profitability, and valuation multiples.

Corporate Finance

Learn through hands-on projects how corporate finance adds value to the company. We study the principles of corporate finance, including capital budgeting, cost of capital, working capital management, and ESG investing.

Investment Banking

An inside look into the investment banking industry. Learn how investment bankers create value for clients and why companies pay millions for such services as IPO, debt underwriting, M&A, corporate restructuring, and asset management.

Founder’s Note

Over the years, 365 has provided financial training to thousands of people worldwide. We used the gained experience to create the best learning journey for you. The fact that you’re here means the world to us. I hope you find value and enjoy using the 365 Financial Analyst platform and that one day, we will connect on LinkedIn, and I will see you have achieved success in building your ideal career in finance.

Nedko Krastev

Co-Founder and CEO at 365 Financial Analyst

Sign Up to Continue

- Search Search Please fill out this field.

What Is a Financial Analyst?

Areas of work.

- Skills and Education

- Exams to Take

Types of Analyst Positions

Median salary.

- Job Outlook

- What to Expect

- Opportunities

Skill Set for Success

The bottom line.

- Career Advice

How to Become a Financial Analyst

:max_bytes(150000):strip_icc():format(webp)/troypic__troy_segal-5bfc2629c9e77c005142f6d9.jpg)

Katie Miller is a consumer financial services expert. She worked for almost two decades as an executive, leading multi-billion dollar mortgage, credit card, and savings portfolios with operations worldwide and a unique focus on the consumer. Her mortgage expertise was honed post-2008 crisis as she implemented the significant changes resulting from Dodd-Frank required regulations.

A financial analyst makes recommendations on prospective investments based on an examination of the data about a company, an industry, or a sector. The financial analyst may work for a bank, insurance company, real estate investment brokerage, or other data-driven business.

A financial analyst researches macroeconomic and microeconomic conditions along with company fundamentals to make a judgment about the potential success of an investment. They recommend a course of action, such as buying or selling stock, based on the past performance and future outlook of the company that issues it.

Financial analysts work in junior and senior capacities within a firm, and it is a niche that often leads to other career opportunities.

Key Takeaways

- A financial analyst pores over data to identify business opportunities or make recommendations on proposed actions.

- Junior analysts spend much of their time on data gathering, financial modeling, and spreadsheet maintenance.

- Senior analysts may spend time developing investment theses, speaking with company management teams and other investors, and marketing ideas.

- A bachelor's degree in math or a finance-related major is commonly sought.

The financial analysts who are best known to the public evaluate individual stocks and bonds and present their conclusions to prospective investors. However, there are financial analysts at work in many other areas of business.

For example, businesses that use the franchise model often employ financial analysts to track individual franchises or groups of franchises within a geographic region. The analysts determine where the strengths and weaknesses lie and make profit and loss forecasts.

An analyst must be aware of current developments in the field in which they specialize and prepare financial models to predict future economic conditions for any number of variables.

Required Skills and Education

The qualifications to become a financial analyst are less rigid and well-defined than those of many high-paying careers. Unlike law and medicine, there are no standard educational requirements. Some roles require licenses but this varies among employers and specializations.

A bachelor's degree—preferably with a major in economics , finance , or statistics —has become a de facto requirement for becoming a financial analyst. Other majors that are looked upon favorably include accounting and math. Biology and engineering degrees may interest an employer, especially if the applicant is interested in specializing in those industries.

In this highly competitive job market, a master's degree gives an applicant a boost.

A successful career as a financial analyst requires strong quantitative skills, expert problem-solving abilities, adeptness in logic, and above-average communication skills. Financial analysts have to crunch data, but they also have to report their findings to their superiors clearly, concisely, and persuasively.

The big investment banks, where the huge first-year salaries are paid, recruit almost exclusively out of MBA programs at elite universities like Harvard and Princeton. These graduates are often hired as associates right out of business school.

Certification Exams to Take

If you are not an MBA graduate student or an economics major as an undergraduate, you may want to consider studying for and taking the Series 7 and Series 63 exams. The Series 7 exam will require sponsorship from a FINRA member firm or a regulatory organization.

Completing the Series 7 and Series 63 exams can demonstrate a basic familiarity with investment terms and accounting practices. You might also consider a newer exam created by FINRA in 2018 called the Securities Industry Essentials (SIE) exam .

Other more advanced certifications may be needed down the road when you're already established in a junior analyst position.

The field of financial analysis is broad, featuring a variety of job titles and career paths. Within the financial/investment industry, the three major categories of analysts are those who work for:

- Buy-side firms (investment houses that manage their own funds)

- Sell-side firms

- Investment banks

Buy-Side Analysts

Most financial analysts work on what is known as the buy side. They help their employers decide how to spend their money, whether that means investing in stocks and other securities for an in-house fund, buying income properties (in the case of a real estate investment firm), or allocating marketing dollars.

Some analysts perform their jobs not for a specific employer but for a third-party company that provides financial and revenue analysis to its clients. This shows the value of what a financial analyst does; an entire industry exists around it.

Buy-side financial analysts rarely have the final say in how their employers or clients spend their money. However, the trends they uncover and their forecasts are invaluable in decision-making. With global financial markets evolving faster than ever and regulatory environments changing seemingly daily, it stands to reason that the demand for skilled buy-side financial analysts will only increase in the future.

Sell-Side Analysts

At a sell-side firm, analysts evaluate and compare the quality of securities in a given sector or industry. Based on this analysis, they then write research reports with certain recommendations, such as "buy , " "sell," "strong buy," "strong sell," or "hold."

They also track the stocks in a fund's portfolio to determine if and when individual stocks should be sold. The recommendations of these research analysts carry a great deal of weight in the investment industry, including for people employed at buy-side firms.

Perhaps the most prestigious and highest-paid financial analyst job is that of a sell-side analyst for a big investment bank. These analysts help banks price their investment products and sell them in the marketplace. They compile data on the bank's stocks and bonds and use quantitative analysis to project how these securities will perform in the market. Based on this research, they make buy and sell recommendations to the bank's clients, steering them into certain securities from the bank's menu of products.

Even within these specialties, there are subspecialties: analysts who focus on stocks or on fixed-income instruments. Many analysts specialize even further within a specific sector or industry. An analyst may concentrate on energy or technology, for example.

Investment Banking and Equity Analysts

Analysts in investment banking firms often play a role in determining whether or not certain deals between companies, such as initial public offerings (IPOs) or mergers, and acquisitions (M&As) , are feasible based on corporate fundamentals.

Analysts assess current financial conditions—relying heavily on modeling and forecasting—to make recommendations as to whether a certain merger is appropriate for that investment bank's client or whether a client should invest venture capital in an enterprise.

Analysts who help make buy and sell decisions for big banks and who attempt to identify IPO opportunities are called equity analysts. They help find companies that present the most lucrative opportunities for ownership.

Typically, equity analysts are among the highest-paid professionals in the field of financial analysis. This is partly a function of their employers; the big investment banks use big salaries to lure the best talent.

Equity analysts often deal with huge sums of money. When they make a winning prediction, the gain for the employer is often in the millions of dollars. Equity analysts are handsomely compensated for their contributions.

Most financial analysts make significantly less than those in other professions in the finance industry, particularly in New York City. However, the median annual income for an entry-level financial analyst is significantly higher than the median annual income for a full-time wage or salary worker in the United States overall.

In the fourth quarter of 2023, according to the U.S. Bureau of Labor Statistics (BLS), the average weekly income for a full-time wage or salary worker in the U.S. was $1,145. This translates to a yearly income of about $59,540.

Compare that to the median annual income for financial analysts across all experience levels in 2022 (the latest data available) was $96,220 per year.

Granted, It's not unusual for an analyst to work 80 or more hours per week.

Financial Analyst Job Outlook

Employment-wise, the outlook is good for the financial analyst profession. While it's a competitive field, in 2022 there were around 376,100 total jobs in this field, according to the latest available BLS statistics. The profession is expected to grow about 8% in the decade between 2022-2032.

The BLS notes:

Demand for financial analysts tends to grow with overall economic activity. Financial analysts will be needed to evaluate investment opportunities when new businesses are established or existing businesses expand. In addition, emerging markets throughout the world are providing new investment opportunities, which require expertise in geographic regions where those markets are located.

What to Expect on the Job

Financial analysts need to remain vigilant about gathering information on the macroeconomic level, as well as gathering information about specific companies and assessing their financial fundamentals via company balance sheets.

Analysts must do a lot of reading on their own time. They tend to peruse The Wall Street Journal , The Financial Times , and The Economist , as well as financial websites.

Being an analyst also often involves a significant amount of travel. Some analysts visit companies to get a first-hand look at operations on the ground level. Analysts frequently attend conferences with colleagues who share the same specialty.

When in the office, analysts need to be proficient with spreadsheets, relational databases, and statistical and graphics packages. They use these tools to develop recommendations for senior management and to produce detailed presentations and financial reports that include forecasting , cost-benefit analysis, and trend analysis.

Analysts also interpret financial transactions and must verify documents for their compliance with government regulations. An understanding of these laws and regulations is key for those working with the Securities and Exchange Commission (SEC) ,

Opportunities for Advancement

In terms of interoffice protocol, analysts usually interact with one another as colleagues, while also reporting to a portfolio manager or other more senior management role.

A junior analyst may work their way up to senior analyst in three to five years. For senior analysts who continue to look for career advancement, there is the potential to become a portfolio manager, a partner in an investment bank, or a senior manager in a retail bank or insurance company.

Some analysts go on to become investment advisors or financial consultants.

The most successful junior analysts are those who are proficient in the use of spreadsheets, databases, and PowerPoint presentations and learn other software applications.

Most successful senior analysts have developed interpersonal relationships with superiors and are available to mentor junior analysts.

Analysts must also develop communication and people skills by crafting written and oral presentations that impress senior management.

What Is the Job Outlook for a Financial Analyst?

According to U.S. government estimates, employment of financial analysts is projected to grow 8% from 2022 to 2032 (faster than the average for all occupations), with 27,400 new job openings per year in that period.

Many of those openings are expected to result from the need to replace workers who transfer to different occupations or retire.

What's the Difference Between a Financial Analyst and an Equity Research Analyst?

Financial analysts look at market trends to help with investment decisions or examine the financial statements of companies to identify an investment's potential.

An equity research analyst looks closely at a company's financial information, examining, interpreting, and reporting on the data collected to come up with a price target for a stock.

What Type of Education Do I Need to Become a Financial Analyst?

According to the BLS, a majority of financial analysts hold a bachelor's degree in a field related to finance, including finance and accounting, economics, statistics, analytics, business management, or mathematics.

A career as a financial analyst requires preparation and hard work. It also has the potential to deliver not just financial rewards but the genuine satisfaction that comes from being an integral part of the business landscape.

U.S. Bureau of Labor Statistics. " Usual Weekly Earnings of Wage and Salary Workers Fourth Quarter 2021 ," Page 1.

U.S. Bureau of Labor Statistic. " Financial Analysts: Summary ."

U.S. Bureau Labor of Statistics. " Financial Analysts: Job Outlook ."

- Is Finance a Good Career Path? 1 of 30

- Making It Big on Wall Street 2 of 30

- Best Websites to Find a Job in Finance 3 of 30

- Top 4 Financial Jobs You Can Do From Home 4 of 30

- How to Get a Head Start on Your Financial Career 5 of 30

- 10 Ways to Land a Finance Career Without a Finance Degree 6 of 30

- Most Prestigious Finance Internships 7 of 30

- A Career Guide for Marketing Majors 8 of 30

- How to Land a Finance Job with a Bachelor’s Degree 9 of 30

- Uncommon Jobs for Your Finance Degree 10 of 30

- What's the Average Salary for a Finance Major? 11 of 30

- Best Series 7 Exam Prep Courses 12 of 30

- Best Series 63 Exam Prep Courses 13 of 30

- Best CPA Prep Courses of 2024 14 of 30

- Is a Career in Financial Planning in Your Future? 15 of 30

- How to Become an Investment Bank Analyst 16 of 30

- How to Become a Managing Director at an Investment Bank 17 of 30

- How to Transition Into a Finance Career 18 of 30

- How to Become a Financial Writer 19 of 30

- How to Become a Financial Analyst 20 of 30

- Financial Analyst: Career Path and Qualifications 21 of 30

- A Day in the Life of a Financial Analyst 22 of 30

- Financial Analyst vs. Data Analyst: What's the Difference? 23 of 30

- Financial Analyst vs. Accountant: Knowing the Difference 24 of 30

- Financial Analyst vs. Financial Consultant Careers 25 of 30

- Investment Banking vs. Corporate Finance: What's the Difference? 26 of 30

- Equity Research vs. Investment Banking: What's the Difference? 27 of 30

- Career As an Investment Banker 28 of 30

- A Day in the Life of a Financial Advisor 29 of 30

- 5 Forex Careers for Financial Professionals 30 of 30

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1206249788-47ee99bf82264d57a538463db4e1951e.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Upskill Yourself

Financial analysis course.

- Financial Analysis Course with 100% Placement Support

- 180 + Hours of HD Video Content with Detail notes

- Lectures by seasoned investment bankers and industry experts.

- Hands-on Financial Analysis simulations for practical application.

- Real-world case studies and examples from notable deals.

- Download Brochure

Get a Call - Back

Program highlights.

Here are a few features of our coaching which will help you breeze through Financial Analysis.

180+ Hours Videos

Revision & Backup Classes

Relevant Industry Updates

Exhaustive Question Banks

Unlimited Doubt Sessions

Case Studies Approach

Other Features

What Makes Us The Best?

Below are a few key points that make us a preferred choice amongst students for Financial Analysis Course

Fully Practical Approach

Learn Financial Modeling and valuation from the real-world perspective, not books

Highly Credible Trainers

Our trainers are Investment Bankers themselves and have extensive experience in core finance.

Most Detailed Curriculum

Our curriculum is THE MOST detailed across the Finance training industry

100% Placement Assistance

After the course completion, students get access to our placement network of 200+ recruiters

Financial Analysis Course Curriculum

Our curriculum is the most detailed, concept driven and Industry relevant.

How do we cover the syllabus efficiently?

- Basic excel formulas as sum, product, division, multiplications, paste special,

- Sorting Data and using advanced filters

- Using conditional formatting

- Vlook Up/Hlook up

- Match, Index/ Offset Function

- Combination of multiple functions in a problem as Vlook +Match, Index+Match, VlookUp

- If, ifs and nested function

- Present value calculation

- CAGR Calculation

- Pivot Tables

- IRR, XIRR Calculation

- EMI calculator

- Sum if, Count if, Sumifs

- P&L account

- Balance sheet

- Cash flow statement

- Annual reports (10K), Quarterly reports (10Q), Earnings reports (8K), Proxy statements (14A)

- Working capital

- Deferred tax asset / Deferred tax liability

- Fixed assets

- Contingent liabilities

- Basic 3 statement model case study 1

- Basic 3 statement model case study 2

- Advanced 3 statement model

- 3 Statement model of public company

- Most efficient way to use PPT commands

- Setting up PowerPoint correctly

- Slide Master

- PowerPoint shortcuts

- Inserting aligning distributing shapes

- DCF valuation of Hindustan Unilever (Project)

- DCF valuation of Tesla (In Class)

- DCF valuation of Netflix (Project)

- DCF valuation of Apple (Project)

- Tracking Microsoft and LinkedIn deal (In Class)

- Tracking Kraft and Heinz merger (Project)

- Tracking acquisition of GrubHub by Just Eat (Project)

- Tracking Microsoft and Linkedin deal (In Class)

- Microsoft and Linkedin deal

- Kraft and Heinz deal

- What is LBO?

- Why less LBOs in India?

- Characteristics of Ideal LBO candidate

- LBO basic model case study

- LBO advance model case study

- Trying to replicate Bristol Myers Squibb and Celgene Corp deal

- Understanding of banking industry (Regulatory capital, RBI norms, Creating of provision, Liquidity coverage ratio and Net Stable funding ratio projection)

- Projecting balance sheet of IDFC first bank

- Projecting Income statement of IDFC first bank

- Projecting cash flow of IDFC first bank

- Valuation of IDFC first bank

- Return on equity and return on assets

- Sensitivity analysis

- Pre-sold condo development model

- Hotel acquisition and renovation model

- Office acquisition and renovation model

- Overview of Oil and Gas companies

- Production overview

- Price realization

- Hedging revenue

- Expenses per Boe/Mcfe

- Income statement

- Cashflow statement

- Debt schedule

- Linking all statements

Real-World Valuation Case Studies of Leading Innovators

Gain unparalleled insights into the art of Financial Analysis with our meticulously crafted case studies.

Netflix Delving into OTTs subscriber growth, content investment, and competitive positioning.

Tesla Innovation-driven valuation and the impact of technology on market capitalization

ChatGPT Assessing revenue models, growth trajectories, and the role of AI in market disruption

Jio Telecom Pricing models, and impact on the tele- communications sector’s valuation landscape

Exclusive Content Access

Unlock Premium Resources: Your Comprehensive Financial Analysis Banking Toolkit

Investment Banking Handbook

A comprehensive guide covering the A-Z of investment banking , from fundamental concepts to advanced strategies.

Financial Model Templates

Ready-to-use Excel templates for various financial modeling scenarios , designed by industry veterans for real-world applications.

Mobile App With Up-to-Date Resources

Our Mobile Application provides instant access to all our study materials, updated regularly to reflect the latest industry trends

QuintEdge Vs Others

Unlock unparalleled advantages with Quintedge Where we go the extra mile in Financial Analysis unlike any other

24/7 Peer and Tutor Forums for immediate query resolution

Exclusive industry insights with current market trends

Continuous course updates , ensuring current content relevancy

Full Length Mock Interviews with ‘ Near’ Job Level Difficulty

Access to global finance job boards & internship opportunities

VIP guest lectures from top-tier finance professionals

Dedicated Faculty for last-minute doubt solving before Interview

Discover The Seamless Learning Experience

Our platform's features.

- Personalized study plans tailored to individual strengths and weaknesses.

- Detailed dashboards to track, analyze, and improve your learning journey.

- Engaging modules with simulations, gamified elements, and interactive case studies.

- Real-time forums, projects, and live Q&A sessions with tutors and peers.

- Learn anytime, anywhere with our seamless mobile app and responsive design.

Know Your Timeline

How to become a financial anlayst.

Charting Your Path to Financial anlaysis: A Step-by-Step Journey with Quintedge

Our Faculty Members

We’re here to help you every step of the way, from preparation to ongoing support and motivation.

Yash is a seasoned Investment Banking Trainer and Ex – Senior Associate at Bain & Co. specializing in Corporate Finance. He has trained over 5000 candidates till date and is renowned for his engaging sessions at prestigious institutions like IIT, Goldman Sachs, and NIFM.

Sudhanshu kanwar

Sudhanshu is a Global Markets Strategist, with a storied career at Goldman Sachs. His credentials, including CQF, FRM, and CFA , reflect his deep analytical acumen. As a member for the Harvard Review, he combines expertise with a passion for mentorship.

Rohit Sachdev

Rohit Sachdev is an adept Options Trader with extensive experience, specializing in both Fundamental and Technical Analysis. His background as an Investment Banker at Deutsche Bank and FRM Charterholder underscore his deep understanding of financial markets.

Ankita Agarwal

Ankita is a distinguished finance professional with a strong background in investment strategy and management . Having held significant positions at top-tier firms, she’s a CFA Charter holder. She is known for her interactive and insightful teaching approach.

Placements & Career Assistance

Placement Assistance Program

Crack Jobs At Best Finance Roles

Learn with real work experience and get placed at Top Finance & Accounting based Job Roles.

- Experiential Masterclasses by Investment Bankers

- AI Based Resume Maker Tool Trained by Industry Experts

- Interview Preparation AI tool based on 10,000 Questions asked in Real Interviews

- Job Opportunities in Core Finance Roles

Career Counseling

Personalized career guidance in identifying work goals and potential job roles

Extensive Support , starting from Job search, to getting the offer letter from Company

Access Duration

Job applications, mock interviews, ai based resume drafting, monthly masterclasses by industry experts.

Makeing You Well Versed With Current Industry Trends

Industry Recognized Certification

Here's to our Achievements

Our awesome records.

Over the years, our students’ satisfaction and the success rate are worth an eyeball.

Batches Taken

Positive feedback, past students.

Work At Big 4s, Investment Banks & MNCs

Build your Skillset with us and impress recruiters at Investment Banks, global MNCs, and Big 4s.

Testimonials of Financial Analysis Course

From the past candidates.

Read on to know what our students have to say

Vaishali Jain

I was a CA working in an audit role when I joined Quintedge’s Investment Banking Course. The depth of knowledge included in their modules (Financial Modeling and Valuations) was exactly what’s needed in my dream profile i.e. Valuations. Without their guidance, it won’t have been possible for me to shortlist the companies and crack the interview .

Vikas Burakoti

Most other Investment Banking courses teach what I should call ‘Theory’ which has no relation with the requisite job skills . On the other hand, Yash sir is an Industry veteran, having tremendous exposure in the valuation field. His vast experience speaks when he teaches the concepts in the class with utmost detail and practical examples .

Akshay Gupta

Being from non-finance background , it was practically difficult for me to even understand basic financial models, let alone getting a Job in core finance. However, this course has been a career changer for me. Even the most basic concepts were explained from scratch so that all the students are par when the toughest Valuation topics started.

Financial Analysis Career, Scope & Salary

Let’s get to know how this qualification can shape your future and career.

Growth & Recognition

Financial Analysis is the most recognized and growth oriented core finance job due to the dynamic nature of the work.

Job Profiles

After completing our course, you can get a core finance job in Investment banking, Equity research, Valuations etc.

Median Salary

Although the salary depends upon your experience & education, the median CTC of a Financial Analyst amounts to INR 8 LPA.

Fees & Variants of Financial Analysis Course

Certification in Investment Banking

- 2.5 months of Live Training with Expert faculties and Hands on Practice

- Live Instructor Led Classes

- Access to Learning Portal with 180+ Hours of Video Content

- Real World case Studies

- Concept Wise Tests & Quizzes

- Discussion Forum Access

- Quintedge's In-house Financial Modeling Handbook

- Unlimited Doubt Solving

- Weekly Office Hours

- 180 hours of Self Paced Training with Expert faculties and Hands on Practice

3 Months of Extensive Placement Assistance for Certified Candidates

- Placement Support for core Finance Job Roles

- Monthly Industry Based Masterclasses

- AI Based Resume Maker & Interview Preparation Tool

Additional Fees

(For 3 Months)

Eligibility: Passing The Final Exam

AI Resume Evaluator

Want to know your chances of getting a job in core finance.

Try out our Free AI Based Resume Evaluator Tool to know your chances of getting a Job in core Finance, and customized profile suggestions to increase them exponentially.

Have Doubts?

Know more about financial analysis.

Unlock insights into the Financial Analysis – the gold standard in finance

Frequently Asked Questions

Here are a few questions which our students ask every now and then. We have collated them all.

To apply for our Live Program, you can call up our counsellors and they will guide you with the registration process.

Yes, basic accounting knowledge is required. That’s thy we give pre-lecture study material so that students get a strong hold of the concepts delivered in the class.

In live course, there will be 80 classes of 3 hours each in the Live course, amounting to total 240 hours of training. The recorded Course will be around 150 hours long.

No, we don’t because a Job offer depends upon multiplicity of factors. However, rest assured that ample placement opportunities will be given in core finance roles.

After completing this certification, one can get a Job in core finance profiles such as Valuations, Investment Banking, Portfolio Management etc.

Still have questions?

If you can’t find answers to your questions in our FAQ section, you can always contact us. We will get back to you shortly.

Upcoming Batches

+91-7303381314, whatsapp us, get the brochure in your inbox.

- Investment Banking Program

- CFA Level 1 Coaching

- CFA Level 2 Coaching

- FRM Part 1 Coaching

- FRM Part 2 Coaching

- ACCA Coaching Program

- Investment Banking Online Course

- CFA Level 1 Online Coaching

- CFA Level 2 Online Coaching

- FRM Part 1 Online Coaching

- FRM Part 2 Online Coaching

- ACCA Online Course

- CFA Reviews

- FRM Reviews

- ACCA Reviews

KPMG Personalisation

Certification Program in Corporate Finance & Analytics

The Certification Program in Corporate Finance & Analytics is aimed at providing strategic finance and analytical skills that will prepare...

- Share Share close

- 1000 Save this article to my library

- Go to bottom of page

- Home ›

- Services ›

- The KPMG Learning Academy ›

- Certification Program in Corporate Finance & Analytics

Virtual classroom

Delivery format

Course duration

Learning Hours

20 January 2024

Upcoming batch start date

Course overview:

The certification program in Corporate Finance and Analytics offered by KPMG in India and Jaro Education is aimed at providing strategic finance and analytical skills that will prepare a working professional for the next step in his or her career.

This program provides knowledge in the domains of corporate strategy, investments, private equity, and start-ups, with a focus on hands-on learning. Besides core finance topics, the curriculum aims to develop soft skills such as inter-personal effectiveness and business partnering.

Who is this course for?

Learn accounting from practitioners.

- B.com, M.com, MBA (finance) or similar

- Bachelor’s degree in B.com, M.com, MBA (Finance) or similar with at least 50% marks or equivalent CGPA from a recognised institute/university institute/university

- The selection will be based on candidate’s profile evaluation and personal interview through video conferencing or Zoom.

Proven content from Becker

- Working professionals between 3 to 7 years (with no CA/CFA/CPA degree)

- Prior work experience from 1 to 7 years is necessary in the finance domain

Key features of the course are:

- 125 hours of live virtual instructor-led training, spread across 6 months

100% live instructor-led sessions

- Learn from industry and subject matter experts of KPMG in India

- Multi-disciplinary curriculum with finance, analytics and business partnering

Masterclass with KPMG global professionals

- Peer networking across various industries

- Certificate of completion from KPMG in India.

To know more about the programme connect with us

Sachin Sharma

+918875782959

Corporate Finance & Analytics

Click here to download the brochure

What does this course cover?

Course completion certificate:.

- The learners shall receive a certificate from KPMG in India after the course competition.

Course faculty:

- The course will be facilitated by experienced practitioners from KPMG in India.

Course fee:

- INR 96,000/- (exclusive of GST) EMI option available* *finance approval and EMI is at the discretion of the finance partners

About Jaro Education:

Jaro Education is a leading provider of Executive education. It provides a bridge to the working professionals and students by enabling new age courses on management, finance and technology. Jaro’s association with some of the best institutes and universities makes it one of the finest Edtech players in the industry.

Jaro Education offers a wide choice of courses from top level global corporates, universities and institutes. Jaro Education’s strategic partnerships with some of the marquee colleges, b-schools and corporates include IIM Ahmedabad, IIM Trichy, IIM Nagpur, IMT Ghaziabad, Welingkar Institute of Management, KPMG India, Dayananda Sagar, and Bharati Vidyapeeth (DU) University.

IMAGES

VIDEO

COMMENTS

In summary, here are 10 of our most popular financial analysis courses. Financial Analysis - Skills for Success: University of Illinois at Urbana-Champaign. Financial Markets: Yale University. Finance & Quantitative Modeling for Analysts: University of Pennsylvania.

The Complete Financial Analyst Course is the most comprehensive, dynamic, and practical course you will find online. It covers the following topics, fundamental for every aspiring financial analyst: Microsoft Excel for beginner and intermediate users — become proficient with the world's #1 productivity software.

Financial analysis is a crucial aspect of assessing a business's financial health. It offers insights into performance and highlights potential vulnerabilities. In CFI's "Financial Analysis Fundamentals" course, we will compute and interpret ratios for three different companies, offering insights into their profitability, asset ...

Learn about career opportunities as a financial analyst in this audio-only course adapted from the Free the Data Podcast. 52,349 viewers Released May 16, 2022. 2 Corporate Financial Statement ...

Financial analysis involves gathering and analyzing data related to cash flow to gain deeper insights into business performance. Financial analysts interpret the data to provide actionable information regarding the investments, profitability, and economic viability of an organization. A financial analysis course on Udemy can give you the tools ...

Learn financial analysis with online courses delivered through edX to advance your career today.

Finance Courses Library. Browse through all the 365 Financial Analyst finance courses. Filter them by job title, topic, or length to find the ones that suit your needs. We cover various beginner to advanced topics—from introduction to financial analysis to machine learning in Excel. Follow one of our structured career tracks with investment ...

The FP&A course will guide you through the process of financial planning and analysis, including budgeting, forecasting, and performance measurement. Throughout thе lessons, you will work on real-world case studies that will help you apply your new skills in a practical setting. 4 Hours. 38 Lessons. Certificate.

A successful career as a financial analyst requires strong quantitative skills, expert problem-solving abilities, adeptness in logic, and above-average communication skills. Financial analysts ...

Financial Analyst Education Requirements. Most firms require candidates to have at least a bachelor's degree. The CFA Institute recommends a finance-related major such as a bachelor's degree ...

Complete 1 course from the required statistics section and 3 courses from the required financial analytics section; Complete 2 courses from each section. Your time commitment will vary for each course. You should expect an average of 15-20 hours per week for the lecture and homework assignments. Most students complete the program in 1-2 years.

Free Financial Analyst Courses. In the financial analyst learning path, you'll learn how to read and interpret financial statements, work with economic data, and make business recommendations on ...

Detailed career path guide: how much do Investment Analysts make, what skills they need, how they begin their career. Learn the basics and how to get this job

Financial Analysis Course with 100% Placement Support. 180 + Hours of HD Video Content with Detail notes. Lectures by seasoned investment bankers and industry experts. Hands-on Financial Analysis simulations for practical application. Real-world case studies and examples from notable deals.

Some examples of high-quality data visualization courses for financial analysts are detailed below. 1. Data Visualization - University of Illinois at Urbana-Champaign. Offered online through Coursera, the University of Illinois at Urbana-Champaign's course on data visualization consists of five modules.

Course overview: The certification program in Corporate Finance and Analytics offered by KPMG in India and Jaro Education is aimed at providing strategic finance and analytical skills that will prepare a working professional for the next step in his or her career. This program provides knowledge in the domains of corporate strategy, investments ...

Learn Essential Data Analytics Skills. The Data Analytics courses listed equip you with skills in big data, predictive analysis, and statistical modeling, vital for careers in business intelligence and data-driven decision making. These programs cover essential tools and techniques to manage and analyze large datasets effectively.