Tax Business Plan Template: Everything You Need to Know

Its a strategy for all aspects of your business. It is a necessity for those looking to start a tax preparation or tax consulting business. 3 min read updated on February 01, 2023

A tax business plan template is a strategy for all aspects of your business. It is a necessity for those looking to start a tax preparation or tax consulting business. A tax preparation business assists individuals and small businesses to prepare and file their taxes correctly and accurately. There are several advantages to choosing a tax preparation business:

- There is little initial investment compared to most other businesses. A tax preparation business can even be started with $500 or less.

- Tax preparation is a flexible business that can be done on a part-time basis and allows for the flexibility to work around family and other obligations. This is a great business venture for stay-at-home parents.

- Tax preparation and consultation services are in demand by small businesses that don't have a full-time accountant. These businesses are able to pay for your expertise only when they need it the most.

- As a tax consultant, earnings can be $100-$200 per month, depending on your expertise.

The first step in determining if a tax business is the right choice for you is to complete research to determine the feasibility. Research is a way to learn important things about the business that will be helpful in your success. This will help you determine if this is the right business for you, and what type of business you should create.

This information gathering will assist you in preparing a tax business plan template. A tax preparation business service plan can include several different parts consisting of a business overview, strategy, marketing, accounting, services, and all aspects of the business. Before you start your business, make sure you consider how to form a solid business plan.

Sample Tax Preparation Service Business Plan

Business overview/products and services/mission statement.

- The company is a financial consulting firm specializing in tax preparation of all types- income tax compilation and returns, tax preparation, financial services, and standard, basic and full-service income tax preparation.

- The employees will be professionals in the financial consulting services industry whose ethics and values align with those of the company.

- The company and employees will be held accountable to meet their clients' needs and will create a working environment focused on sustainable living and community involvement.

- The brand goal is to become the top tax preparation service in the city and among the top tax preparation businesses in the United States within 20 years.

- The tax consulting firm will offer many services within the scope of tax preparation services, tax consulting, and tax-related financial products. The primary clients will be individuals, start of corporations, and established corporations looking to outsource tax preparation.

SWOT Analysis/ Market Analysis/Accounting Plan

- Strength- Our strength lies in our employees who are professional, well-trained, and do what it takes to ensure that our clients get a great value.

- Weakness- As a new company, it will take time to gain respect and acceptance in the community. We also do not yet have the cash flow for expensive marketing efforts.

- Opportunities- There are many opportunities for a tax preparation services company in the community. Individuals and companies both large and small need to use tax preparation services to ensure they are reporting accurately and to save them money.

- Threats- Other similar financial services firms in the area will cause a threat, as well as the existence of certain government policies regarding taxes. Neither of these threats can be reduced or eliminated.

- Financial services and tax preparation is a large industry with the potential to serve many individuals and businesses in need of these services.

- Many small businesses and mom and pop shops don't have the financial capacity to hire a full-time accountant but find it cost effective and less stressful to use tax preparation services and financial consulting services to ensure that everything is handled correctly.

- The target market is anyone who needs tax preparation services and is not restricted to any particular demographic groups. This also includes businesses of any size.

- Competitive advantage- the competitive advantage depends on the location of the business and if it is possible to create a unique angle in which to market your business in that locale, such as offering related services

It is possible to start a successful tax preparation business in just a few days with appropriate research and resources. Training is important, and a degree in an accounting or financial field will put you at an advantage. Make sure to complete state requirements, such as registering your new business.

For more information on tax business plan templates or legal requirements, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Cost To Do Business Taxes: Everything You Need To Know

- CPA Fees for Corporate Tax Returns

- What Is Tennessee Corporate Income Tax?

- Business Taxation Meaning

- Business Taxation

- LLC Tax Rates by State

- Business Income Tax

- What Is Washington Franchise Tax?

- States With No Business Tax

- How to Start a Business: A Comprehensive Guide for Entrepreneurs

- Sample Business Plans

Tax Preparation Business Plan

Tax preparation is a recession-proof business. No matter what happens to the economy, this business never goes off-trend. So starting a tax preparation business is an excellent choice.

Starting a business from scratch and standing up against big industry giants may feel overwhelming, but a detailed business plan can help you succeed.

Need help writing a business plan for your tax preparation business? You’re at the right place. Our tax preparation business plan template will help you get started.

Free Business Plan Template

Download our Free Business Plan Template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write a Tax Preparation Business Plan?

Writing a tax preparation business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your business:

- This section may include the name of your tax preparation business, its location, when it was founded, the type of tax preparation business (E.g., franchise tax preparation services, enrolled agent firms, tax law firms.), etc.

Market opportunity:

Tax preparation services:.

- For instance, your services may include tax preparation, accounting, tax resolution and representation, tax planning, and tax consulting.

Marketing & sales strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business description:

- Franchise tax preparation services

- Independent tax preparation services

- Online tax preparation services

- Enrolled Agent (EA) firms

- Tax law firms

- Certified Public Accountant (CPA) firms

- Describe the legal structure of your tax preparation company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission statement:

Business history:.

- Additionally, If you have received any awards or recognition for excellent work, describe them.

Future goal:

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

- For example, if you are an independent tax preparation service provider, you might target busy individuals, self-employed professionals, retirees, new immigrants, and people with low and moderate incomes.

Market size and growth potential:

Competitive analysis:, market trends:.

- For instance, the COVID-19 pandemic has accelerated the trend toward remote and hybrid work in the tax preparation industry, so you may need to explain how you plan to handle your remote team.

Regulatory environment:

Here are a few tips for writing the market analysis section of your tax consultant business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Describe the tax preparation services your business will offer. This list may include services like,

- Preparation of federal, state, and local tax returns

- Review of tax documents

- Electronic filing

- Tax planning

- Audit assistance

- Tax resolution services

Describe each service:

- Tax resolution processes, for instance, include consultation, investigation, strategy development, negotiation, resolution, and ongoing compliance.

Quality measures:

- This may include,

- Regular training and education for staff

- Thorough review and quality control processes to ensure accuracy

- Compliance with all relevant laws and regulations governing tax preparation services, etc.

Additional services:

In short, this section of your tax preparation plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique selling proposition (USP):

- For example, personal attention, year-round services, niche specialization, and commitment to excellence could be some of the great USPs for a professional tax preparation company.

Pricing strategy:

Marketing strategies:, sales strategies:, customer retention:.

Overall, this section of your tax preparation business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your tax preparation business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & training:

Operational process:, esoftware & technology:.

- Explain how these software and technologies help you maintain quality standards and improve the efficiency of your business operations.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your tax preparation business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founder/CEO:

Key managers:.

- It should include key executives, senior management, and other department managers (e.g., Tax manager, Accounting manager.) involved in the business operations, including their education, professional background, and any relevant experience in the taxation industry.

Organizational structure:

Compensation plan:, advisors/consultants:.

- So, if you have any advisors or consultants, include them with their names and brief information consisting of roles and years of experience.

This section should describe the key personnel for your tax preparation services, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

- This exercise will help you understand how much revenue you need to generate to sustain or be profitable.

Financing needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the taxation industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your tax preparation company business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample tax preparation business plan will provide an idea for writing a successful tax preparation plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our tax preparation business plan pdf .

Related Posts

Bookkeeping Business Plan

Hedge Fund Business Plan

How To Conduct Consumer Analysis

Writing a Business Plan Table of Contents

10 Components of Business Plan

How to do Competitive Analysis

Frequently asked questions, why do you need a tax preparation business plan.

A business plan is an essential tool for anyone looking to start or run a successful tax preparation business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your tax preparation company.

How to get funding for your tax preparation business?

There are several ways to get funding for your tax preparation business, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your tax preparation business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your tax preparation business plan and outline your vision as you have in your mind.

What is the easiest way to write your tax preparation business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any tax preparation business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software.

About the Author

Vinay Kevadiya

Vinay Kevadiya is the founder and CEO of Upmetrics, the #1 business planning software. His ultimate goal with Upmetrics is to revolutionize how entrepreneurs create, manage, and execute their business plans. He enjoys sharing his insights on business planning and other relevant topics through his articles and blog posts. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Tax Preparation Business Plan Template

Written by Dave Lavinsky

Tax Preparation Business Plan

You’ve come to the right place to create your Tax Preparation business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Tax Preparation businesses.

Below is a template to help you create each section of your Tax Preparation business plan.

Executive Summary

Business overview.

Denver Tax Services, Inc. is a new tax preparation company located in downtown Denver, Colorado. We help businesses and residents prepare their taxes and are trained to provide guidance and help for a variety of tax situations. We offer the best customer service in the industry and have a guarantee of accuracy or your money back. Clients who work with us will feel supported during every step of the tax prep and filing process.

Denver Tax Services, Inc. is run by Robert Schwartz. Robert is a certified tax professional and has decades of tax preparation experience under his belt. He has worked for several other firms (including H&R Block) and has provided his services to thousands of clients. His experience and professionalism has gained him a loyal clientbase. The combination of Robert’s expertise, experience, and clientbase will ensure that Denver Tax Services, Inc. is a success.

Product Offering

Denver Tax Services, Inc. provides guidance and support through every step of the tax preparation process. We help individuals and businesses get the maximum refund possible and file their taxes on their behalf. In addition to our tax preparation services, we also provide tax planning, business consulting, estate and trust tax preparation, audit support, and IRS representation services.

Customer Focus

Denver Tax Services, Inc. will help individuals and businesses located within 20 miles of the Denver area. We expect that most of the businesses that utilize our services will be small businesses that have less than 1,000 employees and earn less than $10 million in revenue per year. Most individuals who seek out our services will be middle class or affluent in order to have the disposable income to pay for our services.

Management Team

Denver Tax Services, Inc.’s most valuable asset is the expertise and experience of its founder, Robert Schwartz. Robert has been a certified tax professional for the past 20 years. Throughout his career, he has developed a loyal client base, with many clients having stated that they will switch to Denver Tax Services, Inc. once the company is established and running. Robert’s combination of skills, tax knowledge, and loyal following will ensure that Denver Tax Services, Inc. is a successful firm.

Success Factors

Denver Tax Services, Inc. will be able to achieve success by offering the following competitive advantages:

- Robert Schwartz already has a clientbase from his twenty years of experience working with other tax firms. This clientbase will help the company grow with their repeat business and by referring their friends and loved ones to our services.

- The company will emphasize providing client-focused service so that our clients feel valued.

- The company will provide our tax preparation services at a more affordable rate than the competition.

Financial Highlights

Denver Tax Services, Inc. is currently seeking $400,000 to launch. The funding will be dedicated to the office build out, purchase of initial equipment, working capital, marketing costs, and startup overhead expenses. The breakout of the funding is below:

- Office design/build: $100,000

- Office equipment, supplies, and materials: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $50,000

- Working capital: $50,000

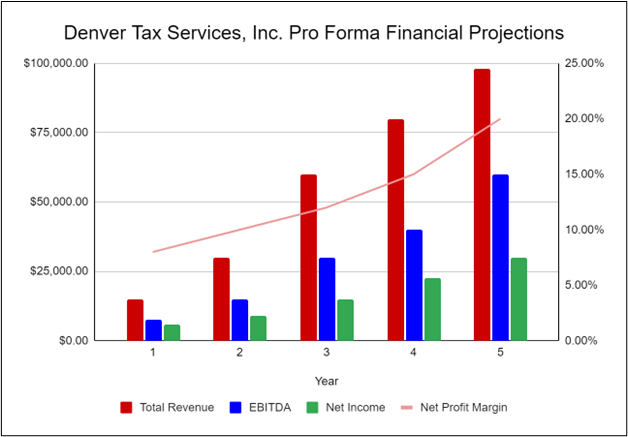

The following graph below outlines the pro forma financial projections for Denver Tax Services, Inc.

Company Overview

Who is denver tax services, inc..

Denver Tax Services, Inc. helps the businesses and residents of Denver, Colorado with tax preparation and filing. We thoroughly analyze our clients’ tax situations to minimize their taxes and get them the biggest refund possible. We offer a guarantee of accuracy and will refund the fee for our services if our clients are not satisfied.

In addition to helping our clients with tax preparation and filing, we also provide a suite of other tax services, including tax planning, audit support, and IRS representation. We don’t want to just help our clients out during tax time. We want to support our clients throughout the year so they don’t get any surprises come April 15th.

Denver Tax Services, Inc. is run by Robert Schwartz. Robert has decades of tax prep experience and has gained a loyal clientbase from providing his services through competing firms. After working for several tax prep firms around town, he surveyed his clientbase to see if they would be willing to switch to his new company once launched. Most of his clients responded positively, which motivated Robert to finally launch his business.

Denver Tax Services, Inc.’s History

Upon surveying his clientbase and finding a potential office, Robert Schwartz incorporated Denver Tax Services, Inc. as an S-Corporation in July 2023.

The business is currently being run out of Robert’s home office, but once the lease on Denver Tax Services, Inc.’s office location is finalized, all operations will be run from there.

Since incorporation, Denver Tax Services, Inc. has achieved the following milestones:

- Found an office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

- Began recruiting key employees

Denver Tax Services, Inc.’s Services

Denver Tax Services, Inc.’s mission is to maximize the tax refunds of all of our clients. To do this, we help our clients through every step of the tax return process and analyze every situation to make sure each client is getting as many deductions as possible. We help our clients minimize their taxes as much as possible during tax time and provide guidance on how to minimize taxes for the following year.

In addition to tax preparation and filing, we also provide the following services:

- Tax planning

- Business consulting

- Estate and trust tax preparation

- Audit support

- IRS representation

Industry Analysis

Taxes are one of the few certainties in life. However, tax time can be one of the most confusing and stressful times of the year for Americans. As such, many Americans seek out tax preparation software or tax professionals to help them with their tax returns every year. Due to tax law becoming increasingly complicated, the tax preparation industry has become an essential industry for the American economy. As such, the industry is expected to thrive for the foreseeable future.

The tax preparation industry helps citizens and businesses make sense of their tax returns to minimize their taxes and maximize their deductions. These professionals go through every applicable tax form and ask about every possible situation to ensure that customers are getting the biggest refund possible. In addition to tax preparation and filing, these companies also provide a full suite of other tax services, such as planning, consultation, and audit support.

According to IBIS World, the tax preparation industry has been growing steadily at a CAGR of 4.3% for the past several years. The demand for these services only continues to grow as tax law becomes more complicated. Therefore, this growth is expected to continue, meaning that Denver Tax Services, Inc. can expect to be successful in the following years.

Customer Analysis

Demographic profile of target market, customer segmentation.

Denver Tax Services, Inc. will primarily target the following customer profiles:

- Small and medium-sized businesses

- Middle class residents and families

- Affluent residents and families

Competitive Analysis

Direct and indirect competitors.

Denver Tax Services, Inc. will face competition from other companies with similar business profiles. A description of each competitor company is below.

H&R Block

H&R Block has been a king in the tax prep industry for several decades. With thousands of locations around the country and thousands of professionals available online, customers of H&R Block can get the tax prep and guidance they need with ease. H&R Block offers software and online tax prep services but also has in person services for those who would rather work with a professional. H&R Block has several offices in the Denver area, so we expect them to be a major competitor.

TurboTax is the most popular tax preparation service in the market. TurboTax provides easy- to-use software so the average American can file their taxes with ease. For those that have more complicated tax situations, TurboTax also offers consultations with tax professionals for an additional fee. Whether customers are doing their taxes on their own or with a professional, TurboTax provides all the support they need to make tax filing a smooth process.

Though TurboTax will continue to be popular, the company’s reputation has tarnished in recent years. The company has been sued several times for misleading their customers and lying about their pricing. These practices have made TurboTax untrustworthy. As such, many former customers of TurboTax will be eager to get the help of a local and reputable tax professional such as those that work for Denver Tax Services, Inc.

Jackson Hewitt

Jackson Hewitt is another major competitor that has prepared and filed millions of tax returns during their 40 year tenure. Like H&R Block, they offer both online and in person tax services to create the most convenient experience possible for their clients. They are well regarded for their refund guarantee as well as their professionalism and customer service. As such, they will be another major competitor for Denver Tax Services, Inc.

Competitive Advantage

Denver Tax Services, Inc. will be able to offer the following advantages over the competition:

- Client-oriented service : Denver Tax Services, Inc. will put a focus on customer service and maintaining long-term relationships. We aim to be the best tax preparation firm in the area by catering to our customer’s needs and developing a strong connection with them.

- Management : Robert has been extremely successful working in the tax preparation sector and will be able to use his previous experience to help his clients better than the competition.

- Competitive pricing : Denver Tax Services Inc.’s pricing is more affordable than our competitors.

- Relationships : Having lived in the community for 20 years, Robert Schwartz knows many of the local leaders, newspapers and other influencers. As such, it will be relatively easy to build a large clientbase over the next several years.

Marketing Plan

Brand & value proposition.

Denver Tax Services, Inc. will offer a unique value proposition to its clientele:

- Client-focused tax prep services, where the company’s interests are aligned with the customer

- Service built on long-term relationships

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for Denver Tax Services, Inc. is as follows:

Targeted Cold Calls

Denver Tax Services, Inc. will initially invest significant time and energy into contacting potential clients via telephone. In order to improve the effectiveness of this phase of the marketing strategy, a highly-focused call list will be used, targeting individuals in areas and occupations that are most likely to need tax prep services. As this is a very time-consuming process, it will primarily be used during the startup phase to build an initial client base.

Denver Tax Services, Inc. understands that the best promotion comes from satisfied customers. The company will encourage its clients to refer other businesses and individuals by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Social Media

Denver Tax Services, Inc. will invest heavily in a social media advertising campaign. The company will create social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Website/SEO

Denver Tax Services, Inc. will invest heavily in developing a professional website that displays all of the company’s services. It will also invest heavily in SEO so that the firm’s website will appear at the top of search engine results.

Denver Tax Services, Inc.’s fees will be moderate and competitive so clients feel they are receiving great value when utilizing our tax prep services.

Operations Plan

The following will be the operations plan for Denver Tax Services, Inc. Operation Functions:

- Robert Schwartz will be the Owner of Denver Tax Services, Inc.. In addition to providing tax prep services, he will also manage the general operations of the business.

- Robert Schwartz is joined by a full-time administrative assistant, Rebecca Hackett, who will take charge of the administrative tasks for the company. She will also be available to answer client questions and will be the primary employee in charge of client communications.

- As the company builds its client base, Robert will hire more tax professionals to provide the company’s services, attract more clients, and grow our business further.

Milestones:

Denver Tax Services, Inc. will have the following milestones completed in the next six months.

- 9/2023 Finalize lease agreement

- 10/2023 Design and build out Denver Tax Services, Inc.

- 11/2023 Hire and train initial staff

- 12/2023 Kickoff of promotional campaign

- 1/2024 Launch Denver Tax Services, Inc.

- 2/2024 Reach break-even

Denver Tax Services, Inc.’s most valuable asset is the expertise and experience of its founder, Robert Schwartz. Robert has been a certified tax professional for the past 20 years and gained his experience and clientbase by working for competing firms. After years of working with large firms (such as H&R Block), Robert decided he wanted to run his own tax prep firm where he can provide quality services in a small firm environment. He surveyed his clientbase and found that many clients would be willing to transition to his business once established. Robert’s combination of skills, tax knowledge, and loyal clientbase will ensure that Denver Tax Services, Inc. is a successful firm.

Though he has never run his own business, Robert Schwartz has worked as a tax professional long enough to gain an in-depth knowledge of the operations (e.g., running day-to-day operations) and the business (e.g., staffing, marketing, etc.) sides of the industry. He also already has a starting client base that he served while working for other tax prep firms. He will hire several other employees who can help him run the aspects of the business that he is unfamiliar with.

Financial Plan

Key revenue & costs.

Denver Tax Services, Inc.’s revenues will primarily come from charging clients for the tax preparation services we provide. We will charge our clients an hourly rate that will vary depending on the type of tax return they are filing. Clients who owe money on their tax return will be charged directly for our services. Clients who are expecting a refund have the option to either pay us directly or let us take the fee from their refund.

The notable cost drivers for the company will include labor expenses, overhead, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Number of clients per year:

- Year 4: 100

- Year 5: 140

- Annual Rent: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, tax preparation business plan faqs, what is a tax preparation business plan.

A tax preparation business plan is a plan to start and/or grow your tax preparation business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Tax Preparation business plan using our Tax Preparation Business Plan Template here .

What are the Main Types of Tax Preparation Businesses?

There are a number of different kinds of tax preparation businesses , some examples include: Certified Public Accountant (CPA), Tax Attorney, and Enrolled Agent (EA).

How Do You Get Funding for Your Tax Preparation Business Plan?

Tax Preparation businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Tax Preparation Business?

Starting a tax preparation business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Tax Preparation Business Plan - The first step in starting a business is to create a detailed tax preparation business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your tax preparation business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your tax preparation business is in compliance with local laws.

3. Register Your Tax Preparation Business - Once you have chosen a legal structure, the next step is to register your tax preparation business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your tax preparation business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Tax Preparation Equipment & Supplies - In order to start your tax preparation business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your tax preparation business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Tax Preparation Business Plan Template & Guidebook

Starting a tax preparation business requires extensive planning and research to ensure success. The #1 Tax Preparation Business Plan Template & Guidebook provides a comprehensive resource for any aspiring business owner looking to make their vision a reality. This guidebook offers actionable advice and tips for developing an effective business plan, as well as templates and resources to help you understand and organize the various components. With this comprehensive guide, you can develop a clear strategy for launching the tax preparation business of your dreams.

Get worry-free services and support to launch your business starting at $0 plus state fees.

- How to Start a Profitable Tax Preparation Business [11 Steps]

- 25 Catchy Tax Preparation Business Names:

How to Write a Tax Preparation Business Plan in 7 Steps:

1. describe the purpose of your tax preparation business..

The first step to writing your business plan is to describe the purpose of your tax preparation business. This includes describing why you are starting this type of business, and what problems it will solve for customers. This is a quick way to get your mind thinking about the customers’ problems. It also helps you identify what makes your business different from others in its industry.

It also helps to include a vision statement so that readers can understand what type of company you want to build.

Here is an example of a purpose mission statement for a tax preparation business:

Our mission at XYZ Tax Preparation is to provide the highest quality, individualized tax services to our clients in an efficient, ethical, and cost-effective manner. We strive to create meaningful relationships with our clients and ensure that their individual tax needs are met by providing unparalleled customer service. We are committed to being a top provider of tax services in our community and providing accurate and reliable information to ensure compliance with IRS regulations.

2. Products & Services Offered by Your Tax Preparation Business.

The next step is to outline your products and services for your tax preparation business.

When you think about the products and services that you offer, it's helpful to ask yourself the following questions:

- What is my business?

- What are the products and/or services that I offer?

- Why am I offering these particular products and/or services?

- How do I differentiate myself from competitors with similar offerings?

- How will I market my products and services?

You may want to do a comparison of your business plan against those of other competitors in the area, or even with online reviews. This way, you can find out what people like about them and what they don’t like, so that you can either improve upon their offerings or avoid doing so altogether.

3. Build a Creative Marketing Stratgey.

If you don't have a marketing plan for your tax preparation business, it's time to write one. Your marketing plan should be part of your business plan and be a roadmap to your goals.

A good marketing plan for your tax preparation business includes the following elements:

Target market

- Who is your target market?

- What do these customers have in common?

- How many of them are there?

- How can you best reach them with your message or product?

Customer base

- Who are your current customers?

- Where did they come from (i.e., referrals)?

- How can their experience with your tax preparation business help make them repeat customers, consumers, visitors, subscribers, or advocates for other people in their network or industry who might also benefit from using this service, product, or brand?

Product or service description

- How does it work, what features does it have, and what are its benefits?

- Can anyone use this product or service regardless of age or gender?

- Can anyone visually see themselves using this product or service?

- How will they feel when they do so? If so, how long will the feeling last after purchasing (or trying) the product/service for the first time?

Competitive analysis

- Which companies are competing with yours today (and why)?

- Which ones may enter into competition with yours tomorrow if they find out about it now through word-of-mouth advertising; social media networks; friends' recommendations; etc.)

- What specific advantages does each competitor offer over yours currently?

Marketing channels

- Which marketing channel do you intend to leverage to attract new customers?

- What is your estimated marketing budget needed?

- What is the projected cost to acquire a new customer?

- How many of your customers do you instead will return?

Form an LLC in your state!

4. Write Your Operational Plan.

Next, you'll need to build your operational plan. This section describes the type of business you'll be running, and includes the steps involved in your operations.

In it, you should list:

- The equipment and facilities needed

- Who will be involved in the business (employees, contractors)

- Financial requirements for each step

- Milestones & KPIs

- Location of your business

- Zoning & permits required for the business

What equipment, supplies, or permits are needed to run a tax preparation business?

To run a Tax Preparation business, one will need the following equipment, supplies, and permits:

- Computer with a reliable internet connection

- Tax software

- Printer/scanner/copier

- Business license

- Filing cabinets or storage system for paperwork

- E-file provider authorization from the IRS

5. Management & Organization of Your Tax Preparation Business.

The second part of your tax preparation business plan is to develop a management and organization section.

This section will cover all of the following:

- How many employees you need in order to run your tax preparation business. This should include the roles they will play (for example, one person may be responsible for managing administrative duties while another might be in charge of customer service).

- The structure of your management team. The higher-ups like yourself should be able to delegate tasks through lower-level managers who are directly responsible for their given department (inventory and sales, etc.).

- How you’re going to make sure that everyone on board is doing their job well. You’ll want check-ins with employees regularly so they have time to ask questions or voice concerns if needed; this also gives you time to offer support where necessary while staying informed on how things are going within individual departments too!

6. Tax Preparation Business Startup Expenses & Captial Needed.

This section should be broken down by month and year. If you are still in the planning stage of your business, it may be helpful to estimate how much money will be needed each month until you reach profitability.

Typically, expenses for your business can be broken into a few basic categories:

Startup Costs

Startup costs are typically the first expenses you will incur when beginning an enterprise. These include legal fees, accounting expenses, and other costs associated with getting your business off the ground. The amount of money needed to start a tax preparation business varies based on many different variables, but below are a few different types of startup costs for a tax preparation business.

Running & Operating Costs

Running costs refer to ongoing expenses related directly with operating your business over time like electricity bills or salaries paid out each month. These types of expenses will vary greatly depending on multiple variables such as location, team size, utility costs, etc.

Marketing & Sales Expenses

You should include any costs associated with marketing and sales, such as advertising and promotions, website design or maintenance. Also, consider any additional expenses that may be incurred if you decide to launch a new product or service line. For example, if your tax preparation business has an existing website that needs an upgrade in order to sell more products or services, then this should be listed here.

7. Financial Plan & Projections

A financial plan is an important part of any business plan, as it outlines how the business will generate revenue and profit, and how it will use that profit to grow and sustain itself. To devise a financial plan for your tax preparation business, you will need to consider a number of factors, including your start-up costs, operating costs, projected revenue, and expenses.

Here are some steps you can follow to devise a financial plan for your tax preparation business plan:

- Determine your start-up costs: This will include the cost of purchasing or leasing the space where you will operate your business, as well as the cost of buying or leasing any equipment or supplies that you need to start the business.

- Estimate your operating costs: Operating costs will include utilities, such as electricity, gas, and water, as well as labor costs for employees, if any, and the cost of purchasing any materials or supplies that you will need to run your business.

- Project your revenue: To project your revenue, you will need to consider the number of customers you expect to have and the average amount they will spend on each visit. You can use this information to estimate how much money you will make from selling your products or services.

- Estimate your expenses: In addition to your operating costs, you will need to consider other expenses, such as insurance, marketing, and maintenance. You will also need to set aside money for taxes and other fees.

- Create a budget: Once you have estimated your start-up costs, operating costs, revenue, and expenses, you can use this information to create a budget for your business. This will help you to see how much money you will need to start the business, and how much profit you can expect to make.

- Develop a plan for using your profit: Finally, you will need to decide how you will use your profit to grow and sustain your business. This might include investing in new equipment, expanding the business, or saving for a rainy day.

Frequently Asked Questions About Tax Preparation Business Plans:

Why do you need a business plan for a tax preparation business.

A business plan for a tax preparation business is an important document that outlines the goals and objectives of the business, describes how it will be organized and operated, evaluates potential risks and rewards, and provides estimates of expected costs, income and other financial information. It is an essential tool for getting financial backing from investors or lenders, as well as being a key factor in determining success. A comprehensive business plan also helps in understanding the current market conditions and setting realistic goals.

Who should you ask for help with your tax preparation business plan?

You should consult with an accountant or tax preparation professional to get help with your tax preparation business plan. This professional can provide you with valuable insight into the necessary steps to set up a successful business, such as document filing requirements, operational costs, and potential revenue. Additionally, depending on the scope of your business plan, you may also need to speak with a lawyer to ensure that you are compliant with all local, state and federal regulations.

Can you write a tax preparation business plan yourself?

Yes, it is possible to write a tax preparation business plan yourself. Writing a business plan can help you gain insights on how to start and run a successful tax preparation business. A comprehensive business plan should include details about the target market, services provided, competitive landscape, marketing strategy, financial projections, management team and more. Researching the industry and consulting with other professionals such as lawyers or accountants can help you develop an effective and comprehensive plan for your tax preparation business.

Related Business Plans

Home Inventory Business Plan Template & Guidebook

Home Inspection Business Plan Template & Guidebook

Home Decor Business Plan Template & Guidebook

Health And Wellness Business Plan Template & Guidebook

Hauling Business Plan Template & Guidebook

Hardware Business Plan Template & Guidebook

Handyman Business Plan Template & Guidebook

Hair Extension Business Plan Template & Guidebook

Handbag Business Plan Template & Guidebook

I'm Nick, co-founder of newfoundr.com, dedicated to helping aspiring entrepreneurs succeed. As a small business owner with over five years of experience, I have garnered valuable knowledge and insights across a diverse range of industries. My passion for entrepreneurship drives me to share my expertise with aspiring entrepreneurs, empowering them to turn their business dreams into reality.

Through meticulous research and firsthand experience, I uncover the essential steps, software, tools, and costs associated with launching and maintaining a successful business. By demystifying the complexities of entrepreneurship, I provide the guidance and support needed for others to embark on their journey with confidence.

From assessing market viability and formulating business plans to selecting the right technology and navigating the financial landscape, I am dedicated to helping fellow entrepreneurs overcome challenges and unlock their full potential. As a steadfast advocate for small business success, my mission is to pave the way for a new generation of innovative and driven entrepreneurs who are ready to make their mark on the world.

Tax Preparation Business Plan Template [Updated 2024]

Tax Preparation Business Plan Template

If you want to start a Tax Preparation business or expand your current Tax business, you need a business plan.

The following Tax Preparation business plan template gives you the key elements to include in a winning Tax Service business plan.

You can download our Business Plan Template (including a full, customizable financial model) to your computer here.

Below are links to each of the key sections of a successful tax preparation service business plan. Once you create your plan, download it to PDF to show banks and investors.

Tax Preparation Business Plan Home I. Executive Summary II. Company Overview III. Industry Analysis IV. Customer Analysis V. Competitive Analysis VI. Marketing Plan VII. Operations Plan VIII. Management Team IX. Financial Plan

Comments are closed.

How to Start a Tax Preparation Business

As the owner of a tax preparation business, you’ll have the responsibility of cutting through the fog of federal, state, and local tax preparation, filing returns, and often earning tax rebates for individuals and, perhaps, small businesses.

Learn how to start your own Tax Preparation Business and whether it is the right fit for you.

Ready to form your LLC? Check out the Top LLC Formation Services .

Start a tax preparation business by following these 10 steps:

- Plan your Tax Preparation Business

- Form your Tax Preparation Business into a Legal Entity

- Register your Tax Preparation Business for Taxes

- Open a Business Bank Account & Credit Card

- Set up Accounting for your Tax Preparation Business

- Get the Necessary Permits & Licenses for your Tax Preparation Business

- Get Tax Preparation Business Insurance

- Define your Tax Preparation Business Brand

- Create your Tax Preparation Business Website

- Set up your Business Phone System

We have put together this simple guide to starting your tax preparation business. These steps will ensure that your new business is well planned out, registered properly and legally compliant.

Exploring your options? Check out other small business ideas .

STEP 1: Plan your business

A clear plan is essential for success as an entrepreneur. It will help you map out the specifics of your business and discover some unknowns. A few important topics to consider are:

What will you name your business?

- What are the startup and ongoing costs?

- Who is your target market?

How much can you charge customers?

Luckily we have done a lot of this research for you.

Choosing the right name is important and challenging. If you don’t already have a name in mind, visit our How to Name a Business guide or get help brainstorming a name with our Tax Preparation Business Name Generator

If you operate a sole proprietorship , you might want to operate under a business name other than your own name. Visit our DBA guide to learn more.

When registering a business name , we recommend researching your business name by checking:

- Your state's business records

- Federal and state trademark records

- Social media platforms

- Web domain availability .

It's very important to secure your domain name before someone else does.

Want some help naming your tax preparation business?

Business name generator, what are the costs involved in opening a tax preparation business.

You can start your tax prep business relatively modestly, but there are some unavoidable costs to consider:

Office rent—zero to $1,500 or more. This is a business that you can run from your home, but you must consider if that would be a smart move. First check to make sure your neighborhood is zoned for seeing clients (hopefully a lot of them over the course of a few months) from your residence. Also keep in mind that a storefront office in a part of town with good traffic can act as a billboard and encourage walk-in trade. This might be especially important when you start out. As for the cost of office space, that can vary dramatically from region to region and even from one part of town to another. Look for space that has been empty for awhile and a landlord who might be motivated to get some cash flow to the building for a short lease period of perhaps only three or four months rather than watch the space sit idle.

Business cards, logo and signage—$1,000 or less. If you’re operating out of your home, signage might not even be allowed. But anytime you are able to hang a sign, it will serve as a free billboard and encourage impulse walk-ins. Your logo and business cards can be designed inexpensively if you find a talented graphic design student trying to build a portfolio.

Office equipment and automation—$2,000, est. or more. Even if you’re working out of your home, you want your business to look as professional as possible. That means you should have an office desk and a comforable chair for yourself and as many as two for clients. You’ll also need at least one laptop and printer, or a computer for every employee.

Tax preparation software—$400-$500. There are various vendors depending on your needs.

Legal, licensure and insurance—2,000 est. You must first pass a 60-hour tax prep training course that can cost in the $500-$600 range, depending on where it’s taken. There are additional costs from the IRS and for liability insurance. Furthermore, a few states require additional regulatory adherence. Visit here for an explanation of some of the training costs and requirements .

Employee costs—Vary. Some of the leading competitors pay individual tax preparers as little as $10 an hour. Others pay a commission of perhaps 20 percent of the fees generated. You’ll also be responsible for tax withholdings and your FICA and Medicare contribution for each hire.

What are the ongoing expenses for a tax preparation business?

If you have a temporary storefront, rent and utilities will be among your largest fixed costs. Temporary employees will also cost you either an hourly rate or a percentage of the business they handle. Other costs might include advertising if you’re looking for a sudden uptick in business.

Who is the target market?

Who will your typical clients be? You might mostly see lower-income earners filing to receive their earned income tax credit. Or more complicated cases from the self-employed or smaller businesses. Or the middle class, who aim to take advantage of various tax credits. Making this decision will help you determine where you might open a storefront, how and where you might market your business and what specific skills you must master.

How does a tax preparation business make money?

You’ll charge a fee for your services, based on the complexity and time involvement of the filing.

According to a National Society of Accountants survey released in 2017, the average fee charged by tax preparers for an individual itemized 1040 return with a Schedule A form and state tax return was $273. For small business clients, the average charge was $457.

How much profit can a tax preparation business make?

Error-free speed is of the essence. With a statistic mentioned earlier of the average itemized individual return generating $273 in fees, one of these per hour is possible. However, especially as you start your business and before you attract a significant client base, you’ll face unprofitable downtime.

How can you make your business more profitable?

Some accountants or CPAs offer tax prep as one of a range of accounting services. This business is also compatible with financial services, real estate brokerages, insurance and other fields where the business owner is comfortable discussing financial issues with clients. Also keep in mind that if your client base significantly consists of private contractors and small business owners, they might have additional tax issues throughout the year.

And finally, consider conducting tax prep training classes as a complementary service. You could conduct such a class through The Income Tax School .

Want a more guided approach? Access TRUiC's free Small Business Startup Guide - a step-by-step course for turning your business idea into reality. Get started today!

STEP 2: Form a legal entity

The most common business structure types are the sole proprietorship , partnership , limited liability company (LLC) , and corporation .

Establishing a legal business entity such as an LLC or corporation protects you from being held personally liable if your tax preparation business is sued.

Form Your LLC

Read our Guide to Form Your Own LLC

Have a Professional Service Form your LLC for You

Two such reliable services:

You can form an LLC yourself and pay only the minimal state LLC costs or hire one of the Best LLC Services for a small, additional fee.

Recommended: You will need to elect a registered agent for your LLC. LLC formation packages usually include a free year of registered agent services . You can choose to hire a registered agent or act as your own.

STEP 3: Register for taxes

You will need to register for a variety of state and federal taxes before you can open for business.

In order to register for taxes you will need to apply for an EIN. It's really easy and free!

You can acquire your EIN through the IRS website . If you would like to learn more about EINs, read our article, What is an EIN?

There are specific state taxes that might apply to your business. Learn more about state sales tax and franchise taxes in our state sales tax guides.

STEP 4: Open a business bank account & credit card

Using dedicated business banking and credit accounts is essential for personal asset protection.

When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at risk in the event your business is sued. In business law, this is referred to as piercing your corporate veil .

Open a business bank account

Besides being a requirement when applying for business loans, opening a business bank account:

- Separates your personal assets from your company's assets, which is necessary for personal asset protection.

- Makes accounting and tax filing easier.

Recommended: Read our Best Banks for Small Business review to find the best national bank or credit union.

Get a business credit card

Getting a business credit card helps you:

- Separate personal and business expenses by putting your business' expenses all in one place.

- Build your company's credit history , which can be useful to raise money later on.

Recommended: Apply for an easy approval business credit card from BILL and build your business credit quickly.

STEP 5: Set up business accounting

Recording your various expenses and sources of income is critical to understanding the financial performance of your business. Keeping accurate and detailed accounts also greatly simplifies your annual tax filing.

Make LLC accounting easy with our LLC Expenses Cheat Sheet.

STEP 6: Obtain necessary permits and licenses

Failure to acquire necessary permits and licenses can result in hefty fines, or even cause your business to be shut down.

State & Local Business Licensing Requirements

Certain state permits and licenses may be needed to operate a tax preparation business. Learn more about licensing requirements in your state by visiting SBA’s reference to state licenses and permits .

Most businesses are required to collect sales tax on the goods or services they provide. To learn more about how sales tax will affect your business, read our article, Sales Tax for Small Businesses .

Certificate of Occupancy

A tax preparation business can be run out of an office. Businesses operating out of a physical location typically require a Certificate of Occupancy (CO). A CO confirms that all building codes, zoning laws and government regulations have been met.

- If you plan to lease a location :

- It is generally the landlord’s responsibility to obtain a CO.

- Before leasing, confirm that your landlord has or can obtain a valid CO that is applicable to a tax preparation business.

- After a major renovation, a new CO often needs to be issued. If your place of business will be renovated before opening, it is recommended to include language in your lease agreement stating that lease payments will not commence until a valid CO is issued.

- If you plan to purchase or build a location :

- You will be responsible for obtaining a valid CO from a local government authority.

- Review all building codes and zoning requirements for your business’ location to ensure your tax preparation business will be in compliance and able to obtain a CO.

Services Contract

Tax preparation businesses should require clients to sign a services agreement before starting a new project. This agreement should clarify client expectations and minimize risk of legal disputes by setting out payment terms and conditions, service level expectations, and intellectual property ownership. Here is an example of one such services agreement.

STEP 7: Get business insurance

Just as with licenses and permits, your business needs insurance in order to operate safely and lawfully. Business Insurance protects your company’s financial wellbeing in the event of a covered loss.

There are several types of insurance policies created for different types of businesses with different risks. If you’re unsure of the types of risks that your business may face, begin with General Liability Insurance . This is the most common coverage that small businesses need, so it’s a great place to start for your business.

Another notable insurance policy that many businesses need is Workers’ Compensation Insurance . If your business will have employees, it’s a good chance that your state will require you to carry Workers' Compensation Coverage.

FInd out what types of insurance your Tax Preparation Business needs and how much it will cost you by reading our guide Business Insurance for Tax Preparation Business.

STEP 8: Define your brand

Your brand is what your company stands for, as well as how your business is perceived by the public. A strong brand will help your business stand out from competitors.

If you aren't feeling confident about designing your small business logo, then check out our Design Guides for Beginners , we'll give you helpful tips and advice for creating the best unique logo for your business.

Recommended : Get a logo using Truic's free logo Generator no email or sign up required, or use a Premium Logo Maker .

If you already have a logo, you can also add it to a QR code with our Free QR Code Generator . Choose from 13 QR code types to create a code for your business cards and publications, or to help spread awareness for your new website.

How to promote & market a tax preparation business

As mentioned, your storefront might be your most effective marketing tool if opened within sight of your market audience. Also use social media, including LinkedIn and a Facebook group, to spread the word and communicate with your clients. Your marketing efforts might also go as low-tech and “old school” as handing out fliers to passersby and asking to post fliers or business cards in area businesses.

How to keep customers coming back

Excellent customer service—and satisfactory tax returns—will earn you repeat business through the years. These loyal clients are also likely to recommend you to friends, family or business associates.

STEP 9: Create your business website

After defining your brand and creating your logo the next step is to create a website for your business .

While creating a website is an essential step, some may fear that it’s out of their reach because they don’t have any website-building experience. While this may have been a reasonable fear back in 2015, web technology has seen huge advancements in the past few years that makes the lives of small business owners much simpler.

Here are the main reasons why you shouldn’t delay building your website:

- All legitimate businesses have websites - full stop. The size or industry of your business does not matter when it comes to getting your business online.

- Social media accounts like Facebook pages or LinkedIn business profiles are not a replacement for a business website that you own.

- Website builder tools like the GoDaddy Website Builder have made creating a basic website extremely simple. You don’t need to hire a web developer or designer to create a website that you can be proud of.

Recommended : Get started today using our recommended website builder or check out our review of the Best Website Builders .

Other popular website builders are: WordPress , WIX , Weebly , Squarespace , and Shopify .

STEP 10: Set up your business phone system

Getting a phone set up for your business is one of the best ways to help keep your personal life and business life separate and private. That’s not the only benefit; it also helps you make your business more automated, gives your business legitimacy, and makes it easier for potential customers to find and contact you.

There are many services available to entrepreneurs who want to set up a business phone system. We’ve reviewed the top companies and rated them based on price, features, and ease of use. Check out our review of the Best Business Phone Systems 2023 to find the best phone service for your small business.

Recommended Business Phone Service: Phone.com

Phone.com is our top choice for small business phone numbers because of all the features it offers for small businesses and it's fair pricing.

Is this Business Right For You?

If you are a well-organized, people-oriented person who’s taken professional courses to learn the tax preparation business and are at ease with automation and digital software, you could thrive at this largely seasonal business. You should be able to handle long and probably stressful hours in a contained season of intense activity from January through mid-April. After that, you’ll have plenty of time to recover!

Want to know if you are cut out to be an entrepreneur?

Take our Entrepreneurship Quiz to find out!

Entrepreneurship Quiz

What happens during a typical day at a tax preparation business?

Think of your business as falling into two periods—tax season and pre-season—with very different areas of responsibility for each. During tax season, you’ll primarily see clients and prepare and file their taxes. Your goal is to do almost nothing but handle your clients since the tax-filing season is bound by the deadline dictates of the Internal Revenue Service and other taxing agencies.

Off-season, your responsibilities are more diverse. Your pre-season day will probably include some or all of the following activities.

- Interviewing and hiring temporary tax-prep employees, if you have a customer base that justifies seasonal help

- Seeking temporary storefront offices if you plan on working from such a public space rather than from your home

- Ordering and mastering your tax preparation software since software glitches or usage confusion during filing season can result in customer fee losses in the hundreds or thousands of dollars

- Conducting marketing and social media strategies to atttract customers

What are some skills and experiences that will help you build a successful tax preparation business?

In the beginning, your sales and marketing skills will be critical. That’s because you have a narrow window of opportunity for attracting business and plenty of name-brand competition (H&R Block, Jackson Hewitt, TurboTax, etc.). You must also have the patience to prepare for your business success by taking the 60-hour tax course you’ll need for certification and applying for efiling licensure from the IRS.

Once you’re in business, you’ll have to be able to work fast, efficiently and accurately to see as many clients and submit as many tax filings as you can over your limited calendar time. You must also be able to make your clients feel at ease regarding such topics as income, debt, taxes and penalties.

What is the growth potential for a tax preparation business?

The U.S. tax code contains 73,000 pages. Eighty-two million individuals file annually and the complexity of the process discourages most people from preparing their own taxes. While politicians from both parties promise simplification of the tax code, the reality is that the process only grows more complex. That means you can always feel confident of a customer base eager for your help.

TRUiC's YouTube Channel

For fun informative videos about starting a business visit the TRUiC YouTube Channel or subscribe to view later.

Take the Next Step

Find a business mentor.

One of the greatest resources an entrepreneur can have is quality mentorship. As you start planning your business, connect with a free business resource near you to get the help you need.

Having a support network in place to turn to during tough times is a major factor of success for new business owners.

Learn from other business owners

Want to learn more about starting a business from entrepreneurs themselves? Visit Startup Savant’s startup founder series to gain entrepreneurial insights, lessons, and advice from founders themselves.

Resources to Help Women in Business

There are many resources out there specifically for women entrepreneurs. We’ve gathered necessary and useful information to help you succeed both professionally and personally:

If you’re a woman looking for some guidance in entrepreneurship, check out this great new series Women in Business created by the women of our partner Startup Savant.

What are some insider tips for jump starting a tax preparation business?

Start slow. In fact, before going on your own you might consider working for a season for one of the large competitors. This is a good way to sharpen your skills at using the software, confronting a variety of taxation challenges and working productively. You might also keep your day job and take on a few clients on nights or weekends at first. If you meet their needs they’re likely to be back for years to come—and be powerful word-of-mouth recruitment tools.

How and when to build a team

You look forward to the day when you’re so busy you need additional help. Remember, you don’t want to turn any client away because you don’t have time for them or you could lose them to a competitor forever. Before that happens, start to post for help on job boards. But be sure you state the requirement that applicants must have passed the 60-hour training course (or additional training if they’re to take on business tax clients).

Useful Links

Industry opportunities.

- National Association of Tax Professionals

- Jackson Hewitt (franchise opportunity)

Real World Examples

- Ann Arbor CPA

Further Reading

- What you need to start this business

- Tips for starting this business

Have a Question? Leave a Comment!

- Start free trial

- About Canopy

- Practice Management

- Highlighted Features

- Future-Focused Firms

- Data-Driven Firm Management

- Practice Optimization

- Communication & Collaboration

- Content Hub

- Why Canopy?

- Case Studies

- Implementation

- Training & Professional Services

- Company Info

Schedule your Canopy Demo.

- Canopy Features and News

- Client Relationships

- Document Management

- Industry News

- Marketing Your Practice

- Product Updates

- Tax Preparation and Planning

- Tax Resolution

How to Create a Business Plan for Your Tax Practice

Before you create your tax and accounting business you should establish a clear vision of what you want your company to become. One of the best ways to do this is to create a business plan.

Before you create your tax and accounting business you should establish a clear vision of what you want your company to become. The more you focus your overall vision, the more likely you are to achieve it. One of the best ways to do this is to create a business plan.

A business plan is often referred to as the roadmap of a business. It’s a comprehensive document that outlines important aspects of your current and future business operations. It also helps give your business direction by clarifying your objectives and goals. In this video, we walk through seven things you will want to consider while creating a business plan for your tax practice.

Number one: The type of entity

An important step in your business planning process is to decide what type of entity you will identify as. The different types of business entities are limited liability companies, also known as LLCs, C corporations, S corporations, partnerships, and sole proprietorships. Each has specific legal rights and responsibilities, from tax requirements to lawsuits, the number of shareholders, and profit divisions.