- Calls In Arrears and Calls In Advance

When a company issues its share in the market , public purchases its shares and they become its shareholders. The Company may call the whole amount at a time in a lump sum or partially by way of calls. Sometimes, the shareholders may not pay the amount called on a particular date, that amount is known as Calls in Arrears.

Suggested Videos

Calls-in-arrears.

If a shareholder is not able to pay the call amount due on allotment or on any calls according to the terms, the amount that becomes due is Calls-In-Arrears . We may transfer or not transfer the arrear amount on account of allotment or calls to Calls-in-Arrears Account.

Methods of Accounting Treatment of Calls-In-Arrears

Without opening calls-in-arrears account, by opening calls-in-arrears account.

Under this method, we credit the receipt from shareholders to the relevant call account and various call accounts will show debit balance equal to the total unpaid amount of calls.

On a subsequent date, when we receive the amount of Calls-in-Arrears, we debit Bank Account and credit the relevant Call Account.

For example, The company makes the first call @ ₹ 2 per share on 10,000 shares . The receipt of the amount on the first call is for 9,500 shares. Entries will be as follows:

Under this method, we transfer the unpaid amount to Calls-In-Arrears Account. As a result, Shares Allotment Accounts and Shares Calls Accounts will not show any balance.

The Calls-in-Arrears Accounts will show a debit balance equal to the total unpaid amount on allotment and calls. Later, on receipt of arrear amount, we credit it to the Calls-in-Arrears Account.

Learn more about Issue of Shares at Par here in detail.

In the above example, if we open Calls-in-Arrears Account is then the first two entries will be the same and third entry passed will be:

In place of second and third entry we can also pass a combined entry which is as follows:

On receipt of Calls-in-Arrears at a subsequent date:

We show the Calls-in-Arrears Account in the Notes to Accounts on Share Capital to the Balance Sheet as a deduction from the amount of ‘Subscribed but not fully paid-up’ under ‘Subscribed Capital’.

Calls-In-Advance

If a company accepts the amount against the call or calls which are not made yet, the amount so received in advance is called Calls-In-Advance.

It may also happen in case of partial or pro-rata allotment of shares when the company retains excess amount received on the application of shares beyond the allotment money.

We show the Calls-In-Advance in the Equity and Liabilities part of the Balance Sheet under the head Current Liabilities and sub-head Other Current Liabilities.

Journal entry to record Calls-In-Advance is:

Solved Example on Calls In Arrears and Calls In Advance

The Indore Coir Mills Ltd. With a registered capital of 5,00,000 Equity Shares of ₹ 10 each, issued 2,00,000 Equity Shares, payable ₹ 3 on the application, ₹ 2 on the allotment, ₹ 3 on the first call and ₹ 2 on second and final call.

The company duly receives the amount due on allotment. One shareholder holding 6,000 Equity Shares pays second and final call along with the first call. While five shareholders with a total holding of 10,000 Equity Shares did not pay the first call on their Equity Shares. The company did not make the final call.

Pass journal entries to record the transactions.

In the Books of Indore Coir Mills Ltd.

JOURNAL

BALANCE SHEET OF INDORE COIR MILLS LTD as at…

Notes to Accounts

Customize your course in 30 seconds

Which class are you in.

Issue, Forfeiture, Reissue of Shares

- Issue of Shares at Discount

- Types of shares

- Forfeiture of Shares

- Issue for Consideration other than Cash

- Pro Rata Allotment

- Issue of Shares at Premium

- Re-issue of Forfeited Shares

- Issue of Shares at Par

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

- Popular Courses

- Python LIVE Course

- More classes

- More Courses

share application money

CA Amit Jaiswal

CA Sanat Pyne

CMA. CS. Sanjay Gupta

Ram Avtar Singh

CA. BIJENDER KR. BANSAL

Similar Resolved Queries

- Querry for 24q4 correction file

- Taxation for Remote Working in India for a UK Firm

- COMPULSORY AQUISITION ON RURAL LAND TAXABLE OR NOT

- Capital Gain Tax on transfer of share to spouse

- Einvoice time limit to generate or upload

- COMMISSION AND BROKERAGE INCOME OPT FOR PRESUMPTIVE TAXATION TDS DEDUCT U/S 194H

- Purchase of Property for consideration less than Stamp duty Value

- E-way bill for gold and other preceious metal transport

- What will happen if the details of issued documents are not updated in GSTR-1?

- Bill of Supply and Tax Invoice not Issued within prescribed time

- RAWS GST QUERY

- Inoperative pan in 24Q return

- "Experience the World: Turkish Airlines at MIA Terminal"

- LATE FEES FOR FILING GST RETURN UNDER SUSPENSION PERIOD

- In the case of bill-cum-supply rule no. 47 is still pplicable, and penalties for not providing a bil

- Statutory Audit checklist of Limited Company

- PF- pension balance not show in EPF login

- Tally ERP 9 Entries for Cash Credit

- TDS/TCS return has been Rejected

- GST on Royalty paid

Trending Online Classes

Certification Course on Chat GPT and AI Tools for Professionals

"Live Course on Python for Financial Analysis: Unlocking Efficiency in Accounting and Finance"

Live Course on PF & ESIC - Advance Course(with recording)

Quick Links

- Experts Home

- Apply As Expert

- Daily Digest

- Show all queries

- Today's Posts

- Ask a Query

- Answer a Query

- Hall of Fame

- Settings (Only for experts)

- Settings (experts)

- Resolved Queries

Whatsapp Groups

Login at caclubindia, caclubindia.

India's largest network for finance professionals

Alternatively, you can log in using:

Home » Blog » Know all about the Financial Statements of Companies

Know all about the Financial Statements of Companies

- Blog | Account & Audit |

- 25 Min Read

- Last Updated on 4 January, 2024

Recent Posts

Blog, Advisory, Company Law

SEBI (LODR) (Amendment) Regulations – New Market Cap Formula | Rumour Verification

Blog, News, Insolvency and Bankruptcy Code

Goods Confiscated by Customs Vest in Govt. Even if Option to Pay Redemption Fine is Not Exercised | NCLAT

Latest from taxmann.

Table of Contents

- Financial Statements

- Share Warrant

- Share Application Money Pending Allotment

- Schedule III to the Companies Act, 2013

- General Instructions for Preparation of Balance Sheet

1. Financial Statements of a Company

1.1 meaning of financial statement.

“According to S. 2(40) financial statement in relation to a company, includes— (i) a balance sheet as at the end of the financial year; (ii) a profit and loss account, or in case of a company carrying on any activity not for profit, an income and expenditure account for the financial year; (iii) cash flow statement for the financial year; and (iv) any explanatory note annexed to, or forming part of, any document referred to in sub-clause (i) to sub-clause (iv).

However, the financial statement, with respect to One Person Company, small company and dormant company (S. 455) may not include cash flow statement.

1.2 Meaning of Financial Year

According to S. 2(41), financial year, in relation to any company or body corporate, means the period ending on the 31st day of March every year. Where a company has been incorporated on or after 1st day of January of a year, the first financial year will end on 31st day of March of the following year.

If a company or body corporate which is a holding company or a subsidiary or associate company of a company incorporated outside India and is required to follow a different financial year for consolidation of its accounts outside India, the Tribunal may, if it is satisfied, allow any period as its financial year, whether or not that period is a year.

1.3 Types of Financial statements on the Basis of Period

The following are the two types of financial statements :

- Annual financial statements: These are prepared once in a financial year

- Quarterly financial statements: These are prepared by listed companies on quarterly basis as per SEBI requirements.

1.4 Legal Requirements related to Financial Statements as provided in S. 129

Sections 128 to 138 deal with financial requirements. The following are the legal requirements as provided in section 129:

Section 129(1) of the Companies Act, 2013 provides that the financial statements

(i) shall give a true and fair view of the state of affairs of the company or companies,

(ii) comply with the accounting standards notified under S. 133,

(iii) shall be in the form or forms as may be provided for different class or classes of companies in Schedule III and (iv) the items contained in such financial statements shall be in accordance with the accounting standards.

However, the aforesaid provisions of S. 129(1) shall not apply to any insurance or banking company or any company engaged in the generation or supply of electricity, or to any other class of company for which form of financial statement has been specified in or under the Act governing such class of company.

Section 129(2) provides that at every general meeting of a company, the Board of Directors of the Company shall lay before such meeting financial statements for the financial year.

Section 129(3) provides that where a company has one or subsidiaries or associate companies, it shall, in addition to standalone financial statement prepared under section 129(2), prepare a consolidated financial statement of the company and of all the subsidiaries and associate companies. The consolidated financial statement shall be prepared by the company in the same form and manner as that of its own and in accordance with applicable standards. The consolidated financial statement shall also be laid before the annual general meeting of the company along with the laying of the standalone financial statement.

Section 129(4) states that the provisions of the Act applicable to the preparation, adoption and audit of the financial statements of a holding company shall, mutatis mutandis, apply to the consolidated financial statements referred in S. 129(3).

Section 129(5) provides that where the financial statements of a company do not comply with the accounting standards referred to in S. 129(1), the company shall disclose in its financial statements, the deviation from the accounting standards, the reasons for such deviation and the financial effects, if any, arising out of such deviation.

Section 129(6) empowers the Central Government to exempt any class or classes of companies from complying with any of the requirements of S. 129 or rules made thereunder, if it is considered necessary to grant such exemption in the public interest. The Central Government may, by notification, constitute a National Financial Reporting Authority to provide for matters relating to accounting and auditing standards under the Companies Act, 2013 [S. 132].

The Central Government may prescribe the standards of accounting or any addendum thereto, as recommended by the Institute of Chartered Accountants of India, in consultation with and after examination of the recommendations made by the National Financial Reporting Authority [S. 133].

2. Share Warrant

As per AS-20, Earnings of per Share, defines ‘share warrants’ as “financial instruments which give the holder the right to acquire equity shares”. Thus, share warrants would ultimately form part of the shareholders’ funds. As shares are yet to be allotted against share warrants, these are not shown as part of share capital. It is shown as a separate line item: ‘Money received against share warrants’.

3. Share Application Money Pending Allotment

Share application money pending allotment is to be disclosed as a separate line time on the face of the balance sheet between “Shareholders’ Funds” and “Non-current liabilities”. Share application money not exceeding the issued capital and to the extent not refundable is to be disclosed under line item: “Share application money pending allotment”. The balance of such money is shown under the head “Other current liabilities”. But the amount due for refund and interest thereon, if any, will be shown under the head “Other current liabilities”.

4. Schedule III to the Companies Act, 2013

Schedule III of the Companies Act, 2013 provides the manner in which every company registered under the Act shall prepare its Statement of Profit and Loss, Balance Sheet and Notes to Accounts or Notes to Financial Statements. There was a need of enhancing the disclosure requirements under the Old Schedule VI to the Companies Act, 1956 to harmonise them with the notified accounting standards. Therefore, the Ministry of Corporate Affairs issued a revised form of Schedule VI, vide Notification No. S.O. 447(E), dated February 28, 2011. The Revised Schedule VI to the Companies Act, 1956 was applicable to the companies for the Financial Statements to be prepared for the financial year commencing on or after April 1, 2011. As per the new Companies Act, 2013 this has been numbered as Schedule III. Schedule III to the Companies Act, 2013 prescribes format of financial statements for the following three categories:

DIVISION I Financial statements for a company whose financial statements are required to comply with the Companies (Accounting Standards) Rules, 2006.

DIVISION II Financial Statements for a company whose financial statements are drawn up in compliance of the Companies (Indian Accounting Standards) Rules, 2015.

DIVISION III Financial Statements for a Non-Banking Finance Company whose financial statements are drawn up in compliance of the Companies (Indian Accounting Standards) Rules, 2015.

4.1 Schedule III | Division-I Non Ind AS

Financial Statements for a company whose financial statements are required to comply with Companies (Accounting Standards) Rules, 2006.

General Instructions for Preparation of Financial Statements

1. Overriding status to other requirements of the Companies Act and to the Accounting Standards: Schedule III of the Companies Act, 2013 Act provides that where compliance with the requirements of the Act including Accounting Standards as applicable to the companies require any change in treatment or disclosure including addition, amendment, substitution or deletion in the head/sub-head or any changes inter se, in the Financial Statements or statements forming part thereof, the same shall be made and the requirements of the Schedule III shall stand modified accordingly. Thus, the Schedule III of the Companies Act, 2013 gives overriding status to the other requirements of the Companies Act, 2013 and the Accounting Standards as applicable to the companies. In other words, the requirements of the Accounting Standards and other provisions of the Companies Act would prevail over the Schedule.

2. Disclosure requirements of the Schedule III are in addition to and not in substitution of disclosure requirements of the Accounting Standards: Disclosure requirements specified in Part I (Form of Balance Sheet) and Part II (Form of Statement of Profit and Loss Account) of the Schedule are in addition to and not in substitution of the disclosure requirements specified in the Accounting Standards prescribed under the Companies Act, 2013. Additional disclosures specified in the Accounting Standards shall be made in the Notes to Accounts or by way of additional statement unless required to be disclosed on the face of the Financial Statements. Similarly, all other disclosures as required by the Companies Act shall be made in the Notes to Accounts in addition to the requirements set out in the Schedule.

3. Notes to Accounts shall contain information in addition to that presented in Financial Statements: The Notes to Accounts shall contain information in addition to that presented in the Financial Statements and shall provide where required

(a) narrative descriptions or disaggregations of items recognized in those statements and

(b) information about items that do not qualify for recognition in those statements. These items normally include contingent liabilities and commitments which are not shown on the face of the Balance Sheet.

It further provides that each item on the face of the Balance Sheet and Statement of Profit and Loss shall be cross-referenced to any related information in the Notes to Accounts. In preparing the Financial Statements including the Notes to Accounts, a balance shall be maintained between providing excessive detail that may not assist users of Financial Statements and not providing important information as a result of too much aggregation. The manner of cross reference has been changed to “Note No.” as compared to “Schedule No.”

4. New norms of rounding off: New norms of rounding off have been introduced depending upon the turnover of the company. The figures appearing in the Financial Statements may be rounded off as below:

Once a unit of measurement is used, it should be used uniformly in the Financial Statements.

5. Figures for immediately preceding period: Except in the case of the first Financial Statements laid before the Company (after its incorporation) the corresponding amounts (comparatives) for the immediately preceding reporting period for all items shown in the Financial Statements including notes shall also be given.

6. Terms used in the Schedule: The terms used in the Schedule shall be as per the applicable Accounting Standards. Notes to General Instructions: This part of Schedule sets out the minimum requirements for disclosure on the face of the Balance Sheet, and the Statement of Profit and Loss (hereinafter referred to as “Financial Statements” for the purpose of this Schedule) and Notes, Line items, sub-line items and sub-totals shall be presented as an addition or substitution on the face of the Financial Statements when such presentation is relevant to an understanding of the company’s financial position or performance or to cater to industry/sector-specific disclosure requirements or when required for compliance with the amendments to the Companies Act or under the Accounting Standards.

4.2 Part I | Format of BALANCE SHEET

The following is the form of the Balance Sheet as per Schedule III (Division I – Non Ind AS) of the Companies Act, 2013, as amended in 2018:

Name of the Company ……… Balance Sheet as at ……………

(Rupees in………)

See accompanying notes to the financial statements.

5. General Instructions for Preparation of Balance Sheet

The general instructions for preparation of Balance Sheet as per Schedule III are reproduced below:

5.1 An asset shall be classified as current when it satisfies any of the following criteria

( a ) it is expected to be realized in, or is intended for sale or consumption in, the company’s normal operating cycle;

( b ) it is held primarily for the purpose of being traded;

( c ) it is expected to be realized within twelve months after the reporting date; or

( d ) it is cash or cash equivalent unless it is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting date.

All other assets shall be classified as non-current.

Explanation of the definition of current assets

Clause (a): If an asset is expected to be realised in, or is intended for sale or consumption in the company’s normal operating cycle: It include debtors, finished goods, stock-in-trade and raw material. Debtors are expected to be realised within the operating cycle of the business and debtors are current assets. However, if some debtors are not expected to be realised within 12 months from the reporting date or in the normal operating cycle of the business, then those debtors will be classified as non-current assets.

Clause (b): If an asset is held primarily for the purpose of being traded: It include stock-in-trade and finished goods, as these are held primarily for the purpose of being traded, and hence these are current assets. Investments may also come under this clause, if these are primarily held for the purpose of being traded.

Clause (c): If an asset is expected to be realised within 12 months after the reporting date: It include investments made in the debentures of another company and maturing within 12 months after the reporting date. Such part of the investments are classified as current assets.

Clause (d): If an asset is cash or cash equivalents unless it is restricted from being exchanged or used to settle a liability for at least 12 months after the reporting date: Cash equivalents are short-term (upto 3 months), highly liquid investments that are readily convertible into known amounts of cash and which are subject to an insignificant risk of changes in value. However, if cash or cash equivalents is restricted from being exchanged or used to settle a liability for at least 12 months after the reporting date, then it will not be classified as current asset. For example, if a company has a bank balance of ` 50,000 in a bank and it has taken a loan of ` 5,00,000 and there is an agreement between the company, bank and the lender under which there is restriction for use of ` 40,000 out of the aforesaid ` 50,000 for more than 12 months after the reporting date (balance sheet), the bank balance of ` 40,000 out of ` 50,000 is not a current asset for the reporting date (balance sheet).

The period of three months should be counted from the date of investment to determine whether the investment is cash equivalent or not.

5.2 Operating Cycle

An operating cycle is the time between the acquisition of assets for processing and their realization in cash or cash equivalents. Operating cycle may be a period of less than 12 months, equal to 12 months or more than 12 months. Where the normal operating cycle cannot be identified, it is assumed to have a duration of 12 months.

Items of inventory which may be consumed or realised within the company’s normal operating cycle should be classified as current even if the same are not expected to be consumed or realised within twelve months after the reporting date.

5.3 Liability

A liability shall be classified as current when it satisfies any of the following criteria:

( a ) it is expected to be settled in the company’s normal operating cycle;

( c ) it is due to be settled within twelve months after the reporting date; or

( d ) the company does not have an unconditional right to defer settlement of the liability for at least twelve months after the reporting date. Terms of a liability that could, at the option of the counterpart, result in its settlement by the issue of equity instruments do not affect its classification.

All other liabilities shall be classified as non-current.

Explanation of definition of current liabilities

Clause (a): If a liability is expected to be settled in the company’s normal operating cycle: A liability, whether arising in the ordinary course of business or otherwise, will be classified as a current liability if it is expected to be settled in the company’s normal operating cycle. Therefore, trade creditors are classified as current liability as they are expected to be settled within the normal operating cycle of the business which may be less than, equal to or more than 12 months.

Clause (b): If a liability is held primarily for the purpose of being traded: If a liability is primarily held for the purpose of being traded, it will be classified as a current liability. This happens when a company trades in the liability (current or non-current) of other organization for a commission or any other form of compensation.

Clause (c): If a liability is due to be settled within 12 months after the reporting date: If a liability is due to be settled within 12 months after the reporting date, it will be classified as a current liability. Such liability may or may not arise in the ordinary course of business of the company. For example, if creditors of the company are to be paid within 3 months of the reporting date, will be classified as a current liability. Further, if a part of the long term liability is payable within 12 months of the reporting date, that part of the long-term liability will be classified as current liability. For example, current maturity of the long-term debentures will be classified as a current liability.

Clause (d): When the company does not have an unconditional right to defer the settlement of the liability for at least 12 months after the reporting date: A liability is classified as a current liability if the company does not have an unconditional right to defer the settlement of the liability for at least 12 months after the reporting date. For example, if a company declares dividend at an Annual General Meeting, the dividend is payable within one month of the declaration. If a part of the dividend payable remains unpaid within the prescribed time, the unpaid dividend is transferred to separate “Unpaid Dividend Account” and has to be transferred to separate bank account. The concerned shareholder can make a claim of the unpaid dividend from the company within 7 years. Thus, the company does not have unconditional right to defer the settlement of the liability for at least 12 months after the reporting date. Therefore, unpaid dividend will be classified as a current liability.

5.4 Definition of Trade Receivable

A receivable shall be classified as a ‘trade receivable’ if it is in respect of the amount due on account of goods sold or services rendered in the normal course of business.

5.5 Definition of Trade Payable

A payable shall be classified as a ‘trade payable’ if it is in respect of the amount due on account of goods (i.e. raw material, work-in-progress or stock-in-trade) purchased or services received in the normal course of business.

5.6 A company shall disclose the following in the Notes to Accounts

A. Share Capital

For each class of share capital (different classes of preference shares to be treated separately)

( a ) the number and amount of shares authorized;

( b ) the number of shares issued, subscribed and fully paid, and subscribed but not fully paid;

( c ) par value per share;

( d ) a reconciliation of the number of shares outstanding at the beginning and at the end of the reporting period;

( e ) the rights, preferences and restrictions attaching to each class of shares including restrictions on the distribution of dividends and the repayment of capital;

( f ) shares in respect of each class in the company held by its holding company or its ultimate holding company including shares held by subsidiaries or associates of the holding company or the ultimate holding company in aggregate;

( g ) shares in the company held by each shareholder holding more than 5 per cent shares specifying the number of shares held;

( h ) shares reserved for issue under options and contracts/commitments for the sale of shares/disinvestment, including the terms and amounts;

( i ) for the period of five years immediately preceding the date as at which the Balance Sheet is prepared—

- Aggregate number and class of shares allotted as fully paid up pursuant to contract(s) without payment being received in cash.

- Aggregate number and class of shares allotted as fully paid up by way of bonus shares,

- Aggregate number and class of shares bought back.

( j ) terms of any securities convertible into equity/preference shares issued along with the earliest date of conversion in descending order starting from the farthest such date;

( k ) calls unpaid (showing aggregate value of calls unpaid by directors and officers);

( l ) forfeited shares (amount originally paid up).

The disclosure, inter alia, will be as follows:

Notes to Accounts

Note: It may be noted that unpaid amount towards shares subscribed by the subscribers of the memorandum of association should be considered as ‘Subscribed and paid up capital’ in the balance sheet and debts due from the subscriber should be appropriately disclosed as an asset in the balance sheet.

Reconciliation of shares outstanding at the beginning and at the end of the reporting year will be shown as follows:

Similarly, reconciliation of preference shares will be shown:

B. Reserves and Surplus

(i) Reserves and Surplus shall be classified as :

( a ) Capital Reserve;

( b ) Capital Redemption Reserve*;

( c ) Securities Premium [*****];

( d ) Debenture Redemption Reserve;

( e ) Revaluation Reserve;

( f ) Share Options Outstanding Account;

( g ) Other Reserves—(specify the nature and purpose of each reserve and the amount in respect thereof);

( h ) Surplus i.e. balance in Statement of Profit and Loss disclosing allocations and appropriations such as dividend, bonus shares and transfer to/from reserves, etc.

(Additions and deductions since last Balance Sheet to be shown under each of the specified heads)

( ii ) A reserve specifically represented by earmarked investments shall be termed as a ‘fund’.

( iii ) Debit or negative balance of Statement of Profit and Loss shall be shown as a negative figure under the head ‘Surplus’. Similarly, the balance of ‘Reserves and Surplus’, after adjusting negative balance of Surplus, if any, shall be shown under the head ‘Reserves and Surplus’ even if the resulting figure is in the negative.

When there has been a change in the balance of any reserve as compared to the last year, disclose the movement in the reserve.

Similarly, show the additions and deductions since the last balance sheet in the surplus i.e. balance in the statement of profit and loss.

C. Long-term Borrowings

( i ) Long-term borrowings shall be classified as :

( a ) Bonds/debentures

( b ) Terms loans

( A ) From banks

( B ) From other parties

( c ) Deferred payment liabilities

( d ) Deposits

( e ) Loans and advances from related parties

( f ) Long-term maturities of finance lease obligations

( g ) Other loans and advances (specify nature)

(ii) Borrowings shall further be sub-classified as secured and unsecured. Nature of security shall be specified separately in each case.

(iii) Where loans have been guaranteed by directors or others, the aggregate amount of such loans under each head shall be disclosed.

(iv) Bonds/debentures (along with the rate of interest and particulars of redemption or conversion, as the case may be) shall be stated in descending order of maturity or conversion, starting from farthest redemption or conversion date, as the case may be. Where bonds/debentures are redeemable by instalments, the date of maturity for this purpose must be reckoned as the date on which the first instalment becomes due.

(v) Particulars of any redeemed bonds/debentures which the company has power to reissue shall be disclosed.

(vi) Terms of repayment of term loans and other loans shall be stated.

(vii) Period and amount of continuing default as on the Balance Sheet date in repayment of loans and interest, shall be specified separately in each case.

D. Other Long-term Liabilities

Other Long-term Liabilities shall be classified as :

( a ) Trade payables

( b ) Others

Dues payable in respect of purchase of property, plant and equipment, intangible assets, etc. cannot be included under trade payable. Such payables should be classified as “Others” and each such item should be disclosed nature-wise. However, long-term bills payable should be disclosed as part of trade payable.

E. Long-term Provisions

The amounts shall be classified as :

( a ) Provision for employee benefits

( b ) Others (specify nature)

F. Short-term Borrowings

( i ) Short-term borrowings shall be classified as :

( a ) Loans repayable on demand

- From other parties

( b ) Loans and advances from related parties

( c ) Deposits

( d ) Other loans and advances (specify nature)

(iv) Period and amount of default as on the Balance Sheet date in repayment of loans and interest, shall be specified separately in each case.

(v) Current maturities of long-term borrowings* (inserted w.e.f. 1-4-2021).

Bank overdraft is shown under “short-term borrowings”. An overdraft is not ordinarily offset with the bank balance, unless there is a legal right to do so.

*FA. Trade payables

The following details relating to Micro, Small and Medium Enterprises shall be disclosed in the notes:-

( a ) the principal amount and the interest thereon (to be shown separately) remaining unpaid to any supplier at the end of each accounting year;

( b ) the amount of interest paid by the buyer in terms of section 16 of the Micro, Small and Medium Enterprises Development Act, 2006, along with the amount of the payment made to the supplier beyond the appointed day during each accounting year;

( c ) the amount of interest due and payable for the period of delay in making payment (which) have been paid but beyond the appointed day during the year) but without adding the interest specified under the Micro, Small and Medium Enterprise Development Act, 2006;

( d ) the amount of interest accrued and remaining unpaid at the end of each accounting year; and

( e ) the amount of further interest remaining due and payable even in the succeeding years, until such date when the interest dues above are actually paid to the small enterprise, for the purpose of disallowance of a deductible expenditure under section 23 of the Micro, Small and Medium Enterprises Development Act, 2006.

Explanation.- The terms ‘appointed day’, ‘buyer’, ‘enterprise’, ‘micro enterprise’, ‘small enterprise’ and ‘supplier’, shall have the same meaning assigned to those under clauses ( b ), ( d ), ( e ), ( h ), ( m ), and ( n ) respectively on section 2 of the Micro, Small and Medium Enterprises Development Act, 2006.]

G. Other Current Liabilities

( a ) Omitted w.e.f. 1-4-2021

( b ) Current maturities of finance lease obligations

( c ) Interest accrued but not due on borrowings

( d ) Interest accrued and due on borrowings

( e ) Income received in advance

( f ) Unpaid dividends

( g ) Application money received for allotment of securities and due for refund and interest accrued thereon.

Share application money includes advances towards allotment of share capital. The terms and conditions including the number of shares proposed to be issued, the amount of premium, if any, and the period before which shares shall be allotted shall be disclosed. It shall also be disclosed whether the company has sufficient authorized capital to cover the share capital amount resulting from allotment of shares out of such share application money. Further, the period for which the share application money has been pending beyond the period for allotment as mentioned in the document inviting application for shares along with the reason for such share application money being pending shall be disclosed. Share application money not exceeding the issued capital and to the extent not refundable shall be shown under the head Equity and share application money to the extent refundable i.e., the amount in excess of subscription or in case the requirements of minimum subscription are not met shall be separately shown under ‘Other current liabilities.’

( h ) Unpaid matured deposits and interest accrued thereon

( i ) Unpaid matured debentures and interest accrued thereon

( j ) Other payable (specify nature);

Term deposits and security deposits which are not in the nature of borrowings should be classified under ‘Other Non-current liabilities’ or ‘Other current liabilities’, as the case may be.

H. Short-term Provisions

( b ) Others (specify nature)

Others would include all provisions other than provision for employee benefits such as provision for taxation, provision for warranties, etc. These should be disclosed separately specifying nature thereof.

Schedule III provides that current tax ( i.e . provision for tax) is to be disclosed under ‘short-term provisions’ on the equity and liabilities part of the balance sheet; and advance tax is to be disclosed under ‘Loans and advances’ on the Assets side part of the balance sheet.

AS-22, Accounting for Taxes on Income , has a specific requirement with respect to off-setting. As per paragraph 27, an enterprise should offset asset and liabilities representing current tax ( i.e. provision for tax) if the enterprise:

( a ) has a legally enforceable right to set off the recognised amounts; and

( b ) intends to settle the asset and liability on a net basis.

Therefore, where the enterprise can in fact fulfil the criteria set in paragraph 27 of AS-22, disclose the advance tax/current tax (i.e. provision for tax) on a net basis, mentioning the adjusted amount in the inner column.

I. Property, Plant and Equipment

( i ) Classification shall be given as :

( b ) Buildings

( c ) Plant and Equipment

( d ) Furniture and Fixtures

( e ) Vehicles

( f ) Office equipment

( g ) Others (specify nature)

(ii) Assets under lease shall be separately specified under each class of asset.

(iii) A reconciliation of the gross and net carrying amounts of each class of assets at the beginning and at end of the reporting period showing additions, disposals, acquisitions through business combinations, amount of change due to revaluation (if change is 10% or more in the aggregate of the net carrying value of each class of Property, Plant and Equipment) and other adjustments and the related depreciation and impairment losses/reversals shall be disclosed separately.

(iv) Where sums have been written off on a reduction of capital or revaluation of assets or where sums have been added on revaluation of assets, every Balance Sheet subsequent to date of such write-off, or addition shall show the reduced or increased figures as applicable and shall by way of a note also show the amount of the reduction or increase as applicable together with the date thereof for the first five years subsequent to the date of such reduction or increase.

Notes to Accounts of Property, Plant and Equipment is to be prepared as follows:

Note No…… Property, Plant and Equipment

J. Tangible Assets

( i ) Classification shall be given as :

( a ) Land

( f ) Office equipment

( g ) Others (specify nature)

(iii) A reconciliation of the gross and net carrying amounts of each class of assets at the beginning and at end of the reporting period showing additions, disposals, acquisitions through business combinations and other adjustments and the related depreciation and impairment losses/reversals shall be disclosed separately.

(iv) Where sums have been written off on a reduction of capital or revaluation of assets or where sums have been added on revaluation of assets, every Balance Sheet subsequent to date of such write-off, or addition shall show the reduced or increased figures as applicable and shall by way of a note also show the amount of the reduction or increase as applicable together with the date thereof for the first five years subsequent to the date of such reduction or increase.

Note: Guidance note on Division I of Schedule III (second edition July, 2019) States that “Tangible Assets” be named as “Property, Plant and Equipment (Tangible Assets)”. Its Notes to Accounts may be prepared as follows:

Note | Tangible Assets

K. Intangible Assets

(i) Classification shall be given as :

( a ) Goodwill

( b ) Brands/trademarks

( c ) Computer software

( d ) Mastheads and publishing titles

( e ) Mining rights

( f ) Copyrights, and patents and other intellectual property rights, services and operating rights

( g ) Recipes, formulae, models, designs and prototypes

(h) Licenses and franchise

( i ) Others (specify nature).

( ii ) A reconciliation of the gross and net carrying amounts of each class of assets at the beginning and at the end of the reporting period showing additions, disposals, acquisitions through business combinations and other adjustments and the related amortization and impairment losses/reversals shall be disclosed separately.

( iii ) Where sums have been written off on a reduction of capital or revaluation of assets or where sums have been added on revaluation of assets, every Balance Sheet subsequent to date of such write-off, or addition shall show the reduced or increased figures as applicable and shall by way of a note also show the amount of the reduction or increase as applicable together with the date thereof for the first five years subsequent to the date of such reduction or increase.

Note No. …… Intangible Assets

(in rupees)

L. Non-current Investments

( i ) Non-current investments shall be classified as trade investments and other investments and further classified as :

( a ) Investment in property

( b ) Investments in Equity Instruments

( c ) Investments in preference shares

( d ) Investments in Government or trust securities

( e ) Investments in debentures or bonds

( f ) Investments in Mutual Funds

( g ) Investments in partnership firms

( h ) Other non-current investments (specify nature)

Under each classification, details shall be given of names of the bodies corporate (indicating separately whether such bodies are (i) subsidiaries, (ii) associates, (iii) joint ventures, or (iv) controlled special purpose entities in whom investments have been made and the nature and extent of the investments so made in each such body corporate (showing separately investments which are partly-paid). In regard to investments in the capital of partnership firms, the names of the firms (with the names of all their partners, total capital and the shares of each partner) shall be given.

(ii) Investments carried at other than at cost should be separately stated specifying the basis for valuation thereof.

(iii) The following shall also be disclosed :

( a ) Aggregate amount of quoted investments and market value thereof;

( b ) Aggregate amount of unquoted investments;

( c ) Aggregate provision for diminution in value of investments.

M. Long-term Loans and Advances

(i) Long-term loans and advances shall be classified as :

( a ) Capital Advances;

( b ) Security Deposits;

( c ) Loans and advances to related parties (giving details thereof);

( d ) Other loans and advances (specify nature).

(ii) The above shall also be separately sub-classified as :

( a ) Secured, considered good;

( b ) Unsecured, considered good;

( c ) Doubtful.

(iii) Allowance for bad and doubtful loans and advances shall be disclosed under the relevant heads separately.

(iv) Loans and advances due by directors or other officers of the company or any of them either severally or jointly with any other persons or amounts due by firms or private companies respectively in which any director is a partner or a director or a member should be separately stated.

N. Other Non-current Assets

Other non-current assets shall be classified as :

(i) Long-term Trade Receivables (including trade receivables on deferred credit terms);

(ia) Security Deposits.

(ii) Others (specify nature).

(iii) Long-term Trade Receivables, shall be sub-classified as:

(A) Secured, considered good;

(B) Unsecured considered good;

(C) Doubtful.

Allowance for bad and doubtful debts shall be disclosed under the relevant heads separately.

Debts due by directors or other officers of the company or any of them either severally or jointly with any other person or debts due by firms or private companies respectively in which any director is a partner or a director or a member should be separately stated.

(iv) For trade receivables outstanding, following ageing schedule shall be given:

Trade Receivables Ageing Schedule

(Amount in `)

Similar information shall be given where no due date of payment is specified, in that case, disclosure shall be from the date of transaction.

Unbilled dues shall be disclosed Separately.

O. Current Investments

(i) Current investments shall be classified as :

( a ) Investments in Equity Instruments;

( b ) Investment in Preference Shares;

( c ) Investments in Government or trust securities;

( d ) Investments in debentures or bonds;

( e ) Investments in Mutual Funds;

( f ) Investments in partnership firms;

( g ) Other investments (specify nature).

Under each classification, details shall be given of names of the bodies corporate (indicating separately whether such bodies are : (i) subsidiaries, (ii) associates, (iii) joint ventures, or (iv) controlled special purpose entities) in whom investments have been made and the nature and extent of the investment so made in each such body corporate (showing separately investments which are partly-paid). In regard to investments in the capital of partnership firms, the names of the firms (with the names of all their partners, total capital and the shares of each partner) shall be given.

(ii) The following shall also be disclosed :

( a ) The basis of valuation of individual investments;

( b ) Aggregate amount of quoted investments and market value thereof;

( c ) Aggregate amount of unquoted investments;

( d ) Aggregate provision made for diminution in value of investments.

P. Inventories

(i) Inventories shall be classified as :

( a ) Raw materials;

( b ) Work-in-progress;

( c ) Finished goods;

( d ) Stock-in-trade (in respect of goods acquired for trading);

( e ) Stores and spares;

( f ) Loose tools;

( g ) Others (specify nature).

_____________________

*Substituted by G.S.R. 1022(E), dated 11th October, 2018 for “Fixed Assets” (w.e.f 11-10-2018).

*The word “Reserve” omitted by GSR 1022(E), dated 11th October, 2018 (w.e.f. 11-10-2018)

*Inserted by G.S.R. 679( E ), dated 4th September, 2015.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

PREVIOUS POST

To subscribe to our weekly newsletter please log in/register on Taxmann.com

Latest books.

R.K. Jain's Customs Tariff of India | Set of 2 Volumes

R.K. Jain's Customs Law Manual | 2023-24 | Set of 2 Volumes

R.K. Jain's GST Law Manual | 2023-24

R.K. Jain's GST Tariff of India | 2023-24

Everything on Tax and Corporate Laws of India

Author: Taxmann

- Font and size that's easy to read and remain consistent across all imprint and digital publications are applied

Everything you need on Tax & Corporate Laws. Authentic Databases, Books, Journals, Practice Modules, Exam Platforms, and More.

- Express Delivery | Secured Payment

- Free Shipping in India on order(s) above ₹500

- Missed call number +91 8688939939

- Virtual Books & Journals

- About Company

- Media Coverage

- Budget 2022-23

- Business & Support

- Sell with Taxmann

- Locate Dealers

- Locate Representatives

- CD Key Activation

- Privacy Policy

- Return Policy

- Payment Terms

404 Not found

Module 13: Accounting for Corporations

Balance sheet presentation, learning outcomes.

- Illustrate the balance sheet presentation of stockholder’s equity

Let’s take another look at the most current regulatory reports for The Home Depot, Inc . On page 33 of the 2019 annual report, the company reported the following components of stockholders’ equity:

Let’s take a look at a side-by-side comparison of a sole proprietorship’s owner’s equity and that of a corporation:

It’s unlikely a sole proprietorship will be following all aspects of GAAP. It would be unlikely to include Other Comprehensive Gains and Losses unless a bank or other influential stakeholder [1] required full GAAP compliance. Other comprehensive gains and losses usually arise from changes in market value of short-term investments and adjustments that arise in translating information from subsidiaries that do business in other nations and therefore use other currencies (foreign currency translation).

In short, other than some differences in terminology and technical differences, the basic expanded version of the accounting equation still holds true:

A = L + E, where E = capital contributions − withdrawals + revenue − expenses.

For a corporation, it could be listed as:

Equity = paid-in capital from the sale of stock (par and in excess of par) − dividends and treasury stock + revenues and other comprehensive income − expenses and other comprehensive losses.

One final note: The balance in retained earnings is generally available for dividend declarations. Some companies state this fact. In some circumstances, however, there may be retained earnings restrictions . These make a portion of the balance currently unavailable for dividends. Restrictions result from one or more of these causes: legal, contractual, or voluntary. For instance, a contractual restriction may be the result of loan covenants. A voluntary restriction may be because of a board resolution. A legal restriction may be imposed as part of a lawsuit settlement. Companies generally disclose retained earnings restrictions in the notes to the financial statements.

In the next section, we’ll study the Statement of Changes in Stockholders’ Equity, but first, check your understanding of the balance sheet presentation.

Practice Question

- A stakeholder is different from a shareholder or stockholder. Employees, creditors, customers, government agencies, and a wide variety of other interested parties can be stakeholders. This means they have some kind of stake in the company and what it does (for instance, a not-for-profit concerned with the environment could be a stakeholder in a manufacturing firm). A shareholder/stockholder is an owner because they hold shares of stock. ↵

- Balance Sheet Presentation. Authored by : Joseph Cooke. Provided by : Lumen Learning. License : CC BY: Attribution

- Accountancy

- Business Studies

- Organisational Behaviour

- Human Resource Management

- Entrepreneurship

- CBSE Class 12 Accountancy Notes

Chapter 1: Accounting for Partnership: Basic Concepts

- Introduction to Accounting for Partnership

- Partnership Deed and Provisions of the Indian Partnership Act 1932

- Difference between Limited Liability Partnership and Partnership Firm

- Accounting Treatment for Interest on Partner's Capital

- Interest on Drawing in case of Partnership

- Accounting Treatment of Partner's Loan, Rent Paid to a Partner, Commission Payable to a Partner, Manager's Commission on Net Profit

- Profit and Loss Appropriation Account : Journal Entries & Format

- Difference between Profit and Loss Account And Profit and Loss Appropriation Account

- Capital Accounts of the Partner: Fixed Capital Method

- Capital Accounts of the Partner: Fluctuating Capital Method

- Difference between Fixed Capital Account and Fluctuating Capital Account

- Past Adjustments in Partnership

- Guarantee of Minimum Profit to a Partner

Chapter 2: Reconstitution of a Partnership Firm: Change in Profit Sharing Ratio

- Reconstitution of a Partnership Firm : Reasons and Change in Profit Sharing Ratio

- Goodwill: Meaning, Factors Affecting Goodwill and Need for Valuation

- Methods of Valuation of Goodwill

- Average Profit Method of calculating Goodwill

- Super Profit Method of Calculating Goodwill

- Capitalisation Method of Calculating Goodwill

- Accounting Treatment of Accumulated Profits and Reserves: Change in Profit Sharing Ratio

- Accounting Treatment of Workmen Compensation Reserve: Change in Profit Sharing Ratio

- Change in Profit Sharing Ratio: Accounting Treatment of Investment Fluctuation Fund

- Accounting Treatment of Revaluation of Assets and Liabilities: Change in Profit Sharing Ratio

- Accounting Treatment of Partner's Capital Account in case of change in Profit Sharing Ratio (Fixed Capital)

- Accounting Treatment of Partner's Capital Account in case of change in Profit Sharing Ratio (Fluctuating Capital)

- Adjustment in Existing Partner's Capital Account in case of Change in Profit Sharing Ratio

Chapter 3: Reconstitution of a Partnership Firm: Admission of a Partner

- Computation of New Profit Sharing Ratio: Admission of a Partner

- Computation of Sacrificing Ratio in case of Admission of a Partner

- Accounting Treatment of Goodwill in case of Admission of a Partner

- Hidden Goodwill: Admission of a Partner

- Accounting Treatment of Revaluation of Assets and Liabilities in case of Admission of a Partner

- Accounting Treatment of Accumulated Profits and Reserves in case of Admission of a Partner

- Accounting Treatment of Workmen Compensation Reserve: Admission of a Partner

- Accounting Treatment of Investment Fluctuation Fund in case of Admission of a Partner

- Accounting Treatment of Partner's Capital Account: Admission of a Partner (Fixed Capital)

- Accounting Treatment of Partner's Capital Account: Admission of a Partner (Fluctuating Capital)

- Preparation of Revaluation Account, Capital Account and Balance Sheet

- Adjustment of Partner's Capital Account: Admission of a Partner

Chapter 4: Reconstitution of a Partnership Firm: Retirement or Death of a Partner

- Retirement of a Partner in case of Reconstitution of a Partnership Firm

- Computation of New Profit Sharing Ratio: Retirement of a Partner

- Calculation of Gaining Ratio: Retirement of a Partner

- Difference between Sacrificing Ratio and Gaining Ratio

- Accounting Treatment of Goodwill in case of Retirement of a Partner

- Hidden Goodwill in case of Retirement of a Partner

- Accounting Treatment of Revaluation of Assets and Liabilities in case of Retirement of a Partner

- Accounting Treatment of Accumulated Profits and Reserves in case of Retirement of a Partner

- Accounting Treatment of Workmen Compensation Reserve in case of Retirement of a Partner

- Accounting Treatment of Investment Fluctuation Fund in case of Retirement of a Partner

- Accounting Treatment of Partner's Capital Account in case of Retirement of a Partner (Fixed Capital)

- Accounting Treatment of Partner's Capital Account in case of Retirement of a Partner (Fluctuating Capital)

- Settlement of Amount due to a Retiring Partner when Full Amount is Paid

- Settlement of Amount due to a Retiring Partner: Amount Paid in Instalment

- Settlement of Amount due to a Retiring Partner: Transferred to Loan Account

- Adjustment of Capital Account in case of Retirement of a Partner

- Reconstitution of a Partnership Firm in case of Death of a Partner

- Calculation of Share of Profit up to the Date of Death of a Partner

- Adjustment of Interest on Deceased Partner's Capital, Deceased Partner's Share in Goodwill and Accumulated Profits and Reserves

- Accounting Treatment of Revaluation of Assets and Liabilities in case of Death of a Partner

- Accounting Treatment of Accumulated Profits and Reserves in case of Death of a Partner

- Accounting Treatment of Workmen Compensation Reserve in case of Death of a Partner

- Accounting Treatment of Investment Fluctuation Fund in case of Death of a Partner

- Accounting Treatment of Partner's Capital Account in case of Death of a Partner (Fixed Capital)

- Accounting Treatment of Partner's Capital Account in case of Death of a Partner (Fluctuating Capital)

- Accounting Treatment of Amount Due to Deceased Partner

- Accounting Treatment of Joint Life Policy in case of Death of a Partner

- Accounting Treatment of Individual Life Policy in case of Death of a Partner

Chapter 5: Dissolution of Partnership Firm

- Dissolution of a Partnership Firm: Meaning, Modes of Dissolution, Modes of Settlement of accounts (Section 48)

- Difference between Dissolution of Firm and Dissolution of Partnership

- Difference between Firm's Debt and Private Debt

- Difference between Realisation account and Revaluation account

- Accounting treatment of Accumulated Profits, Reserves, and Losses in case of Dissolution of Firm

- Dissolution of Firm: Partner's Capital Account

- Dissolution of Partnership Firm: Meaning and Example

- Accounting Treatment of Goodwill in case of Dissolution of Firm

- Accounting Treatment of Joint Life Policy in case of Dissolution of a Firm

- Accounting Treatment of Contingent Assets and Contingent Liabilities in case of Dissolution of a firm

Chapter 1: Accounting for Share Capital

- Company and its Types

- Difference between Public Company and Private Company

- Shares : Meaning, Nature and Types

- Difference between Preference Shares and Equity Shares

- Share Capital: Meaning, Kinds, and Presentation of Share Capital in Company's Balance Sheet

- Difference between Capital Reserve and Reserve Capital

- Accounting for Share Capital: Issues of Shares for Cash

- Issue of Shares At Par: Accounting Entries

- Issue of Shares at Premium: Accounting Entries

- Issue of Share for Consideration other than Cash: Accounting for Share Capital

- Issue of Shares: Accounting Entries on Full Subscription with Share Application

- Calls in Arrear: Accounting Entries with Examples on Issue of Shares

- Calls in Advance: Accounting Entries with Examples on Issue of Shares

- Oversubscription of Shares: Accounting Treatment

- Oversubscription of Shares: Pro-rata Allotment

- Oversubscription of Shares: Pro-rata Allotment with Calls in Arrear

- Forfeiture of Shares : Accounting Entries on Issue of Shares

- Accounting Entries on Re-issue of Forfeited Shares

- Disclosure of Share Capital in the Balance Sheet: Accounting Entries on Issue of Shares

Chapter 2: Issue and Redemption of Debentures

- Issue of Debentures: Meaning, Characteristics, Purpose of Issuing Debentures and Example

- Types of Debentures

- Difference between Shares and Debentures

Issue of Debentures: Accounting Treatment of Issue of Debenture and Presentation of debentures in balance sheet (with format)

- Issue of Debenture at Par and Premium

- Issue of Debentures for Consideration other than Cash

- Issue of Debenture as Collateral Security

- Interest on Debentures

- Redemption of Debentures

- Redemption of Debentures: Meaning, Sources and Rules regarding Redemption

- Redemption of Debentures in case of Lump-Sum

- Redemption of Debentures in case of Installment

- Redemption of Debentures in case of Purchase of Own Debentures

- Redemption of Debentures: Conversion into Shares or New Debentures

Chapter 3: Financial Statements of a Company

- Financial Statements : Meaning, Objectives, Types and Format

- Objectives and Characteristics of Financial Statements

- Financial Statement of a Company: Balance Sheet

- Profit and Loss Account - Meaning, Format and General Instructions

Chapter 4: Analysis of Financial Statements

- Financial Analysis: Need, Types, and Limitations

- Financial Analysis: Uses, Importance, Limitations

- Comparative Statement: Meaning, Importance and Techniques of Presenting Financial Statements

- Comparative Balance Sheet: Objectives, Advantages and Format of Comparative Balance Sheet

- Comparative Income Statement: Objectives, Advantages and Preparation and Format of Comparative Income Statement

- Common Size Income Statement: Objectives, Preparation, Format of Common Size Statement

- Common Size Balance Sheet: Meaning, Objectives, Format & Example

Chapter 5: Accounting Ratios

- Ratio Analysis- Importance, Advantages and Limitations

- Types of Accounting Ratios with Formula

- Liquidity Ratio: Meaning, Types, Formula and Illustrations

- Current Ratio: Meaning, Significance and Examples

- Liquid/Quick Ratio: Meaning, Formula, Significance and Examples

- Solvency Ratio: Meaning, Formula, and Significance

- Debt-Equity Ratio: Meaning, Formula, Significance and Examples

- Total Assets to Debt Ratio: Meaning, Formula and Examples

- Proprietary Ratio: Meaning, Formula, Significance and Examples

- Interest Coverage Ratio | Meaning, Formula, Calculation and Examples

- Activity Ratio: Meaning, Formula and Significance

- Trade Receivables Turnover Ratio: Meaning, Formula, Significance and Illustration

- Trade Payable Turnover Ratio: Meaning, Formula, Significance and Examples

- Working Capital Turnover Ratio: Meaning, Formula, Significance and Examples

- Profitability Ratio or Income Ratio: Meaning, Formula and Significance

- Overall Profitability Ratio: Meaning, Formula, Significance, and Examples

- Gross Profit Ratio: Meaning, Formula, Significance and Examples

- Operating Ratio | Formula and Examples

- Operating Profit Ratio: Meaning, Formula, Significance and Examples

- Net Profit Ratio

- Return on Investment (ROI): Meaning, Formula, Significance and Illustrations

- Ratio Analysis Formula

Chapter 6: Cash Flow Statement

- What is a Cash Flow Statement?

- Cash Flow Statement: Objectives, Importance and Limitations

- Classification of Business Activities in Cash Flow: Operating, Investing and Financing Activities

- Cash Flow from Operating Activities

- Treatment of Special Items in Cash Flow Statement

- Treatment of Special Items in Cash Flow Statement-II

- Examples of Cash Flow from Operating Activities

- Cash Flow from Investing Activities

- Cash Flow from Financing Activities

- Cash Flow Statement: Two Examples

Part-C Chapter 1: Overview of Computerised Accounting System

- Sourcing of Accounting Software

- Computerised Accounting System

- Computerized Accounting System - Meaning, Features, Advantages and Disadvantages

- Difference between Manual and Computerised Accounting

- Difference between Management Information System (MIS) and Accounting Information System (AIS)

- Evolution and Features of Computerised Accounting

- Components of Computer

CBSE Previous Year Papers (2020)

- CBSE Class 12 Accountancy Solved Question Paper (Paper Code: 67/1/1, 2020)

- CBSE Class 12 Accountancy Solved Question Paper (Paper Code: 67/1/2, 2020)

- CBSE Class 12 Accountancy Solved Question Paper (Paper Code: 67/1/3, 2020)

- CBSE Class 12 Accountancy Solved Question (Paper-67/2/1-2020)

- CBSE Class 12 Accountancy Solved Question Paper-67/2/2

- CBSE Class 12 Accountancy Solved Question Paper (Paper Code: 67/2/3, 2020)

- CBSE Class 12 Accountancy Solved Question Paper (67/4/1, 2020)

Accounting for Non-for-Profit Organization (Deleted Syllabus)

- Not for Profit Organisations- Features and Financial Statements

- Difference Between Not for Profit Organisation and Profit Earning Organisation

- Income and Expenditure Account of a Not for Profit Organisation

- Difference between Receipt and Payment Account And Income and Expenditure Account

- Balance Sheet for Not for Profit Organisation

- Accounting Treatment for Subscriptions and Expenses

- Accounting Treatment of Consumable Items: Stationery and Sports Material

- Accounting Treatment: Admission or Entrance Fees, Donation and Legacies, Grants from Government, Sale of Fixed Assets, Life Membership Fees

- Fund based Accounting

- Receipt and Payment Account for Not for Profit Organisation

- Income & Expenditure Account: Accounting Treatment

- Practical Questions on Balance sheet for Not for Profit Organisation

- Practical Questions on Receipt & Payment Account

What is a Debenture?

A written instrument or document which is issued by the company acknowledging the borrowings is known as Debenture . In this document, the terms of repayment of principal and payment of interest at a specific rate are stated.

According to Section 2(30) of the Companies Act, 2013 ,”Debenture includes debenture stock, bonds and any other instrument of the company evidencing a debt, whether constituting a charge on the assets of the company or not.” According to Topham, ” A debenture is a document given by a company as evidence of a debt to the holder usually arising out of a loan and most commonly secured by a charge.”

The person to whom debentures are issued is called Debentureholder .

Characteristics of Debenture:

The characteristics of debentures are as follows:

- A debenture is a certificate or written document, which is an acknowledgement of debt taken by a company.

- It is borrowing of a company.

- It is issued under the seal of a company.

- Interests on Debentures is a charge against profit.

- It contains a contract for the repayment of the principal sum at a specified date.

- The funds raised by the issue of debentures are for a long period of time, such as 7 years, 10 years, or 12 years, and the loan raised by the issue of debentures is also called ‘Loan Capital’.

Issue of Debentures:

A listed company can go for the issue of debentures for public subscription, but an unlisted company cannot issue debentures to the public in general. However, by private placement, both listed and unlisted companies may issue debentures. The accounting entries and procedures for issuing debentures are similar to that for the issue of shares. Debentures may be issued for cash; consideration other than cash; and as collateral security.

Debentures may be issued at par; premium; or at discount whether issued for cash or consideration other than cash.

Accounting Treatment of Issue of Debenture:

The journal entries passed for issuing debentures are the same as in the case of shares. Only ‘Debenture A/c’ is used in place of ‘Share Capital A/c’. The rate of interest is usually pre-fixed with Debenture A/c.

1. On receipt of application money:

2. On transfer of application money to Debenture A/c:

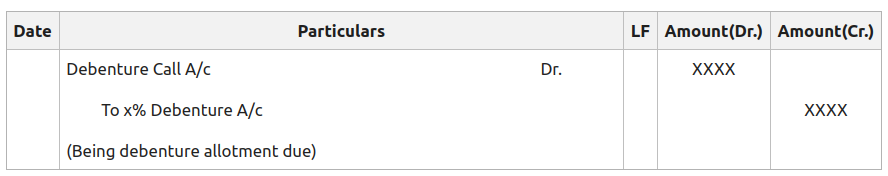

3. On allotment due:

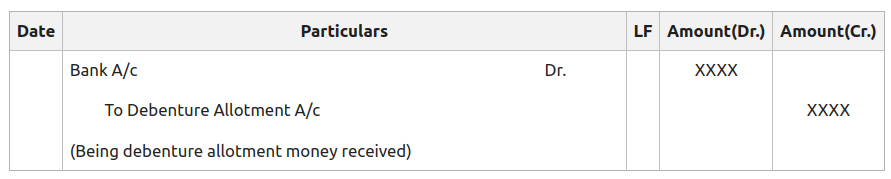

4. On receipt of allotment money:

5. On due of call money:

6. On receipt of call money:

Presentation of Debenture A/c in Balance Sheet:

Notes to Balance Sheet:

Please Login to comment...

Similar reads, improve your coding skills with practice.

What kind of Experience do you want to share?

- Submit Post

- Union Budget 2024

- Company Law

Subscription Money Not Paid in Balance Sheet of Company- Companies Act, 2013

Position of Subscription Money Not Paid in Balance Sheet of Company & under various provisions of Companies Act, 2013

In case of newly incorporated company, situation may occur when subscribers to the Memorandum of Association (‘MOA’) fails to pay subscription money as agreed by them in MOA. Earlier there was no time limit prescribed in the Companies Act, 2013 (the ‘Act, 2013’) for depositing the subscription money by the subscribers to the Company. As per the recent amendment, a Company which has been incorporated on or after 02 November 2018, shall within 180 days of incorporation required to file the declaration by the director with the Registrar of Companies (‘ROC’) stating that every Subscriber to the Memorandum has paid the value of shares taken by them.

As per Section 3(1) of the Companies Act, 2013, “a company may be formed for nay lawful purpose by-

(a) Seven or more person , where the company to be formed is to be a Public Company ;

(b) Two or more person , where the company is to be formed is to be a Private Company ; or

(c) One person , where the company to be formed is to be One Person Company that is to say, a Private Company :

by subscribing their names or his name to memorandum and complying with the requirements of this Act, in respect of registration.”

The minimum paid-up share capital requirement of Rs. 100,000 (in case of a Private Company) and Rs. 500,000 (in case of a Public Company) under the Act, 2013 has been done away by Companies (Amendment) Act, 2015 w.e.f. 29th May, 2015. Accordingly, no minimum paid-up capital requirements will now apply for incorporating private as well as public companies in India.

If any entity has been formed for the lawful purpose it requires capital to carry out the business. Such Capital is infused by the Individual or Corporates by subscribing the shares of the entity, such shares have a nominal value which is to be paid by the subscriber as “Subscription Money”. These persons are termed as “Subscribers” . Subscribers are also considered as first shareholders of the company and later on members of the company.

‘Subscribers’ are those persons whose name is entered in MOA and by signing the MOA they are giving consent to take some number of shares of the company by contributing capital to the entity. It is to be noted that any person who is competent to contract can be a subscriber. A company being a legal person can subscribe. A partnership not being a legal person cannot do so. In this case an individual partner must subscribe. Signing of MOA by subscribers is a contract with the company and subscription money not received from the subscriber then it will be considered as breach of contract by the subscriber and will attract civil dispute for breach of contract.

The ‘ liability of each subscriber’ is equal to the total amount due on the shares subscribed for by him. Each subscriber is liable to pay to the company the full amount of the shares for which he has subscribed when a call to pay up is made on him by the directors or on the date or dates fixed for payment.

The term “Subscription Money ” refers to that amount where subscriber is willing to subscribe shares of the company at a face value and need to deposits the amount in bank of the company. There is no prohibition/restriction under the Act, 2013 for receiving the subscription money in cash (i.e. not through account payee cheque or other banking channel). However, the Company and/or subscribers have to comply with the provisions of the Income Tax Act with regard to cash transaction.

Deemed Allotment.

In case of incorporation of new company, the shares are deemed to be allotted on the date of incorporation of the Company and subscription amount is received subsequently.

Time limit for depositing the Subscription Money.

In case of a newly incorporated company, the recent amendments [via Companies (Amendment) Ordinance, 2018 dated 02.11.2018] specify that the subscribers are mandatorily required to bring in subscription money within 180 days from the date of incorporation and the Directors are required to file a declaration to this effect with the Registrar [Section 10A of the Companies Act, 2013].

It is submitted that situation may occur when subscribers to the Memorandum of Association (‘MOA’) fails to pay subscription money as agreed by them in MOA. In this situation, the various provisions of the Act, 2013 have to deal for different aspects.

Subscribers are Members.

The definition of “Member” is given under Section 2(55) of the Act, 2013 in relation to a company, means-

(i) The subscriber to the memorandum of the company who shall be deemed to have agreed to become a member of the company, and on its registration, shall be entered as a member in its register of members.

(ii) Every other person who agrees in writing to become a member of the company and whose name is entered in the register of members of the company;

(iii) Every person holding shares of the company and whose name is entered as a

beneficial owner in the records of a depository.”

It is clear from the definition that subscriber will become a member on the registration of the company irrespective of the fact that subscription money is received or not .

Register of Member.

Pursuant to Section 88 of the Act, 2013 ‘Register of Member’ every company shall keep and maintain a register of members indicating separately for each class of equity and preference shares held by each member residing in or outside India.

It is to be noted that as subscriber will become a member on the registration of the company irrespective of the fact that subscription money is received or not , therefore name of the subscriber as a member of the company will be entered in the register of Member.

Issuance of share certificates.

Every company pursuant to Section 56 of the Act, 2013, shall deliver the certificates of all securities allotted within a period of 2 months from the date of incorporation, in the case of subscribers to the memorandum.

As per Section 56 of the Act, 2013, company have to issue share certificate within a period of 2 months of incorporation of the company irrespective of the fact that subscription money is received or not .

Whether subscription money not received, shall be included in the share capital of the Company?

As per Section 2(50) of the Act, 2013, “Issued capital” means such capital as the company issues from time to time for subscription.

As per Section 2(86) of the Act, 2013, “Subscribed capital” means such part of capital which is for the time being subscribed by the members of a company.

As per Section 2(64) of the Act, 2013, “Paid up Share Capital” or “share Capital Paid-up” means such aggregate amount of money credited as paid-up as is equivalent to the amount received as paid-up in respect of shares issued and also includes any amount credited as paid-up in respect of shares of the company, but does not include any other amount received in respect of such shares, by whatever name called.”

From the above definitions, it is clear that subscription money not paid, shall be included in the issued capital and subscribed capital. However, in respect of the paid-up share capital, it is submitted that the definition of paid-sup share capital can be seen in two parts.

- One, aggregate amount received and credited as paid-up in respect of shares issued;

- Second, any amount credited as paid-up in respect of shares of the company.

At second instance paid up share capital means ‘any amount credit as paid up.’ In this situation, company can credit the subscription money not received as paid up in the Balance Sheet of the company, which is still receivable

Quorum in the Meeting.

Pursuant to provisions of Section 103 of the Act, 2013, members personally present shall be the quorum for a meeting of the company. As we have already mentioned that subscriber of MOA will be member of Company irrespective of the fact that subscription money is received or not . Therefore, such subscribers will be count for the quorum under Section 103 of the Act, 2013.

Restriction on Voting Rights.

As per Section 106(1) of the Act, 2013, “Notwithstanding anything contained in the Act, the articles of a company may provide that no members shall exercise any voting rights in respect of any shares registered in his name on which any calls or other sums presently payable by him have not been paid, or in regard to which the company has exercised any right of lien.”

In view of the above, articles of a company should be checked first whether it contain any restriction clause that a member shall not exercise any voting right in case of any sums payable by him have not been paid to the Company. If such clause is existing then such member shall not get right to vote in the meeting. But if there is no such clause in the article of a company then member will get the right to vote in meeting.

Transfer of subscribed shares on which subscription money is not paid.