Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 11 September 2023

Research on the influence of digital finance on the economic efficiency of energy industry in the background of artificial intelligence

- Qiao He 1 &

- Ying Xue 2

Scientific Reports volume 13 , Article number: 14984 ( 2023 ) Cite this article

2361 Accesses

2 Citations

Metrics details

- Environmental sciences

- Environmental social sciences

- Solid Earth sciences

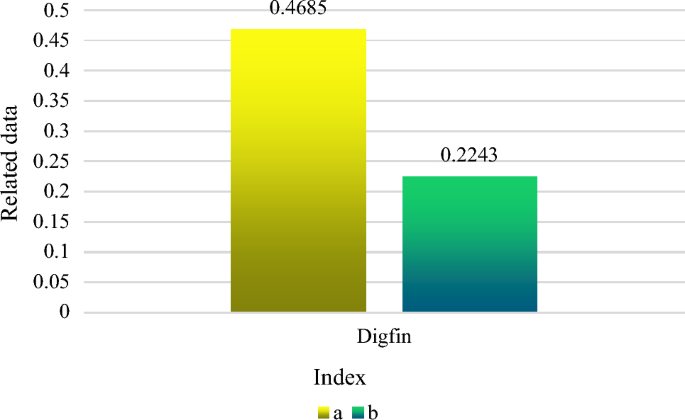

China's economic growth has reached a new plateau. It is no longer appropriate to use the old economic growth model, which relied on labor, land resources, mineral resources, and other economic considerations. Under the background of artificial intelligence, high-quality economic development is an inevitable trend. A new financial paradigm called "digital finance" integrates financial services with information technologies. Digital financial technology is thought to be a crucial foundation for fostering high-quality and sustainable economic and social development since it may offer more economic entities reduced cost of capital and more realistic financial service skills than in traditional financial models. In the era of artificial intelligence, how to reasonably release the momentum of digital finance for China's sustained economic growth has become a hot topic of discussion at this stage. This paper studies the impact of digital finance on the economic efficiency of the energy industry in the context of artificial intelligence. Relevant metrics were also calculated. The findings revealed that: The benchmark regression result of digital finance on the efficiency of the green economy was 0.4685 before adding the main restrictions; the benchmark regression result of digital finance on the efficiency of the green economy was 0.2243 after adding the main constraints. As a result, data finance had a favorable impact on the effectiveness of the green economy.

Similar content being viewed by others

RETRACTED ARTICLE: Digital transformation, green innovation, and carbon emission reduction performance of energy-intensive enterprises

Intelligentization helps the green and energy-saving transformation of power industry-evidence from substation engineering in china.

The influence of AI on the economic growth of different regions in China

Introduction.

The coordinated growth of the real economy and the digital economy takes the conventional "reverse integration" path, with the financial sector serving as the first example of its transformation and development characteristics in the tertiary sector. Digital finance generally refers to the use of electronic information technology by traditional financial institutions and online businesses to carry out new financial services like payment, project investment, and equity financing. The limitations on time and space between product transactions and financial services have been eliminated by the quick development of digital finance. In the era of artificial intelligence, what is the role of the rise and application of digital finance in the critical period of innovation in promoting strategic planning. Whether it can fill the shortcomings of the traditional financial system and improve the efficiency of urban green economic development and the financial market department's strong support and promotion of innovation and manufacturing, and better support the economy of the energy industry, requires further review and debate. Digital financial technology can provide more accurate Market trend forecast and energy price forecast by processing large-scale data and applying advanced data analysis technology. This will help energy companies make more intelligent decisions, optimize resource allocation, reduce production and operating costs, and thus improve Economic efficiency. The application of digital financial technology can improve the Economic efficiency of the energy industry, improve the efficiency of resource utilization, reduce waste and promote the sustainable development of the energy industry.

Literature review

Numerous professionals and academics have always focused their research on strategies to increase the effectiveness of the urban green economy. In order to create a model that could be used for urban green economy planning, Liu T enhanced the conventional algorithm and merged the principle of machine learning algorithm. Efficiency indicators for the green economy were evaluated in terms of input, anticipated output, and unexpected production. Comparison and analysis were done on the green efficiency determined using the relaxation value calculation model. The study's findings demonstrated that the model could be used in the design phase of urban green planning and that it had specific effects 1 . China's green economic efficiency and green total factor productivity were assessed and examined by Gao X. Furthermore, the shortcomings of conventional clustering techniques in high-dimensional data clustering were highlighted by outlining the properties of high-dimensional data. A sampling and residual squared-based density peak clustering technique was put forth. The experimental comparison on the data set revealed that in terms of time complexity and clustering outcomes, the modified algorithm outperformed the delayed procedure call approach 2 . Sarcheshmeh M examined the performance of urban green space in terms of social and economic indices in the Mashhad metropolitan region. 15 social questions and 5 economic questions from the research questionnaire were tested and examined using the SPSS22 program. The findings demonstrated that there was no appreciable impact on the management effectiveness of the urban green space sector in the city of Mashhad. From the perspectives of citizens and managers, several features of the social index were rated as desirable 3 . In order to examine the dynamic changes in the economic effectiveness of urban land use in South Korea at the regional level and to determine whether it would be feasible to implement the green belt policy, Yongrok C used the ecological efficiency measurement model. In order to increase the economic benefits of urban land use and execute sustainable green space management, more performance-oriented policy solutions were advocated 4 . These studies do have some impact on increasing the effectiveness of urban green economy and urban planning, but digital finance has received far too little attention. The market for digital finance is quickly taking over with the pace of the new economic system. The city's long-term development would have an effect on how effective the urban green economy is.

There are more research on the direct or indirect effects of digital finance on economic growth than there are on the effect of digital finance on the effectiveness of urban green economies. Based on the database for the growth of digital financial inclusion and the China Family Panel Studies, Xie W investigated the relationship between coastal rural residents' entrepreneurship and the development of China Family Panel Studies (CFPS). The empirical findings indicated that a crucial factor in encouraging rural entrepreneurship was the thorough development of digital financial inclusion. The monetary capital index and the payment index both significantly boosted rural inhabitants' entrepreneurial activity. The study also discovered that the effects of digital financial inclusion on rural residents' entrepreneurship exhibited signs of geographical variation 5 . In the context of economic digitization and the development direction of contemporary financial technology legal supervision, Barykin S determined the function of digital finance in the financial system. By adding new features of digital assets, the digital financial cube might be expanded to match the level of openness of industrial firms in the future Industry 4.0 technological framework 6 . The long-term causal impacts of digital financial inclusion on economic growth in sub-Saharan Africa were investigated by Thaddeus K J. The study made use of quarterly data from 2011 to 2017 and a sample of 22 sub-Saharan African nations. The findings indicated a long-term causal link between digital financial inclusion and economic growth in sub-Saharan Africa, with the causal relationship running one way from economic growth to inclusion in the latter 7 . Rastogi S set out to investigate how unified payment interface affects financial inclusion, economic development, and financial literacy of the underprivileged in India. He discovered that financial literacy was being impacted. Financial stability and trust both served as partial moderators of the significant associations between digital financial inclusion and economic development as well as the significant link between financial literacy and financial inclusion. This fostered financial inclusion and economic growth for the underprivileged in addition to supporting financial literacy 8 . Lin Boqiang uses the non radial direction distance function to build green Economic efficiency indicators that can evaluate cities at prefecture level and above in China under the super efficiency framework, and further empirically studies the impact of economic agglomeration on green Economic efficiency. To solve the endogenous problem caused by reverse causality between economic agglomeration and green Economic efficiency 9 .

The perfect combination of digital technology and financial services has created a new financial service model. With the help of intelligent digital technology, digital finance can provide lower capital cost and faster service mode for the real economy, provide financial services with "high efficiency, convenience and sustainable commercial services" for the energy industry, and complete the unification of objectivity and precision of financial services. This paper discusses the influence of digital finance on the economic efficiency of the energy industry under the background of artificial intelligence, and aims to provide theoretical guidance for the improvement of the green economic efficiency in the energy industry.

The influence mechanism of digital finance on the economic efficiency of the energy industry

New energy technologies include solar power generation, water energy, wind energy, tidal energy, sea surface temperature difference energy, wave energy, firewood, peat soil, biochemical material energy conversion, geothermal energy, tar sand, etc. At this stage, it is generally recognized that new energy and renewable resources are based on the development trend of new technology application, and gradually change the development and utilization of renewable resources. The traditional fossil energy resources with environmental pollution problems and limited total amount should be replaced by new energy sources that will not be limited by the total amount and the utilization of the recycling system. The key development areas include solar power generation, tidal energy, hydrogen energy and wind energy.

The new energy industry is the exploration, development and utilization of new energy. It uses social methods to achieve effective utilization and popularization, including the whole process of scientific research, industrial utilization, production, manufacturing and operation. It is a high-tech that commercializes solar power generation, wind energy, bioenergy, etc. From the perspective of the characteristics of the industrial chain, the new energy industry is to replace the new industries with strategic status represented by fossil energy, and has extremely important obligations in replacing fossil energy, promoting economic growth, protecting the environment, and building a harmonious society; From the perspective of the whole industry chain, the new energy industry can be divided into energy supply, product research and development, investment and manufacturing, transportation and trading.

The Corona Virus Disease 2019 pandemic has had a major impact on the traditional financial services provided by financial institutions, but it has also accelerated the digital transformation of these services. According to the statistics and analysis of the China Asset Appraisal Association, during the epidemic period, the average service item replacement rate of online banking reached 96%. Despite the epidemic's considerable effects on small and micro businesses and traditional financial "long-tail clients", However, under the background of the intelligent era, the development speed of digital banking is enough to solve the problems of these groups. Through "zero contact" to provide them with low-cost, convenient and fast service projects, especially the contact-free loan has become an important means to help the sustainable development of the energy industry 10 .

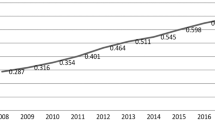

The development of digital finance requires a complete institutional system, and the institutional system of digital finance is the financial ecosystem, which is composed of the main body of the ecosystem and the financial ecological environment. The close combination of the two can produce a regular financial ecosystem with internal logic and self-improvement. Judging from the current overall situation of China's financial institution management system, it has basically formed a large digital financial service ecological chain dominated by banking, Internet banking, non-bank finance, and large and medium-sized financial high-tech companies with electronic payment system, integrity management system, legal norms as infrastructure and institutional guarantee, which is dominated by the "one committee, one bank, two committees and one bureau" supervisory agency 11 , 12 . A schematic representation of the structure of the digital financial ecosystem is given in Fig. 1 .

Digital financial ecosystem.

At this point, a significant trend is the close integration of digital technology with finance. In the era of artificial intelligence, digital technology is playing a unique and important role in modern finance. The following points mostly highlight the benefits of digital finance: Firstly, by increasing financing channels, the threshold for financial services has been lowered; secondly, by greatly reducing service prices, comprehensive financial services have achieved sustainable development; thirdly, the personalized financial services can better meet the various requirements of different users; the fourth is to help reduce information asymmetry and provide new risk management methods 13 .

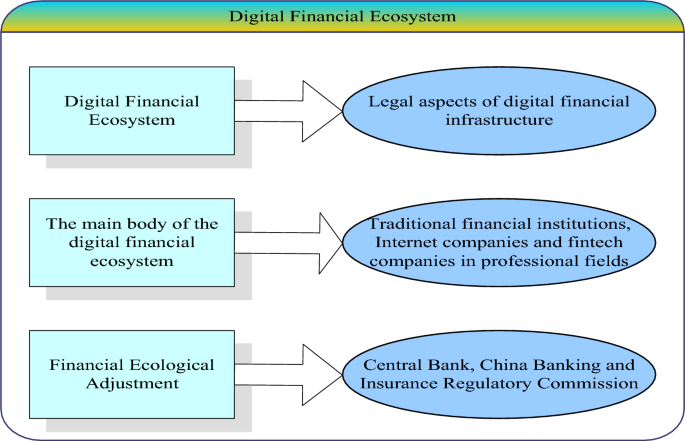

According to different levels of financial functions, digital finance can be divided into three categories: basic functions, leading functions and derivative functions. Figure 2 shows the mechanism of digital finance on the efficiency of urban green development. There are three behavioral paths for the above three functions. The first is digital finance → intermediary services → inclusive utility. Digital finance uses digital information technology to manufacture and expand the role of finance. The network effect of digital technology expands the boundaries of traditional financial services and reduces the service cost of traditional finance. The scale and economic characteristics of digital finance reduce the entry threshold and related costs for innovative enterprises. At the same time, by relying on digital technology, the ability to obtain data and analyze information has been greatly improved and the information asymmetry and the cost of credit intermediary companies have been reduced, and the credit environment has been optimized. After building a three-dimensional credit image based on enterprise big data and cloud technology, sporadic enterprises and start-up companies that are difficult to obtain the support of traditional credit services would obtain a high probability of credit. In order to increase the effectiveness of the urban green economy, the development of digital finance would also help traditional finance change and grow. It would also make full use of the complementary roles that traditional finance and digital finance play in advancing economic growth. Therefore, digital finance will promote the development of traditional finance, and will promote the economic development of the energy industry, and achieve the effect of improving the economic efficiency of the energy industry 14 , 15 .

The impact of digital finance on how well urban green development is carried out.

The second is digital finance → resource allocation service → upgrade utility. Resource allocation service is the core role of finance and an excellent way to correctly guide use value. On the one hand, the birth of digital finance has promoted competition among financial formats and enhanced the charm of folk capital and the financial system, and improved the efficiency and capability of capital allocation. The use of artificial intelligence and electronic information technology can better match the investment needs and financing needs, reduce the financing pressure of the energy industry, and make the capital used more efficiently and quickly for innovation. On the other hand, the circulation of capital factor commodities has been improved. For a long time, in the factor market, the government department has the dominance and dominance of the vast majority of manufacturing factors, and there may be behaviors such as abuse of power. In addition, the popularity of local protectionism and the emergence of administrative systems have resulted in serious market segmentation. The inconsistency and segmentation of the elements of the sales market make some enterprises, especially state-owned enterprises, lose the driving force of "self-innovation". This harms the development of the urban green economy's efficiency. To provide enough financial factors for the supply-side structure's green development, Digital finance enables the energy industry to overcome regional barriers and enhance the environment for the free flow of capital. Therefore, by enhancing and upgrading the efficiency of regional capital element allocation, data finance can achieve the effect of boosting the efficiency of urban green economy 16 .

The third is digital finance → redistribution of finance → inclusive utility. The rapid development of inclusive finance, on the one hand, helps low-income people get rid of poverty and become rich, which improves the level of per capita consumption and promotes economic transformation and upgrading; on the other hand, with the expansion of the number of netizens and network coverage and the rapid rise of e-commerce and Internet consumer finance, the consumption structure of urban residents has also gradually changed. The demand-side consumption capacity and consumption structure have been upgraded, and the energy industry has increased its demand for high-quality products. This has prompted the energy industry to expand the scope of its technology investment and product development efforts, and to encourage the growth of a local green economy. Therefore, digital financing encourages the energy industry to expand technology investment and product research and development, which has the effect of improving the efficiency of urban green economy 17 .

The energy industry is an indispensable part of economic development. Digital finance provides loans to small and medium-sized energy enterprises to meet the financing needs of small and medium-sized energy enterprises, thus stimulating regional economic growth. However, these small and medium-sized energy enterprises are struggling with financial problems and high financing costs. Only a small number of enterprises can apply for loans from financial institutions through official channels, and other enterprises are under pressure of capital loans. The growth of financial inclusion through digital means has reduced borrowing costs and simplified processes. By providing special loans to such enterprises to help them improve their financing and risk management capabilities, it will help improve their profitability and ultimately improve China's economic growth rate 18 , 19 .

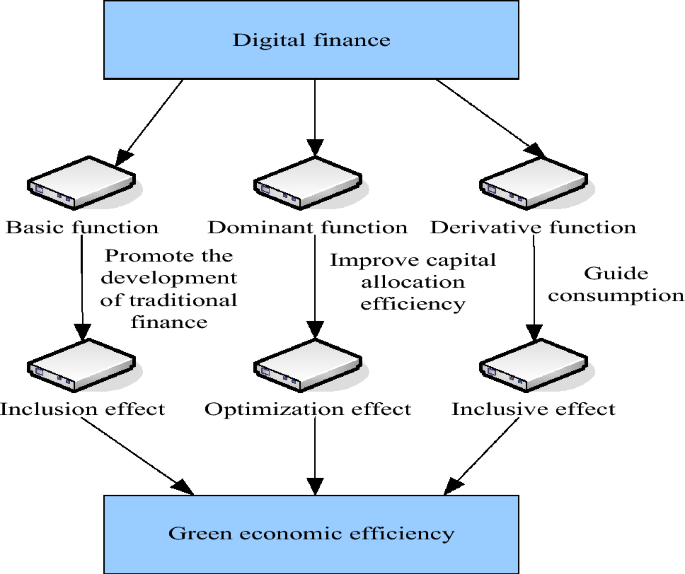

If the capital supply cannot keep up, there will be a lock-in effect, and it is imperative to get rid of this inefficient equilibrium state. The basic strategy is to provide specific capital elements for the energy industry, so the assistance of participating banks is essential, and micro loans for small and medium-sized energy industries can help them achieve higher output. Continuous investment in capital and technology will reduce marginal costs, which will have an impact on increasing output and income 20 , 21 . As shown in Fig. 3 , the structure of micro credit's anti lock support effect.

Anti-lock-in support effect structure diagram of microfinance.

This paper discusses the impact of digital finance on the economic efficiency of the energy industry in the context of artificial intelligence. The calculation formula of some indicators related to the measurement of the economic efficiency of the energy industry is as follows:

\(T\) -set of control variables; \({GTFP}_{au}\) -Green economic efficiency of energy industry; \({df}_{au}\) -digital finance; \({df2}_{au}\) -square term of digital finance; \({\omega }_{au}\) -disturbance term; \({\theta }_{a}\) -time fixed effect

\({m}_{au}{^\prime}\) -a collection of independent variables; \({\mathrm{g}}_{\mathrm{au}}\) -threshold variables

\(distrk\) -degree of capital misallocation

\({\mathrm{lngdp}}_{\mathrm{au}}\) -degree of capital distortion

\({MP}_{au}\) -margin of capital

\(\mathrm{d}\) - \(\mathrm{d}\) kinds of inputs; L-L kinds of expected outputs; J-J kinds of undesired outputs; \(\upgamma \) -green total factor productivity efficiency value.

Restrictions:

Let the formulas be:

\({\mathrm{cap}}_{\mathrm{au}}\) -fixed capital stock of the whole society; \({\propto }_{\mathrm{a}}\) -capital depreciation rate

\({\mathrm{cap}}_{\mathrm{a},0}\) -cap initial capital stock; \({\mathrm{o}}_{\mathrm{a}}\) -cap average annual growth rate.

Empirical study on the impact of digital finance on economic efficiency of energy industry

In order to explore the impact of digital finance on the economic efficiency of the energy industry in the context of artificial intelligence, we calculated some indicators of the economic efficiency development level of the energy industry 22 , 23 . Kao (1999) Panel data cointegration test uses the correlation information between individuals to decompose Panel data into inter individual mean and intra individual changes. If the inter individual mean is non-stationary and the residual term is stationary, then the existence of cointegration can be verified. The results are as follows:

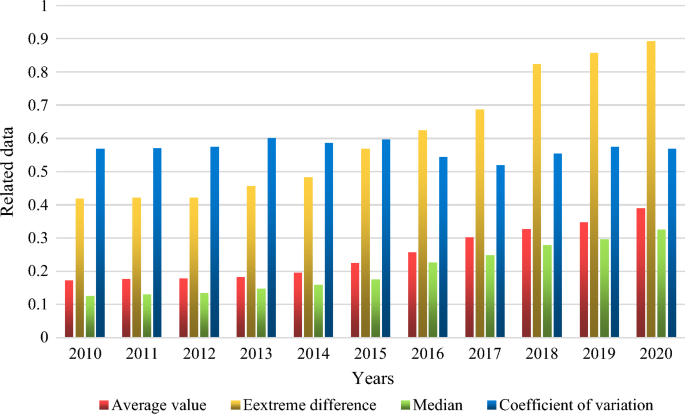

As shown in Fig. 4 , the change index of green economic efficiency development of energy industry in some cities of China from 2010 to 2020. We selected 20 cities in China for data analysis. The standard deviation is used to measure the Statistical dispersion of a group of data. The larger the standard deviation, the higher the volatility of the data. The average is the average of the green Economic efficiency development index. From the average and median, the average development level of green economic efficiency of these energy industries has increased from 0.1782 in 2012 to 0.3891 in 2020, and the median has also increased from 0.1342 in 2012 to 0.3247 in 2020. Both are rising year by year. From these two indicators, the green economic efficiency level of the energy industry shows a trend of doubling, this also means that the green economy development level of the energy industry has made a qualitative leap. The coefficient of variation did not change significantly from 2010 to 2020, with a value of 0.5687 in 2010 and 0.5682 in 2020. From the perspective of range and coefficient of variation, the range describes the difference between the highest level and the lowest level. In 2012, the range value of green economic efficiency of the energy industry was 0.4213, while in 2020, the range value of green economic efficiency of the energy industry was 0.8925, which also shows an increasing trend year by year. This means that the gap between the development levels of green economy of the energy industry is increasing year by year, while the difference between the extreme values from 2018 to 2020 shows a trend of slowing growth, this also shows that we are also increasing the level of green economy development in economically backward energy industries. It can be seen from the figure that the coefficient of variation of the green economic efficiency of the energy industry fluctuates, but it does not change much, and even shows a downward trend, which also shows that the green development level of the energy industry does not show a development trend of two-level differentiation.

Change index of green economic efficiency development of energy industry in some cities.

Regression analysis is conducted with or without control variables to examine the robustness of digital finance on the effectiveness of green economy in the energy industry 24 . The regression results of the efficiency standards of green economy and digital finance in the energy industry are shown in Fig. 5 . Where, A represents the result of basic regression without major control factors, and B represents the result of benchmark regression including major control components. It can be seen that before adding the main restrictions, the benchmark regression result of digital finance on the effectiveness of green economy is 0.4685. After the main limiting factors are included, the benchmark regression result of the effectiveness of digital finance on the green economy is 0.2243. Therefore, data finance has a beneficial impact on the effectiveness of the green economy. The green development level of the energy industry does not show a trend of two-stage differentiation, and the benchmark regression results slightly decrease after adding limiting factors. Digital finance will affect the green development level of the energy industry.

Digital finance and green economy efficiency benchmark regression results.

The benchmark regression coefficient results of the influence of pertinent variables on green economic efficiency are shown in Table 1 . It is clear that the benchmark regression coefficients for improving industrial structure, economic development level, and income from both the public sector and higher education are all positive and pass the 5% significance level test. This demonstrates how investing in financial education, upgrading the industrial structure, and the degree of economic development all help the green economy grow and become more efficient. Despite being positive, the benchmark regression coefficient of environmental legislation on green economic efficiency fails the test of significance. The expense of reducing environmental pollution has perhaps increased, which forces businesses to implement relevant technology advancements. The benchmark regression coefficient for openness to the effectiveness of the green economy is negative, and thus failed the significance threshold test. This may be because the entry of foreign high-tech has raised pressure on environmental governance by bringing about not only economic development but also an industrial chain that produces a lot of pollution and uses a lot of energy.

Choosing cross-sectional analysis with fixed effects rather than random effects means that there are fixed differences between individuals, and the impact of these differences on variables is constant. This fixed effects model assumes that individual specific factors have a significant impact on the observed variables, and these factors are fixed during the observation period.

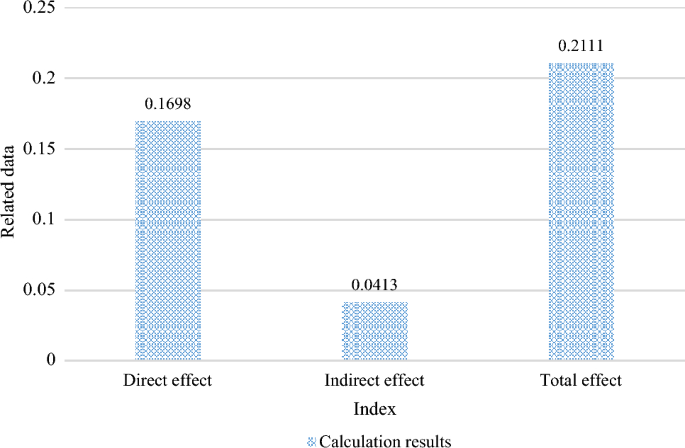

The computation of the conduction effect is shown in Fig. 6 . They are digital finance-green economy development efficiency, digital finance-scientific and technical innovation-green economy efficiency, and digital finance-green economy efficiency as a whole. The conduction line of direct effect is digital finance-green economy efficiency. It can be seen that the computed value of the direct relationship between digital finance and green economic efficiency is 0.1698, indicating that the growth of urban green economic efficiency would be directly impacted by the development of digital finance. The calculated indirect effect value is 0.0413, which suggests that digital finance can boost technological innovation to make cities more environmentally friendly by saving energy and lowering consumption and pollution. The level of green economic growth can be raised while industrial upgrading is encouraged. The total effect of digital finance on the effectiveness of green economy in the energy industry is the sum of its direct effect and indirect effect, of which the intermediary effect accounts for 19.56% of the total effect.

Conduction effect calculation results.

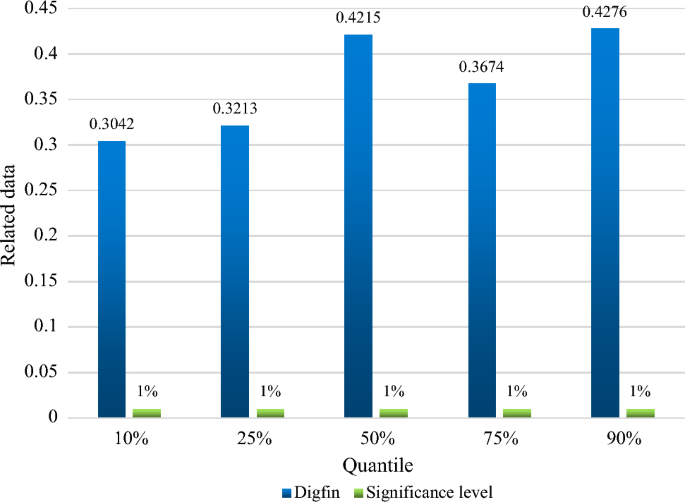

The panel quantile estimation can assess the effect of digital finance on it under each quantile based on the distribution of green economy efficiency levels. The efficiency of the green economy and digital finance are shown in Fig. 7 as the panel quantile regression findings. It is can be seen that for the five quantiles, the estimated coefficient of digital finance climbs as the quantile increases from 0.3042 for the 10% quantile to 0.4276 for the 90% quantile. The increase in the favorable effect is 0.1234, and the significance threshold is 1%. In other words, digital finance has a good effect on the effectiveness of the green economy, and the promotion effect would get stronger as the quantile value rises. This does not help digital finance increase the efficiency of the green economy. However, as the green economy expands and digital infrastructure continues to advance, the beneficial role that digital finance plays in fostering the growth of the green economy would only grow.

Panel quantile regression results of digital finance and green economy efficiency.

In the panel Quantile regression analysis data of digital finance and green Economic efficiency, the estimation coefficient of digital finance is constantly improving, and the significance threshold has always been 1%, so the rise of quantile value will make the promotion of green Economic efficiency stronger.

Conclusions

This paper analyzes the impact of digital finance on the green economic efficiency of energy industry in the context of artificial intelligence, and evaluates the green economic performance of energy industry in some cities from 2010 to 2020. The empirical research results show that the rapid development of digital finance will significantly improve the efficiency of green economy in the energy industry, and show diversity with the change of city size and industrial development level. Digital finance has the synergistic effect of independent innovation and ecological compensation. Through independent innovation and environmental security management, we can jointly improve the efficiency of green economy. Based on this paper, the following suggestions are put forward: encourage financial institutions, insurance and other traditional finance to transform to digital, use data technology to safeguard the traditional financial system, and accelerate the construction of intelligent facilities in various regions; Give full play to the coordinating role of the financial technology service management system in the introduction of innovation policies, patent applications and other aspects. Accelerate the cooperation between the government and the digital financial platform, and give full play to the aggregation effect of financial markets and policies on independent innovation. Make full use of the ecological compensation effect of digital finance on production units, promote financial innovation through joint development of digital finance, and promote the growth of small and medium-sized enterprises in the upstream and downstream of the green industrial chain and supply chain. The government can formulate policies to encourage energy companies to adopt digital financial technologies, such as blockchain, Big data analysis and artificial intelligence, to improve efficiency and reduce costs. For example, the government can provide tax or subsidy incentives to encourage enterprises to invest in the research and application of digital technology. At the same time, it is necessary to prevent losses caused by excessive economic leverage, so that data finance can better provide energy for the urban real economy.

Data availability

Datasets generated and/or analyzed during the current study are available from the corresponding author on request.

Liu, T., Xin, B. & Wu, F. Urban green economic planning based on improved genetic algorithm and machine learning. J. Intell. Fuzzy Syst. 40 (4), 7309–7322 (2021).

Article Google Scholar

Gao, X. Urban green economic development indicators based on spatial clustering algorithm and blockchain. J. Intell. Fuzzy Syst. 40 (3), 1–12 (2020).

Google Scholar

Sarcheshmeh, M., Khakpoor, B. A. & Shokuhi, M. A. Analysis of economic and social indicators in optimizing the performance of urban green space management (a study of Mashhad metropolis). Geoj. Tour. Geosites 32 (4), 1370–1375 (2020).

Yongrok, C. & Na, W. The economic efficiency of urban land use with a sequential slack-based model in Korea. Sustainability 9 (1), 79–79 (2017).

Xie, W., Wang, T. & Zhao, X. Does digital inclusive finance promote coastal rural entrepreneurship?. J. Coastal Res. 103 (sp1), 240–240 (2020).

Barykin, S. & Shamina, L. The logistics approach to perspectives for the digital technologies in Russia. IOP Conf. Ser. Mater. Sci. Eng. 918 (1), 012187–012196 (2020).

Thaddeus, K. J., Chi, A. N. & Manasseh, C. O. Digital financial inclusion and economic growth: Evidence from Sub-Saharan Africa (2011–2017). Int. J. Bus. Manag. 8 (4), 212–226 (2020).

Rastogi, S., Panse, C. & Sharma, A. Unified Payment Interface (UPI): A digital innovation and its impact on financial inclusion and economic development. Univ. J. Account. Financ. 9 (3), 518–530 (2021).

Boqiang, L. & Ruipeng, T. China’s economic agglomeration and green Economic efficiency. Econ. Res. 54 (2), 119–132 (2019).

Monteiro, L., Cristina, R. & Sciubba, E. Water and energy efficiency assessment in urban green spaces. Energies 14 (17), 5490–5490 (2021).

Gwak, J. H., Bo, K. L. & Lee, W. K. Optimal location selection for the installation of urban green roofs considering honeybee habitats along with socio-economic and environmental effects. J. Environ. Manag. 189 (15), 125–133 (2017).

Zhou, L., Zhou, C. & Che, L. Spatio-temporal evolution and influencing factors of urban green development efficiency in China. J. Geog. Sci. 30 (5), 724–742 (2020).

Fu, J., Xiao, G. & Wu, C. Urban green transformation in Northeast China: A comparative study with Jiangsu, Zhejiang and Guangdong provinces. J. Clean. Prod. 273 (3), 122551–122551 (2020).

Vargas-Hernandez, J. G. & Pallagst, K. Urban green innovation: Public interest, territory democratization and institutional design. Int. J. Green Comput. 11 (1), 57–73 (2020).

Zanizdra, M. Y., Harkushenko, O. M. & Vishnevsky, V. Digital and green economy: Common grounds and contradictions. Sci. Innov. 17 (3), 14–27 (2021).

Delcart, L., Neacsu, N. & Oncioiu, I. Regions and cities as stimulators towards green and digital economy. Int. J. Innov. Digit. Econ. 9 (4), 1–10 (2018).

Bongomin, G., Yourougou, P. & Munene, J. C. Digital financial innovations in the twenty-first century: Do transaction tax exemptions promote mobile money services for financial inclusion in developing countries?. J. Econ. Admin. Sci. 36 (3), 185–203 (2019).

Wang, Z., Jin, W. & Dong, Y. Hierarchical life-cycle design of reinforced concrete structures incorporating durability, economic efficiency and green objectives. Eng. Struct. 157 (15), 119–131 (2018).

Sha, R., Li, J. & Ge, T. How do price distortions of fossil energy sources affect China’s green economic efficiency?. Energy 2021 (1), 121017–121017 (2021).

Ren, Y., Wang, C. & Xu, L. Spatial spillover effect of producer services agglomeration on green economic efficiency: Empirical research based on spatial econometric model. J. Intell. Fuzzy Syst. 37 (5), 6389–6402 (2019).

Li, Q. Regional technological innovation and green economic efficiency based on DEA model and fuzzy evaluation. J. Intell. Fuzzy Syst. 37 (3), 1–11 (2019).

Zhang, D., Chen, L. & Yang, Y. Assessing the green economic efficiency of municipalities and provinces in China with a Meta-US-SBM model. Paper Asia 2 (2), 159–162 (2019).

Batrancea, L. M., Pop, M. C., Rathnaswamy, M. M., Batrancea, I. & Rus, M.-I. An empirical investigation on the transition process toward a green economy. Sustainability 13 (23), 13151 (2021).

Aivaz, K. A., Munteanu, I. F., Stan, M. I., Stan, M.-I. & Chiriac, A. A multivariate analysis of the links between transport noncompliance and financial uncertainty in times of COVID-19 pandemics and war. Sustainability 14 (16), 10040 (2022).

Download references

Research on identification and regulation of performance window dressing of China Securities Investment Funds (2023-JC-YB-618), Shaanxi 2023 Natural Science Foundation research project. Research on the motivation, risk and effect of hedging based on empirical data of Chinese listed companies (105–45119026).

Author information

Authors and affiliations.

School of Economics and Management, Xi’an University of Technology, Xi’an, 710000, Shaanxi, China

School of Finance, Shanghai Lixin University of Accounting and Finance, Shanghai, 201209, China

You can also search for this author in PubMed Google Scholar

Contributions

Q.H., Y.X. wrote the main manuscript text.

Corresponding author

Correspondence to Ying Xue .

Ethics declarations

Competing interests.

The authors declare no competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

He, Q., Xue, Y. Research on the influence of digital finance on the economic efficiency of energy industry in the background of artificial intelligence. Sci Rep 13 , 14984 (2023). https://doi.org/10.1038/s41598-023-42309-5

Download citation

Received : 28 February 2023

Accepted : 08 September 2023

Published : 11 September 2023

DOI : https://doi.org/10.1038/s41598-023-42309-5

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

This article is cited by

Research on the coupling mechanism and influencing factors of digital economy and green technology innovation in chinese urban agglomerations.

- Xuesi Zhong

Scientific Reports (2024)

By submitting a comment you agree to abide by our Terms and Community Guidelines . If you find something abusive or that does not comply with our terms or guidelines please flag it as inappropriate.

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

Sign up for the Nature Briefing: Anthropocene newsletter — what matters in anthropocene research, free to your inbox weekly.

What Triggers Consumer Adoption of Central Bank Digital Currency?

- Published: 28 November 2023

- Volume 65 , pages 1–40, ( 2024 )

Cite this article

- Michiel Bijlsma 1 , 2 ,

- Carin van der Cruijsen ORCID: orcid.org/0000-0002-3854-309X 3 ,

- Nicole Jonker 3 &

- Jelmer Reijerink 3

824 Accesses

Explore all metrics

Central banks around the world are examining the possibility of introducing Central Bank Digital Currency (CBDC). The public’s preferences concerning the usage of CBDC for paying and saving are important determinants of the success of CBDC. However, little is known yet about consumers’ attitudes towards CBDC. Using data from a representative panel of Dutch consumers we find that roughly half of the public says it would open a CBDC current account. The same holds for a CBDC savings account. Thus, we find clear potential for CBDC in the Netherlands. This suggests that consumers perceive CBDC as distinct from current and savings accounts offered by traditional banks. Intended CBDC usage is positively related to respondents’ knowledge of CBDC and trust in the central bank. Price incentives matter as well. The amount respondents say they would want to deposit in the CBDC savings account depends on the interest rate offered. Furthermore, intended usage of the CBDC current account is highest among people who find privacy and security important and among consumers with low trust in banks in general. These results suggest that central banks can steer consumers’ adoption of CBDC via the interest rate, by a design of CBDC that takes into account the public’s need for security and privacy, and by clear communication about what CBDC entails.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

The Six Ways to Build Trust and Reduce Privacy Concern in a Central Bank Digital Currency (CBDC)

Central Bank Digital Currency Models

Would a Retail Central Bank Digital Currency Achieve Its Intended Purpose?

Data availability.

The data used in this study are available upon request.

According to, among others, Marchiori ( 2021 ), the relationship between the development of prices of (virtual) goods paid with virtual currencies and the supply of virtual currencies may be opposite to what is predicted by monetary theory when agents providing payments services are rewarded with newly issued virtual currency. A decline in the issuance of a virtual currency raises the prices of goods paid with it. However, Balvers and McDonald ( 2021 ) show that it is theoretically possible to design a global digital currency that mimics the ideal design and whose value reflects the price development of a tradeable goods basket.

See the CBDC Tracker from the Atlantic Council at www.atlanticcouncil.org/cbdctracker/ .

Of the 771 panel members that did not fill in the survey, 727 people did not response and 44 people partly filled in the survey.

For example, Bolt et al. ( 2010 ) have a response rate of 72.7% and Van Rooij et al. ( 2012 ) report a response rate of 74.4%.

People who are selected for participation in the panel but who do not have a computer with Internet access receive the necessary equipment.

For more information on Centerpanel and DHS, see Teppa and Vis ( 2012 ).

The survey is available upon request.

The list of reasons is based on the discussion of preconditions, objectives and design choices for CBDC by Wierts and Boven ( 2020 ).

The question reads as follows “Are you familiar with the following terms? Cash, digital money, public money, private money, central bank money, commercial money, central bank digital currency (CBDC).” For each term the answer options are: “No, I have never heard of it”, “Yes, I have heard of it, but I don't know what is meant with it”, and “Yes, I know what is meant with it”.

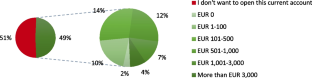

The response shares in Fig. 1 and the lower and upper bound of the balance categories above EUR 0 suggests that, on average, the Dutch would transfer between EUR 260 and EUR 700 to the CBDC current account. These amounts correspond with 10–25% of the average balance of EUR 2,800 that Dutch citizens had on their current account in 2019.

The impact is estimated as follows. People who find safeguarding their privacy very important have a two points higher score on the variable importance privacy CA than people with a neutral position. They have an 8 percentage points higher likelihood to intent to adopt a CBDC current account, as the marginal effect of a 1-point higher score on importance privacy CA amounts 4 percentage points.

People with very much trust in their own bank have a four points higher score on the variable narrow-scope trust in banks than people with very little trust, so we multiplied the marginal effect presented in the last column of Table 3 by four to estimate the impact (4 × 0.04 = 0.16).

The coefficient of the inverse Mills ratio (lambda) is positive and significant in the fourth model (Table 4 , column 4). So, without correction, the coefficient estimates would have been upward-biased.

People who trust the central bank a lot have a three points higher score on the variable trust in the central bank than people with absolutely no trust, so we multiplied the marginal effects presented in Table 5 by three (-0.04*3 = -0.12 and 0.07*3 = 0.21).

Abramova S, Böhme R, Elsinger H, Stix H, Summer M (2022) What can CBDC designers learn from asking potential users? Results from a survey of Austrian residents. OENB Working Paper 241. Vienna: Österreichische Nationalbank

Adrian T, Mancini Griffoli T (2019) The rise of digital money. FinTech Notes No. 19/001. International Monetary Fund, Washington

Aghion P, Algan Y, Cahuc P, Shleifer A (2010) Regulation and distrust. Quart J Econ 125(3):1015–1049

Article Google Scholar

Allen S, Čapkun S, Eyal I, Fanti G, Ford BA, Grimmelmann J, Juels A, Kostiainen K, Meiklejohn S, Miller A, Prasad E, Wüst K, Zhang F (2020) Design choices for Central Bank Digital Currency: policy and technical considerations, NBER Working Papers, no. 27634, Washington: NBER

Ampudia M, Palligkinis S (2018) Trust and the household-bank relationship. ECB Working Paper 2184. ECB, Frankfurt am Main

Andolfatto D (2021) Assessing the impact of central bank digital currencies on private banks. Econ J 131(634):525–540

Arango-Arango C, Bouhdaoui Y, Bounie D, Eschelbach M, Hernandez L (2018) Cash remains top-of-wallet! International evidence from payment diaries. Econ Model 62:38–48

Arauz A, Garratt R, Ramos F. DF (2021) Dinero Electrónico: the rise and fall of Ecuador’s central bank digital currency. Latin Am J Cent Bank 2(2):100030

Bagnall J, Bounie D, Huynh KP, Kosse A, Schmidt T, Schuh S, Stix H (2016) Consumer cash usage: a cross-country comparison with payment diary survey data. Int J Cent Bank 12(4):1–61

Google Scholar

Balloch A, Nicolae A, Philip D (2015) Stock market literacy, trust, and participation. Rev Finance 19:1925–1963

Balvers RJ, McDonald B (2021) Designing a global digital currency. J Int Money Financ 111:102317

Bank of Canada, ECB, Bank of Japan, Sveriges Riksbank, Swiss National Bank, Bank of England, Board of Governors of the Federal Reserve and BIS (2020) Central bank digital currencies: foundational principles and core features. Report no 1

Bank of England (2020) Central Bank Digital Currency: opportunities, challenges and design. Discussion paper. Bank of England, London

Bijlsma M, Jonker N, van der Cruijsen C (2023) Consumer willingness to share payments data: trust for sale? Journal of Financial Services Research 64:41–80

Bolt W, Jonker N, van Renselaar C (2010) Incentives at the counter: an empirical analysis of surcharging card payments and payment behaviour in the Netherlands. J Bank Finance 34:1738–1744

Brunnermeier MK, Niepelt D (2019) On the equivalence of public and private money. J Monet Econ 106:27–41

Centraal Bureau voor de Statistiek (2021) Vermogen van huishoudens; huishoudenskenmerken; vermogensbestanddelen 2021. Retrieved from: https://www.cbs.nl/nl-nl/cijfers/detail/83834NE . Accessed 6 Nov 2023

Chakravarty S, Feinberg R, Rhee EY (2004) Relationships and individuals’ bank switching behavior. J Econ Psychol 25(4):507–527

Chiu J, Davoodalhosseini M, Jiang J, Zhu Y (2022) Bank market power and central bank digital currency: theory and quantitative assessment. J Polit Econ 131(5):1213–1248

ECB (2020) Report on a digital euro. ECB report. ECB, Frankfurt am Main

ECB (2021) Eurosystem report on the public consultation on a digital euro. ECB report. ECB, Frankfurt am Main

European Commission (2006) Interim report II. Current accounts and related services. Sector inquiry under article 17 regulation 1/2003 on retail banking. European Commission, Brussels

Fernández-Villaverde J, Sanches D, Schilling L, Uhlig H (2021) Central bank digital currency: central banking for all? Rev Econ Dyn 41:225–242

Garratt R, van Oordt M (2021) Privacy as a public good: a case for electronic cash. J Polit Econ 129(7):2157–2180

Gerritsen D, Bikker J (2020) Bank switching and interest rates: examining annual transfers between savings accounts. J Financ Serv Res 57:29–49

Gronwald M (2019) Is Bitcoin a commodity? On price jumps, demand shocks, and certainty of supply. J Int Money Financ 97:86–92

Hauff JC (2019) Reasons to switch: empowered vs less powerful bank customers. Int J Bank Market 37(6):1441–1461

Henry CS, Huynh KP, Nichols G, Nicholson MW (2019) 2018 Bitcoin Omnibus Survey: awareness and usage. Staff Discussion Paper 2019–10. Bank of Canada, Ottawa

Hernandez L, Jonker N, Kosse A (2017) Cash versus debit card: the role of budget control. J Consum Aff 51(1):91–112

Jiang D, Lim SS (2018) Trust and household debt. Rev Finance 22(2):783–812

Jonker N (2007) Payment instruments as perceived by consumers: results from a household survey. De Economist 155(3):271–303

Jonker N, van der Cruijsen C, Bijlsma M, Bolt W (2022) Pandemic payment patterns. J Bank Finance 143:106593

Kantar Public (2022) Study on New Digital Payment Methods. Kantar Public, commissioned by the ECB. Retrieved from: https://www.ecb.europa.eu/paym/digital_euro/investigation/profuse/shared/files/dedocs/ecb.dedocs220330_report.en.pdf . Accessed 16 Nov 2023

Keister T, Sanches D (2022) Should central banks issue digital currency? Rev Econ Stud 90(1):404–431

Kiff J, Alwazir J, Davidovic S, Farias A, Khan A, Khiaonarong T, Malaika M, Monroe HK, Sugimoto N, Tourpe H, Zhou P (2020) A survey of research on retail Central Bank Digital Currency. IMF Working Paper No. 20/104. IMF, Washington

Kosse A, Mattei I (2023) Making headway – Results of the 2022 BIS survey on central bank digital currencies and crypto. BIS Papers No. 136. BIS, Basel

Li J (2023) Predicting the demand for central bank digital currency: a structural analysis with survey data. J Monet Econ 134:73–85

Lusardi A, Mitchell OS (2014) The economic importance of financial literacy: theory and evidence. Journal of Economic Literature 52(1):5–44

Marchiori L (2021) Monetary theory reversed: virtual currency issuance and the inflation tax. J Int Money Financ 117:102441

Martenson R (1985) Consumer choice criteria in retail bank selection. Int J Bank Mark 3(2):64–75

Oliveira T, Thomas M, Baptista G, Campos F (2016) Mobile payment: understanding the determinants of customer adoption and intention to recommend the technology. Comput Hum Behav 61:404–414

Paulhus DL (1991) Measurement and control of response bias. In: Robinson JP, Shaver P, Wrightsman LS (eds) Measures of Personality and social psychological attitudes. Academic Press, San Diego, pp 17–59

Chapter Google Scholar

Schnabel I (2020) The importance of trust for the ECB’s monetary policy. Speech as part of the seminar series “Havarie Europa. Zur Pathogenese europäischer Gegenwarten” at the Hamburg Institute for Social Research, 16 December. Retrieved from: https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp201216_1~9caf7588cd.en.html . Accessed 16 Nov 2023

Schuh S, Stavins J (2010) Why are (some) consumers (finally) writing fewer checks? The role of payment characteristics. J Bank Finance 34(8):1745–1758

Simon J, Smith K, West T (2010) Price incentives and consumer payment behaviour. J Bank Finance 34:1759–1772

Stavins J (2018) Consumer preferences for payment methods: role of discounts and surcharges. J Bank Finance 94:35–53

Sveriges Riksbank (2020) Second special issue on the e-krona. Sveriges Riksbank Economic Review. Sveriges Riksbank, Stockholm

Teppa F, Vis C (2012) The CentERpanel and the DNB Household Survey: methodological aspects. DNB Occasional Study 10(4). DNB, Amsterdam

Van der Cruijsen C, Diepstraten M (2017) Banking products: you can take them with you, so why don’t you? J Financ Serv Res 52(1–2):123–154

Van der Cruijsen C, Plooij M (2018) Drivers of payment patterns at the point of sale: stable or not? Contemp Econ Policy 36(2):363–380

Van der Cruijsen C, de Haan J, Roerink R (2021) Financial knowledge and trust in financial institutions. J Consum Aff 55(2):680–714

Van der Cruijsen C, de Haan J, Roerink R (2023) Trust in financial institutions: a survey. J Econ Surv 37(4):1214–1254

Van Rooij MCJ, Lusardi A, Alessie RJM (2012) Financial literacy, retirement planning and household wealth. Econ J 122(560):449–478

Whited TM, Wu Y, Xiao K (2022) Will Central Bank Digital Currency disintermediate banks? https://doi.org/10.2139/ssrn.4112644

Wierts P, Boven H (2020) Central Bank Digital Currency - Objectives, preconditions and design choices. DNB Occasional Study No. 1(2020). DNB, Amsterdam

Download references

Acknowledgements

We would like to thank colleagues at DNB for helpful comments on earlier versions of this paper and the questionnaire. We also received insightful comments from members of the European Central Bank High Level Taskforce on CBDC. One anonymous referee provided many helpful suggestions. We are grateful to Miquelle Marchand and Josette Janssen of Centerdata for collecting the data and for their help with the questionnaire. The views expressed in this paper are our own and do not necessarily reflect those of DNB, the ESCB or SEO Amsterdam Economics. All remaining errors are the authors’.

Author information

Authors and affiliations.

SEO Amsterdam Economics, Amsterdam, The Netherlands

Michiel Bijlsma

Tilburg University, Tilburg, The Netherlands

De Nederlandsche Bank (DNB), PO Box 98, 1000 AB, Amsterdam, The Netherlands

Carin van der Cruijsen, Nicole Jonker & Jelmer Reijerink

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Carin van der Cruijsen .

Ethics declarations

Declarations of interest, conflicts of interests/competing interests.

Not applicable.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix 1. Introductory text CBDC

Currently, you have access to:

cash : coins and banknotes issued by the central bank (public money/central bank money) and

digital money : the money you hold on your current and savings accounts at commercial banks, like ING, Rabobank, ASN bank and ABN AMRO (private money /commercial bank money).

Policymakers are considering whether citizens, like commercial banks, should be able to have an account with the central bank. There is no such possibility yet.

Money on such an account is known as ‘digital central bank money’. This is a new form of public money. We call it here a digital banknote . You will be able to pay with it in different ways, just like with the digital money you are currently holding at the current account of your bank. For example, you will be able to pay directly with digital banknotes for your purchases at physical shops using your debit card or smartphone.

It will also be possible to use digital banknotes to transfer money from your current account to a digital wallet on your smartphone, which you can subsequently use to pay your purchases with. When you run out of digital banknotes in this digital wallet, you can refill it.

Appendix 2. Description of variables

Appendix 3. detailed tables.

Tables 9 , 10 , and 11

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Bijlsma, M., van der Cruijsen, C., Jonker, N. et al. What Triggers Consumer Adoption of Central Bank Digital Currency?. J Financ Serv Res 65 , 1–40 (2024). https://doi.org/10.1007/s10693-023-00420-8

Download citation

Received : 17 January 2022

Accepted : 04 November 2023

Published : 28 November 2023

Issue Date : February 2024

DOI : https://doi.org/10.1007/s10693-023-00420-8

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Public money

- Private money

- Bank accounts

JEL classification

- Find a journal

- Publish with us

- Track your research

IMAGES

VIDEO

COMMENTS

Digital finance and FinTech: Current research and future research directions. Journal of Business Economics, 67 (5) (2017), pp. 537-580. CrossRef Google Scholar. ... stability: Access to bank deposits and the growth of deposits in the global financial crisis. World bank policy research working paper 6577. World Bank (2013) Google Scholar ...

Overview. Digital Finance is a leading journal exploring cutting-edge research in digital financial technologies and their impact on the financial industry. Topics include Data Analytics and Innovative Techniques to improve financial technology. The journal focuses on Blockchain, Cryptocurrencies, Fintech, and Digital Banking.

5.2.6 Research on Digital Financial Advice. The research papers published in the field of Digital Financial Advice can be grouped into papers focusing on the behavior of users in trading communities and into papers analyzing such communities in order to relate the communication within the community to financial markets and, thereby, to make ...

To test the impact of digital finance on industrial structure upgrading, the rest of this paper is listed as follows: The second part is a literature review and research hypotheses; The third part explains the research design of this paper, indicating data sources, estimation models, and variable explanations; The fourth part presents our ...

Durai and Stella [15] investigated how digital financial services impact financial inclusion. Digital financial services which is the independent variable was measured as credit card, internet ...

finance literature by pr oviding a much ne eded futurist review of the s tate of digi tal finance. research and development, and it makes predictions about the future of digital finance in 10 to ...

Based on this paper, the following suggestions are put forward: encourage financial institutions, insurance and other traditional finance to transform to digital, use data technology to safeguard ...

This paper presents a concise review of the existing digital finance research in the literature, and highlight some of the developments in digital finance around the world. The paper reached several conclusions. Firstly, it showed that digital finance has become an important part of modern finance and the major application of digital finance ...

India's financial inclusion has significantly improved during the last several years. In recent years, there has been a rise in the number of Indians who have bank accounts, with this figure believed to be close to 80% at present. Fintech businesses in India are progressively becoming more noticeable as the Government of India (GoI) continues to strive for expanding financial services to the ...

Research and Impacts of Digital Financial Services Dean Karlan, Jake Kendall, Rebecca Mann, Rohini Pande, Tavneet Suri, and Jonathan Zinman NBER Working Paper No. 22633 September 2016, Revised September 2016 JEL No. G21,O12 ABSTRACT A growing body of rigorous research shows that financial services innovations can have

This paper selected the data of 31 provinces in mainland China from 2011 to 2020. Digital finance index (D F), coverage index of digital finance (CDF), and use depth index of digital finance (UDF) are derived from the index report compiled by the Digital Finance Research Center of Peking University. The raw data in index compilation came from ...

This paper's aim is to fill this gap by providing new evidence on the impact of usage of DFSs on economic growth. The bulk of recent empirical work that assesses the economic impact of digital financial inclusion is based on survey data at the household or firm level for specific countries.

Centre for Economic Policy Research (CEPR)), Harish Natarajan (World Bank) and Matthew Saal (International Finance Corporation (IFC))1 ... Definitions of key terms used in this paper Digital financial services (DFS) are financial services which rely on digital technologies for their delivery and use by

Against this backdrop, the research on finance and information systems has started to analyze these changes and the impact of digital progress on the financial sector. Therefore, this article reviews the current state of research in Digital Finance that deals with these novel and innovative business functions.

Finally, the third theme includes nine papers and describes research on behavioral interventions focusing on use of nudging and digital nudging in financial market. TABLE 1. Research on digital financial literacy. Category Focus Authors ... Digital finance literacy initiatives should not be limited to technology access and financial skills. It ...

Over the past two decades, artificial intelligence (AI) has experienced rapid development and is being used in a wide range of sectors and activities, including finance. In the meantime, a growing and heterogeneous strand of literature has explored the use of AI in finance. The aim of this study is to provide a comprehensive overview of the existing research on this topic and to identify which ...

Design/methodology/approach Using critical policy discourse analysis, this paper explains the turn from microfinance to digital finance, and thereafter discusses four issues: the lack of evidence ...

In other words, digital financial literacy is a prerequisite for access and usage of digital financial services. Research studies revealed that the users have low financial literacy, limited awareness of DFS, low or nil digital literacy, and distrust of DFS (Alliance for Financial Inclusion, DFSWG and CEMCWG, Citation 2021; Azeez & Akhtar ...

This research attempts to analyze the effect of digital finance on value creation in Commercial Tunisian banks. Using a quantitative method, 100 people were surveyed in eighteen of the twenty ...

Journal of Financial Services Research - Central banks around the world are examining the possibility of introducing Central Bank Digital Currency (CBDC). ... Tourpe H, Zhou P (2020) A survey of research on retail Central Bank Digital Currency. IMF Working Paper No. 20/104. IMF, Washington. Kosse A, Mattei I (2023) Making headway - Results of ...