An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

OIT Brand System

- General Guidelines

- Branding Philosophy and Policies

File Templates

Word templates.

- PowerPoint Templates

- Signature Logos

- Publications and Layout

- Iconography

- Our Illustration Style

- The DigitalVA Logo

- Asset Library Home All asset library links are for VA staff only. Network access required.

- Static Elements

- Motion Elements

- Designer’s Hub

- Accessibility Guide

- Search for:

PowerPoint Template

This VA OIT PowerPoint template is intended for internal and external audiences. It addresses OIT’s One Voice Policy, increases consistency and versatility, reduces brand chaos, and provides the foundational structure for an accessible presentation.

Templates allow consistency, uniformity, and foundational structure for accessibility across all documents. OIT has three templates in Word — Basic, Report, and Flyer.

InDesign Templates

These require Adobe InDesign to edit and update. If you need these files, they are available in the asset library (VA network access required).

Publication Cover

Publication Page

We’re here anytime, day or night - 24/7

If you are a Veteran in crisis or concerned about one, connect with our caring, qualified responders for confidential help. Many of them are Veterans themselves.

- Call 988 and press 1

- Text to 838255

- Chat confidentially now

- Call TTY if you have hearing loss 1-800-799-4889

Get more resources at VeteransCrisisLine.net .

U.S. Department of Veterans Affairs 810 Vermont Ave., NW Washington, DC 20420 1-800-698-2411

Your feedback matters

or press the esc key

2023 LGY Conference

About SDDVA

Public affairs, veterans home, veterans service officers.

- Department Message

- Veterans Commission

- Introduction

- Burial Benefits

- Headstone Setting Reimbursement

- Hunting/Fishing Licenses

- License Plates

- Drivers License Veterans Designation

- State Parks

- Tax Benefits

- DD214/Discharge Records

- Veterans Preference

- Compensation

- Health Care

- Vocational Rehab/Employment

- Upcoming Events

- News Bulletins

- Press Releases and Columns

- Job Postings

- Other Publications

- Determination of Eligibility

- Cemetery Photos

- History and Foundation

- Mission/ Vision/ Values/ Goals

- Application Process

- VHI Program

- What is a VSO?

- Locating a VSO

- Bridge Dedications

- SD Memorials

- Filing your DD214

- State Resources

- Federal Resources

- Veterans Service Organizations

- Congressional Delegation

- DAV Program

- Transportation Resources for Veterans

- Free Highly Rural Transportation Program

- Homeless Shelters

- Colleges and Universities

- Additional Links

Power Points

Sddva core training presentations, 2023 sddva benefit conference presentations, 2023 sddva/ctvso training presentations, 2022 sddva benefit conference presentations, 2022 sddva staff training presentations, 2022 january mini conference presentations, 2021 sddva annual benefit school presentations, 2021 sddva staff training presentations.

May 19, 2021

20 likes | 21 Views

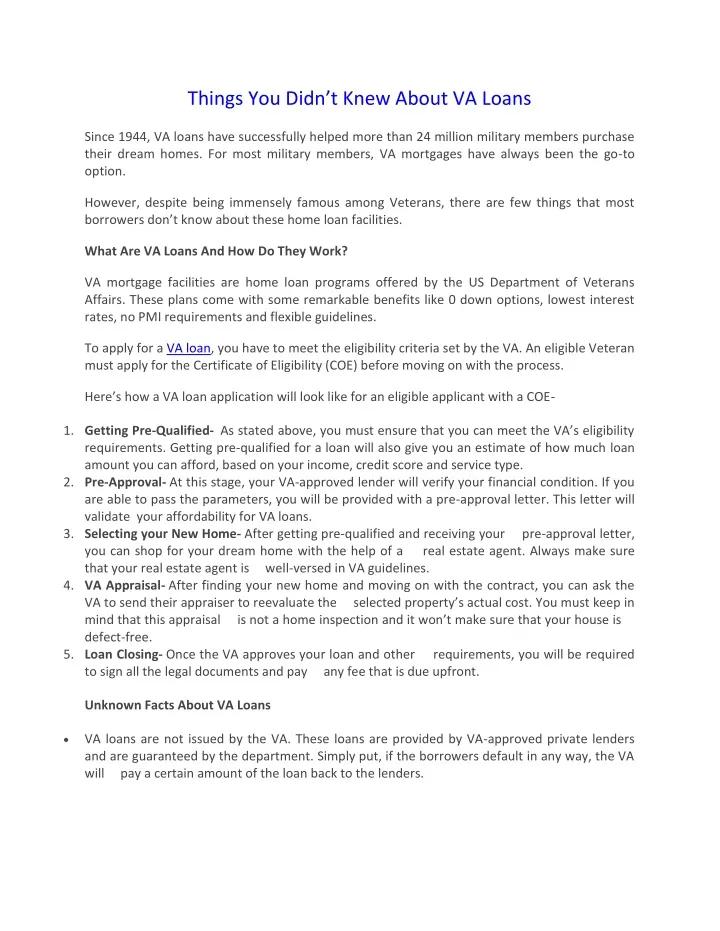

Since 1944, VA loans have successfully helped more than 24 million military members purchase their dream homes. For most military members, VA mortgages have always been the go-to option.

Share Presentation

Presentation Transcript

Things You Didn’t Knew About VA Loans Since 1944, VA loans have successfully helped more than 24 million military members purchase their dream homes. For most military members, VA mortgages have always been the go-to option. However, despite being immensely famous among Veterans, there are few things that most borrowers don’t know about these home loan facilities. What Are VA Loans And How Do They Work? VA mortgage facilities are home loan programs offered by the US Department of Veterans Affairs. These plans come with some remarkable benefits like 0 down options, lowest interest rates, no PMI requirements and flexible guidelines. To apply for a VA loan, you have to meet the eligibility criteria set by the VA. An eligible Veteran must apply for the Certificate of Eligibility (COE) before moving on with the process. Here’s how a VA loan application will look like for an eligible applicant with a COE- 1.Getting Pre-Qualified- As stated above, you must ensure that you can meet the VA’s eligibility requirements. Getting pre-qualified for a loan will also give you an estimate of how much loan amount you can afford, based on your income, credit score and service type. 2.Pre-Approval- At this stage, your VA-approved lender will verify your financial condition. If you are able to pass the parameters, you will be provided with a pre-approval letter. This letter will validate your affordability for VA loans. 3.Selecting your New Home- After getting pre-qualified and receiving your pre-approval letter, you can shop for your dream home with the help of a real estate agent. Always make sure that your real estate agent is well-versed in VA guidelines. 4.VA Appraisal- After finding your new home and moving on with the contract, you can ask the VA to send their appraiser to reevaluate the selected property’s actual cost. You must keep in mind that this appraisal is not a home inspection and it won’t make sure that your house is defect-free. 5.Loan Closing- Once the VA approves your loan and other requirements, you will be required to sign all the legal documents and pay any fee that is due upfront. Unknown Facts About VA Loans •VA loans are not issued by the VA. These loans are provided by VA-approved private lenders and are guaranteed by the department. Simply put, if the borrowers default in any way, the VA will pay a certain amount of the loan back to the lenders.

•You can apply for another VA loan after paying back the existing one. •VA home loans are available only for a primary residence. A borrower cannot borrow the mortgage for buying a vacation home or investment property. However, the VA does allow duplex, multi-unit property, single-family homes, condos and modular housing, given that they will become your primary residence. •Because the VA follows flexible guidelines, an applicant with a defaulter history or bankruptcy is also eligible for VA loans. •Another noteworthy benefit of these loans is that they do not require the applicant to pay any Private Mortgage Insurance (PMI). •Although an applicant won’t be required to pay PMI, they will be subjected to VA funding fees. This fee goes back to the department to keep this program running. A Veteran can either pay this cost upfront or get it rolled into monthly installments. •VA loans come with no limits unless you have 0 or partial VA entitlement.

- More by User

VA Guaranteed Home Loan Program

VA Guaranteed Home Loan Program. Department of Veteran Affairs Atlanta Regional Loan Center. “ To care for him who shall have borne the battle, and for his widow and his orphan.” Abraham Lincoln, 1865 . VA HOME LOAN PROGRAM. VA Training Topics. Why VA Types of Loans Loan Purposes

502 views • 28 slides

STEPS TO A VA LOAN

STEPS TO A VA LOAN. DEPARTMENT OF VETERANS AFFAIRS ST. PETERSBURG FL 888-611-5916. CONTACT INFORMATION. GO WWW.BENEFITS.VA.GOV/HOMELOANS / Locate Lender’s Handbook, CIRCULARS, FORMS and INFORMATION at this site Call 1-888-611-5916, or email FL /[email protected].

262 views • 13 slides

VA Guaranteed Home Loan Program. Department of Veteran Affairs Atlanta Regional Loan Center. “ To care for him who shall have borne the battle, and for his widow and his orphan.” Abraham Lincoln, 1865. VA HOME LOAN PROGRAM. VA Training Topics. Why VA Types of Loans Loan Purposes

521 views • 28 slides

VA Home Loan Tips

Va Loans for Vets provides and assists all veterans and active duty military with ALL of their VA Home Loan Financing Needs. Be a proud homeowner today. For more details call us at 480-351-5904 or visit our site http://www.valoansforvets.com/ VA Loans for Vets 7702 E. Doubletree Ranch Road, Suite 220 Scottsdale, AZ 85258 Phone: (480) 351-5904 Email: [email protected]

396 views • 23 slides

Obtaining A VA Home Loan

Va Loans for Vets provides and assists all veterans and active duty military with ALL of their VA Home Loan Financing Needs. Be a proud homeowner today. For more details call us at 480-351-5904 or visit our site http://www.valoansforvets.com/

374 views • 28 slides

how to get a va loan, va loans in Arizona

351 views • 28 slides

VA Loan Selection Tips

Today, the VA guaranteed home loan program offers a variety of loan types to serve the specific needs of active service members and military veterans. Here are few VA Loan selection tips to guide you in buying a new home. Visit site: http://www.reteotto.net/va-loan-selection-tips/

148 views • 2 slides

26 views • 1 slides

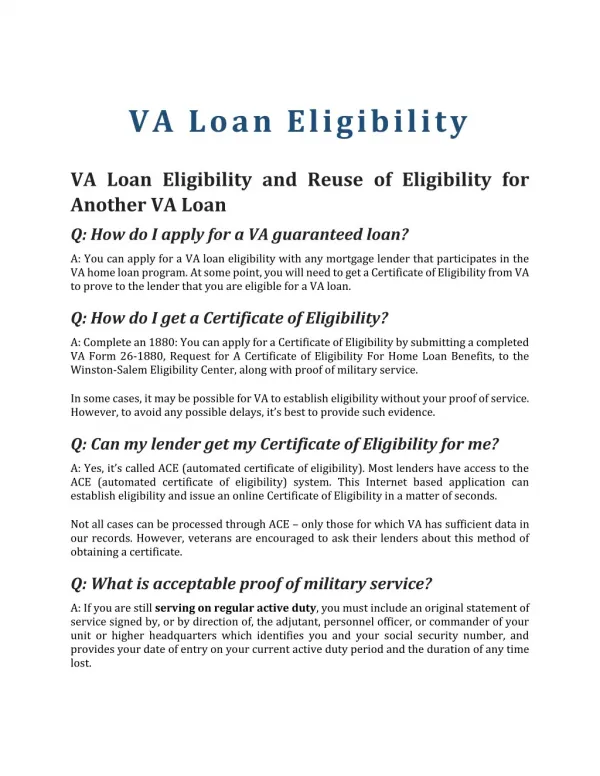

VA Loan Eligibility

VA Loans for Vets NMLS#184169r 5050 North 40th Street, Ste 260r Phoenix, AZ 85018r 602-908-5849r r Jimmy Vercellino is one of the nationu2019s top VA Home Loan mortgage originators. A Marine veteran, he and his team work hard to help veterans take advantage of their VA loan benefit and become homeowners. From start to finish, they guide their clients through the process and make it as smooth and stress-free as possible. Visit the site at https://www.valoansforvets.com

59 views • 5 slides

VA Home Loan Specialist - Quick VA Loans

If you are interested in VA home loan, Quick VA Loans is a VA home loan specialist in Utah, Florida, Texas, Colorado, Idaho and Wyoming. Apply online or speak with one of our friendly VA loan specialists.

90 views • 8 slides

Current VA Mortgage Rates - Visit Satori Mortgage for questions on VA loan eligibility & application process, check Eligibility for VA Loan, Current VA Mortgage Rates and get Military VA Loan in Florida.

23 views • 2 slides

VA Loan Pre-Approval Process

12 views • 1 slides

Texas VA home loan – Texas VA Mortgage

As we know, there are many of the Texas VA home loan providers are available in Texas, USA. But you should contact with those provider who will give you effective and affordable VA Loan services. Texas VA Mortgage is one of those providers. Many of the veterans got VA Home Loan Texas from us and all are satisfied. More information, go through this presentation. Call: (888) 295-4055 Website: https://www.texasvamortgage.org/va-loan-facts/

New VA Mortgage Loan Programs!

A conventional mortgage refers to any loan that is not insured or guaranteed by the federal government, as opposed to government-insured loans including Federal Housing Administration (FHA), U.S. Department of Veteran Affairs (VA), and U.S. Department of Agriculture (USDA). Learn more here - https://themortgageladyteamfairway.com/ Address - Company : The Mortgage Lady Team Fairway Address : 111 Solana Road, Suite B City : Ponte Vedra Beach State : FL Zip code : 32082 Phone number : (904) 383-8374 E-mail : [email protected]

76 views • 7 slides

- Preferences

VA Guaranteed Home Loans

VA Guaranteed Home Loans Roanoke VA Regional Loan Center Compliments of Roanoke and Cleveland RLC WHAT A VA LOAN CAN DO Ensures Equal Opportunity to Veterans No Down ... – PowerPoint PPT presentation

- Roanoke VA Regional

- Loan Center

- Compliments of Roanoke and Cleveland RLC

- National VA website

- www.homeloans.va.gov

- Roanoke VA website

- http//www.vba.va.gov/ro/roanoke/rlc/

- Toll Free (800) 933-5499

- Purchase or construct a home

- Purchase a VA/HUD approved condo or townhouse

- Purchase farm property

- Purchase a home and improve at the same time

- Manufactured home on permanent foundation

- Interest Rate Reduction Refinance Loans (IRRRL)

- Cashout Refinances

- Energy Efficient Improvement

- Ensures Equal Opportunity to Veterans

- No Down Payment Program

- Negotiable Fixed Interest Rate

- Streamlined Processing for Lenders

- Right to Prepay without Penalty

- Assumable Mortgage

- Limitations on Closing Costs

- Forbearance Extended to VA Homeowners Experiencing Temporary Financial Difficulty

- Appraisals take forever!

- Too much red tape!

- Too much paperwork!

- VA takes too long!

- Uses AUS to get decision in minutes

- Orders Appraisal thru TAS

- Lender Closes Loan

- Consolidation

- Underwrites Income Credit packages and the Appraisal

- Closes loan without sending anything to VA

- Lender guarantees loan online through a system called WebLGY

- Joint Loans

- Vets in receipt of non-service connected pension

- Vets rated incompetent by VA

- Interest Rate Reduction Loans when refinancing a delinquent loan

- Submits loan to VA for underwriting

- Closes after VA issues commitment, usually in 3-5 days

- 1 are Priors

- Honorably discharged veterans who served

- 2 years on active duty

- 6 years in the Reserve/National guard

- POWs held in captivity for 90 days of more

- 90 days of wartime duty when called up or ordered under U.S.C. Title 10 (this US code must appear on DD214).

- 181 days of peacetime duty called up under U.S.C. Title 10

- Some unmarried surviving spouses

- World War II (9/16/40 - 07/25/47)

- Korean Conflict (06/27/50 - 1/31/55)

- Vietnam (08/05/64 - 05/07/75)

- Persian Gulf - 08/02/90

- Post WWII - 7/26/47 - 6/26/50

- Post Korean - 2/1/55 - 8/4/64

- Post Vietnam - 5/8/75 - 8/1/90

- Enlisted person - After September 7, 1980

- Officer After October 16, 1981

- (90 days applies to Persian Gulf wartime service called up under U.S.C. Title 10)

- 6 Years Total Service unless activated under Title 10

- VA Form 26-1880

- Proof of service documentation (DD214, active duty statement of service or Reserve/National Guard points statement)

- If veteran had previous VA home that was sold, a copy of the HUD-1 Settlement Statement

- An automated system used by lenders to obtain an online certificate of eligibility

- Accessed through the VIP

- http//vip.vba.va.gov

- For use by lenders and mortgage brokers

- No application for certificate of eligibility needed

- Vets SSN Name all thats required to use ACE system

- Typical successful ACE candidate is a first time user of VA program, discharged after 1980 and served on active duty for 2 years

- ACE certificates of eligibility no longer printed on green or gold safety paper.

- ACE certificates printed from computer on white paper.

- Authorization number distinguishes authenticity

- Reserves/National Guard

- Prior VA loan foreclosure

- Insufficient time/discharge type

- Unmarried surviving spouse

- Winston Salem Eligibility CenterP.O. Box 20729Winston Salem, NC 27120

- GNMA, FNMA and FHLMC require government loans to have a minimum of 25 guaranty coverage

- Basic entitlement under old law, allows for up to 36,000 for loans not to exceed 144,000

- Certificate of eligibility tells the lender, broker or real estate agent how much entitlement a veteran has

- A veteran who previously used the VA home loan program would need to sell the home and transfer title to obtain the full basic and bonus entitlement back (restoration of entitlement)

- A veteran can obtain a certificate of eligibility over and over, provided they have adequate entitlement

- Limited to the lesser of

- Appraised Value or Purchase Price

- VA Funding Fee

- Energy Efficient Improvements

- Maximum VA loan is the lesser of the appraised value or the purchase price

- VA loan is based on available entitlement

- Secondary market requirements for GNMA, FNMA and FHLMC require at least a 25 guaranty

- VAs maximum guaranty on a 417,000 loan is 104,250, or 417,000 x 25 104,250

- WEVE RAISED THE ROOF

- Example The COE issued to you shows 36,000 basic entitlement. This amount can be increased to an amount equal to 25 of the Freddie Mac conforming loan limit which is 417,000 across the country exception for those counties with a temporary increase.

- Alexandria, VA, for example, is one county with a temporary increase of 768,750 for a home over 144,000.

- Entitlement 192,187.5 (36,000 basic 156,187.5 bonus).192,187.5 x 4 768,750.

- If you qualify for a home costing 768,750, the lender that you are approved through would receive a 25 guaranty.

- Veteran purchases a home in 1995 for 100,000

- VA guarantees 25 of loan or 25,000

- Loan is still open and being paid on

- Assuming the conforming loan limit is 417,000.

- If the conforming loan limit is higher ex. bonus as shown on previous screen would be more.

- Remaining Entitlement

- 36,000 basic entitlement

- - 25,000 used

- 11,000 remaining basic

- 68,250 bonus entitlement

- 79,250 total entitlement left

- 317,000 maximum loan to

- Whats changed at VA regarding appraisals?!!!

- 40 increase in number of appraisers in all states

- All appraisers must be e-commerce compliant

- Appraisers are expected to communicate with all parties

- Lender Appraisal Processing Program (92)

- Timeliness issues aggressively monitored

- Minimum Property Standards

- Safe meets local/county safety codes (electrical, structural and location)

- Sanitary well, septic and sanitary sewer pass local/county inspection

- Sound meets local/county structural building codes

- Bottom Line NO FIXER UPPERS!

- Generally, must occupy within 60 days

- IRRRLs do not have to occupy

- Spouse of veteran can satisfy occupancy

- If veteran is on active duty, must occupy within 12 months

- Funding fee can be added to the based loan amount

- Funding fee amount varies depending on loan type, down payment, and whether or not veteran had VA loan previously

- Funding fee is paid online at www.pay.gov/va

- Some borrowers are exempt

- Veteran receiving 10 disability compensation from VA

- Veteran receiving military pension from VA, in lieu of compensation

- Surviving spouse of a veteran who died as a result of active duty injuries

- Determine that the veteran is a

- satisfactory credit risk, and has the

- income to qualify for the loan

- Stable and Reliable

- Anticipated to continue

- Sufficient in amount

- Reportable/Verifiable

- Income must be verifiable

- Prefer a 2 year history, but consideration given for at least 12 months on the job

- Veteran can obtain VA loan immediately out of the military if employment is related to military technical experience

- Explain significant gaps in employment

- VA Form 26-8497, Verification of Employment, or

- Alternative

- Telephone verification

- Pay stubs (30 days)

- W 2s for 2 years

- Faxed Internet Verifications

- Employment Verification Services

- Leave Earning Statement (LES) for Active Duty Service (available at my pay

- Income tax returns (self employment) YTD PL and balance sheet

- Generally not considered stable and reliable

- Carefully consider Employers evaluation of probability of continued employment Special training/education/skills required

- If using this income you must explain why!!!

- Generally not considered stable and reliable unless 2 year history

- Verification for at least 12 months income may be used to offset debts of 10 to 24 months

- 3-File Merged (MCR)

- Residential Mortgage Credit Report (RMCR)

- Verify Rent/Mortgage history

- Most major lenders approved

- to use AUS systems

- Typical VA Accept is in the 640 credit score range

- Desktop Underwriter

- Loan Prospector

- Countrywides CLUES

- Chases ZIPPY

- PMI/AURA For VA Loans

- In the 640 mid-credit score range

- Accept gives credit clearance with waiver of certain derogatory issues

- AUS Accept does not mean loan is clear to close

- Veteran must still meet debt ratio and residual income factors

- Review individual trade lines derogatories in last 12 months?

- Collection accounts minor or major?

- Charge offs how much and how long ago?

- Federal debt cannot close with open, unpaid Federal debt

- Judgments cannot close with open, unpaid judgments

- Absence of credit history

- Discharged 2 years ago if bankruptcy was caused by borrowers financial mismanagement

- Discharged 12 months ago - must be due to circumstances beyond borrowers control

- Must have documentation

- Must have re-established credit in most recent 12 months

- This indicates an effort to pay and may be viewed as evidence of acceptable credit if

- 12 month payment history, no lates

- Acknowledgment of trustee or agency

- Develop facts and circumstances

- Same waiting periods as Chapter 7 Bankruptcy

- Prior VA LoanEnsure no debt to Government and entitlement restored

- May remove debts with 10 monthly payments remaining (if not significant)

- Only monthly revolving and installment accounts considered

- Child care is a monthly obligation

- Investigate all allotments on LES or pay stubs

- Verify and consider Alimony and Child Support

- Co-obligor on anothers loan

- evidence payments made bysomeone else

- No reason to believe applicant will need to make payments in the future

- Student Loan payments deferred 12 months or more.

- 401K loans (or other loans secured against deposited funds).

- VA Form 26-8497a, Verification of Deposit

- Alt Docs Last two bank statements

- Internet and faxed verifications

- Debt-to-income Ratio 41

- Residual Income - should meet VAs residual income tables

- Lender must complete Loan Analysis, VA Form 26-6393

- Approve Loan

- Reject Loan

- Could go either way

- Contingent on VA financing VA

- Escape Clause is mandatory

- Seller must pay termite inspection

- Appraisal Report Compliance Inspections

- Credit Report

- Prepaid Taxes and Hazard Insurance

- Title Exam and Title Insurance Fees

- Flood Zone Determination

- Environmental Endorsements (3.0, 8.1,103.5)

- Recording Fees and Taxes

- EPA Endorsement

- Origination Fee (1)

- Reasonable Discount Points (May roll up to 2 points into an IRRRL)

- Termite/Pest Inspection

- Septic Inspection (as mandated by county)

- Well Inspection (as mandated by county)

- Mortgage Broker Fee

- New HUD1 and Good Faith Estimate

- VA will continue to have a cap on the origination fee and limit the type of charges that may be paid by the veteran.

- In order to monitor these fees, VA is requiring lenders to itemize these charges in the empty 800 lines of the HUD-1 (effective 5/1/2010).

- Lenders will be required to maintain a copy of the GFE and invoices for third party charges as part of their origination package.

- The lender may charge the veteran a flat fee up to one percent of the loan amount. The flat fee is intended to cover the lenders costs and services which are not reimbursable as itemized fees. For Interest Rate Reduction Refinance Loans this fee may not exceed 1 of the existing loan balance of the loan being refinanced plus the cost of energy efficient items less any cash payments from the veteran.

- Circular 26-10-01 Lists Reasonable and Customary Items along with Unallowable Itemized Fees Also refer to Chapter 8, section 2d of the Lenders Handbook.

- 325,675 VA loans nationwide

- 68.2 billion in VA loan volume

- Average VA loan 209,395.

- Repayment Plans

- Deed In Lieu of Foreclosure

- Loan Modification

- VA Refunding

- Compromise Sale

- THE HOMEOWNER NEEDS TO CONTACT THEIR LENDER

- If the value of the veterans property has dropped and you, as a realtor, cannot get a contract to pay the loan in full, you may want to consider the VA compromise sale program.

- If you get a contract equal to the value and the closing costs are reasonable and customary, this program may work for you.

- With this program, the lender (on behalf of VA) can step in and pay the difference to pay the loan off plus closing costs that are reasonable so that the homeowner can avoid foreclosure. When the lender reviews a case for VA compromise, they look at the case as if it were going to foreclosure versus allowing the VA compromise to go through. There must be a savings in order for the compromise sale to go through.

- If, for example, you submit a contract that equals the value but the value has dropped drastically or the closing costs are too high for whatever reason (or a combination of both factors), the contract will fall through.

- Contract Sales Price 95,000

- Closing Costs 7,800

- Total 102,800

- Total Debt of 113,619 less Net After Sale of 102,800

- Comp Claim Payment of 10,819

- Foreclosure

- Principal 110,000

- Interest 2,019

- Foreclosure Costs 1,000

- Advances 600

- TOTAL Debt 113,619

- Net Value -96,943

- Foreclosure Claim 16,676

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

VA.gov content style guide

This is our house style guide for the VA.gov website. It’s shared across VA administrations and teams, so we can speak with one voice and create a consistent, helpful experience for Veterans and non-Veteran customers. This style guide is a living document and will change over time, based on user research and feedback.

See our content principles for the house voice and tone, and the foundation for how we practice language for and with Veterans in mind.

What you’ll find in this style guide

We’ve organized the style guide into searchable topics, so you can go directly to the section you need guidance on. This guide covers common issues on VA.gov. It does not cover basic writing mechanics and grammar. (We assume you know those already.)

We follow plain language and web best practices. Where we vary from standard practices, we call them out in the word list or as a topic section.

For issues not covered in this style guide, refer to:

- Merriam-Webster Dictionary

- VA Office of Public and Intergovernmental Affairs style guide

Suggestions or questions about the VA.gov content style guide? Email us at [email protected] with “Content style guide” in the subject line.

If you’re looking for VA governance requirements—such as compliance, policies, and regulations—please go to VA Web Governance .

Ask a Question

Toll Free Numbers

Hospitals and Clinics

Vet Centers

Regional Benefits Offices

Regional Loan Centers

Cemetery Locations

- site map [a-z]

- Agent Orange

- Post Traumatic Stress Disorder (PTSD)

- Benefit & Claim Status (Registration Required)

- Disability Benefits Questionnaires (DBQ)

- Unemployability/TDIU

- Fiduciary Program

- Identification Card (VIC)

- Benefits (Registration Required)

- Veteran Rapid Retraining Assistance Program (VRRAP)

- Web Automated Verification of Enrollment (W.A.V.E.) (Registration Required)

- Survivors Education & Assistance Benefits (Chapter 35)

- Vocational Rehabilitation

- Veterans Education Assistance Program (VEAP)

- Determine Your Eligibility

- Certificate of Eligibility

- Apply (Registration Required)

- Status (Registration Required)

- Veterans Information Portal (WebLGY) (Registration Required)

- Veterans Group Life Insurance (VGLI)

- Service Members' Group Life Insurance (SGLI)

- Family Servicemembers' Group Life Insurance (FSGLI)

- Servicemembers' Group Life Insurance Traumatic Injury Protection (TSGLI)

- Service-Disabled Veterans Insurance (S-DVI)

- Veterans' Mortgage Life Insurance (VMLI)

- Dental Care

- Blue Button

- Download Your Own VA Medical Records

- Order Hearing Aids

- Batteries (for Hearing Aids & Other Devices)

- VA Social Media Accounts

- Manage Your Prescription Refills with My HealtheVet (Registration Required)

- Mental Health

- Health (Please contact your local VA Medical Center)

- Track Your Appointments with My HealtheVet (Registration Required)

- Travel Pay/Reimbursement

- Aid & Attendance & Housebound

- Community Living Centers (CLC)

- Community Nursing Homes

- Domiciliaries (Please contact your local VA Medical Center)

- Homemaker & Home Health Aid Care

- Hospice and Palliative Care

- State Veterans Homes

- CHAMPVA (Family Members Insurance)

- Burials & Memorials

- Headstones, Markers, & Medallions

- Build Your Career

- Talent Management System (TMS) (Registration Required)

- VA Acquisition Academy

- Direct Deposit Sign-Up Form SF 1199A (PDF)

- Human Resources

- Personal Identification Verification (PIV) Card

- Security Investigation Center/Background Investigations

- Travel & Reimbursement

- Doing Business with VA

- Acquisition, Logistics, & Construction

- Small & Veteran Business Programs

- VetBiz Portal

- Financial & Asset Enterprise Management

- Security Investigation Center/Background Clearances

- Freedom of Information Act (FOIA)/Privacy Act Requests

- DD–214 — Report of Separation

- 21–4138 — Statement in Support of Claim (PDF)

- 22–1995 — Request for Change of Program or Place of Training (PDF)

- 22–1990 — Application for Education Benefits (PDF)

- 10-10ez — Health Benefits Renewal (PDF)

- 21–2680 — Exam for Housebound Status or Permanent Need for Regular Aid and Attendance (PDF)

- 10–10ez — Application for Health Benefits

- Publications

- Employment & Careers

- Volunteer or Donate

- Public & Intergovernmental Affairs

VA Homeless Programs

Va's calendar year 2023 homelessness goals.

On March 15, 2023, VA announced its 2023 goals for preventing and ending Veteran homelessnes s. Specifically, in 2023, VA would:

- Place at least 38,000 Veterans experiencing homelessness into permanent housing.

- Ensure that at least 95% of the Veterans housed in 2023 do not return to homelessness during the year. And of those who return to homelessness, VA will ensure that at least 90% are rehoused or on a path to rehousing by the end of 2023.

- Engage with at least 28,000 unsheltered Veterans to help them obtain housing and other wraparound services.

Listen to the Ending Veteran Homelessness podcast episode announcing the goals .

Final Progress Update

As of December 31, 2023 :

- 46,552 Veterans have been permanently housed, representing 122.5% of the goal. VA has met this goal and will continue to connect homeless Veterans to the permanent housing and supportive services they need.

- 95.9% of the Veterans housed so far have remained in housing. 1,919 Veterans have returned to homelessness, representing 4.1% of the Veterans housed.

- Of the Veterans who returned to homelessness, 1,850 Veterans have been rehoused or placed on a pathway to re-housing, representing 96.4% of Veterans who have returned to homelessness. VA is continuing to monitor progress towards this goal closely and is actively working to prevent returns to homelessness and reengage with the Veterans who have.

- 40,203 unsheltered Veterans have been engaged, representing 143.6% of the goal. VA has met this goal and will continue to engage with unsheltered Veterans to ensure they access the housing resources they need.

View these results broken down by race, ethnicity, gender, and age . VA hosted a monthly Office Hours Call Series to support communities in achieving this goal. Recordings of these calls were posted here.

Call Recordings

- Kickoff Call Recording - VA's CY 2023 Homelessness Goals - March 30, 2023. View the PowerPoint presentation from this call .

- Office Hours Call Recording - Technical Specifications - April 6, 2023. View the PowerPoint presentation from this call .

- Office Hours Call Recording - Housing and Urban Development-VA Supportive Housing (HUD-VASH) Strategies for Achieving the Goals - May 4, 2023. View the PowerPoint presentation from this call .

- Office Hours Call Recording - One Team: Coordinated System and Program Strategies for Achieving the CY 2023 Goals - June 1, 2023. View the PowerPoint presentation from this call .

- Office Hours Call Recording - Strategies to Supplement Case Management Services to Keep Veterans in Housing - July 6, 2023. View the PowerPoint presentation from this call .

- Office Hours Call Recording - Improving Data Quality on Preventing Returns to Homelessness and Setting Veterans Back on Pathways to Rehousing - August 3, 2023. View the PowerPoint presentation from this call .

- Office Hours Recording - One Team Case Conferencing on Returns Guidance - September 7, 2023. View the PowerPoint presentation from this call .

- Office Hours Recording - Using HOMES Assessments to Connect Veterans to Resources - October 5, 2023. View the PowerPoint presentation from this call .

- Office Hours Recording - Integrating One Team Case Conferencing into Your Ongoing Operations - November 2, 2023. View the PowerPoint presentation from this call .

- Office Hours Recording - Point-In-Time Count: Overview, Purpose & Significance - December 7, 2023. View the PowerPoint presentation from this call .

- Office Hours Recording - Final Actions - January 4, 2024. View the PowerPoint presentation from this call .

- Office Hours Recording - Season Finale - February 1, 2024. View the PowerPoint presentation from this call .

If you have questions about this goal, or want to know how you can help, email [email protected]

Read the technical specifications for these goals.

Veterans Crisis Line: Call: 988 (Press 1)

Social Media

Complete Directory

- Regulations

- Web Policies

- No FEAR Act

- Whistleblower Rights & Protections

- White House

- Inspector General

- Apply for Benefits

- Apply for Health Care

- Prescriptions

- My Health e Vet

- Life Insurance Online Applications

- State and Local Resources

- Strat Plan FY 2014-2020

- VA Plans, Budget, & Performance

- VA Claims Representation

- Careers at VA

- Employment Center

- Returning Service Members

- Vocational Rehabilitation & Employment

- Homeless Veterans

- Women Veterans

- Minority Veterans

- Plain Language

- Surviving Spouses & Dependents

- Adaptive Sports Program

- Veterans Health Administration

- Veterans Benefits Administration

- National Cemetery Administration

U.S. Department of Veterans Affairs | 810 Vermont Avenue, NW Washington DC 20420

Last updated February 5, 2024

Get help from Veterans Crisis Line

- Call 988 (Press 1)

- Text to 838255

- Chat confidentially now

- Call TTY if you have hearing loss 1-800-799-4889

If you are in crisis or having thoughts of suicide, visit VeteransCrisisLine.net for more resources.

IMAGES

VIDEO

COMMENTS

When the program began, VA had to underwrite and approve all VA-guaranteed loans. Today, 99% of all VA loans are underwritten by private lenders who have VA prior-approval authority. The first VA-guaranteed home loan was obtained by Captain Miles Myers for a home on Kennedy Street, NW, in Washington, D.C.---about four miles away from the U.S ...

PowerPoint Templates. This VA OIT PowerPoint template is intended for internal and external audiences. It addresses OIT's One Voice Policy, increases consistency and versatility, reduces brand chaos, and provides the foundational structure for an accessible presentation. Accessibility - Accessibility starts with you.

File Templates OIT Office of Communication 2023-05-04T10:52:20-04:00. ... This VA OIT PowerPoint template is intended for internal and external audiences. It addresses OIT's One Voice Policy, increases consistency and versatility, reduces brand chaos, and provides the foundational structure for an accessible presentation. Learn more and download.

Education Service Webinars and Training. The Webinars provide information on the GI Bill, related legislation, and processes. These presentations are provided to a closed audience that includes School Certifying Officials, Education Liaison Representatives, State Approving Agency employees, VetSuccess on Campus Counselors, and Veterans and dependents.

Circular 26-22-18. December 5, 2022. 6. Rescission. This Circular is rescinded January 1, 2024. By Direction of the Under Secretary for Benefits. John E. Bell, III Executive Director Loan Guaranty Service. Distribution: CO: RPC 2021 SS (26A1) FLD: VBAFS, 1 each (Reproduce and distribute based on RPC 2021)

ÐÏ à¡± á> þÿ š þÿÿÿþÿÿÿ ...

Veterans Benefits Administration Home

Greetings, We are pleased to announce the 21st Annual Department of Veterans Affairs (VA) 2023 Loan Guaranty Service (LGY) Conference, hosted at the Sheraton Kansas City Hotel at Crown Center, Kansas City, MO, May 2-4, 2023.. This is your exclusive opportunity to join Senior LGY officials to discuss pressing issues related to the VA-Guaranteed Home Loan program.

VA home loans extend not only to the Army, Air Force, Navy, and the Marines, but also to Reservists and National Guardsmen. To find out exactly what you qualify for in Colorado, talk to one of our certified loan specialists today. - A free PowerPoint PPT presentation (displayed as an HTML5 slide show) on PowerShow.com - id: 974997-M2Y2N

SDDVA Core Training Presentations * 01 Pension UME 2023 SDDVA Benefit Conference Presentations ... * 12 VA Health Care 2021 * 13 VA Home Loans and Adaptations * 14 Supplemental Claims ... * Building Compensation Claims Power Point Presentation * VA Presumptive Conditions Power Point Presentation

Dependents and Survivors Benefits: Death Gratuity Payment: Military services provide payment, called a death gratuity, in the amount of $100,000 to the next of kin of Service members who die while on active duty (including those who die within 120 days of separation) as a result of service-connected injury or illness.

Do you want to learn more about the VA Home Loan Program? Check out this PowerPoint presentation from the 2018 Lenders Conference, where the director of the program shared the latest updates, statistics, and best practices for lenders and borrowers. You will find valuable information on eligibility, appraisal, underwriting, and servicing of VA loans.

Interest Rate Reduction Refinance To refinance an existing VA-guaranteed loan Must lower interest rate and principal and interest payment See Chapter 6, section 1 for guidelines and exceptions. ... PowerPoint Presentation Author: LGYPJESS Last modified by: LGYPJESS Created Date: 2/20/2009 11:10:36 PM Document presentation format: On-screen Show

VA Myths • VA loans take longer • VA property standards are difficult • VA loans are harder to qualify for. Grand Junction: 970-242-7000 Montrose: 970-252-7395 Steamboat Springs: 970-761-2245 For More Info on VA Loans Call: Equal Housing Lender. This is not a commitment to lend or extend credit. Restrictions may apply.

Since 1944, VA loans have successfully helped more than 24 million military members purchase their dream homes. For most military members, VA mortgages have always been the go-to option. Slideshow 10537607 by sarahcarlos12

Authorization of major medical facility leases of Department of Veterans Affairs for fiscal year 2023. Leasing. Authorizes 31 VA leases and authorizes appropriations of $998.14M for these leases ... which is currently $3.613M. VA will be defining leases over $1M as Mid-Level Leases and Major Level Lease definition has been updated for those ...

World's Best PowerPoint Templates - CrystalGraphics offers more PowerPoint templates than anyone else in the world, with over 4 million to choose from. Winner of the Standing Ovation Award for "Best PowerPoint Templates" from Presentations Magazine. They'll give your presentations a professional, memorable appearance - the kind of sophisticated look that today's audiences expect.

Shown Here: Introduced in House (06/23/2023) VA Loan Informed Disclosure Act of 2023 or the VALID Act of 2023. The bill requires a Federal Housing Administration mortgage notice to contain comparative rate and fee information about loans available under the Department of Veterans Affairs home loan program.

VA.gov content style guide. This is our house style guide for the VA.gov website. It's shared across VA administrations and teams, so we can speak with one voice and create a consistent, helpful experience for Veterans and non-Veteran customers. This style guide is a living document and will change over time, based on user research and feedback.

2 HDFC Bank Presentation, May 2023 Contents 1. CEO's Priorities 2. Positioned for attractive macro-variables 3. FY 2023 performance in context 4. Driving growth at scale ... Loans (Rs. bn) Mar'21 Mar'22 Mar'23 FY'22 YoY FY'23 YoY Retail 4,617 5,318 6,346 15% 19% CRB 3,717 4,847 6,292 30%

Office Hours Call Recording - One Team: Coordinated System and Program Strategies for Achieving the CY 2023 Goals - June 1, 2023. View the PowerPoint presentation from this call. Office Hours Call Recording - Strategies to Supplement Case Management Services to Keep Veterans in Housing - July 6, 2023. View the PowerPoint presentation from this ...