ZARA Logistics System & Transportation Strategy

Want to know more about ZARA logistics system? This ZARA transportation strategy case study analyzes the issue and contains recommendations for ZARA supply chain.

Executive Summary

Introduction, zara logistics system & practices.

- Evaluation of Web-Based Processes

- SCM Implementation Plan

- Recommendations

Works Cited

ZARA has been known as the most successful retailer of fashionable clothes at moderate prices. Its unique strategies of vertically integrated system of supply chain allow to produce cheap but fashionable garment within a short period.

In contrast to other retail manufacturers, their logistics system is much more effective because it meets the changing consumer demands. In addition, the company attains much importance to the development of sophisticated IT systems ensuring effective communication and information flow throughout the chains of the network.

Despite the successful growth and increased competitive advantage, ZARA supply chain management still has a number of limitations. These drawbacks are specifically connected with vertical orientations, geographically oriented demands, and high-level transportation costs. A careful re-organization of company managerial systems can be the best solution for effective handling of logistics and data exchange, as well as for increasing the company’s sustainability.

Specifically, the creation of the second center can solve several problems on the spot – eliminate problems with transportation, improve customer demand, and reduce the risk of overproduction. Finally, the integration of the web-based supply management to the North American region can also be advantageous for the company’s profitability and performance. The transportation system, distribution lines, and modes of productions will be greatly optimized.

Purpose of the Paper

The primary goal of the project is to provide an analysis of ZARA’s logistics process to identify the weaknesses and suggest corresponding improvements. The report, therefore, will provide information about the past and current practices of the company’s supply chain management to highlight the differences and track the existing inconsistencies.

A careful analysis of inbound and outbound logistics, as well as understanding the role of the information flow within the organization will also contribute to providing viable solutions and recommendations to the company’s strategies in the field of supply chain management.

Background Information about ZARA

ZARA is a Spanish fashion clothing and accessories chain of stores that was originally based in Arteixo, Galicia. It was organized as the joint venture of the Inditex group and as a new holding company in 1975 (About ZARA, n. p.). Since 1976, the Spanish network of stores has been expanded in a great number of cities all over the world. Its main concept consists in spreading a single fashion culture outside the national frontiers.

In addition, the venture owns such famous brands as Pull and Bear, Stradivarius, Massimo Dutti, and Bershka (About ZARA, n. p). ZARA has introduced the new trend of distributing fast fashion production to the developing countries. This unconventional strategy is also emphasized by a zero advertising policy to invest more moneys in creating new stores in different countries.

ZARA Supply Chain: the History

The company was founded by Ortega Gaona who has introduced an alternative outlook on the concept of clothes that should be consumed quickly rather than held in cupboard. The company has become the leading brand of the Inditex group due to its exclusive strategies and marketing concepts.

In 1975, ZARA began selling the clothes in the native city (Dutta 2). Later, the popularity of brand was spread to other cities and neighboring countries. The major marketing concept, therefore, consisted in distributing democratized fashion to masses. Because the marketing strategy was successful, the network of chains appeared in such leading cities as New York, London, Rome, and Paris.

The main scope of the company’s supply chain management lies in distributing a cheap but fashionable garment within 2 weeks. In order to meet the deadlines, garment is produced in limited supplies, which also enhances the concept of exclusivity. Hence, the retail concept is based on rapid replenishment and regular creation of small amounts of new accessories and clothes.

Judging from this philosophy, the speed of manufacture is extremely high and, therefore, the effectiveness of the product distribution largely depends on the constant information exchange throughout each stage of the company’s supply chain (Ferdows et al. n. p.). ZARA’s managers realize that performance measures, office layouts, and operational procedures can be carried out properly in case the information transparency and quick data transmission is ensured.

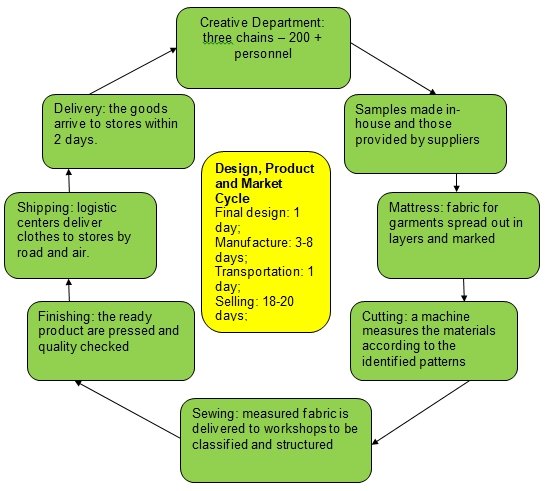

Flow and Cycle Diagram Identifying the Flow of Materials, Money, and Product

The network’s supply management concept is closely connected with time-based competition allowing to source products at the international level. These factors contribute greatly to trades off that have been introduced in order to develop strong relationships with supply chain managers all over the world. In this respect, Zara also supports this concept, as presented in the flow diagram below:

Regarding the diagram, the process of supply starts with cross-functional teams cooperating with the company’s design department located in La Coruna. The team’s perception of the leading fashion trends is further directed by regular inflows of EPOS information from ZARA’s stores from all over the world (Dutta 3). Further, the marketing specialists proceed to consult the supplies concerning the prices, costs, and margins (Dutta 3).

In order to define the volume of the production and establish deadlines, a global sourcing policy provides a wide variety of fabric supplied from different countries. Such an approach significantly reduces the risk of delays because if one supplier is unavailable, there are many other fabric producers to rely on.

Hence, about 40 % of garments are imported whereas the rest is produced in Spain (Dutta 5). Further, the finished products are price-tagged and labeled in La Coruna, the company’s distribution center. The entire production cycle lasts two weeks to gain a time-based competitive advantage and surpass its North American and European rivals.

ZARA Transportation Strategy: Past Key Decisions

For the purpose of controlling the marketing costs, Zara prefers creating prime retail locations to spending money on advertising and attracting the buyers to their stores. As a result, the company spends about 0.3 % only for advertising campaigns instead of 3.5 % spent by its competitors (Dutta 6). Importantly, the company prioritizes the importance of choosing highly notable locations, which makes advertising unimportant.

Unlike other leading retailers located in North America and Europe, Zara’s managers do not outsource their production completely. On the contrary, they locate about 80 % of production in Europe, near the headquarters in Spain to take closer control of the facilities (Dutta 4). Such an approach provides a greater extent of flexibility and minimizes the risk of failure. In addition, the production of limited quantities also enhances the effectiveness of risk management, as well as speed up the supply chain process.

The inventory management is sufficiently ensured by effective IT solutions. At this point, the information and communication networks that the company uses produce cost advantages to operations and allow to follow the fundamental principle of reacting quickly to the shifts in demand.

In addition, success and flexibility allows the company’s managers to define quickly the deadlines of production due to short lead-time, variety of fashion trends, and limited supplies (Ferdows et al. n. p.). In whole, ZARA’s inventory model is based on three main pillars: inventory in store, warehouse inventory, and demand forecast that is closely controlled by the creative departments.

Transportation

Because ZARA is more inclined to use high technologies for transporting and distributing products, the matter of transportation is indispensible for carrying out two-week shipments to stores (Stewart 10). The fabrics and other materials are also quickly distributed because the supplying centers are located near the headquarters.

ZARA Supply Chain: Problems & Weaknesses

Despite the incredible results that ZARA retailer has achieved, it can face a number of challenges that can create serious problems. These limitations can be connected with just-in-time management, transportation system, excess emphasis on technologies, and inappropriate management of human resources (Gallagher 4).

In addition, the transportation process and shipment of materials within the regions can also undergo unforeseen complications in the form of natural disasters, whether, terrorism, political disturbances, or labor strife (Gallagher 6). The disconnection between the center and creative department can significantly halt the information exchange within the network throughout the globe.

Aside from the operation vulnerabilities, the challenges can also be connected with financial problems. In particular, due to the fact that the low-cost regions are supported either by dollar or by Euro, the currency fluctuations can negatively influence the cost management at ZARA.

Such a situation can lead to increase in profit margins and transportation costs. It should be stressed that a twice-weekly model of delivery is directly associated with the transportation costs and, therefore, the circumstance can become the key to ZARA’s failure to control costs (Gallagher 7).

Because the time is one of the core advantages of the company, it should take possible challenges into deeper consideration. The evaluation of rivals’ strategies is also crucial for predicting their further steps because more and more companies have been emulating the vertically integrated supply chain system introduced by ZARA.

Finally, apart from strict monitoring of consumer demands, the company’s managers should also take a closer look at the economic conditions (Dutta 3). Specific, the recession periods can make consumer buy less and shift a share of wallet to lower-cost offerings (Gallagher 6). In order to eliminate the emerged threats, the firm should conduct an in-depth analysis of future marketing opportunities.

ZARA Supply Chain: Evaluation of Web-Based Processes

Existing web-based supply chain systems and processes related to electronic data interchange.

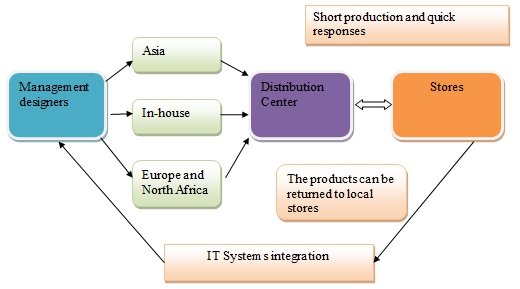

As it has been presented above, ZARA has successfully implemented a quick response program ensuring effective production and distribution of products. Hence, excess inventory and overproduction have been incorporated into the idea of customized retailing through a vertically integrated channel (Cheng and Choi 13).

In order to monitor all stages of supply, effective informational technologies and web-based supply chains should be introduced (See Appendix 1). In order to ensure quick information flow, Electronic Data Interchange (EDI) is crucial for Quick Response program being a fundament technology for processing the received data between the distributors and manufactures (Leeman 142). More importantly, the technology has been the core factor enabling technology for replenishment and efficient coordination of a supply chain process.

Provided by ERP system, this mechanism is indispensable to handling distribution and logistics processes. In addition, the information flow process is significantly enhanced through the introduction of intranet communication. The company’s intranet is necessary for a holistic evaluation of the incoming suggestions concerning the product design and price (Leeman 143). As a result, the firm designs about 10 thousand items annually.

Assistance of Web-Based Technologies in Integration and Collaboration Processes

Effective information exchange is the main condition for implementing collaborative and integrative practices. In contrast to the traditional ordering process, ZARA retailers provide the producers with all necessary information that is impossible to handle manually (Schneider 240). Second, using intranet networks enables constant flow of information and allows ZARA to eliminate the threat of overproduction.

Importantly, the integration between business activities contributes to developing information distribution leading to a tangible increase in performance and productivity. Due to the fact that the primary goal of an ERP system consists in integrating information and activities from diverse functional departments of a company, the introduction of workflow information systems can improve the data exchange and provide transparency and accuracy of communication (Dutta 7).

At this point, vertically integrated types of supply chain management require technologies that can embrace information from operational applications. In order to meet the challenges of remote data processing, the company can introduce technological systems combining the analysis of both external and internal data.

ZARA Logistics: Recommendations & Implementation Plan

Strategies for four key decision areas of supply chain.

The introduction of another distribution center can eliminate possible risks that a vertical integration system of supply presents. In order to sustain a competitive advantage and growth, ZARA should seek alternative opportunities for the global expansion in the apparel market.

In this respect, the company should develop another distribution center in the United States to diminish the logistics level and deliver fashionable clothes in a timely manner. At this point, it is possible to develop smaller distribution centers located in Brazil, Argentina, or Mexico, which enhances the possibility of meeting the demands of the American customers.

The production process can be significantly fostered through investment in Internet retailing directed toward the American market. Online marketing strategy can advance the expansion process to the U. S. market. In addition, the company should also introduce specialize products with regard to various geographic locations.

Inventory system can be improved in case Electronic Data Exchange systems are introduced as powerful tools for integrating and collaborating the internal and external data obtained from stores, designers, and marketing specialists.

The existence of several retail centers can decrease the transportation costs because air shipments are much more expensive due to the rise of prices on fuel.

Functional Decisions Based on the Established Strategies

The presented strategies do not provide tangible shifts to the vertically integrated systems of the company’s supply chain. ZARA’s managers, therefore, only need to develop the second retailing center with similar structure. The existence of additional retailing department can deprive the headquarters of certain responsibilities and provide greater control of other regions.

The integration of IT systems will eliminate the problems of coordination between the two newly introduced centers. In addition, the re-organization process will touch on the design sphere because the American department will be specifically oriented on web-based supply chain process. Hence, part of responsibilities will be imposed on this department and, as result, there will be designers oriented on different geographical regions.

Rationale for the Identified Strategies

The development of the second retail center in the American region can enable the international company to foster the policy of global expansion. What is more important, the company can create a solid platform for controlling the financial and economic conditions in the world.

As per the production process strategies, U. S. consumers are most likely to buy goods without going outside because they feel more comfortable while having more time to select a product. Further, culturally and socially oriented policy of manufacturing can have a potent impact on the increase in consumer demand. Finally, the transportation and inventory can also be improved with the integration of effective ERP systems enhanced by Electronic Data Exchange systems.

Recommendations for ZARA Supply Chain

Excessive emphasis on vertical integration system can create a threat to the effectiveness of global expansion of the world-known retailer. In this respect, ZARA should develop several other creative departments that would control certain regions.

The re-organization, therefore, can greatly increase the customer demands because the department will be specifically oriented on a particular cultural group. Hence, the centers can be coordinated by means of EDI mechanisms integrated by ERP systems that provide greater control and increase the production volumes all over the world. In whole, such a strategy enhances ZARA’s competitive advantage.

“ About ZARA ”. ZARA. 2011. Web.

Cheng, T. C. Edwin, and Tsan-Ming Choi. Innovative Quick Response Programs in Logistics and Supply Management . UK: Springer, 2010. Print.

Dutta, Devangsgu. Retail: The Speed of Fashion . 2002. Web.

Ferdows, Kasra, Michael A. Levis, and Jose A. D. Machura. “ Zara’s Secret for Fast Fashion ”. HBS Working Knowledge. 2002. Web.

Gallagher, John. “ ZARA Case: Fast Fashion from Savvy Systems ”. Gallaugher.com. 2008. Web.

Leeman, Joris. Supply Chain Man agement. US: Books on Demand, 2010. Print.

Schneider, Gary. Electronic Commerce. New York. Cengage Learning, 2010, Print.

Stewart, Thomas A. “Bound To Fail, Or Set Up To Succeed?.” Harvard Business Review Nov. 2004: 10.

Appendix 1: Vertical Supply Chain

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2024, March 26). ZARA Logistics System & Transportation Strategy. https://ivypanda.com/essays/zara-analysis-of-logistics-systems-report/

"ZARA Logistics System & Transportation Strategy." IvyPanda , 26 Mar. 2024, ivypanda.com/essays/zara-analysis-of-logistics-systems-report/.

IvyPanda . (2024) 'ZARA Logistics System & Transportation Strategy'. 26 March.

IvyPanda . 2024. "ZARA Logistics System & Transportation Strategy." March 26, 2024. https://ivypanda.com/essays/zara-analysis-of-logistics-systems-report/.

1. IvyPanda . "ZARA Logistics System & Transportation Strategy." March 26, 2024. https://ivypanda.com/essays/zara-analysis-of-logistics-systems-report/.

Bibliography

IvyPanda . "ZARA Logistics System & Transportation Strategy." March 26, 2024. https://ivypanda.com/essays/zara-analysis-of-logistics-systems-report/.

- Zara apparel fashion Store

- Zara Business External Factors

- Case: Operations at Zara

- Key Elements of Zara Company’s Business Model

- Zara Supply Chain Management

- Zara Company's Competitive Edge and Entry into Japan

- Zara Value Chain Improving Responsibility

- Zara Company's Business Model

- Pricing Strategies of Zara

- Zara Company's Supply Chain Strategies

- Service Operations Analysis of Toyota Motor Corporation

- Company Analysis: AGL Energy’s Risk Management with Reference to ISO 31000

- Internal Analysis of the Kraft Foods Group

- SWOT Analysis of Amazon

- Saudi Arabia Public Transport Company

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Supply Chain Management Design & Simulation Online

Zara Clothing Company Supply Chain

January 4, 2020 By mhugos

CASE STUDY CONCEPT: The Zara supply chain drives its successful business model. Run simulations of the Zara supply chain to see how it works, and how to improve it.

Zara changes its clothing designs every two weeks on average, while competitors change their designs every two or three months. It carries about 11,000 distinct items per year in thousands of stores worldwide compared to competitors that carry 2,000 to 4,000 items per year in their stores. Zara’s highly responsive supply chain is central to its business success. The heart of the Zara supply chain is a huge, highly automated distribution center (DC) called “The Cube”. The screenshot below shows a closeup satellite view of this facility.

The company was founded in Spain in 1974 by Amancio Ortega and his wife Rosalía Mera. It is the flagship business unit of a holding company called Inditex Corporation with headquarters in Arteixo, Galicia, a city in northwestern Spain near where Mr. Ortega was born. In 2020 Zara was ranked as the 41st most valuable brand in the world by Forbes (see bibliography below).

NOTE: This is an advanced case . Work through the three challenges of the beginning case, “ Cincinnati Seasonings ” before taking on the challenges in this case.

[ Instructors, students and professionals can request a free SCM Globe trial demo ]

Company Business Model

Agents for the company are always scouting out new fashion trends at clubs and social gatherings. When they see inspiring examples they quickly send design sketches to the garment designers at the Cube. New items can be designed and out to the stores in 4 – 6 weeks, and existing items can be modified in 2 weeks.

The company’s core market is women 24 – 35 years old. They reach this market by locating their stores in town centers and places with high concentrations of women in this age range. Short production runs create scarcity of given designs and that generates a sense of urgency and reason to buy while supplies last. As a consequence, Zara does not have lots of excess inventory, nor does it need to do big mark-downs on its clothing items.

Zara has 12 inventory turns per year compared to 3 – 4 per year for competitors. Stores place orders twice a week and this drives factory scheduling. Such short term focused order cycles make forecasts very accurate, much more accurate than competitors who may order every two weeks or every month.

Clothing items are priced based on market demand, not on cost of manufacture. The short lead times for delivery of unique fashion items combined with short production runs enable Zara to offer customers more styles and choices, and yet still create a sense of urgency to buy because items often sell out quickly. And that particular item or style may not be available again after it sells out. Zara sells 85 percent of its items at full price compared to the industry average of selling only 60 percent of items at full price. Annually there is 10 percent of inventory unsold compared to industry averages of 17 – 20 percent.

In Spain customers visit Zara stores 17 times per year on average compared to 3 times per year for competitors. Because their clothing designs change often, it is harder for people to see them clearly online. So they are encouraged to come into the stores instead and try on the unique fashions that Zara offers (screenshot below shows people at a Zara store in Madrid, Spain).

Zara spends its money on opening and growing its stores instead of spending a lot on ad campaigns. Estimates vary on the number of Zara stores worldwide. An article in the New York Times Magazine (November 2012, “ How Zara Grew into the World’s Largest Fashion Retailer “), placed the store count at around 5,900. An article in Forbes simply states there are “more nearly 3,000 stores” (2020, “ The World’s Most Valuable Brands – #41 Zara “). Annual sales for 2019 were estimated by Forbes to be $21.9 billion . The holding company, Inditex SA, is a public company and Inditex provides annual statements , but it does not break out Zara sales from sales of the other brands owned by Inditex (Pull&Bear, Massimo Dutti, Bershka, Stradivarius, Oysho, Zara Home, and Uterqüe). Zara uses a flexible business model where its stores can be owned, franchised, or co-owned with partners. So it is not always possible to find exact numbers for Zara’s business operations and finances.

Manufacturing and Supply Chain Operations Make Zara Unique

Zara buys large quantities of only a few types of fabric (just four or five types, but they can change from year to year), and does the garment design and related cutting and dyeing in-house. This way fabric manufacturers can make quick deliveries of bulk quantities of fabric directly to the Zara DC – the Cube. The company purchases raw fabric from suppliers in Italy, Spain, Portugal and Greece. And those suppliers deliver within 5 days of orders being placed. Inbound logistics from suppliers are mostly by truck.

The Cube is 464,500 square meters (5 million square feet), and highly automated with underground monorail links to 11 Zara-owned clothing factories within a 16 km (10 mile ) radius of the Cube. All raw materials pass through the Cube on their way to the clothing factories, and all finished goods also pass through on their way out to the stores. The diagram below illustrates Zara’s supply chain model.

Zara’s factories can quickly increase and decrease production rates, so there is less inventory in the supply chain and less need to finance that inventory with working capital. They do only 50 – 60 percent of their manufacturing in advance versus the 80 – 90 percent done by competitors. Zara does not need to place big bets on yearly fashion trends. They can make many smaller bets on short term trends that are easier to call correctly.

The Zara factories are connected to the Cube by underground tunnels with high speed monorails (about 200 kilometers or 124 miles of rails) to move cut fabric to these factories for dyeing and assembly into clothing items. The monorail system then returns finished products to the Cube for shipment to stores. Here are some facts about the company’s manufacturing operations:

- Zara competes on flexibility and agility instead of low cost and cheap labor. They employ about 3,000 workers in manufacturing operations in Spain at an average cost of 11.00 euros per hour compared to average labor cost in Asia of about 0.80 euros per hour.

- Zara factories in Spain use flexible manufacturing systems for quick change over operations.

- 50% of all items are manufactured in Spain

- 26% in the rest of Europe

- 24% in Asia and Africa

The screenshot below illustrates how the Zara supply chain is organized. Manufacturing is centered in northwestern Spain where company headquarters and the Cube are located. But for their main distribution and logistics hub they chose a more centrally located facility. That facility is located in Zaragoza in a large logistics hub developed by the Spanish government. Raw material is sent by suppliers to Zara’s manufacturing center. Then finished garments leave the Cube and are transported to the Zara logistics hub in Zaragoza. And from there they are delivered to stores around the world by truck and by plane.

[ Instructors, students and professionals can request a free SCM Globe trial demo — NOTE: This is an advanced case . Work through the three online challenges of the beginning case, “ Cincinnati Seasonings ” before working with this case. ]

Zara can deliver garments to stores worldwide in just a few days: China – 48 hrs; Europe – 24 hrs; Japan – 72 hrs; United States – 48 hrs. It uses trucks to deliver to stores in Europe and uses air freight to ship clothes to other markets. Zara can afford this increased shipping cost because it does not need to do much discounting of clothes and it also does not spend much money on advertising.

Zara’s Supply Chain is Lean and Agile

Stores take deliveries twice per week, and they can get ordered inventory often within two days after placing their orders. Items are shipped and arrive at stores already on hangers and with tags and prices on them. So items come off delivery trucks and go directly onto the sales floor. This makes it possible for store managers to order and receive the products customers want when they want them, week by week.

Zara stores respond practically in real-time as styles and customer preferences evolve. It is a great business model for success in the high-change and hard to predict fashion industry. It means about half of the clothing the company sells, which includes most of its high margin and unique fashion items (but not its lower margin basic items), is manufactured based on highly accurate, short-term (2 – 6 week) demand forecasts. Because this business model tracks so closely to real customer demand from one month to the next, it frees the company to a large degree from getting caught in cyclical market ups and downs that ensnare its competitors (those cycles are driven by boom-to-bust gyrations generated by the bullwhip effect ). Turbulence in the global economy since 2008 has hurt sales at many competing fashion retailers, but Zara has seen steady, profitable growth during this time.

[ Editor’s Note: During 2020 Inditex, owner of Zara and other fashion brands closed more than 1,000 stores worldwide in response to the Covid pandemic and increased its focus on online sales. Then in 2021 store business rebounded and surpassed pre-pandemic levels . Can you think of some ways these changes in Zara’s business model affected Zara’s supply chain? ]

A fast-moving and finely tuned supply chain like Zara’s requires constant attention to keep it running smoothly. Supply chain planners and managers are always watching customer demand and making adjustments to manufacturing and supply chain operations. The screenshot below shows the result of one simulation using the supply chain model outlined above. Continuous adjustments need to be made to factory production rates, vehicles, delivery routes, and schedules to keep this supply chain working well.

Zara is a clothing and fashion retailer that uses its supply chain to significantly change the way it operates in a very traditional industry. No other competitor can copy its business model until it first copies its supply chain. And since supply chains are composed of people, process, and technology, even the latest and greatest technology is not a competitive advantage all by itself. People must be well trained, and processes must be put in place that enable people to apply their training and their technology to best effect.

Buying technology similar to that used by Zara is easy. But for the technology to be used effectively, competitors must learn about the mental models and the operating procedures used by Zara. Good mental models enable people to understand the potentials and see the opportunities that a real-time supply chain offers. Effective operating procedures enable people to act on what they see and capitalize on the competitive advantages their technology gives them.

Zara has spent more than 30 years building its unique real-time supply chain and training its people. So competitors have a lot of learning to do to create the mental models, and roll out the operating procedures needed to do what Zara does so well.

[ See our blog article “ Five New Supply Chain Technologies and How to Use Them ” for more about new technologies and how they can be used to improve supply chain operations and create competitive advantages for companies .]

YOUR FIRST SUPPLY CHAIN CHALLENGE

Get this supply chain to run for 15+ days and keep inventory and operating costs as low as you can.

Imagine you are in charge of Zara’s supply chain operations. This case study and supply chain simulation will give you an appreciation of what that job is like. In this exercise your mental model of Zara’s supply chain will expand and your understanding of how this supply chain works will deepen. You will see the continuous adjustments that need to be made to keep the supply chain working and to keep operating expenses and inventory levels under control.

Load a copy of the Zara supply chain model from the online library into your account. Then start running simulations to see how the supply chain works. Start by doing whatever seems necessary to keep the supply chain running without stock-outs or over-stocks for 15 days. When you run the first simulation you will see a problem occurs on day 5. As with all cases, there are many possible ways to respond to this problem. And depending on how you respond, other problems will appear as you work toward getting your supply chain to run for 15 days. Do whatever seems necessary to get the supply chain to run for 15 days. Then refine your solutions to get the supply chain to run at lower costs in transportation, facility operations and on-hand inventory across the supply chain.

Its agile and responsive supply chain enables Zara to work on a short sales and operations planning (S&OP) cycle. Let’s assume Zara works on a 15 day cycle where its competitors work on 30-day or even 60-day planning cycles. So you are creating a 15-day supply plan to meet the 15-day demand plan which is already entered into the model in the form of product demand at the different stores. To get this supply chain to meet demand and run for 15+ days you need to make adjustments to elements of your supply plan:

- Store delivery amounts and frequencies

- Delivery amounts and frequencies on air freight routes

- Product manufacturing rates at Zara clothing factories

- Movement of products between Zara Cube, Zara factories, and Logistics Hub in Zaragoza

- Supplier delivery amounts and frequencies for delivering bulk fabric to the Cube

The screenshot below shows a closeup of the Zara Logistics Hub in Zaragoza, Spain. Product deliveries are made to stores by airplane and truck from this facility every day.

When you have questions about how to work with this case, the answer is always to ask yourself, “What would I do if this were the real world and I was the person in charge?” Model and simulate different ideas. Make reasonable assumptions and estimates. Then add/change/delete products, facilities, vehicles and routes as called for in your supply chain model to reflect your ideas. When you run simulations you will see how well different ideas work. Go with the ideas that work best to find the solutions you need.

Look in the online guide for useful tips and techniques that will help as you work with this case. Here are some places to look:

- Analyzing Simulation Data

- Tips for Building Supply Chain Models

- Cutting Inventory and Operating Costs

ZARA SUPPLY CHAIN REPORTING TEMPLATE: Import your simulation data into this template to create 15-DAY P&L REPORTS and key performance indicators. Zara’s agile supply chain enables it to use shorter planning cycles (15-days instead of 30-days). The reporting template is designed for use with the supply chain model in the online library titled “Zara Clothing Company Ver4”. If you add more products, facilities, or vehicles to the model you will need to expand the spreadsheet to accommodate those additions. A sample P&L report created from simulation data is shown below: D ownload a copy of the Zara Clothing Company P&L Reporting Template here

[ If you are using SCM Globe Professional version, these reports can be generated automatically by clicking on the “ Generate P&L Report ” button on the Simulate Screen ]

CREATE AN EXECUTIVE BRIEFING — a 3 to 5 page report or a short deck of presentation slides. Use screenshots and data produced by simulations to illustrate what you learned about how the Zara supply chain operates. Explain what were the main problems you encountered in getting your simulation to run for 15+ days. Show what you did to address those problems. Present the three or four main things you learned about this supply chain. Explain why these things make this supply chain such a competitive advantage for Zara.

SAVE BACKUP COPIES of your supply chain model from time to time as you make changes. Click “Save” button next to your model in Account Management screen. There is no “undo”, but if a change doesn’t work out, you can restore from a saved copy . And sometimes supply chain model files (json files) become damaged and they no longer work, so you want backup copies of your supply chain to restore from when that happens.

NOTE : An earlier bug that displayed some routes times and distances as ONE-WAY has been fixed. All routes now show ROUND-TRIP times and distances. Simulations use ROUND-TRIP times and distances.

YOUR SECOND CHALLENGE

Expand this supply chain to support more stores, and keep inventory and operating costs under control.

Do some research on store rental costs, labor rates, transportation costs and product demand in different markets, then use your research to update and expand your model of Zara’s supply chain:

- Go to websites of commercial real estate brokers in cities of interest and see what you can find out about rents (for cities in North America start with www.cityfeet.com and for cities in other parts of the world start with www.knightfrank.com ).

- Research salary levels and median incomes in different cities. New stores open in cities with median incomes high enough to be profitable markets for Zara. Store rent and operating costs will also be set by market rates in those cities.

- Go to 3PL and logistics services company websites to find out about transportation costs. Assume air freight rates from Zaragoza remain the same to any city, but truck transportation costs will be different in different cities.

- Consider subdividing the two high level product categories (Zara Basics Pack, Zara Fashion Pack) into lower level product categories to get more insight and into how this supply chain operates. What are some lower level product categories that make up the Fashion Pack, or the Basics Pack?

- Do searches to find fashion industry demand forecasts for clothing in different cities around the world. Use that research to set the product demand levels in the new stores. You can also update product demand levels at existing stores based on this research.

- You can measure the carbon footprint of different supply chain designs. There are default estimates of carbon generation already entered for facilities and vehicles, and the simulations use this to calculate the supply chain carbon footprint. You can enter your own estimates for carbon generation for the facilities and vehicles if you wish.

Do the best you can with the time available! — Do internet searches on relevant key words and phrases. See what comes up, and select sources that seem the most trustworthy and accurate (that’s what we did for this case study; our assumptions and sources are listed below). If you can’t find the exact numbers you are looking for, then estimate numbers you need based on other numbers you find in your research (please read “ All Supply Chain Models are Approximations “). Do not spend more than your allocated time doing research. As the saying goes, “Good is good enough.” Document your sources; make your best estimates; and move on.

Update and expand the Zara supply chain model using your research data. Update product prices and demand at the existing stores based on your research. Also experiment with adding new stores in other cities in Europe, Asia, North America, South America or Africa (represent all stores in a single city with just one or two stores and keep the total number of facilities in your model to between 15 – 20).

For added realism see how stores in New York and Shanghai are located in the existing supply chain model in the SCM Globe library. Stores can be on actual Zara store locations or can be placed in the middle of a cluster of actual Zara stores. Enter the collective demand, costs and on-hand inventory for all actual stores represented by a single store in your model.

Note in the existing model how flights from the logistics hub in Spain land at nearby airports for stores in New York and Shanghai, then delivery trucks move garments from those airports to the stores as shown in the screenshot above. Use this same approach as you expand into other countries outside of Europe. Add new vehicles and create delivery routes for them to deliver products to the new stores. This adds an extra layer of realism and shows how dependent this supply chain is on tight scheduling and just-in-time (JIT) delivery of products.

Adjust your supply chain model to support these new stores and still run for 15+ days . Once you get it running for 15+ days, then make adjustments to your model to lower transportation and operating costs and on-hand inventory amounts.

CREATE A FINAL PRESENTATION showing your expanded supply chain model and describing the supply chain challenges you encountered. Explain why successful solutions to those challenges provides such a competitive advantage for Zara.

- Explain the supply chain principles and best practices you used to solve the challenges you encountered. What were your biggest challenges and how did you solve them?

- Identify places in your expanded supply chain model (facilities, vehicles and routes) where you used new technology such as that explained in the blog article “ Five New Supply Chain Technologies and How to Use Them “. How do these technologies produce the performance capabilities you show in your simulation results?

- Show how a supply chain with these capabilities makes it possible for Zara to use its fast fashion business model. If Zara competitors were to emulate Zara’s business model, what supply chain capabilities would they need?

- What can you do to lower the carbon footprint of your supply chain?

- Use screenshots and data from your simulations to illustrate your report.

NOTE: This is an ADVANCED LEVEL case study – work through a beginning level case such as Cincinnati Seasonings before attempting to work with this case.

Working on this case will be challenging… but the skills and insights you develop here will be the same skills and insights you use to manage a real supply chain like Zara’s.

FIND USEFUL IDEAS in the Online Guide to help you expand and improve your Zara supply chain model. There is a lot going on in this case so check out these ideas:

- See techniques for expanding this supply chain model in “ Tips for Building Supply Chain Models ”

- Reduce on-hand inventory and calculate optimum delivery amounts and schedules in “ Cutting Inventory and Operating Costs “

- Make sure you are familiar with the techniques presented in “ Analyzing Simulation Data “

- Consider using the S&OP process as a framework to organize your work , S&OP is explained in a case called “ Java Furniture Company ” — scroll down to the heading “ Sales & Operations Planning (S&OP) is a Best Practice “

- If you use same size shipping containers for all your products, the beta test reporting template can help identify opportunities to improve performance, see “ Supply Chain Optimizing & Reporting Template “

- Look through the Table of Contents of the Online Guide to find other useful information

ZARA SUPPLY CHAIN REPORTING TEMPLATE: Import your simulation data into this template to create 15-DAY P&L REPORTS and key performance indicators. D ownload a copy of the Zara Clothing Company P&L Reporting Template here

To share your changes and improvements to this model (json file) with other SCM Globe users see “ Download and Share Supply Chain Models ”

Assumptions and Simplifications Used in this Model

Because Zara operations and financial reporting is combined with the other retail brands owned by Inditex, specific details of the Zara business model and supply chain can be difficult to verify. Yet the supply chain model presented here is still a useful picture of the Zara supply chain and illustrates its operations and its capabilities (see more about this in “ Supply Chain Modeling and Simulation Logic “). This case study and supply chain model is based on data from articles listed in the bibliography below. The assumptions and specifications listed here are built into the model, and you can easily change them as better data becomes available . New products, facilities, vehicles and routes can also be added to this model to further explore how Zara’s supply chain operates.

- Zara finished goods garments are combined into two categories of products, Zara Fashion Pack represents in-house manufactured high fashion items, Zara Basics Pack represents basic items contract manufactured by others

- Zara Fashion Pack = 100 garments; price of 5,000 euros; weight of 40 Kg; volume of 1 cubic meter;

- Zara Basics Pack = 200 garments; price of 3,000 euros; weight of 60 Kg; volume of 0.5 cubic meters

- The Cube employs 3,000 people at average rate of 8 euros per hour = 64 euros per day

- Automated warehouse in Zaragoza employs 800 people at avg of 64 euros per day and other facility operating costs for utilities, insurance, etc. cost additional 15,000 euros daily

- Raw fabric costs per case: Fabric 1 = 1 cubic meter; price of 1,000 euros; Fabric 2 = 0.5 cubic meter; price of 800 euros; Fabric 3 = 0.6 cubic meter, price of 1,200 euros

- Zara factories need mix of raw fabrics to create their finished goods; see the definition of these facilities to see individual requirements and production

- The Cube has 1.6 million cubic meters of product storage space

- 150 million items pass through Cube annually or 411,000 per day

- 11 actual Zara factories are represented by 5 factories in the model

- Monorail shipping containers are 50 cubic meters in volume, can carry 10,000 kilograms of weight, and travel at average speed including loading and unloading of 60 kilometers per hour

- Zara stores in a single city are represented by a single store that combines the demand of all stores in that city – not all cities are included and more cities can be added to this model

- Vehicle operating costs per km are set to be just half the normal cost for trucks and airplanes. This more accurately models the process where Zara pays for one-way shipping containers to move products from one facility to another without paying the full round-trip cost (carbon per km was also adjusted to half of normal for the same reason). This compensates for the model logic which calculates vehicle costs based on the round trip distance instead of the one-way distance.

- Full operating cost per km is used for the monorail vehicles that move products between the Cube DC and the Zara garment factories because Zara owns those vehicles and pays for full round-trip costs.

- All specifications for Products, Facilities, Vehicles and Routes in this supply chain model can be edited and changed if you have better data

- New products, facilities, vehicles and routes can be added to this model and you can simulate the results as you expand your model

Bibliography:

A web search on “Zara supply chain” will yield many results; this case study is based on information from some of those results listed below:

The World’s Most Valuable Brands – #41 Zara A ranking and brief profile of the 100 most valuable and recognized brand name companies – Forbes, 2020

We went inside one of the sprawling factories where Zara makes its clothes https://www.businessinsider.nl/how-zara-makes-its-clothes-2018-10?international=true&r=US – By Mary Hanbury, Business Insider, 2018

Zara Uses Supply Chain to Win Again In face of flat or declining retail industry sales, Zara stands out – By Kevin O’Marah – Forbes, 9 Mar 2016

Zara’s Fast Fashion Edge Speed and responsiveness to customer demand drives Zara’s business model – By Susan Berfield and Manuel Baigorri – Bloomberg Business, 14 Nov 2013

How Zara Grew Into the World’s Largest Fashion Retailer History and business model of Zara – By Suzy Hansen, The New York Times Magazine, 9 Nov 2012

Logistics Clustering for Competitive Advantage Zara’s global logistics hub outside Spanish city of Zaragoza – By Yossi Sheffi, Dir MIT Center for Transportation & Logistics, CSCMPs Supply Chain Quarterly, Quarter 3 2012

Polka Dots Are In? Polka Dots It Is! How Zara gets fresh styles to stores insanely fast—within weeks. – By Seth Stevenson – Slate.com, 21 Jun 2012

We found the following slide presentations were also informative:

Register on SCM Globe to gain access to this and other supply chain simulations . Click the blue “ Register ” button on the app login page , and buy an account with a credit card (unless you have an account already). Scan the “ Getting Started ” section, and you are ready to start. Go to the SCM Globe library and click the “Import” button next to this or any other supply chain model.

How Zara’s strategy made her the queen of fast fashion

Table of contents, here’s what you’ll learn from zara's strategy study:.

- How to come up with disruptive ideas for your industry.

- How finding the right people is more important than developing the best strategy.

- How best to address the sustainability question.

Zara is a privately held multinational clothing retail chain with a focus on fast fashion. It was founded by Amancio Ortega in 1975 and it’s the largest company of the Inditex group.

Amancio Ortega was Inditex’s Chairman until 2011 and Zara’s CEO until 2005. The current CEO of Zara is Óscar García Maceiras and Marta Ortega Pérez, daughter of the founder, is the current Chairwoman of Inditex.

Zara's market share and key statistics:

- Brand value of $25,4 billion in 2022

- Net sales of $19,6 billion in 2021

- 1,939 stores worldwide in 2021

- Over 4 billion annual visits to its website

- Inditex employee count of 165,042 in 2021

{{cta('ba277e9c-bdee-47b7-859b-a090f03f4b33')}}

Humble beginnings: How did Zara start?

Most people date Zara’s birth to 1975, when Amancio Ortega and Rosalia Mera, his then-wife, opened the first shop. But, it’s impossible to study the company’s first steps, its initial competitive advantage, and strategic approach by starting at that point in time.

When the first Zara shop opened, Amancio Ortega already had 22 years of industry experience, ten years as a clever and hard-working employee, and 12 years as a business owner. Rosalia Mera also had 20 years of industry experience.

As an employee , Ortega worked in the clothing industry, first as a gofer and then as a delivery boy. He quickly demonstrated great talent for recognizing fabrics, understanding and serving customers, and making sound business suggestions. Soon, he decided to use his insights to develop his own business instead of his boss’s.

As a business owner , he started GOA Confecciones in 1963, along with his siblings, his wife, and a close friend. They started with a humble workshop making women’s quilted dressing gowns, following a trend at the time Amancio had noticed. Within ten years, that workshop had grown to support a workforce of 500 people.

And then, the couple opened the first Zara shop.

Zara’s competitive positioning strategy in its first year

The opening of the first Zara shop in 1975 wasn’t just a new store to sell clothes. It was the final big move of a carefully planned vertical integration strategy.

To understand how the strategy was formulated , we need to understand Amancio’s first steps. His first business, GOA Confecciones, was a manufacturing business. He was supplying small stores and businesses with his products, and he wasn’t in contact with the end customer.

That brought two challenges:

- A lack of insight into market trends and no direct consumer feedback about preferences.

- Very low-profit margins compared to the 70-80% profit margin of retailers.

Amancio developed several ideas to improve distribution and get a direct relationship with the final purchaser. And he was always updating his factories with the latest technological advancements to offer the highest quality of products at the lowest possible price. But he was missing one essential part to reap the benefits of his distribution practices: a store .

So, in 1972 he opened one under the brand name Sprint . An experiment that quickly proved unsuccessful and, seven years later, was shut down. Although it’s unknown the extent to which Amancio put his ideas to the test, Sprint was a private masterclass in the retail world that gave Amancio insights that would later turn Zara into a global success.

Despite Sprint’s failure, Amancio didn’t abandon the idea of opening his own store mainly because he believed that his advanced production model was vulnerable and the rise of a competitor who could replicate and improve his system was imminent.

Adding a store to his vertical integration strategy would have a twofold effect:

- The store would operate as a direct feedback source. The company would be able to test design ideas before going into mass production while simultaneously getting an accurate pulse of the needs, tastes, and fancies of the customers. The store would simultaneously reduce risk and increase opportunity spotting.

- The company would have reduced operating costs as a retailer. Since the group would control all aspects of the process (from manufacturing to distribution to selling), it would solve key retail challenges with stocking. The savings would then be passed on to the customer. The store would have an operational competitive advantage and become a potential cash cow for the company.

The idea was to claim his spot in prime commercial areas (a core and persistent strategic move for Zara) and target the rising middle class. The market conditions were tough, though, with many family-owned businesses losing their customer base, giant players owning a huge market share, and Benetton’s franchising shops stealing great shop locations and competent potential managers.

So the first Zara store had these defining characteristics that made it the successful final piece of Amancio’s strategy:

- It was located near the factory = delivery of products was optimized

- It was in the city’s commercial heart = more expensive, but with access to affluence

- It was located in the city where Ortegas had the most customer experience = knowing thy customer

- It was visibly attractive = expensive, but a great marketing trick

Amancio’s team lacked experience and expertise in one key factor: display window designing . The display window was a massive differentiator and had to be bold and attractive. So, Amancio hired Jordi Bernadó, a designer with innovative ideas whose work transformed display windows and the sales process.

The Zara shop was a success, laying the foundations for the international expansion of the Inditex group.

Key Takeaway #1: Challenge your industry’s conventional wisdom to create a disruptive strategy

Disrupting an industry isn’t an easy task nor a frequent occurrence.

To do it successfully, you need to:

- Understand the prominent business mode of your industry and the forces that contributed to its development.

- Challenge the assumptions behind it and design a radically different business model.

- Develop ample space for experimentation and failures.

The odds of instantly conquering the industry might be low (otherwise, someone would have already done it), but you’ll end up with out-of-the-box ideas and a higher sensitivity to potential disruptors in your competitive arena.

Recommended reading: How To Write A Strategic Plan + Example

How Zara’s supply chain strategy is at the core of its business strategy

According to many analysts, the Zara supply chain strategy is its most important innovative component.

Amancio Ortega and other senior members of the group disagree. Nevertheless, the Inditex logistics strategy is extraordinarily efficient and plays a crucial role in sustaining its competitive advantage. Most companies in the clothing retail industry take an average of 4-8 weeks between inception and putting the product on the shelf. The group achieves the same in an average of two weeks. That’s nothing short of extraordinary.

Let’s see how Zara developed its logistics and business strategy.

Innovative logistics: how Zara’s supply chain evolved

The logistics methods developed by companies are highly dependent on external factors.

Take, for example, infrastructure. In the early days of Zara, when it was expanding through Spain, the company considered using trains as a transportation system. However, the schedule couldn’t keep up with Zara’s needs, which had the goal of distributing products twice a week to its shops. So transportation by road was the only way.

However, when efficiency is a high priority, it shapes logistics processes more than anything else.

And for Zara, efficient logistics was – and still is – of the highest priority.

Initially, leadership tried outsourcing logistics, but the experiment failed and the company assigned a member of the house with a thorough knowledge of the company's operating philosophy to take charge of the project. The tactic of entrusting important big projects to employees imbued with the company’s philosophy became a defining characteristic.

So, one of Zara’s early strategic decisions was that each shop would make orders twice a week. Since the first store was opened, the company has had the shortest stock rotation times in the industry. That’s what drove the development of its logistics methods. The whole strategy behind Zara relied on quick production and distribution. And the proximity of manufacturing and distribution was essential for the model to work. So Zara had these two centers in the same place.

Even when the brand was expanding around the world, its logistics center remained in Arteixo, Spain, despite being a less-than-ideal location for international distribution. At some point, the growth of the brand, and Inditex as a whole, outpaced Arteixo’s capacity, and the decentralization question came up.

The debate was tough among leadership, but the arguments were strong. Decentralization was necessary because of:

- Safety and security. If there was a fire or any other crippling disaster there (especially on a distribution day), then the company would face serious troubles on multiple fronts.

- Arteixo’s limitations. The company’s center in Arteixo was reaching its capacity limits.

So the company decided to decentralize the manufacturing and distribution of its brands.

Initially, the group made the decision to place differentiated logistics centers where the management of its chain of stores was based, i.e. Bershka would have a different logistics center than Pull&Bear, although they were both part of the Inditex Group. That idea emerged after Massimo Dutti and Stradivarius became part of Inditex. Those brands already had that geographical structure, and since the group integrated them successfully into its strategy and logistics model, it made sense to follow the same pattern with its other brands.

Besides, the proximity of the distribution centers to the headquarters of each brand allowed them to consolidate them based on the growth strategy and purpose of each brand (more on this later).

But just a few years after that, the group decided to build another production center for Zara that forced specialization between the two Zara centers. The specialization was based on location, i.e. each center would manufacture products that would stock the shelves of stores in specific locations.

Zara’s supply chain strategy is so successful because it’s constantly evolving as the group adapts to external circumstances and its internal needs. And just like its iconic fashion, the company always stays ahead of the logistics curve.

Zara’s business strategy transcends its logistics innovations

Zara’s business strategy relies on four key pillars:

- Flexibility of supply

- Instant absorption of market demand

- Response speed

- Technological innovation

Zara is the only brand in the Inditex group that is concerned with manufacturing. It’s the first brand in the clothing sector with a complete vertical organization. And the production model requires the adoption or development of the latest technological innovations.

This requirement is counterintuitive in the clothing sector.

Most people believe that making big investments in a market as mature as clothing is a bad idea. But the Zara production model is very capital and labor intensive. The technological edge derived from that investment gave the company, in the early days, the capability to manufacture over 50% of its own products while maintaining an extremely high stock rotation frequency.

Zara might be one of the best logistics companies in the world, but that particular excellence is a supporting factor, or at least a highly contributing factor, to its successful business strategy.

Zara’s business strategy is so much more than its supply chain strategy.

The company created the “fast fashion” term and industry. When other companies were manufacturing their collections once per season, Zara was adapting its collection to suit what people asked for on a weekly basis. The idea was to offer fashionable items at a fair price and faster than everybody else.

Part of its cost-cutting strategic priority was its marketing strategy. Zara didn’t – and still doesn’t – advertise like the rest of the clothing industry. Its marketing strategy starts with choosing the location of the stores and ends with advertising that the sales period has started. In the early years of the brand’s expansion, Amancio would visit potential store locations himself and choose the site to build the Zara shop.

The price was never an issue. If the location was in a commercial center, Zara would build its store there no matter how high the cost was because the company expected to recoup it quickly with increased sales.

Zara’s marketing is its own stores.

The strategy of Zara and her Inditex sisters

Despite Zara’s success (or because of it), Amancio Ortega created – or bought – multiple other brands that he included in the Inditex group, each one with a specific purpose.

- Zara was targeting middle-class women.

- Pull&Bear was targeting young people under twenty-five years old with casual clothing.

- Bershka was targeting rebel teens, especially girls, with hip-hop-style clothing.

- Massimo Dutti was targeting both sexes with more affluence.

- Stradivarius was competing with Bershka, giving Inditex two major brands in the teenage market.

- Oysho was concentrating on women's lingerie.

- Zara Home manufactures home textiles and decor.

Pull&Bear was initially targeting young males between the ages of 14 and 28. Later it extended to young females of the same age and focused on selling leisure and sports clothing. It has the slowest stock turnaround time in the group.

Bershka’s target group was girls between 13 and 23 years of age with highly individualized tastes. Prices were low, but the quality average. Almost a fiasco in the beginning, it underwent a successful strategic turnaround becoming today one of the biggest growth opportunities for the group. And out of all the Inditex chains, Bershka has the most creative designs.

Massimo Dutti was the first retail brand Amancio bought and didn’t create himself. Its strategy is very different from Zara, producing high-quality products and selling them at a high price. It’s an extension of the group’s offer to the higher end of the price spectrum in the fashion industry. It’s also the only Inditex chain brand that advertises regularly.

Stradivarius was the second acquired brand, with the purchase being a defensive move. The chain shares the same target group with Bershka, making it, to this day, a direct competitor.

Oysho started as an underwear and lingerie company. Its product lines evolved to include comfortable night and homewear along with swimwear and a very young children’s line. The brand’s strategy was aggressive from its conception, opening 286 stores in its first six years of existence.

Zara Home is the youngest brand in the Group and the only one outside the clothing sector, though still in the fashion industry. It was launched with the least confidence and with immense prior research. An experiment to extend the Zara brand beyond clothing, it was based on the conservative view that Zara could extend its product categories only to textile items for the home. But it turned out that customers were more accepting of Zara Home selling a wide variety of domestic items. So the brand made a successful strategic pivot.

Key Takeaway #2: The right people are more important than the best strategy

It might not be obvious in the story, but a key reason for Zara's and Inditex’s success has been the people behind them.

For example, a vast number of people in various positions from inside the group claim that Inditex cannot be understood without Amancio Ortega. Additionally, major projects like the development of Zara’s logistics systems and the group's international expansion had such a success precisely because of the people in charge of them.

Zara’s radically different model was a breakthrough because:

- Its leadership had a clear vision and a real strategy to execute it.

- People with a deep understanding of the company’s philosophy led Its largest projects.

Sustainability: Zara’s strategy to make fast fashion sustainable

Building a sustainable business in the fast fashion industry is a tough nut to crack.

To achieve it, Inditex has made sustainability a cornerstone of its business model. Its strategy revolves around the values of collaboration , transparency, and innovation . The group’s ambition is to make a positive impact with a vision of prosperity for the planet and its people by transforming its value chain and industry.

Inditex’s sustainability commitments and strategy to achieve them

Inditex has developed a sustainability roadmap that extends up to 2040 with ambitious goals. Specifically, it has committed to

- 100% consumption of renewable energy in all of its facilities by 2022 (report pending).

- 100% of its cotton to originate from more sustainable sources by 2023.

- 100% of its man-made cellulosic fibers to originate from more sustainable sources by 2023.

- Zero waste from its facilities by 2023.

- 100% elimination of single-use plastic for customers by 2023.

- 100% collection of packaging material for recycling or reuse by 2023.

- 100% of its polyester to originate from more sustainable sources by 2025.

- 100% of its linen to originate from sustainable sources by 2025.

- 25% reduction of water consumption in its supply chain by 2025.

- Net zero emissions by 2040.

The group’s commitments extend beyond environmental issues to how its manufacturing and supplying partners conduct their business . To bring its strategy to fruition, it has set up a new governance and management structure.

The Board of Directors is responsible for approving Inditex’s sustainability strategy. The Sustainability Committee oversees and controls all the proposals around the social, environmental, health, and safety impact of the group’s products, while the Ethics Committee makes sure operations are compliant with the rules of conduct. There is also a Social Advisory Board that includes external independent experts that advises Inditex on sustainability issues.

Finally, Javier Losada, previously the group’s Chief Sustainability Officer and now promoted to Chief Operations Officer, will be leading the sustainability transformation of the group. Javier Losada first joined Inditex back in 1993 and ascended its rank to reach the C-suite.

Inditex is dedicated to its commitment to reducing its environmental impact and seems to be headed in the right direction. The only question is whether it’s fast enough.

Key Takeaway #3: Integrating sustainability with business strategy is a present-day necessity

Governments and international bodies around the world are implementing more stringent environmental regulations, forcing companies to commit to ambitious goals and developing a realistic strategy to achieve them.

The companies that are impacted the least are those that always had sustainability as a high priority .

From the companies that require significant changes in their operations to comply with the new regulations, only those who integrate sustainability into their business strategy and model will succeed.

Why is Zara so successful?

Zara is the biggest Spanish clothing retailer in the world based on sales value. Its success is due to its fast fashion strategy that is based on a strong supply chain and quick market feedback loops.

Zara's customer-centric approach places a strong emphasis on understanding and responding to customer needs and preferences. This is reflected in the company's product design, marketing, and customer service strategies.

Zara made fashionable clothes accessible to the middle class.

Zara’s vision guides its future

Zara's vision, as part of the Inditex Group, is to create a sustainable fashion industry by promoting responsible consumption and production, respecting the environment and people, and contributing to the communities in which it operates.

The company aims to offer the latest fashion trends to its customers at accessible prices while continuously innovating and improving its operations and processes.

Growth by numbers (Inditex)

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

HANDICRAFT SHOWS IN UNITED STATES & CANADA | APRIL 2024

Coronavirus first quarter regional report march 2024 | april 2024, globalization needs reinvigoration part 12 | april 2024, progress report on the paris climate agreement part 23 | april 2024, discover la galerie dior | april 2024, everything you want to know about electrical vehicle & autonomous driving, political elections around the world in 2024 | april 2024, book report – the ultimate sneaker book | april 2024, the rise & fall of american department stores part 1 | april..., library of mistakes | april 2024, market report short read part 2 | april 2024, trend report spring/summer 2025 | april 2024, 2021 october – case study how zara wades through the pandemic.

2021 OCTOBER CASE STUDY HOW ZARA WADES THROUGH THE PANDEMIC

Written by andrew sia, introduction.

Zara is the crown jewel of the Inditex Group and it is known for its fast supply chain, from design approval to market takes only three weeks, and the production takes place on the Iberian Peninsula. With its 700 designers that work only in their headquarters at Arteixo in the region of Galacia. It is churning out 65,000 new styles a year, delivering the latest garments to its network of stores at least twice a week.

What went through with Inditex during the pandemic

At the beginning of the coronavirus, and it was on March 9, 2020, the company stopped all the new stock buying but honoring all those existing orders. A week later, it wrote off €287 million in inventory and suspended dividends. For the three months until the end of April, the company made its first loss of €409 million since it became the public listed company.

In mid-April, Inditex began to fulfil online orders from its shops, while the shops were remaining closed. Combining its tracking system and the fast supply chain, it was able to operate the business through online.

Inditex is known for its operating of 6,700 stores across the world but during the coronavirus period, almost all of the physical stores were closed. During that time, like everyone else, Inditex was depending solely on the selling through online. The company is handling one billion clothing items each year and they are using the RFID, better known as radio-frequency identification, to read the tiny circuits and antennas hidden in the security tags fastened to the clothing in the factory floors in the Inditex factories.

Inditex turns its stores into mini-distribution hubs by merging its online with bricks and mortar presence. This operation reduces the inventories, allows the stores to fulfill online orders in a very cost-effective manner. With its store network of over 6,000 which is equivalent to 6,000 regional warehouses that can ship out orders very efficiently.

This kind of operating system is extended to its sister brands—Massimo Dutti, Pull& Bear and Stradivarius and the rollout was completed in 2019, made it appeared that it was just in time for the pandemic.

Inditex took up online in 2010 and in 2019 online represented only 14% business of its €28 billion in total sales. But in 2020, this online portion jumped to 32% and it used the backrooms in its stores to pack and dispatch €1.2 billion orders taken from mobiles and computers.

By the end of 2020, Inditex’s online revenues soared 77%, more than three times than the peers whose overall increase were 22% in the global online clothing and footwear market.

Inditex has successfully integrated its online sales with its store sales. Last year its online sales reached €6.6 billion and became the world leader in online fashion.

It is using the “pull” system rather than the “push” system, it is all about to produce what sells rather than to sell what one makes. It is said that everyday there are 20 million people viewing Inditex products online on its app or social media.

Customers still prefer to visit the prime locations of the Zara shops and that is the heart of Inditex for what it is all about. Its founder Amancio used to say that the shop windows are the best place for advertising, and its prime shops have this advantage.

Following is what Inditex’s chief executive, Pablo Isla, told us, “ The essence of Inditex’s strategy is the same as ever: flexibility in our business model—the integration of logistics, manufacture and design; production close to hand; and a capacity to react from time to time. Now with the integration between the digital and physical on top of all these, year 2020 was the key year in the strategic transformation of the company from every point of view”.

In recent years, Inditex and the other fast fashion companies are facing criticisms from the environmental activists, and one of the key areas for sustainability is the fast fashion clothes might have just been wearing twice. This is more of the behavior of those followers of fast fashion which is something that is hard to address to.

Like all the brands, Inditex can emphasize about their sustainability in areas like—using less water for dyeing, stop using single-use plastic, apply biodegradable yarns to increase the sustainability.

Lately, the labor activists are showing concerns about where the manufacturing are taking place. At this moment the French prosecutors opened a probe into Zara and three other fashion brands over the alleged use of forced labor by Muslim minority Uyghurs in Xinjiang province in China for the cotton production from there. With this Inditex dare not to make any statement but remain silent. Most of the fashion brands have observed for what happened with H&M over there and they faced the pressure from Chinese government and its consumers. We have to know that Inditex has 320 stores there.

Going forward Inditex is still planning for significant investments, such as spending €1.7 billion on stores and €1 billion on technology over three years. The group’s 15% revenue is still coming from Spain, but the country’s economy is suffering continuously from the pandemic and the growth will have to come from other markets.

During this time many rivals of Inditex closed their stores and more online only retailers come with lower prices and a wider range of products. One of the rivals—Shein from China who comes with a wider range of products and sell at very low prices. Shein can turn products around in shorter time, between product design and delivery than Zara’s own supply chain.

My personal opinion about the business model of Inditex

I feel that it is time I should express my opinion about Inditex and I would like to share my analysis as the following:

Inditex has several brands and the most distinguished ones are Zara, Massimo Dutti, Pull&Bear, and Stradivarius who have all been in business for more than twenty years. Many of these brands are serving a group of customers who are relatively more mature and affluent, and they are more conscious about sustainability, ethical credentials and hopefully that they can afford products at higher price with more value to offer.

With the new players out there, the extensive use of social media and online market with business model that does not hold stock of their own. Their business reacts to “read and response” which is nothing wrong but can only be faster and sharper. This group of fashion retailers we can call them “faster fashion”.

We have also seen those online retailers, such Asos and Boohoo, who are venturing into bricks and mortar. Both announced partnership with Nordstrom in the US and Alshaya in the Middle East. The idea is all very good, but in actual practice they may face problems that they would need to deal with. The relationship between the online and offline is separated with a very thin line in the eyes of the consumers. Especially during this time at the pandemic, the changing rooms in the stores are not fully operated and the return of goods can end up in chaos. Or if the customers have access to the changing room where they would try out the garments but would do their purchase from home without standing in queue in the stores. Then there is always the issue for the return of goods. We have noticed customers who bought online but return to stores. I am not really convinced that this arrangement between the two business entities can work seamlessly.

We are not going to speak about the second-hand clothes and rentals, I do not like to compare the business models here.