Create moving, zooming presentations that grab attention and keep it.

Appear right alongside your content while presenting to your audience.

Make stunning interactive charts, reports, maps, infographics, and more.

You're about to create your best presentation ever

Xiaomi Presentation Template

Xiaomi Presentation

Transcript: Other Products Headphones, speakers among others Xiaomi is a Chinese Company, dedicated to design, development, and selling of smartphones, apps, and other smart products. The Company is recognized in the world of smartphones to offer high-performance devices at low cost, always Keeping the quality and good services. Xiaomi offers high quality smartphones because they use the best internal components, one example of this quality is the Xiaomi Mi5, and this is the new flagship killer of the company In the 2013 Xiaomi was the best smartphones seller in China, beating the Samsung Galaxy s4 and iPhone 5 in sales. The other companies thought that Xiaomi would fall for his own success, but in the same year Xiaomi created a new flagship killer, the new Xiaomi Mi3, and this new smartphone was sold very fast in internet, just 100,000 units in 86 seconds. Audio Speaker Xiaomi created the next generation of smartphones after Xiaomi Mi3, always keeping the high quality and low cost. Sunday, April, 24, 2015 $0.00 (Free) The Latest Products Xiaomi A Bit About The Company Next Generation Xiaomi Redmi Note 3 A little history Vol I, No. 1 Xiaomi Mi5 and Xiaomi Redmi Note 3 The Beginning Xiaomi Mi5 Piston 3 Headphones Xiaomi Mi4 and Xiaomi Redmi Note 2 What thought the other companies about Xiaomi? Xiaomi Mi4 Xiaomi Redmi Note 2

Xiaomi UVAS presentation

Transcript: Xiaomi Corporation Company's Profile Company's Profile Chinese electronics company April 2010 Lei Jun Initially started as a software company Developing a custom ROM for Android smartphones called MIUI. Producing high-quality, affordable smartphones. About Xiaomi Hong Kong Stock Exchange on July 9, 2018. Sub-Brands Xiaomi Redmi POCO Mi Home Mi TV Black Shark Amazfit IoT (smart home system) platform at its core. About Xiaomi The "MI" in logo stands for “Mobile Internet”. It also has other meanings, including "Mission Impossible", because Xiaomi faced many challenges that had seemed impossible to defy in their early days. Logo Product Offered Product Offered Products in Pakistan: Including smartphones tablets laptops smart home devices audio accessories wearables High-quality products at affordable prices Gain a significant market share in the country's smartphone industry. Pakistani Market Pakistani Market Entered the Pakistani market in 2016 Online marketplaces like Daraz.pk & Telemart. In 2017, First authorized Mi Store in Lahore Expanded its distribution channels by partnering Local retailers In 2018, Second Mi Home store in Karachi In 2019, Xiaomi established a manufacturing plant in Pakistan in partnership with Descon. Local Partnerships Partnerships with several local companies to promotion and distribution Smartlink Technologies is the official distributor of Xiaomi smartphones in the Pakistan Mistore.pk is an online marketplace that sells Xiaomi products. Xiaomi has also partnered with local telecom operators Zong, to offer its products to their customers. Local partnerships Smartlink Tech Established in 2016, Smartlink Technologies (PVT.) Ltd is a brainchild of a pool of professionals whose strong vision and even stronger conviction paved the way for an exclusive partnership with Xiaomi. We were the first official distributor of Xiaomi smartphones and Eco-products in Pakistan. Still, we are the major importer of Xiaomi in Pakistan. We also pride ourselves in acquiring Apple Authorized retail contract by Mercantile Pakistan and the official retail distribution of Infinix Transition group. Smartlink Tech Mistore.pk Mistore.pk is an online marketplace in Pakistan that sells a range of products from Xiaomi, a Chinese electronics company. Mistore.pk is the official online store for Xiaomi products in Pakistan and is operated by Smartlink Technologies, which is the authorized distributor of Xiaomi products in the country Mistore.pk Zong Zong Zong is a mobile network operator in Pakistan, providing mobile voice and data services to millions of customers across the country. The company was launched in 2008 as the first 4G LTE network in Pakistan, and it is currently the third-largest mobile network operator in the country in terms of subscribers. Marketing & Ads Marketing and advertising channels to promote its products in Pakistan social media digital advertising outdoor advertising The company also sponsors local events and engages with influencers to reach out to its target audience Marketing and advertising Social Media Xiaomi utilizes social media advertising on platforms such as Facebook and Instagram to reach its target audience in Pakistan. The company creates ads that highlight the features and specifications of its smartphones and other products, and targets users who are interested in mobile phones and technology. Social Media Digital Marketing Digital Advertising Digital marketing strategies in Pakistan to promote its products and increase brand awareness. Here are some ways Xiaomi does digital marketing in Pakistan: Search Engine Marketing (SEM) Social Media Marketing (SMM) Content Marketing Email Marketing Affiliate Marketing Outdoor Advertising Outdoor Advertising Here are some ways Xiaomi does outdoor advertising in Pakistan: Billboards Transit Advertising Digital Signage Event Sponsorship In-Store Signage Sponsor Events Sponsor Events Here are some ways Xiaomi does event sponsorship in Pakistan: Music Concerts Sports Tournaments Tech Conferences Cultural Festivals Social Initiatives Sources Xiaomi Market me china The Express Tribune Business Recoder Pakistan Today The Marcom Avenue IIDE Sources

Transcript: Content Marketing strategy Q&A Henrike Muhl S2944618 Rianne Wieffer S2945800 Sandra Karomi S2970694 Multiculturalism Marketing strategy MIUI Emerging markets Multiculturalism Conclusion Currently Social Media Local platforms Mail Order Companies Global structure Identification with the product Employ multicultural managers Customized products GOAL! Solidarity Feedback Low R&D Demand increases Less competitors Increase of production Change of supplier network Emerging markets The road to success Conclusion

Transcript: Pricing Business Initiatives & Strategy Xiaomi has been a successful company from the start and it is only getting better throughout time In the short 9 years, its founder and CEO Lei Jun has become worth an estimated $12.5 Billion USD and became China's 11th richest person The company values at approximately $46 Billion USD They offer easy to use equipment for all ages to use. Xiaomi is becoming rapidly popular throughout the globe, even so that many people are even comparing their products to Apple. The company kept expanding its network, little by little, but the latest push is a big one. Another strategy for Xiaomi would be to follow in the footsteps of other Chinese tech conglomerates and invest in international companies. This would allow Xiaomi to further establish their leading role in China and abroad. 20 November 2018 Xiaomi India announced the opening of 500 stores simultaneously, Global Strategies Fulfillment of India’s regulations Fair pricing of products. Development of multi-brand strategy Introduction of web-based services in India Introduction of Internet of things (IoT) Supporting SDGs, human rights, and environmental sustainability Challenge Corruption in India PESTEL Framework China’s advancements in tech have quickly ranked them as a global technological leader and they are soon to be #1. XIAOMI CORPORATION Millet ( )CC9 Pro - $397.82 Millet ( )Pro 5G - $524.18 Millet ( ) 9 - $383.61 Millet Notebook ( ) Pro 15.6” - $682.08 RedmiBook 14 - $568.38 Gamebook 2019 ( ) - $1037.41 Social: It is estimated that nearly 1 in 5 people own smartphones, creating an expansive market for tech companies. Although Xiaomi is committed to delivering quality products, the notion that Chinese products are substandard is likely to affect the profitability of the company in the international market. High-quality technology brand Selling products at a lower price than competitors "Apple of China" 4th largest retailer of smartphones Competitors Risk Who is Xiaomi? Political: China has a socialist framework and is governed by the Communist Party. There have been many capitalist reforms in China, specifically in the form of tech . The protectionist policies adopted by the Chinese government have greatly benefited Xiaomi, increasing its market share and achieving a competitive edge. Similarities The Look Differences Consumer demand Apple: Pays less attention to consumer demand, instead, imagines what consumers want Xiaomi: Customizability, MiFans incorporates user feedback (abandon pre-installed MIUI system) Friday at 5PM, MIUI software updates, forums open to describe bugs/give feedback Marketing Strategy Apple: Global, buy-it-everywhere blowouts Xiaomi: "hunger-marketing" strategy, very limited sales windows August 2013, Xiaomi Red Rice, 100,000 units, sold within 90 seconds What makes Xiaomi stand out from Apple? CEO, Lei Jun Engineer by training Co-founded Kingsoft, a Chinese software company Founded Joyo.com, largest online retailer (books, music, movies) in China Xiaomi was founded in 2010 from mobile chip developer Qualcomm and Temasek Holdings The company released its first product in 2011 - Android software with its first smart phone called the Xiaomi Mi 1 It is primarily based in Asia, but has migrated globally. The main countries they supply its products to are China, India, Malaysia, and Singapore with expansions to The Philippines, Indonesia, and South Africa Primarily based in the Asia region, Xiaomi currently employs 15,000 workers with plans to hire more for their fast growing company China is also set up for success when it comes to its proximity to emerging markets around India and Southeast Asia. This is a large reason behind the success of Xiaomi's international expansion. Flash sales in countries like Pakistan, India and Taiwan have sold out in record time. Recently, Xiaomi has opened 7 retail stores in South America, the latest location being Uruguay. PESTEL Framework Products Technological: Over the years, Xiaomi has cut a niche for itself as a provider of a wide range of products, like smart TVs, smartphones, and smartwatches. The organization must continue investing in research and development to be able to manufacture products with cutting-edge technology. Environmental: China has suffered greatly when it comes to their environment due to the modernization and industrialization of their society. These factors, and their economic growth, have led to severe air pollution. Xiaomi must work towards creating systems/processes that will have a minimal impact on the environment. Legal: As of August 2019, the US has been barred from doing business with Chinese tech companies, who have been allegedly leaving opportunities for espionage by their government. Other relevant legal issues are to the company data privacy and IP laws. These issues may influence how Xiaomi conducts business. Laptops Air dots Trimmers Bags Shoes Software Fitness bands Xiaomi, the "Apple of China"? History Economic: China

Transcript: Barriers to Entry More Strategies: Low to medium price range 1000-10,000 php ($20-$220 USD) Suburban to rural regions Farmers, blue collar workers Target Age: 16-38 years old Students to working families “This, then, is the key to understanding Xiaomi: they’re not so much selling smartphones as they are selling a lifestyle, and the key to that lifestyle is MIUI, Xiaomi’s software layer that ties all of these things together” - Ben Thompson, Xiaomi’s Ambition. Distributing to: China, India, Brazil, Mexico, Malaysia, Philippines, Taiwan, Thailand, Vietnam, Russia, Turkey, Hong Kong, Singapore, Indonesia, Hungary, Myanmar. HQ in Beijing, China Accounts for 5.1% of global market share in smartphone sales. 3rd largest smartphone distributor in the world. Currently valued at US$46billion China accounts for 90% of smartphone sales (Forbes) Cultural Differences Established phones or biases Second mover for Chinese phone brand Government rules and regulations Production Strategy Global Markets & Organizational Structure What is Xiaomi About? How did Xiaomi Get Started? Global Markets Who Runs This? Pack your bags! We're going to .........!!!! Cheapest Smartphone Offered in India - $90 central marketing central manufacturing local distribution specialized portfolio Market Share Breakdown CherryMobile ($15-$269) Cheapest Smartphone $38 XIAOMI PRODUCTS Competitors and Prices Competitors and Prices 15% smartphone penetration rate, experts anticipate this tripling in a few years Malaysia 80%, Thailand 49%, Indonesia 23% 44% of the Filipino market pays less than $12 a month for smartphone plan, only 3% pays more than $41 a month 88% of the total mobile internet population is below the age of 34 MIUI Marketing Strategy Responsive marketing campaign Ads dedicated to needs of the population World class celebrity endorsement Manny Pacquiao, Kathryn Bernardo Smartphone integration (Google mobile report Philippines, 1QT 2013) 39% penetration 33% smartphone usage intensity 39% consumers choose phone vs. TV 83% watched videos "To provide additional functionality that Android had yet to offer and an easy to use user interface." Sony ($90-$314) Cheapest Smartphone - $101 Technology Adaption to Market • Samsung – 43% • Sony – 7% • CherryMobile – 7% • Alcatel – 3% • Huawei – New to market Export Products Trusted Retailer Make brand known capitalize on company's reputation for innovation and low price Eventually look to open a storefront Strategic Orientation Plan to Enter the Market Samsung ($15-$673) Cheapest Smartphone - $67 Founded by Lei Jun in April 2010 China's 23rd richest person Former CEO of Kingsoft Chinese brand opening storefronts in the Philippines Planning to open 10 more stores over the next 3 years Smartphone prices range from $70-$538 Similar plan for Xiaomi “We are an internet and a software company much more than we are a hardware company” - Hugo Barra, VP Global Division, Products & Operations Emphasize camera capabilities Selfies & social media integration Reducing distance gaps Skype & internet calls to families Medium to high level technical specs HD level display, 2mp front camera 1. Where does Xiaomi stand? 2. What is their strategic orientation? 3. Where are they in the world? 4. How are they structured? Overview of Cell Phone Market Short Term: JV Market Integration CMKcellphones.com, lazadaphones.com.ph Local retailer back, export strategy License to electronics retailers locally Long term: Retail Store Front Post purchase customer care Experience based presentation Dedicated accessory selection No direct phone sales History Xiaomi Name Alcatel ($15-$336) Cheapest Smartphone - $45 Current Standings The Crew Competitors and Prices PRIVATE: Global Expansion Plan Purpose of Xiaomi: Huawei Competitors and Prices Profile: "Millet and Rice" "Xiao" - Buddhist Concept "Mi" - Mobile Internet "Apple of the East" Strategic Model: Affordable Prices No Retail Stores Employees mainly in China, Malaysia, and Singapore Revenue: $12 billion Target Market Expansion Strategy Vertical strategy: all products are designed around MIUI, supports the lifestyle that Xiaomi promotes. Michael, Paul, Zack, Jennifer Company Profile ROM similar to Apple's iOS 2014 - Can be downloaded and installed onto 200+ devices in English and Chinese MIUI Express 2013 - 30+ million MIUI users worldwide Sub-contracting to major manufacturers Foxconn, Inventec New plants in India No plans to build mi plants Competitors and Prices

Xiaomi presentation

Transcript: Xiaomi Corporation Company's Profile Company's Profile Better known as “Mi” is a privately owned Chinese electronics company headquartered in Beijing, China CEO: Lei Jun Began its operation in August 2010 Initially started as a software company Developing a custom ROM for Android smartphones called MIUI. Producing high-quality, affordable smartphones. Xiaomi has more than 15,000 employees and it is currently operating in China, Hong Kong, Taiwan, Singapore, Malaysia, Indonesia, Philippines, India and South Africa. About Xiaomi About Xiaomi Hong Kong Stock Exchange on July 9, 2018. Sub-Brands Xiaomi Redmi POCO Mi Home Mi TV Black Shark Amazfit IoT (smart home system) platform at its core. Product Offered Product Offered Products Diversitification: Including Smartphones Tablets Laptops Smart home devices Audio accessories Smart Watch High-quality products at affordable prices Smartphones Smartphones Redmi Note 7 pro Black Shark 2 MI 9 Transparent POCO f1 Others Other than mobile phone MI Smart TV MI BT Speaker Smart IP Camera Xiaomi Smart Watches The "MI" in logo stands for “Mobile Internet”. It also has other meanings, including "Mission Impossible", because Xiaomi faced many challenges that had seemed impossible to defy in their early days. Logo SWOT Analaysis of Xiaomi SWOT Analaysis SWOT Analysis is a proven management framework which enables a brand like Xiaomi to benchmark its business & performance as compared to the competitors, and make strategic improvements. Xiaomi is one of the leading brands in the consumer electronics sector. Strengths Xiaomi is one of the largest smartphone makers in the world. Huge China and Asia market available. Rising Brand Awareness. The product are regularly rated high on all E-commerce portals. Manufacturing advantage as the labour cost is low. SWOT Analaysis Weakness Weakness The advertising and maketing spends of the brand is very low. Offline Distribution is not upto mark. Xiaomi launches its own phones at low prices in the flash sales. => As a result, it cannot take advantage of skimming price. Opportunity Opportunity Covering the developing countries and emerging markets. Besides onlines distribution, Xiaomi also needs to concentrate on offline distribution. Product innovations & differentiation. Internet of Thing (IOT) and Artificial Intelligence (AI) Threats Oppo and Vivo are 2 of the biggest competitor for Xiaomi because they are themselves from China. The lack of service centres equivalent to the number of sales. Anti Chinese products sentiments. Data privacy issues. Threats Martketing Objectives and Goals of Xiaomi Marketing Objectives 1. Earning Profits from its Software: Xiaomi's revenue stream comes from its software-the highly customizable MIUI firmware that is based on Android which already has more than 30 million users. Thus unlike Apple, for example, which makes money from margins on selling its phone, Xiaomi is more like Amazon where it wants to earn via its ecosystem by selling various goodies and reap profits like an e-commerce company. 2. Retailing Directly: Another objective is going directly to retail to cut out the margins and, in turn, pass on the benefits to the consumers. Xiaomi will sharpen its focus on its own Mi online stores to sell its wares, a strategy which has paid off rich dividends in its home market. The 4Ps of Xiaomi 4Ps Product Presenting itself as the good quality phone with the low prices is the good strategy that drives Xiaomi to the top spot in the smartphone industry in China. It has more special features than the standard Android phones and has options fors customization. The biggest key is that drives Xiaomi on becoming successful is the software rather than the hardware. Price Price Xiaomi sells its phones at a price that just covers the cost of the device rather than its cost of production. Xiaomi is focusing more on selling its phones at a low price today but gaining more in the future from selling contents such as applications, services, and accessories. Place Place There are many countries outside China where the smartphone market is dominated by Apple and Sumsung. This is the main obstacle for Xiaomi in expanding its brand internationally. Xiaomi already has a strong base in mainland China, Malaysia,Singapore, India and Philippines. Xiaomi mostly sells its products online instead of opening physical stores. Promotion Promotion Word of mouth Xiaomi uses flash sales,a mean of selling their product in limited quantities within a limited period as part of their sales strategies. This strategy enables Xiaomi to save money from doing advertisement. Social media Xiaomi uses social media not only to broadcast messages to actively get in tocuh with its customers but the engineers from Xaiomi also use this platform to routinely communicate directly with users to get feedback. Competitor Competitor Anual Report 2021 Recently, Xiaomi has announced its financial results for 2021 with extremely impressive numbers. The Beijing-based

Transcript: Xiaomi AGENDA What is it? Who created this project? What is the range of products? Why you schould buy it? Xiaomi FOUNDER On being No. 1 On being called the Apple of China On being a price warrior company's goals PRODUCTS Enjoy

Transcript: Until 2012, Xiaomi concentrated only on the chinese Market August 2013, Xiaomi hired Hugo Barra as vice president Xiaomi plan to foothold in 10 new countries in 2014 Young company (4 years) Unique OS Exeptionnal growth Iphone 6 vs MI4 In 2011 Lei Ju come close to Meizu, hanking Hi Tech company. First smartphone release in October 2011 in China Taïwan and Hong Kong. Selling strategy Number of smartphones sells: 2012: 7,2 millions 2013: 18,6 millions 2014: 41 millions. Objective 60 millions 2015: Goal: 100 millions September 2014: Xiaomi is leader on the chinese market and 5th worlwide constructor. Communication based on social networking: utilisation of the word of mouth The consumer comunity is consulted New update every week Progression of the company Unlike other maker, Xiaomi sells smartphone at a bill-of-material prices (Less than 10% profit margin) You can only buy it on the internet mi.com Wikipédia Phonandroid http://www.lesnumeriques.com/telephone-portable/xiaomi-en-tete-marche-chinois-n35457.html http://jtgeek.com/xiaomi-success-story/ http://www.macplus.net/chronique-74650-qui-est-xiaomi-l-apple-de-la-chine https://www.apple.com/fr/iphone/ Communication strategy OS based on Android Open Source Custom Rom such as CyanogenMod Improve performance Conclusion MI4: screen size 5" Processor Snapdragon 801 RAM 3Go Camera 13mPx Memry 64Go Price 499 $ Start up Created on April 6th 2010 Director: Lei Jun Market Valuation estimated at 10 billon $ First known for his OS: MIUI Flash sale: 15 000 MI2 in 2 seconds 40 000 Redmi 1s in 4,2 seconds 200 000 MI2S in 45 seconds Low stocks Main products The Chinese Apple? Business model Summary Steve Jobs is an inspiration for Xioami's CEO. Similarities in terms of design. Loyal users Xiaomi is based on 3 fundaments: eCommerce MIUI ROM its fans Just an OS inspired from IOS at the beginning Xiaomi on Chinese Market International deployment Bibliography Xiaomi's ranking in worlwide market From software to hardware Iphone 6: screen size 4.7" Processor Apple A8 RAM 1Go Camera 8mPx Memry 128 Go Price 919 $ Smartphones: MI3,MI4,Redmi 1s Touchpad: MiPad Miband, power bank... An exponential growth Adapted on numerous Android Samsung Galaxy Htc One Sony, LG... mix the best features of IOS and Android Hight level of personalisation XIAOMI I- History and progression II- Business model III- The new Apple

Explore our templates for more presentation inspiration

World Map - Antique

Description: Impactful presentations need stunning visuals and a meaningful metaphor to show high-level concepts and the smaller details. This customizable presentation template uses a classic world map visual to help you navigate complex information while staying grounded in your presentation’s core message.

Lesson Plan - Chalk | Prezi

Description: Structuring your syllabus doesn't have to be a huge headache with this customizable lesson plan presentation template. With a classic chalkboard theme and adaptable structure, it's easy to add new subjects, assessments, assignments, and more.

Easy Globe Templates for Stunning Presentations | Prezi

Description: For grant requests, program proposals, or any other nonprofit or education presentation, this globe-themed creative Prezi template is the way to generate interest and momentum. Like all Prezi education templates and Prezi nonprofit templates, it’s easy to customize.

Training - EDU

Description: A well-organized training presentation template is a critical tool for education professionals. From roadmaps to reviews, this training template will help you take your next EDU training presentation to the top of the class.

Now you can make any subject more engaging and memorable

- The Science

- Conversational Presenting

- For Business

- For Education

- Testimonials

- Presentation Gallery

- Video Gallery

- Design Gallery

- Our Customers

- Company Information

- Prezi Support

- Prezi Classic Support

- Hire an Expert

- Data Visualization

- Infographics

April 13, 2024

April 12, 2024

April 4, 2024

- Latest posts

© 2024 Prezi Inc. Terms

- PC Hardware

- Buying Guides

- Technology News

- Mobile Phones

- CPU/Processors

- Motherboards

- Graphic Cards

- Memory/ RAM

- Storage SSD/HDD

- CPU Fans & Cooling

- Computer Case

Official presentation of the Xiaomi 14 Ultra and the entire 14 series live

The manufacturer has confirmed that this year the Xiaomi 14 Ultra is presented at the MWC in Barcelona , a phone that already arouses passion and no wonder because it is the most daring bet. Although this one will not arrive alone, everything indicates that we will also get to know the Xiaomi 14 and the Xiaomi 14 Pro, two smartphones that were already shown in China, but that can now be purchased in Spain, we will see if there are surprises in the price and if Xiaomi reveals other products that are beyond our plans.

Table of Contents

Xiaomi’s event with MovilZona

As we have done on other occasions, we do not want to miss even the smallest detail of what happens on the MWC stage, an event that becomes the best starting signal that the technology fair could offer us. So that you don’t miss any details either, we are going to show and tell you everything that Xiaomi shows us, explains and details. At 3:00 p.m. in Spain, we have the appointment, at which time a few lines below we will explain everything that happens, but we will also share the live streaming below so that you can see through the Xiaomi YouTube channel everything live, if you prefer it in the Xiaomi Facebook or your X account .

Furthermore, if you do not have the possibility of calmly watching the live broadcast and being aware of everything we tell you, you can learn Xiaomi’s news at MWC through our X account we will immediately show you the highlights in images and text, from the features to the sale price.

Under the hashtag #UnaLenteDeLeyenda, Xiaomi has been leaving us clues about the possibilities that the new Xiaomi 14 Ultra will offer us, which leads us to think that thanks to a collaboration with Leica, it wants to mark a photographic before and after, something in which who has become quite an expert. We will see what he is capable of, what other secrets his most important phones of 2024 hold, and above all, if they are as good as they say that we want to buy them.

15:01 – The Xiaomi presentation event at MWC 2024 in Barcelona begins!

15:02 – An introductory video presents the capabilities of the Leica and Xiaomi cameras and optics.

15:04 – William Lu, president of Xiaomi, welcomes everyone and talks about the role of innovation for the brand, being one of its most important principles. Xiaomi becomes the third brand globally after 14 consecutive quarters.

15:05 – Xiaomi is considered one of the 50 most innovative companies of 2024 and the second Chinese brand globally.

15:06 – By 2040, Xiaomi wants to achieve carbon neutrality and 100% use of renewable energy.

15:08 – Xiaomi presents for the first time in Spain Xiaomi HyperOS, the new universal software that seeks to centralize all its devices under the same ecosystem. In addition, mention is made of the Xiaomi SU7, the Chinese giant’s first electric car.

15:10 – A video shows how Xiaomi intends to connect user with their devices through Xiaomi HyperOS with an intelligent, versatile, and accessible ecosystem for anyone.

15:11 – Xiaomi HyperOS is based on 5 keys: optimize performance, offer a better connection, have a neuralgic network, improve security, and promote shared development.

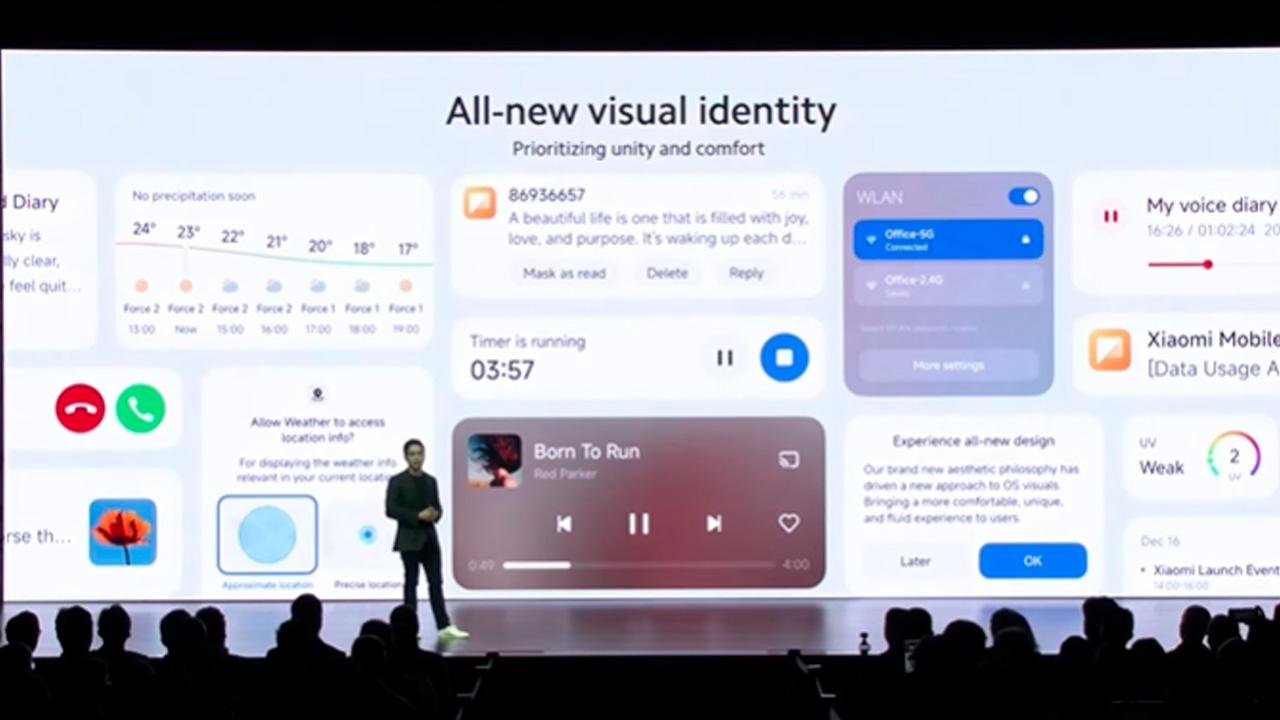

15:13 – Xiaomi HyperOS greatly improves performance when executing processes, transferring files, and reducing latency… The design is another section that has been rebuilt, giving an appearance that consists of unity and comfort.

15:15 – Screen elements are now more realistic, refined and elegant with the aim of enjoying an attractive and pleasant experience for the user.

15:18 – Interconnectivity is one of the most important features of Xiaomi HyperOS. HyperConnect is an ecosystem that integrates different Xiaomi devices with Smart Hub. Proactive intelligence is the brand’s solution so that its entire catalog works in unison and behaves in specific ways. This is Xiaomi HyperMind. The headphones will automatically play the content you were playing on another device, for example.

- Discover Latest News and Updates on Artificial Intelligence/ AI

- Discover Latest News and Updates on Apple

- Samsung Latest Price and Specs | Latest Update 2024

- Apple iPhone Price in Nepal Latest Update 2024

- Latest News and Updates on Android and Technology

- Latest Cars and Auto News | Latest Update

- Latest Apple Products, Official Website of Apple

- Best Buying Guides to Help You Choose the Right Products

- Latest Development in ChatGPT and Updates | Discover News and Tips & Tricks on ChatGPT

- Want to Know the Latest News on Crypto, Crypto Trading Browse Here

- Recently Launched Gadgets, Latest News and Updates

- Gaming Industry News and Latest Information on Esports, PC Gaming, Mobile Gaming and Games Updates

- Tech Guides, Tips, and Tricks, Mobile Hacks, Windows Update, Mac Tips and Tricks

- Latest Laptop Launched, Updates and Features | Laptop News

- Laptop Price in Nepal | Laptop in Nepal

- Mobile Phone Reviews, News, Specs, and Features | Latest Mobile Updates

- PC Hardware Latest News, Upgrades, PC Components and PCMR News

- Latest Reviews on the Latest Tech Gadgets, software, computers, mobile phones, and more

- Top Technology News and Updates

- Best Gaming PC Price and Best Custom Gaming PC Build Available Here

- Find Your Dream Laptop at Aliteq: Best Laptop Price in Nepal & Latest Releases in Nepal 2024

Related Posts

- Free Outlaw with Intel Core 14 Processor

- Vivo Y51s Price in Pakistan Latest Update, Specs, Features

- major change to home screen design

- If you play a lot on your mobile, you are going to want this controller no matter what.

- New Amazon Prime Video: films, series and documentaries to watch in streaming in April 2024

- This AI offers you more than 100 artistic styles to create spectacular images

- Free offers subscribers four Universal+ channels. How can you take advantage of this?

- The April patch for Samsung phones arrives early with improvements to the camera

Awesome Samsung One UI 6.1 Features You Need to Know

New cubot kingkong ax: ultra-thin and rugged mobile, orange price increases go down very badly with customers, leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

You can get a refund if you purchase an ASUS RTX 40 ProArt graphics card.

Biostar is now officially an intel partner with its first branded graphics., 4 programs to catch and block him, do you use messenger so you will be delighted with these 3 new features, learn programming in just a few weeks with this free course from harvard university., how to choose the best desktop computer, this portable console mines cryptocurrency as you play and stores it for itself., need a new mac 2 unstoppable tips to avoid breaking the bank, this trick allows you to use an animation or video as wallpaper on your pc., has ubisoft removed the crew from its library you are not the only one, i-nfo.fr app: how to favorite an article, it tells you where the cheapest gas station is., don’t think twice. please give me something from razer for my son’s companionship., do you have an intel 13th generation k series processor those people are already retired., here’s how to open a port in your firewall:, iphone game releases: these 4 new titles are validated by the editorial staff, editor picks, buy for the lowest price, how to make amazing excel charts from your data, why your eyes will say thank you to the new ps5 update, popular posts, amd apus will maintain the rdna3+ architecture until at least 2027., we got the message, baldur’s gate 3 is the game of the century, websites that download music without permission and use it in videos.

Contact us: [email protected]

All Rights Reserved © Aliteq 2024

- Privacy Policy

- Advertisement

News . Data . Research

Categories Earnings Call Transcripts , Technology

Xiaomi Corp. (1810) Q3 2021 Earnings Call Transcript

1810 earnings call - final transcript.

Xiaomi Corp. ( HKG : 1810 ) Q3 2021 earnings call dated Nov. 23, 2021

Corporate Participants:

Anita Chen — Head, Investor Relations

Wang Xiang — Partner and President

Alain Lam Sai Wai — Vice President

Kyna Wong — Credit Suisse — Analyst

Andy Meng — Morgan Stanley — Analyst

Piyush Mubayi — Goldman Sachs — Analyst

Gokul Hariharan — JPMorgan — Analyst

Leping Huang — CICC — Analyst

Xu Yingbo — CITIC — Analyst

Presentation:

Ladies and gentlemen, thank you for standing by and welcome to Xiaomi 2021 Third Quarter Results Announcement Conference Call. [Operator Instructions]

I’d now like to hand over the conference to your host today, Ms. Anita Chen [Phonetic], Head of Investor Relations. Please go ahead, Ms. Chen.

Good evening, ladies and gentlemen. Welcome to the investor conference call hosted by Xiaomi Corporation regarding the company’s 2021 third quarter results. Before we start the call, we would like to remind you that the call may include forward-looking statements, which are underlined by a number of risks and uncertainties and may not be realized in the future for various reasons.

Information about general market conditions is coming from a variety of sources outside of Xiaomi. This presentation also contains some unaudited non-IFRS financial measures that should be considered in addition to, but not as a substitute for, the company’s financials prepared in accordance with IFRS.

Joining us on the call today are Mr. Wang Xiang, Partner and President of Xiaomi Corporation; and Mr. Alain Lam, Vice President and CFO of Xiaomi Corporation.

To start, Mr. Wang will share recent strategic initiatives of the company. Thereafter, Mr. Lam will review the business and financial performance for the quarter. Following that, we’ll move on to the Q&A session.

I will now turn the call over to Mr. Wang.

Yeah. Thank you. Thank you, Anita. Hello, everyone. Thank you for joining our 2021 third quarter earnings call. This quarter actually ended the background of global supply shortage. All our business segments continued to grow. Total revenue reached RMB78.1 billion, up about 8.2% and adjusted net profit reached RMB5.2 billion, up 25.4% year-over-year.

And our global smartphone shipment remained strong despite the shortage of key components. In the third quarter, we ranked number three globally in terms of smartphone shipments. In the first three quarters of 2021, our global smartphone shipment reached 146 million units, equivalent to our 2020 full-year shipments. This allowed us to support our market positions as much as possible across our key market globally.

At the same time, our smartphone gross margin reached 12.8% this quarter and increased by 4.4% year-over-year and 1% quarter-over-quarter. We continued to strengthen our position in the premium smartphone market. In the first three quarters of 2021, we shipped around 18 million premium smartphones globally. It accounted for more than 12% of total smartphone shipments compared with less than 8% in the same period of last year. The growth of premium smartphone shipment has also led to an increase in our overall ASP.

Meanwhile, we are using different product lines to penetrate different target market segments and to attract new Xiaomi smartphone users. Among our new smartphone product launch this year, over half of users are new users. Similarly, our stylish Xiaomi Civi attract over 50% female users. We remain committed to technology innovation to deliver best product and user experience.

In China Telecom’s 5G smartphone performance test in November, we ranked number one across all price categories, a result of our relentless focus on user needs and R&D investments. In the first three quarters, our R&D expenses reached RMB9.3 billion, up more than 50% year-over-year.

As we continue to make amazing products, actually we are also strengthening our distribution channels. In online channel, we were the clear leader in the year’s Double 11 shopping festival. We rank as the number one smartphone brand by sales volume. At the same time, we continue to expand our offline channel. By now, we have over 10,000 stores in Mainland China. Going forward, we will seize the growth opportunity in lower-tier offline markets and continue to strengthen our market share.

This quarter, Internet service performance remained strong. In September, our global MIUI MAU reached 486 million. At the same time, our Mainland China MIUI MAU increased for the fourth consecutive quarters reaching 127 million. As we grow our user base and increase our premium smartphone shipments, Internet service revenue and advertising revenue both achieved record highs in this quarter.

Furthermore, our overseas Internet services revenue contribute to nearly 20% of our total Internet service revenue. And we are happy to share that as of yesterday, our global MIUI MAU exceeded 500 million users. It took us only 10 months for our global MIUI MAU to increase from the 400 million to 500 million. And this marks an important milestone for our smartphone times AIoT strategy.

Now, I’d like to invite Alain to discuss our third quarter earnings results in greater details. Alain, please.

Thank you, Xiang zong. Good evening, everyone. Thank you for joining us today for our third quarter 2021 earnings call.

Our total revenue and adjusted net profit continued to grow despite the global shortage of key components. In the third quarter, we ranked number three globally in terms of smartphone shipments. Our MIUI user base in Mainland China as well as globally both reached record highs as of September, driving our Internet services revenue to set another record. The number of connected devices on our AIoT platform exceeded 400 million for the first time. And the number of users with five or more connected devices also surpassed 8 million for the first time.

In the third quarter of 2021, our total revenue reached RMB78.1 billion, up 8.2% from a year ago as all business segments continued growth year-over-year. Adjusted net profit increased 25.4% year-over-year to RMB5.2 billion and adjusted net profit margin was a robust 6.6%.

By further refining our smartphone user segmentation, we have been attracting new users to Xiaomi. Notably, for many of our new smartphones launched this year, over half of the users are new Xiaomi users. For example, over 70% of Xiaomi MIX FOLD users and over 60% of Xiaomi 11 series and Xiaomi Civi users are new users of Xiaomi. These new users help us increase our Internet MAUs in China from 111 million in December of 2020 to 127 million in September 2021.

We continue to improve our competitive position in the premium smartphones market. In the third quarter of 2021, our premium smartphone shipments reached approximately 18 million units globally, significantly higher than the 10 million units in all of 2020. In the first three quarters of 2021, we’ve expanded our premium smartphone market share in Mainland China across all price categories. For example, in the RMB3,000 to RMB4,000 category, our market share grew 6.4% year-over-year. In the RMB4,000 to RMB5,000 category, our market share grew by 7.7% year-over-year. At the same time, models such as Xiaomi 11 Pro, 11 Ultra and MIX FOLD continue to attract new premium users and improve our market share in the RMB5,000 or above price category.

The outstanding performance of our 5G smartphones has also been well-recognized by the industry. In the most recent China Telecom 5G smartphone performance test in November, which included tests on speed and stability, Xiaomi and Redmi smartphones ranked number one across all price categories against all of our peers. The result shows the competitiveness of our 5G smartphone products. As Xiang Wang mentioned, we have achieved remarkable results during the Double 11 shopping festival.

We set new records as our cumulative GMV exceeded RMB19 billion, an increase of 35% year-over-year. We ranked as the number one smartphone brand by sales volume across the major e-commerce platforms. In the Android RMB4,000 and above category, our premium smartphones ranked number one on JD.com and Tmall. Furthermore, our AIoT products achieved 208 number one rankings across different categories.

Also, as Xiang Wang mentioned earlier, we’re very happy to share that as of yesterday, our global MIUI MAU exceeded 500 million users. This marks another milestone of our history and demonstrating the strong growth momentum of our user base.

We continued to step up our investments in R&D. In the third quarter of 2021, our R&D expenses increased by 39.5% year-over-year to reach RMB3.2 billion. For the first nine months of 2021, total R&D expenses reached RMB9.3 billion, up 51.4% year-over-year. At the end of the third quarter, we had approximately 14,000 R&D personnel, accounting for more than 44% of our total employees. In addition, our total patent applications exceeded 48,000 globally.

Our Smart EV business has been progressing ahead of schedule since we officially announced our entry in March of this year. So far, we have a team of over 500 people. We expect to continue to execute on our strategies and begin mass production in the first half of 2024.

Now, let’s dive deeper into each of our segments, starting with smartphones. In the third quarter of 2021, despite the global shortage of key components, we managed to increase our smartphone revenue by 0.5% year-over-year to RMB48 billion, while our ASP increased 6.7% year-over-year. Our smartphone market share has maintained an upward trend. In the third quarter of 2021, our smartphone market share was 13.5% globally and 13.8% in Mainland China, over and above our historical averages.

In this past quarter, we launched our Xiaomi Civi for fashion conscious users. With a lightweight and attractive design, Xiaomi Civi has been well received. Since launched, based on our data, over 60% of Civi users are new Xiaomi users and over half are female, demonstrating our ability to penetrate new user segments.

The Redmi Note 11 Series is another exciting new product that offers cutting-edge technology to a wide user base. The Redmi Note 11 Pro+ comes equipped with a high refresh rate display, ultra-clear camera and 120-watt fast charging. Since launch at the end of October, sales of the Redmi Note 11 Series in Mainland China have already exceeded 1 million units.

We continue to expand our offline network in Mainland China. We currently have over 10,000 offline retail stores, covering over 95% of cities and over 80% of counties in Mainland China. We will focus on expanding in lower tier markets as well as improving the efficiency of our offline stores in the future.

In the overseas markets, our premium smartphones have gained wide popularity. In the third quarter, our overseas premium smartphone shipments grew more than 180% year-over-year, mainly driven by growth in Latin America, Western Europe and the Middle East. As a result, our overseas smartphone ASP also saw a year-over-year increase. We maintain the number one position in 11 markets globally and was among the top five in 59 markets in the third quarter, according to Canalys.

Now let’s move on to the IoT and lifestyle products. In the third quarter, our IoT and lifestyle products revenue reached RMB20.9 billion, up 15.5% year-over-year. In particular, overseas IoT and lifestyle products revenue reached a historical high, even though there were challenges with respect to overseas shipping logistics costs, which had impacted some of the IoT products overseas.

As the global leading consumer AIoT platform, we continue to expand our global IoT user base. By the end of September, the number of connected IoT devices on our AIoT platform exceed 400 million for the first time, up 33.1% year-over-year. Moreover, the number of users who had five or more devices on our AIoT platform exceeded 8 million for the first time, up 42.8% year-over-year. Our AI Assistant MAU reached RMB105.1 million in September, an increase of 34.1% year-over-year. Also, our Mi Home App MAU reached 59.9 million, up 39% year-over-year.

In the smart TV category, we are rapidly expanding our global footprint. In the third quarter, global shipments of our smart TV reached 3 million units despite the impact of increased panel prices and we ranked top five globally. In India, our smart TV ranked number one for the 13th consecutive quarter. In Mainland China, we ranked number one overall for the 11th consecutive quarter. And since launching our new OLED+ in August, our OLED TV have ranked number one for two consecutive months, demonstrating our achievement in the premium segment.

We have made continuous efforts to penetrate the high-end white goods market. We believe we can capture significant opportunities by enhancing traditional white goods with smart technologies, while making our premium products available to the mass market. As an example of these efforts, we launched our first premium smart refrigerator in October 2021, which supports connectivity with our Mi Home App as well as our AI Smart Assistant.

Also, during the Double 11 shopping festival, our home appliances products achieved record sales. On JD.com, as you can see, we ranked number three in the overall home appliances category by sales value, outpacing other players like Geely. Notably, in the smart AC with ventilation category, which we have talked about in the previous earnings call, Xiaomi ranked number one in terms of both sales volumes as well as sales value.

We’ve continued to make progress in the wearable areas. In the third quarter, according to Canalys, we were the global number two vendor in wearable bands. As we execute our Smartphone times AIoT strategy, we strive to offer our users the coolest wearable products such as our Xiaomi Buds 3 Pro and Redmi Watch 2, while enhancing connectivity with our smartphones.

Now let’s talk about our Internet services. In the third quarter, our global Internet user base continued its strong growth momentum to reach another record high. Our MIUI global MAU increased by 32% year-over-year to 485.9 million in September, while our MIUI MAU in Mainland China reached 127.3 million, an increase of 3.3 million users from June of 2021. And as Xiang said earlier, our global MIUI MAU exceeded 500 million a couple of days ago.

Just to recap, in the first nine months of the year, MIUI MAU in Mainland China increased by more than 16 million. Our global TV MAU also continued to grow rapidly, increasing over 33% year-over-year. As our global and Mainland China user base continues to grow, revenue from Internet services achieved another record high, reaching RMB7.3 billion in the third quarter, up 27.1% year-over-year.

Our advertising revenue reached another quarterly high of RMB4.8 billion, up 44.7% year-over-year. Gaming revenue also grew 25% year-over-year to reach RMB1 billion, our first year-over-year growth in the past year.

Let me elaborate further on our advertising and gaming business. Our advertising revenue is mainly derived from after installation, by search and by performance-based and brand advertisements. In the third quarter, pre-installation revenue per smartphone in Mainland China increased by over 50% year-over-year, driven by increased premium smartphone shipments. In the overseas markets, search revenue increased over 200% year-over-year and performance-based and brand advertising revenue increased over 100% year-over-year, driving our significant growth in advertising business.

For online games, contract terms are now comparable with the same period last year. Furthermore, higher ARPU contribution from our premium as well as our gaming smartphone users helped drive solid revenue growth.

Our overseas Internet services revenue also continued its rapid growth and achieved a record high. In the third quarter, overseas Internet services revenue increased 110% year-over-year, accounting for 19.9% of our total Internet services revenue. Going forward, we will deepen our collaboration with global business partners and further enrich our overseas services offerings.

Now let’s move on to more detailed financials. As we mentioned before, in the third quarter, total revenue reached RMB78.1 billion. By segment, smartphone revenue grew 0.5% year-over-year to 47.8% — RMB47.8 billion. IoT products revenue grew to RMB20.9 billion and Internet services revenue grew 27% to RMB7.3 billion. Overseas revenue increased 2.8% year-over-year to RMB40.9 billion, accounting for 52.4% of our total revenue.

Our overall gross margin increased year-over-year and quarter-over-quarter to 18.3%. This increase was mainly driven by higher smartphone gross margin, which reached 12.8% in Q3, and increased contribution from the Internet services segments which achieved 73.6% gross margin. As we mentioned before, we continue to invest in R&D in the third quarter. As you can see, our overall operating expense ratio was 12%, which was mainly driven by R&D expense ratio increase to 4.1%. In the third quarter, our cash resources remained abundant at RMB98.1 billion.

Let me provide you with an update on our ESG initiatives. Number one, we continuously strive to protect our users’ data and privacy and hold ourselves to the highest standards. Our efforts have been recognized by the British Standard Institution which has granted Kitemark certification to our Mi 360 Degree Home Security Camera. Furthermore, in this quarter, we screened more than 85,000 apps in our Mainland China Xiaomi App Store for data collection violations and rectified any issues immediately.

We also understand our social responsibility extends far beyond our products and services. In response to the natural disasters in the Henan and Shaanxi provinces, Xiaomi Foundations donated RMB50 million and RMB10 million to the respective areas. In July, we also donated EUR1 million to those affected by the flood disasters in Germany, Netherlands and Belgium.

We also strive to give back to our communities through education. In November, the Xiaomi Scholarship was launched to the second batch of top universities in China to support eligible students. In the future, as we grow our business, we will continue to give back to our communities and fulfill our corporate social responsibilities.

This concludes our prepared remarks. We’d now like to open the call for questions from investors.

Thank you, Alain. We will now proceed to the Q&A session. Please limit your questions to a maximum of two so that we could allow more investors to ask the questions. Operator?

Questions and Answers:

[Operator Instructions] And our first question comes from Kyna Wong with Credit Suisse. And please go ahead.

Thank you. Thank you for taking my question. I have two questions. The first one is about the Internet business. We see that a strong momentum in the advertising business and also gaming is picking up. And we see overseas contribution also increased like over 100% year-over-year in the third quarter. Could management give us some kind of like outlook in the Internet business in the fourth quarter and also first half next year because the overall, as we think that it’s important to know the growth momentum going forward as the MAU has already achieved the kind of like second half of that potentially contribute the Internet business in the next few quarters as well.

The second question is about smartphone size. I think, we know that the chip shortage is hard to release in the near-term, but any improvement in the fourth quarter and what should we expect on the full-year shipments is the RMB190 million, a reasonable target for us and should we also expect — what should we expect the target for 2022 if the chip tightness is actually improving in the second half next year? Thank you.

Thanks, Kyna. Let me try to take the first question and then I’ll let Xiang take the second question. With respect to the growth in the Internet business, number one, I think it’s driven by the increase of our global Internet users. As we said before, our Q3 MAU reached 486 million, which means an increase of over 100 million in 2021 alone, right. In the first three quarters, our China MAU increased by 16 million. And so, a huge part of the increase in Internet Services is, obviously, driven by the increased number of our user base as well as our shipment base. I think that’s number one.

Number two is the increased percentage of our premium smartphones — as our overall premium smartphone portfolio. As we’ve demonstrated in the chart — one of the charts, our premium smartphones do drive higher gaming ARPU, also drive higher pre-installation revenue. And so, the move towards more premium smartphones for Xiaomi will also increase our advertising — Internet Services revenue.

Number three is also the gaming revenue, as we talk about. In the past four quarters, we’ve been hit by some changes in the contract terms with some of our providers — suppliers. And Q3 is the first quarter that we are able to compare apples to apples in the past five quarters. And so, as a result, we are very encouraged to see that our gaming revenue has increased year-over-year. Number four, you talked about overseas. I mean, obviously overseas is a function of the user base in the overseas market. We talk about the increase in revenue from our search business in the overseas market. And so, I think that that will continue to contribute to our revenue as well as our net income.

Lastly, I think the TV, as we mentioned — we talk about the TV MAUs, the TV Internet revenue has also contributed to the significant increase due to some of the memberships, etc, that we’ve seen a year-over-year increase. In the future, we continue to be optimistic. So, obviously, I think, as you mentioned, there is a lot of regulatory headwind, which are facing some of our peers as well which are well-recognized. But at the same time, I think given the strong shipments that we have, the increased number of new users on Xiaomi’s platform, the premium users on Xiaomi’s phones and to the extent that we can continue to improve our customer experience, customer services, we believe that we will continue to see — hopefully continue to see a healthy growth in the Internet business.

Yeah. The second question is related to the supply and also the forecast. Actually everybody knows, during the entire year 2021, we are facing the challenge of supply shortage. Actually, the second half of 2021, the challenge is even bigger. So — but even with the serious supply situation, actually we have achieved actually record-high shipments. In the first three quarters, actually the total shipment is over 146 million. This is equivalent to the entire last year’s shipment actually. So, I think, it’s a very, very good result. Actually, in Q3 and also Q4, the challenge is even bigger as I mentioned earlier. But I think we can — we are working very closely with our suppliers to try to get more supply as much as possible. I think — so, I think 190 million is a good number, but we still work very hard to try to get more. So I think — yeah, so it is getting the middle of the Q4, we are working very hard.

So for next year, actually, we see very good — how to say — momentum of the improvement, but unfortunately, in the first half actually, we still see some structural challenges in the first half, Q1 to Q2, but in entire year 2022, the supply situation will be very much improved. So, we are working very hard for the supply for Q1 and Q2, especially for the 4G devices.

We are still — right now, we are in the more than 100 different markets actually, many of our markets, the consumer really need a lot of the 4G devices, even in the developed market like Europe. So, we are working very hard for that supply. So, overall, it’s good, but yeah, as I mentioned, the first half will be a challenge. We will maintain very high growth for the year 2022.

I think, just to contextualize some of what Xiang just said, right, I mean if you look at our shipments in the first three quarters of the year, we’ve already reached 146 million, which was comparable to the entire 2020. If you look at our revenue from smartphones in the first nine months of this year, that has already exceeded the whole of 2020. So despite overall shipments being flat in the global market, we have achieved very considerable growth in our smartphones this year. So that’s why we are very encouraged by the results. So I think that that’s point number one.

Point number two is, obviously as we mentioned in the last couple of conference calls already, in the global supply shortage situation, we’re also able to maintain a very healthy gross margin. So if you look at our smartphone gross margin this quarter, it’s back to 12.8%, which is comparable to what we achieved in the first quarter. So, I just want to point those numbers out to you.

Got you. So, ’22 sounds good growth — [Technical Issues] good growth for 2022 [Indecipherable].

Thank you. Thank you, Alain.

Thank you. And our next question come from Andy Meng with Morgan Stanley. Please go ahead.

Thank you, Xiang. Thank you, Alain. I have two questions. So the first question is related to the AIoT business. We have seen — the margins see a slight decline on a quarter-over-quarter basis. So is it possible for Xiaomi to raise the ASP of the AIoT products and try to pass through the cost pressure? And can we say this will help us to improve the margin or basically the margin is more likely to stay at a current level without much improvement in the following quarters? Okay. This is my first question.

My second question is related to the smartphone. We have highlighted two products in our presentation, which is the Xiaomi Civi and the Redmi Note 11 Series. So basically I want to check, you mentioned about the positive feedback on those new products. But compared with the models we launched early this year, what’s the key improvement we have achieved on those two models? And what are the key areas we want to do better in the future? And also, if you can share a bit more regarding the offline channel, which like a product is selling better and why is that? And do we figure out how to play this offline promotion or this like setting the popular models, etc, that will be very helpful? Thank you.

So — yeah, the first question is related to the AIoT profit margin. So, during the entire 2021, actually we have — I just mentioned, the challenge is the supply, right. But on the AIoT side, I think there is another challenge, that is the logistics, transportations. The transportation cost is very high, increased significantly. So that will give us some impact on the international profit margin generally from the international market and also because of the slow response of the transportation. So, they also give some impact on the revenue side for the international market. And also, because of the supply shortage, so some of the cost of our AIoT devices increased significantly. That gave us a temporary impact on the profit margins. This is what I see.

Probably, Alain, you can…

Yeah. I think, Andy, on the IoT side, as Xiang mentioned, we do have some products that we normally sell to the overseas market, that has been delayed or that has been canceled due to the shipping costs into the overseas market. So that I think that’s the first point. And what that means is, we also shifted some of the product mix between China, as well as the overseas market. That’s the second point.

And China, as you know, is predominantly dominated by some of the larger white goods products such as TV and laptops. And obviously TV and laptops are due to have OC prices, carry lower margins. And so, I think, it’s just a math function. I think, as OC price — people have already seen OC price dropping a lot, significantly in fact. And so, it does help in terms of the gross margin in future periods. And as we can see, the overall shipping cost also has been normalizing and so it will also help the overall margin in the future periods. So I think that’s the first question.

I think the second question is with respect to Civi and Redmi Note 11. I think, first of all, the Civi product is really made for different demographics, demographics that we haven’t really targeted previously, which is the fashion-conscious female demographics. And as I mentioned in my prepared remarks, the female users we estimated to be around half of the buyers. And probably some of the other buyers give it to their girlfriends and wives, we don’t know, but that percentage could be higher. And so, I think from our data we already targeted kind of new demographics that we haven’t touched before.

Second is, we targeted the Civi products a lot into the offline channels and so this is also our first try in to trying different types of products into different channels. We’re very encouraged. I mean, obviously, I think it will take time like our premium products to get used to serving the high-end premium users as well as the female demographics. So, so hopefully the next series of the Civi products will be much more competitive. I think that’s something that we will like to see.

In terms of the Redmi Note 11 Series, so obviously we have been improving the performance, but at the same time, we also increased the price. I think the price range that we offered our Redmi Note 11 was much higher than previously. So I think you can see that we are also trying to broaden the reach using this Redmi Note 11 product. And so, this is something that we are trying.

Your last question is with respect to the offline channel. The offline channel, I think, this year, we’ve added a lot of new stores. We are over 10,000 now. I think the next stage for us to focus on is really to increase the efficiency of these stores or increase the productivity of these stores. I think that a lot of these new stores are open for less than three to six months and that it takes time to ramp up these stores. I think an important focus for us is to improve the productivity of each of these stores in the near future.

Thank you very much.

Thank you. And our next question is come from Piyush with Goldman Sachs. Please go ahead.

Thank you for taking my question. Just speaking up from the store point that you talked about, Alain, could you take us through, you’ve expanded the store number by more than a factor of three. Could you take us through what’s prompted that expansion that we’re observing and give us a feel of whatever the initial feedback has been on the ability to sell through in market share gains you’re seeing in the offline space. And also give us a feel for whether this is coming in at a higher end versus the overall ASP or at another price point versus the overall ASP.

Second is, what have been the key learnings for you from building out this retail presence from the standpoint of how effective your sales force has been. And how could the quality of the smartphone overall is versus the high end of the market? And third is more specific to how we should be thinking of the expenses related to EV, where I noticed you’ve flashed out how many people had applied for, and how many have been — have started to work in that segment. Could you take us through what that cost point is at this stage and how that’s likely to evolve and how we should think about that and baking that into our numbers? Thank you.

Thanks, Piyush. On the offline store expansion, as we mentioned previously, we are significantly lower in terms of number of stores versus our peers, right. If you look at OPPO and Vivo, each of them has probably 20,000 sales points in China. At this point, we are still very, very low in terms of where we are. I mean, obviously we believe that we can be more efficient and we don’t need to have that many stores to achieve their market share, right. But I think for — if you compare the market share store, I think we are much higher versus OPPO and Vivo at this point.

Key lessons learned, obviously, number one is that these stores needs time to ramp up. If you think about 10,000 stores, we are hiring 10,000 employees into Xiaomi, we assume one store manager per store, right? And that puts significant pressure on training these people on getting them up to speed, on getting them familiar with selling Xiaomi product, etc, etc. So we have to implement a lot of training sessions for them to learn about our style, our culture, how to sell the product, etc. So obviously, it takes longer — it takes a while for these stores to get ramp up. I think that’s one of the key lessons learned.

And so, for the next few months, I think, what we are spending consider efforts, trying to ramp up the profitability — the productivity of these stores. I think what we’ve been encouraged to see obviously is our business partners, because a lot of these stores are not opened by us — opened by our business partners. And they only open more stores with us if they make money, right. And we’ve been talking about this how I model for a while now, which we think is working, because if you look at the number of average stores open per partner, that number has been increasing. So at the beginning, each partner probably opened like three-ish stores for us. In the most recent data that we collected, they’re opening more than five stores with us.

And that’s something that we want to — we are encouraged to see, because obviously they’re making money, otherwise they won’t be opening that many stores with us. So that’s something that we’ll continue to work on, increase the productivity of each store, improve the returns of each partner so that they will continue to build their network with us.

In terms of EV expenses, right now it’s still relatively small compared to other parts of our business. So that’s why we are not breaking that out at this point. I think this year will continue to be low versus where our other businesses are. But as we grow the business, we also thinking about how to better disclose the expenses related to EV, so that analysts and investors will have a better view. So stay tuned on that. We are not quite ready yet, but when we are ready, we’ll let you know.

I think — sorry, one last point you mentioned. So obviously we do see higher percentage of premium products sold in our offline stores. I think that that’s something that we’ve observed as well. So that’s why, as we continue to push our effort into the premium smartphone side, these stores will also be very, very helpful in that distribution.

And our next question comes from Gokul with JPMorgan. Please go ahead.

Thanks for taking my question. My first question is about competition in China. It seems like HONOR has come in and taken a fair bit of market share in a short period of time. How do you see competition evolve now that there are four local brands who are all competing for market share? How does Xiaomi plan to kind of gain further market share in addition to the offline push in the next, let’s say, 12 to 18 months? I think previously we’ve talked about potentially getting to high teens to 20% market share. We were there in first half of the year. Seems like there has been a little bit of a slippage in Q3. Could you talk a little bit about how we think market share evolves in China?

Second is on the overseas Internet business. Alain, I think you talked a little bit more in detail about advertising growth in overseas. Could you also get some more details on where is the revenue coming from overseas, is it primarily coming from the higher ARPU areas like Europe or is it more broad-based in terms of the overseas Internet revenues? Thank you.

Yeah. Regarding to the competition, actually we have a lot of competition. Actually, we respect every competitors in this market. China is the most competitive market. I think we — instead of looking at what competitors are doing, actually, we should focus more on ourselves to improve the user experience, the quality of our product, improve the channel coverage. I think that’s the way we are doing it. So, actually focus on our key strengths. I think one of the strengths we have is we have the scale. Right now, we have — last year, we have almost 150 million smartphones shipped to the global market. We have that scale. Scale means we have higher efficiency. We have a better cost structure. That’s the key strength we have. And also, we optimize everything in terms of the R&D and also the channel cost. So that’s what we are doing now.

I think we are confident that in the future while we are building our coverage in offline in China, we will continue to improve the efficiency, and that I think we are confident we can compete with anyone more efficiently. It takes a little while for us to establish the offline channels in China, but actually we are still the leader in the online market and also we have a very broad global market. So I think that’s all our strengths.

I think, Gokul, a couple of other points. Obviously, in Q3, our market share was lower than Q2. I think one of the key reasons was really the strong performance by the iPhone 13. I think it actually managed to squeeze all the Android players down in terms of their market share. So I think that’s the first factor there. They are still very, very strong. I think, second thing is, obviously if you look at some of the recent market shares that we have in the Chinese market, we’ve seen — last week, we’ve seen 16.5%, two weeks ago, we’ve seen 18.6%. So, as the November 11 festival plays out, we’ve been able to achieve a pretty high market share on a weekly basis in China.

Third point is also — and I think this is a point that we’ve made for the past couple of quarters already. As we are facing supply shortage, we are also trying to optimize our product portfolio globally, because we do have 100 markets to take care of and so we have also been strategically I mean allocating our resources globally to make sure that we are satisfying as much as we can all the channel demand under the constraint supply that we are getting. So I think that kind of addresses your question on the market share.

With respect to the overseas Internet revenue, I mean, frankly speaking, we haven’t been doing a lot of monetization, although some of these search revenue, pre-installation revenue comes naturally but obviously, we’ve been focused on growing our user base. And as I just mentioned earlier, I think this past nine months, we increased our user base by over 100 million. And so the user base increase is actually helpful to our Internet revenue. In terms of regions, I do think that if you look at the breakdown, the higher ARPU obviously comes from the more developed markets such as Western Europe, part of Latin America, then over Southeast Asia, etc. So I think you do see similar trends with respect to the economic development reflected in the overseas Internet services revenue.

Got it. Thank you.

Thank you. Our next question come from Leping Huang [Phonetic] with CICC. Thank you.

Okay. Good evening, management. Thanks for taking my question. And I have two questions. The first one is about the overseas smartphone markets, especially in India and Europe. So could management share the future channel strategy of these two markets and how well Xiaomi increase the SP of smartphone in these two markets?

And the second question is a follow-up question about either business. We see that recently the company registered the second car company. So could management update either business such as the number and focus area of R&D team and the construction of supply chain? Thanks.

Yeah. I think, yeah, every market actually is different, specifically in Europe. Actually we continue to execute the channel strategy we’re using right now. So in Europe, actually there are half-a-half market in terms of the market share half as the open market, we sell the product, our smartphones, our ALT products through the open channel. That means the big chain stores like a medium market and others, right. We sell our product through that channels and other smaller channels that’s open market. That still represent 50% of the European market. Another half will be the carrier market. Actually we have been establishing a partnership with the global carriers, especially European carriers. So we’ll continue to grow that market. Still up to now, our market share in the carrier channel is still, they have a lot of room to grow.

So especially in the higher tier product, this high end product, we’ll continue to strengthen the partnership with our partners — with our carrier partner to help them and help ourself to increase the market share in the high tier segment. That’s the very important thing to do. India market is a different. Indian market actually online market is close to 40%. The online market is highest market share globally among all the countries. So we’ll continue to strengthen our position in online market through the dot-com and also our partners including the Amazon and Flipkart. But at the same time, we’ll continue to grow the offline channels in the India market. And India market actually is the mom-and-pop stores. There are thousands of those stores covering the cities and also the rural area. So we’ll continue to improve the coverage. We use a very high efficient methodology to cover those areas. We’ll continue to do that.

So this year, actually our challenge in India is the shortage and also pandemic give us a very big challenge on the manufacturing side, as well as the channel side as well. So I think next year is they are going to be improvement in supply and also the pandemic we hope. We see a very big potential to grow our market share in both Europe and India, as well as Latin America and the Southeast Asian countries.

Yeah. On the EV side, unfortunately there’s not much to update. I think we’ve been spending time and efforts on defining our product as well as the product design as well as reaching out to some of our supply chain partners. We are starting to reach out to our supply chain partners. But beyond that, I think that there’s not much to do. I mean, obviously not much to say. I mean, obviously, you’ve seen that we’ve registered a couple of companies, obviously from a corporate structure perspective. We also need to set up the corporate structure. And so that’s been progressing on schedule.

Okay. Thanks a lot.

Thank you. Now, you might have last question and the question is come from Xu Yingbo with CITIC. And please go ahead.

Thanks for taking the question. My first question is about overseas Internet revenue. We are very glad to find that overseas Internet revenue keep on acceleration on increase. And also, when we calculated overseas ARPU, it keep on increasing quarter-on-quarter. So my first question is that, could you please give us some color on the forecast of the Internet business, especially the overseas Internet business.

And my second question is about AIoT business. We find that we have launched a new refrigerator and washing machine has been launched for a while. So could you please give us some forecast for the next year’s AIoT revenue increase? So, thank you.

On the overseas Internet question, again, we’ve been trying — what we’ve been trying to do is to increase our number of users in the global market at this point in time. Again, if you look at the average ARPU in the overseas market, it remains quite small, quite low, but at the same time, because we have such a large user base. We’ve been able to get a pretty significant revenue from the Internet services side. And going forward, we are optimistic that we will continue to increase the number of users that we have in the overseas market. And as a result, I think it’ll continue to grow quite naturally. So I think that answers your first question.

On your second question with respect to the AIoT business, I think we’ve been trying to improve our product mix as well as improve each category of our products over time. So, for example, this year we’ve seen a very popular product on the air conditioner side. We’ve seen very good responses on the premium refrigerator. We’ve seen very good responses from our Pad. And we’ve seen very positive feedback from our variable business as we improve the interconnectivity between them as well as our smartphone.

So we’ll be encouraged by some of these product lines that we have continued improvement and continued popularity among our users. And that’s something that will continue to do. But, as you know, AIoT is a very diversified business line. We do have a lot of SKUs. Some of them will be doing better, some of them will be doing worse in one year. So over time, I think kind of we will continue to see — we are quite optimistic. We’ll continue to see growth in this area overall.

And also, I think, as we ship more and more high end product to the overseas market actually will improve the international service as well.

Thanks, Xiang and Alain. Thank you.

[Operator Closing Remarks]