Build my resume

- Resume builder

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

7 Business Resume Examples That Got the Job in 2024

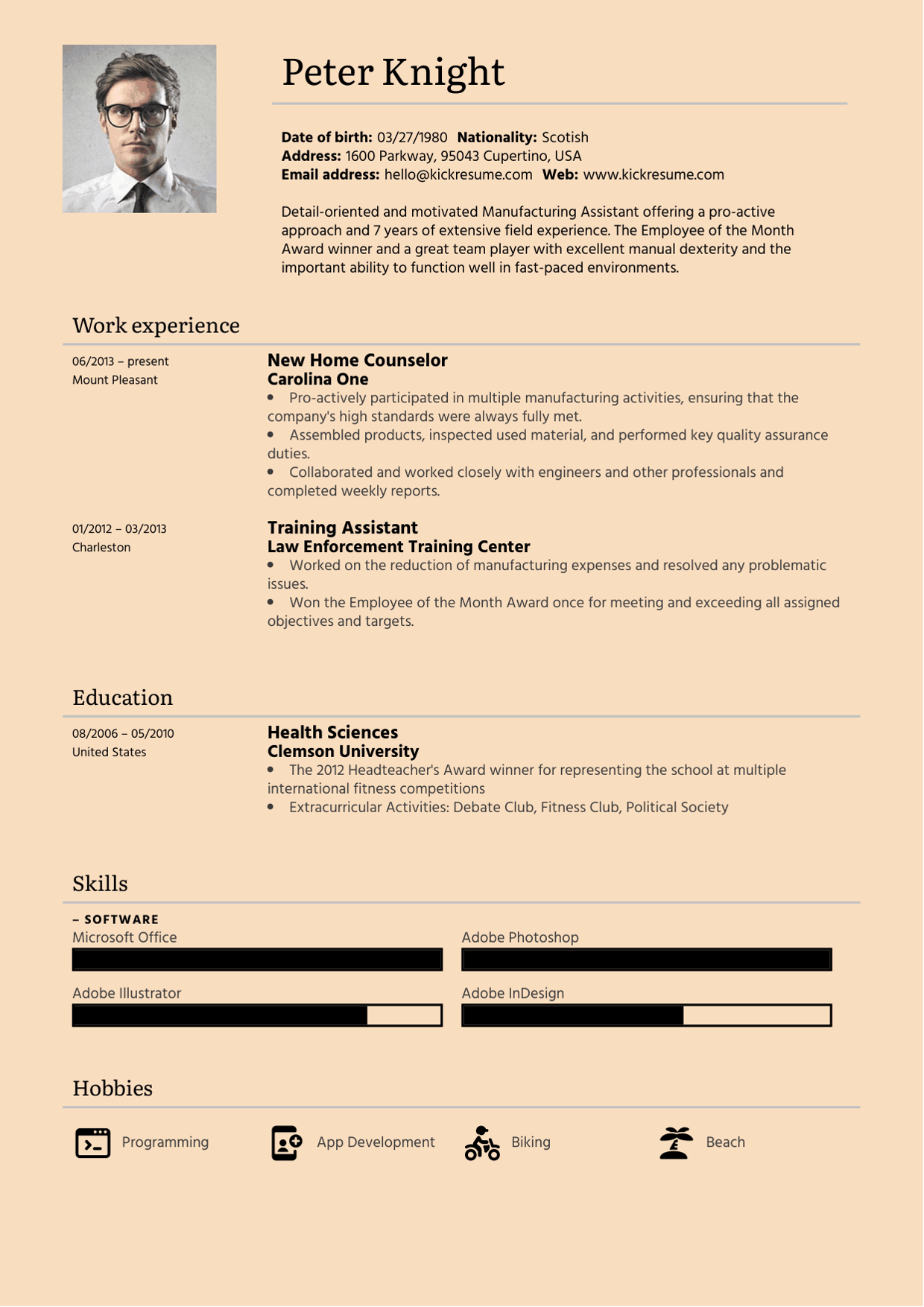

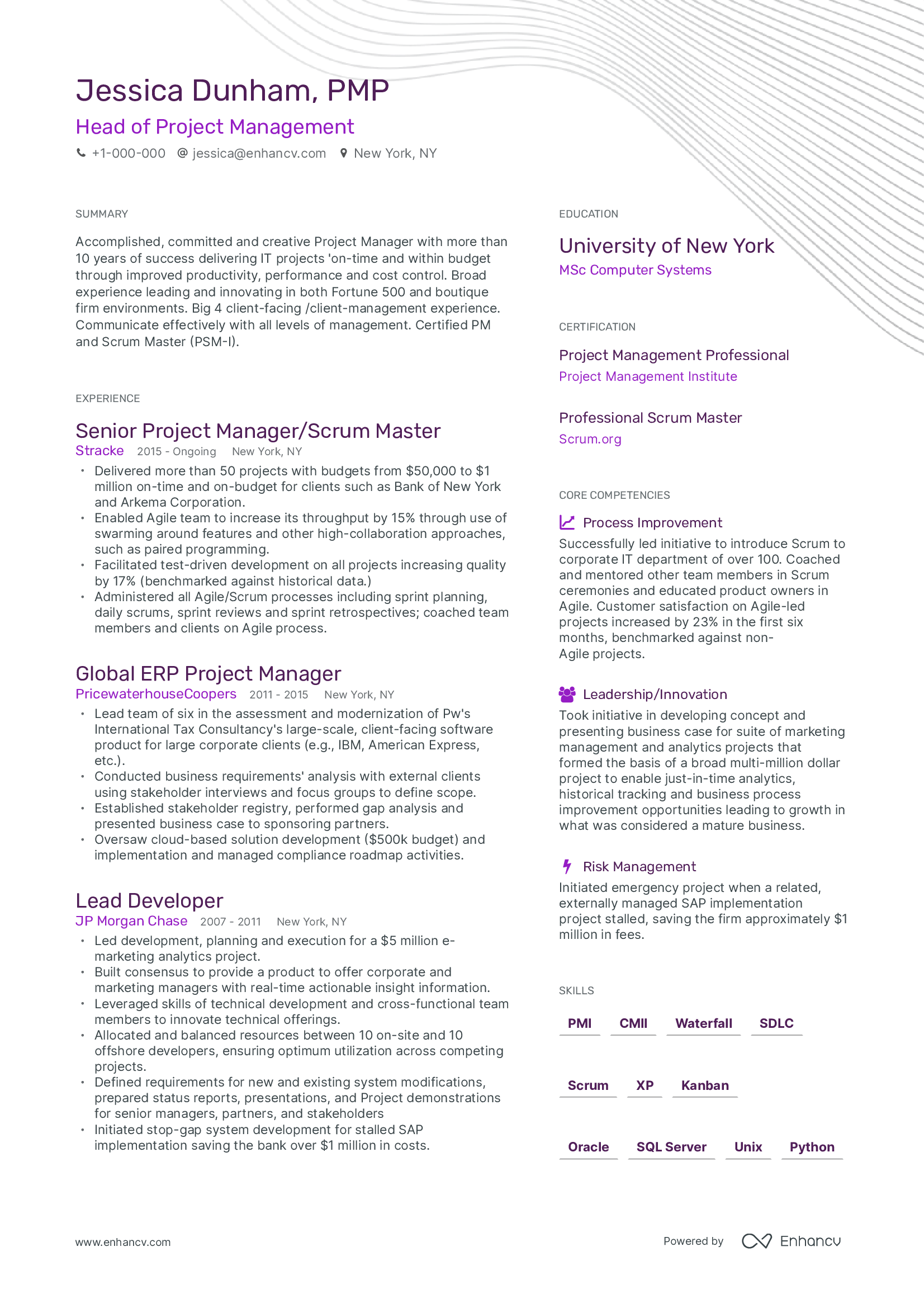

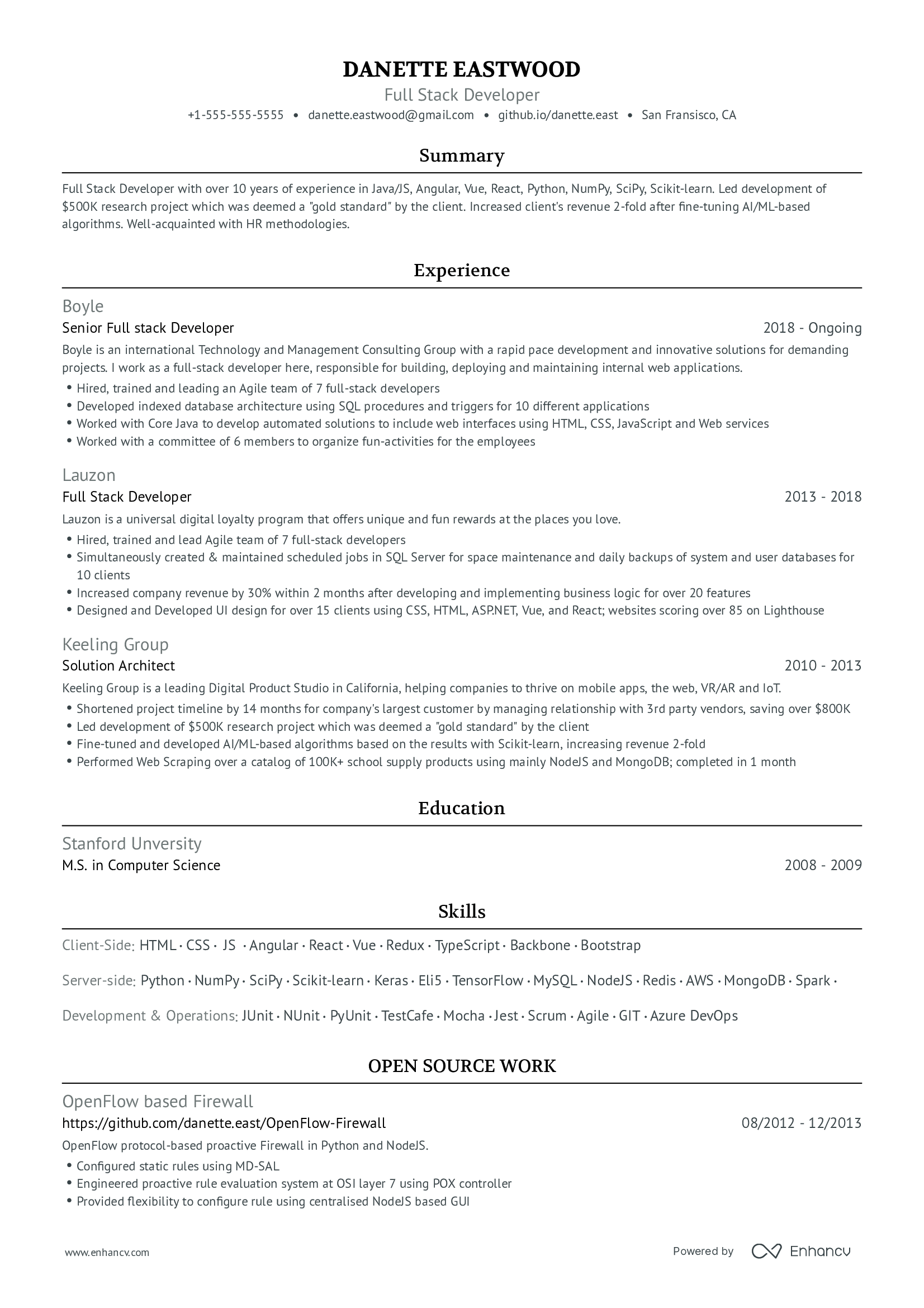

Best for senior and mid-level candidates

There’s plenty of room in our elegant resume template to add your professional experience while impressing recruiters with a sleek design.

Resume Builder

Like this template? Customize this resume and make it your own with the help of our Al-powered suggestions, accent colors, and modern fonts.

- Business Resumes

- Experienced Business Resumes

- Business Resumes by Role

How to Make a Business Resume

Some college degrees provide limited options, whereas pursuing a business degree opens endless doors. From overseeing the operations of a business to recruiting top talent, business occupations can be highly rewarding.

Writing the perfect resume and tinkering with a cover letter maker may seem like the least fun way to spend your time, but like your career choice, if you invest in some upfront work, your resume will work hard for you, and the rewards can be limitless .

We’ve done the heavy lifting, so you can spend more time hunting for that ideal job.

Take advantage of our seven business resume examples and our proven writing tips that will set you up for success. Your resume, we’re sure, will stand apart from the competition, ushering you into your dream job in 2024.

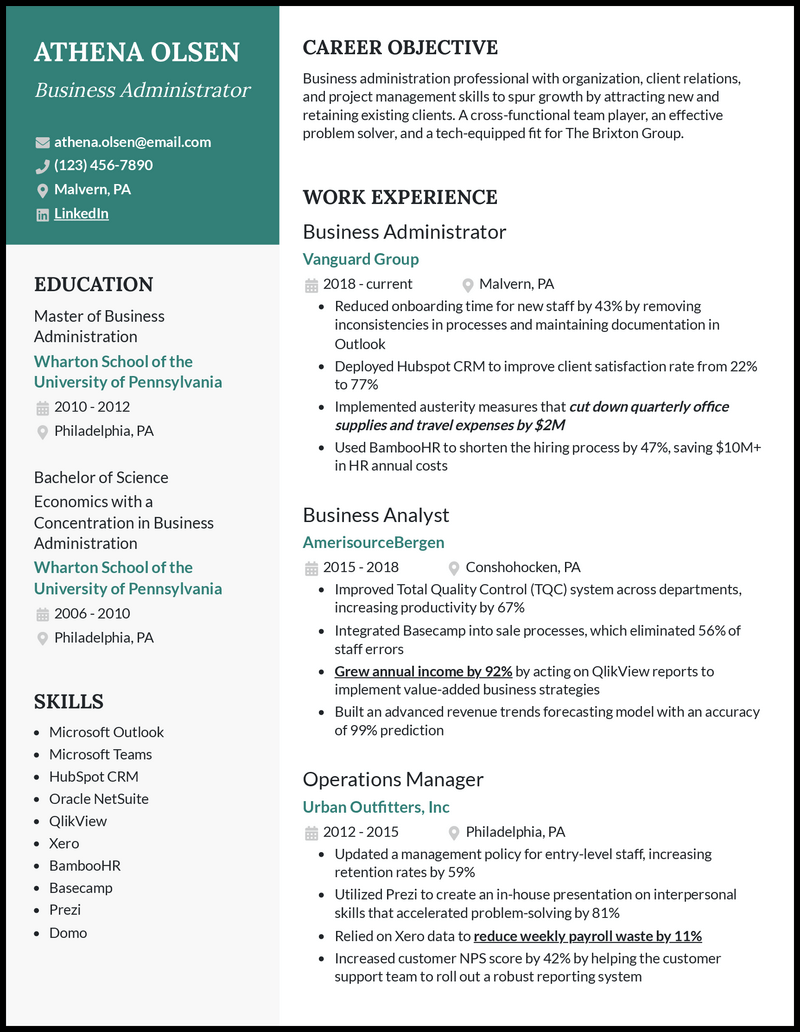

Business Resume

or download as PDF

Why this resume works

- Your business resume can benefit from a resume summary if you’ve been in your industry for at least 10 years. While not required, it can showcase your work experience and any specializations you’ve acquired along the length of your career.

- While you’re job hunting, verify that you’re qualified for the role as some positions require a master’s degree. An MBA will really help you stand out among other applicants on your business resume.

- We suggest you show how you met those goals using numbers and statistics, as they’re easy to read and speak volumes quickly.

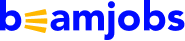

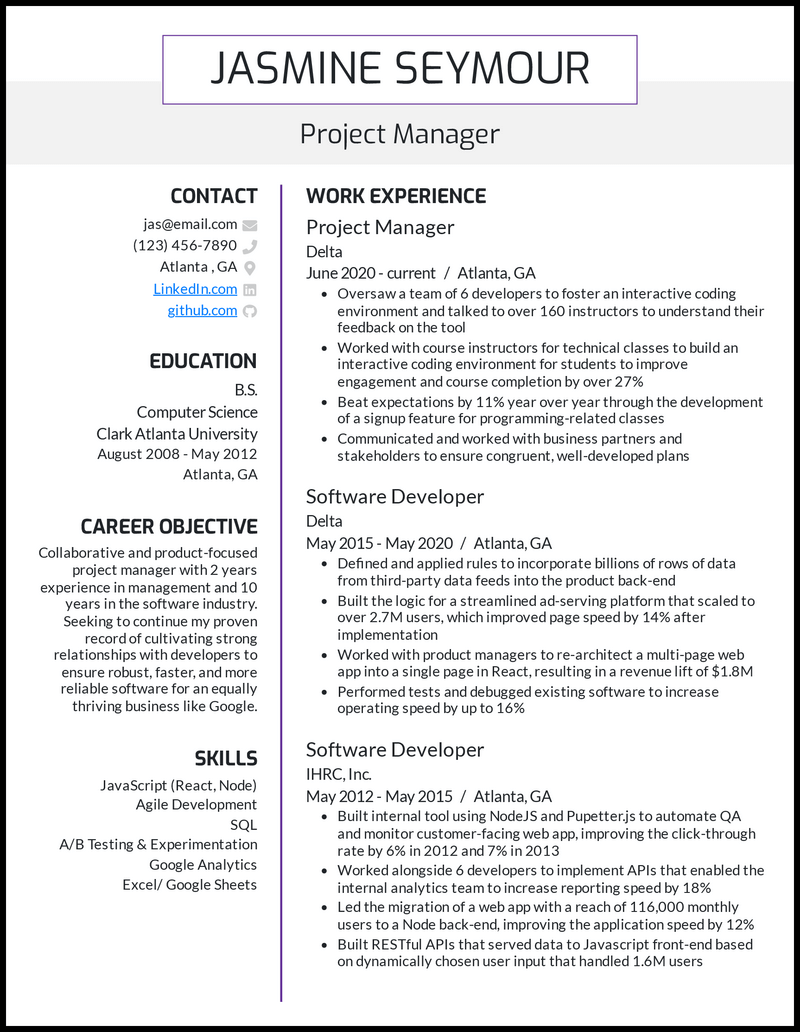

Business Student Resume

- You already have a track record in increasing traffic, boosting brand visibility, and using analytics to grow brands. Leverage past success to propel your potential in your business student resume.

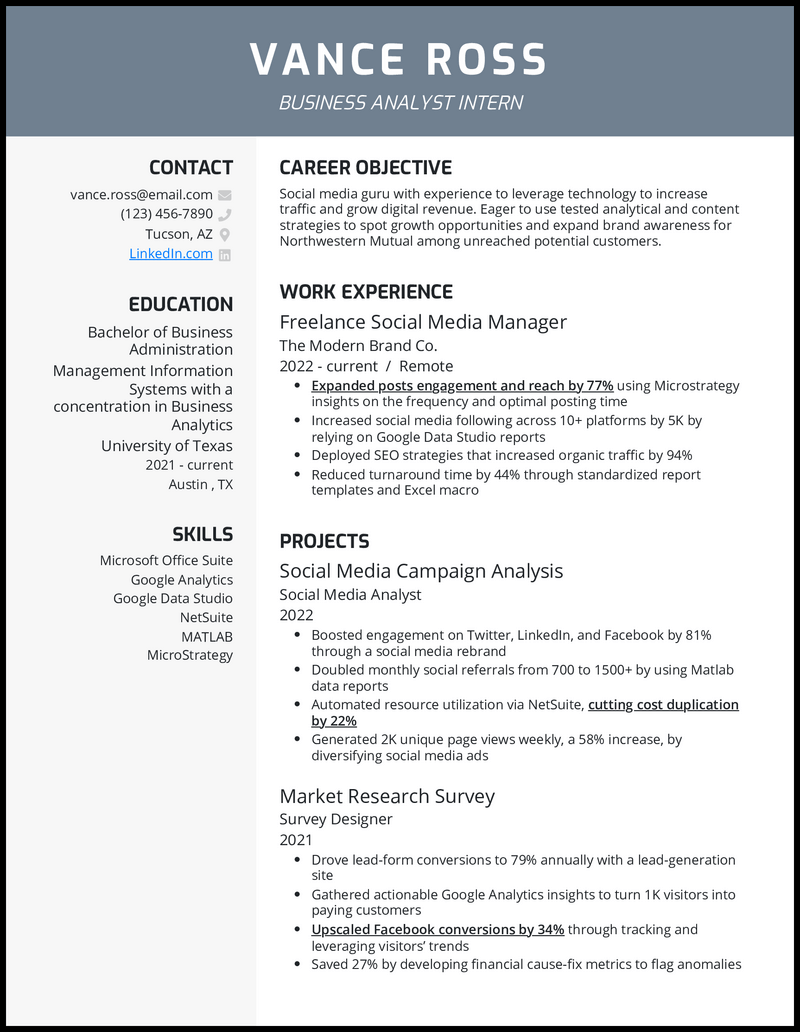

Experienced Business Analyst Resume

- It’s a good idea to include abilities that are mentioned in the business job description of the position you’re applying for (if you’re honestly skilled in those areas). Don’t fib, but don’t sell yourself short either!

- For example, if you’re skilled with SQL, try writing about the impact you made using SQL in a previous position.

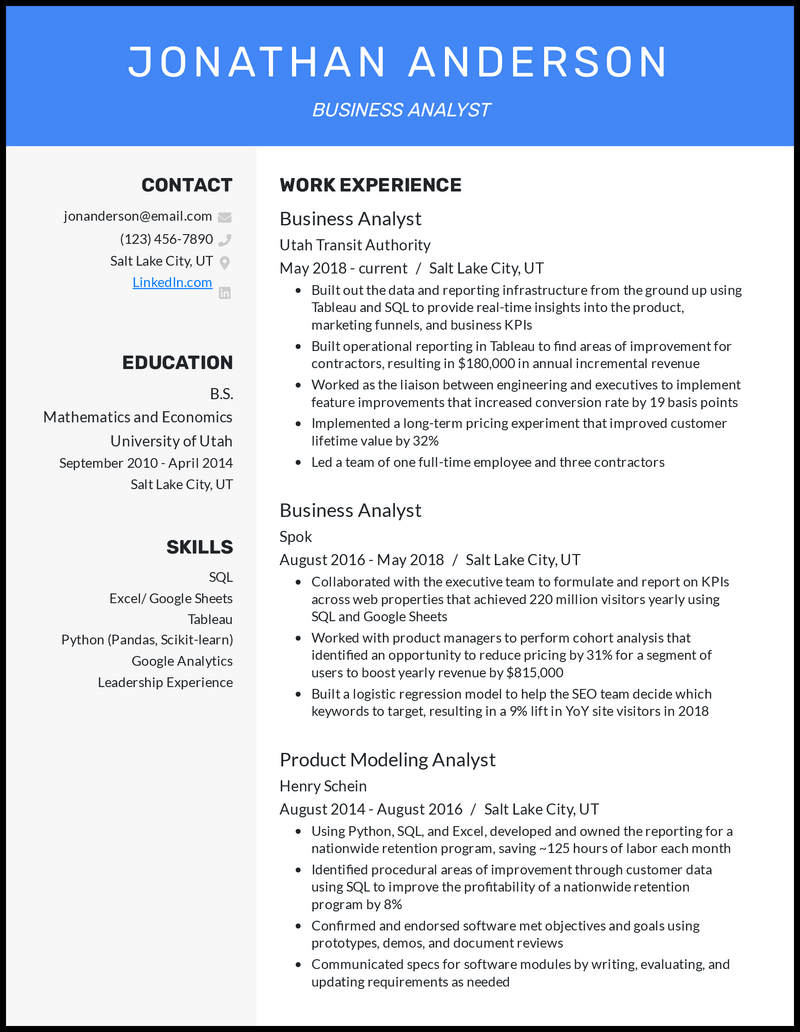

Experienced Business Development Manager Resume

- Reverse-chronological formatting displays your most recent or current position at the top, which will likely be most similar to the position you’re seeking.

- This format also shows the evolution of your career history naturally. Your latter work history may detail more basic duties and less responsibility, and you’ll want the job you’ve listed first to clearly showcase your advanced expertise.

- Choose a template that’s both professional and eye-catching.

- Be consistent with your resume formatting . Headings, font, and even punctuation (or lack thereof) should be consistent.

Business Administration Resume

- Display how you helped cut costs, increased productivity, automated processes for optimal performance, etc.

Business Management Resume

- Avoid personal pronouns, adjectives, or non-active verbs. Instead, start with strong verbs, such as “defined” and “beat.”

- Make your way over to our free resume checking tool for more on using active verbs, getting your grammar just right, and ensuring your resume’s spit-spot.

- While optional, a well-written, concise couple of sentences highlighting your best self, coupled with a few impressive metrics, can be a slam dunk for an interview.

- Keep each bullet point’s content fresh and varied.

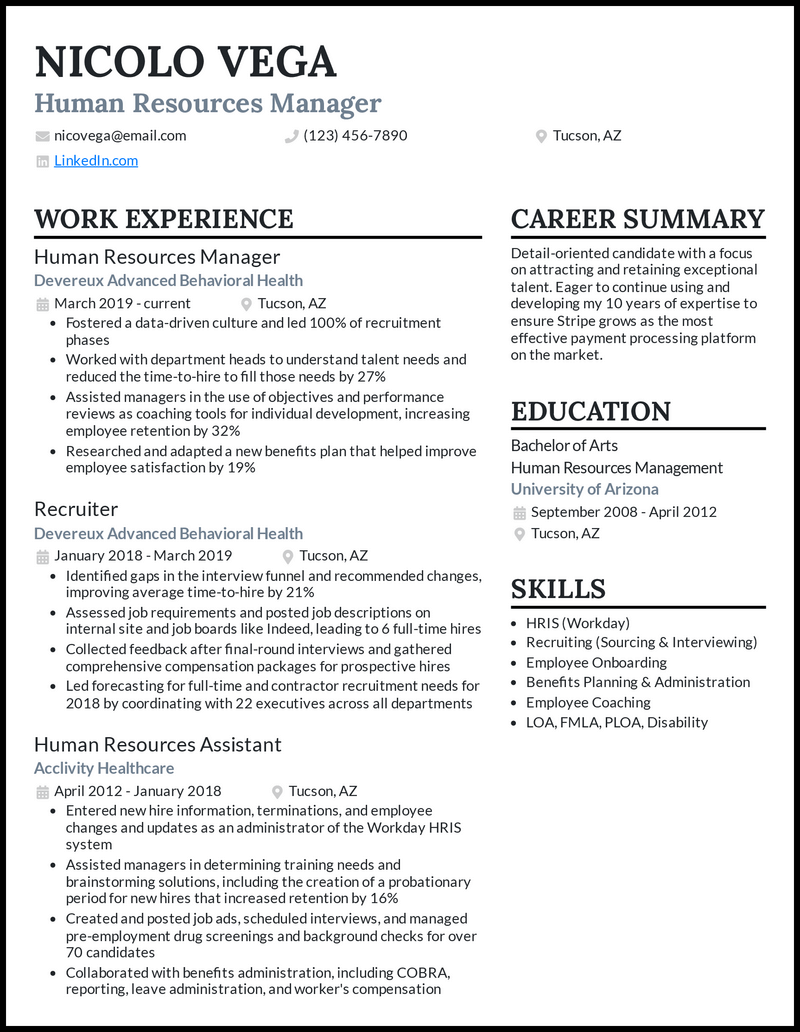

HR Business Partner Resume

- Many times, adjusting the spacing, margin size, or even rearranging the sections can do just the trick.

- Accomplish this with a resume career summary if you boast at least 10 years in your field. It’ll set you apart from the rookies! You can leverage your summary to remind the employer that you want this position and are aiming to contribute to the rise of the company with any noteworthy specializations you have under your belt.

- A final formatting tip—prominently display your contact information close to your name, so a busy employer can readily and easily contact you; don’t give them a reason to trash your resume.

Related resume guides

- Business Development

- Operations manager

Stay tuned for a quick step-by-step guide on how to make your own business resume. Use this guide and a business resume template above to get your foot in the door.

Choose a professional resume template that compliments the company’s tone. A business degree opens the door to a myriad of jobs, which range from casual to formal roles. As a business development manager in the healthcare industry, you might choose a more traditional resume template. On the other hand, if you plan to your use your business degree to be a project manager in the travel industry, a creative resume template could work well.

Within your resume’s contact header, add the business title you desire beneath your name. Get this information directly from the job description. For instance, a business development specialist might also be called a business development associate or business development representative. Adding this professional touch is one way to show the company you care about getting the details right.

If you have a master’s degree in business, list that first. Follow that with your bachelor’s. If you’re freshly graduated, consider adding relevant coursework, such as Principles of Operations Management or Business Finance, beneath your most recent education as well as your GPA if it’s above a 3.5 and any academic awards that are relevant to your degree.

Ask yourself how your work tangibly impacted a company or further developed its operations and processes. Did you identify gaps in reporting, which led you to oversee the development of more robust documentation? Did you experiment with pricing to improve customer lifetime value? Did you increase annual revenue through a referral program you created?

Your resume’s job description bullet points are a chance to share quantifiable business accomplishments rather than daily responsibilities. And your business cover letter is the perfect place to dive into the details of how you made those accomplishments happen.

Your business background means you could be skilled in communication, CRM, negotiation, employee onboarding, or even technical abilities like SQL, Python, or data analysis. It depends on the direction you’ve gone and the company’s job description that’s caught your attention. Try jotting down your skills. In a new column, jot down the skills mentioned in the job listing. Which ones are the same? Those are the business skills to include in your skills section.

Land your next job with our AI-powered, user-friendly tool.

Gut the guesswork in your job hunt. Upload your existing resume to check your score and make improvements. Build a resume with one of our eye-catching, recruiter-friendly templates.

• Work in real-time with immediate feedback and tips from our AI-powered experience. • Leverage thousands of pre-written, job-specific bullet points. • Edit your resume in-line like a Google Doc or let us walk you through each section at a time. • Enjoy peace of mind with our money-back guarantee and 5-star customer support.

Resume Checker Resume Builder

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Business Resume Examples & Writing Guide for 2024

The business world offers an infinite number of opportunities for success, but you’ll need a well-crafted resume to get your foot in the door. When writing a resume, it’s important to understand the process it goes through.

After a hiring manager receives applications, they’ll skim over each one to look for qualified potential employees, reducing the hiring pool to a handful of candidates for in-person interviews. But fret not! With a great business resume, you'll already be well ahead of your fellow applicants.

Read on to learn how to:

- Craft a compelling business resume summary

- Optimize your work experience section

- List your education properly

- Write an effective skills section

- Find the best job search resources for business professionals

1. Write a compelling business resume summary

When hiring managers look at resumes, they normally have dozens to go through, especially for entry-level business positions. If they thoroughly read every single resume, this process would take hours. Most businesses today usually use programs that automatically scan for keywords they’ve listed in the job listing, like “ work ethic ”, “ qualified ” or “ experienced ”.

After passing the computer test (which greatly reduces the candidate pool), hiring managers will usually go through applicants’ resume summaries to further refine candidates before deciding which candidates will receive an in-person interview. Obviously, your resume summary needs to be strong.

The best way to look at the resume summary is a personalized elevator pitch , a brief statement that explains exactly why you are perfect for the position. Read over the job listing to find some of the key skills and experiences they’re looking for in an employee. For example, if a company says they’re looking for an experienced administrator with exceptional organizational skills, you’ll want to include these terms in your summary.

Also look to include your educational background and experience in this section as well, making sure you don’t exceed three sentences . By including terms used in the job listing, you’ll find that hiring managers won’t be able to resist reading the rest of your resume.

Here's an effective example of a business resume summary

Results-driven business professional with a proven track record of driving revenue growth and improving operational efficiency. Strategic thinker and problem solver with expertise in market analysis, business development, and project management. Led a cross-functional team to successfully launch a new product line, resulting in a 25% increase in annual sales.

2. Optimize your work experience section

Your work experience shows hiring managers why you’re right for a position, but it’s important to know what hiring managers are looking for. Unfortunately, most people think that they can list off their job responsibilities and call it a day.

Trust us when we say this is the absolute worst thing a job candidate can do, turning off a hiring manager almost instantly.

Hiring managers don’t need to know what you were supposed to do at a job; instead, they want to know exactly what you did and accomplished at your past workplaces.

As someone looking to work in the business field, you likely have a lot of job experience that’s relevant to a position. Tell hiring managers more about your past jobs by providing them with specific measurements. For example, if your department increased revenue by 25% in a single quarter, talk about how you contributed to this increase by pointing out exactly what you contributed to your team.

For each job (start with your most recent position) and include relevant, measurable experiences in 5-6 bullet points to show how what you can bring to a potential employer.

Here's an example of a great business experience resume section

- Conducted thorough market research and analysis, identifying new market opportunities and consumer trends that led to the successful launch of three new products, contributing to a revenue increase of $2 million annually.

- Led a cross-functional team of 10 members in implementing process improvements, resulting in a 20% reduction in project delivery time and cost savings of $500,000.

- Developed and implemented a customer retention strategy, resulting in a 15% increase in customer retention rate and an additional $1.5 million in recurring revenue.

- Collaborated with the sales team to optimize pricing strategies, resulting in a 10% increase in profit margins and an additional $1 million in annual revenue.

- Conducted financial analysis and forecasting, resulting in the identification of cost-saving opportunities, leading to an annual expense reduction of $300,000.

Try our AI Resume Writer and have your resume ready in minutes!

3. list your educational credentials succintly.

While experience is always important, your business education can open a lot of doors as well. However, a lot of people will list their school, degree, attendance years and GPA. This is a total snooze fest and isn’t going to wow a hiring manager. You’ll want to include what you accomplished in school as well as specific programs you completed that prove you are the best fit for a job.

For example, if you minored in finance and worked as a club’s accountant, you will want to point out both your minor and your experience in your extracurriculars. By relating your educational experiences to the job you’re applying for, you’ll make your educational section stand out as well as show an extra layer of qualifications.

Finally, make sure to limit what you write to a few sentences by selecting experiences that are relevant to the position . No one needs to know that you were a part of the glee club for one semester if you’re applying for a business administrative position.

Here's an effective way to list your educational credentials

Master of Business Administration (MBA), XYZ University, City, State

Specialization in Marketing and Strategy

- Graduated with Distinction\

- Bachelor of Business Administration (BBA)

- ABC University, City, State

Concentration in Finance

- Dean's List for Academic Excellence

- Certified Business Analyst (CBA)

- International Institute of Business Analysis (IIBA

Find out your resume score!

4. Choose the right skills for your business resume

As someone looking to work in the business field, you likely have a lot of skills . From your top-notch organization to your ability to create spreadsheets in a matter of seconds, you have a lot to bring to the table for any business. However, a resume isn’t going to have enough room for you to include every skill that’s relevant to a position.

You need to talk about your skillset that’s relevant to the position you’re applying for (yes, this means you’ll want to examine what you include in your resume for each business you apply to, making edits depending on the job listing).

Instead of listing every skill you have, list out all of your skills in a separate document, organizing them into two categories: soft and hard skills . Soft skills are your internal skills, including time management and work ethic. Hard skills are (usually) what we think of with skills, meaning physical skills like typing speed or writing.

Next, look at what the job listing is looking for. If they want someone with great communication skills, talk about how your leadership and teamwork abilities. Do they need someone who is great with computers, talk about what programs you’re proficient in. Tailor your skills section to the job you’re applying for , limiting this section to about six different skills.

Here's an example of the best business hard skills for your resume

- Financial Analysis : Proficient in analyzing financial statements, conducting financial forecasting, and performing ratio analysis to evaluate company performance and make informed business decisions.

- Market Research : Skilled in conducting market research, competitor analysis, and customer segmentation to identify market trends, customer needs, and opportunities for growth.

- Data Analysis : Proficient in using data analysis tools such as Excel, SQL, and statistical software to extract insights, identify patterns, and make data-driven recommendations.

- Project Management : Experienced in leading cross-functional teams, developing project plans, setting timelines, and ensuring successful project execution within budget and timeline constraints.

- Business Development : Proven ability to identify and pursue new business opportunities, cultivate client relationships, negotiate contracts, and close deals to drive revenue growth.

- Strategic Planning : Skilled in developing and executing strategic plans, conducting SWOT analysis, and identifying key objectives and initiatives to drive business success.

The best soft skills for your business resume

- Leadership : Effective in leading and motivating teams towards achieving common goals, delegating tasks, and providing guidance to foster a collaborative and high-performing work environment.

- Communication : Strong verbal and written communication skills, adept at conveying complex ideas and information to diverse audiences, and fostering positive relationships with stakeholders.

- Problem Solving : Excellent problem-solving and critical-thinking abilities to analyze complex issues, identify root causes, and develop innovative solutions to drive business improvement.

- Adaptability : Ability to thrive in fast-paced environments, embrace change, and quickly adapt to new technologies, processes, and market dynamics.

Getting a job in business can be extremely rewarding, but you need to take the time to perfect your resume. By delivering a resume with a strong summary and relevant work experience, education and skills sections, your resume will definitely appeal to hiring managers .

Tailor your resume to every job you apply for by basing what you submit on the language of the job listing and watch those interview requests start rolling in sooner rather than later.

5. Must-visit job search resources for business professionals

The Internet is vast, but when it comes to landing your dream job, knowing where to look can be just as vital as having a stellar resume. Here are some top-notch platforms to aid your job hunting efforts if you're in the business field:

- LinkedIn : This platform empowers users with networking capabilities, a robust job listing pool and a profile page that serves as a digital resume. For business professionals, LinkedIn is indispensable.

- Indeed : Housing millions of job postings from companies across the world, Indeed offers a powerful search engine that allows job seekers to filter results, helping you pinpoint your ideal business role.

- Glassdoor : Apart from accessing numerous job listings, on Glassdoor, you can also gain insights into a company's inner workings, including worker testimonials, salary reports and company reviews.

- Vault : This is a tremendous platform for those interested in research. Vault provides employer profiles, rankings, internships, and a wealth of career advice resources.

- AngelList : If you're interested in joining a startup, AngelList has thousands of jobs and can connect you directly with CEOs and hiring managers.

These platforms could be your ticket to securing your dream job in the business field. No matter the site, remember that the key to success is patience, persistence, and a well-polished, up-to-date business resume. Happy job hunting!

Business Resume FAQ

A good rule of thumb is to keep your cover letter under one page. This usually equates to 3-4 concise paragraphs.

While it's important to highlight your skills, don't just list them. Use the cover letter to demonstrate how you've successfully used these skills in past roles.

Each cover letter you write should be customized for the specific job you're applying for. It should echo the language of the job posting and show how you're the ideal candidate for that particular role.

Unless the job posting specifically asks for that information, it's best to avoid discussing salary in your cover letter. This is often better discussed after an offer has been made.

If you have a noticeable employment gap, your cover letter is a good chance to explain it. Keep the explanation brief and steer the focus back to your qualifications and eagerness for the job.

A documentary photographer and writer. Noel has worked for International publications like Deutsche Welle in Germany to News Deeply in New York. He also co-founded the global multimedia project Women Who Stay and collaborated as a journalist fellow with the University of Southern California . He went from traveling around the world to sitting on a couch thanks to the pandemic, but he gets to help other people actually do things (like find jobs) thanks to Kickresume, so he won't complain.

Subcategories

- Account Manager

- Business Development

- Entrepreneur / Business Owner

- Procurement

All business resume examples

Related business cover letter examples

Resume guides

How to write a professional resume summary [+examples], how to put your education on a resume [+examples], how to describe your work experience on a resume [+examples], let your resume do the work..

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

Corporate Resume Templates

Business resume templates made executives or executives-to-be in the corp world. To get started, click on your template of choice below and replace the content with your own. It’s that easy.

Our timeline resume template is made for people who’d like to visualize their climb on the corporate ladder. We added a splash of color to highlight the talking points of the resume.

The compact corporate template packs at 50% more information than a standard double-column template. Fit for execs with over a decade of experience.

Traditional resume template. A classic design that is timeless and appropriate for any industry or job type.

Single Column

Formal resume template. Convey a sense of professionalism and attention to detail with a formal and straightforward design.

Two-column resume template. Present your information in a well-organized and easy-to-follow format with multiple columns.

Minimalist resume template. Keep it simple with a clean and uncluttered design that puts the focus on your content.

In This Guide:

What is a corporate resume template, when to use a corporate resume template, tips for building the best corporate resume, corporate resume templates pros and cons.

Do you want to understand what a corporate resume is? Then you have to understand what a corporation is first.

When we talk about corporations in general, we mean a larger company or group of companies acting as a single entity. These businesses have shareholders that receive dividends and can sell their stocks for profit. A typical characteristic of a corporation is the limited liability of its shareholders. This means that they are not personally responsible for the company's debts.

In general, the main objective of a corporation is to make a profit. The exceptions are incorporated nonprofit charities. It is also typical that each big corporation has its own distinctive internal culture and traditions. Another important thing that you have to know regarding corporations is that they are very formal. Procedures, management style, decision-making and hiring always follow a certain set of rules.

So, what is a corporate resume template?

The corporate resume is formal and professional above all. Numbers, metrics, facts, statistics and results are its cornerstones. This document must show that you have attention to detail, and you are a doer. This type of resume is packed with action verbs demonstrating your organizational and analytical thinking skills . All business resumes are about achievements.

In the world of human resources management, the terms executive, business and corporate resume are overlapping and can be used as synonyms.

- Personality: This type of resume template is suitable for entrepreneurial and business people. If you are interested in the corporate world, management and entrepreneurship, this is the right one for you. One of the most valuable traits in the business world is being a team player , so you need to demonstrate it through your resume. Being a team player does not exclude your ability to supervise teams. You must also be a leader. You can be a formal or an informal leader, and the corporate resume is where you need to demonstrate it.

- Professional field: The corporate resume is suitable for companies offering executive or managerial positions. The professional field does not matter if the job has something to do with management, marketing, or sales. The executive resume is a must when you apply to a firm specializing in banking, finances , investments, law, marketing, management, sales, etc. with no regard to hierarchy.

- Company: If you want to work for the top 100 corporations in the world such as Berkshire Hathaway, JPMorgan Chase, Bank of America, HSBC, Barclays, Kirkland & Ellis, BlackRock, Allianz, etc. your best opportunity will be to submit an impeccable resume in a formal corporate style.

- Background and education: The background and education of the candidates submitting corporate resumes reflect the industries mentioned a few lines earlier. They almost always come from business, management, or sales backgrounds and schools. The applicants for high executive-level positions usually have MBAs.

- Hierarchy: All business-related positions require a professional corporate resume. You could be submitting a resume for an intern position, but you still need to show that you know the rules.

The corporate resume shows your future employer that you understand the rules, and you will play by the book.

The design of the corporate resume should be formal and reserved. The minimalist approach is the safest one in this case. You can use infographics to present information related to numbers in a way that will save some space.

Bullet points in the Job Experience and Education section are highly recommended. You can also use small stylized icons for your Achievements and Skills sections, but make sure they are not too expressive.

Make sure your sections’ headings are bold and impressive. This will make the resume easy to navigate and will suggest a strong character.

Play safe and do not add a background color. Your resume can still be attractive with a white background.

Arial is often used in official correspondence, so it is a good choice, albeit a bit boring. Enhancv resumes use Lato as a more modern, yet ATS-friendly font. You can also choose other fonts as long as they are readible serif and sans-serif.

Do not use more than two fonts . You can write your headings in a different font than your other content.

The font size should be 11-12 but not less than 10 and the headings should be between 14 and 18.

The use of colors on a corporate resume should be limited and subtle. Do not use more than 2 different colors. You can highlight your sections’ headings and your header. A little trick you can apply is to use the color of the company you want to get a job at. Each corporation usually has distinctive colors they use on their logo, slogan, or corporate website.

The layout is very important because it should allow the recruiter to take a good look at your resume in less than 10 seconds. This is how much time you will get. Remember this. How your hiring would benefit the company should be clear immediately. This is why the most important information must be presented in a condensed way in the Summary section. The first one-third of the resume will get the most attention.

The Header is what the recruiter will see first. It should contain your name, address, phone number, email, and social media accounts.

You can use a bigger font size for your name to make a statement. Use size 14-20. Do not forget to include any honorifics if you have one.

Your email should look professional and contemporary. Use your name instead of a nickname and modern email service such as Gmail.

If you have a LinkedIn, you should also include a link to your profile in the Header section. This is also a good alternative if you decided not to include a photo. In this way, the recruiter will be able to see your photo on LinkedIn.

The header is also the place where you can include a headline . This is a short phrase or a statement that describes you best. Few examples of headlines

- Goal-Oriented Senior Manager with Ten Years of Management Experience.

- Creative Online Marketing Campaigns Manager with Focus on ROI.

- Restaurant Manager with Extensive Fine Dining Experience.

- Award-Winning Web Designer Skilled in HTML

- Detail-Oriented Sales Manager with a Record of 100 Million USD in Annual Sales

Next comes the Summary section . This is where you can shine in a few short sentences. Make sure to describe your most relevant achievements and skills. Mention your education if it is relevant. Above all, mention numbers. Preferably, profits or turnover you achieved. Remember what we said about why corporations exist? To profit!

But wait? What should I write if I have no experience and achievements and I apply for an entry or training position in the corporate world? Well, in this case, you should add an Objective section instead of a Summary. There you can describe what you want to achieve with your new job and how you intend to use your motivation to help the company.

Next is the Work Experience section . This is the essence of the resume. Try to be short and precise and show some numbers. List your experience in a reverse-chronological order starting with the most recent post. Include the name of the organization with a brief overview, its location, and your job title. Show the period of your employment by adding month and year. Use bullet points to present your duties and responsibilities through the prism of your accomplishments.

Make sure to leave no gaps in your work history or be prepared to explain it during the interview. If a position is not relevant, you worked there a very long time ago, it was in a different industry, or you only worked there for a short period you may not include it depending on the case. The other option is to include it but exclude any details and list it just for the record.

After the Work Experience Section, you can place your Education section . Do not include your High School information if it is not relevant to the position. Start listing your degrees in reverse chronological order.

If you decide to use a two-column format, you can add your Achievements and Skills section just opposite the Education and Work Experience sections, aligned right. In this way, you can put emphasis on the most important information and present it right at the beginning of the document. You can use stylized icons in both sections. Use keywords and short phrases. Make sure to support the information you share in both sections with more details in the Job Experience and Education sections.

In the Achievements section, you could add not only job-related information but also academic or other achievements that are relevant.

The same applies to the Skills section. You can list skills acquired on the job or through courses and education.

Do I need to include any Additional sections ? We recommend you include a Languages section if you speak foreign languages. Languages are very useful in the corporate world. Especially if you work at an international corporation. A foreign language can open the gates to lucrative positions abroad and make you a very prospective candidate for every organization.

In a corporate resume, you could also include more sections such as Certificates, Awards, Projects, etc.

Number of pages

One-page resumes are the best choice in almost any case. The executive resume is one exception. The reason is that unless you are applying for an entry corporate position, chances are your Job Experience will not fit on one page. Feel free to add a new page for every ten years of Job Experience you have.

- They are very traditional and formal. If you follow the protocol, you have higher chances to demonstrate that you know how to speak the corporate language.

- Corporations have a very distinctive internal culture and if you pay attention to their communications you can easily reflect it on your resume. This small effort will earn you extra points.

- Because the corporate resume is so formal, you can easily customize it by making small adjustments when you apply to different companies.

- You are expected to be very formal. If you decide to use creative ideas, you risk being rejected just for that.

- You can not stand out with design and formatting. You will need to use numbers to make an impression.

- You will have to control your individuality and embrace the corporate culture.

Frequently asked questions about corporate resume templates

What is the best resume template for an experienced professional, what is the best resume format for executives, what should a ceo resume look like, is it ok to use a template for a resume.

- Resume Examples

How to List Address on a Resume in 2024 – Format, Pro Tips & Examples

Can i leave a job i was fired from off my resume, overqualified for a job tips to overcome this hurdle, the best resume formats you need to consider (5+ examples included), how to write a resume personal statement (with examples), what should i put in the about me section on my resume.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

- Corporate Recruiter Resume Example

Resume Examples

- Common Tasks & Responsibilities

- Top Hard & Soft Skills

- Action Verbs & Keywords

- Resume FAQs

- Similar Resumes

Common Responsibilities Listed on Corporate Recruiter Resumes:

- Source and attract candidates by using databases, social media, etc.

- Develop and update job descriptions and specifications

- Screen candidates resumes and job applications

- Conduct interviews using various reliable recruiting and selection tools/methods to filter candidates within schedule

- Assess applicants’ relevant knowledge, skills, soft skills, experience and aptitudes

- Onboard new employees in order to become fully integrated

- Monitor and apply HR recruiting best practices

- Provide analytical and well documented recruiting reports to the rest of the team

- Act as a point of contact and build influential candidate relationships during the selection process

- Promote company’s reputation as “best place to work”

- Coordinate with department managers to forecast future hiring needs

- Keep up-to-date with latest recruiting methods

Speed up your resume creation process with the AI-Powered Resume Builder . Generate tailored achievements in seconds for every role you apply to.

Corporate Recruiter Resume Example:

- Implemented a new sourcing strategy using social media platforms, resulting in a 30% increase in the number of qualified candidates for open positions.

- Developed and implemented a new onboarding process, resulting in a 20% increase in employee retention rates within the first year.

- Collaborated with hiring managers to create a new interview process, resulting in a 25% decrease in time-to-hire and a 15% increase in candidate satisfaction.

- Managed a team of recruiters to successfully fill 100+ open positions within a 6-month period, meeting company hiring goals and reducing time-to-fill by 20%.

- Developed and implemented a diversity and inclusion hiring initiative, resulting in a 50% increase in diverse hires within the first year.

- Collaborated with department managers to forecast future hiring needs and create a hiring plan, resulting in a 30% decrease in hiring costs and a 10% increase in overall hiring efficiency.

- Developed and implemented a new applicant tracking system, resulting in a 40% increase in recruiter productivity and a 20% decrease in time-to-hire.

- Collaborated with HR team to create a new employee referral program, resulting in a 25% increase in employee referrals and a 10% increase in overall hiring efficiency.

- Conducted training sessions for hiring managers on best practices for interviewing and hiring, resulting in a 15% increase in candidate satisfaction and a 10% increase in overall hiring efficiency.

- Talent acquisition

- Sourcing strategies

- Social media recruiting

- Onboarding process development

- Interview process design

- Team management

- Diversity and inclusion initiatives

- Hiring forecasting and planning

- Applicant tracking systems (ATS)

- Employee referral programs

- Training and development

- Collaboration and communication

- Time management

- Analytical skills

- Negotiation and persuasion

Top Skills & Keywords for Corporate Recruiter Resumes:

Hard skills.

- Applicant Tracking Systems (ATS)

- Candidate Sourcing and Screening

- Interviewing Techniques

- Job Posting and Advertising

- Recruitment Metrics and Analytics

- Employer Branding

- Diversity and Inclusion Strategies

- Negotiation and Offer Management

- Talent Pipeline Development

- Compliance and Legal Knowledge

- HRIS and HR Technology

- Onboarding and Orientation Programs

Soft Skills

- Communication and Interpersonal Skills

- Relationship Building and Networking

- Time Management and Prioritization

- Adaptability and Flexibility

- Attention to Detail and Organization

- Problem Solving and Critical Thinking

- Active Listening and Feedback Incorporation

- Empathy and Emotional Intelligence

- Conflict Resolution and Negotiation

- Creativity and Innovation

- Strategic Planning and Decision Making

- Teamwork and Collaboration

Resume Action Verbs for Corporate Recruiters:

- Collaborated

- Strategized

- Implemented

- Facilitated

- Streamlined

- Coordinated

- Established

- Orchestrated

Generate Your Resume Summary

Resume FAQs for Corporate Recruiters:

How long should i make my corporate recruiter resume, what is the best way to format a corporate recruiter resume, which keywords are important to highlight in a corporate recruiter resume, how should i write my resume if i have no experience as a corporate recruiter, compare your corporate recruiter resume to a job description:.

- Identify opportunities to further tailor your resume to the Corporate Recruiter job

- Improve your keyword usage to align your experience and skills with the position

- Uncover and address potential gaps in your resume that may be important to the hiring manager

Complete the steps below to generate your free resume analysis.

Related Resumes for Corporate Recruiters:

Hr recruiter, talent acquisition specialist, technical recruiter, executive recruiter, senior recruiter, campus recruiter, staffing recruiter, talent acquisition manager.

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

- Resume Samples

Corporate Development Resume Samples

The guide to resume tailoring.

Guide the recruiter to the conclusion that you are the best candidate for the corporate development job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies, tailor your resume & cover letter with wording that best fits for each job you apply.

Create a Resume in Minutes with Professional Resume Templates

- Manage day-to-day activities – interact with sellers / investment bankers; process / negotiate non-disclosure agreements; summarize M&A opportunities; work with internal stakeholders to assess attractiveness of targets and alignment with ICF’s corporate strategy; develop management meeting presentations; coordinate with internal and external stakeholders to ensure all process deadlines are met; maintain M&A target tracking database, etc

- Establish relationships with key officials in certain ministries in Japan central government, targeted provincial government officials, and key industry associations. Coordinate and manage company interaction with such officials, including executive engagements

- Create and manage pipeline

- Developing and monitoring pipeline development, metrics and scorecard

- Manage day-to-day communications with Japanese ministries, government officials, industry associations; manage internal cross-functional communications to coordinate execution of any cross-functional policy initiatives

- Stay abreast of policy developments of importance to the business; advise management team on such developments; consult and coordinate with company stakeholders to establish consensus on policy priorities , and formulate strategies and action plans to achieve objectives

- Lead cross-functional teams in developing business cases and performing due diligence

- Partner with international team to develop business plans and proposals and development activities

- Lead all aspects of the transaction through completion and provides quarterly transaction updates to senior management

- Responsible for management and development of teammates in their geographical area

- Manage a due diligence process and ensure adherence to consistent quality standards

- Participate in the development and implementation of various strategic initiatives

- Responsible to own and manage Hot Spots as they arise within responsible area

- Develop and met expense budget for their team

- Compile and analyze company information on potential acquisition targets covering all aspects of their business and apply the information to develop integrated financial and business analysis, projections, reports and presentations

- Lead and/or assist M&A team on potential acquisition targets and other related projects

- The position will have exposure to all aspects of corporate development including deal sourcing and scoping, business and financial analysis, presentations to senior executives and the BOD, due diligence and interpretation of findings, deal and contract negotiations, closing and integration

- Provide leadership and mentorship to junior staff as well as cross-functional teams in executing transactions

- Lead integration teams and work closely with business units to conduct successful handoffs, post transaction close

- Support acquisitions post-closing to ensure deal drivers are met or exceeded

- Work with RingCentral’s business and innovation teams to understand their business objectives and strategies and then execute through M&A, investments and other strategic transactions

- Excellent communication and interpersonal skills, with the ability to be personable yet persistent

- Strong communication and people skills, personable and able to operate at the highest levels (internally and externally)

- Detail-oriented with strong organizational skills and an ability to manage multiple projects

- Advanced knowledge of power point and excel. Knowledge of salesforce.com

- Comfortable with manipulating and modelling large data sets in Excel / Tableau or equivalent applications

- Strong analytical skills with attention to detail

- Ability to manage work and meet specific deadlines, highly organized and self-sufficient, with high energy and enthusiasm

- Strong initiative and the ability to work well with others in a fast-paced, dynamic environment

- Excellent team player, ability to work within a team in virtual mode with remote resources

- Strong written, oral and presentation based communication skills

15 Corporate Development resume templates

Read our complete resume writing guides

How to tailor your resume, how to make a resume, how to mention achievements, work experience in resume, 50+ skills to put on a resume, how and why put hobbies, top 22 fonts for your resume, 50 best resume tips, 200+ action words to use, internship resume, killer resume summary, write a resume objective, what to put on a resume, how long should a resume be, the best resume format, how to list education, cv vs. resume: the difference, include contact information, resume format pdf vs word, how to write a student resume, corporate development consultant resume examples & samples.

- 2-5 years’ experience in strategy and planning

- Proven project management experience including schedule, scope, issue and risk management experience, change management, strategic planning and analysis

- Proactive desire to broaden and deepen technical, business, consulting and project management skills

- Excellent leadership, communication (written and oral), interpersonal, and organizational skills

- Upbeat, friendly, motivated, and positive team builder

- Advanced proficiency in the use of Microsoft Office applications (Excel, Word, PowerPoint)

- Ability to work permanently in the United States without sponsorship

- Prior investment banking, private equity, or consulting experience is a plus

Corporate Development Resume Examples & Samples

- 6 – 8 years of experience in asset management, investment banking or private equity

- Exceptional leadership and project management skills

- Strong background in client service (internal or external)

- Familiarity with financial statements, valuation and financial modeling

Head of Corporate Development Resume Examples & Samples

- Head a team of 4-5 M&A execution specialists

- Help to identify potential targets through deep insight into the relevant business sectors and an active networking with relevant corporates, M&A advisors and consultants

- Drive the execution process, effectively leading the project team and successfully managing the entire process of the respective transactions up to a successful closing

- To a lesser degree, the professional will also be responsible for strategy development, post-merger integration and internal consulting

- M&A knowledge: As demonstrated by a successful track record in M&A and execution process know-how. The candidate will have a leading edge understanding of managing international M&A projects and driving transactions to a successful closing

- Market knowledge and credibility: The candidate should have built up a seniority and a sector know how to be immediately accepted by the relevant colleagues in the respective business segments. Self-motivation, enthusiasm and a high energy level as well as a style and approach well accepted among large corporates as well as smaller “Mittelstands” companies are other important indicators for a high level credibility

- Effective deal impact and market access: As demonstrated by having built up relationships at board level and with relevant M&A and strategy consultants, maintaining a strategic dialogue and providing value-adding solutions. The candidate will show an extrovert and professional style, communicating impactfully with board members and senior management of large as well as mid size corporates

- Judgement and results orientation: The successful candidate will evidence a strong business judgement and an outstanding track record of successful activity, will be able to reach stretched goals and will constantly achieve beyond what is expected

- Leadership, Collaboration and Influencing: As demonstrated by strong interpersonal skills to build relationships. The candidate will have demonstrated a team approach to solving problems by consulting relevant peers as well as using internal and external networks. The ideal candidate should have demonstrated his/her ability to lead and direct teams as a trusted and respected senior level professional on the basis of solid collaboration skills across all parts of the firm

Corporate Development Program Manager India Resume Examples & Samples

- Provide regular updates to Tech and Ops steering committees on program updates and engaging key senior leadership for program governance across India

- Work with stakeholders and global team on demand planning and forecasting for the program and program strategy

- Analyze performance and feedback to track analysts professional and career progression

- Point person for India on progress reports and management updates for global team

- Work with business representative to ensure consistency of activities across Technology and Operations programs

- Plan & organize events in partnership with analysts stretch teams to improve visibility of the program

- Gather feedback on the program and developing robust strategies to engage and retain analysts while leveraging global best practices

- Manage end to end execution of new analyst CDP Induction (approx 200 analysts annually)

- Execution and project management of 6 weeks Technology Bootcamp Training (approx 120 analysts annually)

- Needs analysis and design of training roadmap for the programs (Technology and Operations) and on going execution oversight

- Manage relationship with internal/external trainers for on-going development of analysts & vendors for training requirements

- Work with internal GSC L&OD teams for program roadmap training delivery

- Deliver training sessions when required for interns or full time analysts

- Expense tracking and budget management for India program

- Oversight of the program website including refreshing content and reviewing existing content

- Provide support to recruitment efforts as required

- Involvement in program wide global, regional as well as local HR related projects

- Work with elected leadership, HR & training contacts to share program processes

- Masters degree with 4-6 years of relevant work experience in managing programs

- Strong stakeholder management skills

- Experience in project management and performance management

- Strong ability to constantly prioritize workload & multi tasking ability

- Ability to deliver presentations in front of large audiences

- Presentable & approachable with strong English written and oral communication skills; interpersonal skills

- Keen interest in people development, creativity and process improvement focus

- Strong PC skills: Word, Excel, PowerPoint, Outlook (Knowledge of confirm it or other survey tools; SharePoint navigation and training central administration is preferred

Associate Corporate Development Resume Examples & Samples

- Play a key role in analyzing potential acquisitions, joint ventures and divestitures as directed, including financial modeling and project management

- Build financial model to help evaluate transaction opportunities

- Collaborate with key stakeholders across the bank to assess the potential acquisition, divestiture, or investment, including Capital, TBSM, and Tax

- Lead project management for due diligence, including drafting the due diligence framework, managing data request lists and data room access, and compiling due diligence results

Financial Products Corporate Development Resume Examples & Samples

- 7 to 10 years of professional work experience ideally with some tenure at a top-tier management consulting firm or investment bank. Strong foundation in business strategy required

- Strong knowledge of business strategy, strategic and business planning, product development, and general business operations

- Experience as a strategic investor and/or within corporate business development also highly desirable

- Expertise in both financial services and technology required. Familiarity with business models in brokerage and information services highly valuable

- Demonstrated ability to define and articulate a product strategy required

- Experience analyzing deal structure, completing valuations, articulating business strategy and positioning with market dynamics

- Exposure to M&A and joint venture processes required

- Exceptional problem-solving, quantitative, and analytical skills; strategic and creative thinker

- Relationship-builder who is solutions-oriented and can effectively link the interests of multiple stakeholders

- Distinctive financial modeling skills and proficiency in Excel and PowerPoint

- Outstanding project management skills and resourcefulness

- Solid business and financial acumen - understanding of fundamental principles of economics and finance

- Collegial orientation; relationship-builder who is solutions-oriented

- Accustomed to "open door" office setting

- Self-starter eager to work in an fast paced entrepreneurial setting

- Demonstrable attention to detail and organizational skills

- Exceptional written and oral communication skills are essential

- Strong personal initiative, good judgment, and impeccable ethics; desire to succeed in a demanding, innovative, and entrepreneurial environment

Senior Analyst of Corporate Development Resume Examples & Samples

- Provide financial analytical support including extensive valuation and pro forma impact modeling on new business opportunities

- Develop and manage a long range company financial model including P&L, balance sheet cash flow and financial/credit metrics

- Prepare presentations/memorandums to the Board of Directors and Senior Management

- Ad hoc analysis and special projects for Senior Management to support strategic decisions

VP-corporate Development & M&A Resume Examples & Samples

- Develops and maintains acquisition pipeline across Sabre business units and functions based on an overall Sabre strategy and key growth initiatives

- Leads the day to day activities of the Mergers and Acquisitions (M&A) team to include, Finance, Legal, HR and sector team members

- Insures due diligence activities are appropriately resourced and insures financial and non-financial risks, valuations, and perspective terms and conditions are appropriately considered

- Leads negotiation process

- Evaluate the viability of outside business partners, merger and acquisition opportunities, alliances, joint ventures, and venture capital sources to support the development and implementation of strategic initiatives

- Leads ongoing relationship management activities post implementation for recurring asset sales and strategic partnerships including ongoing negotiation and oversight

- Manages efficient Due Diligence processes for new business opportunities

- Ensures continued development of teams through communication, performance management, development plans, and training

- Strategic Orientation: This executive needs to be able to work with leadership across the company to build a company-wide strategy. It is imperative that this executive have both the capability to develop a strategy that incorporates the long term goals of the company but is also capable of evangelizing the risk/ reward tradeoffs. Candidates will need to drive a growth strategy in markets that have changed considerably already and are likely to evolve even more rapidly in future. They will therefore need to demonstrate the ability to create a compelling strategy and narrative, drawing on insights from multiple industries and situations, link it to clearly actionable initiatives, and deliver against it

- Collaboration and Influencing: Sabre is transforming and integrating (One Sabre), into a technology Company where there is a customer focused and holistic approach to delivering client solutions. To help facilitate this change, the company has been making strategic organizational changes to help facilitate the change and inject a culture that is even more fast moving, exciting and client focused. Candidates should be recognized as a natural partner to senior executives and business leaders, influential among external constituents, with a strong ability to identify, negotiate and maintain long-term, productive partnerships. Gaining the support and involvement of key internal constituencies will also be critical to success in the role. Sabre is a global company where M&A activities must be aligned with the organization’s overall strategic goals, priorities and practices

Corporate Development Integration Leader Resume Examples & Samples

- Lead the strategic integration planning, due diligence, and execution phases of M&A transactions to ensure alignment with deal rationale and achievement of long-term business objectives

- Spot and creatively solve complex, cross-functional operational issues, often unique to each deal

- Continually refine best practices for integration consistent with Facebook culture

- Stay abreast of Facebook company priorities and embody culture to support and advise target companies during integration

- Act as an adviser to senior leadership and partners

- Provide government affairs support in relation to sales opportunities and new business models for EV, such as auto financing, car rental, car sharing

- Stay apprised of business goals and strategies in order to assess the impact to Japanese EV policy and regulatory developments

- Participate in and manage Tesla’s role in industry associations, coalitions, and other organizations related to EV policy and advocacy to advance company policy objectives, foster strong relationships with like-minded companies-both within and beyond the technology community-to strengthen support for policy objectives, such as EV type approval requirements, key standards, charging infrastructure regulations, EV incentives

- Lead the implementation of governmental demonstration programs and partnership projects

- Manage and interacts with outside professionals and legal counsel

- Support license compliance program and advise LC group about effective and appropriate strategies in Japanese

- Support compliance with all applicable laws, including Japanese and US laws relating to ethics, government relations

- Develop and Manage the Japanese government affairs team

- Distinctive problem solving leadership and analytical thinking

- Strong influencing skills and ability to build lasting relationships across multiple layers in the organization and able to gain respect of cross functional organization

- Excellent communication and synthesizing skills of both written and verbal

- Strong leadership skills and an ownership mindset

- 2-3 years management consulting experiences with top management consulting firms / professional services experiences (e.g. investment banking, equity research) after a top MBA / advanced degree

- Or 6-8 years in either high tech companies or internal strategy team with extensive strategy experience

- Demonstrated successes in strategy development projects

- Operations knowledge / experience in high tech industry is a plus

Associate, Corporate Development Resume Examples & Samples

- Play a key role in analyzing potential acquisitions, joint ventures and divestitures as directed, including financial modeling and project management Build financial model to help evaluate transaction opportunities

- Support management with drafting / providing content for presentations to senior business leaders and executives Keep abreast of industry and global trends that will impact the financial services sector generally, and TDBG specifically

- Build and maintain relationships with key internal and external stakeholders, along with external data sources including sources for published reports, consultancies and industry experts on topics of interest

- High degree of numeracy and comfort with strategic and financial analysis

- Excellent skills with MS Excel, including financial modeling

- Good capability with MS Word, MS Powerpoint

- Willingness and ability to be flexible, work independently, be self-directed, organized, and articulate

- Comfortable managing and prioritizing multiple projects

- Demonstrated ability to work effectively on small and large teams

- Maturity, presence, sensitivity and experience in dealing with senior relationships (internal management, external advisors, target employees, etc.)

- Demonstrated knowledge of key Finance / Accounting issues a plus

- Deal experience a plus

Director Global Corporate Development & M&a Integration Resume Examples & Samples

- Drive higher awareness and train cross-functional teams on PMI throughout organization

- Engage in transaction diligence identifying operational issues based on deal structure that will need to be managed with business during implementation

- With Business sponsor, develop overall integration approach, guiding principles and end-state vision that will be used by teams to guide integration planning

- Ensure resources and process in place to successfully integrate new acquisitions into Visa while meeting business objectives

- “Quarterback” overall integration approach and support business leadership throughout integration process

- Facilitate cross-functional SME and Steering Committee meetings as needed to monitor integration progress, identify, escalate and resolve issues

- Act as primary liaison to cross-functional subject matter experts (SMEs) at Visa and target

- Direct and manage resources including contractors and/or consultants as required

- Develop and track key integration metrics

- Build and develop management and SME relationships throughout Visa to stay abreast of organizational dynamics, identify and implement process improvements and effect change

- Attend / lead integration reviews on overall PMI or related project activity

- Identify and implement integration best practices relevant for Visa

- In times of low deal activity, lead or represent Corporate Development in related corporate initiatives (e.g. org re-design, business controls assessment, product lifecycle management)

- Travel up to 30%

- BA/BS degree required. MBA or relevant graduate degree from top-tier institution preferred

- Minimum of 5-7 years prior business consulting, functional and/or integration experience

- Excellent project management and leadership skills

- Demonstrated ability to lead cross-functional global virtual teams and manage by influence

- Ability to quickly grasp complex business strategies and identify downstream operational implications

- Proactive and adept at building relationships at multiple levels within the company (i.e., senior management to individual contributor)

- Team oriented and collaborative

- Comfortable with working in complex and often ambiguous environments

- Ability to extrapolate and drive fact based recommendations based on limited information

Associate Corporate Development & M&a Resume Examples & Samples

- Support corporate development activities ranging from evaluating and executing public and private company acquisitions, joint ventures, asset divestitures and restructurings, and minority investments; managing in-bound deal flow and M&A pipeline activities; and working with multi-functional teams to develop transaction rationale / business plans. Transaction sizes can range from multi-billion dollar to sub-100 million dollar acquisitions to single-digit million dollar investments

- Implement and manage best practices; evaluate strategic, operational and financial impact; coordinate cross-functional teams to facilitate due diligence for potential transactions; develop and own financial modeling of M&A combinations; support transaction structuring and ultimate integration

- Build relationships with product and regional counterparts (peer level), design and construct analytical frameworks to make decisions, identify business and operational opportunities and risks, and assist in coordinating and managing internal and external service providers (legal, accounting, investment banking, consulting, etc.)

- Play a key role in all of Visa’s M&A activities and provide general transaction and analytic support to CDMA team including the creation of presentation materials to communicate recommendations to senior management

- Minimum 1-2 years relevant work experience at a tier 1 investment bank; must have significant M&A buy-side experience

- Four year college degree required; this is a pre-MBA position

- Knowledge of transaction process, due diligence and general M&A best practices

- Strong analytical, modeling and valuation skills: substantial experience modeling business combinations and running valuation analyses (i.e. comparable companies, precedent transactions, discounted cash flow, etc.)

- Excellent drafting and writing skills, with high proficiency using Excel (financial modeling) and PowerPoint (presentations)

- Demonstrated ability to work with large, cross-functional teams (e.g. accountants, lawyers, clients, consultants) and proven track-record of managing multiple projects simultaneously

- A team player who is able to work collaboratively within the group and across business units/functions, learn quickly, assimilate to new teams and projects, and work well under pressure with appropriate attention to detail

- Experience as point person role for internal (investment bank) and external (client and counterparty) interactions and transactions

- Payments or technology industry knowledge and cross-border transaction experience a significant plus

Summer Corporate Development Mba Intern Resume Examples & Samples

- Evaluate potential business development opportunities

- Provide financial and strategic support in evaluating and/or executing mergers & acquisitions, partnerships, investments and joint ventures

- Assist in the development of Lionsgate’s long-term strategy

- Closely monitor industry trends and competitive dynamics, summarizing key findings

- Help prepare materials to be presented to Lionsgate’s Board of Directors

- Currently enrolled in a full-time MBA program

- 3+ years of relevant experience that may include previous roles in finance (investment banking and other), strategy consulting, technology or media

- Excellent communication skills and the ability to concisely and confidently present to high-level executives

- Strong research and analytical skills

- A high level of proficiency in Microsoft Excel and comfort with complex numerical analysis

- Strong interpersonal and financial skills are required

- No media and entertainment industry experience is necessary; however, the ideal candidate will be highly motivated to pursue a career in business/finance in the media and entertainment industry. The ideal candidate will also be a self-starter and have a strong work ethic

Corporate Development Assistant Resume Examples & Samples

- Managing calendar, phone correspondence, expenses and travel arrangements

- Coordinating internal and external meetings and conference calls

- Preparing documents/presentations

- Keeping the team organized and on time to all meetings and appointments

- Ordering office supplies, beverages and other miscellaneous items as needed

- Shipping and messengering packages

- Ensuring office operational efficiency

- Updating department investment/acquisition opportunity tracker on a frequent basis

- Compiling research on specific target companies and competitors using Comscore and Conde Nast library tools

- Creating one sheets with relevant information about target companies

- Working with research to provide support data for acquisition targets

- Superior organizational skills, detail oriented and punctual

- Thrives in a fast-paced, deadline-driven environment

- Ability to anticipate the needs of his/her direct reports

- Proficiency in Excel, Word, PowerPoint

- Bachelor’s degree in Finance, Accounting and two-four years of corporate finance / M&A advisory experience

- Strong finance background -- able to review business financials and operational metrics, and perform ROI, CBA, and other types of data analysis

- Strong work ethic and a passion for excellence

- Ability to perform analysis or process evaluations in order to provide the information necessary to make informed decisions

- Excellent verbal and written communication skills, high level of emotional intelligence, and strong presentation skills

- Proficiency with Microsoft Word, Excel, and PowerPoint

- Experience creating client marketing materials

- Understanding of the capital markets

- Understanding of the healthcare industry, including relationships between key constituents and overview of competitive landscape

- This position can be based in either our New York City or Los Angeles office*

- Analyzing markets, products and new business opportunities in order to develop recommendations on the appropriate strategy for Oaktree

- Performing quantitative and qualitative analysis, including due diligence, valuation, benchmarking and industry / sector studies

- Building detailed financial models

- Preparing presentations for senior management and external stakeholders

- Supporting the general efforts of the Corporate Development team

- The successful candidate will have outstanding initiative and be a self-starter

- The candidate must have excellent written, verbal, and interpersonal communication skills

- He/She will be team-oriented and collaborative and must possess strong integrity and professionalism

- Bachelor’s degree with honors from a top university or college

- 1-3 years’ experience at a top investment bank, asset management firm, or consulting firm is required

Corporate Development, Senior Manager Resume Examples & Samples

- Establish and maintain strong relationships with founders and senior executives from startups and leading technology companies

- Be a key person for Yelp’s Corporate Development efforts, driving strategic value and continued growth for Yelp’s 142 million users in 31 countries, through acquisitions and market intelligence

- Map out the strategic landscape in various sectors thoroughly, presenting written findings to executive team

- During an acquisition, drive all aspects of offer and closing process, including negotiations, analysis, and the full due diligence process

- Be product-driven and develop strong relationships with the product team and engineers, internally and externally

- Represent Yelp as a spokesperson and evangelist at industry events

Executive Assistant, Corporate Development Resume Examples & Samples

- 1-3 years of administrative experience, preferably in the media/entertainment industry

- Professional phone skills

- Ability to multi-task and prioritize numerous tasks and projects

- Excellent follow up skills and organized

- Strong interpersonal skills, ability to interact with employees at all levels of the organization

- Ability to maintain strict confidentiality in all work situations

- Excellent written and verbal communication skills, as well as high facility with Microsoft Office

- General Entertainment Industry knowledge a plus

Global Head of Corporate Development & M&A Resume Examples & Samples

- Manage Visa’s current and potential global partners and lead financial investments designed to drive payments innovation. Establish and lead a robust and comprehensive process to identify and evaluate potential opportunities, which includes a rigorous idea generation and screening process that will bring quality acquisition and investment ideas to the Visa management team

- Partner with the Strategy team and the Senior Business Unit Leaders to think about corporate development opportunities in a progressive, systematic and routine fashion. Build relationships with each business unit to keep an ongoing flow of ideas that are strategically aligned with their financial goals

- Manage Visa’s global industry engagement and deal/investment relationships with Investment Banking firms. Serve as the primary Visa interface with partner companies and the point of coordination for all co-investment and other activities with these companies

- Partner with business leaders before, during and after the M&A process, to ensure the deals make strategic sense, fit with their forward-looking business plans, and are integrated smoothly and fully optimized

- Work closely with the head of M&A, Pricing and Corporate Initiatives. Partner closely with the legal, finance and other departments to ensure that processes and agreements are handled appropriately and effectively

- Manage and develop the Corporate Development/M&A team. Evolve the team and its capabilities as required over time

- 15+ years of transaction experience in Corporate Development or M&A at a large global Corporation or Investment Bank

- Significant experience in leading teams to successfully execute all aspects of deal transactions including: acquisitions, divestitures, strategic investments, joint ventures and other strategic alliances

- Deep knowledge and understanding of payments and/or technology industries

- Experience working in a demanding environment with highly motivated and driven professionals

- An advanced degree (i.e. MBA) or additional certifications (i.e. CPA, CFA) are preferred, but not required

- Think creatively and develop innovative approaches and solutions that address technical deal issues

- Work with legal advisors to identify and overcome legal challenges including those presented from various regulatory, governmental and tax aspects

- Lead the transaction processes from concept, initial approach, through due diligence, valuation and structuring, as well as post-merger integration

- Manage projects, anticipate issues, overcome obstacles and marshal internal and external resources, where necessary, in order to move transaction processes forward

Analyst, Corporate Development Resume Examples & Samples

- Performing financial modeling, in-depth valuation and other financial analysis