- Coaching Team

- Investor Tools

- Student Success

Real Estate Investing Strategies

- Real Estate Business

- Real Estate Markets

- Real Estate Financing

- REITs & Stock Investing

11 Components Of A Successful House Flipping Business Plan

Why Start Flipping Houses?

What is a house flipping business plan, why you need a business plan for flipping houses, 11 important steps in your fix-and-flip business plan, assemble a team & execute, 5 house flipping mistakes to avoid.

There is absolutely no reason for a real estate investor to treat a flipping career like anything less than a legitimate business in today’s competitive marketplace. Whether flipping houses as a full-time job or supplementing a nine-to-five, every investor could benefit immensely from implementing sound business practices into their existing strategy. More specifically, however, there’s no reason to think a well-devised house flipping business plan can’t maximize even a new investor’s potential. If for nothing else, treating flips like a business will tip the scales in an investor’s favor while simultaneously eliminating inefficiency and inconsistency–two of the greatest threats to today’s entrepreneurs.

When asked why they start flipping houses, most investors will instantly lean into the fact that they get to work for themselves, that, and the money. In fact, it’s not a hard argument to make. Becoming a real estate entrepreneur can simultaneously be lucrative and fun. Few career paths award hard-working individuals with more freedom and the ability to generate wealth on the same level as a career in real estate.

Even when the pandemic all but brought the U.S. economy to a standstill, a proper house flipping business plan proved lucrative. As recently as last year, the average home flip “generated a gross profit of $66,300 nationwide (the difference between the median sales price and the median amount originally paid by investors). That was up 6.6 percent from $62,188 in 2019 to the highest point since at least 2005,” according to Attom Data Solutions’ year-end 2020 U.S. Home Flipping Report .

However, it is worth noting that the answer to the question will resonate on multiple levels for today’s best investors. You see, on the surface, it’s easy to understand why someone would want to start flipping houses: it’s a good way to work for yourself and make money. However, some see flipping houses as a bridge to get closer to what they really want. With the ability to realize financial freedom and work at their own pace, investors use real estate as a vehicle to bring them true happiness. Whether spending more uninterrupted time with family and friends or traveling the world, real estate can serve as the means to an end investors envision.

A house flipping business plan is nothing short of the most important aspect of a real estate investor’s career. To that end, I remain convinced few things–if any–come with a better return on investment (ROI) than a well-crafted business plan for house flipping. I could easily argue a great business plan is invaluable, which begs the question: What is a house flipping business plan? Better yet, why does anyone looking to flip properties need to implement one?

To be clear, a business plan for flipping houses is exactly what it sounds like: a plan for flipping houses. However, it is worth noting that a truly great house flipping business plan isn’t meant for flipping a single property but rather multiple properties. You see, a truly great flipping strategy isn’t meant to be used on a single property; it’s meant to guide investors through the house flipping process over the course of their entire careers. Therefore, any investor intent on running a successful rehab company needs to have a real estate flipping business plan of their own.

Today’s most prolific house flipping business plans act as a blueprint for success; better yet, they award savvy investors the chance to make success habitual.

It is not enough to simply start flipping houses on a whim; doing so exercises a reckless abandonment nobody will appreciate. Instead, investors need to devise a plan of attack, as to increase their odds of realizing success and giving themselves a blueprint to follow in times of need. It is worth noting, however, that a house flipping business plan does more than simply tell investors where to go. A truly great flipping houses business plan will also:

Help investors maintain an organizational level that is conducive to a successful business.

Show others how serious investors are, perhaps awarding them with a more trusted network.

Clarify whether or not a respective revenue model makes sense.

Share an investor’s vision with others easier than just about anything else.

Help lenders decide if they want to work with a specific borrower.

Help investors turn their thoughts into more actionable processes.

Bring to light an individual’s strengths and weaknesses.

Force some investors to address their own risk tolerance.

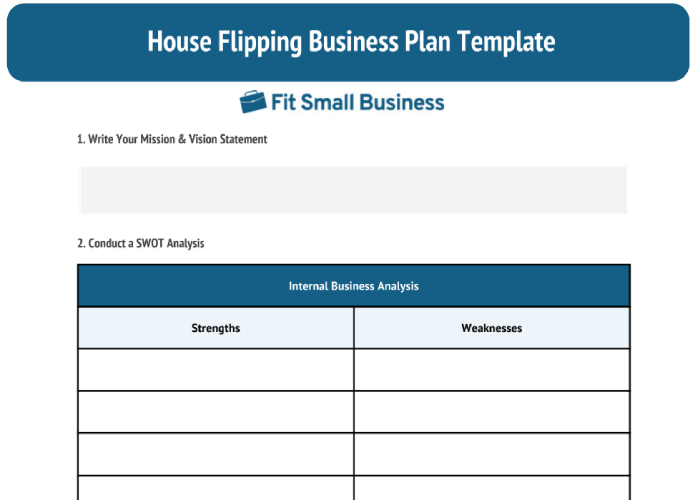

No two businesses are exactly alike, and it’s unfair to expect even similar companies to share the exact same business plan. Perhaps even more importantly, there isn’t a single, universal business plan for flipping houses that will work for every investor in a given market. What works for one investor may or may not work for another, and vice versa. Case in point: there are several ways to draft a promising business plan. That said, no house flipping business plan template is complete without the following sections:

Executive Summary (Mission Statement)

Team dynamic, swot analysis, opportunity, market analysis, financing and projections, growth strategy, lead generation and marketing, goals and objectives, competition, exit strategies.

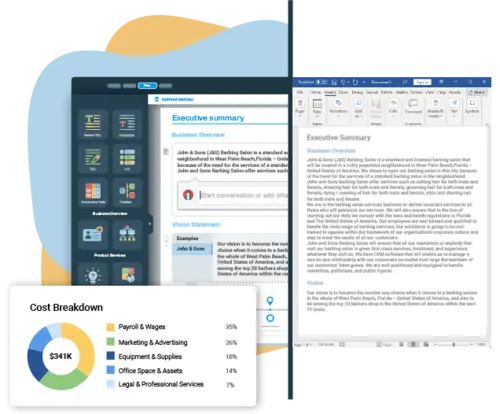

Aptly named, the executive summary section of a house flipping business plan should sum up an investor’s intentions in a clear, concise mission statement. Perhaps even more specifically, the executive summary will serve as the foundation for an entire business; it’s the first impression, and it’s what customers will use to determine whether or not they want to work with a respective company. Every executive summary should, therefore, clearly define the company’s purpose and long-term goals.

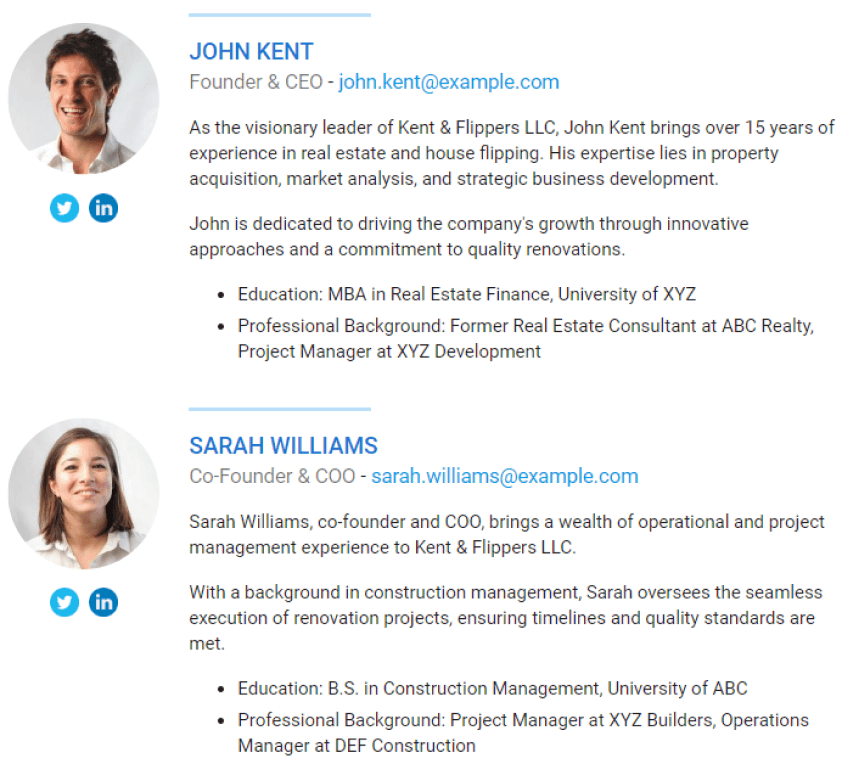

No rehab strategy is complete without clearly identifying the team’s dynamic . Identify the most important positions that will be held and who will hold them. There is no need to acknowledge every person in the rank and file, but it’s important to include the most important positions. In addition to each person’s title and name included in the team dynamic section, be sure to include a description of the title and why it’s needed. This section aims to identify each person’s role moving forward and prevent any disputes over whose responsibility a specific task will be. More importantly, the team dynamic section will see that everyone has a clear idea of what they need to do.

A popular acronym is used to acknowledge a company’s strengths, weaknesses, opportunities, and threats. A SWOT analysis will help up-and-coming real estate investors identify the very components working for and against their current business plan. If for nothing else, success favors those that are most prepared. Few things will prepare a real estate investor for what’s to come better than identifying their own strengths and weaknesses. Perhaps even more importantly, an in-depth, unbiased SWOT analysis will help investors carve out their own niche moving forward.

It is in the best interest of today’s investors to identify the problems that plague their industry and the opportunities that are inevitably created as a result. It’s a sad reality, but a truth, nonetheless: distressed homeowners are in a difficult situation. However, their problems create an opportunity for investors to lend a helping hand. That said, investors need to identify their own opportunities and how they can take advantage of them. This part of the rehab strategy should identify the target audience’s needs and offer a solution.

The market analysis section of a flipping houses business plan should identify the main indicators of the area investors intend to work in. As its name suggests, a market analysis should offer an in-depth look at what’s taking place in the same neighborhoods investors intend to work in. Pay special considerations to the past, present, and future. Among other things, be sure to reference changes in the market share, nearby competitors, historical shifts in the market, costs, pricing, and anything else deemed important to an investor’s success. The more comprehensive, the better a market analysis will serve an investor.

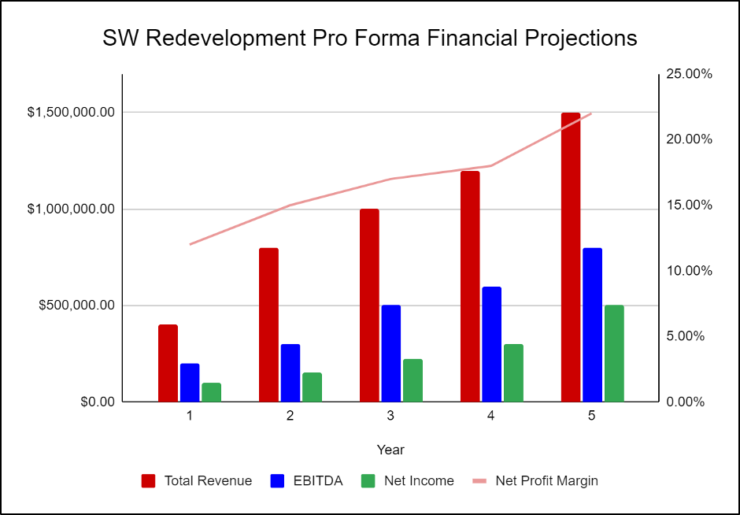

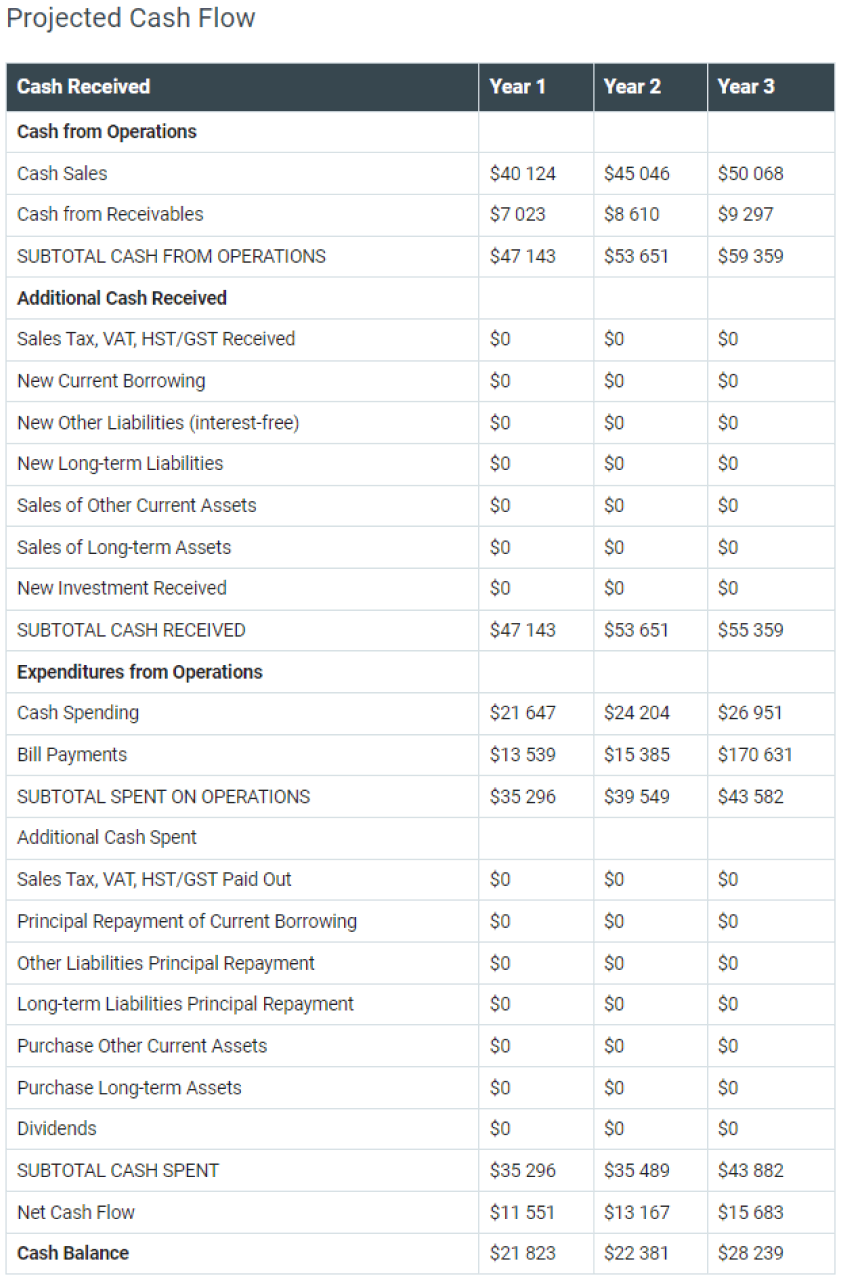

Not surprisingly, the best strategies will detail a company’s financial outlook. Financial literacy about one’s own company can’t be underestimated, and one should prioritize almost everything else involved in a house flipping business plan template. Be sure to explain the model you intend to use and any pricing assumptions gleaned from the market analysis. Additionally, investors will also want to include where exactly they intend to get their funding from and how they will secure money for future deals. To be safe, consider forecasting for at least three years; that way, investors are less likely to receive rude or unwelcome awakenings. The financing section should also touch on how the investors intend to finance future deals. Include which sources will be used, and their respective fees and timelines. The more methods of financing a deal investors have at their disposal, the better. This section should include, but isn’t limited to:

Private Money Lenders

Hard Money Lenders

Institutional Lenders

Owner Financing Strategies

Crowdsourcing

Creating a business plan for house flipping will require investors to think proactively. More importantly, house flipping business plans–even those accommodating new investors–should be written with the intentions of future growth. Scaling a business can prove difficult for those companies that aren’t ready for it. Therefore, it is best to include a section in your initial rehab strategy that outlines any growth strategies that may be relevant. The best time to entertain a growth trajectory is from the onset of one’s career, not in the heat of the moment. Those prepared for growth from the beginning will find the transition to be a lot easier.

Every great house flipping business plan will include a section on how to generate leads through a proper marketing strategy. If for nothing else, this section will serve as the foundation for a great deal of the company to function off of. It is with a great marketing strategy that investors will be able to operate and maintain a funnel of hot leads. It is worth noting, however, that a truly great marketing system is the sum of its parts. There isn’t a single marketing strategy investors should be using, but rather several. For a better idea of what today’s investors are using, here’s a list of what has worked for us:

Direct Mail Marketing

Bandit Signs

Door Hangers

Curated Lists Purchased Online

Real Estate Investment Clubs

No real estate investor can hope to realize success if they can’t clearly define what success for their own company would look like. In other words, it’s impossible to succeed if there are no clear goals and objectives to aim for. Likewise, you can’t possibly know if you realized success if you never sought to define what success actually means. Success is, after all, a relative term. What one investor may deem as a successful business, another could completely disagree with. Therefore, today’s new investors need to develop their own definition of success; that way, they can have something to strive for and even reference when times get tough.

For as important as it is to know your own business, it’s equally important to keep tabs on the competition’s business. There is a great deal of information that can be gleaned from the way your competition runs its business. Therefore, I recommend dedicating an entire section of your house flipping business plan to the people you intend to compete against. What are they currently doing that is working? What hasn’t worked out well for them? Do they currently have a competitive advantage? In understanding the competition, investors will have a better idea of how to proceed and what not to do. Be sure to learn from their successful efforts, but don’t ignore their shortcomings; they are just as valuable.

No plan is even remotely close to complete without a section that outlines potential exit strategies. Therefore, it is at this point in the planning process that investors need to weigh their available options. First, evaluate the property based on its merits and determine how it may meet your specific investing goals. If, for nothing else, there’s an ideal exit strategy for each property, but it must line up with your own goals. In other words, you need to know whether you will flip, rehab, wholesale, or rent the asset before you even buy it. Not only that, but you’ll need a backup plan in place in the event things don’t go according to plan.

It is entirely possible to pull off the perfect house flipping business plan by yourself. After all, one of the best reasons for becoming an investor is to become your own boss. That said, this industry can get very involved very fast. In addition, many skills are required to complete a single deal, all of which can be performed by a different professional. As a result, it may be in every investor’s best interest to assemble a well-qualified team. With a competent team at your side, you’ll be free to do more important activities. Not only that, but if you hire the right team, you can remain confident the job is getting done well.

A good real estate team is invaluable and can increase productivity exponentially. To see to it your team can compete on the highest level, you may want to consider enlisting the help of the following individuals:

Real Estate Agent: A truly great real estate agent is worth their weight in gold. Their knowledge of a given area and their contacts — alone — can save investors an incredible amount of time and money. As a result, a good real estate agent should be one of the first additions to your team.

Attorney: As I already alluded to, the real estate industry can get complicated really fast. A good real estate attorney can make sure you have every corner covered. Their help will mitigate risk around every corner.

Contractor: Good contractors may be found in any city, but the key isn’t to hire just any contractor; you need to hire the right one. A trustworthy contractor is invaluable to today’s investors. Their skills will show in the final product and keep investors on schedule.

CPA: Not unlike the industry itself, the numbers behind everything can get confusing. Therefore, it is important to hire someone familiar with real estate deals and their respective “numbers.” That way, there is much less of a risk of running the numbers incorrectly.

Inspector/Appraiser: Aligning your services with an appraiser or inspector can give investors an advantage. Not only will they serve as a valuable contact when it comes to getting a home inspected, but they can also expedite the process. Remember, time isn’t just money to real estate investors; it’s everything.

Successfully flipping homes requires investors to hone specific skills to increase their odds of making a profit. However, many investors don’t realize that it’s just as important to avoid mistakes as it is to be successful. Sometimes knowing what not to do is just as valuable as knowing what to do. With that in mind, here are some of the most serious house flipping mistakes to avoid:

Inadequate Funds: Any failure to calculate the amount of necessary funds could be disastrous. Running out of capital in the middle of a project can potentially lead to deal-ruining delays and perhaps the deal from being completed altogether. Consequently, those without adequate funds may find the urge to cut corners and produce an inadequate product, which can ultimately cut into profit margins. Instead of beginning a deal with inadequate funds, it’s better to give yourself extra cash to serve as a safety net.

Poor Time Management: Time isn’t simply money; it’s everything to an investor. Therefore, today’s investors really need to learn time management. The faster they can get in and out of a deal, the better. Holding costs will be down, and they’ll be able to move onto another deal even sooner if they can efficiently manage their time. Failure to do so can cost investors a lot of money and perhaps even ruin a deal. Instead of heading into a deal without a plan, investors need to have a schedule. Not only that, but they need to do everything they can to stick to it to avoid unnecessary setbacks.

Inexperience: As perhaps the biggest mistake of them all, far too many investors tend to get in over their heads. A lack of experience, for example, can lead o poor decision-making and folding under pressure. Therefore, investors should work within their comfort zone. Instead of attempting an exit strategy you aren’t familiar with, stick with what you know. When the time comes to branch out, educate yourself before moving forward.

Lack Of Education: A lack of education can be disastrous at any stage of an investment. Nothing is more sure to ruin a deal than ignorance. Therefore, investors must know everything about a deal before going into it. Proactively learn about every aspect of a deal. Read, listen to podcasts, take classes and talk to anyone you may learn from. Education is invaluable to an investor and can alter the course of their career in great ways.

Impatience: Patience is a virtue in the investing world. While time is money, it’s also important to maintain a level head. Sometimes patience can prevent investors from making a huge mistake. If for nothing else, acting irrationally can be devastating.

Today’s greatest real estate investors know it, and it’s about time everyone else did, too: no real estate investing company is complete without a thoroughly crafted house flipping business plan . As the blueprint for running a successful company, business plans are instrumental in developing a new investor’s name and even furthering seasoned entrepreneurs’ success. All things considered, the majority of today’s most successful investors can attribute their current position to a sound business plan.

There’s no reason to think a well-devised business plan for flipping houses can’t maximize even a new investor’s potential.

With a flipping houses business plan in place, investors should have a blueprint to follow before they even get started.

Use a house flipping business plan template if you aren’t sure how to draft one yourself.

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

What is an STR in Real Estate?

Wholetailing: a guide for real estate investors, what is chain of title in real estate investing, what is a real estate fund of funds (fof), reits vs real estate: which is the better investment, multi-family vs. single-family property investments: a comprehensive guide.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Start a House-Flipping Business: Your Essential Toolkit

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If you've tuned into HGTV lately, it won't come as a shock to learn that more people than ever are interested in how to start a house-flipping business. For enterprising investors who aren’t afraid of hard work, flipping a house is an exciting opportunity for short-term investment and for starting a new business. But there’s a lot of research to be done, plus financing and resources you need before you can start a house-flipping business yourself.

So we’re all on the same page here, house flipping is the process of purchasing distressed, foreclosed, or otherwise desirably priced property with the intent to fix it up and sell at a higher price within a short period of time.

»MORE: Read how to fix up that first property you're flipping

If you’re one of those enterprising investors who want in, you’ll need to know more about how to start a house-flipping business. Follow this guide to help you develop a business strategy, plus determine and execute the optimal financing plan.

Starting a house-flipping business in 8 steps

If you’re determined to invest in short-term real estate and flip a house, here’s where to start:

Step 1: Write a business plan

Before taking any action, financial or otherwise, it’s crucial that writing a business plan is the first step in starting your own house-flipping business. A business plan will be key to keeping your business on track, helping you estimate profits, and getting investors.

Your business plan should be fairly in-depth and there is a lot of information you should be sure to include in it. You can either write it on your own or use a business plan template to help you. No matter what you choose, you should be sure to include the key parts of a business plan.

You'll want to start out with an executive summary detailing the purpose of your business, the vision you have for it, some high-level financial projections and identify who will be involved in the business. The rest of the business plan should include a section on the competition and the demand for your business. After all, you need to be sure that there's enough demand to sustain your house-flipping business—a lack of demand for a small business is the reason 42% of small businesses don't make it. That's a group you don't want to be a part of simply because you didn't do your research before starting your business.

You should also use your business plan to lay out what exactly your business will do and how much it will cost, along with how much you expect to make. With house flipping, you'll want to detail how much money you have, how much you expect to need to buy properties and flip them, and then how much you expect to make back.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Step 2: Grow your network

Flipping houses is tough work, and you'll need a plethora or resources to help you finish each job. Identify the resources already available to you to take full advantage of your strengths. Experience in the real estate business, access to a network of excellent craftspeople, or just a promising property are all assets.

Talk to friends or relatives involved in real estate investment, particularly in the area where you plan to invest in property. Anecdotal evidence and word-of-mouth advice can help you find reputable wholesalers, contractors, and realtors to help you find and complete jobs within budget.

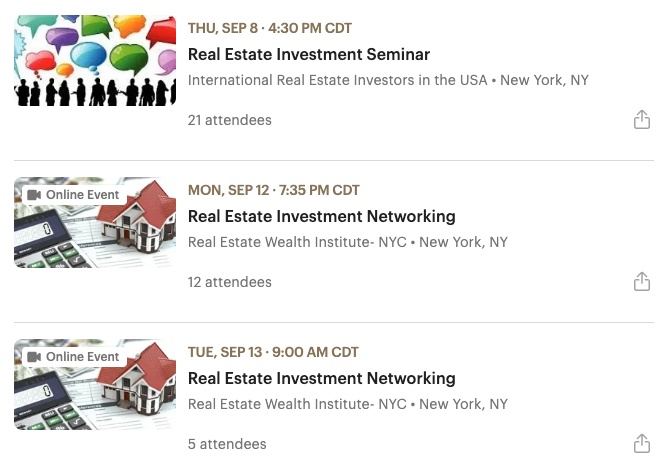

Reach out to your existing professional or personal network to find contacts within the industry, and seek out experts for mentoring and advice. Get active in local real estate investment groups or find your chapter of REIClub to connect with industry professionals.

Step 3: Choose a business entity

In order to operate your house-flipping business legally, you'll need to choose a business entity and register your business with the state in which you plan to operate. While there are many business entity types to choose from, you will want to opt for one with limited liability protection, such as an LLC or corporation.

Liability protection is especially important for a house-flipping business because there are many opportunities for things to go wrong. If someone sues your company over an issue with a property you flipped, you'll want to make sure your personal assets are protected. If you're unsure which entity is right for your business, consult a business attorney to help you weigh your options.

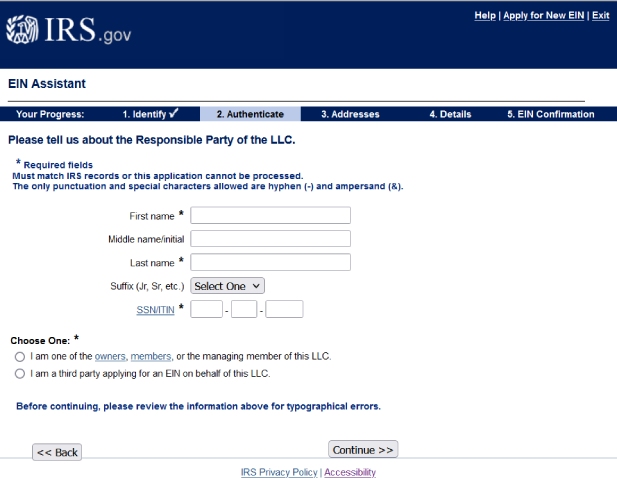

Step 4: Obtain an EIN, insurance, permits, and licenses

Registering your business is the first step to legally establish your operation, but there are a few more steps to take to make sure you're officially allowed to start work as a house flipper. First, you should register for an employer identification number, also known as an EIN. Think of this as a socials security number for your business, which you will use for tax purposes, as well as when applying for business loans or a business bank account or credit card. Applying for an EIN can be done online through the IRS website.

Next, you'll want to look into your business insurance options. If you hire employees, you'll need workers compensation, unemployment, and disability insurance. Beyond those policies, you should also look into general liability and commercial property insurance to protect yourself, your business, and your properties.

Finally, you'll need the proper business licenses and permits to operate your business. The licenses and permits you need will depend on your state and the scope of work you're doing; however, you can expect to need several permits when working in the construction business. Check with your local chamber as commerce and consult with your business attorney to make sure you have all the paperwork you need before you start any work.

Step 5: Find suppliers and contractors

Once your business is legally established, it's time to find contractors and suppliers to help you get your business going. Even if you plan to contribute sweat equity to your house-flipping business, you’ll probably need additional contractors to complete a project successfully. Look for contractors with a portfolio of demonstrable work, references, and positive feedback from previous projects.

A trusted general contractor can also look over any remodeling plans and budget projections you make to check for accuracy with regard to cost and timeliness. Finding suppliers who are reliable and can work within your budget is also incredibly important. Tap into your network and do your research to find some reputable options.

Step 6: Assemble a team

Whether you plan on bringing in a partner, hiring outside contractors, or renovating each property yourself, you’ll need to recruit a team of qualified people to complete a successful flip. In particular, consider sourcing for these roles, which could really help you keep things organized and get the most out of your investment:

Business partners or investors

A good potential partner might be an active private investor in your personal network or a real estate investor looking for a project manager. A good business partner brings an asset or skill to the relationship—be it capital resources, skilled labor, industry expertise, or simply a great work ethic and determination to make an honest profit.

According to Jamell Givens, a partner and real estate investor at Leave the Key Homebuyers, the advantage of having a business partner is the ability to evaluate a deal in different ways. Whereas one partner might think only of a home's profit potential, the other might bring local knowledge or connections with contractors.

Realtors or property owners

A background in real estate and property ownership is a huge plus in the house-flipping business. An experienced partner can help you search efficiently for prospective properties, identify the most valuable improvements for a given area, and navigate contracts and sales once the rehabilitation is complete.

Or, if you know a homeowner looking to sell and willing to loan you the money for necessary repairs and renovations, owner or seller financing may work for you.

Legal counsel

Seeking legal advice about any financial agreement or contractual obligation is a good idea, especially when you’re considering making major investments and buying property.

Step 7: Obtain financing

You’ve found a partner, done your research, and maybe even identified the first property you want to flip. In other words, you’re ready to finance your house-flipping business’s first fix-and-flip.

If this is the beginning of your house-flipping career, you’re probably not going to be eligible for a traditional bank loan. Typically, banks only approve businesses with many years of profitability under their belts. And in house-flipping, time is money. That makes the best fix-and-flip loans short-term financing option—usually around 12 months. Repayment terms on bank loans, on the other hand, can run between five and seven years.

That said, you do have a wide variety of fix-and-flip loans available to you. As a brand-new business, you also have a good option to tap into your personal funds or investments. It’s a little risky to throw your own skin in the game—in other words, your nest egg—but it’s likely that your business doesn’t have the revenue and financial stability that most lenders want to see before extending you a business loan .

As always, it’s wise to explore all of your possible options before settling on a loan that best suits your needs. Start your search with these options for new house-flipping businesses:

Friends and family loan

Many rookie real estate investors fund their first projects with personal loans from partners, friends, or family members. If the loan is comfortably within the lender’s means, this alternative to a bank or private loan can alleviate some of the pressure of a traditional loan, as well as ensure a degree of accountability.

If a friend or family member is an investor or partner in your house-flipping project, it’s a good idea to establish terms of the arrangement in writing as soon as you reach an agreement.

Tap into your 401(k)

For first-time flippers with a retirement plan who are not planning to retire in the near future, one financing possibility is taking out a loan from your 401(k). This option incurs the risk of losing your nest egg, which is always a scary prospect. But financing a business with a 401(k) might be the only viable option for entrepreneurs just starting out—and if you’re smart with starting your house-flipping business, you can hopefully make back the cash and then some.

There are two main options for 401(k) loans: The classic 401(k) loan, in which the IRS allows you to borrow up to half the vested balance, or $50,000, whichever is amount is lower; or a ROBS . You’ll determine which type of financing makes the most sense for you based on the size of your investment and your willingness to dip into your retirement savings.

Combination financing

Many experienced short-term real estate investors find success using multiple financing sources to purchase and renovate a property. Depending on your own capital, a partner or investor, and external lenders, it’s likely that you’ll end up using a combined solution to finance your house flipping business.

Step 8: Source your deal

The success of flipping a home depends in large part on supply and demand in the local real estate market, as well as the cost of labor and value appreciation of the renovations.

Identifying your target property market might help you decide if a real estate wholesaler, auction, or a traditional broker is the right choice for your project. If you’re interested in distressed or foreclosed properties, a wholesale broker or auction will have higher volumes of properties available. A traditional broker might be right for you if the real estate market is new to you or if you need help finding a specific type of property or building.

Determine the scope of renovations or rehabilitation you are equipped to complete on a property, keeping in mind the duration and amount of your fix-and-flip loan.

Start Your Dream Business

Follow these best practices for a successful house-flipping business

Once you develop a business strategy, assemble a team, identify a property, and secure financing, it’s time to start implementing your renovation plans, thinking about marketing and selling the property , and generally getting your house-flipping business underway. Make sure you:

Commit to your business plan. Planning, logistics, and administrative organization will make or break your project—although you have the potential to make a big, quick profit, starting a house-flipping business is no walk in the park. You’ll need to scout properties, calculate renovation costs, source a trustworthy crew, possibly apply for a small business loan… not to mention the curveballs that may arise with every step.

Approaching the process with a detailed business plan in hand will help keep you on track. And the more confident you are in your business strategy and execution plan, the more adaptable you’ll be to those unpredictable circumstances that’ll inevitably arise.

Grow your network. Use your first fix-and-flip project to foster relationships with industry professionals—from investors to realtors to carpenters—whose collaboration and skills you will need for your next house flip. Experienced contractors and agents can connect you with other vendors, give you leads on properties and service-providers, as well as provide advice on specific projects. Trusted contacts in the industry can also help you cover your blind spots, and make sure estimates for properties and repairs are accurate, saving you time and money.

Make estimates—then double them . Unless you’re already in possession of a property, sufficient cash, and experience with home repairs, the process of flipping a home will require timelines and cost estimates at every turn.

Err on the side of caution when making any projections about the cost and duration of the renovation. That’s especially important if you’re financing your startup with outside investors who need to see that you’ve done your due diligence before putting their own capital on the line.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

How to Write a House Flipping Business Plan

The most important part of starting a new rehab project is having a house flipping business plan.

Before making an offer on a property, you need to define what your goals are for the project and how you’re planning to reach them. House flipping needs to be approached from an objective and quantifiable perspective, not an emotional one. As such, a house flipping project plan is essential to create a clear path to success.

To make the process as easy as possible, we have created a free house flipping business plan that you can download.

We also encourage you to read the rest of this article to help you understand each part of the house flipping business plan.

Click Here Get Your Free House Flipping Business Plan Template

Benefits of writing a house flipping business plan, writing a house flipping project plan is important because:.

- It will turn your vague ideas into concrete thoughts.

- It will help you to resolve lingering issues that you keep pushing off.

- It will help you to fully understand what you are getting into and how to get out of it.

- It will force you to consider the time, money and emotional commitment needed.

- It will force you to address your tolerance for risk.

- It will make you think about your own strengths and weaknesses and identify areas where you may need assistance.

- It will show people who are working with you (lenders, lawyers, contractors, etc.) that you are serious about the project.

- It will improve your chances of getting approved for a loan.

- It will help you plan and organize your house flipping business beyond single house flips

- It will let you know if/when you are going off-track

House Flipping Business Plan Outline

Now that you know why you should create a house flipping business plan, let’s jump into what a business plan actually looks like.

Our free house flipping business plan template includes the following topics:

Executive Summary

Mission statement.

- Market Analysis

- Strategy, Timing, and Financial Projections

- Team Description

Exit Strategies and Backup Plans

What are you doing.

The executive summary is the elevator pitch version of your business plan. It should briefly cover all of the topics covered in the business plan, starting with your mission statement and a brief overview of the project goals.

If someone only has time to read one page of your house flipping business plan, this will be it. They should gain a basic understanding of the whole project, your ideas, and what you bring to the table. It’s often easiest to write this piece last after all of your planning from the other sections are established.

Why are you embarking on this business venture?

The mission statement is a one to three sentence synopsis of your project objectives and the underlying philosophies behind them. This statement says a lot about your central ideals and business culture, and it is very important when laying the foundations for your project.

When writing your mission statement, cut the jargon! Make it clear, concise and useful.

Comparative Market Analysis

What is the economic environment surrounding your project.

Read more about how to prepare your own CMA in our Real Estate Strategy section.

Understanding the neighborhood where you are buying is essential to your success. Only when you have done your own due diligence can you be sure that you are getting a good deal. In the end, your thoughtful planning should be rewarded with moving forward on a successful project.

Sites such as Realtor , Zillow , and Trulia are all free sites that can give you information on the property to be purchased and neighborhood value. These sites can show you the selling prices of nearby homes and the characteristics of the home (bedrooms, bathrooms, square footage, lot size, etc.), allowing comparisons to be made between properties. These sites will also show you what is for sale in the neighborhood, so you will have a sense of the competition in the local market. Another great strategy is attending as many open houses in the neighborhood as possible to get a real sense of size, finishes, configurations, and more.

Below is a list of ways to better understand the market you want to buy in:

- Work with a realtor to help you identify properties

- Join real estate investment groups to get education

- Align with a wholesaler

- Find lists on the Internet

- Review foreclosure sale lists

All of these tools may help you identify your best opportunities, but you must do the work yourself, and not rely on what others tell you.

Once you do your due diligence, be sure you describe your research and rationale within your business plan. Write this section as an organized series of data points that explain the decisions that you are making with the choice of house and rehabbing decisions.

The goal of this section is to show a third party reader where the property and project fit in the current economic and regional real estate markets.

A house flipping business plan will force you to consider any difficulties that may arise, and prepare for them. This is just one of the ways that a house flipping project plan can help you plan, prepare, and get ahead of future roadblocks.

Project timeframe, how long will your project take.

Now that you’ve outlined your executive summary, mission and market analysis, you’ll want to develop a timeframe for your rehab project.

Keep in mind that rehabbing and flipping always takes longer and costs more than you think it will. Make a timeline that is realistic, and then add additional time to it to cover inevitable delays that you can’t initially account for.

Next, “cost out” each month on your timeline being as detailed as possible.

Consider the following questions when costing out your timeline:

- How much will you need to pay on the loan you have for the property?

- How much are insurance and taxes monthly?

- How much will you need to pay your contractor?

- How much are the monthly utility bills going to be?

To read more about developing a project timeline, read Chapter 4 of our Flipping Houses 101 Guide, “ Develop a Property Investment Plan and Timeline .”

Financial Projections

How much will it cost where will the time & money go.

After you determine how long your flipping project will take, you will need to show a budget and financial projection. The financial projection takes into account both time spent flipping the property and money spent across the whole project. This is one of the most important sections of the business plan.

Here are a few costs to include in your budget:

- Cost of the property

- Expected rehab costs

- Other expenses like marketing costs to sell the property

- Additional contingency expenses

Add all of these costs to get a total investment number.

Then, provide a realistic, supportable value for the sale of the property and deduct liquidation costs (such as realtor fees, transfer taxes, etc.) to project your expected profit on the property.

Use our House Flipping Calculator to help calculate a cost breakdown for your project, and then include these details in your business plan. This will not only help you identify potential budget challenges, but also show people you are working with that you’ve strategically thought through your budget!

Pro tip: Make sure that your numbers are realistic, and do not rely on everything going right.

After identifying all of the costs to buy a home, and how long it will take to actually complete the rehab, you should be able to fully estimate your cash flow through the duration of the project. This financial projection will help you understand how much cash is necessary to keep your project moving forward.

Financing Strategy

How do you plan to fund your project.

This section of the business plan should identify all of the sources of your start-up capital for your rehab project. To put it simply: Where will you get the money to flip a house?

There are numerous house flipping funding options, including:

- Conventional Mortgage

- Government Insured Loans

- Owner Financing

- Private Money

Keep in mind that your source of funding will have an impact on your timeline, costs and overall budget.

In the world of real estate investing, an all-cash offer is always preferred over an offer from someone with financing contingencies. Financing your project with your own cash is a good option if you don’t want to be in debt to an institution. However, most house flippers cannot afford to flip a house without financial help. It’s important to do your research about each type of funding listed above to compare the short and long term costs of each option.

To learn more about these six types of funding, check out Chapter 3 of our Flipping Houses 101 Guide, “ Getting Rehab Funding Right .”

If you want to get funding from a lender, watch the video below, where Rehab Financial’s President, Susan Naftulin, offers key tips to help you get approved by a lender.

Once you choose a source of funding, clearly explain which financial assistance you intend to use in your house flipping business plan, if you are going to get pre-approved, and how far in advance you plan to get pre-approved.

About Your Team

How is your organization structured are you building a team or taking on responsibilities yourself.

Now, you need to decide how you want your house flipping business to be organized.

Do you want to borrow in your own name as a sole proprietor? Or, do you want to form a partnership, corporation, limited liability company?

Read more about the best business structures for real estate investors in our Real Estate Strategy section.

You may need to seek the advice of an attorney or accountant to fully understand the implications of each organization type. Be careful about this choice, because your selection can affect your ability to borrow money, mitigate your risk, attract investors, etc.

This section of the business plan is also where you should talk about yourself. Include a brief bio, relevant experience and unique skills that will be advantageous to your company.

If you are working with a house flipping team , include who these people are, and why you chose to work with them. Make sure that the reader understands what you are doing and how the team you are working with will contribute to a successful rehab project.

How are you getting out of the investment? Do you have contingencies in place in case of unforeseen circumstances?

Finally, your house flipping business plan needs to address your exit strategy. Essentially, an exit strategy is what a house flipper plans to do with their property once the rehab is complete.

You also need to address contingencies in case the project doesn’t go as planned.

Below are a few examples of common scenarios where you’ll need to explain your contingency plans.

Scenario 1: Your property doesn’t sell

- What will you do if your property does not sell? Will you use it as a rental?

- If so, you should show that the rental will pay the carrying expenses of the building.

Scenario 2: You’re going to use your property as a rental

- Do you plan to refinance the property and hold it as a rental?

- If so, show your plans for refinancing it, but also show what you will do if you cannot obtain the needed credit.

Scenario 3: You’re going to sell the property

- Will you sell the property?

- If so, state how much you plan to sell it for. In addition, you will also need to know the rules related to your exit strategy.

Scenario 4: You’re going to sell the property to an FHA buyer

- Do you plan to sell to an FHA buyer?

- If so, make sure you understand the anti-flipping regulations to make sure you aren’t trying to sell too soon. Generally, you will need to hold the property for more than 90 days in an FHA situation.

Why a House Flipping Business Plan is Crucial

A thorough, well-written business plan can be an invaluable tool in helping you meet your house flipping goals. Time spent on planning at the beginning of the process will save you immeasurable time, money and worry during the process.

Get Your Free House Flipping Business Plan Template

Real Estate Investing & Rental Management | How To

How to Start a House-flipping Business in 7 Steps (+ Free Download)

Published October 18, 2023

Published Oct 18, 2023

REVIEWED BY: Gina Baker

WRITTEN BY: Melanie Patterson

Download our Merchant Account Application Guide

Your Privacy is important to us.

This article is part of a larger series on Investing in Real Estate .

Get the templates and resources you need as a landlord

Download our Landlord Handbook e-book

- 1 Prepare a Real Estate Investment Business Plan

- 2 Set Up Your House-flipping Business Operations

- 3 Find Financing Sources for Your House-flipping Business

- 4 Hire the Right House-flipping Professionals

- 5 Identify the Right Properties to Fix & Flip

- 6 Create a Marketing & Lead Generation Plan

- 7 Buy, Rehab, Market & Sell Properties

- 8 Mistakes to Avoid When Starting Your Own House-flipping Business

- 9 Frequently Asked Questions (FAQs)

- 10 Bottom Line

Before taking any house-flipping steps, it’s crucial to lay a strong foundation. This base involves creating a comprehensive business plan encompassing operational setup, team recruitment, property evaluation, securing funds, and the flipping process. To aid in this endeavor, we offer a free template and seven critical steps on how to start a house-flipping business to help you craft a solid strategy and ensure your venture’s success.

If you landed here looking for information on where to find fix-and-flip houses, see our article, How to Find Houses to Flip for Profit in 7 Ways .

1. Prepare a Real Estate Investment Business Plan

Before taking any steps to buying and flipping houses, you need a business plan with specific strategies that pertain to the fix-and-flip business model. A business plan provides a roadmap for how many projects you’ll need to take on, how much profit you need to generate, and funding details that will keep you on track to meet your goals. A clear plan also demonstrates professionalism to lenders and investors when seeking funding.

Use our real estate investment business plan and complete the following information to get started:

- Write mission and vision statements

- Conduct a SWOT analysis (strengths, weaknesses, opportunities, and threats)

- Set specific and measurable goals

- Write a company summary

- Conduct a market analysis

However, in addition to items from a general investment business plan, a strong house-flipping business plan includes detailed information about this unique business model. Make sure your plan also includes the following:

- Types of properties: Such as single-family homes, duplexes, or multifamily properties.

- Geographic area: The specific locations and neighborhoods where you want to invest.

- Who’ll do the work: Decide if a contractor does the work, you hire a team of specialists, or if you’re doing the work yourself.

- Project timeline: The projected timeline to complete the flip and a six-month margin for inevitable delays.

- Number of projects: How many projects you can realistically manage and complete during the course of one year.

- Financial plan and sources: Define your financing sources and include all costs such as materials, labor, carrying costs (taxes, insurance, utilities, mortgage principal and interest), marketing, and real estate agent commission.

- Expected return on investment (ROI): This figure should include actual calculations, not just a goal. It’s common for flippers to aim for an ROI of 20%. However, returns will vary depending on the location, property values, and the current real estate market conditions.

Use our free template below to write your house-flipping plan and start your business on the right foot:

FILE TO DOWNLOAD OR INTEGRATE

FREE House Flipping Business Plan Template

Thank you for downloading!

2. set up your house-flipping business operations.

While many think flipping houses is solely about buying, renovating, and selling, it’s crucial to establish the proper business foundation for long-term success. This step involves choosing the correct legal entity, like an LLC, registering your business, and creating separate bank accounts. Consulting professionals, such as attorneys and accountants, ensure you set up your entity correctly. Proper business operations keep your enterprise organized, efficient, and legally compliant.

Choose the Right Business Entity

When launching your house-flipping business, selecting the appropriate legal structure and registering it with your state creates a separation between your personal and business assets—safeguarding you in case of business-related liabilities. For instance, if someone gets injured during a demolition, they can sue your company. Still, it creates a hedge from them suing you personally.

Common entity types for investing in real estate include DBA (doing business as), S Corp (subchapter or small business corporation), LLC (limited liability company), and sole proprietorship (the lowest form of legal protection). You must consult with your accountant and attorney as part of your learning how to start a house-flipping business to determine the best fit for your business since this also ties into your financial situation and varies by person.

Read our guide on How to Start a Real Estate Holding Company in 6 Steps for more details.

Register Your Business With the IRS & Obtain Permits

Apart from your legal business entity, you must register your business with the Internal Revenue Service (IRS) and get an employee identification number (EIN) . An EIN identifies it as a business entity. Make sure to also check with your state and local municipality for what other business licenses and permits you may need, such as building permits, change of use, or special exceptions to zoning ordinances.

Conveniently apply online (Source: U.S. Internal Revenue Service )

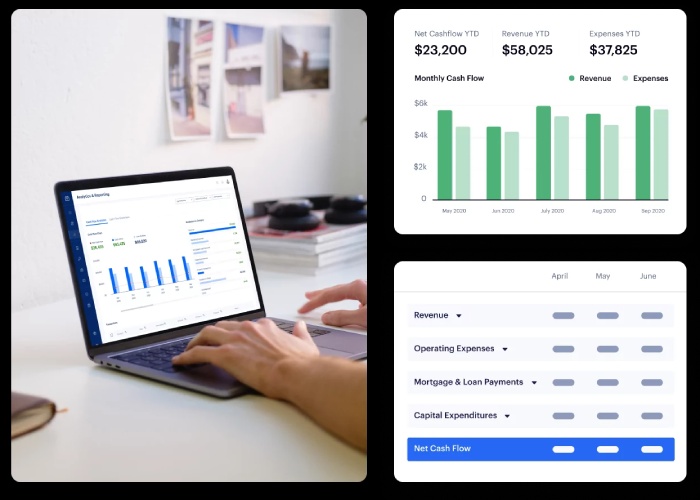

Open a Business Bank Account

With your EIN, you can open a business bank account . Keeping your personal and business money separate is essential to protecting your livelihood and staying legally compliant. Having this account up and running is crucial when starting a flipping business.

For example, you’ll be spending money on gas when looking for properties; all business expenses should come from the same account. You also need to pay your newly hired attorney and accountant. Managing your business account and costs will eliminate auditing from the IRS and complications when your accountant does your taxes.

Analytics in the Baselane dashboard (Source: Baselane )

With Baselane’s analytics and reporting capabilities, gain real-time insights into your property’s performance, such as cash flow, profit and loss (P&L), capital expenditures, carrying expenses, and transfers. Streamline the consolidation of your investment property’s financial data from both your business banking and external accounts, all within a single, user-friendly platform.

Visit Baselane

Pro tip: Once your business bank account is up and running, consider applying for a business credit card —a valuable tool for acquiring building materials and office supplies without any upfront costs. Some business credit cards offer perks like cash back, which saves on your upfront costs. Some provide a 30-day to 18-month interest-free period, allowing you to manage expenses more effectively.

3. Find Financing Sources for Your House-flipping Business

A common question in house flipping is how to begin with no money. While you’ll need some funds to buy properties, many flippers don’t use cash for the entire process. They typically secure financing through hard money lenders or specialized loans for house flippers.

The two most common ways to get into the flipping homes business are:

- Hard money loans : These loans offer faster approval and funding times than traditional mortgages. The borrower qualifications are more lenient but with shorter loan terms and higher interest rates.

- Rehab loans: These include home equity lines of credit (HELOCs), HomeStyle renovation mortgages, 203(k) rehab loans, or CHOICERenovation loans. They require a lower down payment but also have more extensive criteria and paperwork.

If you have a construction or real estate background, you can join investment groups and find investors willing to put up some cash. It’s easy to find local events and groups for investors by searching on Google or Meetup.com.

Real estate investor groups (Source: Meetup )

Remember that the costs to flip a house vary depending on the individual property, its condition, prices of repairs, and the real estate market. Learning how much money you need to flip a house and how much money you can make by flipping houses can be complex. Still, getting the right financing and maximizing your profits is necessary.

Creating a budget and calculating each project is an important part of your house-flipping checklist. Use the free house-flipping calculator to generate your potential profits when shopping and evaluating potential properties.

4. Hire the Right House-flipping Professionals

When starting as a house-flipper, remember the significance of your professional network for your business plan. Flipping houses isn’t a solo venture; you’ll collaborate with experts like lawyers, accountants, real estate agents, and contractors. These professionals provide valuable insights and guidance for successful house flips, making the difference between a lucrative investment and a costly mistake.

Some important house-flipping pros to hire include:

- Real estate attorney: Manages legal aspects, ensures compliance with local laws, and drafts contracts.

- Accountant: Helps with business structure, filing house-flipping taxes , expense tracking, and financial advice.

- Real estate agent: Offers industry insights, local connections, and accurate market data.

- General contractor (GC): Oversees rehabs, ensuring quality and reducing errors.

- Administrative assistant: Assists with tasks and project management as your business grows.

- Handyperson: Handles smaller jobs, saving time and costs.

- Landscaper: Enhances curb appeal for higher ROI.

- Architect (for large projects): Ensures structural integrity and avoids costly issues.

The most trusted way to find experts is through referrals. Suppose other real estate investors or agents in your network succeeded with a professional. In that case, it’s more likely that you’ll also have a smooth experience with them. However, you should still check them out and vet them with an interview or meeting to ensure you choose the right professionals. In the long run, spending time and effort to choose an expert saves you time, money, and stress.

Pro tip: Building and utilizing your network is crucial for success in house flipping. A strong network can connect you with the right professionals, making it easier to find deals and resources. Your network provides valuable insights, market knowledge, and support from experienced individuals who can guide you through the process and help avoid common pitfalls. Additionally, networking can lead to partnerships and opportunities for collaboration, enabling you to scale your house-flipping business effectively.

5. Identify the Right Properties to Fix & Flip

Before jumping into a purchase, begin by evaluating potential properties to flip. Run a comparative market analysis (CMA) on properties or have a real estate agent run one to determine the value and calculate the return on investment (ROI). Evaluate each property within its neighborhood, location, and real estate market context.

When learning how to find houses to flip , some essential factors to evaluate include:

- Location: Pick nearby properties for easy site visits.

- Neighborhood: Choose desirable neighborhoods for curb appeal.

- Amenities: Houses near parks, schools, and other establishments attract buyers.

- Structural issues: Avoid costly structural problems.

- Value-add repairs: Research profitable upgrades like kitchens and bathrooms.

- Property size: Focus on square footage over the floor plan.

- Outdoor space: Properties with outdoor areas tend to yield higher returns.

Did you know? The potential return on investment (ROI) in a house-flipping business can be significant. Investors purchase distressed properties at a lower cost, renovate them to increase their market value, and then sell them at a higher price, resulting in a profit. ROI percentages vary widely, but successful flips can yield returns ranging from 10% to 100% or even more of the initial investment , depending on location and other factors. However, house flipping comes with risks, such as unexpected renovation costs or market fluctuations, so thorough research and proper planning are crucial to maximize ROI and minimize potential losses.

6. Create a Marketing & Lead Generation Plan

Setting up a successful house-flipping business involves some marketing and real estate branding . While a complex marketing funnel isn’t necessary initially, a well-crafted marketing strategy ensures a steady influx of new projects for your house-flipping business.

Marketing Your Fix & Flip Business

Having foundational marketing elements is crucial for projecting professionalism, building your reputation as a reliable home flipper, and marketing your newly renovated properties, especially if you seek funding. Lenders see your professionalism and experience as favorable.

Consider starting your business with these marketing elements :

Logo: A quality logo distinguishes your brand and is useful across future marketing materials.

Business cards: Affordable and handy for networking; consider adding QR codes for website access.

Website: A simple, one-page site effectively communicates your identity, services, and contact information.

Gmail business email account. (Source: Google Workspace )

Business email: Use your website domain for a professional email address, boosting your image.

Business card templates (Source: Canva )

As you dive into house flipping, consider expanding your marketing with tools like social media and email campaigns. Canva, a versatile and user-friendly design platform, offers templates for various needs, from social media posts to postcards and letterheads. It’s a go-to tool for business owners, making it easy to create diverse marketing materials, both digital and print.

Visit Canva

Lead Generation Strategies for Your Business

Additionally, you will need to consistently generate potential renovation projects and motivated sellers. Many beginners use listing platforms like Zillow to find houses to flip, which offers versatile search filters to refine property searches based on your chosen criteria.

Homeowners opting to sell without agents often use FSBO.com ( For Sale By Owner ), Craigslist, or Facebook Marketplace. Foreclosed and bank-owned properties typically appear on websites like Foreclosure.com or the government’s HUD Homes site. These properties are appealing to investors for their potential to offer significant discounts and investment opportunities. Generate leads and learn how to find cheap houses to flip, start with the following resources:

7. Buy, Rehab, Market & Sell Properties

Once you have all the right business strategies and structures in place, the bulk of your work as a house flipper comes to buying, renovating, and selling properties. As soon as you close on your property, you’ll have monthly carrying costs that can add to your planned expenses. Therefore, the more efficiently you can complete the flip, the higher your profits.

The process of making money flipping houses goes like this:

- Close on the investment property: Buying an investment property is different than purchasing a primary home, so make sure you know how to determine a budget, evaluate properties, and choose the right lender. Depending on your financing, closing on the property can take 15 to 45 days.

- Make all repairs, renovations, and upgrades: Repairing a fix-and-flip property will take the most time. You or your general contractor should manage the timeline, remembering that delays increase your carrying costs.

- Market the property for sale: There are endless ways to generate excitement about your property and increase the sale price. For some ideas, read 21 Real Estate Marketing Ideas & Strategies . Although these strategies are aimed at agents, they are equally effective for home flippers.

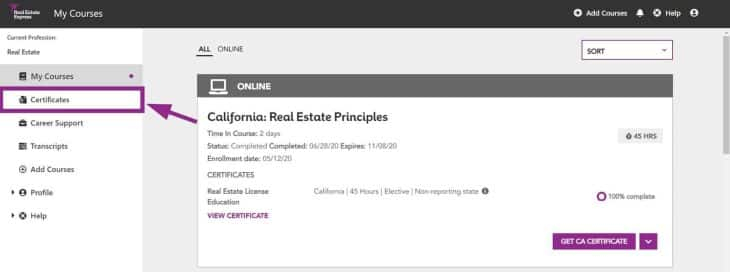

- Sell the property: Working with a real estate agent is often the most efficient way for flippers to sell their properties since they manage communications with the buyer’s agent and lender and often schedule the necessary appointments. However, many flippers choose to get a real estate license to gain access to the MLS and save even more on fees.

Course platform (Source: Colibri Real Estate )

Experienced house flippers often handle their property transactions to reduce expenses. You can conveniently pursue a real estate license through online schools like Colibri Real Estate, which offers comprehensive courses, instructor support, e-books, live Q&A sessions, and exam prep tools with a pass guarantee. Colibri Real Estate, an accredited education provider, has assisted countless agents and brokers nationwide in obtaining their licenses, enhancing profit opportunities.

Visit Colibri Real Estate – Use Promo Code: FSB30 for 30% off

Mistakes to Avoid When Starting a House Flipping Business

Every beginner inevitably makes mistakes while building their business. For house flippers, there are some definite learning curves, and every new project presents unique challenges. However, the more mistakes you can avoid in the beginning, the more efficiently you’ll be able to build your flipping business and generate a strong ROI.

Some mistakes to avoid when flipping houses include:

- Overestimating your abilities: Avoid taking on major electrical work or plumbing tasks if you lack the necessary skills. It can lead to costly mistakes.

- Lacking a team: House flipping often requires collaboration with contractors, real estate agents, and other professionals. Trying to do it all alone can lead to delays and errors.

- Overspending on renovations: Going over budget can eat into your profits. Plan carefully and prioritize cost-effective improvements.

- Buying a flip far away: Distance can make managing the project effectively and promptly responding to issues challenging.

- Not understanding the numbers: Accurate financial calculations are crucial. Failing to grasp costs and potential profits can result in financial setbacks.

- Being unprepared for the unexpected: House flips often encounter unexpected issues, such as hidden structural problems. Have a contingency plan and budget for surprises.

Frequently Asked Questions (FAQs)

What is the 70% rule in house flipping.

Real estate investors use the 70% rule in house flipping to determine the maximum purchase price for a property to ensure a profitable flip. According to this rule, investors should not pay more than 70% of the property’s after-repair value (ARV) minus the estimated repair and carrying costs.

How much money do you need to start flipping houses?

The initial capital needed for house flipping varies due to location, property type, and your specific flipping houses business plan. Generally, having access to $20,000 to $50,000 is a good starting point. This budget should encompass property purchase, renovation, carrying costs (like taxes and utilities), and contingencies for surprises. Access to financing options, such as loans or partnerships, can also affect your capital requirements.

How many houses a year can you flip?

The number of houses you can reasonably flip in a year depends on various factors, including your experience, team, resources, and local market conditions. On average, experienced house flippers may aim for two to five flips yearly. Beginners may start with one to two flips annually. Scaling beyond these numbers often requires a well-established operation, access to financing, and efficient project management.

Bottom Line

Learning how to start a house-flipping business begins with a strong business plan. It also starts by setting up the right legal and financial systems to set yourself up for success as the business grows. Successful home flippers also create a network of professionals to get their flips done properly and implement strategic marketing and lead generation systems. After following this step-by-step guide, your house-flipping business will be ready to generate strong profits.

About the Author

Find Melanie On LinkedIn

Melanie Patterson

Melanie is a contributing real estate expert at Fit Small Business and the editor of our sister site, The Close, specializing in real estate business development for new and seasoned agents, property managers, and real estate investors. She has over 30 years combined experience in real estate sales, marketing, property management, and investing and is a licensed real estate agent in NH & MA.

By downloading, you’ll automatically subscribe to our weekly newsletter.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

House Flipping Business Plan Template

Written by Dave Lavinsky

House Flipping Business Plan

Over the past 20+ years, we have helped over 10,000 entrepreneurs and business owners create business plans to start and grow their house flipping businesses. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a house flipping business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a House Flipping Business Plan?

A business plan provides a snapshot of your house flipping business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your House Flipping Business

If you’re looking to start a house flipping business, or grow your existing house flipping business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your house flipping business in order to improve your chances of success. Your house flipping business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for House Flipping Businesses

With regards to funding, the main sources of funding for a house flipping business are personal savings, credit cards, bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

Personal savings is the other most common form of funding for a house flipping business. Venture capitalists will usually not fund a house flipping business. They might consider funding a house flipping business with a national presence, but never an individual location. This is because most venture capitalists are looking for millions of dollars in return when they make an investment, and an individual location could never achieve such results. With that said, personal savings and bank loans are the most common funding paths for house flippers.

Finish Your Business Plan Today!

If you want to start a house flipping business or expand your current one, you need a business plan. Below are links to each section of your house flipping business plan template:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of house flipping business you are operating and the status. For example, are you a startup, do you have a house flipping business that you would like to grow, or are you operating a chain of house flipping businesses?

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the house flipping industry. Discuss the type of house flipping business you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of house flipping business you are operating.

For example, you might operate one of the following types of house flipping businesses:

- Single Family Home : this type of house flipping business focuses on one property that is usually bought at a low price, completely renovated and then sold for a profit.

- Multi-unit Complex: this type of business focuses on a multi-unit building where a house flipper rehabs every unit within the building and then either sells those units individually or sells the complex as a whole.

- Multi-investor Flipping: this type of house flipping is where houses are flipped between multiple investors before it enters the fix and flip stage.

In addition to explaining the type of house flipping business you will operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of customers served, number of positive reviews, number of referrals, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the house flipping industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the house flipping industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your house flipping business plan:

- How big is the house flipping industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your house flipping business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your real estate flipping business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: homeowners, prospective homeowners, contractors and real estate agents.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of house flipping business you operate. Clearly, prospective buyers would respond to different marketing promotions than contractors, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve. Because most house flipping businesses primarily serve customers living in their same city or town, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other house flipping businesses.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes real estate agents, online home listing services and investors. You need to mention such competition as well.

With regards to direct competition, you want to describe the other house flipping businesses with which you compete. Most likely, your direct competitors will be house flippers located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What types of housing units do they buy, rehab and sell?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide better design, construction and renovation services?

- Will you provide services that your competitors don’t offer?

- Will you provide better customer service?

- Will you offer better pricing?