Career in Consulting

280 Free Case Interview Examples

Do you want to get access to over 280 free case interview examples (with answers)?

If you have interviews planned at McKinsey , The Boston Consulting Group , or any other consulting firm, you are probably looking for case interview examples.

So, to help you prepare, I have compiled a list of 280 free case interview examples:

- Over 30 free case interview examples (+ interview prep tips) from the websites of top consulting firms

- More than 250 free case interview examples from top business school case books

Moreover, you’ll get my take on which case studies you will likely have in interviews.

In short, the resources listed hereafter will be very helpful if you are starting out or have already made good progress in preparing for your case interviews.

One last word : check out this free case-cracking course to learn how to crack the most recent types of case questions consulting firms use in actual interviews.

Let’s get started!

Table of Contents

Get the latest data about salaries in consulting, mckinsey: tips and case interview examples.

McKinsey & Company’s website is definitely one of my favorites.

Because this gives so much insightful information about the role of a consultant and what the hiring process looks like.

Therefore, I highly recommend spending time on their website, even if you are not targeting McKinsey.

In the meantime, here are 8 McKinsey case interview examples

- Electro-light

- GlobaPharma

- National Education

- Talbot trucks

- Shops corporation

- Conservation forever

Check out the McKinsey Hub : A library of 20+ free resources that cover everything you need to secure a job offer at McKinsey.

Besides, here is another McKinsey case interview example.

This case interview question has been recently asked in a real interview:

𝘦𝘊𝘢𝘳𝘊𝘰, 𝘢 𝘑𝘢𝘱𝘢𝘯𝘦𝘴𝘦 𝘭𝘦𝘢𝘥𝘪𝘯𝘨 𝘮𝘢𝘯𝘶𝘧𝘢𝘤𝘵𝘶𝘳𝘦𝘳 𝘰𝘧 𝘦𝘭𝘦𝘤𝘵𝘳𝘪𝘤 𝘱𝘢𝘴𝘴𝘦𝘯𝘨𝘦𝘳 𝘷𝘦𝘩𝘪𝘤𝘭𝘦𝘴, 𝘩𝘢𝘴 𝘣𝘦𝘦𝘯 𝘴𝘵𝘳𝘶𝘨𝘨𝘭𝘪𝘯𝘨 𝘸𝘪𝘵𝘩 𝘢 𝘭𝘰𝘸 𝘮𝘢𝘳𝘬𝘦𝘵 𝘴𝘩𝘢𝘳𝘦 𝘪𝘯 𝘵𝘩𝘦 𝘉2𝘉 𝘴𝘦𝘨𝘮𝘦𝘯𝘵. 𝘛𝘩𝘦𝘺 𝘦𝘯𝘫𝘰𝘺 𝘴𝘵𝘳𝘰𝘯𝘨 𝘱𝘰𝘴𝘪𝘵𝘪𝘰𝘯𝘴 𝘪𝘯 𝘵𝘩𝘦 𝘉2𝘊 𝘴𝘱𝘢𝘤𝘦, 𝘣𝘰𝘵𝘩 𝘥𝘰𝘮𝘦𝘴𝘵𝘪𝘤𝘢𝘭𝘭𝘺 𝘢𝘯𝘥 𝘪𝘯 𝘵𝘩𝘦 𝘪𝘯𝘵𝘦𝘳𝘯𝘢𝘵𝘪𝘰𝘯𝘢𝘭 𝘮𝘢𝘳𝘬𝘦𝘵. 𝘏𝘰𝘸𝘦𝘷𝘦𝘳, 𝘦𝘊𝘢𝘳𝘊𝘰’𝘴 𝘴𝘢𝘭𝘦𝘴 𝘵𝘰 𝘴𝘮𝘢𝘭𝘭 𝘢𝘯𝘥 𝘮𝘦𝘥𝘪𝘶𝘮 𝘴𝘪𝘻𝘦 𝘣𝘶𝘴𝘪𝘯𝘦𝘴𝘴𝘦𝘴 𝘤𝘰𝘯𝘵𝘪𝘯𝘶𝘦 𝘴𝘵𝘢𝘺𝘪𝘯𝘨 𝘧𝘢𝘳 𝘣𝘦𝘭𝘰𝘸 𝘦𝘹𝘱𝘦𝘤𝘵𝘢𝘵𝘪𝘰𝘯𝘴. 𝘛𝘩𝘦 𝘊𝘌𝘖 𝘩𝘢𝘴 𝘪𝘯𝘷𝘪𝘵𝘦𝘥 𝘺𝘰𝘶 𝘵𝘰 𝘩𝘦𝘭𝘱 𝘵𝘩𝘦𝘮 𝘰𝘶𝘵.

How would you approach this business problem?

When ready, check this video below where I present how to approach this problem.

BCG: Tips And Case Interview Examples

The Boston Consulting Group website states something very important: the goal of the hiring process is to get to know you better, which means, in the context of Consulting interviews, understanding how you solve problems .

Remember this: in case interviews, to show how you think is MUCH MORE IMPORTANT than to find an answer to the case .

As a result, you will have case study questions to showcase your problem-solving skills. Likewise, fit interviews have the same purpose: to show what problems you faced and how you resolved them.

- BCG interview prep tips

- BCG’s interactive case tool

- BCG case interview example: climate change challenge

- BCG case interview example: GenCo

- BCG case interview example: FoodCo

Check out the BCG Hub : A library of 20+ free resources that cover everything you need to secure a job offer at BCG.

Bain: Tips And Case Interview Examples

Bain & Company’s website highlights something very important: successful applicants manage to turn a case interview into a conversation between two consultants .

In other words, you don’t want to appear as a candidate but as a consultant !

To do this, you need to master the main problem-solving techniques that consulting firms want to see.

- Bain interview prep tips here and here

- Bain case interview examples: coffee , fashioco

- Bain case interview sample videos: a first video , a second video

Check out the Bain Hub : A library of 20+ free resources that cover everything you need to secure a job offer at Bain & Company.

Deloitte: Tips And Case Interview Examples

As for the BCG’s section above, the Deloitte website clearly states that in case interviews , it is much more important to show how you think and interact with your interviewer than to find the right answer to the case.

- Deloitte interview prep tips

- Deloitte case interview examples: here (more than 15 case interview examples)

- Deloitte case interview example: Federal Agency

- Deloitte case interview example: Recreation Unlimited

- Deloitte case interview example: Federal benefits Provider

- Deloitte case interview example: Federal Civil Cargo protection Bureau

Get 4 Complete Case Interview Courses For Free

You need 4 skills to be successful in all case interviews: Case Structuring, Case Leadership, Case Analytics, and Communication. Join this free training and learn how to ace ANY case questions.

Oliver Wyman: Tips And Case Interview Examples

Like the Deloitte website, Oliver Wyman’s website points out that, above all, you must demonstrate your ability to think in a structured, analytical, and creative way.

In other words, there are no right or wrong answers, but only showing how you solve problems matters.

- Oliver Wyman interview prep tips

- Oliver Wyman case interview examples: here (Aqualine) and here (Wumbleworld)

Kearney: Tips And Case Interview Examples

Now it’s time to tell you something you could have heard a hundred times.

Yet too many candidates do it.

Do NOT force your solution to adapt to a standard framework . As a result, this will only take you to a place you don’t want to go: the pool of rejected candidates .

To learn more about this, check the “What Not To Do” section on the AT Kearney website .

- Kearney interview prep tips

- Kearney case interview examples: here and here

- Kearney case book: here

Strategy&: Interview Prep Tips

Strategy& doesn’t provide case study examples on its website, but it shares insights on career progression, which I recommend reading when you prepare for your fit interviews.

- Strategy& interview prep tips

Roland Berger: Tips And Case Interview Examples

I like the examples of case studies presented on the Roland Berger website .

Because the two examples of case studies are very detailed and illustrate the kind of solutions your interviewers expect during case discussions.

- Roland Berger interview prep tips

- A first Roland Berger case interview example: part 1 and part 2

- A second Roland Berger case interview example: part 1 and part 2

Alix Partners: Interview Prep Tips

Like Strategy&, Alix Partners doesn’t provide case study examples on its website.

However, they give an overview of what they are looking for: they want entrepreneurial, self-starter, and analytical candidates, which are skills that all consulting firms highly appreciate .

- Alix Partners interview prep tips

OC&C: Interview Prep Tips

Here are two case study examples from OC&C:

- Imported spirit

- Leisure clubs

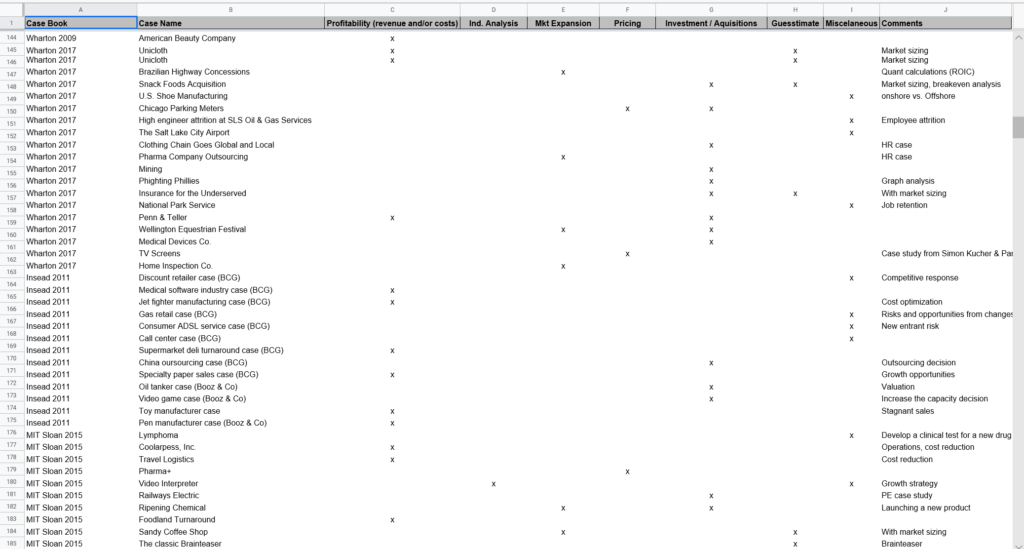

253 Case Studies From Business School Case Books

Most of these 253 case study examples are based on case interviews used by consulting firms in real job interviews .

As a result, you can have a good idea of the case study questions you can have when interviewing at these firms .

The Full List Of 253 Free Case Study Examples

- Chicago business school

- Australian Graduate School of Management

- Columbia business school

- Harvard business school

- Wharton business school (2009)

- Wharton busines school (2017)

- Darden business school

Do you want to practice a specific type of case study? Now you can…

I have sorted this list of 253 case studies by type: profitability, market expansion, industry analysis, pricing, investment or acquisition, and guesstimates (also known as market sizing questions).

Bonus #1: Know The Types Of Cases You Are Likely To have During Your Interviews

- Profitability cases (29% of cases from that list)

- Investment cases (19% of cases from that list)

- Market sizing questions (15% of cases from that list)

As a result, assuming you’ll have 6 interviews (and therefore 6 case interviews) during the recruitment process:

- “Profitability cases are 29%” means that chances to have 2 profitability case studies during your recruitment process are very high

- “Investment cases are 19%” means that chances to have 1 investment case study during your recruitment process are very high.

- “ Guesstimates are 15%” means that chances of having 1 market sizing question during your recruitment process are high.

Bonus #2: The 10 Cases I Recommend You Doing Now

Over 250 examples of case interviews are a great list, and you may not know where to start.

So, I’ve compiled a list of my 10 favorite case studies.

The 5 case studies I recommend doing if you are a BEGINNER

1. stern case book: drinks gone flat (starting at page 24).

This is a good introduction to a common type of case (declining sales here). I liked the solution presented for this case, particularly how it started by isolating declining sales (what range of products? Volumes or prices, or both?).

2. Stern case book: Sport bar (starting at page 46)

This is an investment case (should you invest in a new bar). Even if the solution presented in this case book is not MECE , it covers the most common quantitative questions you might have in such a case. I recommend doing this case.

3. Stern case book: MJ Wineries (starting at page 85)

This is a profitability case. I liked the solution presented in this case because it illustrates how specific good candidates should be. The case concerns wine, so a good candidate should mention the quality of lands and grapes as important factors.

4. AGSM case book: Piano tuners (starting at page 57)

This is a typical market sizing question. How to answer this type of question is a must-know before going to your interviews.

5. Darden case book: National Logistics (starting at page 49)

Again, this is a very common case (how to reduce costs). I liked the broad range of questions asked in this case, covering key skills assessed by consulting firms during case interviews: brainstorming skills (or creativity), quantitative skills, and business sense.

The 5 case studies I recommend if you are more ADVANCED in your preparation

1. stern: the pricing games (starting at page 55).

This case study asks you to help your client assess different business models. I liked this case because the range of issues to tackle is quite broad.

2. Wharton 2017: Engineer attrition at SLS Oil & Gas Services (starting at page 55)

I liked this case study because the case prompt is uncommon: your client has been facing a very high attrition rate among its population of Engineers. As a result, it’s very unlikely that your solution fits a well-known framework, and you’ll have to demonstrate your problem-solving skills by developing a specific solution.

3. Wharton 2017: Pharma Company Goes International, Outsources Benefits, Integrates New Technology (starting at page 95)

This case is about a client considering outsourcing a part of their activity. Even though I don’t know if this type of case study is very common, I had many case studies like this when I passed my interviews a few years ago. And I always found them difficult!

4. Insead: Gas retail case (starting at page 73)

The question in the problem statement is very broad, making this case difficult. So, only good candidates can have a structured case discussion here.

5. Darden: Fire Proof (starting at page 84)

This is a market entry case. Try to solve it by developing a structure as MECE as possible.

CareerInConsulting.com's Free Resources

Access my exclusive free training to help you prepare for your case interviews .

Besides, you can learn my step-by-step guide to answering market sizing questions .

You’ll get my formula to solve all market sizing questions.

Moreover, if you are a beginner, you can read my article on how to solve business cases (+ a 4-week prep plan to get case interview ready).

Also, check these 11 must-know frameworks to ace your case interviews.

Finally, you can read the articles in the blog section of my website.

That’s quite a list.

To complete this list, check this free case interview course , where you’ll find case questions recently asked in actual interviews.

Now, I’d like to hear from you.

Which key insights were new to you?

Or maybe I have missed something.

Either way, let me know by leaving a comment below.

SHARE THIS POST

3 thoughts on “280 Free Case Interview Examples”

Pingback: Market sizing questions: the definite guide (2020) - Career in Consulting

Pingback: Case interview prep: a guide for beginners - Career in Consulting

Pingback: What Does A Management Consultant Do? - Career in Consulting

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

You need 4 skills to be successful in all case interviews: Case Structuring, Case Leadership, Case Analytics, and Communication. Enroll in our 4 free courses and discover the proven systems +300 candidates used to learn these 4 skills and land offers in consulting.

- The 1%: Conquer Your Consulting Case Interview

- Consulting Career Secrets

- Cover Letter & Resume

- McKinsey Solve Game (Imbellus)

- BCG Online Case (+ Pymetrics, Spark Hire)

- Bain Aptitude Tests (SOVA, Pymetrics, HireVue)

- Kearney Recruitment Test

- All-in-One Case Interview Preparation

- Industry Cheat Sheets

- Structuring & Brainstorming

- Data & Chart Interpretation

- Case Math Mastery

- McKinsey Interview Academy

- Brainteasers

Case Interview Math: The Insider Guide

Last Updated on March 27, 2024

Embarking on a career in consulting at leading firms demands mastery over consulting math problems. Statistically speaking, a staggering 85% of management consulting case interviews put candidates to the test with case interview math questions. At top consultancies such as McKinsey , BCG , and Bain , this expectation skyrockets to nearly 100%.

During case interviews, candidates are tasked with dissecting complex mathematical business puzzles, delving into the qualitative aspects that underpin these numbers, and ultimately crafting strategic recommendations.

These mathematical challenges often emerge as the largest hurdle for many aspiring consultants. Drawing from our extensive background in conducting interviews at McKinsey and coaching thousands of interviews on platforms such as PrepLounge and StrategyCase.com, we’ve observed that the lion’s share of mishaps during case interviews arises within this quantitative segment.

Developing math skills in consulting interviews is crucial for candidates aiming for top-tier firms. The ability to navigate these numerical problems not only sets the foundation for success in case interviews but also mirrors the analytical challenges consultants face in real-world scenarios.

This article is your ultimate guide to consulting interview preparation, with a focus on math challenges. Our insights in this expert article aim to demystify the numerical proficiency required by top-tier consulting firms, preparing you to tackle these challenges head-on with confidence and strategic insight. It includes all relevant tips for solving consulting math problems, making complex calculations manageable.

It is a critical installment in our comprehensive consulting case interview prep series:

- Overview of case interviews: what is a consulting case interview?

- How to create a case interview framework

- How to ace case interview exhibit and chart interpretation

- How to ace case interview math questions (this article)

- How to approach brainstorming questions in case interviews

Why Candidates Struggle with Case Interview Math

The conundrum of case interview math is not intrinsically tied to the difficulty of the mathematical problems themselves, which often do not surpass high school-level arithmetic. You have solved similar problems before, maybe not in a business or interview context, but in a classroom setting.

Let’s start with some positivity.

There is no need to fear quantitative problems in case interviews. The level of math required is not more complex than what you have already learned in school and you do not need a specific degree to pass the case interviews.

The true challenge emerges from the synthesis of multiple skills under the high-pressure environment of a case interview.

Logical thinking is paramount, as you must not only arrive at the correct approach but do so swiftly and efficiently. This is compounded by the need to execute calculations with potentially large numbers accurately and quickly, all while maintaining composure to manage the interviewer’s impression. Communication also plays a critical role; articulating your thought process and conclusions in a clear and concise manner is essential.

When faced with the task of juggling these aspects simultaneously, it’s common for candidates to experience panic, leading to a decrease in overall performance. However, by deconstructing these skills and mastering each individually – logical problem-solving, fast and accurate arithmetic, effective communication, and impression management – you can significantly bolster your confidence. This strategic preparation not only mitigates the fear associated with case interview math but equips you with the comprehensive skill set necessary to excel.

That being said, as with every other element in a case interview ( structuring , brainstorming , exhibit and data interpretation ), there is a very specific way of approaching case interview math, which candidates are not used to from their previous academic or professional experience. Learn how to apply business case math to real-world consulting scenarios.

Let’s get to it!

Case Math Mastery Course and Drills

Learn how to tackle case interview math questions with the insight and precision of an experienced consultant with the most comprehensive preparation program on the market. Learn from our McKinsey interviewer experience and benefit from the detailed curriculum of the guidebook and the video program as well as 40 hours of practice.

The Purpose of Case Interview Math

Numerical analysis forms the backbone of decision-making and strategic recommendations in case interviews, reflecting the real-world consulting emphasis on data-driven insights.

In the context of a business problem usually found in a case interview, quantitative analyses are conducted for two reasons.

Identifying problems and quantifying their impact

Initially, consultants are tasked with identifying underlying issues within a business context. Through quantitative analysis, they delve deep into the problem, quantifying its impact to uncover root causes and, subsequently, potential solutions.

In the condensed format of a case interview, you’re expected to mirror this investigative approach, albeit in a more abbreviated manner.

Supporting recommendations

Quantitative data underpins every business recommendation, providing a solid foundation for decision-making. In consulting practice, every suggestion or strategic plan presented to a client is supported by numerical evidence.

Similarly, during a case interview, the quantitative analyses you conduct will critically inform your final recommendations.

Test of your quantitative skills

Moreover, case interviews serve as a proving ground for your quantitative skills, simulating the analytical rigor required in consulting. I cannot remember a single day in my McKinsey career, where I was not running some form of quantitative analysis.

Therefore, honing your ability to devise strategic, logical approaches to quantitative challenges and execute precise calculations is crucial not only for acing case interviews but also for thriving as a consultant.

This skillset ensures you’re well-equipped to deliver insights that drive impactful business decisions, marking your capability to thrive in the consulting domain.

A simplified version of reality

In the case interview context, the mathematical problems presented are invariably a streamlined representation of real business challenges, often drawn from the interviewer’s direct experience with actual clients. This means that while the scenarios aim to mimic the complexities of business decision-making, the approach and calculations are deliberately simplified for the sake of brevity and clarity.

For instance, scenarios might feature fewer market segments or shorter time periods than those in actual business cases, and variables are designed to be more straightforward, allowing for easier manipulation and calculation. It’s also common practice for candidates to round numbers to simplify the process further. Unlike the exhaustive analyses that can span weeks on the job as new insights emerge, a typical math problem in a case interview is designed to be resolved within a succinct 5 to 8-minute window from start to finish. That should give you an idea of how complex it can really be.

This distilled version of reality, however, does not make the task at hand any less challenging. The dual demands of strategizing your steps and executing calculations unfold under the watchful eye of the interviewer, all within a high-pressure, calculator-free environment.

Yet, mastering the basics – quick mental arithmetic, fundamental operations (addition, subtraction, multiplication, division, percentages, and fractions), and the ability to make judicious estimates – proves invaluable. These skills equip you to tackle most interview problems effectively, without the need for advanced mathematical knowledge.

While some problems might feature a complexity that demands logical problem-solving and potentially multiple calculation steps, the essence of case interview math lies in its reduced complexity, designed to assess your analytical acumen rather than your prowess in advanced mathematics.

The myth of perfection

In the high-stakes environment of case interviews, there’s a prevalent myth that perfection is the key to success. This belief leads many to think that any mistake, particularly in math, spells automatic rejection. However, this couldn’t be further from the truth. Mistakes, whether in calculations or pacing, are not uncommon and do not necessarily jeopardize your chances of success.

It’s important to recognize that errors, to an extent, are expected. You might miscalculate, take a bit longer to arrive at an answer, or even find the interviewer stepping in to guide you. These instances, in isolation, aren’t deal-breakers. They’re often seen as part of the process, providing insights into your problem-solving approach and resilience.

The critical factor is how you handle mistakes. An isolated error or a moment of slowness doesn’t doom your interview outcome. However, repeated errors, especially if they’re indicative of a pattern within the same interview or across multiple interviews, can raise concerns. Moreover, a single mistake leading to a cascade of follow-up errors, triggered by loss of confidence or panic, can be detrimental. This reaction, rather than the initial mistake itself, can hinder your performance significantly. I have seen this hundreds of times in live settings.

One key strategy to mitigate the impact of mistakes is to excel in other aspects of the case interview. Demonstrating exceptional analytical skills, creative problem-solving, or outstanding communication can offset occasional mathematical errors. Interviewers are looking for a well-rounded skill set, so performance spikes in areas other than math can greatly enhance your overall evaluation.

Ultimately, how you respond to mistakes is crucial. Viewing them as learning opportunities rather than failures can transform your interview experience. Showing the interviewer your ability to quickly recover, correct errors, and proceed with confidence speaks volumes about your potential as a consultant. It demonstrates resilience, adaptability, and a growth mindset.

Effective Strategies for Tackling Case Interview Math Questions

Different skill levels, same problem.

Understanding the unique challenges and logic behind math questions in case interviews reveals an interesting observation:

Candidates from various academic backgrounds might find themselves revisiting basic mathematical concepts not engaged with since high school. Conversely, individuals with a strong quantitative foundation, such as engineers, may need to simplify their analytical approach to align with the straightforward nature of case interview math. This adjustment is crucial for all candidates, regardless of their initial competency levels, to adapt to the nuances of case interview calculations effectively.

Both types of backgrounds need to adapt to the specific case interview math principles and process.

Unlike traditional math problems, case interview questions prioritize the relevance and application of mathematical solutions to the business scenario at hand. The aim is not merely to arrive at precise numerical answers but to receive directionally correct results to leverage these findings and inform strategic decisions within the case’s context. Thus, achieving perfectly accurate results is less critical than developing a sound, strategic approach that yields directionally correct insights swiftly.

It’s better to get directionally correct results swiftly and interpret them correctly than getting 100% accurate results and not providing any insights into the case problem. Approach case interview math with this mantra

Adopting a mindset that embraces quantitative analysis as an integral part of every case scenario is essential. This involves not just solving the problem at hand but also considering the broader implications of your calculations on the strategic recommendations you propose. The ability to relate different numerical factors and assess their impact on the business challenge is key.

The apprehension some candidates feel towards case math can be mitigated by understanding that these calculations are designed to reflect real-world business problems in a simplified manner. Therefore, embracing the opportunity to demonstrate logical thinking and analytical prowess through these mathematical exercises is vital.

Even more so, have a quantitative angle in every case, even if the interviewer does not explicitly ask you for it. For example, try to relate numbers to each other, think about the potential quantitative impact of your recommendation, etc.

Many candidates are simply scared of digging into the mathematics of a case. Don’t be that person! rather go where no one else is going and highlight your numerical prowess at every opportunity.

As we delve further, I aim to equip you with the knowledge and strategies to confidently tackle both the structuring and calculation aspects of math questions in case interviews, ensuring you’re well-prepared to handle the quantitative analysis that underpins effective case interview performances.

My approach to every case math problem

Mastering the art of solving quantitative problems in case interviews involves a two-pronged approach: developing a universal strategy applicable across various case scenarios and executing calculations to arrive at concrete insights.

How, then, should one tackle the numerical aspects of case interviews with a structured strategy that you can always rely on? Proving essential math skills for case interviews is less daunting with my step-by-step guide.

- Listening : Engage fully, paying close attention to the information provided by your interviewer. Active listening forms the foundation of your analytical process.

- Clarification : Pause to ensure clarity around the data presented or derived from visual aids such as charts and tables. It’s crucial to confirm the accuracy of these figures and understand the objective of your analysis before proceeding.

- Strategizing : Outline a clear, logical plan for your calculations. For complex problems, don’t hesitate to request a brief moment – typically a minute or two – to organize your thoughts and structure your approach on paper.

- Articulating your strategy : Communicate your planned methodology to the interviewer. This step is vital for preemptively identifying any potential errors and ensuring alignment on the approach.

- Calculation execution : With the interviewer’s nod, carry out your calculations diligently. It’s advisable to work through this phase methodically, allowing yourself time to focus without interruption.

- Verification : Review your work to catch and correct any errors. Ensuring your numbers are reasonable and accurate is key to building a solid argument.

- Presentation of results : Share your findings in a clear, concise, and assertive manner, avoiding presenting your conclusion as a question. Highlight the most critical results, adhering to a top-down communication style as recommended by the Pyramid Principle .

- Interpretation and next steps : Beyond just presenting numbers, interpret what they mean in the context of the case. How do they influence your analysis and recommendations? Always connect your findings back to the larger case narrative, exploring their implications and forming hypotheses based on these insights. Propose next steps.

The benefit of adopting a structured approach to quantitative problems in case interviews is twofold. Firstly, it showcases to the interviewer your ability to navigate complex situations with a level-headed, systematic strategy, effectively demonstrating case leadership qualities. This organized methodology signals that you possess the poise and strategic foresight necessary to dissect and solve business challenges – a trait highly valued in consulting.

Secondly, this approach creates an optimal environment for you to perform at your peak. By delineating the processes of thinking, communicating, and calculating, you’re able to maintain a sharp focus at any given moment. This separation ensures that each step of the problem-solving process receives your undivided attention, significantly enhancing your efficiency and effectiveness.

Conversely, when candidates attempt to juggle multiple aspects simultaneously – such as solving the problem while overly concentrating on managing the interviewer’s impression – results tend to suffer. This scattered focus often leads to underperformance in case interviews, as it dilutes the clarity and precision necessary for success.

By adhering to a structured approach, you not only present yourself as a composed and capable candidate but also set the stage for demonstrating your best analytical and problem-solving skills.

Exercise caution with mental math

For those adept at mental arithmetic, a word of caution: always jot down your calculations. Relying solely on mental computations can lead to significant challenges if errors occur. Without a written record, pinpointing and rectifying mistakes becomes a daunting task, necessitating a complete reevaluation of your work. This not only hampers your ability to quickly identify where you went wrong but also prevents the interviewer from offering guidance or corrections.

Moreover, maintaining written documentation of your steps and intermediate results serves a dual purpose. It enables the interviewer to follow your thought process more effectively, providing an opportunity for intervention if necessary. Furthermore, it allows you to efficiently review your calculations, ensuring accuracy and clarity throughout the problem-solving phase.

Typical Case Interview Math Problems and Key Formulas

3 types of case math problems.

In case interviews, math problems predominantly fall into three main categories, each designed to test your analytical prowess and decision-making capabilities. Understanding these categories not only aids in your preparation but also equips you with the insight to tackle these challenges methodically.

Roughly 90% of case interview math problems can be categorized as follows, guiding you toward strategic recommendations:

- Market or segment sizing : This type of problem requires you to estimate the size of a market or a specific segment within a market. For instance, you might be asked to calculate the potential sales of sports cars in China over the next five years. Alternatively, you might be asked to estimate something, i.e. the impact of an initiative. This involves understanding key influencing variables and making reasonable assumptions to provide a well-reasoned estimate.

- Operational calculations and decisions : These problems focus on the operational aspects of a business and often involve making calculations to improve efficiency, reduce costs, or enhance productivity. A typical question might involve calculating the total time saved if the lead time for each production step is reduced by 15%. Such questions require an analysis of current operations and an understanding of how changes can impact overall performance.

- Investment and financial strategic decisions : This category involves assessing various investment options or financial strategies to determine the most beneficial course of action. For example, you might need to compare the returns of two investment options, where Investment A offers a 12% annual return and Investment B offers a 5.5% return every six months. These problems test your ability to apply financial concepts and formulas to real-world scenarios, evaluating options based on their potential returns, risks, and strategic fit with the client’s objectives.

Extending beyond these primary categories, case interview math problems may also touch upon areas such as cost-benefit analysis, pricing strategies, and financial forecasting. Each type of problem requires a blend of quantitative skills, logical reasoning, and strategic thinking, allowing you to demonstrate your comprehensive understanding of business fundamentals. As you prepare for your case interviews, focusing on these core categories will help you develop a robust footing for tackling mathematical challenges, enabling you to approach each problem.

Case math formulas

Market sizing. When it comes to market or segment sizing questions, it’s perfectly acceptable to seek clarification from your interviewer on specific figures, such as the population of a particular country. Nonetheless, arming yourself with a foundational knowledge of key statistics can streamline your analysis and enhance your efficiency during these exercises. Familiarizing yourself with essential data points, including:

- Global population

- Populations of major countries such as the US, UK, Germany, China, India

- Demographic specifics of regions pertinent to your geographic area

- Average life expectancy rates

- Typical household sizes

- General income brackets

Equipping yourself with these statistics not only speeds up your calculation process but also demonstrates your preparedness and broad understanding of global and regional demographics. For a deeper dive into tackling market sizing questions with confidence and accuracy, including common formulas and strategic approaches, be sure to explore our dedicated article on market sizing questions . This resource is crafted to further refine your skills in estimating market potential, a critical component of case interview success.

Operational calculations. Operational calculations in case interviews demand a tailored approach, requiring you to devise formulas that are directly applicable to the case’s specific context and challenges. Unlike predefined equations, these formulas need to be thoughtfully constructed on the fly, taking into account the unique aspects of the business scenario at hand. Whether it’s streamlining processes, optimizing resource allocation, or improving operational efficiency, your ability to craft and apply these custom formulas is key.

In many instances, you might find yourself tackling optimization problems. These are designed to identify the most efficient way to allocate resources or adjust processes to maximize or minimize a particular outcome, such as cost, time, or production output. Understanding the principles of optimization and how to apply them in various business contexts can significantly enhance your problem-solving toolkit.

To get started, familiarizing yourself with a couple of foundational operational formulas can prove invaluable:

- Utilization rate = Actual output / Maximum output

- Capacity = Total capacity / capacity need per unit

- Resources needed = Demand / Supply (e.g., Employees needed per day = 80 hours of customer requests per day / 8 daily working hours per employee; 10 employees are needed per day)

- Output = Rate (per time) x Time (e.g., Rate = 5 pieces per hour, Time = 5 hours; Output for 5 hours = 25)

These formulas serve as a foundational base from which to approach operational challenges within case interviews.

To evaluate the financial impact of decisions, these few formulas are key.

- Profit = Revenue – Cost

- Revenue = Price x Quantity

- Cost = Fixed cost (the cost that cannot be changed in the short term, e.g., rent) + Variable cost (the cost that changes with the number of products produced or services rendered, e.g., material cost)

- Contribution margin = Price – Variable cost

- Profitability (Profit margin) = Profit / Revenue

- Market share = Revenue of one product / Revenue of all products (in one market)

- Total market share = Total company revenue in a market / Total market revenue

- Relative market share = Company market share / (largest) Competitor market share

- Growth rate = (New number – Old number) / Old number

- Payback period = Investment / Profit per specific time frame (e.g., annual)

- Breakeven number of sales = Investment / Profit per product

- Return on investment = (Revenue – Cost of investment) / Cost of investment = Profit / Cost of investment

- Depreciation refers to the reduction in the value of an asset over time

There are also more advanced concepts, which are common for more specialized financial case interviews, not for generalist roles:

- The NPV is the present value of the sum of future cash in and outflows over a period (t = number of time periods, e.g., years) and is used to analyze the profitability of an investment or project

- Rule of 72: To find out how long it takes for a market, company, or investment to double in size, simply divide 72 by the annual growth rate

- The CAGR shows the rate of return of an investment or a project over a certain period of years (t = the number of years), expressed as an annual percentage

- The perpetuity is an annuity that lasts forever

- The ROE measures how effectively equity is used to generate profit

- The ROA measures how effectively assets are used to generate profit

- It measures how a change in price affects the change in demand

- Gross profit = Revenue from sales – Cost of goods sold (COGS, e.g., materials)

- Operating profit = Gross profit – Operating expenses (e.g., rent) – Depreciation (the spread of an asset’s cost over its useful lifetime, e.g., of a machine) – Amortization (the spread of an intangible asset’s cost over its useful lifetime, e.g., of a patent)

- Gross profit margin = Gross profit / Revenue

- Operating profit margin = Operating profit / Revenue

- The EBITDA looks at the profitability of the core business

Case Interview Math Tips and Tricks

Keep the following tips in mind to 3x your case interview math performance and speed, while reducing the potential for errors and mistakes.

Tackle the problems aggressively

Tackle case study math questions with confidence. Consulting interviewers want to see highly driven candidates who show self-initiative and engagement. If you hesitate whenever a number pops up or make mistakes in the quantitative section of the case, interviewers will test if this is just an anomaly or happens repeatedly. Candidates who struggle with math get more quantitative challenges during the case, whereas candidates who proceed flawlessly through the initial math question(s) often get shortcuts for the remaining quantitative parts or even whole results readily delivered by the interviewer as they have collected enough positive data points about their candidate’s performance in that area.

Hence, it is important to tackle math problems aggressively and with confidence. In most of my client interviews, I notice a hesitancy once the case moves into a more quantitative direction. Many are simply scared of digging into the numerical parts of a case or of discussing things in a quantitative context. Do not be that person!

If you mess up one calculation, you should not let this have a negative impact on the next one.

Re-learn and practice basic calculus

(Re-)learn simple arithmetic operations and practice until you can perform them in your sleep. While case math is never difficult, many candidates struggle with the concept of being watched while doing these basic operations. Therefore, the better your skill to compute quickly in a stressful environment, the bigger your quantitative muscle in the interview.

Practice calculations both mentally and with pen and paper under time pressure and the vigilant eyes of friends and peers. Go through number generators and math drill exercises to work on large-number additions, subtractions, multiplications, and divisions. Work with averages, percentages, and fractions. This certainly helps to build resilience and stamina.

Consider the numerical impact in your analysis

Get a feeling for numbers, percentages, and magnitudes. You should be able to accurately and approximately estimate percentages, percentages of percentages, as well as magnitudes on the spot. This helps you to interpret results and put them into context as well as to spot more obvious mistakes.

You should always have a critical eye on the quantitative aspects of a situation, even if the interviewer does not explicitly ask you about it. For example, relate numbers to each other (e.g., “The total is x, which represents a y% increase” ) or automatically think about the potential financial impact of your recommendation (e.g., “While these measures would definitely help improve our client’s customer satisfaction, I would be curious to understand how much the implementation would actually cost.” ). In addition, put numbers you hear into perspective (e.g., “I heard you say a 12% decrease is needed to achieve our planned cost reduction. I believe that in the current market environment with increasing commodities prices, this could be a difficult undertaking.” ). By interpreting numerical results in that way, you demonstrate strong business sense and judgment. You spot the implications of your outcomes and conclude correctly by discussing the so-what? of your analysis.

Putting numbers into perspective is also a valuable skill during a sanity check (e.g., “Is it really possible that we could increase our revenue by 200 million if we currently only make 50 million? Let me check my calculations again because that doesn’t seem right.” ).

On the other hand, if you are basing your recommendation solely on the outcome of a calculation, it makes sense to also discuss qualitative arguments to demonstrate your holistic big-picture thinking. Management consulting math goes beyond simple calculations, involving strategic thinking and analysis. For instance, if you recommend choosing a supplier solely because it is cheaper than the others, you could discuss that you would also like to look at the quality of their products, the supply chain, the availability, etc. Supplement a quantitative result with qualitative factors and vice versa.

Express problems quantitatively

Instead of approaching problems purely from a qualitative side, make a habit of using equations to describe relationships, ideas, and parts of the issue tree (if appropriate). It helps your thinking, shows that you are structured in your approach, and demonstrates that you are not afraid to get your quantitative hands dirty. A brief example: “Our client’s train tracks on Route A suffer from more than 100% utilization during the peak hours, leading to delays for many trains and passengers. What ways can you think of that could improve the capacity issue?”

To investigate and improve the over-utilization of the route, you could come up with the following equation: Utilization = demand / capacity. From this equation, you can instantly see that you need to either decrease demand or increase the capacity to improve the utilization situation. Demand and Capacity could be potential top-level buckets for your issue tree. You can now list investigative areas or ideas below each to structure your problem analysis. This approach would help you to quickly isolate quantitatively where the problem is coming from and how big it is, then quantify your remedies as you go along, indicating the best levers to pull and the best course of action.

Sanity check everything

Quantitative problems come with the most potential for errors and mistakes as they involve multiple challenging steps and actions you need to go through before reaching a sensible outcome. You want to avoid mistakes in the first place, but we all know that they do happen; even on the job later on. If you cannot avoid a mistake, at least try to catch your own mistakes before the interviewer does. How can you do that?

- Do not assume that the approach you came up with on the spot is correct without double-checking or thinking it through properly (the importance of taking time) .

- Remain vigilant and aware that mistakes are common in the math section. Never communicate the outcome of a calculation before double-checking that it is at least in the right ballpark and not the result of a careless mistake (the importance of sanity checking).

This also applies (or even more so) when you think that the math seems to be relatively easy. I have seen many interviewees getting caught off guard with simple math problems since they pay less attention to them compared to more difficult examples, then falling into a trap or making avoidable mistakes.

In sum, sanity-check your approach to the problem and outcome of each (intermediate) calculation. Use your judgment to spot calculation and estimation results that seem out of line (e.g., 18.3% vs. 183%). There are eight typical error sources:

- The logic is off or too complex.

- Your calculation is wrong (e.g., forgetting to carry the one, magnitude errors).

- You use the wrong numbers for the right approach. I see this often when candidates do not have organized notes and – in the heat of the moment – plug in the wrong numbers to calculate, even though their approach is correct.

- Your assumptions are off.

- You round numbers too generously or simplify the calculations too much (more on rounding later in this chapter).

- You fail to keep track of units and compare apples and oranges (more on that next).

- You forget one or several steps of your calculation. I see this often when candidates are glad to have made it through the math section yet forget to work on the final step of their approach (e.g., adding up two numbers).

- You interpret the results in the wrong way. I see this often when candidates are happy to have finished their calculations and then jump to a conclusion without thinking first. For instance, if we are comparing several scenarios and are interested in the alternative with the best net benefit, you would want to recommend the alternative with the highest result (highest net benefit). Some candidates do not think and select the alternative with the lowest number (lowest net benefit) as they somehow confuse lower with being better in this situation, by mixing it up with costs in their mind. Always make sure to interpret your results correctly and define what your outcome should be when drafting and communicating your approach.

If you spot a mistake and have not yet communicated the faulty result, ask for more time to sanity-check the calculation or the approach. If you have already blurted out a wrong number, state “This cannot be right.” Then, go back to think about your approach or re-do the calculation. Provide reasons why your numbers might be off. Fix the problem quickly if the interviewer does not intervene. Most importantly, do not get thrown off by a mistake, and keep your composure.

Do not go faster after a mistake. Often, follow-up mistakes occur due to your newfound sense of urgency and disappointment in your performance. From my experience, more than 50% of candidates who make a math mistake make another one in the next two minutes. Rather, slow down and take some extra time to pick yourself up! It is not necessarily over yet unless you let it impact your performance going forward.

Keep track of units

Do not lose track of your units. Is it kg or tons, is it USD or EUR, etc.?

- When receiving the brief for a math question, write down every number including its unit.

- While setting up the calculation already prepare (either mentally or preferably on paper) a space for the end result including the correct unit.

- Keep the units for your intermediate results organized and label every number.

Interviewers might use different units for different numbers to check if you are paying close attention or simply just to confuse you. Stay vigilant, play back the units to make sure you have noted them down correctly. You must track the units of the input variables, and manipulate them correctly (i.e., convert all to the same unit), to then get to the right output. Do not compare apples and oranges.

Sometimes interviewers also use multiple units for one variable. For instance, “Our client would pay USD 500 per employee per year with option #1 and USD 1000 per three employees for 10 months with option #2.” Pay close attention in such cases and convert both options to the same units before comparing them, e.g., cost per employee per year.

Use shortcuts in your approach

Set up efficient and effective calculations. Most analyses in the business world rely on multiple assumptions and reasonable estimates, therefore not requiring a 100% level of precision. Hence, most of the time, close-to-correct answers are expected. Employ shortcuts in your approach to get accurate and directionally correct answers. Less is often more.

A couple of examples:

- When drafting formulas, always look for the simplest way to get to an accurate answer. For instance, if you are asked to decide between two potential suppliers by comparing the cost of both over a 40-week period, yet all information in the brief is on a weekly basis, for your decision it is enough to calculate and compare the weekly cost for each. If for some reason you want to calculate the difference over 40 weeks, first take the difference of the weekly cost, then multiply it by 40. Alternatively, you could calculate the cost for each supplier for 40 weeks, and then calculate the difference, but you would end up with more calculation steps and more difficult calculations since larger numbers are involved.

- Think critically about what outcome is needed to support your decision. For instance, if you must find out if the profit margin of a deal for 30 aircraft is more than 10% there is no need to calculate the profit margin for all 30 units but calculating the profit margin for one aircraft is sufficient to evaluate the deal. This leaves you with smaller numbers which are easier to handle and interpret.

- When evaluating which option out of several is the best, only look at metrics that differ for every option. For instance, if the fixed cost for every option is the same, yet the variable cost and revenue are different, you would only need to consider the latter two to provide a recommendation (given that you are not asked to evaluate the total value of each option but just to pick the best).

Always explain your logic, shortcuts, and simplifications to the interviewer. They need to understand why your approach is enough to answer the question. Ninety-nine percent of the time, they will agree. Your final results won’t be 100% accurate either way and are not expected to be for most cases. Use plausible shortcuts in your approach and calculation to reach plausible numbers. The same is true for rounding.

Simplify and round numbers

Like the point above, use rounding to make your calculations easier and minimize the risk of mistakes. Ask the interviewer if it is okay to round beforehand and explain exactly how you want to do it. For instance, if you come up with a revenue number of 82.5 million, ask to use 80 million instead. State beforehand that you will trim the fat a bit; if the interviewer agrees, proceed with your calculation. Similarly, if you get 42.65 as an intermediate result say that in the following calculations, this will be rounded down to 40. Other examples include:

- 83 million Germans become 80 million

- 331 million Americans become 320 or even 300 million (by making some clever assumptions explaining why not everyone in the population should be included in your approach, e.g., by excluding certain demographic segments or areas)

- 365 days in a year become 350 or even 300 days (by making some clever assumptions about bank holidays, opening hours, weekends, etc.)

- USD 983 million in revenue becomes one billion.

The tricky part about rounding numbers is to know when it is a good time to do so. Some case math questions demand precise results. For example, if you are asked whether an investment has an ROI above 12% and you can already spot that the final result is close to that number, it would be wise to calculate with precision. Similarly, if you are comparing two alternatives or outcomes, be careful. Outcomes could be very close to each other so extensive rounding might just flip their ranking and the direction of your answer. That is why you should always ask if you can round and provide details on how you would like to do it. That way, the interviewer could provide feedback on whether rounding is a good idea or not.

On the other hand, rounding is especially helpful when 100% precise answers are not needed. For instance, when you calculate a singular outcome, i.e., not comparing multiple numbers or outcomes. You might also round if your calculations yield only directionally correct results anyway, and precise answers are not expected, for instance, when you need to rely on (multiple) assumptions in your approach. Examples would be estimating the size of a market or the impact of a measure, which come with many assumptions and degrees of uncertainty.

What are the best practices related to rounding?

You should round only within a ten percent margin, ideally less, and within five percent. Otherwise, you might skew the results, over or understate the outcome, and provide false recommendations. Think about the impact of rounding consecutive numbers. You can either get more precise results because the effects cancel each other out or magnify the blur of rounding.

For instance, if you want to calculate the revenue, which is quantity times price and the quantity is 9,500 units and the price is USD 35, you could calculate with a quantity of 10,000 and a price of USD 30. That roughly keeps you in a 10% margin of the precise result. If you round both numbers in the same direction, up or down, you would already be off by around 20% from the precise result.

To create a general rule: When you sum two numbers or multiply them, make sure to round one number up and the other one down, essentially rounding in the opposite direction. If you want to subtract or divide, make sure to round both numbers either up or down, rounding in the same direction. Lastly, whenever you deal with indivisible items, round them up to a whole. For instance, if you calculate that you would need to purchase 533.4 new cars for a taxi company to meet their demand, round it up to 534. There are no half-cars.

Take your time

The single biggest lever to improve the outcome of your quantitative analysis is to take time and perform numerical tasks on your terms. What this means is that you should not get pressured to answer or calculate on the spot but rather ask the interviewer for some time to prepare your logic and then, again, to perform your calculations. One minute is usually fine for the logic and up to three minutes are okay for the actual calculations. Of course, faster is better but faster and wrong is worse than slow, steady, and accurate.

Remember our initial discussion. You do not need to have a spike in every area of the case, yet you should avoid mistakes at all costs. A slow but accurate math answer helps you get the offer if you demonstrate spikes in other areas. A wrong but fast answer might lead to a rejection, even if you spike in other areas.

Do not feel pressured to talk to the interviewer while you are thinking or calculating. Focus on one thing at a time. Only communicate your logic, your results, or if you want, your intermediate outcomes once you are done with each step.

Watch the 0s

You would not believe how many candidates fall into this trap. Many people struggle with large numbers, simplify them by cutting zeros, and then end up losing zeros along the way or even adding some to the result. Watch out for zeros that you have trimmed or left out to facilitate your calculations. There are two best practice solutions to deal with and keep track of zeros:

- scientific notation.

For labels, add k for thousand (000), m for million (000,000), and b for billion (000,000,000) when manipulating larger numbers. That way you can simplify and keep track of your zeros.

Alternatively, by applying the scientific notation, you can trim the power of 10s and then perform simple calculations. Once you reach a conclusion you can add your zeros back. Let’s look at one example: Calculate 96 x 1,300,000.

First, just calculate 96 x 13 x 10 5 , essentially getting rid of the five zeros of the second number: 96 x 13 = 96 x 10 + 96 x 3 = 1,248

Add the 5 zeros back, which makes it to 124,800,000.

Another example, a division: 1.4bn / 70mn = (1.4 x 10 9 ) / (7 x 10 7 ) = 0.2 x 10 2 = 20

When adding the zeros back, for a multiplication you would add the superscripted numbers, for a division you would subtract one from the other.

Adopt one of the two options discussed above when practicing so it becomes second nature to you. You will never struggle with zeros again.

Case Interview Math Practice Questions

Practice case math question #1.

It’s important to understand what to expect when preparing for your case interviews.

Let’s look at the following case interview math example:

Scenario : Imagine you are a consultant working for a beverage company, “RefreshCo,” which is considering launching a new line of herbal tea products. RefreshCo aims to understand the potential market size, profitability, and key financial metrics associated with this launch to make an informed decision. Your task is to help RefreshCo by analyzing if the breakeven will be achieved within 5 years. Data provided : RefreshCo estimates the initial investment for launching the new herbal tea line at $2 million. The expected lifetime of the product in the market is 5 years. The target market size for herbal tea in Year 1 is estimated at 2 million potential purchases initially, with a 5% annual growth rate. RefreshCo aims to capture a 10% market share in Year 1, with a 10% growth in market share each subsequent year. The selling price per unit is set at $4, with the cost of goods sold (COGS) at $2.5 per unit. Fixed costs (excluding the initial investment) are estimated at $500,000 per year. Prompt for a case interview math problem

Take some time to work on this question and then come back to the solutions below.

Let’s go through the calculations for each section in detail:

Market size calculation

The market size for each year is calculated using the compound growth formula: Market size=Initial market size×(1+Growth Rate)^Years

- Year 1 : 2,000,000 (Given)

- Year 2 : 2,000,000×(1+0.05)=2,100,000

- Year 3 : 2,000,000×(1+0.05)^2=2,205,000

- Year 4 : 2,000,000×(1+0.05)^3=2,315,250

- Year 5 : 2,000,000×(1+0.05)^4=2,431,013

You could also calculate each year based on the number of the previous year.

Revenue projections

Revenue is calculated as the product of potential customers and selling price, considering the annual growth in market share.

- Year 1 Revenue : 800,000 (Calculated based on market share, which is growing by 10% every year, and the selling price)

- Year 2 Revenue : 924,000

- Year 3 Revenue : 1,067,220

- Year 4 Revenue : 1,232,639

- Year 5 Revenue : 1,423,698

Profitability analysis

Profit for each year is calculated by subtracting total costs (COGS per unit multiplied by the number of units sold plus fixed costs) from total revenue.

- Year 1 Profit : −200,000 (Revenue minus costs)

- Year 2 Profit : −153,500

- Year 3 Profit : −99,792

- Year 4 Profit : −37,760

- Year 5 Profit : 33,887

Break-even analysis

The break-even point is not reached within the 5-year period as cumulative costs exceed cumulative revenues throughout the period. Based on the calculations, RefreshCo will not achieve breakeven within the first 5 years of launching the new line of herbal tea products.

By the end of the 5th year, the cumulative profit (including the initial investment as a negative profit) is still negative, amounting to approximately -$2,457,166 .

To facilitate and speed up your calculations you could also work with shortcuts such as generous rounding or estimating the impact of the growth rate in market size and market share. The result would still be directionally correct, indicating that this is not a good business idea.

Practice case math question #2

Let’s look at another example:

Scenario : AutoPartsCo is a manufacturer specializing in automotive parts. Due to increasing demand, the company is exploring ways to optimize its production process for one of its key products: brake pads. The company operates two production lines, Line A and Line B, each with different capacities, costs, and output levels. Your task as a consultant is to analyze the provided data and recommend which production line should be optimized to maximize efficiency and reduce costs, based on average cost per unit. Data provided : Line A : Capacity: 10,000 units/month Current monthly production: 8,000 units Fixed costs: $120,000/month Variable cost per unit: $15 Line B : Capacity: 15,000 units/month Current monthly production: 12,000 units Fixed costs: $150,000/month Variable cost per unit: $12 Based on the average cost per unit, recommend which production line AutoPartsCo should focus on optimizing. Consider factors like capacity utilization and potential for cost reduction. Prompt for a case interview math problem

- For Line A and Line B, calculate the total costs (fixed costs + total variable costs) and then divide by the number of units produced to find the average cost per unit.

- Total Variable Costs for each line are calculated as the product of the variable cost per unit and the number of units produced.

- Compare the average costs per unit between Line A and Line B to determine which line is currently more cost-efficient.

- Assess the capacity utilization for each line (current production divided by total capacity) to identify potential for optimization.

- Based on the cost efficiency and capacity utilization, recommend which production line offers the best opportunity for optimization and why.

Average cost per unit:

- Line A : The average cost per unit is $30.

- Line B : The average cost per unit is $24.5.

Capacity utilization

- Both Line A and Line B have a capacity utilization rate of 80%.

Recommendation

Based on the average cost per unit, Line B is currently more cost-efficient than Line A, with a lower average cost per unit of $24.5 compared to $30 for Line A. Additionally, both production lines are operating at the same capacity utilization rate of 80%, suggesting that neither line is currently overburdened.

Considering the lower average cost per unit and equal capacity utilization, AutoPartsCo should focus on optimizing Line B . Optimizing Line B could further reduce costs and enhance efficiency, given its already lower cost base and potential for increasing production closer to its full capacity without the immediate need for significant capital investment.

This recommendation is made with the assumption that demand can absorb the increased production and that similar quality standards can be maintained across both lines. Further analysis could involve exploring ways to reduce the variable and fixed costs of Line A or increasing its production volume to improve its cost efficiency.

Mental Math Concepts and Shortcuts

Mental math for consulting requires practice and strategy. Below are some tricks to become faster, more accurate, and more comfortable with case math as well as more advanced concepts that you might encounter during interviews. The more often you employ these tricks during practice and work with certain concepts, the more it becomes second nature to you. Sometimes you might be able to combine a couple of tricks to become even faster.

While there are many specific calculation shortcuts (e.g., when multiplying a number by eleven), you should focus on a couple of shortcuts that are replicable and can be used for most situations. Don’t try to memorize many different shortcuts that only have highly isolated use cases. Internalize and use a few shortcuts well. Like everything else in consulting interviews: Do not boil the ocean.

Basic arithmetic calculations

Master quick and effective arithmetic shortcuts essential for acing Bain, BCG, and McKinsey math case interviews:

Learn these simple shortcuts and use the examples below as pointers.

Build groups of 10

When adding up numbers, build groups of numbers that add up to 10 or multiples of 10.

7 + 3 + 12 + 8 + 5 + 5 = 40

(10) + (20) + (10) = 40

Go from left to right

356 + 678 = (356 + 600) + 70 + 8 = (956 + 70) + 8 = 1026 + 8 = 1034

This is a simple way to become faster and more accurate once you have internalized it.

Subtractions

Make it to 10

When performing quick subtraction, figure out what makes it to 10.

For instance: 4 2 – 2 5

- Reverse the subtraction for the unit digit (5 – 2 = 3)

- Add the number that would make it to 10 (3 + 7 = 10); this is the units digit of the result

- Add 1 to the digit on the left of the number you are subtracting (2 + 1 = 3)

- You end up with 7 on the unit digit and 4 – 3 = 1 on the 10s place, which is 17

Let’s use another example: 3853 – 148

- Reverse the unit digit (8 – 3 = 5)

- Add the number that would make it to 10 (5 + 5 = 10)

- Add 1 to the digit on the left of the number you are subtracting (4 + 1 = 5)

- You end up with 5 on the unit digit, 5 – 5 = 0 on the 10s place, and 8 – 1 = 7 on the hundreds place, which gives you a result of 3705

With a bit of practice, the what do you need to add to make it to 10 becomes an automated habit for your subtractions: 1 + 9, 2 + 8, 3 + 7, 4 + 6, 5 + 5, 6 + 4, 7+ 3, 8 + 2, 9 + 1

You can use the same approach we’ve discussed for additions for subtractions as well:

42 – 25 = (42 – 20) – 5 = 22 – 5 = 17

Multiplications

Get rid of 0s

To make your calculations simpler, get rid of the zeros at first, adding them again at the end. For instance, if asked to calculate 34 x 36,000,000: convert it into 34 x 36m, which is 1,224, then add six zeros to that number which is 1,224,000,000

Use the label method ( “m” ) or the scientific notation (x10 6 ). If you had to multiply 3,400 times 36,000,000: convert again to 3.4k x 36m, which is 122.4, then move the comma to the right side of the 4 and add eight zeros (the sum of the zeros you got rid of in the beginning: 3 + 6), which is 122,400,000,000. Using the scientific notation, we would end up with this: (3.4 x 10 3 ) x (36 x 10 6 ) = 122.4 x 10 9 = 122,400,000,000.

Break apart multiplications by expanding them and breaking one of the terms into simpler numbers. For instance: 18 x 5 = 10 x 5 + 8 x 5 OR (20 – 2) x 5 = 20 x 5 – 10 = 90

Factor with five

Factor common numbers to simplify your calculations when dealing with multiples of 5. For instance: 17 x 5 = 17 x 10 / 2 = 85.

Another example would be 20 x 15 = 20 x 10 x 3 / 2 = 300

The most common numbers to keep in mind are: 5 = 10 / 2; 7.5 = 10 x 3 / 4; 15 = 10 x 3 / 2; 25 = 100 / 4; 50 = 100 / 2; 75 = 100 x 3 / 4

Exchange percentages

Sometimes you can exchange percentages to simplify the calculation. For instance:

60 x 13% = 0.6 x 13 or 6 x 1.3 = 7.8

Convert to yearly data

If you want to convert daily to yearly data, instead of multiplying by 365, multiply by 30 and then by 12, which would add up to 360 days. For most cases, this is close enough and can be argued for well by using certain assumptions, e.g., bank holidays, and downtimes. Always notify interviewers about your assumptions and simplifications.

Convert percentages

Convert percentages into divisions. For instance: 20% of 500 = 500 x 1 / 5 = 500 / 5 = 100

Split into 10ths

Split numbers into 10ths. For instance: 60% of 200 = 10% of 200 x 6 = 120

Apply expansion in a similar manner as described already for multiplications:

- Simple example: 35 / 5 = 30 / 5 + 5 / 5 = 6 + 1 = 7

- More complex example: 265 / 5 = 200 / 5 + 60 / 5 + 5 / 5 = 40 + 12 + 1 = 53

This can be extremely useful when trying to estimate a number as you do not need to perform all calculations up to the last digit to get to a ballpark estimate, e.g., 200 / 5 + 60 / 5 = 52 ≈ 50

Advanced case math concepts

In case interviews, calculating the average is popular since it is simple, yet demands several calculations to arrive at a result. It is a good pressure test for candidates. For example, you might be presented with a table containing data on three products, each with different production costs and the same production quantity. You might have to calculate the average production cost for one unit. The average is the sum of terms divided by the number of terms. For instance, the production cost of Product A is 5, of Product B, 10, and of Product C, 15. The average production cost is (5 + 10 + 15) / 3 = 30 / 3 = 10 for one unit.

A common variation is weighted averages . Instead of each of the data points contributing equally to the final average, some data points contribute more than others and therefore, need to be weighted differently in your calculations. If the weights add up to one, multiply each number by its weight and sum the results. If the weights do not add up to one, multiply each variable by their weight, sum the results, and then divide by the sum of the weights.

To stick with the example above, Product A might be responsible for 20% of the sales, whereas Product B and C for 30% and 50% respectively. Alternatively, it could be written as the following: There are 40 units of Product A, 60 units of Product B, and 100 units of Product C. The weighted average is: 5 x 20% + 10 x 30% + 15 x 50% = 5 x 0.2 + 10 x 0.3 + 15 x 0.5 = 1 + 3 + 7.5 = 11.5. For the second set, you could calculate it as: (5 x 40 + 10 x 60 + 15 x 100) / 200 = 11.5. Other common contexts, where you are asked to calculate averages could be growth rates, demographics, economic data, geographies and countries, product categories, business segments and units, revenue streams, prices, cost data, etc.

Fractions, ratios, percentages, and rates

Fractions, ratios, percentages, and rates are all different sides of the same coin and can help expedite your calculations.

For instance, fractions can be used to represent a number between 0 and 1. Expressing numbers as fractions and using them for additions and subtractions as well as multiplication and divisions can help you solve problems faster and more conveniently through simplification. For example, you can write 0.167 as 1/6, or 0.5 as 1/2. You can also combine fractions with large number divisions. For instance, let’s assume you want to see how much percent 400k is of 1.7m.

Write it as a fraction: 4/17 = 1/17 x 4

Now look at the division table for 1/17, which is 0.059, essentially 0.06.

1/17 x 4 = 0.06 x 4 = 0.24 or 24%

If you had calculated it more accurately by taking three times as long, you would get to 0.235 or 23.5%, rounding it up again to 24%.

As you can see, using fractions for larger number divisions can be a huge time saver. I would recommend you learn all fractions up to a divisor of 20 (e.g., 1/20) by heart, using the fraction table I shared earlier. It increases your speed and accuracy in interviews.

Ratios are comparisons of two quantities, telling you the amount of one thing in relation to another. If you have five apples and four oranges, the ratio is 5:4 and you have nine fruits in total. In case interviews, one tip is to write ratios as fractions of the total, e.g., apples are five out of a total of nine fruits, which is 5/9.

Percentages are a specific form of ratios, with the denominator always being fixed at 100. From experience, almost 80% of case interviews include some reference to or use of percentages, pun intended. Discussion points such as “Revenue increased by 15%” or “Costs are down four percent over the last six months” are common. Percentages are also useful when you want to put things into perspective, state your hypotheses, or guide your next steps. For instance, “That would translate to a 15% increase compared to our current revenue. Now, is a 15% increase realistic? What would we need to do to achieve this?”

Be careful not to mix percentage points with percentages. A percentage point or percent point is the unit for the arithmetic difference of two percentages. For example, moving up from 40% to 44% is a four-percentage point increase, but it is a 10% increase in what is being measured. Interviewers might ask for one or the other.

Rates are ratios between two related quantities in different units, where the denominator is fixed at one. If the denominator of the ratio is expressed as a single unit of one of these quantities, and if it is assumed that this quantity can be changed systematically (i.e., is an independent variable), then the numerator of the ratio expresses the corresponding rate of change in the other (dependent) variable. To make this more practical, let’s look at common rates. One common type of rate is per unit of time , such as speed or heart rate. Ratios with a non-time denominator include exchange rates, literacy rates, and many others. Case interviews might include some of the following rates:

- Growth rate: the ratio of the change of one variable over a period versus the starting level

- Exchange rate: the worth of one currency in terms of another

- Inflation rate: the ratio of the change in the general price level in a period to the starting price level

- Interest rate: the price a borrower pays for the use of the money they do not own (ratio of payment to amount borrowed)

- Price-earnings ratio: the market price per share of stock divided by annual earnings per share

- Rate of return: the ratio of money gained or lost on an investment relative to the amount of money invested

- Tax rate: the tax amount divided by the taxable income

- Unemployment rate: the ratio of the number of people who are unemployed to the number of people in the labor force

- Wage rate: the amount paid for working a given amount of time, or doing a standard amount of accomplished work (ratio of payment to time)

If you are not familiar with these or others that might come up, it is always okay to ask the interviewer for a clarification of the definition. Keep an eye on the time frames rates are expressed in. This could be annually (per annum = p.a.), quarterly, per month, etc. Often, information is provided for different time frames, divisors, or units (e.g., “the top speed of vehicle A is two miles per minute, the top speed of vehicle B is 150 miles per hour” ). Interviewers often use different units for different figures to trick you. For instance, when dealing with two different currencies, always convert all numbers to the same currency by using the exchange rate first. Otherwise, you are comparing apples and oranges. Convert to the same before conducting your analysis, calculations, or comparisons.

Growth rates

You should be able to work with growth rates, which is easy for one time period.

- (Increase of 30% in year 1): 100m x 1.3 = 130m

It gets trickier when you must calculate growth over multiple periods. You need to get the compound growth rate first.

- (Increase of 30% in year 1, 30% in year two): 100 x 1.3 x 1.3 = 100 x 1.69 = 169

The latter can be done quickly if you want to calculate growth over two to three time periods. Everything beyond that becomes tedious and lengthy. If you want to calculate growth for several periods, it is better to estimate the outcome. A shortcut is to use the growth rate and multiply it by the number of years.

- (Increase of 4% p.a. over 8 years): 4% x 8 years ≈ 32%; 100 x 1.32 = 132