Stripe logo

Global payments.

Online payments

Prebuilt payment form

Customizable payments UIs

No-code payments

Fraud & risk management

Payments for platforms

Subscription management

Online invoices

In-person payments

Linked financial account data

Online identity verification

Carbon removal

Revenue and Finance Automation

Sales tax & VAT automation

Accounting automation

Custom reports

Data warehouse sync

Startup incorporation

Banking-as-a-Service

Business financing

Card creation

Banking-as-a-service

- Startups

- Enterprises

By use case

- Platforms

- Ecommerce

- Marketplaces

- Crypto

- Creator Economy

- Embedded Finance

- Global Businesses

- Finance Automation

Integrations & Custom Solutions

- App Marketplace

- Professional Services

- Partner Ecosystem

- Documentation

Get started

- Prebuilt checkout

- Libraries and SDKs

- App integrations

- Accept Online Payments

- Manage Subscriptions

- Send Payments

- Full API Reference

- API Status

- API Changelog

- Build on Stripe Apps

- Support Center

- Support Plans

- Guides

- Customer Stories

- Annual Conference

- Contact Sales

- Newsroom

- Stripe Press

- Become a Partner

Accept payments online, in person, or through your platform.

Grow your business with automated revenue and finance.

Embed financial services in your platform or product.

By Use Case

Start integrating Stripe’s products and tools

- Code samples

- Accept online payments

- Manage subscriptions

- Send payments

- Set up in-person payments

- Chat With Us

Introduction to collecting online payments

This guide offers a high-level overview of online payments and covers nuances based on different business models.

- Introduction

Online payments flow

Transaction fees and costs involved in online payments, how the online payments funnel can increase your conversion, global payment methods, simplify sales tax, vat, and gst compliance, for online retailers, for saas and subscription companies, for platforms and marketplaces, additional reading, payments glossary.

- Download PDF

This guide covers the basics of online payments and explains the differences for common business models: online retailers, SaaS and subscription companies, and platforms and marketplaces. Start by reading about payment fundamentals and what all businesses need to know about online payments, and then go directly to the section about your business model.

We’ve also put together a list of the most common industry terms and their definitions, so if you’re unfamiliar with any phrases in this guide, refer to the glossary .

If you want to start accepting online payments right away, read our docs to get started.

Payments fundamentals: How do online payments work?

Before diving into payment details for different business models, it’s helpful to have a high-level understanding of how payments work: how money moves from a customer to your business, how banks facilitate these payments, and the costs involved in the system. Learning about these fundamental building blocks of online payments will help you better understand the nuances of the payments setup for your own business model.

There are four major players involved in each online transaction:

Cardholder: The person who owns a credit card

Merchant: The business owner

Acquirer: A bank that processes credit card payments on behalf of the merchant and routes them through the card networks (such as Visa, Mastercard, Discover, or American Express) to the issuing bank. Sometimes acquirers may also partner with a third party to help process payments.

Issuing bank: The bank that extends credit and issues cards to consumers on behalf of the card networks.

To accept online card payments, you need to work with each one of these players (either via a single payment service provider or by building your own integrations).

First, you’ll need to set up a business bank account and establish a relationship with an acquirer or payment processor. Acquirers and processors help route payments from your website to card networks, such as Visa, Mastercard, Discover, and American Express. Depending on your setup, you may have a separate acquirer (often a bank that maintains network relationships) and processor (which partners with the acquirer to facilitate transactions), or a single relationship that includes both services.

In order to securely capture payment details, you may also need a gateway, which helps properly secure information. Gateways frequently use tokenization to anonymize payment details and keep sensitive data out of your systems, helping you meet industry-wide security guidelines called PCI standards .

A single provider can offer gateway, processing, and acquiring services, which can help streamline your online payments. Sometimes, the payments provider will build direct integrations with the card networks, helping to reduce third-party dependencies.

When you accept a payment online, the gateway will securely encrypt the data to be sent to the acquirer, and then to the card networks. The card networks then communicate with the issuing bank, which either confirms or denies the payment (bank rules or regulatory requirements may sometimes require additional card authentication, like 3D Secure , before accepting a payment). The issuing bank will relay the message back to the gateway or acquirer so you can confirm the payment with the customer (by displaying a “payment accepted” or “payment declined” message on your site, for example).

This describes the online payment process for one-time payments using US dollars in the US. If you want to expand internationally, you may need to find a bank partner and set up relationships locally. Or, if you introduce a new product and want to start charging customers on a recurring basis, you would need to not only accept the credit card number, but also accurately initiate and collect payments at a set time interval. You would also need to build logic to accommodate different pricing models, figure out how to recover failed payments, manage prorations when customers switch plans, and more.

There are a variety of fees that accompany each transaction processed through this four-party system. Visa, Mastercard, Discover, American Express, and other card networks set the fees, referred to as interchange and scheme fees.

Interchange typically represents the bulk of the costs involved in a transaction. This amount is given to the issuing bank because it takes on the greatest amount of risk by extending credit or banking services to the cardholder.

Scheme fees are collected by the card networks themselves and can include additional authorization and cross-border transaction fees. Fees can also be assessed for refunds and other network services.

Together, these fees make up the network costs. These vary depending on the card type, transaction location, channel (in-person or online), and Merchant Category Code (MCC). For example, a transaction made with a rewards credit card would incur higher network fees than a transaction with a non-rewards card since banks often use these fees to subsidize the cost of the rewards program.

Stripe’s standard pay-as-you-go pricing offers a single, transparent rate for all card payments, helping give you more predictability over your payments costs. Learn more .

For all businesses accepting online payments

This section covers three important topics for all businesses accepting payments: how the online payments funnel can increase your conversion, how adding the right payment methods can expand your pool of potential customers, and how to simplify tax compliance so you can focus on growing your business.

Transactions go through three steps: checkout completion, fraud protection, and network acceptance. Conversion happens when a transaction is successfully completed.

Through each stage of online payment processing, your pool of potential customers can gradually shrink. If you have a long or complicated checkout process, a fraction of customers will fall off. Then, when you factor in fraud and average transaction acceptance rates, the pool shrinks even more.

Understanding the interaction between these steps is important to optimizing your entire funnel. This is especially true for businesses that have separate teams owning checkout, fraud, and network acceptance, with each one optimizing for their own metrics. For example, if the team working on checkout completion solely focuses on reducing cart abandonment rates, they may ask for less customer information to reduce friction. However, this can result in more fraud since you’re not always capturing details like the full billing address and ZIP code to help validate the transaction.

In this section, we’ll give you an overview of the online payments funnel and share best practices to increase conversion.

Designing the best checkout forms

The online payments funnel starts with the checkout experience, where customers enter their payment information to purchase goods or services. At this stage, you want to collect enough details to be able to verify that customers are who they say they are, but avoid adding too much friction to the checkout process—which can cause customers to abandon it altogether.

If your checkout form is too complicated, you risk losing sales from the most likely buyers—customers with items in their cart and every intention to make a purchase. In fact, 87% of customers abandon a purchase if the checkout process is too difficult.

To improve your checkout completion rate, the first step is to go through your own checkout process from the customer’s point of view and look for any friction that could lead to drop off. Pay attention to how long the site takes to load, how many fields are in your form, and if your checkout process supports autofill.

The best checkout forms adapt to the customer’s experience. For example, it’s best practice to offer responsive checkout forms that automatically resize to the smaller screen of a mobile device and offer a numerical keypad when customers are prompted to enter their card information. You should also consider supporting mobile payment methods, such as Apple Pay or Google Pay, to bypass manual data entry.

If you choose to expand internationally, your checkout form should cater to each market. Allowing customers to pay in their local currency is a start, but you also need to support local payment methods to provide the most relevant experience. For example, more than half of customers in the Netherlands prefer to pay with iDEAL , a payment method which directly transfers funds from a customer’s bank account to the business.

The card number can also indicate where a customer is located geographically, allowing you to dynamically change the form fields to capture the right information for each country. For example, if your form recognizes a UK card, you should add a field to capture the postcode. If your form recognizes an American credit or debit card, you should change that field to ZIP code.

Stripe Checkout is a drop-in payments page designed to drive conversion. It dynamically surfaces mobile wallets when appropriate and supports 15 languages so customers can use a checkout form that‘s personalized and relevant. Learn more here .

Managing risk online

The next step is to evaluate whether a transaction is fraudulent. The majority of illegitimate payments involve fraudsters pretending to be legitimate customers by using stolen cards and card numbers.

For example, if a fraudster makes a purchase on your website using a stolen card number that hasn’t been reported, it’s possible the payment would be processed successfully. Then, when the cardholder discovers the fraudulent use of the card, he or she would question the payment with his or her bank by filing a chargeback. While you have the chance to dispute this chargeback by submitting evidence about whether the payment was valid, card network rules tend to favor the customer in most disputes. If your business loses a dispute, your business would lose the original transaction amount. You, as the business owner, would also have to pay a chargeback fee, the cost associated with the bank reversing the card payment.

While chargebacks are a part of accepting payments online, the best way to manage them is to prevent them from happening in the first place. There are two primary approaches: rules-based logic and machine learning.

Rules-based fraud detection

Rules-based fraud detection operates on an “If x happens, then do y” logic created and is managed on an ongoing basis by fraud analysts. Examples include blocking all transactions from a certain country, IP address, or above a certain dollar amount. However, because this logic is based on strict rules, it doesn’t recognize hidden patterns nor does it adapt to shifting fraud vectors by analyzing information beyond these defined parameters. As a result, analysts are often playing catch up—manually creating new rules after they detect fraud rather than proactively fighting fraud.

Using machine learning to detect fraud

Fraud management based on machine learning, on the other hand, can use transaction data to train algorithms that learn and adapt. Some machine learning models mimic the behavior of human reviewers, while others are trained by millions of data points. These models learn how to discern legitimate transactions from those that are potentially fraudulent. Some of these models can even train themselves, making them more scalable and efficient than rules-based logic.

For example, let’s say a customer with normal browsing behavior and a suspicious IP address wants to purchase something from your site. Machine learning decides how much weight each of these signals should carry. For example, should the transaction be declined solely based on the IP address? A rules-based system may block all transactions from that location, but a machine learning model should be able to distinguish between good and bad transactions by weighting the location alongside all the other information available to determine the probability that a given payment will result in a chargeback.

Combining these two approaches—rules-based logic and machine learning fraud management—can be a powerful, customizable solution. You are able to leverage the sophistication of machine learning, but also customize the approach and encode logic that is specific to your business. For example, you can set custom rules based on the risk level of a subset of your users and what they are buying.

For more information, read our guide on machine learning for fraud detection .

Stripe Radar is a suite of modern tools for fraud detection and prevention. Its core is powered by adaptive machine learning, with algorithms evaluating every transaction for fraud risk and taking appropriate actions. Radar is included for free as part of Stripe’s integrated pricing. Users can upgrade to Radar for Fraud Teams to set their own rules-based logic, and use other powerful tools for fraud professionals.

Improving network acceptance

The last step in the online payments funnel is card network acceptance: having the issuing bank successfully process and accept the card payment.

When customers make a purchase, a payment request is sent to the issuing bank. Based on a variety of factors, ranging from your customer’s available balance, the formatting of transaction metadata , or even system downtime, the issuing bank will either accept or decline the request. The higher your acceptance rate, the more transactions you‘ve been able to successfully process.

You can help reduce unnecessary declines by collecting additional data or passing through details like CVC, billing address, and ZIP code during checkout. This information gives the issuing bank extra information about the transaction, helping improve the chances of acceptance for legitimate transactions.

Stripe helps automatically improve network acceptance for businesses thanks to direct network integrations and industry partnerships that provide additional data and insights into the reasons for declines. We use this to build machine learning models that identify the best ways to update payment metadata to improve the chances of acceptance. Learn more here .

While cards are the predominant online payment method in the US, 40% of consumers outside the US prefer to use a payment method other than a credit or debit card, including bank transfers and digital wallets (such as Alipay, WeChat Pay, or Apple Pay). You may lose sales simply because you don’t offer the preferred payment methods of a global audience.

To capitalize on a global customer base, you need to offer the payment methods that are most commonly used in the countries in which you operate. There are the five common types of payment methods:

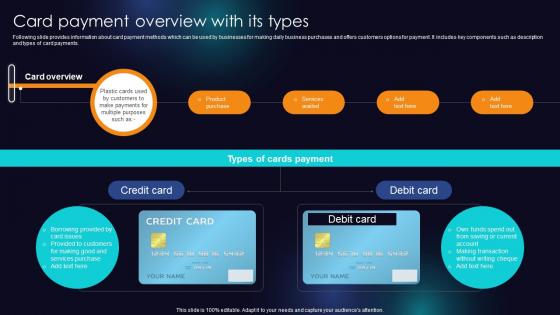

Credit cards allow customers to borrow funds from a bank and either pay the balance in full each month or pay the money back with interest. Debit cards make payments by deducting money directly from a customer‘s checking account, rather than using a line of credit.

Digital wallets , including Apple Pay and Google Pay, let customers pay for products or services electronically by linking a card or bank account. Digital wallets can also allow customers to store monetary value directly in the app with top-ups.

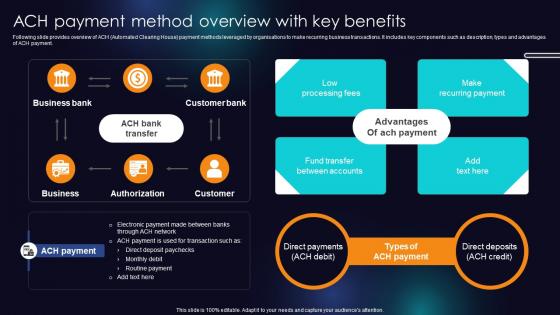

Bank debits and transfers move money directly from a customer’s bank account. Account debits collect your customers’ banking information and pull funds from their accounts (for example, ACH in the US). Credit transfers link to customers’ bank accounts and they push money to you (like wire transfers). There are also payment methods like Giropay in Germany and iDEAL in the Netherlands that operate as a layer on top of banks to facilitate transfers, but look more like digital wallets.

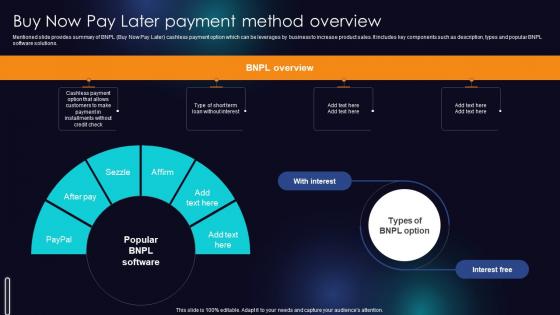

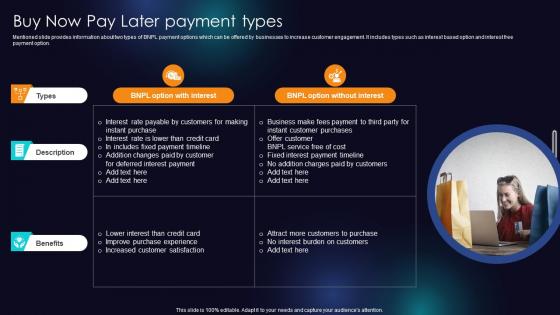

Buy now, pay later is a growing category of payment methods that offers customers immediate financing for online payments, typically repaid in fixed installments over time. Examples include Afterpay, Klarna, and Affirm.

Cash-based payment methods , from companies like OXXO and Boleto, allow customers to make online purchases without a bank account. Instead of paying for a product or service, customers receive a scannable voucher with a transaction reference number that they can then bring to an ATM, bank, convenience store, or supermarket and make a payment in cash. Once the reference number for the cash payment is matched to the initial purchase, the business gets paid and can ship the product.

For more information, read our guide to payment methods .

Stripe lets you support dozens of payment methods with a single integration. Learn more .

Internet businesses are required to collect indirect taxes in over 130 countries and in most US states; however, staying compliant can be challenging, especially as your business scales. Tax rules and rates change constantly and vary based on what and where you sell. If you ignore these complexities, you risk paying penalties and interest on top of uncollected taxes.

Indirect taxes have various names around the world. Indirect tax is called sales tax in the US, value-added tax (VAT) in Europe, goods and services tax (GST) in Australia and Canada, and consumption tax (JCT) in Japan. The process for collecting these taxes can vary significantly, but the outcome is the same: The end customer pays the tax.

Tax treatments depend on whether you sell a physical or digital product. For physical goods, the tax treatment depends on the ship-from and ship-to locations, plus how each jurisdiction categorizes the product. There are many differences across city, state, and country lines. Digital products (such as online courses or website memberships) can be just as complex. In the US, 40 states tax digital goods, and in the EU, digital products are taxable if they fit certain criteria.

No matter what you are selling, you’ll need to answer these questions to comply with sales tax, VAT, and GST:

- Where and when am I obligated to collect taxes?

- How do I register to collect taxes?

- How much tax should I charge on each product or service?

- How do I file and remit the money I collect?

For more information about these taxes, read our guides:

- Introduction to sales tax, VAT, and GST compliance

- Introduction to US sales tax and economic nexus

- Introduction to EU VAT & VAT OSS

Stripe Tax automatically calculates and collects sales tax, VAT, and GST on both physical and digital goods and services in all US states and more than 30 countries. Learn more .

Read this section if you want to sell goods in person at retail locations in addition to your website or mobile app.

Increasingly, retailers that started as online-only operations are finding success in expanding into the physical world by opening in-person locations. With more than 90% of purchases still happening in person, this creates the potential for digital businesses to create a new revenue stream.

The challenge, however, is unifying data across your online and in-person payments. Customers expect to engage with your business in the same way across channels and, as part of that, how they make a purchase needs to be consistent and on-brand. For example, users may expect discount codes and promotions to apply to both online and in-person purchases.

Here are two things you need to know if you want to expand your online business to support in-person sales:

1. Leverage existing infrastructure

Retailers often have to set up two separate payment providers: one for online and one for in-person purchases. This requires two integrations and two separate accounts, doubling the amount of work required to get started, making it hard to manage financial reconciliation, and often siloing customer data within each account.

Instead, make sure you leverage your existing payments infrastructure—what you already set up for online payments—rather than onboarding a new vendor. This not only saves you time and resources, it also simplifies reporting and helps create a more unified customer experience.

This creates a seamless payments experience whether customers make a purchase on their smartphone or walk into your store. For example, customers could start a subscription in person that continues online. The payment method they used in the store would be saved to their online profile, where they would be able to update any details or change the subscription cadence.

2. Support chip cards and mobile wallets

Magnetic stripe cards increase a business’s exposure to risk because they’re easy for fraudsters to copy and require additional steps to encrypt customer payment information. As a result, EMV chip cards—which are more secure and protect businesses from liability in the event of fraud—have been the global standard for decades.

In 2015, the US began its transition to chip cards and today, they are used for the majority of credit card transactions. However, there are still businesses that use older card readers that support magnetic stripe cards. As you’re evaluating hardware to accept in-person payments, it’s important to pick a newer card reader that allows you to accept chip cards.

You should also consider supporting mobile wallets, such as Apple Pay and Google Pay, for in-person transactions. Like chip cards, they securely encrypt payment information and minimize your liability associated with fraudulent transactions. Mobile wallets also improve the payment experience, making transactions more convenient and streamlined for customers.

Stripe Terminal helps you unify your online and offline channels with flexible developer tools, pre-certified card readers, and cloud-based hardware management.

Read this section if you charge your customers on a recurring basis or use stored payment information.

When managing recurring revenue, there’s a lot of complexity around how you initiate and collect payments, and accommodate different pricing models. You must store customers’ payment information and accurately charge them at set time intervals.

There are two ways to set this up: Build your own payments system or buy existing software. Either way, you need to make sure your billing system can accept orders from a web or mobile checkout, correctly bill the customer based on the pricing model (flat-rate billing or tiered pricing, for example), and collect payments using whichever payment methods customers prefer to use. You also need the ability to surface insights that are important for recurring businesses, including churn, monthly recurring revenue, and other key subscription metrics—or integrate with your customer relationship management system or account system.

As you decide whether to build your own software from scratch or buy an existing one, think about the opportunity costs. Consider the ongoing engineering resources required to build and maintain your billing software versus the other needs of your business.

Here are three considerations for SaaS and subscription payments:

1. Set flexible subscription logic

Subscription logic is made up of time-based and price-based rules that, together, accurately charge your customers on a predetermined cadence. When you only have one product and simple pricing, like $25 per month for a software subscription, setting up this logic in your billing system is easy because the dollar amount doesn’t change from month to month.

Over time, you may expand your business to add new products and promotions. You need to ensure that your subscription logic can handle this growth with the ability to experiment with different pricing models, like flat-rate, per-seat, or metered subscriptions, or tiered pricing, freemium, and free trials. You may also want the ability to offer bundles or discounts.

Your subscription logic should also be flexible enough to account for customers changing plans at any time. If someone wants to switch to a cheaper plan mid-month, you have to prorate the costs of both plans and ensure that the customer will be charged for the right amount going forward.

2. Think about your invoicing needs

Customers usually prefer to receive an invoice if you’re charging them for a large amount or sending a one-off bill (both of which are common for SaaS companies that have other businesses as their customers).

To send invoices, think about what the creation process should look like: Do invoices have the same line items or does each one need to be customized? Depending on which countries you are operating in, you also have to follow different invoice requirements . For example, you may have to follow sequential invoice numbering or set invoice prefixes at either the customer or account level.

Then, you need a way to send the invoices to your customers. Think about whether you want to manually send them via email or if your billing solution can automate this process for you.

For more information, read our guide to invoicing .

3. Minimize involuntary churn

Most SaaS and subscription companies face involuntary churn issues, where customers intend to pay for a product but their payment attempt fails due to expired cards, insufficient funds, or outdated card details (9% of subscription invoices fail on the first charge attempt due to involuntary churn).

When you only have a handful of failed payments a month, it’s easy to call or email each customer and ask him or her to remedy the situation (whether that’s by using a new payment method or updating payment information). However, as your business grows and you have to manage hundreds of customers with failed payments, this approach becomes less manageable.

A more scalable way to communicate with your customers is to send automated failed payment emails whenever a payment is declined.

In addition to outbound communication, you can also retry payments directly. Many businesses will retry failed transactions on a set schedule, like every seven days (this process is known as dunning). Experiment with different cadences to learn what is most effective for your business or find a payments provider that automates the dunning process and allows you to adapt it based on your customers’ preferences.

Stripe Billing offers an end-to-end billing solution. You can create and manage subscription logic and invoices, accept any supported payment method, and reduce involuntary churn with smart retry logic.

Read this section if you are a software platform and enable other businesses to accept payments directly from their customers (like Shopify) or if you are a marketplace , where you collect payments from customers and then pay them out to sellers or service providers (like Lyft).

Platforms and marketplaces have some of the most complex payment requirements because they accept money on behalf of sellers or service providers and issue payouts to them. As a result, there are many unique considerations, including verifying sellers’ identities, compliantly managing money transmission, taking a service fee from each payment, and filing 1099s with the IRS when applicable.

However, providing payments functionality to your customers allows you to differentiate your platform or marketplace and add value for your sellers or service providers. You can help them launch businesses faster without having to worry about lengthy merchant account applications or writing code to be able to accept payments.

Traditionally, adding payments functionality required you to become licensed, and register and maintain status as a payment facilitator with card networks (such as Visa, Mastercard, Discover, or American Express). Since you are seen as controlling the flow of funds when you move money between buyers and sellers, the card networks apply strict regulations. This process can take months (sometimes years) and require millions of dollars in up-front and ongoing costs.

Today, however, several options exist for platforms and marketplaces to add customized payments capabilities for their customers and earn revenue from payments, without having to register as a payment facilitator themselves.

Here are two capabilities you need to consider when adding payments to your platform or marketplace:

1. Verify users during onboarding

Before you accept any money on behalf of your sellers or businesses, you need to onboard them to your payment system and verify their identity. This step is complicated due to stringent laws and regulations including Know Your Customer (KYC) laws and sanctions screening requirements, which carry penalties and fines for violations. In addition to government regulations, which can vary from country to country, card networks including Visa, Mastercard, Discover, and American Express have their own information collection requirements, which are regularly updated.

Balancing these information requirements with the user experience is delicate. On the one hand, you want to collect as much information as possible (such as full name, email, date of birth, last four digits of their social security number in the US, phone number, and address) to ensure your platform isn’t being used for nefarious purposes like money laundering or terrorist financing. You also want to avoid penalties with regulatory bodies and financial partners.

On the other hand, you want to make your user experience better than the competition. That means providing a low-friction onboarding experience, which isn’t always compatible with detailed information requests.

To help remove friction, consider collecting data in a phased approach and auto-completing fields for your users when possible. For example, you could only ask for sellers’ or service providers’ tax information once they pass an IRS reporting threshold. And, you could pre-populate fields for their legal name and address if you already collected this information.

2. Support different ways to move money

Paying your users involves more than just moving money from point A to point B. You need the ability to collect service fees for your platform, split and route funds among sellers, and control when payouts are sent to your sellers’ bank accounts.

Let’s say you run an ecommerce platform and a customer makes a $50 purchase from a seller. You need to think about three parties: your platform, your sellers or service providers, and their buyers or end-users. Before you pay the seller, you need to take your platform fee. Then, you need to figure out how and when to send the remaining funds to the seller. Do you send the payout immediately upon receipt of the goods or services, or do you aggregate the funds and pay out every week? Do you have the correct banking information to route the payment?

You also need to ensure you’re moving money in a compliant way. For example, in the US, 46 states require their own licenses to move money on behalf of others. In Europe, PSD2 laws require licensing for payment intermediaries. If you are deemed a money transmitter or payment intermediary by a regulatory body and are not licensed, you can be fined or at risk of being shut down.

Depending on your business model, you should be able to support a number of different ways of moving money, such as:

- One-to-one: One customer is charged and one recipient is paid out (e.g., a ride-sharing service).

- One-to-many: One transaction is split between multiple sellers or recipients (e.g., a retail marketplace where a customer purchases one “cart” with items sourced from multiple online stores).

- Holding funds: A platform accepts funds from customers and holds them in reserve before paying out recipients (e.g., a ticketing platform that pays recipients only after an event has taken place).

- Account debits: A platform performs a debit or transaction reversal to pull funds from its sellers or service providers (e.g., an ecommerce platform pulling a monthly store maintenance fee from its business customers).

- Subscriptions: A platform allows its sellers to collect a recurring charge from customers (e.g., a SaaS platform enables its nonprofits to accept recurring donations).

Stripe Connect enables platforms and marketplaces to facilitate payments for their sellers, service providers, and customers. It supports onboarding and verification , allows you to accept 135+ currencies and dozens of local payment methods around the world with built-in fraud protection, pay out users , and track the flow of funds.

We hope this guide gave you a high-level overview of online payments and helped you understand the nuances of your own payments setup.

This is our first guide in a series about the fundamentals of online payments. We’ll continue to explore foundational concepts, like in-person and recurring payments, as well as more advanced topics like declines and payout management, in future guides.

In the meantime, here is some additional reading:

All businesses accepting payments

- A guide to payment methods

- A guide to PCI compliance

- A primer on machine learning for fraud detection

- 3D Secure 2: A new authentication standard

- How to manage fraudulent transactions

Online retailers

- How to use Stripe Terminal to accept in-person payments

- A guide to buy now, pay later

SaaS companies

- A guide to invoicing

- A guide to recurring billing

- How to create and charge for a subscription with Stripe

- A guide to SaaS businesses and how to grow them

- SCA best practices for recurring revenue businesses

Platforms and marketplaces

- How to route payments between multiple parties with Stripe

- How PSD2 impacts marketplaces and platforms in Europe

- A guide to payment facilitation for platforms and marketplaces

- A guide to risk management for software platforms

This glossary defines the most common terms in the payments industry.

Also referred to as an acquiring bank, an acquirer is a bank or financial institution that processes credit or debit card payments on behalf of the merchant and routes them through the card networks to the issuing bank.

Bank transfers

Can refer to an account debit, where you collect your customers’ banking information and pull funds from their accounts, or a credit transfer, where you link to customers’ bank accounts and they push money to you.

A person who owns a credit or debit card.

Card networks

Process transactions between merchants and issuers and control where credit cards can be accepted. They also control the network costs. Examples include Visa, Mastercard, Discover, and American Express.

Also referred to as a dispute, a chargeback occurs when cardholders question a payment with their card issuer. During the chargeback process, the burden is on the merchant to prove that the person who made the purchase owns the card and authorized the transaction.

Chargeback fees

The cost incurred by the merchant when the acquiring bank reverses a card payment.

Digital wallet

Lets customers pay for products or services electronically by linking a card or bank account, or storing monetary value directly in the app. Examples include Apple Pay, Google Pay, Alipay, and WeChat.

See definition for “Chargeback.”

Four-party system

The four parties involved in processing payments: the cardholder, merchant, acquirer, and issuing bank.

Any false or illegal transaction. It typically occurs when someone has stolen a card number or checking account data and uses that information to make an unauthorized transaction.

Interchange

A fee paid to the issuing bank for processing a card payment.

Issuing bank

The bank that issues credit and debit cards to consumers.

Merchant Category Code (MCC)

A four-digit number used to classify a business by the type of goods or services it provides.

Network acceptance

The percentage of transactions that are accepted or declined by the issuing bank. A decline can occur due to outdated credentials, suspicion of fraud, or insufficient funds.

Network costs

The total of interchange and scheme fees.

Payment facilitator

Traditionally, adding payments functionality required a platform or marketplace to register and maintain status as a payment facilitator (or payfac) with the card networks, since it was seen as controlling the flow of funds between buyers and sellers. Today, it’s easy to add the payments functionality that most platforms and marketplaces require without becoming a payment facilitator.

Payment gateway

A piece of software that encrypts credit card information on a merchant’s server and sends it to the acquirer. Gateway services and acquirers are often the same entity.

Payment method

The way a consumer chooses to pay for goods or services. Payment methods include bank transfers, credit or debit cards, and digital wallets.

Payment processor

Facilitates the credit card transaction by sending payment information between the merchant, the issuing bank, and the acquirer. The payment processor usually gets the payment details from a payment gateway.

PCI Data Security Standards (PCI DSS)

An information security standard that applies to all entities involved in storing, processing, or transmitting cardholder data, and/or sensitive authentication data.

Scheme fees

Fees collected by the card network. A single transaction may incur multiple scheme fees, such as authorization fees or service fees.

Ready to get started? Get in touch or create an account.

Create an account and start accepting payments—no contracts or banking details required. Or, contact us to design a custom package for your business.

- All Resource

PPT Templates

Single slides.

- Pitch Deck 207 templates

- Animation 326 templates

- Vertical Report 316 templates

- Business 799 templates

- Finance 56 templates

- Construction 45 templates

- IT/Commerce 171 templates

- Medical 64 templates

- Education 45 templates

- Lifestyle 390 templates

- Pitch Decks 138 templates

- Business 539 templates

- Finance 20 templates

- Construction 75 templates

- IT/Commerce 73 templates

- Medical 27 templates

- Lifestyle 578 templates

- Pitch Decks 140 templates

- Business 469 templates

- Finance 19 templates

- Construction 64 templates

- IT/Commerce 72 templates

- Medical 29 templates

- Education 39 templates

- Lifestyle 490 templates

- Cover 266 templates

- Agenda 97 templates

- Overview 216 templates

- CEO 28 templates

- Our Team 142 templates

- Organization 48 templates

- History 38 templates

- Vision, Mission 109 templates

- Problem, Solution 193 templates

- Opportunity 154 templates

- Business Model 158 templates

- Product, Services 299 templates

- Technology 65 templates

- Market 155 templates

- Prices 56 templates

- Customers 55 templates

- Competitor 113 templates

- Business Process 151 templates

- Analysis 222 templates

- Strategy 120 templates

- Marketing, Sales 61 templates

- Profit, Loss 69 templates

- Financials 247 templates

- Timeline 122 templates

- Proposal 40 templates

- Contact Us 272 templates

- Break Slides 16 templates

- List 361 templates

- Process 351 templates

- Cycle 177 templates

- Hierarchy 98 templates

- Relationship 152 templates

- Matrix 86 templates

- Pyramid 67 templates

- Tables 145 templates

- Map 96 templates

- Puzzles 163 templates

- Graph 217 templates

- Infographics 436 templates

- SWOT 111 templates

- Icon 418 templates

- Theme Slides 138 templates

- Mockup 42 templates

- Column 315 templates

- Line 199 templates

- Pie 139 templates

- Bar 179 templates

- Area 130 templates

- X Y,Scatter 16 templates

- Stock 59 templates

- Surface 3 templates

- Doughnut 256 templates

- Bubble 65 templates

- Radar 83 templates

- Free PPT Templates 2,101 templates

- Free Keynote 2,017 templates

- Free Google Slides 2,098 templates

- Free Theme Slides 35 templates

- Free Diagram 126 templates

- Free Chart 49 templates

- New Updates

Slide Members Premium Membership Benefits

If you sign up for our premium membership, you can enjoy the better contents all year round.

- Unlimited Download

- Premium Templates

- Animation Slides

- 24/7 Support

- Pitch Decks , Business , Finance

Online Payment Service Business Presentation Templates

- Product ID : SM-11130

- Subject : Online Payment Service

- Quantity : 15 slides

- Ratio : 16:9

- Format : MS Powerpoint

- Colors : blue yellow

- Languages : EN

- Used Font : Impact, Calibri

- License : Personal and commercial use

- Rating : Basic, Premium

- K Keynote version : go to item chevron_right

- G Google Slides version : go to item chevron_right

- A Animation version : go to item chevron_right

Slide Description

- Creative slides

- Drag & drop friendly

- Fully editable content (graphics and text) via PowerPoint - No Photoshop needed!

- Easy editable data driven charts (pie, bar, line)

- 100% vector objects & icons

Table of Contents

Membership Pricing

Premium member of Slide Members can have unlimited access to the 19,000+ advanced slide templates.

Basic (1 Day)

5 Downloads per Day

Basic (7 Days)

$ 10.99 /mo

All contents in Slide Members are available for commercial and personal use.

The contents that other members downloaded with this content

Mobile Payment System Pitch Deck PowerPoint Design

Vector icons 100% editable Free images and artwork Smart and innovative presentation slides Modern layouts based on master slides

Pitch Deck PPT Templates Simple Design

Easy customization 16:9 aspect ratio Easy color change Modern layouts based on master slides

Financial Service Group Design Slides Business Presentations

Easy customization Easy to edit and customize Data charts (editable via Excel) Vector icons 100% editable Professional business presentation

Free PowerPoint Design - Calculator

Creative and innovative presentation slides Trend template Standard (4x3) version of this template also available. Easy color change

Online Payment Service Simple Slides Templates

Creative slides All elements are editable Drag & drop friendly Highly editable presentation template. 100% vector objects & icons

Mobile Payment System Pitch Deck Simple Google Templates

Smart and innovative presentation slides Drag & drop friendly Easy to change colors 100% vector objects & icons

Finance Pitch Deck Google Slides Themes & Templates

Professional business presentation Modern layouts based on master slides Easy customization Easy color change Vector icons 100% editable

3d Growth Pie Chart Diagram (Finance)

Standard (4x3) version of this template also available. Easy to edit and customize Shapes: fully editable vector graphics Dark & light backgrounds

Free Slides

Slide Members

All Rights Reserved 2024 © Copyright Slide Members

Information

- Privacy Policy

- Terms & Conditions

Recent Slides

- 19+ Recently Powerpoint Templates & Google slides Update

- 9+ New Powerpoint Templates & Google Slides Update

- 18+ New Templates Update (PPT templates & Google slides)

Home Online Payments Industry PowerPoint Template PowerPoint Online Payment Process Template

PowerPoint Online Payment Process Template

Return to Online Payments Industry PowerPoint Template .

Download unlimited PowerPoint templates, charts and graphics for your presentations with our annual plan.

Template Tags:

Download unlimited content, our annual unlimited plan let you download unlimited content from slidemodel. save hours of manual work and use awesome slide designs in your next presentation..

Home Collections Financials Credit Card Online Payment Presentation Template

Portfolio Online Payment Presentation Template Slide

Online Payment Slide Template Presentation

About the template:, features of the template:.

- Innovative slide background designs

- 100% easy to edit and customize slides

- The slide contained 16:9 and 4:3 format.

- Easy to change the slide colors quickly.

- The elegant look of this template will give life to your presentation.

- Crisp and clear font styles.

- Fantastic slide template.

- credit card

- Online Payment

- Online Payment System

- Online Payment Infographic

- Online Payment Method

- Digital Payments

680+ Templates

24+ Templates

157+ Templates

197+ Templates

Credit Card

21+ Templates

26+ Templates

32+ Templates

54+ Templates

39+ Templates

You May Also Like These PowerPoint Templates

online payment

Jul 10, 2014

150 likes | 303 Views

online payment. 在范文中学习模板写作. 目前网上支付已成为一种时尚购物方式.

Share Presentation

- good internet environment

- really trustworthy

- very convenient

- effective precautions

Presentation Transcript

online payment 在范文中学习模板写作

目前网上支付已成为一种时尚购物方式 • Nowadays, with the rapid development of information technology, online payment has been put into constant practice and been permeating into internet users’ daily life. For its convenience, it has caught many youngsters’ fancy for the online purchase of daily essentials, such as books, clothes, electrical devices.

网上支付有很多好处 • No doubt, online payment has many advantages over payment in cash. Firstly, as mentioned before, compared with traditional ways of payment, it’s very convenient. What you need to do is just get access to the Internet, click your mouse and finish the process of buying, instead of going out and carrying money to buy certain items in entity stores. Secondly, you may cancel a deal you had made, which means that you have more liberty to make your shopping decisions.

网上支付也存在不少问题 • However, in spite of the convenience and freedom, we cannot turn a blind eye to its demerits. Firstly, it’ll be a tough job to guarantee the safety of online payment. After all, there are always some hackers waiting for victims. In addition, if you become addicted to online shopping, this convenient way of paying will become a habit which may gradually eat a hole of your bank savings.

你的建议 • As a college student, I like online payment but I expect that effective precautions should be taken to make it more customer-friendly. Specifically speaking, relevant government departments should work out concrete regulations and rules, and build a good internet environment to ensure safe online payments. Only in this way can online payment become a really trustworthy alternative for customers to pay for what appeal to them.

模板带入 固定一个自己的模板

目前XX已成为时尚/潮流/焦点/热议 • Nowadays, with the rapid development of _____, ________ has been put into constant practice and been permeating into ______’ daily life. For its convenience, it has caught many ____’ fancy for the ______(, such as ______).

模版如何填充 如何将中文翻译成合格甚至优秀的英文

造短句子 • 先按照中文语序直接翻译 • 再删除或替换拿不准的英文表达 • 把中文内容放低 V.S. 把英文翻译做高 • 弱句子但是对句子 V.S. 看起来很美但是错句子

XX有很多好处 • No doubt, ______ has many advantages over ______. Firstly, as mentioned before, compared with ______, it’s very convenient. What you need to do is just ______, instead of ______.Secondly, ______, which means that you have more liberty to ______.

XX也存在不少问题 • However, in spite of the convenience and freedom, we cannot turn a blind eye to its demerits. Firstly, it’ll be a tough job to ______. After all, ______. In addition, ______.

你的建议 • As a college student, I like ______but I expect that ______should be taken to make it more ______. Specifically speaking, relevant government departments should work out concrete regulations and rules, and build a good ______ to ensure ______. Only in this way can ______ become a really trustworthy alternative for ______.

- More by User

Payment online

MPP Global Solutions are the leading provider of Payment Services and eCommerce Solutions to the Media and Entertainment Industries. With over 11 years’ experience in the payment services industry MPP has the breadth of advanced payment functionality to ensure your company is prepared for every eventuality.

249 views • 6 slides

Online payment Rameesh

Some individuals engaged in mobile computing and communications use personal digital assistants. The future of the PDA will be phenomenal, especially as it becomes integrated with cell phones.

91 views • 1 slides

online payment services of rameesh online payment

While consumption taxes are increasingly being levied in Asia (Australia and Singapore are two recent examples), electronic purchasing does not confer the same tax advantages that it does in the US.

152 views • 1 slides

Online Payment Services

For More Details Visit Us : http://algocharge.com/ Fraud is one of the biggest enemies which you may face while doing online payment but with the aid of reliable and authentic online payment services you can protect your customer and your company fame too.

211 views • 6 slides

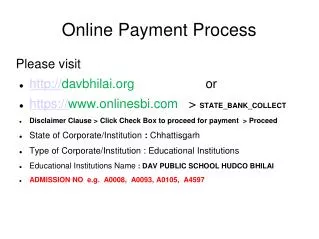

Online Payment Process

Online Payment Process. Please visit http:// davbhilai.org or https:// www.onlinesbi.com > STATE_BANK_COLLECT Disclaimer Clause > Click Check Box to proceed for payment > Proceed State of Corporate/Institution : Chhattisgarh Type of Corporate/Institution : Educational Institutions

417 views • 16 slides

Online Payment Services. Ezz Hantash. Java What?!. Began in1990 by Patrick Naughton , Mike Sheridan, and James Gosling Originally Oak It was a revolutionary idea creating the next wave of application development. Java Enterprise Edition. Separate presentation from business logic

471 views • 23 slides

Online Payment System

Online Payment System.

485 views • 9 slides

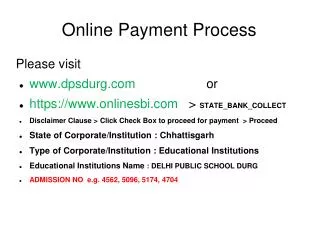

Online Payment Process. Please visit www.dpsdurg.com or https://www.onlinesbi.com > STATE_BANK_COLLECT Disclaimer Clause > Click Check Box to proceed for payment > Proceed State of Corporate/Institution : Chhattisgarh Type of Corporate/Institution : Educational Institutions

280 views • 14 slides

Online Payment Process. Each Student must go to: www.interpretive.com/students Login with your Individual User ID and Password. Follow the on screen directions to complete the payment process. Each Student will receive an Individual User ID and Password via email from Interpretive.

114 views • 2 slides

OnLIne bill payment

OnLIne bill payment. IT Project Circle Jun-2011. Online Bill Payment Trend Jan’09 to Jun’11-30 months Collection per Month. Jan ‘09. Jan 10. Jan 11. Jun ‘11. Online collection increases from Rs 1 Cr to Rs 9.4 Crore per month from Jan’09 to Jun’11.

353 views • 9 slides

Online Payment Portal

PDCflow’s software gets a payment or signature quickly, efficiently & securely so your workflow is fast and smooth everytime.

209 views • 10 slides

Tneb Online Payment

TNEB website is the best way of making payments online in Tamil Nadu. One just needs to create a login on the website using the customer number or service number.

385 views • 15 slides

EPF online payment

Learn to remit EPF Online Payment. We have shown procedure to pay EPF payment online through SBI, HDFC, ICICI, Axis and many other supported banks. http://epfbalancestatus.co.in/epf-online-payment/

187 views • 11 slides

Service Online Payment

Digitzs is an online payment to make the payment painless.It is a beneficial platform to gives you online payment services without any risk.

96 views • 7 slides

Online Payment Platform

Ipaydna.biz provides a single, secured online payment platform where you can conduct all your monetary transactions smoothly without any trouble whatsoever. Find all types of solutions here, visit our website or live chat with us for all your queries.

103 views • 8 slides

Tneb Online payment

Pay your tneb online payment in easy steps with TalkCharge

85 views • 8 slides

online payment services

Mobile payment is becoming an increasingly popular way for consumers to shop, whether itu2019s through online ordering. Tiptapgo is the best mobile payment app makes your payment easy with it.https://www.tiptapgo.io/

63 views • 5 slides

Online Payment System. David Christensen Herbie Hanson Sean Johgart. OPS Activities. Create an OPS account. Delete an OPS account. Deposits and withdrawals to and from an OPS account. Transfer between OPS Accounts. Records are maintained for all transactions.

120 views • 11 slides

Eric Mazzocco, Jake Smith, Ian Anderson. Online Payment System. What is OPS?. An Online Payment System Pays your bills automatically Pays your bills when you want. User Activities. Create an Account Users can create an account associated with one or more bank accounts Log Into An Account

227 views • 17 slides

Online Banking Payment

The news that uplifts you is that you can depend on a surePAYu2019s Third Party Online Payment Solution to guarantee that payment is secured and fast.

66 views • 6 slides

Online payment application

We offer Online payment services in Saudi Arabia. Our service enables schools to accept fees and housing societies' to accept their payments and credit card payments via mobile. Trustpay is domestically grown company with global aspirations. The platform is connected to world class fraud prevention platforms, which provide an additional layer of security to the entire transaction flow. The company envisages to reach out to end users through its downstream aggregation platforms such as mSociety & mSchool. This would enable us to reach to a wider payments audience with lower overheads. Trustpay is one of the few service providers who cater to the cross border ecommerce through International acquiring partnerships. For more Info:- https://trustpaygcc.com/services #SaudiPaymentProcessor #TrustpayApp #Onlinepaymentapplication #Saudiarabiapaymentapp #Onlinesecurepaymentsapp #ecommercepaymentgateway #Ecommercepaymentapp #PaymentProcessorSaudiarabia #onlinepaymentinsaudiarabia #onlinepaymentgateway #mobilepaymentsinsaudiarabia #mobilepaymentapps

27 views • 2 slides

Online Payment Processing

Here is how online payment processing is carried out. Kindly refer to the document to read in detail the process of how online processing is done.

- Payment Security Technology

- Popular Categories

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Powerpoint Templates and Google slides for Payment Security Technology

Save your time and attract your audience with our fully editable ppt templates and slides..

Item 1 to 60 of 297 total items

- You're currently reading page 1

Deliver an informational PPT on various topics by using this Mobile Banking For Convenient And Secure Online Payments Fin CD. This deck focuses and implements best industry practices, thus providing a birds-eye view of the topic. Encompassed with ninty nine slides, designed using high-quality visuals and graphics, this deck is a complete package to use and download. All the slides offered in this deck are subjective to innumerable alterations, thus making you a pro at delivering and educating. You can modify the color of the graphics, background, or anything else as per your needs and requirements. It suits every business vertical because of its adaptable layout.

Deliver this complete deck to your team members and other collaborators. Encompassed with stylized slides presenting various concepts, this Enhancing Transaction Security With E Payment Powerpoint Presentation Slides is the best tool you can utilize. Personalize its content and graphics to make it unique and thought-provoking. All the eighty five slides are editable and modifiable, so feel free to adjust them to your business setting. The font, color, and other components also come in an editable format making this PPT design the best choice for your next presentation. So, download now.

Provide your investors essential insights into your project and company with this influential Investor Capital Pitch Deck For Secure Digital Payment Platform PPT Template. This is an in-depth pitch deck PPT template that covers all the extensive information and statistics of your organization. From revenue models to basic statistics, there are unique charts and graphs added to make your presentation more informative and strategically advanced. This gives you a competitive edge and ample amount of space to showcase your brands USP. Apart from this, all the thirty three slides added to this deck, helps provide a breakdown of various facets and key fundamentals. Including the history of your company, marketing strategies, traction, etc. The biggest advantage of this template is that it is pliable to any business domain be it e-commerce, IT revolution, etc, to introduce a new product or bring changes to the existing one. Therefore, download this complete deck now in the form of PNG, JPG, or PDF.

If you require a professional template with great design, then this Ecommerce Payment Gateway And Security System Powerpoint PPT Template Bundles DK MD is an ideal fit for you. Deploy it to enthrall your audience and increase your presentation threshold with the right graphics, images, and structure. Portray your ideas and vision using thirteen slides included in this complete deck. This template is suitable for expert discussion meetings presenting your views on the topic. With a variety of slides having the same thematic representation, this template can be regarded as a complete package. It employs some of the best design practices, so everything is well structured. Not only this, it responds to all your needs and requirements by quickly adapting itself to the changes you make. This PPT slideshow is available for immediate download in PNG, JPG, and PDF formats, further enhancing its usability. Grab it by clicking the download button.

This complete presentation has PPT slides on wide range of topics highlighting the core areas of your business needs. It has professionally designed templates with relevant visuals and subject driven content. This presentation deck has total of twelve slides. Get access to the customizable templates. Our designers have created editable templates for your convenience. You can edit the colour, text and font size as per your need. You can add or delete the content if required. You are just a click to away to have this ready-made presentation. Click the download button now.

It covers all the important concepts and has relevant templates which cater to your business needs. This complete deck has PPT slides on Payment Icon Circle Arrow Dollar Monitor Secure with well suited graphics and subject driven content. This deck consists of total of twelve slides. All templates are completely editable for your convenience. You can change the colour, text and font size of these slides. You can add or delete the content as per your requirement. Get access to this professionally designed complete deck presentation by clicking the download button below.

Engage buyer personas and boost brand awareness by pitching yourself using this prefabricated set. This Blockchain In Banking Technology Security Payment Transactions Financial Settlement is a great tool to connect with your audience as it contains high-quality content and graphics. This helps in conveying your thoughts in a well-structured manner. It also helps you attain a competitive advantage because of its unique design and aesthetics. In addition to this, you can use this PPT design to portray information and educate your audience on various topics. With twelve slides, this is a great design to use for your upcoming presentations. Not only is it cost-effective but also easily pliable depending on your needs and requirements. As such color, font, or any other design component can be altered. It is also available for immediate download in different formats such as PNG, JPG, etc. So, without any further ado, download it now.

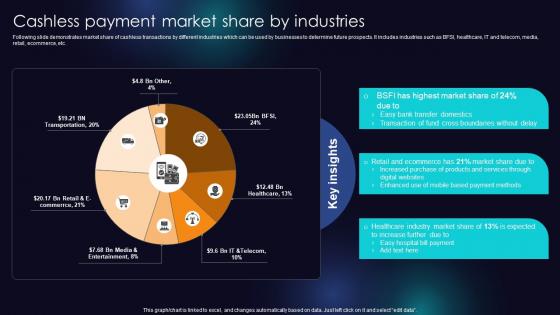

Following slide demonstrates market share of cashless transactions by different industries which can be used by businesses to determine future prospects. It includes industries such as BFSI, healthcare, IT and telecom, media, retail, ecommerce, etc. Deliver an outstanding presentation on the topic using this Cashless Payment Market Share By Industries Enhancing Transaction Security With E Payment Dispense information and present a thorough explanation of Bank Transfer Domestics, Payment Methods, Products And Services using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

Following slide showcase market summary of cashless payment method which can be used by businesses to evaluate investment options. It includes key elements such as growth rate in billion, CAGR, and reasons of market share growth. Present the topic in a bit more detail with this Cashless Payment Market Size Growth Overview Enhancing Transaction Security With E Payment Use it as a tool for discussion and navigation on Cashless Payment Market, Retail, Healthcare, Transportation This template is free to edit as deemed fit for your organization. Therefore download it now.

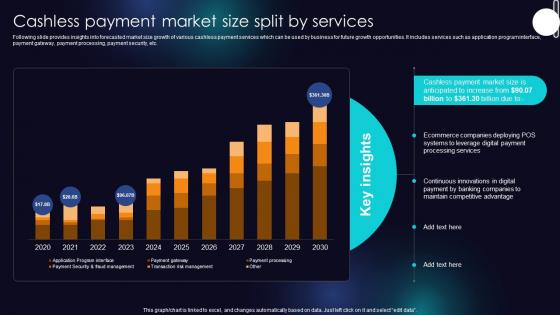

Following slide provides insights into forecasted market size growth of various cashless payment services which can be used by business for future growth opportunities. It includes services such as application program interface, payment gateway, payment processing, payment security, etc. Deliver an outstanding presentation on the topic using this Cashless Payment Market Size Split By Services Enhancing Transaction Security With E Payment Dispense information and present a thorough explanation of Processing Services, POS Systems, Ecommerce using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

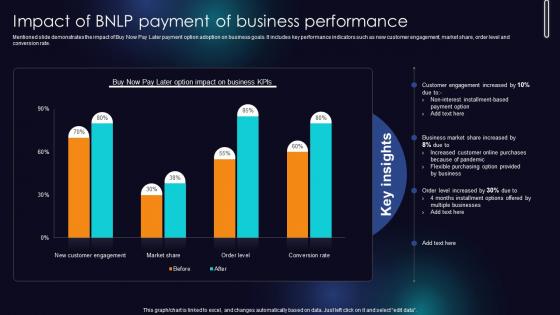

Mentioned slide demonstrates the impact of Buy Now Pay Later payment option adoption on business goals. It includes key performance indicators such as new customer engagement, market share, order level and conversion rate. Deliver an outstanding presentation on the topic using this Impact Of BNLP Payment Of Business Performance Enhancing Transaction Security With E Payment Dispense information and present a thorough explanation of Customer, Business, Installment using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

Mentioned slide demonstrates impact of multiple card payment adoption on business growth. It includes key metrics such as business sales, customer satisfaction, convenience and expense tracking accuracy. Present the topic in a bit more detail with this Impact Of Credit And Debit Payment On Business Enhancing Transaction Security With E Payment Use it as a tool for discussion and navigation on Business Sales, Payment, Business This template is free to edit as deemed fit for your organization. Therefore download it now.

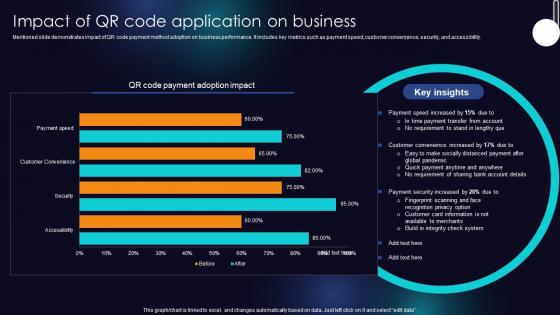

Mentioned slide demonstrates impact of QR code payment method adoption on business performance. It includes key metrics such as payment speed, customer convenience, security, and accessibility. Present the topic in a bit more detail with this Impact Of QR Code Application On Business Enhancing Transaction Security With E Payment Use it as a tool for discussion and navigation on Payment Speed, Account Details, Customer This template is free to edit as deemed fit for your organization. Therefore download it now.

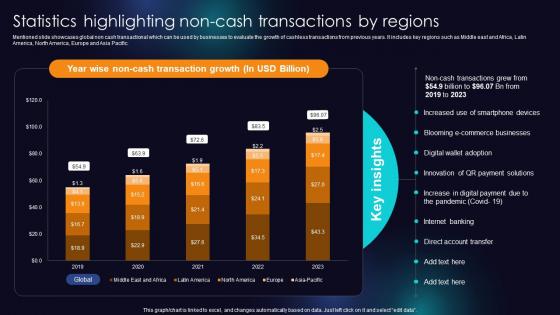

Mentioned slide showcases global non cash transactional which can be used by businesses to evaluate the growth of cashless transactions from previous years. It includes key regions such as Middle east and Africa, Latin America, North America, Europe and Asia Pacific. Deliver an outstanding presentation on the topic using this Statistics Highlighting Non Cash Transactions By Regions Enhancing Transaction Security With E Payment Dispense information and present a thorough explanation of E Commerce Businesses, Smartphone Devices, Digital Payment using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

Introducing Table Of Contents For Enhancing Transaction Security With E Payment to increase your presentation threshold. Encompassed with one stages, this template is a great option to educate and entice your audience. Dispence information on Cashless Payment Overview, Cashless Market Overview, Cashless Payment Selection using this template. Grab it now to reap its full benefits.

Mentioned slide provides insights into cashless payment community growth by different countries. It includes countries such as Brazil, Mexico, Australia, India, China, Japan, Malaysia, Canada, and USA. Deliver an outstanding presentation on the topic using this Top Countries Moving Towards Cashless Society Enhancing Transaction Security With E Payment Dispense information and present a thorough explanation of Cashless Society, Digital Wallet, Cyber Frauds using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

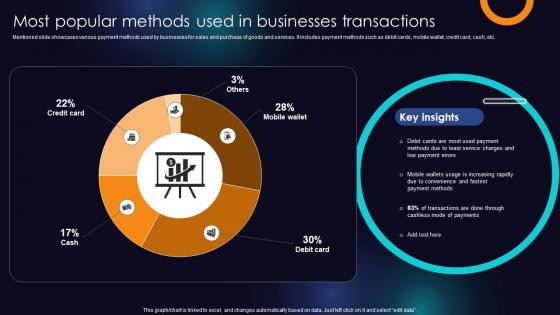

Mentioned slide showcases various payment methods used by businesses for sales and purchase of goods and services. It includes payment methods such as debit cards, mobile wallet, credit card, cash, etc. Present the topic in a bit more detail with this Most Popular Methods Used In Businesses Transactions Enhancing Transaction Security With E Payment Use it as a tool for discussion and navigation on Service, Payment, Debit Cards This template is free to edit as deemed fit for your organization. Therefore download it now.

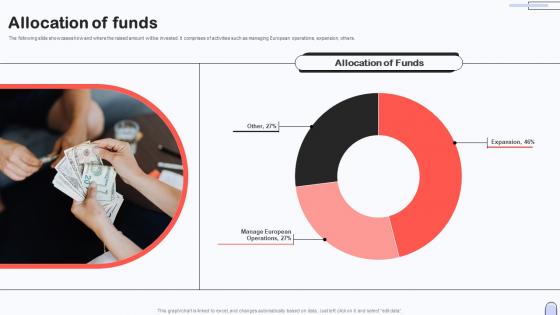

The following slide showcases how and where the raised amount will be invested. It comprises of activities such as managing European operations, expansion, others. Present the topic in a bit more detail with this Allocation Of Funds Investor Capital Pitch Deck For Secure Digital Payment Platform. Use it as a tool for discussion and navigation on Allocation, Funds. This template is free to edit as deemed fit for your organization. Therefore download it now.

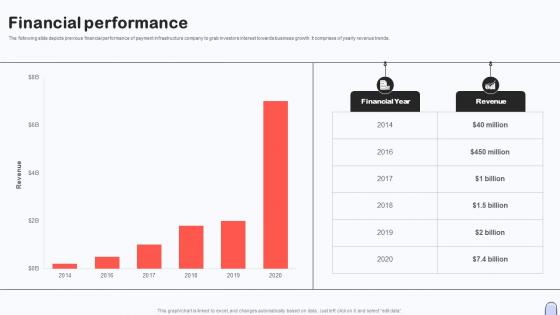

The following slide depicts previous financial performance of payment infrastructure company to grab investors interest towards business growth. It comprises of yearly revenue trends. Present the topic in a bit more detail with this Financial Performance Investor Capital Pitch Deck For Secure Digital Payment Platform Use it as a tool for discussion and navigation on Financial Performance. This template is free to edit as deemed fit for your organization. Therefore download it now.

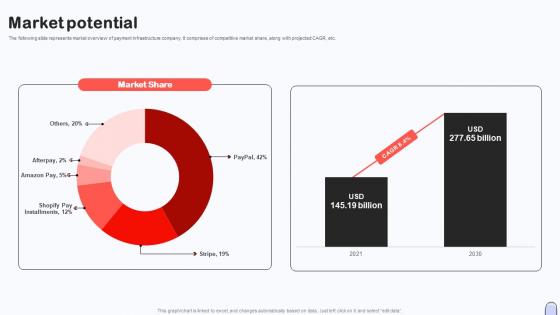

The following slide represents market overview of payment infrastructure company. It comprises of competitive market share, along with projected CAGR, etc. Present the topic in a bit more detail with this Market Potential Investor Capital Pitch Deck For Secure Digital Payment Platform Use it as a tool for discussion and navigation on Market Share, Market Potential. This template is free to edit as deemed fit for your organization. Therefore download it now.

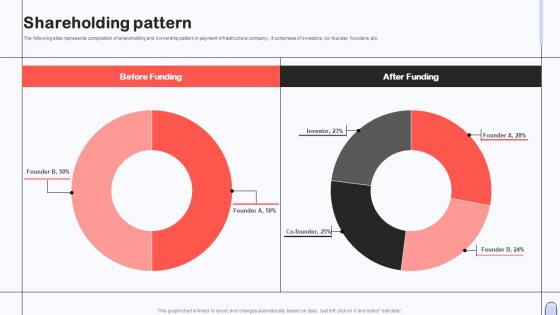

The following slide represents composition of shareholding and ownership pattern in payment infrastructure company,. It comprises of investors, co-founder, founders, etc. Deliver an outstanding presentation on the topic using this Shareholding Pattern Investor Capital Pitch Deck For Secure Digital Payment Platform Dispense information and present a thorough explanation of Shareholding Pattern using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

Presenting our Security Issues Payment System Ppt Powerpoint Presentation Slides Visuals Cpb PowerPoint template design. This PowerPoint slide showcases four stages. It is useful to share insightful information on Security Issues Payment System This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

Presenting our Security Systems Payment Systems Ppt Powerpoint Presentation Infographic Template Format Ideas Cpb PowerPoint template design. This PowerPoint slide showcases three stages. It is useful to share insightful information on Security Systems Payment Systems This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

Presenting Social Security Survivor Benefits Payment Schedule In Powerpoint And Google Slides Cpb slide which is completely adaptable. The graphics in this PowerPoint slide showcase two stages that will help you succinctly convey the information. In addition, you can alternate the color, font size, font type, and shapes of this PPT layout according to your content. This PPT presentation can be accessed with Google Slides and is available in both standard screen and widescreen aspect ratios. It is also a useful set to elucidate topics like Social Security Survivor Benefits Payment Schedule. This well structured design can be downloaded in different formats like PDF, JPG, and PNG. So, without any delay, click on the download button now.

Presenting our Social Security Payment Calculator In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases four stages. It is useful to share insightful information on Social Security Payment Calculator. This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

This coloured PowerPoint icon is the perfect addition to any presentation. It features a vibrant BUY button, perfect for emphasizing key points and drawing attention to important information. Its easy to use and adds a professional touch to any project.

This Monotone PowerPoint Icon on Buy Button is a perfect choice for your presentation. It is a simple and modern design with a black and white color scheme. It is easy to customize and use. It is a great way to add a professional touch to your slides.

Presenting Social Security Disability Payment In Powerpoint And Google Slides Cpb slide which is completely adaptable. The graphics in this PowerPoint slide showcase four stages that will help you succinctly convey the information. In addition, you can alternate the color, font size, font type, and shapes of this PPT layout according to your content. This PPT presentation can be accessed with Google Slides and is available in both standard screen and widescreen aspect ratios. It is also a useful set to elucidate topics like Social Security Disability Payment. This well structured design can be downloaded in different formats like PDF, JPG, and PNG. So, without any delay, click on the download button now.

Presenting our Security Digital Payments In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases three stages. It is useful to share insightful information on Security Digital Payments This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

Presenting our Social Security Payment In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases Four stages. It is useful to share insightful information on Social Security Payment This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

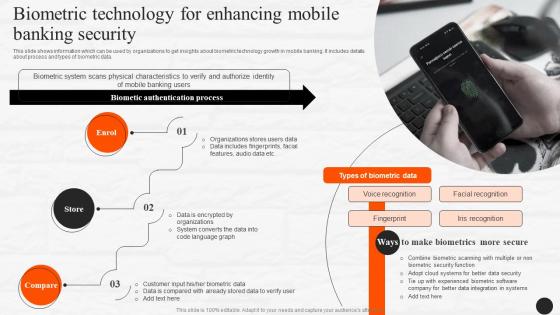

This slide shows information which can be used by organizations to get insights about biometric technology growth in mobile banking. It includes details about process and types of biometric data. Present the topic in a bit more detail with this Biometric Technology For Enhancing Mobile Banking Security E Wallets As Emerging Payment Method Fin SS V. Use it as a tool for discussion and navigation on Biometric, Technology, Iris Recognition. This template is free to edit as deemed fit for your organization. Therefore download it now.

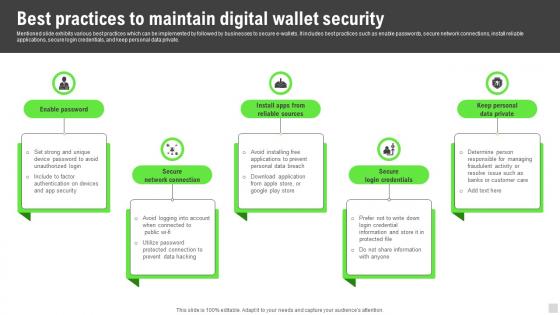

This slide shows checklist which can be used to adopt various security measure while using mobile banking. It includes tasks such as change passwords frequently, monitor transactions, avoid using public networks. Present the topic in a bit more detail with this Checklist To Ensure Secure Mobile Banking E Wallets As Emerging Payment Method Fin SS V. Use it as a tool for discussion and navigation on Measure, Transactions, Passwords Frequently. This template is free to edit as deemed fit for your organization. Therefore download it now.

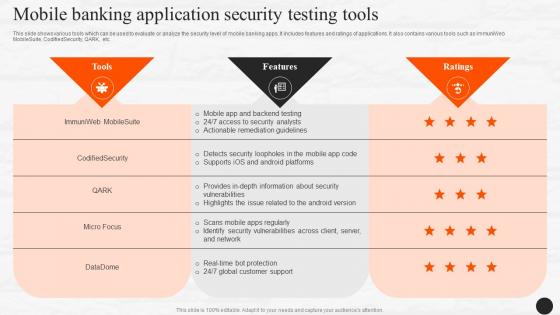

This slide shows various tools which can be used to evaluate or analyze the security level of mobile banking apps. It includes features and ratings of applications. It also contains various tools such as ImmuniWeb MobileSuite, CodifiedSecurity, QARK, etc. Present the topic in a bit more detail with this Mobile Banking Application Security Testing Tools E Wallets As Emerging Payment Method Fin SS V. Use it as a tool for discussion and navigation on Application, Evaluate, Analyze. This template is free to edit as deemed fit for your organization. Therefore download it now.

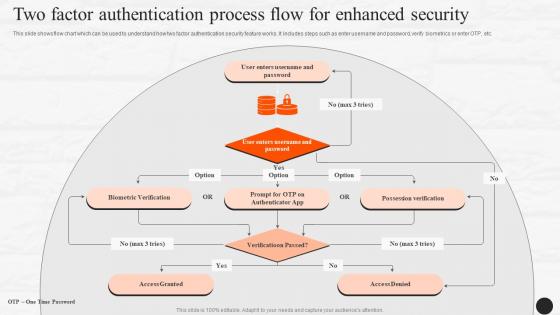

This slide shows flow chart which can be used to understand how two factor authentication security feature works. It includes steps such as enter username and password, verify biometrics or enter OTP, etc. Present the topic in a bit more detail with this Two Factor Authentication Process Flow For Enhanced Security E Wallets As Emerging Payment Method Fin SS V. Use it as a tool for discussion and navigation on Authentication, Process, Possession Verification. This template is free to edit as deemed fit for your organization. Therefore download it now.