Language selection

- Français fr

Assignment of a Purchase and Sale Agreement for a New House or Condominium Unit

From: Canada Revenue Agency

Effective May 7, 2022, all assignment sales in respect of newly constructed or substantially renovated residential housing are taxable for GST/HST purposes. This publication will be updated to reflect this legislative change. For more information about the legislative amendment, refer to GST/HST Notice 323, Proposed GST/HST Treatment of Assignment Sales .

GST/HST Info Sheet GI-120 July 2011

This info sheet explains how the GST/HST applies to the assignment of a purchase and sale agreement for the construction and sale of a new house.

The term "new house" used in this info sheet refers to a newly constructed or substantially renovated house or condominium unit. A house that has been substantially renovated is generally given the same treatment under the GST/HST as a newly constructed house. Extensive modifications must be made to a previously occupied house in order to meet the definition of a "substantial renovation" for GST/HST purposes. For a full explanation of the factors to consider in deciding if a substantial renovation has taken place, refer to GST/HST Technical Information Bulletin B-092, Substantial Renovations and the GST/HST New Housing Rebate .

In this publication, a house includes a single unit house, a semi detached house, a duplex, a rowhouse unit and a residential condominium unit (condo unit), but does not include a mobile home or floating home.

Where a person enters into a purchase and sale agreement with a builder for the construction and sale of a new house, the person may be entitled to assign their rights and obligations under the agreement to another person (an assignee). Generally, the result of the assignment is that the purchase and sale agreement is then between the builder and the assignee.

This publication addresses the situation where

- a purchaser (referred to as the first purchaser) enters into a purchase and sale agreement with a builder (Builder A) for the construction and sale of a new house, and

- the first purchaser subsequently assigns the agreement to an assignee (referred to as the assignee purchaser) before Builder A transfers possession or ownership of the house to the first purchaser and before any individual has occupied the house as a place of residence or lodging.

Generally, upon entering into an agreement for the construction and sale of a new house, the first purchaser is considered to have acquired an interest in the house. For GST/HST purposes, the assignment of the agreement to the assignee purchaser is normally considered to be a sale of the first purchaser's interest in the new house. The sale of an interest in a new house is generally taxable where the person selling the interest is a builder of the house.

For GST/HST purposes, the term "builder" is specifically defined and is not limited to a person who physically constructs a house. There are several instances in which an individual or other person is a builder for GST/HST purposes. For more information on persons who are included in the definition of "builder", refer to GST/HST Memorandum 19.2, Residential Real Property .

This info sheet addresses only whether a person is a builder as described in the following paragraph.

Primary purpose: selling the house or an interest in the house or leasing the house in certain circumstances

A builder includes a person who acquires an interest in a new house before it has been occupied by an individual as a place of residence or lodging for the primary purpose of selling the house or an interest in the house or leasing the house, other than to an individual who is acquiring the house otherwise than in the course of a business or adventure or concern in the nature of trade. When that person is an individual, the individual must acquire the interest in the course of a business or an adventure or concern in the nature of trade in order to be a builder described by this paragraph.

Even if a person is not a builder as described in the preceding paragraph, the person may be a builder based on one of the other definitions of the term as described in GST/HST Memorandum 19.2.

Assignment of a purchase and sale agreement by a person other than an individual

Where a person other than an individual (e.g., a corporation) is a builder as described in the section "Primary purpose: selling the house or an interest in the house or leasing the house in certain circumstances" and the person assigns a purchase and sale agreement for a new house, the person's sale of the interest in the house is subject to the GST/HST whether the sale takes place in the course of a business, an adventure or concern in the nature of trade, or otherwise.

Assignment of a purchase and sale agreement by an individual

If an individual enters into a purchase and sale agreement for one of the primary purposes described in the section "Primary purpose: selling the house or an interest in the house or leasing the house in certain circumstances", the sale of the interest in the house (or the house itself) is normally considered to be made in the course of an adventure or concern in the nature of trade or, depending on all of the surrounding circumstances, in the course of a business. If it is established that an individual is selling an interest in a new house in the course of a business or adventure or concern in the nature of trade, the individual is considered to have entered into the purchase and sale agreement for the primary purpose of selling the house or an interest in the house.

Whether the activity of acquiring an interest in a house, as a result of entering into a purchase and sale agreement, is done in the course of a business or an adventure or concern in the nature of trade is a question of fact. For more information on how to determine whether an activity is done in the course of a business or an adventure or concern in the nature of trade, refer to Appendix C of GST/HST Memorandum 19.5, Land and Associated Real Property .

Factors in determining the primary purpose

All of the relevant factors surrounding entering into a purchase and sale agreement should be considered in determining the primary purpose for a person's acquisition of an interest in a new house.

The following factors may indicate that, for GST/HST purposes, a person entered into a purchase and sale agreement for the primary purpose of selling an interest in the new house or the house itself. The factors are not listed in any particular order and there is no intent to weigh one more heavily than another.

- The person offers to sell their interest in the house or takes other actions to attract buyers before, or while, the house is under construction.

- The person finances the purchase of the house by a short-term mortgage, or an open mortgage that can be paid off without penalty, rather than by a long-term or closed mortgage.

- Financing of the house is beyond the person's means and that person is relying on the increased value and saleability of the house, or an interest in the house, in a rising housing market.

- The person is an individual and their stated intention to occupy the house as a place of residence is not supported by the circumstances of the case. For example, an individual has a family of four and enters into a purchase and sale agreement for a one-bedroom condo unit where they are not contemplating any changes in family circumstances.

- The person's pattern of activity is such that their occupancy of the house does not have the qualities or characteristics of being permanent. For example, the person purchases more than one house at or around the same time. This factor may be given extra weight where the person has previously entered into a purchase and sale agreement for purposes of selling the house or an interest in the house. There are no outward indicators to support a contrary primary intention (i.e., an intention contrary to an intention of resale). For example, an individual is selling a condo unit, one or more of the above factors are present, there are no physical actions or evidence that the individual's primary intention was to live in the condo unit, use it as a vacation home, or rent it to another individual for use as their place of residence, and no evidence that the sale of the condo unit was triggered by some unforeseen event.

In order for the acquisition of an interest in a new house to be for one of the primary purposes described in the section "Primary purpose: selling the house or an interest in the house or leasing the house in certain circumstances", the intention to sell the house or an interest in it, or to lease the house in the manner described in that section, must have existed at the time of acquiring the interest. Nonetheless, the intention at the time of acquisition may be demonstrated over a period of time.

If an individual acquired an interest in the house for the primary purpose of using it as a place of residence, the person is not considered to be a builder of the type described in this info sheet even if, at a later point in time, the person sells the house or an interest in the house. However, the person may still be a builder if the person meets one of the other definitions of that term as described in GST/HST Memorandum 19.2.

The following examples illustrate when a person may or may not be a builder of a new house.

Sarah, Francine, and Angela are roommates renting a three-bedroom house. They entered into a purchase and sale agreement with a builder in January 2010 for a one-bedroom condo unit in a new condominium complex that was to be built. The purchase price under the agreement was $300,000 and the closing date was July 31, 2013.

In March 2011, the fair market value of the new condo unit had increased by 50%. They entertained several offers for the sale of their interest in the condo unit before assigning it to James. No individual had occupied the condo unit as a place of residence or lodging when they sold their interest in the unit. They split the proceeds, which they each used as a down payment to buy their own homes.

As it would not be practical for the three individuals to live in the condo unit together, they considered several offers for their interest in the unit, and there are no indicators to support a contrary intention, Sarah, Francine and Angela are considered to have acquired their interest in the condo unit for the primary purpose of selling the unit or an interest in it. The sale is considered to be made in the course of a business or adventure or concern in the nature of trade. Accordingly, Sarah, Francine, and Angela are all builders of the condo unit for GST/HST purposes. As they are builders of the unit and the sale of their interest in the unit is not exempt, GST/HST applies to the sale of each of their interests.

Pascal and Chantal own a four-bedroom house where they live with their three children. This is the only home they have ever owned and lived in. They have never purchased any other real property.

In June 2009, they entered into a purchase and sale agreement with a builder for a 1-bedroom condo unit in a new high-rise condominium complex that was to be built. The purchase price under the agreement was $275,000 and the closing date was June 30, 2010. In May 2010, they sold their interest in the new condo unit for $400,000 before it had been occupied by any individual as a place of residence or lodging. They used the sale proceeds to build an addition to their current home.

Although Pascal and Chantal have no history of buying and selling real property, it would not be practical for their family of five to occupy the condo unit as their place of residence. Lacking evidence to support a contrary intention, their primary purpose in acquiring the interest in the condo unit is considered to be for the purpose of selling the condo unit or an interest in it in the course of a business or an adventure or concern in the nature of trade. Accordingly, they are builders of the new condo unit for GST/HST purposes. As the sale of their interest in the unit is not exempt, GST/HST applies to the sale of their interest.

Eric and Gina owned a 3-bedroom house where they lived with their 3 children. They entered into a purchase and sale agreement with a builder in October 2010 to purchase a new 4-bedroom house that was to be built. They intended to use the new house as their primary place of residence as it was located much closer to the children's school and to Eric and Gina's workplaces and had more space. The closing date is July 31, 2011.

Eric and Gina sold their current home in January 2011 and moved into a rented home they planned to live in until their new house was ready. However, in June 2011, Gina's mother became ill and moved in with them as she was no longer able to live on her own.

Eric and Gina decided that the new house would no longer be large enough and that they would now need a house with a granny suite. They sold their interest in the new 4-bedroom house so that they could buy a bigger home that would suit their changed needs.

Eric and Gina's sale of their original home and temporary move to a rented house during the construction of the new home and their choice to purchase a home located closer to school and work support that their intention in acquiring the interest in the new house was to use the house as their primary place of residence. Given this, and the fact that their only reason for selling the interest was due to a change in personal circumstance (i.e., the new house would no longer accommodate their family's needs), they are not considered to have acquired the interest in the house for the primary purpose of selling it. Accordingly, they are not builders of the new house for GST/HST purposes and the sale of their interest in the house is exempt.

Cindy entered into a purchase and sale agreement with a builder in November 2010 for a new house that was to be built. She intended to use the house as her primary place of residence. Her new home would be located within walking distance from her workplace and would be closer to her family than the apartment she is currently renting. The closing date for the purchase is September 30, 2011.

In July 2011, Cindy's employer announced that it was relocating to another city located three hours away. To keep her current job, Cindy had to move to that city. She sold her interest in the house to John.

Since Cindy had intended to use the house as her primary place of residence and her only reason for selling her interest in the house was due to work relocation, she did not acquire the interest in the house for the primary purpose of selling it. Therefore she is not a builder of the house for GST/HST purposes and the sale of her interest in the house is exempt.

Assignment fees

The consideration charged for the sale of an interest in a house generally includes amounts that a person paid to a builder (e.g., a deposit) and that the person wants to recover when assigning their interest in the house. The sale price for the interest may also include a profit, i.e., an amount over and above amounts the person had paid to the builder. If a person's sale of their interest to an assignee purchaser is taxable, the total amount payable for the sale of the interest is subject to GST/HST, including any amount the person paid as a deposit to the builder, whether or not such an amount is separately identified.

A first purchaser enters into a purchase and sale agreement for a new house with a builder (Builder A) and pays a deposit of $10,000 at that time. The first purchaser does not make any further payments to Builder A. The first purchaser subsequently assigns the agreement to an assignee purchaser for $15,000. If the sale of the interest in the house from the first purchaser to the assignee purchaser is subject to GST/HST, tax applies to the full $15,000. This is the case even if the assignment agreement identifies that the $10,000 is a recovery of the deposit that the first purchaser paid to Builder A.

The assignment of a purchase and sale agreement for a new house may be subject to the approval of the builder with whom the first purchaser originally entered into the agreement to construct and sell the new house. The agreement may list conditions related to the first purchaser's right to assign the agreement to an assignee purchaser and, in many cases, the builder charges a fee to the first purchaser for the assignment of the agreement to another person.

The fee charged by the builder in such circumstances is generally subject to the GST/HST.

Eligibility for a GST/HST new housing rebate and provincial new housing rebate (where applicable) where a purchase and sale agreement is assigned

The GST/HST new housing rebate, and where applicable, a provincial new housing rebate, may be available for a new house purchased from a builder and for owner-built new housing. Guide RC4028, GST/HST New Housing Rebate , sets out the eligibility criteria for both types of GST/HST new housing rebates and provincial new housing rebates.

If the first purchaser (the assignor) makes a taxable sale of an interest in a house, i.e., the first purchaser is a builder and assigns the purchase and sale agreement to an assignee purchaser, the first purchaser would not be eligible for either a GST/HST new housing rebate or provincial new housing rebate as they did not acquire the house for use as their primary place of residence. Even if the sale of the interest in the house by the first purchaser is not subject to GST/HST (i.e., in situations where the first purchaser is not a builder of the house), the first purchaser would generally not be eligible for either a GST/HST new housing rebate or a provincial new housing rebate as the conditions for claiming the rebates are not met (e.g., ownership of the house would not transfer to the first purchaser, but to the assignee purchaser).

The assignee purchaser, if an individual, may be eligible for a GST/HST new housing rebate, and where applicable a provincial new housing rebate, where the assignee purchaser receives an assignment of a purchase and sale agreement for a new house. The assignee purchaser would have to meet the eligibility conditions for the rebates as set out in Guide RC4028.

Where a purchase and sale agreement for a new house is assigned, there may be two builders of the house – the original builder (Builder A) and the first purchaser (the assignor). If that is the case, an assignee purchaser would generally have to pay the GST/HST to Builder A for the purchase of the new house and to the first purchaser for the purchase of the interest in the new house.

Claiming a GST/HST new housing rebate when there is more than one builder

In some cases, the builder of a new house pays or credits the amount of the GST/HST new housing rebate, and where applicable, a provincial new housing rebate, to the purchaser of the house. In this case, the builder credits the amount of the new housing rebates to the purchaser by reducing the total amount payable for the purchase of the house by the amount of the expected rebates.

Where this happens, the purchaser and the builder have to sign Form GST190, GST/HST New Housing Rebate Application for Houses Purchased from a Builder , and the builder has to send the form to the Canada Revenue Agency (CRA). As the purchaser receives the amount of the rebate from the builder, the builder may claim the amount as a credit against its net tax when it files its GST/HST return.

Only one new housing rebate application can be made for each new house. Therefore, an assignee purchaser cannot submit a rebate application through a builder (Builder A) for the tax paid to Builder A on the purchase of the house and submit a second rebate application through the first purchaser (the assignor), or directly to the CRA, for the tax paid to the first purchaser on the purchase of the interest in the house.

In such cases, the assignee purchaser may want to file their new housing rebate application directly with the CRA rather than through Builder A. In this way, the assignee purchaser can include in the new housing rebate application the tax paid to Builder A and the tax paid to the assignor in determining the amount of their GST/HST new housing rebate and, where applicable, a provincial new housing rebate.

This info sheet does not replace the law found in the Excise Tax Act (the Act) and its regulations. It is provided for your reference. As it may not completely address your particular operation, you may wish to refer to the Act or appropriate regulation, or contact any CRA GST/HST rulings office for additional information. A ruling should be requested for certainty in respect of any particular GST/HST matter. Pamphlet RC4405, GST/HST Rulings – Experts in GST/HST Legislation explains how to obtain a ruling and lists the GST/HST rulings offices. If you wish to make a technical enquiry on the GST/HST by telephone, please call 1-800-959-8287.

Reference in this publication is made to supplies that are subject to the GST or the HST. The HST applies in the participating provinces at the following rates: 13% in Ontario, New Brunswick and Newfoundland and Labrador, 15% in Nova Scotia, and 12% in British Columbia. The GST applies in the rest of Canada at the rate of 5%. If you are uncertain as to whether a supply is made in a participating province, you may refer to GST/HST Technical Information Bulletin B-103, Harmonized Sales Tax – Place of Supply Rules for Determining Whether a Supply is Made in a Province .

If you are located in Quebec and wish to make a technical enquiry or request a ruling related to the GST/HST, please contact Revenu Québec at 1-800-567-4692. You may also visit the Revenu Québec Web site to obtain general information.

All technical publications related to GST/HST are available on the CRA Web site at www.cra.gc.ca/gsthsttech .

Page details

2022 Changes to GST/HST on Assignments

- Post author By Edward Tse

- Post date 11 May 2022

- 4 Comments on 2022 Changes to GST/HST on Assignments

The 2022 Federal budget included a few changes to the way some real estate transactions are taxed. The two mains changes are the new residential property flipping rule and changes to the way GST/HST on assignments is taxed for individual. In this post I will be discussing the latter.

Summary of the changes to GST/HST on assignments effective May 7th 2022:

- The new change makes it so that there is GST/HST on assignments regardless of original intentions. Previously, if the original intention of entering the pre-construction contract/Agreement of Purchase and Sale (APS) was for personal use, GST/HST on assignments did not apply. But if the intention was to sell for profit or flip the property, GST/HST applied.

- The legislation officially recognizes that GST/HST is not payable on the portion of the consideration exchanged that represents the deposit that the assignor paid to the seller/builder.

I have seen people talk about these changes as if it will slow down the housing market because they seem to incorrectly assume that GST/HST on assignments is double levied or increased. The changes actually add certainty to the way GST/HST on assignments are taxed.

Let’s do an example of pre- and post- May 7th 2022 changes. Here is the assignment details (closely maps on to OREA Form 145/150 Schedule B):

- Purchase Price on the original APS = $1,000,000

- Payment by Assignee to Assignor for this Assignment Agreement = $100,000*

- Total Purchase Price including the Original APS and this Assignment Agreement: $1,100,000

- Deposit paid by the Assignor to the seller under the original APS to be paid by the Assignee to the Assignor: $200,000

**For the sake of simplicity, this excludes GST/HST but in practice, most assignment agreements will stipulate that GST/HST is included

Under the pre-May 7th 2022 rules according to the CRA*, GST/HST would have been payable on the whole amount that the assignee pays to the assignor, $300,000, which results in HST payable of $39,000 in Ontario (13%*300,000).

*Note that it was the CRA’s view that GST/HST is levied on the deposit. In reality this was challenged successfully in a 2013 Tax Court case and a taxpayer can file their GST/HST return without including the amount attributable to the deposit. But the CRA continued to levy GST/HST on the deposit amount in audits and reassessments so taxpayers unaware of the Tax Court ruling would end up paying additional GST/HST.

Under the post-May 7th 2022 rules, GST/HST on assignments is officially only payable on the payment by the assignee to the assignor, $100,000, which results in HST payable of $13,000 in Ontario. This will force the CRA to update their practice guidelines and hopefully they will no longer expect GST/HST on deposits in audits and reassessments.

The Nitty-Gritty

Lately, I have seen a lot of incorrect information shared by investors, agents, accountants, and lawyers regarding the new GST/HST changes so I hope that this post can put to rest any uncertainty on this issue by giving concrete examples and referring to the budget documents (the link goes to the Supplementary Information attached to the Federal Budget).

Many people are confused about the new changes to GST/HST on assignments and I think it largely stems from the imprecise use of language when talking about assignment agreements.

Before we begin, let’s start with some general definitions I will use in this post and are relevant in assignments:

- APS = Agreement of Purchase of Sale = Pre-Construction Contract

- Buyer = Assignor. The buyer is the individual who signed APS to buy the property. They will also be the assignor in the assignment agreement by assigning the APS to the assignee.

- Seller = Builder. The seller is the builder who signed the APS to sell the property. Note that most pre-construction agreements have a clause that give the seller some rights in an assignment of the contract (ie. seek seller permission and/or an assignment fee).

- Assignee = first occupant. The assignee is the person who will be assigned the APS and wants to eventually close on the property and live in it therefore, in most cases, they will be the first occupant.

- Taxable Supply – means a supply that is made in the course of a commercial activity (from the Excise Tax Act (the “ ETA “) S123(1))

- Budget Day – April 7th 2022.

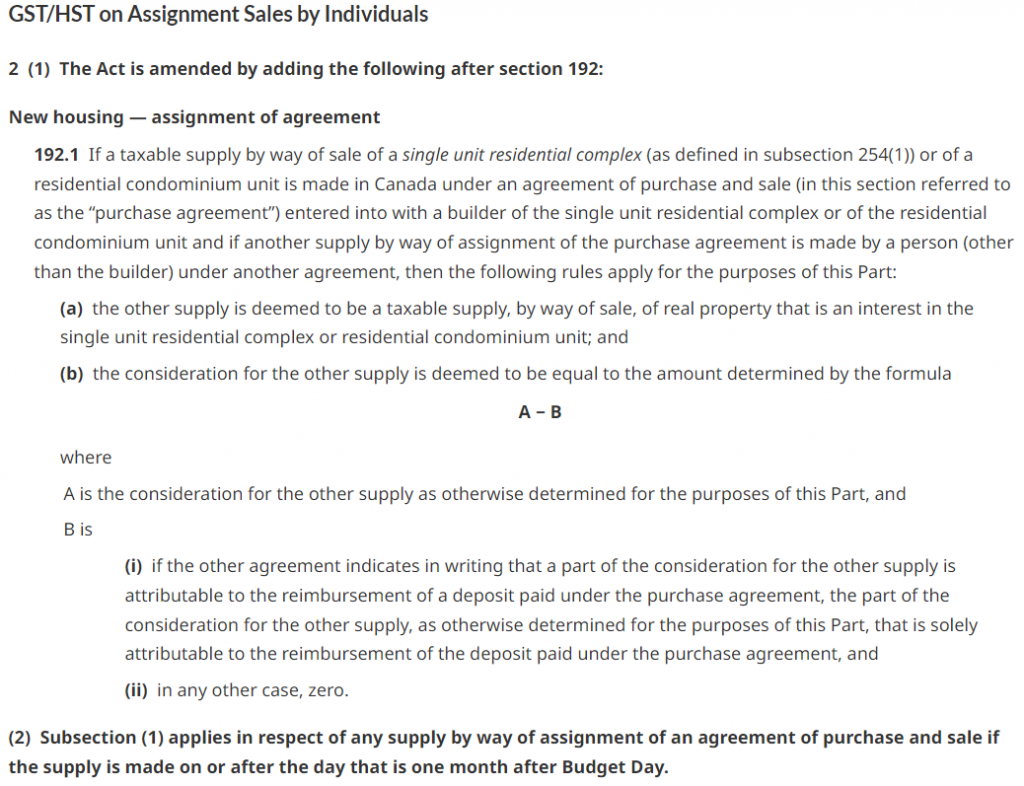

There are two main paragraphs most relevant to the new changes and I will explain what both of them mean. The first:

Budget 2022 proposes to amend the Excise Tax Act to make all assignment sales in respect of newly constructed or substantially renovated residential housing taxable for GST/HST purposes. As a result, the GST/HST would apply to the total amount paid for a new home by its first occupant and there would be greater certainty regarding the GST/HST treatment of assignment sales. Supplementary Information for the 2022 Federal Budget (https://budget.gc.ca/2022/report-rapport/tm-mf-en.html#a5_2)

I believe some people have misinterpreted this paragraph, specifically the underlined section. The total amount paid by the first occupant is the purchase price on the APS (net of GST/HST as it is usually included in the price) plus the amount the first occupant/assignee paid for the assignment contract (also net of GST/HST).

The legislators have reframed the GST/HST on assignment sales from a taxable supply provided by the assignor, to the GST/HST owed because that is the “true purchase price” that the first occupant paid for the property. There is no double taxation. The amount of GST/HST on assignments is just being levied on the original APS price plus the additional amount the assignee paid to the assignor.

Which leads to the next paragraph:

Typically, the consideration for an assignment sale includes an amount attributable to a deposit that had previously been paid to the builder by the assignor. Since the deposit would already be subject to GST/HST when applied by the builder to the purchase price on closing, Budget 2022 proposes that the amount attributable to the deposit be excluded from the consideration for a taxable assignment sale. Supplementary Information for the 2022 Federal Budget (https://budget.gc.ca/2022/report-rapport/tm-mf-en.html#a5_2)

The GST/HST on the deposit never made sense because the assignee was essentially returning the deposit that the assignor already paid to the builder which was already subject to GST/HST in the APS. This new reframing of the assignment sale solves that quirk because the deposit is already accounted for in the assignee’s “true purchase price”.

The Nittier-Gritt ier

So this is where going to law school comes in handy. If the above has not convinced you, please read on but otherwise, this might be a bit dense as I convert each part of the change to the ETA in everyday language that even a non-tax lawyer can understand (hopefully).

If a taxable supply by way of sale of a single unit residential complex (as defined in subsection 254(1)) or of a residential condominium unit is made in Canada under an agreement of purchase and sale (in this section referred to as the “purchase agreement”) entered into with a builder of the single unit residential complex or of the residential condominium unit […]

Translation/simplification: If a taxable supply by way of an APS is entered into …

[…]and if another supply by way of assignment of the purchase agreement is made by a person (other than the builder) under another agreement, then the following rules apply for the purposes of this Part:

Translation/simplification: …and if there is another supply (profit from the assignment) by way of the assignment of the APS, then the following rules apply:

(a) the other supply is deemed to be a taxable supply, by way of sale, of real property that is an interest in the single unit residential complex or residential condominium unit; and

They key phrase here is “other supply” because it does not refer to the original taxable supply which would have been the entire purchase price of the property in the APS. Instead, the “other supply” refers to the profit the assignor made in assigning the APS to the assignee.

Translation/simplification: (a) the profit from the assignment agreement is deemed to be a taxable supply.

(b) the consideration for the other supply is deemed to be equal to the amount determined by the formula A-B where

Translation/simplification: (b) the profit from the assignment agreement is determined by the following formula A-B where

A is the consideration for the other supply as otherwise determined for the purposes of this Part, and

Translation/simplification: A is the total amount the assignor received before HST, and

B is (i) if the other agreement indicates in writing that a part of the consideration for the other supply is attributable to the reimbursement of a deposit paid under the purchase agreement, the part of the consideration for the other supply, as otherwise determined for the purposes of this Part, that is solely attributable to the reimbursement of the deposit paid under the purchase agreement, and (ii) in any other case, zero.

Translation/simplification: B is a reimbursement from the assignee to the assignor for the deposit paid in the APS if applicable

And putting it all together:

If a taxable supply by way of an APS is entered into and if there is another supply (profit from the assignment) by way of the assignment of the APS, then the following rules apply

(a) the profit from the assignment agreement is deemed to be a taxable supply.

(b) the profit from the assignment agreement is determined by the following formula A-B where

- A is the total amount the assignor received before HST, and

- B is a reimbursement from the assignee to the assignor for the deposit paid in the preconstruction agreement if applicable

This new change introduces more certainty and logic into the tax code which is good for society overall.

Realistically, this only disadvantages those who have a change in circumstance and are “forced” to assign their property before closing. For example, this could be due to interest rate hikes that prevent a taxpayer from obtaining a mortgage or getting a new job elsewhere and no longer needing the property.

But it does create a positive incentive for real estate flippers to follow the law as it closes off one of the avenues for avoiding GST/HST on assignments (though income tax is a whole other issue). I don’t think it will have any meaningful effect on house prices, unless people believe in the incorrect information.

4 replies on “2022 Changes to GST/HST on Assignments”

First, I love the article. I called CRA. The gentlemen there said he is not aware of any changes from May 7th and says HST is still chargeable on the deposit. This makes no sense that the deposit should have ever been considered to be taxed.

Thank you! Yes, the CRA phone reps aren’t really held accountable for the information they give out so if there is ever any conflicting information I would triple check it. As I mention in the post as well, the CRA continued to audit and reassess HST on the whole deposit. I guess the CRA auditors rely on their practice guidance which, as far as I can tell, is from 2011 and wasn’t updated even after the 2013 case against their interpretation. Hopefully they will be issued new practice guidance soon but it might take awhile for it to trickle down to the CRA phone reps.

Awesome article Ed. 👏

Thanks, glad it was helpful!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Preparing for the tidal wave of Canadian tax changes

2024 Canadian ESG Reporting Insights

Findings from the 2024 Global Digital Trust Insights

PwC Canada's Federal budget analysis

Canada’s Draft Sustainability Disclosure Standards

27th Annual Global CEO Survey—Canadian insights

2023 Canadian holiday outlook

Embracing the future of capital markets

Five opportunities facing Canadian government and public-sector organizations

How can Canadian family business founders and owners create the right outcomes

Managed Services

Nicolas Marcoux, CEO of PwC Canada, recognized for his commitment to the advancement of women in business

PwC Canada drives adoption of Generative AI with firmwide implementation of Copilot for Microsoft 365

Our purpose, vision and values

Apply today! Now hiring students and new graduates

We’re empowering women to thrive in tech

Why join our assurance practice?

Loading Results

No Match Found

Tax Insights: GST/HST issues relating to the assignment of agreements to purchase newly constructed condominiums

February 01, 2021

Issue 2021-03

The combination of rising home prices and the financial stress and uncertainty created by the COVID-19 pandemic is resulting in more condominium purchasers reconsidering their acquisition. While some buyers always planned to assign their agreements of purchase and sale (APS) to a third party, many other buyers that originally intended to lease or reside in their condominium units are also assigning their APS. There are a number of reasons for this, one of which is a reduction in the demand for rental condominiums in many Canadian cities. As discussed in a recent Tax Court of Canada decision, Chen Sun v. The Queen, 2020 TCC 112, there are many Goods and Services Tax/Harmonized Sales Tax (GST/HST) issues to consider when an APS is assigned to a third party, including whether:

- GST/HST is payable by the assignee on the assignment fee and the amount attributable to the deposit that was paid by the assignor to the builder of the property

- the assignee is eligible to claim the GST/HST new housing rebate

- the new housing rebate can be assigned to the builder and credited against the purchase price

Is the assignment of an APS a taxable supply

The assignment of an APS will constitute a taxable supply, unless it qualifies for an exemption. This is because “real property” is defined to include an interest in real property, and the making of a supply of real property (other than an exempt supply) is deemed to be made in the course of a “commercial activity.” The sale of an interest in a residential complex by a person that is not a “builder” is generally exempt; however, the sale of an interest in a new home or condominium is generally subject to GST/HST when the assignor is a “builder.”

A “builder” is defined in a manner which can potentially include someone that is merely entering into an APS with a builder. For example, subject to a specific exclusion that only applies to individuals, someone that acquires an interest in a home before it is occupied (or a condominium before it is registered) can be a builder if their primary purpose was to either:

- sell the home to any person

- lease the home to someone other than an individual for their personal use

Individuals are excluded from being a builder if they did not acquire their interest in the course of a business or an adventure or concern in the nature of trade, which is determined by considering the following factors:

- nature of the property sold

- length of period of ownership

- frequency or number of other similar transactions by the taxpayer

- work expended on or in connection with the property realized

- circumstances that were responsible for the sale of the property

- taxpayer’s motive or intention

To the extent that the assignor is a “builder,” GST/HST will be payable on the value of consideration that is paid by the assignee and the assignor will be required to collect GST/HST unless the assignee is registered for GST/HST.

The Canada Revenue Agency (CRA) considers an amount paid by an assignee on account of the assignor’s deposit to be part of the consideration paid for the assignment of an APS, and is therefore subject to GST/HST if the assignor is a builder. Accordingly, unless the assignment is restructured to result in the builder refunding the deposit to the assignor and receiving a replacement deposit from the assignee, the assignee may pay double tax on the deposit. It is also important to note that the Tax Court of Canada’s decision in Casa Blanca Homes Ltd. v. The Queen, 2013 TCC 338 contradicts the CRA’s view. In Casa Blanca Homes Ltd., the Tax Court of Canada held that the amount paid to the assignor relating to the deposit constituted an exempt supply of a financial service and would therefore not be subject to GST/HST.

Can the assignee claim the GST/HST new housing rebate

The assignment of an APS may also impact the assignee’s eligibility to claim the new housing rebate, as evidenced by the Tax Court of Canada’s recent decision in Chen Sun. The federal new housing rebate is equal to 36% of the federal component of GST/HST paid, up to a maximum of $6,300 (for homes valued at $350,000), with the rebate being gradually reduced and phased out when the value of the home reaches $450,000. For properties in Ontario, the provincial new housing rebate is equal to 75% of the provincial component of GST/HST paid, up to a maximum of $24,000 (for homes valued at $400,000 or higher).

For a purchaser to be eligible for the new housing rebate, the following conditions must be met:

- the purchaser must be an individual that is acquiring the home from a builder, as opposed to an assignor who may not be a builder

- at the time the individual becomes liable or assumes liability, they must acquire the home as their primary place of residence or that of a relation

- ownership of the property must be transferred to the individual after construction is substantially completed

- the first person to occupy the home must be the individual or a relation

- all persons named on the APS must meet the aforementioned conditions

When the purchaser qualifies for the new housing rebate, the builder is generally entitled to pay or credit the rebate amount to the purchaser pursuant to subsection 254(4) of the Excise Tax Act.

In situations where a third party is acquiring ownership of a home or condominium and they receive title directly from the builder, it does not necessarily mean that the APS has been assigned to the third party and that the builder has sold the condominium to the assignee. As argued by the Crown in Chen Sun, if the builder has not accepted the assignment, then the assignee may not be the person that is acquiring the condominium from the builder. Fortunately, in Chen Sun, the court ultimately held that the APS was in fact assigned on the basis that the builder, by its conduct, accepted the assignment and therefore the builder did sell the condominium directly to the assignee. Accordingly, the assignee was eligible to claim the new housing rebate (and the builder was entitled to credit the assignee with the rebate) because the assignee acquired the condominium from the builder and the other conditions to claim the rebate were satisfied.

How should builders deal with assignments

As the builder and purchaser are jointly and severally liable for housing rebates that have been claimed in error, it is important for builders to make sure that purchasers qualify for the rebate before they pay or credit the purchaser with the rebate. The CRA heavily scrutinizes rebate claims and, to the extent each and every condition to claim the rebate is not satisfied, the CRA will deny the rebate claim. In situations where an APS has been assigned, builders should consider whether:

- they should credit the assignee with the housing rebate or advise the assignee to file the rebate claim directly with the CRA

- it is easier to “tear” up the original APS and enter into a new APS with the assignee

- the assignment has been clearly documented so that there is no dispute that the assignee has become the purchaser under the APS, which may not be the case when only the title is transferred to the assignee at the assignor’s direction

The takeaway

All parties to a transaction in which an APS is being assigned and a housing rebate is being claimed should consider the GST/HST implications of the assignment. Failure to structure these assignments in an appropriate manner can significantly increase GST/HST costs for the respective parties, including:

- builders being assessed penalties for erroneously crediting the housing rebate to assignees

- assignors being assessed penalties for failing to collect tax on the assignments

- assignees paying GST/HST on the replacement deposits

PwC can help structure these assignments in a tax-efficient manner.

Download a PDF

Related services

Real estate

Subscribe to tax publications

Brent Murray

Partner, PwC Law LLP

Tel: +1 416 947 8960

Wayne Mandel

Director, PwC Canada

Tel: + 1 905 738 2914

Fred Cassano

Partner, National Real Estate Tax Leader, PwC Canada

Tel: +1 905 418 3469

Ken Griffin

Partner, PwC Canada

Tel: +1 416 815 5211

Dean Landry

National Tax Leader, PwC Canada

Tel: +1 416 815 5090

© 2018 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Cookies info

- Terms & Conditions

- Site Provider

- Accessibility

GST on Assignments and Resales

Whether you’re buying or selling a home, you’ve probably wondered about GST. Although GST only applies to brand new or substantially renovated homes, there are some caveats when it comes to assignments and resales.

What is an assignment?

An assignment occurs when the purchaser transfers their rights in the purchase contract to someone else before the completion date. Assignments are most commonly found in presale condo and townhome communities where a buyer will enter a contract with the developer prior to construction of the home being completed. For many new home buyers, presales are an ever-attractive option, allowing them to only pay the deposit upfront.

What are the tax implications on assignments?

When purchasing a presale home, the buyer is also responsible for both the PST and GST on the cost of the home, and GST on the assignment amount (which is often already included). That being said, some buyers may qualify for a GST/HST new housing rebate if the property will be their primary residence and if the purchase amount is under $450,000.

Head’s up! If you’re looking to learn more about how GST can be applied in various assignment scenarios, Canadian Real Estate Wealth Magazine has a great blog post with some real-life examples.

What are the tax implications on resales?

When it comes to resales, on the other hand, the seller’s intent determines whether GST is applicable. For example, if the seller originally purchased the home as their primary residence, then GST wouldn’t apply. If, however, the seller purchased the home with the intent to renovate and resell, then they are legally considered the ‘builder’, and GST would be applied.

If you’re purchasing a resale home, it’s important to know whether the seller can also be considered the builder. Ensuring that your contract clearly states the seller’s intent can be crucial in determining whether or not you’re on the hook for GST.

Ultimately, when it comes to real estate, taxes can be quite complex. For this reason, it’s important to discuss potential tax scenarios with your realtor and/or lawyer prior to entering a contract to buy or sell a home.

Navigating the real estate market doesn’t need to be a daunting task. We’re here to help make things easier! Let’s chat .

Featured Listings

6081 SHERBROOKE STREET, Vancouver

Amazing opportunity to secure this 44 x 122.38 lot in a great neighbourhood just steps from Memorial Park. This one owner home has been well cared... Read More >

307 189 E 16TH AVENUE, Vancouver

This TOP FLOOR 1 bed + den is sure to impress with its tasteful upgrades & stellar location in the heart of Main Street. Cartier Place is a solid,... Read More >

Blog Archives

- Assessments

- First Time Buyers

- Market Updates

- Cedar Cottage

- Character Home

- Condo Living

- Condo Sales

- Development

- Duplex Listing

- Electric Vehicles

- Half Duplex

- Heritage Home

- Home Inspection

- Home Maintenance

- Interior Design

- Laneway Home

- Neighbourhood Profile

- New Condo Listing

- New Listing

- New Westminster

- North Vancouver

- Corey Martin

- Ruth Chuang

- Willo Jackson

- Renovations

- Uncategorised

- Commercial Drive

- East Vancouver

- Hastings-Sunrise

- Mount Pleasant

- Vancouver Real Estate

- Vancouver Special

Login now to view your favourite listings and view all listing information.

Signup for our website and gain access to new features including favouriting listings and viewing all listing information.

ADVO TAX LAW

PROFESSIONAL CORPORATION

- May 11, 2022

Tax Implications of a Real Estate Assignment: a Tax Exposure Calculator

This article provides an overview of GST/HST and Income Tax rules (current and proposed by the Federal Budget 2022) as they apply to real estate assignments sales.

In order to illustrate the points we discuss in the article, we have created a fun and interactive Assignment Tax Exposure Calculator for real estate assignments in Ontario (HST rate 13%) that result in business income for Income Tax purposes . If your assignment sale results in capital gain for Income Tax purposes, this calculator won't work for you (we might create one for our readers, if there is enough interest). Talk to your tax advisor to determine whether your assignment sale would result in business income or in capital gain.

We hope that our readers enjoy testing their business strategies with our Tax Exposure Calculator as they plan their assignment sales, but we caution them not to rely on the calculator in lieu of professional tax, legal or accounting advice.

Federal Budget 2022

A typical purchase agreement for a pre-construction residential property has a closing date scheduled months, often years in advance. As purchasers wait for the construction to complete/the transaction to close, some choose to assign their rights under the purchase agreement for the property for a fee. Federal Budget 2022 proposes new tax rules that will affect both such assignors and assignees.

Take, for example, Rebecca who purchased a pre-construction condominium in Downtown Toronto in 2017 for $300,000 (including HST) with a November 2022 tentative closing date. She provided a deposit of $60,000 to the builder. At the time of purchase, Rebecca’s intention was to live in the condo. As years went by, Rebecca changed her mind about living in Downtown; she decided to live in the suburbs instead. Lucky for Rebecca, the market value of her pre-construction condo surged to $500,000. In June 2022, Rebecca assigns her rights under the purchase agreement for the condo to a new purchaser who is willing to pay $260,000 ($60,000 to reimburse her for the deposit she made + $200,000 on account of the increase in price). Rebecca thinks she made an impressive profit of $200,000 but she did not consider taxes.

If you are like Rebecca, Federal Budget 2022 has some good news and some bad news for you (but mostly bad).

GST/HST to Apply on All Assignment Sales

The bad news is that effective May 7, 2022, under the Excise Tax Act (Canada) (“ETA”) every individual assignor of residential real estate would have to collect GST/HST on their assignment profit and remit it to the CRA. The rule will apply even to those who believe they are unrelated to the business of real estate and did not have a GST/HST number. Where an assignor is a non-resident, the assignee would be required to self-assess and pay the GST/HST to the CRA. In my example, Rebecca would have to remit 13% HST included in the $200,000 assignment profit ($23,008) directly to the CRA.

Before the Budget proposal, Rebecca’s HST liability depended on whether or not she purchased and assigned a condo in the course of a commercial activity. If Rebecca’s true intentions were to live in the condo, she would have been exempt from HST.

Income from Assignment: Business Income or Capital Gain?

Another element of bad news does not directly follow from the proposals, but raises concerns. Some commentators believe that, as an indirect effect of the Budget, we may see more assignment sales treated as business income (taxed at full rates) as opposed to capital gain (taxed at half rates) under the Income Tax Act (Canada) (“ITA”).

First, if all assignments are “taxable supplies” subject to GST/HST under the ETA, it generally implies the existence of a “commercial activity.” In its turn, a commercial activity generally implies business income treatment under the ITA. Granted, if an activity is deemed to be a “taxable supply” under the ETA, the deeming rule should not extend to a different Act, the ITA, but tax practitioners are watching carefully.

Second, Budget 2022 includes a new “anti-flipping” rule, which deems sales of residential properties owned for less than 12 months to generate business income under the ITA, subject to limited “life events” exceptions, such as a divorce or a job relocation. It is unclear whether the proposed “anti-flipping” rule would apply to assignments when taxpayers technically do not “own” the properties. Stay tuned.

In any event, the new “acceptable” list of life events replaces the current capital vs. income legal test entirely. Instead of determining whether the condo was Rebecca’s capital property or inventory, the focus shifts to merely checking whether her reason to sell/assign was on the list of the “acceptable” ones.

If Rebecca’s assignment profit is treated as business income for income tax purposes, her highest marginal tax rate would be 53.53% in Ontario. In very rough terms, Rebecca should budget well over 50% of her assignment profits for HST remittances and income tax. Depending on her marginal tax rate, she may be able to only keep about $88,000 of her original $200,000 assignment profit.

Before the Budget proposal, Rebecca’s intentions for the property (business or personal) would have been a question of fact. If she could prove that she intended to live in the condo, she would pay no HST and pay tax on capital gain. Her total tax liability would have been approximately $50,000 (25% of the $200,000 assignment profit).

No HST On Deposit Portion of Assignment Price

But there is also good news: the Budget proposes to exclude deposits from consideration for taxable supplies by assignment for GST/HST purposes. This means that GST/HST will only apply on the profit portion of the assignment price (in Rebecca’s case, $200,000), and not on the entire assignment price, which includes the deposit ($260,000). This is a welcome change that eliminates double taxation and is consistent with current caselaw ( Casa Blanca Homes Ltd. v. The Queen , 2013 TCC 338).

To generally estimate Income Tax and HST (Ontario) implications of an assignment that results in a business income, check out the Assignment Tax Exposure Calculator on our website .

IMPORTANT: Always speak to your tax professional to estimate or determine tax consequences applicable to your specific situation. DO NOT rely on our calculator for an accurate estimation of your tax liability. Nothing in this article constitutes legal advice and no solicitor-client relationship is created. If you require legal advice pertaining to your specific situation, please contact our tax lawyer .

If you enjoyed this article, please do not forget to s ubscribe to our blog and our social media for important updates.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

#advotaxlaw #annamalazhavaya #taxlawyer #taxlawyerToronto #taxlawyermississauga #taxlawyeretobicoke #taxlitigationlawyer #hst #realestate #gstcanada #torontotax #filingtaxescanada #revenuecanada #canadarevenueagency #taxcreditscanada #hstrebatecanada #hstcanadatax #realestatetoronto #realestatebuilder #residentialbuilder #buildertoronto #intention #principalresidence #craaudit #craappeal #taxcourt #penalties #assignment #preconstruction #budget2022 #businessincome #taxcalculator #taxexposurecalculator #hstonassignment

Recent Posts

2024 Federal Budget Changes in Tax on Capital Gain: What They Mean to "Rich" and "Regular" Canadians

Basic Guide on Bare Trusts for Canadian Taxpayers

The Future of Tax Audits Looks Digital

- Create new account

- Request new password

You are here

Cra explains the implications of the new gst/hst treatment of home purchase flips.

Para. (d) of the ETA definition of “builder” generally has the effect of exempting an assignment of an agreement to purchase a home from the builder where the assignor was acquiring the home for personal use, and para. (f) effectively provides a further exemption regarding such an assignment where the assignor is an individual who is not engaged in an adventure in the nature of trade or a business – whereas ETA draft s. 192.1 will eliminate this exemption. Comments of CRA on the effects of this new rule include:

- Under the new rule, where the (post-May 22, 2022) assignment agreement indicates that a part of the consideration is attributable to the reimbursement of a deposit paid by the assignor to the builder under the subject purchase and sale agreement, that deposit amount is excluded from the taxable amount of the assignment – whereas under the old regime, if the assignment was taxable, the total consideration for the assignment - including any portion referable to the assignment of the deposit - was taxable.

- Given that the amount of the new housing rebate is based on the total consideration for the taxable supply of the house, including any consideration paid by an assignee for a taxable assignment sale of an agreement to purchase the house from the builder (but excluding the amount attributable to a deposit assignment), the new rule will affect the Ontario or federal new housing rebate amounts.

- As only one new housing rebate application can be made for each new house, and the builder (“Builder A”) does not receive the consideration for the assignment of the purchase contract to the assignee:

[T]he assignee purchaser may want to file their new housing rebate application directly with the CRA rather than through Builder A. In this way, the assignee purchaser can include in the new housing rebate application the tax paid to Builder A and the tax paid to the assignor in determining the amount of their GST/HST new housing rebate and, where applicable, a provincial new housing rebate.

Neal Armstrong. Summaries of GST/HST Notice 323, Proposed GST/HST Treatment of Assignment Sales, May 2022 under ETA s. 123(1) – builder – (d) , s. 254(1) - single unit residential complex , s. 254(2)(i) , s. 254(4) , s. 256.2(3) and s. 192.1 .

Tax on Assignment Sales: What You Need to Know

Real estate assignment sales and flipping pre-construction condos have become popular strategies for investors looking to make a quick return. And CRA has noticed. In this blog, I will explain two ways CRA is cracking down on pre-construction investors and what you can do to minimize your tax paid on assignment sales.

#1 – CRA May Tax Assignment Sales as Business Income

Similar to selling a resale home, you are required to report an assignment sale on your tax return and pay the necessary tax. Many real estate investors are quick to assume that the profit from an assignment sale is a capital gain.

However, CRA may tax assignment sales in two ways:

- Capital gain – where only 50% of the profit is taxable

- Business income – where 100% of the profit is taxable

To make its determination, CRA will consider factors such as:

- What was your motive or intention in buying the property?

- How long did you hold the property before selling?

- Do you have a history of similar transactions?

- What is your reason for selling?

Based on past court cases, we know that CRA will generally consider the profit from assignment sales to be business income unless you have a compelling explanation.

With the potential to double its tax collection, you can bet that CRA is watching this closely!

#2 – CRA May Assess GST/HST on Assignment Sales

This is probably one of the most overlooked tax implications when it comes to assignment sales.

While resale homes are generally exempt from GST/HST, you may be surprised to learn that this may not be the case with assignments.

Similar to income tax, CRA will look at your intentions in buying the property to determine whether GST/HST applies to you.

For example, you are likely considered a “builder” and will have to charge GST/HST if you assign a pre-construction unit that you bought for the purpose of flipping to make a quick profit.

And it gets worse:

Not only do you have to charge GST/HST on your profit, you also have to charge GST/HST on the deposit you recoup from the buyer!

Since most real estate contracts embed GST/HST into the sales price, this cost will likely be borne by the assignor.

Let’s look at an example:

Scenario Luca purchased a pre-construction condo unit for $450,000 a couple of years ago. He paid a deposit of $90,000 to the builder. The unit is currently worth $575,000. Luca had always planned to buy this unit as an investment and assign it for a profit. He has a personal tax rate of 50%.

On the surface, it looks like Luca stands to make a great profit. But, let’s see how that holds up:

What Can You Do to Save Tax on Assignment Sales?

Firstly, if you are unsure whether you have a capital gain or business income, you should reach out to a tax professional for advice.

Secondly, if the profit on your assignment sale is in fact business income because of the factors discussed above, then you should consider incorporating.

The benefit here is that business income is usually taxed at low rates inside a corporation (about 12.2% in Ontario and 11% in British Columbia). This is much lower than the the top tax rate of 53% paid by individuals.

Now be warned:

Setting up a corporation for real estate investing is not for everyone. Be sure to consult with a tax professional before implementing this strategy.

Lastly, it is important to work with an experienced real estate lawyer to discuss your GST/HST options. In my experience, it may be possible to restructure an assignment sale to reduce the GST/HST you pay as an assignor.

In Luca’s case, with the right professionals on his team, he was able to restructure the deal to reduce his taxes by about 38% (50% less 12.2%), pay less GST/HST and put this money into his next real estate project.

Have qu estions about flipping pre-construction real estate? Contact us for a consultation.

The content of this blog is intended to provide a general guide to the subject matter. Professional advice should be sought about your specific circumstances.

95 Mural St., Suite 600, Richmond Hill, ON L4B 3G2

905.731.8108

(844) 538-2937 or ( 416) 593-4357

Real Estate Assignment Sales – New Tax Rules

The Federal Budget for 2022 has made amendments to Part IX of the Excise Tax Act (“ETA”). Effective May 7, 2022, all assignment sales in respect of newly constructed or substantially renovated single unit residential complexes or residential condominium units are taxable.

For clarity, with respect to residential housing transactions, the purchaser (assignor) enters into an agreement of Purchase and Sale with the builder and then sells (assigns) their “rights and obligations” in the agreement of Purchase and Sale to another person (assignee).

Typically, the closing date for a pre-constructions residential property can take several months or even years. During this time, purchasers may decide to assign their rights outlined in the Purchase and Sale agreement to an assignee. The Federal Budget for 2022 now imposes GST/HST tax obligations on assignors and assignees. Essentially, an individual assignor of residential real estate now must collect GST/HST remit it to the CRA. This rule is applicable even to those who do not have a GST/HST number and believe that they are not purchasing and assigning in the course of commercial activity. In cases where the assignor is a non-resident, the assignee is obligated to self-assess the GST/HST. Prior to this amendment, the GST/HST liability depended on whether an individual purchased and assigned their rights in the course of commercial activity and if the purchaser’s true intentions were to live in and use the property, then there would be no GST/HST liability.

Deposit Portion of Assignments

Where an assignment agreement is entered into on or after May 7, 2022, the Budget confirms that GST/HST would not be applicable to the deposit portion of the assignment price. However, it must be indicated in writing that a part of the consideration is attributable to the reimbursement of a deposit paid by the assignor to the builder under the Purchase and Sale agreement. This means that an assignor would only be liable for GST/HST on the amount above the deposit. This also eliminates double taxation and is consistent with the holding from current caselaw, Casa Blanca Homes Ltd. v. The Queen , 2013 TCC 338 .

Where an assignment agreement is entered into before May 7, 2022, and the assignment sale is taxable, the total amount payable for the sale is subject to the GST/HST, this includes any amount paid by the assignor as a deposit to the builder, whether or not this amount is separately identified.

“Anti-flipping” Rule

Budget 2022 further proposes that sales of residential properties owned for less than 12 months are deemed to generate business income under the Income Tax Act (“ITA”). These are subject to limited exceptions such as divorce, or relocation for employment purposes. In terms of assignment sales, it has not yet been determined whether the proposed “anti-flipping” rules would apply since taxpayers do not technically “own” the properties. Tax practitioners are carefully monitoring this. For more information see our previous blog discussing this .

If you have questions about the new rules contact us today !

**Disclaimer

This article provides information of a general nature only. It does not provide legal advice nor can it or should it be relied upon. All tax situations are specific to their facts and will differ from the situations in this article. If you have specific legal questions, you should consult a lawyer.

Related posts:

- Withholding Tax for Non-Residents on Real Estate Sales

- Assigning Property and the GST/HST Implications

- How Real Estate Agents can Incorporate a Company

- Capital Gains – Canadians Selling U.S. Real Estate

- Business Expenses for Real Estate Agents

Jason Rosen

Rafia javaid, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Become a CPA

- Member & Practice Regulation

- News & Events

- Member Services

- Protecting the Public

Sales Tax Issues in Real-Property Transactions

Real-property transactions in BC are complex, and they’re becoming increasingly valuable. Sales tax rules add complexity to a wide variety of real estate sales and leasehold arrangements. Adding to this complexity is the fact BC’s unique real estate rules—such as those related to stratified leasehold interests and assignments of lease—seldom align neatly with the federal Excise Tax Act (ETA), which means that each must be carefully reviewed in the context of sales tax treatment.

This article covers GST basics, available GST rebates, some special cases, and the documentation requirements with respect to real-property transactions.

Unless it is specifically listed as exempt in schedule V of the ETA, the sale of real property is taxable. Exemptions are quite limited, but include:

- Used residential complexes (unless substantially renovated);

- Personal-use residences or land (unless the land is subdivided into three or more parcels); and

- Residential land, such as a residential land lease or trailer park.

With respect to bare land, the GST circumstances vary as follows:

- If sold by a corporation or partnership, bare land is always subject to GST;

- If sold by a non-profit entity, the land is usually GST-exempt; and

- If personal-use land is sold by an individual or trust, it is generally GST-exempt.

For GST purposes, bare land also includes any “excess land” associated with a residence, which is defined as any land not reasonably necessary for the enjoyment of the residence. The Canada Revenue Agency (CRA) administratively limits the necessary land to one-half of a hectare, subject to the minimum lot size possible in the area.

It is important to note that, generally, the GST registration status of the seller does not affect a taxable sale. Whereas sales of tangible goods and capital property by an unregistered vendor are generally not taxable, the nature and use of real property usually dictates whether a sale is subject to GST.

There are scenarios wherein a vendor who is not registered may still make a GST-taxable sale of real property. To prevent cascading tax on such properties, unregistered vendors may claim a rebate for the GST on the cost of the property using GST form 189—“General Application for Rebate of GST/HST.” The GST rebate will be the lesser of the actual tax embedded in the cost of the property or the amount of tax collectible on the current sale.

Available GST rebates

The following rebates are available for any property valued up to $450,000. The rebate is equal to 36% of the GST paid on a property up to $350,000, and diminishes to 0% at a property valued at $450,000 or above. All new housing rebate applications must be filed within two years after the end of the month in which the tax first becomes payable.

Builder-built

A constructed home that is sold to an individual who intends to occupy it as a primary place of residence is eligible for a new housing rebate. This rebate can be assigned to the builder/developer at the closing of the sale, which will permit them to collect GST as low as 3.2% on the selling price (for example, 5% - {36% x 5%}). Otherwise, the purchaser will have to pay the full GST and file a separate rebate claim.

Owner-built

Where a home is constructed by contractors on the homeowner’s land, a new housing rebate is also available; however, this rebate must be claimed directly by the homeowner—it cannot be assigned to the contractor.

Rental property

The “New Residential Rental Property Rebate” provides a rebate to long-term residential rental properties where the property is used as an individual (tenant)’s primary place of residence.

Note: For a residential rental property with multiple units, the landlord’s rebate is determined by reference to each qualifying residential unit in the complex.

Some special cases

Listed below are some of the less common transactions for real property in BC:

Mixed-use buildings – residential/commercial

A mixed-use building that contains both commercial and residential units is treated as two separate properties for GST purposes.

If the residential portion of the building is comprised of stratified or condominium units, the GST treatment of each individual residential condominium unit is determined separately. If the residential portion of the building is a multi-unit complex, it is treated as one multiple-unit residential complex.

Resort properties and vacation homes

Resort properties and vacation homes, including those involving fractional ownership, timeshare facilities, and/or memberships, are not specifically dealt with in the ETA. Rather, each transaction has to be considered carefully in light of the current GST rules, which are limited in effect to residential, personal-use, or commercial real-property developments.

Moreover, the application of the GST rules is more difficult where a proration is required based on a split for personal and investment/short-term rental purposes.

Used residential properties – change in taxable status

Where a GST registrant buys a used house GST-exempt, tears it down, and then sells the bare land, the resale of this land may be taxable. In such cases, the registrant will be able to claim input tax credits on the cost of demolishing the house; however, where the purchaser is intending the land for personal use, this will create an unfavorable tax outcome, forcing them to pay unrecoverable GST.

To avoid this scenario, the seller is best advised to resell the property with the used house on it, potentially with a contract in place for the removal of the structure. The sale of the whole property would then be GST-exempt, and only the demolition contract would be taxable.

Purchase of a house for removal and relocation

If a house is being sold without the land (for removal and relocation), the sale is not considered to be the sale of a residential complex. Further, the house is not considered to be real property, unless it is being relocated within the same legal description (lot) in which it was previously situated. The sale of a house for relocation to a new lot is generally subject to GST and PST.

Assignment of purchase and sale contract

Historically, CRA has been known to assess GST on assignment fees received following the resale of presale units prior to the completion of construction; however, GST does not apply to these assignment fees in most cases. Where the original purchaser was not a “builder” of the underlying residential complex and the purchase agreement was entered into for strictly a personal-use purpose, the assignment of the agreement is GST-exempt.

The sale of farmland is generally subject to GST, and if the land is being purchased for personal use, a non-recoverable GST payment can add significantly to its cost.

Documentation requirements

As with all GST reporting, documentation is key. There are numerous special clauses that should be included in purchase and sale agreements, such as a certification of exempt sale or the assignment of a new housing rebate. Some other examples:

GST registration – certificate by purchaser

Generally, if a taxable sale is being made to a GST registrant, a vendor is not required to collect GST. To support the position, however, a vendor must obtain the purchaser’s GST registration number and ensure that the number is valid.

Incorrect statement of GST exemption

Vendors often rely on the “used residential housing” or “personal use property” exemptions. Where a vendor provides a purchaser with a certificate indicating that their transaction is not subject to GST, but this status is later determined to be false or incorrect, section 194 of the ETA provides the purchaser with some protection.

GST-included vs. GST-extra pricing

Unless explicitly noted, a GST-taxable sale price is considered “GST-extra” pricing, which means that GST must be added to the agreed purchase price.

Each transaction is unique

This overview does not provide an exhaustive list of possibilities. Each real-property transaction involves a distinct set of facts, which can necessitate significantly different sales tax treatments. If you have any doubts or questions about the taxability of a specific transaction, it is best to contact your sales tax adviser.

Matt Beck is a manager with Grant Thornton LLP in Vancouver. He specializes in sales and indirect tax planning and compliance services, with a focus on the real estate, health care, education, and not-for-profit sectors.

Rate this Entry

Was this entry helpful for you?

Current rating: 44 yes votes, 13 no votes

- Public Practice Knowledge Base

- Financial Reporting & Assurance Standards Canada

- Toronto Tax Lawyer

- Articling Program

- Canadian Tax Lawyers

- Case Results

- Case Studies

- Certified Specialists in Taxation

- Company Profile

- Leadership Team

- Articles & tips

- Canadian Accountant Articles

- Definitions

- Media Appearances

- News Releases

- Related Links

- CRA Tax Audits

- Unfiled Taxes

- Net Worth Audits

- Taxes Owing & Liens

- Tax Minimization

- CRA & Bitcoin Taxation

- Unreported Offshore Assets

- Unreported Offshore Income

- Unreported Foreign Pension

- Unreported Internet Income

- Unfiled GST/HST returns

- Individual & Family Income Tax Planning

- Succession Will, Estate and Tax Planning Ontario

- Tax Problems & Representation

- Tax Shelters

- Corporate Reorganizations

- Butterfly Transactions

- Incorporations

- Business Agreements

- Business Startup Planning

- Tax Consulting & Planning

- CEWS Tax Audit Services

- CERB Tax Audit Services

- CEBA Tax Audit Services

- Contact a Tax Lawyer

Tax Guidance for Assignors in Real Estate Assignment Transactions

Published: November 13, 2020

Last Updated: April 26, 2021

Tax Guidance for Assignors in a Real Estate Assignment Transaction – a Toronto Tax Lawyer Analysis

Introduction – what is real estate assignment.

Buying and Selling real estate assignments is a common form of transaction in the real estate market. An assignment is a transaction of the rights to a property before the legal ownership of the actual property is transferred. In the real estate context, the buyer of an assignment (the “assignee”) would purchase the rights to a real estate property, typically but not always a condo, that is being built under a Purchase and Sale Agreement, between the assignment seller and the builder, from the seller of the assignment (the “assignor”). This transaction would take place before the closing date of the property, and the ownership of the property legally remained with a third party, the builder, throughout the assignment transaction. Hence only contractual rights to a piece of property were assigned from one party to another in an assignment transaction and not the property itself.

Tax Guidance to Reporting Profits from an Assignment Sale – Capital Gains and GST/HST

The two main tax issues associated with the assignor in an assignment transaction are whether the profits from the sales are to be characterized as business income or taxable capital gain and whether the sales of assignments give rise to the obligation for the assignor to collect and remit GST/HST.

While many assignors would report their profits as taxable capital gains as well as taking the position that assignors are exempt from collecting and remitting GST/HST for sales of the assignments, over the past few years, the CRA has been aggressively going after assignment transactions, often auditing Canadian taxpayers for both unreported taxable business income and unremitted excise tax.

Whether a particular assignment sale will give rise to taxable business income will depend on the facts involved in the case. Similarly, whether the assignor has an obligation to collect and remit GST/HST will also depend on the facts. In short, there is no single answer and simple tax guidance as to how to report your taxes on every assignment transaction. We will breakdown the relevant tax factors below

Taxable Capital Gain vs. Taxable Income