Free Simple Business Plan Template

Our experts

Written and reviewed by:.

Startups.co.uk is reader supported – we may earn a commission from our recommendations, at no extra cost to you and without impacting our editorial impartiality.

Your business plan is the document that adds structure to your proposal and helps you focus your objectives on an achievable and realistic target. It should cover every aspect of what your business journey will look like, from licensing and revenue, to competitor and sector analysis.

Writing a business plan doesn’t need to be a difficult process, but it should take at least a month to be done properly.

In today’s capricious business climate there’s a lot to consider, such as the impact of political challenges like Brexit. These details are especially important in today’s bad economy. Investors are looking for entrepreneurs who are aware of the challenges ahead and how to properly plan for them.

Below, you’ll find everything you need to create a concise, specific and authoritative business plan. So let’s get started turning your idea into a reality!

Click here to download your free Business Plan template PDF – you can fill in your own details and those of your business, its target market, your customers, competitors and your vision for growth.

Our below guide will give you detailed advice on how to write a quality business plan, and our PDF download above can give you a clear template to work through.

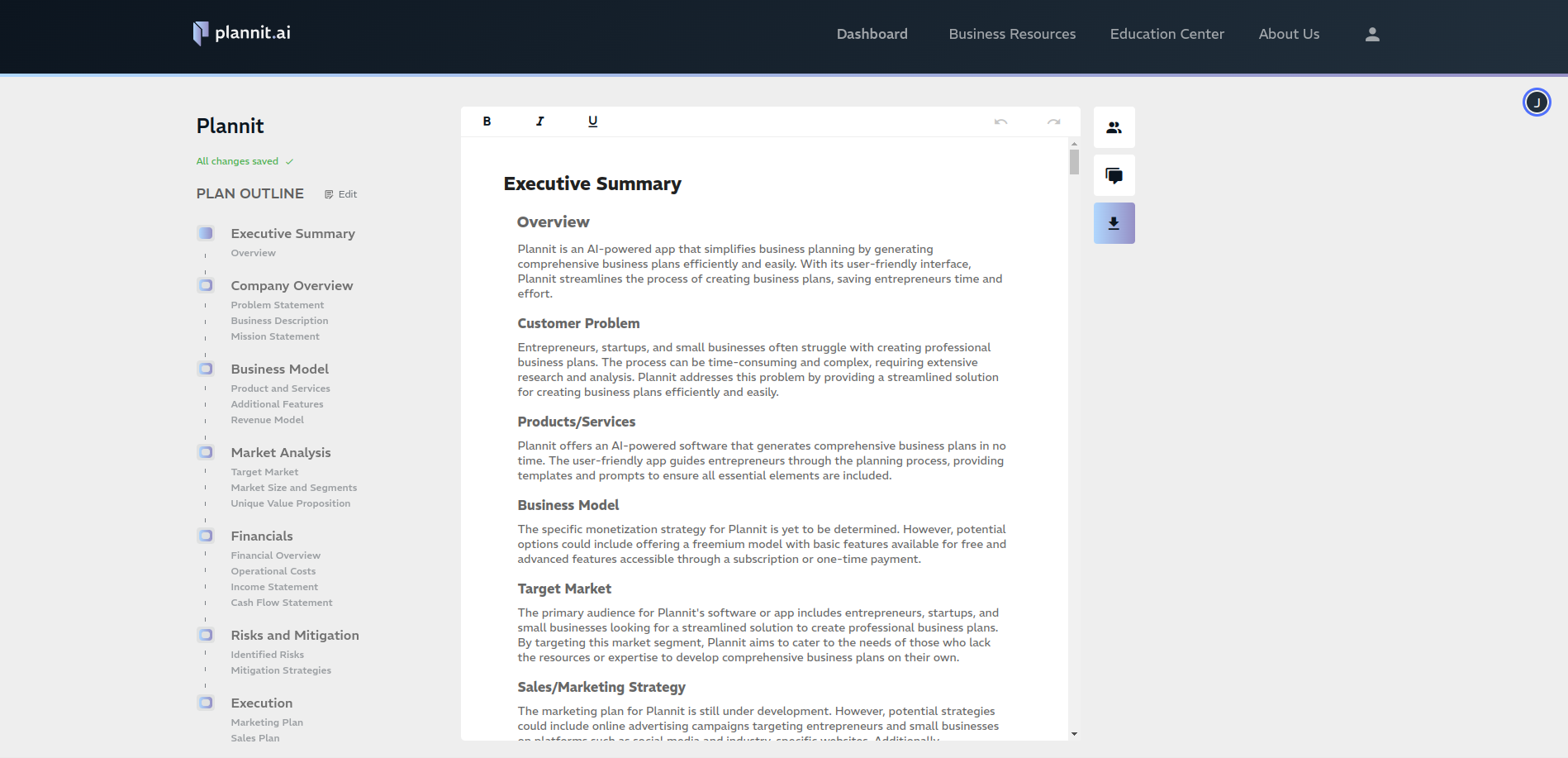

But, creating an effective business plan needs….planning! That’s where a high quality planning tool can help.

We recommend creating an account with monday to use this tool – there’s even a free trial . Doing so means you can start your entrepreneurial journey on the right foot.

Get the latest startup news, straight to your inbox

Stay informed on the top business stories with Startups.co.uk’s weekly newsletter

By signing up to receive our newsletter, you agree to our Privacy Policy . You can unsubscribe at any time.

What to include in your business plan template

There’s a lot of information online about how to write a business plan – making it a confusing task to work out what is and isn’t good advice.

We’re here to cut through the noise by telling you exactly what you need to include for a business plan that will satisfy stakeholders and help develop a key identity for your brand. By the end, you’ll have a plan to make even Alan Sugar proud and can get started with the most exciting part – running your business.

Throughout this guide, we’ve featured an example business plan template for a new restaurant opening in Birmingham called ‘The Plew’. In each section, you’ll be able to see what the contents we’re describing would look like in a ‘real-life’ document.

What to include in your business plan:

- Executive Summary

- Personal summary

- Business idea

- Your product or service

- Market analysis

- Competitor analysis

- Cash forecast

- Operations and logistics

- Backup plan

- Top tips for writing a business plan

- Business plan template UK FAQs

1. Executive summary

This section is a summary of your entire business plan. Because of this, it is a good idea to write it at the end of your plan, not the beginning.

Just as with the overall business plan, the executive summary should be clearly written and powerfully persuasive, yet it should balance sales talk with realism in order to be convincing. It should be no more than 1,000 words.

It should cover:

- Mission statement – what is your company’s purpose?

- Business idea and opportunity – what unique selling point (USP) will you provide?

- Business model – how will your business operate?

- Business objectives – what are you aiming to achieve?

- Target market – who is your customer base?

- Management team – who are the owners/senior staff?

- Competition – who are you competing against?

- Financial summary – can you prove the business will be profitable?

- Marketing strategy – what is your marketing plan and associated costs?

- Timeline – how long will it take to launch/grow your new business?

It sounds like a lot – but don’t feel you have to spend hours putting this together. Here’s what the above information for an executive summary might look like when put into our example business plan template for ‘The Plew’:

Startups’ business plan template example: executive summary

2. Personal summary

Investors want to know who they’re investing in, as much as what. This is where you tell people who you are, and why you’re starting your business.

Outline your general contact details first, giving your telephone number, email address, website or portfolio, and any professional social media profiles you might have.

Run through this checklist to tell the reader more about yourself, and put your business ambitions into context.

- What skills/qualifications do you have?

- What are you passionate about?

- What is/are your area(s) of industry expertise?

- Why do you want to run your own business?

Here’s what our two fictional co-founders of ‘The Plew’ might write in their personal summaries for our example business plan. CEO Gabrielle Shelby, has highlighted her expertise in the restaurant industry, while CFO Freya Moore outlines her accounting and finance knowledge.

Startups’ business plan template example: personal summary

Richard Osborne, founder and CEO of UK Business Forums, says personality is important in a business plan.

“Having a strong, personal reason at the heart of your business model will help keep you going and give you the motivation to carry on,” he affirms.

3. Business idea

This section is essentially to offer a general outline of what your business idea is, and why it brings something new to the market.

Here, you should include your general company details, such as your business name and a one-line summary of your business idea known as an elevator pitch. This section should also list a few key business objectives to show how you plan to scale over the next 1-3 years.

We also recommend carrying out a SWOT analysis to tell investors what the strengths, weaknesses, opportunities, and threats are for your business idea. Think about:

- Strengths: ie. why is this a good time to enter the sector?

- Weaknesses: ie. what market challenges might you encounter?

- Opportunities: ie. what demand is your product/service meeting in today’s market?

- Threats: ie. how will the business be financed to maintain liquidity?

In the template below, you can see a breakdown of the above information for ‘The Plew’. At the top is its mission statement: “to craft an unforgettable dining experience in a chic atmosphere.”

Startups’ business plan template example: business idea

Need a business idea? We’ve crunched the numbers and come up with a list of the best business ideas for startup success in 2023 based on today’s most popular and growing industries.

4. Your products or services

Now it’s time to explain what you are selling to customers and how will you produce your sales offering.

Use this section to answer all of the below questions and explain what you plan to sell and how. Just like your business idea outline, your answers should be concise and declarative.

- What product(s) or service(s) will you sell?

- Do you plan to offer new products or services in the future?

- How much does the product or service cost to produce/deliver?

- What is your pricing strategy ?

- What sales channels will you use?

- Are there legal requirements to start this business?

- What about insurance requirements?

- What is the growth potential for the product or service?

- What are the challenges? eg. if you’re looking to sell abroad, acknowledge the potential delays caused by post-Brexit regulations.

What insurance and licensing requirements do you need to consider?

Depending on what your business offers, you might need to invest in insurance or licensing. Our How To Start guides have more details about sector-specific insurance or licensing.

Public Liability, Professional Indemnity, and Employers’ Liability are the most well-known types of business insurance. We’ve listed some other common other licensing and insurance requirements below:

In our example product/service page for ‘The Plew”s business plan, the founders choose to separate this information into multiple pages. Below, they outline their cost and pricing, as well as sales strategy. But they also include an example menu, to offer something a bit more unique and tantalising to the reader:

Startups’ business plan template example: product list and pricing strategy

5. Market analysis

This section demonstrates your understanding of the market you are entering, and any challenges you will likely face when trying to establish your company.

This section pulls all of your target market and customer research together to indicate to stakeholders that you are knowledgable about the sector and how to succeed in it.

- Who is your typical customer and where are they are based? Describe the profile of your expected customers eg. average age, location, budget, interests, etc.

- How many customers will your business reach? Outline the size of your market, and the share of the market that your business can reach.

- Have you sold any products/services to customers already? If yes, describe these sales. If no, have people expressed interest in buying your products or services?

- What have you learned about the market from desk-based research? What are the industry’s current challenges, and how has it been affected by the economic downturn?

- What have you learned about the market from field research? (eg. feedback from market testing like customer questionnaires or focus group feedback).

What is your marketing strategy?

Once you’ve highlighted who your rivals are in the market, you can provide details on how you plan to stand out from them through your marketing strategy. Outline your business’ USP, your current marketing strategy, and any associated advertising costs.

‘The Plew’ identifies its target audience as young, adventurous people in their mid-30s. Because of the restaurant’s premium service offering, its audience works in a well-paid sector like tech:

Startups’ business plan template example: customer analysis

6. Competitor analysis

This section demonstrates how well you know the key players and rivals in the industry. It should show the research you have carried out in a table format.

Begin by listing the key information about your competitors. Don’t worry about sounding too critical, or too positive. Try to prioritise accuracy above all else.

- Business size

- Product/service offering

- Sales channels

- Strengths/weaknesses

Competitors will take two forms, either direct or indirect. Direct competitors sell the same or similar products or services. Indirect competitors sell substitute or alternative products or services.

Here’s a breakdown of the strengths, weaknesses, and opportunities, and threats presented by a competitor restaurant for ‘The Plew’ called Eateria 24. At the bottom, the founders have written what learnings they can take from the chart.

Startups’ business plan template example: competitor analysis

Check out our list of the top competitor analysis templates to download free resources for your business, plus advice on what to include and how to get started.

7. Cash forecast

Outline your financial outlook including how much you expect to spend, and make, in your first year

All of your considered costs can be put into one easy-to-read document called a monthly cash forecast. Cash forecasts contain:

1. Incoming costs such as sales revenue, customer account fees, or funding.

2. Outgoing costs such as staff wages or operating expenses. The latter can cover everything from advertising costs to office supplies.

For those firms which have already started trading, include any previous year’s accounts (up to three years) as well as details of any outstanding loans or assets.

Annual cash forecast: what is it?

By conducting 12 monthly cash forecasts, you can create an annual cash forecast to work out when your company will become profitable (also known as breakeven analysis) . You will break even when total incoming costs = total outgoing costs.

In your annual cost budget, make sure to also include month opening/closing balance. This is important to monitor for accounting, particularly for year-end.

- Opening balance = the amount of cash at the beginning of the month

- Closing balance = the amount of cash at the end of the month

The opening balance of any month will always be the same as the closing balance of the previous month. If you are repeatedly opening months with a negative closing balance, you need to adjust your spending. Here’s an example of what ‘The Plew’s financials might look like in its first year of operation:

Startups’ business plan template example: cash forecast

8. Operations and logistics

Explain how your day-to-day business activities will be run, including key business partnerships around production and delivery.

A.) Production

List all of the behind the scenes information about how your business will operate. Include:

- Management team – who do you plan to hire as senior staff and why?

- Premises – where will you be based? What will be the cost?

- Materials – what materials/equipment will you need to make your product/service?

- Staffing – how many employees will you hire? How much will they cost?

- Insurance – what insurance do you need for production?

B.) Delivery

Detail how your customers will receive your product or service. Include:

- Distribution – how will you sell your product to customers?

- Transport – how will you transport the product/service to customers or partners?

- Insurance – what insurance do you need for delivery?

C.) Supplier analysis

Lastly, you should carry out a supplier analysis. Write down 2-3 suppliers you plan to use as part of your business operations and evaluate them on factors like location and pricing.

In our example business plan for ‘The Plew’, the founders have chosen to present this information in an easily-digestible chart, breaking down the leadership and employees into two different areas: product development and operations.

Startups’ business plan template example: staffing section

9. Backup plan

Explain how you will manage any surprise losses if your cash forecast does not go to plan.

In the event that your business does not go to plan, there will be costs to incur. A backup plan outlines to potential investors how you will pay back any outstanding loans or debt.

In the short-term:

If your cash-flow temporarily stalls, what steps could you take to quickly raise money or make savings? For example, by negotiating shorter payment terms with your customers.

In the long-term:

If you’ve noticed a drop in sales that seems to be persisting, what changes can you make that would improve cash flow longer term? For example, can you do more of your business online to reduce rent fees?

To placate investors even further, it’s a good idea to include details about potential support channels you can utilise (eg. a business network or contact) who might be able to help if you get caught in a sticky cash-flow situation.

Startups’ 5 top tips for writing a business plan

- Keep your predictions realistic. Your business plan should showcase your knowledge of the sector and what’s achievable. It’s not about impressing investors with big numbers or meaningless buzzwords.

- Don’t go over 15 pages. Business plans should be engaging, which means sticking to the point and avoiding a lot of long-winded sentences. Keep your executive summary to less than 1,000 words, for example.

- End with supporting documents. Use your appendix to include product diagrams or detailed research findings if these are helpful to your business case.

- Get a second pair of eyes. Everyone misses a spelling error or two – invite a trusted business contact or associate to look over your business plan before you send it anywhere.

- Leave enough time to write! It’s exciting to think about getting your business up and running – but planning is an important step that can’t be rushed over. Spend at least a month on writing to get all the details correct and laid-out.

At Startups.co.uk, we’re here to help small UK businesses to get started, grow and succeed. We have practical resources for helping new businesses get off the ground – use the tool below to get started today.

What Does Your Business Need Help With?

Designing a business plan is very important for laying the foundation of your business. Ensure you spend an appropriate amount of time filling it out, as it could save you many headaches further down the line.

Once your plan is complete, you’ll then be ready to look at other aspects of business set-up, such as registering your company. Sound daunting? Don’t worry!

Our experts have pulled together a simple, comprehensive guide on How to Start a Business in 2024, which will tell you everything you need to know to put your new plan into action.

- Can I write a business plan myself? Absolutely! There are plenty of resources available to help, but the truth is a business plan needs to reflect the owner's personal ambitions and passion - which is why entrepreneurs are best-placed to write their own.

- How long should a business plan be? We recommend your business plan is kept to a maximum of 15 pages. Keep it short and concise - your executive summary, for example, should be no more than 1,000 words.

- Is it OK to copy a business plan? While not technically illegal, copying a business plan will leave you in a poor position to attract investment. Customising your plan to your unique business idea and industry specialism is the best way to persuade stakeholders that you have a winning startup formula.

Startups.co.uk is reader-supported. If you make a purchase through the links on our site, we may earn a commission from the retailers of the products we have reviewed. This helps Startups.co.uk to provide free reviews for our readers. It has no additional cost to you, and never affects the editorial independence of our reviews.

- Essential Guides

Written by:

Leave a comment.

Save my name, email, and website in this browser for the next time I comment.

We value your comments but kindly requests all posts are on topic, constructive and respectful. Please review our commenting policy.

Related Articles

HELPING SMALL BUSINESSES SUCCEED

MORE DONUTS:

What do you need to know about starting a business?

- Start up business ideas

- Set up a business

- Skills and wellbeing

- Business planning

- Financing a business

- Tax and National Insurance

- Business law

- Sales and marketing

- Business premises

- Business IT

- Grow your business

- Types of business

- Testing business ideas

- Product development

- Is running a business really for you?

- Start up stories

- Registering as a sole trader

- Setting up a limited company

- Business names

- Buy a franchise

- Buying a business

- Starting an online business

- Setting up a social enterprise

- Small business support

Protect your wellbeing from the pressures of starting and running a business and develop key business skills.

- Dealing with stress

- Manage your time

- Self-confidence

- Write a business plan

- Business strategy

- Start up costs

- Start up funding

- Setting prices

- How to work out tax and NI

- Accounting and bookkeeping

- Licences and registration

- Protecting intellectual property

- Insurance for business

- Workplace health, safety and environmental rules

- Looking after your customers

- Promote your business

- Your marketing strategy

- Sales techniques

- Research your market

- Creating and optimising a website

- Commercial premises

- Premises security

- People management

- Recruitment, contracts, discipline and grievance

- Employment rights

- Hiring employees

- Buying IT for your new business

- Basic IT security

- Preparing for business growth

- How to scale up your business

- Funding business growth

- Start exporting

- Personal development

Essential guide to writing a business plan

Your business plan outlines what your business does and what you are trying to achieve. It explains what the market opportunity is, what makes your business special and how you will make it a success.

Writing a business plan helps you:

- check that your business idea makes sense

- plan your sales, marketing and business operations

- identify potential problems and how to overcome them

- set out your objectives and the financial return you expect

- work out what financing you need

- convince other people to back your business

Why write a business plan?

How to write a business plan

Your business and products

Your market and competition

Your marketing and sales

Management and personnel structure

Your business operations

Financial performance

SWOT analysis

1. Why write a business plan?

Writing a business plan helps you think about what you are doing.

- The plan sets out your strategy and action plan for the next one to three years, or sometimes longer.

- As part of the process, you set concrete objectives and plan how you will achieve them.

- Writing a business plan helps you focus and develop your ideas. Priorities are identified. Non-priorities are dropped, saving precious time.

- Putting the plan in writing makes it easier to spot any gaps where you have more work to do.

- Once written, the plan is a benchmark for the performance of the business.

- By involving your employees in the planning process, you can build a successful, committed team.

You may need a business plan to explain your idea to other people

- A business plan is essential if you are raising finance from a bank or outside investors.

- A good plan can help you attract new senior management, or business partners such as distributors and agents.

- You should tailor your plan to the target audience. For example, you may want the plan to 'sell' the business to your bank manager or investors.

- Ask the intended recipient if there are any specific issues they want the plan to address or a template you should follow.

2. How to write a business plan

Base your business plan on accurate, detailed information where possible. But do not include all the detail in the plan. Leave the detail for operational or marketing plans.

Keep the plan short

- Focus on what the reader needs to know.

- Cut out any waffle.

- Make sure there are no spelling mistakes.

- Detailed business plans are often quickly shelved because they are difficult to use on an ongoing basis.

Include any detailed information you need in an appendix

For example, you might want:

- detailed financial forecasts and assumptions

- market research data that backs up what you say

- CVs of key personnel (essential if you are seeking outside funding)

- product literature or technical specifications

Base your business plan on reality, or it may be counterproductive

- Over-optimistic forecasts can lead to increased overheads followed by a cash flow crisis and drastic cost-cutting.

- Be realistic, even if you are selling the business to a third party. Financiers, business partners and employees will see through over-optimistic plans that ignore weaknesses or threats. Management credibility can be damaged.

Make the plan professional

- Put a cover on it.

- Include a contents page, with page and section numbering.

- Start with an executive summary. This summarises the key points, starting with the purpose of the business plan.

- Use charts, if helpful.

Even if the plan is for internal use only, write it as if it were aimed at an outsider

- Include company or product literature as an appendix.

- Give details about the history and current status of the business.

Review your business plan

- Read through the plan from your target reader's point of view. For example, try to imagine the impression the plan will make on your bank manager.

- Check the plan is realistic. Include evidence to back up what you say (perhaps in the appendix) or provide evidence if needed.

- Make sure you assess the risks. What might go wrong (eg if your main supplier closes down or you lose a key customer) and what would you do about it?

- Concentrate on the executive summary. People often make provisional judgements based on this. Only then do they read the rest of the plan to confirm their decision.

- Show the plan to friends, business peers and expert advisers for comments. Which parts did they not understand or find unconvincing?

3. Your business and products

Explain the history of the business.

- When did it start trading and what progress has it made to date?

- If the business is just starting up, what is your personal industry background and what progress towards launching the business has been made?

- Who owned the business originally?

- What is the current ownership structure?

Describe what your product or service is, avoiding technical jargon if possible

- In general, what makes your product or service different ?

- What benefits does it offer? What are its disadvantages and how will you address these?

- What changes and improvements are you planning?

Explain any key features of the industry

- For example, any special regulations, whether the industry is dominated by a few large companies or any major changes in technology.

4. Your market and competition

Describe the market in which you sell.

- Highlight the segments of the market in which you compete. What are the key characteristics of customers in each segment and what influences their purchasing decisions?

- How large is each market segment? What is your market share?

- What are the important trends, such as market growth or changing tastes? Explain the reasons behind the trend.

- What is the outlook for each important market segment?

Describe the nature and distribution of existing customers

- Do they fit the profile of the chosen market segment? If not, why not?

- Are sales largely made to one or two major customers?

- If you are a new start-up, do you have any confirmed orders and who are your best prospects?

Outline the main competition

- What are the competing products or services ? Who supplies them?

- What are their advantages and disadvantages compared to you? For example, price, quality, distribution.

- Why will customers buy your product or service instead? How will your competitors react to losing business and how you will respond?

- Never openly criticise or underestimate competitors.

5. Your marketing and sales strategy

Where do you position your product or service in the market.

- Is it high quality and high price?

- Is it marketed as a specialist product due to a particular feature?

- What unique benefits does it offer customers? For example, product reliability or customer service.

- Which of these benefits are you going to highlight?

What is your pricing policy?

- Explain how price-sensitive your customers are.

- Look at each product or market segment in turn. Identify where you make your profits and where it may be possible to increase margins or sales or cut costs. Set your pricing accordingly.

How do you promote your product or service?

- Each market segment will have one or two promotional methods that work best. For example, social media marketing, direct marketing, advertising or PR.

- If you are considering a new marketing strategy, start small. A failed investment in marketing can be costly.

What sales channels do you use to reach your target customers?

- For example, do you sell directly to the customer, or through retailers or agents? Do you sell online?

- Compare your current channels with the alternatives. Note the distribution channels used by your competitors.

- Look at the positive and negative trends in your chosen distribution channels.

How do you do your selling?

- Look at the cost-efficiency of each of your sales methods . For example, online sales, in person, through an agent or using telesales.

- Include all the hidden costs, such as management time when calculating prices or return on investment.

- Explain how long it takes to make sales (and to get paid for them), what the average sales value is and how likely customers are to give repeat orders.

6. Management and personnel structure

Set out the structure and key skills and experience of the management team and the staff.

- Clarify how you cover the key areas of production, sales, marketing, finance and administration.

- Address any areas of deficiency, and your plans to cover this weakness.

- Explain your recruitment and training plans, including timescales and costs.

Analyse the workforce in terms of total numbers and by department

- Compare the efficiency ratios with competitors, or with similar industries. Useful figures might be sales, average salaries, employee retention rates and measures of productivity.

Be realistic about the commitment and motivation of the workforce

- Show how committed you and other members of the management team are. For example, how much you have invested in the business.

- Consider how you would survive the loss of a key member of the team.

- Note any unusual upward pressure on pay levels.

- Spell out any plans to improve or maintain motivation.

7. Your business operations

Look at the capacity and efficiency of your operations, and any planned improvements.

What premises does the business have?

- Do your business premises meet your current and future needs? What are your long-term commitments to property?

- What are the advantages and disadvantages of the present location? Should the business expand or move?

What production facilities do you have and how is production organised?

- How modern is the equipment?

- What is the capacity of the current facilities compared with existing and forecast demand?

- Who are your key suppliers? How do you select and manage them?

What management information systems are in place?

- For example, management accounts, sales, stock control and quality control.

- Are they reliable? Can they deal with any proposed expansion?

- A financier will be very concerned if management information systems are inadequate. Management of a business is always limited by the quality of the information available.

Are your IT systems reliable?

- Is IT a key strength (or weakness) of your business? The development of IT systems to help your business is usually an important issue.

What quality or regulatory standards does the business conform to?

- For example, ISO 9000 or CE approval.

8. Financial forecasts

Your financial forecasts translate what you have said about your business into numbers.

Set out historical financial information for the last three to five years, if available

- Break total sales figures down into component parts. For example, sales of different types of product or to different groups of customers.

- Show the gross margin for each sales component. List what costs are included as direct costs for each component.

- Show the movement in the key working capital items of stock, trade debtors and creditors. Use ratios such as stock turnover (in months), debtors period (in days), and creditors period (in days).

- Highlight any major capital expenditure made.

- Provide an up-to-date balance sheet, and a profit and loss account .

- Explain the reasons for movements in profitability, working capital and cash flow . Compare them with industry norms.

Provide forecasts for the next three (or even five) years

- The sophistication of your forecasts should reflect the sophistication of your business. A small business may only need sales, profit and cash flow budgets .

- A more complex, asset-based business - or one with complex working capital requirements - will need balance sheet forecasts as well.

- Use the same format as for the historical information, to make comparison easier.

- Clearly state the assumptions behind the forecasts. These should tie in with what you say in the rest of the plan. For example, if the plan says that the market is becoming more competitive, profit margins should probably be falling.

- Be realistic about forecasts in new markets. For example, how much resource can you devote to selling, what success rate can you expect and how long will it take to convince new customers ?

- Look at the overall trends of historical and forecast numbers. Are they believable? Do the forecasts allow for the possibility of problems and delays in payments that could affect cash flow?

- Consider 'what-if' scenarios. For example, consider what will happen to your cash flow if sales are 20% lower than forecast (or 15% higher).

Put detailed financial forecasts in an appendix at the end

Include a detailed list of assumptions. For example:

- the profit margin on each product

- how long it takes to collect payment from debtors

- what credit suppliers will offer you

- what financing you are expecting and the interest rate you will pay

Use the cash flow forecast to predict any financing requirements

- Add an extra contingency element onto the funding requirement shown in the forecast (perhaps 10-20%). Think about what mid-month peaks might be.

- Identify what types of financing you want. For example, long-term loans or an increased overdraft facility.

- Include the likely interest or dividend costs of any new finance.

- Carry out sensitivity tests on the cash required by changing key factors, such as sales or margin. Note the outcomes.

- Explain why the financing is required and what it will be used for.

If necessary, get help

- Small business advisers at banks and business support organisations may help you put together financial forecasts free of charge.

Need to open a bank account for your business?

We have taken the hassle out of shortlisting possible providers. See our top picks.

Best business bank account for free extras

Tide | Free | Free company formation and financial management features

Best business bank account for start-ups and small businesses

Starling | Free | App-based account tops customer satisfaction ratings

Best business bank account for easy bookkeeping

ANNA Money | Free plan (just pay for what you use), business plan £14.90 per month | Easy invoicing and tax estimation

Best high street business bank account

NatWest | Free banking for two years | Keen pricing and free accounting software

Best business bank account for international businesses

Revolut Business | Typically £25 per month | Strong multi-currency and international payments services

9. SWOT analysis

A SWOT analysis helps show that you really understand your business and the key external factors that you need to deal with.

Set out a one-page analysis of strengths, weaknesses, opportunities and threats

- Strengths might include brand name, quality of product, or management experience.

- Weaknesses might be lack of finance, or reliance on just a few customers.

- Opportunities might be increasing demand or a competitor going bust.

- Threats might be a downturn in the economy or a new competitor.

Be honest about your weaknesses and the threats you face

- Spell out mitigating circumstances and the defensive actions you are taking.

Driving your business forward

Identify what makes you better than the competition.

- Think about what the key ingredients of your future success will be and how you will strengthen your position in the market.

Establish your overall business aims

- Where do you realistically intend to be in three years' time?

Decide on half a dozen key objectives that will make a significant difference

Many businesses think in terms of:

- income - more sales, better margins

- customers - new customers, higher levels of customer satisfaction

- products - improving existing products, launching new ones

- human resources - recruiting new employees, developing new skills

Set clear targets

- You should know exactly what you want to achieve, by when.

Work out how you will reach these targets

- Look at each aspect of your business in turn and create a step-by-step action plan for it.

- Get help preparing a business plan and financial forecasts from your local enterprise agency .

- Find an ICAEW chartered accountant or an ACCA accountancy firm for help with financial forecasting and business planning.

- Find a trade association relevant to your sector through the Trade Association Forum.

Browse topics: Business planning

What does the * mean?

If a link has a * this means it is an affiliate link. To find out more, see our FAQs .

- Login / Register

Already a member?

Remember Me

Login Forgot password?

Want to become a member?

What are you looking for, how to write a business plan uk | free uk business plan template.

- Brought to you by AAT Business Finance Basics

- 1. What is a business plan?

- 2. Download: Free UK business plan template

- 3. Getting started on a business plan

- 4. How to structure a business plan step-by-step

- 5. Business plan examples

- 6. Business plan writing tips

You’ve got the brilliant business idea, you might have even started setting up or running your business, but writing a business plan and creating business proposals are vital for the launch and growth of any venture. It’s a document where you can organise all your ideas, create a company description, make sure that you’ve considered and researched everything, and ultimately decide that the business is viable. Commitment to making a business plan is a commitment to the business. Read our guide and download your free business plan template.

What is a business plan?

A business plan is a document that details all the future plans and predictions for your business. It will explain your ideas, map out how they’ll be put into practice and provide relevant information and facts including the business details, management plan, operating plan, marketing and sales strategy , financial projections, and operational and team specifics.

A business plan is essential in helping you:

The business plan is a living, working document that should be read and reviewed regularly. If there are multiple directors or partners in the business then they should all be in agreement with what the plan outlines, the detailed information in the plan, and what is written in the plan. You will also need to share it with potential investors. The business plan will formalise all the ideas and assumptions, keep you focused, and ensure that everyone is on the same page.

How long writing your business plan should take will depend on your business size, the complexities of it and what stage you’re at. The most important thing is that it’s user-friendly and doesn’t include any waffle. Get straight to the nitty-gritty so that your stakeholders are engaged when reading it and so that you are more likely to use and update it regularly. Your business plan will probably cover the first three to five years. It’s important to include all the right information (see the checklist below) but it’s not a document to spend too long on. It’s more important that you are spending time running the business.

There are lots of business plan examples out there but typically yours should include:

- What your business will do

- The business structure and operations

- Team members and their expertise

- Market analysis to see current and projected state of the market and industry

- How your business will sell and market

- Startup costs and funding required

- Financial projections

- Legal requirements

Writing a business plan will allow you to take a step back and look at the business more objectively, predicting potential issues in advance, such as financial forecasts, and coming up with solutions or a shift in how you originally thought that you would do something.

Download: Free UK business plan template

We want to take the stress out of writing a business plan. Our free downloadable UK business plan template will guide you on everything you need to include and get your business primed for success.

Download: Please login or register to get your download.

Login or Register

Getting started on a business plan

Before you begin to make your business plan, keep these three things at the forefront of your mind.

Focus on what makes you unique

Be creative with your plan, shout about your unique selling proposition (USPs) and what makes you different. Represent your brand using language and visuals, and talk about why you and your team are best to run this business.

Don’t over complicate it

Keep it concise so that you can get on with running the business and so the business plan is an easily readable and usable document. Too much detail in the plan can become confusing.

Be realistic and honest

The business plan will give you an indication of where you’re supposed to be. Review it every few months, update it as you go and change your activities in line with it. It will be impossible for you to predict everything so just give it your best shot and be prepared to be flexible.

How to structure a business plan step-by-step

The business plan should follow this format with these six sections.

You must be logged in to use this checklist

The executive summary should always be written last. Think of it as a one-pager giving an overview of all the best bits of your plan. If the executive summary doesn’t captivate and interest the reader then it’s unlikely that they will read the rest of your plan.

Describe your what, where, who and why - including your product/service, brand, location, business model and size.

This section will involve the most amount of research as you study the current and projected conditions of the market and the industry, and look at what your competition is doing , before making your own marketing plans .

Explain the experience, skills and credentials of all the people involved. Why are they the right people to make this a success?

Detail your required facilities, premises, systems and software.

This section translates everything into numbers - your startup and running costs, funding , revenue projections with a cash flow forecast .

Business plan examples

Take a look at these business plan sections in more detail to see examples of the sort of details you should include, depending on your type of business.

1. The executive summary

Give a topline description of:

- In the most basic terms, what is the business? Is it a product or service? What does it do and how?

- Why is there a need for this business?

- What does this business do better than similar existing businesses?

- What experience or skills do you have that will help make this business a success?

- How will it make money?

- Who will your customers be?

- Who are your main competitors?

- How will people find out about you?

- What is the opportunity for investors?

2. Business details and description

- Describe your what, where, who and why – including your product/service, brand, location, business model and size.

- Food (lunch / dinner)

- Private hire for meetings / parties / events

- Putting on own events (music, comedy)

- Classes (e.g. cocktail making)

- What will the legal structure of your company be (LTD, PLC, sole trader, partnership, charity, social enterprise)?

3. Marketing and sales strategy

4. management and employees.

- Who will make up your team and what relevant skills and experience do they have?

- Do you need to employ people?

- What friends/family/business contacts do you have with skills that might be able to help you (preferably for free)?

- Do you need to outsource anything?

5. Operational set up

- What premises do you need? Where will they be? Where will you work from?

- What assets/tools do you require (and which of these do you already have)?

- Are there any licences that you require? Any other legal considerations?

6. Financial plan and projections

Business plan writing tips.

Writing a business plan can take some time and some areas of the plan will be easier to tackle than others.

- Make initial notes every time you think of something and don’t worry if you can’t cover all points at the start.

- When you are ready to start to write the plan, make sure you use sections and these are in a logical order.

- It is important that your plan is simple, accurate and easy to follow if you are going to ask others to look at it.

- Try to avoid jargon or terms that only people in your type of industry will understand.

Share this content

Brought to you by:, aat business finance basics.

AAT Business Finance Basics are a series of online e-learning courses covering the core financial skills every business needs. They draw from AAT’s world-leading qualifications and will quickly build your knowledge on key topics including bookkeeping, budgeting and cash flow.

Recommended reading

How to start a business in 20 days, how do i get funding for a new business, how do i create a business marketing strategy, register with informi today:.

- Join over 30,000 like-minded business professionals.

- Create your own personalised account with curated reading lists and checklists.

- Access exclusive resources including business plans, templates, and tax calculators.

- Receive the latest business advice and insights from Informi.

- Join in the discussion through the comments section.

Login / Register or Subscribe for Updates

Creating a business plan for your startup: step-by-step guide

You’ve had a great idea for a startup or new business. Now you need to make sure it all makes sense and create a document that shows how and why your business will succeed.

Every company is unique and this will be reflected in its business plan. The steps below can be tailored to your requirements but should ensure the key elements are all included.

Step 1. Set out your stall

You may be clear about what will make your new business great, but you need to be able to communicate that to investors, customers and other stakeholders. An effective business plan will often start with a clear statement about what the business will do, and what product or service it will sell.

Step 2. Set clear goals

Do you want to takeover the world or just a small corner of it? Is creativity, social impact or innovation more important than maximum profit? Decide on the business, financial and even personal goals you want to achieve in the short and medium term.

Step 3. Explain your product

Describe what your product or service will be, and what makes it unique or different. What are its limitations or downsides? How will you make, develop or source it?

Step 4. Introduce your customer and market

Who is your target customer and how big is your potential market? The better you understand the customer, the more likely you will create something they will buy. Market research is critical. Consider how you could test the market and assess demand with a Minimal Viable Product.

Step 5. Explain your sales and marketing approach

How will you make potential customers aware of your product or service? Marketing and advertising costs are often underestimated, especially in a crowded market with a lot of competition for customers. Will you have time to do the marketing yourself or will you need to hire staff or outsource tasks?

Step 6. Consider variable costs

These are the costs associated with the product or service itself, including manufacture, storage and delivery. For a digital business this could include development and testing.

Step 7. Estimate fixed costs

There will also be fixed costs that you will need to pay no matter how much you sell. These could include salaries and wages, National Insurance, tax, office costs, accountant’s fees, bad debts, interest payments and rates.

Step 8. Work out your pricing

Take the cost of the product or service away from the sales price and you have your gross profit. Subtract your overhead costs for the relevant time period and you’ll start to have an idea of how much you’ll need to sell to make a profit. There are various pricing models and you may need to experiment to find the right one for your business.

Step 9. Evaluate the competition

Identify other businesses that could compete for customers. Make a list of factors related to their product or service – everything from cost and service level to features and reputation. Assess your idea against the competition to spot risks and opportunities.

Step 10. Crunch the numbers

Financial calculations and forecasts are at the heart of a business plan. They could include capital requirements, profit and loss forecasts, cashflow forecasts, required assets and funding requirements. How much startup capital do you need and what runway will that give you before more investment or revenue is required?

Step 11. Decide on a legal structure and business organisation

Will you be a sole trader, limited company or set up a business partnership, perhaps with a co-founder? Do you need staff and will they be offered any equity? What access to advice and expertise do you have – and what will you need to pay for?

Step 12. Assess the risks

With so much disruption and uncertainty it has never been more important to assess the risks your business may face. Be honest about gaps in the founders’ knowledge or experience and look to fill them. Work out contingency plans and stress-test your assumptions.

Step 13. Iterate your approach

A business plan should be an evolving document that reflects what you are learning and the data and insight that is being collected. The sections may need to be adapted or added to, depending on the nature of the business, its sales model and type of funding.

Step 14. Talk to Barclays Eagle Labs

The Ecosystem Managers at Barclays Eagle Labs are used to working with founders and entrepreneurs at the start of their business journey. They can advise you on approaches, considerations and next steps. Find your nearest Eagle Lab here.

Step 15. Find a business plan template to suit your needs

There are numerous business plan templates online with some specifically tailored for startups. No two are the same, so it pays to search widely and borrow from multiple sources to create the business plan that best fits your circumstances and concept.

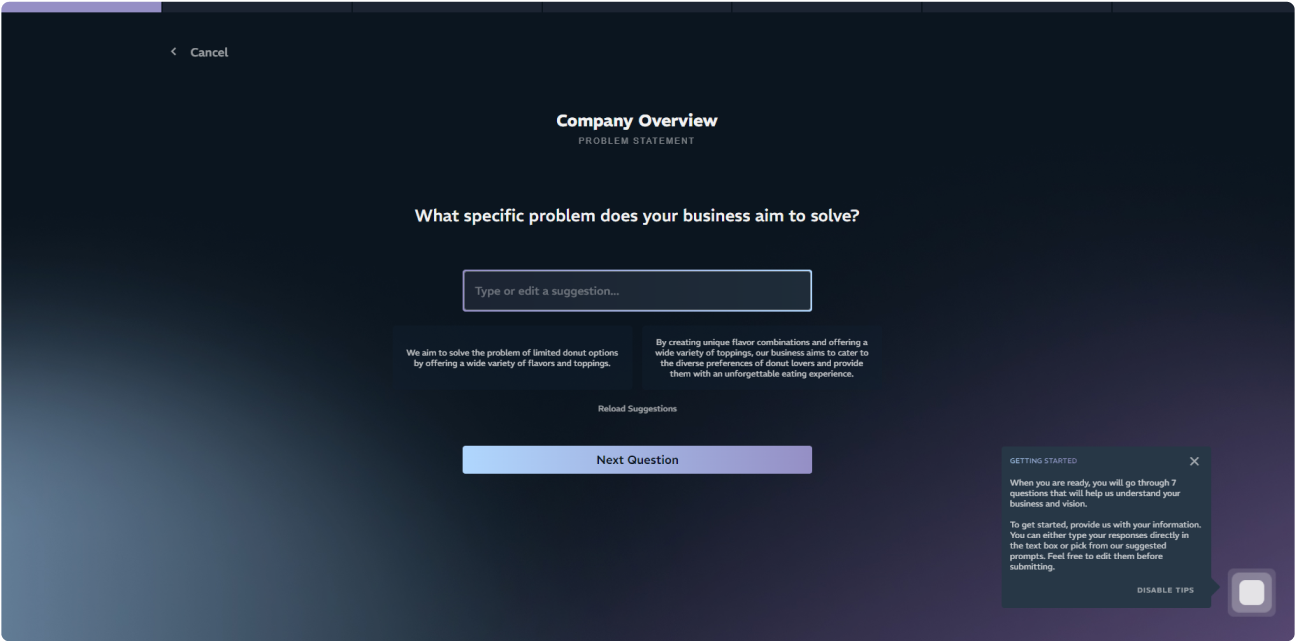

This Barclays Business Plan Generator is a great first step in clarifying your business idea.

Barclays (including its employees, Directors and agents) accepts no responsibility and shall have no liability in contract, tort or otherwise to any person in connection with this content or the use of or reliance on any information or data set out in this content unless it expressly agrees otherwise in writing. It does not constitute an offer to sell or buy any security, investment, financial product or service and does not constitute investment, professional, legal or tax advice, or a recommendation with respect to any securities or financial instruments.

The information, statements and opinions contained in this content are of a general nature only and do not take into account your individual circumstances including any laws, policies, procedures or practices you, or your employer or businesses may have or be subject to. Although the statements of fact on this page have been obtained from and are based upon sources that Barclays believes to be reliable, Barclays does not guarantee their accuracy or completeness.

Related tags

Stay Connected with Barclays Eagle Labs

Sign up for our newsletter to get the latest news and views from across our national ecosystem.

Fields marked with * are mandatory

Your information will be used in accordance with Barclays Eagle Labs privacy policy . You may opt out at any time.

Barclays Bank UK PLC. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register No. 759676). Registered in England. Registered No. 9740322. Registered Office: 1 Churchill Place, London E14 5HP.

- What we offer

- Our programmes

- Our industries

- Resources and events

- Terms of Use

- Privacy Policy

- Accessibility

How to write a business plan

According to Barclays, only 47% of small businesses in the UK have a formal business plan in place that is written down or recorded.

And we understand, it's so tempting to jump straight into building a business; formally documenting it sounds exhausting and unnecessary. But before you jump in headfirst, you need to gain clarity around the market you're hoping to enter, pinpoint your target customers and figure out whether your product is viable.

And that's precisely what a business plan can help you do.

Without that information, you stand to waste time and money on a business idea that lacks real thought or structured direction. For example, did you know that the most common reasons for business failure in the UK include lack of funding, cash flow problems, and not having a structured business plan?

Please don't fall into the trap of jumping straight in; let's start planning.

So, firstly, what is a business plan?

A business plan is a formal document outlining your business idea — it’s a process that can help you work out whether your small business is viable, e.g. is there a market out there for your product? Can you adequately compete in the current marketplace? And what does your target market look like?

These are the kinds of questions you need answers to before starting your new business venture.

Do I need a business plan?

If you plan to set up a small business, let’s say an Etsy shop, then you might not think it’s necessary to create a business plan. But, if you’re planning on bringing partners on board, accessing financial help or approaching potential investors — then chances are, you’re going to need a comprehensive business plan. After all, who wants to invest in something that’s no more than an idea?

Even if you don’t plan to bring investors on board or apply for business grants, mapping out a path to business success can be helpful regardless of your business idea. Even if it’s just so you know what associated costs you can expect to fork out on.

Having a bona fide business plan can help you get your ducks in a row.

More reasons why you should consider writing a business plan:

- To understand the marketplace and for solidifying what makes your business different

- To understand your customer and their motivations for buying a product like yours

- An idea of how much money you can make and how you’re going to get there

- To identify and mitigate risks associated with your business idea

- To help build a roadmap for getting your business off the ground

The above are just a handful of reasons, but if you can identify with any of them, then chances are, you’ll need to create a business plan.

But we’ve got good news; writing a business plan might seem daunting, but we’re going to walk you through a simple layout template. So follow along and make notes as you go. Before you know it, you’ll be well on your way to making your business idea happen in real life.

Before we talk you through how you should structure your business plan, we’re sharing a few tips you should consider as you write it.

Keep it simple

When writing your business plan, you want to cut straight to the important bits, keeping it concise and trimming any flowery language or long sentences. You also need to be mindful of jargon or unexplained industry acronyms; remember, it has to be quick and easy to understand.

Keep it professional

You don’t want to write your business plan flippantly; it’s a document you should take seriously. Lay out your document with headings, numbered pages, and a cover page. You want whoever reads it to be able to find what they’re looking for.

Keep it error-free

When it comes to financial projections and market analysis, you need to make sure your information is spot on, so we’d advise giving the plan a thorough proofread and fact check. Then, read and re-read to ensure it’s up to scratch — because it might not just be you reading it, it could be your future business partner or passed around potential investors.

How to layout a business plan

Now the all-important part, actually creating a business plan. We’ve broken down the contents of a business plan into six sections:

- Executive summary

- Goals, vision and mission statement

- Market research

- Sales and marketing plan

- Financial projections

- A roadmap of your business milestones

1. Executive summary

You should be able to hand your business plan to anyone, have them read the executive summary, and they should grasp a pretty good idea of your business plan. It should inform the reader what they can expect from your business plan and, if it’s written well, it can pique their interest from the start.

In your executive summary, you’ll want to include your business’ purpose, your vision for the company, your goals and objectives. You’ll need to briefly introduce the product or service you’re hoping to sell and why you think it’s a viable business proposition.

Basically, it’s a watered-down version of your entire business plan, so it can be a good idea to write this section last.

2. Goals, vision and mission statement

In this section, you should start by briefly describing your mission statement. According to a retired professor of strategy and governance at McMaster University, Chris Bart , three key components make an impactful mission statement :

- Your target audience

- The product/service you’re selling (and how it solves a problem)

- Your business USPs (why would people buy from you over competitors?)

You should also set out your long-term and short-term vision for your business — what does an ideal yet realistic future look like for you? What goals are you setting for yourself in the first few years? Why are these goals important to you?

3. Market research

Before you jump into any new business venture, you need to see if there’s actually a market for it, and that’s where market research comes in.

In your market research section, you’ll want to demonstrate that you know the market you’re targeting and what they look like. What age bracket do they belong to? What’s their income? Why would they purchase your product?

Understanding your target market is crucial to a successful business; without this knowledge, you’re building a business on shaky foundations. There are plenty of data sources to help you explore data trends and demographics, including Statista , ONS Census , and Gov.uk .

You’ll also need to include competitor research to show you’ve thought about what brands are already out there and how you see yourself slotting into the market. To conduct competitor research, you can undertake a PEST analysis to highlight big external factors that could affect your industry or your business directly: political, economic, social and tech. And you can also perform a SWOT analysis, which helps you determine strengths and weaknesses (internal) and opportunities and threats (external).

These frameworks are here to help guide you through your market research.

4. Sales and marketing plan

So now that you’ve identified your target market, how are you going to spread the word about your business? A solid sales and marketing plan is vital. It’s easy to waste budget trialling new channels, so take your time and understand which sales channels you’re going to focus on and think about the marketing tactics you’re going to use to capture and convert customers.

When firming up your marketing plan, it’s good to use the 4 Ps of marketing as a guideline. P rice, P lace, P roduct and P romotion. All four overlap each other.

You need to outline how you’re going to price your product and why, where you’re going to find these target markets, the product and its USP and the problem or need it addresses, and finally, promotion. How are you going to promote your product to that target market?

5. Financial projections

Without financial projections, investors or partners can’t come on board; it’s too risky. In your business plan, you need to layout your cash flow projections and discuss any capital you need to raise.

As a startup business , you haven’t got past sales to make accurate predictions, which can be tricky. But that doesn’t mean you can’t use your market research to inform future projections.

You should know about the state of the industry you’re looking to compete in; you can analyse industry trends and use your competitor analysis to get a crystal clear picture of pricing strategies and gaps your product can fill.

Break down your financial projections by monthly sales — when you’re into your second year, you can start breaking them down by quarter. Include how many units you sold, the price you sold them at, and predicted monthly sales.

You should also include cash flow projections. Again, difficult when you’re just starting out. But in your business plan, you need to show that you’ve thought about any revenue lags. For example, if you rely on invoice payments, take into account it could take your client between 30 and 120 days to pay the full invoiced amount. Make sure you’re aware of these pockets where expenditure will come out of your account before you’ve been paid.

6. A roadmap of your business milestones

Once you’ve researched and filled in each section of your business plan, it’s helpful to write a timeline of when you expect to complete certain milestones. For example, milestones could include deciding which structure your company will take, registering your business, and building a website, setting up marketing channels and designing and printing product packaging.

This section can be used to summarise all the milestones you want to achieve and by when keeping you focused and pushing the business forward and into fruition.

Where can I get a free business plan template?

Sometimes, when faced with writing such an important document, it can be tricky to know where to start. Luckily, there are plenty of free business plan templates available online . We’ve included links to a handful below:

- Barclays free business template [PDF]

- The Prince’s Trust free business template

- HubSpot free business template

Before you go

Hopefully, you’ve got an idea of how to lay out your business plan from scratch. Take it from us, writing a business plan saves time and money down the road; it’s best to put the leg work in now.

If you’re looking to access a startup loan to help you grow, we can help you. We’re brokers, which means our loan comparison service is 100% free for you to use. Apply in minutes and see funds in as little as 48 hours. Read more about startup loans .

About the author

Money Writer

Helen has over nine years of experience in content writing and writes financial content for us here at Capalona.

Share this guide?

Related articles.

Yearning for self-employment? 10 viable business ideas for 2024

Looking for your first office space? Advice for businesses

How much does it cost to start a business in the UK?

The ultimate guide to starting a business

Checking won’t affect your credit score

We value your privacy

We use cookies to enhance your browsing experience and to analyse our traffic. By clicking "Accept All", you consent to our use of cookies. Read our privacy policy and cookie policy for more information.

Existing Clients

Opening times.

Unlock Your Free Limited Company Expense Guide!

Save your seat live e-commerce webinar, how to create an effective business plan in 2023.

Professional Bio Templates & Examples

The mere thought of putting a business plan together can send even the most enthusiastic entrepreneur into a tailspin, but writing one can help you work out whether you actually have a viable business idea on your hands.

First and foremost, the person who must be convinced by your business plan is you. After all, if you’re not persuaded by it, why should anyone else be?

Once you’re sold on the basics, you can use your business plan to convince potential sources of finance, investors, partners, and employees that you’re the real deal.

This jargon-free article will give you a better idea of how to get the ball rolling.

Executive Summary

The executive summary highlights and emphasises the main points of your business. No more than a page in length, the executive summary needs to be succinct, compelling, and engaging - you want the reader / potential investor to be interested enough to read on and, even better, buy into your business.

This section should help the reader understand the purpose and passion behind your business. You’ll need to include brief outlines of:

- Your business name and location

- A short, simple summary of your business concept

- When were you founded?

- A description of your business’ competitive advantages

- Proof that there’s a market for your product or service

- A summary of the management team you’ve assembled

- A brief description of at what stage of development your business is in

- What is your background and experience, if any?

- What was your decision making process?

- When did the initial idea occur?

- Where will the business operate?

- How long is the lease, if you have one?

- Why - the mission statement of your business

You’ll be elaborating on most of these themes throughout the document, so keep it fairly succinct. Revisit the content once you’ve finished the rest of the business plan - you might find better ways to express your ideas.

Products and services

This is your opportunity to really wax lyrical about the core aspect of your business: what you’re going to be selling. You want complete belief from the reader that your product is the best out there, and for them to see why they should invest.

Here’s what you need to include:

- What is your product or service?

- Why should customers purchase from you?

- How do you aim to sell your product or service?

- How are your products manufactured?

- Do you have any exclusive deals or partnerships?

- What is your pricing strategy?

- What problems, if any, do you see with your product or service? What are the benefits to the customer?

- How will the product be sold - online or retail?

- What makes your product or service stand out?

Management team

Your business plan needs to detail specifically who is involved in your business.

You want this particular section of your business plan to highlight that you have a more-than-capable team running your business, a team that will use their expertises to make the business work and profit.

Make a list or tree diagram of people's responsibilities, and attach CVs as appendices if you feel this supports your choices.

You’ll need to include:

- Who owns the business?

- Who are the directors and shareholders?

- Who will be involved in the day-to-day running of the business?

- What experience do these people have and how will this benefit the business?

- Who is your management team?

- What experience do they have?

- Who has direct reports?

- Do you have any vacancies yet to be filled?

- What is your recruitment process?

The marketing section is key in showing a potential investor that you know how you will bring in custom. It needs to show you’ve thought about how to get people interested in your business, and what makes it different from competitors in your market or area.

How you promote your business will differ depending on how you’ll make sales. If you’re opening a shop you’ll need to employ some local marketing techniques (think print adverts, flyers, broadcast media etc.) but if you’ll be selling online you should consider search marketing and social media promotion.

What to include can be broken down into four sections - the four P’s:

Who are you aiming your product at? Who is your target market? For example, “22-34, London based, interested in photography and male”.

What is the price of your product/service? How did you arrive at this price point?

How does this compare with other products in your market? What budget have you set aside for marketing?

How and where are you going to distribute your product/service? Retail, wholesale or online? For e-commerce, you’ll need to show you can drive traffic to your website, and with retail you’ll need to show you understand the importance of putting your product in the right shop/area.

Promotion

How are you going to promote your business? How and where will you advertise?

Think about the methods mentioned in the opening paragraph - will any of these help get your business noticed?

The operations section of your business plan deep-dives into the logistical side of your idea. It highlights that you have thought concisely about the day-to-day running of your business. It needs to highlight and set clear expectations of exactly how your business will operate, and include details of the following:

Now is the time to be more specific about where you are based. Are there any works that need carrying out? Is there adequate parking? What licence do you need (if any)? Is there scope for you to develop a hybrid working space - could this suit your goals and how would it function?

Facilities and utilities

Does your location have internet access? Who will supply your water, gas and electricity?

How will you store and track your assets, stock, equipment?

What are your hours of trading? Are these flexible?

What payment systems will you have in place? Do you accept AmEx or contactless?

Do you need to invoice clients?

How many members of staff will you need? What will their duties be?

What is the customer journey? What is your refund policy? How will customer complaints be handled?

Financial Plan

A financial plan helps a potential investor think about whether they are likely to get a healthy return on investment (ROI). For this reason, it’s likely to be the most scrutinised section of your business plan.

If your business is brand new, think about how you’ll show predicted earnings - or you might want to outline any plans to scale up, including any intentions you have to access help in the form of an unsecured loan to grow your business . You could even look at a company similar to yours and what their earnings have been to compare. You’ll also need to include details of the following:

Profit and loss

Also known as an income statement, the profit and loss statement measures just that: the profit and loss of your business over a specific period. This takes information from the following equation:

Revenue - Cost of goods - Expenses = Net

Cashflow shows how much money is going in and out of your business. Think of cashflow as money management. Much like your personal finances, you need money coming in before you can take money out. If you spend money you don’t have coming in, this will amount to debt - this isn’t something an investor will look favourably upon.

Balance sheets

Compiled on an annual basis, the balance sheet gives a picture of the financial state of your business. Include assets, liabilities, and equity (see glossary on next page).

Sales forecast

Forecasting shows the depth of knowledge of your business. Break this section down into manageable parts, showing estimated sales by month over 12 months, then each year over five years. As with profit and loss, it’s important to be realistic, otherwise you will lose credibility.

Glossary of terms

Unsure of the difference between cash-flow and capital? While we do our best to avoid jargon, it’s important to understand the terminology when starting a business. To help you write your business plan, we’ve compiled a glossary of the most-used business terms and have provided easy-to-understand definitions.

An item owned by a business that has monetary value, for example, property, cash in the bank or inventory.

Lists the assets, liabilities, and equity of a business in order to calculate net worth.

An organisation that trades in goods or services.

Wealth owned by a person or business that is available for reinvestment in the company.

The amount of money being transferred in and out of a business.

A person who runs a limited company, often owning shares in the company.

A person who works for wages or salary in a business.

A person who employs people and pays them a wage or salary.

The value of the shares issued by a company.

Financial forecasts

A calculated estimation of future financial outcomes for a business.

A business licence granted by a company that enables a party (franchise) to market its products or services. For example, Ben and Jerry’s is the company, and the parlours where you buy the ice-cream are a franchise.

The items or stock owned by a business.

A person who invests money or capital into a business with an expectation of future financial return.

A company’s legal debts, for example, loans, mortgages or accounts payable.

Limited company

An organisation set up to run a business, which is responsible for everything it does. Finances are separate from personal finances, and Directors are responsible for decisions which affect the company.

Total assets of a business minus total liabilities. Determines the value of a company, for example, a business has £50,000 in cash, £200,000 of inventory and £20,000 in savings = £270,000 in assets. The business also has a £100,000 mortgage and £10,000 credit card debt (liabilities). Therefore the total net worth is £160,000.

An account showing a businesses net profit and loss over a given time frame.

Prediction of future sales.

Shareholder

A person who owns shares in a company or business, whose rights are often governed by a Shareholders’ Agreement.

A portion of the company’s ownership divided amongst shareholders, giving the owner a proportion of the company.

Sole trader

A person who is exclusively the owner of a business and solely responsible for all profits and losses of that business.

A new business.

Target market

A group of consumers at which a product is aimed. For example, sweets are often aimed at a target market of small children.

Umbrella company

A company that acts as an employer to agency contractors and processes their payments.

Keeping track of your accounting & finances

Ensuring you have a great accounting and financial plan is essential. Using a simple to navigate accounting system can be a perfect option. Why not consider using Crunch’s software ? Not only is it easy to use, but it also comes with support from our experts who can guide you through your accounting tasks and tracking your finances. We also have a ton of Crunch integrations , providing our clients with even more tools to run their businesses efficiently. For example, our integration with financial forecasting software Brixx allows you to project your business's financial future so you can test scenarios and be prepared for any eventuality. This is also a great tool to have when preparing your business plan.

We're comitted to helping new businesses thrive, and to encourage this we've shared lots of free resources - from in-depth business guides to blank invoice templates , we're here to help you succeed. To find more ways that Crunch can help make running your business effortless, join us online for 14 days completely free, or get in touch with our friendly advisors at a time that suits you. Alternatively, read our complete free guide to writing a business plan for lots of in-depth, interesting insights and considerations.

Speak to an accounting expert

Related knowledge, more from our knowledge.

Commonly asked accounting questions

What is VAT reverse charge in the construction sector?

.webp)

Record-breaking Government Spending On Small Business. What Do The Figures Mean?

Knowledge hubs.