What is Cost Assignment?

Share This...

Cost assignment.

Cost assignment is the process of associating costs with cost objects, such as products, services, departments, or projects. It encompasses the identification, measurement, and allocation of both direct and indirect costs to ensure a comprehensive understanding of the resources consumed by various cost objects within an organization. Cost assignment is a crucial aspect of cost accounting and management accounting, as it helps organizations make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

There are two main components of cost assignment:

- Direct cost assignment: Direct costs are those costs that can be specifically traced or identified with a particular cost object. Examples of direct costs include direct materials, such as raw materials used in manufacturing a product, and direct labor, such as the wages paid to workers directly involved in producing a product or providing a service. Direct cost assignment involves linking these costs directly to the relevant cost objects, typically through invoices, timesheets, or other documentation.

- Indirect cost assignment (Cost allocation): Indirect costs, also known as overhead or shared costs, are those costs that cannot be directly traced to a specific cost object or are not economically feasible to trace directly. Examples of indirect costs include rent, utilities, depreciation, insurance, and administrative expenses. Since indirect costs cannot be assigned directly to cost objects, organizations use various cost allocation methods to distribute these costs in a systematic and rational manner. Some common cost allocation methods include direct allocation, step-down allocation, reciprocal allocation, and activity-based costing (ABC).

In summary, cost assignment is the process of associating both direct and indirect costs with cost objects, such as products, services, departments, or projects. It plays a critical role in cost accounting and management accounting by providing organizations with the necessary information to make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

Example of Cost Assignment

Let’s consider an example of cost assignment at a bakery called “BreadHeaven” that produces two types of bread: white bread and whole wheat bread.

BreadHeaven incurs various direct and indirect costs to produce the bread. Here’s how the company would assign these costs to the two types of bread:

- Direct cost assignment:

Direct costs can be specifically traced to each type of bread. In this case, the direct costs include:

- Direct materials: BreadHeaven purchases flour, yeast, salt, and other ingredients required to make the bread. The cost of these ingredients can be directly traced to each type of bread.

- Direct labor: BreadHeaven employs bakers who are directly involved in making the bread. The wages paid to these bakers can be directly traced to each type of bread based on the time spent working on each bread type.

For example, if BreadHeaven spent $2,000 on direct materials and $1,500 on direct labor for white bread, and $3,000 on direct materials and $2,500 on direct labor for whole wheat bread, these costs would be directly assigned to each bread type.

- Indirect cost assignment (Cost allocation):

Indirect costs, such as rent, utilities, equipment maintenance, and administrative expenses, cannot be directly traced to each type of bread. BreadHeaven uses a cost allocation method to assign these costs to the two types of bread.

Suppose the total indirect costs for the month are $6,000. BreadHeaven decides to use the number of loaves produced as the allocation base , as it believes that indirect costs are driven by the production volume. During the month, the bakery produces 3,000 loaves of white bread and 2,000 loaves of whole wheat bread, totaling 5,000 loaves.

The allocation rate per loaf is:

Allocation Rate = Total Indirect Costs / Total Loaves Allocation Rate = $6,000 / 5,000 loaves = $1.20 per loaf

BreadHeaven allocates the indirect costs to each type of bread using the allocation rate and the number of loaves produced:

- White bread: 3,000 loaves × $1.20 per loaf = $3,600

- Whole wheat bread: 2,000 loaves × $1.20 per loaf = $2,400

After completing the cost assignment, BreadHeaven can determine the total costs for each type of bread:

- White bread: $2,000 (direct materials) + $1,500 (direct labor) + $3,600 (indirect costs) = $7,100

- Whole wheat bread: $3,000 (direct materials) + $2,500 (direct labor) + $2,400 (indirect costs) = $7,900

By assigning both direct and indirect costs to each type of bread, BreadHeaven gains a better understanding of the full cost of producing each bread type, which can inform pricing decisions, resource allocation, and performance evaluation.

Other Posts You'll Like...

TCP CPA Practice Questions Explained: Calculating The Foreign-Earned Income Exclusion

TCP CPA Practice Questions Explained: Calculating Imputed Interest

TCP CPA Practice Questions Explained: AMTI (Alternative Minimum Taxable Income)

How Ekta Passed Her CPA 6 Months Faster Than She Planned

TCP CPA Practice Questions Explained: Stock Options (ISOs and NSOs)

Free TCP CPA Practice Question Walkthroughs

Helpful links.

- Learn to Study "Strategically"

- How to Pass a Failed CPA Exam

- Samples of SFCPA Study Tools

- SuperfastCPA Podcast

2024 CPA Exams F.A.Q.s Answered

How Jackie Got Re-Motivated by Simplifying Her CPA Study

The Study Tweaks That Turned Kevin’s CPA Journey Around

Helicopter Pilot to CPA: How Chase Passed His CPA Exams

How Josh Passed His CPA Exams Using Shorter Study Sessions

Want to pass as fast as possible, ( and avoid failing sections ), watch one of our free "study hacks" trainings for a free walkthrough of the superfastcpa study methods that have helped so many candidates pass their sections faster and avoid failing scores....

Make Your Study Process Easier and more effective with SuperfastCPA

Take Your CPA Exams with Confidence

- Free "Study Hacks" Training

- SuperfastCPA PRO Course

- SuperfastCPA Review Notes

- SuperfastCPA Audio Notes

- SuperfastCPA Quizzes

Get Started

- Free "Study Hacks Training"

- Read Reviews of SuperfastCPA

- Busy Candidate's Guide to Passing

- Subscribe to the Podcast

- Purchase Now

- Nate's Story

- Interviews with SFCPA Customers

- Our Study Methods

- SuperfastCPA Reviews

- CPA Score Release Dates

- The "Best" CPA Review Course

- Do You Really Need the CPA License?

- 7 Habits of Successful Candidates

- "Deep Work" & CPA Study

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Accounting Articles

Cost Allocation

The process of identifying a company’s costs and assigning those costs to cost objects

Chris currently works as an investment associate with Ascension Ventures, a strategic healthcare venture fund that invests on behalf of thirteen of the nation's leading health systems with $88 billion in combined operating revenue. Previously, Chris served as an investment analyst with New Holland Capital, a hedge fund-of-funds asset management firm with $20 billion under management, and as an investment banking analyst in SunTrust Robinson Humphrey 's Financial Sponsor Group.

Chris graduated Magna Cum Laude from the University of Florida with a Bachelor of Arts in Economics and earned a Master of Finance (MSF) from the Olin School of Business at Washington University in St. Louis.

Currently an investment analyst focused on the TMT sector at 1818 Partners (a New York Based Hedge Fund), Sid previously worked in private equity at BV Investment Partners and BBH Capital Partners and prior to that in investment banking at UBS.

Sid holds a BS from The Tepper School of Business at Carnegie Mellon.

- What Is Cost Allocation?

- Types Of Costs

- How To Allocate Costs

- Why Do We Need To Allocate Costs?

- Examples Of Cost Allocation & Calculations

What is Cost Allocation?

Cost allocation is the process of identifying a company’s costs and assigning those costs to cost objects. Cost objects are the products, services, and activities of different departments of a company.

This process of allocating costs helps a business determine which parts of the company are responsible for what costs.

Sometimes it is difficult to draw the connection between allocated costs and their cost objects. When this happens, companies can use spreading costs.

Spreading costs occur when businesses spread the responsibility for production expenses across various areas.

When businesses can accurately allocate their costs, they are able to easily assess what particular cost objects are creating profits and losses for the company. On the other hand, if businesses are unable to allocate their costs correctly, their profit and loss calculations will be off.

Also, businesses must charge a price for their goods and services that covers their expenses and allows them to make a profit.

Intuitively, one can recognize the importance of cost allocation for the optimal performance of a company. Incorrect cost allocation calculations are extremely detrimental to any business and disrupt the ability to operate properly.

Cost allocation is necessary for any business, but as companies get larger and more complex, it becomes even more important to allocate costs accurately.

Key Takeaways

Cost allocation is fundamental and necessary for any business, big or small.

It helps with assessing profits and losses and the management of staffing.

Cost allocation allows companies to explain the pricing of their goods and services to customers.

Allocating costs is necessary for companies to maintain efficiency and financial accountability.

Types of Costs

Companies have various types of costs, and it is important to be able to distinguish between the different types when allocating them.

We can break them down into a few different categories.

- Direct costs: direct costs are those that can be traced to a certain product or service offered by a company. Included in direct costs are materials and labor that go into the production of a good.

- Indirect costs : these expenses are those that go into the production of a good but do not have a connection to a specific cost object. Examples of indirect costs include rent, utilities, and office supplies.

- Fixed costs : these costs remain constant, regardless of a company’s production volume. (e.g., rent)

- Variable costs : these costs increase or decrease as a company’s volume of production changes (e.g., supplies).

- A few examples of fixed overhead costs include rent, insurance, and workers’ salaries. Variable overhead costs include supplies and energy expenses, which both change as the volume of production increases or decreases.

How to Allocate Costs

Now that we understand the different types of costs, we can better understand the processes involved in cost allocation. Regardless of what good or service a company produces, the process remains consistent across industries.

- Identify Cost Objects : anything within a business that creates an expense is considered a cost object. The first step for allocating costs is to note all the cost objects of your company.

Electricity usage

Water usage

Fuel consumption

- Fixed cost allocation: this method assigns particular direct costs with cost objects. Drawing direct connections between costs and cost objects makes this method one of the most simple.

- Proportional allocation: proportional allocation deals with the distribution of indirect costs across associated cost objects. Sometimes proportional allocation divides costs equally across cost objects, while other times, it considers other factors (i.e., size) and divides costs accordingly.

- Activity-based allocation: this method is commonly considered the more accurate method of allocating costs. Activity-based allocation utilizes precise documentation to determine costs within departments and allocates the costs appropriately.

Why Do We Need to Allocate Costs?

A company must allocate its costs in order to optimize its business activities.

Recognizing Profits And Losses

Understanding the distribution of expenses helps companies analyze which areas of their business may be profitable or which areas may be causing a loss. This allows companies to determine whether or not certain expenses can be justified or not.

Companies do not know how much to charge the customer’s goods and services without cost allocation. Once non-profitable cost objects are identified, companies can cut expenses in those departments and focus their efforts on profitable cost objects.

Management Decisions

Cost allocation is also important for a company to manage its staff. In areas where the company is not profitable, it can evaluate the staff performance of that department. Often, the losses incurred by part of a company are due to the underperformance of employees.

Similarly, companies can analyze the allocation of their costs to determine where they are profitable and award the employees of that department.

Using cost allocation to motivate employees offers the administration of a company an objective, quantitative justification for their management decisions.

Transfer Pricing

Transfer pricing is the practice of charging for goods and services at an arm's length. The practice is used by departments the organization to charge for the goods and services exchanged within the same firm.

Cost allocation is vital for deriving transfer pricing, the exchange price of goods or services between two companies.

Examples of Cost Allocation & Calculations

Now we understand cost allocation, the different types, and why we need it. Here are several examples of different ways a company might allocate its costs.

Example 1: Square Footage

Christina’s business has an office and a manufacturing space. The square footage of the office is 1,000 square feet, and the manufacturing space is 1,500 square feet. The rent for the two spaces is $10,000 per month. The company will allocate the rent expense between the two spaces.

$10,000 (rent) / 2,500 square feet = $4 per square foot

- Calculate the rental cost for the office

$4 x 1,000 = $4,000

This means that Christina will allocate $4,000 of the rent to the office.

- Calculate the rental cost for the manufacturing space

$4 x 1,500 = $6,000

This means that Christina will allocate $6,000 of the rent to the manufacturing space.

Example 2: Units Produced

Alex’s manufacturing company makes water bottles. In January, Alex produced 5,000 water bottles with direct material costs of $2.50 per water bottle and $3.00 in direct labor costs per water bottle.

Alex also had $6,500 in overhead costs in January. Using the number of units produced as his allocation method, Alex can calculate his overhead costs using the overhead cost formula.

- Calculate the overhead costs:

$6,500 / 5,000 = $1.30 per water bottle

- Add the overhead costs to the direct costs to find the total costs:

$1.30 + $2.50 + $3.00 = $6.80 per backpack

So, Alex’s total costs in January were $6.80 per backpack. If Alex had not allocated the overhead costs, he would have most likely underpriced the backpacks, which would have resulted in a loss of income.

Everything You Need To Build Your Accounting Skills

To Help you Thrive in the Most Flexible Job in the World.

Researched and authored by Rachel Kim | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Accounting Ratios

- Amortization

- Depreciated Cost

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

Module 5: Job Order Costing

Introduction to accumulating and assigning costs, what you will learn to do: assign costs to jobs.

Financial and managerial accountants record costs of production in an account called Work in Process. The total of these direct materials, direct labor, and factory overhead costs equal the cost of producing the item.

In order to understand the accounting process, here is a quick review of how financial accountants record transactions:

Let’s take as simple an example as possible. Jackie Ma has decided to make high-end custom skateboards. She starts her business on July 1 by filing the proper forms with the state and then opening a checking account in the name of her new business, MaBoards. She transfers $150,000 from her retirement account into the business account and records it in a journal as follows:

For purposes of this ongoing example, we’ll ignore pennies and dollar signs, and we’ll also ignore selling, general, and administrative costs.

After Jackie writes the journal entry, she posts it to a ledger that currently has only two accounts: Checking Account, and Owner’s Capital.

Debits are entries on the left side of the account, and credits are entries on the right side.

Here is a quick review of debits and credits:

You can view the transcript for “Colin Dodds – Debit Credit Theory (Accounting Rap Song)” here (opens in new window) .

Also, this system of debits and credits is based on the following accounting equation:

Assets = Liabilities + Equity.

- Assets are resources that the company owns

- Liabilities are debts

- Equity is the amount of assets left over after all debts are paid

Let’s look at one more initial transaction before we dive into recording and accumulating direct costs such as materials and labor.

Jackie finds the perfect building for her new business; an old woodworking shop that has most of the equipment she will need. She writes a check from her new business account in the amount of $2,500 for July rent. Because she took managerial accounting in college, she determines this to be an indirect product expense, so she records it as Factory Overhead following a three-step process:

- Analyze transaction

Because her entire facility is devoted to production, she determines that the rent expense is factory overhead.

2. Journalize transaction using debits and credits

If she is using QuickBooks ® or other accounting software, when she enters the transaction into the system, the software will create the journal entry. In any case, whether she does it by hand or computer, the entry will look much like this:

3. Post to the ledger

Again, her computer software will post the journal entry to the ledger, but we will follow this example using a visual system accountants call T-accounts. The T-account is an abbreviated ledger. Click here to view a more detailed example of a ledger .

Jackie posts her journal entry to the ledger (T-accounts here).

She now has three accounts: Checking Account, Owner’s Capital, and Factory Overhead, and the company ledger looks like this:

In a retail business, rent, salaries, insurance, and other operating costs are categorized into accounts classified as expenses. In a manufacturing business, some costs are classified as product costs while others are classified as period costs (selling, general, and administrative).

We’ll treat factory overhead as an expense for now, which is ultimately a sub-category of Owner’s Equity, so our accounting equation now looks like this:

Assets = Liabilities + Owner’s Equity

147,500 = 150,000 – 2,500

Notice that debits offset credits and vice versa. The balance in the checking account is the original deposit of $150,000, less the check written for $2,500. Once the check clears, if Jackie checks her account online, she’ll see that her ledger balance and the balance the bank reports will be the same.

Here is a summary of the rules of debits and credits:

Assets = increased by a debit, decreased by a credit

Liabilities = increased by a credit, decreased by a debit

Owner’s Equity = increased by a credit, decreased by a debit

Revenues increase owner’s equity, therefore an individual revenue account is increased by a credit, decreased by a debit

Expenses decrease owner’s equity, therefore an individual expense account is increased by a debit, decreased by a credit

Here’s Colin Dodds’s Accounting Rap Song again to help you remember the rules of debits and credits:

Let’s continue to explore job costing now by using this accounting system to assign and accumulate direct and indirect costs for each project.

When you are done with this section, you will be able to:

- Record direct materials and direct labor for a job

- Record allocated manufacturing overhead

- Prepare a job cost record

Learning Activities

The learning activities for this section include the following:

- Reading: Direct Costs

- Self Check: Direct Costs

- Reading: Allocated Overhead

- Self Check: Allocated Overhead

- Reading: Subsidiary Ledgers and Records

- Self Check: Subsidiary Ledgers and Records

- Introduction to Accumulating and Assigning Costs. Authored by : Joseph Cooke. Provided by : Lumen Learning. License : CC BY: Attribution

- Colin Dodds - Debit Credit Theory (Accounting Rap Song). Authored by : Mr. Colin Dodds. Located at : https://youtu.be/j71Kmxv7smk . License : All Rights Reserved . License Terms : Standard YouTube License

- What the General Ledger Can Tell You About Your Business. Authored by : Mary Girsch-Bock. Located at : https://www.fool.com/the-blueprint/general-ledger/ . License : All Rights Reserved . License Terms : Standard YouTube License

Privacy Policy

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

What Is Cost Allocation?

Table of Contents

Entrepreneurs, small business owners and managers need accurate, timely financial data to run their operations. Specifically, understanding and connecting costs to items or departments helps them create budgets, develop strategies and make the best business decisions for their organizations. This is where cost allocation comes in. Detailed cost allocation reports help businesses ensure they’re charging enough to cover expenses and make a profit.

While a detailed cost allocation report may not be vital for extremely small businesses, more complex businesses require cost allocation to optimize profitability and productivity.

What is cost allocation?

Cost allocation is the process of identifying and assigning costs to business objects, such as products, projects, departments or individual company branches. Business owners use cost allocation to calculate profitability. Costs are separated or allocated, into different categories based on the business area they impact. These amounts are then used in accounting reports .

For example, say you’re a small clothing manufacturer. Your product line’s cost allocation would include materials, shipping and labor costs. It would also include a portion of the operation’s overhead costs. Calculating these costs consistently helps business leaders determine if profits from sales are higher than the costs of producing the product line. If not, it can help the owner pinpoint where to raise prices or cut expenses .

For a larger company, cost allocation is applied to each department or business location . Many companies also use cost allocation to determine annual bonuses for each area.

Types of costs

If you’re starting a business , the cost allocation process is relatively straightforward. However, larger businesses have many more costs that can be divided into two primary categories: direct and indirect costs:

- Purchased inventory

- Materials used to make inventory

- Direct labor costs for employees who make inventory

- Payroll for those who work in operations

- Manufacturing overhead, including rent, insurance and utilities costs

- Other overhead costs, including expenses that support the company but aren’t directly related to production, such as marketing and human resources

What is a cost driver?

A cost driver is a variable that affects business costs, such as the number of invoices issued, employee hours worked or units of electricity used. Unlike cost objects, such as units produced or departments, a cost driver reflects the reason for the incurred cost amounts.

How to allocate costs

While cost objects vary by business type, the cost allocation process is the same regardless of what your company produces. Here are the steps involved.

1. Identify your business’s cost objects.

Determine the cost objects to which you want to allocate costs, such as units of production, number of employees or departments. Remember that anything within your business that generates an expense is a cost object. Review each product line, project and department to ensure you’ve gathered all cost objects for which you must allocate costs.

2. Create a cost pool.

Next, create a detailed list of all business costs. Categories should cover utilities, business insurance policies, rent and any other expenses your business incurs.

3. Choose the best cost allocation method for your needs.

After identifying your business’s cost objects and creating a cost pool, you must choose a cost allocation method. Several methods exist, including the following standard ones:

- Direct materials cost method: This cost allocation method assumes all products have the same allocation base and variable rate.

- Direct labor cost method: This cost allocation method is most helpful if labor costs can be allocated to one product or if expenses vary directly with labor costs.

- High/low method. This cost allocation method is best if you have more than one cost driver and each driver has different fixed or variable rates.

- Step-up or step-down method: With this cost allocation method, departments are first ranked and then the cost of services is allocated from one service department to another in a series of steps.

- Full absorption costing (FAC): This cost allocation method combines direct material and direct labor costs with a predetermined FAC rate based on company historical data or industry standards.

- Variable costing: Consider this cost allocation method if your business has many variable cost allocations (costs that vary by quantity) and uses significant direct labor.

4. Allocate costs.

Now that you’ve listed cost objects, created a cost pool and chosen a cost allocation method, you’re ready to allocate costs.

Here’s a cost allocation example to help you visualize the process:

Dave owns a business that manufactures eyeglasses. In January, Dave’s overhead costs totaled $5,000. In the same month, he produced 3,000 eyeglasses with $2 in direct labor per product. Direct materials for each pair of eyeglasses totaled $5. Here’s what cost allocation would look like for Dave: Direct costs: $5 direct materials + $2 direct labor = $7 direct costs per pair Indirect costs: Overhead allocation: $5,000 ÷ 3,000 pairs = $1.66 overhead costs per pair Direct costs: $7 per pair + Indirect costs: $1.66 per pair Total cost: $8.66 per pair

As you can see, cost allocation helps Dave determine how much he must charge wholesale for each pair of eyeglasses to make a profit. Larger companies would apply this same process to each department and product to ensure sufficient sales goals.

5. Review and adjust cost allocations.

Cost allocations are never static. To be meaningful, they must be monitored and adjusted constantly as circumstances change.

What are the benefits of cost allocation?

Accurate, regular cost allocation can bring your business the following benefits:

- Helps you run your business: The information you glean from cost allocation reports helps you perform vital functions like preparing income tax returns and creating financial reports for investors, creditors and regulators.

- Informs business decisions: Cost allocation is an excellent business decision tool that can help you monitor productivity and justify expenses. Cost allocation gives a detailed overview of how your business expenses are used. From this perspective, you can determine which products and services are profitable and which departments are most productive.

- Helps produce accurate business reports: Tax accounting, financial accounting and management accounting all require some kind of cost allocation. This information is the foundation of accurate business reports.

- Can reveal accurate production costs: Knowing what it costs to create a product, including all expenses allocated to it, is essential to making good pricing decisions and allocating resources efficiently.

- Helps you evaluate staff: Cost allocation can help you assess the performance of different departments and staff members. If a department is not profitable, staff productivity may need improvement.

Common cost allocation mistakes

To get the most from cost allocation, avoid these common mistakes:

- Equal or inflexible allocation : Cost allocation is not as simple as allocating any given cost over different product lines or departments. Some cost objects require more time, expense or labor than others, for example.

- Missing costs: Costing is meaningless if it doesn’t include all expenses. Don’t forget costs, such as overhead, time spent and intangible expenses.

- Failing to adjust as needed: Costs and priorities in business are changing constantly. Be sure your cost allocations are monitored and adjusted to meet your information needs.

- Not considering fluctuating revenue with indirect costs: If your business is seasonal or fluctuates over time, it’s important to account for that when allocating costs.

Cost allocation and your business

Even if you operate a very small business, it’s essential to properly allocate your expenses. Otherwise, you could make all-too-common mistakes, such as charging too little for your product or spending too much on overhead. Whether you choose to start allocating costs on your own with software or with the help of a professional small business accountant , cost allocation is a process no business owner can afford to overlook.

Dachondra Cason contributed to this article.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

- Cost Classifications

- Relevant Cost of Material

- Manufacturing Overhead Costs

- Conversion Costs

- Quality Costs

- Revenue Expenditure

- Product Cost vs Period Cost

- Direct Costs and Indirect Costs

- Prime Costs and Conversion Costs

- Relevant vs Irrelevant Costs

- Avoidable and Unavoidable Costs

- Cost Allocation

- Joint Products

- Accounting for Joint Costs

- Service Department Cost Allocation

- Repeated Distribution Method

- Simultaneous Equation Method

- Specific Order of Closing Method

- Direct Allocation Method

Cost allocation is the process by which the indirect costs are distributed among different cost objects such as a project, a department, a branch, a customer, etc. It involves identifying the cost object, identifying and accumulating the costs that are incurred and assigning them to the cost object on some reasonable basis.

Cost allocation is important for both pricing and planning and control decisions. If costs are not accurately calculated, a business might never know which products are making money and which ones are losing money. If cost are mis-allocated, a business may be charging wrong price to its customers and/or it might be wasting resources on products that are wrongly categorized as profitable.

Cost allocation is a sub-process of cost assignment , which is the overall process of finding total cost of a cost object. Cost assignment involves both cost tracing and cost allocation. Cost tracing encompasses finding direct costs of a cost object while the cost allocation is concerned with indirect cost charge.

Steps in cost allocation process

Typical cost allocation mechanism involves:

- Identifying the object to which the costs have to be assigned,

- Accumulating the costs in different pools,

- Identifying the most appropriate basis/method for allocating the cost.

Cost object

A cost object is an item for which a business need to separately estimate cost.

Examples of cost object include a branch, a product line, a service line, a customer, a department, a brand, a project, etc.

A cost pool is the account head in which costs are accumulated for further assignment to cost objects.

Examples of cost pools include factory rent, insurance, machine maintenance cost, factory fuel, etc. Selection of cost pool depends on the cost allocation base used. For example if a company uses just one allocation base say direct labor hours, it might use a broad cost pool such as fixed manufacturing overheads. However, if it uses more specific cost allocation bases, for example labor hours, machine hours, etc. it might define narrower cost pools.

Cost driver

A cost driver is any variable that ‘drives’ some cost. If increase or decrease in a variable causes an increase or decrease is a cost that variable is a cost driver for that cost.

Examples of cost driver include:

- Number of payments processed can be a good cost driver for salaries of Accounts Payable section of accounting department,

- Number of purchase orders can be a good cost driver for cost of purchasing department,

- Number of invoices sent can be a good cost driver for cost of billing department,

- Number of units shipped can be a good cost driver for cost of distribution department, etc.

While direct costs are easily traced to cost objects, indirect costs are allocated using some systematic approach.

Cost allocation base

Cost allocation base is the variable that is used for allocating/assigning costs in different cost pools to different cost objects. A good cost allocation base is something which is an appropriate cost driver for a particular cost pool.

T2F is a university café owned an operated by a student. While it has plans for expansion it currently offers two products: (a) tea & coffee and (b) shakes. It employs 2 people: Mr. A, who looks after tea & coffee and Mr. B who prepares and serves shakes & desserts.

Its costs for the first quarter are as follows:

Total tea and coffee sales and shakes sales were $50,000 & $60,000 respectively. Number of customers who ordered tea or coffee were 10,000 while those ordering shakes were 8,000.

The owner is interested in finding out which product performed better.

Salaries of Mr. A & B and direct materials consumed are direct costs which do not need any allocation. They are traced directly to the products. The rest of the costs are indirect costs and need some basis for allocation.

Cost objects in this situation are the products: hot beverages (i.e. tea & coffee) & shakes. Cost pools include rent, electricity, music, internet and wi-fi subscription and magazines.

Appropriate cost drivers for the indirect costs are as follows:

Since number of customers is a good cost driver for almost all the costs, the costs can be accumulated together to form one cost pool called manufacturing overheads. This would simply the cost allocation.

Total manufacturing overheads for the first quarter are $19,700. Total number of customers who ordered either product are 18,000. This gives us a cost allocation base of $1.1 per customer ($19,700/18,000).

A detailed cost assignment is as follows:

Manufacturing overheads allocated to Tea & Cofee = $1.1×10,000

Manufacturing overheads allocated to Shakes = $1.1×8,000

by Irfanullah Jan, ACCA and last modified on Jul 22, 2020

Related Topics

- Cost Behavior

All Chapters in Accounting

- Intl. Financial Reporting Standards

- Introduction

- Accounting Principles

- Business Combinations

- Accounting Cycle

- Financial Statements

- Non-Current Assets

- Fixed Assets

- Investments

- Revenue Recognition

- Current Assets

- Receivables

- Inventories

- Shareholders' Equity

- Liability Accounts

- Accounting for Taxes

- Employee Benefits

- Accounting for Partnerships

- Financial Ratios

- Cost Accounting Systems

- CVP Analysis

- Relevant Costing

- Capital Budgeting

- Master Budget

- Inventory Management

- Cash Management

- Standard Costing

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

- Search Search Please fill out this field.

Direct Costs

Indirect costs, fixed costs, variable costs, operating costs, opportunity costs, controllable costs, the bottom line.

- Corporate Finance

What Are the Types of Costs in Cost Accounting?

:max_bytes(150000):strip_icc():format(webp)/me_jpeg__chris_murphy-5bfc262746e0fb0051bcea2f.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Ariel Courage is an experienced editor, researcher, and former fact-checker. She has performed editing and fact-checking work for several leading finance publications, including The Motley Fool and Passport to Wall Street.

:max_bytes(150000):strip_icc():format(webp)/ArielCourage-50e270c152b046738d83fb7355117d67.jpg)

Cost accounting is an accounting process that measures all of the costs associated with production, including both fixed and variable costs. The purpose of cost accounting is to assist management in decision-making processes that optimize operations based on efficient cost management. The costs included in cost accounting are discussed in detail below.

Key Takeaways

- Cost accounting is an accounting method that takes into consideration a company's total cost of production by evaluating both fixed and variable costs.

- Managers use cost accounting to help make business decisions based on efficient cost management.

- The types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs, opportunity costs, sunk costs, and controllable costs.

- Cost accounting is not generally accepted accounting principles (GAAP) compliant and can only be used for internal decision-making.

Direct costs are related to producing a good or service. A direct cost includes raw materials, labor, and expense or distribution costs associated with producing a product. The cost can easily be traced to a product, department, or project.

For example, Ford Motor Company ( F ) manufactures cars and trucks. A plant worker spends eight hours building a car. The direct costs associated with the car are the wages paid to the worker and the cost of the parts used to build the car.

Indirect costs, on the other hand, are expenses unrelated to producing a good or service. An indirect cost cannot be easily traced to a product, department, activity, or project. For example, with Ford, the direct costs associated with each vehicle include tires and steel.

However, the electricity used to power the plant is considered an indirect cost because the electricity is used for all the products made in the plant. No one product can be traced back to the electric bill.

Fixed costs do not vary with the number of goods or services a company produces over the short term. For example, suppose a company leases a machine for production for two years. The company has to pay $2,000 per month to cover the cost of the lease , no matter how many products that machine is used to make. The lease payment is considered a fixed cost as it remains unchanged.

Variable costs fluctuate as the level of production output changes, contrary to a fixed cost. This type of cost varies depending on the number of products a company produces. A variable cost increases as the production volume increases, and it falls as the production volume decreases. Businesses can also decide to forego an activity or production to avoid the associated expenses—called the avoidable costs .

For example, a toy manufacturer must package its toys before shipping products out to stores. This is considered a type of variable cost because, as the manufacturer produces more toys, its packaging costs increase, however, if the toy manufacturer's production level is decreasing, the variable cost associated with the packaging decreases.

Operating costs are expenses associated with day-to-day business activities but are not traced back to one product. Operating costs can be variable or fixed. Examples of operating costs, which are more commonly called operating expenses , include rent and utilities for a manufacturing plant.

Operating costs are day-to-day expenses, but are classified separately from indirect costs – i.e., costs tied to actual production. Investors can calculate a company's operating expense ratio, which shows how efficient a company is in using its costs to generate sales.

Opportunity cost is the benefits of an alternative given up when one decision is made over another. This cost is, therefore, most relevant for two mutually exclusive events. In investing, it's the difference in return between a chosen investment and one that is passed up. For companies, opportunity costs do not show up in the financial statements but are useful in planning by management.

For example, a company decides to buy a new piece of manufacturing equipment rather than lease it. The opportunity cost would be the difference between the cost of the cash outlay for the equipment and the improved productivity versus how much money could have been saved in interest expense had the money been used to pay down debt.

Sunk costs are historical costs that have already been incurred and will not make any difference in the current decisions by management. Sunk costs are those costs that a company has committed to and are unavoidable or unrecoverable costs. Sunk costs are excluded from future business decisions.

Controllable costs are expenses managers have control over and have the power to increase or decrease. Controllable costs are considered when the decision of taking on the cost is made by one individual. Common examples of controllable costs are office supplies, advertising expenses, employee bonuses, and charitable donations. Controllable costs are categorized as short-term costs as they can be adjusted quickly.

What Are the Types of Cost Accounting?

The different types of cost accounting include standard costing, activity-based costing, lean accounting, and marginal costing. Standard costing uses standard costs rather than actual costs for cost of goods sold (COGS) and inventory. Activity-based costing takes overhead costs from different departments and pairs them with certain cost objects. Lean accounting replaces traditional costing methods with value-based pricing. Marginal costing evaluates the impact on cost by adding one additional unit into production.

What Is the Main Purpose of Cost Accounting?

The main purpose of cost accounting is to evaluate the costs of a business and based on the data, make better decisions, improve efficiency, determine the best selling price, reduce costs, and determine the profit of each activity involved in the operational process.

What Is the Difference Between Cost Accounting and Financial Accounting?

Cost accounting focuses on a business's costs and uses the data on costs to make better business decisions, with the goal of reducing costs and improving profitability at every stage of the operational process. Financial accounting is focused on reporting the financial results and financial condition of the entire business entity.

Cost accounting looks to assess the different costs of a business and how they impact operations, costs, efficiency, and profits. Individually assessing a company's cost structure allows management to improve the way it runs its business and therefore improve the value of the firm.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-982493310-8309982cf401480aba022056d8934f07.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

10.19: Assignment- Production and Costs

- Last updated

- Save as PDF

- Page ID 60725

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

In this module you learned that cost functions are derived from production functions and that the marginal cost curve is the inverse of the marginal product curve. Work through this problem to demonstrate those findings.

Production Function:

1. Using the production function, compute the figures for marginal product using the definition given earlier in this module. Draw a graph of the marginal product curve using the numbers you computed.

Suppose this firm can hire workers at a wage rate of $10 per hour to work in its factory which has a rental cost of $100. Use the production function to derive the cost function.

2. First compute the variable cost for Q = 0 through Q = 5.

3. Next compute the fixed cost for Q = 0 through Q = 5.

4. Then compute the total cost for Q = 0 through Q = 5. This is the cost function.

5. Finally compute the marginal cost for Q = 0 through Q = 5. Draw the marginal cost curve and compare it to the marginal product curve above. Explain what you see.

- Assignment: Production and Costs. Authored by : Steven Greenlaw and Lumen Learning. License : CC BY: Attribution

An Expert Guide to Cost Benefit Analysis

By Joe Weller | December 8, 2016

- Share on Facebook

- Share on LinkedIn

Link copied

In business today, it’s essential to get the most out of every idea, option, and investment. To accomplish this, many organizations - from large enterprises to startups and small businesses - use cost benefit analyses to help make important decisions. Using a cost benefit analysis can help teams identify the highest and best return on an investment based on the cost, resources, and risk involved. In this article, we’ll walk you through the process of cost benefit analysis, and offer insight and tips from industry experts. They’ll shine a light on the risks and uncertainties you should be aware of as you work, and provide real-world examples to show cost benefit analysis in action.

Cost benefit analysis: What is it?

A cost benefit analysis (also known as a benefit cost analysis) is a process by which organizations can analyze decisions, systems or projects, or determine a value for intangibles. The model is built by identifying the benefits of an action as well as the associated costs, and subtracting the costs from benefits. When completed, a cost benefit analysis will yield concrete results that can be used to develop reasonable conclusions around the feasibility and/or advisability of a decision or situation. Why Use Cost Benefit Analysis? Organizations rely on cost benefit analysis to support decision making because it provides an agnostic, evidence-based view of the issue being evaluated—without the influences of opinion, politics, or bias. By providing an unclouded view of the consequences of a decision, cost benefit analysis is an invaluable tool in developing business strategy, evaluating a new hire, or making resource allocation or purchase decisions. Origins of Cost Benefit Analysis The earliest evidence of the use of cost benefit analysis in business is associated with a French engineer, Jules Dupuit, who was also a self-taught economist. In the mid-19th century, Dupuit used basic concepts of what later became known as cost benefit analysis in determining tolls for a bridge project on which he was working. Dupuit outlined the principles of his evaluation process in an article written in 1848, and the process was further refined and popularized in the late 1800s by British economist Alfred Marshall, author of the landmark text, Principles of Economics (1890).

Scenarios Utilizing Cost Benefit Analysis

As mentioned previously, cost benefit analysis is the foundation of the decision-making process across a wide variety of disciplines. In business, government, finance, and even the nonprofit world, cost benefit analysis offers unique and valuable insight when:

- Developing benchmarks for comparing projects

- Deciding whether to pursue a proposed project

- Evaluating new hires

- Weighing investment opportunities

- Measuring social benefits

- Appraising the desirability of suggested policies

- Assessing change initiatives

- Quantifying effects on stakeholders and participants

How to Do a Cost Benefit Analysis

While there is no “standard” format for performing a cost benefit analysis, there are certain core elements that will be present across almost all analyses. Use the structure that works best for your situation or industry, or try one of the resources and tools listed at the end of this article. We’ll go through the five basic steps to performing a cost benefit analysis in the sections below, but first, here’s a high-level of overview:

- Establish a framework to outline the parameters of the analysis

- Identify costs and benefits so they can be categorized by type, and intent

- Calculate costs and benefits across the assumed life of a project or initiative

- Compare cost and benefits using aggregate information

- Analyze results and make an informed, final recommendation

As with any process, it’s important to work through all the steps thoroughly and not give in to the temptation to cut corners or base assumptions on opinion or “best guesses.” According to a paper from Dr. Josiah Kaplan, former Research Associate at the University of Oxford, it’s important to ensure that your analysis is as comprehensive as possible: “The best cost-benefit analyses take a broad view of costs and benefits, including indirect and longer-term effects, reflecting the interests of all stakeholders who will be affected by the program.”

How to Establish a Framework

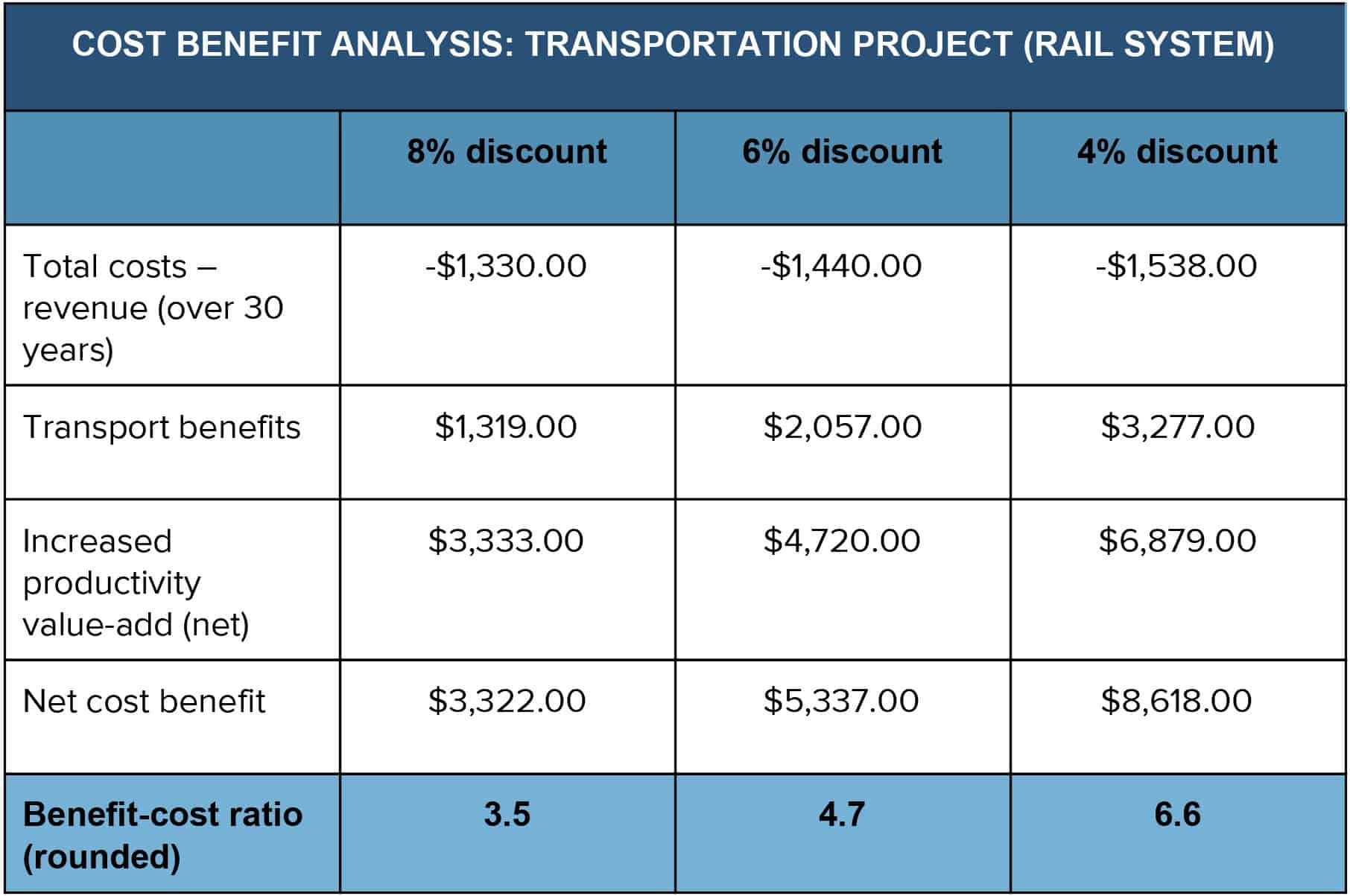

In establishing the framework of your cost benefit analysis, first outline the proposed program or policy change in detail. Look carefully at how you position what exactly is being evaluated in relationship to the problem being solved. For example, the analysis associated with the question, “should we add a new professor to our staff?” will be much more straightforward than a broader programmatic question, such as, “how should we resolve the gaps in our educational offering?” Example:

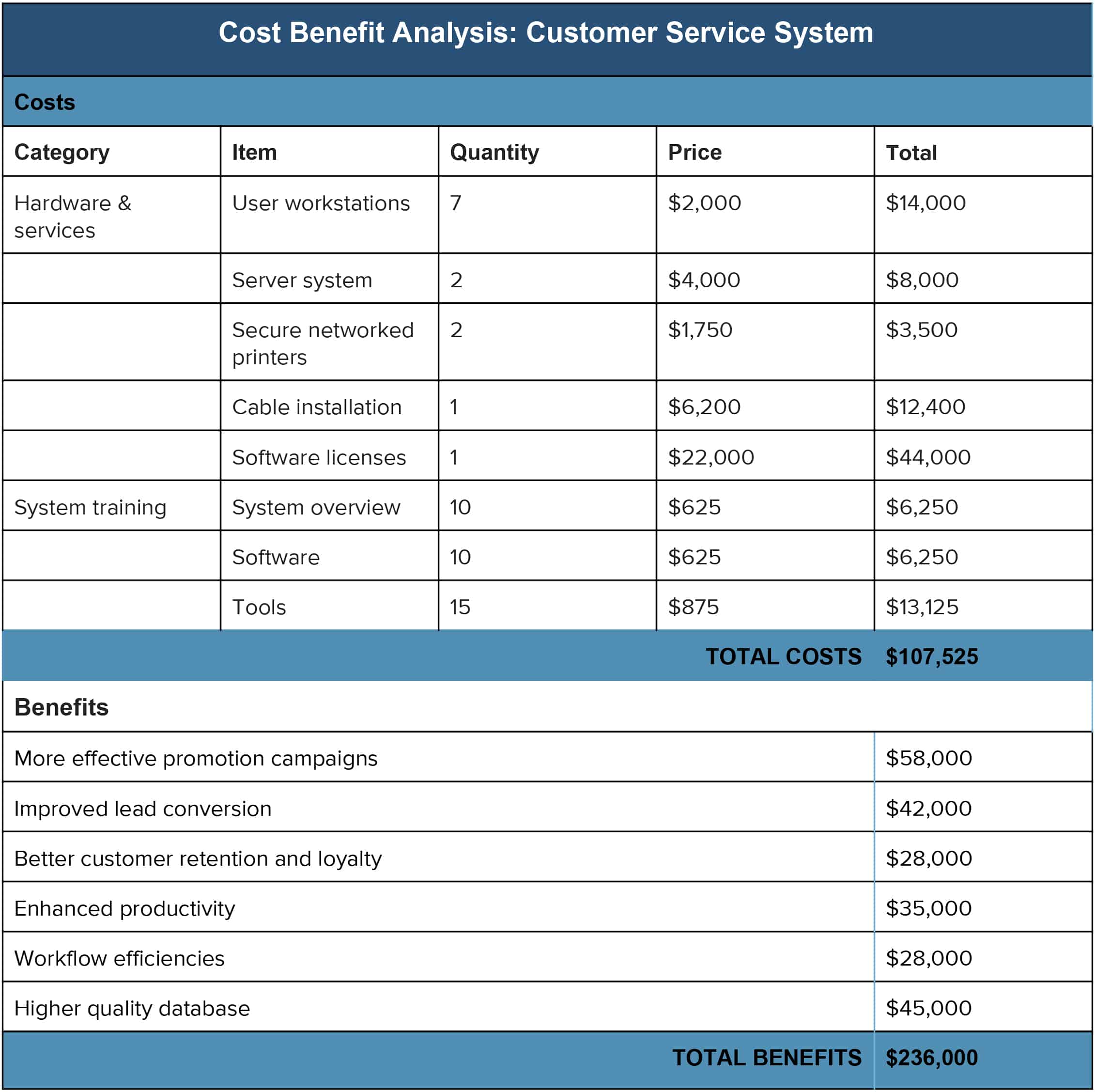

Once your program or policy change is clearly outlined, you’ll need to build out a situational overview to examine the existing state of affairs including background, current performance, any opportunities it has brought to the table, and its projected performance in the future. Also make sure to factor in an objective look at any risks involved in maintaining the status quo moving forward. Now decide on how you will approach cost benefits. Which cost benefits should be included in your analysis? Include the basics, but also do a bit of thinking outside the box to come up with any unforeseen costs that could impact the initiative in both the short and long term. In some cases geography could play a role in determining feasibility of a project or initiative. If geographically dispersed stakeholders or groups will be affected by the decision being analyzed, make sure to build that into the framework upfront, to avoid surprises down the road. Conversely, if the scope of the project or initiative may scale beyond the intended geographic parameters, that should be taken into consideration as well.

Identify and Categorize Costs and Benefits

Now that your framework is in place, it’s time to sort your costs and benefits into buckets by type. The primary categories that costs and benefits fall into are direct/indirect , tangible/intangible , and real :

- Direct costs are often associated with production of a cost object (product, service, customer, project, or activity)

- Indirect costs are usually fixed in nature, and may come from overhead of a department or cost center

- Tangible costs are easy to measure and quantify, and are usually related to an identifiable source or asset, like payroll, rent, and purchasing tools

- Intangible cost s are difficult to identify and measure, like shifts in customer satisfaction, and productivity levels

- Real costs are expenses associated with producing an offering, such as labor costs and raw materials

Now that you’ve developed the categories into which you’ll sort your costs and benefits, it’s time to start crunching numbers.

How to Calculate Costs and Benefits

With the framework and categories in place, you can start outlining overall costs and benefits. As mentioned earlier, it’s important to take both the short and long term into consideration, so ensure that you make your projections based on the life of the program or initiative, and look at how both costs and benefits will evolve over time.

TIP: People often make the mistake of monetizing incorrectly when projecting costs and benefits, and therefore end up with flawed results. When factoring in future costs and benefits, always be sure to adjust the figures and convert them into present value.

Compare Aggregate Costs and Benefits

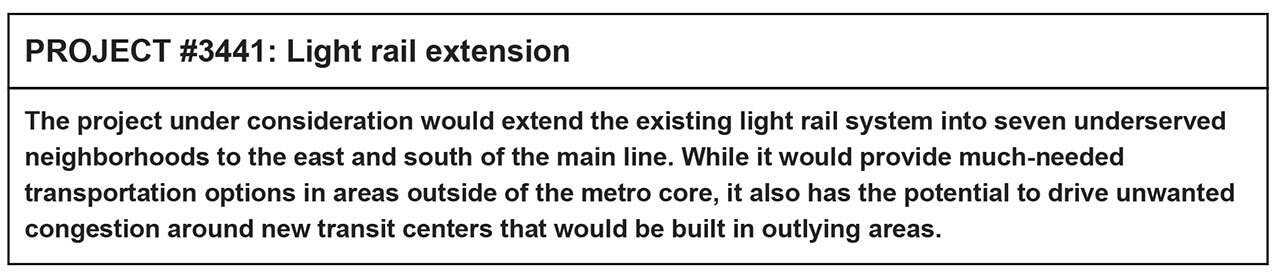

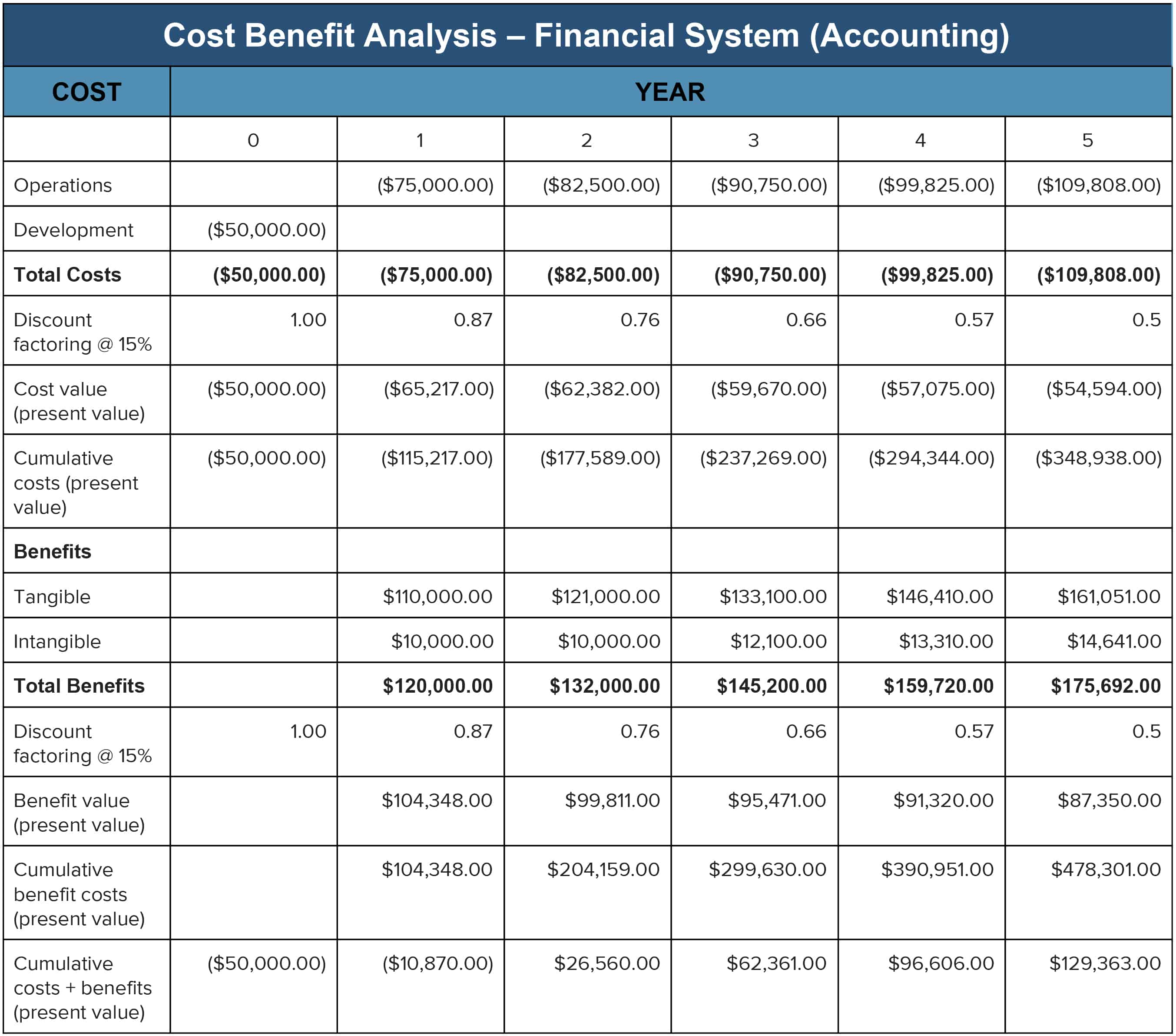

Here we’ll determine net present values by subtracting costs from benefits, and project the timeframe required for benefits to repay costs, also known as return on investment (ROI). Example:

The process doesn’t end there. In certain situations, it’s important to address any serious concerns that could impact feasibility from a legal or social justice standpoint. In cases like these, it can be helpful to incorporate a “with/without” comparison to identify areas of potential concern. With/Without Comparison The impact of an initiative can be brought into sharp focus through a basic “with/without” comparison. In other words, this is where we look at what the impact would be—on organizations, stakeholders, or users—both with, and without, this initiative. Thayer Watkins, who taught a course on cost benefit analysis during his 30-year career as a professor in the San Jose State University Department of Economics, offers this example of a “with/without” comparison: “The impact of a project is the difference between what the situation in the study area would be with and without the project. So that when a project is being evaluated the analysis must estimate not only what the situation would be with the project but also what it would be without the project. For example, in determining the impact of a fixed guideway rapid transit system such as the Bay Area Rapid Transit (BART) in the San Francisco Bay Area the number of rides that would have been taken on an expansion of the bus system should be deducted from the rides provided by BART and likewise the additional costs of such an expanded bus system would be deducted from the costs of BART. In other words, the alternative to the project must be explicitly specified and considered in the evaluation of the project.” TIP: Never confuse with/without with a before-and-after comparison.

3 Steps for Analyzing the Results and Make a Recommendation

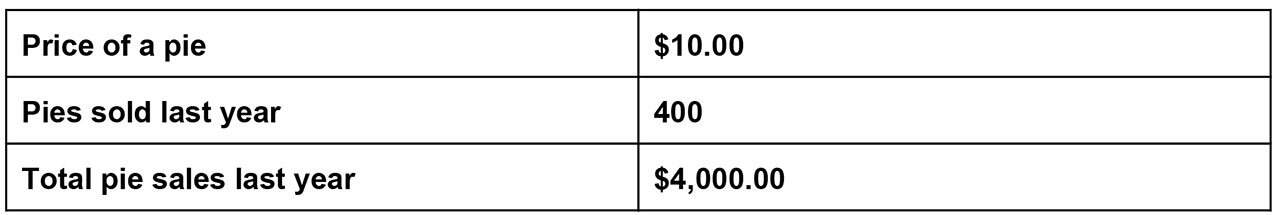

In the home stretch of the cost benefit analysis, you’ll be looking at the results of your work and forming the basis to make your decision. 1. Perform Sensitivity Analysis Dr. Kaplan recommends performing a sensitivity analysis (also known as a “what-if”) to predict outcomes and check accuracy in the face of a collection of variables. “Information on costs, benefits, and risks is rarely known with certainty, especially when one looks to the future,” Dr. Kaplan says. “This makes it essential that sensitivity analysis is carried out, testing the robustness of the CBA result to changes in some of the key numbers.” EXAMPLE of Sensitivity Analysis In trying to understand how customer traffic impacts sales in Bob’s Pie Shop, in which sales are a function of both price and volume of transactions, let’s look at some sales figures:

Bob has determined that a 10% increase in store traffic will boost his pie sales by 5%. This allows Bob to build the following sensitivity analysis, based upon his sales of 400 pies last year, that demonstrates that his pie sales are significantly impacted by fluctuations or growth in store traffic:

2. Consider Discount Rates When evaluating your findings, it’s important to take discount rates into consideration when determining project feasibility.

- Social discount rates – Used to determine the value to funds spent on government projects (education, transportation, etc.)

- Hurdle rates – The minimum return on investment required by investors or stakeholders

- Annual effective discount rates – Based on a percentage of the end-of-year balance, the amount of interest paid or earned

Here is a template where you can make your Cost Benefit Analysis

Download Simple Cost Benefit Analysis Template

Microsoft Excel | Smartsheet

3. Use Discount Rates to Determine Course of Action After determining the appropriate discount rate, look at the change in results as you both increase and decrease the rate:

- Positive - If both increasing and decreasing the rate yields a positive result, the policy or initiative is financially viable.

- Negative - If both increasing and decreasing the rate yields a negative result, revisit your calculations based upon adjusting to a zero-balance point, and evaluate using the new findings.

Based upon these results, you will now be able to make a clear recommendation, grounded in realistic data projections.

The Risks and Uncertainties of Cost Benefit Analysis

Despite its usefulness, cost benefit analysis has several associated risks and uncertainties that are important to note. These risks and uncertainties can result from human agendas, inaccuracies around data utilized, and the use of heuristics to reach conclusions. Know the Risks Much of the risk involved with cost benefit analysis can be correlated to the human elements involved. Stakeholders or interested parties may try to influence results by over- or understating costs. In some cases, supporters of a project may insert a personal or organizational bias into the analysis. On the data side, there can be a tendency to rely too much on data compiled from previous projects. This may inadvertently yield results that don’t directly apply to the situation being considered. Since data leveraged from an earlier analysis may not directly apply to the circumstances at hand, this may yield results that are not consistent with the requirements of the situation being considered. Using heuristics to assess the dollar value of intangibles may provide quick, “ballpark-type” information, but it can also result in errors that produce an inaccurate picture of costs that can invalidate findings. In addressing risk, it’s sometimes helpful to utilize probability theory to identify and examine key patterns that can influence the outcome. Uncertainties There are several “wild-card” issues that can influence the results of any cost benefit analysis, and while they won’t apply in every situation, it’s important to keep them in mind as you work:

- Accuracy affects value – Inaccurate cost and benefit information can diminish findings around value.

- Don’t rely on intuition – Always research benefits and costs thoroughly to gather concrete data—regardless of your level of expertise with the subject at hand.

- Cash is unpredictable – Revenue and cash flow are moving targets, experiencing peaks and valleys, and translating them into meaningful data for analysis can be challenging.

- Income influences decisions – Income level can drive a customer’s ability or willingness to make purchases.

- Money isn’t everything – Some benefits cannot be directly reflected in dollar amounts.

- Value is subjective – The value of intangibles can always be subject to interpretation.

- Don’t automatically double up – When measuring a project in multiple ways, be mindful that doubling benefits or costs can results in inconsistent results.

Controversial Aspects When thinking about the most controversial aspects of cost benefit analysis, all paths seem to lead to intangibles. Concepts and things that are difficult to quantify, such as human life, brand equity, the environment, and customer loyalty can be difficult to map directly to costs or value. With respect to intangibles, Dr. Kaplan suggests that using the cost benefit analysis process to drive more critical thinking around all aspects of value—perceived and concrete—can be beneficial outcomes. “[Cost benefit analysis] assumes that a monetary value can be placed on all the costs and benefits of a program, including tangible and intangible returns. ...As such, a major advantage of cost-benefit analysis lies in forcing people to explicitly and systematically consider the various factors which should influence strategic choice,” he says.

Cost Benefit Analysis in the Real World

Extending Transport Options in Seattle

Originally built for the 1962 World’s Fair, the Seattle monorail runs between the Seattle Center and the city’s downtown area. Several times over the past 50+ years, the city has considered extending monorail service to key areas in order to provide more transport options for residents. The following is an excerpt from a cost benefit analysis performed by DJM Consulting and ECONorthwest on behalf of the Elevated Transportation Company to assess an expansion project. Costs The estimated costs for constructing and operating the monorail are $1.68 billion (in 2002 dollars). This includes a total capital cost of $1.26 billion and a total discounted stream of operating costs of $420 million (at approximately $29 million a year), using the same discount rate (7.95%). Operating costs were discounted over a span of 22 years, from 2008 through 2029. Benefits

Benefit type Benefit value (millions, 2002$) Value of travel time savings $77.1 Parking savings 28.7 Reduced auto operating/ownership costs 11.2 Reliability 7.7 Road capacity for drivers 4.6 Reduction in bus-related accidents 3.7 Reduction in auto-related accidents 2.6 2020 Benefits $135.6

Benefits accrue for 23 years from 2007 through 2029. A discount rate of 7.95% was used to estimate the total benefits, in 2002 dollars. The net benefits were evaluated to be $2,067,263,000. Analysis

- Net present value B-C = $390,164,000

- Benefit-cost ratio B/C = 1.23

- Nominal rate of return = 7.95%

Sensitivity Analysis A team of outside engineers and contractors determined that there is a 60% chance the monorail project would come in at or under budget and a 90% chance the project will come in under 1.15 times the budget. The travel demand forecasters included a 10% range around their estimate of future monorail ridership. For the case where the costs are low and the benefits are high, a 9.9% return is expected. For the case where the costs are higher than expected and the benefits are lower, a 5.2% return is expected. Read the full analysis here . Solid Waste Reduction in California California's Department of Resources Recycling and Recovery’s mission is to help state residents achieve the highest waste reduction, recycling and reuse goals in the U.S. The following is an excerpt from a cost benefit analysis performed in 1997 to compare the costs of Cardiovascular Group’s (CVG) solid waste reduction program to its economic benefits. Costs According to the Environmental Manager, one employee spends eight hours per day on recycling duties. This employee is paid an average of $5.50 per hour. The Environmental Manager spends an estimated 5% of his time ($100,000/per year compensation) directing the solid waste reduction program. Utilizing this cost data, the calculations below demonstrate that CVG spent an estimated $16,440 in 1997 on its solid waste reduction program: (1 Employee) X ($5.50/hr.) X (8 hrs./day) X (260 work days/year) = $11,440 per year + 5%(100,000) = $16,440 per year Benefits 1995 Disposal cost reductions (1989 Baseline disposal costs – 1995 disposal costs) = $99,190 - $26,800 = $72,390 1996 Disposal cost reductions (1989 Baseline disposal costs – 1996 disposal costs) = $99,190 - $33,850 = $65,340 Average Annual Disposal Cost Reduction (DCR) (1995 DCR + 1996 DCR)/ 2 = ($72,390 + $65,340)/2 = $68,865 Analysis

- Nominal Rate of Return = 7.95%

From these data, it is clear that CVG has benefited economically from its solid waste reduction programs. Average annual costs amounted to $16,440 per year, while benefits equaled $1,308,865 per year. Therefore, net savings from CVG’s solid waste reduction program amounted to $1,292,425 per year.

Discover a Better Way to Manage Your Finance Operations

Befähigen Sie Ihr Team, über sich selbst hinauszuwachsen – mit einer flexiblen Plattform, die auf seine Bedürfnisse zugeschnitten ist und sich anpasst, wenn sich die Bedürfnisse ändern. Mit der Plattform von Smartsheet ist es einfach, Arbeiten von überall zu planen, zu erfassen, zu verwalten und darüber zu berichten. So helfen Sie Ihrem Team, effektiver zu sein und mehr zu schaffen. Sie können über die Schlüsselmetriken Bericht erstatten und erhalten Echtzeit-Einblicke in laufende Arbeiten durch Rollup-Berichte, Dashboards und automatisierte Workflows, mit denen Ihr Team stets miteinander verbunden und informiert ist. Es ist erstaunlich, wie viel mehr Teams in der gleichen Zeit erledigen können, wenn sie ein klares Bild von der geleisteten Arbeit haben. Testen Sie Smartsheet gleich heute kostenlos.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Kantata SX Knowledge has migrated, please visit sx.customers.kantata.com if you have a portal login or sx.knowledge.kantata.com for public knowledge articles

20-Nov-2023 • Knowledge

Information, related links.

- What-If Key Feature Video

- SX Fundamentals Webinar: What-If, Managing cost and FX rate changes automatically in Kantata SX

- Enhanced What-If Scenarios (1.36+)

Assignment Cost Basis What-If Scenarios

- Assignment Cost Exchange Rate What-If Scenario The Assignment cost changes because the Exchange Rate changes between the Resource’s currency and the Engagement’s operating currency.

- Assignment Cost Basis What-If Scenario The Assignment cost changes because the assigned Resource’s cost changes, for example if the Resource was due a new effective Rate Card or if they are promoted or otherwise change grades.

- Update your Exchange Rates (See Managing Currencies and Exchange Rates )

- Run the Assignment Cost Exchange Rate What-If Scenario

- Run the Assignment Cost-Basis What-If Scenario

Worked Spreadsheet Examples

Assignment cost basis.

- Resource Cost

- Resource Currency

- Base Currency is the Currency of the Proposal, used as the display currency for the Engagement Dashboard as well as for the currency of the costs on Activity Assignments and Cost Milestones.

- When a Resource is assigned to the Assignment, Kantata SX takes all known Exchange Rates and their Effective Dates between Supplier/Resource and Base Currencies and stamps them against the Assignment. This may mean that multiple Exchange Rates apply to different portions of the Assignment.

- Usage on the Assignment

Assignment Cost Basis Calculation

- Maintain the standard cost directly on the Resource record. Note that the Standard Cost field cannot be edited when using Rate Cards.

- maintain a cost on the Resource record using a Rate Card combination (see Rate Card Management ) .

- RateCard (Cost is calculated from an Assignment Rate Card lookup) Used where your Org defines the Cost Rate based on a Rate Card using attributes of the Assignment, with no reference to the Resource record.

- NoCost (Assignment is created with 0 Cost - running an Assignment Cost Basis What-If Calculation will not impact NoCost Assignments)

ResourceType

- the Resource's Supplier Invoicing Currency (if set), or if not set:

- the Currency set on the Resource

- Gets all Resource Cost Rate changes from the earliest Unlocked Period (see Time Adjustment in a Closed Period )

- the Assignment Supplier Invoicing Currency Code

- Stores Resource Cost Rates in the Resource's Currency Code. Where the Resource’s Currency Code differs from the Supplier Invoicing Currency, Kantata SX performs a real-time exchange rate conversion (using the most up-to-date rates on the most recent date that a Resource was Assigned on the Assignment).

- Stores Resource Cost Rate changes that are set with future effective dates at the point of Assignment Creation, which can result in several rates with effective dates

- Sets the default Cost Rate field on the Assignment to be the Cost Rate effective at the Assignment Start Date. This is stored in the Base Currency, so a real-time currency conversion will apply (using the most recent up-to-date rates on the most recent date that a Resource was Assigned on the Assignment) where the Base Currency and Supplier Invoicing Currency are different.

Assignment Cost Basis What-If Scenario

- Assignments are not Lost

- Where the Cost Behaviour Rule is set to Accept Cost Changes = Manual

- The Assignment End Date exceeds the what if date i.e. some part of the Assignment is after the what if date

Assignment Cost Basis What-If Scenario Calculation

- Gets and applies the Assignment Cost Basis and new Costs from the What-If Date.

- Calculates Assignment Costs using previously stored Exchange Rates (see Assignment Cost Basis Calculation ).

Assignment Cost Basis Exchange Rates What-If Scenario

Assignment cost basis exchange rates what-if scenario calculation.

- Gets the latest known Kantata SX Exchange Rates from the Base Currency to the Assignment Supplier Invoicing Currency and stores this on the Assignment. These are the exchanges rates that will be used for all future cost currency conversions until an AssignmentWhatIfExchangeRate is run for the assignment. See Managing Currencies and Exchange Rates for more on Kantata SX Exchange Rates)

- Multiplies each of the Assignment Cost Basis costs by each of the Assignment Cost Basis Exchange Rates to produce a list of Assignment Costs in the Base Currency over time.

- Calculates Assignment Total Cost: Assignment Total Cost = Sum Of the cost on each day of the Assignment, calculated by multiplying Forecast Time on the Assignment on the day multiplied by the effective Cost Rate on the day. Where Actual Time exists on the day then the Actual Cost Field on the Time Entry is used, catering for Actual Time recorded against different Rate Bands (e.g. overtime).

Purdue Online Writing Lab Purdue OWL® College of Liberal Arts

Welcome to the Purdue Online Writing Lab

Welcome to the Purdue OWL

This page is brought to you by the OWL at Purdue University. When printing this page, you must include the entire legal notice.

Copyright ©1995-2018 by The Writing Lab & The OWL at Purdue and Purdue University. All rights reserved. This material may not be published, reproduced, broadcast, rewritten, or redistributed without permission. Use of this site constitutes acceptance of our terms and conditions of fair use.

The Online Writing Lab at Purdue University houses writing resources and instructional material, and we provide these as a free service of the Writing Lab at Purdue. Students, members of the community, and users worldwide will find information to assist with many writing projects. Teachers and trainers may use this material for in-class and out-of-class instruction.

The Purdue On-Campus Writing Lab and Purdue Online Writing Lab assist clients in their development as writers—no matter what their skill level—with on-campus consultations, online participation, and community engagement. The Purdue Writing Lab serves the Purdue, West Lafayette, campus and coordinates with local literacy initiatives. The Purdue OWL offers global support through online reference materials and services.

A Message From the Assistant Director of Content Development

The Purdue OWL® is committed to supporting students, instructors, and writers by offering a wide range of resources that are developed and revised with them in mind. To do this, the OWL team is always exploring possibilties for a better design, allowing accessibility and user experience to guide our process. As the OWL undergoes some changes, we welcome your feedback and suggestions by email at any time.

Please don't hesitate to contact us via our contact page if you have any questions or comments.

All the best,

Social Media

Facebook twitter.

- Using Manufacturing

Defining Work Order Material Availability Rules: Worked Example