Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Data Descriptor

- Open access

- Published: 24 June 2023

Comprehensive green growth indicators across countries and territories

- Samuel Asumadu Sarkodie ORCID: orcid.org/0000-0001-5035-5983 1 ,

- Phebe Asantewaa Owusu 1 &

- John Taden ORCID: orcid.org/0000-0002-3038-1831 2

Scientific Data volume 10 , Article number: 413 ( 2023 ) Cite this article

7837 Accesses

3 Altmetric

Metrics details

- Environmental economics

- Interdisciplinary studies

- Sustainability

A sustainable transition to green growth is crucial for climate change adaptation and mitigation. However, the lack of clear and consistent definitions and common measures for green growth implies a disagreement on its determinants which hampers the ability to proffer valuable guidance to policymakers. We contribute to the global debate on green economic development by constructing green growth measures from 1990 to 2021 across 203 countries. The pillars of green growth are anchored on five dimensions namely natural resource base, socio-economic outcomes, environmental productivity, environmental-related policy responses, and quality of life. Contrary to the aggregated methods used in constructing indices in the extant literature, we employ a novel summary index technique with generalized least squares attributed-standardized-weighted index that controls for highly correlated variables and missing values. The constructed indicators can be used for both country-specific and global data modeling on green economic development useful for policy formulation.

Similar content being viewed by others

Green finance, renewable energy development, and climate change: evidence from regions of China

Shades of green growth scepticism among climate policy researchers

Perceptions of degrowth in the European Parliament

Background & summary.

Policies to promote green growth should be anchored on thorough knowledge and understanding of the concept. Likewise, tools to monitor green growth must have a reliable and comprehensive framework upon which progress can be recorded and compared across multiple entities. Yet, no two studies have a common measure or definition of green growth despite its widespread application in the scholarly and public policy discourse 1 . Not only does the lack of a common green growth measure stifle policymaking but also, hinders investments in its success 2 . The discourse on green growth is fairly new within international institutional development programs. As a multilateral agenda, green growth was first adopted in 2005 by 52 Asia-Pacific countries at Seoul’s 5 th Ministerial Conference on Environment and Development (MCED). The UN Economic and Social Commission for Asia and the Pacific (UNESCAP) then described the concept as a focus on sustained economic progress driven by environmental sustainability while improving low-carbon society and socially inclusive development (UNDESA, 2012, p. 35). The OECD in 2009 defined the term as achieving sustained economic development while reducing the negative environmental externalities including climate change, loss of biodiversity, and natural resource exploitation 3 . The organization also became the first to provide a cross-country ranking and comparative framework of green growth indicators for its industrialized economies in 2011 4 . The UN Environment Program (UNEP), under Towards Green Growth: Monitoring Progress program, also presented its first set of indicators in 2011. Per its definition, green economic growth improves well-being and social justice while reducing environmental risks and ecological footprint 5 . This infers that achieving green economic growth should prioritize green innovation, decarbonization, green trade, resource efficiency, and social inclusion 6 . Other international bodies such as the Global Green Growth Institute (GGGI), European Commission, and World Bank have all since proffered their definitions of the concept. In the wake of the discrepancies and unwieldy growth of the discourse surrounding green growth, the World Bank, UNIDO, OECD, and UNEP created the Green Growth Knowledge Platform (GGKP) in 2012. The GGKP is entrusted with the responsibility of collaboratively generating, managing, and sharing knowledge and data on green growth 7 . The GGGI produced the green growth index in 2019 aimed at preparing a measure that will enhance efforts to track the implementation of the Aichi Biodiversity Targets, Paris Accord, and SDGs 8 . At a country level, South Korea is widely recognized as the first to incorporate a comprehensive national strategy of green growth into its development plan in 2008 9 . Today, myriad countries across the globe have adopted various strategies to achieve green growth, even outside the frameworks of the SDGs and the Paris Climate Accord. Noticeably, developing countries such as Rwanda, Ethiopia, Vietnam, and Morocco have recently been commended for their track records on the incorporation of green growth into national development programs 10 .

In light of the growing adoption of green growth development into national development plans, researchers have recently focused on assessing performances and prospects of a green future across countries, but mostly relying on varied measures of the concept. For example, Houssini and Geng 10 assessed Morocco’s green growth performance between 2000 and 2018 using a self-derived green growth measure developed with a data envelopment (D.E) analysis technique. The assessment proceeded to score Morocco positively on several variables, commending the government on its conscious effort to promote green growth. Wang and Shao 11 developed the “Hybrid Global ML Index” to assess the effect of formal and informal national green growth performance among G20 economies. The study found that most countries in the G20 have achieved green growth benchmarks in the entire sample period, except from 2008 to 2009 11 . Several other studies used D.E analysis techniques but derived different green growth measures even when applied to the same units of analysis 12 , 13 , 14 , 15 , 16 . In related studies, Acosta, et al . 8 assessed and ranked 115 countries in 2019 after using composite (C.O) analysis to develop a green growth index that strayed significantly from what its member partners such as the OECD and the UNEP historically relied upon. Their measure particularly paid attention to the inclusivity of green growth by being one of the first and only known two [with Kararach et al . 17 ] to incorporate a gender dimension into the impacts of green growth policies. Though, using C.O analysis, other researchers 2 , however, arrived at measures that capture different sets of indicators for the same or different countries in their analyses.

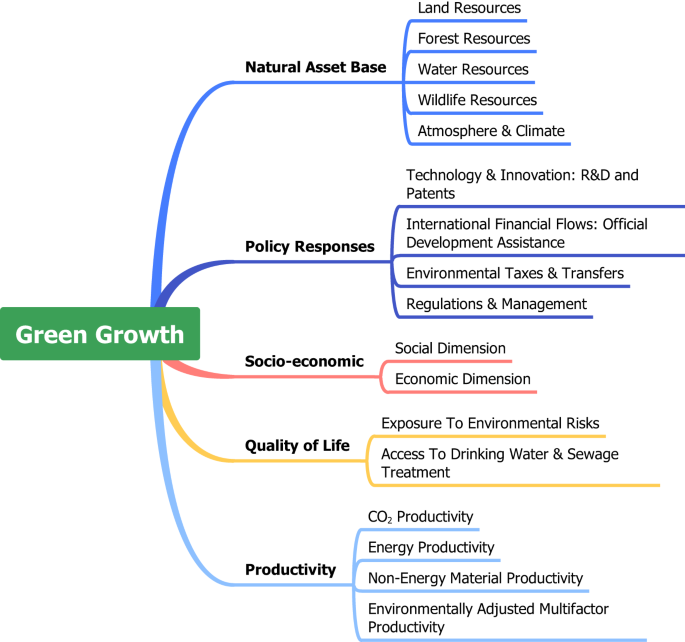

Patently, the lack of clear and consistent definitions and common measures for green growth imperils attempts to compare findings across multiple studies 1 , discourages investments in its success 2 , and forces the “comparison of apples to oranges” when analyzing the extant literature 1 . Likewise, the lack of a common understanding of the meaning of green growth and the utilization of myriad varying sets of indicators implies a lack of agreement on its determinants 2 , which hampers the ability to proffer valuable guidance to policymakers. In this study, we propose a new set of green growth indicators that is founded on a thorough assessment of a wider range of factors contributing to green growth. Theoretically, we portend that the dynamic shift from brown to green growth entails strategic multifaceted actions that are informed by economic endowments, political choices, socio-economic capabilities, and environmental outcomes. Accordingly, we define green growth as a sustained economic development approach decoupled from negative environmental consequences but thrives on eco-technological efficiency, reduces poverty, and increases social inclusion. Empirically, we construct green growth measures whose pillars are anchored on the five dimensions of (i) natural asset base, (ii) policy responses, (iii) socio-economic outcomes, (iv) quality of life, and (v) environmental productivity (see Fig. 1 ). Contrary to the aggregated methods used in constructing indices, we employ a novel summary index technique with generalized least squares attributed-standardized-weighted index that control for highly correlated variables and missing values.

Dimensions of green growth. Data source: OECD ( https://buff.ly/43cKbKU ).

We analyze the frameworks and several indicators adopted by existing studies measuring green growth. For brevity, we analyze the indicators in light of our theoretical and empirical framework. Our empirical framework covers the dimensions of (i) natural asset base, (ii) policy responses, (iii) socio-economic outcomes, (iv) quality of life, and (v) environmental productivity (Fig. 1 ). To the best of our knowledge, these dimensions subsume the differing frameworks in the extant literature and, thus, allow us to review and analyze the individual indicators espoused in most studies. While not all studies in the extant literature are analyzed, Tables 1 , 2 describe all known studies, their measurement frameworks, and other applications.

Natural asset base

Natural resources are central to the purpose of all green growth or sustainable development initiatives under the Aichi Biodiversity Targets, Paris Climate Accord, and SDGs 8 . The Green Growth Performance Measurement (GGPM) Program, for instance, developed in 2019 utilizes data from 115 countries and relies on 36 sampled indicators categorized under four dimensions. The dimensions include sustainable and efficient resource utilization, economic opportunities, natural capital protection, and social inclusion. Within the dimension of natural capital protection, for example, the authors discussed 12 indicators that reflect components such as the proportion of forests, biodiversity cover, and marine protected areas. However, the authors also incorporated measures such as the share of non-carbon agricultural emissions, mean annual air pollution, and the level of recreation and tourism in marine areas. By this calibration, the authors developed factors such as ecosystem, environmental quality, GHG reductions, and the cultural value of resources useful in measuring green growth under natural capital protection.

To design a novel tool to measure the complete impacts of green growth policies, Kim et al . 4 synthesized a pool of 78 indicators in the extant literature down to what they describe as the 30 core and the 12 international indicators pertinent to assessing and comparing green growth across countries. Among the final 12 international indicators, two were used to measure the natural capital assets and environmental quality dimension which are: the inverse of domestic material consumption and the share of forest coverage per total land size. The authors’ omission of other non-forest resources in measuring natural capital is puzzling—as they offer no theoretical justification for the decision. However, the authors admit that by placing more weight on forest resources, the measure unfairly punishes countries with low forest cover such as Iceland. Baniya, et al . 18 utilized six indicators to analyze green growth in Bangladesh and Nepal from 1985 to 2016—and to project its 2030 prospects in both countries. Natural capital was measured using the share of land with forest coverage. The authors argued that the six indicators chosen for analyses are the most frequently used in the extant literature from the OECD (2017) framework. However, similar to Kim et al . 4 , the omission of indicators capturing non-forest resources poses a challenge to the generalizability of the final measure of green growth.

Kararach, et al . 17 developed the African Green Growth Index using data from 22 African countries. They featured 48 indicators representing five different dimensions including, socioeconomic context, productivity of resources and environment, natural asset base monitoring, gender, and governance. While natural assets include the usual measures of forests, land, agriculture, water, and aquatic resources, they also incorporated a disaster risk component. This measure tracks all disaster events from 1900 to 2014 and the population affected by disasters. Nonetheless, attempts to derive variables as far back as 1900 meant that the authors had to statistically impute a significant portion of the missing data, which admittedly leads to model uncertainties and affects the accuracy 17 . Inspired by the need to design a green growth index that accounts for the connection among society, economy, and nature, Li, et al . 19 employed factor analysis to design an inclusive green growth indicator covering four unique dimensions, viz. social inclusion, economic security, resource use, and sustainability. However, the design failed to provide a stand-alone measure for natural capital. Instead, the authors created a resource use dimension that is measured by a derivation of energy consumption and variables of natural capital including arable land holdings, forest cover, land yield efficiency, and freshwater resources.

Environmental productivity

The productivity dimension of green growth entails the efficient ways by which economic growth is decoupled from resource use. An existing study focused on both ecosystem services and the productive use of resources such as energy, water, and land 8 . The authors reinforced this dimension with eight indicators ranging from measures such as the share of primary energy provision to GDP to total material footprint per capita. Kim, et al . 4 dedicated two of the five dimensions of their framework to measuring productivity. The first dimension labeled as environmental efficiency of production is proxied by two indicators namely GHG emissions per GDP as well as the share of GDP from services. The second dimension labeled as environmental efficiency of consumption is proxied by three indicators including energy utilization per GDP, the share of renewable energy consumed, and withdrawal of both surface and groundwater out of total available water. The authors argued that their framework aligns with that of the OECD and purposely adopts the growth-accounting approach to reach a broader context of global decision-making. However, this also implies that unique country characteristics of certain measures are glossed over for the sake of generalizability. Similarly, four of the six indicators that constitute Baniya, et al .’s 18 framework have productivity connotations. These include the productivity of carbon, energy, materials, and the share of renewables. The authors, however, do not account for other crucial dimensions seen in other studies such as policy responses, quality of life, and social inclusion.

Socio-economic dimension

New and sustainable economic opportunities are crucial to the success of green growth strategies. Thus, some authors incorporated socio-economic variables of green growth into their frameworks. For instance, Acosta, et al . 8 employed a dimension termed green economic opportunities—that capture the share of economic opportunities that arise as investments shift from traditional activities to green sectors. They integrated this dimension with four indicators that capture environmental technology (i.e., number of patent publications), green employment, environmental goods exports, and net savings minus resource and pollution damages. On the other hand, Kararach, et al . 17 introduced an entire dimension for gender, into which seven different indicators are fed. They argued that green growth must be assessed by its impact on societal inequalities. However, it is unclear why such indicators (i.e., female HIV prevalence, female labor force, female literacy, parliamentary seats, and ministerial positions held by women) were used to measure the gender dimension. Li, et al . 19 argued that a green growth measure must quantitatively incorporate the themes of social equity, stability, and happiness. The authors provided an extensive set of indicators incorporated into the measure of social inclusion. However, unlike other studies that specifically addressed opportunities for women and minorities, Li, et al . 19 does not specify what constitutes fair opportunities and what specific group of people development must consciously cater for.

Quality of life

The quality-of-life dimension of green growth tracks individuals’ social well-being attributed to resources extracted for economic growth. The existing studies that incorporated aspects of quality of life conceptualize the measures with different but similar and overlapping terminologies. For example, Acosta, et al . 8 combined variables that track economic and social well-being into a single dimension described as social inclusion. They argued that inequality and poverty are directly affected by the availability of resources and crucial basic services. Conversely, people rely heavily on the environment such as forests, wildlife resources, and among other natural assets for livelihoods. They postulated that the social performance of green growth should be measured because sustained economic growth requires reduced inequality 8 . Consequently, they classified concepts such as “access to basic services and resources, gender balance, social equity, and social protection” under the social inclusion dimension. The authors supported this dimension with 12 indicators ranging from “access to safe drinking water and sanitation” to “proportion of urban population living in slums”. While theoretically cogent, this dimension does not distinguish traditional economic conditions such as income levels from social conditions or quality of life such as health. Kim et al . 4 measured the quality-of-life dimension with only one indicator, viz. the public transportation modal split. They justified the selection of this measure among other dimensions on a criterium of policy relevance, analytical soundness, and measurability.

Policy responses

The policy response dimension of green growth is represented in fewer studies. Although the OECD framework incorporates a policy response dimension, the Green Growth Index developed by Acosta, et al . 8 omits it. Among studies that justify the policy response dimension, Kim et al . 4 measured the response with four indicators: environmental expenditure, environmental patents, green ODA per GDP, and green R&D per government budget. While Kararach, et al . 17 does not incorporate a precise dimension for policy responses, they accentuated the distinct role of governance in their equation. Their “governance” dimension spells out four political indicators pertinent to measuring green growth. These indicators include “violence and/or terrorism, control of corruption, government effectiveness, political stability, rule of law, and regulatory quality”. Nonetheless, these variables primarily capture institutional quality and could have been complemented by other deliberate governmental efforts to promote green growth, such as eco-innovation R&D and environmental taxes.

Analysis of the literature

No two studies in the extant literature have the same or directly comparable measures of green growth 1 . From our review, no two studies have a common understanding of what set of indicators constitutes green growth or dimensions of green growth. In other scenarios, indicators used as proxies for one dimension in a study—for example, resource productivity—might be adopted as proxies for an entirely different dimension (such as economic opportunities) in another study. Consequently, their differential weightings in different dimensions imply they feature at different levels of importance in different studies. In such scenarios, comparing findings in the literature using these different measures might be tantamount to comparing apples to oranges 1 .

A few existing studies introduced distinct dimensions in their frameworks for various reasons. For instance, Li, et al . 19 utilized GDP as a measure of economic growth and termed as “economic prosperity”. They proceeded to introduce an economic prosperity dimension using indicators such as trade volumes, R&D expenditure, urbanization, and inflation in addition to GDP and GDP per capita. They argued that economic prosperity should be the primary criterion of green and inclusive growth, stating further that more focus must be placed on the growth, development, and stability potentials of the economy. Notably, these indicators were captured in different studies, even under different dimensions and for different conceptual purposes. Contrary to studies that employed C.O. analysis to measure green growth, a large share of the extant literature relies on D.E. analysis to derive the green growth index. Studies that used C.O. analysis adopted a range of diverse inputs. For instance, whereas Song, et al . 14 used labor and capital as inputs in their model, Cao, et al . 13 relied on capital, labor, technological innovation, and energy consumption. Tables 1 , 2 provide more information on the variability of datasets (used as inputs) and techniques in the existing studies.

Beyond studies utilizing C.O analysis and D.E techniques to measure green growth, a few other studies insist on simplifying the discourse further by adopting a single indicator out of the larger literature as a proxy for green growth. Accordingly, some researchers measure green growth using single indicators such as environmental and resource productivity 20 , carbon productivity 21 , and environmentally-adjusted-multifactor productivity 22 . In earnest, while these measures simplify analyses of green growth, they risk revealing only a portion of the picture. For instance, the use of carbon emissions as a sole indicator for green growth does not reveal any information beyond the pollution levels of the set of tools applied to achieving a certain level of growth 23 . Consequently, the contributions of other factors such as economic opportunities, policy responses, and resource protection to green growth are untenably omitted.

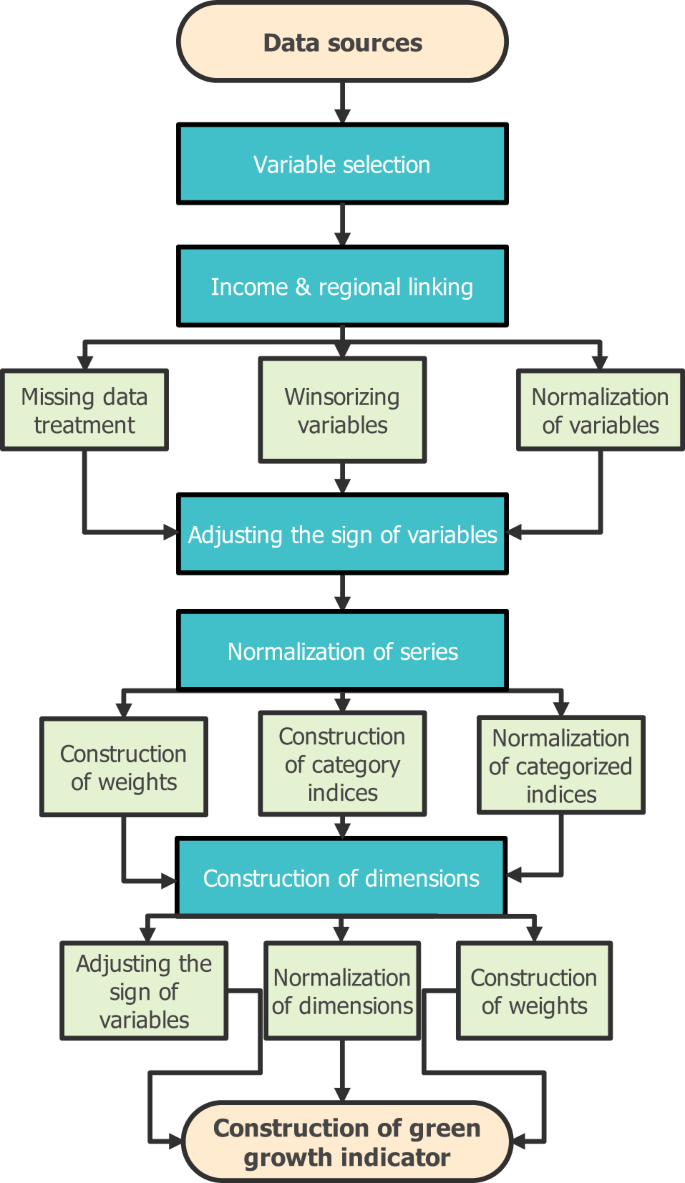

Index-making model

The schematic representation depicted in Fig. 2 shows the green growth index-making methodological structure used in this study. The steps include variable selection—used for categorization and classifying dimensions, income group & regional classifications, treatment of missing data, winsorization & normalization of data, adjusting the sign of variables where applicable, construction of weights, and construction of summary indices. While missing observations are often problematic in panel data, the estimation technique ignores missing outcomes (but also receives low weight) in creating new indices but utilizes all available data. Following the normalization procedure in developing the summary indicator, the technique further controls for missing data by fixing the values of the missing indicator to zero (0) — the mean of the reference group. This strategy further improves estimation efficiency by assigning lower weights to categories and dimensions with missing values 24 . The winsorizing technique entails generating new data by trimming 1 st and 99 th percentiles across countries and territories to treat extreme outliers 25 . Normalization \(\left[{\rm{norm}}=\left({y}_{i}-{y}_{min}\right)/\left({y}_{max}-{y}_{min}\right)\right]\) involves the generation of new data by normalization of scores ranging between 0 and 1 using the minimum ( y min ) and maximum ( y max ) observations while accounting for periodic data frequency across countries and territories. The summary index approach used to construct the green growth indicators can be expressed as 24 :

Where \({\bar{s}}_{i,j}\) is the constructed index (i.e., the outcomes can be categories, dimensions, and green growth indicators) with a weighted average W i,j . w j,k denotes the weight of the normalized output \([({y}_{i,j,k}-{\bar{y}}_{j,k})/{{\sigma }}_{j,k}^{y}]\) from inverse covariance matrix \({\widehat{\Sigma }}_{j}^{-1}\) , \({\widetilde{y}}_{i,j,k}\) is the inputs for individual i , indicators k , and country j . The normalized output is generated via effect sizes by dividing demeaned indicators \(({y}_{i,j,k}-{\bar{y}}_{j,k})\) by the standard deviation \({\sigma }_{j,k}^{y}\) of the reference group, whereas \({{\mathbb{K}}}_{i,j}\) represents non-missing outcomes for indicators k and country j . The summary index combines several variables into categories and several categories into dimensions and subsequently develops the green growth indicators. This test involves: (1) adjusting the sign of variables to indicate a better result, thus, a positive direction of the series always has positive consequences on the environment. (2) normalizing indicators into similar scales (3) constructing weights (4) constructing indices using weighted average and (5) normalizing indices. Thus, the winsorized and normalized dataset was classified into categories, dimensions, and green growth indicators. Contrary to the aggregated methods used in constructing indices 26 , the novel summary index technique with generalized least squares (GLS) attributed-standardized-weighted index used in this study controls for highly correlated variables and missing values.

Green growth index-making methodological structure.

Category indices of green growth

Our empirical assessment began with a panel-based descriptive statistical analysis of 152 raw data series spanning over 30 years. The descriptive statistical metrics led to the identification of several missing and extreme distributions requiring winsorizing. The winsorized and normalized dataset was classified into 18 category indices with a composition of the estimated weight of 152 variables. As the rule of the GLS summary index algorithm presented in Schwab, et al . 27 , highly-correlated variables were apportioned offsetting or small constructed weights whereas less-correlated or unique variables were apportioned higher constructed weights (Tables 3 , 4 ). Positive weights signify a higher contribution to the summary index whereas negative weights signify factors that decrease the summary index. For example, demand-based CO 2 emissions (CO2_DBEM) contribute the highest weight (1.447) to the summary emission index whereas production-based CO 2 emissions (CO2_PBEM) show the highest weight (−0.865) that negatively enter the summary emission productivity index (Table 3 ). Energy consumption in other sectors (NRGC_OTH) and biomass (DMC_BIO) contribute the highest weights (0.350 and 0.278, respectively) to the energy productivity and non-energy material productivity indices whereas environmentally-adjusted multifactor productivity growth (EAMFP_EAMFPG) and relative advantage in environment-related technology (GPAT_DE_RTA) have the lowest weights (0.280 and 0.124, respectively) in the multifactor productivity and patents summary indices. Similarly, marine protected areas (PA_MARINE), allocable ODA to the environment sector (ODA_ENVSEC), and Petrol tax (FTAX_DIE_S) are assigned larger weights (0.520, 0.312, and 0.548, respectively) for environmental regulations, taxes & transfer, and official development assistance summary indices while purchasing power parity (PPP), environmentally-related R&D expenditure (ENVRD_GDP), and welfare costs of premature mortalities from exposure to PM 2.5 (PM_SC) are assigned offsetting or small weights (−0.011, 0.079, and −1.859, respectively) for the economic dimension, environmental risks, and R&D summary indices. Besides, the population connected to public sewerage (ASEW_POP), permanent surface water (SW_PERMWAT), threatened vascular plant species (WLIFE_PL), and net migration (POP_NETMIGR) show the lowest weights (−0.144, −0.044, −0.025, and 0.070, respectively) assigned for the summary indices of access to drinking water & sanitation, water resources, wildlife resources, and social dimension (Table 4 ).

Constructing green growth Indicators

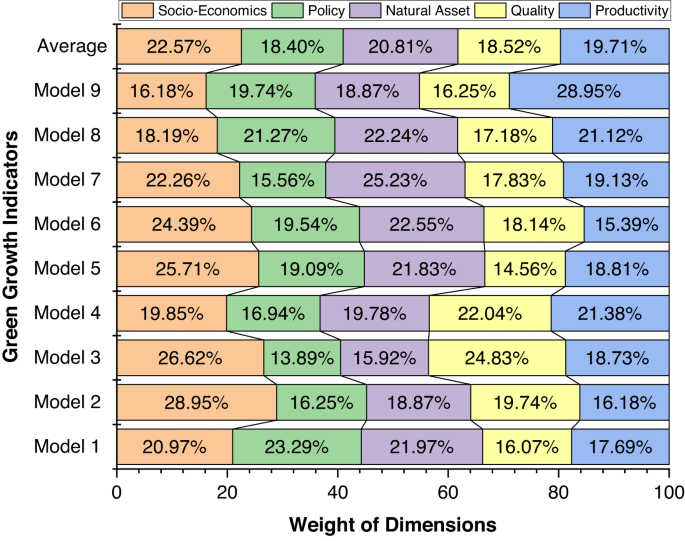

We constructed 10 green growth indicators (Models 1–10) using all five dimensions in Fig. 1 but with varying input characteristics for users to choose from. In Model 2, the characteristics of all five dimensions (i.e., environmental productivity, environmental quality, natural asset base, policy response, and socioeconomics) show better environmental performance. In Model 1, the characteristics of policy response, and socioeconomics dimensions show better environmental impacts but environmental productivity, environmental quality, and natural asset base worsen the environment. In Model 3, the characteristics of environmental quality, natural asset base, policy response, and socioeconomics improve the environment but environmental productivity declines environmental sustainability. In Model 4, the characteristics of environmental productivity, natural asset base, policy response, and socioeconomics improve the environment but the environmental quality dimension spurs environmental degradation. In Model 5, the characteristics of environmental productivity, environmental quality, policy response, and socioeconomics promote sustainable environment whereas natural asset base is detrimental to the environment. In Model 6, the characteristics of natural asset base, policy response, and socioeconomics reduces environmental degradation whereas environmental productivity and environmental quality increase pollution. In Model 7, environmental quality, policy response, and socioeconomics improve sustainability while environmental productivity and natural asset base hamper clean environment. In Model 8, environmental productivity, policy response, and socioeconomics decline environmental threats whereas environmental quality and natural asset base escalate environmental consequences. In Model 9, the characteristics of environmental productivity, environmental quality, natural asset base, policy response, and socioeconomics deteriorate the environment and thwart sustainable transition. Model 10 incorporates all conditions in Models 1–9 except that the average weights of all indicators was used for its construction.

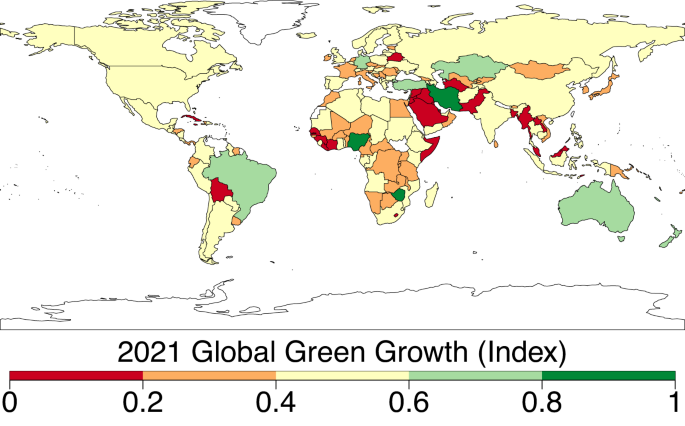

The negative characteristics of dimensions in Models 1–10 (used to construct the 10 green growth indicators) were determined using the flipping scenarios. The flipping scenarios used in calculating the ten green growth indicators are presented in Table 5 . The parenthesis (…%) denotes the percentage weight of dimensions (in Fig. 3 ) from the model used to construct green growth indicators. Model 1 covers the role of policy response (23.29%), natural asset base (21.97%), socioeconomics (20.97%), environmental productivity (17.69%), and environmental quality (16.07%) while altering the sign (i.e., flipping implies altering the sign to move in the opposite direction) of environmental productivity, environmental quality, and natural asset base. Model 2 captures socioeconomics (28.95%), environmental quality (19.74%), natural asset base (18.87%), policy response (16.25%), and environmental productivity (16.18%) with no flipping option. Model 3 comprises socioeconomics (26.62%), environmental quality (24.83%), environmental productivity (18.73%), natural asset base (15.92%), and policy response (13.89%) while altering the sign of environmental productivity. Model 4 encompasses environmental quality (22.04%), environmental productivity (21.38%), socioeconomics (19.85%), natural asset base (19.78%), and policy response (16.94%) while altering the sign of environmental quality. Model 5 includes socioeconomics (25.71%), natural asset base (21.83%), policy response (19.09%), environmental productivity (18.81%), and environmental quality (14.56%) while altering the sign of natural asset base. Model 6 captures socioeconomics (24.39%), natural asset base (22.55%), policy response (19.54%), environmental quality (18.14%), and environmental productivity (15.39%) while altering the sign of environmental productivity, and environmental quality. Model 7 entails natural asset base (25.23%), socioeconomics (22.26%), environmental productivity (19.13%), environmental quality (17.83%), and policy response (15.56%) while altering the sign of environmental productivity, and natural asset base. Model 8 covers natural asset base (22.24%), policy response (21.27%), environmental productivity (21.12%), socioeconomics (18.19%), and environmental quality (17.18%) while altering the sign of environmental quality, and natural asset base. Model 9 includes environmental productivity (28.95%), policy response (19.74%), natural asset base (18.87%), environmental quality (16.25%), and socioeconomics (16.18%) while altering the sign of socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity. Finally, the weight of dimensions used to construct green growth indicators reveals an average weight contribution (Model 10) of 22.57%, 20.81%, 19.71%, 18.52%, and 18.40% in the order of dimensions: socioeconomics > natural asset base > environmental productivity > environmental quality > policy response (Fig. 3 ). Figure 4 presents the optimal green growth index across countries for the period 2021. Score 0 implies economies have low performance in transitioning toward green growth whereas Score 1 infers countries have high performance toward green growth. The comparisons between countries for other green growth indicators are presented in Supplementary Fig. 1 .

Weight of dimensions used to construct green growth indicators. Legend: Model 1- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign (i.e., flipping implies altering the sign to move in the opposite direction) of environmental productivity, environmental quality, and natural asset base. Model 2- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity with no flipping. Model 3- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign of environmental productivity. Model 4- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign of environmental quality. Model 5- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign of natural asset base. Model 6- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign of environmental productivity and quality. Model 7- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign of environmental productivity, and natural asset base. Model 8- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign of environmental quality, and natural asset base. Model 9- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign of socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity. Model 10 (Average)- Comprise the average weight of socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity in Models 1–9.

Global distribution of green growth (Index, Reference year: 2021, Model 2). Legend: Score 0 implies low green growth performance whereas Score 1 infers high green growth performance. The optimal green growth indicator (i.e., Model 2) captures 28.95% weight of socioeconomics dimension, 19.74% weight of environmental quality, 18.87% weight of natural asset base, 16.25% weight of policy response, and 16.18% weight of environmental productivity.

Data Records

We employed 152 variables (“OriginalData.xlsx” 28 ) for 203 economies (see sampled countries with ISO3 code in Supplementary Table 1 ) based on the theoretical and empirical framework presented in Tables 1 , 2 and Fig. 1 while integrating the sustainable development goals. We collected our global dataset spanning the period from 1990 to 2021 from OECD 29 with an initial 16,184 observations. The data were sorted into 17 categories (see Fig. 2 ) namely emissions (12 variables), energy (12 variables), non-energy (10 variables), multifactor productivity (3 variables), environmental risks (11 variables), access (5 variables), water (10 variables), land (17 variables), forest (5 variables), wildlife (4 variables), temperature (1 variable), patents (4 variables), research & development [R&D] (5 variables), official development assistance [ODA] (9 variables), taxes (27 variables), regulations (2 variables), economic (10 variables), and social (5 variables) [see details of the 152 variables in Supplementary Table 2 ]. The 17 categories are subsequently classified into 5 dimensions, viz. natural assets (5 categories—water, land, forest, wildlife, and temperature), policy responses (5 categories—patents, R&D, ODA, taxes, and regulations), socio-economic (2 categories—social, and economic), quality of life (2 categories—environmental risks, and access), and environmental productivity (4 categories—emissions, energy, non-energy, and multifactor productivity). Finally, we use permutation and combination strategies detailed in subsequent sub-sections to construct 10 global indicators of green growth labeled as Model 1 (GreenGrowth1), Model 2 (GreenGrowth2), …, and Model 10 (GreenGrowth10). Table 6 shows the data description of constructed categories, dimensions, and green growth indicators—which are publicly available in the Figshare repository 28 .

Technical Validation

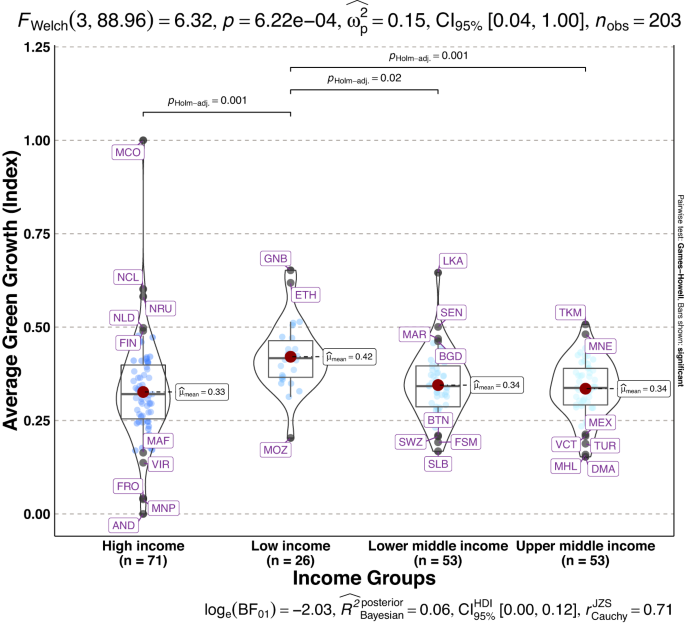

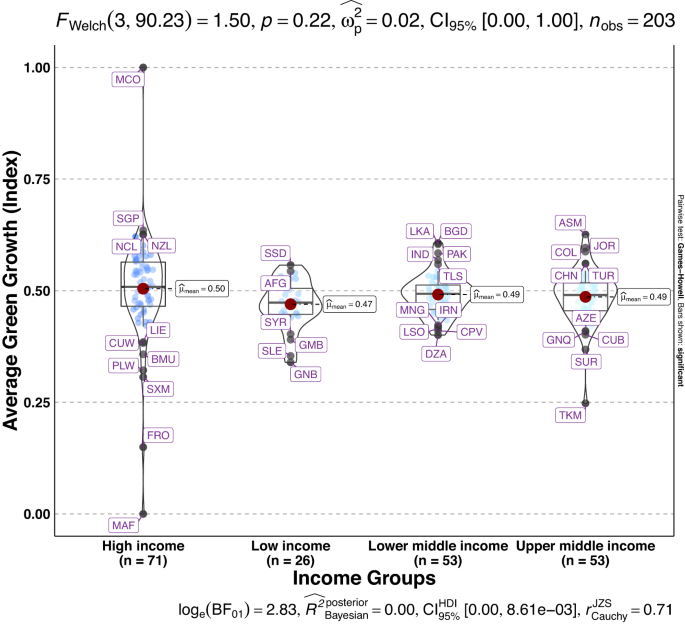

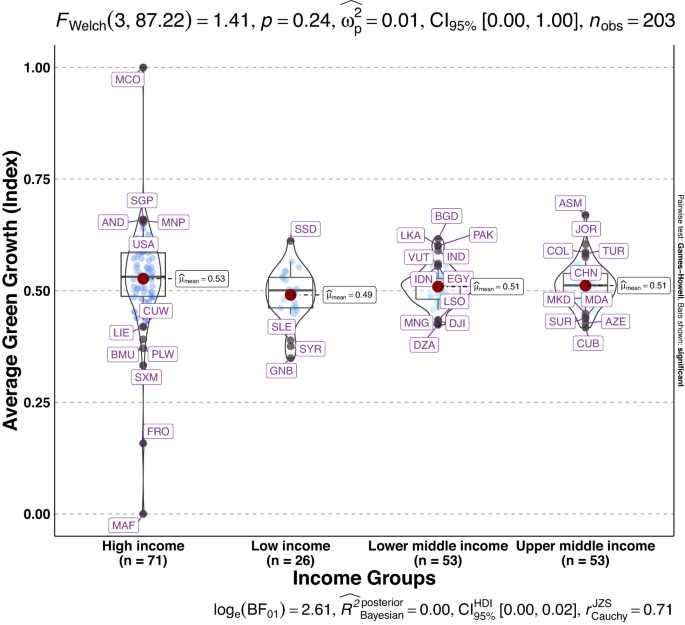

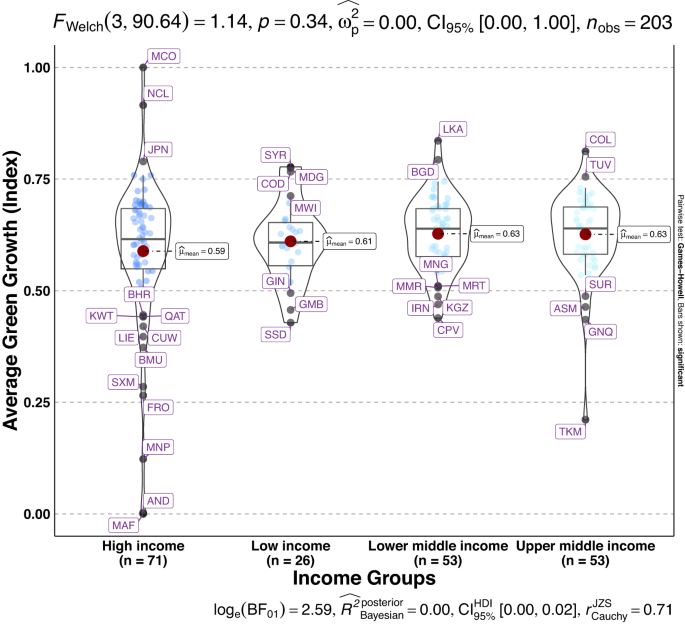

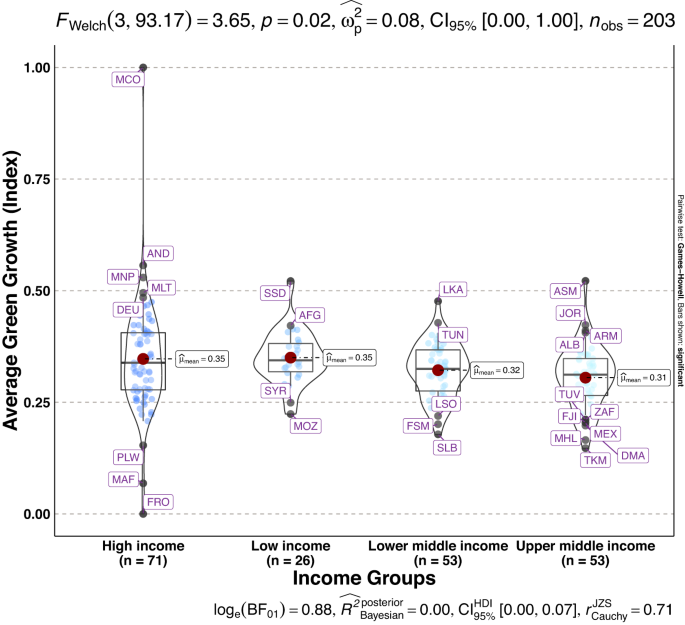

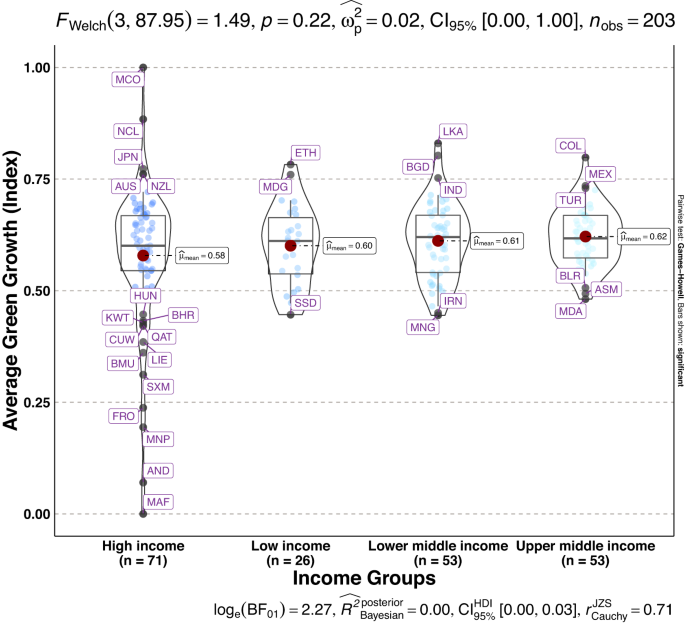

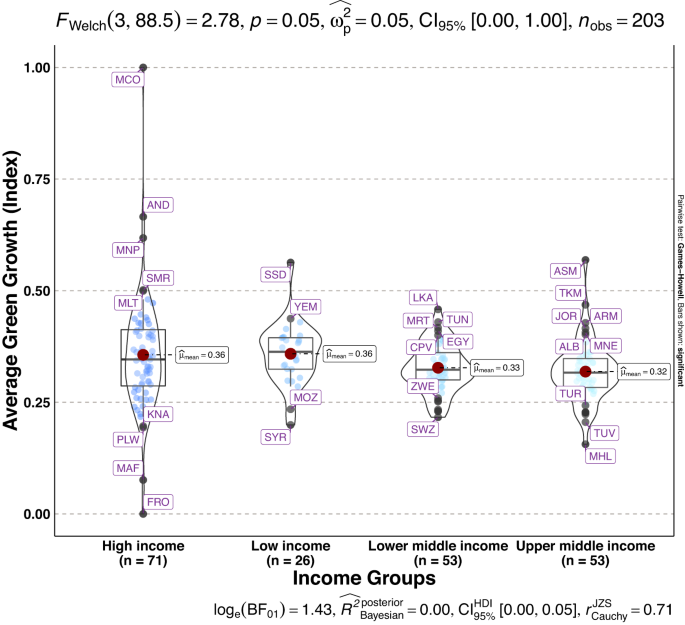

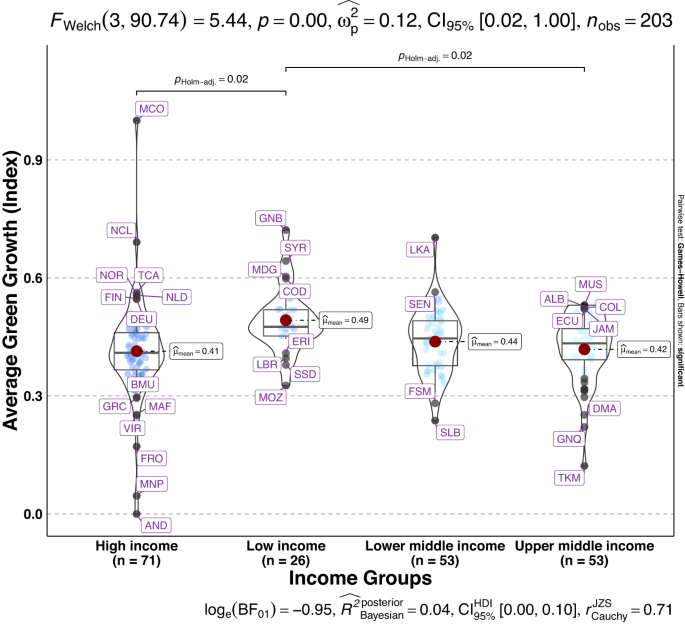

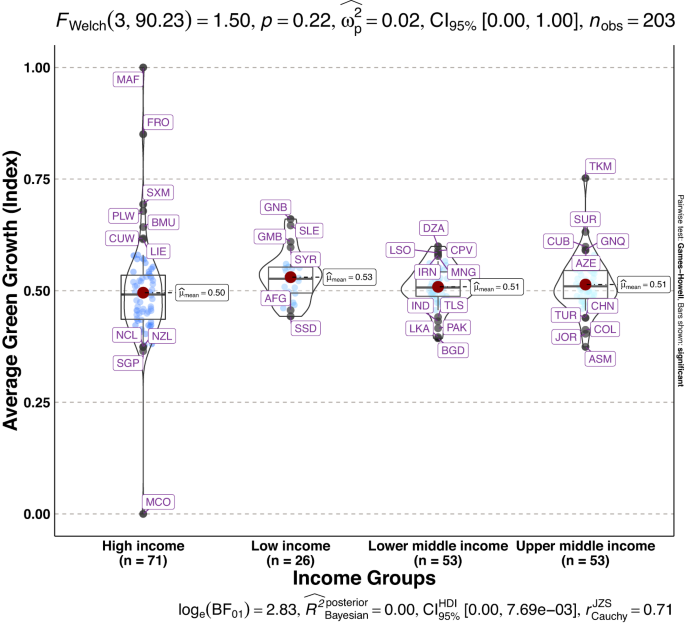

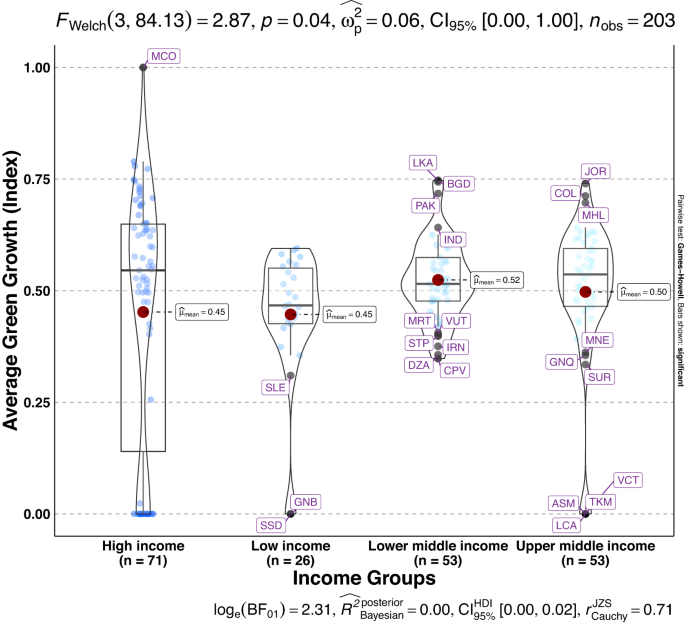

To validate the quality of the dataset, we employed permutation and combination scenarios to construct 9 green growth indicators aside from the optimal indicator (labeled as Model 2). We further used statistical distribution 30 to examine variations across income groups. The Games-Howell test shows that the pairwise distribution in Figs. 5 – 14 (excluding Figs. 5 , 12 ) is not significantly different across groups, however, the mean of the optimal green growth (Fig. 6 ) indicator across income groups is in the descending order of high-income > upper-middle-income > lower-middle-income > low-income. This order is consistent with the environmental Kuznets curve (EKC) hypothesis 31 which underscores improved environmental performance with rising income. Changes in the order across income groups in Figs. 5 – 14 (excluding Fig. 6 ) can be explained by the scenarios presented in Fig. 3 . Yet, all constructed green growth indicators are heterogeneous across countries and territories (Fig. 15 ).

Statistical distribution of green growth indicator (Model 1) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 2) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 3) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 4) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 5) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 6) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 7) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 8) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 9) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 10) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

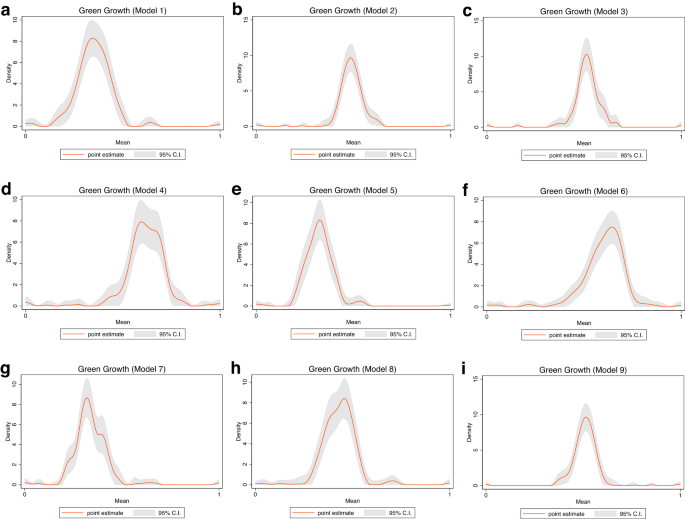

Panel heterogeneous effects of green growth indicators across economies ( a ) Model 1 ( b ) Model 2 ( c ) Model 3 ( d ) Model 4 ( e ) Model 5 ( f ) Model 6 ( g ) Model 7 ( h ) Model 8 ( i ) Model 9. Model 10 was ignored due to missing values with the function returning as an error.

Usage Notes

We developed 10 green growth indicators to examine the progress toward achieving a sustainable transition from a brown economy to a green economy. Each of the green growth indicators has underlying conditions and assumptions presented in Table 5 and Fig. 3 . However, Model 2 (GreenGrowth2) is the most optimal green growth indicator showing economies with high scores have better performance and sustainable transition to green economic development. Evidence from Fig. 15 shows that future research that employs our datasets for panel data modeling should control for heterogeneous effects across economies. The caveat: there may be an underestimation of the standard errors of constructed dimensions and indicators because the GLS-derived weights are inclusively estimated parameters.

Code availability

No custom code was used to generate or process the data described in the manuscript—however, we used the “swindex” package in Stata [Stata/SE 17.0 for Mac (Intel 64-bit)] software to execute the steps detailed in the Methods section.

Leth, N. E. The complications of measuring green growth: Current pitfalls, further developments, and impact on cross-country longitudinal analyses , Lund University (2022).

Ates, S. A. & Derinkuyu, K. Green growth and OECD countries: measurement of country performances through distance-based analysis (DBA). Environment, Development and Sustainability: A Multidisciplinary Approach to the Theory and Practice of Sustainable Development 23 , 15062–15073, https://doi.org/10.1007/s10668-021-01285-4 (2021).

Article Google Scholar

OECD. Declaration on Green Growth. (2009).

Kim, S. E., Kim, H. & Chae, Y. A new approach to measuring green growth: Application to the OECD and Korea. Futures Complete , 37–48, https://doi.org/10.1016/j.futures.2014.08.002 (2014).

UNEP. Towards a Green Economy Pathways to Sustainable Development and Poverty Eradication. UNEP - UN Environment Programme (2011).

UNEP. Green Economy and Trade: Trends, Challenges and Opportunities . (2013).

Green Growth Knowledge, P. About Us | Green Growth Knowledge Partnership. (2023).

Acosta, L. et al . Green growth index: Concepts, methods and applications. Report No. 5, (Global Green Growth Institute, Republic of Korea, 2019).

Kamal-Chaoui, L., Grazi, F., Joo, J. & Plouin, M. The Implementation of the Korean Green Growth Strategy in Urban Areas. (OECD, Paris, 2011).

Houssini, K. & Geng, Y. Measuring Morocco’s green growth performance. Environ. Sci. Pollut. Res. 29 , 1144–1154, https://doi.org/10.1007/s11356-021-15698-1 (2022).

Wang, X. & Shao, Q. Non-linear effects of heterogeneous environmental regulations on green growth in G20 countries: Evidence from panel threshold regression. Sci Total Environ 660 , 1346–1354, https://doi.org/10.1016/j.scitotenv.2019.01.094 (2019).

Article ADS CAS PubMed Google Scholar

Zhu, S. & Ye, A. Does foreign direct investment improve inclusive green growth? Empirical evidence from China. Economies 6 , 44 (2018).

Cao, Y., Liu, J., Yu, Y. & Wei, G. Impact of environmental regulation on green growth in China’s manufacturing industry-based on the Malmquist-Luenberger index and the system GMM model. Environ. Sci. Pollut. Res. 27 , 41928–41945 (2020).

Article CAS Google Scholar

Song, M., Zhu, S., Wang, J. & Zhao, J. Share green growth: Regional evaluation of green output performance in China. International Journal of Production Economics 219 , 152–163 (2020).

Sun, Y., Ding, W., Yang, Z., Yang, G. & Du, J. Measuring China’s regional inclusive green growth. Sci Total Environ 713 , 136367 (2020).

Qu, C., Shao, J. & Cheng, Z. Can embedding in global value chain drive green growth in China’s manufacturing industry? Journal of Cleaner Production 268 , 121962 (2020).

Kararach, G. et al . Reflections on the Green Growth Index for developing countries: A focus of selected African countries. Development Policy Review 36 , O432–O454, https://doi.org/10.1111/dpr.12265 (2018).

Baniya, B., Giurco, D. & Kelly, S. Green growth in Nepal and Bangladesh: Empirical analysis and future prospects. Energy Policy 149 , https://doi.org/10.1016/j.enpol.2020.112049 (2021).

Li, M., Zhang, Y., Fan, Z. & Chen, H. Evaluation and Research on the Level of Inclusive Green Growth in Asia-Pacific Region. Sustainability-Basel 13 , 7482, https://doi.org/10.3390/su13137482 (2021).

Fotros, M. H., Ferdosi, M. & Mehrpeyma, H. An examination of energy intensity and urbanization effect on environment degradation in Iran (a cointegration analysis). J. Environ. Stud. 37 , 13–22 (2012).

Google Scholar

Stoknes, P. E. & Rockström, J. Redefining green growth within planetary boundaries. Energy Research & Social Science 44 , 41–49, https://doi.org/10.1016/j.erss.2018.04.030 (2018).

Fernandes, C. I., Veiga, P. M., Ferreira, J. J. M. & Hughes, M. Green growth versus economic growth: Do sustainable technology transfer and innovations lead to an imperfect choice. Business Strategy and the Environment 30 , 2021–2037, https://doi.org/10.1002/bse.2730 (2021).

Sarkodie, S. A. The invisible hand and EKC hypothesis: what are the drivers of environmental degradation and pollution in Africa? Environ. Sci. Pollut. Res. 25 , 21993–22022, https://doi.org/10.1007/s11356-018-2347-x (2018).

Anderson, M. L. Multiple Inference and Gender Differences in the Effects of Early Intervention: A Reevaluation of the Abecedarian, Perry Preschool, and Early Training Projects. Journal of the American Statistical Association 103 , 1481–1495, https://doi.org/10.1198/016214508000000841 (2008).

Article MathSciNet CAS MATH Google Scholar

Barnett, V. & Lewis, T. Outliers in statistical data . Vol. 3 (Wiley New York, 1994).

Svirydzenka, K. Introducing a new broad-based index of financial development . (International Monetary Fund, 2016).

Schwab, B., Janzen, S., Magnan, N. P. & Thompson, W. M. Constructing a summary index using the standardized inverse-covariance weighted average of indicators. The Stata Journal 20 , 952–964 (2020).

Sarkodie, SA., Owusu, PA. & Taden, J. Comprehensive green growth indicators across countries and territories, figshare , https://doi.org/10.6084/m9.figshare.22291069.v2 (2023).

OECD. Green Growth Indicators https://stats.oecd.org/Index.aspx?DataSetCode=GREEN_GROWTH (2023).

Patil, I. Visualizations with statistical details: The’ggstatsplot’approach. Journal of Open Source Software 6 , 3167 (2021).

Article ADS Google Scholar

Sarkodie, S. A. & Strezov, V. A review on Environmental Kuznets Curve hypothesis using bibliometric and meta-analysis. Sci Total Environ 649 , 128–145, https://doi.org/10.1016/j.scitotenv.2018.08.276 (2019).

Huang, Y. & Quibria, M. G. Green growth: Theory and evidence. UNU-WIDER 2013/56 , 25 (2013).

Guo, L. L., Qu, Y. & Tseng, M.-L. The interaction effects of environmental regulation and technological innovation on regional green growth performance. Journal of Cleaner Production 162 , 894–902, https://doi.org/10.1016/j.jclepro.2017.05.210 (2017).

Jha, S., Sandhu, S. C. & Wachirapunyanont, R. Inclusive Green Growth Index: A New Benchmark for Quality of Growth . (Asian Development Bank, 2018).

Lee, C.-M. & Chou, H.-H. Green growth in taiwan — an application of the oecd green growth monitoring indicators. Singapore Econ. Rev. 63 , 249–274, https://doi.org/10.1142/S0217590817400100 (2018).

Šneiderienė, A., Viederytė, R. & Ābele, L. Green growth assessment discourse on evaluation indices in the European Union. Entrepreneurship and Sustainability Issues 8 , 360–369 (2020).

Gu, K., Dong, F., Sun, H. & Zhou, Y. How economic policy uncertainty processes impact on inclusive green growth in emerging industrialized countries: A case study of China. Journal of Cleaner Production 322 , 128963, https://doi.org/10.1016/j.jclepro.2021.128963 (2021).

Jadoon, I. A., Mumtaz, R., Sheikh, J., Ayub, U. & Tahir, M. The impact of green growth on financial stability. Journal of Financial Regulation and Compliance 29 , 533–560 (2021).

Liu, Z. et al . Inclusive Green Growth and Regional Disparities: Evidence from China. Sustainability-Basel 13 , 11651, https://doi.org/10.3390/su132111651 (2021).

Wu, Y. & Zhou, X. Research on the Efficiency of China’s Fiscal Expenditure Structure under the Goal of Inclusive Green Growth. Sustainability-Basel 13 , 9725, https://doi.org/10.3390/su13179725 (2021).

Zhang, X., Guo, W. & Bashir, M. B. Inclusive green growth and development of the high-quality tourism industry in China: The dependence on imports. Sustainable Production and Consumption 29 , 57–78, https://doi.org/10.1016/j.spc.2021.09.023 (2022).

Chen, G., Yang, Z. & Chen, S. Measurement and Convergence Analysis of Inclusive Green Growth in the Yangtze River Economic Belt Cities. Sustainability-Basel 12 , 2356, https://doi.org/10.3390/su12062356 (2020).

Download references

Acknowledgements

Open access funding provided by Nord University.

Author information

Authors and affiliations.

Nord University Business School (HHN), Post Box 1490, 8049, Bodø, Norway

Samuel Asumadu Sarkodie & Phebe Asantewaa Owusu

Pepperdine University, Malibu, California, USA

You can also search for this author in PubMed Google Scholar

Contributions

S.A.S. and P.O.A. designed the dataset; S.A.S. collated the data, S.A.S., P.O.A. and J.T. wrote the manuscript, and S.A.S. supervised the research.

Corresponding authors

Correspondence to Samuel Asumadu Sarkodie or Phebe Asantewaa Owusu .

Ethics declarations

Competing interests.

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplementary information, rights and permissions.

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Sarkodie, S.A., Owusu, P.A. & Taden, J. Comprehensive green growth indicators across countries and territories. Sci Data 10 , 413 (2023). https://doi.org/10.1038/s41597-023-02319-4

Download citation

Received : 28 March 2023

Accepted : 19 June 2023

Published : 24 June 2023

DOI : https://doi.org/10.1038/s41597-023-02319-4

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

This article is cited by

A double machine learning model for measuring the impact of the made in china 2025 strategy on green economic growth.

- Shucheng Liu

Scientific Reports (2024)

The Dynamic Relationship Between Education and Green Growth in BRICS Countries

- Qasim Raza Syed

- Raja Fawad Zafar

Journal of the Knowledge Economy (2024)

Economic complexity and inclusive green growth: the moderating role of public expenditure on education

- Idrys Fransmel Okombi

- Niclaige Elion Lebomoyi

Journal of Environmental Studies and Sciences (2024)

New data and descriptor for crowdfunding and renewable energy

- Dario Salerno

- Andrea Gatto

- Simona Russo

Quality & Quantity (2024)

The impact of domestic materials and renewable energy consumption towards environmental sustainability: evidence from green growth policy across regional and global levels

- Jean Pierre Namahoro

- Wu Qiaosheng

Environment, Development and Sustainability (2024)

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

Sign up for the Nature Briefing newsletter — what matters in science, free to your inbox daily.

Advertisement

Determinants of green growth in developed and developing countries

- Research Article

- Open access

- Published: 22 March 2021

- Volume 28 , pages 39227–39242, ( 2021 )

Cite this article

You have full access to this open access article

- Vincent Tawiah 1 ,

- Abdulrasheed Zakari 2 , 3 &

- Festus Fatai Adedoyin ORCID: orcid.org/0000-0002-3586-2570 4

15k Accesses

114 Citations

7 Altmetric

Explore all metrics

Considering the need for environmental sustainability while ensuring economic growth and development by 2030, this study uses data on 123 developed and developing countries to examine factors that influence green growth. The empirical results show that economic development positively influences green growth. However, trade openness is detrimental to green growth. Regarding energy-related factors, we find energy consumption negatively affecting green growth, but renewable energy consumption significantly improves green growth. In further analysis, we find that the influence of these factors differs between developed and developing countries. The result implies that countries at a different development level will require different strategies in achieving the Sustainable Development Goals in 2030. The results are robust to alternative identification strategies such as the System Generalised Method of Movement, which accounts for potential endogeneity.

Similar content being viewed by others

Diverging or converging to a green world? Impact of green growth measures on countries’ economic performance

Green technology, green electricity, and environmental sustainability in Western European countries

Comprehensive green growth indicators across countries and territories

Explore related subjects.

- Environmental Chemistry

Avoid common mistakes on your manuscript.

Introduction

The continuous rise in temperature and its concomitant effect on livelihood has put sustainable development as the top priority in international discourse (IPCC 2018 ) Footnote 1 . Many nations have also continuously look for avenues to address climate change. The Paris Agreement and 2030 Sustainable Development Agenda have renewed the actions towards a better environment (Organisation for Economic Co-operation and Development—OECD 2020 ). Indeed, OECD ( 2020 ) suggests that Agenda 2030 for sustainable development is the norm for all countries, been developed or developing country. Despite these commitments by almost all countries, there are significant variations at which countries are moving towards environmentally sustainable economic development. For example, among OECD members, Australia and Belgium are experiencing a significant increase in green growth, but Portugal and Turkey are stagnant or decreasing in green growth.

Reflecting on the multi-facet nature of environmental issues and the fact that one size fit all strategy cannot solve these issues in this age of increasing economic activities, we examine the different set of factors that drive green growth. According to OECD ( 2020 ), green growth indicates whether economic growth is becoming greener with more efficient use of natural capital. The green growth indicator monitors progress towards a sustainable and greener economy (OECD 2020 ). Attaining green growth simply implies the use of natural assets towards economic growth in a sustainable manner. The goal is to move towards an economy that leads to human well-being and reduce inequalities among people in the long run, and not exposing future generations to environmental risk (OECD 2018 ).

We employ a fixed effect estimation technique on a large panel data of 123 countries over 18 years. The results show that economic development is positive and significantly associated with green growth, while trade openness negatively impacts green growth. We find no significant relationship between institutional quality and green growth. Although we find energy consumption to impair green growth, renewable energy consumption significantly increases green growth. Our results remain robust to different model specifications, including country effect and accounting for CO 2 as an additional control variable. We also use the System Generalised Method of Movement to address any potential endogeneity issue. The results are also economically significant in explaining the variations of green growth across the world. For example, our results show that a 1% increase in trade openness, given its standard deviation, leads to 0.017 points decrease in green growth.

In further analyses, using sub-sampling techniques, we find interesting results between developed and developing countries. We find economic growth positive and significantly associated with green growth in developed countries but insignificant in developing countries. Next, while internationalization does not significantly impact green growth in developed countries, it is negatively and significantly associated with green growth in developing countries. Notwithstanding these contrasting findings, institutional quality and energy consumption remain similar for both developed and developing countries.

This study is timely as countries work towards achieving the Sustainable Development Goals, including high and progressive green growth by 2030. Our findings, which demonstrate the significant drivers of green growth, will enable policymakers to shape some of the country’s activities, leading to green growth. As evident in the results, countries at different development levels will require different strategies to achieve Sustainable Development Goals. For example, developing countries have to pay attention to foreign direct investment and trade they engage in to avoid harming the environment. Both developed and developing will also need to look closely at 'their institutional quality and regulations to boost green growth.

Our paper also makes an incremental contribution to the environmental literature by deviating from the traditional stream of carbon emission to a new area of improving its efficiency in using natural assets. More specifically, by focusing on green growth, we draw attention to factors that facilitate efficient and effective use of resources to achieve economic development and environmental sustainability.

The remainder of the paper is as follows. The next section presents a literature review on green energy determinants, capturing variables such as economic growth, foreign direct investment, foreign trade, and renewable energy, among others. Research methods, including data, description of variables, and econometric model, are presented in Section 3 , while results are discussed in Section 4 with implications of results. The study concludes in Section 5 with vital policy recommendations.

Review of prior studies

Economic factors and the environment.

Since the first Rio summit on environmental sustainability, the world falls short of numerous challenges, including the tense pressure to keep economic activities moving and the rising environmental degradation (The Washington Post 2017 ). Given these tense issues, green growth came to a place to bring these two issues together and address them (OECD 2011 ). In essence, green growth oversees economic growth and development while utilizing natural assets for the well-being of humanity. Despite this significant association between economic growth and green growth, there is scanty research on green growth. In light of the scarce literature on green growth, we present studies that may appear distinctively different but related to the environment and its consequence on green growth.

Alam and Kabir ( 2013 ) find that increase in economic growth sustains the environment by reducing carbon emissions. The author suggests joint pollution and eco-efficiency policies to enable environmental sustainability. Similarly, Rahman et al. ( 2020 ) posit the underline effect of dangerous emissions on economic growth to be approximately more than one digit, indicating that dangerous emissions alongside the population promote economic growth. However, the impact is insignificant because the trade openness causes a further decrease in economic growth. In another notion, investment in clean energy and advanced technologies is confirmed to effectively moderate pollution, which improves the economic growth of the host country (Muhammad and Khan 2019 ).

Furthermore, Mikayilov et al. ( 2018 ) confirm a long-run positive relationship between economic growth and a sustainable environment in Azerbaijan. These findings coined CO 2 mitigating policies such as implementing the carbon price mechanism, public enlighten on the cause and danger of carbon dioxide emissions, and the use of less pollution-intensive technologies. Equally, economic growth could influence environmental performance regardless of the level of the education system. What matters the most is the mediating effect of education on the nation’s cultures and demographic density, which could prompt the influence of environmental performance (Peng and Lin 2009 ). Chang and Hao ( 2017 ) also confirm that environmental performance positively interacts with economic growth in OECD and non-OECD countries.

However, when output and consumption increase, we are most likely to observe cost imposed on the environment, which, by implication, increased the consumption of non-renewable resources to increase pollution levels. Ardakani and Seyedaliakbar ( 2019 ) and Xie and Liu ( 2019 ) sustain this claim and argue that economic growth below the turning point could cause more carbon emissions, but economic growth crosses the turning point, and then environmental quality is achieved or improve. Although economic growth enables inhabitants to maintain a higher life expectancy and increase enrolment to school, this impact may not hold volume to contain the pollution (Cracolici et al. 2010 ). Wang et al. ( 2019 ) find that investment and economic growth jointly contribute to environmental quality. The authors suggest emission mitigation policies that encompass the efficient use of energy, clean technology investment, and promotion of labour standards will cut down the rising emissions.

Similarly, Shahbaz et al. ( 2013 ) confirm economic growth as the major contributor to CO 2 emission. The authors suggest a reduction at the cost of economic growth and financing the importation of environmentally friendly technologies. More so, the impact of economic growth may differ according to region. In China’s central and western region, Chen et al. ( 2019a , b ) suggest that economic growth increases CO2 emissions when it is below a threshold level but reduces CO 2 emission when the economic growth rises above a threshold. Adedoyin et al. ( 2020a , b ) demonstrate that the BRICS economic’ CO 2 emissions are aggravated by economic growth.

Internalization and the environment

In the quest to grow the economic base, nations are pushed to embrace foreign investment and trade. Through foreign direct investment, a country can improve technological progress as well as promote human capital. Trade helps achieve an efficiency of production by allocating resources in areas where a country has a comparative advantage. However, the effect of both foreign direct investment and trade on the environment has not always been straightforward. Existing studies provide two contrasting findings on the impact of internationalization on the environment. Following the pollution haven hypothesis (Walter and Ugelow 1979 ), critics of internationalization argue that foreign investment and trade serve as a channel for transferring pollution-intensive operations from one country to another. Hence, foreign investment and trade are associated with the poor environmental quality of the host country while lowering pollution (Beradovic 2009 ). Haug and Ucal ( 2019 ) and Salahuddin et al. ( 2018 ) validate this claim and report that the underlying effect of foreign direct investment on carbon emission is positive and implies that an increase in FDI leads to a deteriorating environment. However, the long-run effect shows no significant relationship between FDI and carbon emissions (Ayamba et al. 2020 ). Meanwhile, trade is found to be asymmetrically correlated with carbon emission; a rise in export causes an increase in carbon emission, while a rise in import reduces carbon emission in Turkey. The reduction in CO 2 emissions could have been caused by the transfer of highly emission-intensive production capacities from developed economies to low economies (Essandoh et al. 2020 ).

The pollution haven hypothesis is directly opposite to the pollution halo hypothesis, which states that internationalization facilitates the transfer of technology and acceptable practices from one country to another, particularly from developed to developing. Hence, foreign investment and trade improve the environmental quality of the host country (Birdsall and Wheeler 1993 ). There is a considerable amount of literature on which empirical evidence supports this hypothesis (Ayamba et al. 2019 ; Cole and Elliott 2003 ; Mihci et al. 2005 ; Pao and Tsai 2011 ; Romer 1993 , Zhu et al. 2016 ). Mihci et al. ( 2005 ) argue that international investment and trade help fill the technology gap among countries. Shahbaz et al. ( 2019 ) argue that allowing free trading in and out of the country can improve environmental quality, but an increase in foreign investment is detrimental to a greener environment. The author suggests investment in technological innovation, capital stock, and the implementation of stringent environmental policies that will re-direct FDI towards green investment.

Furthermore, trade openness and FDI has pushed for healthy economic development, but not without contributing to pollution. However, Muhammad et al. ( 2020 ) provide evidence of the positive impact of import and export on the environment. Bopkin ( 2017 ) suggests that FDI can positively impact the environment if there are quality institutions to monitor foreign investors.

Energy-related factors and the environment

High energy consumption is associated with low environmental quality (Bilgen 2014 ; Dincer 1998 ; Bailis et al. 2005 ; Fotis and Polemis 2018 ). Because energy consumption is inevitable in daily life, there is a strong argument for a different mix of energy sources of which renewable energy source has been considered the best alternative. Nonetheless, the empirical evidence on the impact of renewable energy on the environment remains very controversial, although it is perceived by many as a direct positive effect. Saidi and Omri ( 2020 ), for instance, claim that in order not to cause harm to the economy while promoting environmental quality, the private sector, such as industries, has to imbibe the use of nuclear and renewable energy during production. Equally, investment in human capital could cut-down emissions (Wang et al. 2020 ). Mendonca et al. ( 2020 ) confirm similar results in the 50 largest economies across the globe. According to Ikram et al. ( 2020 ), following the international standard’s issuance that specifies requirements for an effective environmental management system known as ISO 14001 has added a tally to factor helping to sustain the environment.

On the negative side, Jebli and Youssef ( 2017 ) argue that renewable energy consumption could raise CO 2 emissions because combustible and wastes renewable energy are highly pollution-intensive energy sources. Hence, carbon emissions are likely to increase. Furthermore, renewable energy alone as an indicator may not effectively reduce the CO 2 emissions until a fully renewable energy system is implemented, and then renewable energy will cut-down emissions (Pata 2018 ; Mitchell and Cleveland 1993 ). Kahouli ( 2018 ) reports that increasing renewable energy consumption could increase energy-intensive economic activities.

Institutional quality and the environment.

The institutional quality, which includes the quality of laws and the strength of enforcement agents can either promote or retard green growth. A well-established institutional quality promotes economic activities while reducing carbon emissions (Salman et al. 2019 ). Specifically, political-institutional quality provides all the social, governance, and economic readiness to cut down carbon emissions (Sarkodie and Adams 2018 ). High institutional quality is more beneficial in improving a sustainable environment through the effect of trade than in low institutional quality (Ibrahim and Law 2016 ). Quality institutions also ensure that firms are complying with environmental regulations.

However, a strong enforcement environment with ever-changing regulations will likely hamper the growth of firms, especially foreign business flow. There could be less innovation and creativity towards improving the environment (Nguyen et al. 2018 ). It should be noted that the evidence on the negative impact of institutional quality is fragile. Therefore, Abid ( 2017 ) suggests that some parts of institutional quality, such as government effectiveness and democracy, deteriorate environmental quality while regulatory quality and the rule of law increase sustainability. Democratic institution paves the way for foreign investment at the expense of the environment. The fact is that foreign investors tried to avoid environmental laws; thus, they invest in the economy where such policies are not in place and thereby raise the pollution (Kinda 2011 ).

Previous studies have been conducted linking economic growth, development, renewable energy, foreign direct investment, and trade on the environment. However, the previous failed to account for the green growth determinant. Therefore, we fill this gap by investigating the determinants of green growth across a panel of 123 countries.

Developed and developing countries

Given the difference between developed and developing countries regarding economic development and environmental degradation (De Angelis et al. 2019 ; Shahbaz et al. 2019 ), it is likely that their journey to green growth can be different. For example, whereas developing countries have a high pollution rate, developed countries are the largest contributors to CO 2 emission but at a decreasing rate (De Angelis et al. 2019 ). Shahbaz et al. ( 2019 ) argue that the developed countries such as the US maintained policies within “scale effect” to reduce carbon emissions. This is done through investment in technological innovation, addressing capital consumption, and providing informed knowledge about trade liberalization has helped reduce CO 2 emissions. Likewise, in Western Europe, CO 2 emissions are well managed because of the enforcement of policies targeted at improving economic growth and environmental protection simultaneously (Paramati et al. 2017 ), which is not the case of Eastern Europe, which is made of developing countries. In Eastern Europe, CO 2 emissions continue to surge beyond because the nation’s intent is directed towards tourism to grow its agenda for employment generation, income, and economic development without considering the environment (Paramati et al. 2017 ). This similar feature of most developing countries where there are weak institutions to enforce environmental laws.

In developing countries, Aye and Edoja ( 2017 ) found that economic growth has a negative impact on carbon emission in developing countries. However, Iwata et al. ( 2012 ) did not find any significant relationship between economic growth and carbon emission in developed countries. But the authors found a positive impact of energy consumption on carbon emission. Regarding the impact of foreign direct investment and trade, prior studies have found different results for developed and developing countries. Demena and Afesorgbor ( 2020 ) report that foreign direct investment reduces CO 2, but the result is stronger in developed countries than in developing countries. However, Khan et al. ( 2020 ) find FDI to negatively affect the environment in developing countries. Tang ( 2015 ) also reports a negative impact of FDI on the environment. Similarly, international trade has a negative impact on developing countries (Tawiah et al. 2021 ).

Data and methods

Data and sample selection.

The sample selection begins with all 134 countries listed in the OECD database. We drop six countries that have missing data for more than 3 years on green growth. Next, we drop five countries with missing data from World Development Indicators. Our final sample covers a large panel of data of 123 developed and developing countries over 18 years (2000–2017). We begin in 2000 and end in 2017 because the OCED data on green growth is limited to only this period.

Measurement of variables

- Green growth

According to the OECD Statistic ( 2020 ), green growth is the measure of efficient use of natural capital. Green growth indicates whether economic growth is becoming greener. It captures aspects of production which are rarely quantified in economic models and accounting frameworks. Green growth is measured by the environmental and resource productivity of a country. The higher the value, the more the country’s economic growth is becoming greener. Data is sourced from OECD statistics.

Economic factors

These factors include the general economic activities of a country. We use GDP per capita to measure the effect of economic development on green growth. Similarly, we use annualized GDP growth to measure the impact of economic growth . Both variables are collected from World Development Indicators.

Internationalization factors

These determinants include trade openness and foreign direct investment. These factors are used to examine how foreign activities drive green growth. Trade openness is measured by the sum of imports and export as a percentage of GDP. Foreign direct investment is measured by the net inflow of foreign direct investment as a percentage of GDP. Following the pollution haven and pollution halo hypothesis, we expect the relationship between internationalization factors and green growth to go either way. Data on import, export, and foreign direct investment are sourced from World Development Indicators.

Institutional quality factors

Although there are different measurements of the institutional quality of a country including, the legal origin, bureaucratic quality, the Worldwide Governance Indicators (WGI) by Kaufmann and Kraay ( 2018 ) is the most widely used proxy for institutional quality (Elamer et al. 2020 ; Konara and Shirodkar 2018 ; Tunyi et al. 2020 ). Therefore, we use the six WGI indicators to measure the institutional quality of a country. These six indicators are government effectiveness, political stability, absence of violence, regulatory quality, the rule of law, voice and accountability, and control of corruption. According to Kaufman and Kraay ( 2018 ), these indicators cover institutional quality and governance’s core areas. Although each indicator covers different aspects of institutional quality, including all the six indicators in a single model as individual variables will create multicollinearity due to the high correlation (seen Table 9 of Appendix 2). To capture all the six indicators without the problem of multicollinearity, we follow prior studies such as Elamer et al., (2020), Konara and Shirodkar ( 2018 ), and Tunyi et al. ( 2020 ) and use the principal component analysis (PCA) technique to construct a single composite index from all the six indicators. The PCA statistics presented in Table 10 of Appendix 2 show that the first principal component explains about 86.65% of the variance among the components, whereas the other five components altogether capture less than 2% of the variance. Consequently, we use only the first principal component to predict the sample countries’ institutional quality index. We find our constructed index to be positively and significantly correlated with the average of the six indicators.

Energy-related factors

This group of determinants is related to the type and level of energy consumption in the country. It includes energy consumption measured by energy use and the type of energy consumption measured by renewable energy . Data on energy-related variables are collected from World Development Indicators.

Control factors