A systematic review of fundamental and technical analysis of stock market predictions

- Published: 20 August 2019

- Volume 53 , pages 3007–3057, ( 2020 )

Cite this article

- Isaac Kofi Nti ORCID: orcid.org/0000-0001-9257-4295 1 , 2 ,

- Adebayo Felix Adekoya ORCID: orcid.org/0000-0002-5029-2393 2 &

- Benjamin Asubam Weyori ORCID: orcid.org/0000-0001-5422-4251 2

16k Accesses

193 Citations

Explore all metrics

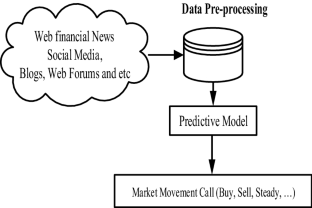

The stock market is a key pivot in every growing and thriving economy, and every investment in the market is aimed at maximising profit and minimising associated risk. As a result, numerous studies have been conducted on the stock-market prediction using technical or fundamental analysis through various soft-computing techniques and algorithms. This study attempted to undertake a systematic and critical review of about one hundred and twenty-two (122) pertinent research works reported in academic journals over 11 years (2007–2018) in the area of stock market prediction using machine learning. The various techniques identified from these reports were clustered into three categories, namely technical, fundamental, and combined analyses. The grouping was done based on the following criteria: the nature of a dataset and the number of data sources used, the data timeframe, the machine learning algorithms used, machine learning task, used accuracy and error metrics and software packages used for modelling. The results revealed that 66% of documents reviewed were based on technical analysis; whiles 23% and 11% were based on fundamental analysis and combined analyses, respectively. Concerning the number of data source, 89.34% of documents reviewed, used single sources; whiles 8.2% and 2.46% used two and three sources respectively. Support vector machine and artificial neural network were found to be the most used machine learning algorithms for stock market prediction.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Stock Market Prediction Using Machine Learning Techniques: A Comparative Study

A Study on Stock Market Forecasting and Machine Learning Models: 1970–2020

Machine Learning Techniques for Stock Market Predictions: A Case of Mexican Stocks

Abhishek K et al (2012) A stock market prediction model using artificial neural network. In: Third international conference on computing communication & networking technologies (ICCCNT), pp 1–5. https://doi.org/10.1109/icccnt.2012.6396089

Adam AM, Tweneboah G (2008) Macroeconomic factors and stock market movement: evidence from Ghana. University of Leicester, Leicester. https://doi.org/10.2139/ssrn.1289842

Book Google Scholar

Adebayo AD, Adekoya AF, Rahman TM (2017) Predicting stock trends using Tsk-fuzzy rule based system. JENRM 4(7):48–55

Google Scholar

Adebiyi AA et al (2012) Stock price prediction using neural network with hybridized market indicators. J Emerg Trends Comput Inf Sci 3(1):1–9

Adebiyi AA, Adewumi AO, Ayo CK (2014a) Comparison of ARIMA and artificial neural networks models for stock price prediction. J Appl Math 2014:9–11. https://doi.org/10.1155/2014/614342

Article MathSciNet Google Scholar

Adebiyi AA, Adewumi AO, Ayo CK (2014) Stock price prediction using the ARIMA model. In: Proceedings—UKSim-AMSS 16th international conference on computer modelling and simulation, UKSim 2014, pp 106–112. https://doi.org/10.1109/uksim.2014.67

Adusei M (2014) The inflation-stock market returns nexus: evidence from the Ghana stock exchange. J Econ Int Finance 6(2):38–46. https://doi.org/10.5958/2321-5763.2016.00010.X

Article Google Scholar

Agarwal P et al (2017) Stock market price trend forecasting using machine learning. Int J Res Appl Sci Eng Technol: IJRASET 5(IV):1673–1676

Agrawal S, Jindal M, Pillai GN (2010) Momentum analysis based stock market prediction using adaptive neuro-fuzzy inference system (ANFIS). In: International multiconference of engineers and computer scientists (IMECS). Hong Kong

Agrawal JG, Chourasia VS, Mittra AK (2013) State-of-the-art in stock prediction techniques. Int J Adv Res Electr Electron Instrum Eng 2(4):1360–1366

Ahmadi E et al (2018) New efficient hybrid candlestick technical analysis model for stock market timing on the basis of the support vector machine and heuristic algorithms of imperialist competition and genetic. Expert Syst Appl 94(April):21–31. https://doi.org/10.1016/j.eswa.2017.10.023

Akinwale Adio T, Arogundade OT, Adekoya AF (2009) Translated Nigeria stock market prices using artificial neural network for effective prediction. J Theor Appl Inf Technol. pp 36–43. http://jatit.org/volumes/research-papers/Vol9No1/6Vol9No1.pdf

Almeida L, Lorena A, De Oliveira I (2010) Expert systems with applications a method for automatic stock trading combining technical analysis and nearest neighbor classification. Expert Syst Appl 37(10):6885–6890. https://doi.org/10.1016/j.eswa.2010.03.033

Anbalagan T, Maheswari SU (2014) Classification and prediction of stock market index based on fuzzy metagraph. Procedia Comput Sci 47(C):214–221. https://doi.org/10.1016/j.procs.2015.03.200

Ansari T et al (2010) Sequential combination of statistics, econometrics and adaptive neural-fuzzy interface for stock market prediction. Expert Syst Appl 37(7):5116–5125. https://doi.org/10.1016/j.eswa.2009.12.083

Anthony J, Maurice L, Eshwar S (2011) Predictive ability of the interest rate spread using neural networks. Procedia Comput Sci 6:207–212. https://doi.org/10.1016/j.procs.2011.08.039

Argiddi VR, Apte SS (2012) Future trend prediction of Indian IT stock market using association rule mining of transaction data. Int J Comput Appl 39(10):30–34. https://doi.org/10.5120/4858-7132

Asadi S et al (2012) Hybridization of evolutionary Levenberg–Marquardt neural networks and data pre-processing for stock market prediction. Knowl Based Syst 35:245–258. https://doi.org/10.1016/j.knosys.2012.05.003

Atsalakis GS, Dimitrakakis EM, Zopounidis CD (2011) Elliott wave theory and neuro-fuzzy systems, in stock market prediction: the WASP system. Expert Syst Appl 38(8):9196–9206. https://doi.org/10.1016/j.eswa.2011.01.068

Ayub A (2018) Volatility transmission from oil prices to agriculture commodity and stock market in Pakistan. Capital University of Science and Technology, Islamabad

Babu MS, Geethanjali N, Satyanarayana PB (2012) Clustering approach to stock market prediction. Int J Adv Netw Appl 03(04):1281–1291

Baker M, Wurgler J (2007) Investor sentiment in the stock market. http://www.nber.org/papers/w13189

Ballings M et al (2015) Evaluating multiple classifiers for stock price direction prediction. Expert Syst Appl 42(20):7046–7056. https://doi.org/10.1016/j.eswa.2015.05.013

Bhagwant C et al (2014) Stock market prediction using artificial neural networks. Int J Comput Sci Inf Technol 5(1):904–907. https://doi.org/10.4028/www.scientific.net/AEF.6-7.1055

Bisoi R, Dash PK (2014) A hybrid evolutionary dynamic neural network for stock market trend analysis and prediction using unscented Kalman filter. Appl Soft Comput J 19:41–56. https://doi.org/10.1016/j.asoc.2014.01.039

Boachie MK et al (2016) Interest rate, liquidity and stock market performance in Ghana. Int J Account Econ Stud 4(1):46. https://doi.org/10.14419/ijaes.v4i1.5990

Bollen J, Mao H, Zeng X-J (2011) Twitter mood predicts the stock market. J Comput Sci 2(1):1–8. https://doi.org/10.1016/j.jocs.2010.12.007

Bordino I et al (2012) Web search queries can predict stock market volumes. PLoS ONE. https://doi.org/10.1371/journal.pone.0040014

Boyacioglu MA, Avci D (2010) Adaptive network-based fuzzy inference system (ANFIS) for the prediction of stock market return: the case of the Istanbul stock exchange. Expert Syst Appl 37(12):7908–7912. https://doi.org/10.1016/j.eswa.2010.04.045

Chakravarty S, Dash PK (2012) A PSO based integrated functional link net and interval type-2 fuzzy logic system for predicting stock market indices. Appl Soft Comput J 12(2):931–941. https://doi.org/10.1016/j.asoc.2011.09.013

Chan K et al (2017) What do stock price levels tell us about the firms? J Corp Finance 46:34–50. https://doi.org/10.1016/j.jcorpfin.2017.06.013

Chang SV et al (2013) A review of stock market prediction with artificial neural network (ANN). In: 2013 IEEE international conference on control system, computing and engineering, pp 477–482. https://doi.org/10.1109/iccsce.2013.6720012

Checkley MS, Higón DA, Alles H (2017) The hasty wisdom of the mob: how market sentiment predicts stock market behavior. Expert Syst Appl 77:256–263. https://doi.org/10.1016/j.eswa.2017.01.029

Chen C et al (2014) Exploiting social media for stock market prediction with factorization machine. In: 2014 IEEE/WIC/ACM international joint conference on web intelligence and intelligent agent technology—workshops, WI-IAT 2014, pp 49–56. https://doi.org/10.1109/wi-iat.2014.91

Chen Y, Hao Y (2017) A feature weighted support vector machine and K-nearest neighbor algorithm for stock market indices prediction. Expert Syst Appl 80:340–355. https://doi.org/10.1016/j.eswa.2017.02.044

Chen R, Lazer M (2013) Sentiment analysis of Twitter feeds for the prediction of stock market movement. Stanf Educ 25:1–5. https://doi.org/10.1016/j.ufug.2017.05.003

Chong E, Han C, Park FC (2017) Deep learning networks for stock market analysis and prediction: methodology, data representations, and case studies. Expert Syst Appl 83:187–205. https://doi.org/10.1016/j.eswa.2017.04.030

Coyne S, Madiraju P, Coelho J (2017) Forecasting stock prices using social media analysis. In: IEEE 15th international conference on big data intelligence and computing and cyber science and technology congress. IEEE Computer Society, pp 1031–1038. https://doi.org/10.1109/dasc-picom-datacom-cyberscitec.2017.169

Dase RK, Pawar DD (2010) Application of artificial neural network for stock market predictions: a review of literature. Int J Mach Intell 2(2):14–17

Dash R, Dash PK (2016) Efficient stock price prediction using a self evolving recurrent neuro-fuzzy inference system optimized through a modified technique. Expert Syst Appl 52:75–90. https://doi.org/10.1016/j.eswa.2016.01.016

de Araújo RA (2010) A quantum-inspired evolutionary hybrid intelligent approach for stock market prediction. Int J Intell Comput Cybern 3(1):24–54

Article MathSciNet MATH Google Scholar

de Araújo RA, Ferreira TAE (2013) A morphological-rank-linear evolutionary method for stock market prediction. Inf Sci 237:3–17. https://doi.org/10.1016/j.ins.2009.07.007

de Oliveira FA, Nobre CN, Zárate LE (2013) Applying artificial neural networks to prediction of stock price and improvement of the directional prediction index—case study of PETR4, Petrobras, Brazil. Expert Syst Appl 40(18):7596–7606. https://doi.org/10.1016/j.eswa.2013.06.071

Demyanyk Y, Hasan I (2010) Financial crises and bank failures: a review of prediction methods. Omega. https://doi.org/10.1016/j.omega.2009.09.007

Ding X et al (2014) Using structured events to predict stock price movement: an empirical investigation. In: The 2014 conference on empirical methods in natural language processing (EMNLP). Association for Computational Linguistics, Doha, pp 1415–1425. https://doi.org/10.3115/v1/d14-1148

Dondio P (2013) Stock market prediction without sentiment analysis: using a web-traffic based classifier and user-level analysis. In: Proceedings of the annual hawaii international conference on system sciences, pp 3137–3146. https://doi.org/10.1109/hicss.2013.498

Dosdoğru AT et al (2018) Assessment of hybrid artificial neural networks and metaheuristics for stock market forecasting. Ç. Ü. Sosyal Bilimler Enstitüsü Dergisi 24(1):63–78

Dunne M (2015) Stock market prediction. University College Cork, Cork

Dutta A, Bandopadhyay G, Sengupta S (2012) Prediction of stock performance in the indian stock market using logistic regression. Int J Bus Inf 7(1):105–136

Enke D, Mehdiyev N (2013) Stock market prediction using a combination of stepwise regression analysis, differential evolution-based fuzzy clustering, and a fuzzy inference neural network. Intell Autom Soft Comput 19(4):636–648. https://doi.org/10.1080/10798587.2013.839287

Enke D, Grauer M, Mehdiyev N (2011) Stock market prediction with multiple regression, fuzzy type-2 clustering and neural networks. Procedia Comput Sci 6:201–206. https://doi.org/10.1016/j.procs.2011.08.038

Ertuna L (2016) Stock market prediction using neural network time series forecasting (May). https://doi.org/10.13140/rg.2.1.1954.1368

Esfahanipour A, Aghamiri W (2010) Adapted neuro-fuzzy inference system on indirect approach TSK fuzzy rule base for stock market analysis. Expert Syst Appl 37(7):4742–4748. https://doi.org/10.1016/j.eswa.2009.11.020

Fajiang L, Wang J (2012) Fluctuation prediction of stock market index by Legendre neural network with random time strength function. Neurocomputing 83:12–21. https://doi.org/10.1016/j.neucom.2011.09.033

Fama EF (1965) Random walks in stock market prices. Financ Anal J 21:55–59

Fama EF (1970) Efficient capital markets: a review of theory and empirical work. J Finance 25:383–417

Fang Y et al (2014) Improving the genetic-algorithm-optimized wavelet neural network for stock market prediction. In: International joint conference on neural networks. IEEE, Beijing, pp 3038–3042. https://doi.org/10.1109/ijcnn.2014.6889969

Gaius KD (2015) Assessing the performance of active and passive trading on the Ghana stock exchange. University of Ghana, Accra

García F, Guijarro F, Oliver J (2018) Hybrid fuzzy neural network to predict price direction in the German DAX-30 index. Technol Econ Dev Econ 24(6):2161–2178

Geva T, Zahavi J (2014) Empirical evaluation of an automated intraday stock recommendation system incorporating both market data and textual news. Decis Support Syst 57(1):212–223. https://doi.org/10.1016/j.dss.2013.09.013

Ghaznavi A, Aliyari M, Mohammadi MR (2016) Predicting stock price changes of tehran artmis company using radial basis function neural networks. Int Res J Appl Basic Sci 10(8):972–978

Göçken M et al (2016) Integrating metaheuristics and artificial neural networks for improved stock price prediction. Expert Syst Appl 44:320–331. https://doi.org/10.1016/j.eswa.2015.09.029

Goel SK, Poovathingal B, Kumari N (2016) Applications of neural networks to stock market prediction. Int Res J Eng Technol: IRJET 03(05):2192–2197

Gupta A, Sharma SD (2014) Clustering-classification based prediction of stock market future prediction. Int J Comput Sci Inf Technol 5(3):2806–2809

Guresen E, Kayakutlu G, Daim TU (2011) Using artificial neural network models in stock market index prediction. Expert Syst Appl 38(8):10389–10397. https://doi.org/10.1016/j.eswa.2011.02.068

Gyan MK (2015) Factors influencing the patronage of stocks, Knu. Kwame Nkrumah University of Science & Technology (KNUST), Kumasi

Hadavandi E, Shavandi H, Ghanbari A (2010) Knowledge-based systems integration of genetic fuzzy systems and artificial neural networks for stock price forecasting. Knowl Based Syst 23(8):800–808. https://doi.org/10.1016/j.knosys.2010.05.004

Hagenau M, Liebmann M, Neumann D (2013) Automated news reading: stock price prediction based on financial news using context-capturing features. Decis Support Syst 55(3):685–697. https://doi.org/10.1016/j.dss.2013.02.006

Hassan MR et al (2013) A HMM-based adaptive fuzzy inference system for stock market forecasting. Neurocomputing 104:10–25. https://doi.org/10.1016/j.neucom.2012.09.017

Hegazy O, Soliman OS, Salam MA (2013) A machine learning model for stock market prediction. Int J Comput Sci Telecommun 4(12):17–23

Henriksson A et al (2016) Ensembles of randomized trees using diverse distributed representation of clinical events. BMC Med Inf Decis Mak 16(2):69

Ibrahim SO (2017) Forecasting the volatilities of the Nigeria stock market prices. CBN J Appl Stat 8(2):23–45

MathSciNet Google Scholar

Javed K, Gouriveau R, Zerhouni N (2014) SW-ELM: a summation wavelet extreme learning machine algorithm with a priori parameter initialization. Neurocomputing 123:299–307. https://doi.org/10.1016/j.neucom.2013.07.021

Jianfeng S et al (2014) Exploiting social relations and sentiment for stock prediction. In: Conference on empirical methods in natural language processing (EMNLP). Association for Computational Linguistics, Doha, pp 1139–1145. https://doi.org/10.1080/00378941.1956.10837773

Ju-Jie W et al (2012) Stock index forecasting based on a hybrid model. Omega 40(6):758–766. https://doi.org/10.1016/j.omega.2011.07.008

Kannan KS et al (2010) Financial stock market forecast using data mining techniques. In: International multiconference of engineers and computer scientists (IMECS)

Kara Y, Acar Boyacioglu M, Baykan ÖK (2011) Predicting direction of stock price index movement using artificial neural networks and support vector machines: the sample of the Istanbul stock exchange. Expert Syst Appl 38(5):5311–5319. https://doi.org/10.1016/j.eswa.2010.10.027

Kazem A et al (2013) Support vector regression with chaos-based firefly algorithm for stock market price forecasting. Appl Soft Comput J 13(2):947–958. https://doi.org/10.1016/j.asoc.2012.09.024

Kearney C, Liu S (2014) Textual sentiment in finance: a survey of methods and models. Int Rev Financ Anal 33(Cc):171–185. https://doi.org/10.1016/j.irfa.2014.02.006

Khan HZ, Alin ST, Hussain A (2011) Price prediction of share market using artificial neural network “ANN”. Int J Comput Appl 22(2):42–47. https://doi.org/10.5120/2552-3497

Kraus M, Feuerriegel S (2017) Decision support from financial disclosures with deep neural networks and transfer learning. Decis Support Syst 104:38–48. https://doi.org/10.1016/j.dss.2017.10.001

Krollner B, Vanstone B, Finnie G (2010a) Financial time series forecasting with machine learning techniques: a survey. In: European symposium on artificial neural networks: computational and machine learning. Bond University, Bruges, pp 25–30

Krollner B, Vanstone B, Finnie G (2010b) Financial time series forecasting with machine learning techniques: a survey. http://epublications.bond.edu.au/infotech_pubs/110

Kumar DA, Murugan S (2013) Performance analysis of Indian stock market index using neural network time series model. In: Proceedings of the 2013 international conference on pattern recognition, informatics and mobile engineering, PRIME 2013, pp 72–78. https://doi.org/10.1109/icprime.2013.6496450

Kumar M, Thenmozhi M (2006) Forecasting stock index movement: a comparison of support vector machines and random forest. In Indian Institute of capital markets 9th capital markets conference paper.

Kumar D, Meghwani SS, Thakur M (2016) Proximal support vector machine based hybrid prediction models for trend forecasting in financial markets. J Comput Sci 17:1–13. https://doi.org/10.1016/j.jocs.2016.07.006

Kuwornu JKM, Victor O-N (2011) Macroeconomic variables and stock market returns: full information maximum likelihood estimation. Res J Finance Account 2(4):49–64

Kwofie C, Ansah RK (2018) A study of the effect of inflation and exchange rate on stock market returns in Ghana. Int J Math Math Sci. https://doi.org/10.1155/2018/7016792

Laboissiere LA, Fernandes RAS, Lage GG (2015) Maximum and minimum stock price forecasting of Brazilian power distribution companies based on artificial neural networks. Appl Soft Comput J 35:66–74. https://doi.org/10.1016/j.asoc.2015.06.005

Lahmiri S (2011) A Comparison of PNN and SVM for stock market trend prediction using economic and technical information. Int J Comput Appl 29(3):975–8887

Li Q et al (2015) Tensor-based learning for predicting stock movements. In: Twenty-ninth AAAI conference on artificial intelligence-2015, pp 1784–1790. https://doi.org/10.1073/pnas.0601853103

Li Q, Wang T, Gong Q et al (2014a) Media-aware quantitative trading based on public Web information. Decis Support Syst 61(1):93–105. https://doi.org/10.1016/j.dss.2014.01.013

Li Q, Wang T, Li P et al (2014b) The effect of news and public mood on stock movements. Inf Sci 278:826–840. https://doi.org/10.1016/j.ins.2014.03.096

Li X, Huang X et al (2014c) Enhancing quantitative intra-day stock return prediction by integrating both market news and stock prices information. Neurocomputing 142:228–238. https://doi.org/10.1016/j.neucom.2014.04.043

Li X, Xie H et al (2014d) News impact on stock price return via sentiment analysis. Knowl-Based Syst 69(1):14–23. https://doi.org/10.1016/j.knosys.2014.04.022

Lin Z (2018) Modelling and forecasting the stock market volatility of SSE composite index using GARCH models. Future Gener Comput Syst 79:960–972. https://doi.org/10.1016/j.future.2017.08.033

Lin Y, Guo H, Hu J (2013) An SVM-based approach for stock market trend prediction. In: Proceedings of the international joint conference on neural networks. https://doi.org/10.1109/ijcnn.2013.6706743

Liu L et al (2015) A social-media-based approach to predicting stock comovement. Expert Syst Appl 42(8):3893–3901. https://doi.org/10.1016/j.eswa.2014.12.049

Luo F, Wu J, Yan K (2010) A novel nonlinear combination model based on support vector machine for stock market prediction. In: Jinan C (ed) World congress on intelligent control and automation. IEEE, Piscataway, pp 5048–5053

Maknickiene N, Lapinskaite I, Maknickas A (2018) Application of ensemble of recurrent neural networks for forecasting of stock market sentiments. Equilib Q J Econ Econ Policy 13(1):7–27. https://doi.org/10.24136/eq.2018.001

Makrehchi M, Shah S, Liao W (2013) Stock prediction using event-based sentiment analysis. In: Proceedings—2013 IEEE/WIC/ACM international conference on web intelligence, WI 2013, 1, pp 337–342. https://doi.org/10.1109/wi-iat.2013.48

Malkiel BG (1999) A random walk down Wall Street: including a life-cycle guide to personal investing. WW Norton & Company

Metghalchi M, Kagochi J, Hayes LA (2014) Contrarian technical trading rules: evidence from Nairobi stock index. J Appl Bus Res 30(3):833–846

Ming F et al (2014) Stock market prediction from WSJ: text mining via sparse matrix factorization. In: EEE international conference on data mining, ICDM, pp 430–439. https://doi.org/10.1109/icdm.2014.116

Minxia L, Zhang K (2014) A hybrid approach combining extreme learning machine and sparse representation for image classification. Eng Appl Artif Intell 27:228–235. https://doi.org/10.1016/j.engappai.2013.05.012

Mittal A, Goel A (2012) Stock prediction using twitter sentiment analysis. Standford University, CS229, (June). https://doi.org/10.1109/wi-iat.2013.48

Mohapatra P, Raj A (2012) Indian stock market prediction using differential evolutionary neural network model. Int J Electron Commun Comput Technol: IJECCT 2(4):159–166

Murekachiro D (2016) A review of artificial neural networks application to stock market predictions. Netw Complex Syst 6(4):2010–2013

Naeini MP, Taremian H, Hashemi HB (2010) Stock market value prediction using neural networks. IEEE, Piscataway, pp 132–136

Nair BB et al (2010) Stock market prediction using a hybrid neuro-fuzzy system. In: International conference on advances in recent technologies in communication and computing, India, pp 243–247. https://doi.org/10.1109/artcom.2010.76

Nair BB, Mohandas VP, Sakthivel NR (2010) A decision tree-rough set hybrid system for stock market trend prediction. Int J Comput Appl 6(9):1–6

Nassirtoussi AK et al (2014) Text mining for market prediction: a systematic review. Expert Syst Appl 41(16):7653–7670. https://doi.org/10.1016/j.eswa.2014.06.009

Nayak RK, Mishra D, Rath AK (2015) A Naïve SVM-KNN based stock market trend reversal analysis for Indian benchmark indices. Appl Soft Comput J 35:670–680. https://doi.org/10.1016/j.asoc.2015.06.040

Nazário RTF et al (2017) A literature review of technical analysis on stock markets. Q Rev Econ Finance 66:115–126. https://doi.org/10.1016/j.qref.2017.01.014

Neelima B, Jha CK, Saneep BK (2012) Application of neural network in analysis of stock market prediction. Int J Comput Sci Technol: IJCSET 3(4):61–68

Nhu HN, Nitsuwat S, Sodanil M (2013) Prediction of stock price using an adaptive neuro-fuzzy inference system trained by firefly algorithm. In: 2013 international computer science and engineering conference, ICSEC 2013, pp 302–307. https://doi.org/10.1109/icsec.2013.6694798

Nikfarjam A, Emadzadeh E, Muthaiyah S (2010) Text mining approaches for stock market prediction. IEEE, vol 4, pp 256–260

Nisar TM, Yeung M (2018) Twitter as a tool for forecasting stock market movements: a short-window event study. J Finance Data Sci 4(February):1–19. https://doi.org/10.1016/j.jfds.2017.11.002

Olaniyi S, Adewole K, Jimoh R (2011) Stock trend prediction using regression analysis—a data mining approach. ARPN J Syst Softw 1(4):154–157

Paik P, Kumari B (2017) Stock market prediction using ANN, SVM, ELM: a review. Ijettcs 6(3):88–94. https://doi.org/10.1038/33071

Patel J et al (2015a) Predicting stock and stock price index movement using trend deterministic data preparation and machine learning techniques. Expert Syst Appl 42(1):259–268. https://doi.org/10.1016/j.eswa.2014.07.040

Patel J et al (2015b) Predicting stock market index using fusion of machine learning techniques. Expert Syst Appl 42(4):2162–2172. https://doi.org/10.1016/j.eswa.2014.10.031

Pervaiz J, Masih J, Jian-Zhou T (2018) Impact of macroeconomic variables on Karachi stock market returns. Int J Econ Finance 10(2):28. https://doi.org/10.5539/ijef.v10n2p28

Perwej Y, Perwej A (2012) Prediction of the Bombay stock exchange (BSE) market returns using artificial neural network and genetic algorithm. J Intell Learn Syst Appl 04(02):108–119. https://doi.org/10.4236/jilsa.2012.42010

Pimprikar R, Ramachadran S, Senthilkumar K (2017) Use of machine learning algorithms and Twitter sentiment analysis for stock market prediction. Int J Pure Appl Math 115(6):521–526

Porshnev A, Redkin I, Shevchenko A (2013) Improving prediction of stock market indices by analyzing the psychological states of Twitter users. Financ Econ. https://doi.org/10.2139/ssrn.2368151

Prem Sankar C, Vidyaraj R, Satheesh Kumar K (2015) Trust based stock recommendation system—a social network analysis approach. In: Procedia computer science: international conference on information and communication technologies (ICICT 2014). Elsevier Masson SAS, pp 299–305. https://doi.org/10.1016/j.procs.2015.02.024

Pulido M, Melin P, Castillo O (2014) Particle swarm optimization of ensemble neural networks with fuzzy aggregation for time series prediction of the Mexican stock exchange. Inf Sci 342(May):317–329. https://doi.org/10.1007/978-3-319-32229-2_23

Rajashree D, Dash PK, Bisoi R (2014) A self adaptive differential harmony search based optimized extreme learning machine for financial time series prediction. Swarm Evol Comput 19:25–42. https://doi.org/10.1016/j.swevo.2014.07.003

Rather AM, Agarwal A, Sastry VN (2014) Recurrent neural network and a hybrid model for prediction of stock returns. Expert Syst Appl 42(8):3234–3241. https://doi.org/10.1016/j.eswa.2016.05.033

Renu IR, Christie R (2018) Fundamental analysis versus technical analysis—a comparative review. Int J Recent Sci Res 9(1):23009–23013. https://doi.org/10.24327/IJRSR

Sasan B, Azadeh A, Ortobelli S (2017) Fusion of multiple diverse predictors in stock market. Inf Fusion 36:90–102. https://doi.org/10.1016/j.inffus.2016.11.006

Shen S, Jiang H, Zhang T (2012) Stock market forecasting using machine learning algorithms. Department of Electrical Engineering, Stanford University, Stanford, CA, pp 1–5

Sheta A, Farisy H, Alkasassbehz M (2013) A genetic programming model for S&P 500 stock market prediction. Int J Control Autom 6(6):303–314. https://doi.org/10.14257/ijca.2013.6.6.29

Shobana T, Umamakeswari A (2016) A review on prediction of stock market using various methods in the field of data mining. Indian J Sci Technol 9(48):9–14. https://doi.org/10.17485/ijst/2016/v9i48/107985

Shom P Das, Padhy S (2012) Support vector machines for prediction of futures prices in Indian stock market. Int J Comput Appl 41(3):22–26. https://doi.org/10.5120/5522-7555

Si J et al (2013) Exploiting topic based twitter sentiment for stock prediction. In: The 51st annual meeting of the association for computational linguistics, vol 2(2011), pp 24–29. http://www.scopus.com/inward/record.url?eid=2-s2.0-84907356594&partnerID=tZOtx3y1

Solanki H (2013) Comparative study of data mining tools and analysis with unified data mining theory. Int J Comput Appl 75(16):23–28

Soni S (2011) Applications of ANNs in stock market prediction: a survey. In: International conference on computer information systems and industrial management applications (CISIM), vol 2, no. 3, pp 132–136. https://doi.org/10.1177/1040638713493779

Sorto M, Aasheim C, Wimmer H (2017) Feeling the stock market: a study in the prediction of financial markets based on news sentiment. In: Hatzivassiloglou V, Klavans J, Eskin E (eds) Southern association for information systems conference. St. Simons Island, GA, USA, p. 19. http://aisel.aisnet.org/sais2017%0Ahttp://aisel.aisnet.org/sais2017/30%0Ahttp://aisel.aisnet.org/sais2017%0Ahttp://aisel.aisnet.org/sais2017/30

Stanković J, Marković I, Stojanović M (2015) Investment strategy optimization using technical analysis and predictive modeling in emerging markets. Procedia Econ Finance 19(15):51–62. https://doi.org/10.1016/S2212-5671(15)00007-6

Su CH, Cheng CH (2016) A hybrid fuzzy time series model based on ANFIS and integrated nonlinear feature selection method for forecasting stock. Neurocomputing 205:264–273. https://doi.org/10.1016/j.neucom.2016.03.068

Suhaibu I, Harvey SK, Amidu M (2017) The impact of monetary policy on stock market performance: evidence from twelve (12) African countries. Res Int Bus Finance 42(12):1372–1382. https://doi.org/10.1016/j.ribaf.2017.07.075

Sun A, Lachanski M, Fabozzi FJ (2016) Trade the tweet: social media text mining and sparse matrix factorization for stock market prediction. Int Rev Financ Anal 48:272–281. https://doi.org/10.1016/j.irfa.2016.10.009

Sureshkumar KK, Elango NM (2011) An efficient approach to forecast Indian stock market price and their performance analysis. Int J Comput Appl 34(5):44–49. https://doi.org/10.1196/annals.1364.016

Suthar BA, Patel RH, Parikh MS (2012) A comparative study on financial stock market prediction models. Int J Eng Sci: IJES 1(2):188–191. https://doi.org/10.1007/BF00629127

Talib R et al (2016) Text mining-techniques applications and issues. Int J Adv Comput Sci Appl 7(11):414–418

Thanh D Van, Minh Hai N, Hieu DD (2018) Building unconditional forecast model of stock market indexes using combined leading indicators and principal components: application to Vietnamese stock market. Indian J Sci Technol 11(2):1–13. https://doi.org/10.17485/ijst/2018/v11i2/104908

Ticknor JL (2013) A Bayesian regularized artificial neural network for stock market forecasting. Expert Syst Appl 40(14):5501–5506. https://doi.org/10.1016/j.eswa.2013.04.013

Tsai C-F, Hsiao Y-C (2010) Combining multiple feature selection methods for stock prediction: union, intersection, and multi-intersection approaches. Decis Support Syst 50(1):258–269. https://doi.org/10.1016/j.dss.2010.08.028

Tsai MF, Wang C-J (2017) On the risk prediction and analysis of soft information in finance reports. Eur J Oper Res 257(1):243–250. https://doi.org/10.1016/j.ejor.2016.06.069

Tsaurai K (2018) What are the determinants of stock market development in emerging markets? Acad Account Financ Stud J 22(2):1–11

Tziralis G, Tatsiopoulos I (2007) Prediction markets: an extended literature review. J Predict Mark 1:75–91

Umoru D, Nwokoye GA (2018) FAVAR analysis of foreign investment with capital market predictors: evidence on Nigerian and selected African stock exchanges. Acad J Econ Stud 4(1):12–20

Uysal AK, Gunal S (2014) The impact of preprocessing on text classification. Inf Process Manage 50:104–112

Vaisla SK, Bhatt KA (2010) An analysis of the performance of artificial neural network technique for stock market forecasting. Int J Comput Sci Eng 02(06):2104–2109

Vu T-T et al (2012) An experiment in integrating sentiment features for tech stock prediction in Twitter. In: Workshop on information extraction and entity analytics on social media data, pp 23–38. http://www.aclweb.org/anthology/W12-5503

Wang Y (2013) Stock price direction prediction by directly using prices data: an empirical study on the KOSPI and HSI, pp 1–13. https://doi.org/10.1504/ijbidm.2014.065091

Wang L, Qiang W (2011) Stock market prediction using artificial neural networks based on HLP. In: Proceedings—2011 3rd international conference on intelligent human-machine systems and cybernetics, IHMSC 2011, vol 1, pp 116–119. https://doi.org/10.1109/ihmsc.2011.34

Wanjawa BW (2016) Predicting future Shanghai stock market price using ANN in the period 21 Sept 2016 to 11 Oct 2016

Wanjawa BW, Muchemi L (2014) ANN model to predict stock prices at stock exchange markets. Nairobi

Wei LY (2016) A hybrid ANFIS model based on empirical mode decomposition for stock time series forecasting. Appl Soft Comput J 42:368–376. https://doi.org/10.1016/j.asoc.2016.01.027

Wei L-Y, Chen T-L, Ho T-H (2011) A hybrid model based on adaptive-network-based fuzzy inference system to forecast Taiwan stock market. Expert Syst Appl 38(11):13625–13631. https://doi.org/10.1016/j.eswa.2011.04.127

Wensheng D, Wu JY, Lu CJ (2012) Combining nonlinear independent component analysis and neural network for the prediction of Asian stock market indexes. Expert Syst Appl 39(4):4444–4452. https://doi.org/10.1016/j.eswa.2011.09.145

Xi L et al (2014) A new constructive neural network method for noise processing and its application on stock market prediction. Appl Soft Comput J 15:57–66. https://doi.org/10.4171/RLM/692

Yeh C-Y, Huang C-W, Lee S-J (2011) A multiple-kernel support vector regression approach for stock market price forecasting. Expert Syst Appl 38(3):2177–2186. https://doi.org/10.1016/j.eswa.2010.08.004

Yetis Y, Kaplan H, Jamshidi M (2014) Stock market prediction using artificial neural network. In: World Automation Congress. ISI Press, pp 1–5. https://doi.org/10.5120/17399-7959

Yifan L et al (2017) Stock volatility prediction using recurrent neural networks with sentiment analysis. https://doi.org/10.1007/978-3-319-60042-0_22

Yoosin K, Seung RJ, Ghani I (2014) Text opinion mining to analyze news for stock market prediction. Int J Adv Soft Comput Appl 6(1–13):44. https://doi.org/10.1016/S0399-077X(16)30365-1

Yu H, Liu H (2012) Improved stock market prediction by combining support vector machine and empirical mode decomposition. In: 2012 5th international symposium on computational intelligence and design, ISCID 2012, pp 531–534. https://doi.org/10.1109/iscid.2012.138

Zhang X, Fuehres H, Gloor PA (2011) Predicting stock market indicators through Twitter “I hope it is not as bad as I fear”. Procedia Soc Behav Sci 26(2007):55–62. https://doi.org/10.1016/j.sbspro.2011.10.562

Zhang X et al (2014) A causal feature selection algorithm for stock prediction modeling. Neurocomputing 142:48–59. https://doi.org/10.1016/j.neucom.2014.01.057

Zhang X et al (2017) Improving stock market prediction via heterogeneous information fusion. Knowl Based Syst 143:236–247. https://doi.org/10.1016/j.knosys.2017.12.025

Zhou Z, Xu K, Zhao J (2017) Tales of emotion and stock in China: volatility, causality and prediction. https://doi.org/10.1007/s11280-017-0495-4

Zhou X et al (2018) Stock market prediction on high frequency data using generative adversarial nets. Math Probl Eng 2018:1–12. https://doi.org/10.1155/2018/4907423

Download references

The declare that they have not received any funding or Grant for this work.

Author information

Authors and affiliations.

Department of Computer Science, Sunyani Technical University, Sunyani, Ghana

Isaac Kofi Nti

Department of Computer Science and Informatics, University of Energy and Natural Resources, Sunyani, Ghana

Isaac Kofi Nti, Adebayo Felix Adekoya & Benjamin Asubam Weyori

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Isaac Kofi Nti .

Ethics declarations

Conflict of interest.

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

See Tables 2 , 3 , 4 , 5 , 6 and 7 .

Rights and permissions

Reprints and permissions

About this article

Nti, I.K., Adekoya, A.F. & Weyori, B.A. A systematic review of fundamental and technical analysis of stock market predictions. Artif Intell Rev 53 , 3007–3057 (2020). https://doi.org/10.1007/s10462-019-09754-z

Download citation

Published : 20 August 2019

Issue Date : April 2020

DOI : https://doi.org/10.1007/s10462-019-09754-z

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Machine-learning

- Stock-prediction

- Artificial intelligence

- Technical-analysis

- Fundamental-analysis

- Find a journal

- Publish with us

- Track your research

Technical Analysis Indicators in Stock Market Using Machine Learning: A Comparative Analysis

Ieee account.

- Change Username/Password

- Update Address

Purchase Details

- Payment Options

- Order History

- View Purchased Documents

Profile Information

- Communications Preferences

- Profession and Education

- Technical Interests

- US & Canada: +1 800 678 4333

- Worldwide: +1 732 981 0060

- Contact & Support

- About IEEE Xplore

- Accessibility

- Terms of Use

- Nondiscrimination Policy

- Privacy & Opting Out of Cookies

A not-for-profit organization, IEEE is the world's largest technical professional organization dedicated to advancing technology for the benefit of humanity. © Copyright 2024 IEEE - All rights reserved. Use of this web site signifies your agreement to the terms and conditions.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

A Study of the Best Combination of Technical Analysis Tools Used in the Stock Markets: Evidence in Indian Context

2020, IAEME PUBLICATION

The stock market is volatile and can be influenced by multiple factors. This can be studied by the fundamental and technical analysis of the stock. Here the objective of this research paper is to study various technical analysis tools and determine the optimum combination of the above tools which can be used to generate buy or sell signals with the highest accuracy. Few technical indicators are studied and considered for this research like Trend lines, Support and Resistance (previous highs and lows), Candlesticks, Bollinger bands, RSI, Stochastics and Moving Averages. Five stocks from five different industries were studied and further analysed. and the Technical indicators in a 6-month time frame were checked. Bollinger Bands have the highest hit rates among all the other indicators with RSI having the second-highest and Williams % R the third.

Related Papers

The purpose of this study is to determine which indicators are more capable of showing more accurate sell and buy signals on the LQ45 index by using the oscillator indicator Moving Average Divergent Convergent (MACD), Bollinger Band, and Relative Strength Index (RSI). This research combines several indicators, whereas some previous studies use only one fator in their research so that there is no better visible difference and indicators. The results in this study indicate that the sell signal can be captured well by the Bollinger band and MACD indicators, but it cannot be captured properly by the RSI, the volume can be small or heading and are in the side ways, while the MACD plays a too slow role in capturing the signal buy compared to Bollinger bands and RSI. The use of a single indicator will never show a buy and sell signal that is really accurate, this is based on the results of research that shows the difference in timeliness in Bollinger, RSI and also MACD so that the combinat...

Development Economics: Macroeconomic Issues in Developing Economies eJournal

This study includes the description of indicators which can be used for technical analysis of Indian market Nifty stocks. The indicators which have been used in this study are Moving Averages, Moving Averages cross rules and Moving Averages Convergence/Divergence. Later this study also includes the usage and application of Moving Average on Nifty stocks. Additionally, the analysis demonstrates that these indicators are the tools for successful trading and profit generation.

International Journal of Finance & Banking Studies (2147-4486)

Senthilmurugan Paramasivan

Technical Analysis is a study of the stock market relating to factors affecting the supply and demand of stocks and also helps in understanding the intrinsic value of shares and to know whether the shares are undervalued or overvalued. The stock market indicators would help the investor to identify major market turning points. This is a significant technical analysis of selected companies which helps to understand the price behaviour of the shares, the signals given by them and the major turning points of the market price. Any investor or trader must certainly consider technical analysis as a tool whether to buy the stock at a particular point of time though it is fundamentally strong. The objective of the study is the technical analysis on selected stocks of steel sector and interprets on whether to buy or sell them by using techniques. The study is purely based on secondary sources which includes the historical data available from the website. For the purpose of analysis, techniqu...

IOSR Journals

Banking sector is the backbone of the economy which also goes through its own phases of ups and down. The State Bank of India, popularly known as SBI is one of the leading bank of public sector in India. ICICI is second largest and leading bank of private sector in India. Even in the share markets, the performance of banks shares is of great importance. Thus, the performance of the share market, the rise and the fall of market is greatly affected by the performance of the banking sector shares and this study revolves around all factors, their understanding and a theoretical and technical analysis. The stock market is one of the vital components of a free-market economy, as it provides companies with access to capital in exchange for giving investors a slice of ownership in the company. A stock is a general term term used to describe the ownership certificates of any company. A share, on the other hand, refers to the stock certificate of a company. In this research paper researcher tried to compare the public and private banks and did the technical analysis to get more insight. Data has been considered for 3 months starting from 1st October 2020 to 19 January 2021.The study found that SBI is performing well and financially sound than ICICI Bank but in context of deposits and expenditure ICICI bank has better managing efficiency than SBI.

International Journal of Innovative Technology and Exploring Engineering

Rajesh Mamilla

Financial markets generate vast data every trading day. There are markets for equity shares, commodities, fixed income securities and currencies etc. Further, we do have organised markets for financial ddderivatives. The exponential growth of financial markets isthe order of the modern-day. Developments in information and communication technology (ICT) helped the growth of financial markets and its operations to greater heights. One of the financial market analysis is Candlestick Technical analysis also is known as Japanese candlestick charting. It is the oldest form of financial market analysis originated in japan. This study measured the occurrence and tested the efficiency of various bullish reversal candlestick patterns on 17 stocks of India’s leading stock market benchmark index NIFTY 50 for the period of 16 years from 2000 to 2015.Data mining with backtesting methodology is used to find the top 10 candlestick patterns with respect to the frequency of occurrence during the stud...

International Journal of Scientific Research in Computer Science, Engineering and Information Technology

International Journal of Scientific Research in Computer Science, Engineering and Information Technology IJSRCSEIT

There are many stocks available in the market for purchase. The process for selecting stocks for making decision is a complex task. Moreover, there are two main decision making tools used widely. One is fundamental analysis and other is technical analysis. This paper discusses about these analysis in details and also the factors affecting them. By considering all the associated factors, better analysis can be done and hence better prediction.

Dr. Qamar Abbas

This paper examines the validity of Technical analysis on Karachi Stock Exchange by investigating the tools used in Technical analysis for the sample period of 1997 to 2014. The KSE-100 index was examined to investigate the efficiency of stock exchange by employing Wright's sign based variance ratio test. The results indicate that KSE-100 index is not efficient in its weak form. The study then compared a broad range of technical trading rules based on Simple Moving Averages, Exponential Moving Averages, with Generalized Regression Neural Network (GRNN) to find the forecasting ability of these indicators individually as well as in combination. The results indicate the predictive power over future stock price behavior. The insertion of GRNN enhances the profit generating capacity of above average return. To know that whether it is possible to beat buy-and-hold strategy, the study proposes two trading strategies based on these rules. The proposed strategies have the capability to outstrip the buy-and-hold strategy, even in the presence of transactional cost. Technical analysis is very effective for the investors in creating excess return for the sample period. The concept of modern financial market is enthralling and multifaceted and thus attracting the interest of traders. Modern financial system has an important attribute of having an organized place for trading of financial assets. The detailed financial data is recorded daily in shapes of either ticker tapes or on board with chalks (Michie, 1999). Before the dawn of efficient market hypothesis (EMH), the practitioners of financial market have already been employing some simple statistical techniques for the analysis of such data. In 1884, Dow Theory developed by Charles Dow was an attempt to analyze the board momentum of the US stock market. Similarly Bachelier (1900) employed the Random walk theory to investigate the movements in stock prices. Due to the works of the early pioneers, a new area in finance materialized. This area uses the data of previous stock prices to foretell future prices of these stocks and is known as Technical analysis today.

International Scientific Journal Monte

SEADIN Xhaferi

Trading with stocks in developed market conditions for some is fun, for others it is a way to preserve the real value of the asset, while for the most is a challenge to gain bigger profits quickly and easily. Dreams on stock market alchemy rely on the development and upgrading of special systems whose ultimate goal is to uncover stock price secrets and their changes. What are the chances of this happening? Chances are minimal, according to experiences from the world’s leading stock exchanges in the past. The stock market complexity, the number and unpredictability of factors affecting stock prices and unexpected changes or stability do not give much hope to those who know what’s going to happen in the future. In such endeavors there are equal opportunities for both stock exchange experts and full-time amateurs. For all this, if the stock market cannot be defeated or deceived, then it is better to join it. So this means: to create a diversified portfolio of securities that provides a...

Stock market is a market of Equities and debts, through which the companies and government raise the funds for long term. India, being the developing country has received a huge capital inflow in recent years. Stock price movement mainly depends on Inflation, Deflation, Interest rates and Exchange rates. Since India is a developing country, a widespread of capital inflow has been witnessed in the recent years. Indian economy is particularly focused on developing the company sectors. A good knowledge about the market will help to take better investment decisions, which will help investors to maximize the return on their investment. Performance of the company will reflect in the stock price. Stock price movement of company will depend on the financial and functional elements. The paper aimed at analyzing the equity percentage return over the fluctuations in the Indian stock market. Also measure the potential of returns an investor could get over his investment over a period of time. Relative Strength Index and Moving Average Exponential technical indicators are used for identification of trend to help the investors to make the right invest decision. Stock market is place where the risk is involved. An investor should know how to manage the risk by taking timely buy and sell decisions. The investor should keenly observe the Macro and Micro Economic conditions to invest in the market. This will help the investors to make good returns on their investment with the proper entry and proper exit for stock at the right time.

RELATED PAPERS

JETP Letters

Yuriy Gnatenko

Adarsh Journal of Management Research

Sachin Balbhimrao

Timotheos Frey

Revista Eletrônica de Enfermagem

Marcus Antonio De Souza

sistemadif.jalisco.gob.mx

Jose Cervantes

2006 International Workshop on Integrated Nonlinear Microwave and Millimeter-Wave Circuits

Khaled Gharaibeh

Spectrochimica Acta Part B: Atomic Spectroscopy

Jesús Manuel Anzano Lacarte

Francisco Herrera

Viorel Istrate

Anais Brasileiros de Dermatologia

Arley Junior

Canadian Prosthetics & Orthotics Journal

Hamid Bateni

Geográfica digital

Clarisa Suden

Sarwititi Sarwoprasodjo

Psicol Reflex Crit

Paula Harris

Zenodo (CERN European Organization for Nuclear Research)

Estela Guedes

Journal of Clinical Oncology

Shannon Bailey

British Journal of Psychiatry

Renzo Puccetti

HAL (Le Centre pour la Communication Scientifique Directe)

Stephanie Fontagne

Formación universitaria

Agustin Alfredo Torres Rodriguez

Leukemia research reports

Ole Bjerrum

Japan Geoscience Union

Ulusal travma ve acil cerrahi dergisi = Turkish journal of trauma & emergency surgery : TJTES

Journal of Economic Theory

B. Douglas Bernheim

Acta medica Indonesiana

Hikmat Permana

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Open access

- Published: 24 February 2018

Examination of the profitability of technical analysis based on moving average strategies in BRICS

- Matheus José Silva de Souza 1 ,

- Danilo Guimarães Franco Ramos 2 ,

- Marina Garcia Pena 2 ,

- Vinicius Amorim Sobreiro 2 &

- Herbert Kimura 2

Financial Innovation volume 4 , Article number: 3 ( 2018 ) Cite this article

39k Accesses

30 Citations

9 Altmetric

Metrics details

In this paper, we investigated the profitability of technical analysis as applied to the stock markets of the BRICS member nations. In addition, we searched for evidence that technical analysis and fundamental analysis can complement each other in these markets. To implement this research, we created a comprehensive portfolio containing the assets traded in the markets of each BRICS member. We developed an automated trading system that simulated transactions in this portfolio using technical analysis techniques. Our assessment updated the findings of previous research by including more recent data and adding South Africa, the latest member included in BRICS. Our results showed that the returns obtained by the automated system, on average, exceeded the value invested. There were groups of assets from each country that performed well above the portfolio average, surpassing the returns obtained using a buy and hold strategy. The returns from the sample portfolio were very strong in Russia and India. We also found that technical analysis can help fundamental analysis identify the most dynamic companies in the stock market.

Introduction

The basic principle of technical analysis (TA) is that patterns related to past prices of instruments traded in the asset markets can be used to predict the direction of future prices. The objective is to enhance the return of an investment portfolio by understanding the interaction of price indicators for the portfolio’s holdings over an identified time period. According to Stanković et al. ( 2015 ), TA is a way of detecting trends in asset prices based on the premise that the price series moves according to investors’ perceived standards. Their study demonstrated that the duration of these standards is sufficient for the investor to make above-average profits, even if the investments incur transaction costs.

The goal of our research was to investigate the profitability of trading strategies based on TA in the stock markets of BRICS countries. To this end, we developed an automated trading system based on the moving averages of past prices. We demonstrated that this trading system, using technical analysis techniques, could surpass the profitability of a buy and hold strategy for a portion of the traded assets, calculated by country. The work presented in this paper updated the findings of previous research, and found that technical analysis can help fundamental analysis identify the most dynamic companies in the stock market.

TA uses a systematic, graphical approach to identify patterns of historical trading prices and market movements, and then formulate predictions that may generate abnormally strong returns. According to Murphy ( 1999 , pp. 1–2), graphs are the primary instruments of TA. The graphs reflect indicators, such as moving averages and oscillators, that allow analysts to detect trends, identify points of inflection in the price movement, and track capital inflows and outflows.

The tools used by TA can provide an index of resistance and support as well. Indicators include the Relative Strength Index (RSI), the Moving Average Convergence Divergence (MACD), and the Average Directional Index (ADX), among others. These indicators seek to estimate patterns of future behavior and predict buy and sell opportunities solely from the previously verified pricing of assets. More specifically, Vandewalle et al. ( 1999 , pp. 170–172) defined moving averages as transformations of a price series that allow us to identify trends from data smoothing.

According to Gerritsen ( 2016 ), the success of technical analysis trading rules would conflict with the weak form of the Efficient Market Hypothesis (EMH) (Fama 1970 ), which holds that current asset prices reflect all relevant past data. In its weak form, EMH states that it is not possible to obtain above-average returns from the study of past prices (Malkiel and Fama 1970 , p. 383), implying that a price series has a unit root. Therefore, belief in the validity of TA means rejecting EMH. Expressed in economic terms, Jensen ( 1978 , p. 97) considered a market to be efficient if the economic profit is null, i.e., if the market meets the optimal condition that marginal benefit equals the marginal cost of acting based on the publicly available information.

Technical analysis is not compatible with the idea that stock prices can change at random (the random walk hypothesis), as pointed out by Lo and MacKinlay ( 1987 , pp. 87–88). A series of prices presents a unit root, or follows a random walk, if the observations at an instant t can be expressed as the price in t − 1 added to a random shock. In other words, random factors persist in determining the observations of the variable, since the shock is little dissipated over time. More formally, let pt. be the price of an asset at the instant t , and let εt be a term denoting a random shock. If the data generation process is in the following form:

, then the series of prices is said to be a unit root if α is not statistically different from 1, which means that the random shock is completely absorbed in the process.

In comparison to TA, fundamental analysis (FA) is focused on the economic and financial aspects of stocks and the markets. According to Lui and Mole ( 1998 ), FA turns to the microeconomic aspects of companies and to the macroeconomic fundamentals of sectors and countries — known as market fundamentals (Allen and Taylor 1990 ) — to justify past movements and to predict fluctuations. Through the review of previous research, we also made clear that FA and TA are not mutually exclusive tools for analyzing market data, but rather explore different drivers of price behavior. TA could be an auxiliary tool to FA. In fact, some studies explored a hybrid approach using both TA and FA, e.g., Lui and Mole ( 1998 ), Lam ( 2004 ), and António Silva and Neves ( 2015 ). In this paper, however, we focused primarily on TA. For our research, we assumed that prices are determined by the equilibrium between the supply and demand of the asset to which they refer. Therefore, prices captures any considerations that may be brought by fundamental analysis (Nison 1991 , pp. 8–11).

The remainder of this paper is structured as follows: In Section 2, we give a brief summary of related research regarding both the development of TA and the results of experiments with data from emerging countries. Section 3 provides the conceptual foundation of TA, while section 4 explains our method and the algorithm applied to generate buy and sell signals. Section 5 discusses the main results obtained, demonstrates the importance of using TA and FA as complementary tools for obtaining profits in the open market, and draws attention to the importance of these results for the literature. Section 6 provides our conclusion.

Related research

Scholars have tested the efficiency of the tools of technical analysis frequently, for example, in the studies of Allen and Taylor ( 1990 ), Jegadeesh ( 2000 ), and Kuang et al. ( 2014 ). The main reasons for this continued research, as discussed in Zhu and Zhou ( 2009 ), were that previous studies of the profitability of technical analysis obtained inconclusive results and lacked a scientific basis. Consequently, more consistent hypotheses to justify TA were needed. For example, Allen and Taylor ( 1990 ), Frankel and Froot ( 1986 ), Shiller ( 1989 ), and others pointed out the irrationality of TA. According to Allen and Taylor ( 1990 ), the subjectivity of this approach prevents it from acquiring a scientific character. Frankel and Froot ( 1986 ) and Shiller ( 1989 ) held that the use of technical indicators leads to overvaluation of asset prices, thereby heating up the demand for some assets without good reason.

There have been few experimental tests of the profitability of the TA indicators across the typical market structures of emerging countries. In particular, further work is needed regarding the BRICS member nations, a special subgroup composed of Brazil, Russia, India, China, and South Africa. Recently, studies were carried out on isolated emerging markets that are not similar to each other, including contributions by Chang et al. ( 2004 ), Kuang et al. ( 2014 ), Mitra ( 2011 ), and Mobarek et al. ( 2008 ). However, none of these studies proposed a comparison of the results for groups of similar countries, so they failed to answer whether TA is profitable for emerging markets as a whole.

Interest in these countries has been stimulated by the typical characteristics of their macroeconomic environments, such as instability, uncertainty, and inflation resulting from their adopted economic growth strategies. According to Chang et al. ( 2004 ), emerging countries became attractive markets to investors looking for portfolio diversification and financial returns above the average attainable from the consolidated markets of developed countries. Emerging markets differ from markets in developing countries insofar as they are closer to the markets of developed countries, making them more dynamic and attractive to foreign investors. On this topic, Mukherjee and Roy ( 2016 ) emphasized the relationship between instrument price fluctuations and macroeconomic particularities.

The good predictability of TA and the high returns in emerging markets are not unanimously accepted in the literature. Chang et al. ( 2004 ) and Harvey ( 1995 ) emphasized that there is a strong autocorrelation in the price series of emerging markets, which means that the random walk hypothesis is rejected. Therefore, there is a good predictive capacity in these markets. However, Costa et al. ( 2015 ) and Ratner and Leal ( 1999 ), who considered transaction costs, identified that the predictive capacity of TA does not lead to abnormally strong returns.

In this context, Urrutia ( 1995 ) identified positive results of TA for Latin American countries. Noakes and Rajaratnam ( 2014 ) signaled mixed results for South Africa because the profitability of TA for low capitalization assets sustains itself, which is the opposite of more commonly traded assets. Sharma and Kennedy ( 1977 ) showed negative results for India. Almujamed et al. ( 2013 ); Errunza and Losq ( 1985 ) suggested there is a lower degree of efficiency in emerging markets, compared to the consolidated markets of developed countries. Sobreiro et al. ( 2016 , p. 99) found that a strategy based on the crossover of moving averages generated greater profits than a static strategy for Russia, Brazil, and Argentina, but not for the markets of Jamaica and China.

Table 1 summarizes the results of the main studies of the profitability of TA in both emerging and developed countries. Surveys were considered to provide mixed evidence if their results demonstrated that the good performance of technical analysis was not sustained after considering transaction costs.

Based on this context, the objective of this paper was to investigate the profitability of moving average trading strategies in the stock markets of BRICS countries. We sought to analyze the performance of TA in environments that are different from those of developed countries and other emerging nations in terms of their stock markets, the behavior of investors, and national economic policies (Mozumder et al. 2015 ; Naresha et al. 2017 ).

For this research, we used an automated trading system (ATS) that simulated the transactions based on patterns verified by the data and related to the signals of the moving averages over the prices of the assets. We prepared a comprehensive portfolio for each country, containing all the assets traded in the markets of each BRICS member. For South Africa, China, and India, we included the asset prices from 2000 to 2016. For Brazil and Russia, we used price data from 2007 to 2016. Initial capital transactions were carried out as the model issued buy and sell signals from the interaction of the series of moving averages over prices.

In this work, we sought to complement the approach of Costa et al. ( 2015 ) and Sobreiro et al. ( 2016 ) in some respects. First, we studied the performance of technical analysis for the instruments traded in Brazil as verified in Costa et al. ( 2015 ), and also for the BRICS members, to check the profitability of indicators for a more general class of countries. In contrast to Sobreiro et al. ( 2016 ), we included transaction costs, aiming to establish more realistic assumptions.

Our study aimed to update results from Chong et al. ( 2010 ) by using more recent data and adding South Africa to the analysis, the latest member to be included in the BRICS countries. In this context, we investigated all BRICS countries, instead of only the BRIC nations, using data through 2016. It is important to highlight that both Sobreiro et al. ( 2016 ) and Chong et al. ( 2010 ) did not analyze the results of trading strategies that took into account transaction costs. Therefore, our automated trading system, by operating with and without brokerage fees, allowed us to assess the impact of transaction costs on the overall profitability of the strategies.

A brief overview of the conceptual foundation of technical a nalysis

Nison ( 1991 , pp. 8–11) added the psychological and emotional components of the rational agents to the study of asset prices in the financial market. This approach was capable of capturing the animal spirits spoken about by Keynes ( 1936 ), a concept that is not incorporated in fundamental analysis. Nison ( 1991 ) suggested that the study of technical analysis is important because it provides an understanding of why the market moves. The author emphasized that great negotiators make their decisions based on technical indicators. Both the previous price and the influence exercised by leaders over the decisions of other investors are factors that determine the price movement itself.

Ellis and Parbery ( 2005 ) highlighted the use of moving averages for the generation of buy and sell signals as a mechanism to identify price trends. While the short-term moving average is more sensitive to price changes, longer term moving averages capture medium- and long-term trends. Investors in the stock exchanges utilize technical analysis extensively, and moving averages are the most commonly used indicators because they are simple to understand and relatively easy to use.

Regarding the calculation of the moving averages, let h be the length of the moving average, i.e., the number of observations from which the average of the values will be extracted, and let N ≥ h be the position of a given observation from which the previous h values will be included in the calculation of the N -th moving average. If SMAN is the N -th simple moving average, and EMAN is the N th exponential moving average, they can be calculated as follows:

For a deeper explanation of the simple moving average, please see Vandewalle et al. ( 1999 ). According to Appel ( 2005 ), the exponential moving average is better than the simple moving average for identifying trends in a price series. Park and Irwin ( 2007 , p. 67) summarized the evidence for the profitability of technical analysis in futures contracts, foreign currency markets, and in the capital markets. According to the authors, from 1988 to 2004, 26 studies obtained positive results for the use of technical indicators in the capital markets, and 12 found negative results. However, Park and Irwin ( 2007 , pp. 29–30) concluded that the positive results of technical analysis were more consistent and significant for the futures and foreign currency markets, compared to results for the stock markets. Also, the authors concluded that TA’s positive results for asset markets were subject to data manipulation problems and the creation of ex-post strategies.

In previous research, findings about the profitability of technical analysis were quite inconsistent when applied to the stock markets of emerging countries. In general, the simple moving average (SMA) or exponential moving average (EMA) strategies assured a positive return, but the return was not sustained when transaction costs were considered, such as fees paid to the broker (Brock et al. 1992 ).

Similar results were presented by Mitra ( 2011 ), and Ratner and Leal ( 1999 ) when they compared the returns obtained from the generation of buy or sell signals with the returns of a static strategy such as buy and hold. The former study focused on financial assets traded in India, and found that when the short-term moving average crossed above the long-term moving average, the prices generated positive net results. However, when transaction costs were considered, this profitability did not sustain itself. Ratner and Leal’s study (Ratner and Leal 1999 ), which was broader and considered countries in Latin America and Asia, reached the same conclusion. The exceptions were the Taiwanese, Mexican, and Thai markets, whose profitability was maintained even after transaction costs were included.

For data regarding the United States of America (USA), Alexander ( 1961 ), Brock et al. ( 1992 ), and Fama and Blume ( 1966 ) found that if the transaction costs were not zero, the profitability gained by applying technical analysis was not significant. In comparison, Kuang et al. ( 2014 ) achieved an average annual return of approximately 30% for emerging countries’ stock markets. However, they considered that this profitability was not accurate, since it was the result of problems arising from prior manipulation of the data to discover ex-ante patterns.

In a study using data from Bangladesh, Mobarek et al. ( 2008 ) proposed that the accelerated growth of the capitalization level in that country was an investment opportunity. The research emphasized that Bangladesh was an emerging country that had undergone extreme structural economic changes in which the focus on agriculture was abandoned in favor of a strategy involving industrialization and the formation of new companies. The null hypothesis that the market is weakly efficient was rejected after verification.

These results showed the weakness of moving average techniques in predicting price behavior. They also suggested that if transaction costs are negligible, technical analysis becomes a viable alternative, indicating that under certain conditions the markets are not efficient. Treynor and Ferguson ( 1985 ) emphasized the importance of historical prices in forecasting price behavior as a complement to the role played by the information available to suppliers and claimants who are, above all, responsible for creating profit opportunities.

Shynkevich ( 2012 ) concluded that the profitability of technical analysis for portfolios holding small cap assets with less liquidity was greater than for portfolios holding large cap companies from the technology area. For this reason, it is especially relevant to analyze the returns of classic technical indicators for emerging markets where more small caps are expected, possibly because of policies used to stimulate industrial activity.

Recent empirical evidence for South Africa verified by Noakes and Rajaratnam ( 2014 ) suggested that the level of capitalization of traded assets in that country was inversely related to market inefficiency. Moreover, the authors suggested that the degree of market efficiency falls during periods of crisis, as during the financial crisis of 2008.

The research of Costa et al. ( 2015 ) analyzed the power of technical analysis indicators for the Brazilian asset market. The authors concluded that technical analysis has weak predictive power whether or not brokerage fees are considered. However, the use of crossing moving averages, simple or exponential, and Moving Average Convergence Divergence (MACD) provided a high probability of guaranteeing a return greater than the amount invested. In general, research indicated that it is natural for markets to become efficient, because they do not obtain significant returns from past price behavior. Thus, evidence for technical analysis in emerging markets suggested less efficiency in these countries, which might set up an attractive investment option for the foreign investor.

Sobreiro et al. ( 2016 ) obtained positive and above-average returns generated by the static buy and hold strategy for the short-term SMA crossing over the long-term SMA. However, although some combinations of short- and long-term SMAs were profitable for some countries, they did not provide sustained profitability for other emerging countries. Consequently, a more general conclusion could not be reached from the study. In general, buy and hold is a more profitable and risk-free alternative to an automated strategy for most emerging markets.

It is worth mentioning that the approach of Sobreiro et al. ( 2016 ) does not explore the impact of transaction cost on a portfolio’s return, which has a significant cooling effect on the performance of the trades, and is subject to currency rate volatility. With regard to this last aspect, it is worth noting that the authors’ use of 10,000.00 local currency units as the initial value of the portfolio left the investments open to the effects of exchange rate fluctuations and inflation that often impact the currencies of emerging countries.

Concerning the influence of technical analysis on fundamental analysis, Almujamed et al. ( 2013 , pp. 57–58) studied data for Kuwait. They concluded that investors check a firm’s profitability before looking at the stock chart movements and stock price trends of the company. Furthermore, they asserted that fundamental analysis that uses a more recent series of prices, usually within five years, is employed more commonly by investors in developed markets, while emerging markets are considered inefficient.

According to Bettman et al. ( 2009 , pp. 21–22), TA and FA are complementary, since models that combine the assumptions and elements of both analyses achieve higher profitability than models based on a single approach only. For their analysis of TA and FA, the authors ran linear regression models with explanatory variables from TA, e.g., trend and momentum indicators based on past prices. They also ran models using variables from FA, e.g., book value and earnings per share, and models using variables from both. Bettman’s findings indicated that a model with independent variables from both approaches provided better performance based on statistics such as the Akaike information criterion (AIC) and likelihood ratio tests. The work of Wang et al. ( 2014 , pp. 33) supported a similar conclusion, showing that the joint application of FA and TA reduced the risk of the investment.

Chong et al. ( 2010 , pp. 237–238) set out to compare the performance of the traditional technical analysis indicators for the BRIC1. They concluded that the average profit in Russia surpassed the returns obtained in the other countries, and the evidence indicated that the Brazilian open market was the most efficient. The authors attributed these findings to the fact that the age of the market was directly related to efficiency. Therefore, they supported the view that markets become efficient over time. However, the costs associated with open market buy and sell transactions were not considered. Lo et al. ( 2000 , pp. 1753–1764) demonstrated that technical analysis benefits from the automation provided by computerized trading systems, with emphasis on the identification of visual patterns in the asset price series.

Tharavanij et al. ( 2015 , pp. 39–40) analyzed the performance of a wide variety of technical indicators for similar Asian emerging markets, such as Malaysia, Indonesia, Singapore, and Thailand. The analysis was conducted on a risk-adjusted basis, and accounted for brokerage fees. The authors found several levels of efficiency in the markets, but overall, TA strategies could not beat the buy and hold benchmark, and prices could not foster excess returns above the market average. These results indicated that similar characteristics did not lead to a single winning strategy.

To meet the objectives of this paper, we developed a transaction model, called the automated trading system (ATS), that worked automatically based on classic technical analysis, especially the use of moving averages, to soften price series and identify trends. As described by Booth et al. ( 2014 , p. 3651), automated trading systems perform trades autonomously, identifying investment opportunities based on artificial intelligence methods. The procedures that define the strategy used to generate trading signals can vary substantially. Technical indicators have found wide spread use for this purpose as a result of their extensive application by market practitioners.

Whatever the method used in a trading system, the base assumption is still the same: price predictions are based on past price data. According to Cervelló-Royo et al. ( 2015 , p. 5963), this principle imposes an important challenge for individual investors and companies, because forecasts of future prices are subject to occasional unexpected fluctuations that do not depend on the historical behavior of the markets. Chen and Chen ( 2016 , pp. 261–262) indicated that the stock market is subject to many changes in the underlying environment, such as variations in economic, political, and industrial conditions. According to the authors, finding the proper means for analysis is paramount for defining better or worse strategies for generating profits in the market.