100 Project Topics For Accounting Students [Updated]

The world of accounting is vast and diverse, offering exciting opportunities to explore various aspects of financial management and analysis. As an accounting student, embarking on a project can be a daunting yet enriching experience. But worry not! This blog serves as your guide to navigating the multitude of project topics for accounting students, categorized under key areas within accounting.

How Do You Choose a Research Topic in Accounting?

Table of Contents

Choosing a research topic in accounting involves balancing your interests, research feasibility, and relevance to the field. Here are some steps to guide you:

- Identify your interests: Reflect on the areas of accounting that excite you. Do you enjoy financial analysis, delving into regulations, or understanding cost management practices? Exploring your intrinsic motivation ensures you maintain enthusiasm for your project.

- Review current trends and literature: Browse academic journals, professional publications, and online resources related to accounting. See which areas are receiving significant attention or lack sufficient research. This helps identify potential gaps you can contribute to.

- Consult with professors or advisors: Discuss your interests and research ideas with professors or academic advisors. They can provide valuable insights, suggest relevant areas of research, and guide you towards feasible topics.

- Ensure feasibility and resources: Choose a topic with accessible data and research materials. Consider the time constraints of your project and ensure the topic can be adequately explored within that time frame.

- Refine your topic into a research question: Your chosen topic should culminate in a focused research question that can be answered through your research methodology. This helps maintain a clear direction for your research.

- Relevance: Ensure your topic aligns with your chosen field of study within accounting.

- Researchability: Choose a topic with sufficient data and resources readily available.

- Interest: Pick a topic that genuinely interests you to sustain your motivation throughout the research process.

By following these steps and considering these factors, you can choose a research topic in accounting that is both engaging and relevant to your academic pursuits and potential career path.

100 Project Topics For Accounting Students

Financial accounting and auditing.

- Impact of Cryptocurrency Adoption on Financial Reporting Standards.

- The Role of Blockchain Technology in Enhancing Audit Efficiency.

- Comparative Analysis of Accounting Standards: IFRS vs. US GAAP.

- Ethical Considerations in Revenue Recognition Practices.

- The Effectiveness of Internal Controls in Preventing Fraud: A Case Study.

- The Impact of Big Data Analytics on Financial Statement Analysis.

- Using Financial Ratios to Evaluate Company Performance Across Different Industries.

- The Role of Financial Statements in Mergers and Acquisitions.

- Exploring the Challenges and Opportunities of Implementing Cloud-based Accounting Systems.

- Analyzing the Effectiveness of Corporate Social Responsibility (CSR) Reporting.

Management Accounting and Cost Management

- Activity-Based Costing (ABC) vs. Traditional Costing Methods: A Comparative Study.

- Implementing Cost Reduction Strategies in a Specific Industry (e.g., Manufacturing, Healthcare).

- The Role of Management Accounting in Strategic Decision Making: A Case Study.

- Budgeting and Budgetary Control Techniques for Effective Financial Planning.

- Performance Measurement Systems for Different Departments: A Comparative Analysis.

- The Impact of Advanced Manufacturing Technologies on Cost Management Systems.

- Cost-Volume-Profit (CVP) Analysis for Pricing Decisions and Inventory Management.

- Exploring the Use of Lean Manufacturing Principles in Reducing Production Costs.

- The Role of Management Accounting in Sustainability Reporting Practices.

- Analyzing the Impact of Employee Engagement on Productivity and Cost Management.

Taxation and Public Accounting

- The Impact of Recent Tax Law Changes on Small Businesses.

- Exploring Tax Planning Strategies for Different Entity Types (e.g., C-Corporations, Partnerships).

- The Role of Government Agencies in Regulating Tax Compliance (e.g., IRS).

- Ethical Considerations in Tax Planning: A Case Study Analysis.

- The Future of Public Accounting in the Age of Artificial Intelligence (AI).

- Exploring Career Opportunities in Forensic Accounting and Fraud Investigation.

- The Impact of Tax Policy on Foreign Direct Investment (FDI) Decisions.

- Analyzing the Challenges and Opportunities of International Tax Compliance.

- The Role of Non-Profit Organizations in Public Accounting and Tax Planning.

- Comparing Tax Systems Across Different Countries: A Case Study Approach.

International Accounting and Finance

- The Challenges of Implementing International Financial Reporting Standards (IFRS) in Developing Economies.

- The Impact of Currency Fluctuations on Financial Statements of Multinational Companies.

- Comparative Analysis of Accounting Practices in the European Union (EU) vs. the United States (US).

- Exploring the Role of International Accounting Firms in Mergers and Acquisitions.

- The Ethical Implications of Transfer Pricing Practices in Multinational Corporations.

- Analyzing the Impact of Global Trade Agreements on International Accounting Standards.

- The Role of Cultural Differences in Financial Reporting Practices Across Countries.

- Exploring the Challenges of Foreign Corrupt Practices Act (FCPA) Compliance for Multinational Companies.

- The Future of International Accounting in the Era of Globalization and Technology.

- Analyzing the Impact of International Financial Reporting Standards (IFRS) on a Specific Industry.

Emerging Trends and Special Topics

- The Rise of Fintech and its Impact on Traditional Accounting Practices.

- Exploring the Ethical Implications of Using Big Data in Accounting and Auditing.

- Implementing Artificial Intelligence (AI) and Machine Learning (ML) in Accounting Tasks.

- The Future of the Accounting Profession in the Digital Age.

- The Increasing Focus on Environmental, Social, and Governance (ESG) Factors in Financial Reporting.

- The Impact of Blockchain Technology on Supply Chain Management and Accounting.

- Exploring the Use of Robotic Process Automation (RPA) in Streamlining Accounting Processes.

- The Impact of the Sharing Economy on Traditional Accounting and Tax Systems.

- Analyzing the Ethical Considerations of Cybersecurity Breaches in Accounting Firms.

- Exploring the Role of Accounting Professionals in Sustainable Development Goals (SDGs).

Additional Topics

- The Impact of Accounting Standards on Small and Medium-sized Enterprises (SMEs).

- The Role of Behavioral Accounting in Understanding Financial Decisions.

- The Importance of Communication Skills for Accounting Professionals.

- Ethical Considerations in Whistle-blowing Practices Within Accounting Firms.

- Exploring the Use of Data Visualization Tools in Financial Reporting.

- The Impact of Corporate Social Responsibility (CSR) on Investor Decisions.

- Analyzing the Cost-Effectiveness of Implementing Internal Audit Functions.

- Exploring the Ethical Implications of Market Manipulation Practices.

- Analyzing the Relationship Between Corporate Governance and Financial Performance.

- The Impact of Environmental Regulations on Accounting and Reporting Practices.

- The Role of Accounting Standards in Addressing Climate Change Issues.

- Exploring the Use of Blockchain Technology in Financial Reporting Automation.

- Analyzing the Ethical Considerations of Using Social Media by Accounting Professionals.

- The Impact of Artificial Intelligence (AI) on the Future of Tax Planning Strategies.

- Exploring the Challenges and Opportunities of Implementing Activity-Based Budgeting (ABB).

- Analyzing the Effectiveness of Different Management Accounting Information Systems (MAIS)

- The Role of Internal Controls in Ensuring Data Security and Privacy in Accounting Systems.

- Exploring the Use of Gamification Techniques in Accounting Education.

- Analyzing the Impact of the Gig Economy on Traditional Accounting and Tax Practices.

Specialized Topics

- The Role of Forensic Accounting in Detecting and Investigating Fraudulent Activities.

- Exploring the Ethical Considerations of Valuation Techniques in Mergers and Acquisitions.

- Analyzing the Impact of International Trade Agreements on Transfer Pricing Practices.

- The Role of Cost Accounting in Project Management and Decision Making.

- Exploring the Use of Financial Modeling in Corporate Budgeting and Forecasting.

- Analyzing the Ethical Considerations of International Tax Havens and their Impact on Global Tax Compliance.

- The Role of Government Accounting in Ensuring Transparency and Accountability in Public Spending.

- Exploring the Use of Blockchain Technology in Cryptocurrency Accounting and Auditing.

- Analyzing the Impact of Environmental, Social, and Governance (ESG) Factors on Investment Decisions in the Financial Sector.

- The Role of Accounting Information Systems (AIS) in Streamlining Financial Reporting Processes.

Contemporary Issues

- The Impact of COVID-19 Pandemic on Financial Reporting and Auditing Practices.

- Exploring the Ethical Considerations of Remote Work Arrangements for Accounting Professionals.

- Analyzing the Impact of Artificial Intelligence (AI) on the Job Market for Accountants.

- The Role of Accounting Professionals in Addressing Income Inequality and Social Justice Issues.

- Exploring the Use of Blockchain Technology in Disaster Recovery and Business Continuity Planning for Accounting Firms.

- Analyzing the Ethical Considerations of Accounting Practices in the Metaverse and Web3 Ecosystem.

- The Impact of Climate Change on Financial Reporting and Risk Management Strategies.

- Exploring the Use of Sustainable Accounting Practices to Address Environmental Concerns.

- Analyzing the Ethical Considerations of Artificial Intelligence (AI) Bias in Algorithmic Accounting Decisions.

- The Role of Accounting Professionals in Promoting Sustainable Development and Corporate Social Responsibility.

Personal Interest Topics

- The Role of Accounting in the Non-Profit Sector (e.g., Charities, Foundations).

- Exploring the Use of Accounting Practices in the Sports Industry.

- Analyzing the Financial Management Strategies of a Specific Company.

- The History of Accounting and its Evolution Through Different Eras.

- Comparing the Accounting Practices of Different Historical Empires or Civilizations.

- The ethical considerations of using social media by accounting professionals.

- Exploring the impact of artificial intelligence (AI) on the future of tax planning strategies.

- Analyzing the challenges and opportunities of implementing activity-based budgeting (ABB).

- The role of internal controls in ensuring data security and privacy in accounting systems.

- Exploring the use of gamification techniques in accounting education.

- Analyzing the impact of the gig economy on traditional accounting and tax practices.

Tips to Make Successful Projects for Accounting Students

Before you start.

- Choose a topic you’re passionate about: This will keep you motivated throughout the research and writing process. Consider your personal interests and career aspirations when selecting a topic.

- Do your research: Understand the scope of your chosen topic. Explore existing academic literature, professional journals, and relevant news articles to gain a comprehensive understanding of the subject matter.

- Define clear objectives and research questions: What are you trying to achieve with your project? What specific questions do you want to answer? Having a clear focus will guide your research and ensure your project addresses a specific concern or adds to existing knowledge.

- Develop a project timeline: Set realistic deadlines for each stage of your project, including research, writing, and revisions. This will help you stay on track and avoid last-minute scrambles.

- Identify your resources: Ensure you have access to the necessary data and materials to complete your project successfully. This might involve requesting access to academic databases, collecting data through surveys or interviews, or finding reliable government and industry reports.

During your project

- Develop a strong research methodology: How will you gather your data? Will you use surveys, interviews, case studies, or other methods? Ensure your approach is appropriate for your chosen topic and research questions.

- Organize your research and findings: Take detailed notes, categorize your data, and use reference management tools to keep track of your sources. This will save you time and ensure proper citation when writing your project.

- Maintain a clear and concise writing style : Write in a professional tone that is easy to understand. Avoid unnecessary jargon and focus on delivering your message effectively.

- Proofread and edit your work diligently: Ensure your project is free of grammatical errors, typos, and formatting inconsistencies. Consider asking a classmate or professor to review your work for additional feedback.

Additional tips

- Present your findings effectively: Consider using visual aids such as charts, graphs, or tables to enhance the clarity and impact of your presentation. Practice your presentation beforehand to ensure you convey your message confidently.

- Seek feedback and guidance: Don’t be afraid to ask your professor, teaching assistants, or peers for feedback on your project. This can help you identify areas for improvement and strengthen your overall work.

- Utilize available resources: Many universities offer writing centers and research assistance programs. Don’t hesitate to seek help from these resources to ensure your project meets the required standards.

Unveiling a treasure trove of project topics for accounting students, this blog empowers accounting students to delve into the captivating realms of financial accounting, cost management, taxation, and beyond.

Whether your passion lies in financial analysis, navigating complex regulations, or mastering the intricacies of cost management, this diverse list serves as a springboard for your academic exploration. Remember, a successful project hinges on careful consideration.

Choose a topic that ignites your curiosity and aligns with your personal interests and career aspirations. Conduct thorough research, define clear goals and research questions, and create a realistic project timeline. Finally, ensure you have access to the necessary resources to embark on this enriching academic journey.

By following these steps and exploring the plethora of provided topics, you can transform your academic experience into a fulfilling and insightful exploration of the accounting world.

Related Posts

Step by Step Guide on The Best Way to Finance Car

The Best Way on How to Get Fund For Business to Grow it Efficiently

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

27+ Excellent Final Year Project Topics For ACCOUNTING Students

For accounting students, the final year project stands as a pinnacle moment, representing the culmination of their academic journey. Selecting an apt and compelling topic is not just a requirement but a gateway to showcasing their prowess, expertise, and in-depth understanding of the subject matter. The Final year project topics for ACCOUNTING students hold immense significance, serving as a canvas for students to demonstrate their analytical acumen, critical thinking, and practical application of accounting principles.

This critical decision of choosing a final year project topic is akin to navigating through a diverse landscape of possibilities. Each accounting research topic represents an opportunity for students to delve into specific niches within accounting, exploring emerging trends, technological advancements, ethical dilemmas, or in-depth analyses of financial strategies. The chosen topic is not merely a research subject but a reflection of the student’s passion, interests, and potential contribution to the accounting discipline.

In this blog, we delve into an array of engaging final year project topics meticulously crafted for ACCOUNTING students. These topics encompass a wide spectrum of accounting aspects, offering students a chance to immerse themselves in areas that resonate with their aspirations and academic inclinations.

Table of Contents

What Are Good Topics For A Project In Accounting?

Good topics for a project in accounting encompass various aspects of financial management, reporting, and analysis. They may include investigating the impact of technological advancements like blockchain or AI on accounting practices, exploring ethical dilemmas in financial decision-making, examining the effects of taxation policies on economic development, or conducting forensic accounting to uncover financial frauds.

Other topics could revolve around environmental accounting, corporate sustainability reporting, risk management strategies, big data analytics in management accounting, and the relationship between corporate governance and firm performance. These subjects offer opportunities for in-depth research, critical analysis, and practical application of accounting principles, allowing students to showcase their understanding and expertise in the field.

How Do You Start A Finance Project?

Starting a finance project involves several key steps to ensure a structured and successful endeavor:

- Topic Selection: Begin by choosing a specific area of finance that interests you. It could be corporate finance, investment analysis, financial markets, risk management, or any other subfield. Select a topic that aligns with your interests and goals.

- Research and Background Study: Conduct thorough research on your chosen topic. Review academic journals, books, articles, and reputable online sources to gain a comprehensive understanding of the subject matter. This step helps in establishing a strong foundation and identifying gaps in existing knowledge.

- Formulate Objectives: Define clear and achievable objectives for your project. Establish what you aim to achieve or investigate through your research. Clear objectives will guide your project’s direction and scope.

- Create a Project Plan: Outline a detailed plan specifying the project’s structure, timeline, and milestones. Break down tasks into manageable steps, including research, data collection, analysis, and writing. A well-structured plan ensures efficient progress and helps manage time effectively.

- Gather Data: Collect relevant data needed for your project. This may involve gathering financial statements, market data, conducting surveys, or utilizing databases. Ensure the data collected is credible and supports your research objectives.

- Analysis and Interpretation: Analyze the gathered data using appropriate financial tools, techniques, or models. Interpret the findings in line with your research objectives, providing meaningful insights and conclusions.

- Report Writing: Organize your findings and insights into a coherent and structured report. Include an introduction, literature review, methodology, results, discussion, conclusions, and recommendations. Ensure clarity, accuracy, and proper referencing throughout the document.

- Review and Refinement: Review your project meticulously, checking for coherence, accuracy, and alignment with objectives. Revise and refine as needed to enhance the quality of your project.

- Presentation: Prepare a compelling presentation summarizing your project’s key findings, conclusions, and recommendations. Practice your presentation to effectively communicate your work to your audience.

List of 27+ Excellent Final Year Project Topics For ACCOUNTING Students

Here’s a detailed explanation of each of the 27 final year project topics for accounting students:

1. Adoption of Blockchain Technology in Financial Reporting

Explore the integration of blockchain technology in financial reporting processes. Investigate its potential to enhance transparency, accuracy, and security in recording financial transactions.

2. Impact of Artificial Intelligence on Auditing Procedures

Examine the influence of AI on auditing practices. Analyze how AI-driven tools and algorithms impact audit efficiency, accuracy, and the future role of auditors.

3. Environmental Accounting and Corporate Sustainability Reporting

Study the incorporation of environmental factors into accounting practices. Assess how companies report sustainability initiatives and their impact on financial disclosures.

4. Forensic Accounting: Unveiling Financial Frauds and Misconducts

Delve into forensic accounting methods to uncover financial frauds. Evaluate techniques used to detect and prevent fraudulent activities in financial records.

5. Taxation Policies and Economic Development: A Comparative Analysis

Compare different taxation policies and their effects on economic growth. Analyze the relationship between tax reforms and a country’s economic development.

6. Ethical Dilemmas in Accounting: Case Studies and Solutions

Examine ethical challenges faced in accounting. Present real-life case studies and propose solutions to navigate ethical dilemmas in financial practices.

7. Financial Risk Management Strategies in Global Markets

Investigate risk management approaches in global financial markets. Analyze strategies employed by multinational corporations to mitigate financial risks.

8. The Role of Big Data Analytics in Management Accounting

Explore the utilization of big data analytics in management accounting. Assess how data-driven insights improve decision-making processes.

9. Accounting for E-commerce Businesses: Challenges and Solutions

Study accounting challenges specific to e-commerce enterprises. Evaluate accounting methods tailored to address issues unique to online businesses.

10. Corporate Governance and Firm Performance: A Financial Perspective

Analyze the impact of corporate governance structures on a firm’s financial performance. Investigate the correlation between governance practices and profitability.

11. Analysis of Financial Statements for Investment Decision Making

Examine methods to analyze financial statements for investment purposes. Evaluate key financial ratios and indicators used in investment decision-making processes.

12. Role of Cost Accounting in Managerial Decision Making

Investigate how cost accounting influences managerial decisions. Analyze cost data’s role in determining product pricing, budgeting, and performance evaluation.

13. Implications of International Financial Reporting Standards (IFRS) on Businesses

Explore the adoption of IFRS and its impact on financial reporting. Assess how implementing these standards affects global businesses’ financial statements.

14. Financial Modeling for Risk Assessment and Management

Study financial modeling techniques to assess and manage risks. Analyze how models predict and mitigate financial risks in various industries.

15. Role of Accounting Information Systems in Modern Businesses

Examine the significance of accounting information systems in contemporary business operations. Evaluate their role in streamlining financial processes and enhancing decision-making.

16. Fraud Detection and Prevention in Financial Institutions

Explore strategies to detect and prevent fraud in financial institutions. Assess technologies and practices used to safeguard against fraudulent activities.

17. Sustainability Reporting and Its Impact on Stakeholder Perception

Analyze how sustainability reports influence stakeholder perception. Evaluate the effects of corporate sustainability practices on investor and public perception.

18. Analysis of Tax Policies and Their Influence on Business Strategies

Study the relationship between tax policies and business strategies. Assess how tax laws shape companies’ financial planning and operational decisions.

19. Impact of Corporate Social Responsibility (CSR) on Financial Performance

Investigate the correlation between CSR initiatives and financial performance. Analyze how socially responsible practices affect a company’s bottom line.

20. Strategic Management Accounting Techniques for Performance Evaluation

Explore strategic management accounting tools for performance assessment. Evaluate how these techniques aid in strategic decision-making processes.

21. Challenges and Opportunities in Not-for-profit Organizations’ Financial Management

Examine financial management issues specific to non-profit entities. Analyze challenges and opportunities in managing finances within these organizations.

22. Behavioral Finance: Understanding Investor Decision Making

Study behavioral aspects influencing investor decisions. Evaluate psychological factors impacting financial decision-making processes.

23. The Evolution of Accounting Standards and Their Implications

Trace the evolution of accounting standards. Assess the implications of changing standards on financial reporting practices.

24. Role of Accountants in Navigating Digital Transformations in Businesses

Explore the changing role of accountants in the digital era. Analyze how accountants adapt to and contribute to digital transformations in businesses.

25. Corporate Financial Analysis: Evaluating Profitability and Liquidity Ratios

Examine various financial ratios for assessing corporate performance. Evaluate profitability and liquidity ratios in analyzing company financial health.

26. The Relationship Between Corporate Governance and Financial Reporting Quality

Analyze the connection between governance practices and financial reporting accuracy. Evaluate how governance influences the quality of financial disclosures.

27. Accounting for Intangible Assets: Valuation and Reporting Challenges

Explore challenges in valuing and reporting intangible assets. Assess methods used to evaluate and account for intangible assets’ value.

What Is An Example of A Finance Project?

An example of a finance project could involve conducting a comprehensive financial analysis of a company or industry, utilizing various financial tools and methodologies to evaluate its performance, profitability, and investment potential. Here’s an example project outline:

Title: Financial Analysis of Company XYZ: Assessing Performance and Investment Viability

Objective: To conduct an in-depth financial analysis of Company XYZ, evaluating its financial health, profitability, and suitability for investment.

Project Components:

- Provide an overview of the project’s objectives, Company XYZ’s background, and its industry.

- Review relevant financial analysis methods, theories, and frameworks used in evaluating companies.

- Outline the methodology used in collecting and analyzing financial data. Include sources of data, such as annual reports, financial statements, and industry benchmarks.

- Present a detailed overview of Company XYZ, its history, operations, market presence, and key competitors.

- Conduct a comprehensive analysis of Company XYZ’s financial statements (income statement, balance sheet, cash flow statement) over the past few years.

- Calculate and interpret key financial ratios (liquidity, profitability, solvency, efficiency) to assess the company’s performance.

- Analyze the industry trends, market conditions, and competitive landscape in which Company XYZ operates.

- Compare Company XYZ’s performance against industry benchmarks and competitors.

- Identify and evaluate potential risks that may impact Company XYZ’s financial stability and growth prospects.

- Provide an investment recommendation based on the financial analysis findings.

- Offer insights on the company’s strengths, weaknesses, opportunities, and threats (SWOT analysis) for potential investors.

- Summarize the key findings of the financial analysis.

- Offer recommendations for Company XYZ’s strategic financial management and potential areas for improvement.

- List all sources and references used in the project.

Final year project topics for ACCOUNTING students present an extensive spectrum of critical areas within the accounting discipline. These topics offer a comprehensive platform for students to delve into emerging trends, ethical dilemmas, technological advancements, and various financial aspects. Engaging in these topics allows students to showcase their analytical prowess, critical thinking skills, and practical application of accounting principles. By exploring these diverse topics, students not only deepen their understanding of accounting concepts but also contribute valuable insights to the field. The chosen project topic serves as a canvas for students to exhibit their expertise, bridging academic knowledge with real-world applications, and making a meaningful impact in the dynamic landscape of accounting practices.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Top 20 Best Project Topics On Accounting Education

- 31 August 2023

- Bookkeeping

Are you looking for project topics on accounting education? Perhaps you’re writing a thesis or you’re just an educator seeking fresh ideas in various project topics on accounting education, well I got exactly what you’re looking for.

In the dynamic realm of finance and business, accounting education serves as the cornerstone for nurturing adept professionals who can navigate the complexities of financial management, reporting, and analysis.

Whether you’re an educator seeking fresh ideas for engaging project topics or a student aiming to delve into the intricacies of accounting education, this article presents a comprehensive list of 20 captivating project topics that merge theoretical insights with real-world applications. Let’s embark on this enriching journey of discovery.

What Are Project Topics In Education?

B. flipped classroom approach in accounting, b. international financial reporting standards (ifrs) vs. generally accepted accounting principles (gaap), b. gender disparities in accounting, b. forensic accounting and fraud examination, b. gamification in accounting education, list of the 20 best project topics on accounting education.

- Impact of Accounting Software on Student Learning

- Effectiveness of Virtual Simulations in Teaching Accounting

- Benefits of Flipped Classroom in Accounting Education

- Case Studies of Successful Flipped Accounting Classrooms

- Role of Accountants in Promoting Sustainable Business Practices

- Challenges and Opportunities of Integrating Sustainability Reporting in Accounting Curricula

- Comparative Analysis of IFRS and GAAP Adoption Across Different Countries

- Implications of Converged Accounting Standards on Global Financial Reporting

- Factors Influencing Ethical Judgments Among Accounting Students

- Strategies to Enhance Ethical Sensitivity in Future Accountants

- Analyzing the Underrepresentation of Women in Leadership Roles in Accounting

- Promoting Gender Diversity and Equity in Accounting Education

- Integration of Data Analytics Tools in Auditing Curriculum

- Real-world Examples of Data Analytics Transforming the Audit Process

- Role of Forensic Accounting in Detecting and Preventing Financial Fraud

- Lessons from High-profile Fraud Cases for Accounting Students

- Effectiveness of Online Learning Platforms for Accounting Education

- Strategies for Maintaining Engagement in Virtual Accounting Classrooms

Gamified Approaches to Enhance Accounting Learning Experiences

- Incorporating Gamification Elements into Accounting Curricula

The Crucial Role of Accounting Education

Before we dive into the myriad project topics, let’s underscore the significance of accounting education.

It’s the foundation upon which future accountants, auditors, and financial experts build their careers. Selecting the right project topic is akin to choosing the right path—one that aligns with your interests and contributes to the ever-evolving landscape of accounting education.

How Do You Select Accounting Research Topics?

Selecting project topics on accounting education is a pivotal step that sets the tone for your study’s success and impact. To guide your selection process, I have put together these steps to ease down the process for you:

I. Enhancing Accounting Pedagogy

A. integrating technology in accounting education.

Modern education thrives on technology, and accounting is no exception. Embracing technology can enhance the learning experience and provide students with practical skills that translate seamlessly into their careers. Here are two intriguing project topics to consider:

- Conduct a comprehensive study on how accounting software, such as QuickBooks and Sage, influences student understanding and mastery of accounting concepts.

- Utilize surveys, interviews, and performance evaluations to measure the effectiveness of software integration.

- Present findings through charts and graphs to illustrate comprehension and skill development improvements.

- Explore the role of virtual simulations in teaching complex accounting scenarios, like financial statement analysis or budget forecasting.

- Compare the learning outcomes of students exposed to virtual simulations with those taught through traditional methods.

- Include screenshots and user feedback to showcase the immersive nature of virtual simulations.

The traditional classroom setup is evolving, and the flipped classroom model has gained momentum. In this approach, students learn theoretical content at home through videos or readings and engage in active learning during class. Here are two compelling project topics in this area:

- Investigate how the flipped classroom method enhances student engagement and comprehension in accounting courses.

- Analyze quantitative data, such as pre-and-post assessments, to measure knowledge retention and academic performance.

- Craft a comparison between flipped and traditional classroom outcomes, supported by statistical data.

- Choose a few educational institutions that have implemented the flipped classroom approach in their accounting curriculum.

- Conduct in-depth interviews with educators and students to gather insights into the challenges faced, strategies employed, and outcomes achieved.

- Present the findings through detailed case studies, outlining the step-by-step transformation of traditional teaching to a flipped model.

II. Current Trends in Financial Reporting

A. sustainability accounting.

The contemporary business landscape places a premium on sustainability. Accountants play a vital role in advocating for environmentally and socially responsible financial practices. These project topics delve into the realm of sustainability accounting:

- Examine the evolving responsibilities of accountants in ensuring accurate and transparent sustainability reporting.

- Showcase real-world examples of companies that have integrated sustainability practices into their financial reporting and analyze the impact on stakeholders’ perceptions.

- Explore the challenges educators face when incorporating sustainability accounting into their courses.

- Provide practical recommendations and strategies for seamlessly integrating sustainability content, supported by insights from interviews with educators.

In the globalized economy, the convergence of accounting standards has become a significant topic of discussion. Delve into the complexities of IFRS and GAAP with these project topics:

- Collect data on the adoption of IFRS and GAAP in various countries and regions.

- Create tables and charts to showcase the differences and similarities in accounting standards’ application, highlighting their impact on financial reporting.

- Investigate how the convergence of IFRS and GAAP affects financial reporting consistency and transparency.

- Analyze case studies of multinational corporations that have navigated the challenges of dual reporting standards and their strategies for ensuring compliance.

III. Behavioral Accounting and Ethics

A. ethical decision-making in accounting.

Ethical considerations are at the heart of the accounting profession. Explore the factors influencing ethical judgments among accounting students with these thought-provoking project topics:

- Conduct surveys and scenario-based studies to identify the psychological, societal, and educational factors shaping ethical decision-making in accounting.

- Present findings using pie charts and bar graphs to illustrate the prevalence of different factors among students.

- Propose practical strategies that educators can implement to foster ethical sensitivity and decision-making skills among accounting students.

- Provide a comprehensive list of teaching methodologies, including case studies, role-playing exercises, and classroom discussions, with their respective benefits.

Gender diversity and equality in the workplace are pressing issues. Examine the underrepresentation of women in leadership roles within the accounting profession through these insightful project topics:

- Compile data on the gender distribution in accounting firms’ leadership positions, highlighting the disparities.

- Create visual representations, such as bar graphs and pie charts, to underscore the magnitude of the issue.

- Investigate successful initiatives and programs that address gender disparities in accounting education.

- Develop a comprehensive guide for educators and institutions to promote gender diversity through mentorship, networking, and inclusive curriculum design.

IV. Innovations in Auditing Education

A. data analytics in auditing.

As technology advances, data analytics is transforming the audit landscape. Explore its integration into auditing curricula with these illuminating project topics:

- Evaluate the effectiveness of introducing data analytics software (e.g., Tableau, ACL) in teaching audit techniques.

- Present quantitative results that demonstrate improvements in audit accuracy and efficiency when data analytics tools are employed.

- Select prominent audit cases where data analytics played a pivotal role in identifying anomalies or patterns.

- Utilize tables and diagrams to visually depict how data analysis contributed to uncovering fraud or enhancing audit outcomes.

Financial fraud remains a concern for businesses and society. Delve into the realm of forensic accounting and its role in fraud detection and prevention with these captivating project topics:

- Explore the methodologies used by forensic accountants to uncover fraud, including data analysis, investigative techniques, and financial statement scrutiny.

- Provide real-life case studies that illustrate the pivotal role of forensic accountants in exposing fraudulent activities.

- Analyze infamous fraud cases, such as Enron or WorldCom, to extract valuable lessons for accounting students.

- Organize the lessons learned into a comprehensive list that educates students about the signs of potential financial misconduct.

V. Accounting Education in the Digital Era

A. online learning platforms for accounting.

The digital age has ushered in a new era of online education. Explore the effectiveness of online learning platforms in delivering accounting education through these insightful project topics:

- Conduct surveys and gather feedback from students to assess the advantages and challenges of online accounting courses.

- Present the results using tables and graphs that highlight student preferences and learning outcomes.

- Investigate techniques to ensure active participation and engagement in virtual accounting classrooms.

- Compile a list of strategies, along with real-world examples, that educators can implement to create a vibrant online learning environment.

Gamification introduces an element of fun and competition into learning. Discover its potential to enhance accounting education through these captivating project topics:

- Explore the concept of gamification and its application in accounting education.

- Provide real examples of accounting-related games and simulations that foster learning and skill development.

- Propose practical ways to integrate gamification elements into accounting courses, such as quizzes, simulations, and leaderboard systems.

- Present a step-by-step guide for educators to create gamified activities that align with learning objectives.

Conclusion: Nurturing Future Accountants Through Engaging Projects

Accounting education is a journey that involves not only learning but also exploration and discovery. The project topics outlined in this article offer a panoramic view of the diverse avenues within accounting education . From technology integration to ethical decision-making, each topic holds the potential to enrich both educators’ pedagogical approaches and students’ learning experiences. As you embark on your journey of exploration, remember that the world of accounting is ever-evolving, and by delving into these project topics, you contribute to its advancement and innovation.

Remember, the pursuit of knowledge is a continuous endeavor. So, whether you’re a final year student searching for the perfect project topic or an educator seeking to inspire the next generation of accountants, the world of accounting education is yours to explore.

Share this post on your Social Media Pages!

Impact of Accounting Software on Student Learning : Conduct a comprehensive study on how accounting software, such as QuickBooks and Sage, influences student understanding and mastery of accounting concepts. Utilize surveys, interviews, and performance evaluations to measure the effectiveness of software integration. Present findings through charts and graphs to illustrate improvements in comprehension and skill development. Comprehension and skill development improvements

Role of Forensic Accounting in Detecting and Preventing Financial Fraud : Explore the methodologies used by forensic accountants to uncover fraud, including data analysis, investigative techniques, and financial statement scrutiny. Provide real-life case studies that illustrate the pivotal role of forensic accountants in exposing fraudulent activities.

Michiel Cleuvenberghe

Hi there, I'm Michiel Cleuvenberghe, the chief editor of moneygrindmind.com I'm a professional private accountant since 2015, and I want to train you to become a professional in your finances as well!

Related Posts

How To Become A Rich Accountant: Are Accountants Rich?

- 22 August 2023

Are Accounting Jobs in Demand and Can They Be Replaced by AI? (2023)

- 12 August 2023

How to Close the Books in Accounting (2023): A Step-by-Step Guide

- 11 August 2023

Leave a Reply Cancel Reply

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment *

Save my name, email, and website in this browser for the next time I comment.

Post Comment

189+ Best Accounting Project Topics And Materials For Students

Are you wondering about cool projects to explore in the world of numbers and money? Well, buckle up because we’re about to dive into an awesome list of Accounting Project Topics And Materials designed just for you!

You might be thinking, ‘What’s so exciting about accounting?’ Trust me, it’s not just about counting coins. These topics are like treasure chests filled with fascinating ideas. From learning how businesses handle their cash to uncovering the secrets behind financial statements, taxation, and even catching financial fraudsters—there’s a whole bunch of interesting stuff waiting for you.

Think of these topics as your ticket to understanding how money moves in the business world. Ever wondered how companies figure out what to spend and where to save? Or how do they make sure everything adds up correctly? Well, these projects will give you a sneak peek into those secrets.

So, get ready to explore, learn, and become the next financially proficient youth with these awesome Accounting Project Topics And Materials! Let’s get started on this money-making adventure together!

Must Know: Insurance Project Ideas

Table of Contents

What Are The Best Accounting Project Topics?

Selecting the finest Accounting Project Topics involves thoughtful consideration of subjects that open doors to comprehensive learning experiences. These topics are carefully curated to offer students engaging insights into the intricate world of finance and accounting. Ranging from dissecting financial statements and understanding taxation principles to exploring the nuances of cost accounting and auditing practices, these topics serve as pathways to comprehend essential financial management concepts.

They aim not only to broaden students’ horizons but also to instill practical skills and analytical thinking crucial for navigating the complexities of the accounting domain. The best Accounting Project Topics and materials are those that serve as bridges between theoretical knowledge and practical application. They act as catalysts for deeper understanding by immersing students in topics such as ethics in accounting, international standards, risk management strategies, and the integration of technology in modern accounting systems.

How Do You Select A Very Good Topic For Your Graduation Project In The Accounting Section?

Here are 7 easy steps to help you choose an excellent topic for your graduation project in the accounting section:

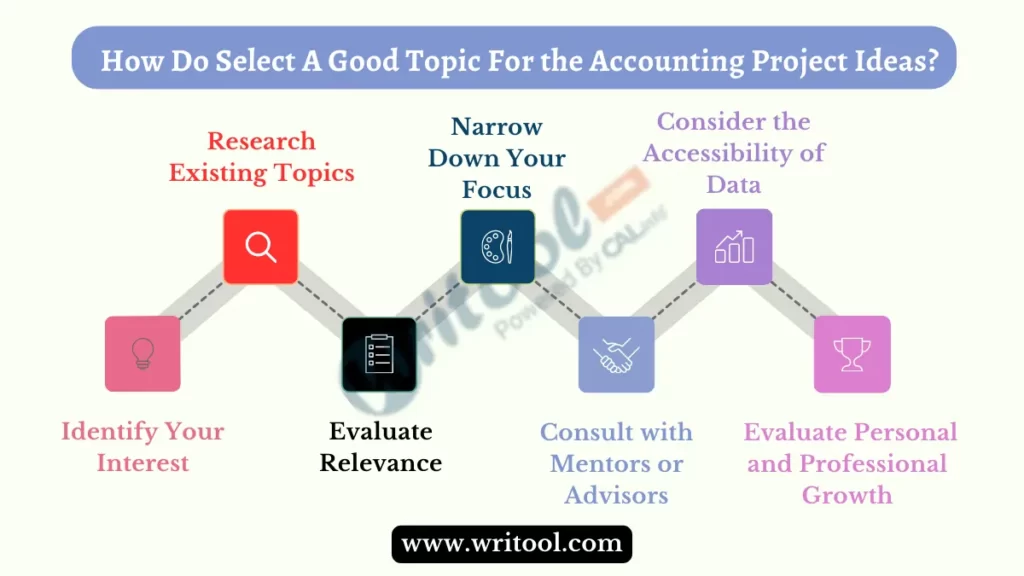

1. Identify Your Interests

Start by listing areas of accounting that captivate your attention. Whether it’s auditing, taxation, financial analysis, or cost accounting, understanding your interests will guide you toward a topic that keeps you engaged throughout your project.

2. Research Existing Topics

Explore various resources like textbooks, journals, online databases, and academic websites to discover existing topics in accounting. This can inspire new ideas or help you refine existing ones by understanding what has been previously studied.

3. Evaluate Relevance

Consider the relevance and significance of potential topics. Ensure the chosen subject aligns with current trends, addresses practical issues, or offers solutions to existing problems in the accounting field.

4. Narrow Down Your Focus

Once you have a list of potential topics, narrow it down based on feasibility, resources available, and the scope of your project. Aim for a specific aspect within a broader topic to maintain focus and depth.

5. Consult with Mentors or Advisors

Seek guidance from professors, mentors, or advisors. Discuss your ideas with them to receive valuable insights, suggestions, and feedback. Their expertise can help you refine your topic and ensure its academic viability.

6. Consider the Accessibility of Data

Ensure that you can access the necessary data and resources to support your research. A feasible project topic should have readily available information for analysis and study.

7. Evaluate Personal and Professional Growth

Lastly, reflect on how the chosen topic aligns with your academic and career goals. Consider how researching this topic might contribute to your knowledge, skills, and future aspirations in the field of accounting.

List of 189+ Best Accounting Project Topics And Materials For Students

These topics cover various areas within accounting and can be further developed into project proposals or research papers:

Good Financial Accounting Project Topics And Materials

- Impact of Financial Reporting Quality on Investment Decisions

- Evaluation of Accounting Conservatism in Financial Statements

- Adoption and Implementation of International Accounting Standards in Developing Countries

- Assessing the Effectiveness of Accounting Information in Stock Market Predictions

- Corporate Disclosure Practices and Investor Confidence

- Financial Statement Analysis of Multinational Corporations

- Accounting for Leases under IFRS 16 vs. ASC 842: A Comparative Analysis

- Accounting for Intangible Assets: Valuation and Reporting Issues

- Financial Reporting and Corporate Social Responsibility (CSR) Disclosures

- The Role of Accounting in Mergers and Acquisitions

Recent Managerial Accounting Project Topics And Materials

- Throughput Accounting: Theory and Practical Application in Manufacturing

- Target Costing in New Product Development: Case Studies in Different Industries

- Performance Measurement Systems in Service Industries

- Cost Management Techniques in Healthcare Organizations

- Transfer Pricing Strategies and Their Impact on Multinational Corporations

- Strategic Cost Analysis for Decision-Making in Competitive Markets

- Environmental Management Accounting Practices in Sustainable Businesses

- Activity-Based Budgeting: Implementation Challenges and Benefits

- Cost Allocation Methods and Their Effect on Profitability Analysis

- Management Accounting Techniques for Non-Profit Organizations

Auditing and Assurance

- Audit Committee Effectiveness and its Impact on Financial Reporting Quality

- Role of Big Data Analytics in Auditing Procedures

- Auditor Liability: Legal and Ethical Implications

- The Impact of Corporate Governance on External Audit Quality

- Auditing in the Era of Industry 4.0: IoT, AI, and Automation

- Forensic Audit Techniques in Fraud Detection and Prevention

- Internal vs. External Audits: Comparative Analysis and Advantages

- The Evolution of Audit Reports: Past, Present, and Future Trends

- Assessing Audit Risk in Complex Business Environments

- Continuous Auditing and its Application in Contemporary Businesses

Taxation And Accounting Project Topics And Materials

- Tax Compliance and Ethics: A Comparative Study Across Countries

- Taxation Policies and Economic Development: Lessons from Emerging Markets

- Tax Incentives and Investment Decisions in Developing Economies

- Taxation of E-commerce Transactions: Challenges and Opportunities

- Tax Implications of Cryptocurrency Transactions

- Environmental Taxation and its Role in Sustainable Development

- Tax Planning Strategies for High-Net-Worth Individuals

- Tax Reform Proposals and Their Socioeconomic Impact

- Taxation of Multinational Corporations: Transfer Pricing Issues

- Tax Treaties and their Influence on International Business Transactions

Forensic Accounting

- Corporate Governance and Fraudulent Financial Reporting

- Cybersecurity Risks in Financial Systems and Forensic Countermeasures

- Whistleblowing Policies and Their Role in Fraud Detection

- Digital Forensics and Investigation Techniques in Financial Crimes

- The Use of Artificial Intelligence in Forensic Accounting

- Investigating Embezzlement and Financial Misconduct in Organizations

- The Role of Forensic Accountants in Dispute Resolution

- Money Laundering: Detection and Prevention Strategies

- Forensic Accounting Techniques in Bankruptcy Cases

- Ethical Dilemmas and Challenges in Forensic Accounting Investigations

Accounting Information Systems

- ERP Systems Implementation and its Impact on Accounting Processes

- Cloud Computing in Accounting Information Systems

- Data Analytics in AIS: Enhancing Decision-Making Processes

- Information Security in Accounting Information Systems

- Blockchain Technology in Financial Reporting and Auditing

- AIS and Corporate Governance: Ensuring Data Integrity and Security

- AI-Powered Predictive Analytics in Financial Reporting

- The Evolution of AIS and its Future Trends

- AIS in Small and Medium-sized Enterprises (SMEs): Challenges and Opportunities

- Mobile Accounting Applications: Advantages and Risks

Easy Ethics in Accounting Project Topics And Materials

- Professional Ethics in Accounting: Codes and Practices

- Ethical Leadership and its Impact on Financial Reporting Integrity

- Conflicts of Interest in Accounting: Analysis and Mitigation Strategies

- Corporate Social Responsibility (CSR) and Ethical Accounting Practices

- Ethical Decision-Making in Accounting: Case Studies

- The Role of Ethics in Accounting Education and Professional Development

- Whistleblowing and Ethical Dilemmas in Accounting Firms

- Ethical Challenges in Tax Planning and Compliance

- Gender Diversity in Accounting and Ethical Implications

- Ethical Issues Surrounding Creative Accounting Practices

Accounting for Specific Industries

- Hospitality Industry Accounting Practices and Challenges

- Accounting in the Pharmaceutical Industry: Regulations and Reporting Standards

- Accounting for Government and Non-Governmental Organizations (NGOs)

- Agricultural Accounting: Challenges and Solutions

- Financial Reporting in the Entertainment Industry

- Real Estate Accounting and Property Management

- Healthcare Accounting: Revenue Recognition and Cost Control

- Accounting Practices in the Fashion and Retail Industry

- Aviation Industry Accounting: Revenue Management and Cost Analysis

- Accounting for the Energy Sector: Challenges and Environmental Reporting

Financial Regulation and Compliance

- Dodd-Frank Act and its Impact on Financial Reporting

- Basel Accords and their Influence on Banking Regulations

- Financial Regulatory Reforms post-Global Financial Crisis

- Compliance with Anti-Money Laundering (AML) Regulations in Financial Institutions

- Role of Central Banks in Ensuring Financial Stability

- Regulatory Challenges in Fintech and Digital Banking

- Insider Trading Regulations: Case Studies and Implications

- Credit Risk Management and Regulatory Compliance

- Corporate Governance Regulations and Financial Performance

- Regulatory Changes and Their Effects on Financial Markets

International Accounting Project Topics And Materials

- International Tax Planning Strategies for Multinational Corporations

- Cross-Border Mergers and Acquisitions: Accounting and Reporting Challenges

- Harmonization of Accounting Standards: Achievements and Challenges

- The Impact of Globalization on Accounting Practices

- International Financial Reporting Standards (IFRS) and US GAAP Convergence

- Comparative Analysis of Accounting Systems in Different Countries

- Challenges of Foreign Currency Translation in International Accounting

- International Accounting and Reporting in Developing Economies

- Accounting Harmonization in the European Union

- Cultural Influences on Accounting Practices in Global Businesses

Accounting Education and Profession

- Pedagogical Techniques in Teaching Accounting to Students

- The Role of Technology in Accounting Education

- Accounting Skills and Competencies for Future Professionals

- Continuous Professional Development in Accounting: Challenges and Solutions

- The Influence of Internships on Accounting Students’ Career Choices

- Gender Disparity in the Accounting Profession

- Accounting Accreditation and its Impact on Education Quality

- Ethics Education in Accounting Programs: Curricular Design and Effectiveness

- The Future of Accounting: Emerging Roles and Career Prospects

- Professional Certifications in Accounting: Benefits and Challenges

Financial Management and Analysis

- Working Capital Management Strategies and Firm Performance

- Capital Budgeting Techniques in Investment Decision-Making

- Financial Risk Management in Global Corporations

- Corporate Restructuring and Financial Performance

- Merger and Acquisition Valuation Methods

- Dividend Policy and its Impact on Shareholder Wealth

- Initial Public Offerings (IPOs) and Stock Market Performance

- Corporate Cash Holdings and Firm Value

- Behavioral Finance: Biases in Investment Decision-Making

- Corporate Governance and Financial Distress Prediction Models

Accounting for Non-Profit Organizations

- Financial Sustainability of Non-Profit Organizations

- Donor Stewardship and Financial Accountability in NGOs

- Fund Accounting and Grant Management in Non-Profit Entities

- Performance Measurement in Non-Profit Organizations

- Budgeting and Financial Planning in Non-Profit Sector

- Reporting Requirements for Non-Profit Entities

- Fundraising Strategies and Financial Reporting for Non-Profits

- Volunteer Services and their Valuation in Non-Profit Accounting

- Compliance and Governance Challenges for Non-Profit Organizations

- Impact Assessment and Reporting in Non-Profit Sector

Accounting for Small Businesses and Startups

- Accounting Practices for Small Business Sustainability

- Financial Reporting Challenges for Small Businesses

- Start-up Financing Options and Accounting Implications

- Cash Flow Management in Small Businesses

- Tax Planning Strategies for Small and Medium-sized Enterprises (SMEs)

- Accounting Software for Small Business: Selection and Implementation

- Financial Decision-Making in Startup Ventures

- Accounting for Intellectual Property in Startups

- Challenges of Financial Management in Growing Small Businesses

- Cost Accounting for Small-Scale Manufacturing Units

Accounting in Developing Economies

- Accounting Infrastructure in Developing Countries

- Challenges of Implementing International Accounting Standards in Developing Economies

- Corporate Governance in Emerging Markets

- Accounting for Microfinance Institutions in Developing Nations

- Public Sector Accounting Reforms in Developing Economies

- Financial Reporting Challenges in Less-Developed Countries

- Role of Informal Economies in Accounting Practices

- Accounting for Poverty Alleviation Programs

- Challenges of Taxation in Developing Nations

- Accounting Education in Developing Economies

Environmental Accounting Project Topics And Materials

- Environmental Accounting Standards and Reporting Frameworks

- Carbon Accounting and Emission Trading

- Environmental Cost Accounting: Measurement and Reporting

- Social and Environmental Responsibility Reporting by Corporations

- Ecological Footprint Accounting in Organizations

- Sustainability Reporting and Triple Bottom Line Accounting

- Environmental Management Accounting for Business Decision-Making

- Green Accounting: Benefits and Implementation Challenges

- Renewable Energy Accounting and Financial Reporting

- Environmental Auditing and Compliance Reporting

Accounting and Technology

- Accounting Automation and its Effects on Employment

- Robotic Process Automation in Accounting and Finance

- Accounting Information Systems Integration with AI and Machine Learning

- Cybersecurity Measures in Accounting Information Systems

- Cloud-Based Accounting Solutions: Advantages and Risks

- Big Data Analytics in Accounting: Applications and Limitations

- Role of Blockchain in Accounting and Financial Transactions

- Mobile Applications for Personal Financial Management

- AI-powered Financial Planning and Analysis Tools

- Digital Transformation in Accounting Firms

Accounting and Social Issues

- Impact Investing and Social Accounting

- Gender Pay Gap Reporting and its Financial Implications

- Diversity and Inclusion Reporting in Corporate Financial Statements

- Corporate Philanthropy Reporting and its Effect on Stakeholders

- Income Inequality and its Reflection in Financial Reporting

- Human Rights and Corporate Accountability Reporting

- Social Impact Measurement in Financial Reporting

- Corporate Ethics and Social Responsibility Reporting

- Accounting for Sustainable Development Goals (SDGs)

- Fair Trade Accounting and Reporting

Accounting in Specific Geographic Regions

- Accounting Practices in Asia-Pacific Countries

- Accounting Standards and Regulations in Latin America

- Accounting Challenges in African Nations

- European Union Accounting Harmonization and its Implications

- North American Accounting Regulations and Practices

- Accounting Differences in Middle Eastern Countries

- Accounting Reforms and Practices in BRICS Nations

- Accounting Challenges in Post-Soviet Bloc Countries

- Accounting Practices in Pacific Island Nations

- Comparative Analysis of Accounting Systems in Developed vs. Developing Nations

Accounting and Governance

- Corporate Governance Mechanisms and Financial Reporting Quality

- Board Diversity and Financial Performance of Companies

- Shareholder Activism and Corporate Governance

- Corporate Social Responsibility and Board Oversight

- Governance Mechanisms in Family-Owned Businesses

- Executive Compensation and Corporate Governance

- Role of Auditors in Corporate Governance

- Governmental Influence on Corporate Governance Practices

- Whistleblowing Policies and Corporate Governance

- Stakeholder Theory and Corporate Governance

Best Accounting Project Materials For Students

Here, we give various types of educational, professional, and other materials commonly used in the field of accounting, including some examples and potential categories.

1. Educational Materials

Textbooks play a crucial role in accounting education, covering fundamental concepts to specialized areas. Here’s a table showcasing some popular accounting textbooks:

Online Courses

Online platforms offer a variety of accounting courses. Here are examples from different levels:

Lecture Notes and Slides

Universities and colleges often provide lecture materials online. Here’s how a table might categorize these:

2. Professional Materials

Accounting standards and pronouncements.

Accounting standards issued by various bodies are crucial for professionals. Here’s a potential table layout:

Journal Articles and Research Papers

Research papers and articles contribute to accounting knowledge. Here’s an example table structure:

Accounting software aids in managing financial tasks. A table could display different software options:

3. Other Materials

Calculators.

Financial calculators are essential tools in accounting. A simple table might look like this:

Templates and Spreadsheets

Pre-made templates and spreadsheets streamline accounting tasks. Here’s a sample table layout:

News and Analysis

Staying updated with current business news is vital for accountants. A table could display different news sources:

List of Simple accounting project topics and materials PDF

Here are the simplest final-year project topics for accounting students and good Accounting project topics and materials for college students.

What Are Some Creative Project Topics For Accountancy And Oc?

Here are ten creative project topics that blend Accountancy (Accounting) with Organizational Communication (OC):

- Communication Strategies in Financial Reporting: Analyzing how effective communication enhances the comprehension of financial reports for diverse stakeholders.

- Ethical Communication in Accounting Practices: Investigating how ethical communication influences decision-making processes within accounting firms and financial organizations.

- Impact of Digital Transformation on Accounting Communication: Exploring how technological advancements affect communication practices in accounting, such as through automation and AI.

- Narrative Accounting: Storytelling in Financial Reporting: Examining the use of storytelling techniques in financial statements and their impact on stakeholders’ understanding.

- Cross-Cultural Communication Challenges in Global Accounting Firms: Studying communication barriers and strategies in multinational accounting corporations operating in diverse cultural settings.

- Communication Styles and Conflict Resolution in Accounting Teams: Analyzing various communication styles within accounting teams and their role in resolving conflicts and enhancing productivity.

- Internal Communication and Change Management in Accounting Practices: Investigating effective internal communication strategies during organizational changes within accounting firms.

- Role of Communication in Forensic Accounting Investigations: Examining how communication techniques aid in conducting successful forensic accounting investigations.

- Communicating Sustainability in Financial Reporting: Exploring the communication of sustainable accounting practices and environmental/social impact in financial reports.

- Communication and Client Relationships in Accounting Services: Investigating the significance of effective communication in maintaining client relationships and delivering quality accounting services.

So, these ‘Accounting Project Topics and Materials’ are all about money and how it works in different places. Imagine them like different doors you can open to learn cool things about numbers and businesses. They show how people use math to talk about money in companies, how new tech helps with accounting, and even how working together in accounting teams is super important. It’s not just about numbers; it’s like discovering secrets about money in the real world. These materials are like a treasure map, helping us explore and understand how money decisions are made in companies, charities, and more.

These ‘Accounting Project Topics and Materials’ are a bit like a fun book series but about money and business. They’re packed with stories about how people handle cash and make smart choices. From learning about how companies talk about money to discovering new ways technology helps count coins, these topics are like puzzle pieces that make up the big picture of money. They’re a guide to exploring how cash moves around and how people make decisions with it.

What are examples of projects in accounting?

An example of a project in accounting could involve conducting a financial statement analysis to evaluate a company’s performance and financial health.

What is a good project for a recent accounting graduate

A comprehensive project in forensic accounting investigating financial fraud or irregularities within an organization could be valuable for a recent accounting graduate.

How do I get the best accounting project topics?

Exploring recent industry trends, consulting academic resources, and discussing potential ideas with mentors or professors can help in identifying the best accounting project topics.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Top 111+ Project Topics for Accounting Students In 2024

Are you a budding accounting enthusiast eager to embark on an exciting academic journey? Accounting, the language of business, is all about deciphering the stories hidden within numbers. As a student, you have the unique opportunity to delve into this dynamic field and choose a project topic that not only ignites your curiosity but also highlights your expertise.

In this captivating blog, we’ll guide you through a treasure trove of top-notch project topics for accounting students that promise to captivate your interest and impress your professors. These topics aren’t just academically stimulating; they are also highly relevant in the ever-evolving world of finance and business. So, let’s set sail on a voyage of discovery as we explore the most compelling project topics for accounting students.

Table of Contents

Meaning of Accounting

Accounting is the systematic process of recording, summarizing, analyzing, and reporting financial transactions within an organization. It serves as the language of business, providing a structured framework for businesses and individuals to track their financial activities.

However, the primary purpose of accounting is to ensure the accuracy of financial information, enabling stakeholders to make informed decisions about investments, budgeting, taxation, and overall financial health. It involves creating financial statements, such as balance sheets, income statements, and cash flow statements, to present a clear picture of an entity’s financial performance. Accounting is a vital tool for measuring and managing economic activities, ensuring transparency, and promoting financial accountability.

Benefits of Project Topics for Accounting Students

Here are the benefits of project topics for accounting students in a bullet point format:

- Application of Knowledge: Projects help students apply theoretical accounting concepts to real-world situations, deepening their understanding.

- Enhanced Research Skills: Researching for projects improves analytical and investigative skills, which are valuable in the field of accounting.

- Problem-Solving Abilities: Projects challenge students to solve complex accounting problems, honing their critical thinking skills.

- Teamwork and Communication: Collaborative projects promote effective communication and teamwork, essential in the workplace.

- Time Management: Meeting project deadlines teaches time management, a crucial skill in the fast-paced accounting profession.

- Portfolio Enhancement: Well-executed projects serve as impressive portfolio pieces, boosting career prospects.

- Practical Experience: Projects provide practical experience, preparing students for the challenges of accounting careers.

- Networking Opportunities: Projects often involve interactions with professors and professionals, expanding students’ networks.

- Career Advancement: Successful projects can lead to job offers and career opportunities in the financial and accounting sectors.

Also Read: Digital Techniques Micro Project Topics

List of Project Topics for Accounting Students

Here is a complete list of project topics for accounting students in 2024:

Financial Accounting

- Analysis of Financial Statements

- Earnings Management and Its Implications

- Revenue Recognition Methods

- Effects of IFRS on Financial Reporting

- Accounting for Goodwill and Intangible Assets

- Cash Flow Statement Analysis

- Accounting for Leases

- Audit Quality and Financial Reporting

- Accounting for Income Taxes

- Financial Reporting for Non-Profit Organizations

- Accounting for Business Combinations

Managerial Accounting

- Cost-Volume-Profit Analysis

- Activity-Based Costing (ABC)

- Budgeting and Variance Analysis

- Transfer Pricing in Multinational Corporations

- Performance Measurement and Management

- Decision-Making Using Relevant Costs

- Environmental Accounting and Sustainability

- Target Costing in Manufacturing

- Responsibility Accounting

- Balanced Scorecard Implementation

- Audit Risk and Materiality

- Internal Audit Effectiveness

- Forensic Accounting and Fraud Detection

- Role of Technology in Auditing

- Audit Committee Effectiveness

- Auditor Independence and Ethics

- Auditor Liability and Legal Liability

- Continuous Auditing and Monitoring

- Audit Sampling Techniques

- Emerging Trends in Audit

- Tax Planning for Individuals

- Corporate Taxation and Tax Credits

- International Taxation and Transfer Pricing

- Tax Evasion and Avoidance

- Value Added Tax (VAT) Compliance

- Taxation of E-Commerce Transactions

- Taxation of Cryptocurrencies

- Taxation in Developing Countries

- Estate and Gift Tax Planning

- Taxation Implications of Mergers and Acquisitions

Forensic Accounting

- Money Laundering and Asset Tracing

- Investigating Financial Frauds

- Whistleblower Programs

- Digital Forensics in Accounting

- Expert Witness in Litigation Support

- Data Analytics in Forensic Accounting

- Ethical Issues in Forensic Accounting

- Bankruptcy Fraud Investigations

- Insurance Claims Investigations

- Ponzi Schemes and Investment Fraud

Accounting Information Systems

- Enterprise Resource Planning (ERP) Systems

- Cybersecurity in AIS

- Blockchain in Accounting

- Cloud Computing and Accounting Systems

- Big Data Analytics in Accounting

- XBRL (eXtensible Business Reporting Language)

- Mobile Accounting Applications

- Accounting System Implementation Challenges

- Data Privacy and Accounting Information Systems

- Electronic Invoicing and E-Accounting

Corporate Governance

- Role of Board of Directors

- Shareholder Activism and Corporate Governance

- CEO Compensation and Performance

- Corporate Social Responsibility (CSR) Reporting

- Governance Mechanisms and Firm Performance

- Insider Trading and Corporate Governance

- Stakeholder Theory in Corporate Governance

- Women on Boards and Gender Diversity

- Corporate Governance in Family Businesses

- Sarbanes-Oxley Act and Corporate Governance

Ethics in Accounting

- Ethical Dilemmas in Financial Reporting

- Professional Codes of Ethics for Accountants

- Whistleblowing and Ethical Responsibility

- Accounting Ethics Education

- Ethical Decision-Making in Taxation

- Ethical Implications of Creative Accounting

- Sustainability Reporting and Ethical Considerations

- Conflicts of Interest in Accounting

- Social Responsibility of Accountants

- Ethical Leadership in Accounting

Sustainability Accounting

- Environmental, Social, and Governance (ESG) Reporting

- Carbon Accounting and Reporting

- Sustainable Development Goals (SDGs) and Accounting

- Triple Bottom Line Reporting

- Green Accounting and Eco-Efficiency

- Corporate Sustainability Performance Metrics

- Sustainability Reporting Assurance

- Socially Responsible Investing (SRI) and Accounting

- Sustainable Supply Chain Accounting

- Impact Measurement and Reporting

International Accounting

- Harmonization of International Accounting Standards

- Cross-Border Mergers and Acquisitions

- Foreign Currency Translation and Accounting

- International Taxation Challenges

- IFRS vs. GAAP: A Comparative Study

- International Financial Reporting for Multinational Corporations

- Cultural Impacts on Accounting Practices

- International Financial Reporting Standards (IFRS) Adoption

- Accounting for Foreign Subsidiaries

- Transfer Pricing in Global Business

Emerging Accounting Issues

- Accounting for Cryptocurrencies and Digital Assets

- NFTs (Non-Fungible Tokens) and Accounting Treatment

- Accounting for COVID-19 Pandemic Impacts

- Artificial Intelligence in Accounting

- The Future of Accounting Education

- Accounting Implications of Remote Work

- Accounting for Cybersecurity Breaches

- ESG Disclosures in the Post-Pandemic Era

- Financial Reporting for Special Purpose Acquisition Companies (SPACs)

- Accounting for Artificial Intelligence Startups

- DeFi (Decentralized Finance) and Accounting Considerations

- Environmental, Social, and Governance (ESG) Metrics and Financial Reporting

These project topics for accounting students cover a wide range of accounting-related areas, allowing students to explore various aspects of the field and engage in meaningful research and analysis.

How do I Start a Project for Accounting Students?

Starting a project topics for accounting students involves several essential steps to ensure its success:

- Topic Selection: Choose a relevant and interesting accounting topic that aligns with your interests and the project guidelines.

- Research: Gather information and resources related to your chosen topic. Books, academic journals, and online databases can be valuable sources.

- Project Outline: Create a project plan or outline, including key objectives, methodologies, and a timeline to stay organized.

- Data Collection: Collect necessary financial data or information related to your project. Ensure data accuracy and reliability.

- Analysis: Analyze the collected data using appropriate accounting techniques and tools to draw meaningful conclusions.

- Documentation: Prepare a well-structured report or presentation, including an introduction, methodology, findings, and a conclusion.

- Review and Edit: Proofread your work for errors and clarity, and consider seeking feedback from peers or professors.