Oil & Gas Business Plan Template

A successful oil and gas business is based on a solid business plan. To help you out, we've designed a business plan template PDF specifically for your oil & gas business.

Get your copy today!

Download The Template

For help completing your oil & gas business plan, read our guide .

How can an oil & gas business plan template help you?

- A solid oil & gas business plan acts as your strategy guide for building a successful business.

- Whether you're an existing oil & gas business or just starting out, a business plan helps you get organised.

- Use a oil & gas business plan to help secure funding for your business.

Get your free oil & gas business plan PDF!

Created by tradify - the easiest way to manage your plumbing, oil & gas business..

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Oil and Gas Business Plan

Published Mar.28, 2024

Updated Apr.23, 2024

By: Alex Silensky

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

Table of Content

The oil and gas sector is a highly regulated industry. A well-structured oil and gas business plan can help navigate these complexities.

According to a survey by EY, inadequate business planning is one of the top reasons oil and gas projects fail to achieve target profitability. “Firms that take a comprehensive approach through integrated business planning are better positioned to withstand market volatility and capitalize on opportunities,” notes Herb Listen, EY’s U.S. Oil & Gas Leader.

In this article, we’ll outline the key elements of an oil and gas business plan along with an oil and gas business plan template. By the end of this article, you’ll understand what it takes to develop a robust oil and gas drilling business plan.

What Is the Business Plan for an Oil and Gas Company?

A business plan for the oil and gas industry is a professional document that:

- Outlines the company’s goals

- Specifies strategies

- Producing oil and gas resources

The oil and gas station business plan serves as:

- A roadmap for the company’s operations

- A tool for securing financing from investors or lenders

Here are some key components typically included in an oil and gas business plan:

- Executive Summary: A concise overview of the business, its objectives, and the key elements of the oil and gas development business plan.

- Company Description: Details about the company, its history, ownership structure, and legal form.

- Industry Analysis: An assessment of the current state of the oil and gas industry, including market trends, competition, and regulatory environment.

- Operations Plan: A description of the company’s operational processes, including techniques, methods, processes, and logistics.

- Marketing Plan: An outline of the company’s plans for marketing and selling its oil and gas products, including target markets, pricing strategies, and distribution channels.

- Management and Organization Team: Details about the company’s management team, organizational structure, and key personnel.

- Financial Projections: Detailed financial forecasts, including projected financial statements, supported by assumptions and analyses.

The oil and gas company should tailor the oil and gas startup business plan to their specific goals and circumstances, and they should regularly update it to reflect changes in the industry, market conditions, and operations.

Why Do You Need a Business Plan Sample for an Oil and Gas Exploration Company?

There are a few key reasons why you would need a solid business plan, like the biodiesel business plan when starting your own oil and gas business:

- Attract Investment: The oil and gas industry requires significant upfront capital for exploration, drilling, equipment, and operations. A detailed oil and gas upstream business model and plan demonstrates to potential investors a viable strategy for generating returns.

- Guide Operations: An oil and gas field business plan serves as a roadmap for executing exploration and production activities. It lays out key milestones, timelines, capital expenditures needed, regulatory requirements, and operational plans.

- Analyze Economics: Thorough market analysis, cost projections, pricing forecasts, and breakeven modeling allow testing the economic viability of prospects before committing major resources. The oil and gas exploration business plan quantifies potential returns and profits based on various scenarios.

To illustrate the importance of a sample business plan, let’s walk through the key sections of an oil and gas business plan template for a fictional oil and gas exploration firm called TX Energy:

[related_post id=”112376″]

Clear and detailed

Alex provided us a detailed report on a business we were thinking of buying. The report was very clear and detailed, and he was available to answer any questions. We highly recommend his service

Executive Summary

Business overview.

TX Energy is a newly formed independent oil and gas exploration and production company headquartered in Houston, Texas. Our mission is to become a leading operator in the Gulf of Mexico region through the acquisition and development of high-quality offshore prospects.

Management Team

With a seasoned management team that has over 100 combined years of experience in the offshore Gulf, we plan to leverage our deep industry knowledge and technical expertise to build a portfolio of attractive assets.

Business Strategy

Our initial focus will be on identifying and acquiring undervalued offshore leases with proven undeveloped reserves and executing low-risk, high-return drilling programs.

We are seeking $75 million in equity financing to fund lease acquisitions, drilling operations, and general working capital needs during our start-up phase.

Financial Projections

Financial projections show the potential for strong growth and returns, with estimated revenues of $50 million by Year 5.

Company Overview

TX Energy is an independent exploration and production company in the Gulf of Mexico. We were founded in 2024 by a team of seasoned industry professionals with a successful track record in this region.

Corporate headquarters: Houston, TX

Operating region: U.S. Gulf of Mexico

Business Concept

Leverage management’s expertise to:

- Identify and acquire undervalued offshore leases

- Optimize development plans for discovered resources

- Execute low-risk, high-return drilling programs

- Rapidly build a diversified portfolio of producing properties

Industry Analysis

The U.S. Energy Information Administration expects the demand for oil and natural gas will grow in the coming years. Some key industry statistics and forecasts:

- The oil and gas market size is projected to increase from $7,625.82 billion in 2024 to $9,347.9 billion in 2028, with a CAGR of 5.2%. (Source – The Business Research Company )

- The global oil demand is forecasted to rise by 1.7 million barrels per day (mb/d) in the first quarter of 2024. The expansion pace might slow down from 2.3 mb/d in 2023 to 1.3 mb/d in 2024. (Source – IEA )

Key Industry Drivers and Trends:

Business plan for investors.

- Rapid adoption of subsea tiebacks and multi-well platforms to reduce costs

- Increased interest in re-developing legacy fields using advanced recovery techniques

- Growing regulatory oversight and focus on safety/environmental practices

- Persistent workforce shortages requiring investment in training pipelines

Customer Analysis

Our primary customers will be midstream companies, refiners, and utilities purchasing our crude oil and natural gas production. We have identified the following key players as potential off-takers in the Gulf region:

- Mid-Continent Oil Pipelines (Crude oil transport)

- Kinder Morgan/BP (Natural gas processors)

- Marathon Petroleum (Refiner)

- Southern Company (Utility)

As a non-integrated independent producer, we will aim to establish long-term sales agreements and strategic relationships with creditworthy counterparties. Our go-to-market strategy will focus on:

- Leveraging management’s industry network to engage top prospective customers early

- Ensuring adequate takeaway capacity ahead of new wells coming online

- Negotiating favorable pricing terms based on our high-quality offshore crude

- Bundling gas production with crude offtakes where possible

Competitive Analysis

Large integrated operators such as Chevron, Shell, and BP, as well as several large independent companies, dominate the upstream market of the Gulf of Mexico. Fewer mid-sized players focus solely on exploiting stranded/bypassed reserves on the shelf. Our primary competitors include:

Our primary competitors include:

Relative to these competitors, our key advantages are:

- Unrivaled management experience and technical capabilities specific to shelf opportunities

- Exclusive focus on low-risk, quicker cycle time development projects

- Simple value investment proposition vs. diversified multi-regional operators

Other competitive strengths include a projected low operating cost structure and established relationships with service companies active in the region.

Marketing Plan

TX Energy will position itself as the premier low-risk, low-cost developer of shelf oil and gas resources in the Gulf of Mexico. We will pursue a commodity-focused strategy, marketing our high-quality crude and gas production to maximize netbacks.

Pricing Strategy

As a non-integrated producer, we will pursue a commodity marketing strategy focused on achieving maximum netback pricing for our offshore production. Specific tactics include:

- Crude oil – Secure term marketing agreements with refiners or marketers, pricing based on regional benchmarks like LLS or WTI

- Natural gas – Pursue portfolio-based sales to LDCs, utilities, and marketers at Henry Hub+/- basis pricing

Sales & Distribution Channels

We will employ two primary sales and distribution channels:

- Crude oil production – Pipeline connections from offshore platforms to main corridor pipelines like LOCAP and NGPL

- Natural gas production – Subsea tiebacks into regional gathering systems and interstate/intrastate pipelines

Strategic Partnerships

Establishing strategic relationships across our supply chain will be a critical success factor. Key partnership areas include:

- Offshore drilling contractors

- Subsea construction and installation contractors

- Pipeline companies and midstream providers

- Supply boat and support vessel operators

Marketing Programs

Our key marketing initiatives will focus on building brand awareness and establishing TX Energy as a trusted and preferred supplier to Gulf Coast off-takers:

- Investor marketing/participation at industry conferences and events

- Working interest/royalty owner marketing of upcoming development projects

- Direct outreach to commercial teams at potential customers

- Development of professional digital marketing materials

Operations Plan

Oil & gas leases.

Our lease acquisition strategy will initially target offshore shelf properties with the following characteristics:

- Water depths < 600 feet

- Located near existing infrastructure to minimize upfront capital costs

- Proven undeveloped reserves between 10-50 million BOE

- Technically reasonable development plan via subsea tiebacks or platform drilling

We have already identified a pipeline of potential acquisition targets fitting this criteria. Once leases are acquired, we will conduct geologic and reservoir studies to high-grade the most attractive drilling opportunities.

Drilling & Completion Activities

We will utilize jack-up and submersible rig types commonly used on the shelf For relatively shallow drilling targets. We will use the best available techniques and technologies to drill all wells and to ensure maximum production rates and recoverable reserves.

Production, Facilities & Maintenance

Depending on the size and scope of each project, we will utilize either:

- Subsea tiebacks to existing third-party infrastructure

- New-build production platforms designed for unmanned operations

Environmental & Regulatory

We are committed to operating at the highest level of environmental, safety, and regulatory standards in offshore space. This includes comprehensive SEMS programs, oil spill prevention and response plans, and other mandatory policies/procedures.

Key regulatory bodies overseeing our operations include:

- Bureau of Safety and Environmental Enforcement (BSEE)

- Bureau of Ocean Energy Management (BOEM)

- U.S. Coast Guard

- Environmental Protection Agency

Organization & Management Team

TX Energy has assembled a world-class team with unmatched technical and regional expertise in the offshore Gulf of Mexico:

- John Watson, Chief Executive Officer – John has 30+ years of offshore engineering and operations experience. He is a former VP of offshore at a major energy company with expertise in subsea tieback developments and shelf production.

- Jane Litt, VP of Exploration – Jane has 25 years of experience in offshore Gulf exploration. She was previously a senior exploration advisor at a large independent oil company. She holds a Ph.D. in Petroleum Geology from Rice University.

Additional key hires planned for Year 1 include:

- Drilling Manager

- Production Engineer

- HSE/Regulatory Specialist

- Land/Legal Counsel

- Accounting/Finance support

As we grow, certain additional functions like HR, IT, and engineering teams may be built out internally rather than fully outsourced.

Financial Plan

Based on our phased development plan and production ramp-up schedule, we are seeking $75 million in equity financing to fund TX Energy’s start-up and growth over the initial 5 years period:

Use of Funds

- Offshore lease acquisitions: $25M

- Capital expenditures (drilling/facilities): $30M

- Operating expenditures: $15M

- General working capital: $5M

Projected Profit & Loss Statement

Projected balance sheet, projected cash flow statement.

Overall, these projections in the coal mining business plan illustrate TX Energy’s ability to rapidly grow production, revenue, and cash flow in a capital-efficient manner and achieve strong economic returns for investors.

Partner With OGSCapital for a Professional Oil and Gas Business Plan

Over at OGSCapital, we understand just how crucial it is for independent oil and gas outfits to have a really solid, well-polished business plan. Whether you need to win over investors or secure financing from lenders, our team has got your back.

With more than 15 years of expertise in aiding both startups and established businesses in crafting thorough and persuasive business plans such as the renewable energy business plan and logistics business plan , we’re well-equipped to assist.

Contact us today to learn more about our business plan consulting services and how we can help you.

Download Oil and Gas Business Plan Sample in pdf

Frequently Asked Questions

Is oil and gas a good business?

Yes, because the oil and gas industry is one of the largest sectors in the world, generating over trillion in global revenue as of 2022. In 2024, the industry is expected to have solid growth.

How to start your own oil and gas company?

Starting an oil and gas company involves several steps:

Step 1: Do market research.

Step 2: Decide your geographical location.

Step 3: Build a team.

Step 4: Create an oil and petroleum business plan.

Step 5: Set up a legal entity (LLC, Corporation, etc.)

Step 6: Seek funding.

Step 7: Get the equipment.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

How to Start a Plumbing Business in 2024: A Detailed Guide

Vegetable Farming Business Plan

Trading Business Plan

How To Write A Textile Manufacturing Business Plan

Start a Vending Machine Business in 2024: A Detailed Guide

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Sample Oil and Gas Business Plan

This article will be providing you with an oil and gas business plan guide or template.

The energy sector of every economy is huge and offers enormous investment opportunities. Whatever your niche area or interests are, starting a business can be very challenging.

However, having a plan makes the process a lot less difficult and helps with better coordination.

Here, we aim to help entrepreneurs who, though being experienced in the oil and gas sector have no idea how to launch their business operations.

OIL AND GAS BUSINESS PLAN SAMPLE

To better organize your plan, there are basic sections that cannot be left out. They touch on the different aspects of running a successful oil and gas business.

They include the executive summary, the company description, and the products & services sections.

Other crucial sections include the market analysis section, strategy & implementation, organization & management team as well as the financial plan & projections sections.

So, how do you develop each of these sections? You’ll want to read on to find out.

i. Executive Summary

As the introductory section of your plan, the executive summary gives a concise overview of your oil and gas business plan. What you should seek to do with this section is make and keep your audience interested by learning about your business.

The basics about your company should be known here.

The executive section always appears first in a plan. While this is true, it should be written last. The reason is this; it should capture all the key aspects of the business plan.

Consider adding certain sections like your business name & location, your services & products as well as your mission & vision statements. Also, the specific purpose of your plan should be added.

Business Name & Location

One of the first things you’ll need to include in your business name as well as its location. Introducing your business is paramount and gives your reader or a starting point on what the business is about.

How does your location positively impact your operations?

Services & Products

Here, you’ll need to give a breakdown of your oil and gas products and services . What specific niche area you involved with and how are your products and services beneficial to your clients.

People only pay for value and you should briefly discuss what value your services offer to your clients.

Mission & Vision Statements

The mission and vision statements of your oil and gas business should shed light on your company’s purposes, goals and values. Your mission statement should tell about why the business exists as well as the purpose it serves.

Also include information on what your business offers.

You should focus on what you seek to ultimately achieve with your oil and gas business for the mission statement. In a nutshell, the vision statement gives purpose to the existence of your business.

It’s important when writing this statement to never leave anything open to interpretation.

Specific Purpose

Every serious business has a purpose. What’s yours about? By clarifying your purpose or aims, your chances of achieving your goals are increased.

ii. Company Description

The company description section seeks to further reveal details about your oil and gas business. Basically, you want to explain who you are, your mode of operation as well as the goals you wish to achieve.

Details to be included are the legal structure of the company, as well as its brief history.

Being an oil & gas business, you’ll have to provide details on the needs or demands you intend to fill or meet.

The company description should give an overview of your services & products while also identifying your target market and your suppliers.

Also, include a summary of company growth backed by financial or market highlights.

Of course, this won’t be complete without a summary of your long and short-term goals including how you intend to make a profit.

iii. Products & Services

While this was covered in the executive summary section, only a summary of it was given.

This section takes a more detailed look at the products and services being offered by your oil & gas business with a focus on the benefits being derived by customers.

Here, you’ll also need to explain the market role of such products & services.

What edge or competitive advantages do your products & services have over those from competitors. Are there new products in the works? Provide information on such.

Here is a sample plan on crude oil refining .

iv. Market Analysis

A lot of work in the form of research is required to demonstrate your understanding of the oil and gas industry.

Your research should provide a detailed sketch of your target market with a focus on key aspects such as its size and demographics.

Have an industry description and outlook with statistics serving as proof. What more? There should be historical, current, and projected marketing data for your oil and gas business.

Also, include an evaluation of your competitors with a special focus on their weaknesses and strengths.

v. Strategy & Implementation

Strategy and implementation have a lot to do with sales and marketing. This is basically an operating plan on how you wish to sell and distribute your oil & gas products and services.

It focuses on market entry, pricing, costs, promotion, and distribution details.

What are your operational plans in regards to the operational cycle of the business? You also want to include information on labor sources as well as the number of employees you’ll need.

vi. Organization & Management Team

The organization & management team section discusses the organizational structure of the oil and gas business.

You want to provide a description of key departments as well as employees by providing an organizational chart.

There should be information about the owners, their level of involvement as well as percentage ownership. Also, profiles of your management team will be necessary.

vii. Financial Plan & Projections

Under the financial plan & projections section, you’ll need some expert help. The services of a professional accountant will suffice.

The key areas analyzed under this section include the historical financial data, realistic prospective financial information, and brief analysis of financial data.

With these points covered, your oil and gas business plan should be ready for implementation. You also stand the chance of getting the much-deserved financing required.

One Comment

Hi dear , Iam from Papua New Guinea,Alotau Milne Bay Province. Papua New Guinea. Iam a Tradesmen, Heavy Diesel Fitter and Maintenance Fitter Machinist. Former Mechanical Maintenance Engineer for BHP STEEL and Ok Tedi Mining LTD Mill Maintenance Rebuildshop. Iam urgently seeking for any mechanical Fitter jobs in Australian Oil Rig Drilling companies and Mining. Any other farming jobs suits my qualifications. Thank you very much for your time and kind assistance. I wait patiently to hear from you soon.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

Oil and Gas Business Plan with Wise Business Plans

Corporate oil & gas business plan development.

The Oil and Gas Business Planning industry continues to make new strides in the United States in the oil and gas companies, and many small business owners are finding ways to leverage the booming industry to create their own success stories. However, it takes more than a smart idea to start your engine and race toward success in this competitive field of petroleum.

Post-Pandemic Recovery

During May 2020, the amount of gasoline supplied to the market increased to nearly 5.9 million barrels a day, up from 5.1 million in the first week of April but well below the typically more than 9 million before the pandemic. On the other hand, gasoline saw a normalizing demand at around 55%, which improved by 64% during mid-2020. Industry experts expect a slow but steady recovery during 2021, giving hope to the industry operators.

Key Components of Petroleum Business:

- The clarity in Products and Services- The COVID-19 crisis accelerates what was already shaping up to be one of the industry’s most transformative moments. The Wise Business Plans professionals take time to find out which pain point the product or service will be addressing and develop a business plan that accurately communicates it.

- Costing Strategy- The costs associated with embarking upon a business in the Oil and Gas business industry can be challenging, especially in the post-pandemic era. On its current course and speed, the industry could now be entering an era defined by intense competition, technology-led rapid supply response, flat to declining demand, investor skepticism, and increasing public and government pressure regarding the impact on climate and the environment. However, under most scenarios, oil and gas will remain a multi-trillion-dollar market for decades. Given its role in supplying affordable energy, it is too important to fail. The question of how to create value in the next normal is therefore fundamental.

- Trends- Trends are major in all segments of the economy but especially in those that directly impact the atmosphere. “Clients operating in this industry have to be aware of regulations, laws, and standards that are enacted by governing bodies. Without this type of information their business models could suffer significant losses”, says Mr. Ferriolo. “We do exhaustive, real-time research that protects the client and places them in the best possible position to succeed”, says Mr. Ferriolo.

- Innovation- The industry will need to dig deep and tap its proud history of bold structural moves, innovation, and safe and profitable operations in the toughest conditions to change the current paradigm. The winners will be those that use this crisis to boldly reposition their portfolios and transform their operating models. Companies that don’t will restructure or inevitably atrophy.

How To Get Into The Oil Business

In the oil and gas sector, starting your own company requires a lot of capital, time, and expertise. Even so, as this industry produces multi-millionaires and yields a higher ROI than in any other industry, all your troubles and efforts will be worthwhile.

You should focus on these things if you have previous experience in this area and want to know how to start an oil company.

1. Decide Where to Invest

You can have a filling station or you can drill your wells in the oil and gas industry. One can choose from a variety of options: a service company, a product company, or a company that cleans up oil spills.

It is important to determine your motivations and strengths before making any detrimental moves in this field. Getting a sense of the amount of capital needed can help you make the right choice.

2. Make an Oil and Gas Business Plan

You need to make a detailed oil & gas business plan and list all your resources and liabilities after deciding what you want to focus on. It is imperative to include all the projected operating expenses in your petroleum business plans, such as insurance, permits, licenses, salaries, and ongoing expenses.

A business plan for an oil and gas company will serve as a blueprint for your business. Your business plan will be a valuable tool if you are considering applying for a loan or wish to attract investors. In case you have no prior experience creating business plans , In case you have no prior experience creating business plans, you can hire us to assist you.

Do You Need Help in Creating a Business Plan?

If you need a business plan writer , you no longer have to worry about the complexities of writing a professional business plan. Our MBA-qualified business plan writers have written over 15000+ business plans for over 400 industries in over a decade.

Let our professional business plan writers help you get funding

3. Identify Your Investors

Once you’ve decided what type of oil business is right for you and calculated the loans and funding you’ll need, the next step is to make sure you can get a fair loan.

To run any company in this field, you will need a fair amount of capital from the very beginning, so you may have to consider finding investors. Don’t worry about the capital Here are 7 ways to raise capital for getting into the oil business:

- Self-Funding: If you look around, you may find the capital you need right in your own home. It may come from your already existing assets or savings. You retain full control of the business by providing the initial capital yourself. Angel investors and even single investors can influence the direction of a company.

- Crowdfunding: A method of raising money from a large number of people. Several people pool their small investments to raise the capital needed to launch a company or project. It’s a win-win situation for you. Currently, U.S. oil is the most popular commodity in the world.

- Angel Investor: Private or seed investors (also called angel investors) are high-net-worth individuals who provide financial support to small businesses in exchange for ownership equity. Furthermore, investors can also offer business advice. Particularly if they have oil and gas industry experience, this may be beneficial.

- Friends and Family: Friends and families are the second-largest sources of business capital in the U.S. A family member will be aware of your work history or management experience. It’s likely that they already know about the potential of your gas or oil share, and may even have helped to acquire it.

- Bank Loan: Getting a bank loan is probably the most traditional way to obtain start-up capital. As the bank wants to ensure that you can pay back the loan, you will likely be required to submit a lot of information during your initial application. Our experienced team has helped our clients raise millions in funding through banks (debt financing) and investors (debt/equity financing).

- Small Business Administration (SBA): Despite its long history, the SBA is still a useful source of funding . They offer federally guaranteed loans of up to $5 million to “small” businesses. Furthermore, you will receive the funding you require without compromising your oil and gas business plan. The loan will also likely have light terms and interest rates. SBA’s goal is to boost the economy. A small business loan is one of the easiest ways to get cash. With decades of experience in business credit and lending, Wise Business Plans is uniquely suited to help you. You are just 4 steps away from getting a small business loan .

Pro Tip: Here is a step by step guide on 5 best places to find a venture capitalist

Wise Business Plans has decades of experience in early-stage investments, so we will help you get your first venture capital investment .

Do You Need Investment?

4. check the regulations.

You should check all the relevant regulations, licenses, and permits , as well as your tax identification number, before starting an oil business. You may be aware of some of them from previous experience, but you should always consult a business or tax attorney when addressing legal issues.

Do You Need a License to operate an Oil and Gas Business?

Wise business plans have eased the process to obtain a business license, which is generally necessary to operate an oil and gas business.

Let Wise help you Get your License to operate an Oil and Gas Business

5. Form a Legal Entity

Those in the group will want to shield themselves from personal liability. You can form a limited liability company (LLC) or an S corporation. An LLC is a flexible entity with elements of both a partnership and a corporation. To simplify federal income tax matters, S corporations elect to pass income and losses on to shareholders.

Need to Register an Oil and Gas Business?

We at Wise Business Plans provide you with a wide range of business formation services for incorporating a company in a way that makes the process easy and allows you to stay focused on other important tasks. Our business formation services include

- Tax ID Number

- LLC Formation

- NonProfit Business Formation

- S Corporation Registration

You can form your business entity in just 4 Simple Steps with Wise Business Plans

Open a Business Bank and Get Credit Cards

Personal asset protection is enhanced when you open specialized business banking and credit accounts.

When your personal and professional accounts are mixed, your personal assets (your home, automobile, and other valuables) are vulnerable if your company is sued.

Furthermore, learning how to establish business credit may assist you in receiving credit cards and other financial resources in your company’s name (rather than yours), improved interest rates, greater lines of credit, and more.

6. Set up a Business Bank Account.

Apart from being a requirement when applying for business loans, establishing a business bank account has several benefits.

- Separates your personal belongings from your company’s assets, which is critical for personal asset protection.

- Makes tax preparation and accounting simple.

- It makes tracking expenses easier and more organized.

Recommended: To discover the greatest bank or credit union, read our Best Banks for Small Business review.

7. Open Net 30 Account

To establish and grow business credit, as well as improve company cash flow, net 30 payment terms are utilized. Businesses purchase products and pay off the whole amount within a 30-day period using a net 30 account.

Net 30 credit vendors are reported to the major business credit bureaus (Dun & Bradstreet, Experian Business, and Equifax Business Credit). This is the way businesses build business credit to qualify for credit cards and other lines of credit.

Recommended: Read our list of the top net 30 vendors guide to start getting business credit or simply open your net 30 account with wise business plans in seconds.

8. Get a Business Credit Card

It’s exciting to open a business credit card for your firm. A business credit card can assist you to establish credit, safeguard your company financially, access rewards (such as cashback), and simplify cash flow. It can also assist you to manage your expenditures.

Recommended: Learn more about the best business cards in our business credit card review.

9. Build a Great Team

When taking on such a venture, human capital plays a crucial role. You must determine how many employees you need to hire and whether they have enough experience and training to do their jobs well.

Here are some useful team-building tips which might help you in building your team.

10. Use Top-Notch Equipment

Make sure you use top-notch equipment to ensure and protect your business and investments. For those who work directly in the oil production sector, it is extremely important to ensure your piping, control, and measuring systems are all up-to-date.

If you plan to start a procurement and supply company, you should include quality general equipment, such as valves, pumps, and generators, along with personal safety equipment. By providing high-quality tubular to your customers, along with other drilling and wellhead equipment, you will stand out as a reliable and conscientious provider.

11. Choose an Exploration Site

Obtain county and/or state permits for drilling and land use. Execute a lease with the property owner and/or the owner of mineral rights once you determine which party owns the property and if there are no prior claims that might affect your exploration.

In case your seismic data indicates there could be a subsurface trap containing significant oil, drill multiple exploratory wells on the site. Provide all necessary supplies and equipment for well capping and storing oil in storage tanks prior to hiring a drilling company for this purpose.

Ensure that you have a plan for containing and transporting any natural gas and oil that may be present in your site’s reservoirs. Roads may need to be built to access the site. Trailers or other structures are necessary for offices and living accommodations. Communication capabilities should also be available at the site.

Business Planning for the Oil & Gas Sector

Vigilance is more than ever needed in crafting a solid oil and gas business plan. Smart planning showing commitment and consistency in intentions will always win financiers’ confidence. As part of that strategy, we’ve identified several key components that every oil and gas startup business plan must address, including:

Luckily, a properly written oil and gas business plan is a key element to the process that can help your business raise the necessary capital to purchase equipment, hire staff, and cover operating expenses as you plan to enter the Oil and Gas industry .

Oil And Gas Business Plan Writing Services

Wise Business Plans has had the privilege and the opportunity to create oil and gas Companies that support business owners in this foundational industry, and we have worked hard to build up a knowledge base and the research skills needed to be the premier online provider of oil and gas business plans.

When you’re ready to jump into the action, we’d love to help you start strong and make a mark in the world of energy production, so contact us today to get started on planning your future success.

Download a sample oil and gas business plans template for FREE to get an idea of the basic elements of oil and gas startup business plan writing. Also, you can quickly check our FAQ page for some basic questions and answers.

Wise business plans also offer a net 30 account application . Net-30 accounts allow you 30 days to pay the bill in full after you have purchased products. Net 30 accounts can also make managing your business finances easier. Apply for your net 30 business accounts now

Need Nearest Business Plan Writing Services

Looking for a professional business plan writing services near me ? Contact us to achieve your company’s goals and get funded.

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

It should be noted that there is no special software required to use these templates. All business plans come in Microsoft Word and Microsoft Excel format. Each business plan features:

- Excecutive Summary

- Company and Financing Summary

- Products and Services Overview

- Strategic Analysis with current research!

- Marketing Plan

- Personnel Plan

- 3 Year Advanced Financial Plan

- Expanded Financial Plan with Monthly Financials

- Loan Amortization and ROI Tools

- FREE PowerPoint Presentation for Banks, Investors, or Grant Companies!

1.0 Executive Summary

The purpose of this business plan is to raise $600,000 for the development of a private oil business while showcasing the expected financials and operations over the next three years. Oil Company, Inc. (“the Company”) is a New York based corporation that will extract oil from land leases within United States. The Company was founded by John Doe.

1.1 Products and Services

As stated above, the Company intends to acquire land leases on properties known to have oil deposits. The business will then develop facilities on these properties with the intent to extract and distribute oil for sale onto the open market. The initial capital sought in this business plan will allow the business can acquire its first land lease while concurrently sourcing the equipment needed to operate a moderate sized oil extraction operation. It should be noted that at all times, the business will comply with all applicable federal, state, and local laws (including OSHA) in order to ensure the safety of all employees working for the Oil Company. The third section of the business plan will further describe the operations conducted by the Oil Company.

1.2 The Financing

At this time, Mr. Doe is seeking $600,000 of private funds for the development of the Company’s oil extraction operations. Tentatively, Management is seeking to sell a 40% interest in the business in exchange for the capital sought in this business plan. The financing will be used for the following: • Development of the Company’s initial Oil Extraction location. • Financing for the first six months of operation. • Capital to purchase equipment for oil extraction.

1.3 Mission Statement

The Oil Company’s mission is to cost effectively extract oil from known deposits with the intent to sell the refined oil the open market.

1.4 Mangement Team

The Company was founded by John Doe. Mr. Doe has more than 10 years of exploration experience. Through his expertise, he will be able to bring the operations of the business to profitability within its first year of operations.

1.5 Sales Forecasts

Mr. Doe expects a strong rate of growth at the start of operations. Below are the expected financials over the next three years.

1.6 Expansion Plan

The Founder expects that the business will aggressively expand during the first three years of operation. As the business becomes profitable it will make substantial reinvestments into the Company’s land lease acquisition infrastructure. Additionally, the Company may seek to acquire additional land leases on proven grounds for oil extraction.

2.0 Company and Financing Summary

2.1 Registered Name and Corporate Structure

Oil Company, Inc. The business is registered as a for profit corporation in the State of New York.

2.2 Required Funds

At this time, the Company requires $600,000 of equity funds. Below is a breakdown of how these funds will be used:

2.3 Investor Equity

At this time, Mr. Doe is seeking to sell a 40% interest in the business in exchange for the capital sought in this business plan. The investor(s) will receive a seat on the board of directors and a regular stream of dividends starting in the first year of operations.

2.4 Management Equity

After the requisite capital is raised, Mr. Doe will retain a 60% ownership interest in the business.

2.5 Exit Strategy

The Management has discussed and planned for three possible exit strategies. The first strategy would be to sell the Company to a larger entity at a significant premium. Since, the oil extraction industry maintains a moderately low risk profile once the business is established; the Management feels that the Company could be sold for ten to fifteen times earnings. The second exit scenario would entail selling a portion of the Company via an initial public offering (or “IPO”). After a detailed analysis, it was found that comparable companies sell for ten to fifteen times earnings on the open market. However, taking a company public involves significant legal red tape. Oil Company, Inc. would be bound by the significant legal framework of the Sarbanes-Oxley Act in addition to the legal requirements set forth in form S1 of the Securities and Exchange Commission. The Company would also have to comply with the Securities Act of 1933 and the Exchange Act of 1934. The last exit scenario would involve the use of a private placement memorandum to raise additional capital from private sources. This is also a significantly expensive process that requires the assistance of both an experienced securities law firm and an investment bank. Funds would be raised from private equity and merchant banking sources in exchange for a percentage of the Company’s stock.

3.0 Products and Services

As stated in the executive summary, the Company intends to operate in an oil extraction capacity. Prior to the onset of operations, Mr. Doe will have acquired a land lease on a property that is known to have oil deposits. At this time, it is unclear as to the method that the Company will use in order to extract oil. The most profitable method of exacting oil would be to lease an existing facility with the intent to extract deposits from the underlying soil. This manual method of precious oil acquisition would provide the greatest return on investment for the business. The Company, depending on its land lease, may engage in deep oil extraction if the land is known to have a significant amount of oil/natural gas that is buried deep within the ground. Mr. Doe is also sourcing the necessary equipment so that the business can immediately begin its operations once the land lease has been acquired. The facility will also have all of the necessary chemical treatment to allow the business to distribute its oil deposits directly into the open market.

4.0 Strategic and Market Analysis

4.1 Economic Outlook

This section of the analysis will detail the economic climate, the oil extraction industry, the customer profile, and the competition that the business will face as it progresses through its business operations. Currently, the economic market condition in the United States is moderate. The meltdown of the sub prime mortgage market coupled with increasing gas prices has led many people to believe that the US is on the cusp of a double dip economic recession. This slowdown in the economy has also greatly impacted real estate sales, which has halted to historical lows. However, oil companies operate with great economic stability as it is a product that is in continued demand. This is especially true in today’s economic environment as inflation has pushed the price of oil substantially over the last 12 months. As long as oil prices continue to rise, the business should have no issues producing a continuous profit from its extraction operations.

4.2 Industry Analysis

Localized oil extraction is a $3 billion dollar a year business in the United States. Within the industry there are over 200 domestic providers of oil extraction operations that operate within 20 states. The industry employs more than 10,000 people and provides adjusted annualized payrolls in excess of $500,000,000 dollars. The growth rate of this industry has been tremendous with the recent resurgence of inflation. The prices of oil and related energy products have increased substantially as investors have sought the safe haven of commodities in lieu of the falling value of the dollar. This demand is expected to remain strong in the face of inflationary pressures.

4.3 Customer Profile

As Oil Company, Inc. intends to sell its oil directly to wholesalers in the open market, is it difficult to determine the “average customer” of the business. Any company engaged in the buying and selling of energy products is a potential buyer for the Company.

4.4 Competitive Analysis

This is one of the sections of the business plan that you must write completely on your own. The key to writing a strong competitive analysis is that you do your research on the local competition. Find out who your competitors are by searching online directories and searching in your local Yellow Pages. If there are a number of competitors in the same industry (meaning that it is not feasible to describe each one) then showcase the number of businesses that compete with you, and why your business will provide customers with service/products that are of better quality or less expensive than your competition.

5.0 Marketing Plan

The marketing campaigns required by Oil Company, Inc. are minimal as the business will sell its extracted oil directly to the open market. As such, it is imperative that any marketing expenditures undertaken by the Company focus on developing relationships with metals wholesalers and property management firms that will seek and lease land to the business.

5.1 Marketing Objectives

• Develop relationships with specialty property management firms that will lease land to the business for its oil extraction operations.

• Establish relationships with oil wholesalers within the targeted market.

5.2 Marketing Strategies

Prior to the onset of operations, Mr. Doe will develop ongoing purchase order relationships (based on market prices) with national and international energy product dealers and wholesalers that will acquire the Company’s inventory of extracted oil. In order to complete this aspect of Oil Company’s marketing operations, Mr. Doe will directly contact well known energy wholesalers. As these buyers are constantly searching for new sources, developing these relationships will not be an issue. Additionally, the Company will make its presence known among real estate agents and property management firms that specialize in the sale and placement of leases for land that is known to carry oil deposits. Much like with the oil wholesalers/dealers, Mr. Doe will directly contact these companies in order to develop working relationships.

5.3 Pricing

In this section, describe the pricing of your services and products. You should provide as much information as possible about your pricing as possible in this section. However, if you have hundreds of items, condense your product list categorically. This section of the business plan should not span more than 1 page.

6.0 Organizational Plan and Personnel Summary

6.1 Corporate Organization

6.2 Organizational Budget

6.3 Management Biographies

In this section of the business plan, you should write a two to four paragraph biography about your work experience, your education, and your skill set. For each owner or key employee, you should provide a brief biography in this section.

7.0 Financial Plan

7.1 Underlying Assumptions

• Oil Company, Inc. will have an annual revenue growth rate of 16% per year.

• The Founder will acquire $600,000 of equity funds to develop the business.

• Mr. Doe will sell a 40% equity interest in the business in exchange for the requisite capital sought in this business plan.

7.2 Sensitivity Analysis

In the event of an economic downturn, the business may have a decline in its revenues. In an economic recession, the demand for oil decreases as people will have less discretionary income. However, in today’s economic climate, inflation has become a serious concern, and investors have driven up the price of oil up substantially as a safe investment to hedge against inflationary risks. As such, the business should have very few issues regarding top line income.

7.3 Source of Funds

7.4 General Assumptions

7.5 Profit and Loss Statements

7.6 Cash Flow Analysis

7.7 Balance Sheet

7.8 General Assumptions

7.9 Business Ratios

Expanded Profit and Loss Statements

Expanded Cash Flow Analysis

- Website Design & Development Services

- Startup Branding

- Paid Marketing

- Organic Marketing

- Market Research

- Business Plans

- Pitch Decks

- Financial Forecast

- Industry Market Research Reports

- Social Media & Website Guides

- Case Studies

- Services Marketing Website Design & Development Services Startup Branding Paid Marketing Organic Marketing Consulting Market Research Business Plans Pitch Decks Financial Forecast

- About Resources Articles Templates Industry Market Research Reports Social Media & Website Guides Case Studies Team

Oil And Gas Business Plan Template

Explore Options to Get a Business Plan.

Are you interested in starting your own oil and gas Business?

Licensing and Regulations

Financial planning, raising capital, human resources, marketing strategies, risk management, technology solutions.

Why write a business plan?

- Business Plans can help to articulate and flesh out the business’s goals and objectives. This can be beneficial not only for the business owner, but also for potential investors or partners

- Business Plans can serve as a roadmap for the business, helping to keep it on track and on target. This is especially important for businesses that are growing and evolving, as it can be easy to get sidetracked without a clear plan in place.

- Business plans can be a valuable tool for communicating the business’s vision to employees, customers, and other key stakeholders.

- Business plans are one of the most affordable and straightforward ways of ensuring your business is successful.

- Business plans allow you to understand your competition better to critically analyze your unique business proposition and differentiate yourself from the market.

- Business Plans allow you to better understand your customer. Conducting a customer analysis is essential to create better products and services and market more effectively.

- Business Plans allow you to determine the financial needs of the business leading to a better understanding of how much capital is needed to start the business and how much fundraising is needed.

- Business Plans allow you to put your business model in words and analyze it further to improve revenues or fill the holes in your strategy.

- Business plans allow you to attract investors and partners into the business as they can read an explanation about the business.

- Business plans allow you to position your brand by understanding your company’s role in the marketplace.

- Business Plans allow you to uncover new opportunities by undergoing the process of brainstorming while drafting your business plan which allows you to see your business in a new light. This allows you to come up with new ideas for products/services, business and marketing strategies.

- Business Plans allow you to access the growth and success of your business by comparing actual operational results versus the forecasts and assumptions in your business plan. This allows you to update your business plan to a business growth plan and ensure the long-term success and survival of your business.

Business Plan Content

- Executive Summary

- Company Overview

- Industry Analysis

- Consumer Analysis

- Competitor Analysis & Advantages

- Marketing Strategies & Plan

- Plan of Action

- Management Team

The financial forecast template is an extensive Microsoft Excel sheet with Sheets on Required Start-up Capital, Salary & Wage Plans, 5-year Income Statement, 5-year Cash-Flow Statement, 5-Year Balance Sheet, 5-Year Financial Highlights and other accounting statements that would cost in excess of £1000 if obtained by an accountant.

The financial forecast has been excluded from the business plan template. If you’d like to receive the financial forecast template for your start-up, please contact us at [email protected] . Our consultants will be happy to discuss your business plan and provide you with the financial forecast template to accompany your business plan.

Instructions for the Business Plan Template

To complete your perfect oil and gas business plan, fill out the form below and download our oil and gas business plan template. The template is a word document that can be edited to include information about your oil and gas business. The document contains instructions to complete the business plan and will go over all sections of the plan. Instructions are given in the document in red font and some tips are also included in blue font. The free template includes all sections excluding the financial forecast. If you need any additional help with drafting your business plan from our business plan template, please set up a complimentary 30-minute consultation with one of our consultants.

Ongoing Business Planning

Want a bespoke business plan for your oil and gas business, our expertise, oil and gas business plan template faqs, what is a business plan for a/an oil and gas business, how to customize the business plan template for a oil and gas business, what financial information should be included in a oil and gas business plan, are there industry-specific considerations in the oil and gas business plan template, how to conduct market research for a oil and gas business plan, what are the common challenges when creating a business plan for a oil and gas business, how often should i update my oil and gas business plan, can i use the business plan template for seeking funding for a oil and gas business, what legal considerations are there in a oil and gas business plan.

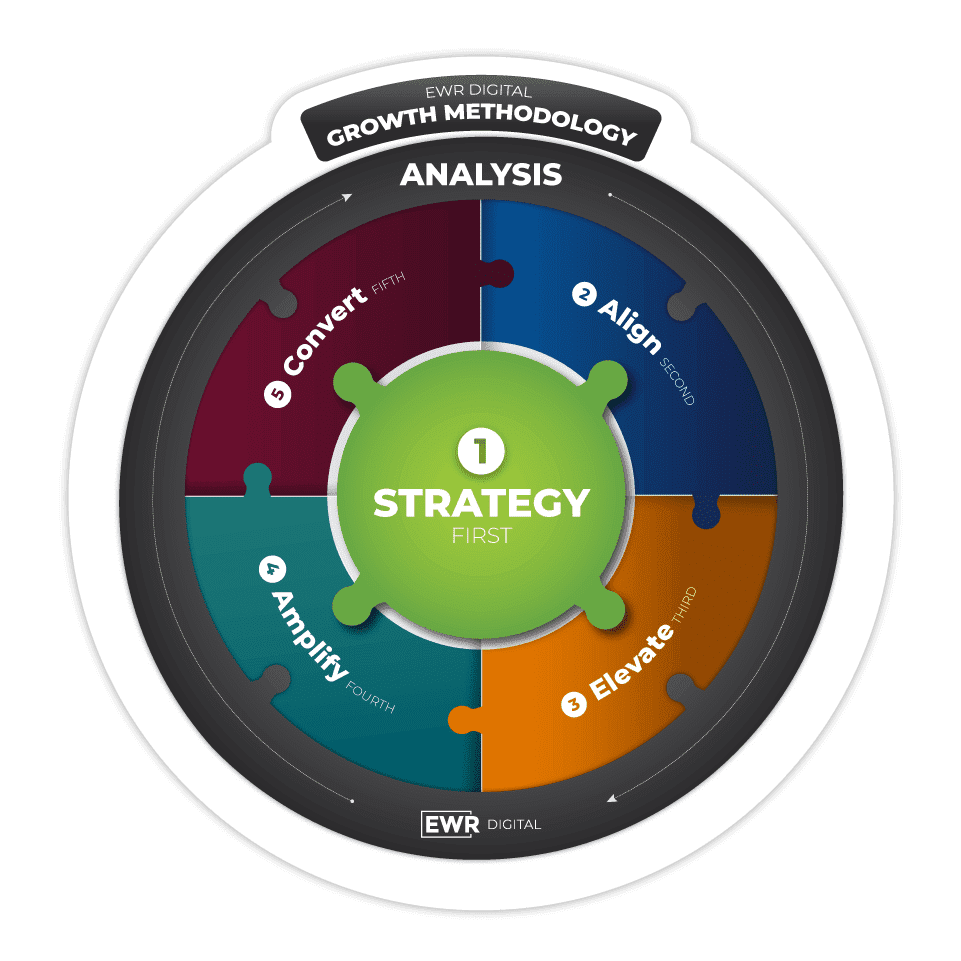

Navigating Oil and Gas Business Development: Proven Strategies for Success

Nov 14, 2023

Matt Bertram

Today, let’s explore the intricate realm of the oil and gas industry and uncover the tried-and-true strategies for effective business development . But first, let’s clarify the distinction between business development and sales—a crucial understanding for a holistic approach to growth.

Understanding Business Development

Oil and gas business development is the strategic process of identifying, pursuing, and acquiring new opportunities and partnerships within the oil and gas industry. It involves activities aimed at fostering growth, creating valuable relationships, and expanding the reach of businesses operating in the oil and gas sector such as hour hours, industry lunchins and conferences. This multifaceted approach goes beyond traditional sales by encompassing elements such as social selling, and now online research and market analysis, identifying potential clients on LinkedIn or other methods, crafting unique value propositions, and adapting to the ever-evolving landscape of the oil and gas industry. Successful oil and gas business development strategies often include a combination of innovation, targeted outreach on social media and by phone, and a deep understanding of the challenges and opportunities within the energy sector to you can articulate to your prospects that you product or service solves their problem.

At its core, business development strategically pursues new business, while sales executes on revenue generation. Ideally, the business development function integrates sales, marketing, and product development for a comprehensive growth strategy for B2B . I would even say that Account Based Selling ( ABS ) fits into this here.

Proven Strategies for Oil and Gas Business Development

Now, let’s delve into the key strategies that can elevate your business development efforts in the dynamic landscape of oil and gas.

Identifying and Solving Core Problems:

Your product or solution addresses specific problems. A thorough understanding of these problems lays the foundation for effective business development.

Imagine there’s a challenge with detecting leaks in pipelines. Leaks not only lead to environmental concerns but can also be super costly for companies. So, a nifty solution could be a smart sensor technology designed specifically for pipelines.

These sensors could be placed strategically along the pipeline route to constantly monitor for any signs of leaks or abnormalities. They might use advanced algorithms to analyze data in real-time, instantly flagging any potential issues to operators.

Now, imagine this system is equipped with predictive analytics. It doesn’t just detect leaks when they happen, but it can also predict when a leak might occur based on various factors like pressure fluctuations or temperature changes.

This predictive capability allows operators to take proactive measures, like scheduling maintenance before a leak even happens, saving both time and money while preventing environmental harm.

Plus, these sensors could be integrated with cloud-based platforms, allowing operators to monitor their entire pipeline network remotely from anywhere in the world. It’s like having eyes and ears all along the pipeline, even in the most remote locations.

So, by leveraging smart sensor technology with predictive analytics and remote monitoring, this solution addresses the critical issue of pipeline leaks head-on, making the oil and gas industry safer, more efficient, and more environmentally friendly.

Pinpointing Your Target Audience:

In the oil and gas sector , identifying those experiencing the identified problem is crucial. Knowing the titles and roles of impacted individuals allows for precise outreach.

Let’s say you’ve developed a groundbreaking solution aimed at optimizing offshore drilling operations. To make a real impact, you need to identify the key players within oil and gas companies who are directly involved in offshore drilling.

These could include drilling engineers responsible for planning and executing operations, operations managers overseeing day-to-day activities, procurement managers handling equipment purchases, health, safety, and environment (HSE) managers ensuring compliance, and C-suite executives steering strategic decisions.

By tailoring your messaging to resonate with each of these stakeholders, highlighting how your solution addresses their specific concerns and contributes to their objectives, you can effectively communicate its value proposition and drive adoption within the industry.

Crafting Unique Value Propositions:

Every problem solved has a distinct value proposition. Whether enhancing shareholder value or improving operational efficiency, tailor your narrative to resonate with your specific audience.

For instance, innovative drilling technologies promise to revolutionize operations by significantly reducing costs and boosting efficiency. Meanwhile, a growing emphasis on environmental sustainability has spurred the development of clean energy solutions tailored to oil and gas operations, offering substantial emissions reductions without sacrificing performance.

Additionally, advancements in safety equipment and protocols aim to mitigate risks inherent in offshore operations, ensuring the well-being of personnel and regulatory compliance. Furthermore, the integration of data-driven analytics enables companies to make informed decisions, optimizing production processes and maximizing profitability.

Lastly, manufacturers offering reliable and high-performance equipment contribute to operational reliability, minimizing downtime and maximizing output. These diverse value propositions address critical pain points within the industry, offering tailored solutions that promise tangible benefits such as cost savings, environmental stewardship, safety enhancements, data-driven insights, and operational efficiency.

Adaptable Narratives for Diverse Stakeholders:

Different stakeholders have different perspectives. Be adaptable, crafting stories and messages that align with the priorities of various target audiences.

magine you’re at the forefront of thought leadership in the oil and gas industry. You understand that stakeholders like investors, regulators, employees, and local communities all have unique perspectives and priorities. So, it’s crucial to be adaptable in your storytelling approach.

For investors, you might craft narratives focusing on innovation, cost-effectiveness, and long-term sustainability. Highlight how your company’s cutting-edge technologies or strategic partnerships are driving growth and delivering value to shareholders.

When it comes to regulators, emphasize compliance, safety, and environmental responsibility. Share stories about your proactive measures to exceed regulatory standards, safeguarding both people and the planet.

For employees, weave narratives that inspire pride and motivation. Celebrate their contributions to the company’s success, and share stories of career growth, training initiatives, and workplace safety measures that prioritize their well-being.

And let’s not forget about local communities. Tailor your storytelling to showcase your company’s commitment to social responsibility, community engagement, and economic development. Share stories of partnerships with local organizations, job creation initiatives, and environmental conservation efforts that benefit the communities where you operate.

By being adaptable and crafting narratives that resonate with the priorities of each stakeholder group, you can build trust, foster meaningful connections, and position your company as a thought leader driving positive change in the industry.

Measure, Analyze, and Optimize:

Implement metrics to measure the success of your business development initiatives. Identify strategies that yield significant results and focus your efforts on those that contribute 80% of the impact.

It’s all about keeping a close eye on what’s happening, figuring out what’s working like a charm, and then fine-tuning your efforts to make the most impact.

Let’s say you’re drilling for oil. You start by measuring key performance indicators like drilling efficiency and production rates. Then, you dive into the data, analyzing everything from drilling techniques to reservoir performance. And here’s the cool part—you use those insights to optimize your approach. Maybe you discover that a certain drilling method leads to higher production rates with lower costs. Boom! You focus your efforts there, maximizing your returns and minimizing expenses.

Now, let’s talk supply chain. You’re measuring stuff like inventory turnover and transportation costs, right? Then, you crunch the numbers, looking for any bottlenecks or inefficiencies. And when you find them, you’re all about optimization. Maybe you streamline your inventory management or find a more efficient way to transport materials. The result? Smoother operations, lower costs, and happier stakeholders.

And hey, safety’s always a top priority. You’re measuring safety metrics like injury rates and regulatory compliance. Then, you’re digging into the data, trying to spot any trends or areas for improvement. Once you’ve got that figured out, it’s all about optimization. You beef up your safety training programs, tighten up procedures, and invest in tech that keeps everyone safe on the job.

And let’s not forget about asset maintenance. You’re measuring reliability, maintenance costs, and downtime rates. After analyzing the data, you’re tweaking your maintenance strategies, maybe shifting towards predictive maintenance to catch problems before they even happen.

So, whether you’re drilling for oil, managing the supply chain, ensuring safety, or maintaining assets, the “Measure, Analyze, and Optimize” approach is your secret sauce for success in the oil and gas game. It’s all about staying sharp, staying efficient, and making the most out of every opportunity that comes your way.

Establishing a Feedback Loop:

Create a feedback loop channeling insights from business development back to product development, sales, and marketing. Tailor your messaging and content based on the unique needs of various stakeholders.

Accelerate Success:

Once successful strategies are identified, allocate resources to accelerate those initiatives. This targeted approach ensures quicker revenue growth.

These proven strategies serve as a blueprint for our work with clients in the oil and gas industry. We comprehend the unique challenges and opportunities this sector presents, and by implementing these strategies, we’ve witnessed accelerated success.

Setup a call today with one of our oil and gas marketing consultants!

EWR Digital for your Oil and Gas Marketing

Trust us with your go-to-market strategy , and here’s why:

Industry Expertise:

With a deep understanding of the oil and gas sector, we bring unparalleled industry expertise to the table. Our team comprehensively grasps the challenges and opportunities unique to your business.

Proven Track Record:

EWR Digital boasts a track record of success, having propelled numerous oil and gas businesses to new heights. Our results-driven approach and client success stories speak volumes about our commitment to excellence.

Tailored Strategies:

We don’t believe in one-size-fits-all solutions. Your business is unique, and so is our approach. EWR Digital crafts tailored marketing strategies that align with your specific goals, ensuring maximum impact and ROI.

Digital Prowess:

In a rapidly evolving digital landscape, we stand out with our cutting-edge digital marketing strategies. From SEO and social media to content creation and data analytics, we leverage the latest tools to elevate your brand in the digital realm.

Customer-Centric Focus:

Your customers are at the heart of our strategy. EWR Digital places a strong emphasis on understanding your target audience, addressing their needs, and creating engaging content that builds lasting connections.

Adaptability and Innovation:

The oil and gas industry is dynamic, and so are we. EWR Digital embraces change, staying ahead of industry trends and technological advancements. Our adaptability ensures your marketing strategy remains relevant and effective.

Transparent Communication:

Communication is key to a successful partnership. EWR Digital prioritizes transparent communication, keeping you informed at every stage. We believe in collaboration and work closely with you to refine strategies for optimal results.

Measurable Results:

Our commitment to measurable results sets us apart. EWR Digital provides comprehensive analytics and regular reporting, giving you a clear understanding of the impact of our marketing efforts on your business objectives.

In the fiercely competitive realm of oil and gas, rely on EWR Digital not merely as a marketing agency but as your dedicated strategic ally, committed to steering you towards unparalleled success. Join us on this collaborative journey as we elevate your brand to unprecedented heights within the industry.

Recent Posts

- Responsive Design in the Energy Sector: Importance and Best Practices

- Crafting Your Narrative: Branding Strategies for Oil and Gas Websites

- Visualizing Insights: Data Design Techniques for Oil and Gas Industry Sites

- Strategies for Proactive Reputation Building in the Energy Sector

- The Importance of Reputation Management in Oil and Gas

- Account-Based Marketing

- Analytics & Analysis

- Automotive Marketing

- B2B Marketing

- Blockchain Marketing

- Branding and Design

- Community Development

- Company News

- Content Marketing

- Contractor Marketing

- Conversion Rate Optimization (CRO)

- Core Web Vitals

- Digital Strategy

- eCommerce Marketing

- Email Marketing

- Enterprise Success

- ESG Sustainability

- Event Marketing

- Fashion Marketing

- Financial Marketing

- Franchise Marketing

- Fundraising Strategies

- Healthcare Marketing

- HVAC Marketing

- Industrial Marketing

- Internet Marketing

- Investor Relations

- Law Firm Marketing

- Marketing Essentials

- Nonprofit Marketing

- Off-Page SEO

- Oil and Gas Marketing

- On-Page SEO

- Opinion Pieces – Digital Disruptor

- Plumbing Marketing

- Pool Marketing

- PPC (Pay-Per-Click) advertising

- Public Relations

- Reputation Management

- Roofer Marketing

- Sales Enablement

- Search Engine Marketing (SEM)

- SEO (Search Engine Optimization)

- SEO Archive

- Small Business Marketing

- Social Media Marketing (SMM)

- Technical SEO

- Texas Businesses

- Thought Leadership

- Video marketing

- Why Choose EWR Digital

13105 Northwest Fwy Suite 765 Houston, TX 77040

(713) 592-6724

Oil and Gas Company Marketing Plan Template

- Great for beginners

- Ready-to-use, fully customizable Subcategory

- Get started in seconds

In the competitive world of oil and gas, having a well-defined marketing plan is essential for success. ClickUp's Oil and Gas Company Marketing Plan Template is here to help you navigate the complexities of the industry and drive your business forward.

With this template, you can:

- Conduct in-depth market analysis to identify trends, opportunities, and challenges

- Define your target audience and create tailored strategies to reach them effectively

- Develop a competitive positioning strategy to differentiate your company from the rest

- Implement pricing strategies that maximize profitability without sacrificing customer satisfaction

- Launch impactful promotion and advertising campaigns that capture attention and drive results

- Maintain and strengthen relationships with existing clients through effective relationship management

Don't let the competition leave you behind. Get started with ClickUp's Oil and Gas Company Marketing Plan Template and take your business to new heights.

Benefits of Oil and Gas Company Marketing Plan Template

An effective marketing plan is vital for any oil and gas company looking to thrive in a competitive market. The Oil and Gas Company Marketing Plan Template helps you achieve success by:

- Conducting in-depth market analysis to identify opportunities and stay ahead of competitors

- Defining your target audience and tailoring your messaging to resonate with them

- Developing a strong competitive positioning to differentiate your company from others in the industry

- Implementing effective pricing strategies to maximize profitability

- Creating impactful promotion and advertising campaigns to reach and attract new clients

- Establishing and maintaining strong relationships with existing customers to enhance loyalty and retention

Main Elements of Oil and Gas Company Marketing Plan Template